MEMBERS ONLY

Is It Time For A Contra Trend Correction?

by Martin Pring,

President, Pring Research

* Major Trend Remains Positive

* Weekly Bar and Candle Charts Offer a Warning

* Reliable Short-Term Indicators, like Sentiment, are Overstretched

Major Trend Remains Positive

Each weekend, I go through a ChartList featuring weekly bar and candle charts of key markets. The idea is to spot technical events that appear on the...

READ MORE

MEMBERS ONLY

REGIONAL BANKS SHOW LEADERSHIP -- THAT INCLUDES BB&T, SUNTRUST, AND U.S. BANCORP -- CITIGROUP AND JP MORGAN CHASE MAY BE NEARING UPSIDE BREAKOUTS OF THEIR OWN -- GOLDMAN SACHS HAS HIT NEW HIGH FOR YEAR TO REVERSE PREVIOUS DOWNTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANKS HELP BOOST FINANCIALS...Financials are one of the day's strongest sectors. And banks are a big reason why. The daily bars in Chart 1 show the KBW Bank Index finding support above its 50- and 200-day moving averages; as well as a rising trendline drawn under its...

READ MORE

MEMBERS ONLY

CSX AND OTHER RAIL STOCKS PULL TRANSPORTS SHARPLY LOWER -- THAT'S MAKING INDUSTRIALS THE DAY'S WEAKEST SECTOR -- FALLING PRICE OF OIL WEAKENS ENERGY STOCKS -- GOLD MINING ETF RESUMES UPTREND WITH THE COMMODITY NOT FAR BEHIND

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS HAVING A VERY BAD DAY... Just a day after reaching a new two-month high, transportation stocks are the day's weakest group. The daily bars in Chart 1 show the Dow Jones Transportation Average falling more than 3% today. And it's being led lower mainly by...

READ MORE

MEMBERS ONLY

Bond Yields May Not Be Headed Lower After All

by Martin Pring,

President, Pring Research

* Money Market Yields Continue to Look Vulnerable

* The 5-Year Yield is in a Secular Uptrend

* Longer-Dated Maturities Overstretched on the Downside

Money Market Yields Continue to Look Vulnerable

Everybody and their dog thinks that short-term rates will be cut by the Fed later this month. Count me in with the...

READ MORE

MEMBERS ONLY

STOCK INDEXES END WEEK AT RECORD HIGHS -- SECTOR RECORDS WERE SET BY CONSUMER DISCRETIONARY AND TECHNOLOGY -- INDUSTRIALS MAY BE GETTING CLOSE TO A RECORD AS WELL -- TRANSPORTATION STOCKS END ON A STRONG NOTE -- FINANCIALS HIT NEW HIGH FOR THE YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. STOCK INDEXES SET NEW RECORDS...The three major U.S. stock indexes ended the week in record territory. A number of sectors hit records as well, or are getting close to doing so. Consumer discretionary and technology SPDRs hit new records. Financials hit a new high for the...

READ MORE

MEMBERS ONLY

GOLD IS THE WORLD'S STRONGEST CURRENCY -- GOLD HAS HIT A SIX-YEAR HIGH QUOTED IN DOLLARS -- AND IS HITTING MULTI-YEAR HIGHS WHEN QUOTED IN MAJOR FOREIGN CURRENCIES AS WELL

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD IS DOING BETTER THAN THE WORLD'S MAJOR CURRENCIES... Gold is more than just a commodity. Gold is sometimes also viewed as an alternate currency. When global traders lose confidence in their currency, they often turn to gold as an alternative store of value. Since gold is quoted...

READ MORE

MEMBERS ONLY

RENEWED HOPE FOR JULY RATE CUT PUSHES STOCK INDEXES TO RECORD HIGHS -- TECHNOLOGY LEADS NASDAQ HIGHER -- UTILITIES HIT NEW HIGH WITH STAPLES AND REITS RIGHT BEHIND -- HOMEBUILDERS LEAD CYCLICALS TO NEW RECORD -- WEAK DOLLAR BOOSTS EMERGING MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

POWELL TESTIMONY MAKES JULY RATE CUT MORE LIKELY...Last Friday's strong jobs report raised concerns about a July rate cut later this month, which boosted interest rates and caused some profit-taking in stocks. Mr. Powell today put the July rate cut back on the table. Traders are now...

READ MORE

MEMBERS ONLY

Three Sectors And Five Industry Groups Poised To Move Higher

by Martin Pring,

President, Pring Research

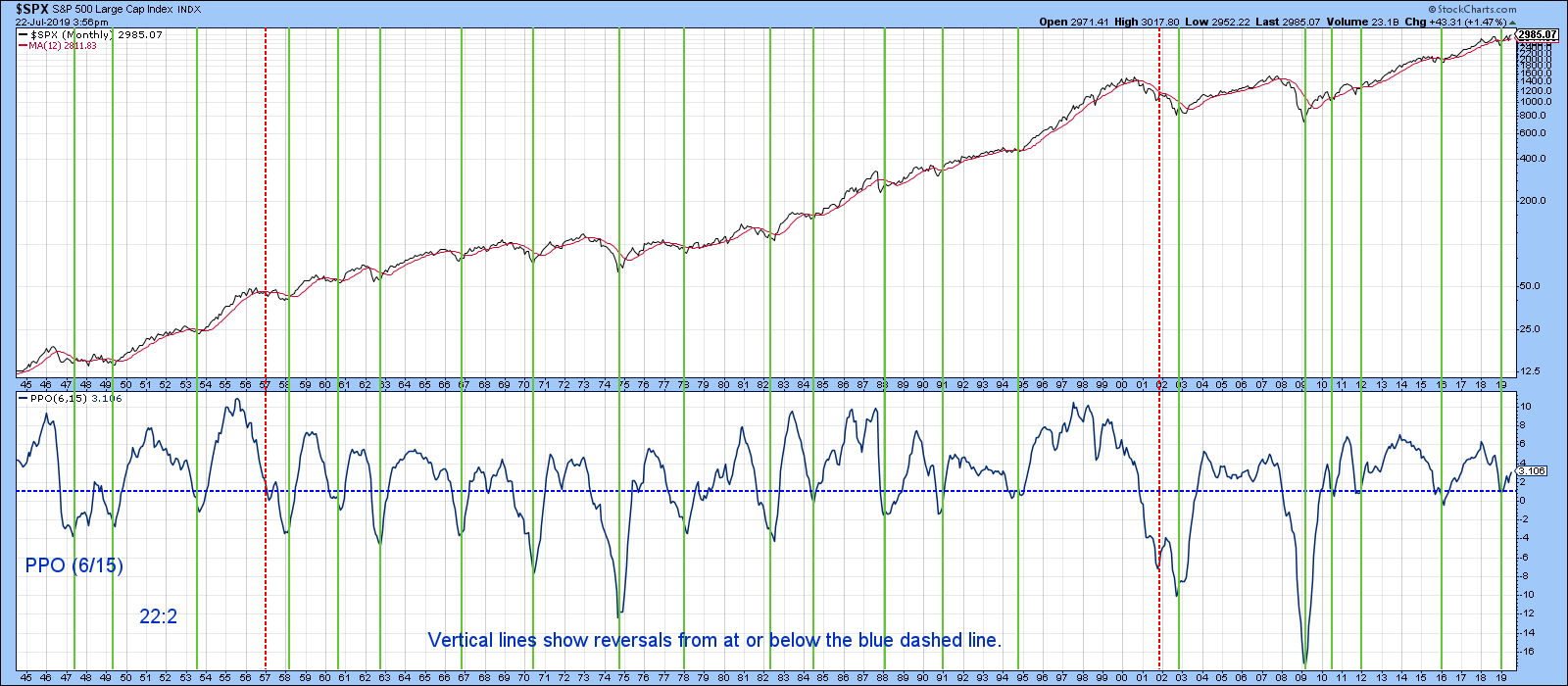

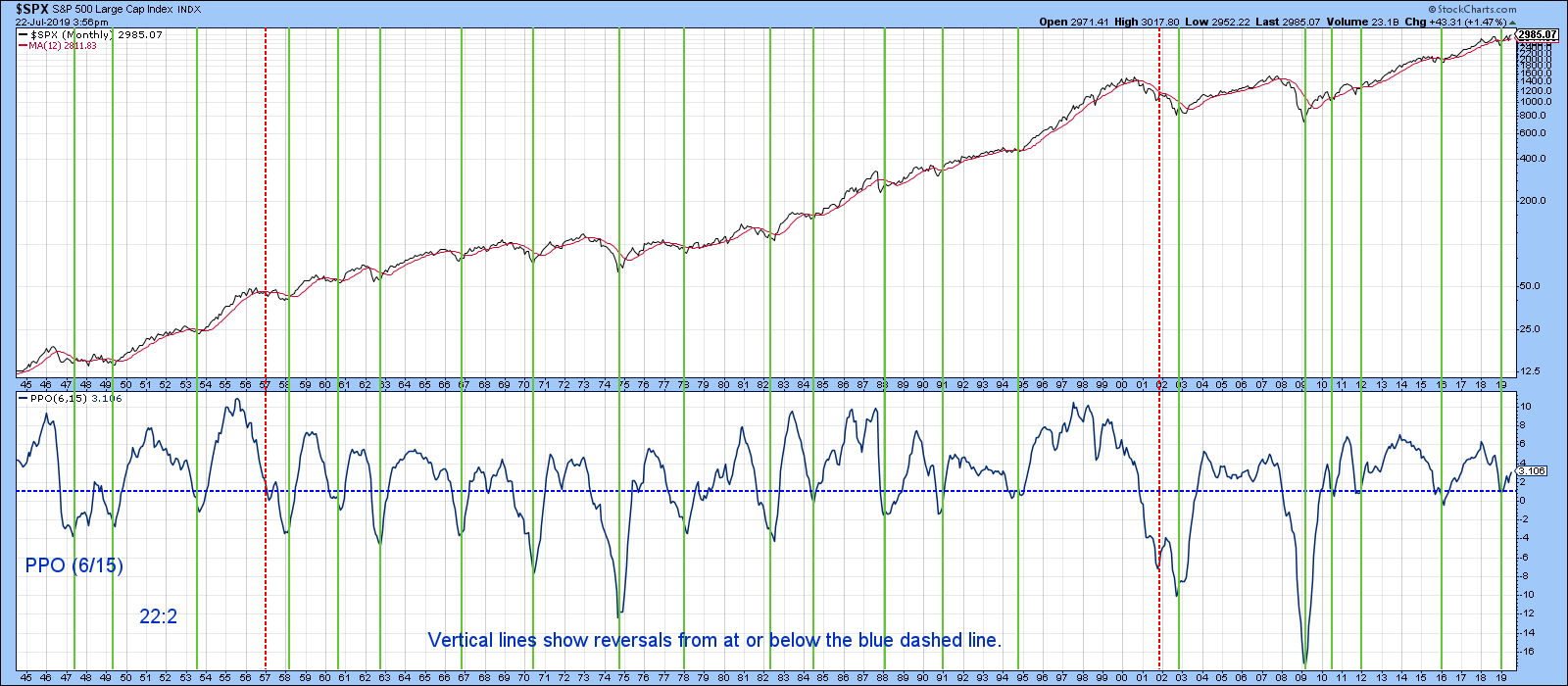

Market Tentatively Triggers a Long-Term Buy Signal

Chart 1 features a Coppock indicator for the NYSE Composite, which triggers buy signals by reversing to the upside from a position at or below the equilibrium level. Since 1970, there have been thirteen such signals and only one failure (in 2002). That&...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-07-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for July is now available.

Good luck and good charting, Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT SENDS BOND YIELDS HIGHER ON DIMINISHED HOPE FOR JULY RATE CUT -- DIVIDEND-PAYING STOCKS ARE LEADING TODAY'S MARKET RETREAT -- RISING YIELDS ARE BOOSTING BANKS AND FINANCIALS -- A STRONGER DOLLAR IS CAUSING PROFIT-TAKING IN GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STRONGER THAN EXPECTED JOBS REPORT BOOSTS YIELDS...A increase of 224,000 jobs in June was much higher than expected, and may have diminished hopes for a July rate cut. That can be seen by rising bond yields today. The 10-Year Treasury yield is rising 11 basis points to 2....

READ MORE

MEMBERS ONLY

DOW AND S&P 500 ARE POISED TO CLOSE AT RECORD HIGHS -- DROP IN BOND YIELDS CONTINUES TO SUPPORT DIVIDEND-PAYING STOCKS -- CONSUMER CYCLICALS ARE TRADING AT RECORD HIGHS TODAY -- BUT STAPLES HAVE DONE BETTER THAN CYCLICALS SINCE LATE APRIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 SETS NEW RECORD... DOW IS GETTING CLOSE...Stocks are trading higher again today in a shortened pre-holiday trading session. Chart 1 shows the S&P 500 trading well above its late-April high and trading in new record territory again today. The SPX is trading well...

READ MORE

MEMBERS ONLY

Are Commodities About To Turn Up?

by Martin Pring,

President, Pring Research

* CRB Still Caught in a Trading Range

* Commodity/Bond Ratio Holding On By its Teeth

* Watch the Canadian Dollar for Clues

CRB Still Caught in a Trading Range

Back in May, I wrote an article entitled “Commodities: Down Now, Up Later?" in which I pointed out some of the...

READ MORE

MEMBERS ONLY

TRANSPORTS AND SMALL CAP INDEXES CLEAR 200-DAY AVERAGES -- TODAY IS REBALANCING DAY FOR RUSSELL INDEXES -- FINANCIALS ARE THE DAY'S STRONGEST SECTOR AND MAY BE BOOSTING SMALL CAPS -- BIG BANKS PASS ANNUAL STRESS TEST AND ARE LEADING XLF HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS CLEAR 200-DAY AVERAGE...Two market groups that have been market laggards all year are suddenly attracting new buying. I'm referring to small cap stocks and transports. Chart 1 shows the Dow Jones Transportation Average ending the week above its 200-day moving average. It's also one...

READ MORE

MEMBERS ONLY

JUNE SECTOR ROTATIONS SHOW MORE CONFIDENCE -- DEFENSIVE SECTORS FALL BEHIND -- WHILE TECHNOLOGY, CYCLICALS, AND INDUSTRIALS TAKE THE LEAD -- SEMICONDUCTORS LEAD TECH HIGHER -- CHIP STOCKS ARE TRACKING THE CHINESE STOCK MARKET VERY CLOSELY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DEFENSIVE SECTORS FALL BEHIND... Previous messages have pointed out that defensive stock sectors were top performers since the market hit a peak at the end of April when trade tensions started to resurface. Stocks, however, have recovered most of their May losses during the month of June. And sector leadership...

READ MORE

MEMBERS ONLY

SMALL CAPS HAVE BEEN WEAKER THAN LARGE CAPS THIS YEAR -- A WEAKER DOLLAR MAY BE A REASON -- FALLING RATES ARE MORE LIKELY -- FINANCIALS ARE BIGGEST SMALL CAP SECTOR -- PREFERENCE FOR LARGE DIVIDEND-PAYING STOCKS MAY ALSO BE HURTING SMALL CAPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS CONTINUE TO UNDERPERFORM...Small cap stocks have been lagging behind larger stocks for most of this year. And in a big way. The black bars in Chart 1 show the Russell 2000 Small Cap Index (RUT) lagging behind the S&P 500 Large Cap Index (gray area)...

READ MORE

MEMBERS ONLY

Four Reasons Why The Gold Breakout Is Likely To Be Valid

by Martin Pring,

President, Pring Research

* A Weaker Dollar is Bullish for Gold

* The Gold 6/15 PPO Model for Gold is Bullish

* Global Gold is Breaking Out

* Gold Shares Showing Signs of Strength

* Gold Special K Crossed its Bear Market Trend Line

Last week, Gold experienced an upside breakout from a multi-year base. I always...

READ MORE

MEMBERS ONLY

FALLING FOREIGN BOND YIELDS ARE PULLING TREASURY YIELDS LOWER -- GLOBAL STOCK INDEXES HAVE A STRONG WEEK AND NEAR UPSIDE BREAKOUTS -- FALLING YIELDS AND A WEAKER DOLLAR PUSH GOLD TO SIX-YEAR HIGH -- GOLD MINERS ALSO HAD A BREAKOUT WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

NEGATIVE FOREIGN YIELDS LEAD TREASURY YIELDS LOWER...Bond yields are dropping all over the world. The British 10-Year yield fell this week to the lowest level since 2016 (0.80%). The Japanese yield remains in negative territory. Nearly a quarter of bond yields in global developed markets are already negative...

READ MORE

MEMBERS ONLY

FED LEAVES RATES UNCHANGED BUT SETS STAGE FOR JULY RATE CUT -- BOND AND STOCK PRICES GAIN -- BIG DROP IN BOND YIELDS WEAKENS BANK STOCKS -- WEAK DOLLAR PUSHES GOLD TO NEW HIGH FOR THE YEAR -- HEALTHCARE SPDR ACHIEVES BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS GAIN ON EXPECTED RATE CUT... The Fed left rates unchanged today, but dropped the word "patient" from its statement, and gave the strong impression that a rate cut is likely. Fed fund futures are betting on a rate cut in July. That sent bond and stock prices...

READ MORE

MEMBERS ONLY

REGIONAL BANK LEADERS INCLUDE SUNTRUST, CITIZENS FINANCIAL, AND BB&T -- ALL THREE APPEAR TO BE FORMING SYMMETRICAL TRIANGLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRIANGLES ON DISPLAY...Today's earlier message showed the S&P Bank SPDR (KBE) trying to rise above its 200-day moving average. It also mentioned that regional banks were leading today's bank rebound. While drilling down through some regional bank charts, I noticed that many of...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR NEARS UPSIDE BREAKOUT -- DRUG STOCKS ARE ALSO BREAKING OUT -- BANKS RALLY ON FED DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SPDR NEARS UPSIDE BREAKOUT...Money has been flowing into healthcare stocks since the end of April. And the sector may be on the verge of a bullish breakout. The daily bars in Chart 1 show the Health Care SPDR (XLV) testing its early March intra-day peak at 93.10....

READ MORE

MEMBERS ONLY

S&P Composite Continues To Lead The World Higher As More Short-Term Indicators Go Bullish

by Martin Pring,

President, Pring Research

* US Breaking Out Against the World

* The World Itself Looks to be in Pretty Good Technical Shape

* NYSE A/D and Upside/Downside Lines at Record Levels

* More Short-Term US Market Indicators Turn Bullish

* Multiple Momentum Trend Line Breaks is Very Positive

* There Is Always Something to Worry About

US...

READ MORE

MEMBERS ONLY

MONTHLY SECTOR RANKINGS SHOW DEFENSIVE LEADERSHIP THAT INCLUDES UTILITIES, HEALTH CARE, REAL ESTATE, AND CONSUMER STAPLES -- GOLD MINERS LED MATERIALS HIGHER -- HOMEBUILDERS ARE LEADING CONSUMER DISCRETIONARY SECTOR HIGHER TODAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MONTHLY PERFORMANCE SHOWS DEFENSIVE LEADERSHIP...Chart 1 is taken from the Sector Summary page for the past month. And it shows that investors are still gravitating toward defensive issues. Four of the top sectors are utilities, health care, real estate, and consumer staples. All four are defensive in nature. Even...

READ MORE

MEMBERS ONLY

GOLD SHARES ARE RISING WITH THE METAL -- AND ARE NEARING A TEST OF 2019 HIGHS -- THE FACT THAT GOLD MINERS ARE RISING FASTER THAN BULLION IS ANOTHER POSITIVE SIGN

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD MINERS ETF NEARS TEST OF 2019 HIGH...Yesterday's message wrote about the price of gold being in the late stages of a potential bottoming formation. It also suggested that three intermarket forces were working in gold's favor. They include a weaker dollar, falling interest rates,...

READ MORE

MEMBERS ONLY

INTERMARKET TRENDS ARE STARTING TO FAVOR GOLD -- A WEAKER DOLLAR IS ONE OF THEM -- AND FALLING INTEREST RATES -- GOLD HAS DONE BETTER OVER THE LAST YEAR WHEN STOCKS HAVE WEAKENED -- GOLD IS TESTING MAJOR OVERHEAD RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

A WEAKER DOLLAR INCREASES APPEAL OF GOLD... The brown monthly bars in Chart 1 show the price of gold forming a potential bottoming formation that started nearly four years ago when it hit bottom in late 2015. Since then, the price of bullion has traded between that low and a...

READ MORE

MEMBERS ONLY

THE McCLELLAN OSCILLATOR TURNED POSITIVE THIS WEEK -- THAT'S BOOSTING THE McCLELLAN SUMMATION INDEX AND KEEPING ITS 2019 UPTREND INTACT -- BOTH ARE MEASURES OF MARKET BREADTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOTH McCLELLAN BREATH INDICATORS TURN UP... Chart 1 includes two breadth indicators that work together. Both are compared to the NYSE Composite Index (upper box). The dashed line in the lower part of the chart plots the McClellan Summation Index. That's a long term measure of market breadth....

READ MORE

MEMBERS ONLY

STOCKS START THE WEEK ON A STRONG NOTE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES CLEAR 50-DAY AVERAGES... Stocks are starting the week on a strong note. Charts 1 and 2 show the Dow and S&P 500 trading above their 50-day averages. The Dow has also cleared initial resistance at 26,000. Chart 2 shows the SPX also exceeding overhead resistance...

READ MORE

MEMBERS ONLY

Seven Reasons For Being Bullish

by Martin Pring,

President, Pring Research

* Financial Velocity Indicator Poised to Go Bullish

* Oversold NASDAQ Volume in a Position to Support a Rally

* Rapid Expansion of Net New Highs is Bullish

* Global Breadth Turning?

* When Stock Exchanges Break to the Upside, That’s Usually Bullish for Stocks

Financial Velocity Indicator Poised to Go Bullish

One of...

READ MORE

MEMBERS ONLY

DOW ENDS WEEK ON A STRONG NOTE -- TECHNOLOGY LEADS FRIDAY RALLY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW ENDS WEEKLY LOSING STREAK The Dow Industrials gained 263 points today (1.02%) to end the week on a strong note. That also ends a six-week losing streak for the blue chip index. Chart 1 shows the Dow regaining its 200-day average on Wednesday, and ending the week right...

READ MORE

MEMBERS ONLY

10-YEAR TREASURY YIELD HEADED TOWARD TEST OF 2017 LOW -- THAT'S HELPING PUSH DIVIDEND PAYING STOCK SECTORS INTO RECORD TERRITORY -- BUT IS CAUSING BANKS TO LAG BEHIND

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD NEARS TEST OF 2017 LOW... The 10-Year Treasury yield is falling another 6 basis points today to 2.06% which is drawing dangerously close to its 2017 low. The weekly bars in Chart 2 show that year's intra-day yield low at 2.03%. Its lowest...

READ MORE

MEMBERS ONLY

PHARMACEUTIALS LEAD HEALTH CARE SPDR TO POSSIBLE UPSIDE BREAKOUT -- DRUG LEADERS ARE ABBOTT LABS, MERCK, AND PFIZER -- MEDICAL EQUIPMENT STOCKS ALSO LOOK STRONG -- THAT INCLUDES BOSTON SCIENTIFIC, MEDTRONIC, AND THERMO FISHER SCIENTIFIC

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SPDR MAY BE TURNING UP ... The health care sector may be nearing an upside breakout. The daily bars in Chart 1 shows the Health Care SPDR (XLV) trading above its 200-day average in today's trading; and testing its late May intra-day peak at 90.18. A close...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-06-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for June is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Can They Pull The Trigger On Gold And The Yen?

by Martin Pring,

President, Pring Research

* Long-Term Picture Shows Gold Close to a Breakout

* The Shares Are on the Cusp As Well

* Short-Term Indicators for Gold Go Bullish

* Yen Emerging From a Breakout

I like to use an indicator that I call “Risk On Risk Off,” which combines an index comprising several risky entities with another...

READ MORE

MEMBERS ONLY

STOCKS RALLY ON INCREASED HOPE FOR A RATE CUT -- S&P 500 REGAINS 200-DAY LINE -- TECHNOLOGY AND CYCLICAL SPDRS HOLD THEIR 200-DAY LINES -- WHILE FINANCIALS, INDUSTRIALS, AND MATERIALS REGAIN THEIR RED LINES -- VIX FALLS FURTHER BELOW 20

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 TRADES BACK OVER ITS 200-DAY AVERAGE... A combination of a short-term oversold condition and dovish sounding comments from the head of the Fed are giving a big lift to stocks today. All major indexes are are showing strong gains with the Nasdaq in the lead (+2....

READ MORE

MEMBERS ONLY

THREAT OF MEXICAN TARIFFS PUSHES GLOBAL STOCKS LOWER -- 200-DAY AVERAGES ARE BEING BROKEN -- AUTOS ARE BEING HIT ESPECIALLY HARD -- INCLUDING GENERAL MOTORS -- THERE'S A REASON WHY BANKS AND ENERGY STOCKS ARE FALLING TOGETHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

200-DAY AVERAGES ARE BEING BROKEN... The threat of tariffs on Mexican imports is rattling global markets today. And more technical damage is being done. Chart 1 shows the Dow Industrials falling below their March low near 25,200. That puts the Dow at the lowest level since late January. Chart...

READ MORE

MEMBERS ONLY

Deteriorating Confidence Is Not Good For Stocks And Commodities But Is For Bonds

by Martin Pring,

President, Pring Research

* Flight to Safety Leaves Stocks Behind

* S&P vs. Gold is Another Measure of Confidence That’s Deteriorating

* High-Quality Bonds Like Deteriorating Confidence

* A Rising Gold/Commodity Ratio is Actually Bearish for Commodities

Flight to Safety Leaves Stocks Behind

Last week, I wrote that it was nail-biting time for...

READ MORE

MEMBERS ONLY

FALLING BOND YIELDS CAUSE FLIGHT TO SAFETY OF TREASURY BONDS -- TEN YEAR - 3 MONTH YIELD CURVE INVERTS -- STOCKS CONTINUE TO WEAKEN -- DOW TRADES BELOW ITS 200-DAY AVERAGE -- NASDAQ AND S&P 500 ARE THREATENING THEIR RED LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD MAY BE HEADING TO 2%... The surprising drop in global bond yields is continuing. The weekly bars in Chart 1 shows the 10-Year Treasury Yield falling today to 2.22% which is the lowest level since September 2017. The weekly bars in Chart 1 show the next...

READ MORE

MEMBERS ONLY

Interest Rates Are Breaking Down On A Worldwide Basis

by Martin Pring,

President, Pring Research

* Current Trend of Declining Rates Seen as Part of a Large Base

* Downside Breakouts in Yields are Worldwide in Scope

* US Short-Rates Look Vulnerable as Well

* 30-Year Yield Completes a Top

* Stocks and Commodities versus Bonds

Current Trend of Declining Rates Seen as Part of a Large Base

This week...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR IS TRYING TO CLEAR MOVING AVERAGE LINES -- MEDTRONIC AND BOSTON SCIENTIFIC LEAD MEDICAL EQUIPMENT GROUP HIGHER -- MERCK AND MCKESSON ARE DRUG LEADERS -- TECH SECTOR IS ONE OF MAY'S WEAKEST GROUPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE IS GETTING BETTER ... While a lot of attention is being given to stock market swings over the last month, and recent selling in everything related to tariffs and global trade, one group has been quietly getting stronger. And that's healthcare. Healthcare remains this year's weakest...

READ MORE

MEMBERS ONLY

STOCK SELLING INTENSIFIES -- DOW TRADES BELOW ITS 200-DAY AVERAGE -- NASDAQ AND S&P 500 ARE DROPPING TOWARD THEIR 200-DAY LINES -- IF THEY DON'T HOLD, A TEST OF THEIR MARCH LOWS WOULD BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRADE TENSIONS CONTINUE TO WEIGH ON STOCKS... Stocks are under heavy selling pressure today. Energy stocks are leading the market lower with a drop of more than -3%, while oil is dropping nearly twice as much. Technology, industrials, and financials are down -2% or more. As has been the case...

READ MORE

MEMBERS ONLY

DOW TRANSPORTS FALL BELOW 200-DAY AVERAGE -- AMERICAN AIRLINES, FEDEX, AND JB HUNT ARE LEADING IT LOWER -- WHILE UTILITIES REACH NEW RECORD -- TECHS, INDUSTRIALS, AND CYCLICALS WEAKEN DURING MAY -- WHILE DEFENSIVE GROUPS TAKE LEADERSHIP ROLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS FALL BACK BELOW 200-DAY LINE... Transportation stocks are one of the weakest parts of the market today. Chart 1 shows the Dow Jones Transportation Average now trading below its 50- and 200-day moving averages. Not surprisingly, tranports are also showing relative weakness. The blue line in Chart 1...

READ MORE