MEMBERS ONLY

These Commodities are On Track for Mega Breakouts in May

by Martin Pring,

President, Pring Research

It's rare when you see a multi-year breakout take place, but, when several materialize more or less at the same time, that should really get our attention. That's not simply because of the opportunities being presented, but also because several simultaneous breakouts indicate a broader participation...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" May 16, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Certainty is needed for a trader's actions. Good judgment comes from experience, and experience is gained from poor judgment. The key to improving your trading is to really, truly study the losing trades.

In this month's Family Gathering video, Larry presents PPI numbers for historical buy...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, May 16 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, May 16 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

Four Reasons Why Emerging Markets are Headed Higher

by Martin Pring,

President, Pring Research

Last February, I wrote an article on emerging markets, using the iShares MSCI Emerging Markets ETF (EEM) as my benchmark. I pointed out that this sector was close, but had not quite broken out to the upside. Now it has, and the outlook is favorable for at least a 4-6-month...

READ MORE

MEMBERS ONLY

NYSE and Global A/D Lines Trade at New All-Time Highs

by Martin Pring,

President, Pring Research

The magnitude and duration of corrections are largely determined by the direction of the prevailing primary trend. If it's bearish, they tend to be more severe and last longer. In a bull market, it's just the opposite, as they are generally short and sweet, if you...

READ MORE

MEMBERS ONLY

Time for a Pause in the Ongoing Dollar Bull Market? Or Full Steam Ahead?

by Martin Pring,

President, Pring Research

I last wrote about the dollar in December, where I came to the conclusion that a limited rally was a likely possibility in what was assumed to be a primary bull market. I am still of the view that the bull market is alive and well, but it's...

READ MORE

MEMBERS ONLY

35 Years of Crude Oil Forecasting the Future | Focus on Stocks: May 2024

by Larry Williams,

Veteran Investor and Author

All You Need to Know About Crude Oil and the Future

Gold, black gold, is what Crude Oil has become. The entire world runs on energy. 98% of our cars and transportation, our lights, the device you are using to read this... virtually everything we can do is thanks to...

READ MORE

MEMBERS ONLY

Are We There Yet?

by Martin Pring,

President, Pring Research

Back in early February, I wrote an article entitled "Only a Fool Would Try to Call a Correction in a Bull Market, So Here Goes". In it, I was trying to point out that counter-cyclical corrections are notably difficult to identify, as they often terminate just at the...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" April 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Right now, there's lots of room for a downside in the market. Do we really want a rate cut?

In this video, Larry talks about past interest rate cuts from the Fed, and what happens to stock prices as a result. Historically, we've seen these cuts...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs TOMORROW - Thursday, April 18 at 2:00pm EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, April 18 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

Precious Metals Reach Exhaustion

by Martin Pring,

President, Pring Research

In the last couple of weeks, I have been reading stories about shoppers picking up gold bars in, of all places, Costco. According to Gemini, the AI branch of Google, "Reports indicate they may be selling up to $200 million worth of gold bars every month."

Normally, thin...

READ MORE

MEMBERS ONLY

The Day the Yields Broke Out

by Martin Pring,

President, Pring Research

Wednesday brought an unexpected firming up of the inflation figures, causing analysts and commentators to trim the number of times they expect interest rates to be cut this year. Whenever it is that the questions turn away from whether to when and by how much, as was the case until...

READ MORE

MEMBERS ONLY

This Sector is Breaking Up and Down Simultaneously

by Martin Pring,

President, Pring Research

This may seem like a contradiction, but it is possible for two different things to be true at the same time.

What I am referring to is the fact that the health care sector (XLV) recently broke out from a consolidation reverse head-and-shoulders pattern, as we can see from the...

READ MORE

MEMBERS ONLY

DJT Has Closed Last Week's Gap, But is It Enough?

by Martin Pring,

President, Pring Research

Sometimes, simple indicators like bar or candlesticks operate just as the textbooks tell us they should. I don't normally follow individual stocks, but the hype surrounding last week's listing of Trump Media piqued my interest to see if the technical position squared with what the many...

READ MORE

MEMBERS ONLY

Business Confidence and Stocks | Focus on Stocks: April 2024

by Larry Williams,

Veteran Investor and Author

Here comes the answer to a very old question, "Do stocks lead the economy, does the economy lead the stock market, or is there something else?"

My work has shown numerous times that GDP is not a good predictor of the Dow Jones. Also, business inventories and a...

READ MORE

MEMBERS ONLY

Don't Bet on Lower Rates

by Martin Pring,

President, Pring Research

To paraphrase the late great contrarian Humphrey Neil: When everyone thinks alike, it's usually time to look for a turn in the market.

It seems to me, after reviewing an unscientific survey of the financial media, that everyone and his dog (no disrespect to our canine friends) is...

READ MORE

MEMBERS ONLY

Is China a Basket Case or a Screaming Buy?

by Martin Pring,

President, Pring Research

By now it's common knowledge that the Chinese property sector is in crisis, foreign investment has slowed, and youth unemployment is at record levels. Should be time to sell Chinese equities, right? After all, we don't know when the other shoe is going to drop. They...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" March 19, 2024 Recording

by Larry Williams,

Veteran Investor and Author

It's March Madness in the stock market!

In this video, Larry begins by presenting his Trading Days of the Month (TDOM) for the rest of March, as well as the days to hold back on trading. He also presents what he dubs his "Machu Picchu" trade....

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs NEXT WEEK - Tuesday, March 19th at 2:00pm EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Tuesday, March 19 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

The Business Cycle is Edging its Way to a More Inflationary Stage

by Martin Pring,

President, Pring Research

Last week, I pointed out the inflationary consequences of the recent gold breakout, as gold market participants initially expect prices to firm up in the commodity pits and later the CPI itself. This week, we will take those thoughts a step further by relating swings in industrial commodity prices to...

READ MORE

MEMBERS ONLY

Everyone Has a Plan Until They Get Punched in the Face. Did Jerome Powell Just Get Punched in the Face?

by Martin Pring,

President, Pring Research

The title of this article may be exaggerated, but, last Friday, the probabilities for an upward reversal in the rate of inflation later this year went substantially higher. That's because the gold price, an inflationary bellwether, broke out from a 4-year trading range to a new all-time high....

READ MORE

MEMBERS ONLY

Three Intermarket Relationships That Say This Bull Market is Going Higher

by Martin Pring,

President, Pring Research

Absorbing the information gleaned from monthly charts for various asset classes or sectors can help gain some perspective. However, I find that an examination of the relationships between them can be equally rewarding, if not moreso. That's because they point out the nature of the current investment environment,...

READ MORE

MEMBERS ONLY

The False Flag of Fed Rate Cuts | Focus on Stocks: March 2024

by Larry Williams,

Veteran Investor and Author

Let's begin this month with a look at...

The False Flag of Fed Rate Cuts

Day after day, we hear how the Fed will embark on a series of rate cuts this year "because inflation has peaked" and is heading lower. The drop in inflation is...

READ MORE

MEMBERS ONLY

Emerging Markets Getting Closer to a Breakout

by Martin Pring,

President, Pring Research

Last November I asked the question "Are emerging markets about to emerge?"Using the iShares MSCI Emerging Markets ETF (EEM) as our benchmark, I concluded that more strength was needed in order to push the indicators into a bullish mode. In the intervening period, things have improved, but...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" February 15, 2024 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry begins by presenting two trade recommendations, then digs into AI stocks, Bitcoin, and what you should be doing right now. Is it time to go long? Go short? Or wait for a decline? He explains the difference between FOMO and actually losing money, and how pain...

READ MORE

MEMBERS ONLY

Gold is at the Crossroad

by Martin Pring,

President, Pring Research

Last November and December, it looked as if gold had broken out from a multi-year inverse head-and-shoulders. Since then, the price has dropped below the breakout area, and the long-term KST has begun to roll over.

Just like takeoff and landing are the critical points for an aircraft, breakouts are...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, February 15th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this coming Thursday, February 15 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current...

READ MORE

MEMBERS ONLY

Only a Fool Would Try to Call a Correction in a Bull Market, So Here Goes!

by Martin Pring,

President, Pring Research

The vast majority of the primary trend indicators are pointing to a bull market and have been doing so for the better part of a year. Chart 1, for instance, shows that NYSE Margin Debt, or rather its long-term KST, has only recently gone bullish. The vertical lines point out...

READ MORE

MEMBERS ONLY

Home Prices and Stocks | Focus on Stocks: February 2024

by Larry Williams,

Veteran Investor and Author

Let's begin this month with a look at ...

Home Prices and Stocks

Most people have the majority of their money in homes and/or stocks. Thus, I thought that this month, I would take a look at what should be happening in the real estate market.

Let'...

READ MORE

MEMBERS ONLY

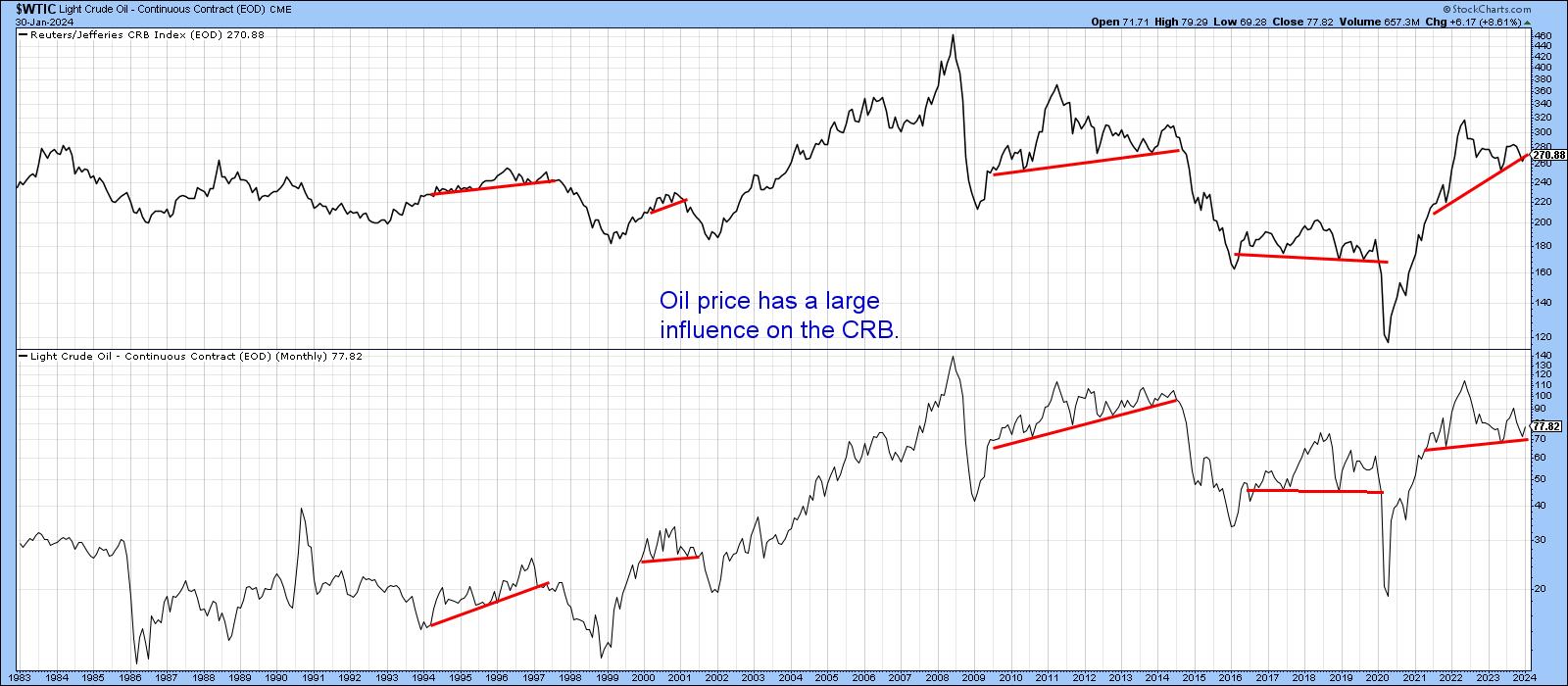

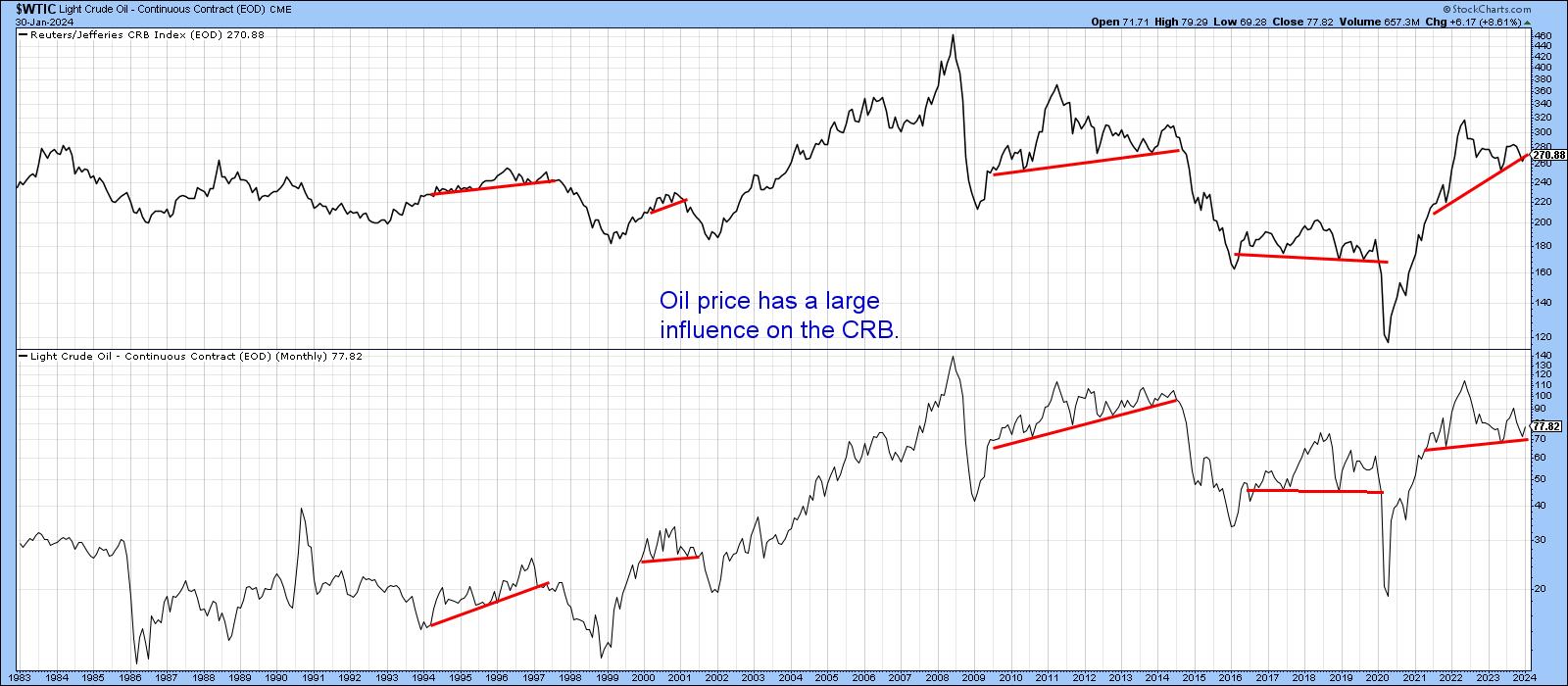

Is Oil Going Up or Down?

by Martin Pring,

President, Pring Research

Oil is not only an important commodity in and of itself, but is also one has a substantial influence on commodity indexes in general. Its weight in the CRB Composite is 23%; for energy in total, it is 39%. Chart 1 compares the oil price to the CRB Composite, where...

READ MORE

MEMBERS ONLY

What Does Dow Theory Say About This Market?

by Martin Pring,

President, Pring Research

Some tools in technical analysis are totally objective, such as a moving average crossover. It may be debatable whether it's a decisive signal or not, but a crossover is nevertheless a crossover. Dow Theory, on the other hand, is much more subjective and, therefore, open to interpretation. For...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" January 16, 2024 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry digs into rate cuts and how they affect the markets. When interest rates are high, money is in circulation. He's been watching the rate of inflation; as he notes, an object in motion tends to stay on the same path. He also warns against...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Buying Bitcoin ETFs is the Easy Part, But What Comes Next?

by Martin Pring,

President, Pring Research

Last week, eight new Bitcoin-based ETFs began trading courtesy of recent SEC approval. This launch was well anticipated, as the price had already run up in the hope that these new buyers would push it to an even higher level. The thought occurred to me that the situation is not...

READ MORE

MEMBERS ONLY

Larry's First LIVE "Family Gathering" Webinar of 2024 Airs NEXT WEEK - Tuesday, January 16th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this coming Tuesday, January 16 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current...

READ MORE

MEMBERS ONLY

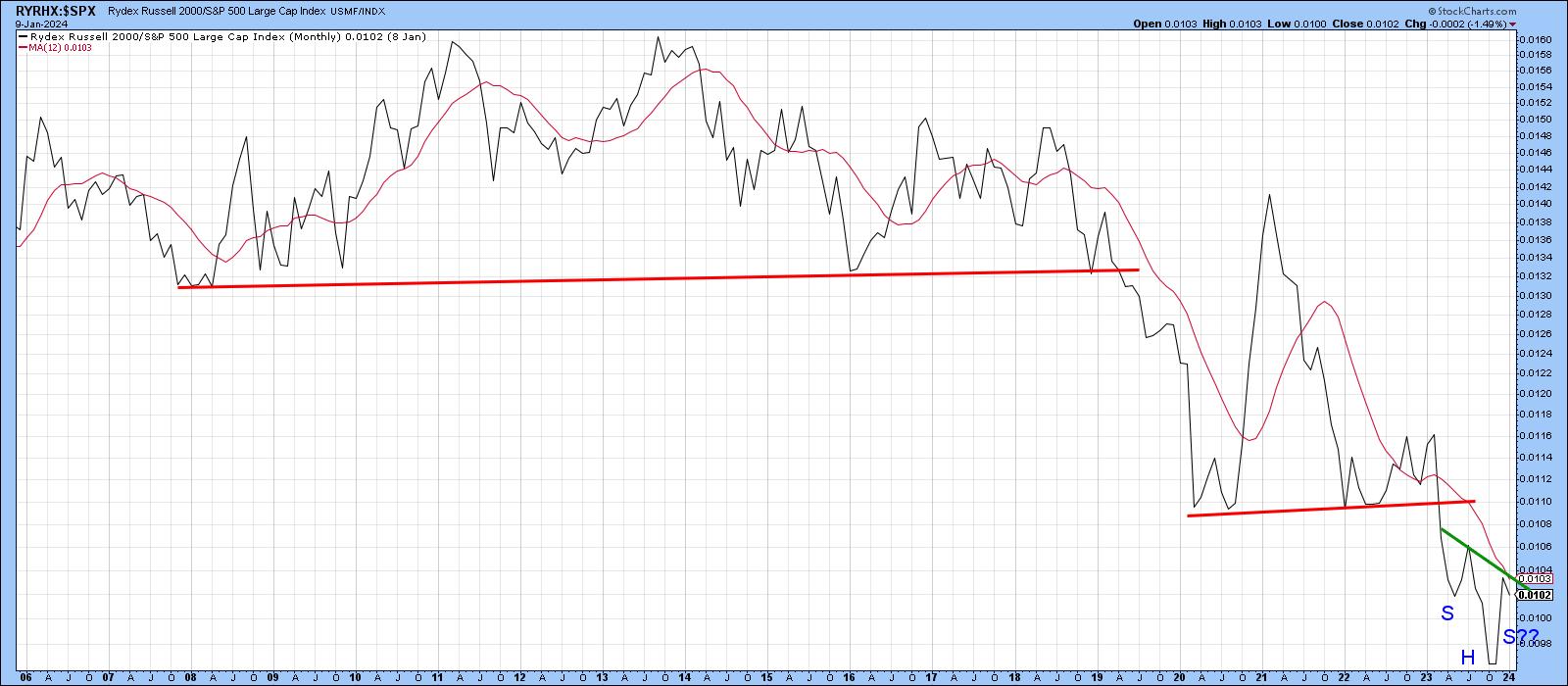

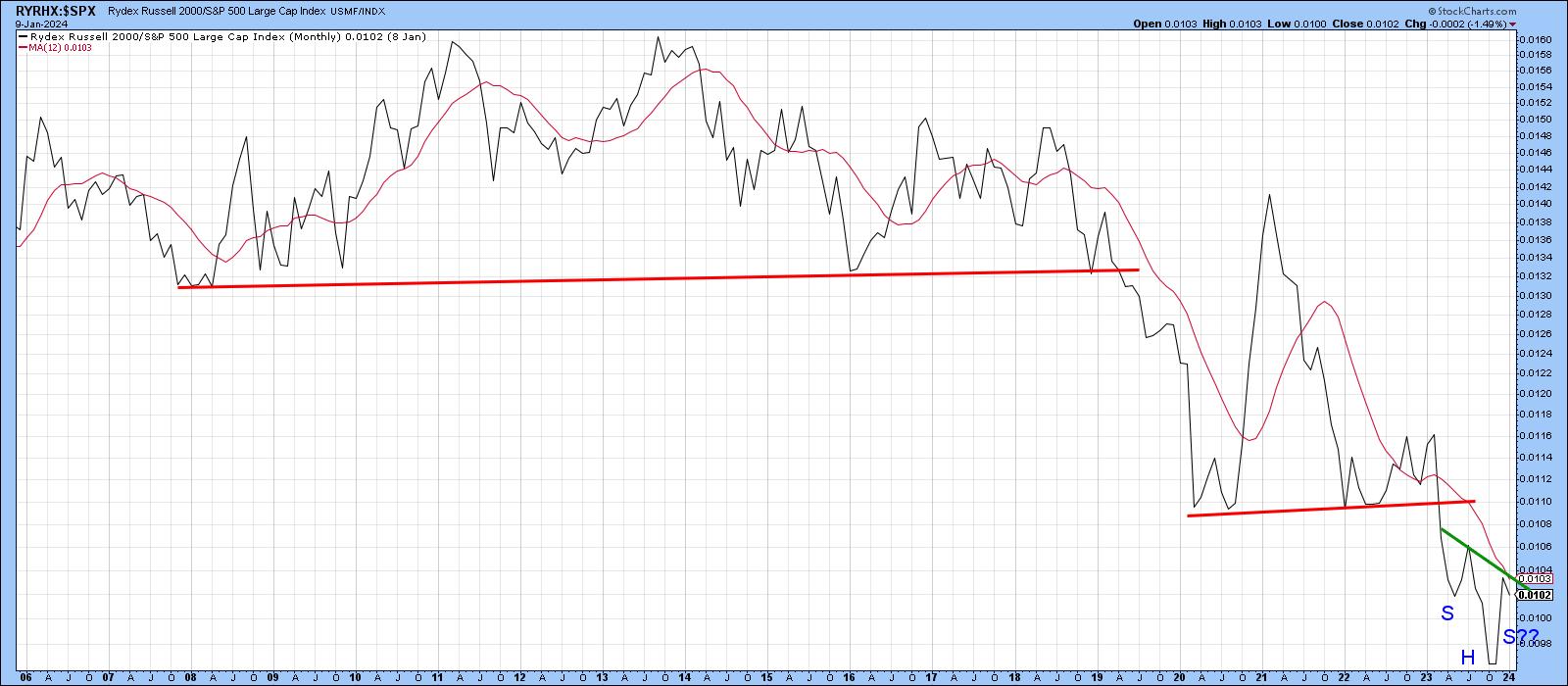

Is it Prime Time for Small Caps?

by Martin Pring,

President, Pring Research

A couple of weeks ago, I took note of the widespread interest in small caps amongst the technical community. I don't normally follow cap plays, but my contrary bones began to shake when I saw such acclaim at their recent performance following several false dawns in the last...

READ MORE