MEMBERS ONLY

AU Surges Above Resistance: Here's How to Take Action

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AngloGold Ashanti Ltd. is outperforming gold and its mining peers.

* Despite long-term bullish projections, AU faces short-term overbought conditions.

* Key levels are at $33 and $28 on the downside and $42 to $45 on the upside.

As precious metals surgeon safe-haven demand, some gold mining companies are following...

READ MORE

MEMBERS ONLY

DP Trading Room: Magnificent Seven Stocks in Bear Markets

by Erin Swenlin,

Vice President, DecisionPoint.com

You may not know it, but all of the Magnificent Seven stocks are in bear markets. Given they are such an integral part of the major indexes, we have to believe that the market will follow suit and continue lower in its own bear market. The SP500 is in correction...

READ MORE

MEMBERS ONLY

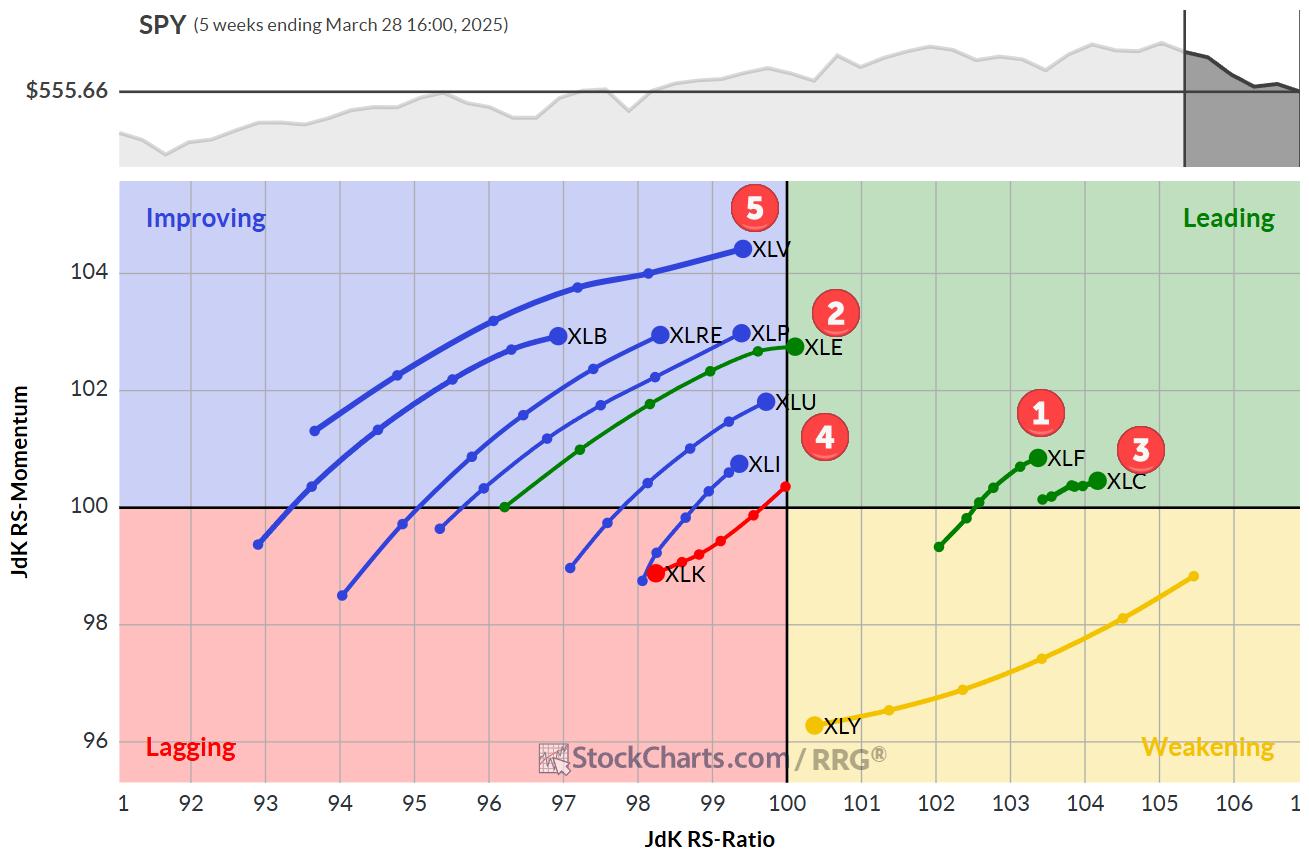

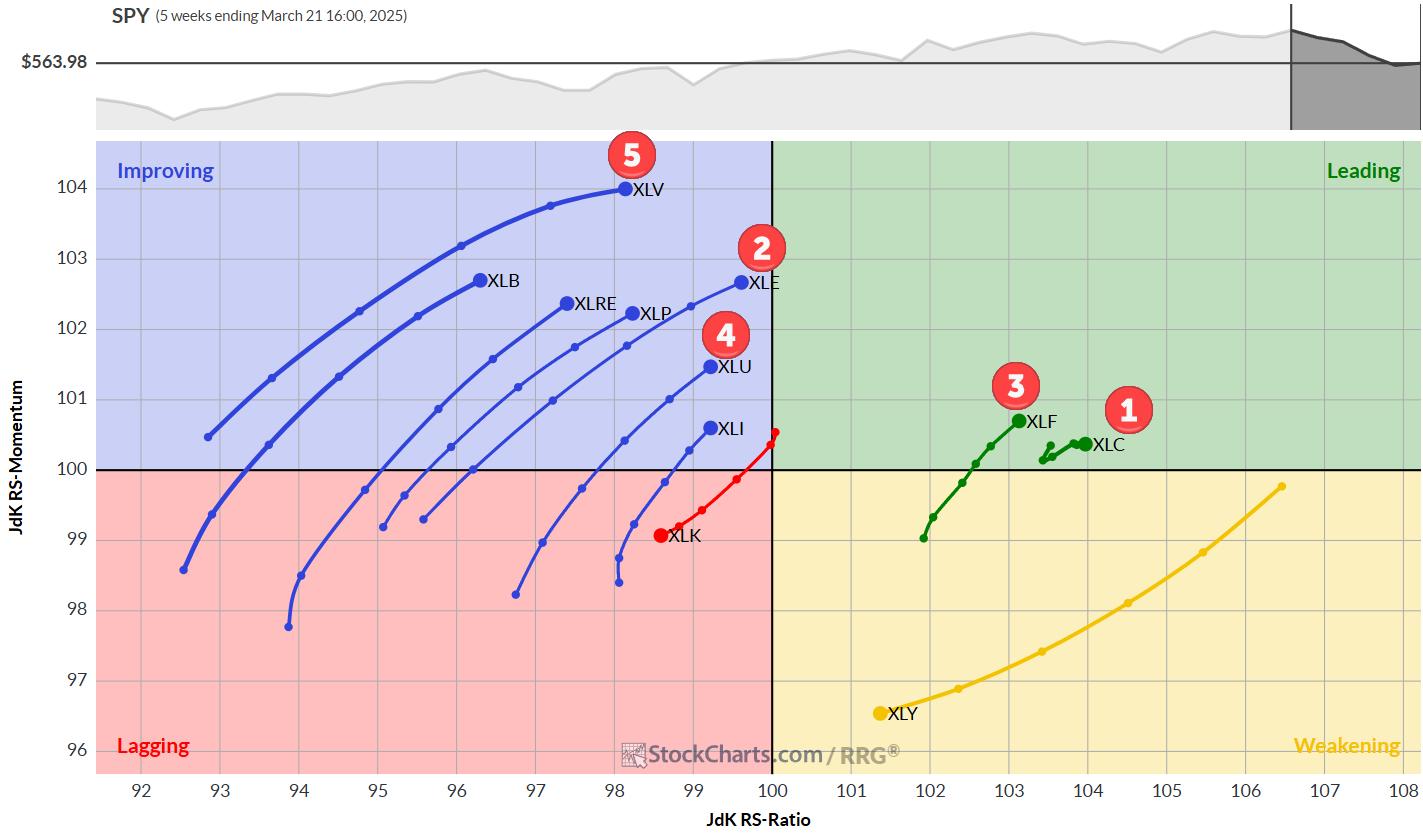

The Best Five Sectors, #13

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Financials jump to #1 spot in S&P 500 sector rankings.

* Three sectors now in leading quadrant on weekly RRG

* Only Tech and Consumer Discretionary showing negative RRG headings

* RRG portfolio outperforming S&P 500 YTD by 10 basis points

Financials take the lead.

No changes...

READ MORE

MEMBERS ONLY

Stocks In Focus: Three Charts to Watch

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* Two Consumer Staples stocks and one Consumer Discretionary stock made the cut this week.

* These three stocks show clear support levels that could serve as potential entry points.

This week, we get back to earnings and, sadly, the pickings are slim.

Given these turbulent times, we have two...

READ MORE

MEMBERS ONLY

This Precious Metal is On the Verge of a Massive Breakout. Here's How to Catch It!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Silver and gold have been rallying due to macroeconomic uncertainty, central bank purchases, and industrial demand.

* Precious metals have risen considerably and many analysts are projecting even higher target prices, especially for silver.

* Gold and silver are approaching key levels of entry and support.

Gold at $3,100...

READ MORE

MEMBERS ONLY

Key Levels for AAPL, AMZN, NVDA — Will This Market Rally Hold?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave breaks down the upside bounce in the Magnificent 7 stocks — AAPL, AMZN, NVDA, and more — highlighting key levels, 200-day moving averages, and top trading strategies using the StockCharts platform. Find out whether these leading growth stocks are set for a bullish reversal or more downside. Will...

READ MORE

MEMBERS ONLY

DRI Stock Breakout Confirmed: Here's What You Need to Know Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* When markets rebound from a sharp decline, you'll have more than enough stocks to choose from.

* If you're considering stocks that are outpacing their peers, you need to run the right scan to spot them.

* Darden Restaurants' stock price made an all-time high,...

READ MORE

MEMBERS ONLY

DP Trading Room: Tariffs Narrowing, Sparks Market Rally

by Erin Swenlin,

Vice President, DecisionPoint.com

Over the weekend it was announced that tariffs will be narrowing and possibly not as widespread as initially thought. Negotiations are continuing in the background and this seems to be allaying market participants' fears. The market rallied strongly on the news.

Carl and Erin gave you their opinions of...

READ MORE

MEMBERS ONLY

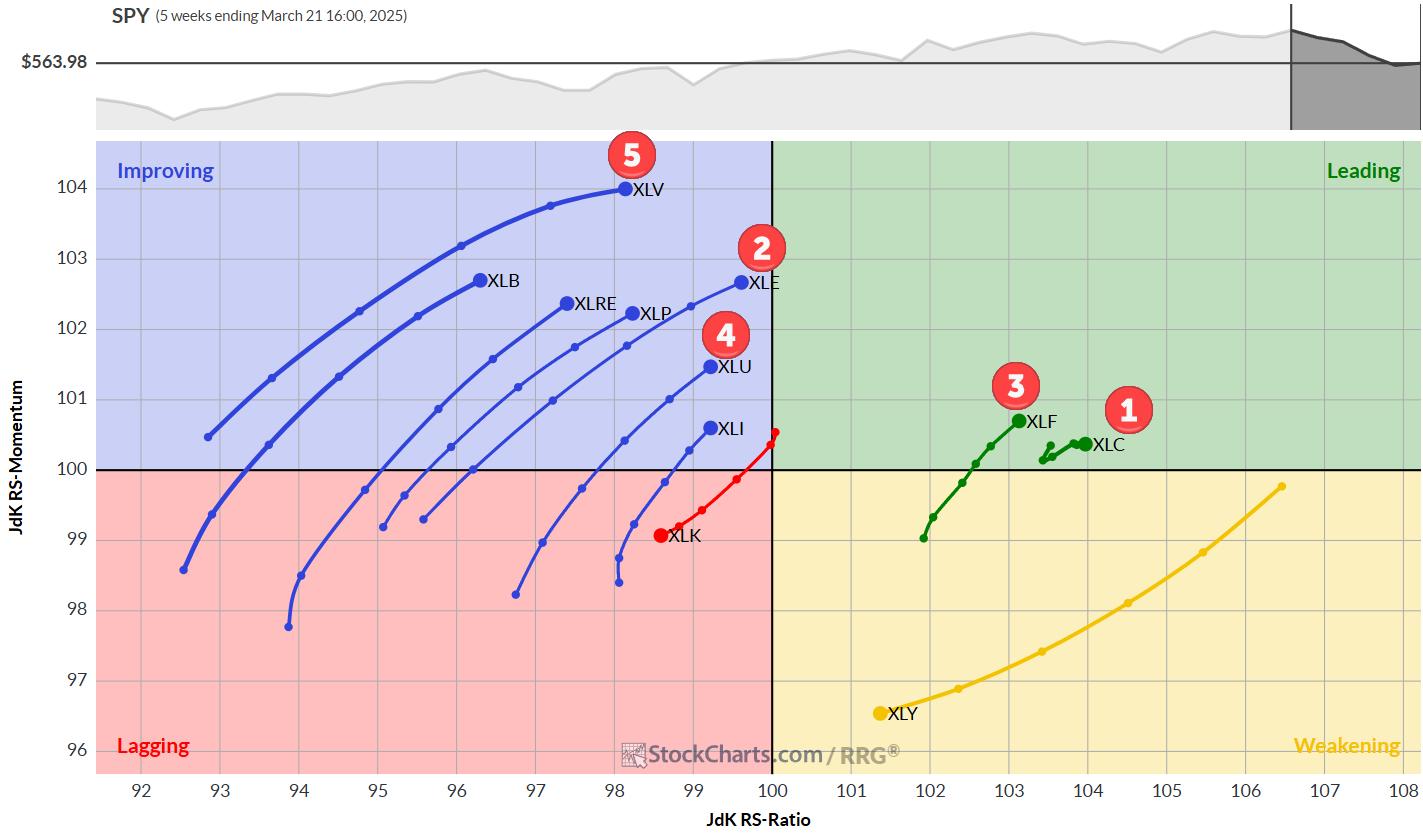

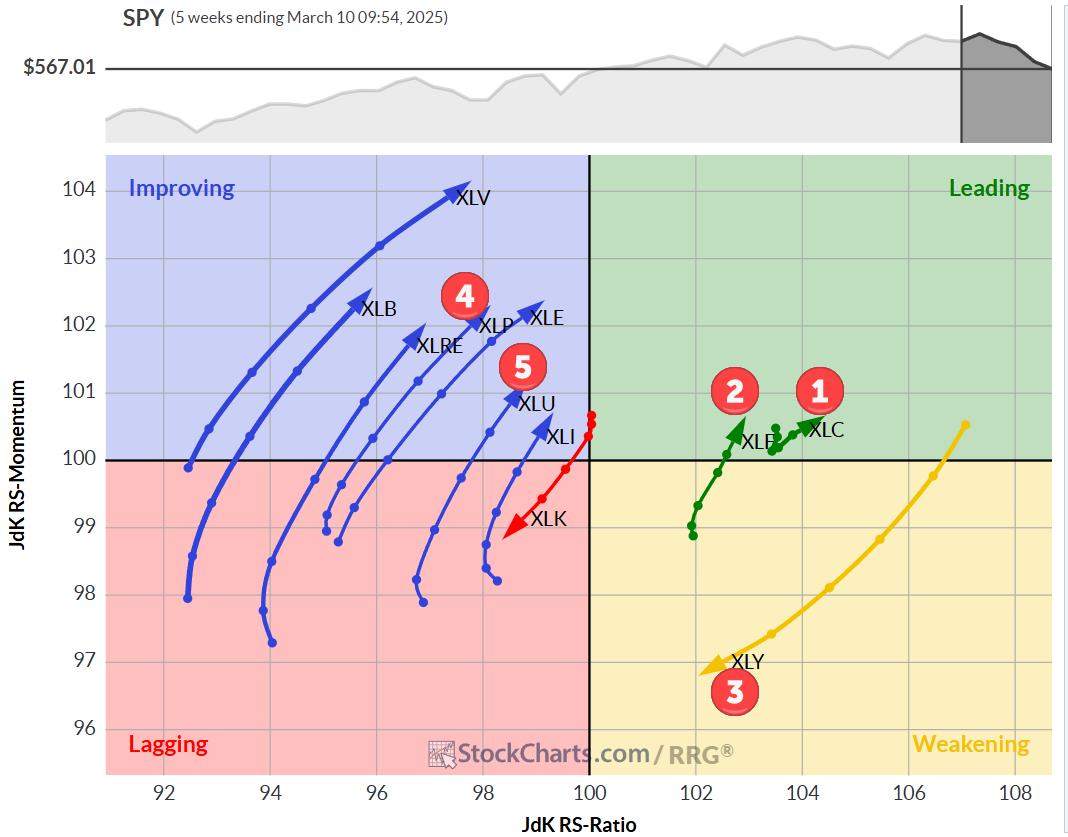

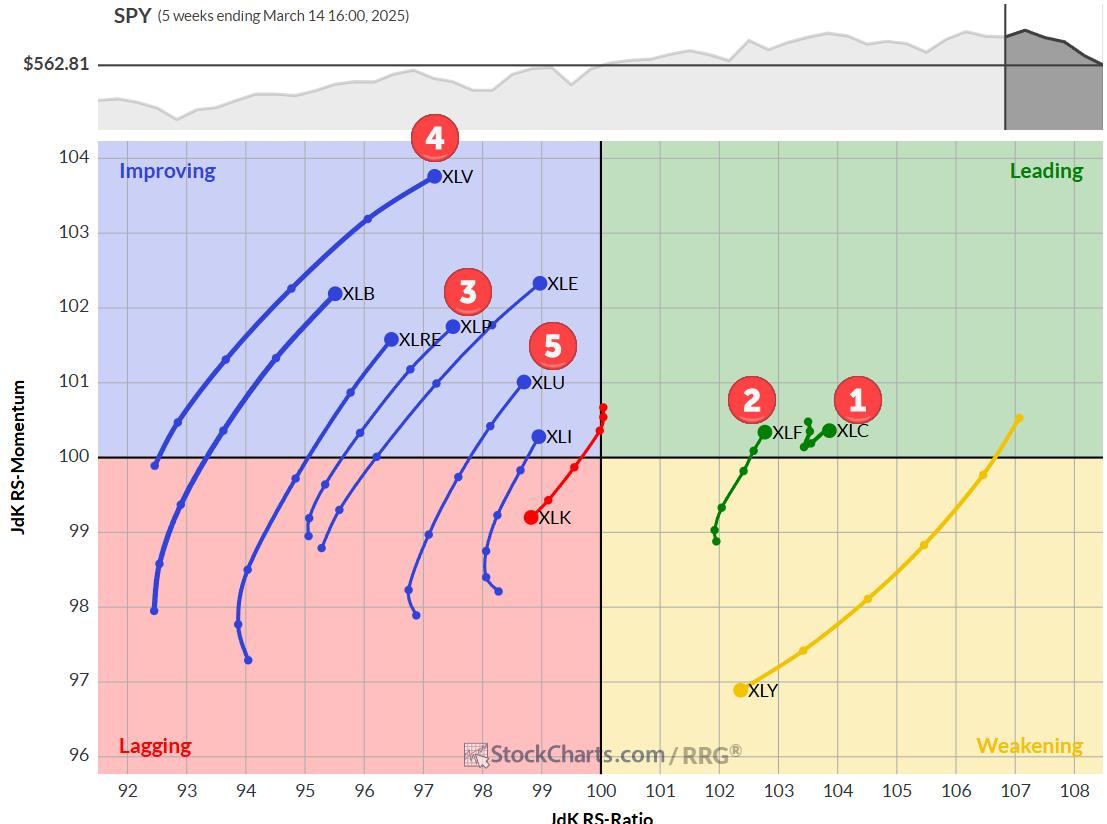

The Best Five Sectors, #12

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

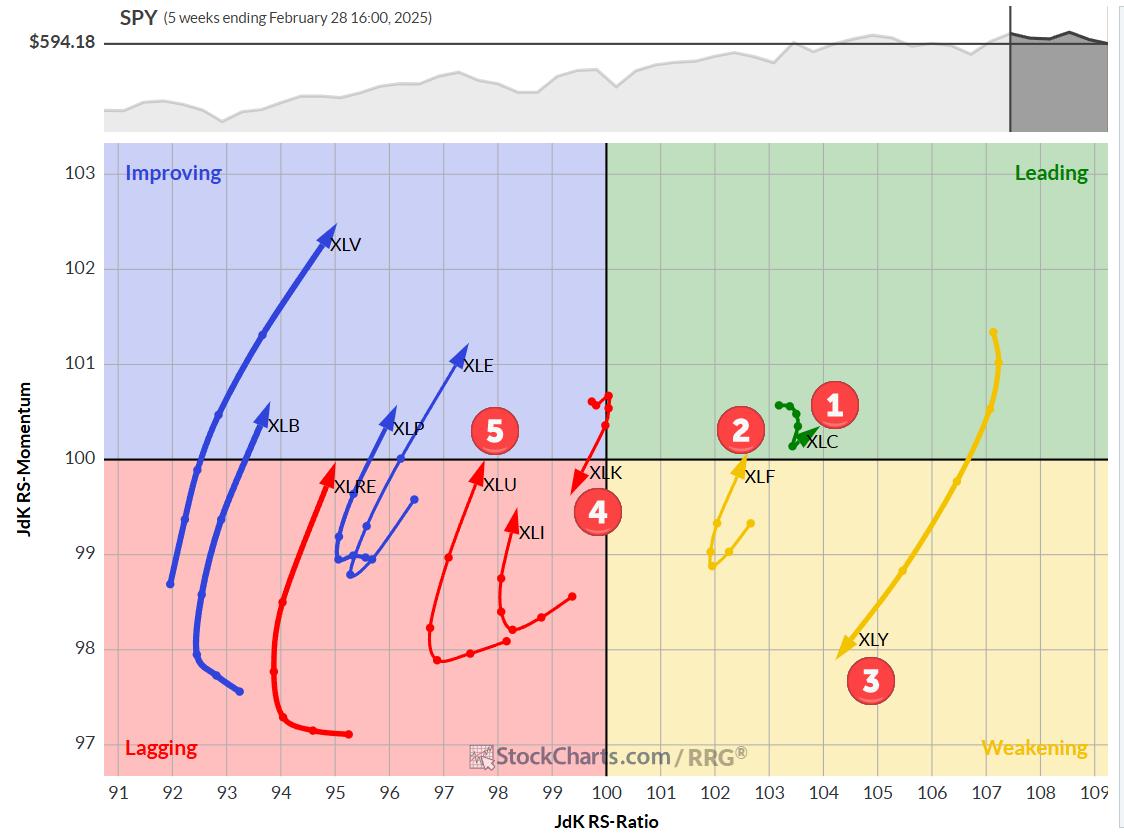

KEY TAKEAWAYS

* Energy sector jumps to position #2 in top 5

* Consumer Staples drops out of portfolio

* Communication Services remains at #1 spot

* Modest pick up of relative momentum for XLK and XLY not enough yet

Energy Jumps to #2

A big move for the energy sector last week as...

READ MORE

MEMBERS ONLY

The Top Options Strategy Hedge Funds Use

by Tony Zhang,

Chief Strategist, OptionsPlay

In a volatile stock market, hedging your portfolio can go a long way in reducing your drawdowns. In this video, follow along with Tony as he uncovers one of the top options trading strategies used by hedge funds. Learn how you can identify optimal put selling trading opportunities and apply...

READ MORE

MEMBERS ONLY

4 Scenarios for Nasdaq 100: Bullish Surge or Bearish Collapse?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Can the Nasdaq 100 rally to all-time highs or break down below key support? In this video, Dave uses probabilistic analysis to explore 4 possible scenarios for the QQQ over the next 6 weeks — from a super bullish surge to a bearish breakdown below the August 2024 low. Discover the...

READ MORE

MEMBERS ONLY

DP Trading Room: Upside Initiation Climax?

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday DP indicators logged an Upside Initiation Climax. This exhaustion events often mark the beginning of new rallies and could indicate that the market is indeed ready to rebound. However, we do question its veracity given lukewarm trading to begin Monday's trading.

Carl started us off by...

READ MORE

MEMBERS ONLY

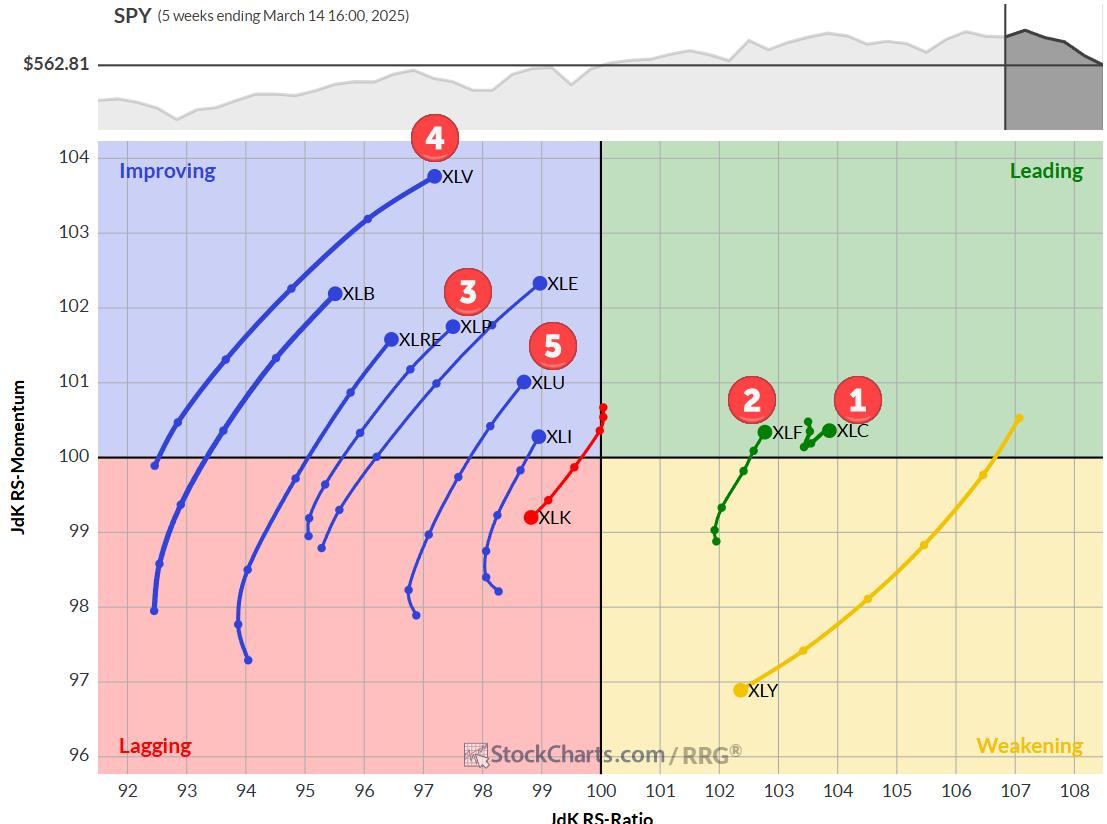

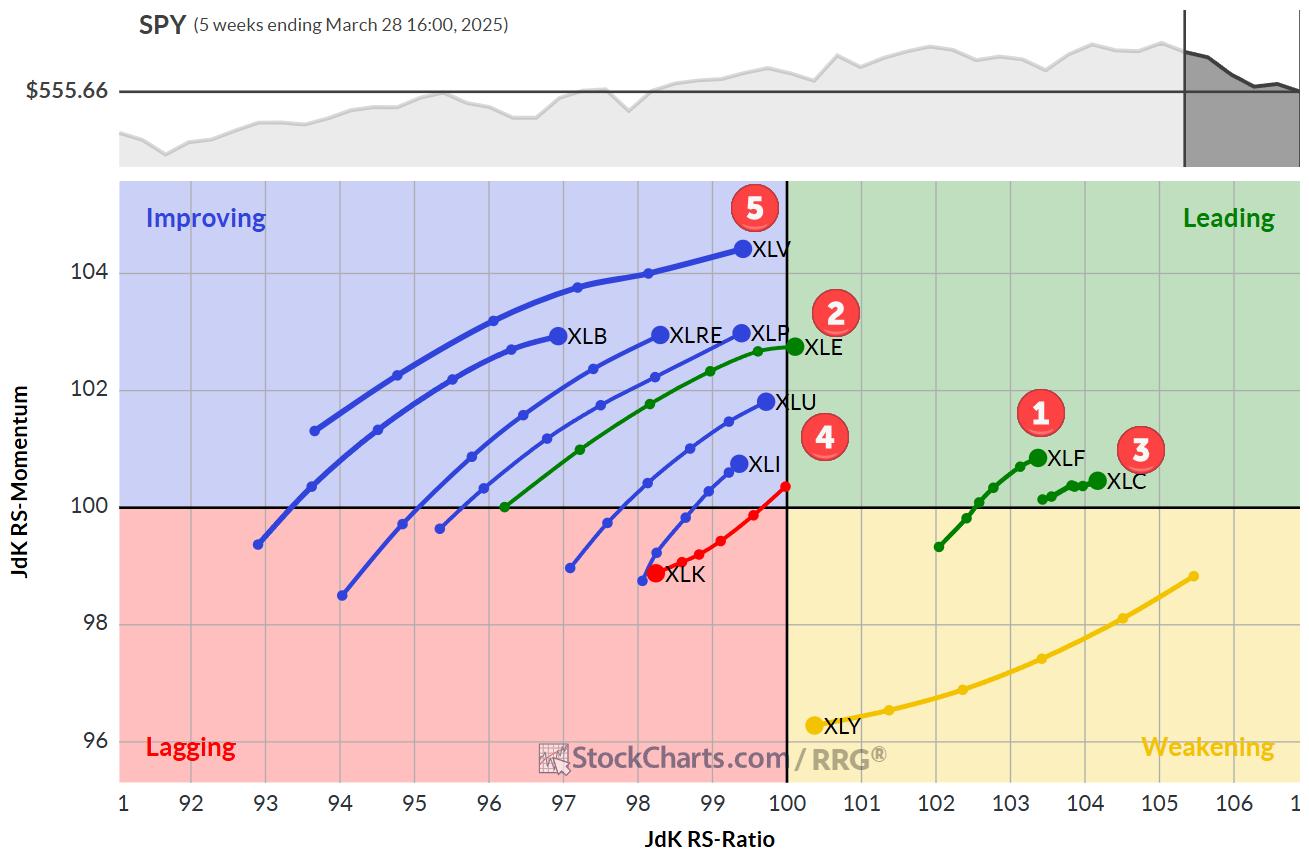

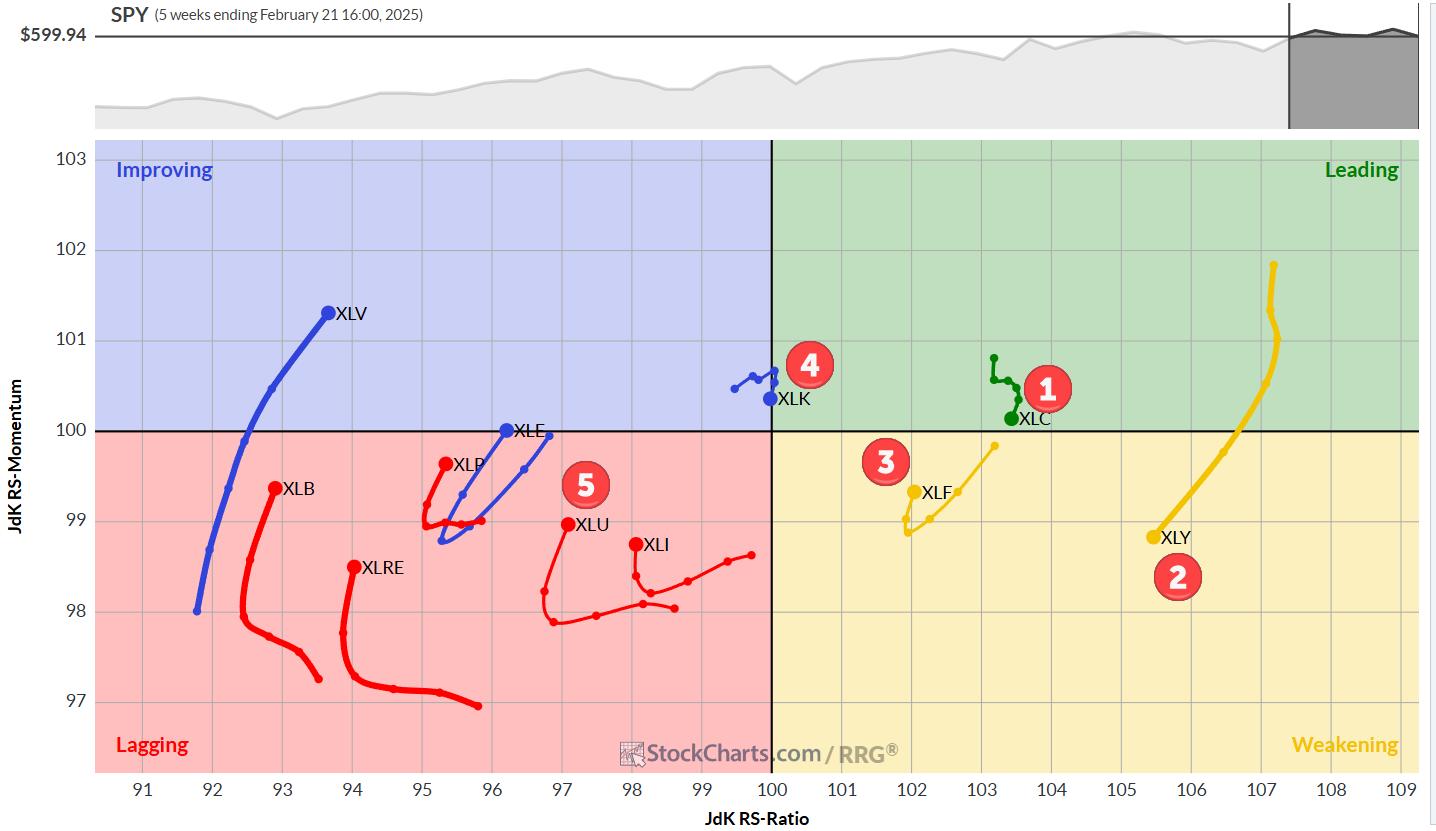

The Best Five Sectors, #11

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

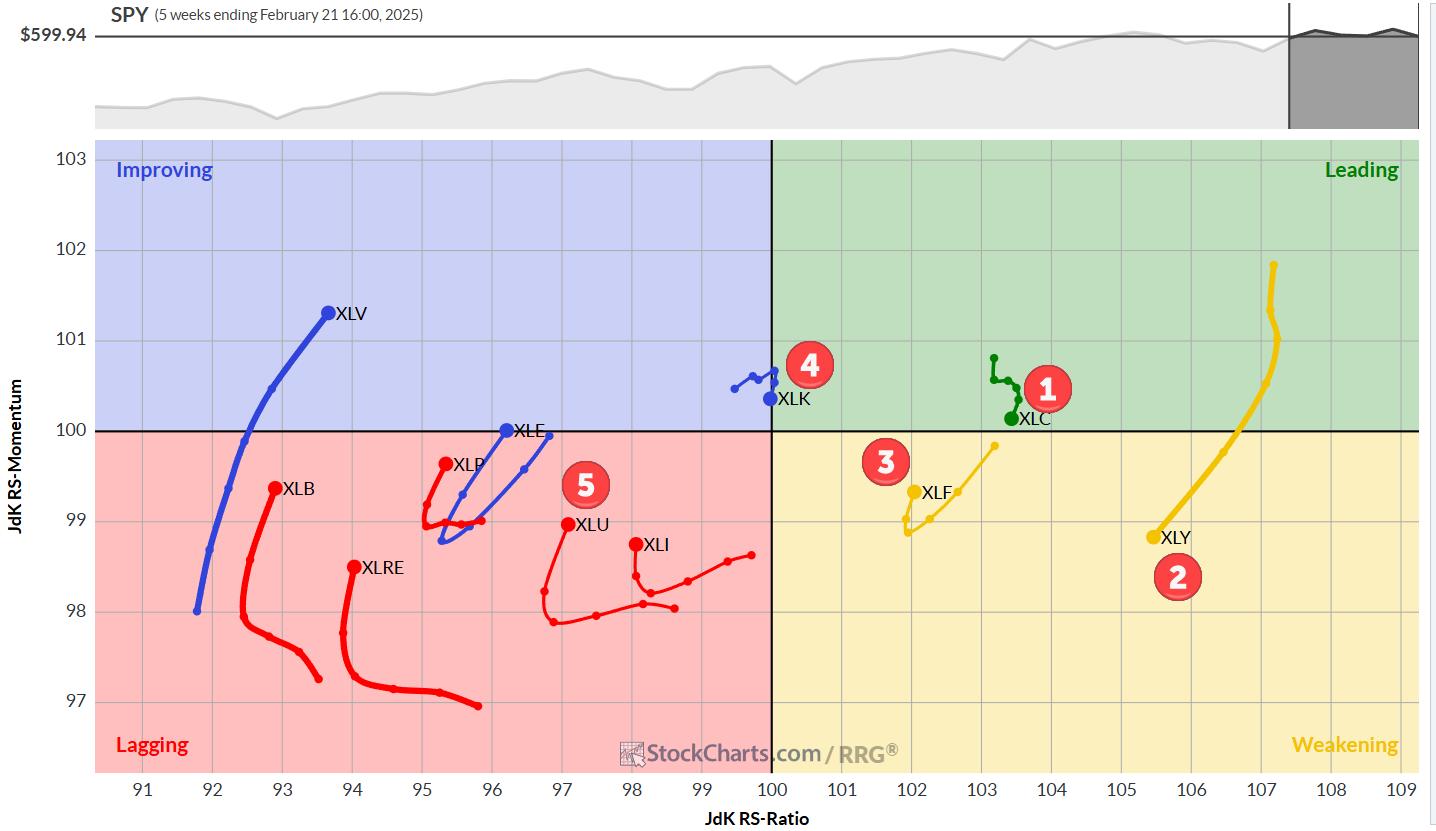

KEY TAKEAWAYS

* At the moment, we're seeing a big shakeup in sector rankings.

* Healthcare has entered the top five.

* Technology is dropping to last position.

* All defensive sectors are now in the top five.

Big Moves in Sector Ranking

The ranking of US sectors continues to shift. At...

READ MORE

MEMBERS ONLY

Stocks in Focus: Three Stocks Primed for Explosive Growth

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* Five Below is in a long-term downtrend and could be setting up for rally from which swing traders could benefit.

* Nike's stock price has struggled to break above its 200-day moving average, but a bullish divergence may be lurking.

* Micron Technology shares have been in a...

READ MORE

MEMBERS ONLY

Is a New Market Uptrend Starting? Key Signals & Trading Strategies

by Mary Ellen McGonagle,

President, MEM Investment Research

Is a new market uptrend on the horizon? In this video, Mary Ellen breaks down the latest stock market outlook, revealing key signals that could confirm a trend reversal. She dives into sector rotation, explains why defensive stocks are losing ground, and shares actionable short-term trading strategies for oversold stocks....

READ MORE

MEMBERS ONLY

Retail (XRT) Dropping Quickly

by Erin Swenlin,

Vice President, DecisionPoint.com

It's been rocky for the S&P 500 and particularly rocky for some industry groups and sectors. The market does appear ready to give us a good bounce, but past that we aren't overly bullish.

Tariff talk has really pummeled the Retail (XRT) industry group...

READ MORE

MEMBERS ONLY

Tariff Turmoil: 3 Stocks You Need To Know Right Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The tariff environment remains unpredictable, resulting in investor fatigue.

* A strong fundamental approach is necessary to identify stocks that can withstand tariff risks.

* Once you find tradable stocks, a technical approach can help you refine your analysis.

No one can predict how tariffs will play out or how...

READ MORE

MEMBERS ONLY

Five Stocks Showing Strength in a Bearish Tape

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* There's strength in the financial sector, but it's not the banks.

* Auto parts remains a strong group in a struggling sector.

* Three-month highs often signal renewed strength.

Where can investors find a safe haven during a period of market uncertainty? Personally, I think it&...

READ MORE

MEMBERS ONLY

How to Spot a Market Rebound Before Everyone Else Does

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* While the major indices represent the market's state, their market cap weighting can sometimes distort what's happening internally.

* Breadth indicators like the McClellan Oscillator provide insight into the internal dynamics of the market.

* Understanding how market participation happens within an index can help you...

READ MORE

MEMBERS ONLY

5 Strong Stocks Defying the Bearish Market!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave analyzes the bearish rotation in his Market Trend Model, highlighting the S&P 500 breakdown below the 200-day moving average and its downside potential. He also identifies five strong stocks with bullish technical setups despite market weakness. Watch now for key technical analysis insights to...

READ MORE

MEMBERS ONLY

Transform Your Investing Strategy: Uncover the 3 Game-Changing Rules

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Setting some investing rules before investing in a stock or ETF is critical.

* Basic principles, such as knowing a security's long-term trend, market participation, and watching shorter-term trends, simplify the investing process.

* Having the discipline to follow your rules makes you a smarter investor.

"The...

READ MORE

MEMBERS ONLY

DP Trading Room: Market Sell-Off

by Erin Swenlin,

Vice President, DecisionPoint.com

The market sell-off continued in earnest after a brief respite on Friday. Uncertainty of geopolitical tensions and tariff talk has spooked the market and given the weakness of mega-cap stocks, we are likely to see more downside before a snapback rally.

Carl was off today so Erin had the controls!...

READ MORE

MEMBERS ONLY

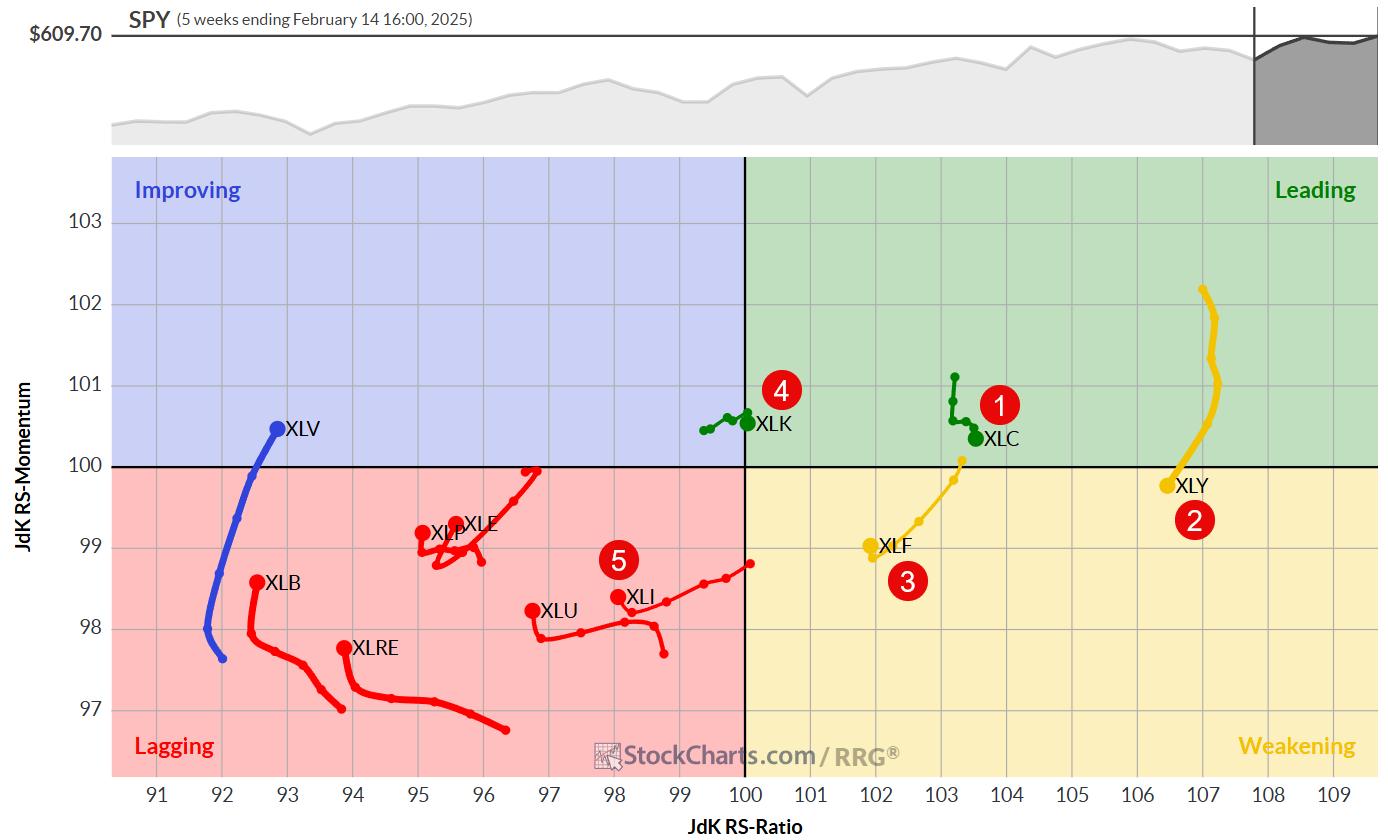

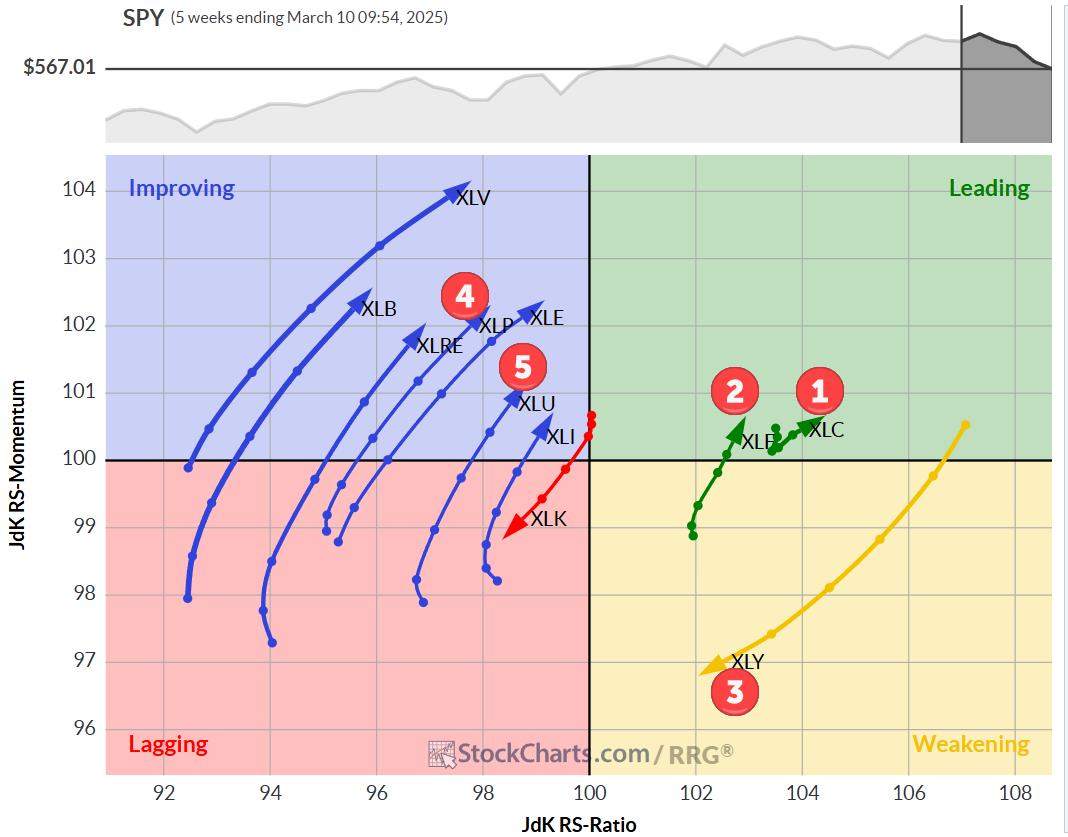

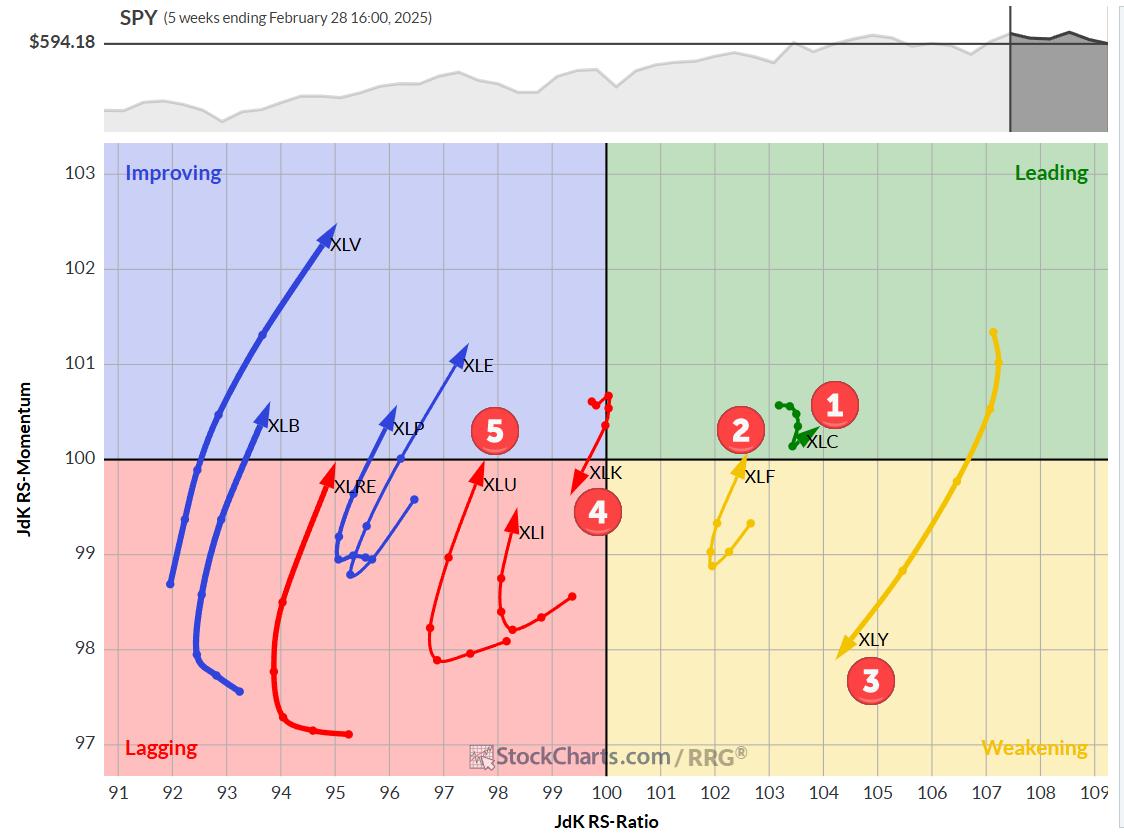

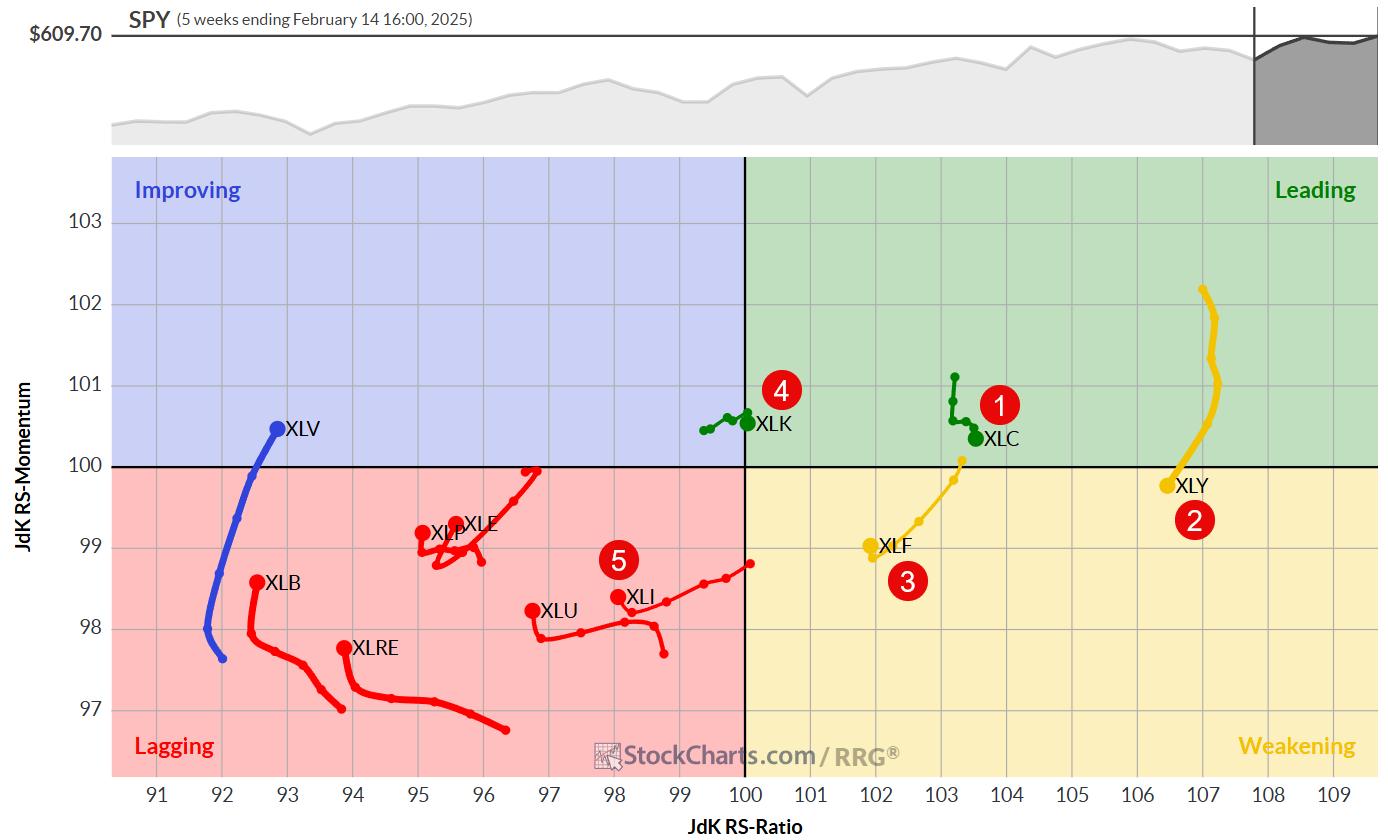

The Best Five Sectors, #10

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Communication Services (XLC) maintains top spot, Tech (XLK) plummets

* Shift towards defensive sectors evident in rankings

* Consumer Discretionary (XLY) showing signs of weakness

* Portfolio slightly outperforming SPY benchmark

Sector Shake-Up: Defensive Moves and Tech's Tumble

Last week's market volatility stirred up the sector rankings,...

READ MORE

MEMBERS ONLY

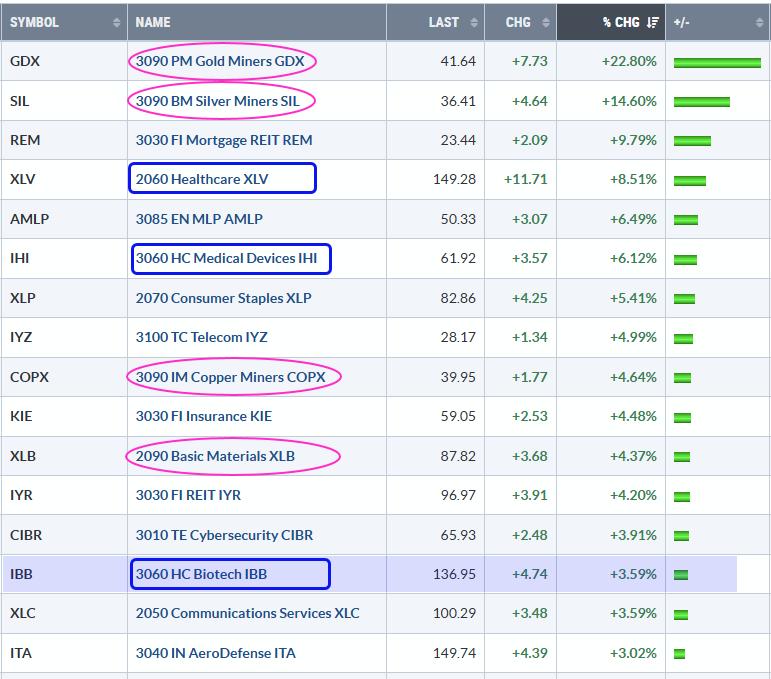

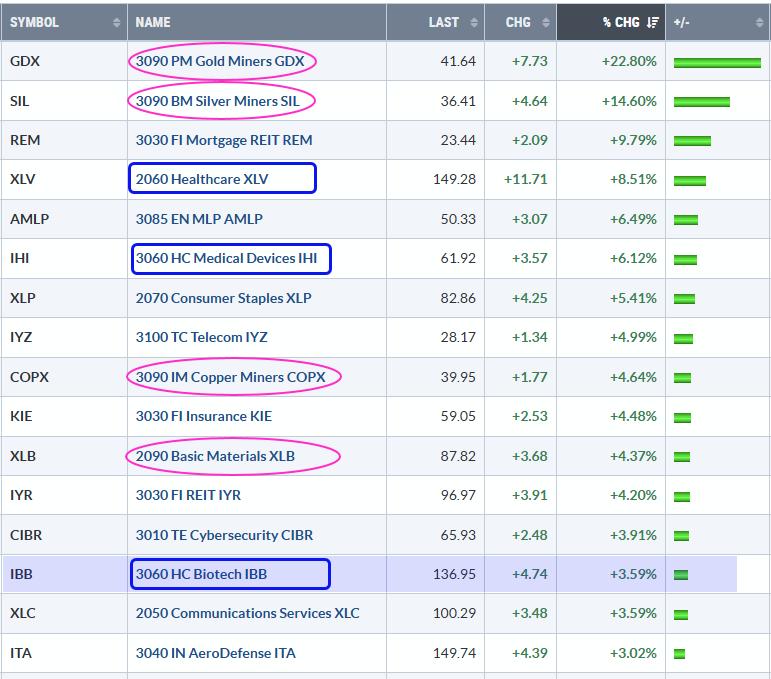

Commodity and Healthcare Related ETFs Lead in 2025 - Bullish Breakout in Biotechs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* 2025 is off to a rough start with SPY, QQQ and IWM sporting losses.

* ETFs with gains are bucking the market by showing relative and absolute strength.

* The Biotech ETF broke out in January and is battling its breakout zone.

2025 is off to a rough start for...

READ MORE

MEMBERS ONLY

Why Investors Are Flocking to XPEV Stock: Decoding High SCTR Scores

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* XPeng's stock price has been rising since 2023 and is approaching a resistance level.

* XPEV stock's high SCTR score indicates the stock is technically strong.

* A pullback in XPEV's stock price followed by a reversal and breakthrough its resistance level would be...

READ MORE

MEMBERS ONLY

Market Movers in Action: How to Identify High-Probability Dip-Buying Setups

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A successful buy-the-dip strategy starts with having the right tools to identify a broad range of opportunities.

* Market Movers paired with MarketCarpets is one approach that can help you spot potentially tradable stocks.

* Conduct a deep-dive analysis to reduce the odds of catching a falling knife.

If the...

READ MORE

MEMBERS ONLY

Simple Approach to Transform Your Trading

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe breaks down his trading strategy using multiple timeframes. He explains how to spot key patterns on higher timeframes and use lower timeframes for confirmation. Joe provides trading examples, including bearish setups, and analyzes the general market using the daily chart to predict the next...

READ MORE

MEMBERS ONLY

Elevate Your Options Trading!

by Tony Zhang,

Chief Strategist, OptionsPlay

Follow along with this must-see video, where Tony will show you how to use the tools in the OptionsPlay Add-on to help find winning trades with just a few clicks.

Enhance your trading performance and discover how you can do the following:

* Find winning trades by leveraging real-time strategy screening...

READ MORE

MEMBERS ONLY

How to Apply Top Options Strategies with the OptionsPlay Add-On

by Tony Zhang,

Chief Strategist, OptionsPlay

In this must-see video, Tony explains the top options strategies and shares the best practices for trade entries, exits, and optimal deployment conditions. As you watch along, you'll get a clear roadmap for confidently utilizing each option strategy. Check it out below!

Note: This video premiered on January...

READ MORE

MEMBERS ONLY

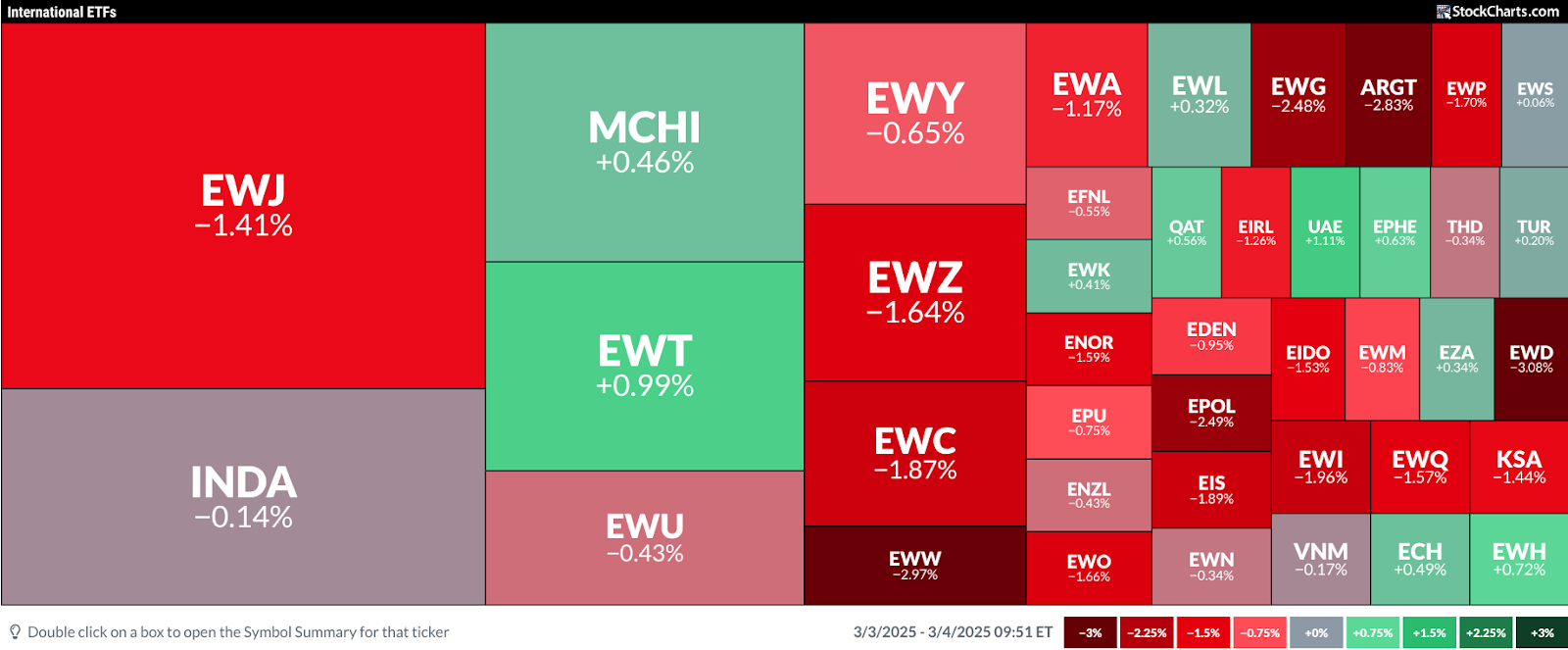

Trade War Panic: Are International Stocks the Safer Bet Now?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Tariffs on China, Canada, and Mexico are officially in effect.

* While US stocks have declined in response, might there be investing opportunities in international markets?

With US tariffs on Canada, Mexico, and China having taken effect at midnight on Tuesday, US indexes extended their Monday losses, deepening concerns...

READ MORE

MEMBERS ONLY

DP Trading Room: Bitcoin Surges!

by Erin Swenlin,

Vice President, DecisionPoint.com

The news is that the United States will have a Cryptocurrency reserve. How this will occur is still murky, but Bitcoin surged on the news. Carl and Erin give you their opinion on Bitcoin's chart setup and possible future movement.

Carl opens the trading room with a review...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #9

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Communication services maintains top spot in sector ranking.

* Financials moves up to #2, pushing consumer discretionary down to #3.

* Technology and utilities hold steady at #4 and #5 respectively.

* Portfolio performance now on par with benchmark after recent outperformance.

Sector Rotation: Financials Climb as Consumer Discretionary Slips

While...

READ MORE

MEMBERS ONLY

Sector Rotation: How to Spot It Early Using Four Tools

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Following the two "confidence" reports over the last few weeks, investors appear to be expecting a recession.

* Defensive stocks are starting to show early strength relative to cyclicals.

* If we're on the verge of a sector rotation, there are several tools you can use...

READ MORE

MEMBERS ONLY

Bearish Signals & Risk Management: Protect Your Portfolio!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave breaks down bearish macro signals and risk management using the "line in the sand" technique! Learn how to spot key support levels, set alerts on StockCharts, and protect your portfolio!

This video originally premiered on February 26, 2025. Watch on StockCharts' dedicated David...

READ MORE

MEMBERS ONLY

Get The BEST Options Trade Ideas for This Week with Tony Zhang

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony breaks down the big-picture market trends before diving deep into bullish and bearish setups for META, BIDU, AMGN, NVDA, DAL, and more! Get expert insights and key analysis you won't want to miss!

This video premiered on February 24, 2025....

READ MORE

MEMBERS ONLY

DP Trading Room: Defensive Sectors Lead the Pack

by Erin Swenlin,

Vice President, DecisionPoint.com

The complexion of the market is changing. Aggressive sectors which have led the market higher are now beginning to show signs of strain as momentum slowly dissipates and prices turn lower. However, defensive sectors (XLP, XLRE, XLV and XLU) are now leading the market. Typically when this occurs the market...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #8

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Utilities entering the top-5

* Industrials dropping out of top-5 portfolio

* Real-Estate and Energy swapping positions in bottom half of the ranking

* Perfomance now 0.3% below SPY since inception.

Utilities enter top 5

Last week's trading, especially the sell-off on Friday, has caused the Utilities sector...

READ MORE

MEMBERS ONLY

From Crash to Comeback: Is SMCI Stock the Hottest AI Asset Right Now?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SMCI shot up 110% following a 1,167% plunge.

* While the company is projecting $40 billion in revenue by next year, many analysts aren't convinced (yet).

* The price action, however, tells its own story and is a few levels away from a buy and an uptrend....

READ MORE

MEMBERS ONLY

How To Grow Your Options Trading Account

by Tony Zhang,

Chief Strategist, OptionsPlay

Learn how to build your confidence in the markets with this high probability of success strategy and how to find the best opportunities every day to earn consistent income with the tools available at StockCharts.com.

This video premiered on February 18, 2025....

READ MORE

MEMBERS ONLY

The Best Five Sectors, #7

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Communication services (XLC) claims the top spot, pushing consumer discretionary (XLY) to second place

* Technology (XLK) shows strength, moving up to fourth and displacing industrials (XLI)

* Industrials displaying weakness, at risk of dropping out of the top five

* RRG portfolio outperforming SPY benchmark by 69 basis points

Shifting...

READ MORE