MEMBERS ONLY

4 Stocks That May Be Bottoming

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've been in a six year bull market where most stocks have been trending higher. But not every industry group and stock follows the primary trend higher. In fact, catching a falling stock just as it hits rock bottom can provide a big lift to your portfolio. So...

READ MORE

MEMBERS ONLY

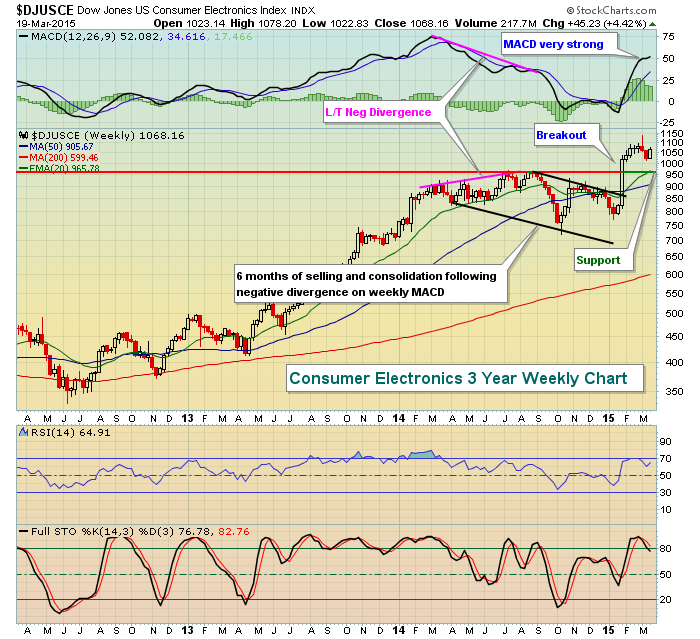

Consumer Electronics Need A Wake Up Call

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past month, the Consumer Electronics Index ($DJUSCE) has fallen close to 9%, which ranks it as the third worst performing industry group. Only gambling stocks (-12.64%) and business training & employment agencies (-15.68%) - two consumer discretionary industry groups - have performed worse. Normally, I tend...

READ MORE

MEMBERS ONLY

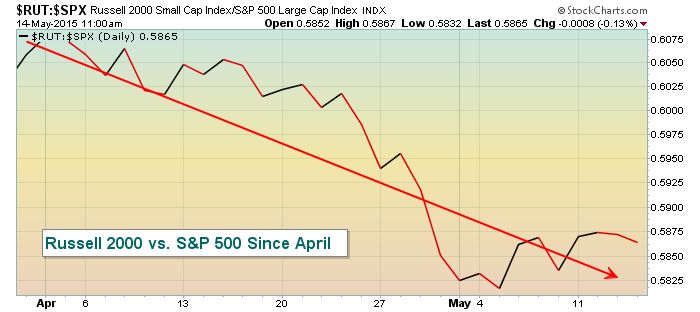

Russell 2000 Relative Performance Suggests Caution

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

During my webinar yesterday, I indicated that I'd take a look at the Russell 2000 ($RUT) and its lagging performance, but then I was sidetracked by other charts and questions. So I'll take an opportunity here in my blog to provide you those Russell 2000 comments....

READ MORE

MEMBERS ONLY

5 Easy Steps to Trading Smarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The best stock traders on the planet share one common ingredient. They manage risk. Managing risk can mean lots of things. You can manage risk by trading Exchange Traded Funds (ETFs) instead of individual stocks. This will help to eliminate, or significantly reduce, specific stock risk. If you don'...

READ MORE

MEMBERS ONLY

How Do Stock Market Tops Form? Part 7 (Final)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This is a series of articles designed to remind each of us the keys to identifying the many potential warning signs that create stock market tops. If you're just tuning in, you can CLICK HERE for Part 1 that begins the series. Enjoy!

This is the final part...

READ MORE

MEMBERS ONLY

How Do Stock Market Tops Form? Part 6

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This is a series of articles designed to remind each of us the keys to identifying the many potential warning signs that create stock market tops. If you're just tuning in, you can CLICK HERE for Part 1 that begins the series. Enjoy!

Today, I want to delve...

READ MORE

MEMBERS ONLY

Place Your Wagers Please

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's Kentucky Derby Day so of course! Oops, wrong blog! :-)

We know that the stock market goes through periods of consolidation and rotation. Groups that lead for a period of time eventually fall out of favor as new groups emerge as leaders. Then we rinse and repeat....

READ MORE

MEMBERS ONLY

How Do Stock Market Tops Form? Part 5

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Today marks two months for me here at StockCharts.com and I just want to thank everyone for your kind words and especially for all of the technical feedback. Your comments are very important to me so please keep them coming. Writing and teaching about the stock market is what...

READ MORE

MEMBERS ONLY

California Amplifier (CAMP) Retests Key Support Zone

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A little more than a week ago, CAMP broke trendline resistance after posting better than expected earnings results. CAMP's top line was $69.2 mil (actual) vs. $68.0 (estimate), while its bottom line also beat Wall Street estimates, $.29 vs. $.25. The breakout occurred on huge volume...

READ MORE

MEMBERS ONLY

How Do Stock Market Tops Form? Part 4

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've discussed price action (duh!), the relative performance of aggressive sectors and defensive sectors vs. the benchmark S&P 500 and the relationship between consumer discretionary (cyclical) stocks and its consumer staples counterparts in prior articles and how they impact the future behavior of stock prices. This...

READ MORE

MEMBERS ONLY

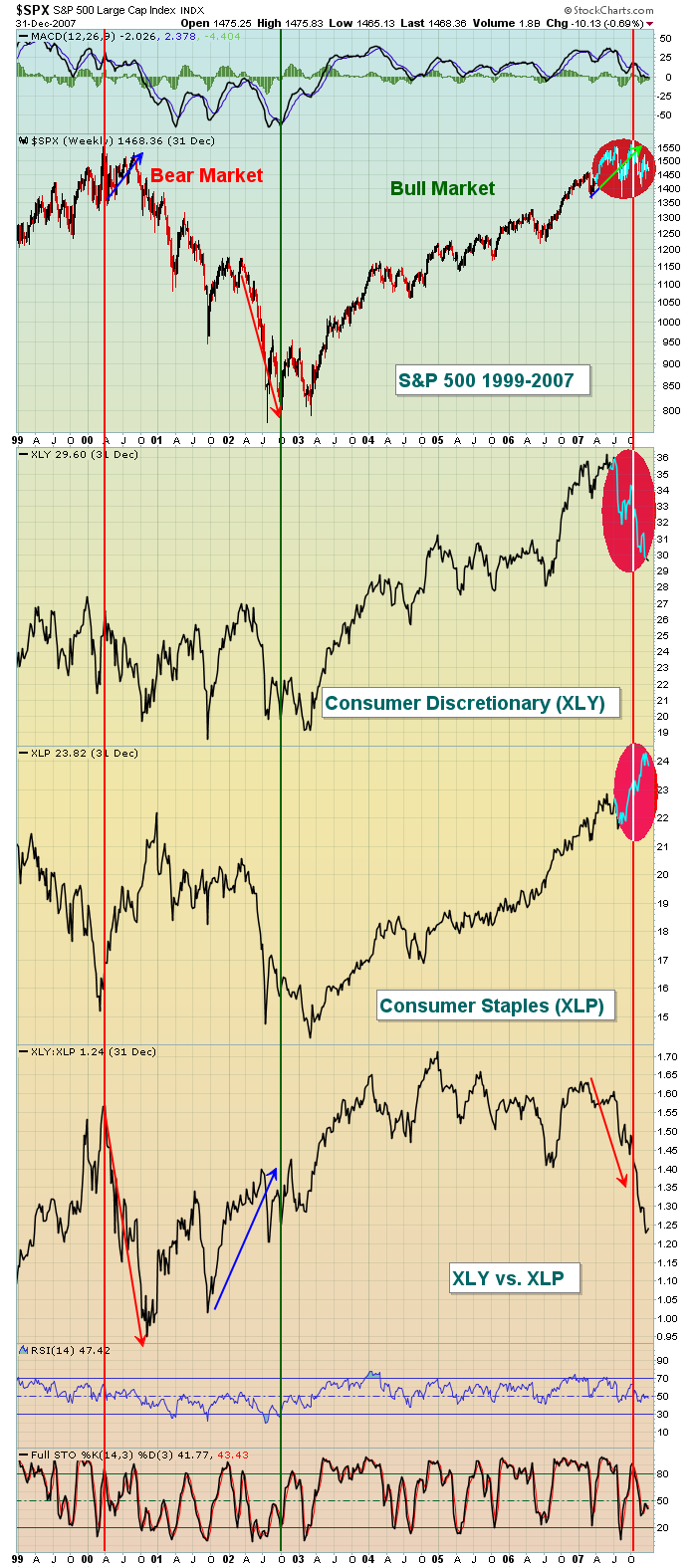

How Do Stock Market Tops Form? Part 3

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When evaluating the stock market for a potential top, there's another intermarket relationship that seems to provide us a nice clue. So without further hesitation, let me move on to my third area of the stock market to watch:

3. WHICH GROUP OF CONSUMER STOCKS IS LEADING?

There&...

READ MORE

MEMBERS ONLY

How Do Stock Market Tops Form? Part 2

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On Wednesday, I began a series of blog articles that is designed to evaluate the health of the stock market. In other words, what should we be looking for in determining whether we should leave our retirement and taxable accounts at risk? Wednesday's blog was the first, and...

READ MORE

MEMBERS ONLY

Home Construction iShares (ITB) Hit Critical Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At 10am EST this morning, March new home sales were released and they fell well short of expectations. Is that a long-term problem for home construction ($DJUSHB) or is it an opportunity for traders to move into this area of the market at lower prices? Well, you'll have...

READ MORE

MEMBERS ONLY

How Do Stock Market Tops Form? Part 1

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wow, this is a loaded question and it will take a few articles to try to address it. For every bear market, we seem to have a different reason. Since the turn of the century, we've seen two significant bear markets - one that gripped the market from...

READ MORE

MEMBERS ONLY

Utilities Running Out Of Power?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Perhaps one of the biggest mistakes we make is to misinterpret normal stock market rotation as a predecessor to a bear market. During a bull market, money rotates from sector to sector, from industry group to industry group and from stock to stock. Of course there are outperformers throughout a...

READ MORE

MEMBERS ONLY

Are Banks Topping or Pausing Before Next Rally?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know looking at one industry group is taking a very small sample of the entire stock market, but throughout much of history the stock market has performed strongest when financial stocks, especially banks, at least go along for the ride. Let me show you a long-term chart of the...

READ MORE

MEMBERS ONLY

Using the SCTR Rankings To Boost Your Trading Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

From a technical perspective, the StockCharts Technical Rank (SCTR) makes a TON of sense. It's a very quick way to see how a stock is performing relative to its peers (ie, large cap, mid cap, small cap). These rankings are based on technical scores developed by John Murphy...

READ MORE

MEMBERS ONLY

Netflix (NFLX) Impresses With Blowout Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After the close on Wednesday, Netflix (NFLX) topped revenue and earnings expectations and promptly rose to all-time highs. NFLX had been consolidating in bullish sideways fashion for over one year following its prior uptrend. Volume today is extremely heavy suggesting accumulation and, in my opinion, likely higher prices ahead. The...

READ MORE

MEMBERS ONLY

Smith & Wesson (SWHC) Fires Back At Its Naysayers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Better than expected earnings and technical price action follow through is perhaps my favorite combination when trading a stock. My background in public accounting leaves a warm place in my heart for management teams that execute on their business plan and are able to surprise Wall Street to the upside....

READ MORE

MEMBERS ONLY

Small Caps Print Bearish Shooting Star Doji

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On Monday, the Russell 2000 ($RUT) was breaking out to an all-time high intraday. Unfortunately, it wasn't confirmed on the close as this benchmark of small cap stocks reversed late in the day. It not only left a bearish tail to the upside and closed at its open...

READ MORE

MEMBERS ONLY

Tax Time Selling: Fact or Fiction?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Most everyone knows that Uncle Sam is waiting anxiously for April 15th to arrive. Don't look now, but it's almost here! Even if you decide to extend the filing date for your tax return, any balance due must be paid now. The payment generally cannot be...

READ MORE

MEMBERS ONLY

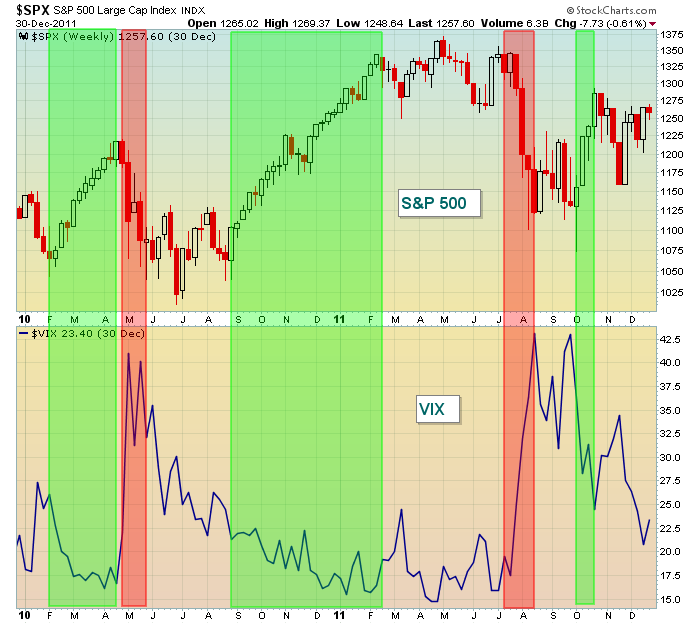

Rising VIX Could Spell Trouble Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The volatility index ($VIX) charts the implied volatility of S&P 500 index options. It's a sentiment indicator that measures the stock market's expectation of volatility over the next 30 day period. I could spend time talking about square roots, variance swaps and standard deviations,...

READ MORE

MEMBERS ONLY

SouFun Holdings (SFUN) Soaring With China Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

SFUN serves as a real estate internet portal in the Peoples Republic of China and is rallying strongly today on the heels of overall strength in most Chinese shares. Technically, the downtrend in SFUN has been reversed on a series of positive technical developments. First, SFUN had been in a...

READ MORE

MEMBERS ONLY

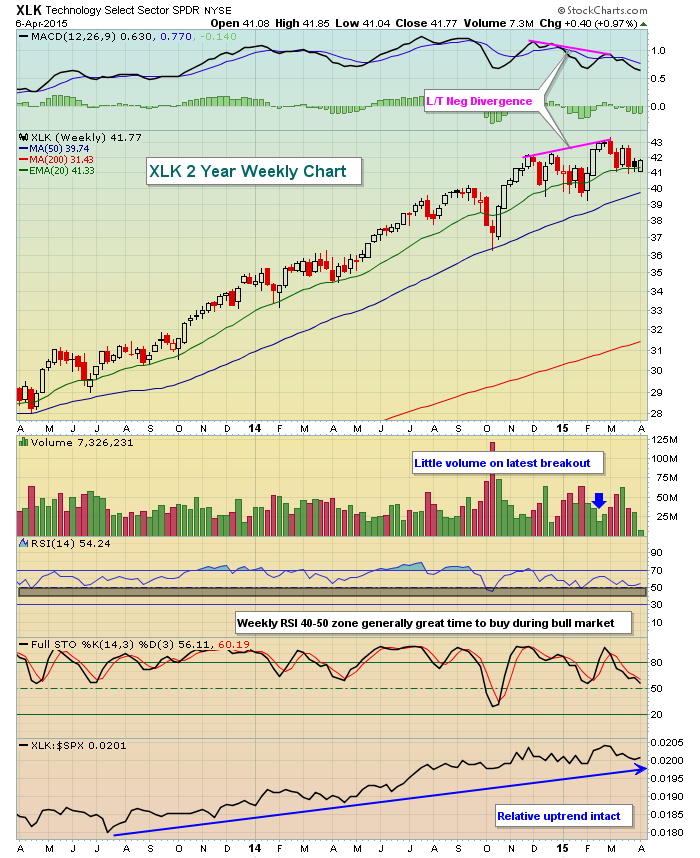

Semiconductors: Consolidating or Reversing?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technology stocks have been lagging throughout 2015. One of the primary reasons for their uninspiring performance has been the underwhelming action in the Dow Jones US Semiconductor Index ($DJUSSC). Before we delve into the semiconductors, let's see what technology as a whole is facing - take a look...

READ MORE

MEMBERS ONLY

Weakening Dollar Providing Short-Term Opportunity In Oil

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

FMC Technologies (FTI) provides technology solutions for the energy sector. Much of the energy space has struggled for the last several months for a number of reasons, one of which has been the higher dollar. The rising greenback has provided a headwind for energy companies, but with the suddenly weak...

READ MORE

MEMBERS ONLY

Negative Divergence Hampers Electrical Components & Equipment Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Two months ago, there weren't many better looking industry groups than the Dow Jones US Electrical Components & Equipment Index ($DJUSEC). The breakout above price resistance was clear, but after a continuing advance of another 10% into mid-March, the DJUSEC ran into technical issues. Take a look at...

READ MORE

MEMBERS ONLY

Buying Is Easy, When Should I Sell? Part 4 (Final)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Generally, I review my trading positions on a stock by stock basis. If I've hit my target on one, I try to be disciplined and take the profits - or at the very least partial profits. If my stop loss has been triggered, it's time to...

READ MORE

MEMBERS ONLY

Buying Is Easy, When Should I Sell? Part 3

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I discussed how using the MACD in concert with price/volume can be instrumental in making a high probability exit in Parts 1 and 2. Today, I want to focus on candlesticks. I'm a fan of Steve Nison's and have read his books on candlesticks. The...

READ MORE

MEMBERS ONLY

Buying Is Easy, When Should I Sell? Part 2

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's continue the discussion from yesterday. Broadcom (BRCM) had fallen back in late January to test both price and multiple gap supports, with an intraday move beneath both that suggested we could be witnessing a breakdown. By the close, however, BRCM printed a very bullish reversing candlestick (hammer)...

READ MORE

MEMBERS ONLY

Buying Is Easy, When Should I Sell? Part 1

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading successfully certainly requires a ton of patience and discipline. Emotions run high when it comes to your money and the prospects of losing it. Panicked selling is the easiest kind because you simply can't take the pain any longer. The best way to rid yourself of the...

READ MORE

MEMBERS ONLY

Colfax (CFX) Bottoming in Reverse Head & Shoulders Fashion?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Industrial machinery ($DJUSFE) stocks have been consolidating in what some technicians might argue is a bullish inverse head & shoulders pattern. If the group does eventually see money rotate back into it, Colfax Corp (CFX) could be a direct beneficiary. CFX lost 40% of its market capitalization in the second...

READ MORE

MEMBERS ONLY

Can You Time The Stock Market?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Well, I suppose it depends on your view and what you believe in. For me, there's no question about it. The stock market can be timed as history repeats itself over and over and over again. The stock market timing that I'm talking about, though, isn&...

READ MORE

MEMBERS ONLY

Lexmark (LXK) Challenges Wedge Resistance On Increasing Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Lexmark (LXK) announced after the closing bell on Tuesday that it was acquiring enterprise software company Kofax (KFX) for $1 billion, its largest acquisition in its history. Traders were initially excited by the announcement, driving LXK's stock price higher by more than 11% and LXK cleared bullish wedge...

READ MORE

MEMBERS ONLY

Flying High With Aerospace ($DJUSAS) and United Technologies (UTX)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The aerospace industry ($DJUSAS) is a component of the industrial sector (XLI). Industrials have been a key driver of the S&P 500 since the turn of the century. There's a clear relative uptrend channel in play that was broken temporarily in 2009 as the 2007-2009 bear...

READ MORE

MEMBERS ONLY

Interface (TILE) Floors It, Approaches Major Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

TILE is an industrial goods company that designs, produces and sells modular carpet products internationally. Strong quarterly results reported in February, exceeding Wall Street estimates, has sent TILE's shares surging 27% higher in just the past month. Major overhead price resistance is approaching, however, so it will be...

READ MORE

MEMBERS ONLY

Aggressive Small Cap Indices Break Out Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Both the Russell 2000 Index ($RUT) and S&P 600 Small Cap Index (SML) broke out to all-time highs last week as money continued to rotate towards aggressive small cap stocks and that should be seen as a bullish sign for equities. In the case of the $RUT, a...

READ MORE

MEMBERS ONLY

Dissecting The Technology Sector

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technology has outperformed every other sector over the past year - except for healthcare. So it begs the question - is there any more gas left in the technology tank? We've seen money rotate to various sectors throughout the past year. Most of the industry groups within technology...

READ MORE

MEMBERS ONLY

Many "Under The Surface" Technical Signals Strong

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not ready to give up on this bull market. While anything is certainly possible, traders are not positioning themselves for a steep market decline. Perhaps we'll see a bit of selling, maybe even a correction, but the longer-term bull market still remains intact in my...

READ MORE

MEMBERS ONLY

Crane (CR) Confirms "W" Bottom, Testing Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Crane (CR) is a part of the Industrial Machinery ($DJUSFE) space, which has been consolidating since last summer and is poised to break out once again. CR printed a "W" bottom in December and January, with this bottom confirmed with the high volume gap up and breakout in...

READ MORE

MEMBERS ONLY

Home Construction ($DJUSHB) Tests Triangle Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

March has been a little rough for the stock market thus far, but there are a few areas where the pullback has represented welcome relief. Home construction ($DJUSHB) is one of those areas. Cyclical stocks, of which home construction is a part, seemed to take a much needed breather in...

READ MORE