MEMBERS ONLY

Lowe's is Lagging

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the stock market moved higher the last two weeks, Lowe's (LOW) failed to break above resistance at 22 and showed relative weakness. A potentially bullish ascending triangle is taking shape, but a breakout is needed for confirmation. Conversely, a break below this week's low would...

READ MORE

MEMBERS ONLY

A Bullish Start on Wednesday

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

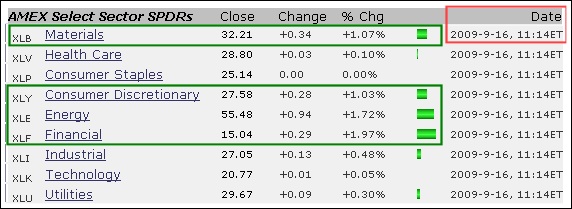

A look at the Market Summary page on Wednesday, September 16th, at 11:14AM ET shows a bullish start for some key sector SPDRs. The Materials SPDR (XLB), Consumer Discretionary SPDR (XLY), Energy SPDR (XLE) and Financials SPDR (XLF) are all up over 1% in early trading. At the top...

READ MORE

MEMBERS ONLY

IYZ Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

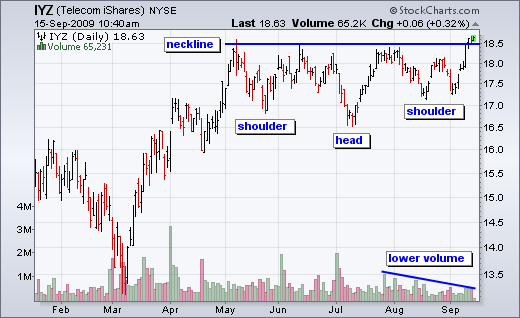

The iShares Telecom ETF (IYZ) is challenging neckline resistance of an inverse head-and-shoulders pattern. The head-and-shoulders represents a big consolidation and the break to new highs is positive. However, declining volume on the Aug-Sep advance is a concern.

Click this chart for details....

READ MORE

MEMBERS ONLY

Moving into a Zigzag Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-SPY Zigzags After July Surge

-SPY Stochastic is Short-term Overbought

-Stocks and Dollar Do Inverse Dance

-Oil Fails to Capitalize on Dollar Weakness

-XLE and OIH Hit Resistance Zones

-XOM Forms Triangle with Relative Weakness

-Falling Agriculture Prices Could Affect ADM

-Stocks: BG, GENZ, IMN, LMT and MOS

-Click here...

READ MORE

MEMBERS ONLY

PnF Objective is Bullish for Gold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Point&Figure chart for the Gold ETF (GLD) is bullish with an upside target at 105. PnF Charts at Stockcharts.com show bullish or bearish price objectives above the chart on the left. GLD broke above its prior highs and clearly shows strength.

Click this chart for details....

READ MORE

MEMBERS ONLY

FXB Gets A Momentum Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The British Pound ETF (FXB) came across the Commodity Channel Index scan as the indicator surged above 100. While some may consider CCI overbought when above 100, it is also a show of strength when CCI moved from -100 to +100 in less than two weeks.

Click this chart for...

READ MORE

MEMBERS ONLY

Breadth & Dollar Keep Stocks in Bull Mode

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

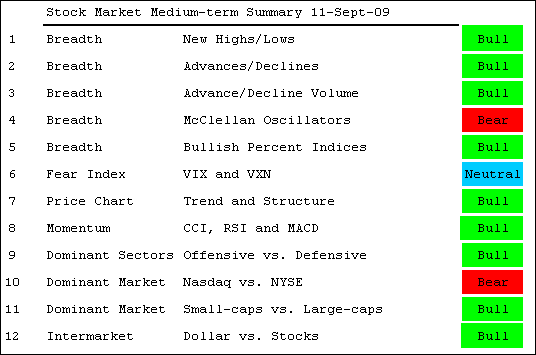

-Evidence Remains Bullish For Stocks

-Weak Dollar Helps Stocks and Commodities

-Major index ETFs Hit New Reaction Highs

-Breadth Remains Bullish Overall

-Small-caps Leading Large-caps

-Nasdaq Lagging NY Composite

-Stocks: ACS, ADSK, APD, ATVI, DVN, HRB, RTN, S, VZ

-Link to today's video (click here)

-Next update: September...

READ MORE

MEMBERS ONLY

XLE Hits Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) broke above wedge resistance with a big gap on Tuesday, but formed a shooting star candlestick on the day. Notice the spike and failure to hold above 54 intraday. Resistance in the 53-55 area is also confirmed by a bearish engulfing in late August.

Click this...

READ MORE

MEMBERS ONLY

Net New Highs Stay Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

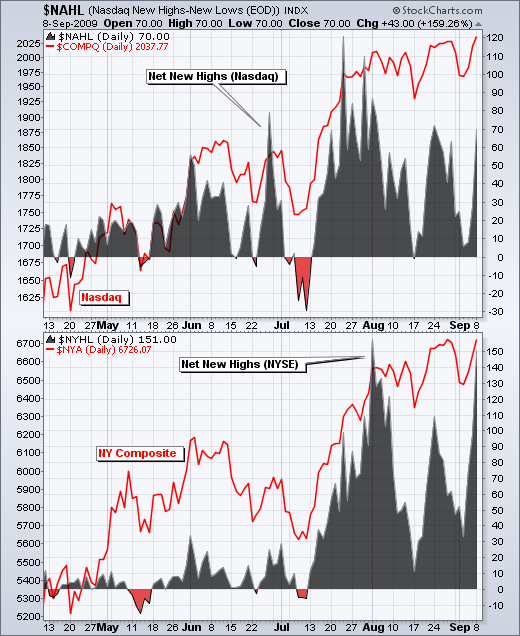

Net New Highs for both the Nasdaq and the NYSE remain positive. Net New Highs equals new 52-week highs less new 52-week lows. The last dip into negative territory occurred in early July. With Tuesday's surge, Net New Highs on the NYSE hit +151 and Net New Highs...

READ MORE

MEMBERS ONLY

A Cup-with-Handle for SLX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big advance from March to June, the Market Vectors Steel ETF (SLX) formed a classic cup-with-handle pattern. This is a bullish continuation pattern that would be confirmed with a break above rim resistance. Conversely, a break below the August lows would call for a reassessment.

Click this chart...

READ MORE

MEMBERS ONLY

August-September Lows Mark Key Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Market Overview

-RSI Holds for QQQQ

-August Lows Mark Key Support

-Defensive Sectors and Technology Lagging

-XLB and XLY Hold Breakouts

-OIH forms Falling Flag

-KRE Hits Key Retracement

-IYT and IYR Bounce off August Lows

-Stocks: AA, DRI, DRYS, EXPD, RIG, SLE, XTO

-Link to today's video....

READ MORE

MEMBERS ONLY

BONDS AND GOLD LEAD THE WAY HIGHER

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

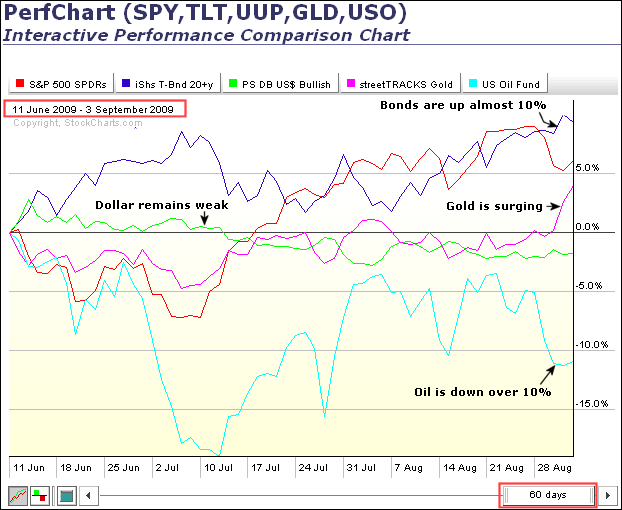

Intermarket analysis shows strength in bonds and gold, but weakness in the Dollar and oil. Strange days indeed. The Intermarket Perfchart below shows performance over the last sixty days, from June 11th to September 3rd. Relative strength in bonds is the first thing that jumps out. Performance for the 20+...

READ MORE

MEMBERS ONLY

Lumber Forms Lower High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

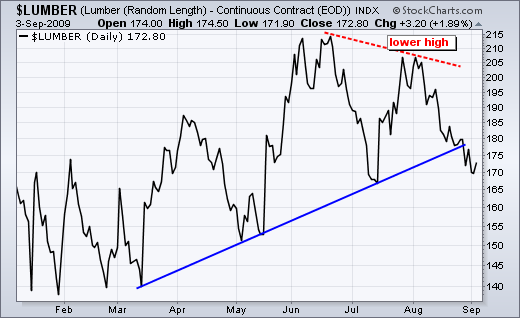

Lumber Continuous Futures ($LUMBER) did not have a good August. Lumber formed a lower high in early August and moved lower throughout the month. As a key component in housing, lumber should be watched for clues on the homebuilders and the economy. Other futures contracts available at Stockcharts.com include...

READ MORE

MEMBERS ONLY

Wave 4 Continues Up for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

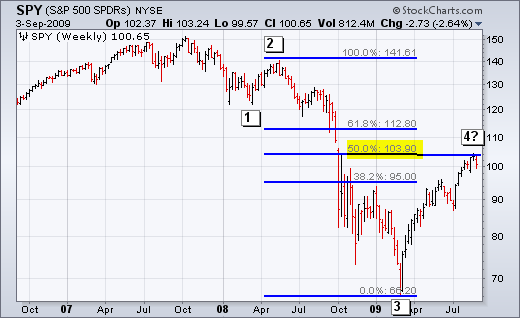

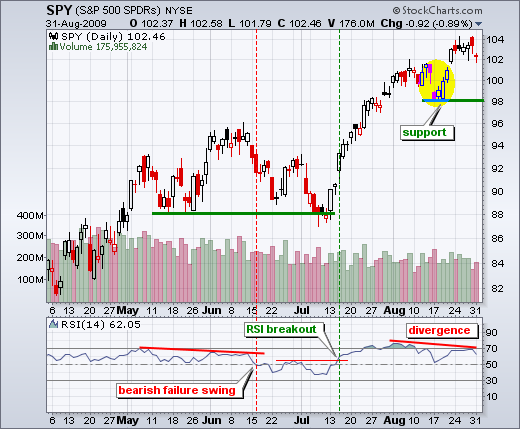

-SPY Nears Long-term Retracement

-Current Advance Looks Like Wave 4

-Momentum Wanes on Daily SPY Chart

-Net New Highs Form Negative Divergence

-AD Lines and AD Volume Lines Remain Bullish

-McClellan Oscillator Turn Bearish

-Volatility Indices Break Resistance

-Link to today's video

-Next update: September 8th (Tuesday) around...

READ MORE

MEMBERS ONLY

XLB Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After breaking above resistance in July, the Materials SPDR (XLB) moved into a holding pattern as broken resistance turned into support. Notice how the ETF bounced off 28.5 in mid August and is testing this level again in early September. A move below support would show weakness.

Click this...

READ MORE

MEMBERS ONLY

Info from the Bollinger Band Scan

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

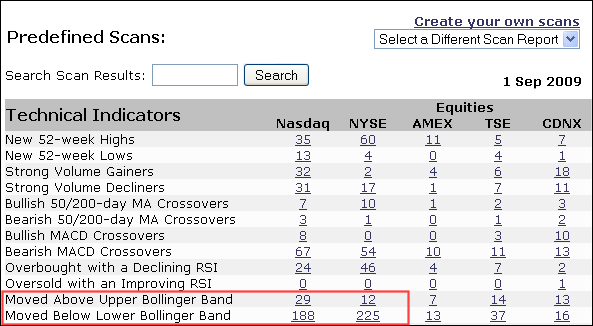

Stockcharts.com provides a number of pre-defined scans using classic indicators. In particular, I always keep an eye on the Bollinger Band scan that shows stocks moving above their upper band and stocks moving below their lower band. Selling pressure is picking up as many more stocks moved below their...

READ MORE

MEMBERS ONLY

Financials Back in Spotlight

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A look at the Market Carpet on Tuesday (11AM ET) shows the finance sector with the most red. In addition, four of the top five losers in the S&P 500 come from the finance sector. Notice the numbered red squares (2-5). Technology is holding up the best with...

READ MORE

MEMBERS ONLY

Negative Divergences and Weakness in China

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Back in the Saddle

-RSI Negative Divergence for SPY

-China Could Foreshadow Market Top

-Nasdaq Lagging NY Composite

-Interest Rates Continue to Fall

-Dollar Remains in Quiet Downtrend

-Gold Stalls Around 950

-Video Includes some Stock Setups

-Link to today's video

The next update will be September 4th...

READ MORE

MEMBERS ONLY

Hang Seng Lagging S&P 500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the S&P 500 sports a small gain for the month of August, the Hong Kong Hang Seng Index ($HSI) is actually down and lagging. The S&P 500 (black) moved above its early August high last week, but the Hang Seng Index (red) formed a lower...

READ MORE

MEMBERS ONLY

When to Ignore Gaps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Nokia is a $49 billion company that trades on the NYSE - as an ADS (American Depository Shares). Nokia also happens to trade on the Nasdaq OMX Helsinki. Yes, Nasdaq bought the Helsinki exchange. Anyhow, this means Nokia starts trading long before the NYSE opens. Because prices have already moved...

READ MORE

MEMBERS ONLY

Combining Factors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Candlesticks are more powerful when combined with other aspects of technical analysis. Noble Energy (NE) gapped down and formed a hammer in early July. Over the next two days, a piercing pattern formed to further affirm support around 28. The catalyst came when the stock surged above 29 with good...

READ MORE

MEMBERS ONLY

Bullish Engulfing Reinforces Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are bullish engulfing patterns and then there are BULLISH ENGULFING patterns. Kohls (KSS) successfully tested support from its May lows with a bullish engulfing on high volume. Three items came together for this bullish signal: support, a bullish candlestick reversal and high upside volume. The more, the merrier. Note:...

READ MORE

MEMBERS ONLY

Bearish Engulfing Marks Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bearish engulfing pattern is a short-term candlestick reversal, but it can also mark future resistance. Jabil Circuit (JBL) formed a bearish engulfing in early May and this area marked resistance a month later. The stock formed a rising wedge that peaked just below the early May high and then...

READ MORE

MEMBERS ONLY

Looking for Volatility Contractions

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

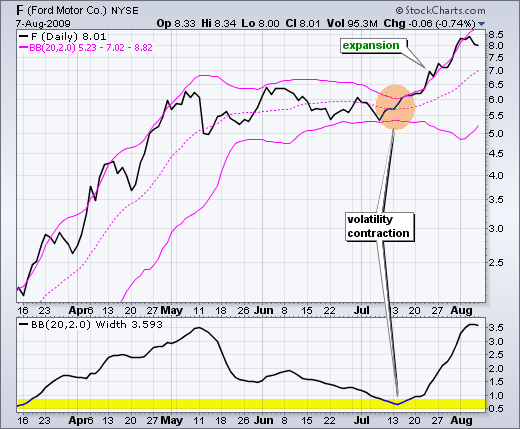

Volatility contractions often precede volatility expansions. This is the rational behind Bollinger Bands. After surging above 5.5, Ford (F) formed a long consolidation and Bollinger Bands contracted as the range narrowed. The subsequent move above resistance and the upper Bollinger Band triggered the volatility expansion (breakout). Note: This is...

READ MORE

MEMBERS ONLY

Using the Price Relative

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

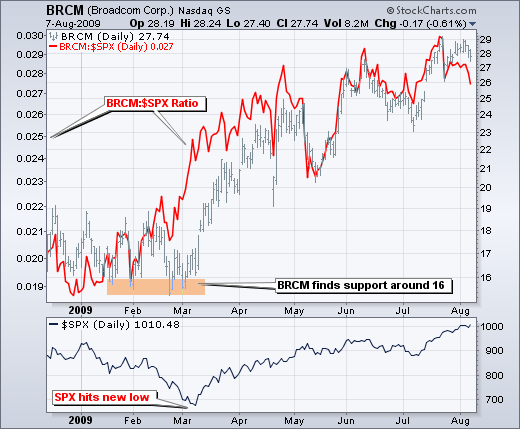

The price relative can be used to show relative strength or relative weakness. While the S&P 500 moved to new lows in March, Broadcom (BRCM) held support around 16 from mid January to early March. As a result of relative strength, the price relative (BRCM:$SPX ratio) surged...

READ MORE

MEMBERS ONLY

Detecting a Fade in Downside Momentum

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

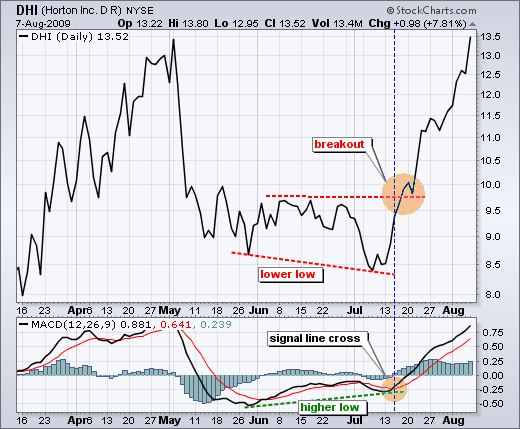

Positive divergences in MACD show waning downside momentum that can lead to a breakout. DR Horton (DHI) forged a lower low in early July, but MACD held above its June low for a positive divergence. Despite a lower low in the stock, downside momentum was fading. MACD's subsequent...

READ MORE

MEMBERS ONLY

Volume By Price Confirms Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The volume-by-price bars for Bank of America were the longest between 11 and 13. Even though the red and green portions were relatively equal, it is clear that many positions were established in this range. Remember, there is a buyer for every seller. With so much volume, the 11-13 area...

READ MORE

MEMBERS ONLY

RSI Breakouts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Momentum indicators like RSI can be used to define periods when there isn't much momentum, such as a consolidation. Applied Materials (AMAT) was largely range bound from mid May to mid July (yellow area). So was RSI. The breakout in the stock corresponded with a range breakout in...

READ MORE

MEMBERS ONLY

Volume By Price Confirms Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The volume-by-price bars for Bank of America were the longest between 11 and 13. Even though the red and green portions were relatively equal, it is clear that many positions were established in this range. Remember, there is a buyer for every seller. With so much volume, the 11-13 area...

READ MORE

MEMBERS ONLY

Envelope Surges Show Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows DIA with a 20-day SMA and an envelope set 4% above/below the 20-day SMA. Notice how the January plunge below the lower envelope triggered an extended decline. Conversely, the March surge above the upper envelope kicked off the current rally. Not all signals are this...

READ MORE

MEMBERS ONLY

Keeping an Eye on Bullish Percent

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Bullish Percent Indices measure the percentage of stocks on a Point&Figure buy signal for a given index. In general, an index has a bullish bias when its Bullish Percent is above 50% and a bearish bias when below 50%. Stockcharts.com users can easily keep an eye...

READ MORE

MEMBERS ONLY

Gamestop Moves above Upper Band

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gamestop (GME) came across the Bollinger Band screen with a move above the upper band on Thursday. Such moves show underlying strength. Notice how GME plunged below the lower band in early May and then worked its way lower until July with the 20-day SMA acting as a short-term bearish...

READ MORE

MEMBERS ONLY

Dollar Hits Resistance as Gold Hits Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Bulls Still Dominate

-A Close-Only View of QQQQ

-SPY Stalls around 100

-Short-term Momentum Deteriorates

-Breadth Remains Bullish Overall

-VIX Shows Short-term Abnormality

-Dollar Reinforces Resistance

-Gold Holds Support and Dollar Falls

-Bonds Bounce off Support After Fed

-Stocks: LMT, PFCB, RIMM

-Click here for today's video.

-Vacation...

READ MORE

MEMBERS ONLY

NDX Consolidates After the Fed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

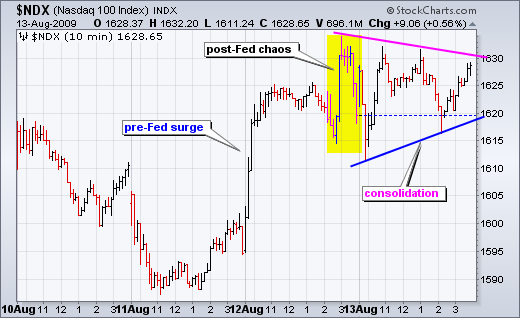

There are three distinct periods over the last two days. First, stocks surged as the Nasdaq 100 advanced above 1620 before the Fed meeting. Second, stocks gyrated rather wildly as NDX moved above and below 1620 after the announcement. Third, stocks consolidated as the market digested the Fed statement. Watch...

READ MORE

MEMBERS ONLY

Oil and Base Metals Keep Pace With Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

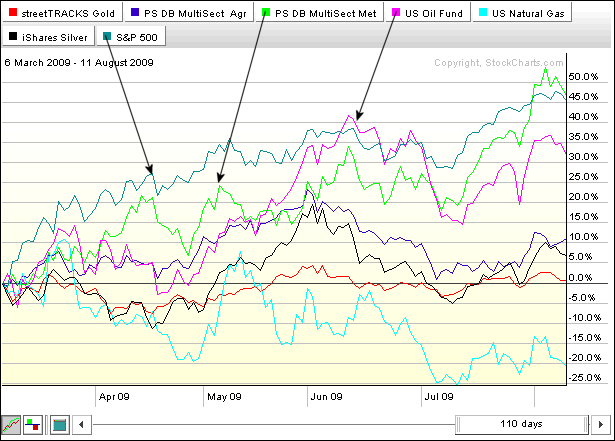

The PerfChart below shows the key commodity related ETFs and the S&P 500 since early March. As the stock market surged, the US Oil Fund ETF (USO) and the Base Metals ETF (DBB) were the only two commodity ETFs able to keep pace. The Natural Gas ETF (UNG)...

READ MORE

MEMBERS ONLY

Steel ETF Hits Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After surging to the June high, the Steel Vectors (SLX) met resistance and pulled back over the last two days. Notice that the August 3rd gap did not hold and the price relative formed a lower high. SLX is starting to show relative weakness.

Users can click on this chart...

READ MORE

MEMBERS ONLY

A Trend in Motion Stays in Motion

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

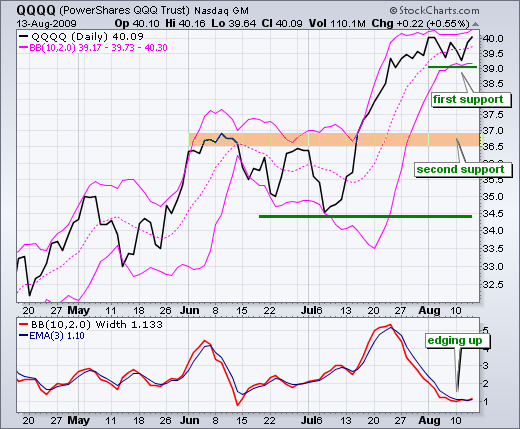

-A Trend in Motion Stays in Motion

-High/Low Range Narrows for SPY

-QQQQ Volatility Contracts Further

-Short-term Uptrends Remain In Place

-XLY Forms Inside Day

-OIH Forges Island Reversal

-IGN Stalls at Resistance

-SMH Declines Five Days Straight

-Stocks Covered: AAPL, ARO, AVY, CHRW, DYN

-Click here for today&...

READ MORE

MEMBERS ONLY

Bullish Percent Index Shows Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 Bullish Percent Index stands at 80%, its highest level since February 2007. Above 70% is generally regarded as overbought because this indicator spends most of its time fluctuating between 30% and 70%. However, 80% testifies to underlying strength within the index and this indicator favors...

READ MORE

MEMBERS ONLY

Sunoco Surges to Broken Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Sunoco (SUN) broke support around 26 with a sharp decline in June. After reversing course in early July, the stock surged back to broken support, which now turns into resistance. Notice how the stock pulled back with high volume on Thursday. This is a big resistance test.

Users can click...

READ MORE

MEMBERS ONLY

A Volatility Contraction for QQQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-QQQQ Extends Volatility Contraction

-SPY Hits Broadening Resistance

-Short-term Momentum Turns Bearish

-AAII Bulls Hit 50%

-Breadth Remains Bullish Overall

-Nasdaq Lags NY Composite

-Finance Sector Pushes Small-caps Higher

-VIX and VXN Diverge

-Intermarket Correlations

-Link to today's video

-Next update will be Tuesday (August 11) by 7AM...

READ MORE