MEMBERS ONLY

Bearish ADX Signal on S&P Plays Out - Now What?

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe revisits a critical ADX signal that gave a major market warning, explaining the pattern and a new low ADX setup to watch. He breaks down SPY and QQQ support zones, sector rotation, and reviews viewer symbol requests including T, WBD, and more. Don'...

READ MORE

MEMBERS ONLY

DP Trading Room: Market Sell-Off

by Erin Swenlin,

Vice President, DecisionPoint.com

The market sell-off continued in earnest after a brief respite on Friday. Uncertainty of geopolitical tensions and tariff talk has spooked the market and given the weakness of mega-cap stocks, we are likely to see more downside before a snapback rally.

Carl was off today so Erin had the controls!...

READ MORE

MEMBERS ONLY

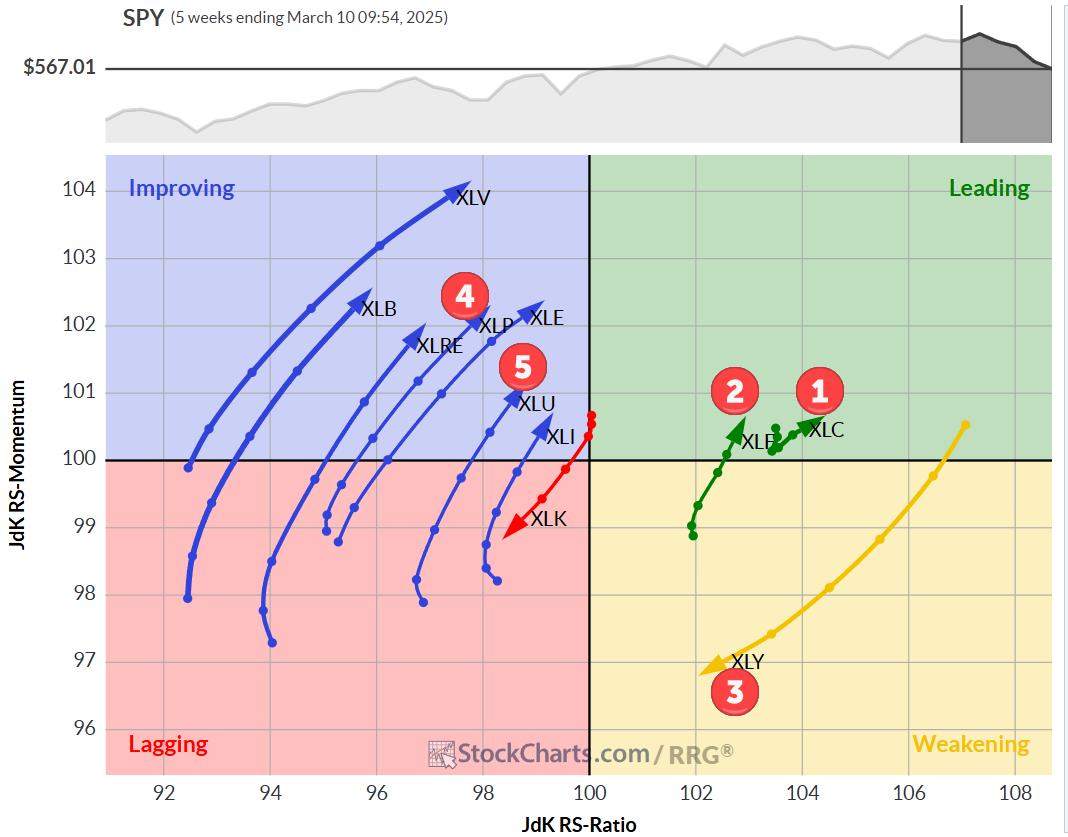

The Best Five Sectors, #10

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

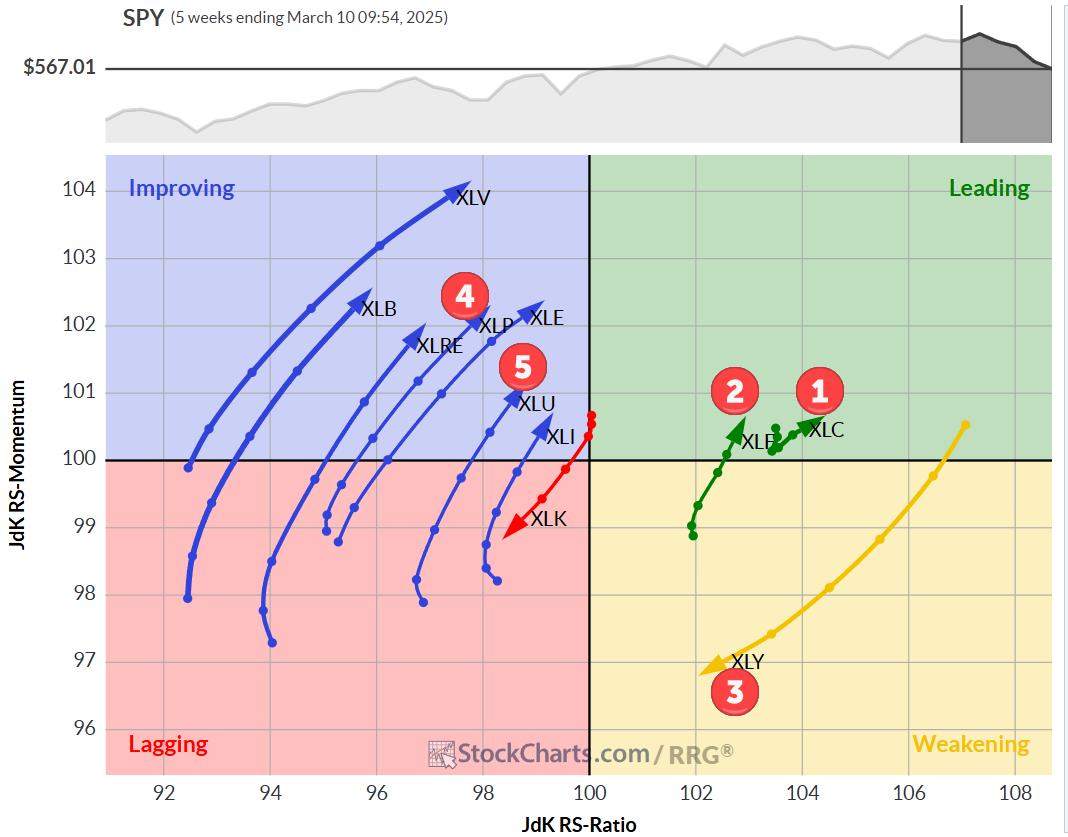

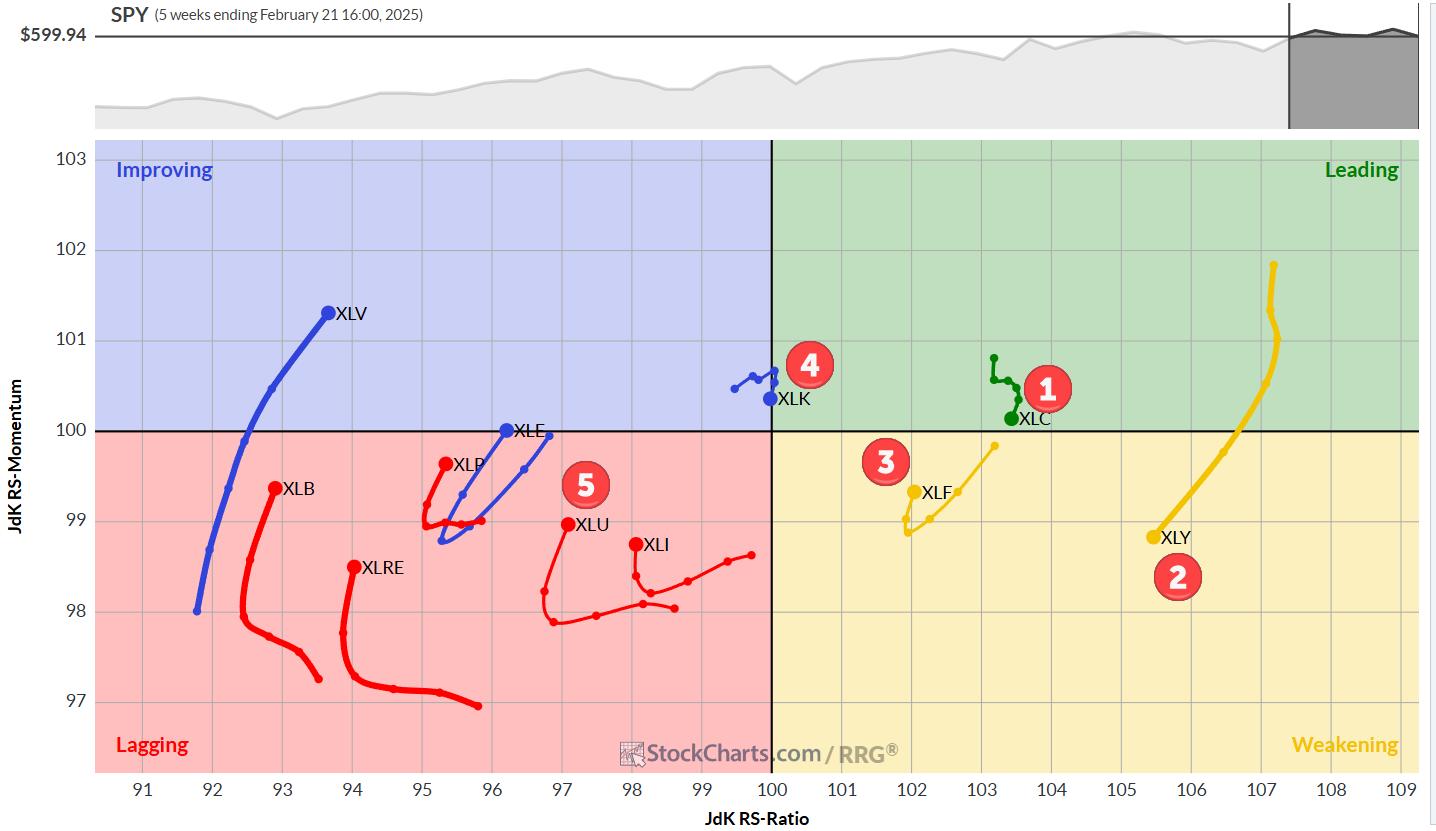

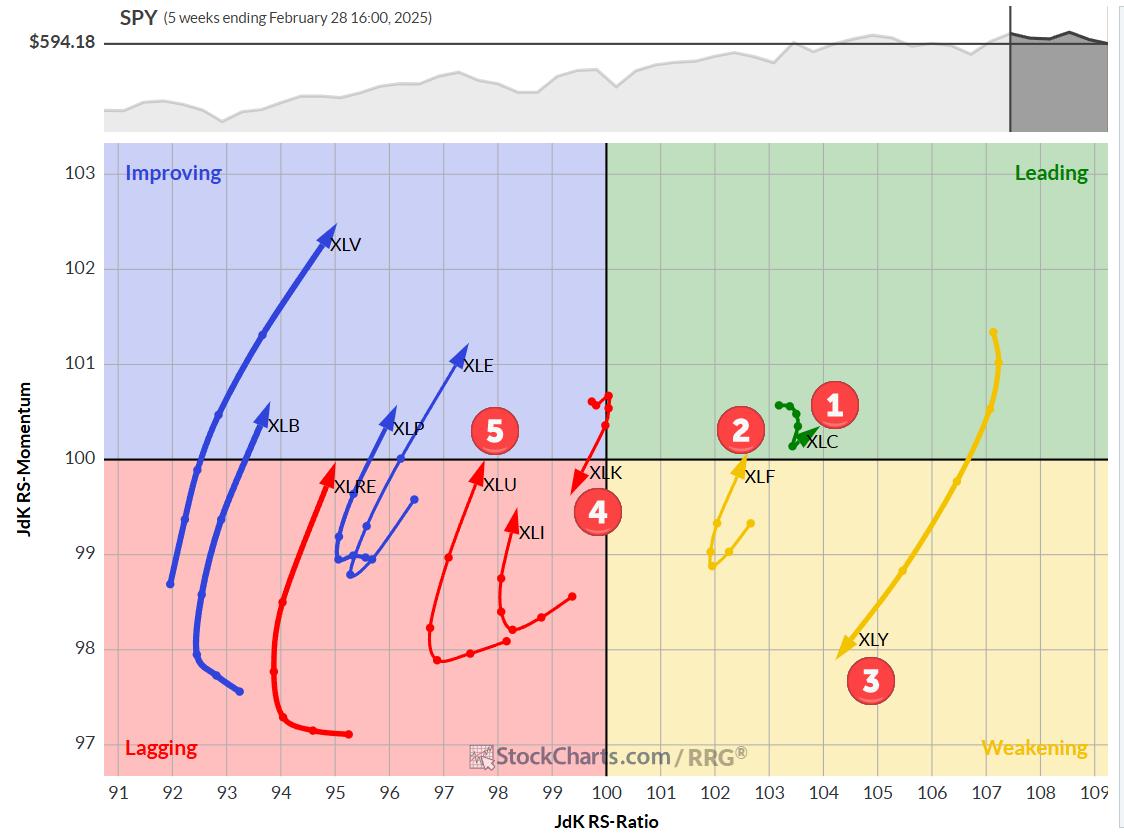

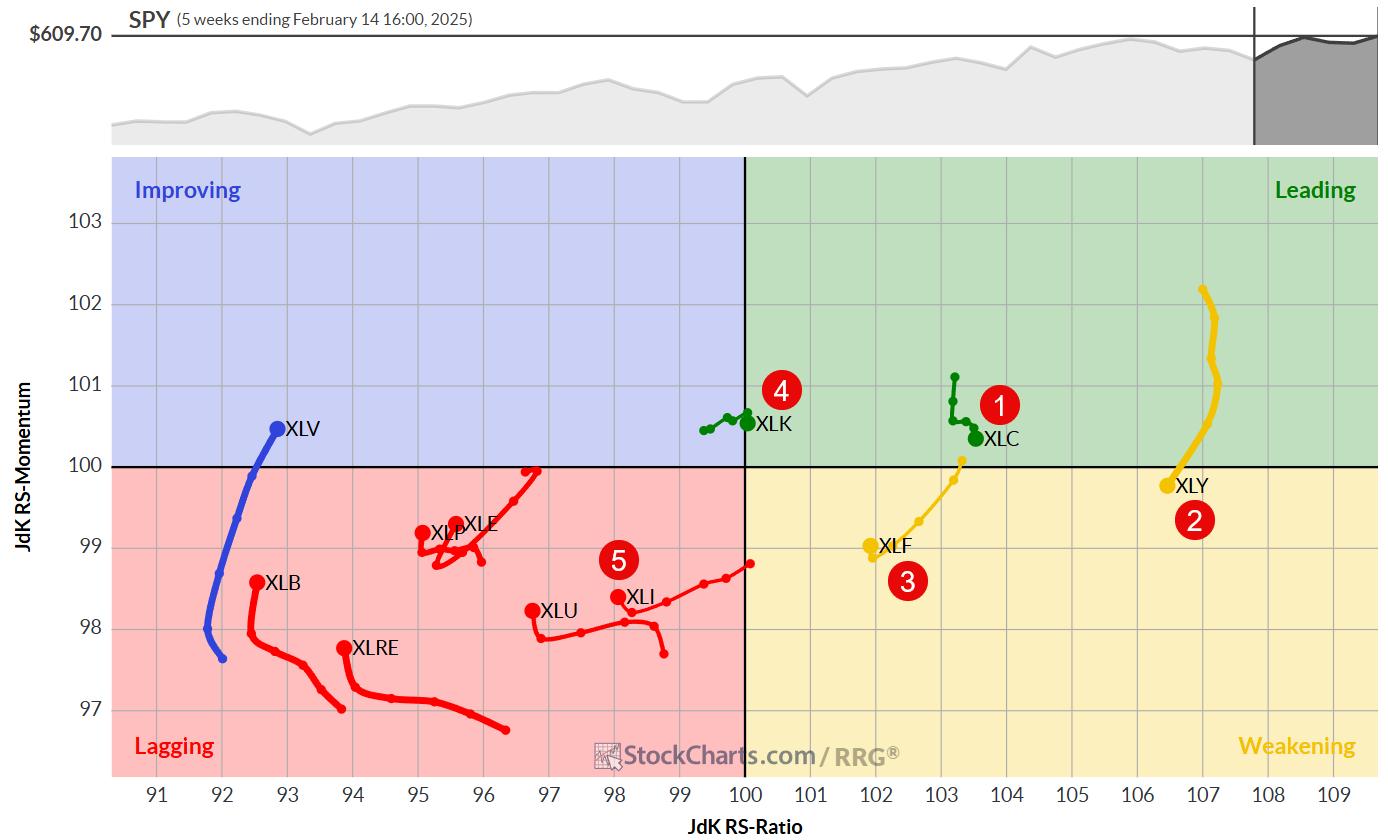

KEY TAKEAWAYS

* Communication Services (XLC) maintains top spot, Tech (XLK) plummets

* Shift towards defensive sectors evident in rankings

* Consumer Discretionary (XLY) showing signs of weakness

* Portfolio slightly outperforming SPY benchmark

Sector Shake-Up: Defensive Moves and Tech's Tumble

Last week's market volatility stirred up the sector rankings,...

READ MORE

MEMBERS ONLY

Sector Rotation Warning: More Downside Ahead for US Markets?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes sector rotation in US markets, assessing recent damage and potential downside risks. He examines the Equal Weight RSP vs. Cap-Weighted SPX ratio and the stocks vs. bonds relationship to identify key market trends. Don't miss this deep dive into market rotation...

READ MORE

MEMBERS ONLY

Navigating Tariffs: Master the Charts to Outsmart Market Volatility

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tariffs have caused shifts in investor sentiment.

* Investors are rotating out of offensive sectors and into defensive sectors.

* The US dollar has weakened relative to the Canadian dollar and Mexican peso.

Tariffs have thrown the stock market into dizzying moves, moving up and/or down based on whatever...

READ MORE

MEMBERS ONLY

S&P 500 Selloff: Bearish Rotation & Key Downside Targets!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave analyzes market conditions, bearish divergences, and leadership rotation in recent weeks. He examines the S&P 500 daily chart, highlighting how this week's selloff may confirm a bearish rotation and set downside price targets using moving averages and Fibonacci retracements. To validate a...

READ MORE

MEMBERS ONLY

DP Trading Room: Bitcoin Surges!

by Erin Swenlin,

Vice President, DecisionPoint.com

The news is that the United States will have a Cryptocurrency reserve. How this will occur is still murky, but Bitcoin surged on the news. Carl and Erin give you their opinion on Bitcoin's chart setup and possible future movement.

Carl opens the trading room with a review...

READ MORE

MEMBERS ONLY

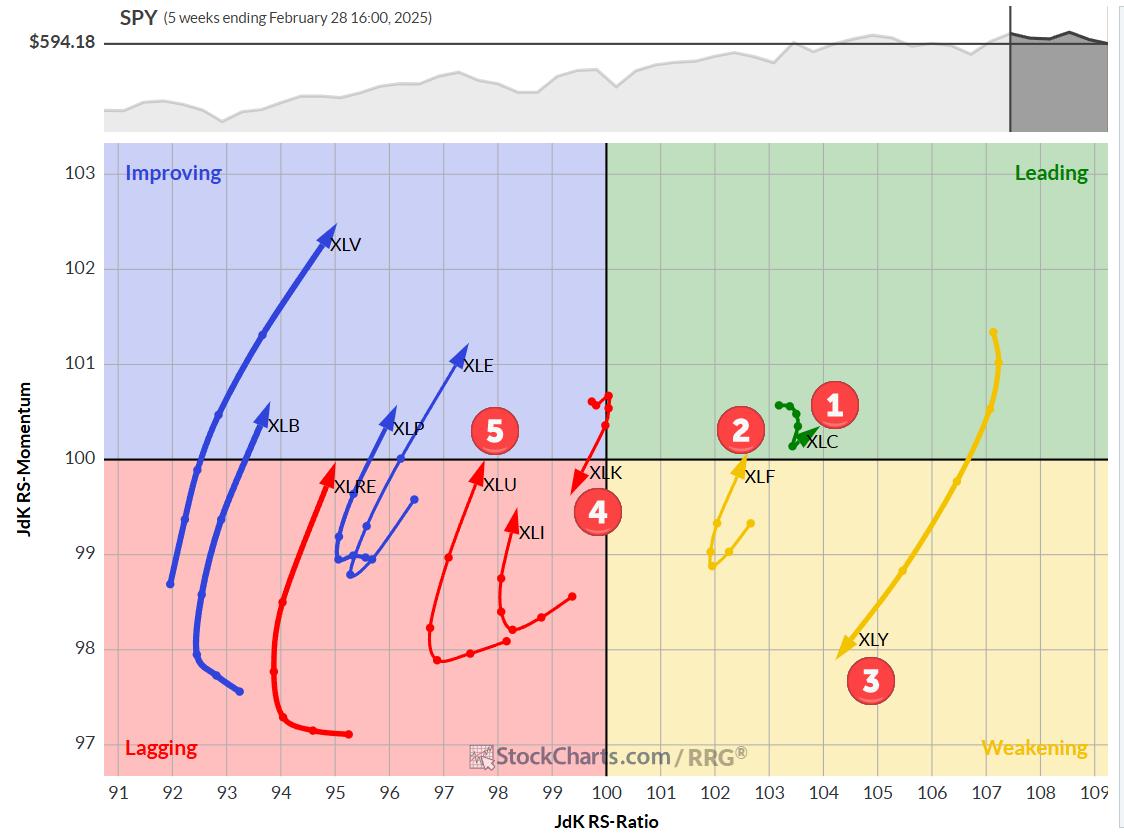

The Best Five Sectors, #9

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

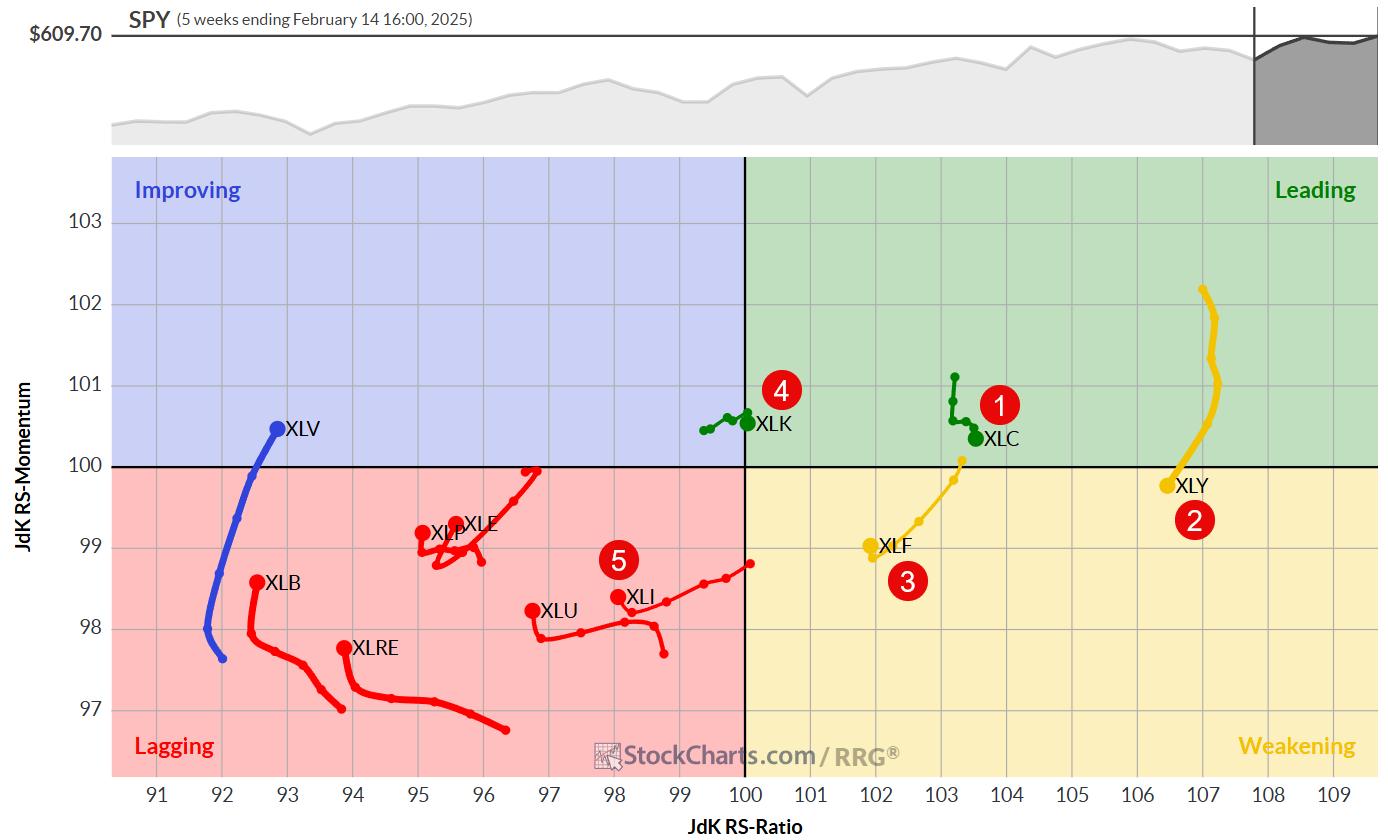

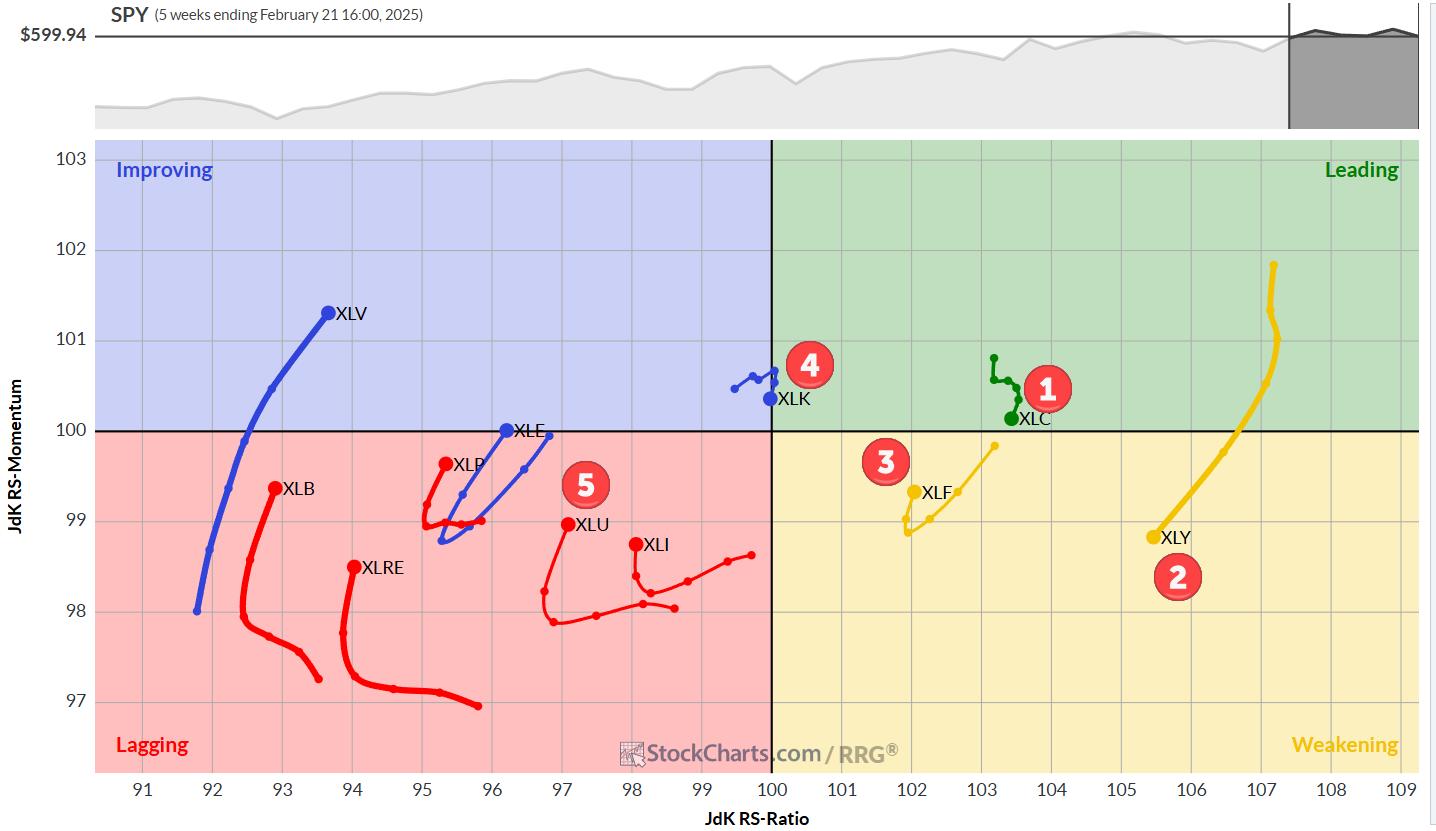

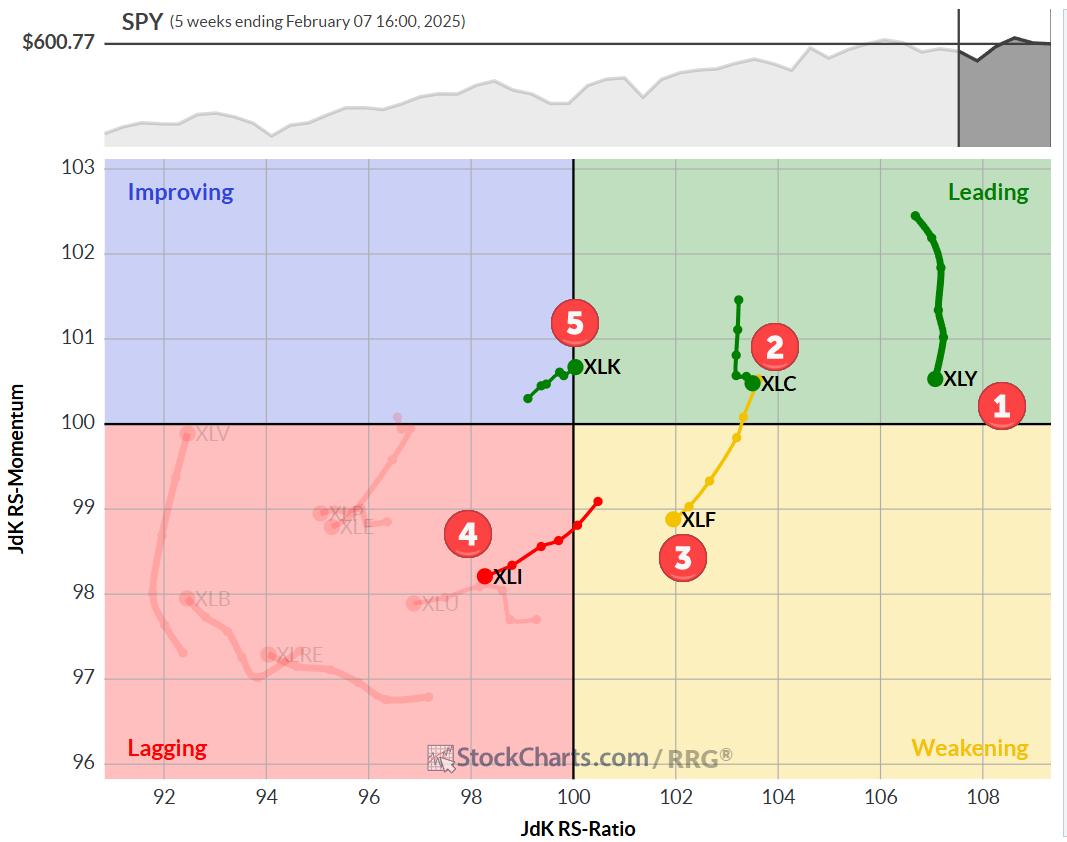

KEY TAKEAWAYS

* Communication services maintains top spot in sector ranking.

* Financials moves up to #2, pushing consumer discretionary down to #3.

* Technology and utilities hold steady at #4 and #5 respectively.

* Portfolio performance now on par with benchmark after recent outperformance.

Sector Rotation: Financials Climb as Consumer Discretionary Slips

While...

READ MORE

MEMBERS ONLY

Growth Stocks Tumbling; Where to Find Safe Havens Now!

by Mary Ellen McGonagle,

President, MEM Investment Research

Growth stocks just took a sharp hit—what does it mean for the market? In this video, Mary Ellen breaks down the impact, reveals why NVDA could soar higher, and highlights safer stocks with strong upside potential!

This video originally premiered February 28, 2025. You can watch it on our...

READ MORE

MEMBERS ONLY

3 Compelling Charts in the Financial Sector

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* ICE pushed to a new all-time high this week, completing a bullish rotation after finding Fibonacci support.

* V has experienced a series of bullish breakouts after completing a cup-and-handle pattern in 2024.

* JPM has pulled back to an ascending 50-day moving average, suggesting a potential short-term low during...

READ MORE

MEMBERS ONLY

Sector Rotation & Seasonality: What's Driving the Market Now?"

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes seasonality for U.S. sectors and aligns it with current sector rotation. He explores how these trends impact the market (SPY) and shares insights on potential movements using RRG analysis. By combining seasonality with sector rotation, he provides a deeper look at market...

READ MORE

MEMBERS ONLY

Bristol Myers Squibb's Rising SCTR Score: Seize the Moment to Invest?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Bristol Myers Squibb's share price is gaining technical strength.

* Monitor the stock price of Bristol Myers Squibb, as it's on the verge of breaking out of its 52-week high.

Bristol Myers Squibb (BMY) reported strong Q4 earnings earlier in February, and prospects remain strong...

READ MORE

MEMBERS ONLY

Retail is at a Crossroads—Buy Now or Stay Away?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The retail sector has been trading sideways for almost three years.

* Wall Street sees moderate growth for retail in 2025.

* Retail may be presenting both swing trading and position trading opportunities right now.

As "economic softening" increasingly emerges as the prevailing narrative driving the markets, the...

READ MORE

MEMBERS ONLY

Sector Rotation: How to Spot It Early Using Four Tools

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Following the two "confidence" reports over the last few weeks, investors appear to be expecting a recession.

* Defensive stocks are starting to show early strength relative to cyclicals.

* If we're on the verge of a sector rotation, there are several tools you can use...

READ MORE

MEMBERS ONLY

Decode the Stock Market's Health With This Key Indicator

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

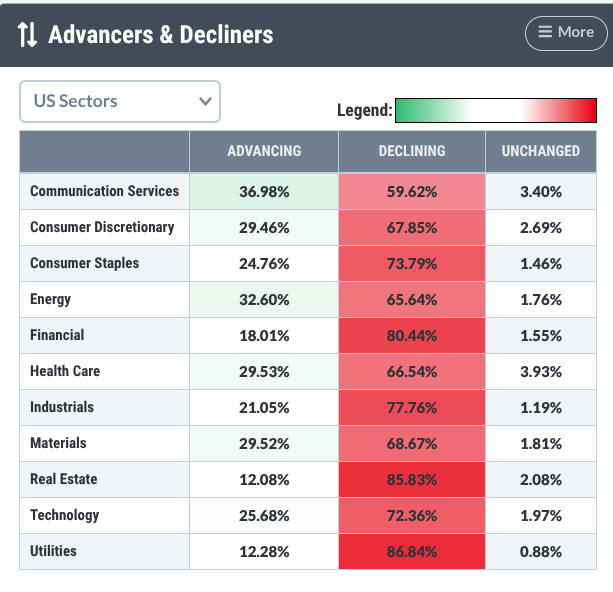

KEY TAKEAWAYS

* Investors are worried about a weakening economy and other headwinds.

* Looking under the hood can reveal the strength or weakness of the overall stock market.

* Investors are rotating out of technology stocks and into more defensive sectors.

The US Consumer Confidence Index® came in much lower than expectations,...

READ MORE

MEMBERS ONLY

Get The BEST Options Trade Ideas for This Week with Tony Zhang

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony breaks down the big-picture market trends before diving deep into bullish and bearish setups for META, BIDU, AMGN, NVDA, DAL, and more! Get expert insights and key analysis you won't want to miss!

This video premiered on February 24, 2025....

READ MORE

MEMBERS ONLY

DP Trading Room: Defensive Sectors Lead the Pack

by Erin Swenlin,

Vice President, DecisionPoint.com

The complexion of the market is changing. Aggressive sectors which have led the market higher are now beginning to show signs of strain as momentum slowly dissipates and prices turn lower. However, defensive sectors (XLP, XLRE, XLV and XLU) are now leading the market. Typically when this occurs the market...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #8

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Utilities entering the top-5

* Industrials dropping out of top-5 portfolio

* Real-Estate and Energy swapping positions in bottom half of the ranking

* Perfomance now 0.3% below SPY since inception.

Utilities enter top 5

Last week's trading, especially the sell-off on Friday, has caused the Utilities sector...

READ MORE

MEMBERS ONLY

Market Rotation and Cap-Weight Dynamics: A Closer Look

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Large cap growth stocks regaining favor as market faces pressure

* Cap-weighted sectors outperforming equal-weighted counterparts

* S&P 500 struggling to break above 610, suggesting potential trading range

* Exceptions in mega-cap dominated sectors (Communication Services, Technology, Consumer Discretionary)

With the market selling off into the close today, it&...

READ MORE

MEMBERS ONLY

Unlocking the Secrets to Profitable Semiconductor Investments

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Semiconductor stocks are waking up from a long slumber.

* The StockCharts MarketCarpets tool can help identify the high performers.

* Analyze each chart to identify trends and support or resistance levels.

Disappointing guidance from Walmart (WMT) may have hurt the stock market on Thursday sending the broader indexes lower....

READ MORE

MEMBERS ONLY

Unleash the Power of BPI: The Key to Boosting Your Investment Returns

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Market breadth is improving in some stock market sectors.

* Monitoring the Bullish Percent Index (BPI) can help you strategize your investments.

* The broader stock market indexes are still bullish.

On Wednesday, the Federal Reserve released minutes from its January 28–29 meeting. There weren't any surprises...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #7

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

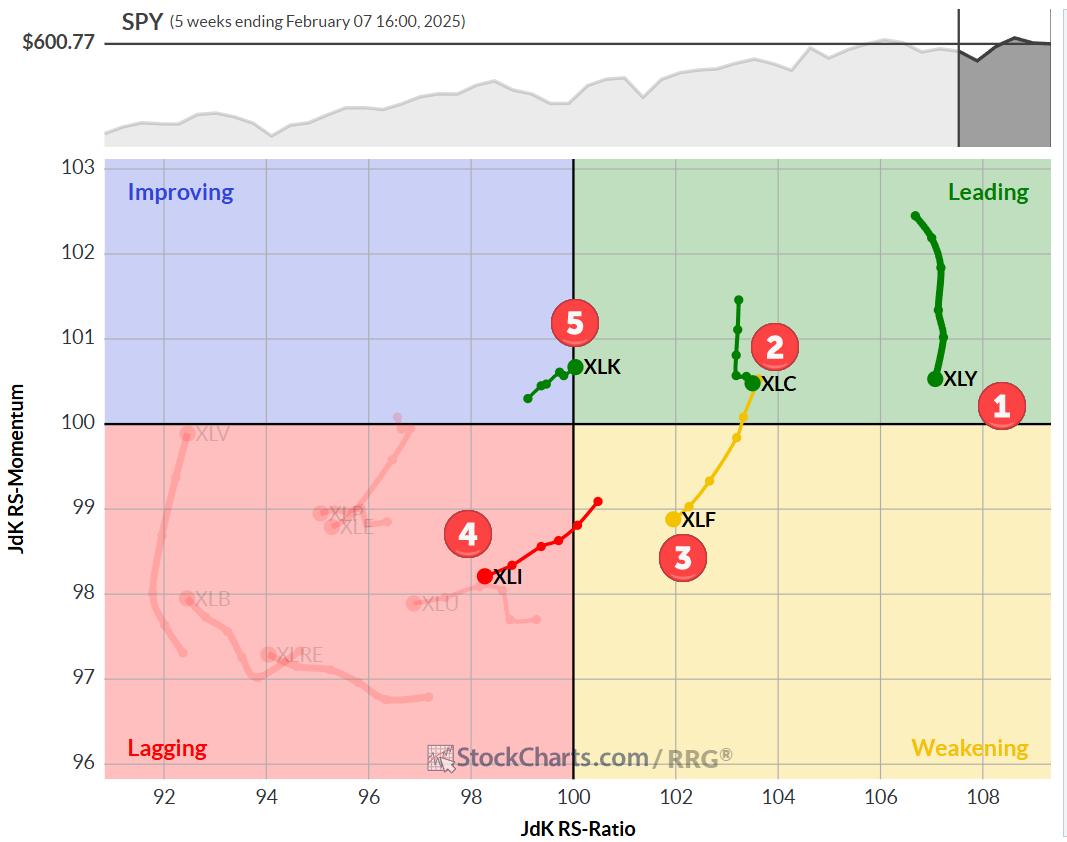

KEY TAKEAWAYS

* Communication services (XLC) claims the top spot, pushing consumer discretionary (XLY) to second place

* Technology (XLK) shows strength, moving up to fourth and displacing industrials (XLI)

* Industrials displaying weakness, at risk of dropping out of the top five

* RRG portfolio outperforming SPY benchmark by 69 basis points

Shifting...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Tests Crucial Support; Violation Of This Level May Invite Incremental Weakness

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets remained under pressure over the past five sessions, witnessing sustained weakness throughout the week. The Nifty50 faced resistance at key levels and struggled to find strong footing as it tested crucial support zones on two separate occasions. Market volatility surged significantly, with India VIX rising by...

READ MORE

MEMBERS ONLY

Stay Ahead of Tariffs: Essential Chart Analysis for Investment Security

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market has been trading sideways for an extended period.

* Tariffs, deregulation, inflation, and tax cuts are likely to occupy investors' minds for the next few years.

* Monitor the charts of the broader stock market, inflation expectations, and industries that are likely to benefit from the...

READ MORE

MEMBERS ONLY

Market Chaos: How to Spot Bottoming Stocks Before the Rebound

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Markets plunged early Wednesday morning following a hotter-than-expected CPI report.

* The Real Estate sector was among those hit hardest.

* These stocks, filtered using a bearish New 52-Week Lows scan, display bottoming opportunities.

Not everyone likes to take a contrarian stance. Most people prefer to move with the market,...

READ MORE

MEMBERS ONLY

Are Trump's 25% Tariffs a Game-Changer for Steel Stocks? Here's What to Watch Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Trump's announced 25% tariffs on steel and aluminum imports are boosting domestic steel producers.

* STLD, NUE, and NEM jumped significantly relative to its peers.

* All three stocks may be approaching buy levels, but only under specific conditions.

On Monday morning, President Trump announced plans to impose...

READ MORE

MEMBERS ONLY

Stay on TOP of the AI Revolution!

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony highlights important moves in equities, then shares the OptionsPlay research report for bull/bear plays. Tony then spends time on NVDA, highlighting the importance of staying on top of the AI revolution. He also looks at key stocks like V, BA, META, and more.

This video...

READ MORE

MEMBERS ONLY

DP Trading Room: Gold Hits Another All-Time High

by Erin Swenlin,

Vice President, DecisionPoint.com

The market rebounded to start trading on Monday, but indicators on Friday suggest internal weakness. Carl gives us his latest analysis on the market as well as taking a look at Gold which is making more all-time highs. Get Carl's perspective on the Gold rally.

Besides looking at...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #6

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Top-5 remains unchanged

* Healthcare and Staples jump to higher positions

* Price and Relative trends remain strong for XLC and XLF

No Changes In Top-5

At the end of the week ending 2/7, there were no changes in the top-5, but there have been some significant shifts in...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stares at Crucial Support; RRG Hints at Defensive & Risk-Off Setups

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In what can be called an indecisive week for the markets, the Nifty oscillated back and forth within a given range and ended the week on a flat note. Over the past five sessions, the Nifty largely remained within a defined range. While it continued resisting the crucial levels, it...

READ MORE

MEMBERS ONLY

Nasdaq DROPS on Weak AMZN, TSLA & GOOGL Earnings!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen reviews the market's flat momentum as uncertainty reemerges after weak AMZN, TSLA and GOOGL reports - PLUS more tariff talk from Trump. She also highlights the move into defensive sectors as growth stocks continue to struggle. Lastly, she shares the top stocks that...

READ MORE

MEMBERS ONLY

Hotel Stocks Spike: Why You Should Add These Stocks to Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Hilton's strong quarterly earnings sent hotel stocks surging.

* The StockCharts Technical Rank score indicates the hotel industry is technically strong.

* If hotel stocks continue to trend higher, consider adding these stocks to your portfolio.

When you think travel industry, airline and cruise line stocks are usually...

READ MORE

MEMBERS ONLY

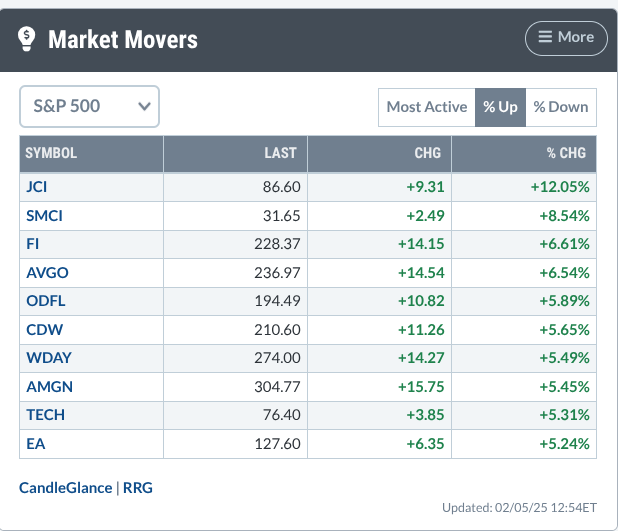

Missed Amgen's 5% Surge? Here's What You Need to Know Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Amgen's stock surged dramatically despite recent challenges.

* The stock has been underperforming its key industries and broader sector for over a year.

* Key support and resistance levels will determine whether Amgen's bullish reversal can be sustained.

On Wednesday morning, the markets wavered, with cautious...

READ MORE

MEMBERS ONLY

S&P 500 Sectors Play Musical Chairs: How To Win the Game With Options

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 sectors keep shuffling from one day to the next.

* It's important to focus on the long-term trends in the S&P sectors by analyzing their respective using a unique indicator.

* Identify a stock within a sector that is likely to...

READ MORE

MEMBERS ONLY

Watch For These Seasonality Patterns in 2025

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius shares a new approach to seasonality by using a more granular, data-set constructed UDI (User Defined Index) for every sector. Using the UDI functionality on StockCharts.com allows Julius to plot the seasonal patterns for each sector forward to the end of 2025 and...

READ MORE

MEMBERS ONLY

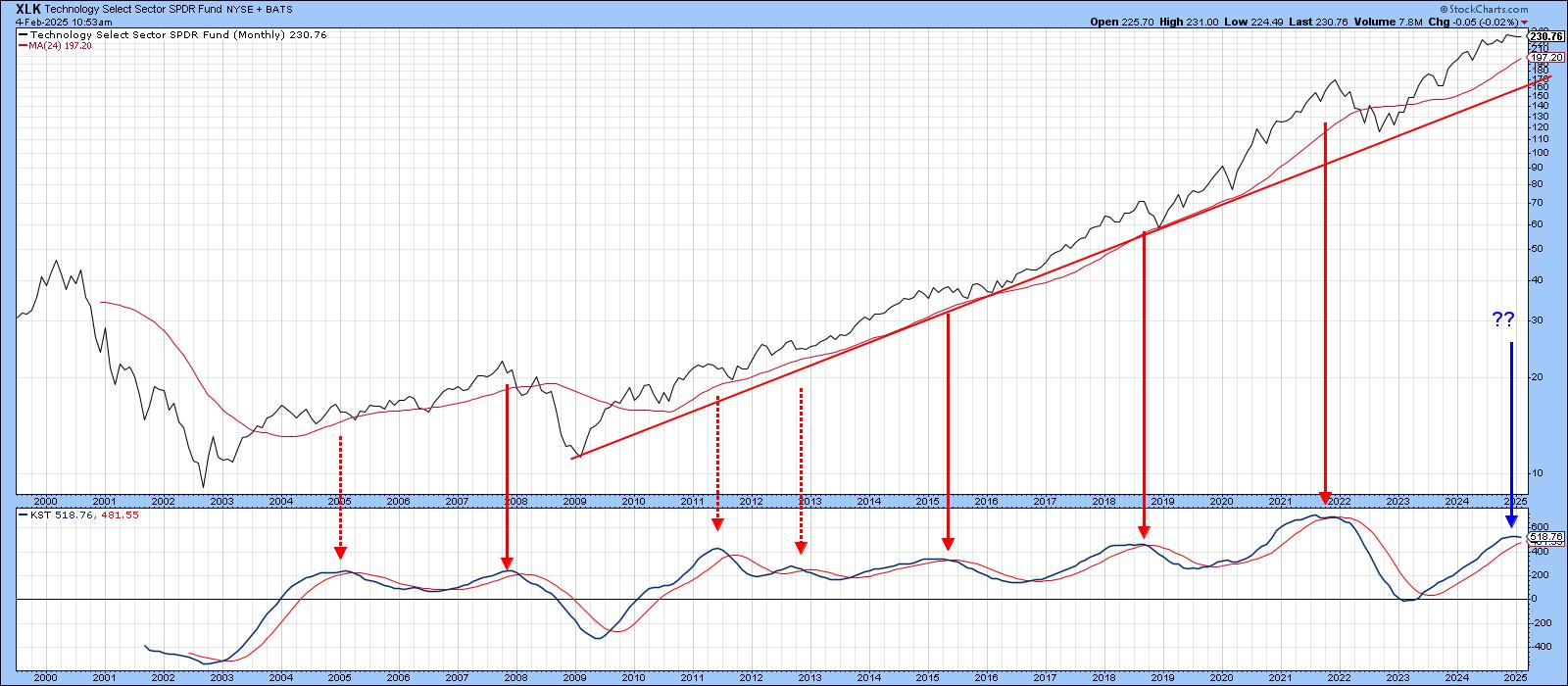

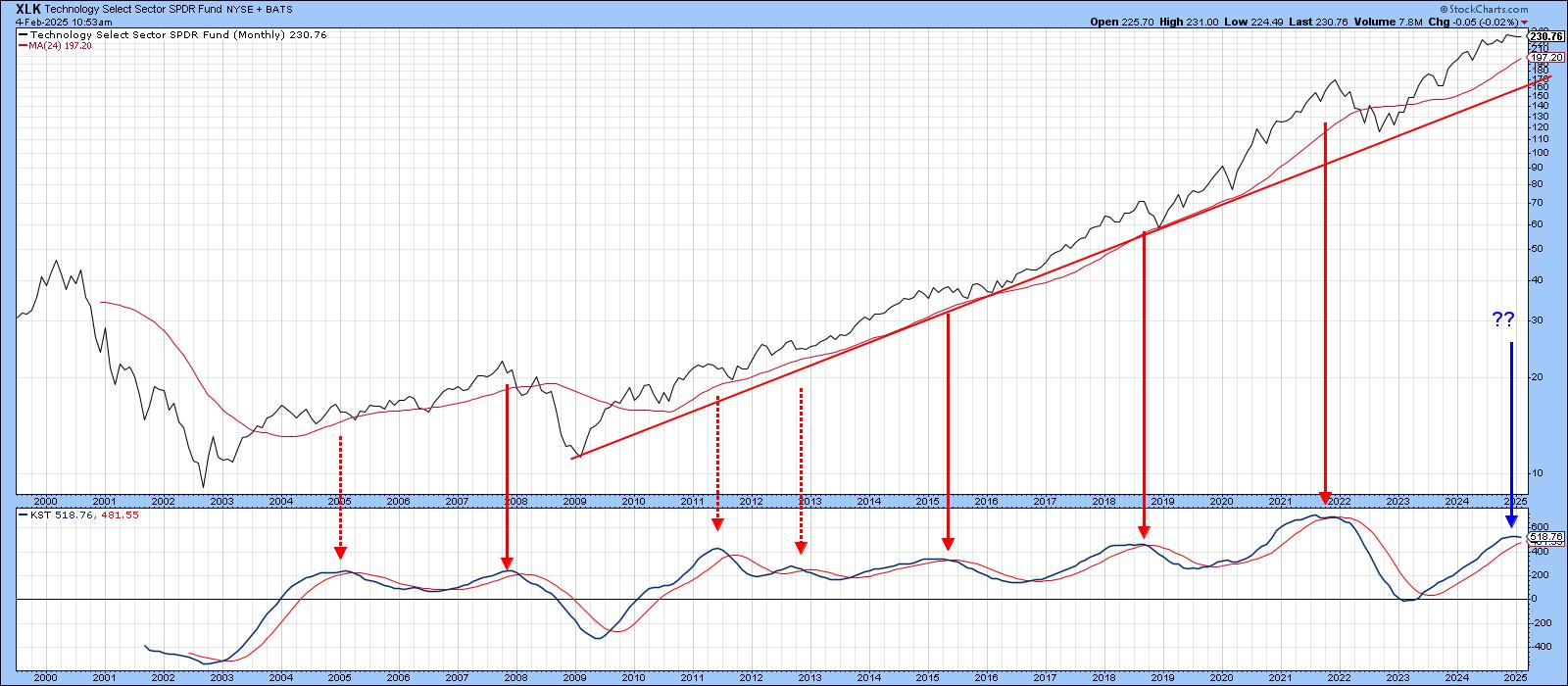

Forget Technology and Take a Look at This Sector

by Martin Pring,

President, Pring Research

Technology stocks, in the form of the SPDR Technology ETF (XLK), have been on a tear since their secular low in 2009. That strength has not only resulted in higher absolute prices, but also striking relative action.

Chart 1 compares the XLK to its long-term KST. Reversals in this indicator...

READ MORE

MEMBERS ONLY

Walmart, Costco, and Sprouts: The Ultimate Trade War Survivors?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A breakout above resistance in Costco's stock price could see the stock move higher.

* Walmart's stock price continues to trend higher, but volume and momentum may be giving.

* Sprouts Farmers Markets Inc. has the momentum to take the stock price higher.

Monday's...

READ MORE

MEMBERS ONLY

BULLISH on These Options Trade Ideas

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony shares his weekly market review, discussing growth vs. value, volatility, commodities, and more. From there, he shares his list of bearish and bullish options trade ideas, including META, AMGN, GOOGL, NVDA, DIS, and more.

This video premiered on February 3, 2025....

READ MORE

MEMBERS ONLY

DP Trading Room: Tariff Trepidation

by Erin Swenlin,

Vice President, DecisionPoint.com

Trading is being affected by the scare of a trade war. With new tariffs being placed on Mexico, Canada and China, the market fell heavily on Friday. The same was occurring this morning, but then the tariff on Mexico was delayed by one month which helped the market breathe a...

READ MORE

MEMBERS ONLY

DeepSeek Rattles AI Stocks - Should You Buy The Dip?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen unpacks the week after the news drop roiled markets; coupled with major earnings reports, it's been a rough week. She highlights what drove the biggest winners last week as we head into one of the busiest time for earnings!

This video originally premiered...

READ MORE