MEMBERS ONLY

Rally Stays Afloat But Major Resistance Approaches

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I'll be joining John Hopkins of EarningsBeats.com just after the market closes today for a lively discussion of analyzing both long and short candidates during a tumultuous trading period like the one we're experiencing now. It's FREE and will be held...

READ MORE

MEMBERS ONLY

Bifurcated Action On Friday, Watch For Possible Reversal Today

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for February 19, 2016

The U.S. market was mixed on Friday with the more aggressive Russell 2000 and NASDAQ leading the action with gains of 0.53% and 0.38%, respectively, while the S&P 500 was flat and the Dow Jones was down fractionally at...

READ MORE

MEMBERS ONLY

Plotting Dividends On A Sharp Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Just about one year ago, StockCharts.com unveiled a "dividend indicator" to allow you to plot the history of dividends on a particular U.S. or Canadian stock. For those who are income-oriented, it's a great way to review the history of dividends that a company...

READ MORE

MEMBERS ONLY

Despite Recent Strength, Long-Term Bearish Momentum Accelerating

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

From a short-term trading perspective, last week's rally was predictable. Positive divergences flashed all over the equity map on daily charts - globally, domestically, and within sectors, industry groups, and individual stocks. So it was certainly an opportunity for the bulls to regain control of the action in...

READ MORE

MEMBERS ONLY

Winning Streak Ends, Futures Lower, Next Leg Lower?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 18, 2016

The keys to the sustainability of the recent rally will be twofold: (1) will there be enough buying pressure to clear key resistance levels as they're approached and tested? and (2) will there be enough rotation to aggressive areas of the...

READ MORE

MEMBERS ONLY

Wal-Mart (WMT) Trending Higher Despite Post-Earnings Weakness

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wal-Mart (WMT) based for more than a decade beginning in 2000 before it finally made a significant technical breakout in 2012. WMT then nearly tripled over the next three years before stumbling over the past year. Perhaps the biggest question is whether the selling has ended and WMT is now...

READ MORE

MEMBERS ONLY

Energy, Discretionary, Technology Stocks Lead Bull Rout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 17, 2016

Energy stocks (XLE) soared yesterday, rising 3.28% to easily lead all sectors. Eight of the nine sectors finished higher with only utilities (XLU) coming up short. Leading energy has been the resurgence of coal stocks ($DJUSCL) as the DJUSCL is setting up...

READ MORE

MEMBERS ONLY

Counter Trend Rally To Continue; Watch This Key Moving Average

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 16, 2016

Tuesday produced what arguably was the best daily performance for U.S. equities in 2016. It wasn't the biggest percentage gain, but the behavior and leadership was outstanding and sets up the market for further short-term gains. Yesterday's leadership,...

READ MORE

MEMBERS ONLY

Banks And Oil Rally, U.S. Market Surges Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 12, 2016

The Dow Jones U.S. Banks Index rallied nearly 6% on Friday, a stunning reversal with a positive divergence indicative that the rally may be closer to starting than finishing. The entire financial sector rallied with the benchmark ETF (XLF) gaining 4.22%...

READ MORE

MEMBERS ONLY

Is The Long-Term Run Over For Apple (AAPL)?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's difficult to argue that Apple has been one of the best performing stocks - if not the best - in the 21st century. But every stock has its limitations and a good question is whether AAPL has reached its top. AAPL has fallen 30% from its peak...

READ MORE

MEMBERS ONLY

Why This Rally Could Last A Bit Longer

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 11, 2016

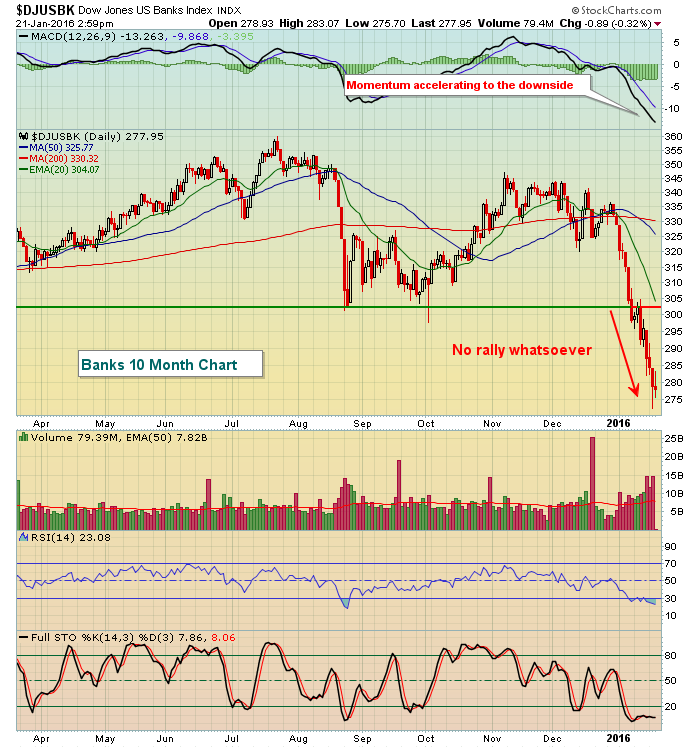

It was another very rough outing for financials (XLF) in general and banks ($DJUSBK) in particular with losses of 3.06% and 4.28%, respectively. The banking issue is most definitely a global one as has been very well documented here at StockCharts....

READ MORE

MEMBERS ONLY

Volatility ($VIX) Nearing Key Breakout As S&P 500 Nears Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Volatility and S&P 500 performance tend to move in opposite directions. As fear escalates and the VIX prices in higher expected volatility, equity markets sell off. Currently, the VIX is nearing its recent resistance near 30, which is a very high level of expected volatility, one in which...

READ MORE

MEMBERS ONLY

Oil, Global Markets And Fed Sink U.S. Futures

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 10, 2016

There was a bit of strength on Wednesday as the NASDAQ managed to finish with a minor gain, while the remaining key indices gave up earlier gains to end the session in negative territory. The bifurcated action was very disappointing to those hoping...

READ MORE

MEMBERS ONLY

U.S. Futures Rally, Looking For Short-Term Clues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 9, 2016

U.S. stocks were lower throughout much of the session on Tuesday before rallying in early afternoon action to move into positive territory with one hour left. Unfortunately, another round of quick selling emerged and all of our major indices finished lower once...

READ MORE

MEMBERS ONLY

Tokyo Nikkei Average Drops 5%; U.S. Futures Weak

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, February 8, 2016

While the U.S. market continued its downward spiral, Tokyo's Nikkei Average ($NIKK) fell more than 5% overnight, losing critical price and trendline support. Check it out:

This chart was shown last week with the key price and trendline support reflected....

READ MORE

MEMBERS ONLY

U.S. Futures Looking To Extend Friday's Losses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note: If you missed our joint webinar on Friday, Greg Schnell and I will be back at it and hosting another joint one hour webinar today. We had a huge crowd on Friday and the two of us providing our own distinct views generated much interest. The webinar is...

READ MORE

MEMBERS ONLY

Recreational Services Index Has A Bad Year......Last Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Recreational Services Index ($DJUSRQ) fell more than 11% last week as traders completely ignored the consumer discretionary space (XLY). The only industry group within consumer discretionary that performed worse was Business Training & Employment Agencies ($DJUSBE), which fell a staggering 28% on Friday after LinkedIn...

READ MORE

MEMBERS ONLY

What You Need To Know About Trading A Bear Market?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are no guarantees to this question, but we do have history and past technical indications to provide us a few guidelines. Trading strategies applied during a bull market simply won't work during a bear market. They may work on a few select industry groups and stocks, but...

READ MORE

MEMBERS ONLY

Tumbling Dollar Benefits Basic Materials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note: I have joined Greg Schnell, "The Canadian Technician", in Phoenix, AZ for a few days and Greg will be hosting my Trading Places LIVE webinar both today and Monday. Greg will offer up his latest thoughts on commodities, which have been on fire, and we'...

READ MORE

MEMBERS ONLY

Disney Teetering At Critical Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First, it's not helping that the consumer discretionary sector is down more than 10% over the past three months. This sector weakness has manifested itself in a very weak three month performance in Walt Disney (DIS) shares, which have fallen more than 15%. Currently, DIS trades near a...

READ MORE

MEMBERS ONLY

Join Me And Greg Schnell, "The Canadian Technician" in 30 Minutes!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's been a last minute scheduling change and I'll be joining Greg Schnell for his weekly webinar "Commodities Countdown" at 5pm EST today. If you'd like to join our joint webinar, you can REGISTER HERE! It's FREE!

Enjoy the show...

READ MORE

MEMBERS ONLY

Big Rally In Energy Again Staves Off Bear Attack

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 3, 2016

This morning's article will be brief as I'll be traveling today.

Energy (XLE) and materials (XLB) rose 3.56% and 3.36%, respectively, to lead a rally from key price support on Wednesday. A more than 1.5% drop...

READ MORE

MEMBERS ONLY

Why Tuesday's Selloff Is So Bearish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note: I am returning at noon EST today for my "Trading Places LIVE" webinar. I'll be discussing several timely topics including the January Effect and the key technical failures that took place on Tuesday across many of our major sectors and industry groups. The webinar is...

READ MORE

MEMBERS ONLY

Transports Strengthen But Energy Stalls S&P 500 Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for February 1, 2016

Yesterday I posted a chart showing that both energy (XLE) and crude oil ($WTIC) were approaching key resistance and likely to retreat. Right on cue, the XLE was the worst performing sector yesterday, falling 1.67% despite a bifurcated market where our major indices...

READ MORE

MEMBERS ONLY

Why Friday's Rally Is Not Likely To Last

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 29, 2016

On the surface, it was a super day. All nine sectors finished at least 1% higher with technology jumping more than 3% to lead the action. 21 of 23 industry groups within consumer discretionary (XLY) rose. And every industry group in the other...

READ MORE

MEMBERS ONLY

Airlines Continue Bouncing Off Key Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Airlines Index ($DJUSAR) made a very significant breakout late in 2014 and after its peak in January 2015, the group has been doing everything possible to hold onto price support ever since. Despite a revenue and earnings miss by Delta Airlines (DAL) on Tuesday, January...

READ MORE

MEMBERS ONLY

Facebook, Internet Leads Market Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 29, 2016

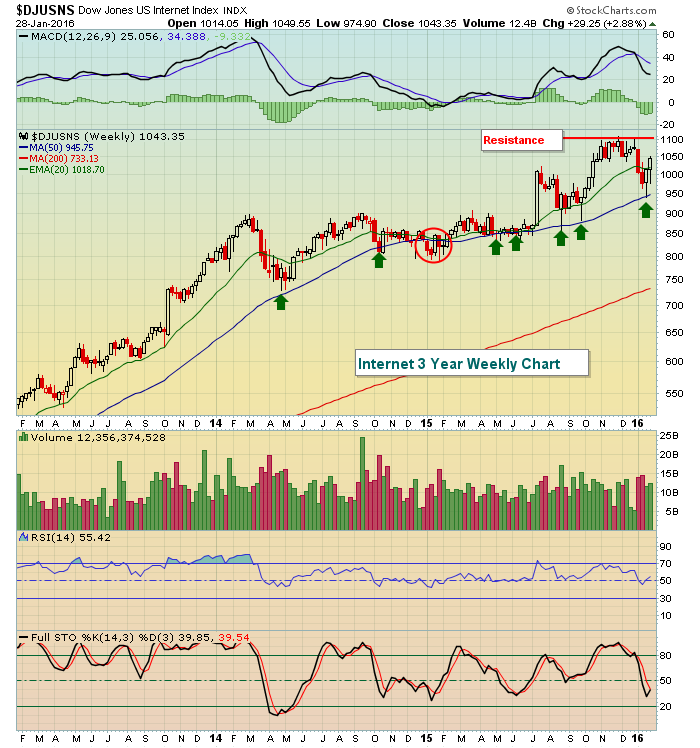

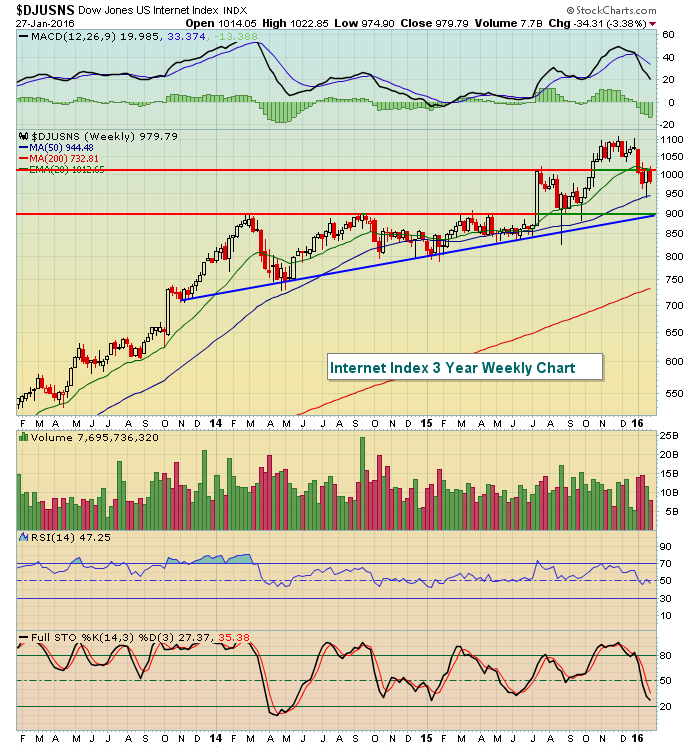

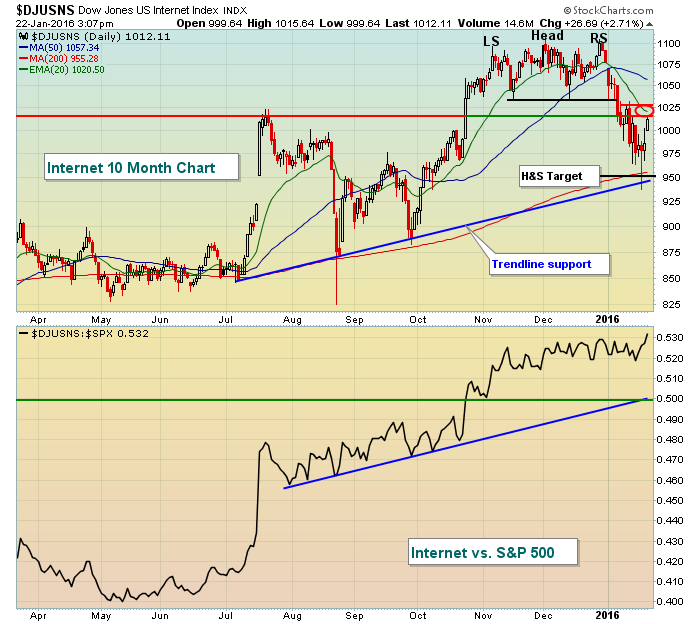

Facebook (FB) posted very strong quarterly earnings results after the closing bell on Wednesday and that propelled a huge rally in internet stocks ($DJUSNS). The timing couldn't have been better as the DJUSNS was testing its 50 week SMA in a...

READ MORE

MEMBERS ONLY

Fed, Poor Earnings Jolt U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 27, 2016

The volatility index ($VIX) was slowly working its way back to key support near 20 just before Wednesday's latest FOMC announcement, but that provided the fear mongers exactly what they were looking for as the VIX surged in the afternoon to...

READ MORE

MEMBERS ONLY

Futures Weak Ahead Of FOMC Announcement

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'll be very brief this morning as I'm traveling. I should be back tomorrow morning with my regular blog article.

Futures are looking a bit lower this morning as traders prepare for the FOMC announcement later this afternoon. Keep an eye on the reaction in the...

READ MORE

MEMBERS ONLY

Bank Relative Weakness Leads To More Downside

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 26, 2016

The afternoon action on Monday is so typical of a stock market environment where the Volatility Index ($VIX) is in the 20s or 30s. We seemed to be in a fairly narrow trading range from 1890 to 1910 on the S&P...

READ MORE

MEMBERS ONLY

2007 All Over Again? Beginning To Look Like It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

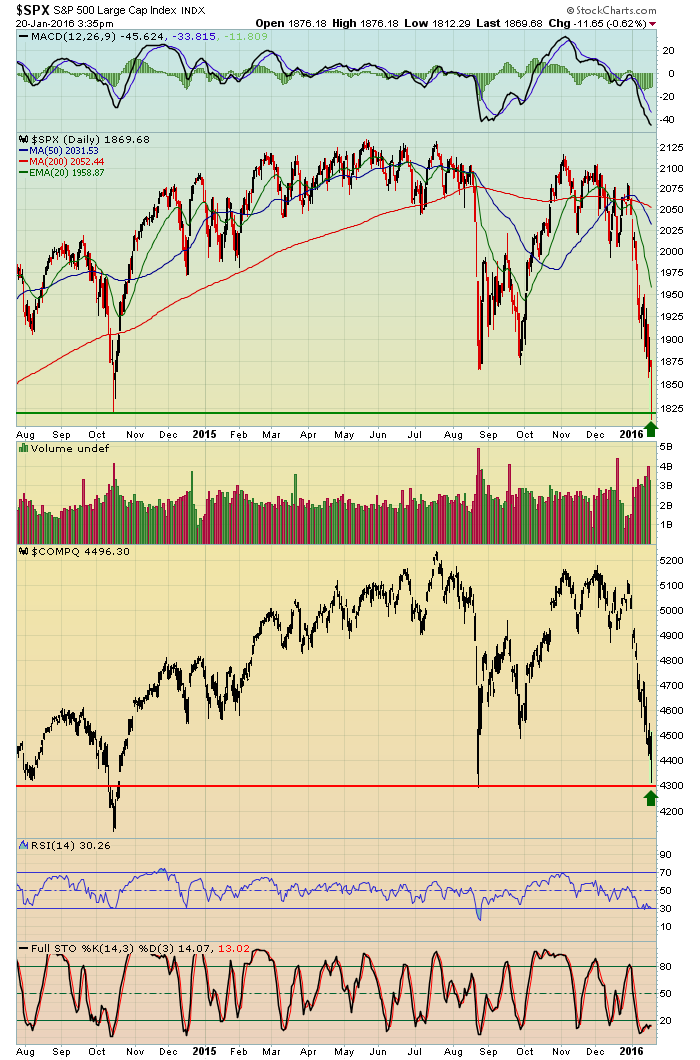

Market Recap for Friday, January 22, 2016

We are seeing an energy-driven rally for sure. On Friday alone, the XLE (ETF that tracks the energy sector) surged 4.42% and that came on the heels of a 3.11% advance on Thursday. While these gains are nice to see as...

READ MORE

MEMBERS ONLY

AmEx Earnings And Heavy Volume Sink Consumer Finance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Consumer finance ($DJUSSF) recently broke below key price support at 170 and did so on heavy confirming volume. To make matters worse a key component - American Express (AXP) - disappointed Wall Street after Thursday's close with its quarterly earnings report. Bottom line results beat consensus estimates, but...

READ MORE

MEMBERS ONLY

When Will Internet Stocks Lose Their Connection?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

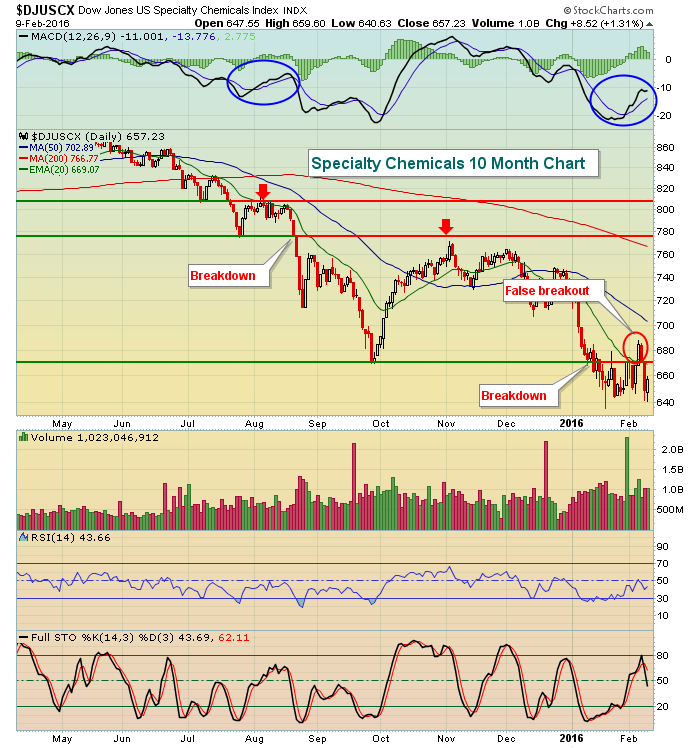

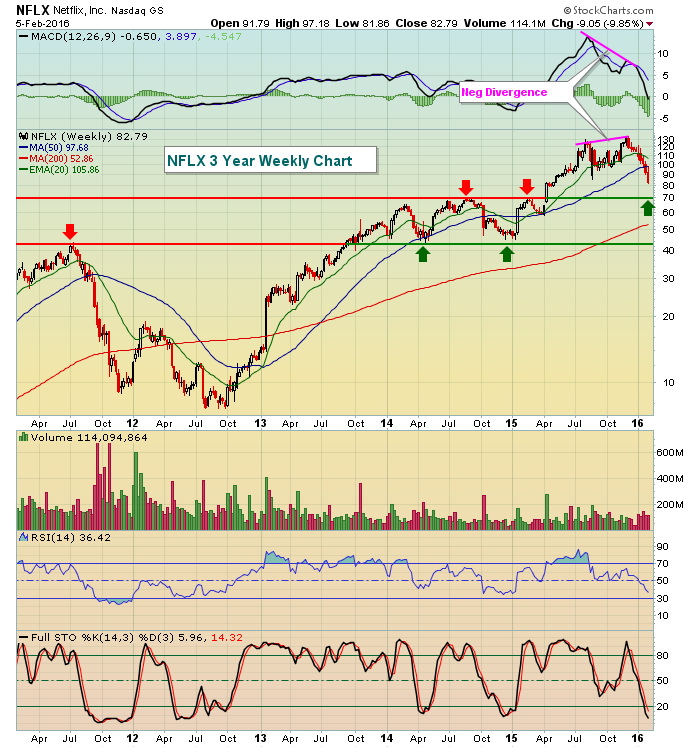

Much of the bull market was led higher by technology, particularly the Dow Jones U.S. Internet Index. So after the 2016 head & shoulders and long-term price breakdown, where might the current rally stall? The 1015-1025 range has proven in the past to be quite significant. Therefore, as prices...

READ MORE

MEMBERS ONLY

Futures Bright Green, How Long Will Rally Last?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 22, 2016

We saw some hesitation from small cap stocks ($RUT) to continue their relative surge from Wednesday, but other key aggressive areas of the market took over to provide hope of a continuing rally. First and foremost, however, the stock market gained relief from...

READ MORE

MEMBERS ONLY

Traders Making Bank Withdrawal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Banks ($DJUSBK) cannot catch a bid. Despite the market's attempt at a rally (finally!), no one appears to be intrigued by bank prospects. We saw an afternoon rally on Wednesday and it's being followed up with a decent rally today on the heels of European Central...

READ MORE

MEMBERS ONLY

Russell 2000 Reverses, ECB President Draghi Lifts Futures

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 20, 2016

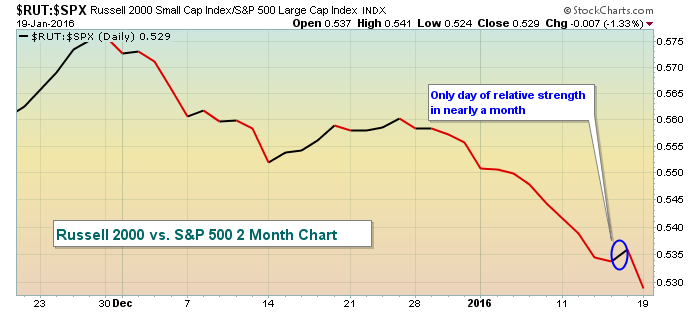

The U.S. stock market finally had a day where traders decided enough was enough and they scurried into aggressive parts of the market. Even the 228 point gain on the Dow Jones Thursday, January 14th wasn't as impressive under the...

READ MORE

MEMBERS ONLY

Rotation Turns Very Bullish This Afternoon

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

But will it last?

I'll be back in the morning with my normal blog article, but wanted to point out that major reversals are taking place this afternoon in terms of rotation. The 10 year treasury yield ($TNX) has reversed in a key support zone from 1.90%...

READ MORE

MEMBERS ONLY

Russell 2000 Sending Ominous Signal; Futures Again Under Pressure

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 19, 2016

Coming off the long holiday weekend, U.S. futures were poised to try to reverse the ugly behavior of equities thus far in 2016. And they did - for roughly 60 seconds. In just another awful performance for equities, the Russell 2000 once...

READ MORE

MEMBERS ONLY

S&P 500 Holds August Lows, Futures Soaring

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 15, 2016

After last Friday's rout to sustain the recent hemorrhaging of the U.S. stock market, one positive developed. The August low close of 1867.61 held. Friday's intraday low was 1857.83 so the bears had an opportunity to...

READ MORE

MEMBERS ONLY

Airlines Approaching Key Support Despite Low Crude Oil Prices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It would seem logical that falling crude oil prices ($WTIC) would help propel airlines ($DJUSAR) higher and rising crude oil prices would have the opposite effect. In the second half of 2014 and into early 2015, that was the case. The same scenario developed over the summer of 2015. More...

READ MORE