MEMBERS ONLY

Internet Goes 'Round The (RRG) World In 20 Days

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 12, 2019

Boeing (BA, -6.15%) was once again a major drag on the Dow Jones as that index ended the session in negative territory (-0.38%), while our other indices were positive. The NASDAQ (+0.44%) was the best performing index as 10 of...

READ MORE

MEMBERS ONLY

Market Rallies But Yield Spread Continues To Hurt Banks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

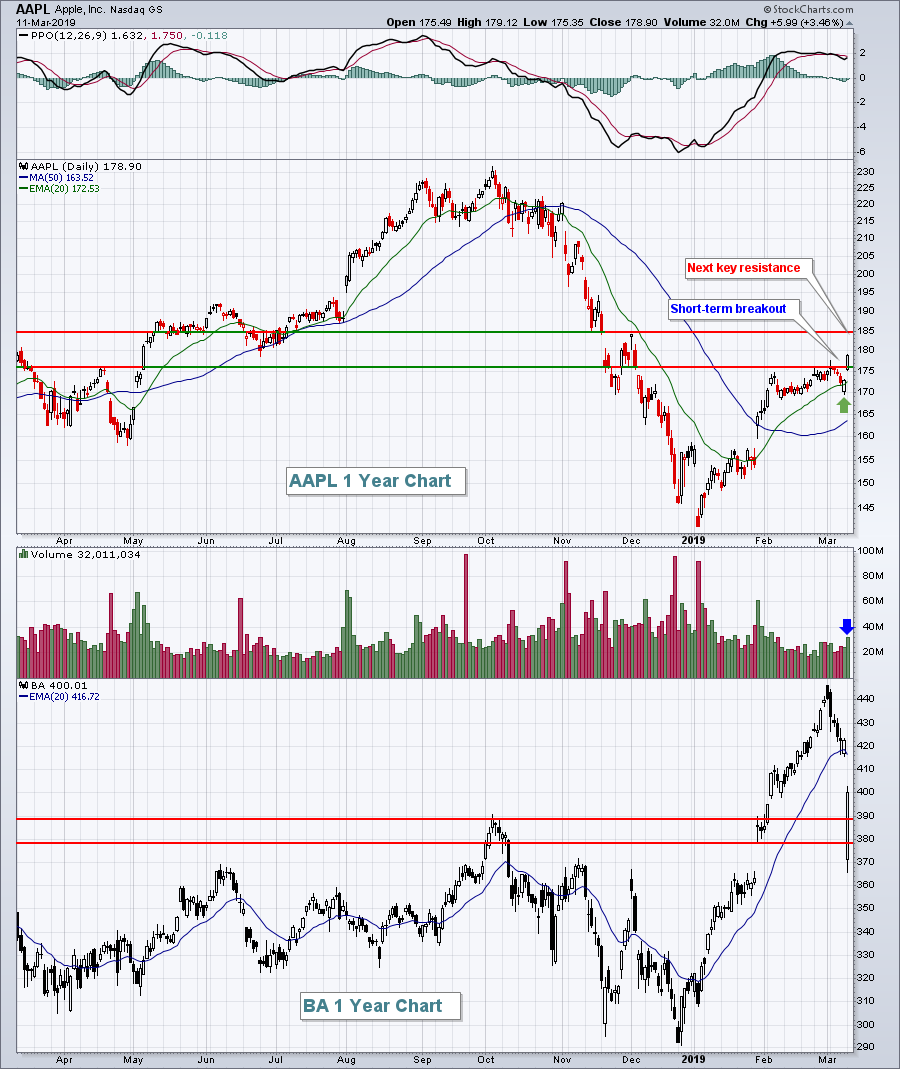

Market Recap for Monday, March 11, 2019

It never hurts to have Apple, Inc. (AAPL, +3.46%) breakout and that's what happened on Monday. It not only lifted the technology sector (XLK, +2.15%), but it provided a spark to our major indices as we experienced a "...

READ MORE

MEMBERS ONLY

Poor Jobs, Big Reversal, What's Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 8, 2019

Friday started ugly. There's no way to sugar coat the worst jobs report in 18 months. Nonfarm payrolls fell way short of expectations, 20,000 actual vs. 175,000 consensus estimate. Slowing job growth was an excellent predictor of the last...

READ MORE

MEMBERS ONLY

Jobs Disappoint; Dollar Breakout Bad For Energy, Materials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

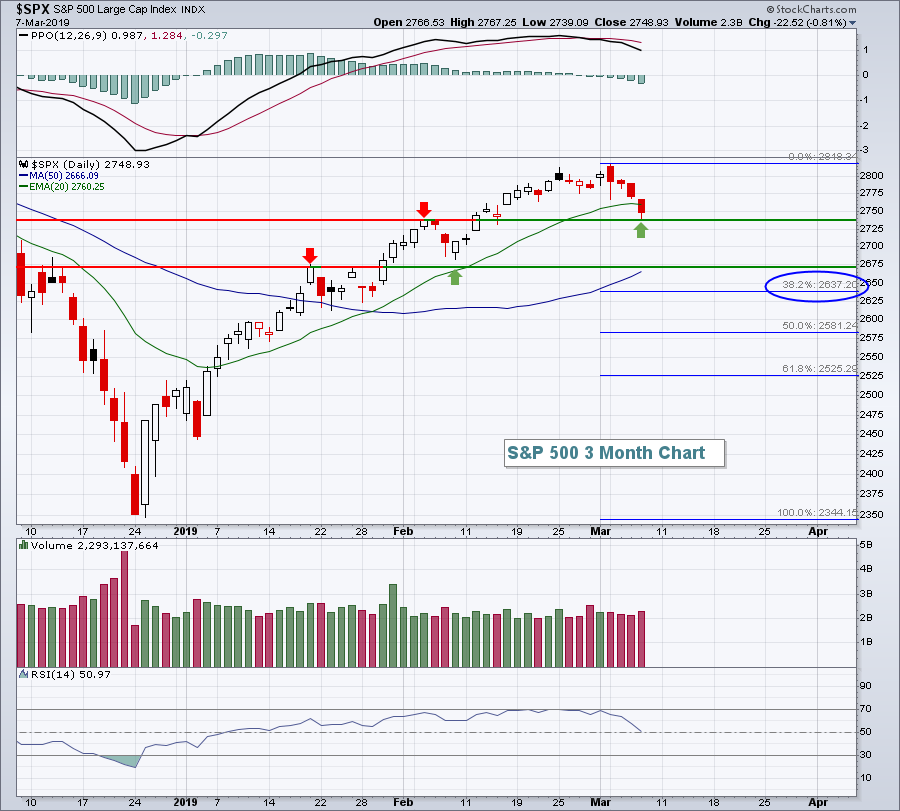

Market Recap for Thursday, March 7, 2019

Selling in U.S. equities continued for a fourth consecutive session as this is easily the most difficult period in 2019 for the equity bulls. The first technical breakdown occurred on daily charts as all of our major indices closed beneath their respective...

READ MORE

MEMBERS ONLY

VIX Clears First Key Level, Bears Regain Grip

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

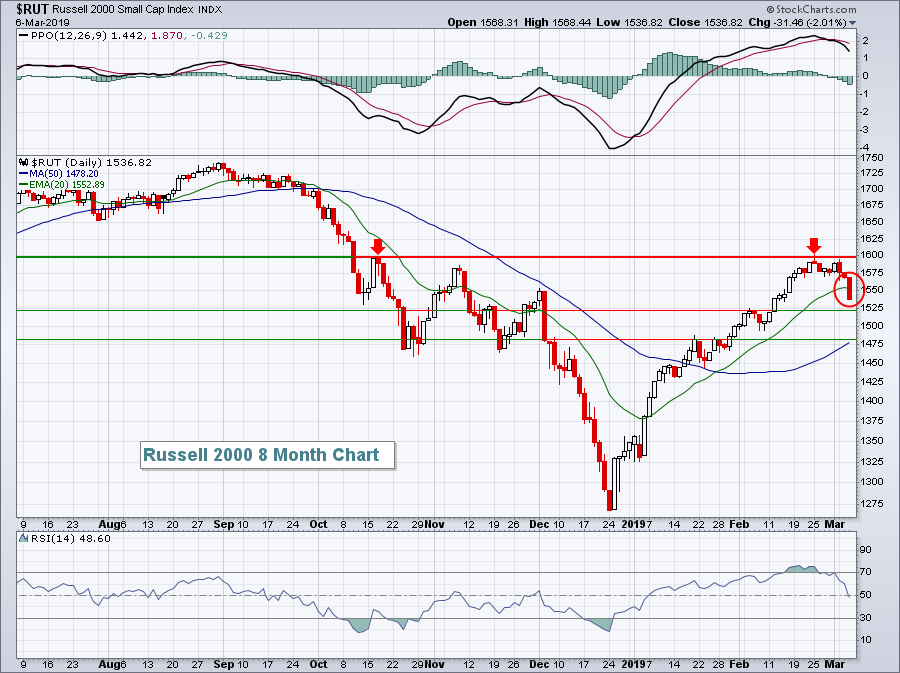

Market Recap for Wednesday, March 6, 2019

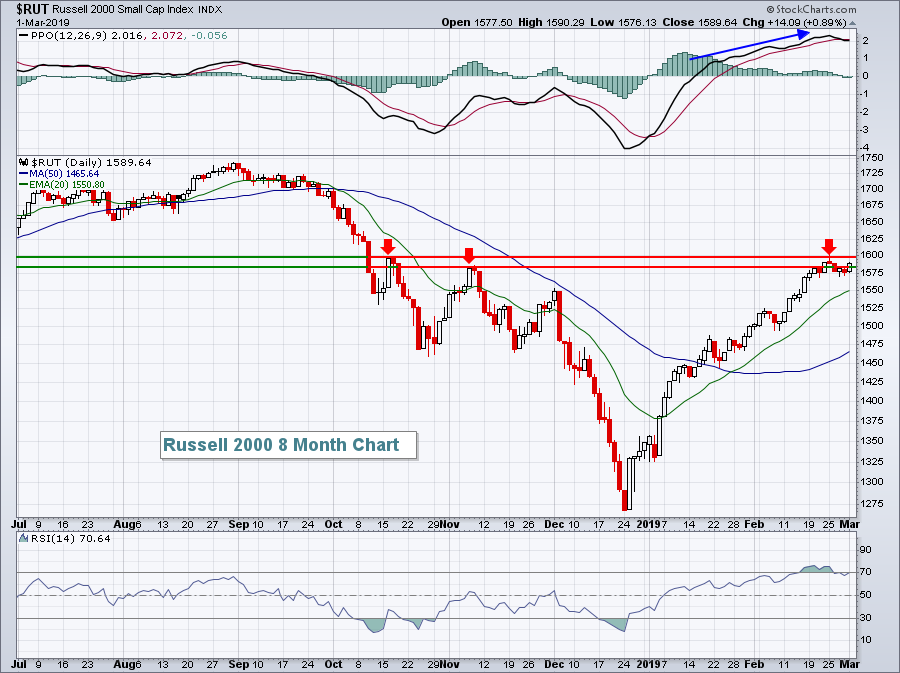

All of our major indices took a hit yesterday, including the small cap Russell 2000 ($RUT), which once again lagged badly and dropped another 2.01%. The RUT was easily the worst performer as the Dow Jones, S&P 500 and NASDAQ...

READ MORE

MEMBERS ONLY

Relative Strength Says We're Going Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 5, 2019

Another weak start and the inability to finish well contributed to minor losses across our major indices on Tuesday. Relative weakness in the small cap Russell 2000 resulted in a 0.45% loss there, while our other major indices fell more modestly -...

READ MORE

MEMBERS ONLY

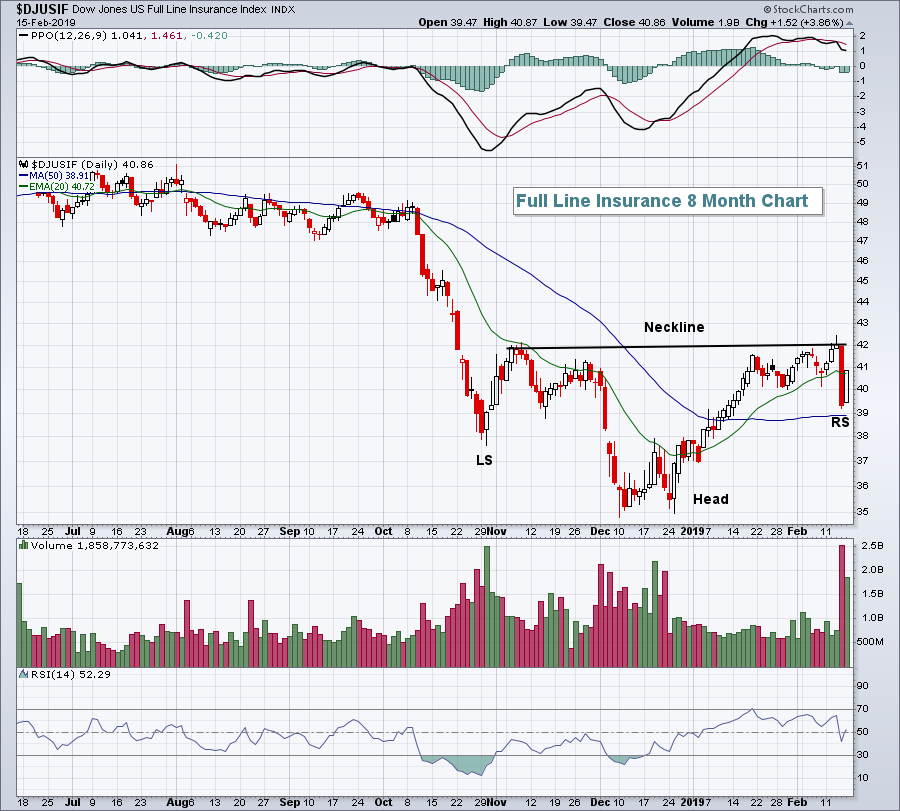

This Financial Sector Group Has Caught Fire

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 4, 2019

It's really hard for me to say who won yesterday's market battle. Obviously, we finished lower so I guess that would be the determining factor to say the bears won this battle. But it sure felt like at least...

READ MORE

MEMBERS ONLY

The NASDAQ Is Showing Little Signs of Topping

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

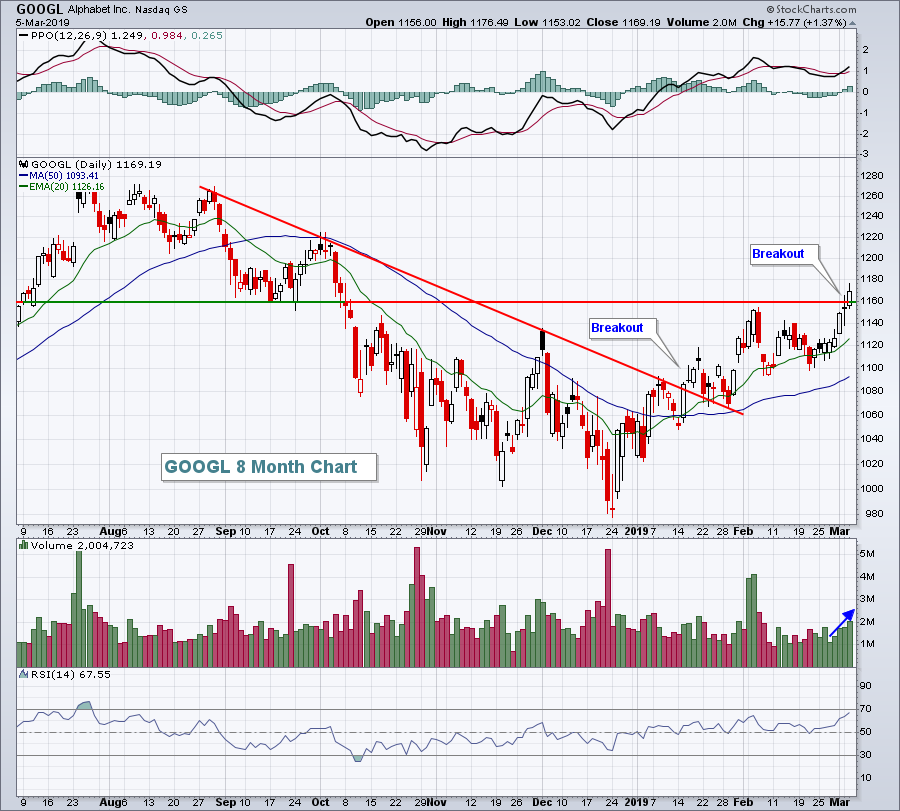

Market Recap for Friday, March 1, 2019

U.S. equities rallied strongly at the open on Friday, then gave back most, if not all, of those gains by late morning, and finally rallied once again in the afternoon. While intraday volatility was high and different, the end result was what...

READ MORE

MEMBERS ONLY

The Gold Rush Is Likely Over

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Gold ($GOLD) performs its best in a falling U.S. Dollar ($USD) environment. There is a solid inverse relationship between the direction of GOLD and the direction of the USD that has existed for decades. The following chart illustrates this relationship from 2001 to 2010:

"Gold thrives when the...

READ MORE

MEMBERS ONLY

Railroads Strength Pointing To Bright Economic Conditions

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 28, 2019

Our major indices were lower across the board on Thursday, but losses were minimal. The Dow Jones, S&P 500, NASDAQ and Russell 2000 dropped 0.27%, 0.28%, 0.29%, and 0.35%, respectively. That's not much damage considering...

READ MORE

MEMBERS ONLY

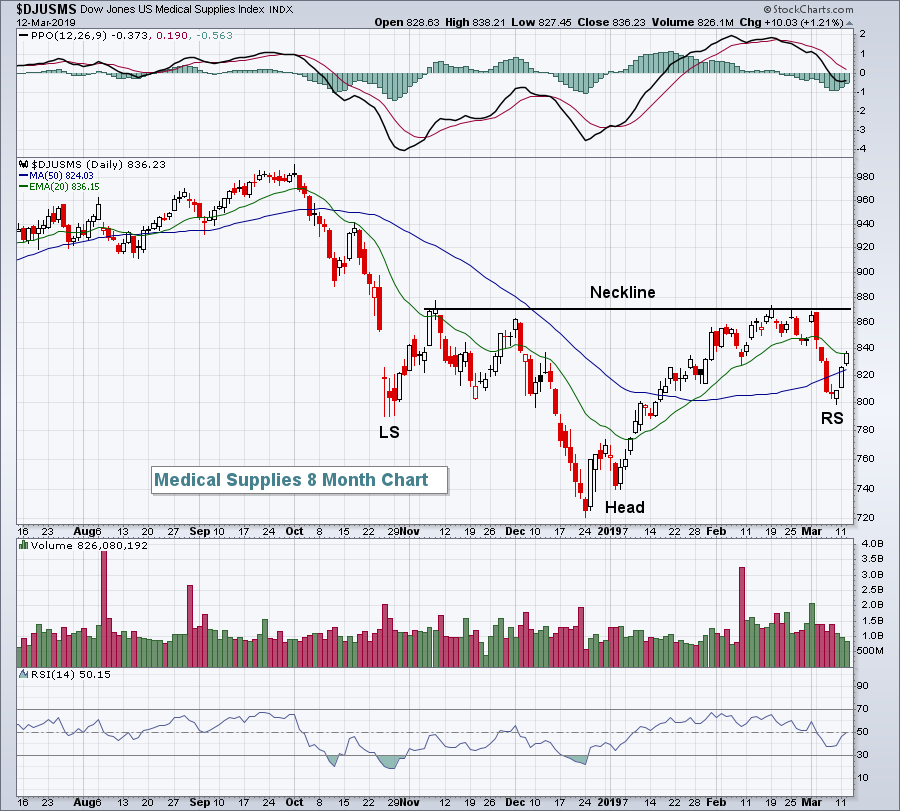

Medical Equipment Stocks Very Healthy, Watch For Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 27, 2019

We're seeing how the stock market deals with a bit of adversity with a Volatility Index ($VIX) at 15 vs. when it was in the 20s and 30s. Every time it appears we're going to have a nasty day,...

READ MORE

MEMBERS ONLY

Travel & Tourism Stocks Seeking A Boost From Booking Holdings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 26, 2019

In what has become a rarity in 2019, all of our major indices finished in negative territory on Tuesday, but it wasn't without a fight. There was early selling, but stocks rallied throughout much of the session to forge to intraday...

READ MORE

MEMBERS ONLY

Monday's Reversal Sets U.S. Equities Up For Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, February 25, 2019

If you looked at the final numbers yesterday, you'd probably think it was just another day in this two-month long advance, but it wasn't just another day. It was a reversal off a gap higher with the market initially...

READ MORE

MEMBERS ONLY

Software And Telecom Lead Technology March Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 22, 2019

Software stocks ($DJUSSW, +1.44%) continued their impressive dash higher, eclipsing their October high to enter all-time high territory. It was a significant breakout as the DJUSSW has been a relative leader for a long, long time. Check this out:

Perhaps the most...

READ MORE

MEMBERS ONLY

Discretionary Stocks Poised For A Bullish Explosion

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

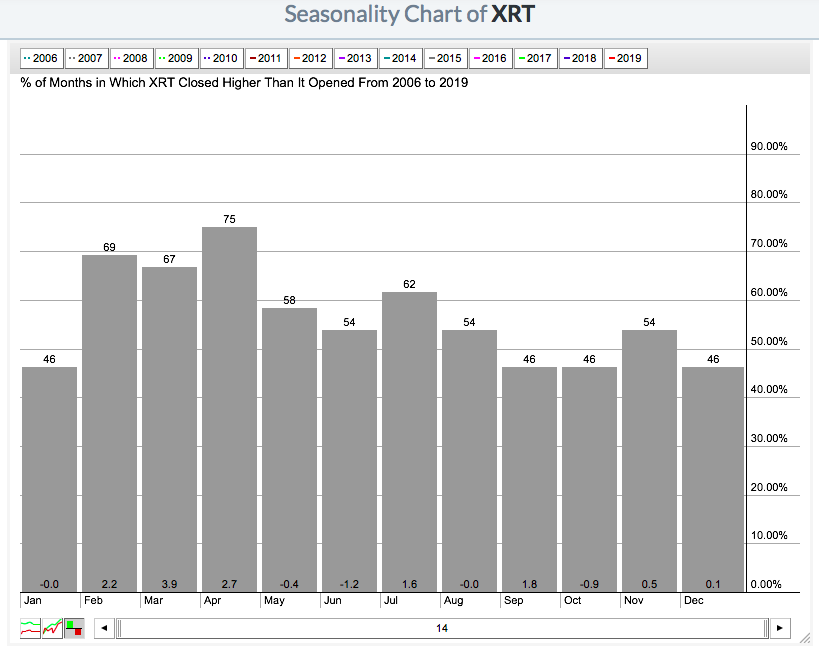

Market Recap for Thursday, February 21, 2019

U.S. stocks stalled on Thursday, but a minimum of sideways consolidation this week was to be expected given 60 minute negative divergences that I discussed earlier in the week. Before we talk about yesterday's action, check out how the negative...

READ MORE

MEMBERS ONLY

A Commodity Bottom? There's Not One In Sight

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

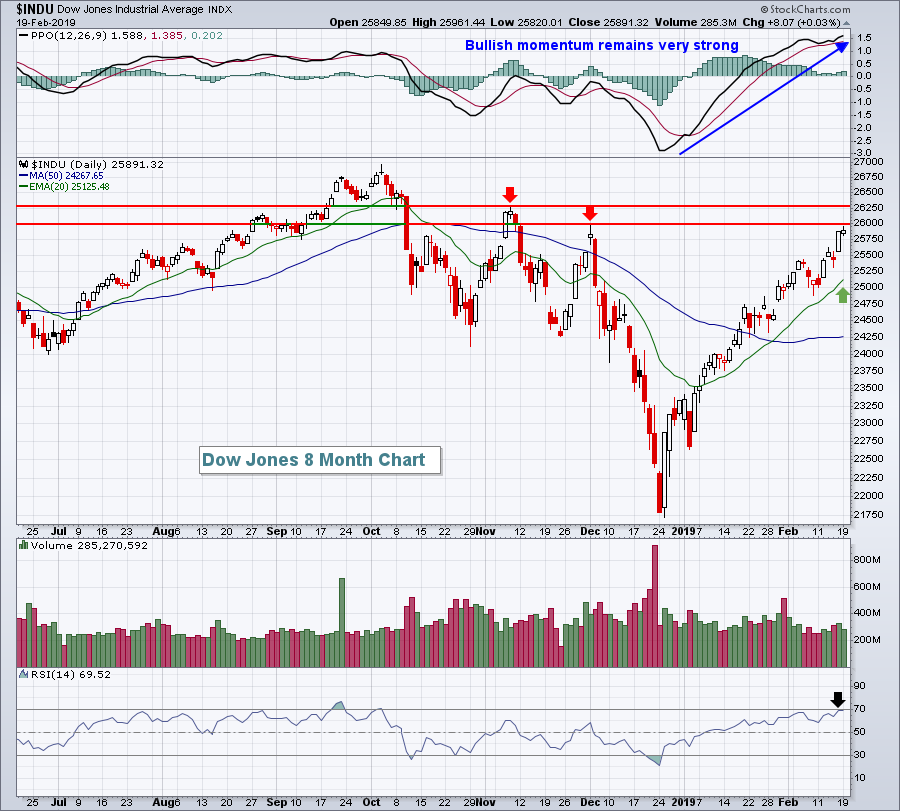

Market Recap for Tuesday, February 19, 2019

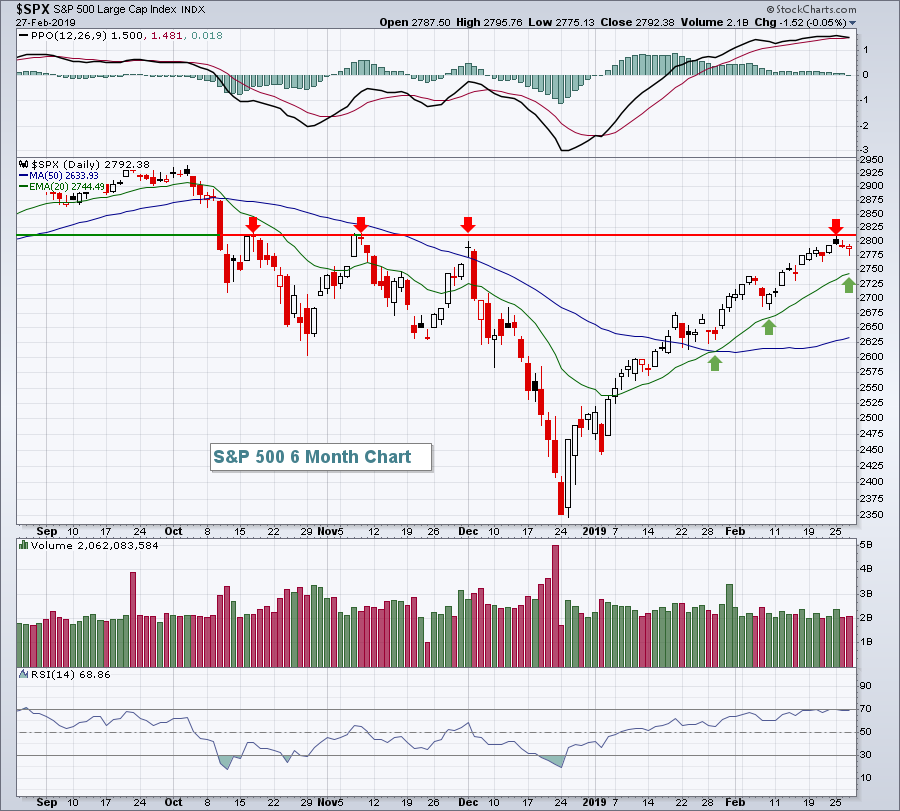

We saw a bit of intraday back and forth action on Wednesday with the same result - another Wall Street gain. I'm really surprised we haven't seen more selling this week. We're at major price resistance levels...

READ MORE

MEMBERS ONLY

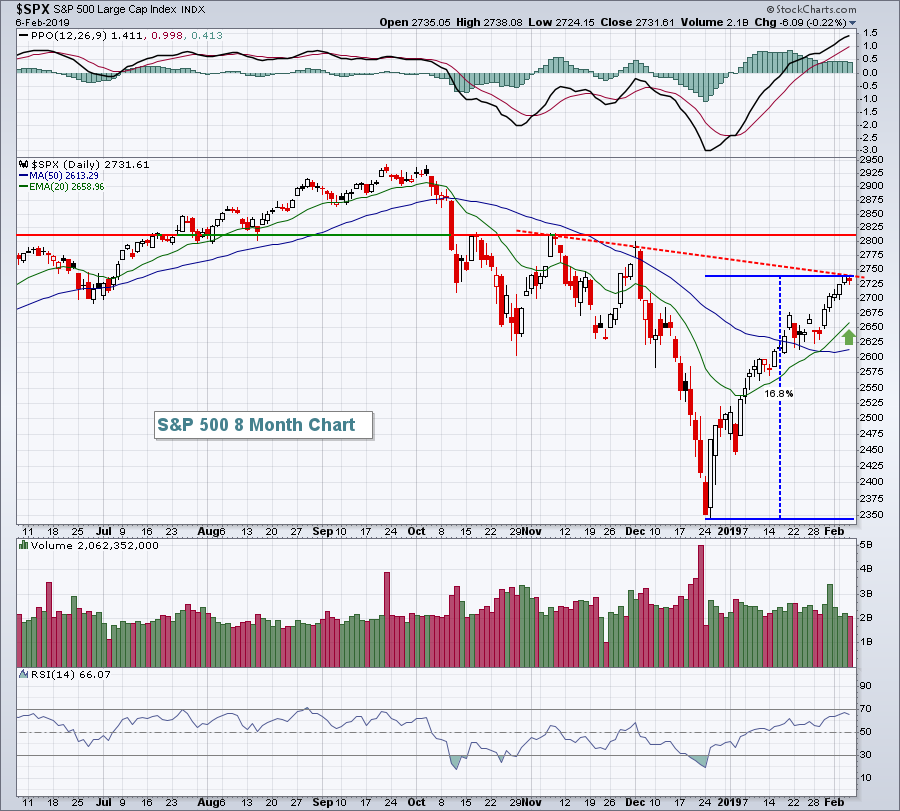

U.S. Equities Approach Key Resistance, Expect A Battle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 19, 2019

Materials (XLB, +0.62%) and utilities (XLU, +0.59%) led another Wall Street rally on Tuesday, although our major indices did see a bit of selling into the close. The XLB and XLU benefited from a falling dollar ($USD, -0.40%) and 10...

READ MORE

MEMBERS ONLY

T-Mobile (TMUS) Breaks Out, Dialed-In For Spring Ka-Ching!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 15, 2019

Friday produced very solid gains as the U.S. government averted a second shutdown as a funding resolution was passed. Also, there was word that US-China trade talks were progressing and any positive developments there are typically well-received by global markets. In an...

READ MORE

MEMBERS ONLY

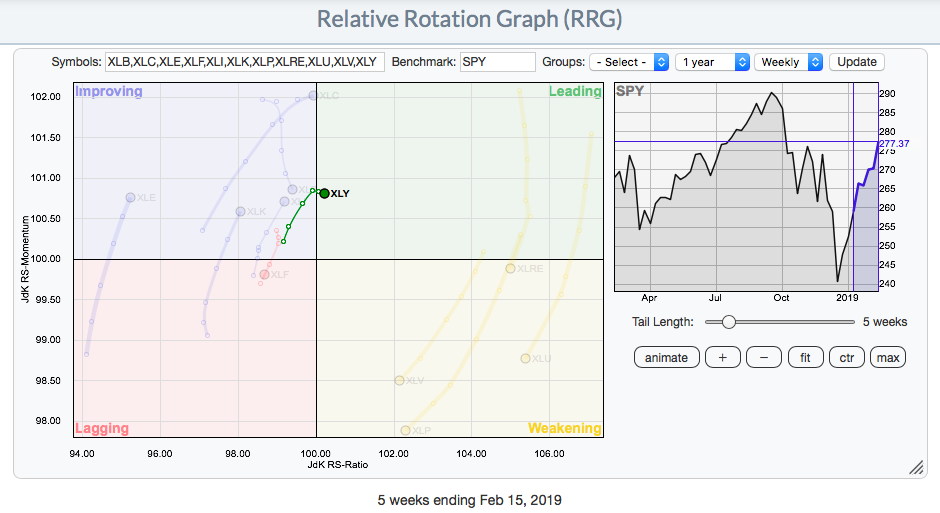

Here's How Relative Strength Will Help Your Trading Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Understanding relative strength is extremely important in outperforming the benchmark S&P 500. As a sector begins to outperform, it tells us that money is rotating towards that particular sector. One way to visualize this is to look at an RRG chart. It will only take one glance to...

READ MORE

MEMBERS ONLY

Turn Off CNBC And Turn On StockCharts TV

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 14, 2019

Real estate (XLRE, +0.38%) and communications services (XLC, +0.37%) were the leaders yesterday as Wall Street staged a rally attempt after dealing with an early blow - a very weak December retail sales report. There's one thing everyone should...

READ MORE

MEMBERS ONLY

For Now, Small Is Better

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 13, 2019

The stock market is beginning to exhibit a bit of the borishness that accompanies bull market advances. The Volatility Index ($VIX) remaining below 16 is confirming the reduced level of fear. There were certainly swings intraday yesterday, but the panicked, impulsive-type selling appears...

READ MORE

MEMBERS ONLY

Finding Stocks To Achieve Your Goals

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

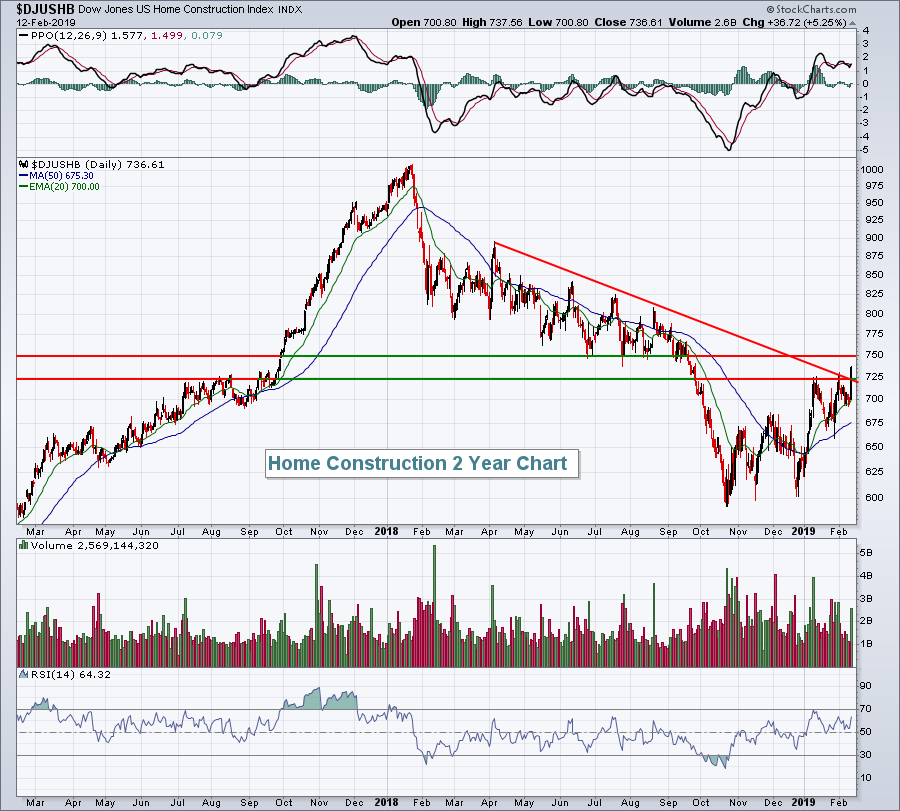

Market Recap for Tuesday, February 12, 2019

Another government shutdown was averted and the U.S. stock market reacted quite favorably, as you might expect, with all of our major indices surging higher. Our major indices had quite a day:

Dow Jones: +1.49%

S&P 500: +1.29%...

READ MORE

MEMBERS ONLY

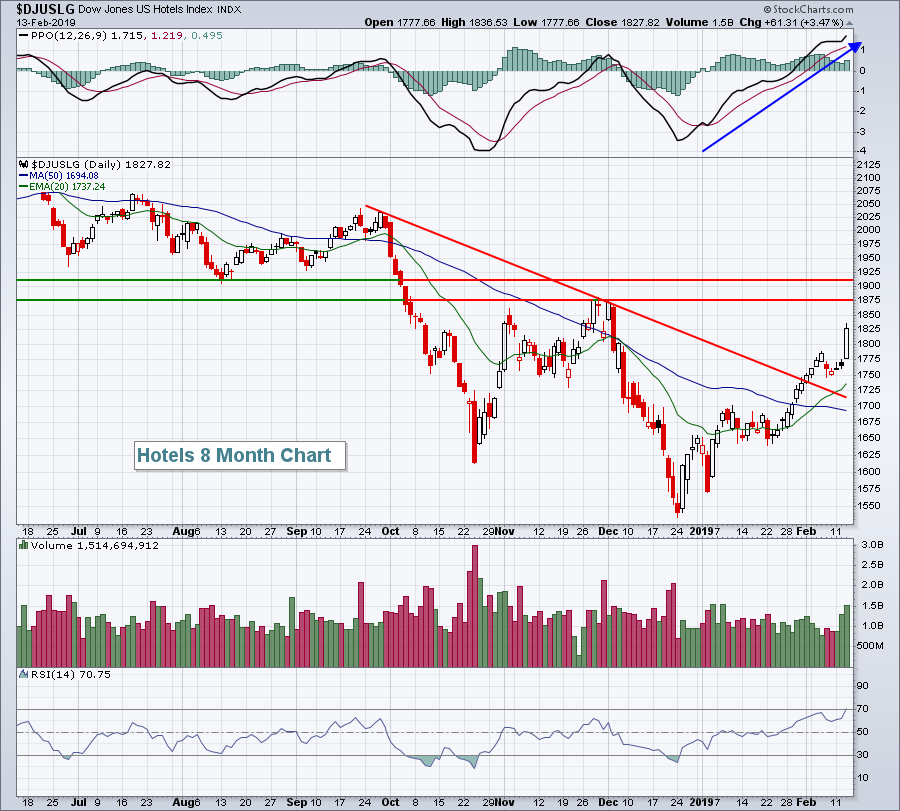

Time To Place Your Spring Hotel Reservation?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

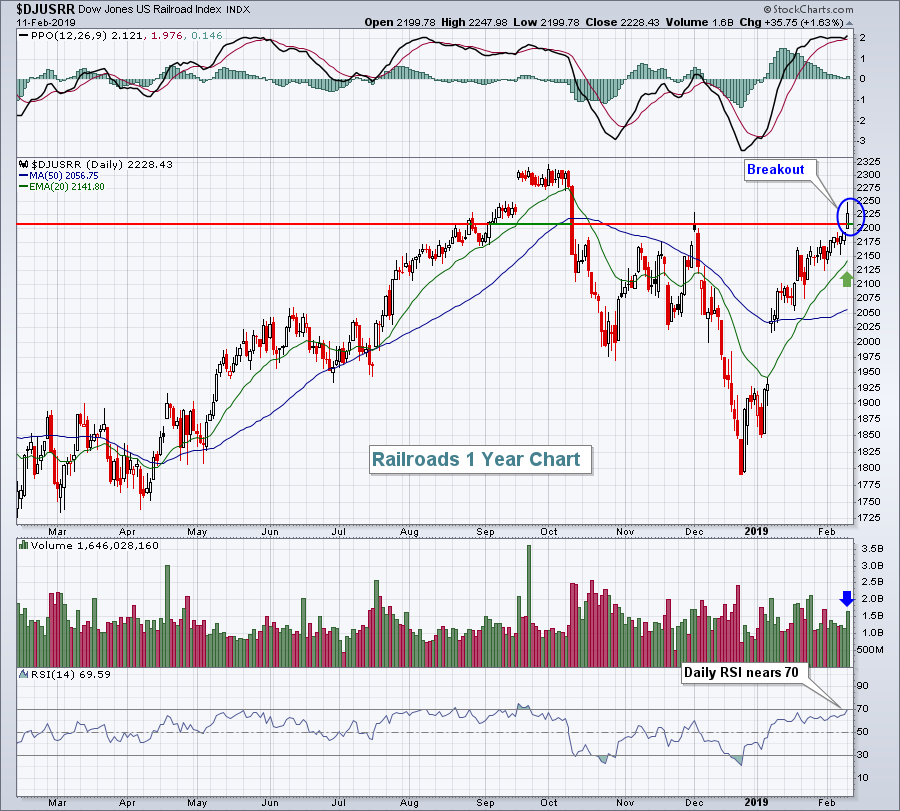

Market Recap for Monday, February 11, 2019

Industrials (XLI, +0.53%), energy (XLE, +0.48%) and financials (XLF, +0.31%) were Monday's leaders as bifurcated action was once again present. The clear index leader was the small cap Russell 2000 index (+0.84%) and that's become...

READ MORE

MEMBERS ONLY

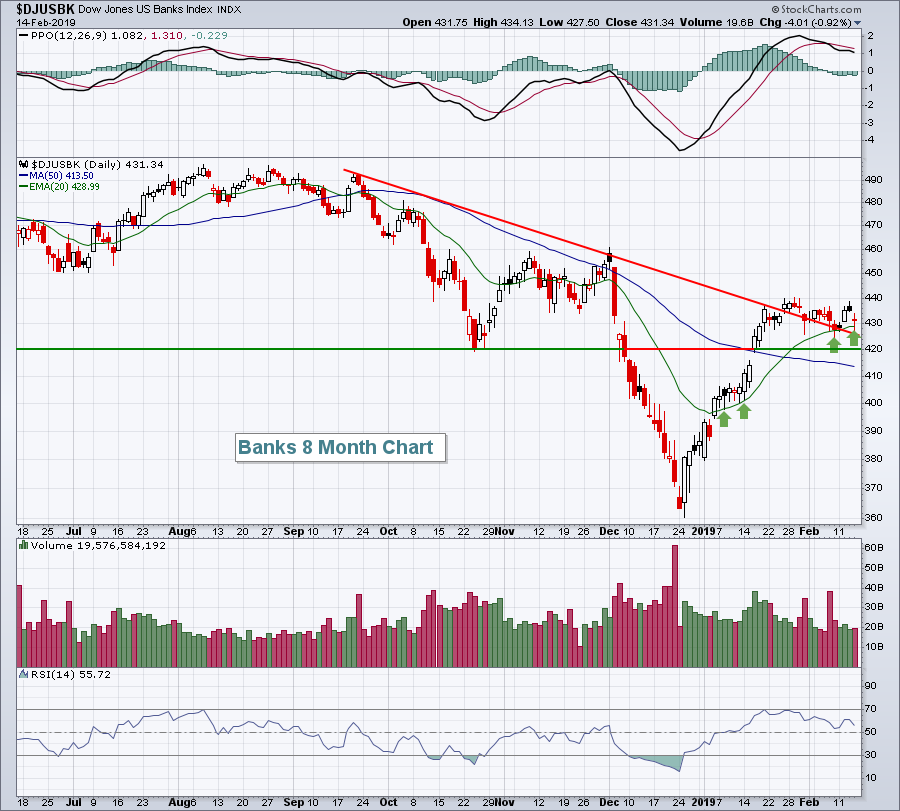

Bank Of America Looks Like A Winner

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 8, 2019

Friday was a solid day for the bulls. It wasn't because we saw large gains, because we didn't. In fact, it was bifurcated action where the S&P 500, NASDAQ and Russell 2000 barely closed higher with gains...

READ MORE

MEMBERS ONLY

Negative Divergences Stymie Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 7, 2019

The bears have been waiting for a day like yesterday, which featured a bit of impulsive selling and an accelerating Volatility Index ($VIX). Unfortunately, the bulls may have already inflicted too much damage upon the bears for them to recover fully. I view...

READ MORE

MEMBERS ONLY

Restaurants Remain A Fan Favorite

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 6, 2019

All of our major indices closed lower on Wednesday and we haven't seen that very often in 2019. The losses were minimal and traders continued to have an appetite for the riskier sectors, so it certainly wasn't a huge...

READ MORE

MEMBERS ONLY

Evaluating Energy And Renewable Energy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

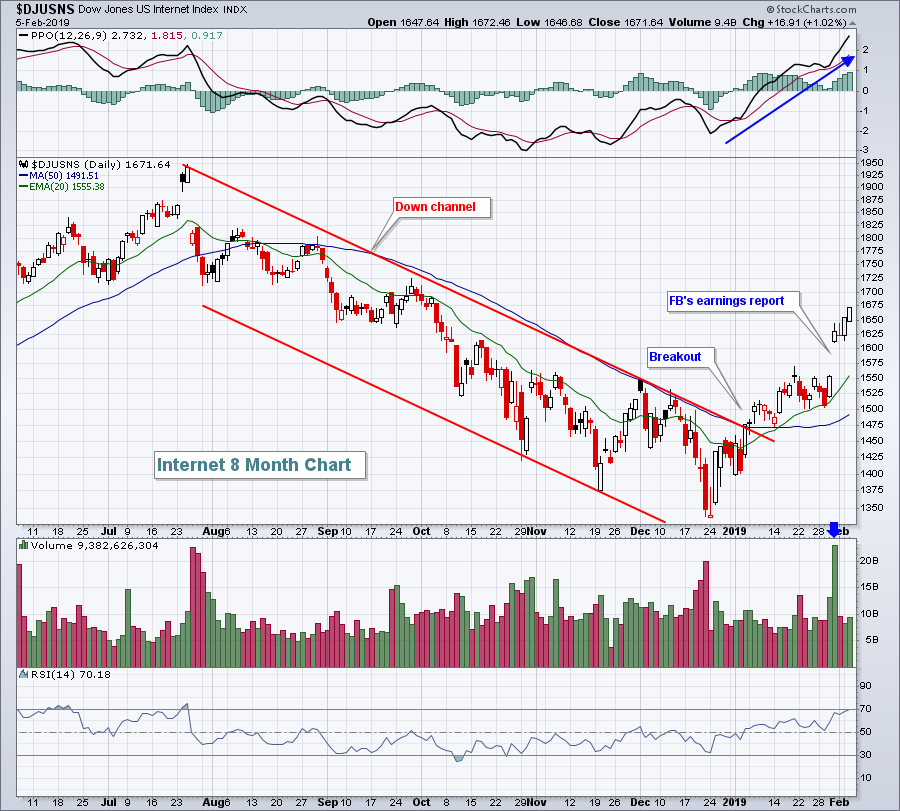

Market Recap for Tuesday, February 5, 2019

Tuesday was Groundhog Day for those that have seen the movie starring Bill Murray. It was a repeat of what we've seen throughout earnings season. We heard a somewhat disappointing outlook from a market leader, in this case Alphabet (GOOGL, +0....

READ MORE

MEMBERS ONLY

Looking At The Dollar And Defense

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

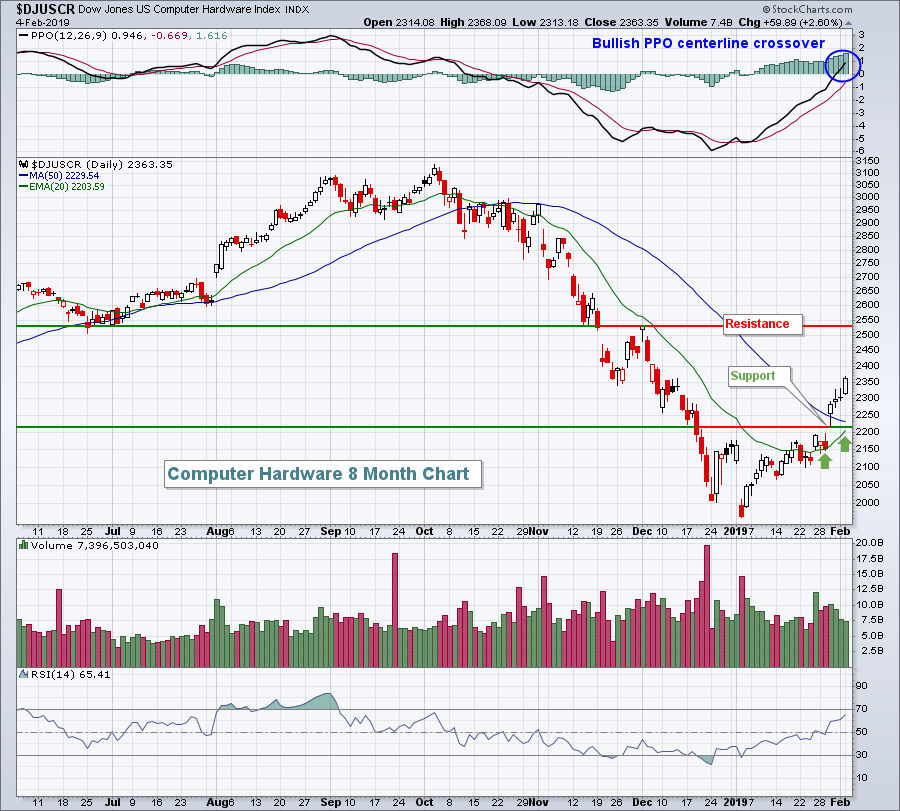

Market Recap for Monday, February 4, 2019

Technology (XLK, +1.60%) led another broad-based rally on Wall Street Monday as all of our major indices closed higher. There was particularly strong action on the aggressive NASDAQ and Russell 2000 as they gained 1.15% and 1.03%, respectively. 9 0f...

READ MORE

MEMBERS ONLY

Amazon Slammed But Fails To Trigger Panicked Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

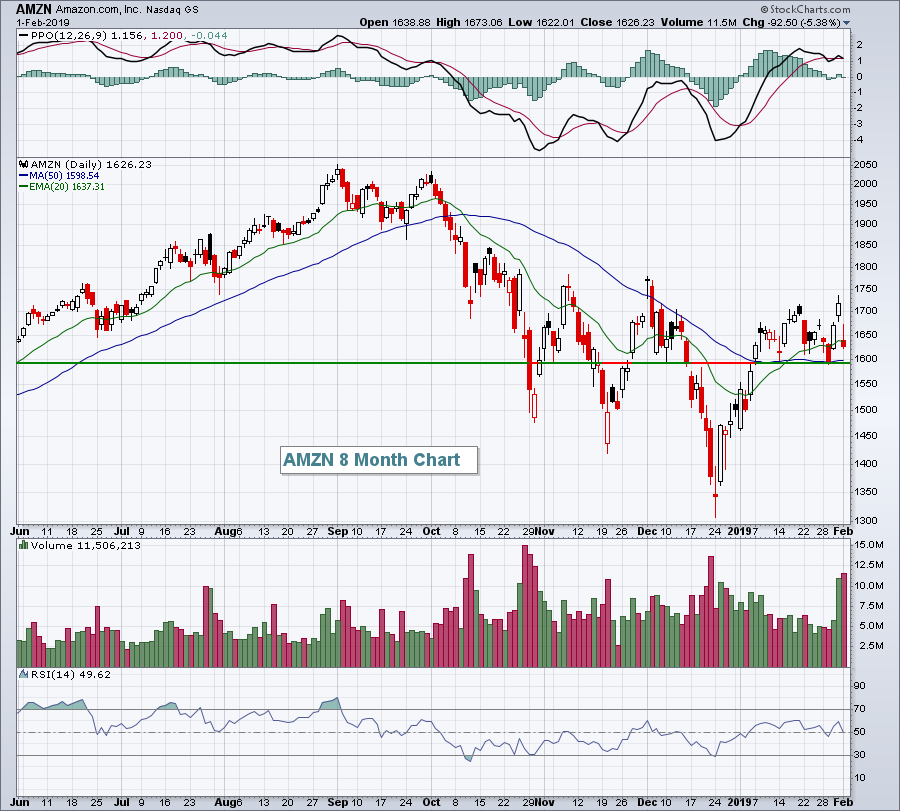

Market Recap for Friday, February 1, 2019

I'm sure I wasn't the only one thinking that the market was doomed on Friday after Amazon.com (AMZN, -5.38%) disappointed traders with its outlook during Thursday's after hours trading. After all, AMZN is a Wall...

READ MORE

MEMBERS ONLY

Combining Earnings Strength And Seasonal Tendencies

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love the seasonality tool here at StockCharts.com. It can potentially give you an advance notification of a price move before it happens. One of the more striking seasonal tendencies that I've seen has been the unbelievable historical performance of Bookings Holdings (BKNG) from January through May,...

READ MORE

MEMBERS ONLY

Bond Market Issues Major Warning

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

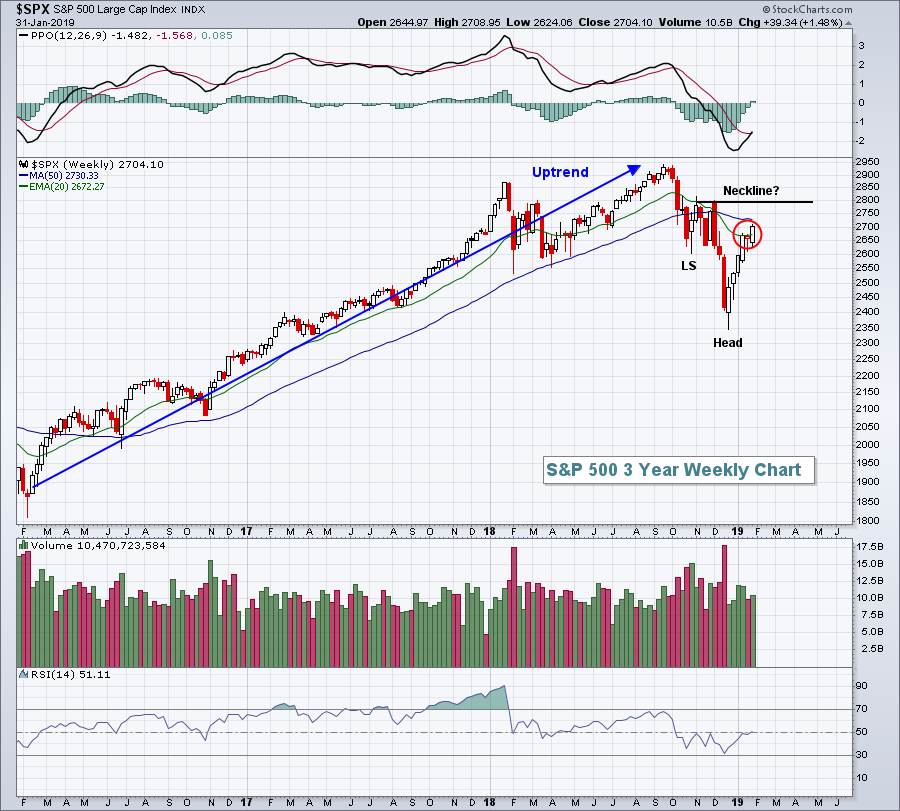

Market Recap for Thursday, January 31, 2019

Wall Street surged again on Thursday, buoyed by additional strong earnings reports and surprisingly strong forecasts by a couple of influential names. Facebook (FB, +10.82%) and General Electric (GE, +11.65%) were two of the leaders on the S&P 500....

READ MORE

MEMBERS ONLY

Consumer Stocks Are Painting A Bullish Picture

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

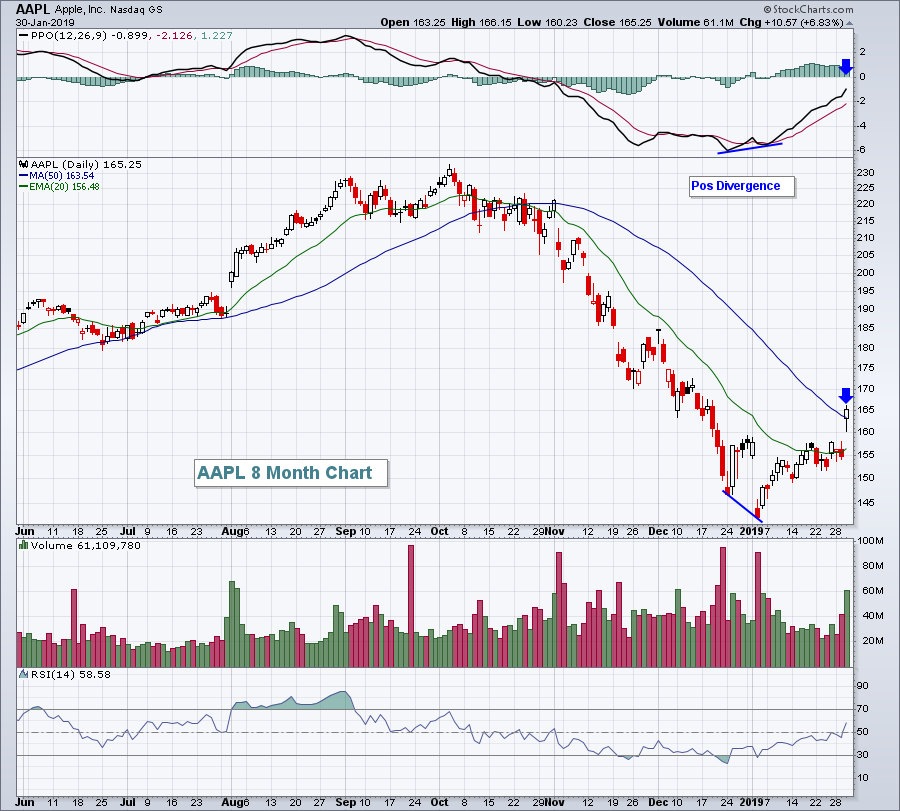

Market Recap for Wednesday, January 30, 2019

Wall Street had much to digest yesterday. There was fresh jobs data as the January ADP employment report was released. The news was much better than anticipated. There was the Apple (AAPL) earnings report from Tuesday evening. While the numbers reported were mostly...

READ MORE

MEMBERS ONLY

FAANG Stocks Weak, Drag Down Influential NASDAQ 100

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 29, 2019

It was a bifurcated and trying day on Wall Street. Bifurcation isn't necessarily a bad thing as some indices will simply outperform others on certain days and short-term trends in that regard can mostly be ignored. But one problem throughout this...

READ MORE

MEMBERS ONLY

Wall Street Averts Meltdown Despite CAT/NVDA Warnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 28, 2019

It seemed like the bears let a perfect opportunity slip right through their fingers yesterday. Caterpillar (CAT, -9.13%) reported their latest quarterly earnings before the bell and they weren't pretty. Despite beating revenue estimates, CAT posted EPS well below estimates...

READ MORE

MEMBERS ONLY

Stocks Finish The Week On A Positive Note, But Overhead Resistance Remains

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

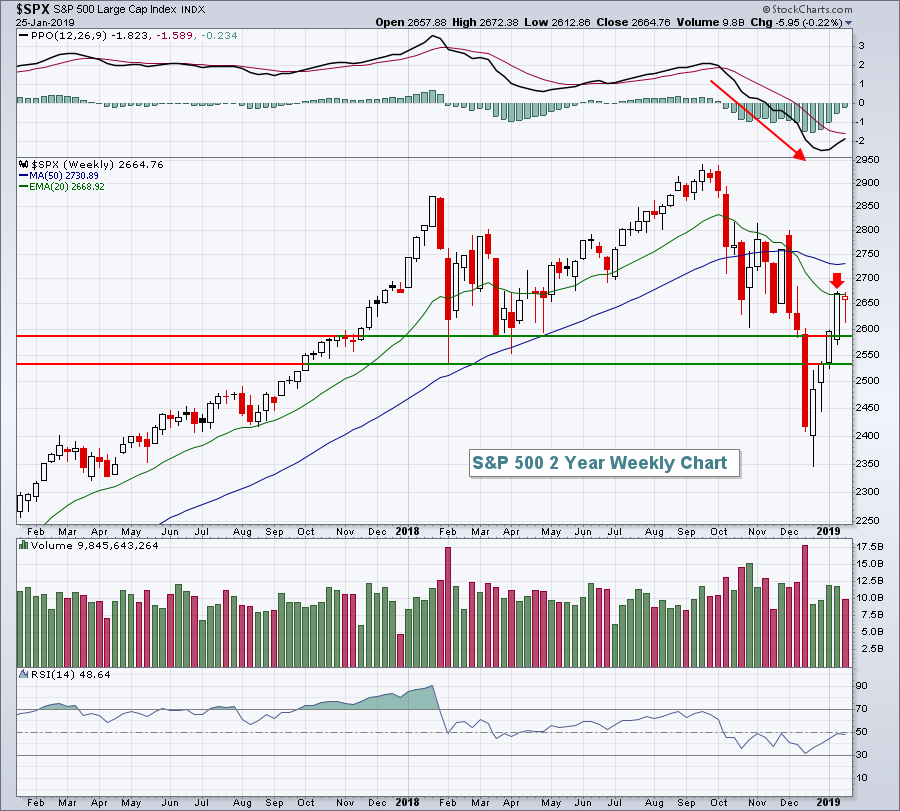

Market Recap for Friday, January 25, 2019

Our major indices rallied strongly on Friday, with 9 of 11 sectors rising to support the move. Only two defensive sectors - utilities (XLU, -1.37%) and consumer staples (XLP, -0.40%) failed to participate in the advance. Leading the charge was materials...

READ MORE

MEMBERS ONLY

Technology Leads Stocks Higher, But Faces Trendline Resistance Test

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

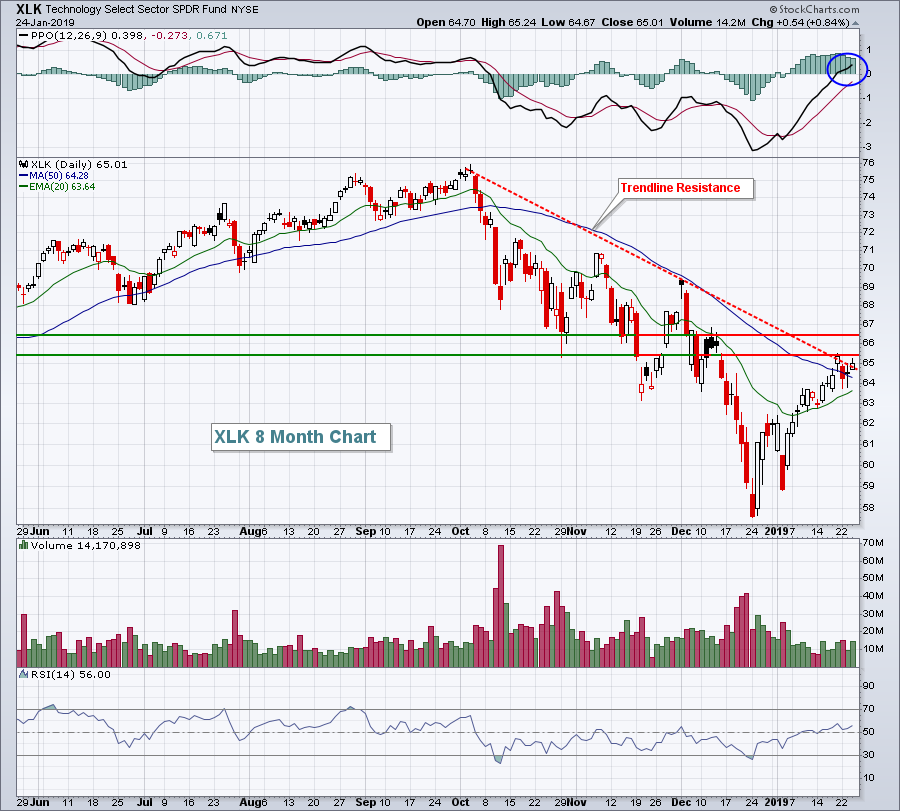

Market Recap for Thursday, January 24, 2019

Semiconductor stocks ($DJUSSC, +5.10%) soared after a few key earnings reports in the group came in better than expected. Xilinx (XLNX, +18.44%) and Lam Research (LRCX, +15.70%) were two of the best performers, but their results lifted much of the...

READ MORE

MEMBERS ONLY

Volatile Session Ends Mostly In Bullish Fashion

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

I'm traveling today so my article will be abbreviated.

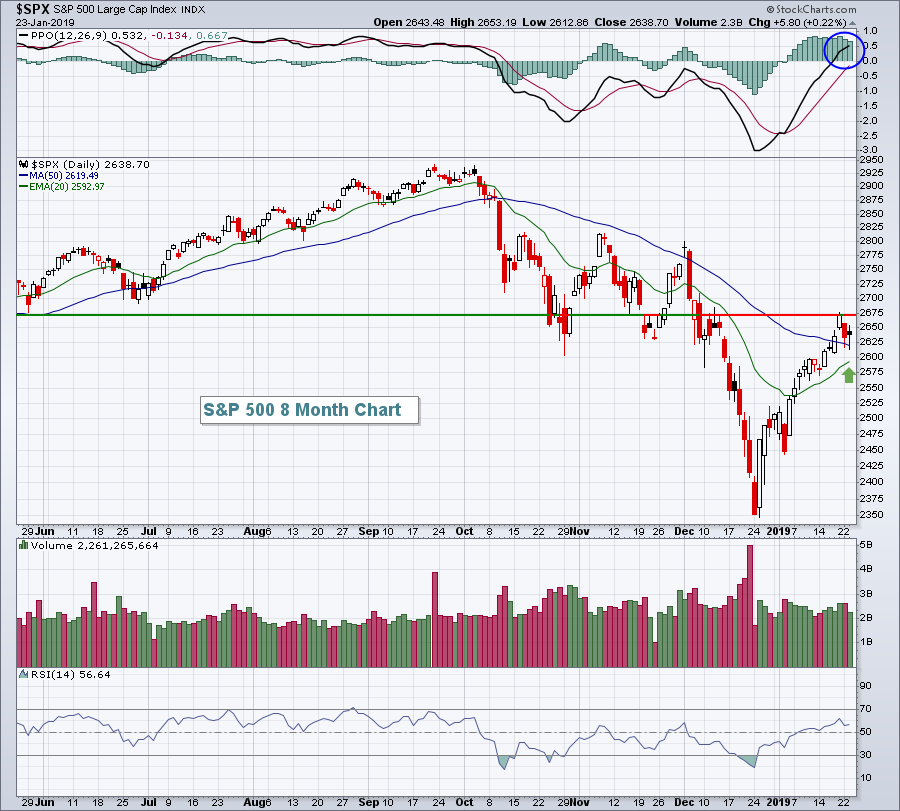

Market Recap for Wednesday, January 23, 2019

It was a fairly volatile session on Wednesday as U.S. indices opened higher, but quickly fell fairly deep into negative territory before rallying in the afternoon. Only the small cap...

READ MORE

MEMBERS ONLY

Bearish Island Reversal Forms With Tuesday's Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

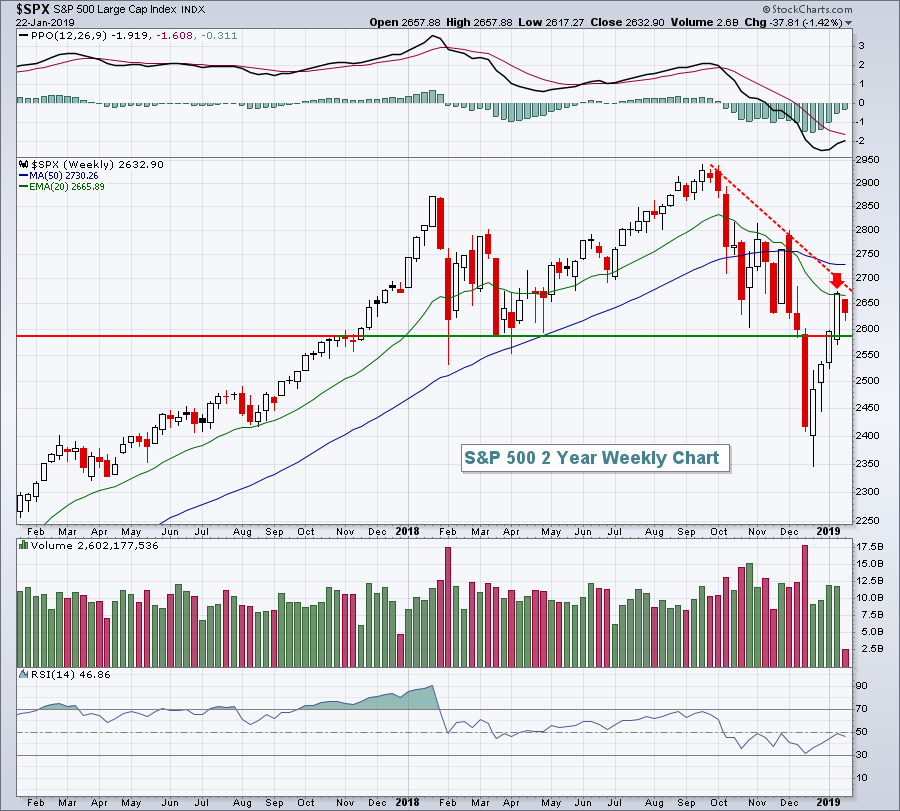

Market Recap for Tuesday, January 22, 2019

Energy (XLE, -2.18%), communication services (XLC, -2.07%) and industrials (XLI, -2.07%) all fell more than 2% on Tuesday as Wall Street had its first significant retreat since the day that Apple (AAPL) warned. Late day buying cut into losses as...

READ MORE

MEMBERS ONLY

Transportation Stocks Hold A Big Clue This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

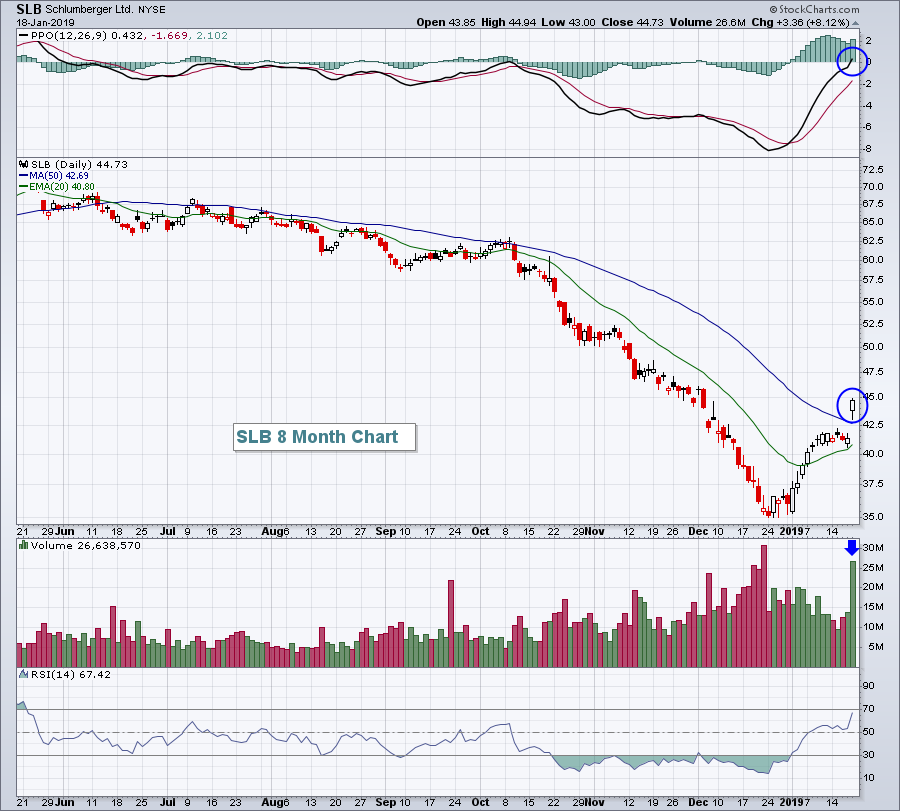

Market Recap for Friday, January 18, 2019

Continuing anticipation of a trade deal with China appeared to fuel very solid stock market action on Friday as all of our major indices pushed higher, as did all 11 sectors. The Dow Jones and S&P 500 led the charge, gaining...

READ MORE

MEMBERS ONLY

3 Stocks Awaiting A Possible Earnings Explosion

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Analysts meet with the management teams of companies and then return to their firms and either buy or sell based on the information they gather. It's the primary reason why technical price action precedes fundamental information. If you understand the dynamics on Wall Street, you're in...

READ MORE