MEMBERS ONLY

Double Tops In Bitcoin and the Dollar

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of the DP Alert, we cover Bitcoin and the Dollar every market day. We have been watching some bearish indications on both Bitcoin and the Dollar with the double top chart patterns.

On Bitcoin, price has been moving mostly sideways above support at 90,000. This happens to...

READ MORE

MEMBERS ONLY

Intel's Rising SCTR Score: Why You Should Add This Stock to Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Intel stock has seen strong upside movement for four consecutive days.

* Intel's stock price is hitting its 200-day moving average resistance.

* If INTC stock breaks above its 200-day moving average and its next resistance level, considering accumulating INTC shares in your portfolio.

Intel's stock...

READ MORE

MEMBERS ONLY

Master Trades in Volatile Markets With This 4MA Strategy

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows how the 4-day moving average can be useful especially in volatile markets. He explains the advantages of using it in conjunction with the 18-day MA to prevent buying at the wrong time and highlighting when good opportunities appear. He then goes through the...

READ MORE

MEMBERS ONLY

Are Trump's 25% Tariffs a Game-Changer for Steel Stocks? Here's What to Watch Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Trump's announced 25% tariffs on steel and aluminum imports are boosting domestic steel producers.

* STLD, NUE, and NEM jumped significantly relative to its peers.

* All three stocks may be approaching buy levels, but only under specific conditions.

On Monday morning, President Trump announced plans to impose...

READ MORE

MEMBERS ONLY

Why NVDA's Stock Price Shift Could Be Your Gain!

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* NVDA stock is staying within clear support and resistance levels.

* NVDA's stock price is approaching a position of strength.

* If NVDA's stock sees upside momentum, it may be time to accumulate positions.

Do you remember when NVDA stock had a very high StockCharts Technical...

READ MORE

MEMBERS ONLY

Three Technical Tools to Minimize Endowment Bias

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Have you ever held on too long to a winning position? You watch as that former top performer in your portfolio slows down, and then rotates lower, and then really begins to deteriorate, and you just watch it all happen without taking action?

If the answer is "yes"...

READ MORE

MEMBERS ONLY

DP Trading Room: Gold Hits Another All-Time High

by Erin Swenlin,

Vice President, DecisionPoint.com

The market rebounded to start trading on Monday, but indicators on Friday suggest internal weakness. Carl gives us his latest analysis on the market as well as taking a look at Gold which is making more all-time highs. Get Carl's perspective on the Gold rally.

Besides looking at...

READ MORE

MEMBERS ONLY

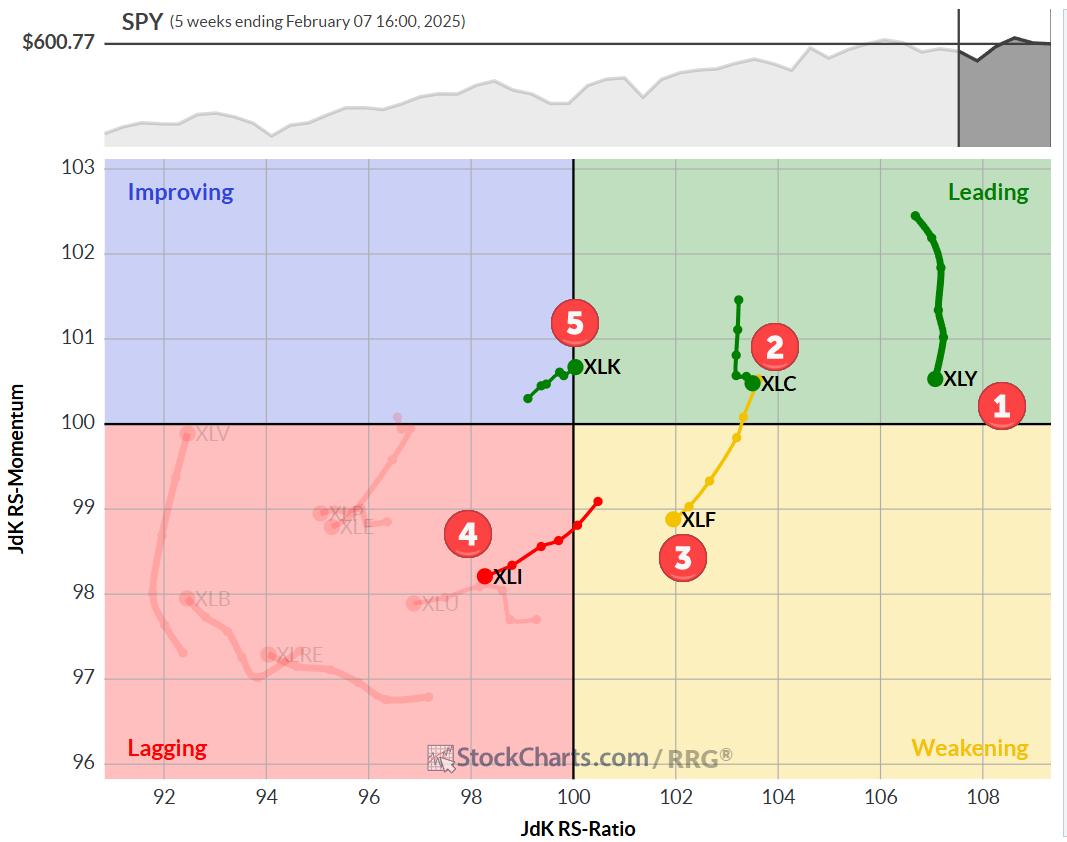

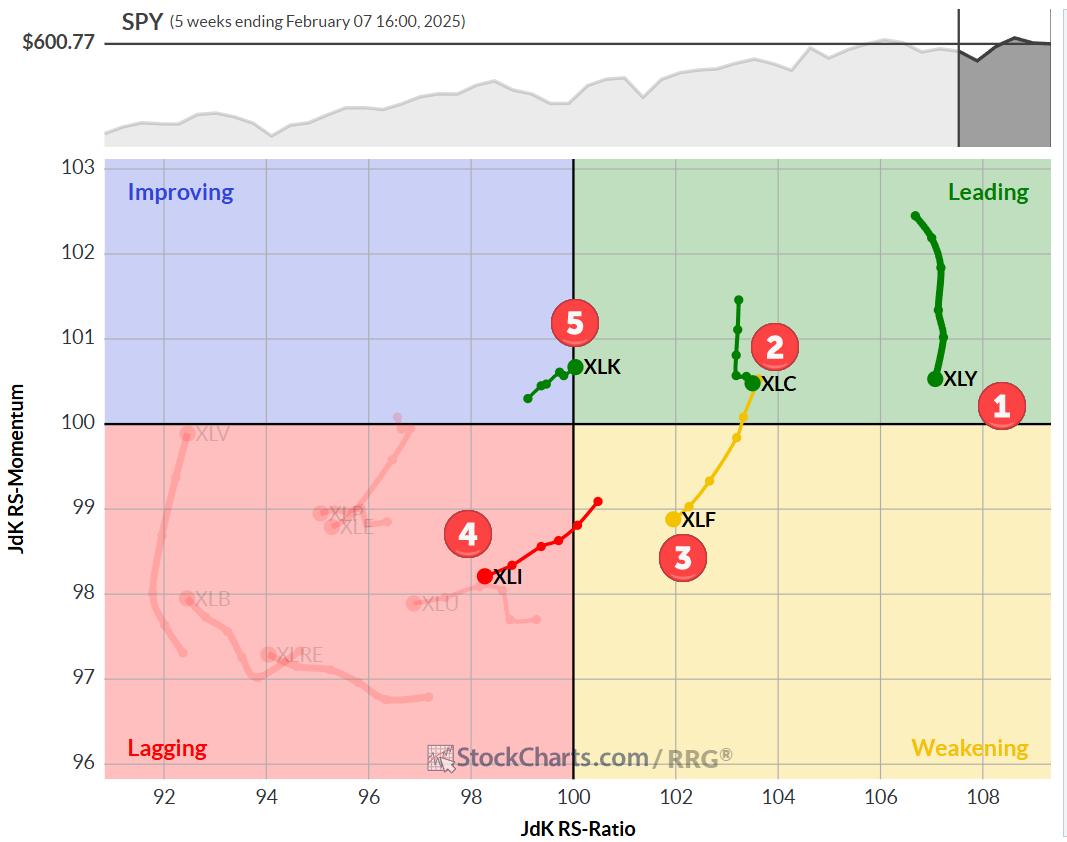

The Best Five Sectors, #6

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

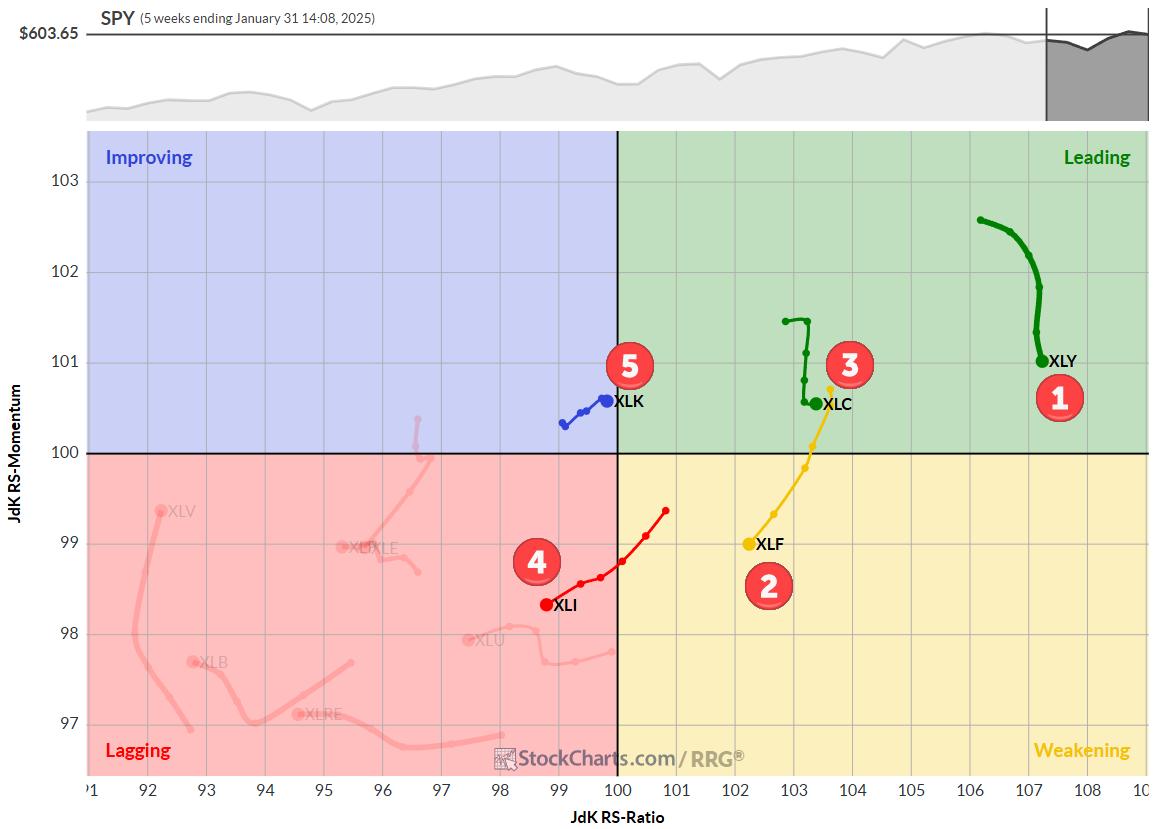

KEY TAKEAWAYS

* Top-5 remains unchanged

* Healthcare and Staples jump to higher positions

* Price and Relative trends remain strong for XLC and XLF

No Changes In Top-5

At the end of the week ending 2/7, there were no changes in the top-5, but there have been some significant shifts in...

READ MORE

MEMBERS ONLY

Three Behavioral Biases Impacting Your Portfolio Right Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reveals three common behavioral biases, shows how they can negatively impact your portfolio returns, and describes how to use the StockCharts platform to minimize these biases in your investment process. He also shares specific examples, from gold to Pfizer to the S&P 500, and...

READ MORE

MEMBERS ONLY

Watch For These Seasonality Patterns in 2025

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius shares a new approach to seasonality by using a more granular, data-set constructed UDI (User Defined Index) for every sector. Using the UDI functionality on StockCharts.com allows Julius to plot the seasonal patterns for each sector forward to the end of 2025 and...

READ MORE

MEMBERS ONLY

DP Trading Room: Tariff Trepidation

by Erin Swenlin,

Vice President, DecisionPoint.com

Trading is being affected by the scare of a trade war. With new tariffs being placed on Mexico, Canada and China, the market fell heavily on Friday. The same was occurring this morning, but then the tariff on Mexico was delayed by one month which helped the market breathe a...

READ MORE

MEMBERS ONLY

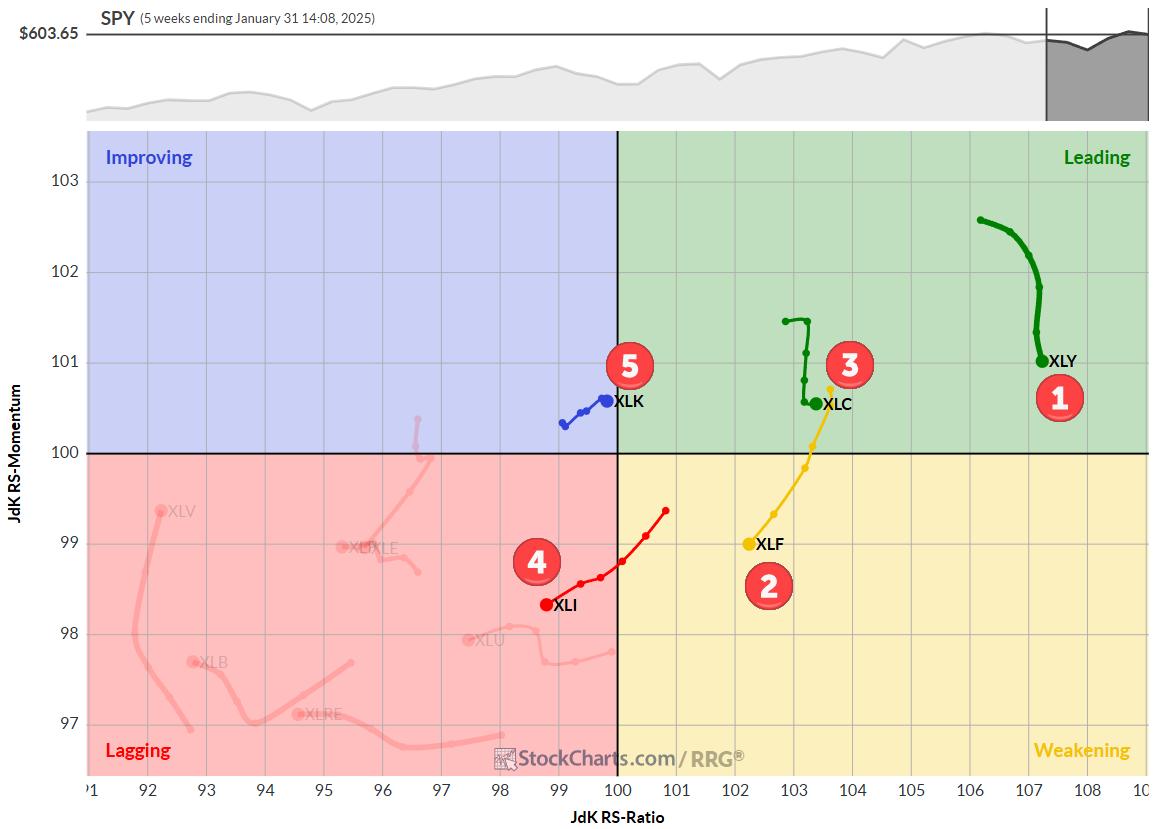

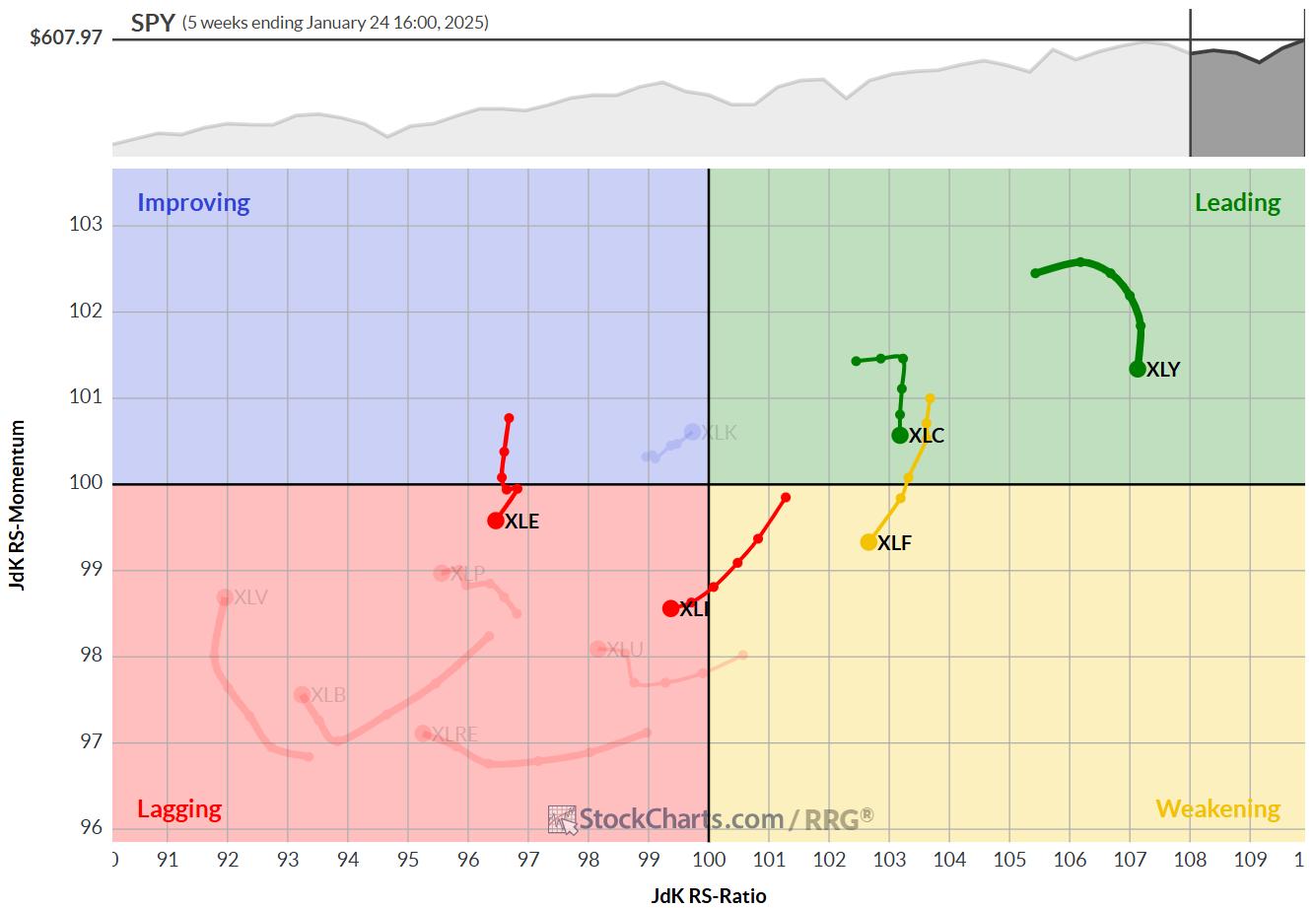

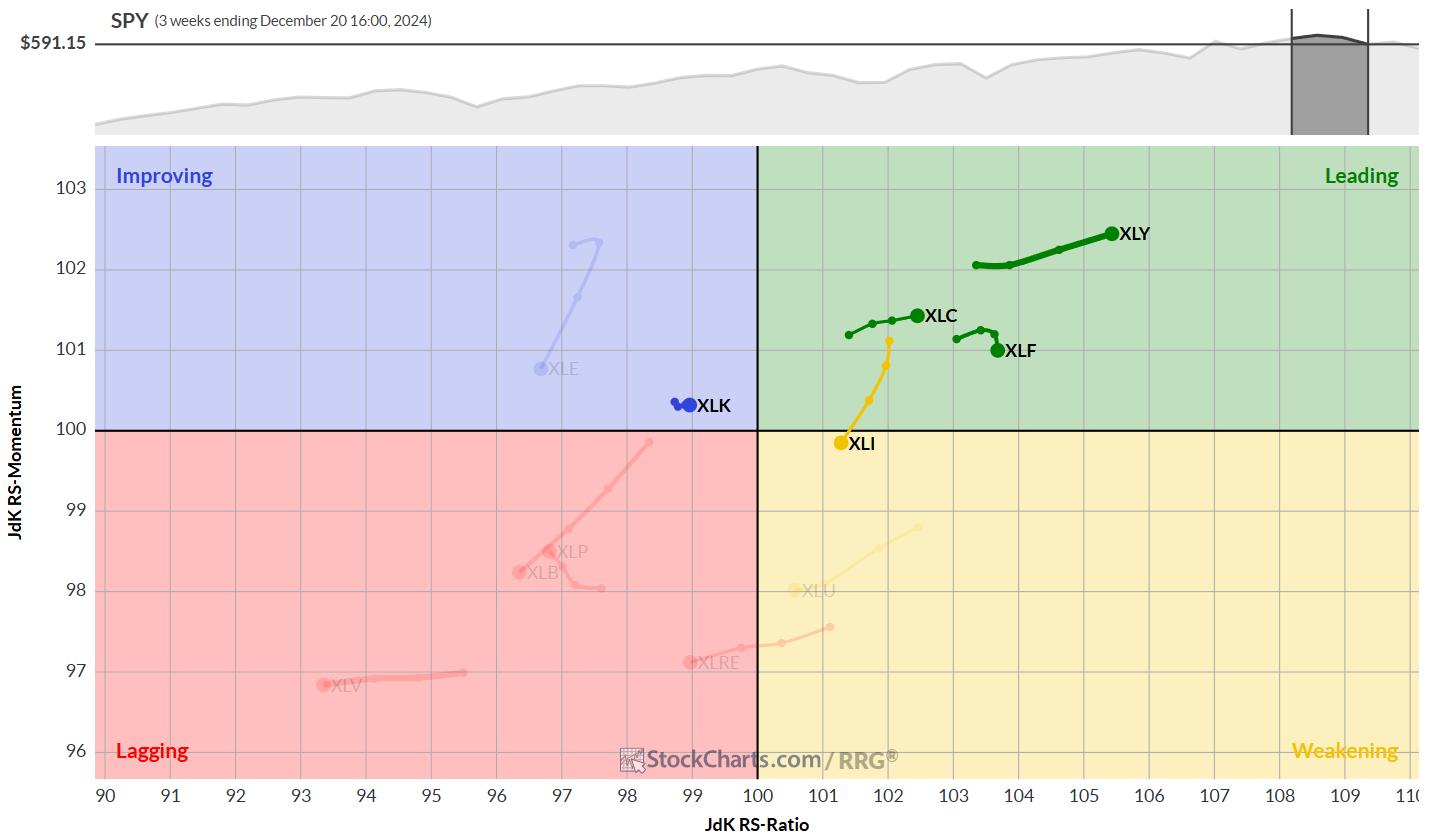

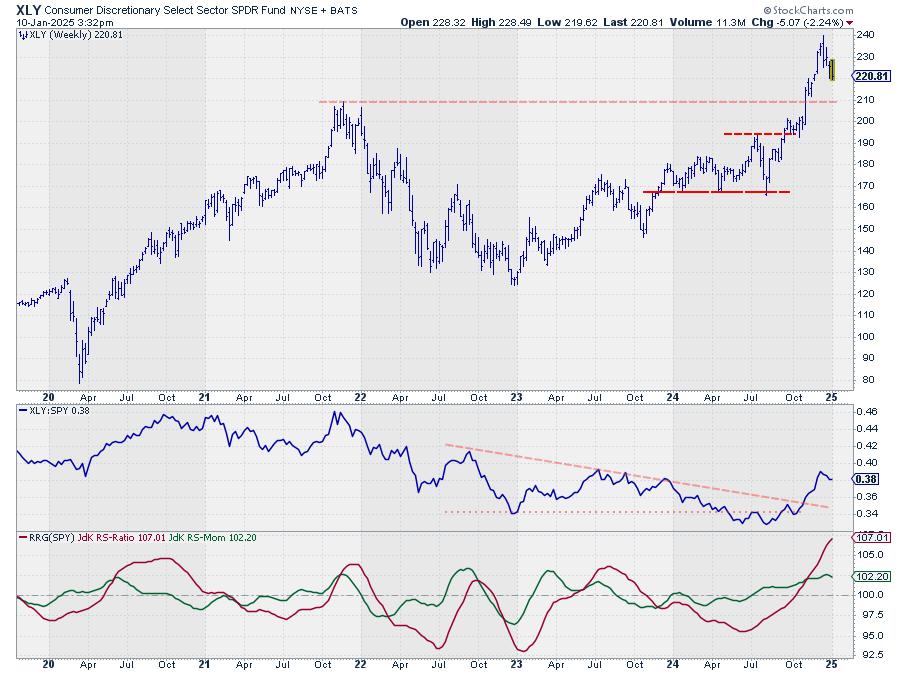

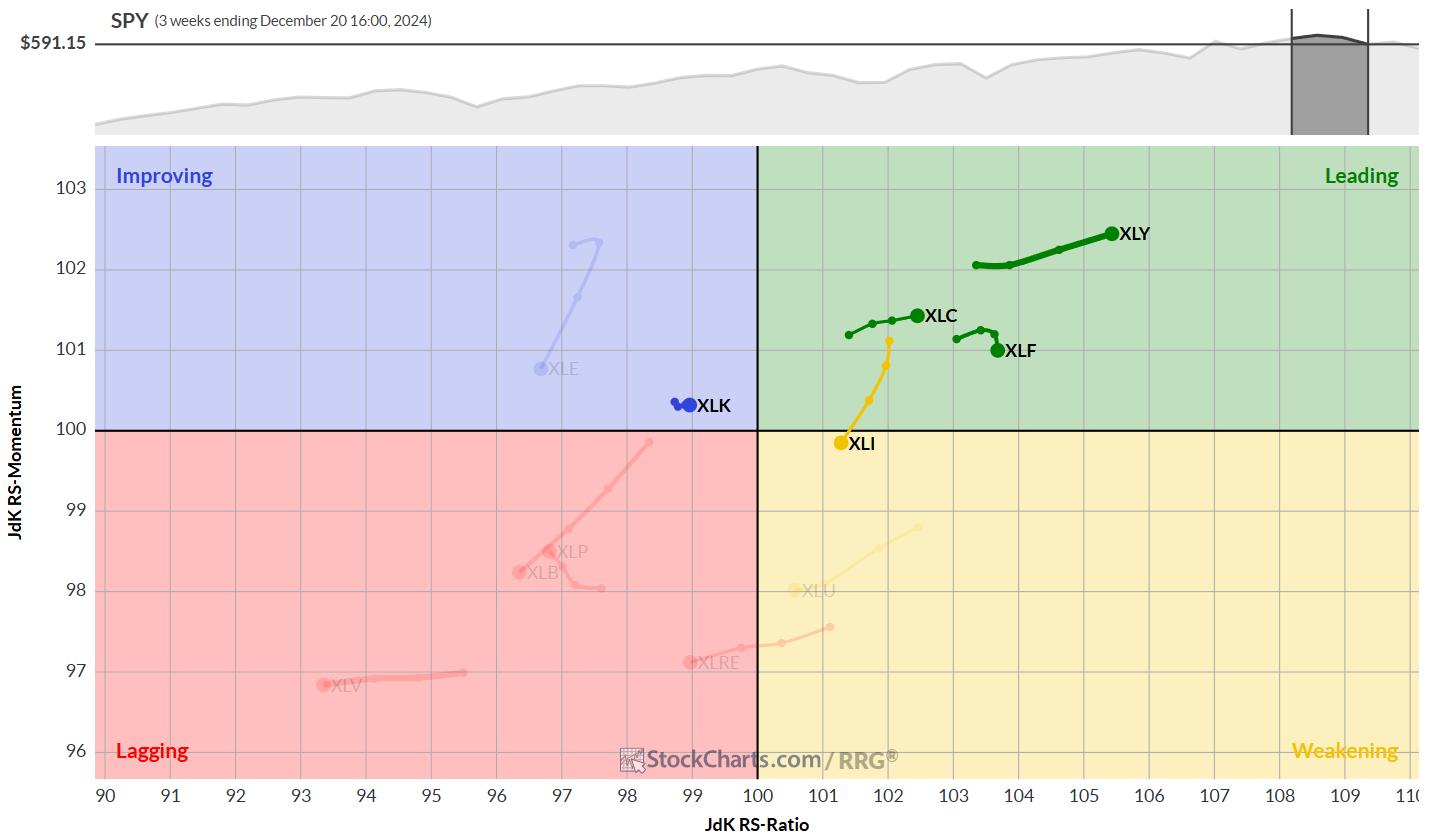

The Best Five Sectors, #5

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

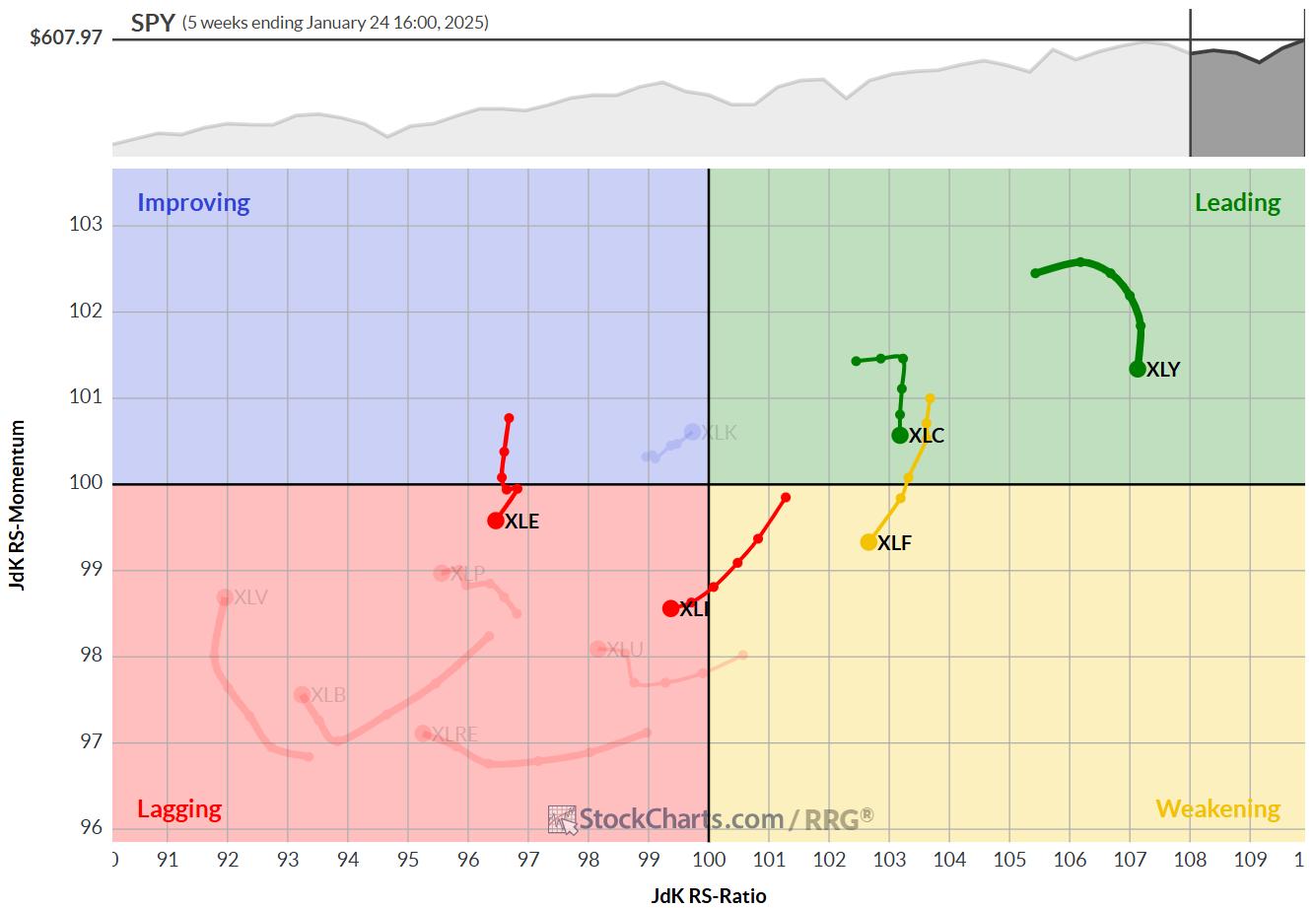

KEY TAKEAWAYS

* Technology (XLK) re-enters top 5 sectors, displacing Energy (XLE)

* Consumer Discretionary (XLY) maintains #1 position

* Weekly and daily RRGs show supportive trends for leading sectors XLY and XLC

* Top-5 portfolio outperforms S&P 500 by nearly 50 basis points

Technology Moves Back into Top-5

As we wrap...

READ MORE

MEMBERS ONLY

XLF's Record Highs: Buy the Dip or Bail Out Now?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* XLF, heavily weighted in bank stocks, broke into all-time high territory, though conviction appears low.

* Breadth, momentum, and technical strength are leaning bullish.

* A likely pullback signals an opportunity for entry.

As the FOMC prepared to announce its rate decision on Wednesday, the Financial Select Sector SPDR Fund...

READ MORE

MEMBERS ONLY

An Enticing Gold Mining Stock with a Strong SCTR Score

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Gold stocks have been rising, which has helped gold mining stocks.

* This gold mining stock is close to its all-time high.

* In this article, we will present an analysis of the monthly and daily charts.

Gold stocks have risen, even after the Federal Reserve decided to keep interest...

READ MORE

MEMBERS ONLY

Snowflake and Twilio Stocks are Surging: Here's What to Do Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SNOW and TWLO stocks are outperforming the market based on a three-month relative highs scan.

* Both stocks show bullish momentum, but conflicting volume signals suggest caution.

* Monitor the key support and resistance levels for potential trade opportunities.

While StockCharts offers numerous tools you can use to find top...

READ MORE

MEMBERS ONLY

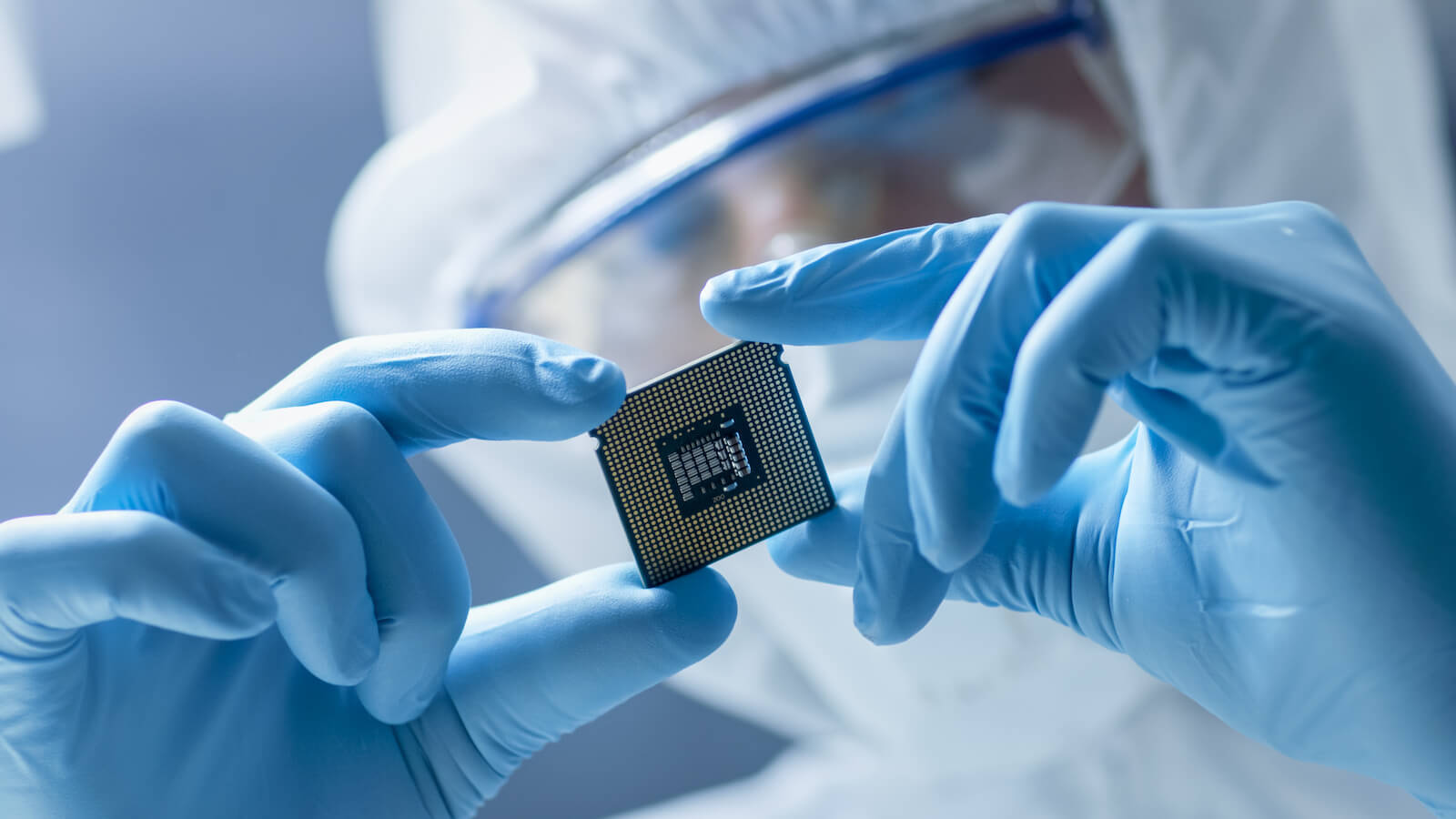

What's NEXT for Semiconductors After Monday's SHOCKING Drop?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reviews the VanEck Semiconductor ETF (SMH) from a technical analysis perspective. He focuses on the recent failure at price gap resistance, the breakdown below price and moving average support, and the frequent appearance of bearish engulfing patterns which have often indicated major highs over the last...

READ MORE

MEMBERS ONLY

Six Dance Steps to Remember for an Extended Market

by Gatis Roze,

Author, "Tensile Trading"

"An investment in Knowledge pays the best interest." — Benjamin Franklin

It's time to revisit a few timeless lessons regarding extended markets.

As I write this, the last correction of any significance was in 2022. The past two years have been one heck of a dance if...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #4

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* No changes in top-5 sectors

* XLC showing strong break from consolidation flag

* XLE remains just barely above XLK as a result of strong daily RRG

No changes in the top-5

At the end of this week, there were no changes in the ranking of the top-5 sectors.

1....

READ MORE

MEMBERS ONLY

Investors are Pouring Into Gold Miners—Here's What You Need to Know!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* There's a renewed interest in gold mining stocks.

* Does gold outperforming miners signal an increase in mining activity and profitability?

* Miners are at a critical turning point, and the key levels discussed can help you assess whether the trend will turn bullish or bearish.

Gold mining...

READ MORE

MEMBERS ONLY

Biotechs Looking Up - Two Stocks To Take Advantage

by Erin Swenlin,

Vice President, DecisionPoint.com

The Biotech industry group is making a comeback, with the 'under the hood' chart displaying new strength coming into the group. We have a constructive bottom that price is breaking from and, while it does need to overcome resistance at the 200-day EMA, it looks encouraging. What was...

READ MORE

MEMBERS ONLY

Lowering the Bar: Why Lowe's Could Head South

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Lowe's stock is showing signs of weakness.

* A bear call spread can capitalize on the neutral to bearish bias on Lowe's stock price.

* The bear call spread has a high probability of profit.

Despite periodic rallies that have buoyed the home improvement retail sector,...

READ MORE

MEMBERS ONLY

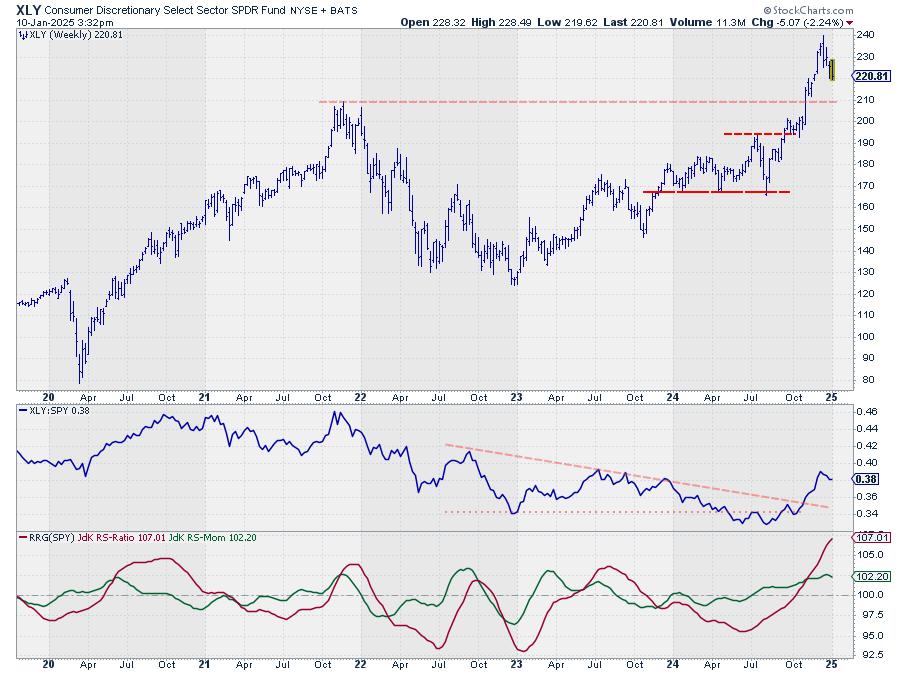

Energy Picks Up and Consumer Discretionary Continues to Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Short term strength drags enery sector up

* Long term strength keeps consumer discretionary on top

* Massive upside potential ready to get unlocked in EOG

I have been traveling in the US since 1/15 and attended the CMTA Mid-Winter retreat in Tampa, FL 1/16-1/17 and then...

READ MORE

MEMBERS ONLY

Discover the BEST Way to Spot TREND CHANGES

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe demonstrates how to use the 1-2-3 reversal pattern as a buy signal on the weekly chart. This approach can be used when the monthly chart is in a strong position. Joe shares how to use MACD and ADX to help when the trendline pattern...

READ MORE

MEMBERS ONLY

Cisco Systems' Stock Keeps Hitting All-Time Highs: Investment Tips to Maximize Your Success

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cisco Systems' stock has made substantial investments in AI, which has helped the stock rally higher.

* CSCO's stock price has been making all-time highs recently and is worth monitoring.

* Look for a pullback and reversal with strong momentum before entering a long position.

When you...

READ MORE

MEMBERS ONLY

Stocks are Facing an Important Test

by Martin Pring,

President, Pring Research

I have been expecting a bull market correction for about a month, but it's not been as deep as I expected. Now, however, several indexes have completed small bullish two-bar reversal patterns on the weekly charts. If they work, that would be a characteristic of a bull market,...

READ MORE

MEMBERS ONLY

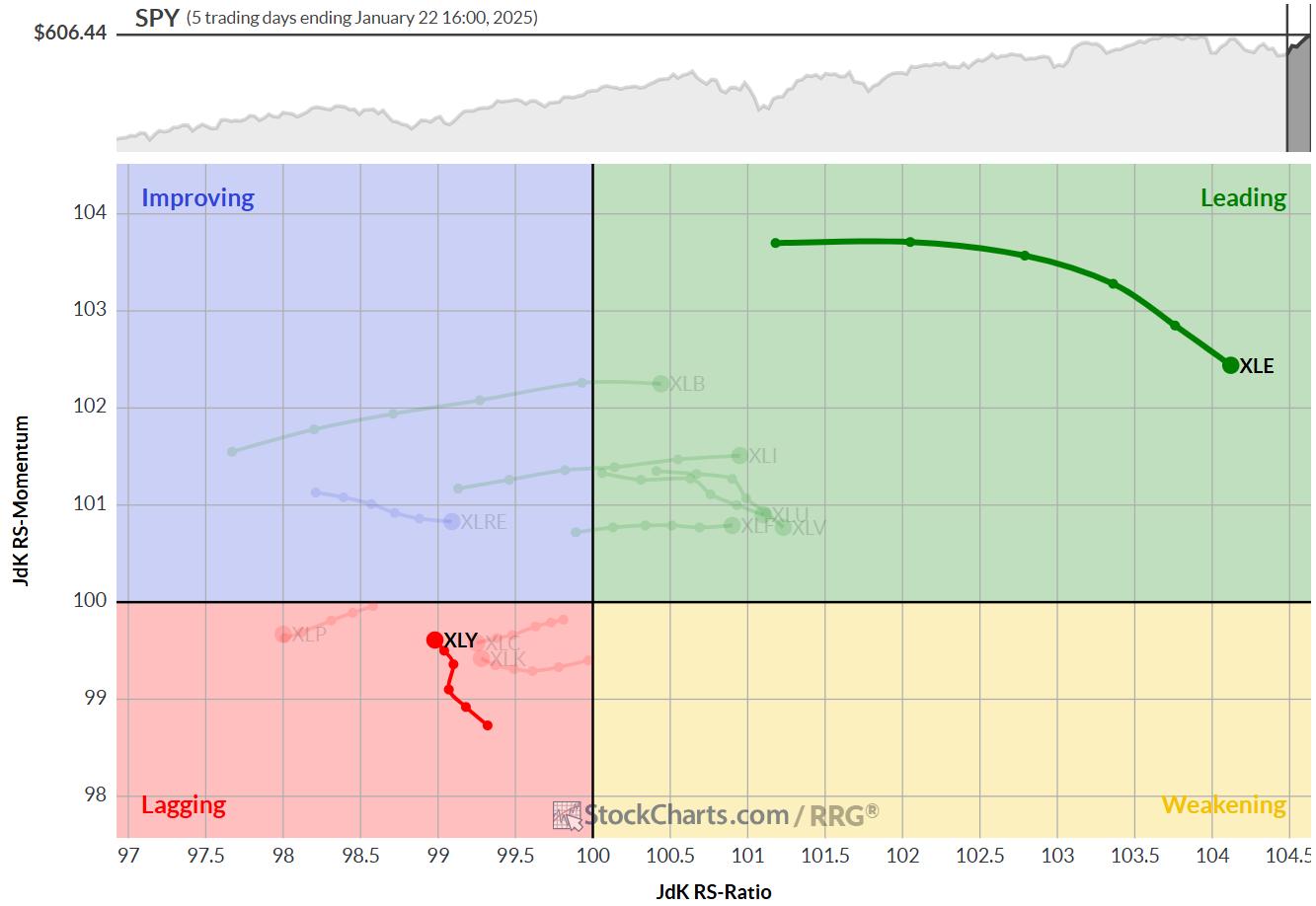

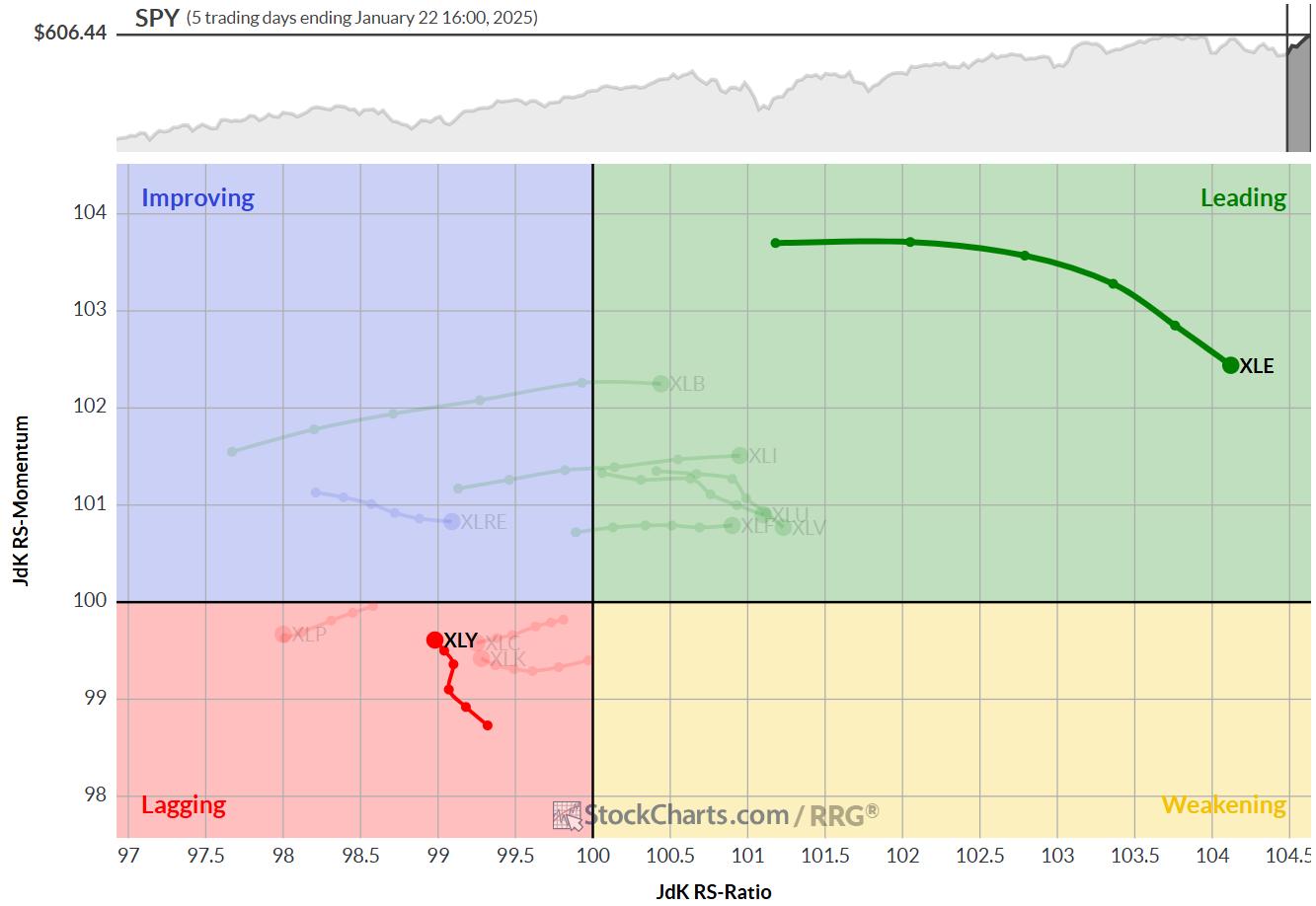

The Best Five Sectors, #3

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy replaces Technology in top-5

* Financials rise to #2 position pushing XLC down to #3

* Top-5 portfolio out-performs SPY 0.52%

* A closer look at the (equal) weighting scheme

Energy Replaces Technology

At the end of this week, 1/17/2024, the Technology sector dropped out of the...

READ MORE

MEMBERS ONLY

DexCom Stock Rises From the Ashes: A Breakout You Can't Ignore

by Tony Zhang,

Chief Strategist, OptionsPlay

As advancements in medical technology continue to shape the healthcare landscape, DexCom, Inc. (DXCM) stands out with its innovative continuous glucose monitoring solutions. Recent price action suggests that DXCM's stock price has triggered a potentially new bullish run. In this article, I will examine the technical and fundamental...

READ MORE

MEMBERS ONLY

The Financial Sector's Bullish Comeback: Is It Time to Start Looking at Bank Stocks?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Bullish Percentage Index for Financials made a dramatic jump on Wednesday.

* Positive bank earnings plus encouraging CPI and PPI data are driving market optimism.

* Citigroup stock notched a 52-week high, making the stock worth analyzing.

One effective way to spot potential market opportunities on a sector level...

READ MORE

MEMBERS ONLY

Gold Prices: De-Dollarization, Inflation, and $3,000 Gold—What You Need to Know Now

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Central banks are accumulating gold at an increased pace which could increase the price of gold.

* While retail sentiment for gold may decline slightly, institutional accumulation remains steady.

* Compare gold futures with the ETF and look at the key levels, as a buying opportunity may be near.

Gold...

READ MORE

MEMBERS ONLY

Market Pullbacks Provide Opportunities <BR>to Build your WatchList - Here's How

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* ETFs holding up during corrections often lead when the market turns up again.

* Ranking performance based on year-to-date and one month Rate-of-Change.

* ARTY and IHI show relative and absolute strength.

The stock market is in pullback mode with the S&P 500 EW ETF down 5.15%...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #2

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The best five sectors remain unchanged.

* XLC and XLF are both starting to show weakness.

* XLI is holding above support, while XLK remains within rising channel.

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop...

READ MORE

MEMBERS ONLY

Boston Scientific's Record Surge: Here's How I Found It

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* StockCharts' New Highs tool is invaluable for spotting outliers during market uncertainty.

* In the case of BSX stock, the New Highs spotted a stock that's significantly defied the healthcare sector's bearish trend.

* BSX may soon be approaching a buy point if you'...

READ MORE

MEMBERS ONLY

Inflation Sparks Stock Market Downturn: What This Means for Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Strong Services PMI and more job openings puts inflation narrative back in focus.

* Rising Treasury yields put pressure on large-cap tech stocks.

* Energy and healthcare stocks saw the biggest gains in Tuesday's trading.

What a difference a day makes! December ISM Services data suggests the service...

READ MORE

MEMBERS ONLY

Which Top AI Semiconductor Stocks are Positioned for Growth?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* CES 2025 kicks off this week with many products likely to feature AI functionalities.

* Semiconductors are among the backbone components driving AI tech.

* Be sure to monitor the general industry and focus on key semiconductor stocks, a few of which may be approaching buy points.

On Tuesday, January...

READ MORE

MEMBERS ONLY

Rising Rates Suggest Weaker Stocks - Here's What I'm Watching!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares a long-term analysis of the Ten-Year Treasury Yield, breaks down how the shape of the yield curve has been a great leading indicator of recessionary periods and weaker stock prices, and outlines the chart he's watching to determine if early 2025 will look...

READ MORE

MEMBERS ONLY

DP Trading Room: Does This Rally Have Legs?

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DP Trading Room Carl and Erin discuss whether this market rally can get legs and push the market even higher? Mega-caps are looking very positive with the Magnificent Seven leading the charge. Technology is showing new strength along with Communication Services.

Carl starts the trading...

READ MORE

MEMBERS ONLY

How to Trade Erratic Uptrends - An Example and Setup using IWM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* The Russell 2000 ETF (IWM) gained 10% in 2024 - but did it the hard way.

* Even when trending higher, IWM is prone to pullbacks and erratic price action.

* Chartists can put this to their advantage by using %B to identify tradable pullbacks.

The Russell 2000 ETF managed...

READ MORE

MEMBERS ONLY

Stock Market Ends the Week Strong: Could It Spark a Bullish January?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* No Santa Claus Rally this year, but the stock market's optimistic price action on Friday lifted investors' moods.

* Stocks like TSLA and NVDA had big gains while X, CVNA, and alcoholic beverages had big declines.

* Treasury yields and the US dollar remain high, and oil...

READ MORE

MEMBERS ONLY

Block and Loaded: Targeting Gains in SQ

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* SQ stock's recent price action makes it a candidate for a favorable risk/reward options strategy.

* Fundamentally, SQ stock looks promising, with attractive valuation, robust growth metrics, and recent earnings.

* A bull put spread would be an ideal strategy to take advantage of SQ stock'...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #1

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

HAPPY NEW YEAR!!!

Ever since the introduction of RRG back in 2011, many people have asked me questions like: "What is the track record for RRG" or "What are the trading rules for RRG"?

My answers have always been, and will continue to be, "There...

READ MORE