MEMBERS ONLY

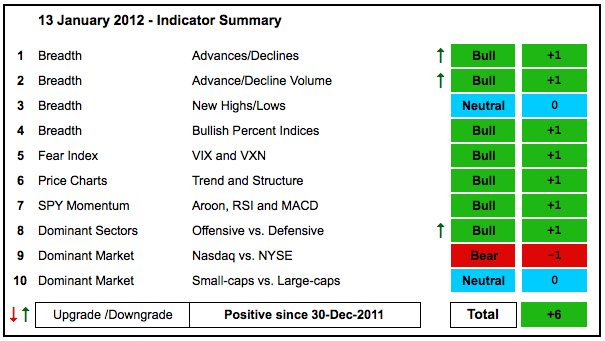

Indicator Summary Strengthens as NYSE AD Line Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With another strong week in the stock market, the indicator summary improved with three indicator upgrades. The AD Lines are considered bullish because the NYSE AD Line broke its summer highs and the Nasdaq AD Line broke its early December high. The AD Volume Lines are bullish because both broke...

READ MORE

MEMBERS ONLY

IWM and QQQ Move to New Highs for the Year

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite lackluster retail sales, stocks recovered from early losses on Thursday and closed near their highs for the session. The sectors were mixed with materials and industrials posting the biggest gains. Utilities and energy were down. The S&P 500 ETF (SPY) remains in an uptrend on the 60-minute...

READ MORE

MEMBERS ONLY

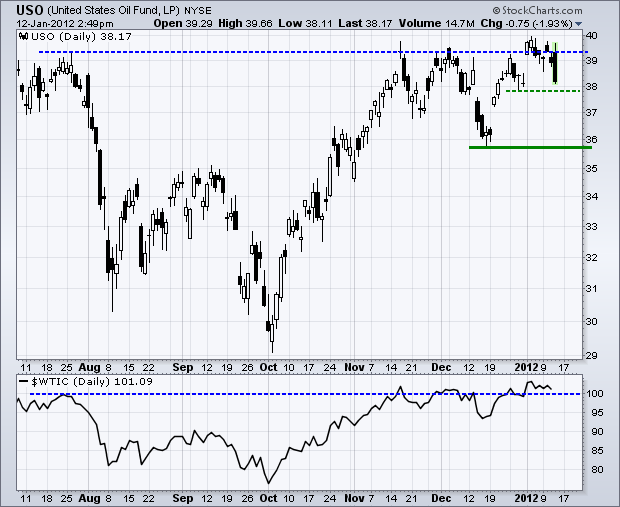

Oil Runs into a Wall of Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US Oil Fund (USO) started the year strong with a surge above 39, but cannot hold above this level as the ETF plunged over 1.5% on Thursday. USO was also turned back in the 39-40 area in November and December. In the indicator window, note that Spot Light...

READ MORE

MEMBERS ONLY

Stocks Hold Strong Despite Bond Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The intermarket picture is getting a bit strange. We have already seen the Euro and the stock market decouple in 2012. Over the last three days, we are also seeing a positive correlation between treasuries and stocks. These two were negatively correlated throughout 2011 and I am most concerned with...

READ MORE

MEMBERS ONLY

Charts of Interest: ARO, EMC, FLEX, GPS, LTD, X, XRAY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

FLEX Breaks Resistance with Big Volume.

LTD Tests Triangle Support.

Bollinger Bands Narrow for XRAY.

Plus ARO, EMC, GPS, X

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all...

READ MORE

MEMBERS ONLY

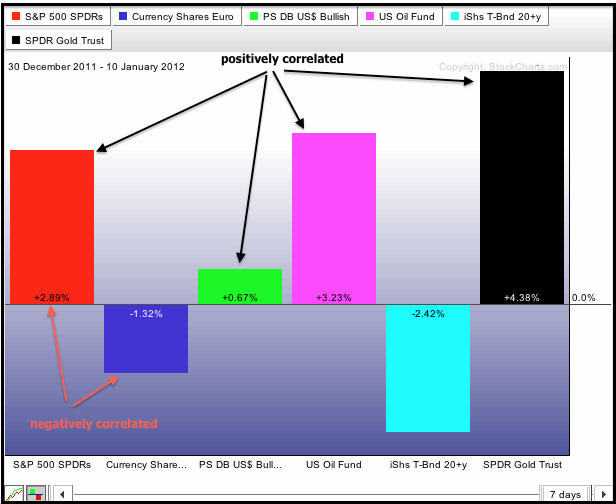

Stocks, Oil and Gold Remain Positively Correlated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The PerfChart below shows six intermarket related ETFs. The S&P 500 ETF (SPY), US Oil Fund (USO) and Gold SPDR (GLD) are positively correlated as all show gains in 2012. In an interesting twist, the Euro Currency Trust (FXE) and the S&P 500 ETF (SPY) are...

READ MORE

MEMBERS ONLY

SPY Gaps and Holds the Gap as TLT Firms at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged on the open and then moved into a holding pattern the rest of the day. There was no upside follow through after the opening surge, but stocks held their gains and selling pressure was relatively muted. All sectors were up with materials, finance and industrials leading the way....

READ MORE

MEMBERS ONLY

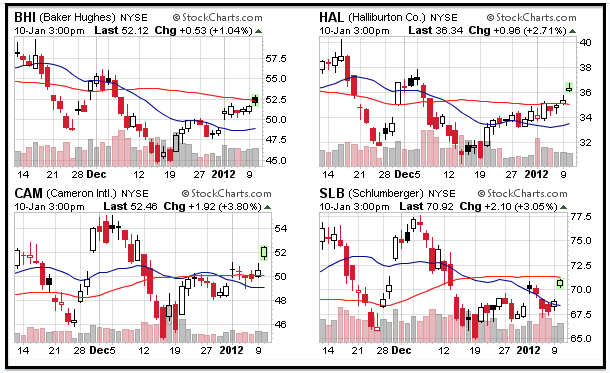

Oil Equipment and Services Stocks Moving Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A look through the CandleGlance groups shows stocks in the oil equipment and services group moving higher on Tuesday. The image below shows four of the six stocks along with the DJ Oil Equipment & Services Index ($DJUSOI). Most of the stocks are up more than 2% with giant Schlumberger...

READ MORE

MEMBERS ONLY

GLD Hugs Resistance as USO Bounces of Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is not much change on the 60-minute chart for SPY. The ETF broke flag resistance with a surge late last week and then consolidated the last two days. The breakout is holding with first support marked at 127.20. While a move below this level would also break the...

READ MORE

MEMBERS ONLY

Charts of Interest: ASEI, CI, CRR, MCK, SUSS, TIF, VRTX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CRR Bounces of 61.80% Retracement.

MCK Breaks Triangle Trendline.

VRTX Breaks Resistance on High Volume.

Plus ASEI, CI, SUSS, TIF

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

Urban Outfitters Advances towards Triangle Trendline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Urban Outfitters (URBN) is showing signs of life with a move toward the upper trendline of a triangle consolidation. The stock is currently up three of the last five days, but volume is light. A breakout on surging volume would be bullish. Failure and a break below support at 27...

READ MORE

MEMBERS ONLY

Gold Challenges Resistance as Treasuries Test Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) did not move much after Tuesday's opening gap, but did manage to hold its gains and close near the high for the week. Even though the ETF did not follow through on this gap, the gains are still holding and the...

READ MORE

MEMBERS ONLY

QQQ Starts the Year Showing Relative Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) is showing relative strength this year with a triangle breakout and surge above its early December high. On the daily candlestick chart below, QQQ surged in October and then consolidated in November-December. This consolidation started wide in November and then narrowed in December as a...

READ MORE

MEMBERS ONLY

Dollar ETF Hits Highest Level since January 2011

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US Dollar Fund (UUP) broke above its October high and is closing in on a 52-week high this month. With higher highs in September, December and January, the trend here is clearly up. The Commodity Index Fund ($DBC) is not happy though. Notice that this ETF peaked in May...

READ MORE

MEMBERS ONLY

NYSE Breadth Indicators Remain Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary got a couple more upgrades this week and remains in positive territory. In particular, the Trend-Structure indicator was upgraded to bullish because the Dow Industrials SPDR, S&P 500 ETF and Nasdaq 100 ETF broke above their early December highs. These breakouts could be reversed on...

READ MORE

MEMBERS ONLY

UUP Breaks Flag Resistance as QQQ Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) gapped up on Tuesday morning, formed a falling flag the next 2-3 days and then broke flag resistance with yesterday's surge. The short-term trend has been up since the breakout on December 20th and the bulls remain in charge. Notice how...

READ MORE

MEMBERS ONLY

Regions Financial Challenges Resistance on High Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Regions Financial (RF), which is part of the regional banking group, is showing strength with a break above the November-December highs on surging volume. Prior to today's breakout, the stock consolidated with a seven day pennant. Watch support in the 4-4.20 area for signs of failure.

Click...

READ MORE

MEMBERS ONLY

IWM Forms Island Reversal as TLT Hits Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) remains in a short-term uptrend on the 60-minute chart. After a big gap on Tuesday morning, the ETF pulled back to broken resistance, which turned into the first support zone in the 126.50 area. SPY bounced back above 127.5 yesterday afternoon...

READ MORE

MEMBERS ONLY

Charts of Interest: AA, ANF, ATVI, LUV, WDC, WIN

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AA Surges off Support with Big Volume.

LUV Consolidates after Strong Surge.

WDC Forms Bullish Pennant after Breakout.

Plus ANF, ATVI, WIN

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise)...

READ MORE

MEMBERS ONLY

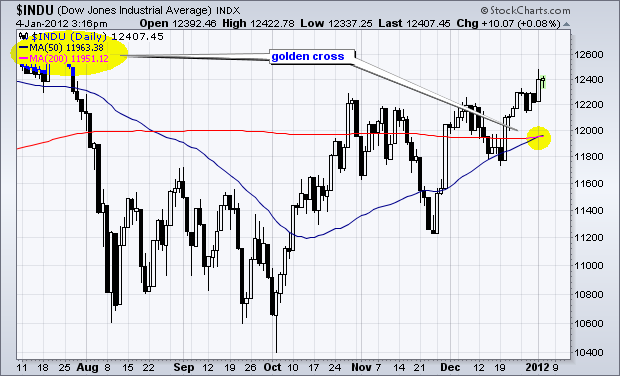

A Golden Cross for the Dow Industrials

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The technical picture for Dow is improving as the 50-day simple moving average crossed above the 200-day simple moving average. Note that the 50-day SMA has not been above the 200-day SMA since August. Also notice that the senior average is trading at its highest level since late July.

Click...

READ MORE

MEMBERS ONLY

UUP Hits Key Retracement as GLD Nears Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged on the open, but did not follow through on these opening gains. The Nasdaq 100 ETF (QQQ) and S&P 500 ETF (SPY) held near their opening levels throughout the day, but the Russell 2000 ETF (IWM) and S&P MidCap 400 SPDR (MDY) sold off...

READ MORE

MEMBERS ONLY

Apollo Bucks the Market with Bearish Engulfing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apollo (APOL) opened strong and moved lower to trace out a bearish engulfing during the day on Tuesday. It is interesting that APOL is not moving higher with the market and that this bearish candlestick pattern formed at resistance. Follow through below Tuesday's low would confirm the pattern....

READ MORE

MEMBERS ONLY

SPY Forms Lower High as GLD Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It is a short, but packed week for the market with several key economic reports on deck. We have ISM Manufacturing and FOMC minutes on Tuesday, Factory Orders and Auto/Truck Sales on Wednesday, ISM Services and Jobless Claims on Thursday, and the big Employment Report on Friday. The first...

READ MORE

MEMBERS ONLY

Charts of Interest: A, ALTR, ARO, CAT, ESRX, MGM, SLB, STX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ARO Forms Pennant after Sharp Decline.

SLB Firms at Support Zone.

STX Challenges Wedge Trendline.

Plus A, ALTR, CAT, ESRX, MGM

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

Dow Transports Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a surge in late December, the Dow Transports is once again challenging resistance from the October highs. Notice that the Average failed at this level in early December. The Dow Industrials is also hitting resistance near the October high. Breakouts in both would be bullish according to Dow Theory....

READ MORE

MEMBERS ONLY

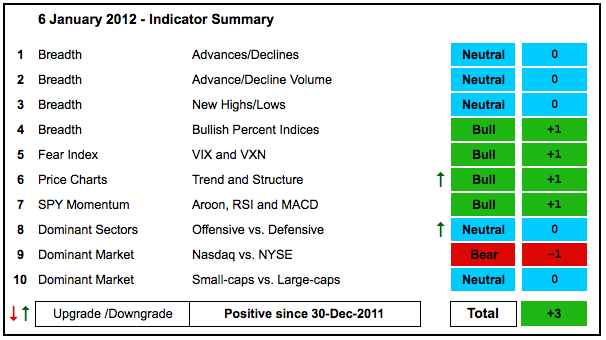

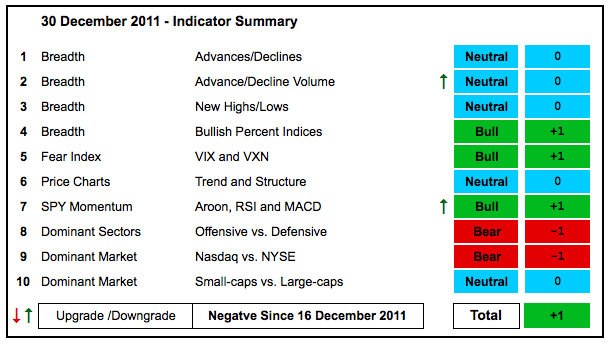

Divided Market Keeps Indicator Summary in Check

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a couple of upgrades, the indicator summary moved from -2 to +1 this week. The total has been waffling around the zero level for a few weeks now, which reflects a divided the market. The average Nasdaq stock is relatively weak, but the average NYSE stock is relatively strong....

READ MORE

MEMBERS ONLY

SPY Maintains Short-Term Uptrend as UUP Breaks Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued their short-term uptrends with further strength on Tuesday and then fell sharply on Wednesday. This decline was not enough to reverse the short-term uptrend. With a modest bounce on Thursday, the major index ETFs established short-term support levels to watch going forward. On the S&P 500...

READ MORE

MEMBERS ONLY

Energy SPDR Forms Large Triangle Consolidation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After surging in October, the Energy SPDR (XLE) moved into a sideways pattern with a lower high and a higher low. In short, the noose is tightening as a triangle consolidation takes shape. Watch resistance from the early December high and support from the mid December low for the next...

READ MORE

MEMBERS ONLY

QQQ Turns Back At November Trendline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) is hitting resistance from the November trendline and a key retracement. Notice that the ETF turned back at the 62% retracement with Wednesday's decline. A lower high could be taking shape as buying pressure dries up below the early December high.

Click this...

READ MORE

MEMBERS ONLY

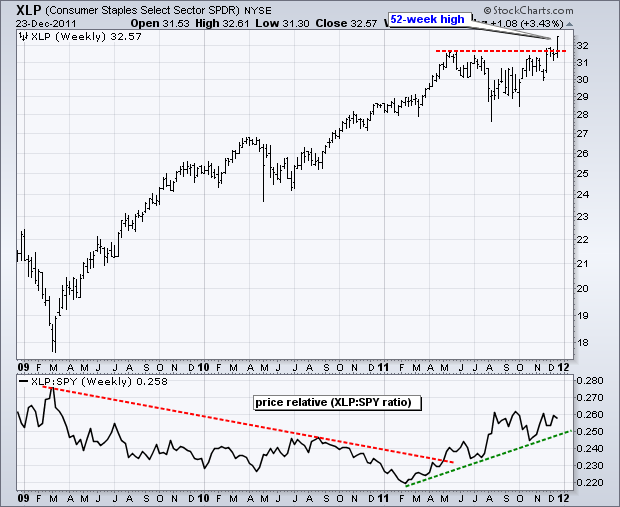

Consumer Staples SPDR Continues to Lead with 52-week High $XLP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Of the nine sector SPDRs, only two hit new 52-week highs last week: the Consumer Staples SPDR (XLP) and the Utilities SPDR (XLU). These two defensive sectors are clearly leading the market right now. The chart below shows XLP breaking its May highs and the Price Relative moving higher since...

READ MORE

MEMBERS ONLY

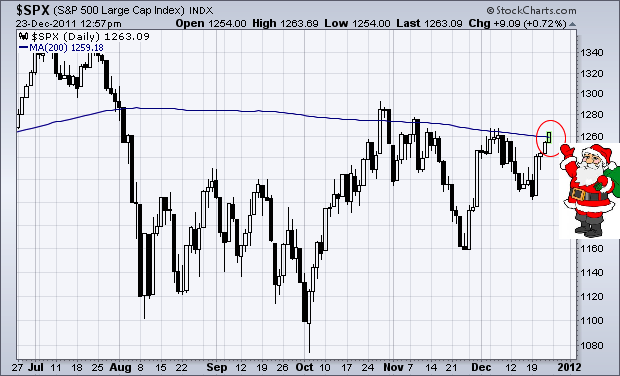

Santa Delivers the 200-day for the S&P 500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Santa Clause rally continued into Friday with the S&P 500 clearing its 200-day moving average in the early afternoon. Prior attempts in early December failed as the index fell back before the close. Let's see if Santa can make good on this one. Merry Christmas!...

READ MORE

MEMBERS ONLY

Market Remains Mixed as Nasdaq Shows Relative Weakness

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the indicator summary remains unchanged this week, there was some strengthening under the hood this week. Notably the NYSE Net New Highs Line continues to rise and shows no signs of weakness. The AD Volume Lines bounced this week and are on the verge of trend changing breakouts....

READ MORE

MEMBERS ONLY

SPY holds Breakout as Euro Bounce Helps Gold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

First, note that Art's Charts will not be published next Monday through Thursday. It is a fine time for family and Christmas. Commentary will resume on Friday, December 30th. Merry Christmas and Happy Holidays from all of us at Stockcharts.com. Now to the charts! The good ole...

READ MORE

MEMBERS ONLY

DIA Forms Inverse Head-and-Shoulders Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Industrials SPDR (DIA) is challenging resistance from an inverse Head-and-Shoulders pattern. After surging in October, the ETF consolidated for two months to set up the pattern. The late November low formed the head and neckline resistance is set just above 122. Before getting too bullish, note that low...

READ MORE

MEMBERS ONLY

SPY Holds the Breakout and QQQ Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

An earnings miss from Oracle hit the Nasdaq 100 ETF (QQQ) hard, but the broader market held up pretty well as the S&P 500 ETF (SPY) finished the day with a slight gain. On the 60-minute chart, SPY broke resistance with Tuesday's surge and broken resistance...

READ MORE

MEMBERS ONLY

Charts of Interest: AET, ATVI, HST, MET, NYB, PBCT, PGR, T

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ATVI Forms Harami at Support.

NYB Edges High on Expanding Volume.

T Breaks Flag Resistance after Failed Deal.

Plus AET, HST, MET, PBCT and PGR.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock...

READ MORE

MEMBERS ONLY

Two Bearish Patterns Take Shape in Akamai

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are two bearish patterns at work with Akamai (AKAM). First, a lower high formed in early December and a descending triangle is taking shape. A move below 26 would confirm this pattern. Second, a bear flag formed the prior five days and the stock is on the verge of...

READ MORE

MEMBERS ONLY

SPY Breaks Channel Resistance as TLT Plunges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The European Central Bank (ECB) is opening the monetary floodgates today. While they may not call it quantitative easing (QE) by name, the ECB is essentially giving money to European banks so they can stimulate the economy with increased lending. Seems I've heard this one before. The US...

READ MORE

MEMBERS ONLY

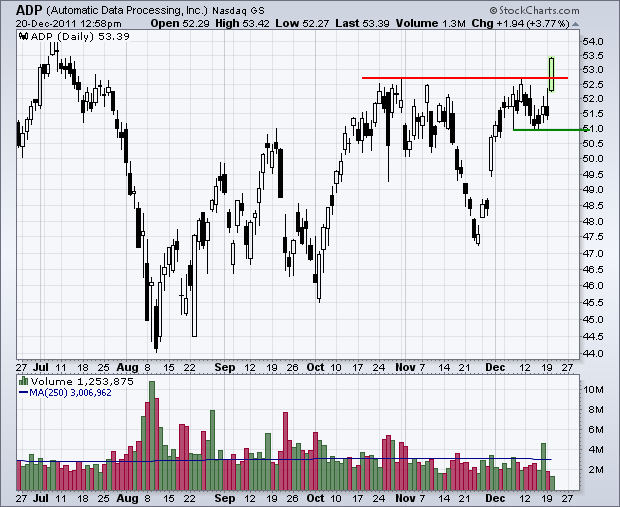

ADP Breaks Resistance with big Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Automatic Data Processing (ADP) may have an antiquated name, but the stock has outperformed Apple (AAPL) since mid September. On the chart below, ADP broke resistance from the October-November highs with a big move. Even though volume is light, the breakout is bullish as long as it holds.

Click this...

READ MORE

MEMBERS ONLY

GLD Holds it Bounce as TLT Becomes Way Overbought

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Now that everyone has officially given up on the Santa Claus rally and stocks are oversold, perhaps we will get that rally. The S&P 500 ETF (SPY) remains in a falling price channel that is defined by the Raff Regression Channel. Key resistance is set at 123. Within...

READ MORE