MEMBERS ONLY

Key Support Levels To Watch On S&P 500 During This Correction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The selling was coming, we just weren't quite sure when. Well, it's here now, so how long might it last and how much pain might we endure? Both questions are difficult to answer, but I do know the 3-4 month channel has been broken. That tells...

READ MORE

MEMBERS ONLY

The Selling Wasn't Due To The Coronavirus; Here's What No One Is Talking About

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The selling that we saw last week was long overdue. Many are panicking over the coronavirus, which is easy to do when it's the only thing that the media is covering. After all, there has to be some fundamental reason that will lead to the next market collapse,...

READ MORE

MEMBERS ONLY

A Proven Method To Better Predict Earnings Results and Free Webinar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Relative strength.

It seems easy enough. Wall Street meets with management teams continuously throughout the year (except during quiet periods). Analysts evaluate not only business strategy, but also business integrity. It's an opportunity for executives to lay out their business plans and strategies to the people that matter...

READ MORE

MEMBERS ONLY

Want To Better Predict Earnings Results BEFORE They're Released? Check This Out...

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At the start of the week, I held a members-only webinar at EarningsBeats.com to provide my "predictions" of upcoming earnings reports based off of the charts. I've turned it into a formal study where I've been summarizing results all week. The best charts...

READ MORE

MEMBERS ONLY

I Will Guarantee You The Upcoming Earnings Performance Of These 2 Giants

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If a company is likely to report strong results, Wall Street knows it. Analysts have met with management and discussed targets, competition, product strategies, margins, etc. If they like what they hear, they return to their offices and buy for themselves and clients. That's how it works. Astute...

READ MORE

MEMBERS ONLY

EB Daily Market Report - Tuesday, January 21, 2020

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Event

Below is a sample of the Daily Market Report that I sent to EarningsBeats.com members this afternoon.

Also, I'd like to extend an invite to everyone to join me at 4:30pm EST today as I will host our "Sneak Preview - Q4 Earnings&...

READ MORE

MEMBERS ONLY

And The FAANG Winner For 2020 Is?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I believe all 5 FAANG stocks - Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOGL) - will end 2020 higher than they started. The question is, how much higher? Which one is THE stock to own? If you asked me which company I believe is simply the...

READ MORE

MEMBERS ONLY

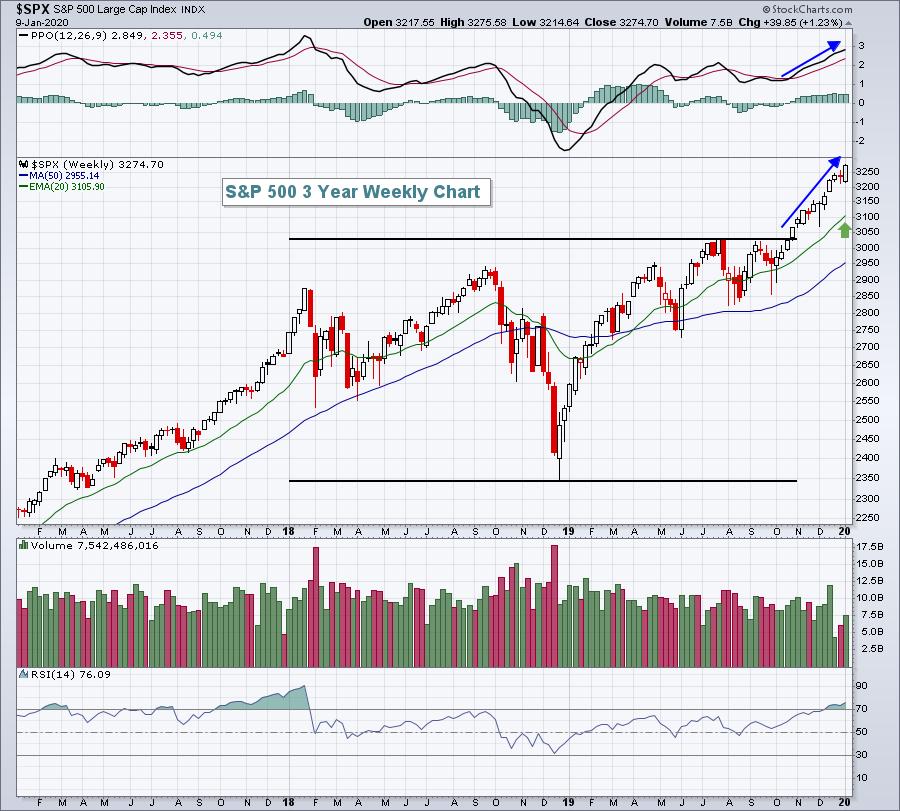

The Masses are Growing Too Bullish; I Smell a Short-Term Top

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Calling tops in a secular bull market advance is not typically a wise thing to do, because it rarely works. But it's very difficult to ignore sentiment readings that border on the absurd. Three months ago, the S&P 500 broke out of a bullish ascending triangle...

READ MORE

MEMBERS ONLY

Prepping For Another Very Strong Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my last article, I discussed the possibility that we could see a short-term top form and many of those warning signs continue to persist. Of course, in a secular bull market advance, trying to predict short-term tops can be a constant disappointment as prices seemingly rise every single day....

READ MORE

MEMBERS ONLY

Short-Term Trouble Is Brewing, Be Careful!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Hey, I'm bullish longer-term so I'm not talking about a major bear market ahead, nothing like that. But as a short-term trader, I need to heed the signs of a potential top and I'm beginning to see them. There are a number of these...

READ MORE

MEMBERS ONLY

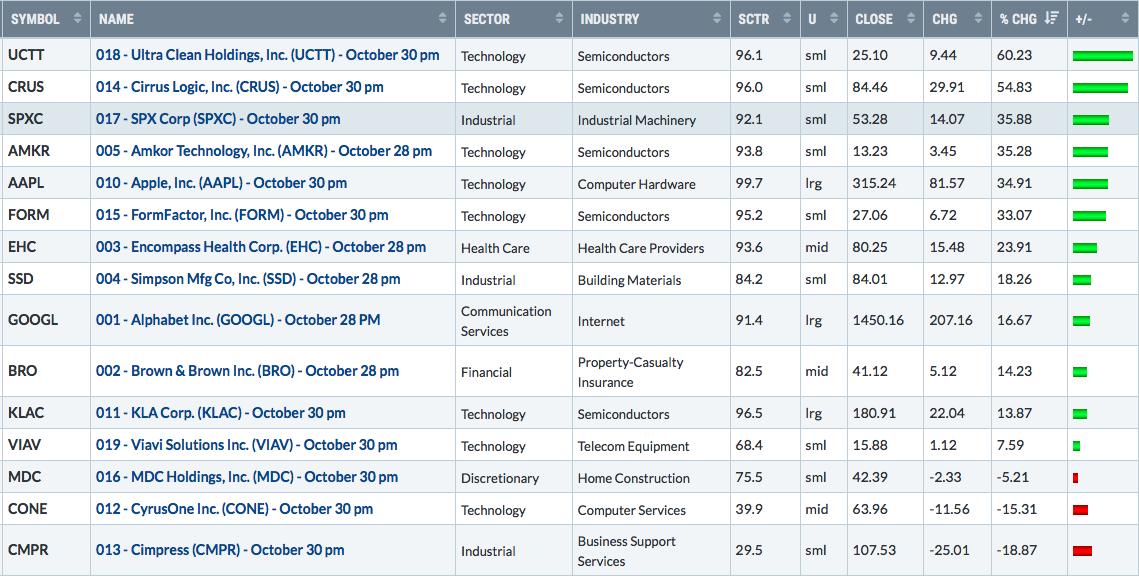

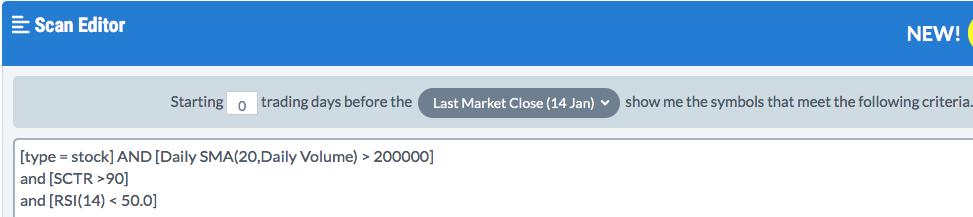

A Simple Scan To Uncover Strong Stocks Pulling Back; Here Are 4 Examples

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A common question I hear now that we've seen a significant advance in U.S. equities is, "when should I get in"? Well, we're in a secular bull market. It started in 2013 and won't end, in my opinion, until the end...

READ MORE

MEMBERS ONLY

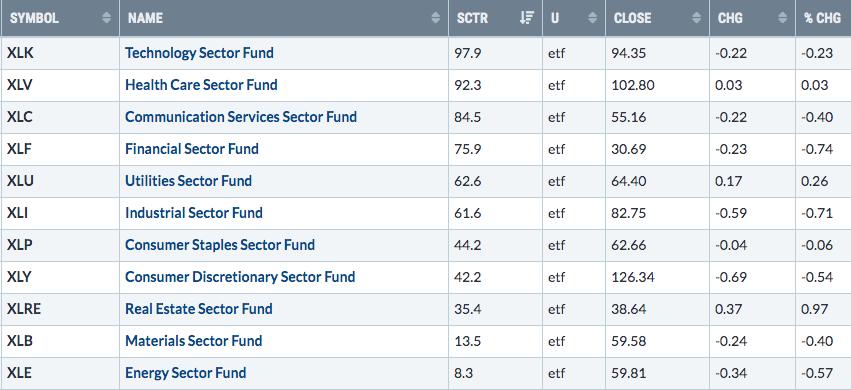

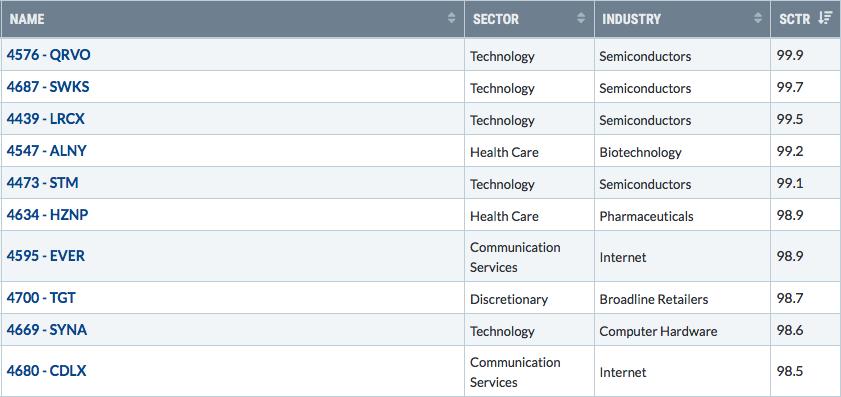

Performance Ranks vs. SCTRs: A 6 Month Test

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's first look at our sector SPDR funds, in SCTR order:

It's important to note that SCTR scores are calculated as of today. Performance ranks will change based on whether we look at one day performance, one week performance, six months performance, etc. SCTRs remain the...

READ MORE

MEMBERS ONLY

Another Solid Jobs Report Likely To Fuel Further Rally; Here Are A Few Winners

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

December nonfarm payrolls were just released and they were solid, though slightly below expectations. They suggest moderate economic improvement and the very slight increase in average hourly earnings confirms that the labor market, while tight, is not too tight. That combination, moderate growth and tame inflation, along with the reduced...

READ MORE

MEMBERS ONLY

Finding the Top 15 S&P 500 Stocks for 2020

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy New Year and welcome to a brand new decade! A century later, I believe the stock market is about to repeat itself as I'm expecting another roaring 20's! And yes, that could lead to another rough 30's decade, but let's worry...

READ MORE

MEMBERS ONLY

Escalating International Tensions Could Lead To Channel Support Test

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

U.S. indices have gone nearly straight up since early October, are extremely overbought near-term, and have needed reason for a pause. They may have received their reason overnight with U.S. airstrikes in Iraq. I refrain from political discussions because it honestly is not necessary nor productive. As technicians,...

READ MORE

MEMBERS ONLY

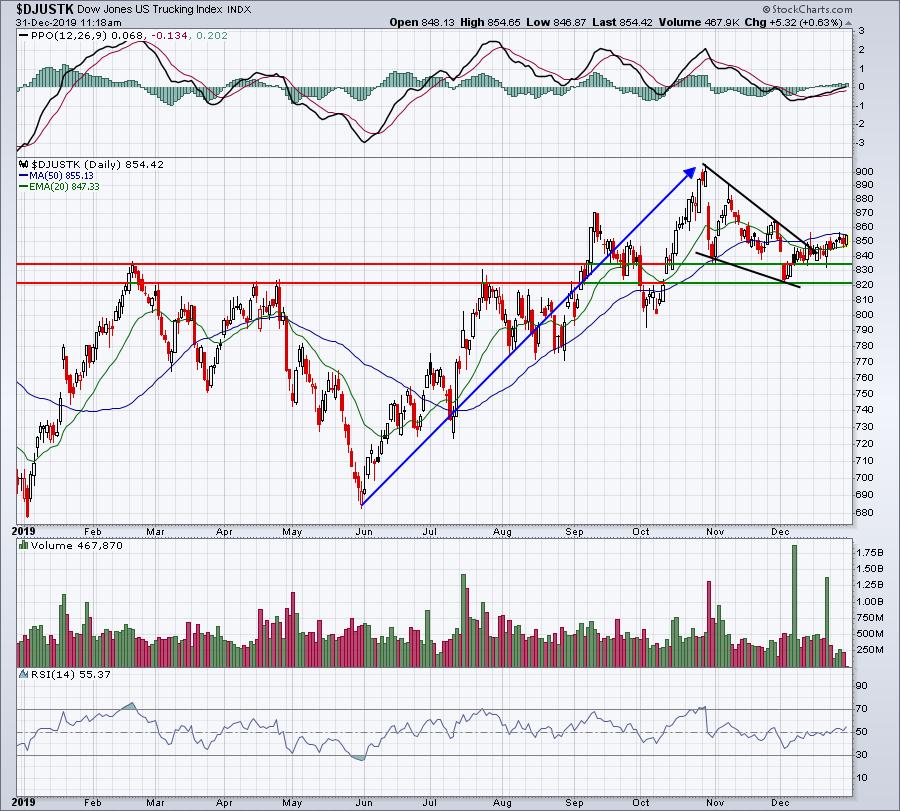

Truckers Appear Poised To Drive Us Into 2020

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* Futures were relatively flat today, but we have seen some slight selling to close out a very solid 2019

* Small and mid caps are leading on a relative basis and clinging to fractional gains

* All sectors are fairly flat to close out the year

* Gold ($GOLD) and...

READ MORE

MEMBERS ONLY

Here's A Solid Support Level To Watch On The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* Futures were slightly higher this morning

* Sellers have dominated the action since the opening bell, although small caps are bucking the trend and slightly higher

* Financials (XLF) are unchanged and the relative leader today

* Energy (XLE) and healthcare (XLV) are the hardest hit sectors

* Semiconductors ($DJUSSC) and...

READ MORE

MEMBERS ONLY

Determining If A Group Could Be A 2020 Market Leader; 2020 Market Vision Is Just One Week Away!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Whether a group looks strong or weak can easily be debated and it's what makes the stock market go round and round. Nondurable household products is one example. Is it breaking out or breaking down? This could be an interesting debate and it really gets to the heart...

READ MORE

MEMBERS ONLY

Will This Rally Continue In January? Use This Chart As A Guide

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* Pre-market action is pointing to another strong open as the year end rally continues

* Dow Jones futures are pointing an 80 point gain at the open and NASDAQ futures are showing relative strength once again

* A couple smaller biotechs - Flexion Therapeutics (FLXN) and Immunomedics, Inc. (IMMU)...

READ MORE

MEMBERS ONLY

OLED, SNAP, AMZN; They're Moving Today, But Are They Worthy?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* We're up again today with leadership from the NASDAQ; small caps lag

* Most sectors are higher with technology (XLK) showing a slight lead

* Apple's (AAPL) leadership is helping the NASDAQ and computer hardware ($DJUSCR)

* Banks ($DJUSBK) are strong with the 10 year treasury...

READ MORE

MEMBERS ONLY

Look For Wall Street Records To Keep Falling Throughout The Holidays

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* Today is an abbreviated session with the equity market closing at 1pm EST; many global equity markets are closed today

* Wall Street opened slightly higher, but has been trading near the flat line

* There are no economic reports of significance due out today as the 10 year...

READ MORE

MEMBERS ONLY

Market Report for Monday, December 23, 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

During the holidays, I'll be publishing my EarningsBeats.com Daily Market Report here in my Trading Places blog. I hope you enjoy it.

Happy holidays!

Executive Market Summary

* We're seeing another solid day as seasonal strength really begins to kick in

* The Dow Jones is...

READ MORE

MEMBERS ONLY

Aggressive Small And Mid Cap Stocks Could Be Poised To Soar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I established an Aggressive portfolio of 10 equal-weighted stocks in 10 different industry groups on May 19th. Every 3 months thereafter, on August 19th and then again on November 19th, I repositioned the portfolio with new relative leaders. That's the concept behind the portfolio. Stick with leaders in...

READ MORE

MEMBERS ONLY

Here's a Stock Breaking Out With 21% of its Float Short!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I was looking at the performance of NASDAQ 100 stocks after the close on Friday and realized that Tesla (TSLA) closed above 400 for the first time in its history. Volume was unusually high all week long as TSLA gained 13% to clear resistance in the upper 300s. TSLA had...

READ MORE

MEMBERS ONLY

S&P 500 Surges Past 3200; Don't Make This Mistake

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Records continue to fall every day. The S&P 500 has now gained 350 points off its October 3rd low. I don't know if it's going to stop any time soon, so I'd want to remain fully invested, especially given the tremendous bullish...

READ MORE

MEMBERS ONLY

Which NASDAQ 100 Stock Has Been The Best Performer In 2019?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you're trying to think of the best performing semiconductor stock ($DJUSSC), you're heading in the right direction. The DJUSSC has been outstanding throughout much of 2019, gaining nearly 50%, rising from 2888 to 4234 at yesterday's close. Semiconductor stocks actually take up the...

READ MORE

MEMBERS ONLY

Dissecting Last Week's 5 Trade Setups....And This Week's Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One week ago, I indicated that I'd have 5 trading candidates for anyone who signed up for a $7 30-day trial. It was similar to the Monday Setups that I had previously provided on MarketWatchers LIVE, the flagship StockCharts TV show that I had hosted for two years....

READ MORE

MEMBERS ONLY

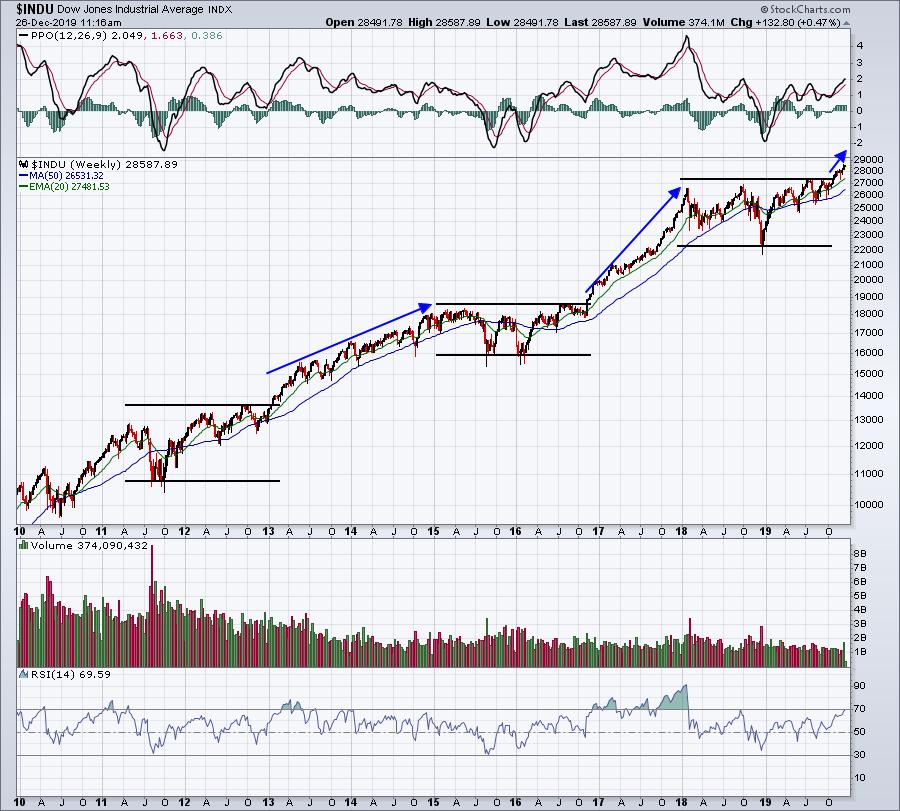

Two Developments Have Changed My Trading Strategy Heading Into 2020; They Should Change Yours Too

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I am extremely bullish as we head into 2020. Everything is lining up, but there are two factors that I believe will help us help our members - both professionals and individual traders.

First, the Fed has finally moved into the dovish position it should have been in one year...

READ MORE

MEMBERS ONLY

Top Sectors And Industry Groups According To My Proprietary Momentum Ranking System

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It made sense to underweight healthcare (XLV) throughout much of 2019, but that's no longer the case. In fact, my proprietary momentum ranking system ranks healthcare behind only technology (XLK) and financials (XLF) in terms of sector momentum. The StockCharts Technical Rank (SCTR) has the same ranking as...

READ MORE

MEMBERS ONLY

Two Drug Retailers That Could Be Very Compelling Buys

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It wasn't too long ago that no one wanted to own a drug retailer ($DJUSRD), but after the group pushed to 9 month absolute and relative highs, a few stocks in the group suddenly became fashionable once again. Perhaps the biggest turnaround came in the form of PetMed...

READ MORE

MEMBERS ONLY

This ETF Will Likely Be A Great Stocking Stuffer

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The S&P 600 Small Cap Index ($SML) broke out again on Friday, closing above 1000 for the first time since October 9, 2018. Its all-time high close is 1098, so the index still has a lot of work to do. I believe this work is likely to be...

READ MORE

MEMBERS ONLY

To Profit from Trading, You Must Allow Trades to Come To You; Don't Chase

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of the great features of our service at EarningsBeats.com is maintaining a Strong Earnings ChartList (SECL) for our members and running scans against it daily to identify trade setups. I do a lot of research every quarter, tracking those companies that beat Wall Street consensus estimates as to...

READ MORE

MEMBERS ONLY

Does A Bull Market Depend On Leadership From Growth Stocks? You Might Be Surprised

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My favorite ratio to watch in order to gauge the market's appetite for growth stocks is the Russell 1000 Growth ETF vs. the Russell 1000 Value ETF (IWF:IWD). When this ratio is moving higher, we want our portfolio to be weighted more toward growth. When the opposite...

READ MORE

MEMBERS ONLY

Based On The Charts, These 2 Stocks Could Explode With Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have found there are no guarantees when it comes to earnings and how a company will report. We can make educated guesses, though, especially when you consider that Wall Street has access to management teams before their "quiet period". A quiet period is simply the time from...

READ MORE

MEMBERS ONLY

This Group LOVES December Historically.......And It Just Broke Out Technically!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Welcome to December! It's hard to believe we're one month away from a new year and a new decade. While 2019 has been exciting for investors and traders, recovering from that massive Q4 2018 decline, I believe 2020 will be very solid as well. We'...

READ MORE

MEMBERS ONLY

Finding The Best Stocks To Make Your Money Grow Faster

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know it seems like a daunting task, but it's not nearly as hard as it seems. Obviously, the first step requires finding a method or strategy that works. At EarningsBeats.com, we've found what works for us. It's combining our strengths with StockCharts....

READ MORE

MEMBERS ONLY

To Chase Or Not To Chase? The Truth Behind Earnings Gaps

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For years, this question was left unanswered. Honestly, I couldn't figure out this answer for a long, long time. I've come to realize through years of experience, however, that I simply needed to watch the action after the gap and show a little patience. It seems...

READ MORE

MEMBERS ONLY

Uncovering "Value" In Uptrending Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Last week when I identified the Top 10 stocks in our Model, Aggressive, and Income portfolios, I provided a bonus to EarningsBeats.com members when I unveiled my first ever Value Portfolio. I'm primarily a momentum trader and you rarely associate momentum stocks with value stocks. But the...

READ MORE

MEMBERS ONLY

Rotation is Yielding New Leaders; Here are Two of My Favorites

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past few months, we've seen some new market leadership emerge. If you're simply following the S&P 500, then you probably haven't noticed much difference. We consolidated a bit in August and September before then resuming the uptrend. It's...

READ MORE

MEMBERS ONLY

Emerging Leadership: When Should We Trust An Emerging Group For Trading?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This is a very interesting question. Many lagging groups will outperform for a day, week, or even a month, but then they fall right back into their relative downtrends. If you're trading stocks within sectors and industry groups showing poor relative strength, you're fighting an uphill...

READ MORE