MEMBERS ONLY

Are You Prepared For A Major Bottom? This Is It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I tend to be very optimistic in my view of the U.S. stock market. I think for good reason, by the way, as 54 of the last 72 years have resulted in U.S. stocks gaining ground. That means only 25% of calendar years since 1950 have resulted in...

READ MORE

MEMBERS ONLY

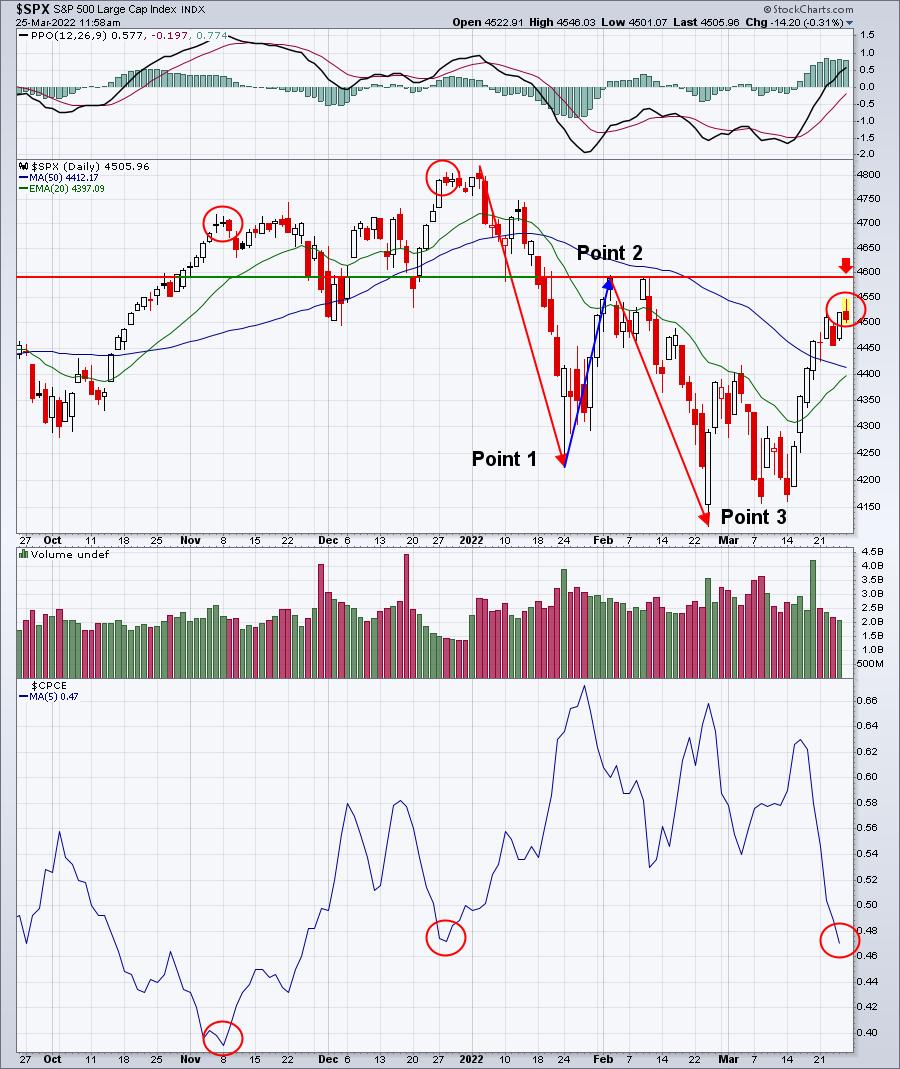

Sentiment Is Playing Out Beautifully; THE Bottom Could Print At Any Time

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At the beginning of 2022, I suggested that one of the biggest issues needing to be resolved was sentiment. The S&P 500 had climbed too far too fast and so many new traders post-pandemic didn't understand what might happen during a cyclical bear market. We honestly...

READ MORE

MEMBERS ONLY

Do Your Homework and Get Better Grades Trading PLUS 3 Trade Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remember many years ago, I was fascinated by the fast-moving, low-dollar stocks. It just seemed like easy money. Let me give you one piece of advice. When you think something is "easy money", run for the hills. To give you a business analogy, those volatile low-dollar stocks...

READ MORE

MEMBERS ONLY

The 2 Most Surprising Charts RIGHT NOW

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I don't think I could possibly write an article like this one without acknowledging the simply amazing 2022 performance of "Big Blue", International Business Machines (IBM). First, I want to tell it like it is. IBM has been one of the worst performing Dow components over...

READ MORE

MEMBERS ONLY

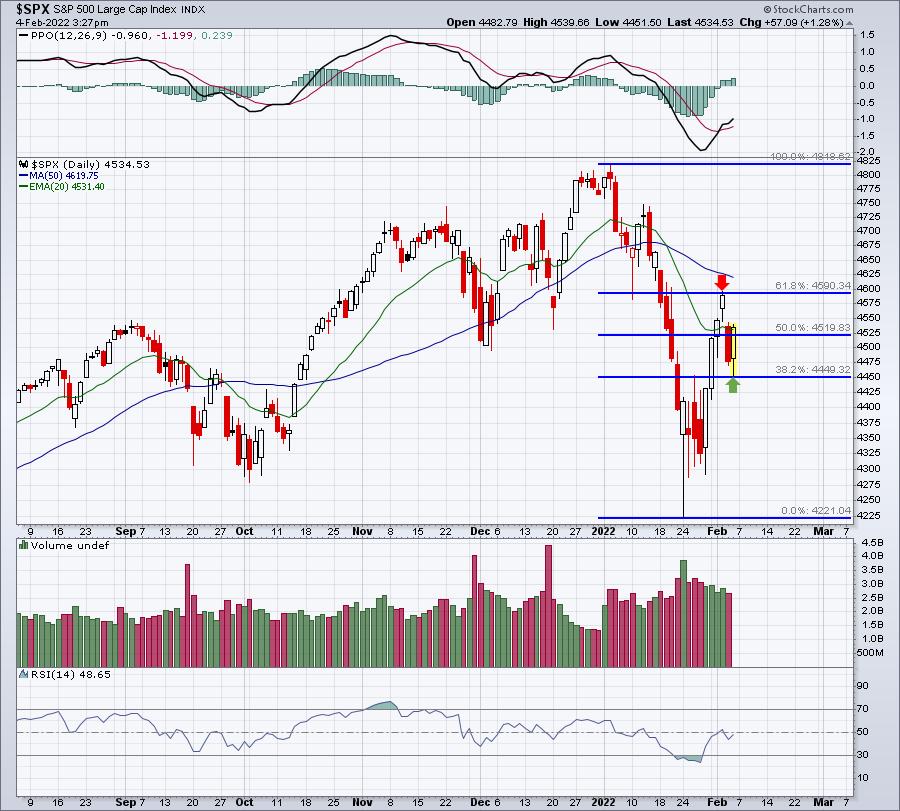

There's A Lot To Like About This Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Hands down, this is the best day of 2022. There have been better days in terms of percentage performance, but considering the negative economic news this morning, it's quite noteworthy that money is rotating into aggressive sectors at the expense of defensive sectors.

At our MarketVision 2022 event...

READ MORE

MEMBERS ONLY

Knowing Historical Tendencies Will Make You A Much More Successful Trader

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I began studying stock market behavior back in the 1980s. It started as a result of my practicing CPA days. While auditing clients, I realized that most of my clients had consistent payroll dates that were generally the beginning and middle of the month. That's a lot of...

READ MORE

MEMBERS ONLY

The Brutal Summer Ahead Will Favor Health Care

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been warning all year about this cyclical bear market and, unfortunately, it's not over just yet. Sentiment is turning more and more bearish, which is good, but we haven't seen the peak to mark the market bottom. That will take time and patience....

READ MORE

MEMBERS ONLY

This is NOT a Long-Term Bear Market - Improving Signs Are Underway

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Everyone is entitled to their own opinion and mine is that the issues we've experienced in the first half of 2022 will be mitigated in the second half. Until 2022, many of you I'm sure viewed me as a perma-bull. I've always said that...

READ MORE

MEMBERS ONLY

It's Not You, It's Me

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If only growth stocks could talk.

You've probably heard of the "it's not you, it's me" breakup excuse. Maybe you've had to endure it. Well, in the land of stock market trading, I believe it's a quite valid...

READ MORE

MEMBERS ONLY

There's 1 Missing Ingredient for a Market Bottom, and It's The Scariest One of All

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As we closed out 2021, I began discussing sentiment and its need for a "reset." We had moved higher for the better part of two years, and the U.S. stock market had picked up a lot of new "post-pandemic" investors and traders. Unfortunately for this...

READ MORE

MEMBERS ONLY

Predicting Earnings Reports Is As Simple As Analyzing One Key Indicator

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let me start off by saying that nothing is a guarantee. In technical analysis, we don't work in guarantees. We work in probabilities. As I approach earnings season, I like to separate companies into 3 baskets:

1. The strong

2. The weak

3. The I don't...

READ MORE

MEMBERS ONLY

The Last 3 Selloffs Have This One Common Ingredient

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In addition to my non-stop writing in 2022 about the bearish market environment and why I believe we're going lower, I've also provided EarningsBeats.com members with some valuable historical information.

Here was an excerpt from last Monday's Daily Market Report (DMR) to our...

READ MORE

MEMBERS ONLY

Bearish Signals Accelerate As Dow Jones Drops 1000 Points on Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ok, I was being a bit dramatic. The Dow Jones Industrial Average only dropped 981 points on Friday, not 1000. But it was another reminder that this bear market has not ended. In fact, I believe the short-term signals are pointing to much more weakness ahead.

Key relative ratios either...

READ MORE

MEMBERS ONLY

This Approach Is The Absolute Best Approach To Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While our primary focus at EarningsBeats.com is technical analysis, we combine that technical approach with fundamental analysis as well. Earnings is what we do. Prior to earnings reports, we're scouting for those companies most likely to report better-than-expected earnings and also the opposite - companies we want...

READ MORE

MEMBERS ONLY

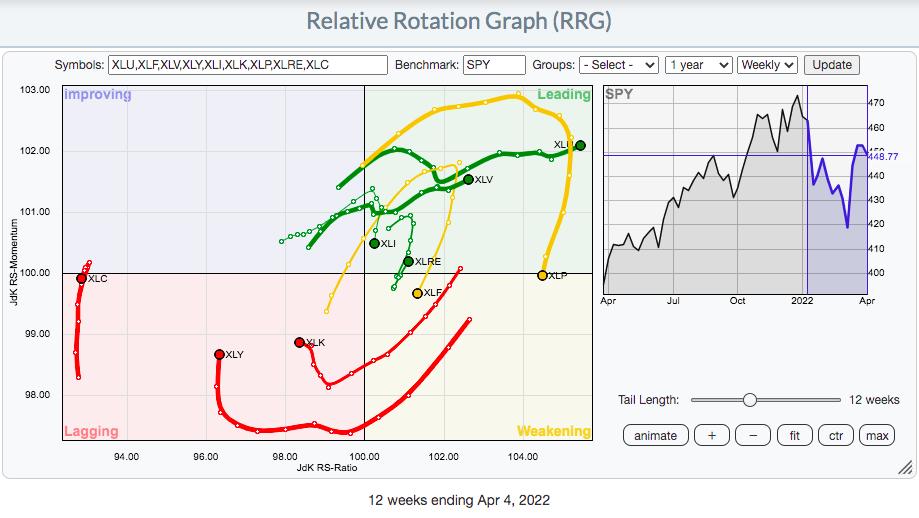

How To Create An ETF Strategy To Weather The Market Storm Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The U.S. equity market is definitely NOT a one-size-fits-all when developing portfolio strategies. Different market environments require that we be flexible and willing to adjust to both "risk on" and "risk off" environments. I don't think there's much question that right...

READ MORE

MEMBERS ONLY

Here's A Red-Hot Group Threatening A Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Defensive sectors is where the money is going right now. Last week was a perfect example. Check out the rotation last week:

The four defensive sectors and energy (XLE) finished the week in positive territory. The aggressive sectors and materials (XLB) were lower. That's been the theme in...

READ MORE

MEMBERS ONLY

Please Do NOT Ignore These 3 Warning Signs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've rallied a TON off the February low, which is certainly encouraging. While I believe it's still possible that we print a new low sometime over the next 3-6 months, the significant rally over the past few weeks should not be ignored and increases the odds...

READ MORE

MEMBERS ONLY

Smile and Say "SQUEEEEEZE"!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Perhaps the most exciting part of any trader's journey is catching that runaway short squeeze. Many traders have only dreamt it, while others have lived it. GameStop Corp (GME) is the most recognizable short squeeze stock of this generation as it soared from 20 on January 13, 2021...

READ MORE

MEMBERS ONLY

Do Not Make This Critical Mistake - Nearly Everyone Does

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

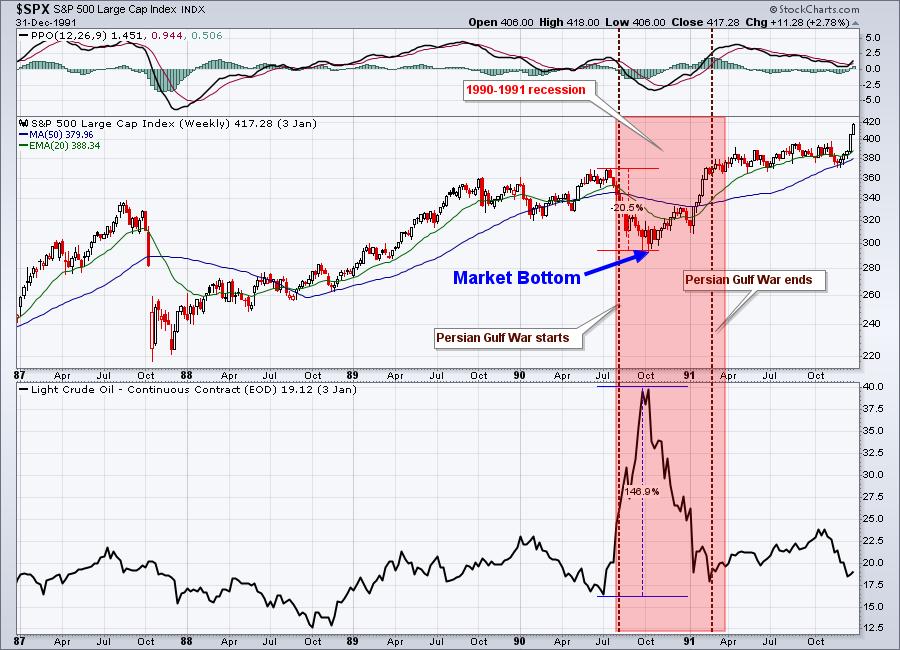

The stock market never works the way we think it should. When the news stories are bleak, we tend to think the stock market must react negatively. But that's not the way things work. Most times, the stock market bottoms LONG BEFORE we see any positive developments in...

READ MORE

MEMBERS ONLY

Is this Bear Market Rally Ending? These 2 Charts Will Tell Us

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Rallies and selloffs can be so crazy during volatile periods, and 2022 definitely qualifies as volatile. The Volatility Index ($VIX) has now been elevated and above 20 every single day since January 18th. That's roughly 9 weeks. It comes after a year in which the VIX has bottomed...

READ MORE

MEMBERS ONLY

FAANG Stocks Rebound, But Is The Bottom In?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've seen a tremendous rally over the past week or so across most U.S. equities, but the FAANG stocks tend to garner the most attention. These large cap growth names help to carry our major indices either higher or lower, because of their huge market caps. They...

READ MORE

MEMBERS ONLY

Growth Stocks Remain Under Big Pressure, But Get Ready To Buy Soon

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The prospects of surging inflation and higher interest rates hinder the performance of growth stocks in a big way. Remember, their valuations are highly dependent on future promises of earnings and earnings growth. Inflation and higher rates eat away at that future growth. And a recession changes the picture completely...

READ MORE

MEMBERS ONLY

Looking Under The Hood of EarningsBeats.com -

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The storm clouds rolled in during the month of December. That was our early warning sign that 2022 would likely be a very rough year. If you haven't been reading my articles over the past few months, I'd highly recommend that you at least go back...

READ MORE

MEMBERS ONLY

Bottom Approaching, But One More Painful Leg Lower Remains

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We saw the latest CPI report (February) released on Thursday. It came in about as expected, with the February Core CPI rising 0.5%, matching consensus estimates. That sent the annual core inflation rate HIGHER (as I've previously suggested) to 6.4%, the highest rate we've...

READ MORE

MEMBERS ONLY

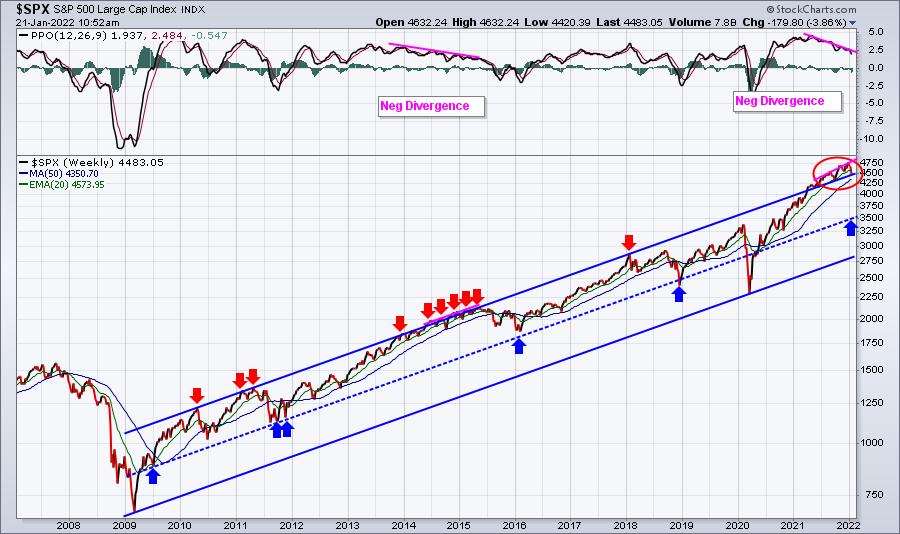

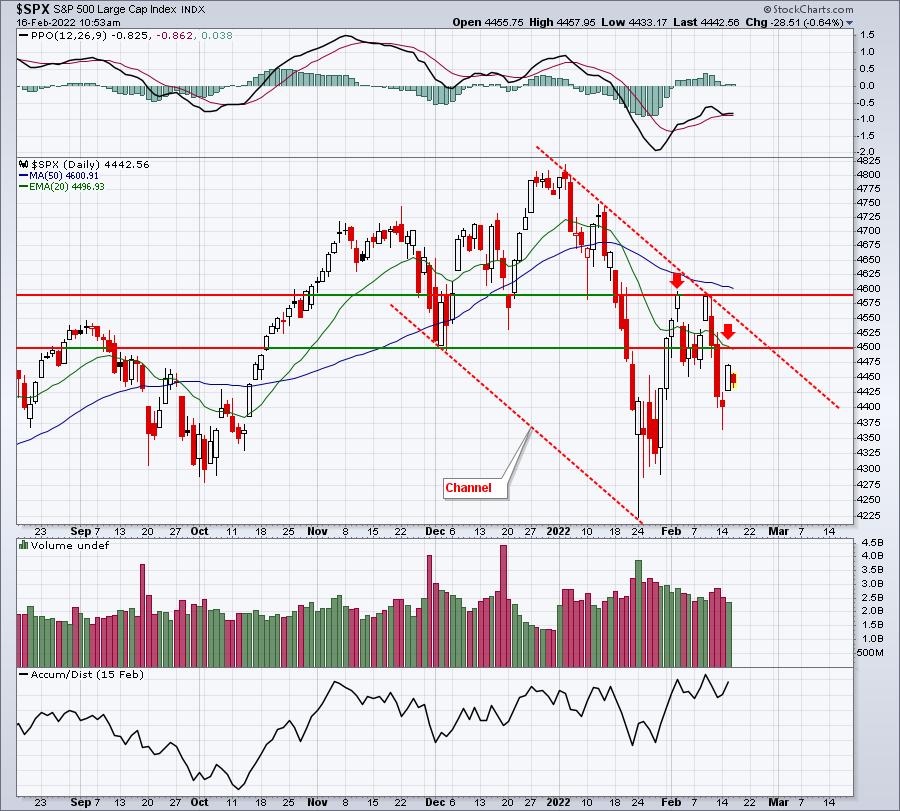

Sentiment and Channel Resistance Remain Two Big Issues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Once a short-term transition from overly bullish to overly bearish begins, sentiment and channel lines can be your two best friends to help you keep your sanity. Whatever you do, turn off the media or you'll be waiting for The Great Depression 2.0. I've always...

READ MORE

MEMBERS ONLY

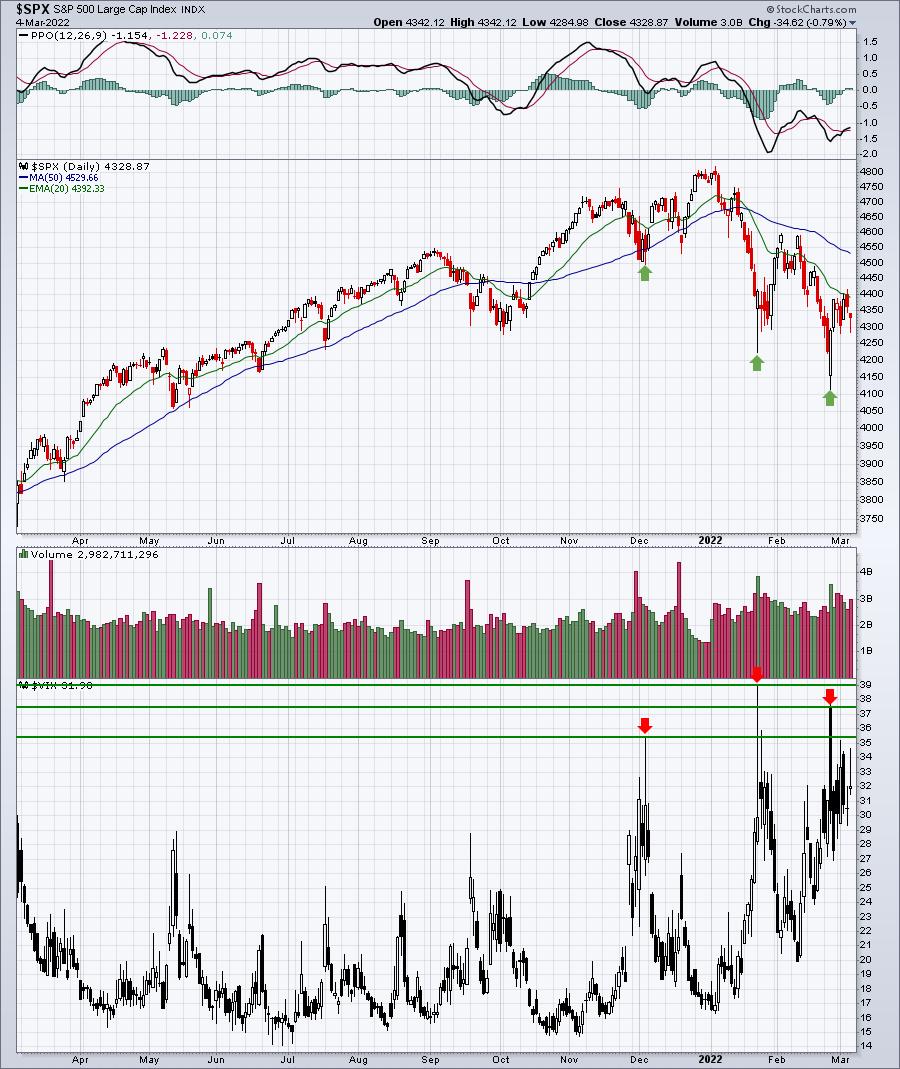

Wall Street Will Sees His Charts And Predicts 4-6 More Weeks Of Bad Market Weather

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's no denying it was a super rally to end last week. Any time you see stocks jumping like they did on Thursday's reversal and Friday's follow through, it's easy to become much more optimistic. But during periods of high volatility, the...

READ MORE

MEMBERS ONLY

Breakouts Galore in This Suddenly Surging Industry

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a fan of relative strength and, even in a market that's been whipsawing back and forth, leaders emerge and you need to be vigilant in seeking them out. One such group hadn't shown relative strength in many months, but that changed in 2022...

READ MORE

MEMBERS ONLY

This Great Big Bear is Gaining A Great Big Grip

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technical analysis pays off. Thank you John Murphy for all the wisdom and inspiration. The warning signs that I see from time to time don't always pay off and that's really not what technical analysis is all about. It's never a guarantee. I use...

READ MORE

MEMBERS ONLY

Are You Ready for a Market Meltdown? It's Coming

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

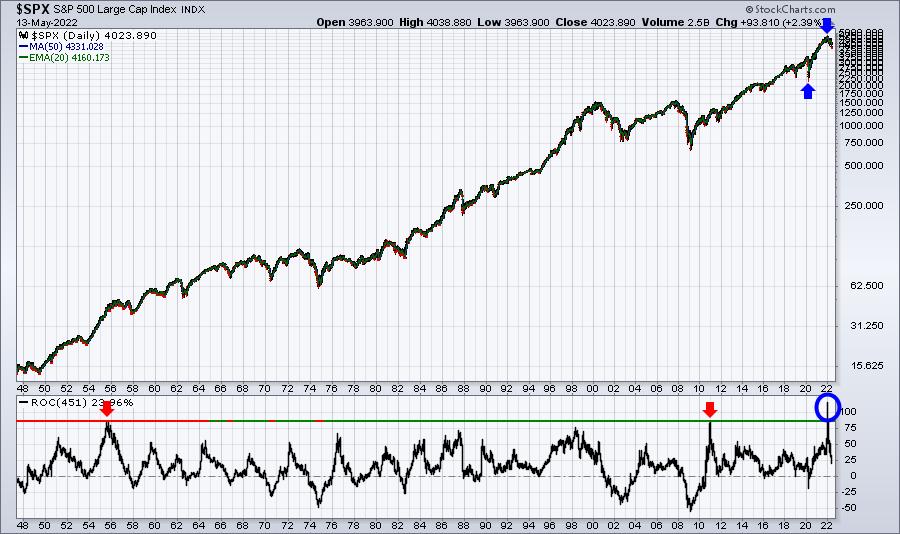

I am rarely dramatic, but 2022 is an exception. I believe we are in the type of bear market that we haven't seen in a long, long time.

The pandemic-driven cyclical bear market in 2020 was a health care crisis, not a financial crisis. I wrote about it...

READ MORE

MEMBERS ONLY

Watching Down Channel for Short-Term Directional Clue

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's options-expiration week so literally anything goes, especially with the Volatility Index ($VIX) remaining so elevated. In the very near-term, I wouldn't be surprised by a quick upside move to channel resistance or even to test the early February high. There's a TON of...

READ MORE

MEMBERS ONLY

Large Cap Names Adding To List of Big Worries

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For the past year, the bulls have been able to hang onto one argument - that the large cap growth stocks continued to outperform their large cap value counterparts, which, in turn, held up our major indices. That may not be the case any longer. The cracks in the large...

READ MORE

MEMBERS ONLY

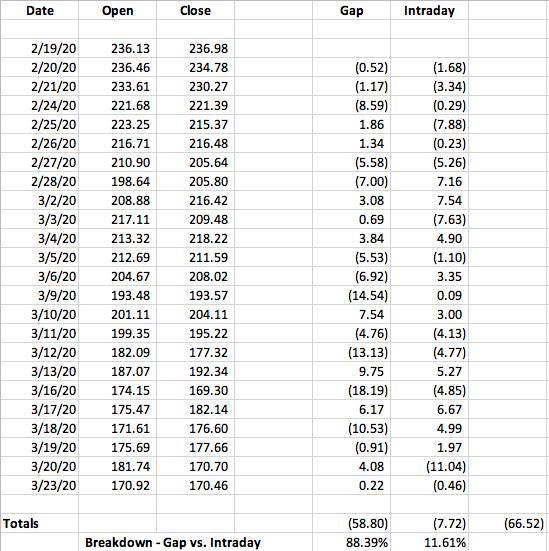

The Rebound Looks Highly Orchestrated And Manipulated

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not a huge conspiracy theorist, but when it comes to Wall Street and all the TRILLIONS of dollars at stake, I believe anything goes! I especially love studying volatile periods. Are there signals out there to help us identify the REAL moves higher from the FAKE moves?...

READ MORE

MEMBERS ONLY

How Do Earnings and Relative Strength Correlate?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I receive dozens of earnings-related questions every quarter from EarningsBeats.com members and non-members alike. They usually revolve around whether "I should hold a stock into earnings?" Let me be clear that, as a short-term trader, I'd be very careful holding any stock into earnings. There...

READ MORE

MEMBERS ONLY

Don't Let The Market Makers Fool You

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As a short-term trader, I've always studied the short-term intraday charts, looking for any possible advantage I can gain. One strategy the market makers employ during uptrends and downtrends is they show traders a morning mirage, which is then followed by afternoon reality. Not every day is alike,...

READ MORE

MEMBERS ONLY

Don't Confuse a Cyclical Bear Market Bounce With a Secular Bull Market Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are never any guarantees in the stock market. As much knowledge as I've gained over the years, and as much respect I have for my fellow technicians here at StockCharts.com, there's simply no way to ever be sure that your forecast is the right...

READ MORE

MEMBERS ONLY

AMZN: Big Earnings, Big Gap, Big Problems

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Call it a reprieve. Amazon.com (AMZN) reported excellent results last night, at least much better than what was expected. Revenues came in a bit light, according to Zacks.com, at $137.41 billion. Estimates were pegged at $137.88 billion. But bottom line EPS soared to $27.75 (actual)...

READ MORE

MEMBERS ONLY

More Signs Pointing To Cyclical Bear Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I was bearish heading into 2022 - before the selling began - and I haven't changed my mind one bit, despite the recent rally. Counter trend rallies are normal and, quite honestly, I think the current one may have just run its course. First, the rally has reached...

READ MORE

MEMBERS ONLY

4 Bold Predictions About This Bear Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Yes, I believe we're in a cyclical bear market. I began discussing bearish signals back in November and those only intensified as we neared year end. You don't need to see a twister in your dining room to realize a storm is approaching. In my last...

READ MORE

MEMBERS ONLY

The Tail is Wagging the Dog; Big Plunge Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Normally, the stock market is humming along and we have indicators all supporting the sustainability of that move higher. But things aren't normal right now.

It started with the rotation into defensive sectors to lead the S&P 500 higher on that last final leg in December....

READ MORE

MEMBERS ONLY

Here Are The Two Most Important Ratios Before Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As our name would imply at EarningsBeats.com, we focus a lot on quarterly earnings reports. We've studied them every which way possible. As a former practicing CPA, it's in my blood. Yes, I'm a technician that understands the importance of technical analysis. But...

READ MORE