MEMBERS ONLY

Positive Divergence Suggests CA Likely To Resume Uptrend

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

CA Inc (CA) topped in March 2015 and was in the midst of an 8 month downtrend - until last week's action. Prior to the break of this downtrend and key 20 week EMA resistance, CA had printed a fresh weekly CLOSING low that was accompanied by a...

READ MORE

MEMBERS ONLY

ECB Falls Short Of Expectations, Global Markets Plunge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for December 3, 2015

The European Central Bank (ECB) announced additional measures to stimulate economic growth, but it clearly was not enough for traders who've grown accustomed to quantitative easing (QE) in all shapes and sizes. That, combined with a very disappointing ISM manufacturing report a...

READ MORE

MEMBERS ONLY

Adobe Losing Momentum One Week Before Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Negative divergences on the MACD and light volume on breakouts are two important criteria in identifying a possible top. Accumulation requires volume so I'm always suspicious if advances begin to run out of it. In the case of Adobe Systems (ADBE), it has these markers in place just...

READ MORE

MEMBERS ONLY

Energy Tumbles, S&P 500 Faces Key Test

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 2, 2015

Wednesday was a very difficult day for energy stocks (XLE) as this sector fell more than 3%, its worst day since the heavy August selling. The culprit is what you would expect - falling crude oil prices ($WTIC). The WTIC finished just above...

READ MORE

MEMBERS ONLY

Is The Fed Really Going To Raise Rates?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 1, 2015

Equity markets enjoyed a very strong Tuesday, although it wasn't all good news. Money flowed into treasuries on a relative basis and this represents defensive action. It also occurred at a fairly critical short-term support area (20 day EMA) on the...

READ MORE

MEMBERS ONLY

Healthcare, Consumer Stocks Drive Market Lower

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for November 30, 2015

All of our major indices finished lower on Monday's session, but there was plenty of sector rotation. Despite the overall losses, four of the nine sectors managed to finish higher, led by energy (XLE), materials (XLB) and utilities (XLU). Technology (XLK) also...

READ MORE

MEMBERS ONLY

Bullish Continuation Patterns Emerge; Stocks Poised To Move Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

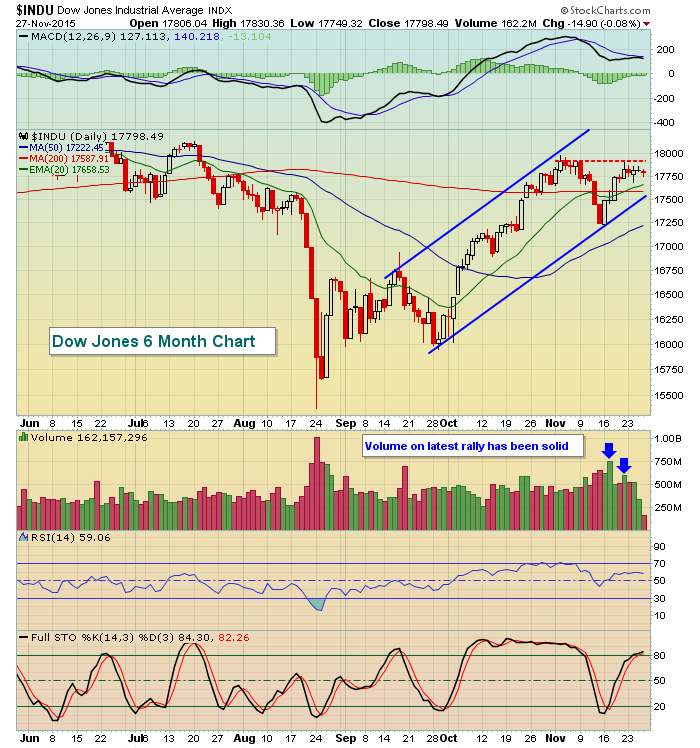

Market Recap for Friday, November 27, 2015

Action was solid on Friday, although a bit bifurcated. The Dow Jones was the only major index to finish in negative territory as this index of behemoth blue chip companies tries to negotiate short-term resistance from 17800-18000. Check out the visual:

The Dow...

READ MORE

MEMBERS ONLY

Understanding What Works For You

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The first thing to investing or trading smarter is understanding your own personal strategy - what works best for you. Are you a short-term trader? Do you swing trade? Do you prefer longer-term holding periods? Without understanding that basic personal trait, deciding whether to buy or sell becomes a very...

READ MORE

MEMBERS ONLY

What To Expect From Friday After Thanksgiving

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 25

Healthcare (XLV) and consumer discretionary (XLY) were the two best performing sectors on Wednesday, leading the U.S. stock market to gains in most of our major indices. The S&P 500 saw a late selloff take that index to a loss of...

READ MORE

MEMBERS ONLY

Classic Ascending Triangle Breakout On This Software Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Imperva Inc (IMPV) made a steady move higher from April through July before consolidating in a very bullish ascending triangle continuation pattern over the past four months. On Tuesday, volume accelerated and triangle resistance near 74.00 was cleared as IMPV extends its prior uptrend. The measurement of this pattern...

READ MORE

MEMBERS ONLY

Weak Start Tuesday, Bulls Roar Back

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 24, 2015

Apparently, the U.S. stock market's shock absorbers are working just fine. After being dealt multiple blows in the early pre-market action - (1) weak European indices, (2) a list of poor quarterly results from the retail space and (3) a...

READ MORE

MEMBERS ONLY

Consolidation Continues As Market Looks For Direction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

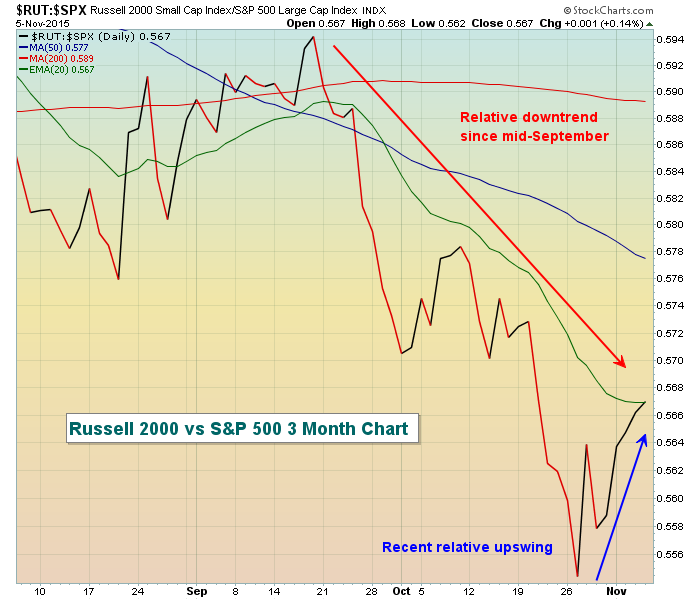

Market Recap for Monday, November 23, 2015

The Russell 2000 was clearly the big winner on Monday as this small cap index rose .44% on a day when the Dow Jones, S&P 500 and NASDAQ all had fractional losses. The NASDAQ 100 ($NDX) fell .25% to perhaps paint...

READ MORE

MEMBERS ONLY

Consumer Discretionary Leads Friday Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 20, 2015

Consumer discretionary stocks (XLY) led six sectors higher on Friday. The only three that did not participate were energy (XLE), materials (XLB) and consumer staples (XLP). Crude oil ($WTIC) reversed on Friday and finished near its low of the session, just above $41...

READ MORE

MEMBERS ONLY

Intel Prints Shooting Star Candle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After gapping up off its recent uptrend, the buying continued on Intel (INTC) intraday on Friday as it surged to a high of 35.29. By day's end, however, INTC closed at 34.66 - EXACTLY where it closed on its recent high on October 23rd. Volume was...

READ MORE

MEMBERS ONLY

Four Reasons The Market Is Heading Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On the surface, the rout that took place in August has been completely reversed and, three months later, it's like nothing ever happened, right? Wrong. What has happened is that the S&P 500 rose from August 19th's close of 2079.61 to Thursday, November...

READ MORE

MEMBERS ONLY

Treasury Yields And Utilities Reach Important Juncture

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 19, 2015

The U.S. stock market was bifurcated on Thursday with the NASDAQ 100 able to eke out small gains while the others were fractionally lower. Utilities were easily the sector performance leader, but it's been a rough few weeks for the...

READ MORE

MEMBERS ONLY

DHI Threatens Breakout; Home Construction At 2 Month High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Home Construction index ($DJUSHB) hit its highest level in two months this morning and a close above 600 would likely signal more strength to come. DR Horton (DHI) and NVR, Inc (NVR) represent two of the strongest stocks in the group technically and are both...

READ MORE

MEMBERS ONLY

U.S. Indices Soar; One Group Poised To Ignite Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 18, 2015

There was strength everywhere on Wednesday. All nine sectors were higher and utilities represented the only sector that was not higher by at least 1%. Healthcare (XLV) rallied 1.95% while materials (XLB) and financials (XLY) both rose by an identical 1.78%...

READ MORE

MEMBERS ONLY

Dollar Climbs To 7 Month High; Gold Mining Shares Tank

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 17, 2015

The U.S. dollar index ($USD) neared 100 for the first time since the second week of April and that sent shock waves throughout commodities once again. Gold, in particular, was hit very hard as GLD broke to fresh lows beneath four month...

READ MORE

MEMBERS ONLY

Specialty Retailers Reset Weekly MACD, Aid Bounce

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 16, 2015

All nine sectors moved higher on Monday and the wide participation was evident in the 1%+ gains across the board. Leadership in energy (XLE) was clear with that sector's 3.33% advance off key support near 66.00. This level was...

READ MORE

MEMBERS ONLY

VIX Breakout Provides Opportunity For Bears

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 13, 2015

Retailers were slammed on Friday after October retail sales came up short of expectations. Retail sales for the month gained 0.1% while expectations were for a much stronger 0.3% rise. Excluding autos, retail sales rose 0.2%, one half of the...

READ MORE

MEMBERS ONLY

DKS Sports A Test Of Long-Term Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Retailers were rocked on Friday with the five worst performing industry groups all in the retail space. The S&P Retail index (XRT) dropped nearly 4% on Friday and more than 8% last week. Many of the retail industry groups and stocks within those groups are at or challenging...

READ MORE

MEMBERS ONLY

Bears Inflict Short-Term Technical Damage; VIX Nears Key Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 12, 2015

Over the past 5-6 trading sessions, the selling was fairly contained and appeared to be nothing more than normal profit taking after a lengthy advance from the depths of the late September lows. That changed yesterday. I'm not writing off the...

READ MORE

MEMBERS ONLY

XLE Negative Divergence Plays Out As Price Support Tested

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Prior to this week, energy had seen its strongest rebound since topping in June 2014. But a long-term negative divergence and slowing volume suggested the rally was long in the tooth. After hitting nearly 72.00, the XLE has retreated and the energy bulls will now be tested. During an...

READ MORE

MEMBERS ONLY

Wednesday's Roller Coaster Ride Gone Bad

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 11, 2015

Wednesday wasn't a horrible day, but the back and forth action ended with a "back" as our major indices finished on or near their lows for the session. Mid-day it was much more promising than that as early losses...

READ MORE

MEMBERS ONLY

Bears Stifled At Support; Market Ends Bifurcated

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 10, 2015

Technology and materials shares held back the market on Tuesday. These sectors were down .66% and .73%, respectively. Industrials were flat, while the remaining six sectors finished higher on the session. CreditSuisse lowered its earnings estimates for Apple (AAPL) and Seabreeze Partners Management...

READ MORE

MEMBERS ONLY

Has The Rally Ended.....Or Just Begun?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 9, 2015

Monday represented the worst one day performance for U.S. stocks since the late September low printed. 8 of 9 sectors were lower, led by consumer discretionary (XLY) and financials (XLF). The only sector spared was the defensive utilities (XLU) group, which simply...

READ MORE

MEMBERS ONLY

Bullish Period Ends Without Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 6, 2015

We didn't make any major breakouts on Friday, but after initial weakness we did see the aggressive indices - NASDAQ and Russell 2000 - close nicely. In addition, the exceptionally strong October jobs report sent financial stocks soaring, especially banks ($DJUSBK)...

READ MORE

MEMBERS ONLY

Bullish Cup With Handle Breakout on Semi Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Semiconductors have been one of the hottest areas of the market off the August low and especially during the month of October. That's created a number of trading opportunities in the space. I would consider Microsemi Corp to be one of those opportunities now based on its cup...

READ MORE

MEMBERS ONLY

Banks Rise On Surge In Yields

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The employment report showed that 271,000 jobs were added in October, above even the highest estimate and that sent traders flocking out of treasuries. But what was bad news for treasuries was great news for banks. Higher treasury yields generally lead to higher net interest margins for banks. Technically,...

READ MORE

MEMBERS ONLY

Jobs SURGE Higher In October

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 5, 2015

Utilities and energy were the laggards on Thursday, which wasn't bad action considering the recent strength we've had. In other words, our aggressive sectors managed to perform well on a relative basis. Also, the small cap Russell 2000 index...

READ MORE

MEMBERS ONLY

This Signal Is Bullish And Rarely Fails

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

No signal is perfect, but the relative performance of consumer stocks is one to watch. The reason is simple. When consumer discretionary stocks (XLY) outperform their consumer staples counterparts (XLP), a bet is being made by market participants that our economy is strong or appears to be strengthening. Keep in...

READ MORE

MEMBERS ONLY

Internet Stocks Remain Hot; Facebook (FB) Delivers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 4, 2015

Wednesday represented a day of consolidation as only two sectors were able to close higher - utilities and technology - and the latter was barely higher. The other 7 sectors finished down in a session of profit taking. While utilities (XLU) rose, they...

READ MORE

MEMBERS ONLY

Energy Ignites Rally With H&S Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 3, 2015

Energy (XLE) surged 2.56% on Tuesday, fueling yet another market rally to spur the S&P 500 to 2110, just 1% beneath its all-time closing high of 2130.82 set on May 21, 2015. Since setting reverse right shoulder support at...

READ MORE

MEMBERS ONLY

S&P 500 Reclaims 2100; All-Time Highs Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 2, 2015

The action on Monday was mostly positive, especially as we look at the performance of our major indices. All were higher and relative strength was seen by the more aggressive Russell 2000 and NASDAQ. That's always a good thing. Energy and...

READ MORE

MEMBERS ONLY

Don't Lose Sight Of The Long-Term Prize

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 30, 2015

It was a lacklaster day for equities until a late day selling binge. U.S. treasuries were bought on Friday after a couple weeks of selling and that sent yields slightly lower and weighed on the financial sector, banks ($DJUSBK) in particular. Technically,...

READ MORE

MEMBERS ONLY

Reverse Head & Shoulders Pattern Worth A Gamble?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Gambling stocks ($DJUSCA) have been BY FAR the worst performing industry group within the consumer discretionary sector over the past year, dropping 27.72%. There are only two other industry groups in this sector in negative territory - clothing & accessories ($DJUSCF) and recreational products ($DJUSRP) which have fallen 8....

READ MORE

MEMBERS ONLY

Is This Rally A Trick Or A Treat?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 29, 2015

All of our major indices saw selling on Thursday, although losses on the Dow Jones and S&P 500 were relatively minor, with the latter losing less than one point. Action was contained in a fairly tight range with energy (XLE) and...

READ MORE

MEMBERS ONLY

GoPro (GPRO) - When The MACD Doesn't Work

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

GPRO reported revenues and earnings that fell short of expectations after the bell last night and the reaction was about as you might expect - down 17% on the open. It's since recovered and is attempting to print a significant red hollow candle on massive volume. As a...

READ MORE

MEMBERS ONLY

Reaction To Fed Paints Very Bullish Picture

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 28, 2015

One of the most bullish historical periods of the year got off to a bullish start with the help of the Fed. But if you've been following the U.S. stock market for a few years, that was nothing new. The...

READ MORE