MEMBERS ONLY

3 Breakouts Ready for Massive Climbs!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As the secular bull market takes a short-term pause, now is the time to research tremendous opportunities that lie ahead. I've looked at more than a thousand charts and wanted to point out 3 in particular that I see heading much, much higher as we close out 2024...

READ MORE

MEMBERS ONLY

This Industry Just Broke Out And Is Poised To Lead U.S. Equities Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Now that Q4 historical bullishness has kicked in, it's time to allow the bears to go into hibernation, while the bulls search for key leadership to drive prices higher. Before I highlight a key industry group that just moved into all-time high territory, it's important to...

READ MORE

MEMBERS ONLY

Secular Bull Market Continues, But With Major Rotation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Enjoying these HUGE rallies is much easier when you have confidence the stock market is in a secular bull market and heading higher. It also helps when you enter a period of historical strength - the absolute best strength that we see anytime throughout the calendar year. This combination can...

READ MORE

MEMBERS ONLY

Only 3 Of The 7 Mag Stocks Are Worth Owning Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The "Magnificent 7", comprised of Apple (AAPL), Microsoft (MSFT), NVIDIA (NVDA), Meta Platforms (META), Amazon.com (AMZN), Alphabet (GOOGL), and Tesla (TSLA) have carried the S&P 500 during this secular bull market - since its breakout in April 2013 above its 2000 and 2007 highs. Here&...

READ MORE

MEMBERS ONLY

Jobs Soar Past Estimates, But What Happens Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This morning, September nonfarm payrolls soared past expectations, 254,000 vs. 132,500. Adding to the bullishness was the upward revision to August nonfarm payrolls as the prior reading of 142,000 was boosted to 159,000. This is solid news, especially in an environment where the Fed is committed...

READ MORE

MEMBERS ONLY

Can The China Strength Last Week Be Sustained?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

China's Shanghai Composite Index ($SSEC) surged higher last week by roughly 13%, which was one of its largest 1-week gains over the past decade. There were solid economic reasons for the surge as China's central bank approved measures to accelerate recent sluggish growth. The People'...

READ MORE

MEMBERS ONLY

Could U.S. Stocks Crash In October?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's a great question right now as many folks still remain quite nervous. The Volatility Index ($VIX), for example, gained more than 10% today, despite a minimal decline in the S&P 500. It's a signal that the stock market likely won't handle...

READ MORE

MEMBERS ONLY

Can We Trust Last Week's BIG Rally?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's a great question, because we saw some very nice gains and we're now approaching all-time highs, especially on the Dow Jones ($INDU) and S&P 500 ($SPX). The more growth-oriented NASDAQ 100 ($NDX) has much more work to do. How much more strength is...

READ MORE

MEMBERS ONLY

September: Exit Light, Enter Night

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Much like the southeastern portion of the U.S. frets over the potential of devastating hurricanes, stock traders and investors brace for their own financial hurricane this time of year. Last week, we saw the NASDAQ 100 ($NDX) tumble, dropping nearly 6% during a holiday-shortened trading week. This isn'...

READ MORE

MEMBERS ONLY

Recognize The New Leaders NOW!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

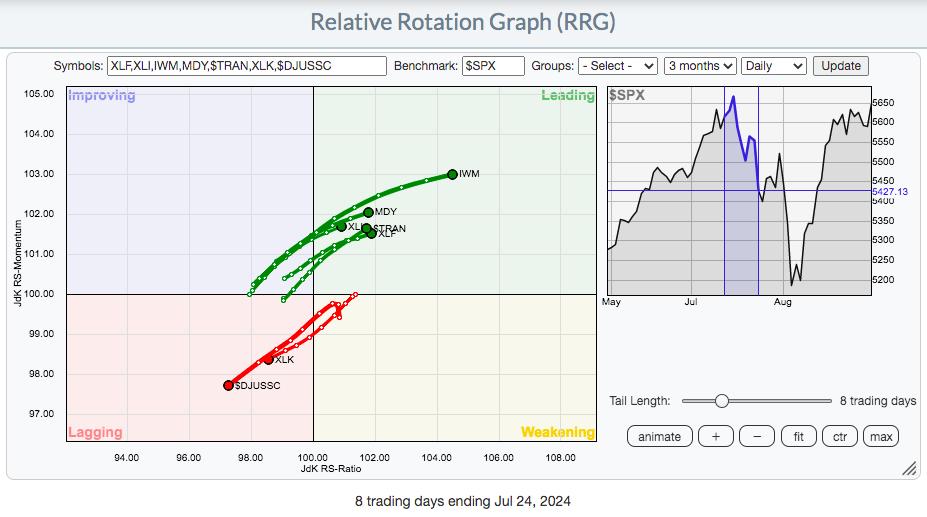

We had a sneak preview of emerging leadership on the morning of July 12th. That was the morning the June Core CPI came in well below expectations. The immediate rotation into several areas was quite evident and you can see it right here on this RRG Chart:

Financials (XLF), industrials...

READ MORE

MEMBERS ONLY

Jackson Hole Jay Doesn't See His Shadow, Worst Market Weather Behind Us

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been nearly two years since Jackson Hole Jay saw his shadow and we all endured 6 more weeks of harsh market weather. If you need a reminder, August 26, 2022 was the day Fed Chief "Jay" Powell climbed out of his Jackson "Hole"...

READ MORE

MEMBERS ONLY

Not Much Good Takes Place When This Happens

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As a long-term stock trader, one development in the stock market takes me and many others to our collective knees. It's a Volatility Index ($VIX) that rises past 20. There has never been a bear market that's unfolded with a VIX that remains below 20. FEAR,...

READ MORE

MEMBERS ONLY

Unbelievable! The Fed Creating Its Own Nightmare And We're The Puppets

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This Fed has got to go. It's time. You've overstayed your welcome, Fed Chief Powell. I literally was just shaking my head after reading the changes to the Fed's policy statement. The changes were in the first two paragraphs, so let me jump right...

READ MORE

MEMBERS ONLY

New Highs Coming or Will We Collapse? What Say You, Fed Chief Powell?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This will be one of the most interesting quarters in recent memory. The Fed has got to choose its poison. Do they stand pat once again next week, leaving rates "higher for longer" and awaiting more data? Or do they finally take the step that just about everyone...

READ MORE

MEMBERS ONLY

Have We Bottomed? Here Are 3 Charts To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tops and bottoms are so much fun to predict, but key signals are not always accurate. That's where a healthy dose of skepticism comes in. At EarningsBeats.com, we try to put as many signals together as possible, looking for corroboration. That helps to build confidence in the...

READ MORE

MEMBERS ONLY

It's Time To Consider These Areas As Emerging Leaders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There was no doubt that new leadership emerged last week. Here were 3 areas that surged higher, either moving to fresh 52-week highs or breaking significant downtrends:

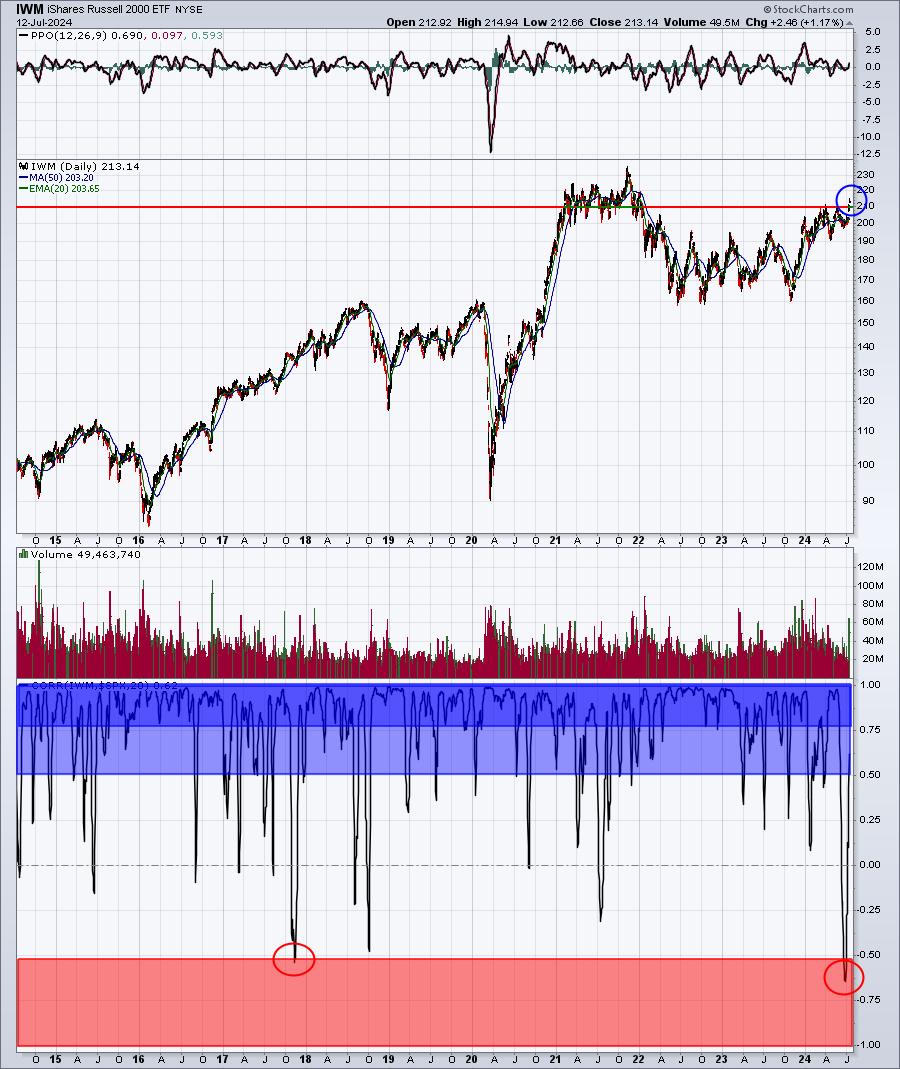

Small Caps

The small cap Russell 2000 (IWM) has been trying to clear the 210-211 area for the past two years. After doing...

READ MORE

MEMBERS ONLY

S&P 500 Sets New Record Highs Because of Value, Not Growth

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was a very interesting week indeed. All-time high records continued to fall on a daily basis, but the complexion of the market most definitely changed during the latter part of the week. First, I want to pull up an hourly RRG chart to track 10 key growth stocks, most...

READ MORE

MEMBERS ONLY

Pre-Earnings Moves Are Underway And History Provides Us GREAT Clues To Find Them!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We're approaching Q2 earnings season, so I'm getting ready for all the short-term trading opportunities that await. But, in the meantime, there are plenty of other earnings opportunities right now - pre-earnings advances. Several of the large cap names (think Mag 7) are already starting powerful...

READ MORE

MEMBERS ONLY

Here's Why You Should Be Buying Software NOW

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

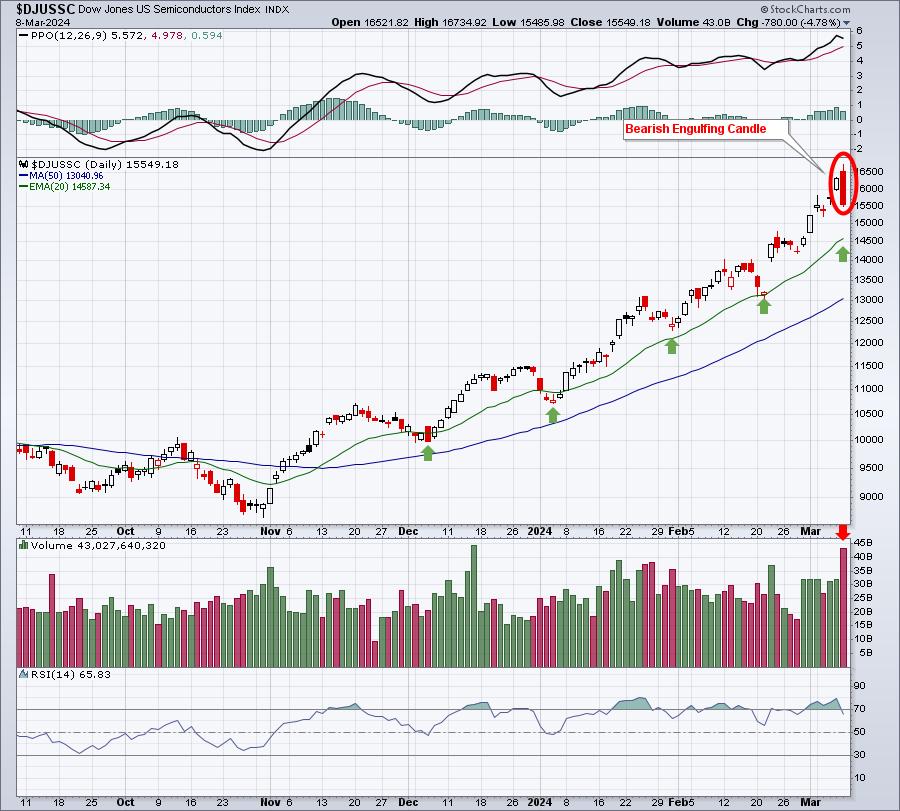

The recovery in semiconductor shares ($DJUSSC) last week, in my opinion, was quite weak. Much of the strength occurred by 10am ET, and the balance of the days really didn't see much progress back to the upside. Accordingly, I'd call the rebound more market maker manipulation...

READ MORE

MEMBERS ONLY

TAG, You're It! Rotation Away From Semiconductors Benefiting These Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One hallmark of secular bull markets is rotation. When leading stocks, sectors, and industry groups falter, there needs to be others that grab the baton and help to keep the bull market intact. Semiconductors ($DJUSSC) have been the clear leader in the stock market for years, but especially since the...

READ MORE

MEMBERS ONLY

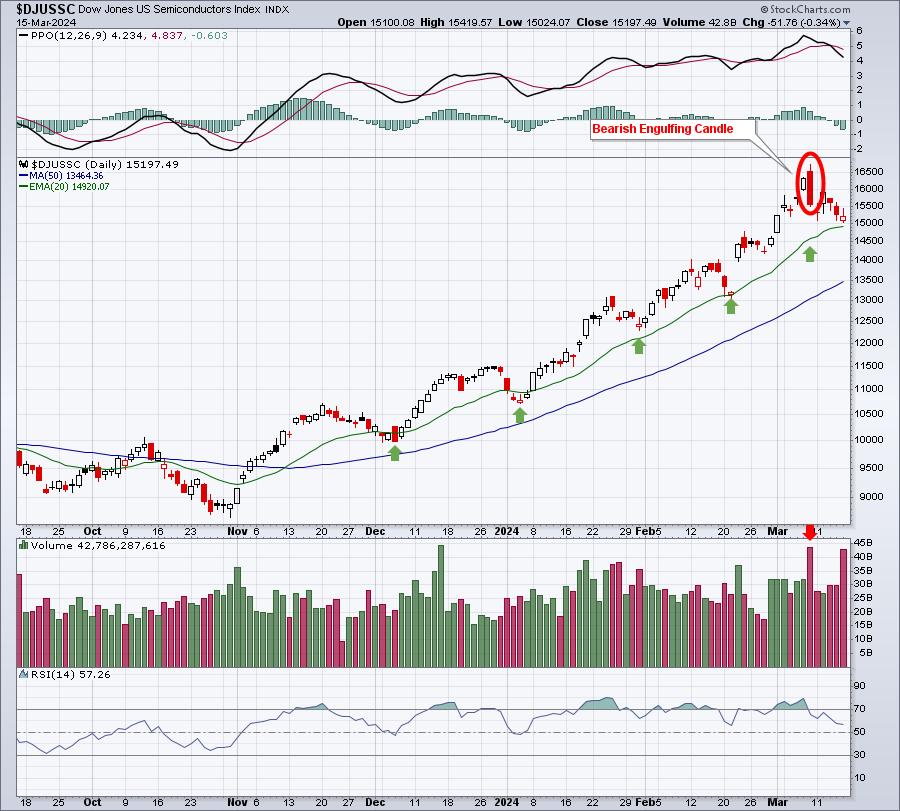

The Semiconductors Have Topped; Look Elsewhere For Opportunities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Extremely heavy volume that accompanies a gap higher and a reversing candle after a lengthy uptrend is typically a sign of buyers' exhaustion and a much more aggressive group of sellers. The longer and more impressive the rally leading up to the reversal, the more likely the top may...

READ MORE

MEMBERS ONLY

Prepare NOW For A Potentially Huge Storm Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not trying to be overly dramatic, because most of you know how I feel about the stock market's long-term direction. We're going higher. Fight that at your own risk. However, short-term, we have a major storm brewing. To fully understand the possible effects...

READ MORE

MEMBERS ONLY

One MAJOR Concern About Friday's Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm all for a big rally with a hammer printing on the long-term weekly chart, especially at 20-week EMA support. That's exactly what happened on Friday on the Dow Jones Industrial Average ($INDU). This index of conglomerates had been underperforming other areas of the stock market...

READ MORE

MEMBERS ONLY

Here Are 4 Steps To Improve Your Trading Process and Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's jump right in. For me, everything starts at the TOP. I take a top-down approach to trading. And when I say "the TOP", I mean market direction.

Step 1: Is it a Bull or Bear Market?

Listen, this is a very easy step to me....

READ MORE

MEMBERS ONLY

One Potentially Big Problem Is Lurking For The Bulls This Summer

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

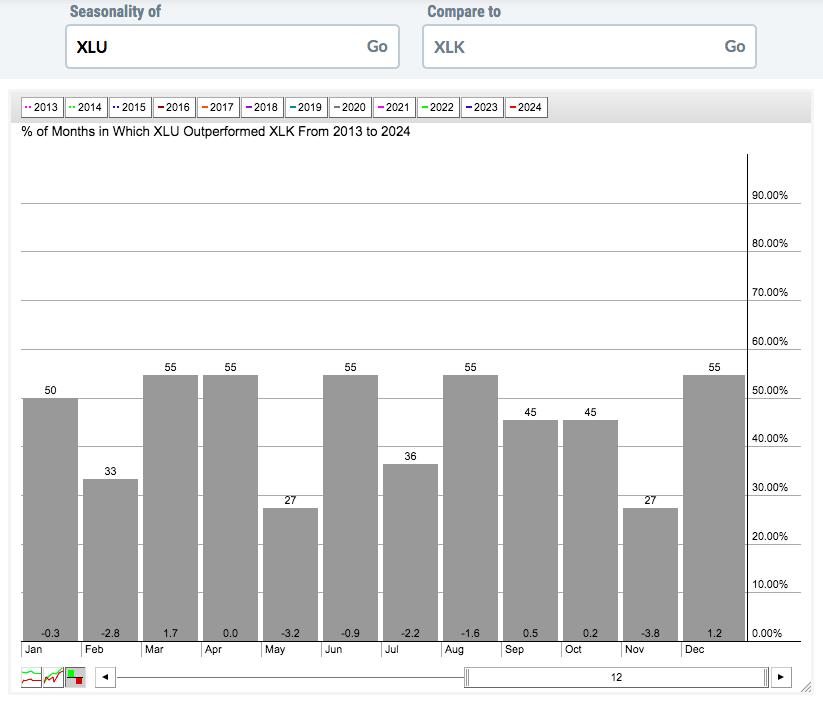

Last week's rally to record highs was due, at least in part, to a rather tame CPI report released on Wednesday. Inflation has been at the heart of nearly every rally and every decline over the past few years. Clearly, we saw inflation soaring throughout 2021 and 2022,...

READ MORE

MEMBERS ONLY

This Is What I Mean By Leading Stocks In Leading Industry Groups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sample Report

A few days ago, I provided a sample of our Weekly Market Report (WMR), which is sent to our EarningsBeats.com members on Mondays. Below is a sample of our Daily Market Report (DMR), sent out to members on Tuesdays through Thursdays. A very brief market update is...

READ MORE

MEMBERS ONLY

Here's My Long-Term Perspective on U.S. Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

EB Weekly Market Recap Video

If you haven't seen our latest weekend recording, it's now available HERE at YouTube.com.

Sample - EB Weekly Market Report

This is a sample of our Weekly Market Report that is sent to EB members every Monday. We also provide...

READ MORE

MEMBERS ONLY

It's May, So Should We Go Away?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've all heard that popular Wall Street adage, "Go away in May", right? It's cute and it rhymes, so why wouldn't we make the HUGE decision to liquidate all of our stock holdings? <sarcasm> Did I mention it rhymes? One...

READ MORE

MEMBERS ONLY

Here's What You Need To Know About Last Week's Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Volatility Index ($VIX) is one of my key sentiment indicators and it has a history of accurately predicting corrections and bear markets. We've had neither without the VIX first clearing an important hurdle in the 17-20 range. Bear markets require a huge dose of fear and panic...

READ MORE

MEMBERS ONLY

Are The Financials Sending Us A Major Warning Signal?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

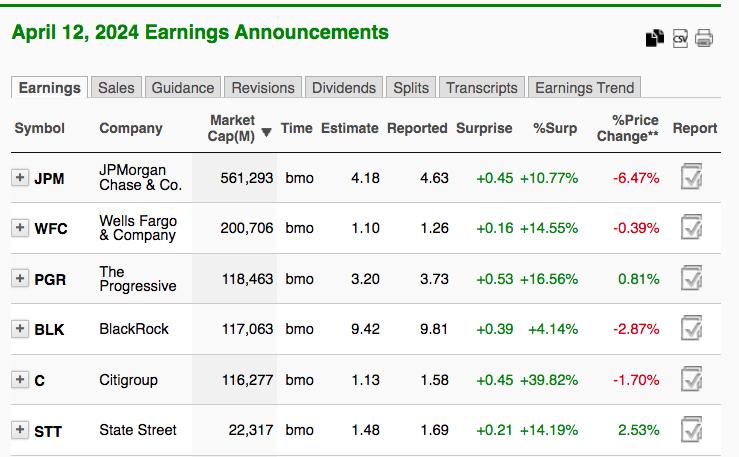

I've said for awhile that we could use some short-term selling to unwind overbought conditions and even negative divergences in some cases. I was looking for perhaps 4-5%, but it's really difficult to predict the kind and depth of selling that we'll see when...

READ MORE

MEMBERS ONLY

2 Consolidating Stocks Ready To Resume Their Uptrends

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My preference is to trade strong stocks that are simply consolidating and ridding themselves of weak hands, hopefully just in time to ride the next wave higher. Software ($DJUSSW) has been consolidating for the past couple months and appears poised to rebound from its latest 50-day SMA test:

Software is...

READ MORE

MEMBERS ONLY

Q1 Ends With A Small Cap Attack! One Small Cap Sector is EXPLODING Higher!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's start off by reviewing a quarterly chart of the S&P 500 ($SPX), NASDAQ 100 ($NDX), and Russell 2000 (IWM) since this secular bull market began in early-April 2013 (44 quarters ago):

S&P 500:

NASDAQ 100:

Russell 2000:

When you look at these 3...

READ MORE

MEMBERS ONLY

You Need To Understand NOW What Changed After The Fed Announcement

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've always liked to look at certain points during a bull market or bear market where the character of the market could change based on key fundamental news. We were at one of those points on Wednesday as 2 o'clock approached. The Fed was about to...

READ MORE

MEMBERS ONLY

Stocks Are Going UP "With or Without You"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

U2 is one of my favorite bands and I can't help but think of their song, "With or Without You", when I look at an S&P 500 chart. This secular bull market is waiting for no one. You're either in it or...

READ MORE

MEMBERS ONLY

Ignore The Naysayers, This Market Is On FIRE!!!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy St. Patrick's Day!

Last week was interesting for sure. Both February Core CPI (consumer price index) and February Core PPI (producer price index) came in above expectations. The headline PPI number doubled expectations. Despite that, the S&P 500 managed to close at an all-time high...

READ MORE

MEMBERS ONLY

GREAT News: This Bull Market is Expanding!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We have seen just about everything we've needed to see to confirm this powerful secular bull market advance since the beginning of 2023. There was really only one thing missing and it's not missing any longer. I'll get to that in a minute.

But...

READ MORE

MEMBERS ONLY

You Need To Realize ONE Important Fact With Big Rallies Like This One

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Make absolutely no mistake about it, Friday was the most bearish day of 2024. There was a bearish engulfing candle on MASSIVE volume in the semiconductors area ($DJUSSC), and this group has been BY FAR the biggest single reason why our major indices have advanced as much as they have....

READ MORE

MEMBERS ONLY

Market Maker Manipulation on AAPL Has Been Egregious in 2024

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Be honest. How many of you thought that Apple (AAPL), Alphabet (GOOGL), and Tesla (TSLA) could struggle collectively, while the S&P 500 continued to set record high after record high? I'm not surprised at all, because secular bull market advances are stubborn and money rotates when...

READ MORE

MEMBERS ONLY

Sentiment And Small Caps Are A 1-2 Punch, Knocking Out The Staggering Bears

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Listen, we all know what the NASDAQ, Magnificent 7, and technology have done and are doing. There's no need to beat a dead horse. For those who somehow view the incredible rallies in these 3 to be bearish, so be it. How's that perma-bear approach working...

READ MORE

MEMBERS ONLY

Evaluating Risk is a Key Difference Between Successful and Unsuccessful Traders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This secular bull market advance is running over everyone attempting to get in its way. It's why I always say never to bet against one. Trying to short this type of bull market is the equivalent of financial suicide. I usually have music playing in the background while...

READ MORE