MEMBERS ONLY

STOCK INDEXES CLEAR JUNE HIGH -- TEST OF 200-DAY AVERAGES MAY BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

JUNE HIGHS CLEARED... Last week's message showed major stock indexes testing initial resistance at their June highs, and suggested that an upside penetration of that resistance could lead to a possible test of their 200-day moving averages. Those June highs have since been exceeded. Chart 1 shows the...

READ MORE

MEMBERS ONLY

Good Inflation News is Helping Stocks Move Through Resistance -- But is It Enough?

by Martin Pring,

President, Pring Research

The summer rally has enabled several indexes to push through important resistance, but, since there was a lot of backing and filling at higher levels earlier this year, there are several places where even more resistance is apparent.

If you want to be bullish, for instance, take a look at...

READ MORE

MEMBERS ONLY

STOCK RALLY CONTINUES -- SOME POTENTIAL UPSIDE TARGETS -- NASDAQ TESTS DOWN TRENDLINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

INTERMEDIATE TERM RALLY CONTINUES... The stock rally that started in mid-June continues to gain ground which confirms that the market has put in an intermediate term bottom. The question is how far that intermediate rally can rally within the current downtrend. Hopefully, the charts shown below will help determine where...

READ MORE

MEMBERS ONLY

Indexes Back to Their Breakdown Points; Should We Pop the Champagne If They Go Through?

by Martin Pring,

President, Pring Research

The rally since mid-June has taken several indexes back to their extended breakdown trendlines, which mark one demarcation point between bull and bear. Chart 1, for instance shows that the NASDAQ completed a top in May and then followed through with further weakness. By mid-June, the Index found a bottom...

READ MORE

MEMBERS ONLY

Markets Ready to Rock & Roll!

by Larry Williams,

Veteran Investor and Author

Markets are getting ready to rock & roll to the upside! In this exclusive StockCharts TV special, Larry has a lot to show you and a lot of education to share. He digs into the three key reasons he's expecting a major rally: panic selling, important buying, and...

READ MORE

MEMBERS ONLY

STOCK INDEXES TEST MOVING AVERAGE RESISTANCE -- ENERGY AND UTILITIES ARE WEEKLY LEADERS -- DROP IN BOND YIELDS MAY BE HELPING STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAIN MORE GROUND... Despite a .75% rate hike by the Fed on Wednesday, and a second quarter of negative GDP growth on Thursday, stock indexes continued to gain ground. And they're in the process of testing some overhead resistance lines. Chart 1 shows the Dow Industrials...

READ MORE

MEMBERS ONLY

The Truth About Recessions

by Martin Pring,

President, Pring Research

This week, we diverge from our normal chart talk to focus on the economy, as the word "recession" is now on virtually every one's lips, provoked by a lot of misinformation.

First, there seems to be a general understanding in the media that the definition of...

READ MORE

MEMBERS ONLY

STOCKS SHOW MODEST WEEKLY GAINS -- BUT DOWNTREND STILL IN EFFECT -- PULLBACK IN BOND YIELDS MAY BE HELPING STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MODEST WEEKLY GAINS... Stock indexes gained some ground this week, but not enough to reverse major downtrends. And they remain below overhead resistance levels. The daily bars in Chart 1 show the Dow Industrials rising to the highest level in six weeks and clearing their 50-day moving average. While that...

READ MORE

MEMBERS ONLY

Housing Data Disappoints, But Housing ETFs Rally

by Martin Pring,

President, Pring Research

Due to its sensitivity to interest rates, housing has the greatest average lead time going into recessions than any other economic (as opposed to financial) indicator. For that reason alone, it is worth examining amid the constant talk of recession.

The HMI vs. Housing Starts

Earlier this week, two important...

READ MORE

MEMBERS ONLY

ONE VERSION OF YIELD CURVE INVERTS -- ANOTHER IS WEAKENING -- ENERGY SECTOR REMAINS WEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN YEAR - TWO YEAR YIELD CURVE INVERTS... Chart 1 shows the spread between the ten year and two year Treasury yields falling below the zero line which signals an inverted yield curve. That means that the shorter two-year yield is now higher than the longer maturity ten-year yield. That...

READ MORE

MEMBERS ONLY

Will the Bond Market Surprise Us?

by Martin Pring,

President, Pring Research

In late April, I wrote that bond yields had run into resistance and a pause in the on-going uptrend was likely. Yields on longer-dated maturities initially moved slightly higher, but are now at approximately the same level as that April article. However, more corrective activity appears likely, as commodities (e....

READ MORE

MEMBERS ONLY

STOCKS SHOW MODEST GAINS ON THE WEEK -- SECTOR BREADTH REMAINS WEAK -- COMMODITIES TEST SUPPORT LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES GAIN ON THE WEEK... Stocks saw modest gains on the week but not enough to disturb their major downtrend. Chart 1 shows the Dow Industrials gaining .77% for the week but remaining well below overhead resistance levels and moving average lines. Chart 2 shows the S&...

READ MORE

MEMBERS ONLY

Credit Spreads May be the Canary in the Financial Mine

by Martin Pring,

President, Pring Research

Waterfall declines leading to capitulation are easy to observe and understand when we have the benefit of hindsight. However, they are almost impossible to identify ahead of time.

One characteristic often associated with such uncomfortable price moves is an unexpected weakening of economic activity, where confidence literally falls off a...

READ MORE

MEMBERS ONLY

STOCKS END SECOND QUARTER ON THE DOWNSIDE -- YIELD CURVE NEARS INVERSION -- SECTOR RANKINGS REMAIN DEFENSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS REMAIN UNDER PRESSURE...Stocks are ending the quarter with more selling. The weekly bars in Chart 1 show the S&P 500 down more than 3% on the week with a monthly loss of more than 8%. For the year, the S&P 500 is down 20%...

READ MORE

MEMBERS ONLY

The Rally Since Mid-June Leaves a Lot to be Desired

by Martin Pring,

President, Pring Research

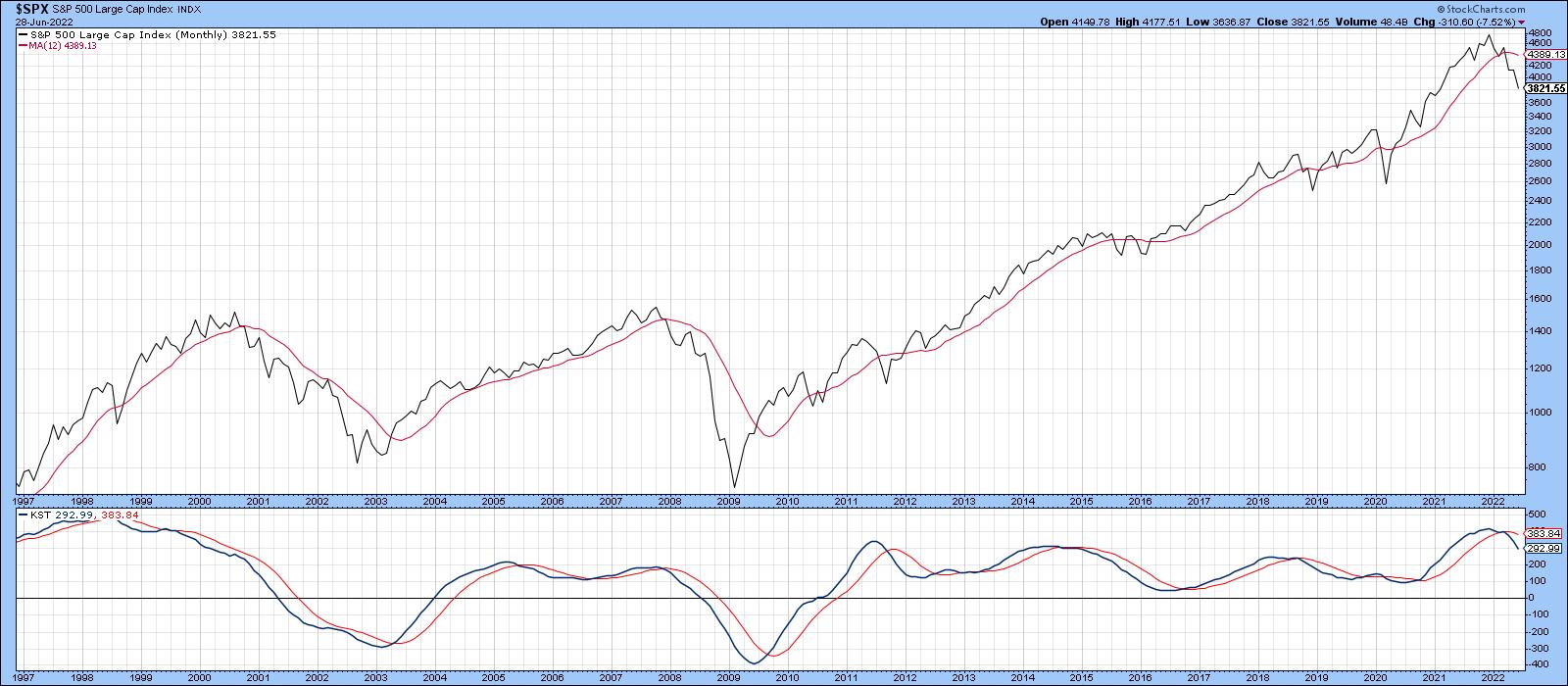

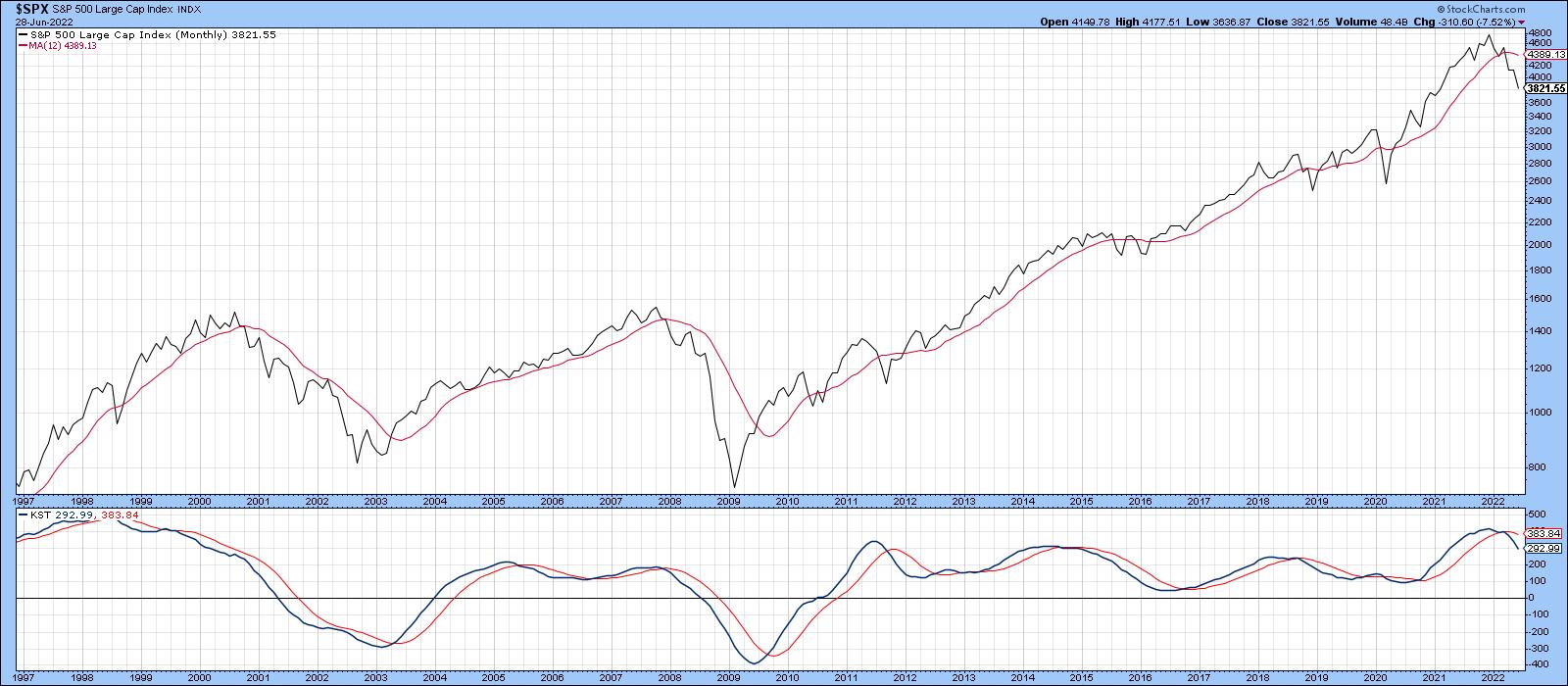

Long-term indicators, such as the KST and the S&P relative to its 12-month MA, remain in a bearish mode, but, that said, it would certainly be unusual to see them turn bullish immediately after the final low. Indeed, Chart 1 shows that the Index is currently well below...

READ MORE

MEMBERS ONLY

STOCKS HAVE A STRONG WEEK WITHIN DOWNTREND -- MARKET BREADTH REMAINS WEAK -- COPPER SELLING SIGNALS ECONOMIC WEAKNESS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BEAR MARKET BOUNCE...Major stock indexes had their first gain in three weeks and made up for the previous week's big losses. But any rebound still has to be viewed as a bear market bounce. The weekly bars in the first three charts below paint a similar picture....

READ MORE

MEMBERS ONLY

Are Commodities Losing their Mojo?

by Martin Pring,

President, Pring Research

Commodities have been on a tear since their lows set in the spring of 2020, but every news outlet you tune into these days is talking about inflation, gasoline in particular. That does not mean that prices cannot go higher. Over the long-term, that's probably a realistic scenario....

READ MORE

MEMBERS ONLY

RISING BOND YIELDS HURT HOMEBUILDERS -- THAT'S HELPING MAKE CONSUMER DISCRETIONARY SECTOR THE WEAKEST PART OF THE MARKET THIS YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING RATES HURT HOMEBUILDERS... Weakness in homebuilding stocks is another sign that the U.S. economy is weakening. Rising mortgage rates which are closely tied to bond yields have a lot to do with that. The brown weekly bars in Chart 1 show the U.S. Home Construction iShares (ITB)...

READ MORE

MEMBERS ONLY

Four Charts that are Acting in an Unintuitive Way

by Martin Pring,

President, Pring Research

Prices often move in the opposite direction to the expectations of most investors and traders. In many cases, that happens because the latest news has already been factored into prices and market participants have already begun to anticipate the next development. For example, a group of institutions might like the...

READ MORE

MEMBERS ONLY

FOUR DECADE HIGH IN INFLATION PUSHES STOCK AND BOND PRICES SHARPLY LOWER -- BOND YIELD NEARING MAJOR UPSIDE BREAKOUT -- NO SIGN OF A TOP IN OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOT CPI REPORT SIGNALS LOWER STOCK PRICES... Friday's report that the May Consumer Price Index gained 8.6% from the previous year was the highest inflation rate in more than forty years and pushed stock prices sharply lower for the day and week. Going into the report, expectations...

READ MORE

MEMBERS ONLY

This Sector Bucked Last Friday's Decline and Could Be Ready to Take Off

by Martin Pring,

President, Pring Research

A couple of weeks ago, I wrote about the fact that the technical position of gold was extremely finely balanced, and that it was "Either in a Hard Place or a Sweet Spot". My conclusion was that its short-term position was improving and that the sweet spot scenario...

READ MORE

MEMBERS ONLY

What Happens When Bonds Start to Outperform Stocks?

by Martin Pring,

President, Pring Research

It is possible for prices of individual asset classes to move in a linear up or down trend for an extended period. However, this rarely happens with inter-asset relationships, which rotate around the business cycle. As a result, it is helpful to monitor inter-asset relationships and their momentum to see...

READ MORE

MEMBERS ONLY

SHORT-TERM STOCK REBOUND NOT THAT IMPRESSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NOT MUCH OF REBOUND...This time last week it seemed clear that stocks had put in a short-term bottom marking the start of a potential bear market rally. So far at least, that rally hasn't gone very far. The three charts shown below show the same overhead resistance...

READ MORE

MEMBERS ONLY

Gold: Either in a Hard Place or a Sweet Spot

by Martin Pring,

President, Pring Research

The long-term technical position of gold is extremely finely balanced and could easily tip into a full-fledged bear market, or start a new secular up leg to the bull trend that began in the opening years of this century.

Chart 1 really says it all. First, it expresses gold adjusted...

READ MORE

MEMBERS ONLY

Where Do We Go From Here? And Will This Rally Last?

by Larry Williams,

Veteran Investor and Author

Larry is back and ready to weigh in with his forecast of where stocks—and the economy—are headed in this new StockCharts TV special. He takes a look at some of the "Fallen Angels" of the market and discusses the ongoing situation with inflation. Afterwards, he focuses...

READ MORE

MEMBERS ONLY

THIS WEEK'S REBOUND SUGGESTS SHORT-TERM STOCK BOTTOM IN PLACE -- BUT HOW FAR CAN IT RALLY?

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEEKLY S&P CHART SHOWS OVERSOLD CONDITION... Stocks are having their best week in two months which suggests that a short-term bottom may be in place. Before looking at daily charts, however, it's worth checking a weekly chart to keep things in perspective. The weekly bars in...

READ MORE

MEMBERS ONLY

It's Time for a Rally, But that Comes with a Catch

by Martin Pring,

President, Pring Research

The stock market's recent sell-off has made the front pages and top headlines in TV broadcasts, and CNN's famous Fear and Greed Index has fallen to an extreme level of fear. My contrarian bones say it's time for a rally. Is that right? Yes...

READ MORE

MEMBERS ONLY

STOCKS REMAIN UNDER PRESSURE -- BREADTH FIGURES CONFIRM BEARISH OUTLOOK

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 REMAINS IN DOWNTREND...Stock prices continue to weaken with no sign of a bottom. The daily bars in Chart 1 show the S&P 500 having fallen to the lowest level in more than a year and nearing a 20% loss which signals a bear...

READ MORE

MEMBERS ONLY

Commodities on the Verge of an Upside Breakout, But Participation Will Likely Narrow

by Martin Pring,

President, Pring Research

Chart 1 shows that the Invesco DB Commodity Tracking Fund could be on the verge of breaking out from a 3-month consolidation pattern. It also points out that the number of commodities participating in the rally has been narrowing of late. That's because the indicator monitoring a universe...

READ MORE

MEMBERS ONLY

USING FIBONACCI RETRACEMENT LINES FOR POTENTIAL DOWNSIDE TARGETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

INFLATION REMAINS THE BIGGEST THREAT TO MARKETS... It was reported this morning that April's Producer Price Index for the past year came in at 11%. That followed yesterday's report that the Consumer Price Index was 8.3%. Both reports confirm that inflation remains dangerously high with...

READ MORE

MEMBERS ONLY

Bitcoin Bubble Finally Bursts

by Martin Pring,

President, Pring Research

I have written two articles about Bitcoin in recent months. The first,last December, concluded that "there are definitely some cracks appearing (in the technical structure), but a shrinking consensus of evidence continues to point to an uptrend." Thesecond, entitled "Has the Bitcoin Bubble Burst", noted...

READ MORE

MEMBERS ONLY

STOCKS RESUME SELLING AFTER FED RELIEF RALLY -- BOND YIELDS NEAR TEST OF OVERHEAD RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK SELLING RESUMES... Stocks are being sold heavily today and are totally reversing yesterday's Fed relief rally. Stocks have given back all of Wednesday's price gains and look poised to fall further. Chart 1 shows the Dow Industrials falling sharply today after meeting resistance at their...

READ MORE

MEMBERS ONLY

It's Not What the Fed Does, But How the Market Reacts to its Decision, That Counts

by Martin Pring,

President, Pring Research

I'll get to the Fed element later, but, first, a few words on the Dow Jones Global Stock Index. Chart 1 shows that it has been experiencing a series of declining peaks and troughs since last November. That's not a bullish sign. Neither is the fact...

READ MORE

MEMBERS ONLY

NASDAQ BREAKS SUPPORT -- THE DOW AND S&P 500 MAY BE NEXT -- HALFWAY TO RECESSION?

by John Murphy,

Chief Technical Analyst, StockCharts.com

A BAD APRIL ENDS UNDER PRESSURE... Stocks fell sharply on Friday to end one of the weakest months in recent memory. The Nasdaq market lost -13.2% to register its worst month since 2008. The S&P 500 and Dow lost -8.8% and -4,9 % and experienced the...

READ MORE

MEMBERS ONLY

Yields May Be Peaking for a While

by Martin Pring,

President, Pring Research

A few weeks ago, I wrote a piece entitled "The Fed Raises Rates; What if it's Already Priced into the Market?". The idea was to point out that the Fed is a lagging indicator and that multiple bond yields had already reached mega resistance in the...

READ MORE

MEMBERS ONLY

HAWKISH FED PUSHES STOCKS SHARPLY LOWER -- MAJOR INDEXES SUFFER DOWNSIDE REVERSAL DAY -- 200 DAY AVERAGES PROVIDE RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

50-BASIS POINT HIKE ON THE TABLE FOR FED MAY MEETING... Today's statement by Fed Chairman Jerome Powell that a 50-basis point rate hike was on the table for May, combined with other hawkish comments, pushed stocks sharply lower today. And their technical condition continues to weaken. Particularly disturbing...

READ MORE

MEMBERS ONLY

Does Recent Stock Market Action Indicate a Recession?

by Martin Pring,

President, Pring Research

I've been reading and hearing a lot about an impending recession, which reminds me of the saying that, when everyone thinks alike, everyone is usually wrong. That's not to say everyone is expecting a recession, but we may have reached a point where there is sufficient...

READ MORE

MEMBERS ONLY

Is it Time to Get Bearish?

by Larry Williams,

Veteran Investor and Author

Larry is back in this new StockCharts TV special! There's a lot of opinions out there about what the curve means and talking heads are flapping all over about inflation. In this video, Larry shows the actual history of what this means so you can make informed decisions....

READ MORE

MEMBERS ONLY

STOCKS END THE WEEK ON THE DOWNSIDE -- SECTOR ALIGNMENTS SEND WARNING SIGNALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS CONTINUE TO WEAKEN... The technical condition of major U.S. stock indexes continues to weaken. All three shown below lost more ground during the week. Chart 1 shows the Dow Industrials meeting overhead resistance near their red 200-day moving average. Chart 2 shows the S&P 500 trading...

READ MORE

MEMBERS ONLY

Has the Bitcoin Bubble Burst?

by Martin Pring,

President, Pring Research

In early December of last year, I wrote an article on whether Bitcoin had reached the tipping point in terms of signaling a peak in the crypto bubble. Some may disagree about the "bubble" label; however, it seems to me that a financial category coming out of nowhere...

READ MORE