MEMBERS ONLY

Investing with the Trend: Conclusions

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-fifth and final in a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete...

READ MORE

MEMBERS ONLY

Analyze This: Will the Dow Soar or Crash in 2024?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Analyst opinions of Dow Jones Industrial Average are mixed, with both bullish and bearish forecasts

* While some analysts expect the Dow to hit 40,000 this year, some say it can fall to 34,000

* Basic tools like trend lines and support-and-resistance, paired with Fibonacci Retracements, can help...

READ MORE

MEMBERS ONLY

June & Gloom | Larry's "Family Gathering" June 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

June is here! Will it be bloom or gloom for the stock market?

In this month's Family Gathering video, Larry examines the current averages in the market and what the advance-decline line is telling us. He explains the Trading Day of the Month (TDOM) concept and how you...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

DP Trading Room: Natural Gas (UNG) Bearish Again?

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl and Erin return to the trading room showing you the charts you need to see to start your week!

Carl covered the market trends and condition to start the program. He also covers Bitcoin, Dollar, Gold, Silver, Gold Miners, Bonds, Yields and Crude Oil.

Carl also gave us a...

READ MORE

MEMBERS ONLY

Breadth Thrust Can Validate a New Bull Phase for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave describes how the "breadth thrust", popularized by legendary market strategist Martin Zweig, can help to validate a new bull phase for stocks. He answers viewer questions on pairs trades, running technical indicators like RSI on price ratios,...

READ MORE

MEMBERS ONLY

A Debit Spread in American Express to Add Long Exposure

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* American Express (AXP) has pulled back and is in oversold levels, which may present a buying opportunity

* AXP has upside potential and, to take advantage of it, you could trade an ITM debit spread

* A debit spread has a favorable risk to reward potential that can add long...

READ MORE

MEMBERS ONLY

How to Stop the "Wealth Destroyers" by Deploying Your Sell Methodology

by Gatis Roze,

Author, "Tensile Trading"

"We are in the business of making mistakes. Winners make small mistakes. Losers make big mistakes."

There are zillions of cliches that paraphrase what Ned Davis said. The umbrella axiom with your portfolio should be to cut your losers.

Nude investing is what I label an investor without...

READ MORE

MEMBERS ONLY

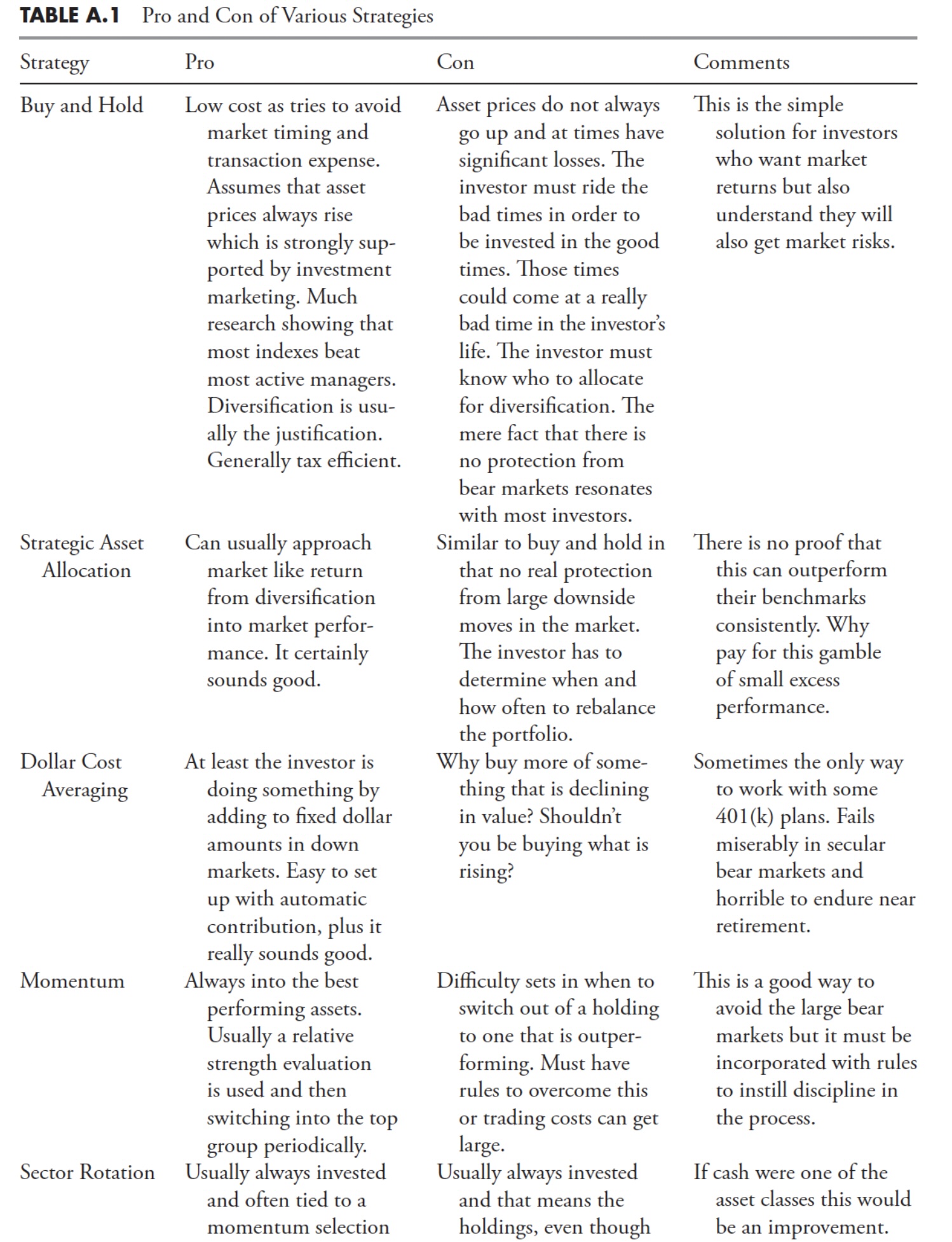

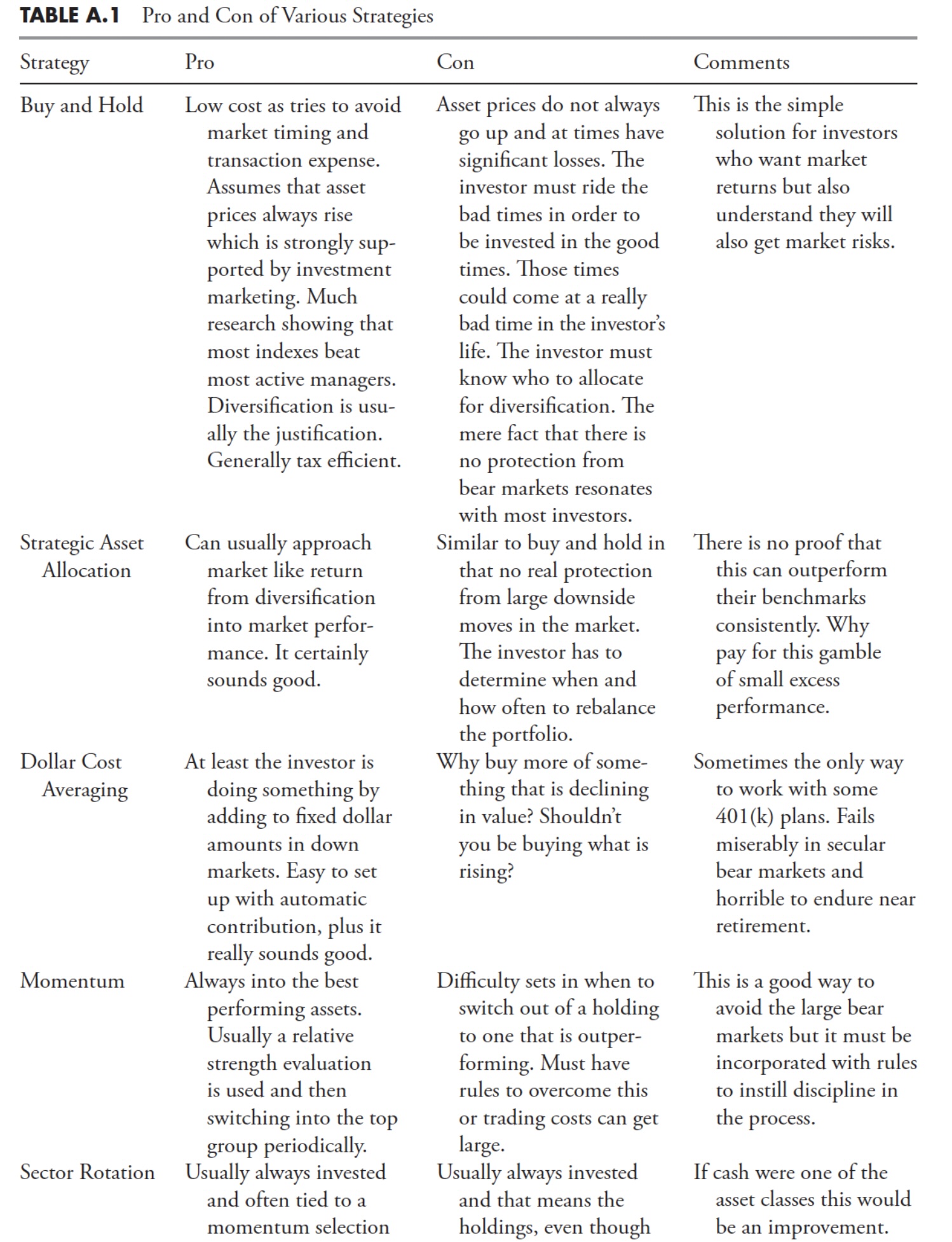

Investing with the Trend: Appendix

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is a set of appendices for a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete...

READ MORE

MEMBERS ONLY

Bitcoin, Politics, and Profits: What You Need to Know About CleanSpark and Riot Platforms

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A presidential contender expressed a desire to mine all remaining Bitcoin in the U.S.

* 90% of Bitcoin's total supply of 21 million has been mined

* If the remaining Bitcoin gets mined, it presents an unprecedented opportunity for two of the largest Bitcoin miners in the...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs NEXT WEEK - Tuesday, June 18 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Tuesday, June 18 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

5 Simple and Powerful Uses for Moving Averages

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the five ways to use the Moving Average lines to help with decision making. He discusses how these lines can help to define trend reversals and confirmed trends, when to be on the alert for a...

READ MORE

MEMBERS ONLY

DP Trading Room: Equal-Weight Losing Against Cap-Weight SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

Did you know that the equally-weighted RSP is seriously underperforming the cap-weighted SPY? It is losing considerable ground against the SPY and that suggests that if mega-caps fail, so will go the market. Carl shows us charts to prove his point.

Next up Carl covers the market in general followed...

READ MORE

MEMBERS ONLY

Tracking the Three Signs of the Bear

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There is no denying that the primary trend for the S&P 500 remains bullish as we push to the end of Q2 2024. But what about the conditions "under the hood" of the major benchmarks? Today, we'll highlight three "signs of the bear&...

READ MORE

MEMBERS ONLY

NVIDIA's Stock Split and Potential Correction

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

When Nvidia (NVDA) opens on Monday, it will have experienced a 10:1 split, and we should remember that one of the purposes of stock splits is to facilitate distribution. That is to say that the lower price after the split attracts investors who avoided the stock at the higher...

READ MORE

MEMBERS ONLY

Retail Stocks Caught in Limbo: Will RTH Break Free and Soar?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* VanEck Vectors Retail ETF (RTH) holds 70% discretionary and 30% staples retail stocks

* Retail stocks have been on a steady long-term uptrend over the last 10 years

* Traders are likely to accumulate or sell positions depending on the Fed's interest rate decisions

VanEck Vectors Retail ETF...

READ MORE

MEMBERS ONLY

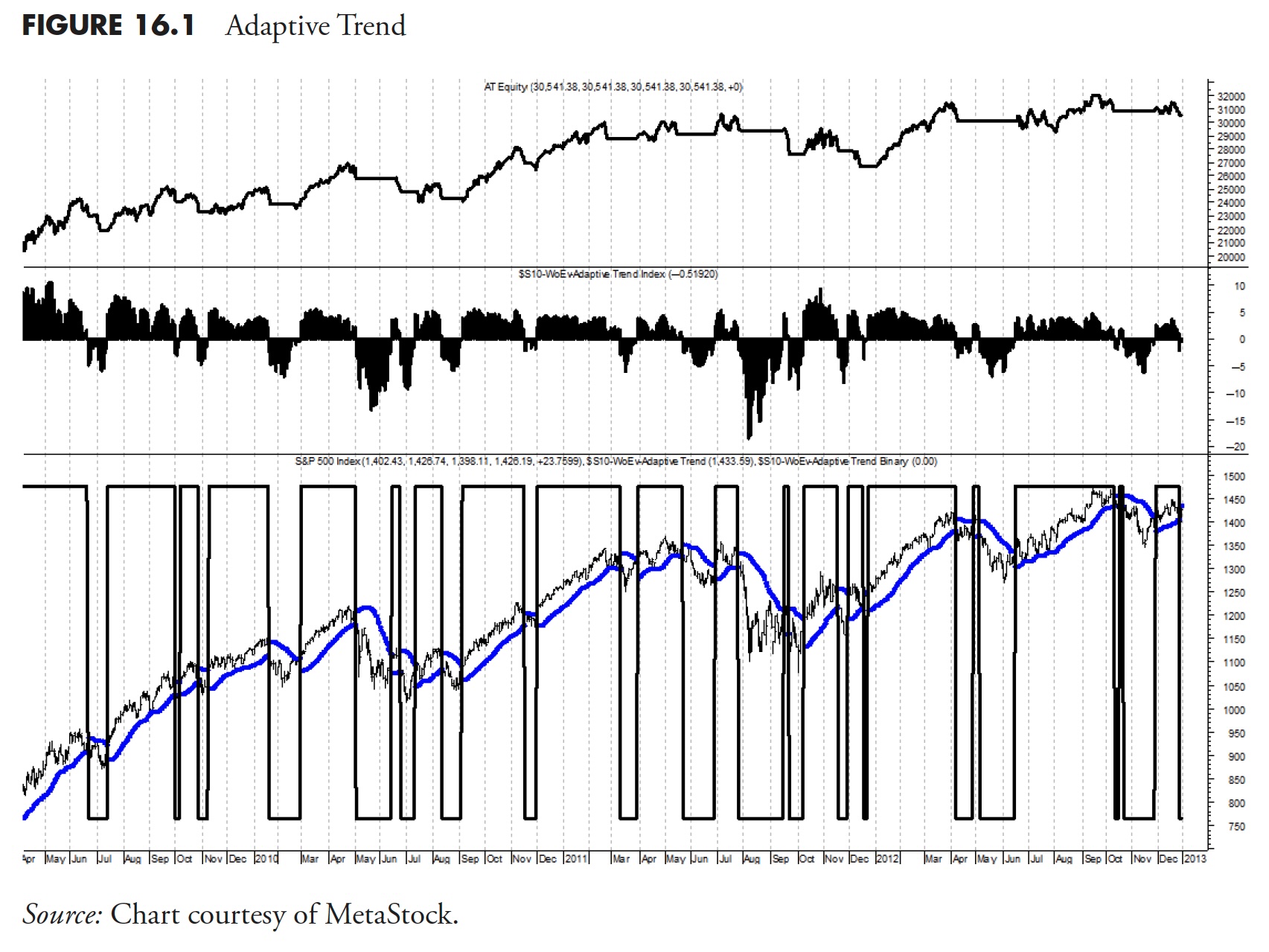

Rules-Based Money Management - Part 8: Putting Trend-Following to Work

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-fourth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

3 Keys to Finding the Strongest Trends

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the three keys he hunts for when identifying reversals and strong trends, giving a few examples and then showing one that is developing now. He then highlights similar techniques he uses while reviewing the Sectors. In...

READ MORE

MEMBERS ONLY

Will Spotify Smash Its All-Time High of $387?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Spotify's stock price has been trending higher for the last 16 months

* Spotify's stock price could reach its all-time high

* Analysts project Spotify's stock price to reach $400 in 2024 and $485 in 2025

Music streamer Spotify Technology (SPOT) isn't...

READ MORE

MEMBERS ONLY

A Practical Options Strategy to Trade Home Depot

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* To take advantage of Home Depot's stock price decline, try implementing the put vertical spread

* The put vertical spread can lower your risk while you capitalize on the downside move in HD

* By going out to the August expiration, you can open a put vertical for...

READ MORE

MEMBERS ONLY

Wyckoff at Work in the Intraday Timeframe

by Bruce Fraser,

Industry-leading "Wyckoffian"

It is well known that stock market indexes are fractal. Demonstrating repeatable price structures in all timeframes. In the intraday timeframe these price structures repeat frequently. The Wyckoff characteristics of Accumulation, Markup, Distribution and Markdown are constantly at work in smaller periods of time. Wyckoff students will study such structures...

READ MORE

MEMBERS ONLY

DP Trading Room: Upside Initiation Climax (Should We Trust It?)

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint Trading Room episode Carl and Erin discuss Friday's "Upside Initiation Climax" and whether it can be trusted. With market follow through tepid, they discuss the implications of this very bullish signal.

Carl reveals his sentiment of the overall market and covers...

READ MORE

MEMBERS ONLY

Top 5 Stocks in "Go" Trends | Fri May 31, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Trend Continuation

* Breakouts

* Momentum Confirmation

* Bull Flags

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE

MEMBERS ONLY

MUST SEE! Top 10 Stock Picks For June 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they run through top 10 charts to watch in June 2024! They'll cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights into...

READ MORE

MEMBERS ONLY

Is Aflac Set to Surpass Analysts' Targets? Find Out Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Aflac stock soars, hitting a new all-time high

* Indicators suggest the stock is strong and could continue rising

* Aflac has the potential to outperform the S&P 500, the Financial sector, and the insurance industry

Boring and captivating rarely coexist, except for contrarians who can uncover the...

READ MORE

MEMBERS ONLY

Textbook Double Top on Silver (SLV)

by Erin Swenlin,

Vice President, DecisionPoint.com

Gold is struggling, moving mostly sideways. Silver has technically been moving sideways as well, only it has formed a textbook double top chart pattern. Textbook double tops show even tops and a clear confirmation line delineated at the middle of the "M" formation. What is good about these...

READ MORE

MEMBERS ONLY

The Sky is Not Falling | Focus on Stocks: June 2024

by Larry Williams,

Veteran Investor and Author

A note to the Cassandras who are now out in full force...

Led by "Rich Dad, Poor Dad" Robert Kiyosaki's warning of "Be careful, it's the biggest crash in world history," the bears have come out of their winter caves. "We...

READ MORE

MEMBERS ONLY

From Summer Doldrums to Year-End Surge: How to Profit from Seasonal Trends in Precious Metals and Bitcoin

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Bitcoin, gold, and silver exhibit similar seasonality patterns.

* Bitcoin, gold, and silver prices largely reflect economic expectations.

* If you're bullish on bitcoin, gold, or silver, there are critical levels to watch.

Safe-haven investments like gold, silver, and now Bitcoin have had a bumpy and uncertain rise,...

READ MORE

MEMBERS ONLY

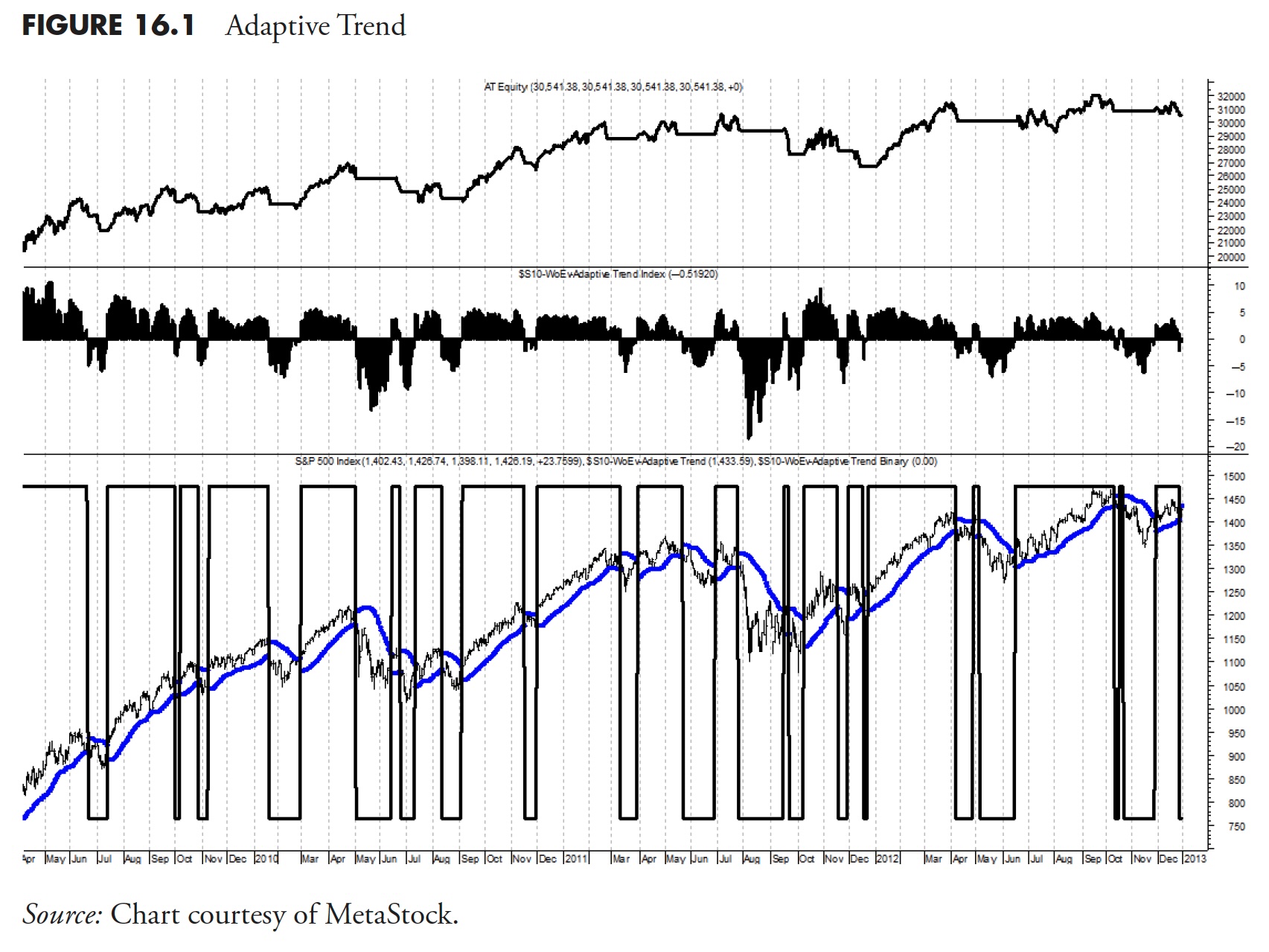

Rules-Based Money Management - Part 7: The "Dancing with the Trend" Model

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-third in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Three Stock Ideas as S&P 500 Treads Water

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Tony Zhang of OptionsPlay. Tony shares three stock ideas showing favorable risk/reward characteristics as the S&P 500 index treads water above support at 5250. David describes the deteriorating market breadth conditions and reviews charts of...

READ MORE

MEMBERS ONLY

This Simple Little Option Is A HUGE Productivity Booster

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to boost your charting workflow with the "Inspect" tool. These powerful little crosshairs pack a punch, with hidden features that let you measure in multiple directions, track price and percent changes...

READ MORE

MEMBERS ONLY

Technical Indicator Showdown: MACD vs. PPO vs. PMO

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions from The Final Bar Mailbag. He outlines the differences between the MACD, PPO, and PMO indicators, covers the mechanics of corporate buybacks, examines the basics of candlestick analysis, and discusses whether applying trendline analysis to the...

READ MORE

MEMBERS ONLY

Surprise! These Grocery Stocks are Crushing 2024 Targets

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Consumer Staples stocks offer stability and growth in a high inflation environment.

* Many consumer staples stocks have exceeded analyst price targets, revealing Wall Street's underestimation of their growth potential.

* Sometimes the next big stock is often found in a seemingly boring name, as Sprouts Farmers Market...

READ MORE

MEMBERS ONLY

Dow Theory Flashes Bear Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dow Theory is based on the foundational work of Charles Dow, considered the "Father of Technical Analysis." Many of the tools we employ to better analyze market structure and investor sentiment, from trend analysis to index construction, are derived from Dow's original essays from the early...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 6: Putting It All Together

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-second in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Hedging the S&P 500 All-Time Highs With Options

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* As stock market indexes hit all-time highs, you may want to consider hedging your portfolio with options.

* Since volatility is low, buying puts can be a relatively inexpensive way to protect your positions while remaining invested in the stock market.

As equity markets print new all-time highs and...

READ MORE

MEMBERS ONLY

Capitalizing on Riot Platforms' Potential: A Sleeper Stock Ready to Soar?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* RIOT may be a beaten-down stock, but it has potential to rise higher

* A breakout above key the $12.65 price range on momentum could mean the stock price would move higher

* A potential resistance level is the $18.30 level

If you're not familiar, Riot...

READ MORE

MEMBERS ONLY

DP Trading Room: What's Up With Semiconductors?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin takes a deep dive into the Semiconductors (SMH). She goes over the "under the hood" health of the industry group and then takes us within the industry group to find the leadership stocks in that area.

Carl shares his wisdom on the current conditions of the...

READ MORE

MEMBERS ONLY

The Most Efficient Way To Follow The Markets - Customize Your Dashboard!

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson walks you through the "heart and soul" of StockCharts - Your Dashboard - and explains how he customizes his layout to serve as a one-stop-shop for following the latest market action. Grayson demonstrates how...

READ MORE

MEMBERS ONLY

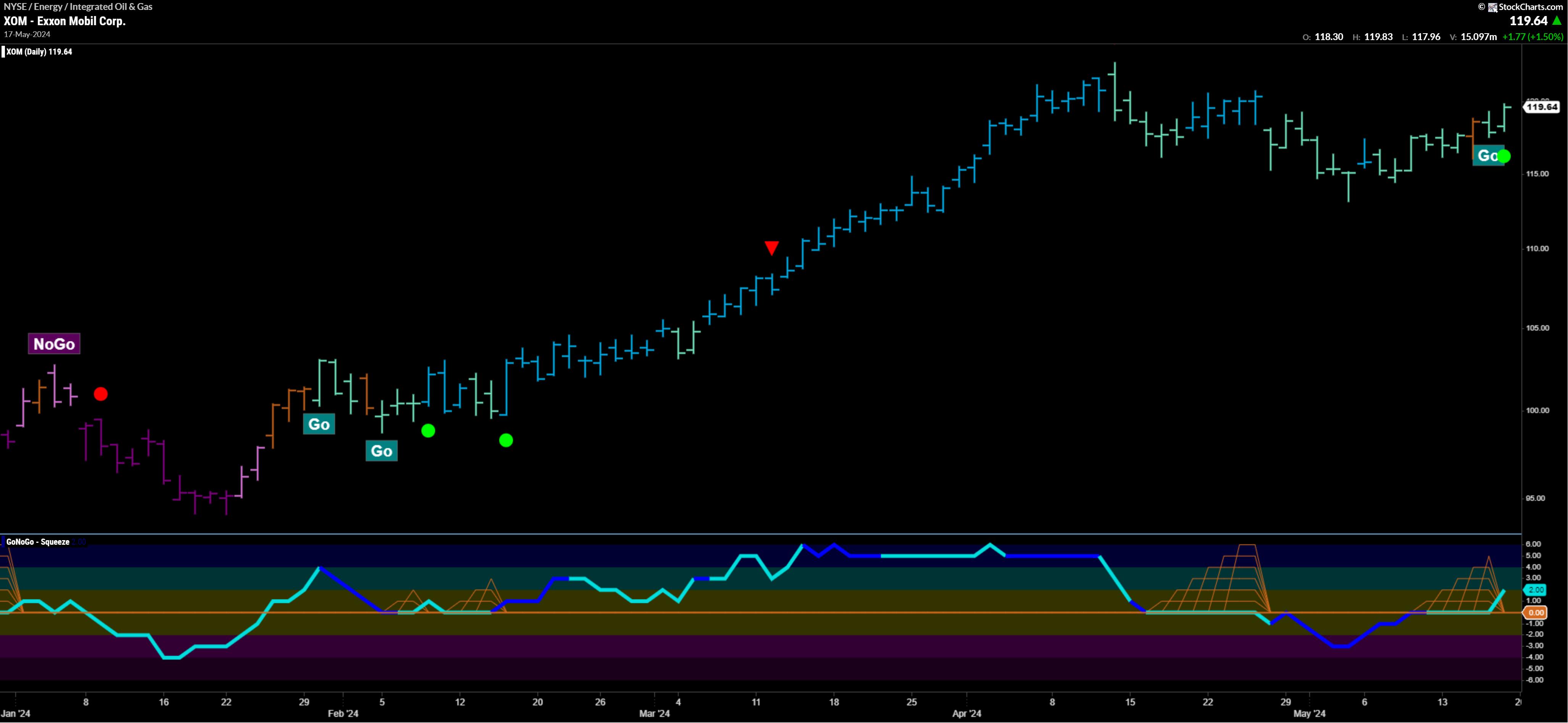

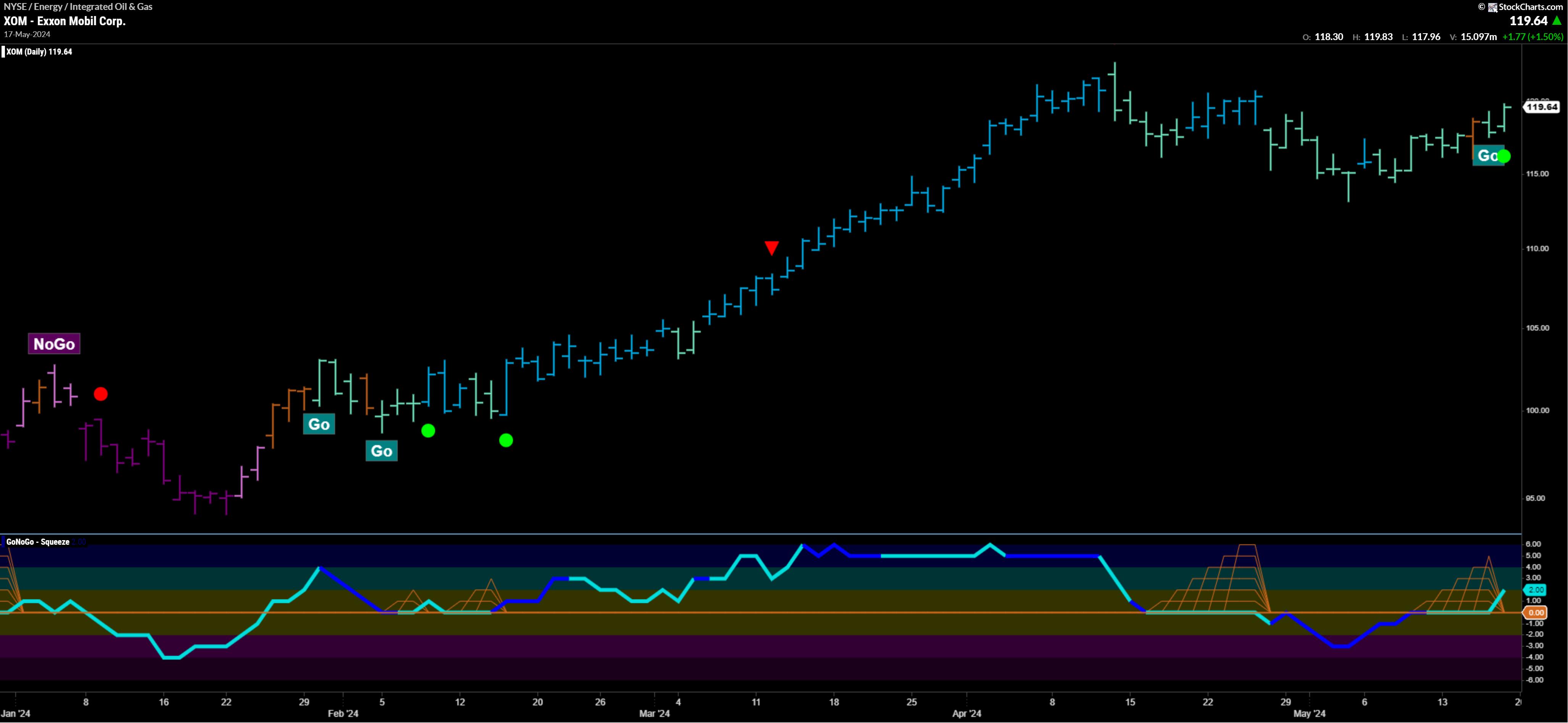

Top 5 Stocks in "Go" Trends | Fri May 17, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* trend continuation

* breakouts

* Momentum Confirmation

* Bull Flags

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE