MEMBERS ONLY

This Stock Awaiting Breakout In The Bullish Medical Supplies Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earlier today, IDEXX Laboratories (IDXX) fell beneath its rising 20 day EMA but quickly recovered and is now on the verge of breaking above a quadruple top in the 79-80 range. Volume isn't huge, but it is increasing so a breakout should be respected. We've seen...

READ MORE

MEMBERS ONLY

Consumer Stocks Keep The Rally Alive

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 30, 2016

U.S. equities jumped again, this time with most of the major indices climbing a similar percentage close to .50%. The Russell 2000 ($RUT) lagged a bit, but considering the huge outperformance on Tuesday, let's give the small caps a one...

READ MORE

MEMBERS ONLY

Negative Divergence Could Slow This Trucker

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The rally in the S&P 500 has been impressive and truckers ($DJUSTK) have been among the best performing industry groups, rising 17% over the past three months. That actually places truckers as the leading industry group within the industrials over that time frame. C. H. Robinson Worldwide (CHRW)...

READ MORE

MEMBERS ONLY

What Constitutes A Bear Market Rally?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminders

First, please subscribe to my blog at the bottom of this article. Simply click on "Yes" to the question, enter your email address and click "Subscribe". By doing so, my article will be sent directly your email as soon as it's published. It&...

READ MORE

MEMBERS ONLY

Transports Drop For Fifth Consecutive Day, Watch These Levels

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 28, 2016

Monday was another day of market bifurcation with the Dow Jones, S&P 500 and Russell 2000 barely higher, while the NASDAQ suffered a minor loss. Few analysts expected the type of rally we've seen off the February 11th bottom,...

READ MORE

MEMBERS ONLY

Energy Regains Leadership Role, Stocks Post Small Gains

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 24, 2016

Despite a rising dollar ($USD), energy (XLE) was the best performing sector on Thursday, posting a .49% gain, while financials (XLF) were the biggest loser, dropping .62%. Four sectors rose while four declined and materials (XLB) finished exactly where they started. The dollar...

READ MORE

MEMBERS ONLY

Here's What A Warning Sign Looks Like

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

From a short- to intermediate-term trading perspective, slowing momentum to the upside is a warning sign if you're long. Slowing momentum can come in different forms, but I consider negative divergences on the MACD and weak volume on price breakouts to be two solid examples. Based on these...

READ MORE

MEMBERS ONLY

Priceline's (PCLN) Continuation Pattern Is Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Priceline (PCLN) has seen lots of volatility over the past several months including sizable gaps higher and lower, but the technical picture remains bright. The near-term has turned dicey as a negative divergence has emerged, but that slowing momentum could be exactly what this bullish inverse head & shoulders pattern...

READ MORE

MEMBERS ONLY

S&P 500 Drops Most In Two Weeks, VIX Climbs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 23, 2016

Energy (XLE) was under heavy selling pressure on Wednesday for the first time in two weeks and that sector was primarily responsible for the weakness in the S&P 500. Seven of nine sectors finished lower, however, as only the defensive utilities...

READ MORE

MEMBERS ONLY

Bifurcated U.S. Market Shows Hesitation and Indecisiveness

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 22, 2016

The Dow Jones, S&P 500 and Russell 2000 all turned lower on Tuesday, but the NASDAQ managed to take over relative leadership and finish with fractional gains. Healthcare (XLV) has been the lagging sector over the past month, but led all...

READ MORE

MEMBERS ONLY

Footwear Makes Bullish Breakout; Broadline Retailers Make Kick Save

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 21, 2016

It was another day of mostly higher prices, albeit gains were modest. That's the hallmark of a bull market - day after day of almost boring gains where bears cannot gain any traction whatsoever. If there's one thing that...

READ MORE

MEMBERS ONLY

Small Caps And Healthcare Lead On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 18, 2016

The Russell 2000 ($RUT) gained 0.95% on Friday and easily outpaced our other major indices. It also closed back above 1100 for the first time since closing below that number on January 6th. Given the successful tests of the rising 20 day...

READ MORE

MEMBERS ONLY

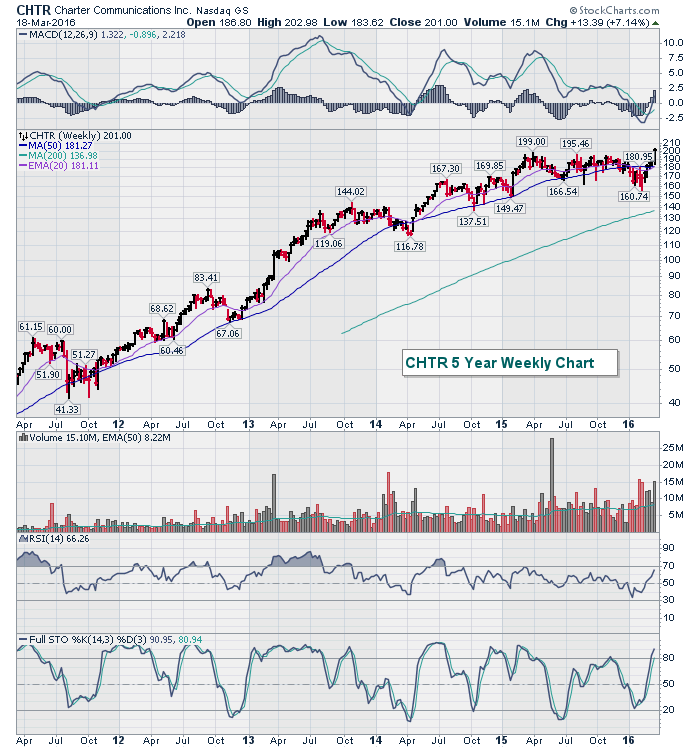

Charter Communications (CHTR) Makes The Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Despite all the market volatility and weakness over the past year, CHTR has held steady in its uptrend and has been consolidating throughout. It was awaiting a heavy volume breakout, but it's waiting no more. More than 15 million shares changed hands last week as CHTR closed above...

READ MORE

MEMBERS ONLY

Medical Supplies Group Bounces At Key Moving Average Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Healthcare (XLV) has been the weakest sector over the past one and three month periods, but you'd never know it from looking at the Dow Jones U.S. Medical Supplies Index ($DJUSMS). The DJUSMS has gained over 8% during the past three months while the Dow Jones U....

READ MORE

MEMBERS ONLY

Quad Witching Season: Here's What Usually Happens

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 17, 2016

All of our major indices continued their five week advance with one notable exception - the NASDAQ 100 ($NDX), which fell slightly despite strong gains elsewhere. In particular, healthcare stocks (XLV) were weak with the XLV the only sector in negative territory, falling...

READ MORE

MEMBERS ONLY

Has Big Blue (IBM) Bottomed?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

IBM had been under intense selling pressure and had lost more than 40% of its market cap from its March 2013 high to its early 2016 double bottom low near 117.00. Was that enough? Has it bottomed? Well, there was an exhaustion gap in mid-January followed by a double...

READ MORE

MEMBERS ONLY

Treasuries And S&P 500 Diverge On FOMC Announcement

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 16, 2016

Energy (XLE) closed at more than a three month high on Wednesday, gaining 1.73% on the session to lead all sectors. Utilities (XLU) were a strong second as they climbed 1.53%. The XLU clearly benefited from the reaction in treasuries to...

READ MORE

MEMBERS ONLY

Apple (AAPL) Testing Highs of 2016 As Technology Leads

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 15, 2016

Apple (AAPL) resumed its upward climb on Tuesday, breaking to its highest close since the first trading day of 2016. AAPL's strength led computer hardware ($DJUSCR) to outsized gains of 1.42%, technology (XLK) to the best finish among sectors and...

READ MORE

MEMBERS ONLY

Market Flat But Bulls Find Comfort In Hotels

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 14, 2016

There was weakness during the first 15 minutes of trading on Monday, then again during the last 15 minutes of trading. Prices meandered higher throughout much of the remaining session, however, and left our major indices bifurcated by the close. The Dow Jones...

READ MORE

MEMBERS ONLY

S&P 500 Closes At Highest Level Of 2016 As Energy and Financials Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

In the Sector/Industry Watch section below, I highlight the historical and current February to April strength in the Exploration & Production ($DJUSOS) industry group within the energy sector (XLE). I plan to discuss how you can research historical strength by sector and industry group in my Trading...

READ MORE

MEMBERS ONLY

This Indicator Says Whole Foods (WFM) Is Under Accumulation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Whole Foods Market (WFM) has been trading in sideways fashion for the past several months and its long-term weekly chart isn't one of the strongest. But there are signs that better fundamental days lie ahead based on technical signs of accumulation. Below is a daily chart of the...

READ MORE

MEMBERS ONLY

Battle Lines Are Drawn As Equity Markets Waffle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 10, 2016

We've had little economic news out this week so equity markets have been left to trade off technical indications. After the European Central Bank's (ECB) announcement of further quantitative measures triggered a very quick surge to the upside in...

READ MORE

MEMBERS ONLY

NASDAQ 100 Faces Major Support Test This Afternoon

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The European Central Bank (ECB) announced its latest quantitative easing measures and though they initially moved global markets higher, the focus now seems to have turned to ECB President Draghi's comment that further interest rate cuts aren't likely. There is weakness across the board in the...

READ MORE

MEMBERS ONLY

The ECB Announces More QE, Global Markets Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 9, 2016

Energy (XLE) was back in the driver's seat on Wednesday as the XLE climbed 1.62% to easily outperform the other eight sectors. Weakness in the dollar (UUP) has contributed to recent strength in commodities and after an early gap higher...

READ MORE

MEMBERS ONLY

Treasuries And Utilities Lead On Tuesday To Begin Next Leg Lower?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 8, 2016

Investors and traders turned to treasuries (TLT) and utilities (XLU) on Tuesday as money rotated back toward defense. The rally off the February 11th low has been characterized by rotation away from defense. It's not unusual to see selling accompanied by...

READ MORE

MEMBERS ONLY

Energy And Materials Hold Bears At Bay

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 7, 2016

Monday was a strange day. First, there was bifurcated action where most of our major indices were able to tack on additional gains despite huge gains over the past few weeks and overhead price resistance at hand. The gains weren't big...

READ MORE

MEMBERS ONLY

It's A Fresh Trading Week, But The Problems Remain The Same

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 4, 2016

All of our major indices ended last week on a high note as U.S. stocks finished with more gains. There's been very solid index and sector rotation to support the recent bullish action and a renewed selling effort in treasuries...

READ MORE

MEMBERS ONLY

This Industry Group Has Broken To An All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

2016 has not been a very good year, although the rally the past few weeks has alleviated some of the earlier pain. I guess we should party like it's 1999.99 because that's where the S&P 500 closed on Friday. Couldn't we...

READ MORE

MEMBERS ONLY

Is Now The Time To Short?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Yes.

Does that mean the stock market is guaranteed to roll over and play dead? Absolutely not. Trading success is not always dependent on being right, as crazy as that might sound. It's about planning your trades to minimize risk in the event your call is incorrect. Many...

READ MORE

MEMBERS ONLY

Jobs Surge In February, S&P 500 Looks To Clear 2000

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 3, 2016

I spoke yesterday about the significance of the XLE's breakout on Wednesday. Thursday's follow through day was impressive as well as the XLE led all sectors, gaining another 1.51%. I'd like to see crude oil ($WTIC)...

READ MORE

MEMBERS ONLY

Small Caps Lead As Major Resistance And Jobs Report Near

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 2, 2016

Energy (XLE) made a very important technical breakout on Wednesday and did so with increasing volume. That's an excellent sign of a further uptrend. The XLE now has important support at its rising 20 day EMA, currently at 56.90. Initial...

READ MORE

MEMBERS ONLY

Home Construction And Bank Stocks Awaiting HUGE Jobs Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tomorrow's nonfarm payrolls report is a really, really big deal. Maybe not so much from a fundamental perspective, but it certainly is from a technical perspective. Over the past few months, we've seen heavy volume selling and a rotation toward defensive areas of the market like...

READ MORE

MEMBERS ONLY

U.S. Indices Explode Higher, Clear Initial Technical Hurdles

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 1, 2016

Tuesday was a very impressive broad-based rally with index leadership from the NASDAQ, especially NASDAQ 100 shares, and also leadership from the key financial (XLF), technology (XLK) and consumer discretionary (XLY) sectors. Among industry groups, banks ($DJUSBK), computer hardware ($DJUSCR), software ($DJUSSW), internet...

READ MORE

MEMBERS ONLY

Banks And Biotechs Weigh On U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

Today marks my one year anniversary as Senior Technical Analyst here at StockCharts.com. I love being here and look forward to many more years with this truly great company. I want to thank everyone at StockCharts and also all of you for your support during the past...

READ MORE

MEMBERS ONLY

Strength In Treasuries Offsets S&P 500 Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 26, 2016

Materials (XLB) led bifurcated action on Friday as this sector rose 1.45%, more than double any other sector. Both the NASDAQ and Russell 2000 showed gains, while the Dow Jones and S&P 500 finished in negative territory. The XLB drew...

READ MORE

MEMBERS ONLY

NFLX Prints Shooting Star On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past few months, traders have shunned risk and we've seen many high flyers begin to take big hits. Netflix (NFLX) certainly fits that category and hasn't been immune to the selling. Recently, NFLX traded at a high of 133.27, but has since fallen...

READ MORE

MEMBERS ONLY

Bears: Pardon The Interruption

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 25, 2016

Financials (XLF) rallied nicely on Thursday to lead this extended market rally. Unfortunately, four of the six best performing industry groups within financials were REITs, the more defensive area of financials. Industrials (XLI) also performed well with aerospace ($DJUSAS) the leader there. The...

READ MORE

MEMBERS ONLY

Is The Current S&P 500 Rally Sustainable? Don't Decide Based On These Two Indicators Alone

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Everyone is trying to evaluate the strength and sustainability of the current U.S. equity rally. StockCharts.com provides us the tools to do just that. But not every indicator tells us the complete truth. A look at the most recent drop in the S&P 500 and subsequent...

READ MORE

MEMBERS ONLY

Bulls Turn Tables After Weak Start, What's Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for February 24, 2016

After very early strength in the U.S. dollar index ($USD) on Wednesday to challenge the 98 level, the greenback fell sharply, allowing for a very quick recovery in energy (XLE) and materials (XLB) stocks and that propelled our major indices into positive territory...

READ MORE

MEMBERS ONLY

Global Markets Fall On Oil, U.S. Futures Plunge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for February 24, 2016

Energy (XLE) and materials (XLB) tumbled on Tuesday as the U.S. dollar ($USD) continued its recent rally. The greenback rose just fractionally yesterday but it followed a very strong rally on Monday and closed above its 20 day EMA for a second consecutive...

READ MORE