MEMBERS ONLY

Week Ahead: While NIFTY Continues To Consolidate, Watching These Levels Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the truncated week due to one trading holiday, the markets extended their gains and closed the week on a positive note. While remaining largely within a defined range, the Nifty continued consolidating above its 200-DMA while not adopting any sustainable directional bias. Though the Index continued defending its key...

READ MORE

MEMBERS ONLY

Stock Market Wrap: Stocks Rebound as May Kicks Off with a Bang—What Investors Should Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* A strong jobs report sparked a stock market rally, with major indexes closing the week higher.

* Positive earnings from Microsoft and Meta Platforms took the Nasdaq Composite above its 50-day moving average.

* Financials, Industrials, and Technology were the leading sectors this week, with Financials showing technical strength.

We...

READ MORE

MEMBERS ONLY

The Hidden Meaning Behind the Tech Sector's Rally (And How to Spot It)

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Technology stocks are back in the lead, with ETFs like XLK showing notable performance.

* MarketCarpets gives you a quick snapshot of sector trends and market breadth.

* Indicators like the Bullish Percent Index and CMF suggest XLK may be approaching overbought territory, highlighting the need to be cautious.

When...

READ MORE

MEMBERS ONLY

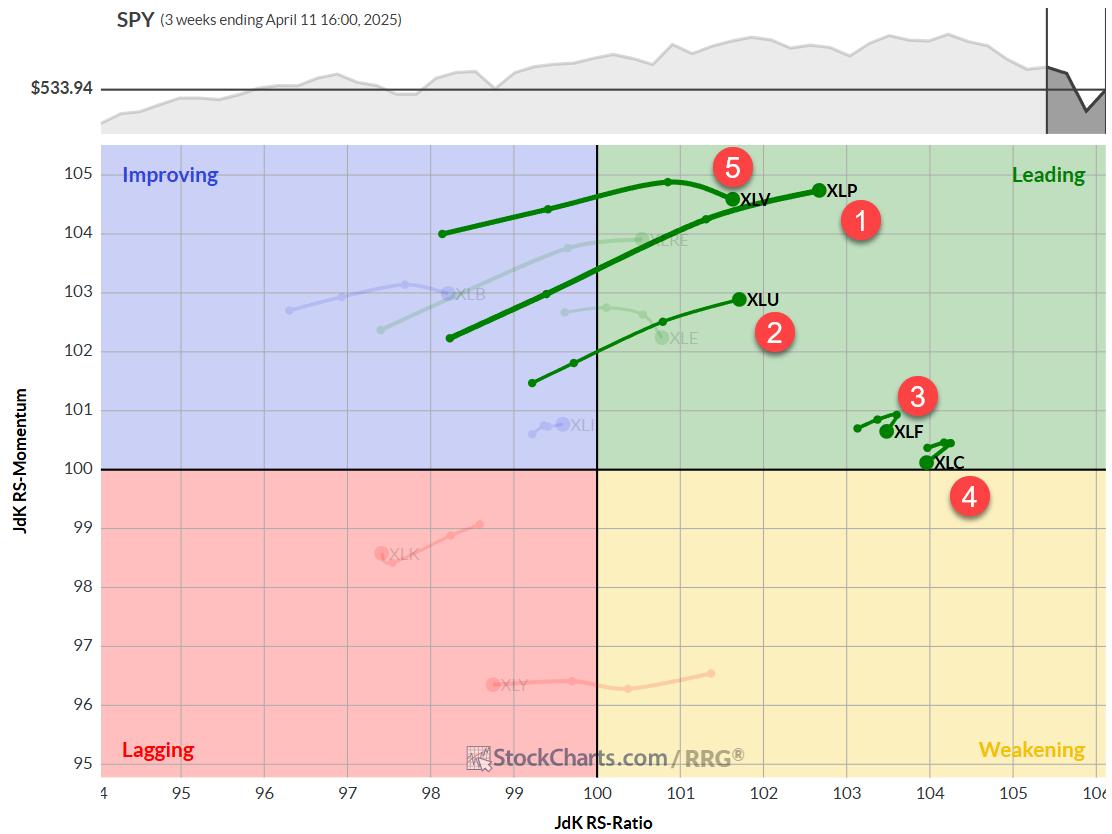

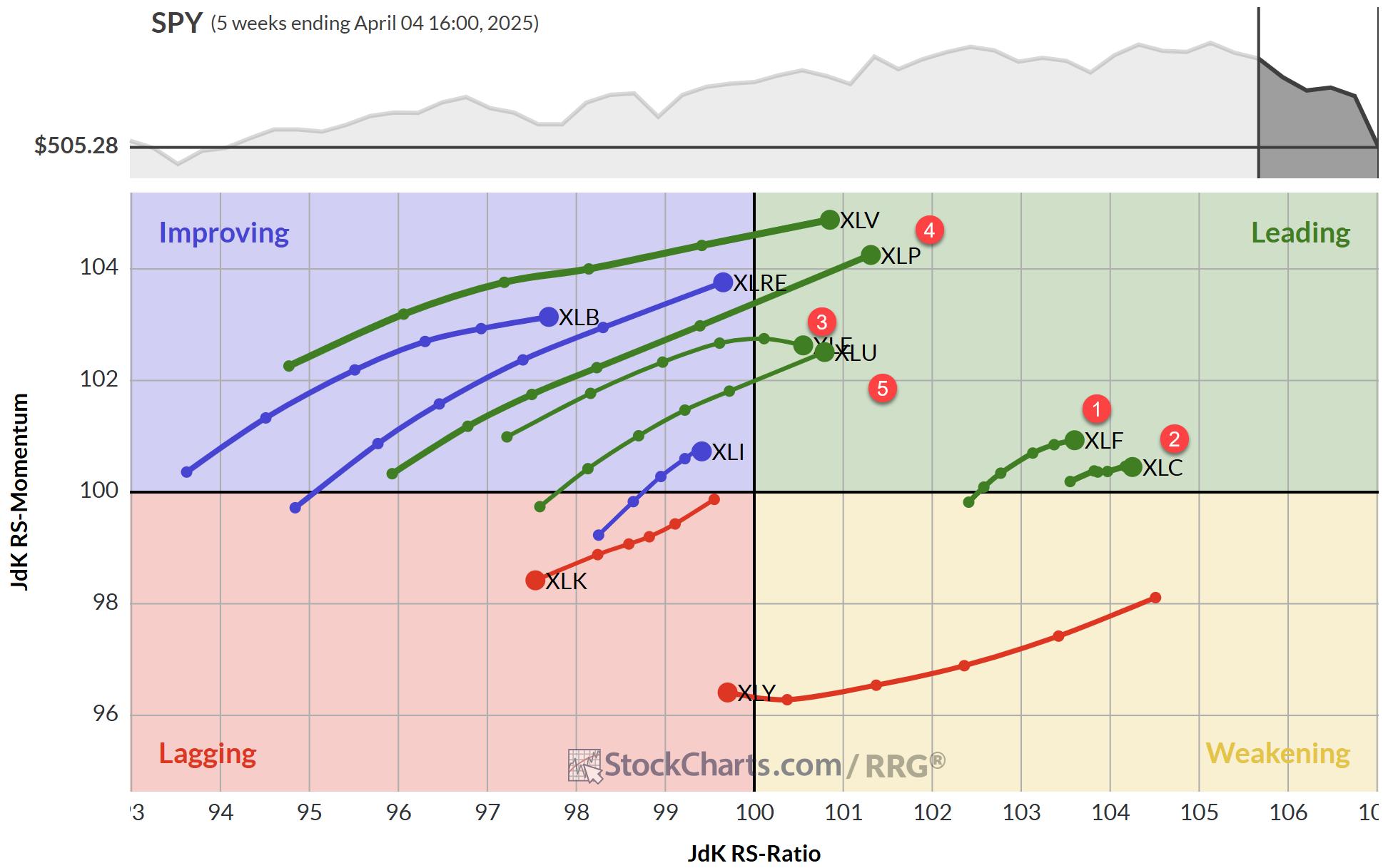

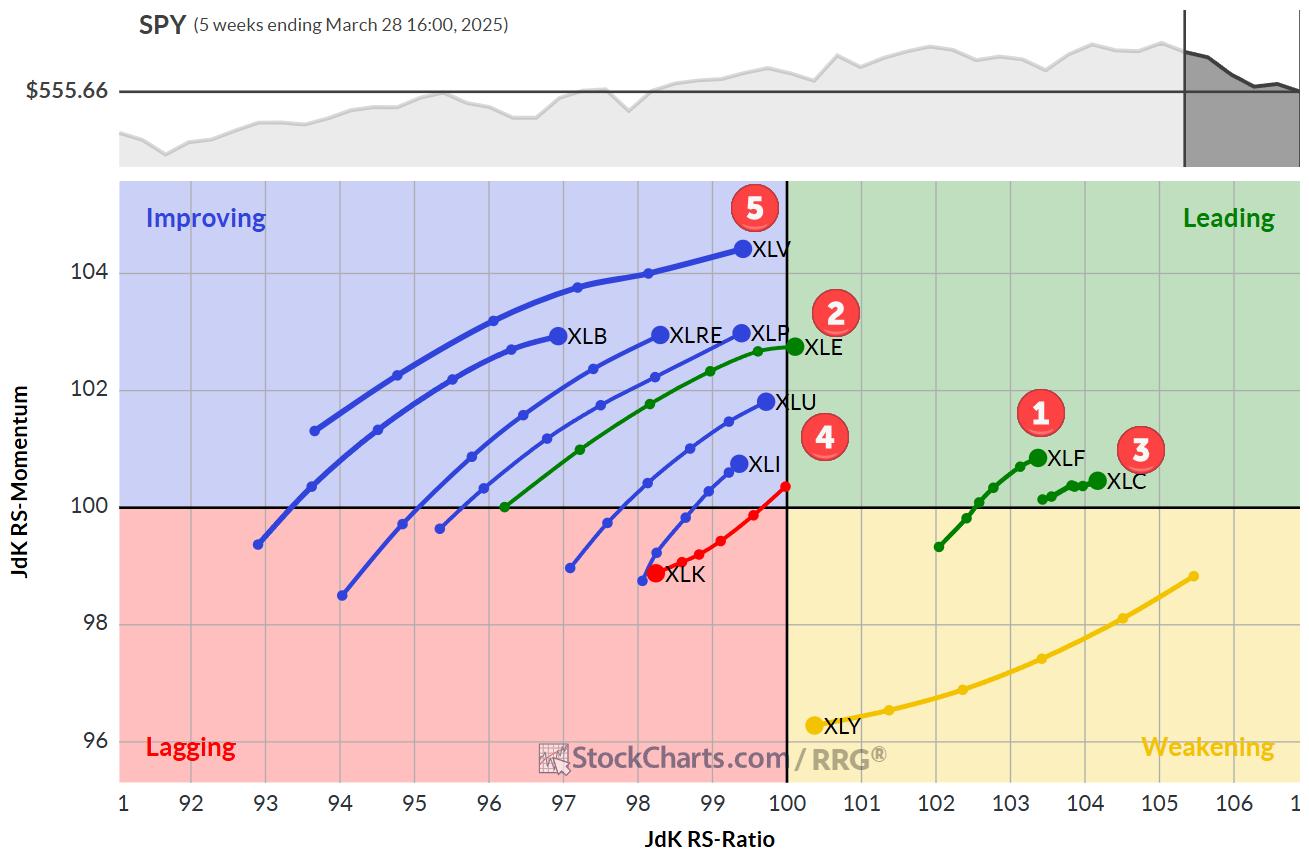

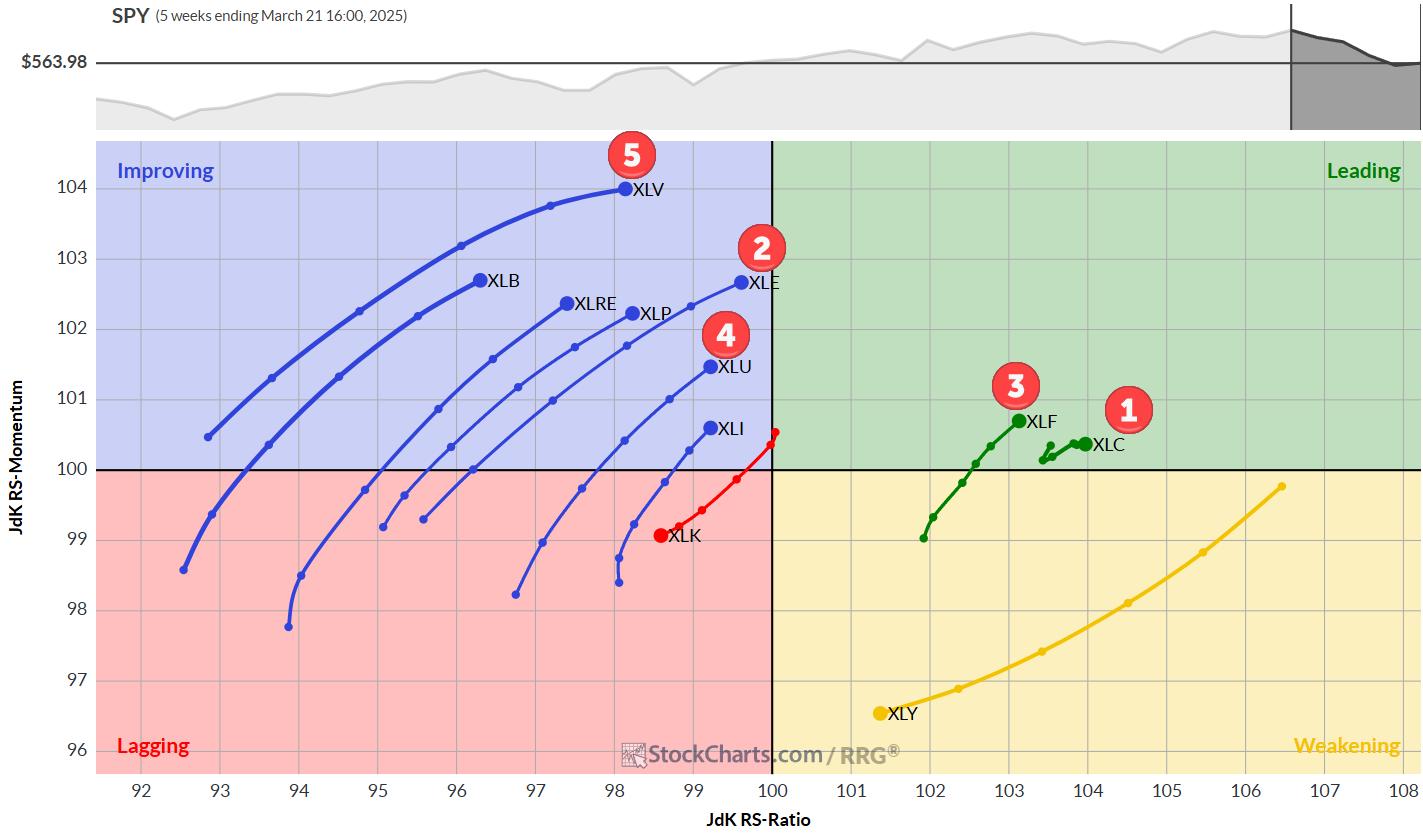

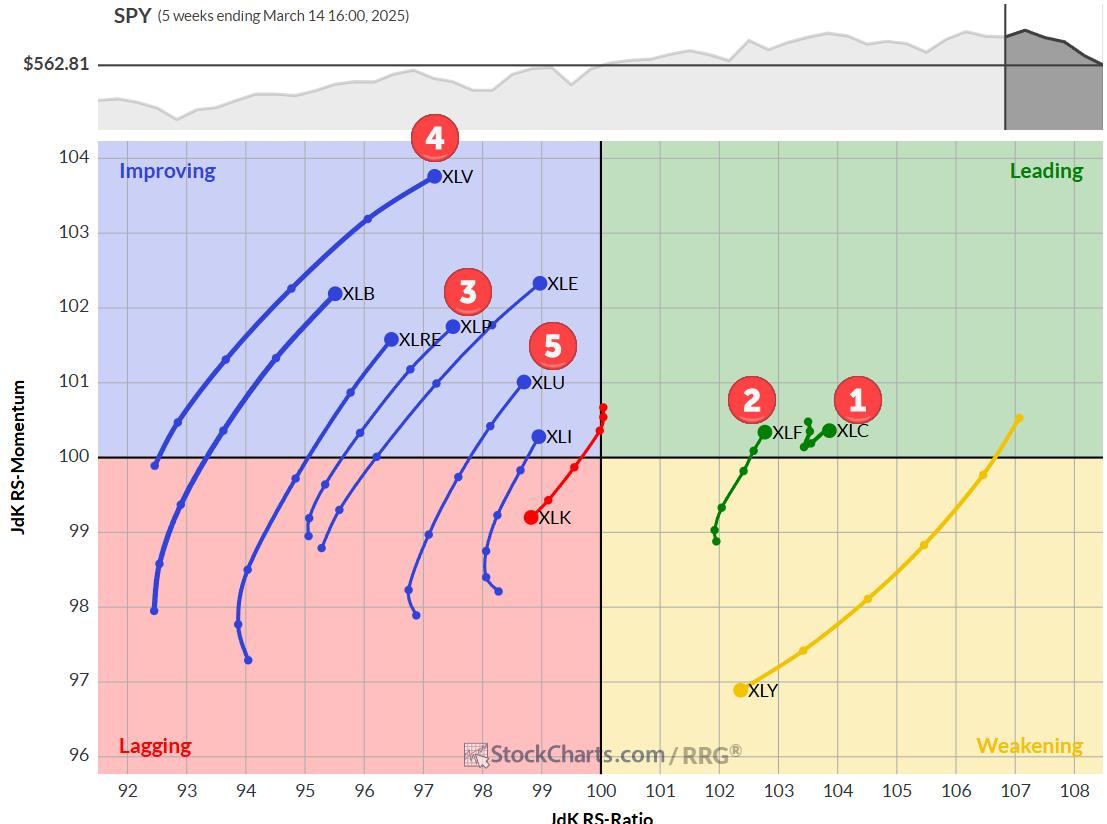

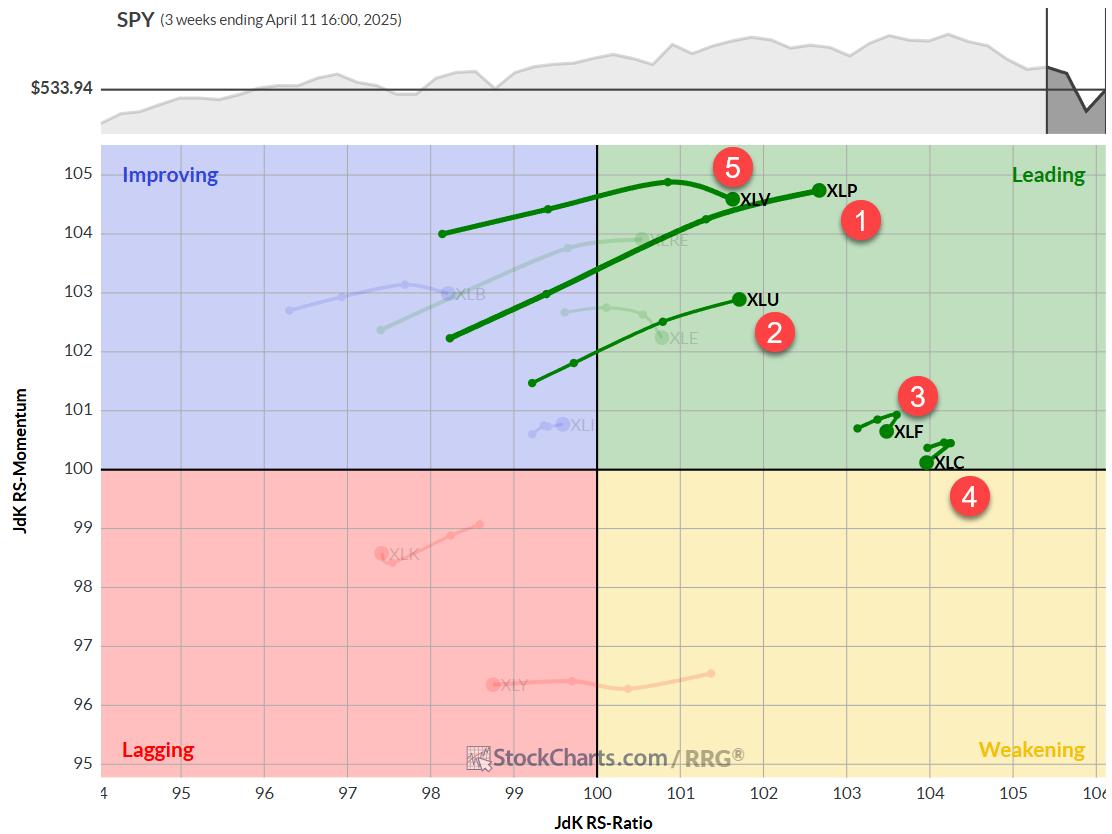

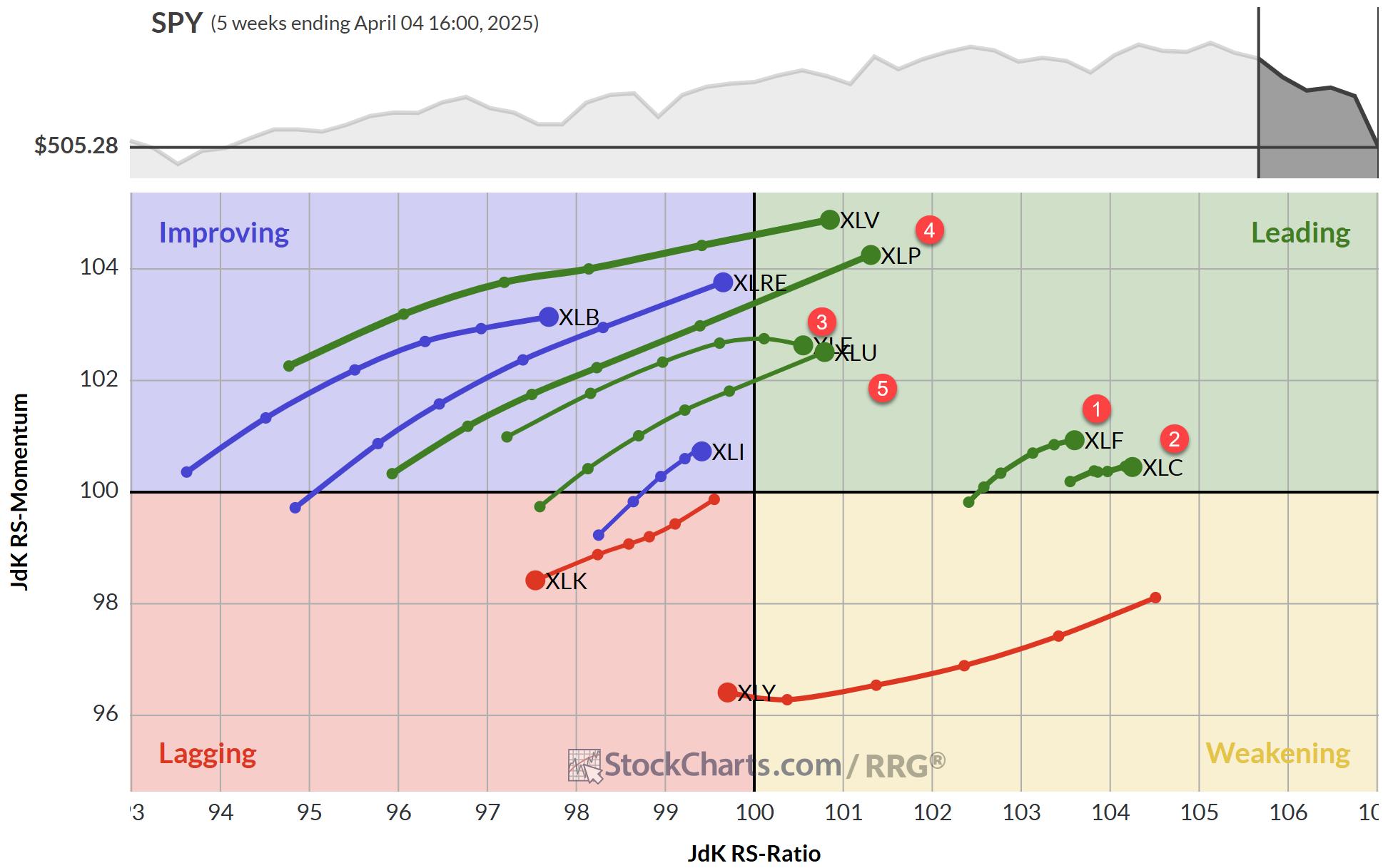

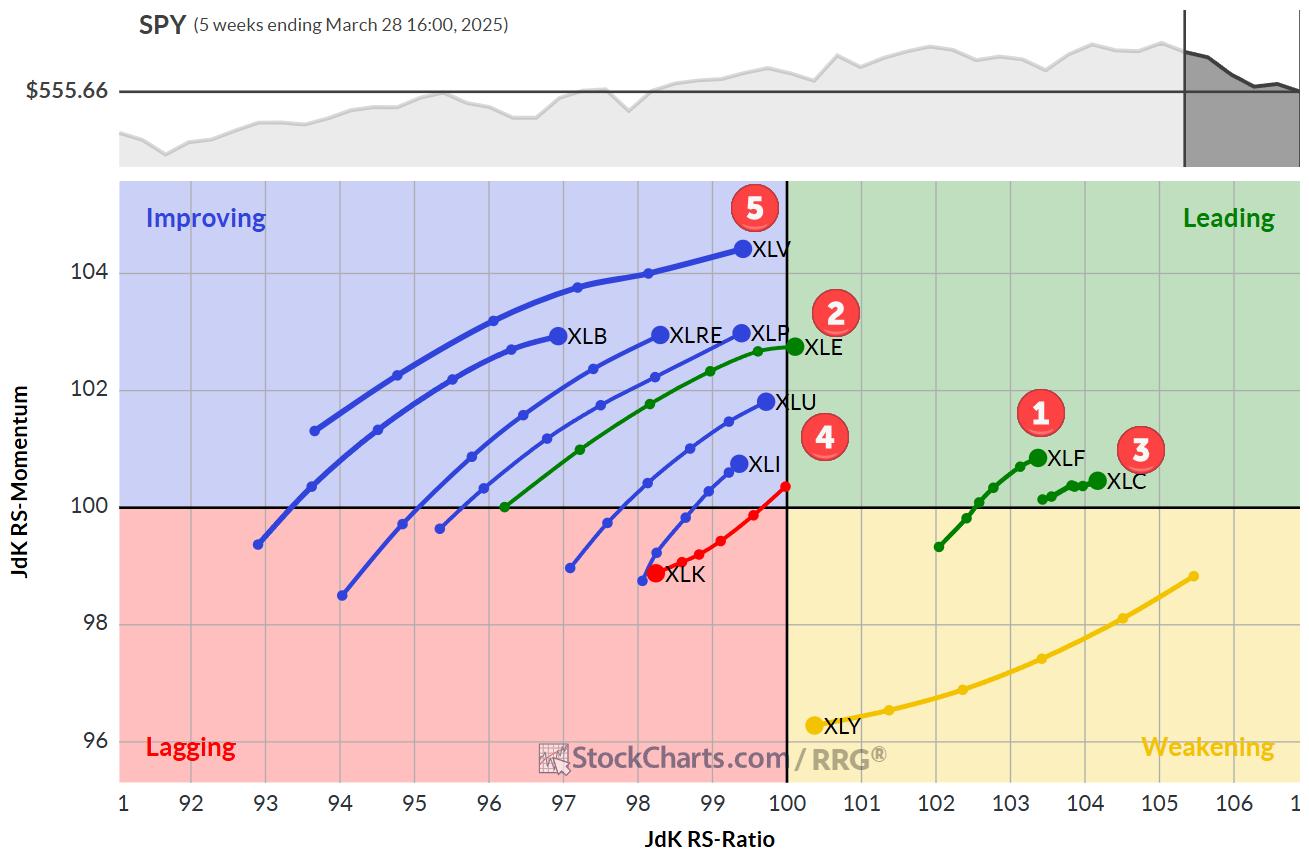

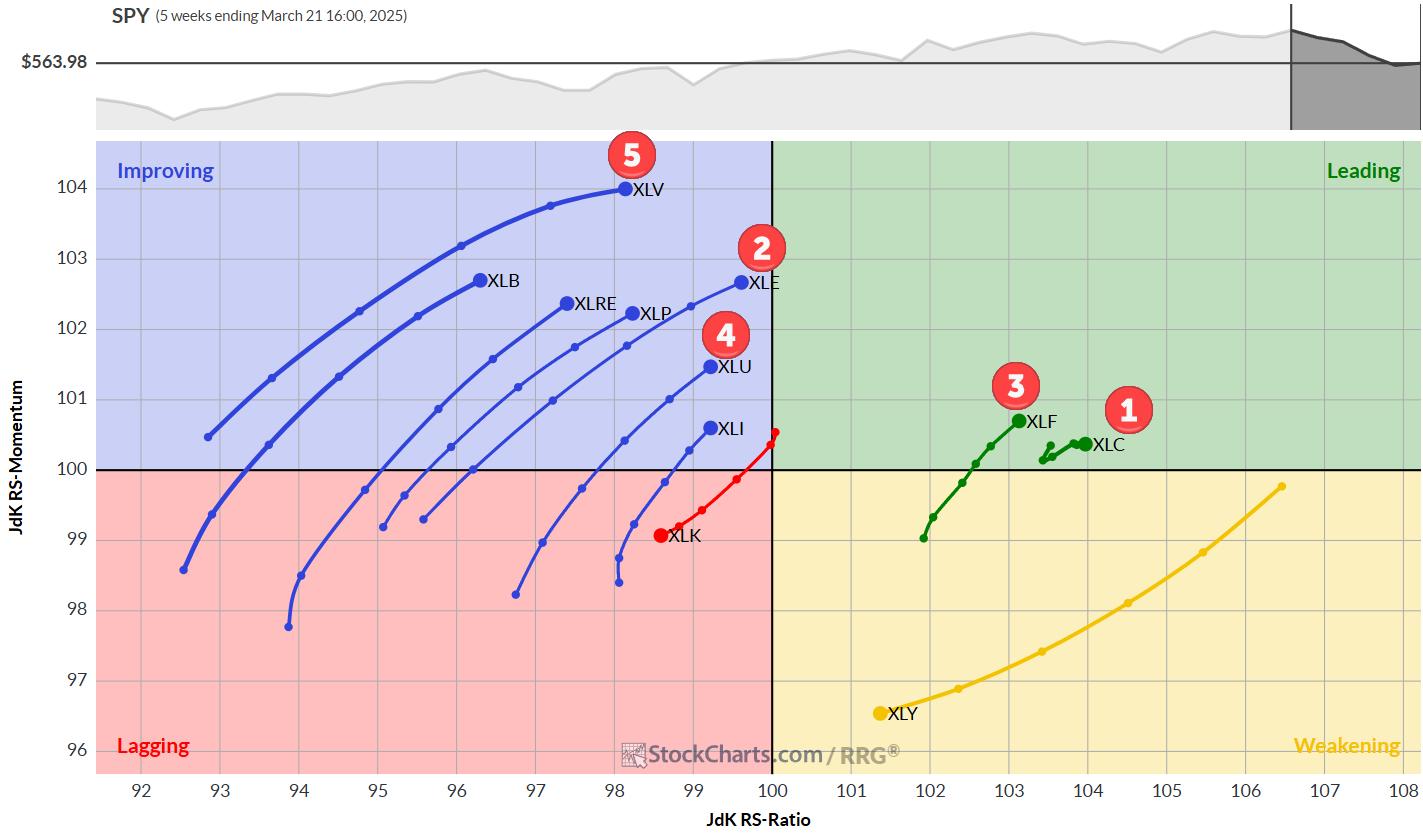

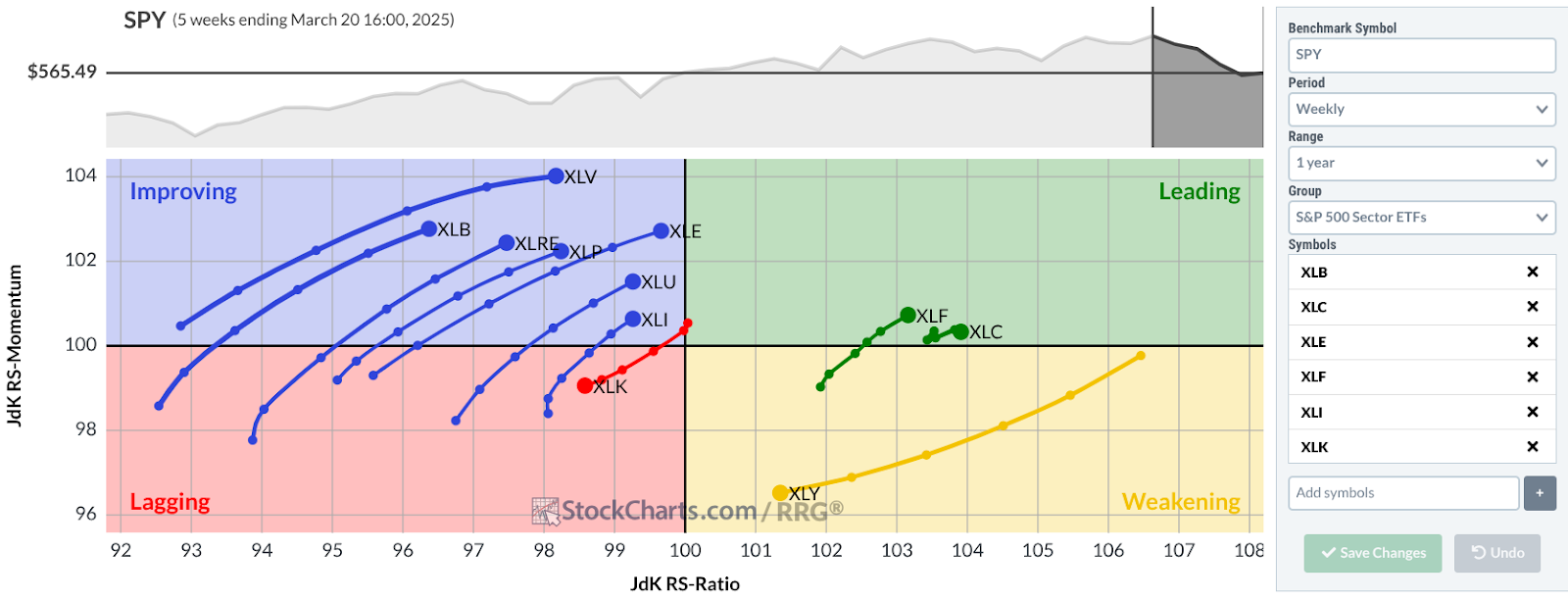

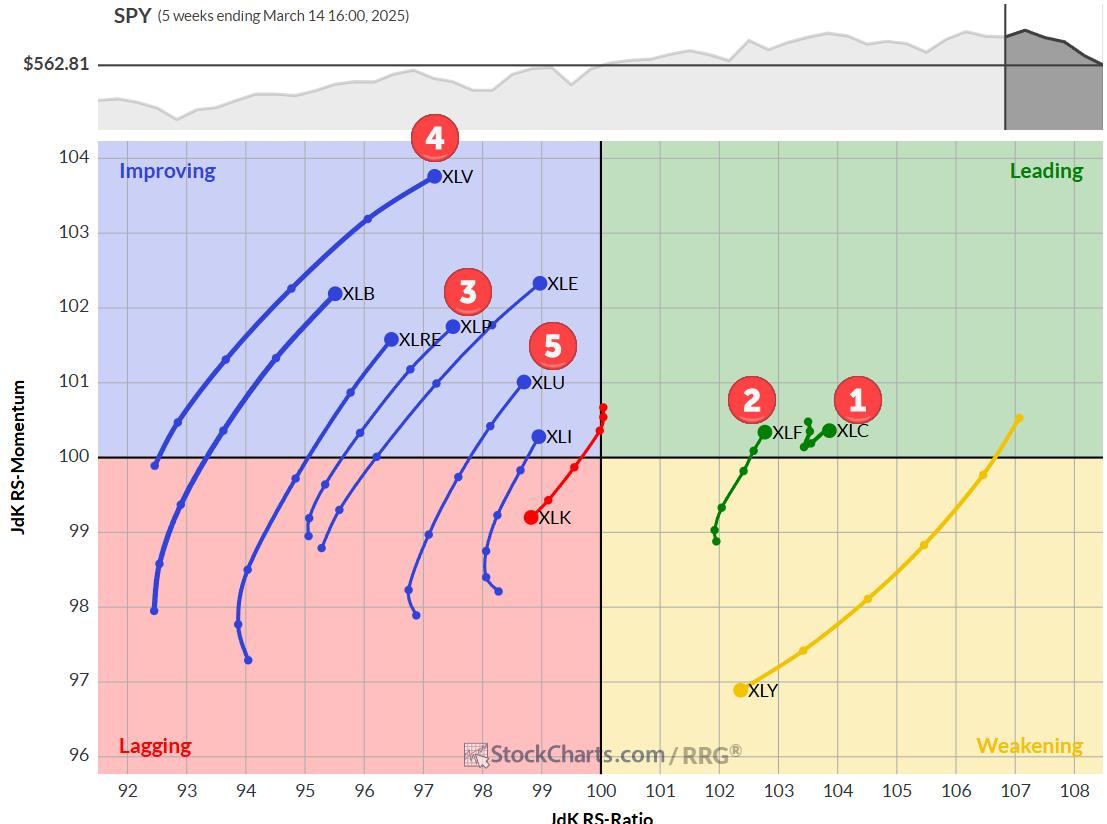

Sector Rotation + SPY Seasonality = Trouble for Bulls?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video, Julius analyzes current asset class rotation, revealing why stocks in the lagging quadrant may signal continued market weakness. By combining sector rotation trends—particularly strength in defensive sectors—with SPY seasonality, Julius builds a compelling case that downside risk in the S&P 500 may outweigh...

READ MORE

MEMBERS ONLY

Big Tech, Big Data, Big Moves: Why This Week Could Be a Market Game-Changer

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market is holding steady after last week's bounce, but remains hesitant.

* Big tech earnings and economic data are the focus this week.

* Sector rotation indicates that investors are shifting to defensive mode.

Speaking overall, the stock market hasn't changed course after last...

READ MORE

MEMBERS ONLY

Our Very Last Trading Room

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, Carl and Erin made a big announcement! They are retiring at the end of June so today was the last free DecisionPoint Trading Room. It has been our pleasure educating you over the years and your participation in the trading room has been fantastic! Be sure and sign up...

READ MORE

MEMBERS ONLY

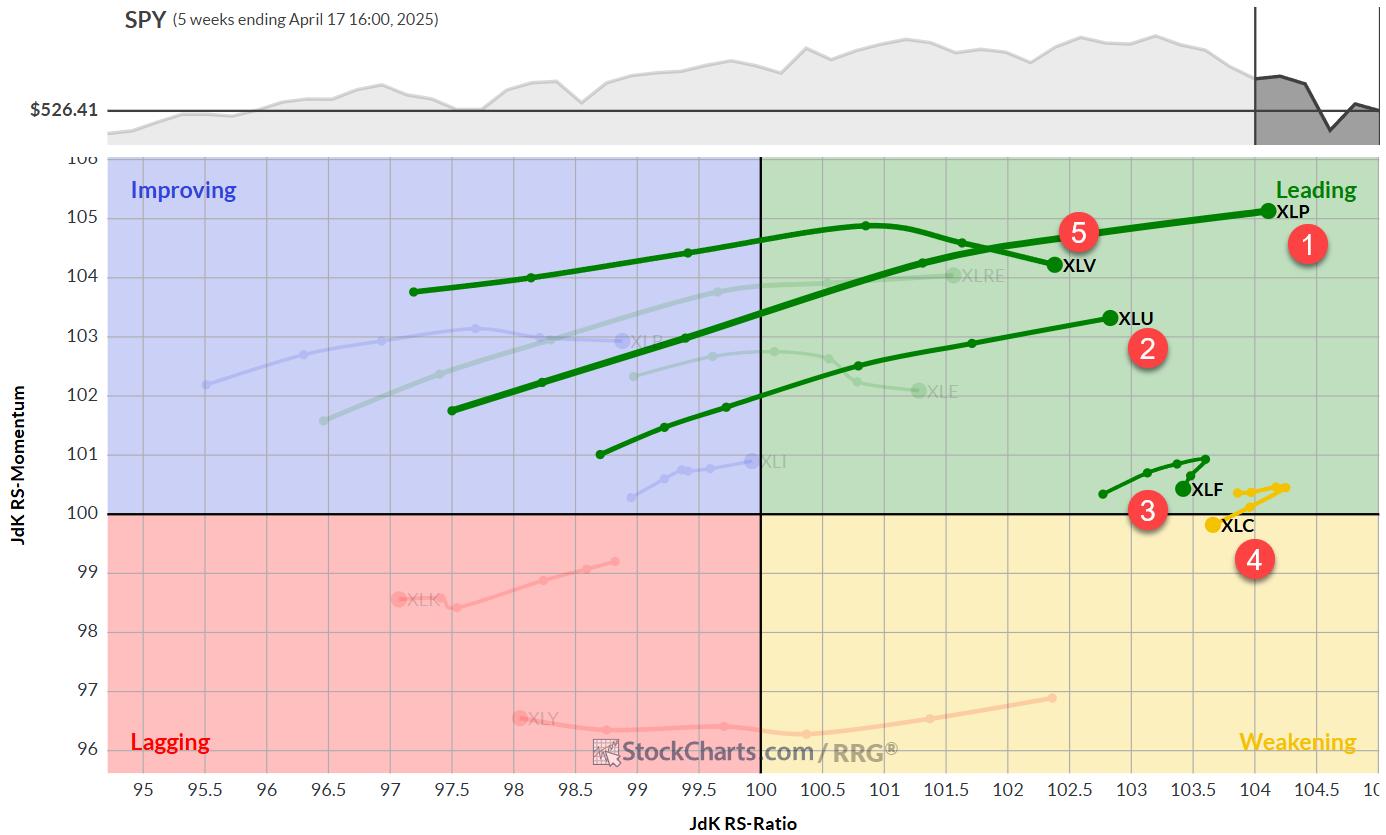

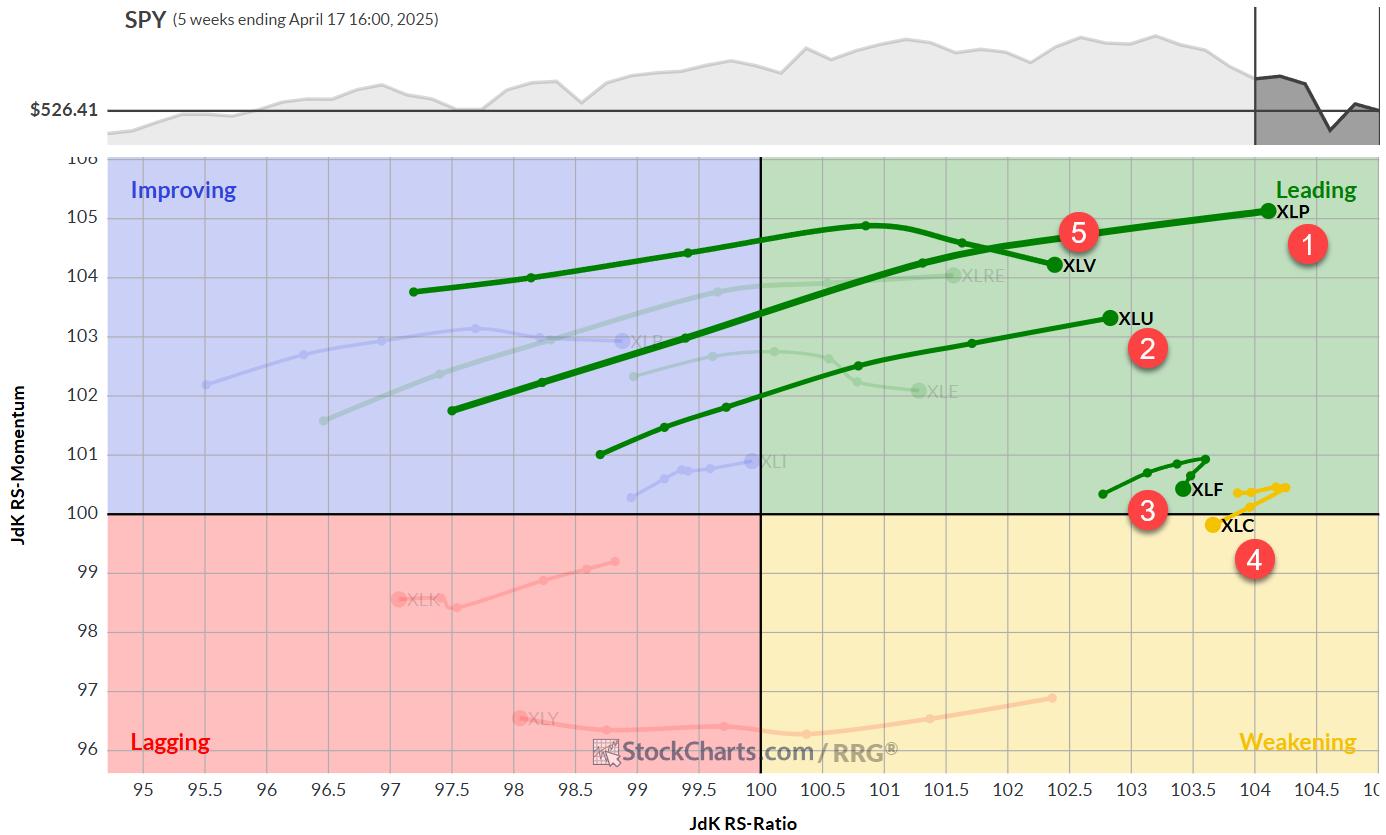

The Best Five Sectors, #17

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Defensive sectors maintain dominance in top 5, despite strong market performance.

* Real Estate enters top 5, replacing Health Care; Consumer Staples, Utilities, and Financials remain stable in top 3 positions.

* Defensive positioning has put a dent in portfolio performance after strong week.

Real Estate and Healthcare Swapping Positions...

READ MORE

MEMBERS ONLY

Week Ahead: RRG Indicates Sector Shifts; NIFTY Deals With These Crucial Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a strong move the week before, the markets took on a more consolidatory look over the past five sessions. Following ranged moves, the Nifty closed the week on just a modestly positive note. From a technical standpoint, the Nifty tested a few important levels on both daily and weekly...

READ MORE

MEMBERS ONLY

Top Stock Areas After the Rally: What Smart Money Is Buying

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, after last week's sharp market rally, Mary Ellen breaks down where the markets stand now, which leading sectors are showing the most strength, and how to recognize if your stocks are entering a new uptrend. Get expert insights on market leadership, sector rotation, and key...

READ MORE

MEMBERS ONLY

Navigate Market Shifts Like a Pro: Utilize This Key Indicator Effectively

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Market breadth indicators are flashing a bullish signal.

* Sector rotation is favoring risk-on investing.

* The Zweig Breadth Thrust triggered a signal, indicating a reversal from bearish to bullish conditions.

After weeks of uncertainty, the stock market finally gave us something to smile about. The major indexes just wrapped...

READ MORE

MEMBERS ONLY

DP Trading Room: Long-Term Outlook for Bonds

by Erin Swenlin,

Vice President, DecisionPoint.com

The market continued to slide lower today as the bear market continues to put downside pressure on stocks in general. Bonds and Yields are at an inflection point as more buyers enter the Bond market which is driving treasury yields higher. What is the long-term outlook for Bonds? Carl gives...

READ MORE

MEMBERS ONLY

Safer Stock Picks for an Uncertain Market (High Yield + Growth)

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, as earnings season heats up, Mary Ellen reviews current stock market trends, highlighting top-performing stocks during past bear markets that are showing strength again today. She also shares a proven market timing system that's signaled every stock market bottom, helping investors stay ahead of major...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #16

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer staples and utilities continue to lead sector rankings.

* Defensive sectors are showing strength in both weekly and daily RRGs.

* Health care struggling, but maintains position in top 5

* RRG portfolio slightly underperforming S&P 500 YTD, but gap narrowing.

Top 5 Remains Unchanged

The latest sector...

READ MORE

MEMBERS ONLY

Week Ahead: What Should You Do as Nifty Marches Higher Towards the Resistance Zone?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by was a short trading week with just three trading days. However, the Indian equities continued to surge higher, demonstrating resilience, and the week ended on a positive note.

During the week before last, the Nifty was able to defend the 100-week MA; last week, it...

READ MORE

MEMBERS ONLY

Sector Rotation Update: Value Stocks and Bonds Lead the Way!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stocks vs. bonds? In this video, Julius breaks down the asset allocation outlook and why defensive sectors, large-cap value, and bonds may continue to outperform in this volatile market. He starts at the asset allocation level using Relative Rotation Graphs (RRGs) to analyze stocks vs bonds performance, then highlights the...

READ MORE

MEMBERS ONLY

Is This the Confidence Trap That Could Wreck Your Retirement Portfolio?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Despite extreme market volatility, the broader market's uptrend may still be intact.

* Defensive sectors like Consumer Staples and Utilities are flashing bullish signals.

* Defensive sectors don't typically drive uptrends so, depending on your time horizon, you will need to create an appropriate strategy.

If...

READ MORE

MEMBERS ONLY

DP Trading Room: SPX Earnings Update

by Erin Swenlin,

Vice President, DecisionPoint.com

The market has been overvalued for some time but how overvalued is it? Today Carl brings his earnings chart to demonstrate how overvalued the market is right now. We have the final data for Q4 2024.

The market continues to show high volatility but it did calm down somewhat Monday....

READ MORE

MEMBERS ONLY

The Best Five Sectors, #15

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The entire top 5 has now changed positions.

* All defensive sectors are now in the top 5, while Healthcare has reentered.

* Portfolio is now lagging S&P 500.

Healthcare Re-Enters the Top 5

After a wild week in the markets, the sector ranking got quite a shake-up....

READ MORE

MEMBERS ONLY

New US Tariffs and Intensifying US–China Trade War: Economic Implications and Opportunities for India

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In 2024-2025, the United States significantly escalated its trade conflict with China through new tariffs, including a substantial 100% tariff on electric vehicles and 50% on essential technologies like semiconductors and solar products. These measures amplify the existing trade tensions and represent a profound shift towards economic decoupling between the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Continue Staying Volatile; Focus On These Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous weekly note categorically mentioned that while the markets may continue to decline, the Indian equities are set to outperform its global peers relatively. In line with this analysis, the market saw wide swings owing to prevailing global uncertainties but continued showing remarkable resilience against other global indices. The...

READ MORE

MEMBERS ONLY

Market Rally or Fakeout? How Politics and Earnings Are Driving Stocks

by Mary Ellen McGonagle,

President, MEM Investment Research

Stock market rally, sector rotation, and earnings movers dominate this week's analysis with Mary Ellen McGonagle. In this video, Mary Ellen reviews where the market stands after last week's bounce and explains how White House activity drove major price action.

Mary Ellen also highlights two top-performing...

READ MORE

MEMBERS ONLY

DP Trading Room: Key Support Levels for the SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

The market is in a tailspin as tariffs add volatility to the market. Carl and Erin believe the SPY is in a bear market given key indexes like the Nasdaq are already in bear markets. It's time to consider where the key support levels are.

Carl addressed his...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #14

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer Staples replaces Healthcare in top 5

* More defensive rotation underway

* RRG portfolio remains in line with market performance

This article was first posted on 4/4/2025 and contained only rankings and charts. Then updated with comments 4/7/2025

I am attending and speaking at the...

READ MORE

MEMBERS ONLY

Market Drop Compared to 2020: What You Need to Know Now

by Mary Ellen McGonagle,

President, MEM Investment Research

How low can the S&P and the Nasdaq fall? More importantly, how can an investor navigate this volatile environment?

In this eye-opening video, Mary Ellen McGonagle delves into the stock market's fall, identifies key support levels, and compares them to past bear markets. She also discusses...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set To Open Lower; Relative Outperformance Against Peers Expected To Continue

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week was short; the Indian markets traded for four days owing to one trading holiday on account of Ramadan Id. However, while staying largely bearish, the markets weathered the storm inflicted by the US announcing reciprocal tariffs on almost everyone and kicking off a serious trade war. The...

READ MORE

MEMBERS ONLY

Sentiment Is Near-Perfect for a Rally: One Thing Could Stand In the Way

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* Several sentiment indicators have reached levels that usually fuel a worthwhile rally or jump-started a new bull market.

* Sentiment indicators could be at levels that are ripe for a rally but keep an eye on them.

* The absence of a rally could increase the odds of a bull...

READ MORE

MEMBERS ONLY

DP Trading Room: Magnificent Seven Stocks in Bear Markets

by Erin Swenlin,

Vice President, DecisionPoint.com

You may not know it, but all of the Magnificent Seven stocks are in bear markets. Given they are such an integral part of the major indexes, we have to believe that the market will follow suit and continue lower in its own bear market. The SP500 is in correction...

READ MORE

MEMBERS ONLY

Volatility Ahead: What Investors Need to Know Right Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes are showing weakness as more tariff news looms.

* The automobile sector continues to get hammered.

* Bond and precious metals prices are rising, indicating risk-off investor sentiment.

It was an ugly close to another roller-coaster trading week as the stock market struggled with several...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #13

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Financials jump to #1 spot in S&P 500 sector rankings.

* Three sectors now in leading quadrant on weekly RRG

* Only Tech and Consumer Discretionary showing negative RRG headings

* RRG portfolio outperforming S&P 500 YTD by 10 basis points

Financials take the lead.

No changes...

READ MORE

MEMBERS ONLY

These High-Yield Stocks are Still Winning Despite Market Chaos!

by Mary Ellen McGonagle,

President, MEM Investment Research

Is a new market uptrend on the horizon? In this video, Mary Ellen breaks down the latest stock market outlook, revealing key signals that could confirm a trend reversal. She dives into sector rotation, explains why defensive stocks are losing ground, and shares actionable short-term trading strategies for oversold stocks....

READ MORE

MEMBERS ONLY

S&P & Tech Stocks: Will Seasonality Lead to More Pain?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sector rotation is shaping the S&P 500's next big move! In this exclusive StockCharts video,Julius analyzes SPY support levels, key sector trends, and the latest seasonal patterns—which indicate further downside for Technology stocks. He breaks down two critical support areas that could signal the...

READ MORE

MEMBERS ONLY

Unveiling Market Trends: What's Triggering a Midweek Bearish Shift?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tariff concerns were elevated once again on Wednesday after President Trump said he would be making a statement later in the day.

* Technology stocks and automobile stocks were hit hard in Wednesday's trading.

* President Trump's tariff announcement after Wednesday's market close could...

READ MORE

MEMBERS ONLY

DP Trading Room: Tariffs Narrowing, Sparks Market Rally

by Erin Swenlin,

Vice President, DecisionPoint.com

Over the weekend it was announced that tariffs will be narrowing and possibly not as widespread as initially thought. Negotiations are continuing in the background and this seems to be allaying market participants' fears. The market rallied strongly on the news.

Carl and Erin gave you their opinions of...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #12

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy sector jumps to position #2 in top 5

* Consumer Staples drops out of portfolio

* Communication Services remains at #1 spot

* Modest pick up of relative momentum for XLK and XLY not enough yet

Energy Jumps to #2

A big move for the energy sector last week as...

READ MORE

MEMBERS ONLY

The Ultimate Guide to Building a Sector-Diversified Stock Portfolio

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Building a diversified portfolio takes a lot of planning, but it doesn't have to be complicated.

* Diversification helps you manage risk, though it can't eliminate it entirely.

* StockCharts has all the tools you need to construct a sector-diversified portfolio.

You already know about diversification....

READ MORE

MEMBERS ONLY

Riding the Wave: What the Stock Market Rebound Means for Your Investments

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indexes rebounded with Real Estate, Energy, and Consumer Staples leading.

* Retail sales data for February were slightly below expectations but better than January's data.

* Investors are looking forward to Wednesday's FOMC meeting to hear what the committees thoughts are on economic...

READ MORE

MEMBERS ONLY

DP Trading Room: Upside Initiation Climax?

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday DP indicators logged an Upside Initiation Climax. This exhaustion events often mark the beginning of new rallies and could indicate that the market is indeed ready to rebound. However, we do question its veracity given lukewarm trading to begin Monday's trading.

Carl started us off by...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #11

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* At the moment, we're seeing a big shakeup in sector rankings.

* Healthcare has entered the top five.

* Technology is dropping to last position.

* All defensive sectors are now in the top five.

Big Moves in Sector Ranking

The ranking of US sectors continues to shift. At...

READ MORE

MEMBERS ONLY

Is a New Market Uptrend Starting? Key Signals & Trading Strategies

by Mary Ellen McGonagle,

President, MEM Investment Research

Is a new market uptrend on the horizon? In this video, Mary Ellen breaks down the latest stock market outlook, revealing key signals that could confirm a trend reversal. She dives into sector rotation, explains why defensive stocks are losing ground, and shares actionable short-term trading strategies for oversold stocks....

READ MORE

MEMBERS ONLY

Sector Rotation Breakdown: Spotting Market Leaders Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes US sector rotation using Relative Rotation Graphs (RRG), starting with the 11 S&P sectors and breaking them into Offensive, Defensive, and Sensitive sectors to uncover unusual market rotations. He then dives into the Financials sector, identifying top stocks with potential for...

READ MORE