MEMBERS ONLY

Amazon Buys Whole Market.....Literally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Announcement

At 4:30pm EST this afternoon, just after the U.S. stock market closes, I'll be joining John Hopkins, President of EarningsBeats.com, for a special 90 minute presentation. John will discuss the benefits of trading companies that have reported strong quarterly revenues and earnings (ahead...

READ MORE

MEMBERS ONLY

Cerner Corp Tests Key Price Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's always nice to go back to the basics of technical analysis. Broken resistance becomes support. That's currently the case with Cerner Corp (CERN) where the stock recently cleared price resistance just above 65.00 and, with recent profit taking, we've seen a return...

READ MORE

MEMBERS ONLY

Summer Generally Means Trading Quality, Not Quantity

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

History tells us many things. One of the lessons is that making money on the long side is much more difficult during the summer months. Why? It's rather simple. On the S&P 500 since 1950, here are the annualized returns by calendar months over the summer:...

READ MORE

MEMBERS ONLY

Industrials Lead, Challenge December Relative Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

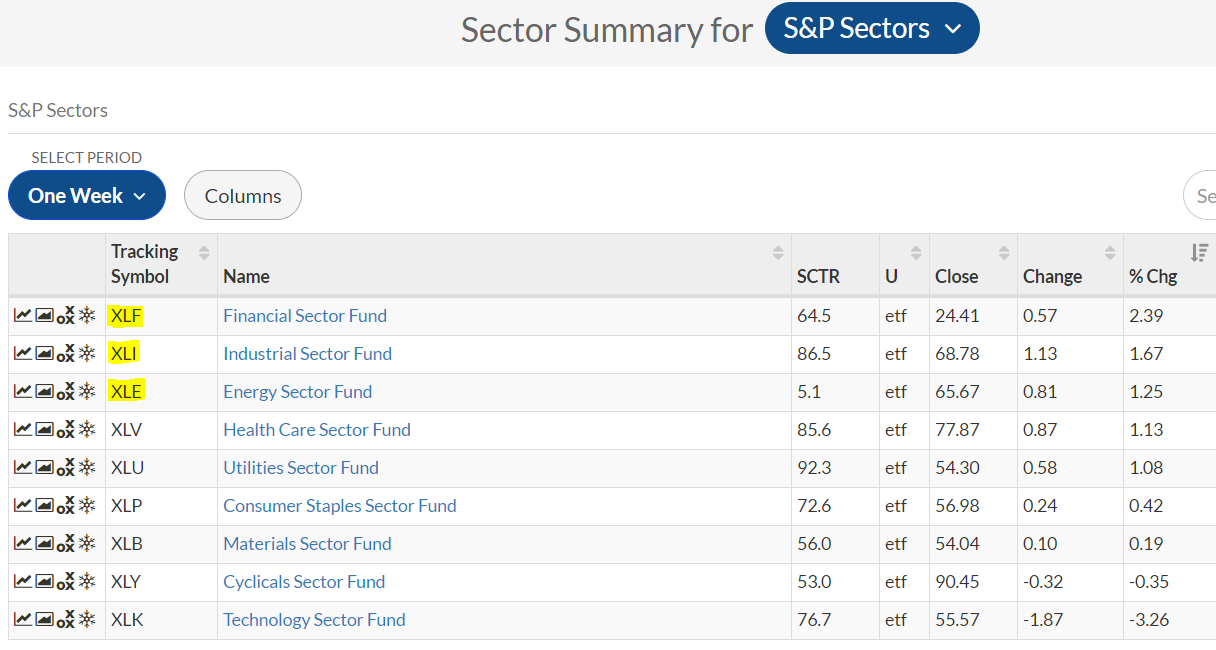

Market Recap for Thursday, June 15, 2017

There's been marked improvement in the relative strength of industrials (XLI, +0.60%) in recent weeks and that was on full display Thursday. Despite all of our major indices finishing lower, the XLI managed to end the session in positive territory...

READ MORE

MEMBERS ONLY

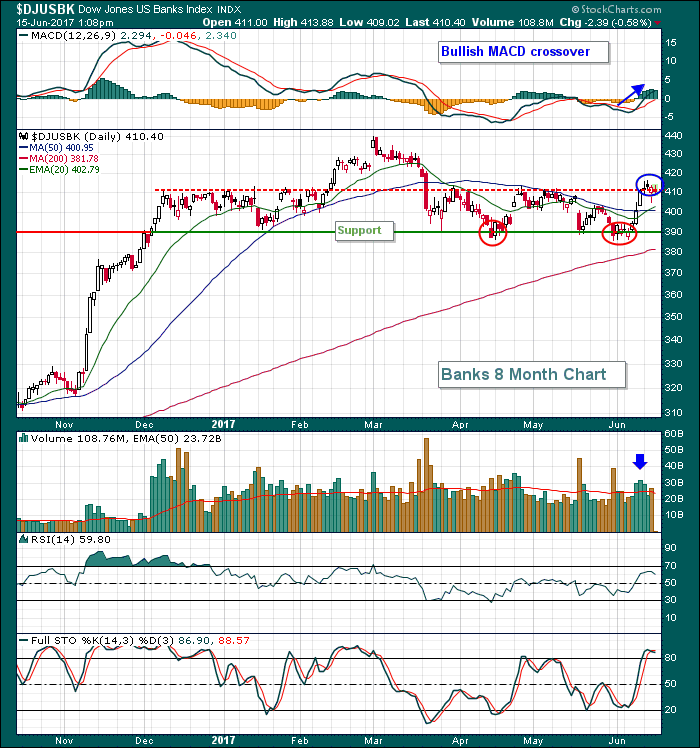

Would The Real Bank Trend Please Stand Up?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One look at the 10 year treasury yield's ($TNX) decline the past several months provides proof that the bond market isn't exactly agreeing with the Federal Reserve's stated position that they see economic improvement in the months ahead. The Fed announced on Wednesday that...

READ MORE

MEMBERS ONLY

Defensive Sectors Lead As Fed Hikes And Maintains Forecast

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 14, 2017

The FOMC concluded its two day meeting on Wednesday afternoon and, for the most part, followed its prior script. They stuck to their previous plan to raise interest rates for a third time in six months and maintain their forecast for another rate...

READ MORE

MEMBERS ONLY

Home Construction Breaks Out Ahead Of FOMC Announcement

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 13, 2017

Technology (XLK, +0.72%) rebounded after two days of brutal selling. It occurred after a hammer printed off a 50 day SMA test on Monday. That was a relief for many market participants as the XLK has been the undisputed sector leader for...

READ MORE

MEMBERS ONLY

NASDAQ And Technology Slump Continues; Apple Downgraded

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 12, 2017

U.S. indices fell in unison on Monday and the tech-laden NASDAQ led the action, but after Friday's bloodbath, it certainly could have been worse. Based on overall action Friday and Monday, it appears to be a healthy rotation from the...

READ MORE

MEMBERS ONLY

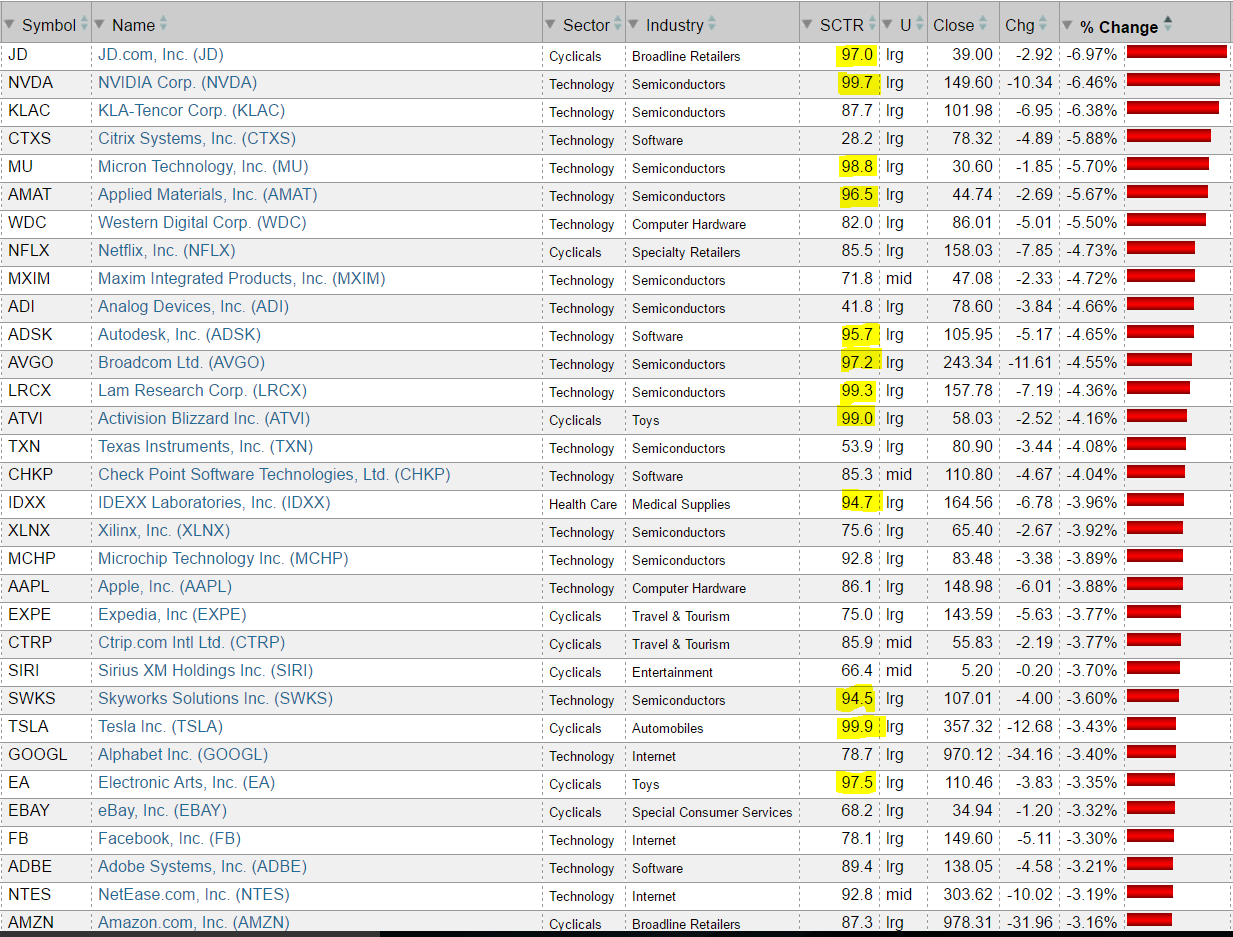

High SCTR Stocks Hammered; NASDAQ 100 Plunges

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 9, 2017

They say a picture can say a thousand words so before I further discuss the carnage from Friday, take a look at this performance chart of NASDAQ 100 components:

Several of the best performing stocks (based on SCTR scores) were absolutely hammered on...

READ MORE

MEMBERS ONLY

Applied Optoelectronics Follows Other High SCTR Stocks Lower On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you're someone that finds great investments among the high SCTR (StockCharts Technical Rank) stocks, you probably enjoy better than average returns most of the time. However, Friday was not one of those times. The NASDAQ 100, clearly the best performing index among our major indices in 2017,...

READ MORE

MEMBERS ONLY

Russell 2000 Soars, On Cusp Of Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 8, 2017

Small caps were the clear and undeniable leader on Thursday as the Russell 2000 gained 1.36% while the NASDAQ was the second best performing index at +0.39%. I posted yesterday in this blog that the Russell 2000 needed to clear 1420...

READ MORE

MEMBERS ONLY

Industrials Back Test Their Ascending Triangle Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past week, it's been about an even split among sectors in terms of winners and losers. Industrials (XLI) is one sector that's been slightly lower over the past week, but technically things still look very bright in this space. Broken price resistance generally becomes...

READ MORE

MEMBERS ONLY

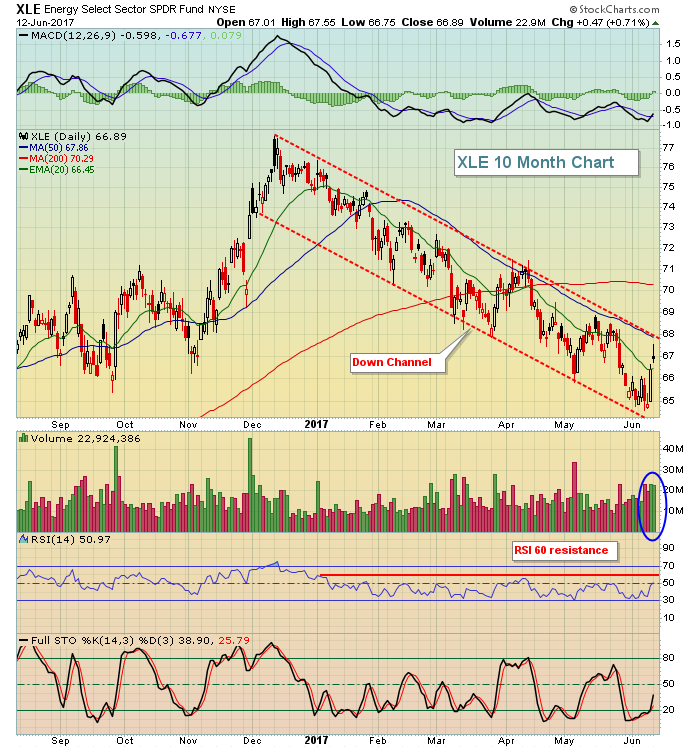

Retail REITs And Banks Lift Financials But Energy Weighs With Plunging Crude

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 7, 2017

Crude oil ($WTIC) took a dive on Wednesday as inventories rose unexpectedly, causing a bit of panic among traders. Inventory supplies had fallen for eight straight weeks and traders were anticipating another drop of 3.5 million barrels. Instead, at 10:30am EST,...

READ MORE

MEMBERS ONLY

Energy Leads And Hadn't Done This Since November

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 6, 2017

Energy (XLE, +1.18) was easily the best performing sector on Tuesday as materials (XLB, +0.06%) was the only other sector to finish in positive territory - barely. Over the last five trading days, the XLE has printed a hollow candle (closing...

READ MORE

MEMBERS ONLY

Equities Down But Losses Mitigated By Two Unlikely Sectors

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 5, 2017

It wasn't a horrible day on Wall Street. After all, we've been in a strong advance since mid-May with the S&P 500 rising nearly 4% during that span. So a little bit of profit taking shouldn'...

READ MORE

MEMBERS ONLY

Software And Semiconductors Lead Another Technology-Driven Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 2, 2017

Technology (XLK, +0.92%) led U.S. equities higher on Friday and that's been the case for several months now. The XLK has been the best performing sector with a current SCTR (StockCharts Technical Rank) reading of 92 further validating that....

READ MORE

MEMBERS ONLY

Fortinet In Strong Industry, Tests Gap And Price Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Fortinet (FTNT) is down roughly 5% from its recent price high as money rotates within the software industry ($DJUSSW). It's up close to 30% year-to-date, however, so a little profit taking in the short-term is likely providing an opportunity. FTNT looks to be approaching and testing a key...

READ MORE

MEMBERS ONLY

Internet Stocks Overbought Amid Slowing Momentum

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Internet stocks ($DJUSNS) have climbed roughly 44% since their bottom in late June 2016. But there are now negative divergences appearing across various time frames and that suggests the summer time could be a period of consolidation, or even a correction. First, let's take a look at the...

READ MORE

MEMBERS ONLY

Financials Rally To Lead U.S. Indices To New Records

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 1, 2017

U.S. equities had a very strong day on Thursday, with the small cap Russell 2000 leading the charge with a solid 1.89% gain. The move was also widely participated in, with all nine sectors finishing higher. Financials (XLF, +1.25%), a...

READ MORE

MEMBERS ONLY

Coal Facing Poor Technical Conditions And Historical Headwinds

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Coal Index ($DJUSCL) spent 2016 bouncing from the ashes after a disastrous 2015 in which the DJUSCL lost 90% of its value. The "dead cat bounce" looks as though it may have ended as price action has rolled over and the weekly MACD...

READ MORE

MEMBERS ONLY

Autos Rise, Break Downtrend Line; Tesla Benefits

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 31, 2017

Utilities (XLU, +0.50%) and healthcare (XLV, +0.40%) led a defensive-oriented market on Wednesday with the latter nearing a significant bullish ascending triangle breakout. Materials (XLB, +0.30%) and consumer staples (XLP, +0.28%) also performed well. The aggressive sectors were mixed...

READ MORE

MEMBERS ONLY

Strength In Internet, Software And Semiconductors Leading Technology Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 30, 2017

Technology (XLK, +0.43%) remains the heart of this current bull market. The XLK was the sector leader on Tuesday, with utilities (XLU, +0.32%) a close second. Over the past week, utilities and consumer discretionary (XLY) hold a slight edge over technology....

READ MORE

MEMBERS ONLY

Dow Jones In Record High Territory Amid Signs Of Slowing Momentum

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 26, 2017

Friday's action was slightly bullish overall, but there was little difference between the best performing sectors and the worst performing sectors. Consumer stocks performed well with consumer staples (XLP, +0.37%) and consumer discretionary (XLY, +0.30%) leading all sectors. On...

READ MORE

MEMBERS ONLY

Infinera Breaks Descending Channel On Heavy Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Infinera (INFN) gapped higher in February on massive volume, but has been falling in a descending channel ever since. Volume accelerated on Friday as INFN clearly broke this down channel. The reversal also is taking place after a key gap support level was filled and tested. Take a look at...

READ MORE

MEMBERS ONLY

Specialty Retailers Rally Off Support, Lead U.S. Stocks To Record Close

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 25, 2017

Retailers led another U.S. market rally on Thursday and helped provide leadership for the consumer discretionary sector (XLY, +0.88%), which outperformed the benchmark S&P 500 for one of the few times over the past 2-3 weeks. There had been...

READ MORE

MEMBERS ONLY

Juniper Networks Trending Higher, Threatens Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Recently, competitor Cisco Systems (CSCO) broke out to a 15 year high. While Juniper Networks (JNPR) hasn't seen its price move to decade and a half highs, it is on the verge of breaking to a six year high amid very heavy volume. JNPR traded more than 25...

READ MORE

MEMBERS ONLY

S&P 500 Breaks To Another Fresh All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 24, 2017

Seven of nine sectors finished higher to lead the S&P 500 to a record high close on Wednesday. Materials (XLB, +0.67%) and utilities (XLU, +0.57%) led the advance as gold mining ($DJUSPM) and mining ($DJUSMG) both performed extremely well,...

READ MORE

MEMBERS ONLY

Financials Lead As Banks Rally Amid Rising Treasury Yields

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 23, 2017

Eight of nine sectors finished in positive territory on Tuesday as only consumer discretionary (XLY, -0.38%) failed to do so. 18 of 23 industry groups within the discretionary sector finished lower, with retail and home construction stocks clearly the weakest links. After...

READ MORE

MEMBERS ONLY

Industrial Suppliers Continue Impressive Bounce Off Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 22, 2017

Utilities (XLU, +0.86%), technology (XLK, +0.80%) and industrials (XLI, +0.77%) were the sector leaders on Monday, aiding our major indices as they mostly have erased the big losses from last Wednesday. The XLI has been a leader of late and...

READ MORE

MEMBERS ONLY

Stocks Rebound On The Strength Of Industrials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 19, 2017

Industrials (XLI, +1.32%) and energy (XLE, +1.23%) were the two clear leaders on Friday. The XLI represents one of the four aggressive sectors in the market so it's always nice to see strength there. Commercial vehicles ($DJUSHR) had a...

READ MORE

MEMBERS ONLY

Northrop Grumman Awaiting Bullish Triangle Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Northrop Grumman (NOC) has risen ten fold since this bull market began in 2009 and its current bullish pattern suggests that this defense company is not ready to roll over just yet. It's been a struggle to clear 250 price resistance the past 6-7 months, but the rising...

READ MORE

MEMBERS ONLY

Are We Topping? Watch These Two Industry Groups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We saw the first significant selling pressure in months last week, especially on Wednesday. Financials (XLF) led the rout to the downside, but the sector did bounce back later in the week and, in the process, held key neckline price support within two key industry groups - banks ($DJUSBK) and...

READ MORE

MEMBERS ONLY

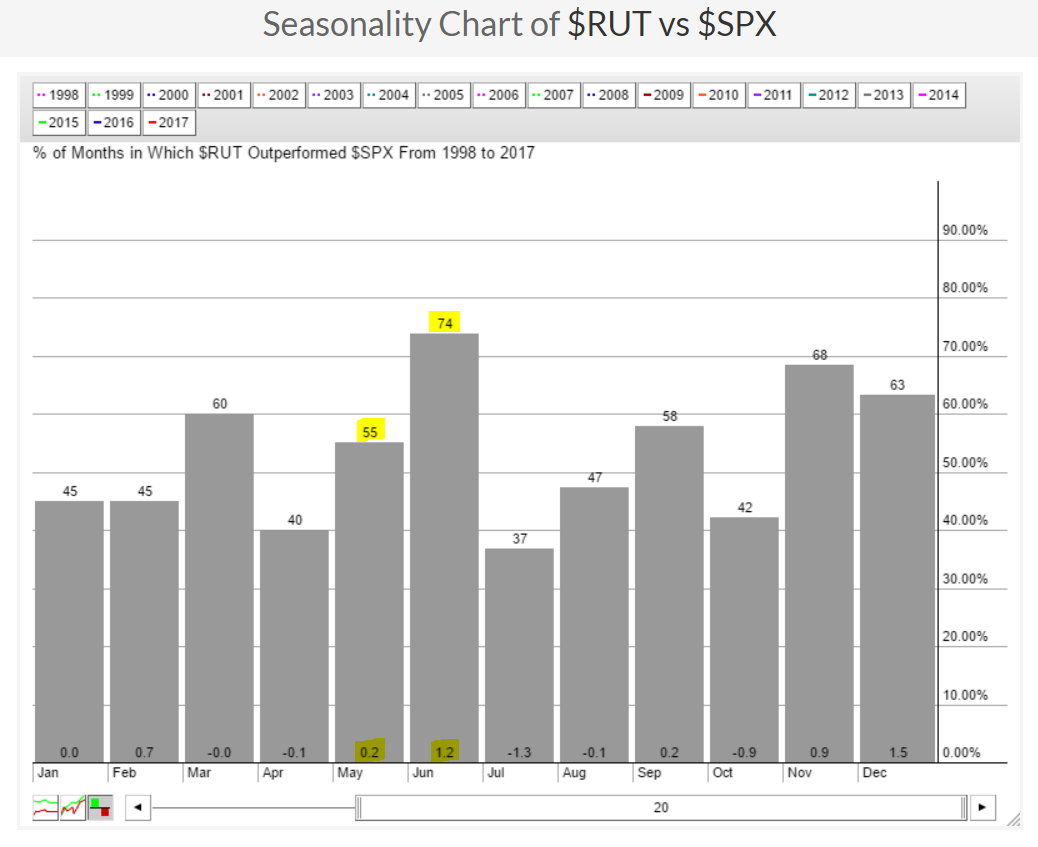

Stocks Rebound, This Relative Ratio Will Be Important To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 18, 2017

Technology (XLK, +0.59%) and consumer discretionary (XLY, +0.58%) led the market's rally on Thursday after mobile telecom ($DJUSWC) managed to hang onto 20 week EMA support after a drubbing on Wednesday. The bad news is that there remains an...

READ MORE

MEMBERS ONLY

Caterpillar Tests Price Support, Nearly Fills Gap

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Caterpillar (CAT) was one of many beneficiaries of the latest quarterly earnings season. With its revenues and EPS topping Wall Street estimates, CAT surged higher on April 25 from its April 24 close of 96.81. The recent market weakness enabled CAT to pull back to test key price support...

READ MORE

MEMBERS ONLY

Major Indices Sell Off Hard, Lose Support; What's Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

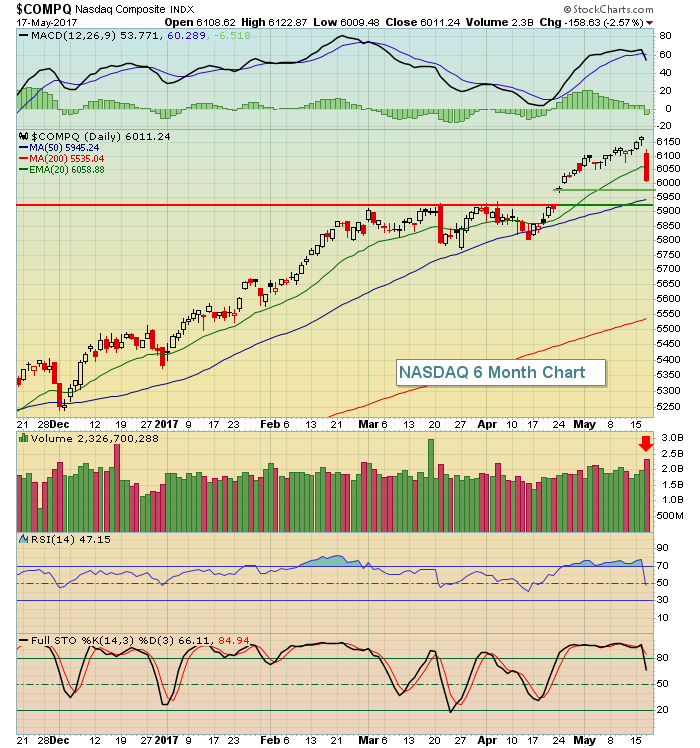

Market Recap for Wednesday, May 17, 2017

It was a brutal day of selling for U.S. equities. The selling began at the open and continued right through the close. The selling also cleared price support levels and that likely will result in further selling in the days and possibly...

READ MORE

MEMBERS ONLY

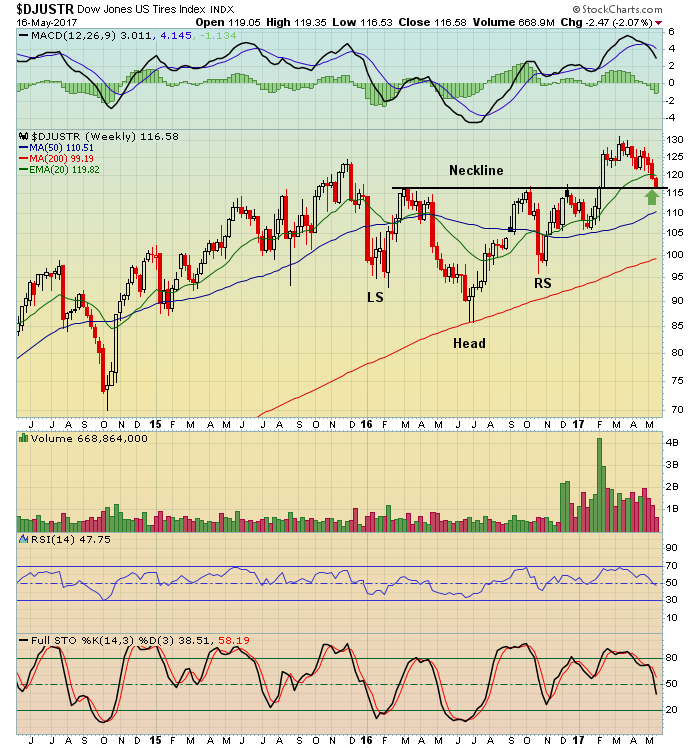

Negative Divergences Weighing On Transports

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 16, 2017

Technology (XLK, +0.47%) and financials (XLF, +0.29%) were the two best performing sectors on Tuesday and the former was the primary reason that the NASDAQ was able to outperform on a day when the U.S. market was bifurcated. The Dow...

READ MORE

MEMBERS ONLY

S&P 500 Sets Fresh Record High Close; Materials And Energy Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 15, 2017

It was another solid day for U.S. equities with index leadership coming from the small caps as the Russell 2000 posted a nice 0.81% rise while the other major indices were just below the +0.50% level. Monday marked only the...

READ MORE

MEMBERS ONLY

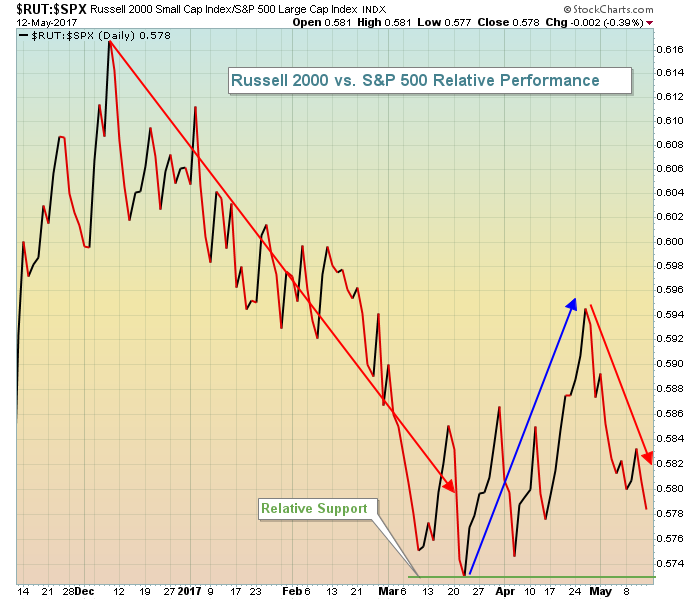

NASDAQ Leads Bifurcated U.S. Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 12, 2017

The NASDAQ finished higher on Friday, but that was not the case for the Dow Jones and S&P 500, which both finished fractionally lower. The Russell 2000 was hit hardest as this small cap index again threatened a short-term breakdown beneath...

READ MORE

MEMBERS ONLY

Breakout Watch: Can Intel Deliver The Goods?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Intel (INTC) has been trading in bullish sideways fashion since topping in October. The Dow Jones U.S. Semiconductor Index ($DJUSSC) has continued to rise and lead the benchmark S&P 500 on a relative basis - even while INTC consolidates. A breakout in Intel would measure to 42...

READ MORE

MEMBERS ONLY

Rotation Turns Defensive As S&P 500 Consolidation Continues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 11, 2017

Consumer staples (XLP, +0.15%) and utilities (XLU, +0.14%) were beneficiaries of money rotating more defensively on Thursday. While the end result at the close wasn't bad overall (the Dow Jones and S&P 500 lost 0.11% and...

READ MORE