MEMBERS ONLY

Week Ahead: NIFTY Defends Key Supports; Upside May Stay Capped Here in This Short 3-Day Week

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had a positive weekly closing; despite the truncated week with just four trading sessions, the NIFTY registered decent gains. Over the past several sessions, the markets were unable to take any major directional calls; however, this week saw the markets rebounding from the lower edge of the trading...

READ MORE

MEMBERS ONLY

Week Ahead: A Shaky Start to the Week Likely; NIFTY Rests at Crucial Supports

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was a volatile, but largely quiet, week for the markets. Over the past five sessions, the markets were able to defend their opening lows and were trading flat until the last trading day of the week. The negative closing of the last trading day saw the markets ending in...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Hangs in Balance Near Crucial Supports; Important to Defend These Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week remained a technically damaging one, as the NIFTY violated a few important supports while closing on a negative note. The volatility, too, increased; however, this was on the expected lines. The past five days also saw the global markets dealing with the collapse of SVB (SVIB); the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stares at Important Supports; Staying Above These Levels Would Be Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The truncated week remained quite volatile; the markets were all over the place, and the week ended on a negative note. The volatility over the last two days was fueled by the testimony of FOMC chief Jerome Powell, who showed all the indications of continuing with the hikes; he also...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Holds 50-Week MA; Low VIX Calls for Vigilant Approach at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was largely a troubled week for the Indian equities, as the markets spent four out of five days struggling to keep their head above the crucial 200-DMA, which currently stands at 17404. Had it not been for Friday, which saw a sharp surge in the Indices, the week was...

READ MORE

MEMBERS ONLY

Are We Staring at a Technical Rebound on This Metal Stock?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Metals and Commodities stocks have been relatively outperforming the broader markets for a couple of months now. This was the period when the US Dollar Index (DXY) underwent a strong corrective move after testing the highs of 114.77 in September. The retracement in the Dollar Index was a...

READ MORE

MEMBERS ONLY

A Breakout May Be in the Offing in This Engineering Stock

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equities have been quite jittery over the past couple of weeks. Broadly speaking, the headline index NIFTY50 ($NIFTY) has been oscillating between its 50-day moving average (MA) and 200-day MA during February. These MAs are placed at 17885 and 17302 respectively. Lately, the index has made strong attempts...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Draws Closer To Potential Support; RRG Charts Show Defensive Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was a weak performance for the equity markets; after heading nowhere over the past two weeks despite staying volatile, the markets gave up some strength as they closed the week on a negative note. In the previous technical note, it was mentioned about the VIX, i.e., INDIAVIX was...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Still Has Key Resistance Points to Deal With; This Sector Rolls Inside the Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was the second week in a row that the markets did not make any major headway, staying directionless and ending with just modest gains. The previous days have seen volatility declining; the VIX remains at one of its lowest levels of the recent past. This week as well, there...

READ MORE

MEMBERS ONLY

Week Ahead: Markets Approaches Union Budget in Bruised State; Expect Volatility to Remain High

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As the week came to an end, the equity markets left behind a very eventful week. Two important events were expected to infuse volatility into the markets. The first was the Union Budget, one of the most major external domestic events that the markets react to. The other was the...

READ MORE

MEMBERS ONLY

Buoyant Technical Setup in this CV Stock

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Today is Friday; however, when the market drew to a close on Thursday, it left both major events behind itself while it also navigated the weekly options expiry. The market is having an immensely volatile week; with the last trading day of the week yet to unfold, the weekly bar...

READ MORE

MEMBERS ONLY

Some Classical Technical Developments Shaping Up As Volatile Markets Gets Selective

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The ghost of the Hindenburg Report continues to haunt the Indian stock markets; the markets have witnessed a sharp selloff over the past two sessions after the activist short-seller leveled some serious allegations against the Adani Group. While Hindenburg Research specializes in "forensic financial research", they have accused...

READ MORE

MEMBERS ONLY

Week Ahead: Market Approaches Union Budget in Bruised State; Expect Volatility to Remain High

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was an immensely volatile and eventful week for the markets as they headed towards the last weekly close before the Union Budget. The last three sessions, more particularly the last two sessions, remained marred by the severely bearish reactions to Hindenburg Research's report on the Adani Group...

READ MORE

MEMBERS ONLY

Week Ahead: Ranged Movement Expected in this Truncated Week; These Levels Remain Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past couple of weeks, it has been categorically mentioned that, so long as the NIFTY stays below the 18300 levels, it is likely to continue to consolidate in the present range. The index has created a very well-defined trading range for itself at the moment, and has continued...

READ MORE

MEMBERS ONLY

This IT Bellwether May Wake Up From a Slumber

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past couple of weeks, the performance of the IT stocks has remained quite muted; the NIFTY IT Index has come off from its November highs and has consolidated over some time. This has led to relative underperformance of the IT group against the broader markets. However, a few...

READ MORE

MEMBERS ONLY

Week Ahead: Expect Markets To Trade With Positive Bias So Long As These Levels Are Defended; These Sectors To Do Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly technical note, it was mentioned that the markets may remain in a trading range until they trade below the crucial 18300 level, which is one of the major resistance points on the chart. Over the past five days, NIFTY not only remained below this point, but...

READ MORE

MEMBERS ONLY

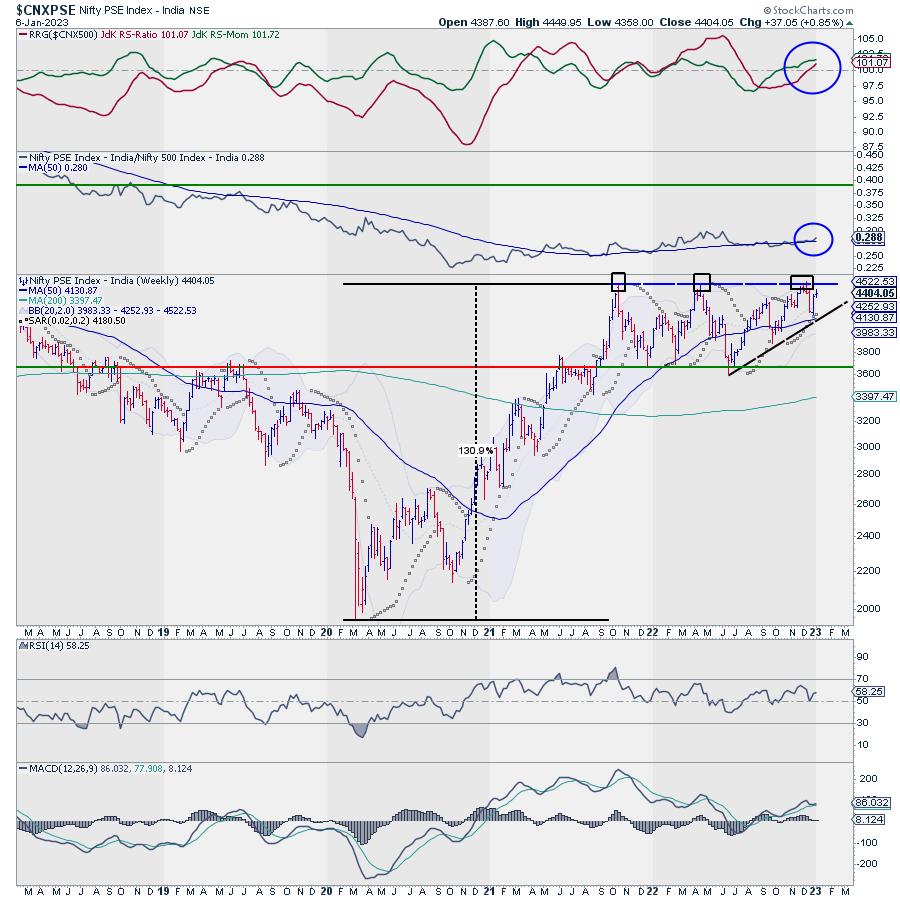

Sector Spotlight: Keep An Eye; This Could Be A Massive Multiyear Breakout

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

There is no debate when it comes to concluding that 2022 has been a choppy year for equities globally. The markets had to deal with all sorts of things; rising inflation, fear of recession, geopolitical tensions, and a slew of rate highs from the central banks all over the world....

READ MORE

MEMBERS ONLY

Week Ahead: Positive Start To Nifty Expected; Muted Dollar Index May Benefit These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The equity markets have entered into the new year on a back foot and stayed choppy as well. In the previous technical note, it was mentioned that, so long as the NIFTY stays below its crucial resistance zone of the 18300-18600 levels, it will remain in a trading zone that...

READ MORE

MEMBERS ONLY

Week Ahead: Markets May Step into New Year On A Quiet Note; Staying Above This Zone Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As the session on Friday ended, we not only ended the trading week, but also the month and the year. 2022 was choppy for the equities, to say the least. The markets had to navigate the weak trends, geopolitical tensions, inflation, fear of recession, and a slew of rate hikes...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Drags Its Resistance Lower; Watch PSE, Energy Along With These Sectors For Resilience

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past few days, the levels of 18600 on NIFTY have assumed a lot of importance as the index had staged a breakout above this point but ended up slipping below this level following a full throwback. In the previous editions of weekly technical notes, it has been mentioned...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Needs to Move Past This Point; Continue Focusing on These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was categorically mentioned that it would be crucial to see if NIFTY could keep its head above 18600 levels to extend and confirm the breakout that it has attempted. However, despite a strong relative outperformance from the NIFTY Bank Index, the NIFTY has delayed...

READ MORE

MEMBERS ONLY

Week Ahead: These Factors Stay a Cause of Concern While Markets Try to Stage a Breakout; Stay Selective

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by saw the markets trading very much on the analyzed lines. It was mentioned that if the NIFTY can keep its head above 18300–18400 levels, there were chances of it testing its lifetime high point of 18604 and attempting a breakout. While moving on the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Approaches Lifetime High Point on Weak Breadth; These Three Sectors Look Promising

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was mentioned that the market has a resistance in the 18300-18400 level zone while it navigates the November month expiry of the derivative series. Quite on the expected lines, the NIFTY consolidated in the first half of the previous week; however, in the last...

READ MORE

MEMBERS ONLY

Week Ahead: BankNifty at High Point & NIFTY Within Striking Distance; Stay with Stocks with Strong Relative Strength

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets navigated the past week quite on the analyzed lines; what we witnessed was a classical consolidation taking place. The NIFTY did not take any directional move throughout the week. Intermittent profit-taking bouts were seen; however, these phases saw the markets recovering from the lower levels. The NIFTY Bank...

READ MORE

MEMBERS ONLY

This Sector Is Poised at a Crucial Juncture

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After showing a great out-performance until the middle of 2022, this key sector index of the Indian markets is showing signs of slowing down. The technical structure of charts shows that, until a particular level is taken out, a potential top may be in place for this sector index. If...

READ MORE

MEMBERS ONLY

Week Ahead: Protect Profits As NIFTY Continues To Surge; This Sector Generates Highest Alpha In Recent Times

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the truncated week that went by, the NIFTY 50 Index ($NIFTY) traded much on the analyzed lines. Despite staying volatile, it largely remained buoyant while it extended its move on the upside.

In the previous week's technical note, there was a categorical mention of the possibility of...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely To See A Buoyant Start; Moving Past Key Levels Likely

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After spending nearly 10 weeks below the falling trend line pattern resistance and taking support at important levels, the NIFTY has finally attempted to break above this significant resistance pattern. In the short trading week interrupted by a holiday, the markets continued inching higher while keeping their head above the...

READ MORE

MEMBERS ONLY

Week Ahead: Festive & Truncated Week May See Markets in a Range; NIFTY Largely to Defend to Stay Stable

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After taking support near the key levels on the charts, the NIFTY finally resumed its up move, ending the week on a decently positive note. The last three weeks had seen the index taking support at its 20-Week MA; now, the NIFTY is above all the key moving averages. The...

READ MORE

MEMBERS ONLY

Week Ahead: Stability In Global Equity Markets A Must For A Technical Pullback; NIFTY Continues To Defend Key Support Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Despite the scale of volatility represented by gaps over the previous days, the NIFTY has by and large maintained its crucial support levels on the weekly charts. The previous technical note mentioned how the Index has created and maintained its crucial support; it managed to keep its head above these...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Eyes This Level as the Immediate Target; Staying Above These Two WMAs Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, we mentioned how the Indian equities stayed in a defined range, as they traded within the defined corners while respecting basic technical levels. In the week that has gone by, the NIFTY once again made measured moves, continuing to strongly inherit buoyancy from the US...

READ MORE

MEMBERS ONLY

Week Ahead: Markets May Stay Volatile and In a Range; These Sectors May Start Doing Better

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week that was volatile for the Indian markets, the NIFTY50 index oscillated in a 448-point range before ending with a net loss. In the previous week, the NIFTY had closed above the 50-Week MA, which is presently placed at 17100; the index slipped below this point and bounced...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Approaches This Key Support on Higher Timeframe Charts; Keep Positions at Modest Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by remained rather contradictory in nature; however, let's consider if this statement holds if we look at it from different perspectives and different timeframes. The markets certainly remained highly volatile, as they reacted, in turn, to the global market reactions to the 75 bps...

READ MORE

MEMBERS ONLY

Week Ahead: Fed Fears Keep Market on Tenterhooks; Staying Selective Holds the Key

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While continuing to stay resilient as they outperformed the global markets, the Indian equities delayed their breakout, continuing to resist the important pattern resistance on the charts. While a strong attempt to break above the crucial resistance zones was underway, the inflation figures again played a spoilsport; US markets reacted...

READ MORE

MEMBERS ONLY

Special Note: A Breakout is in The Offing from This Large Rectangle Pattern; Watch Out

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

ADANIPORTS has been showing some potent technical developments on the longer-term timeframe charts. While most of the Adani Group stocks have run up too high and ahead of the curve, this stock has been consolidating in a wide and well-defined trading range and has formed a great base for itself....

READ MORE

MEMBERS ONLY

Week Ahead: Directional Move in NIFTY Unlikely So Long as the Index is in This Range; RRG Chart Shows Interesting Sector Rotations

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Although the markets ended flat on a weekly note, the past five sessions remained quite volatile. The markets stepped into the week while inheriting a very weak global trade setup; the weakness was inflicted by very bearish reactions of the US markets following Jerome Powell's comments at the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to See Shaky Start to Truncated Week; Stay Highly Selective in Your Approach

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by fared very much on the expected lines. In the previous technical note, it was mentioned that, given the unabated up-move in the markets for a couple of weeks, perhaps it was time that the markets take a breather. In the week before this one, the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stares at Potential Stalling of Rally; Upsides (If Any) to Stay Capped at This Level

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After continuing to rise in an unabated manner for three sessions out of four in the truncated week, the Indian equity markets managed to end the week on a positive note, but also witnessed a sharp profit-taking bout in the last trading session. The markets began the week a bit...

READ MORE

MEMBERS ONLY

Week Ahead: Short Trading Week May Offer Nifty Resistance In This Zone; RRG Shows These Sectors Rolling Inside Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets had a definite directional move over the past five days; it practically nullified the potentially bearish setup that indicated a likely stalling of the present up-move as it trended during the week to end with gains. The markets saw themselves inching higher and opening up some...

READ MORE

MEMBERS ONLY

Special Note: This Bullish Reversal Pattern Might Really be a Continuation Pattern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the discipline of Technical Analysis, there are patterns that can be classified as Reversal Patterns or Continuation Patterns. Where Reversal patterns tend to reverse the prior trend, Continuation patterns tend to resolve in the direction of the prior trend.

One such "Reversal Pattern" is the Inverted (or...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY to See Ranged Consolidation Unless This Zone is Taken Out; RRG Shows These Sectors Doing Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In our previous technical commentary and forecast, we anticipated that this week may see some ranged consolidation. It was also expected that such consolidation may have ranged moves and some profit-taking bouts from the higher levels. However, the downsides were expected to stay limited. While dancing exactly to these tunes,...

READ MORE