MEMBERS ONLY

Your Selling Methodology is Your Paramedic to Profits

by Gatis Roze,

Author, "Tensile Trading"

"When you feel like bragging, it's probably time to sell." — John Neff

Stock market investing is simple, really. You only need to make two choices: when to buy and when to sell. The unfortunate reality is that 75% of casual investors really only want to hear...

READ MORE

MEMBERS ONLY

Spotting Tradable Pullbacks after Trend Reversing Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Most stocks surged with the broader market in the fourth quarter of 2023. SPY and QQQ extended their advances in 2024, but some stocks did not partake and fell back. Even so, some of these stocks show signs of long-term trend reversals and their declines in 2024 look corrective. This...

READ MORE

MEMBERS ONLY

Apple (AAPL) and Google (GOOGL) Flashing "Pure Weakness"

by Erin Swenlin,

Vice President, DecisionPoint.com

We've begun talking more about the Price Momentum Oscillator (PMO) as it relates to finding "pure strength" and "pure weakness". What it all comes down to is the zero line and the PMO's behavior above or below.

We review the Magnificent 7...

READ MORE

MEMBERS ONLY

Swing Trading Strategies, Tips & Trends

by Joe Rabil,

President, Rabil Stock Research

by Bruce Fraser,

Industry-leading "Wyckoffian"

On this week's edition of Stock Talk with Joe Rabil, Joe features special guest, Bruce Fraser of Power Charting. Joe and Bruce discuss swing trading in detail, first by defining swing trading and how it is different from trend trading, and then spending time going through the SIG...

READ MORE

MEMBERS ONLY

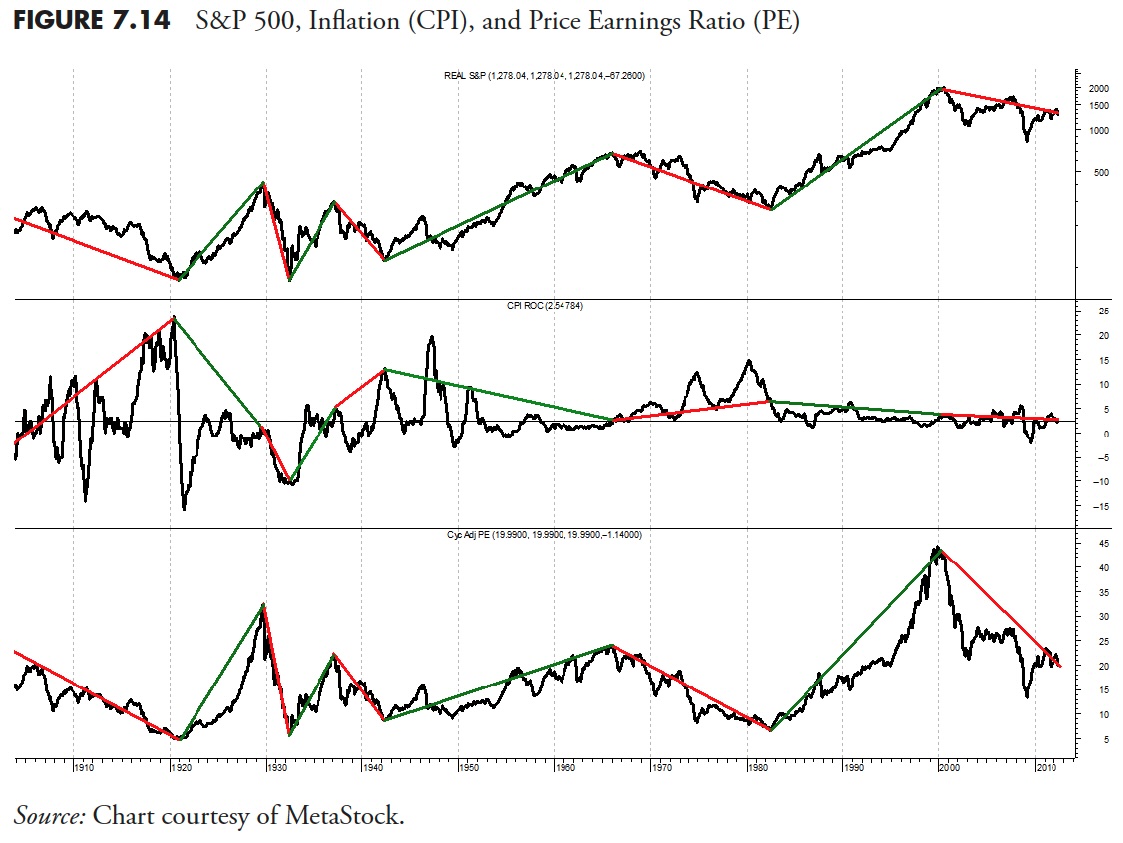

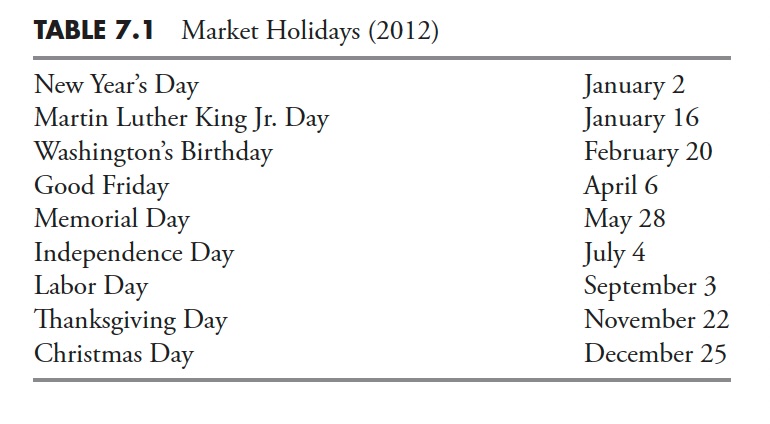

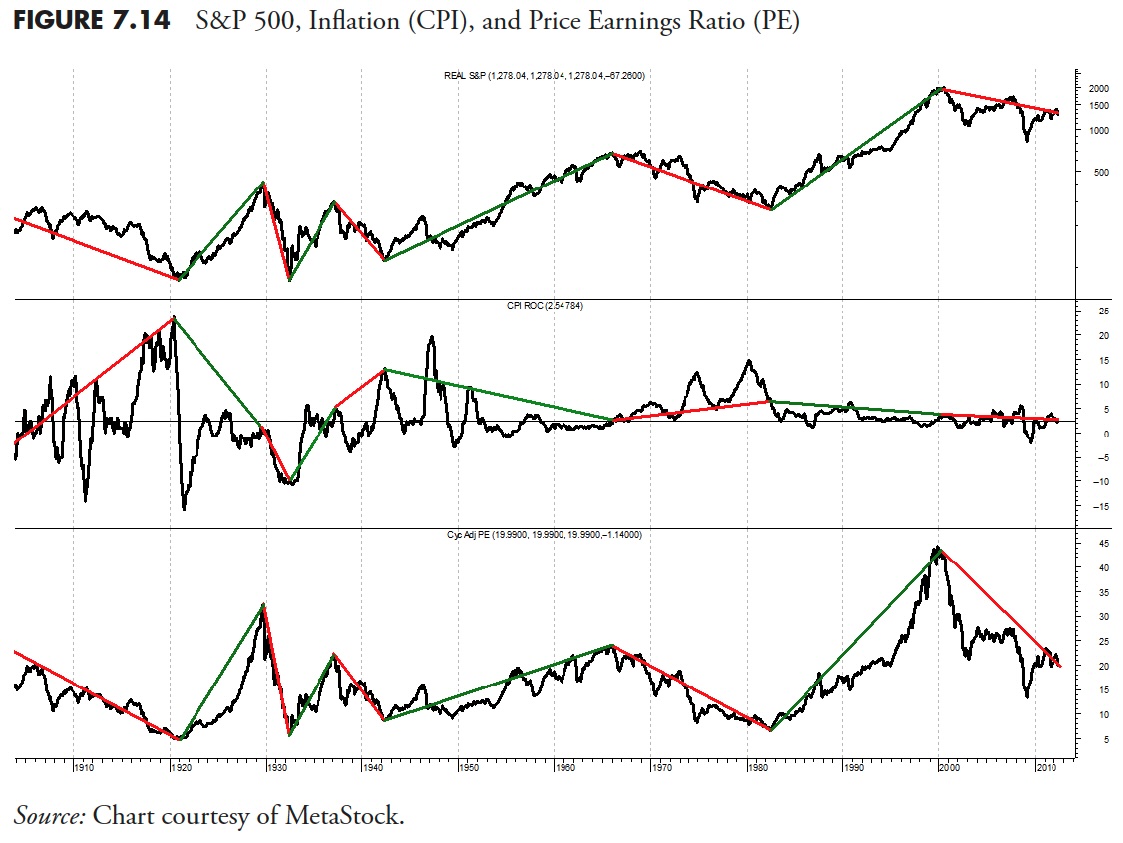

The Hoax of Modern Finance - Part 10: Market Facts — Secular Markets

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the tenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The False Flag of Fed Rate Cuts | Focus on Stocks: March 2024

by Larry Williams,

Veteran Investor and Author

Let's begin this month with a look at...

The False Flag of Fed Rate Cuts

Day after day, we hear how the Fed will embark on a series of rate cuts this year "because inflation has peaked" and is heading lower. The drop in inflation is...

READ MORE

MEMBERS ONLY

Flip the Script: Defense as Your New Offensive Playbook

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* March is a strong seasonal month for Utilities and Consumer Staples in relation to the broader market

* Utilities and Consumer Staples are defensive plays which, if timed correctly, can result in a positive market outcome

* The StockCharts Seasonality charts can help you identify sector plays that may not...

READ MORE

MEMBERS ONLY

DP Trading Room: The PMO Versus the MACD!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl explains the benefits of using the Price Momentum Oscillator versus the MACD. They are not the same!

Carl then gives us his insights on the market in general as well as Bitcoin news, Magnificent 7 overview, as well as Crude Oil and Interest Rates.

Erin gives us an...

READ MORE

MEMBERS ONLY

MEM TV: Simple Way to Identify a Buy Point in NVDA

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the markets to new highs and what areas are outperforming. She also shares how to identify a buy point in NVDA after its gap up following earnings, as well as how to determine when a...

READ MORE

MEMBERS ONLY

AMD's Sensational Halt — What You Need to Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Advanced Micro Devices (AMD) recovered quickly from a post-earnings slump

* Its longer term price action suggests indecision and the current pattern can also break either way

* This can either be a short-term trade or an investment; both scenarios will require different strategies

If you ran a StockCharts Gap...

READ MORE

MEMBERS ONLY

The Best Technical Indicator for Long-Term Investors

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave drops an all-mailbag episode featuring viewer questions on the Hindenburg Omen, ascending triangle patterns, Fibonacci Retracements, projecting upside targets for stocks like NVDA, and the best technical indicator long-term investors should use!

This video originally premiered on February 23,...

READ MORE

MEMBERS ONLY

3 Unique RSI Techniques to Maximize Your Investments

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe dives into the world of technical analysis by sharing three unique ways to utilize the RSI indicator alongside MACD and ADX -- the Pullback Trade, Confirming a Breakout and 2nd Chance Entry. He then covers the symbol...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 9: Market Facts — Bull and Bear Markets

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the ninth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Titanic Syndrome Indicator Issues a WARNING!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave focuses on AAPL which closed below its 200-day moving average as it tests key price support. Guest Jesse Felder of The Felder Report reports on the Titanic Syndrome, a market breadth indicator similar to the Hindenburg Omen that suggests...

READ MORE

MEMBERS ONLY

Capturing the Momentum Phenomenon - Nvidia vs Tesla

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The momentum phenomenon has been a fixture in the US equity markets for decades. There are two types of momentum to consider: absolute momentum and relative momentum. Absolute momentum refers to the underlying trend, up or down. Relative momentum quantifies the strength of the uptrend and compares it to other...

READ MORE

MEMBERS ONLY

What to Do With NVDA (And Others Like It)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on the Money Flow Index, using RSP vs. SPY for relative strength analysis, strategies for names in extended uptrends like NVDA, applying Fibonacci retracements to charts like KRE, and more.

This video originally premiered on February...

READ MORE

MEMBERS ONLY

Discover the Power of These 2 Cutting-Edge Tools!

by Grayson Roze,

Chief Strategist, StockCharts.com

It's all about groups on this week's edition of StockCharts TV'sStockCharts in Focus! In this video, Grayson shows you how to take your market analysis to the next with level with some of the latest enhancements on the StockCharts platform -- new features added...

READ MORE

MEMBERS ONLY

DraftKings' Stock Overheating? Here's What You Need to Do Now

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* DraftKings has demonstrated significant revenue growth following a lengthy period of outperformance relative to the S&P 500 and its respective sector and industry

* DraftKings' stock is overbought, with a declining RSI suggesting near term market correction

* Set a price alert to measure an anticipated pullback...

READ MORE

MEMBERS ONLY

SMCI Breaks $1,000 Level - What's Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Bob Lang of Explosive Options shares three charts he's following as the S&P 500 continues to hold the crucial 5,000 level. Host David Keller, CMT highlights key stocks on the earnings list, including DKNG, COIN,...

READ MORE

MEMBERS ONLY

Identifying Powerful Trends with This Game-Changing ADX Setup

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shares the criteria for his favorite ADX setup. He explains what he needs to see on 2 different timeframes to put a stock into position for a powerful trend that can last a long time. Joe closes...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" February 15, 2024 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry begins by presenting two trade recommendations, then digs into AI stocks, Bitcoin, and what you should be doing right now. Is it time to go long? Go short? Or wait for a decline? He explains the difference between FOMO and actually losing money, and how pain...

READ MORE

MEMBERS ONLY

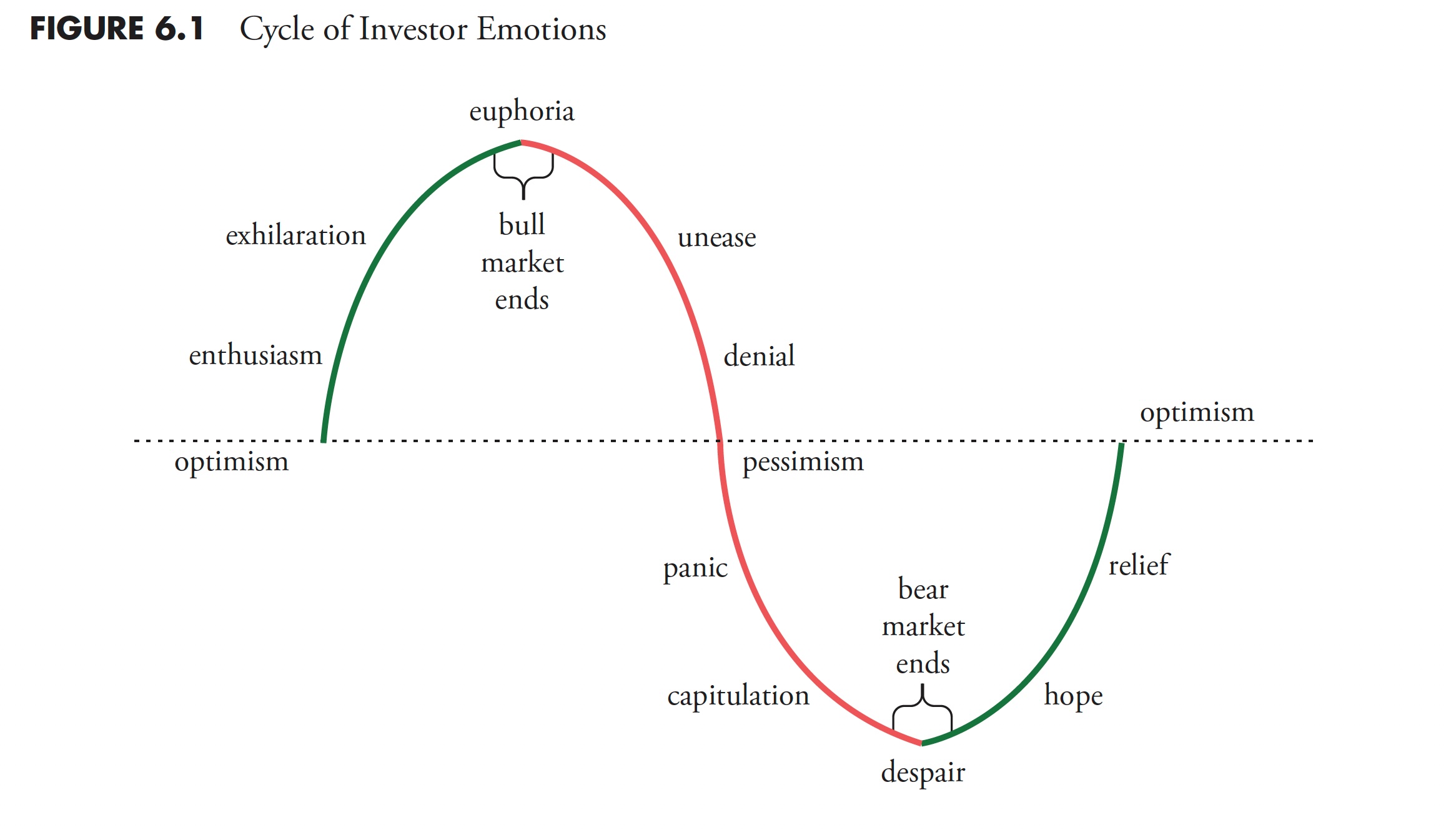

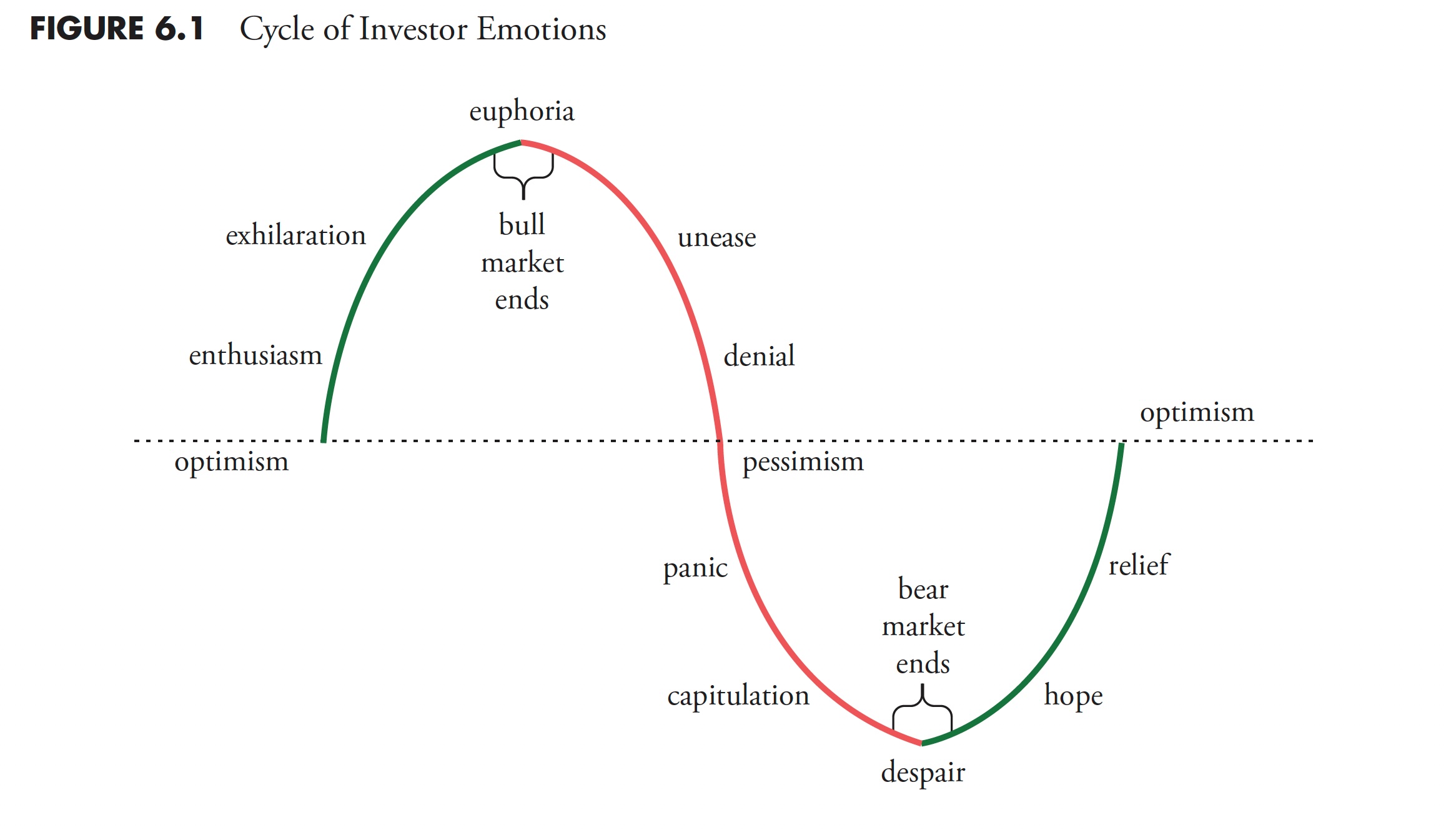

The Hoax of Modern Finance - Part 8: The Enemy in the Mirror

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the eighth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

How To Buy Meta at a Bargain: An Options Strategy You Need to Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* META rose after the company's last earnings report and could be due for a pullback

* If META pulls back, you could buy the stock at a lower price using options

* By selling puts, you could collect premium from selling puts with the possibility of buying META...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Walmart Stood Strong When The Market Crumbled - Time To Buy?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Walmart's stock was one among 37 outliers, rising early amidst a major market decline before slightly pulling back

* Technical indicators warn of potential weakness, signaling an imminent dip, but there's a good entry point for WMT

* Setting price alerts around specific levels and watching...

READ MORE

MEMBERS ONLY

Catch BIGGER GAINS by Fishing for Alpha

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights breakouts in home builders and Bitcoin and reviews key names reporting earnings including ABNB, SHOP, and MAR. He also shares an equity scan he uses every week to identify the next potential breakout candidates. Stay tuned until the...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, February 15th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this coming Thursday, February 15 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current...

READ MORE

MEMBERS ONLY

DP Trading Room: Avoid These "Magnificent 7" Stocks!

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint Trading Room episode, Carl reviews the Magnificent 7 and gives you his opinion on their current and possible future states. He warns against two in particular and gives his stamp of approval on three others. Negative divergences are still a problem and Carl explains why....

READ MORE

MEMBERS ONLY

Your Questions, Answered! Price Gaps, Bull Flags, Inverse Patterns, and MORE

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave digs into The Final Bar Mailbag and answers questions on price patterns like bull flags, what price gaps actually represent on the chart, and why analyzing earnings trends could help you anticipate subsequent moves for stocks like META.

This...

READ MORE

MEMBERS ONLY

The Costco Stock Surge: What You Need to Know Right Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Costco's stock surged to unprecedented heights, surpassing its previous all-time record

* Costco's technical situation looks exceedingly bullish, but like many stocks hitting record highs, the stock may be slightly overbought

* The Money Flow Index can measure momentum and show whether price buying pressure is...

READ MORE

MEMBERS ONLY

3 Expert Earnings Plays: Maximizing Reward, Minimizing Risk

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Danielle Shay of Simpler Trading. Danielle highlights three earnings plays she's focused on this week, and shares how she combines multiple time frames in her trading to better define risk vs. reward. Dave laments the weakening...

READ MORE

MEMBERS ONLY

Master Momentum Using Price Swings and Fibonacci Grids

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses how he uses the price swings and Fibonacci grid to determine the momentum of a trend without the use of indicators. He explains how indicators can lag at reversal points and why we need to lean...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 7: The Illusion of Forecasting

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the seventh in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Why the NAAIM Exposure Index Matters to Your Investments

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Ryan Redfern, ChFC, CMT of Shadowridge Asset Management and President of NAAIM. Ryan provides a primer on the NAAIM Exposure Index, including what it is, how it's calculated, and how it can be used to measure...

READ MORE

MEMBERS ONLY

Decoding PLTR Stock: Why It's an Attractive Investment

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* PLTR stock gapped up after its impressive Q4 earnings and guidance

* Watch the average directional index and relative strength index to monitor the momentum of the upward trend

* If momentum continues to be strong, the stock would be an attractive investment

If you look at a chart of...

READ MORE

MEMBERS ONLY

Eli Lilly's Volatile Victory: What Tuesday's Turnaround Means for Your Portfolio

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Eli Lilly & Co's beat on earnings and revenue expectations led to a swift 5% spike and reversal in its stock price

* Analyzing Eli Lilly's stock price chart reveal some headwinds that may not be apparent in fundamental data

* Eli Lilly's stock...

READ MORE

MEMBERS ONLY

Three Things I WISH I'd Known About Trading

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave speaks to weakening short-term breadth conditions as the McClellan Oscillator rotates to a bearish level this week. Guest Dave Landry of DaveLandry.com drops some serious trader wisdom and also shares what he does first thing every morning to...

READ MORE

MEMBERS ONLY

Market Breadth Divergence Says NO BULL!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave demonstrates how the market's recent upswing has left mid-caps and small-caps in the dust, with deteriorating breadth conditions suggesting an increased risk of downside for the S&P 500. He also unveils the latest enhancements to...

READ MORE

MEMBERS ONLY

Only a Fool Would Try to Call a Correction in a Bull Market, So Here Goes!

by Martin Pring,

President, Pring Research

The vast majority of the primary trend indicators are pointing to a bull market and have been doing so for the better part of a year. Chart 1, for instance, shows that NYSE Margin Debt, or rather its long-term KST, has only recently gone bullish. The vertical lines point out...

READ MORE

MEMBERS ONLY

DecisionPoint Trading Room: Narrow Advance a Big Problem!

by Erin Swenlin,

Vice President, DecisionPoint.com

The market rally last week was very narrow, driven mainly by large gains in communication services stocks like Meta. Many technical indicators are showing negative divergences. The broader market struggled. Erin reviews all of the sectors under the hood and then takes your symbol requests.

Key Takeaways:

- Communication services...

READ MORE