MEMBERS ONLY

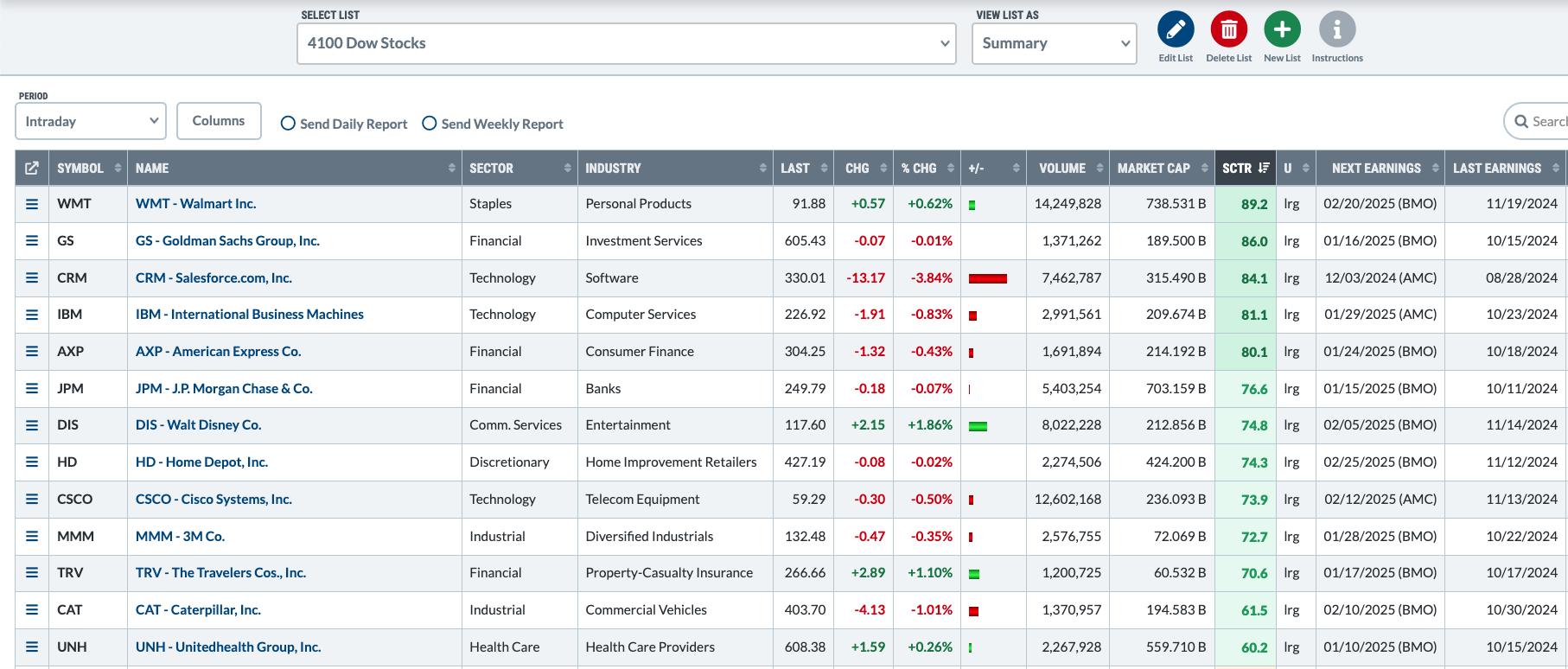

Strongest Top 3 S&P 500 Stocks: Will They Lead the Pack in 2025?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market's annual performance has been stellar, with the S&P gaining over 23%.

* Take care to monitor the three S&P 500 stocks with the strongest technical rank in 2025.

* Make use of scanning tools to help filter stocks that meet your...

READ MORE

MEMBERS ONLY

DP Trading Room: Natural Gas (UNG) Breaks Out!

by Erin Swenlin,

Vice President, DecisionPoint.com

It's an interesting market day with the market moving lower despite positive seasonality. Natural Gas (UNG) broke out in a big way up over 15% at the time of writing. Is it ready to continue its big run higher?

Carl took the day off so Erin gave us...

READ MORE

MEMBERS ONLY

Swing Trading with Point & Figure

by Bruce Fraser,

Industry-leading "Wyckoffian"

There are a number of effective swing trading systems being used today. Let's explore one that is popular among Wyckoffians. It uses two inputs: Point and Figure charts and volume. Let's review this system with a case study of Charles Schwab Corp. (SCHW).

As markets are...

READ MORE

MEMBERS ONLY

Trump's Policy Shift Reveals Potential Big Winner!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights whether to buy last week's pullback. She discusses the rise in interest rates and why, as well as which areas are being most impacted. Last up, she reviews potential winners with new Trump policy, how to spot a downtrend reversal, and the...

READ MORE

MEMBERS ONLY

5 New Year's Resolutions to Transform Your Financial Well-Being in 2025

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* As 2024 winds down, it's time to set some financial resolutions for 2025.

* Always look at long term charts before making investment decisions.

* Be flexible, organized, and disciplined when managing your investment portfolio.

Are you ready to make 2025 a financially healthy year?

The beginning of...

READ MORE

MEMBERS ONLY

Quantum Computing Stocks: Why You Should Invest in Them Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Quantum computing stocks have been rising since November.

* Four quantum computing stocks were in the "Small-Cap, Top 10" category in the StockCharts Technical Rank (SCTR) report.

* You can also gain exposure to quantum computing stocks by investing in the Defiance Quantum ETF.

Qubits, quantum advantage, gate...

READ MORE

MEMBERS ONLY

MUST SEE Options Trade Ideas! DIS, AAPL, META, BA, LULU

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, after a rundown of the general markets and sectors, Tony brings you the latest options trade ideas. These include a number of bullish and bearish ideas, including DIS, AAPL, META, BA, LULU, and many more.

This video premiered on December 23, 2024....

READ MORE

MEMBERS ONLY

Why Now Might Be the Best Time to Invest in META Stock

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* After a pullback, META's stock price could be ready for a reversal.

* The uptrend is still on from a weekly perspective, but the daily chart shows the price is at a crossroads and could move in either direction.

* If META's stock price is too...

READ MORE

MEMBERS ONLY

DP Trading Room: Deceptive Volume Spikes

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DecisionPoint Trading Room Carl discusses volume spikes and how we have to analyze big volume spikes carefully to determine whether they express a confirmation of a move or whether they are a special case and do not really provide insight.

Carl goes over the signal...

READ MORE

MEMBERS ONLY

Navigating the Indecisive SPY: What Investors Should Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The SPDR S&P 500 ETF (SPY) was flagged as a technically strong chart.

* An analysis of the SPY chart shows the ETF is being indecisive.

* Monitor the chart of SPY for indications of a decisive move in either direction.

When running my StockCharts Technical Rank (SCTR)...

READ MORE

MEMBERS ONLY

Don't Be Surprised by an Early 2025 Pullback

by Martin Pring,

President, Pring Research

This year has been a very good one for stockholders. Come to think of it, 2023 wasn't so bad either. After an extended period of gains, it's natural for investors to become complacent, especially as they head home for the holidays.

This is the kind of...

READ MORE

MEMBERS ONLY

DP Trading Room: Is Broadcom (AVGO) the New NVIDA (NVDA)?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin looks at the Broadcom (AVGO) chart and compares it to the NVIDIA (NVDA) chart. She shows us the differences between the two and tells you whether she believes AVGO will be the new NVDA, meaning it will perform as NVDA used to perform with a concerted move up...

READ MORE

MEMBERS ONLY

Why Cisco's Stock Reversal Could Be a Game-Changer

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* CSCO stock has pulled back to its 21-day exponential moving average and is poised for a reversal.

* Monitor the stochastic indicator to confirm a reversal in CSCO's stock price.

* If you enter a long position in CSCO, establish your stop loss and have the discipline to...

READ MORE

MEMBERS ONLY

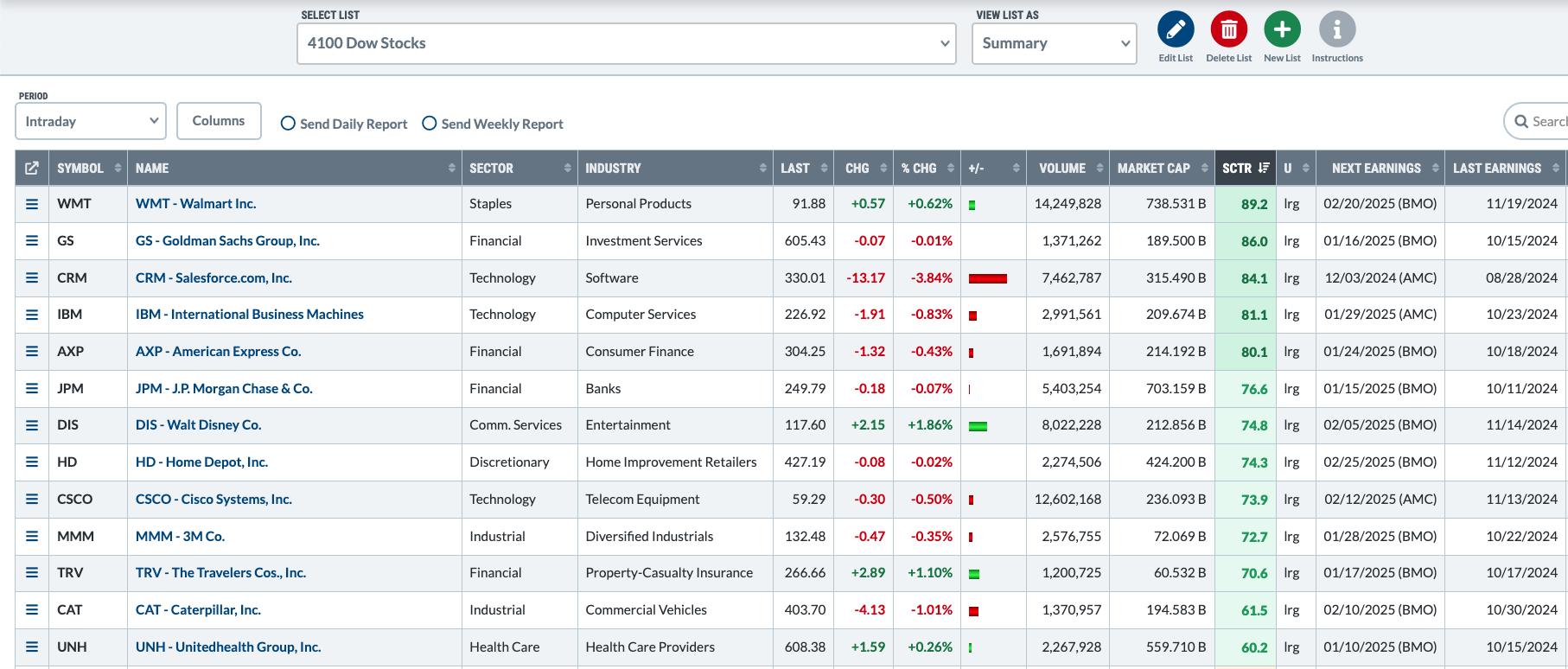

SOFI Advances to SCTR's Top 10: Is Now the Time to Buy?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SOFI's stock price recently appeared in the SCTR Report's top 10 list in the large-cap category.

* After a strong two-month rally, the fintech stock is now pulling back.

* Monitor SOFI's chart and watch key levels closely as the stock approaches a potential...

READ MORE

MEMBERS ONLY

Unlock Options Trading Opportunities with StockCharts & OptionsPlay

by Tony Zhang,

Chief Strategist, OptionsPlay

by Grayson Roze,

Chief Strategist, StockCharts.com

Tony and Grayson are back with another informative video highlighting the opportunities the OptionsPlay add-on brings to the StockCharts platform. Tony highlights income generation ideas you can find with the add on. Together, the duo also cover the strategy center, and the SharpCharts and ACP widgets.

This video premiered on...

READ MORE

MEMBERS ONLY

How to Spot Low-Volatility Stocks That are Ready to Explode

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* If you want to reposition your portfolio for 2025, consider the potential policy changes that can significantly affect the market.

* Focusing on financials and using MarketCarpets Bollinger BandWidth setting identifies stocks with low volatility setups, among other qualities.

* Identify stocks that meet your investing criteria and add them...

READ MORE

MEMBERS ONLY

3 WAYS to Pinpoint When a Stocks Uptrend is Ending

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave unveils his "line in the sand" technique to help determine when stocks in established uptrends may be near the end of the bullish phase. He'll share specific levels he's watching for the S&P 500, AMZN, TMUS, and KR,...

READ MORE

MEMBERS ONLY

Bearish Opportunity in Tractor Supply Co (TSCO) with OptionsPlay Strategy Center

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Tractor Supply Co. may be setting up for a declining move in its stock price.

* Take advantage of the downside move in Tractor Supply using a call vertical spread.

* Monitor the OptionsPlay scans to identify options strategies to apply to stocks like Tractor Supply Co.

Despite attempts to...

READ MORE

MEMBERS ONLY

Market As Good As It Gets

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the 26 indexes, sectors and groups in a CandleGlance to see how the indexes stack up. It is clear that all of the indexes are as good as they can get. Carl warns that when things are as good as they can get, the only place...

READ MORE

MEMBERS ONLY

Are ARK's Innovation ETFs on to Something BIG?

by Mary Ellen McGonagle,

President, MEM Investment Research

After a broad market review, Mary Ellen shares strategies for trading pull backs and breakouts in stocks. Highlights include a deep dive into ARK's Innovation ETFs and their holdings, locating market strength in the process. Tune in for valuable insights and tips to help you make informed investment...

READ MORE

MEMBERS ONLY

Step 1: Asset Creation, Step 2: —————?, Step 3: Asset Growth

by Gatis Roze,

Author, "Tensile Trading"

The secret sauce of 1-2-3 investing is quite simple: don't skip Step 2. Far too many investors who've succeeded in creating wealth are anxious to rush forward with "all gas, no brakes" to embrace the excitement of Step 3 - Asset Growth. Only in...

READ MORE

MEMBERS ONLY

CSCO Stock: A Hidden Gem With Upside Potential

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* CSCO stock has been in a slow uptrend since August and is outperforming the Nasdaq Composite.

* CSCO's stock price is at an all-time high and indicators suggest the stock can continue trending higher.

* Look for a pullback and a bounce off its 21-day exponential moving average....

READ MORE

MEMBERS ONLY

Leverage Salesforce.com's Growth: A Guide to Smart Options Trading

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The technology sector got a boost from Salesforce's stellar rise in stock price.

* In lieu of purchasing shares of Salesforce stock, you could try trading options on the stock.

* The call vertical spread is an optimal strategy to take advantage of Salesforce's growth.

When...

READ MORE

MEMBERS ONLY

After a 29% Bounce, Can SMCI Reclaim Its Former Glory?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* On Monday, Super Micro Computer Inc. (SMCI) jumped 29%.

* Bullish investors began buying SMCI on news of the company's financial stability after its 85% plunge in November.

* Watch the $50 resistance level in SMCI's stock price, in addition to other key levels, as a...

READ MORE

MEMBERS ONLY

NVDA Stock Price Gives Bullish Signal: An Ultimate Options Strategy to Maximize Gains

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* NVDA's stock price has retested its $130 support level and bounced higher, which could provide a bullish trading opportunity using options.

* NVIDIA's fundamentals are compelling and support a rise in its stock price.

* Selling a put vertical spread provides a limited-risk scenario with a...

READ MORE

MEMBERS ONLY

DP Trading Room: Swenlin Trading Oscillators Top!

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday our short-term Swenlin Trading Oscillators (STOs) turned down even after a rally. This is an attention flag that we shouldn't ignore, but what do the intermediate-term indicators tell us? Are they confirming these short-term tops?

Carl goes through the DP Signal tables to start the program...

READ MORE

MEMBERS ONLY

Five Ways You Should Use ChartLists Starting Today!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Having used many technical analysis platforms over my career as a technical analyst, I can tell you with a clear conscience that the ChartList feature on StockCharts provides exceptional capabilities to help you identify investment opportunities and manage risk in your portfolio. Once you get your portfolio or watch list...

READ MORE

MEMBERS ONLY

How to Trade MicroStrategy's Painful Plunge: The Levels Every Investor Must Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* MicroStrategy's price is correlated with Bitcoin's.

* In 2024, Microstrategy's stock price surged from a low of $43 to a high of $543.

* Look for MicroStrategy's stock price to fall between $318 and $320, its next support level.

On November 21,...

READ MORE

MEMBERS ONLY

Five Must-Have Tools for Analyzing Stock Charts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares how he uses the powerful ChartLists feature on StockCharts to analyze trends and momentum shifts as part of his daily, weekly, and monthly chart routines. He shows how mindful investors can use ChartLists to identify inflection points, focus on top performers, analyze performance trends, and...

READ MORE

MEMBERS ONLY

A Bullish Opportunity in CrowdStrike (CRWD) with OptionsPlay Strategy Center

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* CrowdStrike's stock price is showing signs of reaching its 52-week highs and breaking above it.

* The bull put spread is an options strategy you can implement to take advantage of CrowdStrike stock's bullish move.

* A bull put spread will benefit even if CrowdStrike'...

READ MORE

MEMBERS ONLY

Market Rally Broadens - New All-Time Highs?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the small-caps and mid-caps that have now begun to outperform the market. Clearly the rally is broadening, the question now is can we continue to make new all-time highs. It does seem very likely especially given the positive outlook on the Secretary of Treasury nomination.

Carl...

READ MORE

MEMBERS ONLY

AppLovin's 1,303% Rise: The Hidden Power of the SCTR Report

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AppLovin has risen 1,303% since the SCTR Report first gave the green light on the stock.

* Other StockCharts indicators confirmed the opportunity when Wall Street insiders began quietly accumulating the stock.

* Key levels in AppLovin's price chart can guide you to enter a long position...

READ MORE

MEMBERS ONLY

SCTR Report: The Palantir Trade Follow-Up—Transform Insights into Actions

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Palantir stock sold off significantly on Monday and may be ripe for a turnaround.

* The pullback in Palantir stock could be an opportunity to enter a long position.

* The chart of Palantir's stock price indicates increased buying pressure, but more upside momentum is needed to enter...

READ MORE

MEMBERS ONLY

Three Ways Top Investors Track Sector Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave outlines three tools he uses on the StockCharts platform to analyze sector rotation, from sector relative strength ratios to the powerful Relative Rotation Graphs (RRG). Dave shares how institutional investors think about sector rotation strategies, evaluating the current evidence to determine how money managers are allocating...

READ MORE

MEMBERS ONLY

Stocks: "...a PERMANENTLY high plateau"?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today we explore the bullish sentiment that has taken SPX valuations to the moon. There are many out there that believe we have hit a plateau on prices that will continue permanently. We talk about the quote: "Stock prices have reached 'what looks like a permanently high plateau,...

READ MORE

MEMBERS ONLY

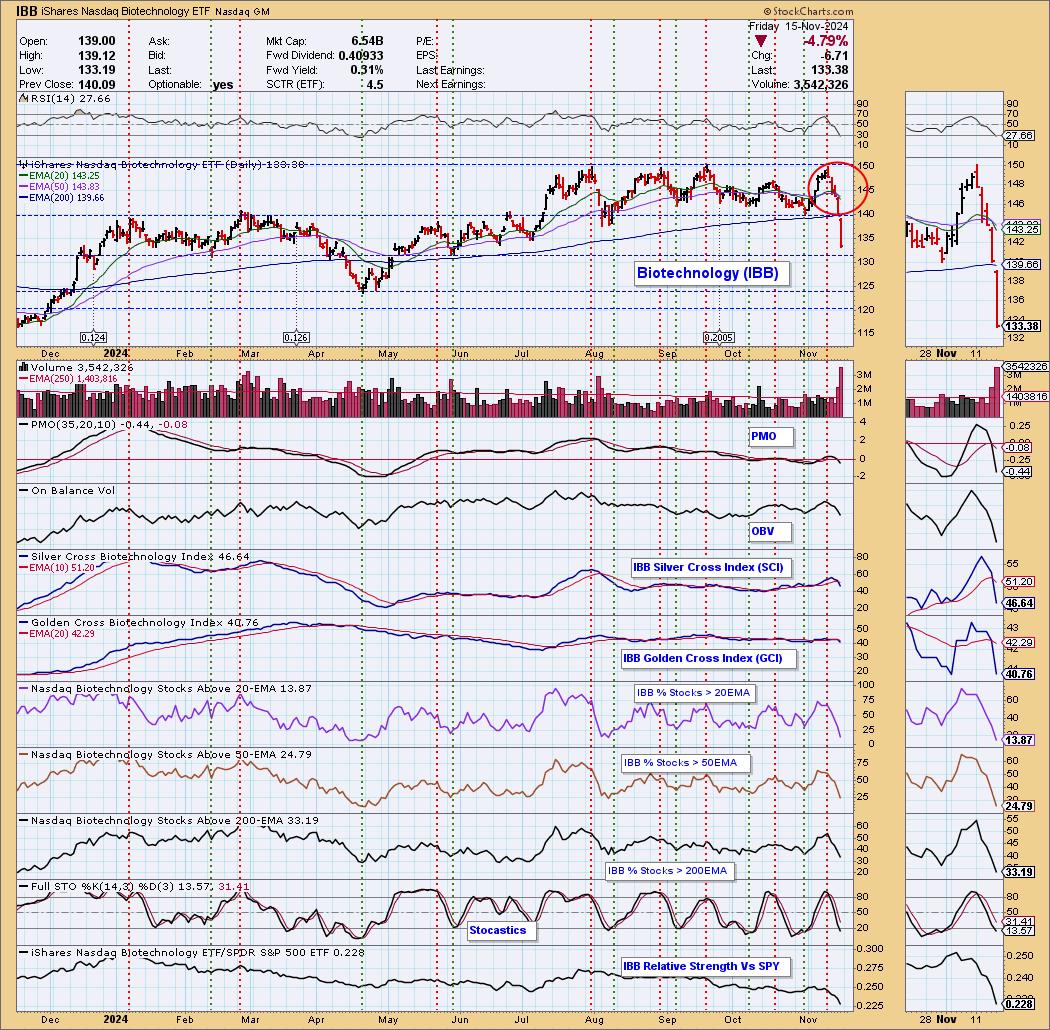

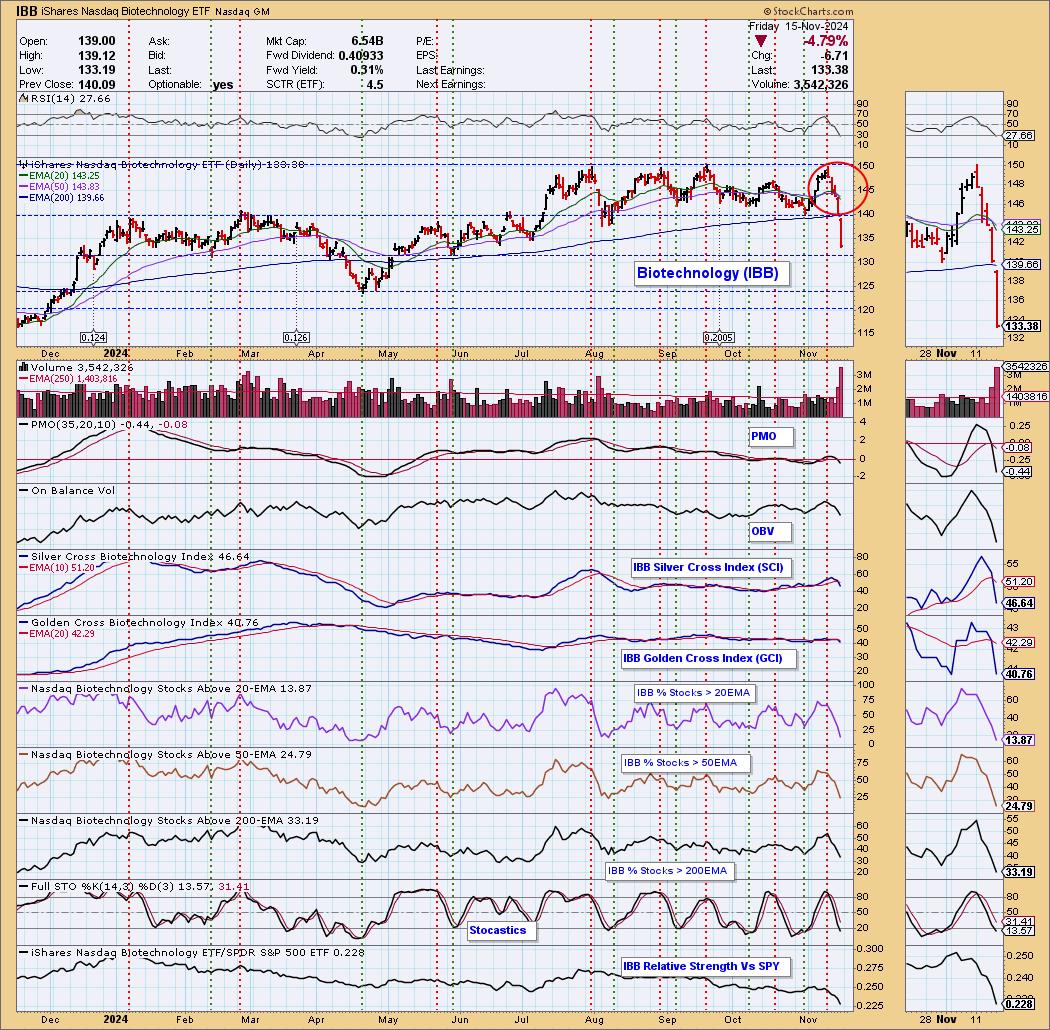

Biotechs Fall Apart with Dark Cross Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from the subscriber-only DP Weekly Wrap for Friday)

On Friday, the Biotechnology ETF (IBB) 20-day EMA crossed down through the 50-day EMA (Dark Cross) and above the 200-day EMA, generating an IT Trend Model NEUTRAL Signal. IBB recently switched to a BUY Signal on Friday November...

READ MORE

MEMBERS ONLY

Spotting a Bullish Opportunity in Zscaler (ZS) with OptionsPlay Strategy Center

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Zscaler was identified as a stock gearing up for a bullish trend in the OptionsPlay Strategy Center.

* Technical and fundamental analysis of Zscaler makes the stock an ideal candidate for a put vertical options trade.

As the cybersecurity landscape continues to evolve with increasing digital threats, Zscaler, Inc....

READ MORE

MEMBERS ONLY

Upgrade Your Options Trading with OptionsPlay on StockCharts

by Tony Zhang,

Chief Strategist, OptionsPlay

by Grayson Roze,

Chief Strategist, StockCharts.com

Should you buy calls/puts? Should you write covered calls? Or should you trade bull/bear vertical spreads?

That's a lot to chew on -- and it's just the beginning. Once you decide on a strategy, you'll have to decide on which strikes and...

READ MORE

MEMBERS ONLY

Simple Way to Find Confluence FAST Using Moving Averages

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe explains how to use an 18 simple moving average in multiple timeframes to identify when a stock has confluence amongst 2-3 timeframes. He shows how to start with the higher timeframes first, before working down to the lower ones. Joe then covers the shifts...

READ MORE

MEMBERS ONLY

The SCTR Report: Palantir Stock's Rise Makes It the Hottest AI Play

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Palantir stock's rise to the third place in the SCTR Report makes it a worthy candidate to add to your portfolio.

* The price surge in Palantir stock after its stellar earnings report may just be the beginning of a bullish move.

* Palantir is a stock that...

READ MORE