MEMBERS ONLY

Short Sellers of Technology Stocks Have A Big Problem This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

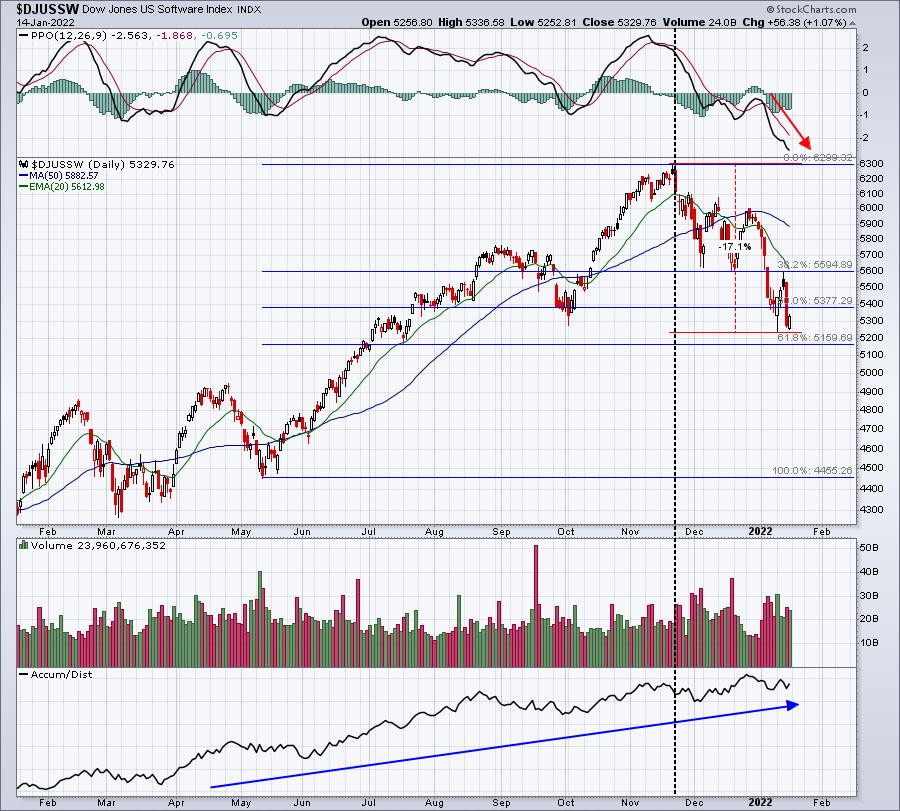

Renewable energy ($DWCREE) and software ($DJUSSW) have been absolutely smoked since November. In the case of software, the selling has accelerated in January with its PPO falling off a cliff:

This group had declined more than 17% off its recent high - before the rally from Monday's low....

READ MORE

MEMBERS ONLY

NASDAQ Under Performance And Where We Now Stand In Historical Terms

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know I'm beating a dead horse, but rotation has been brutal, so timing key reversals in that rotation will be one key to trading success in 2022. Historically, when we compare NASDAQ performance vs. S&P 500 performance, there is a key threshold where we typically...

READ MORE

MEMBERS ONLY

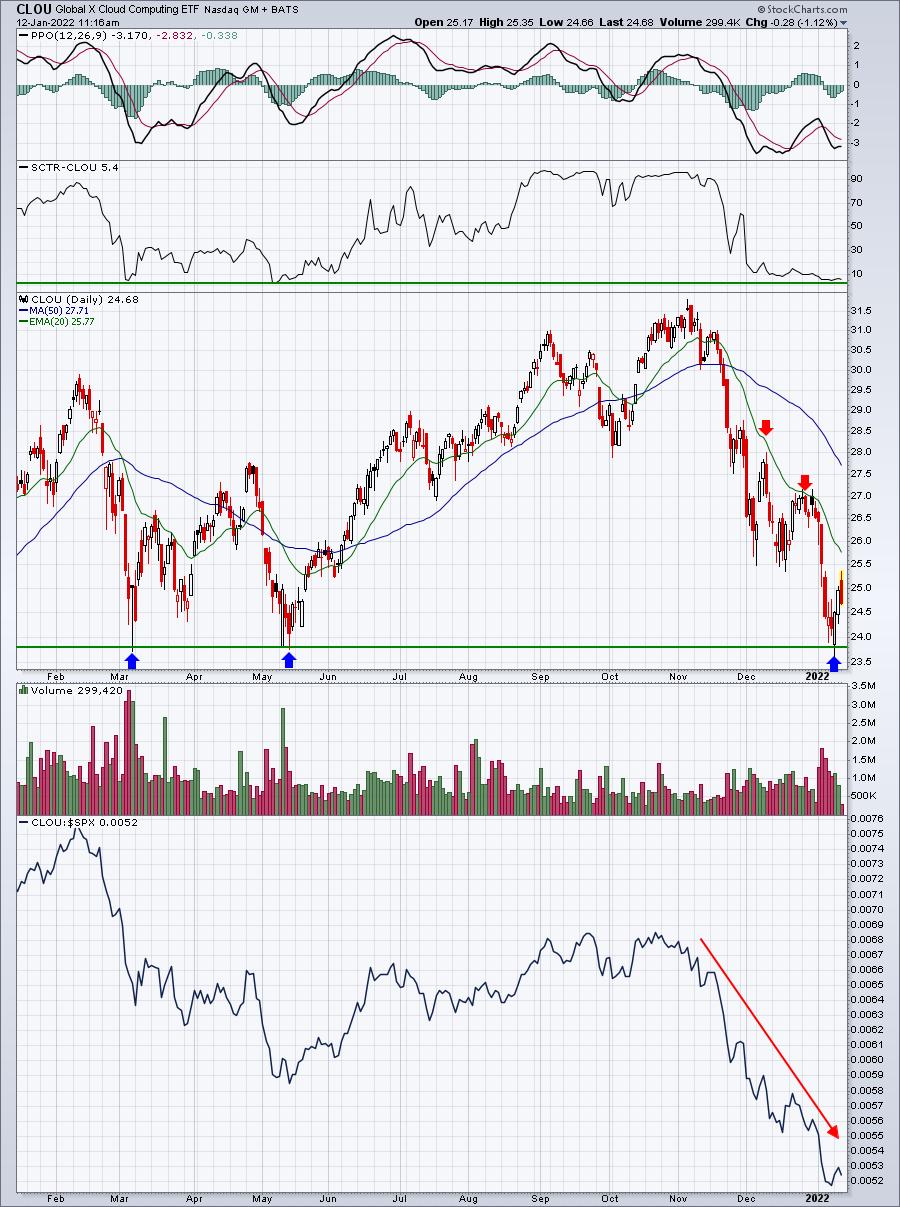

ETF Trading Requires Some Homework - FREE Event Today!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Investing in ETFs (exchange-traded funds) is no different than trading stocks in many respects. We still need to plan the trade. The biggest difference, obviously, is that ETFs hold a basket of stocks so purchasing an ETF requires that you understand what the ETF holds. Or maybe you don'...

READ MORE

MEMBERS ONLY

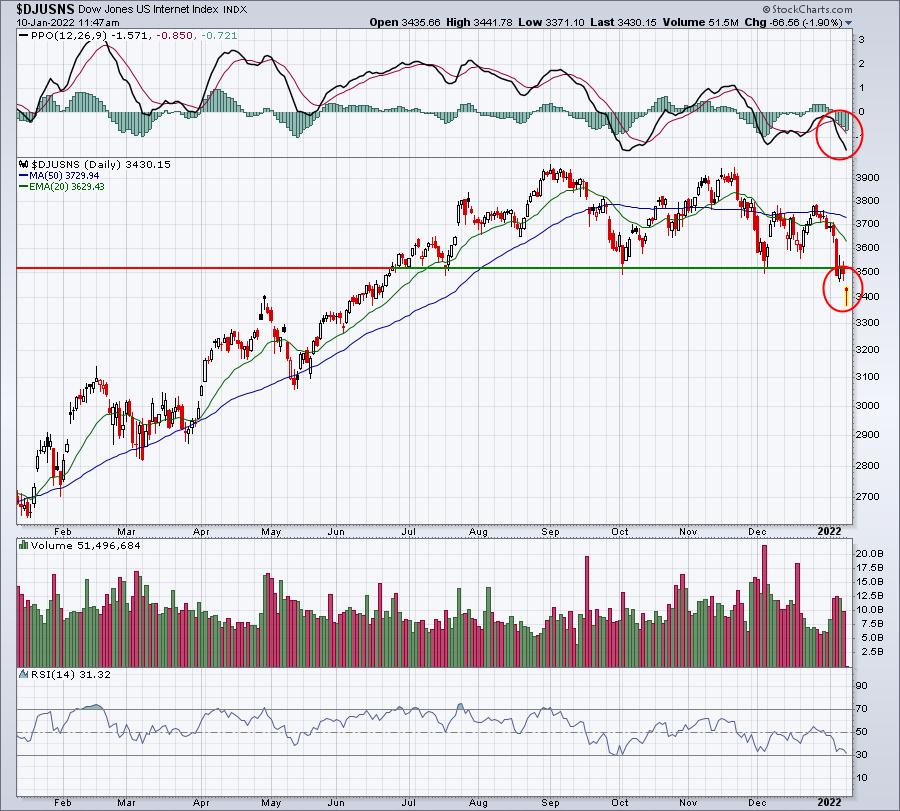

Internet And Semiconductors Are Among Today's Casualties

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been discussing warning signs for the past several weeks, even talking about that nasty (gulp!) cyclical bear market possibility. These are what I refer to as "storm clouds on the horizon." Well, it's starting to rain pretty hard, so make sure you have...

READ MORE

MEMBERS ONLY

Apple (AAPL) Could Be on the Verge of Tumbling, Putting the Entire Stock Market at Risk

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We're about to find out.

I liken the current stock market environment to stepping into The Twilight Zone or the Great Unknown. This post-pandemic market has been brutal in terms of rotation. Most growth stocks have tumbled amid the inflation and interest rate uncertainty; unfortunately, the inflation news...

READ MORE

MEMBERS ONLY

The Great Divide Presents Big Problems....and a Wild Prediction for Apple (AAPL)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Today is just the latest example of the massive divide taking place in U.S. equities right now. There was major rotation throughout 2021 and we're seeing more of the same here in early 2022. Unfortunately, the rotation is not favoring the growth stocks that have powered the...

READ MORE

MEMBERS ONLY

It Could Be a Very Rough Start to 2022

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

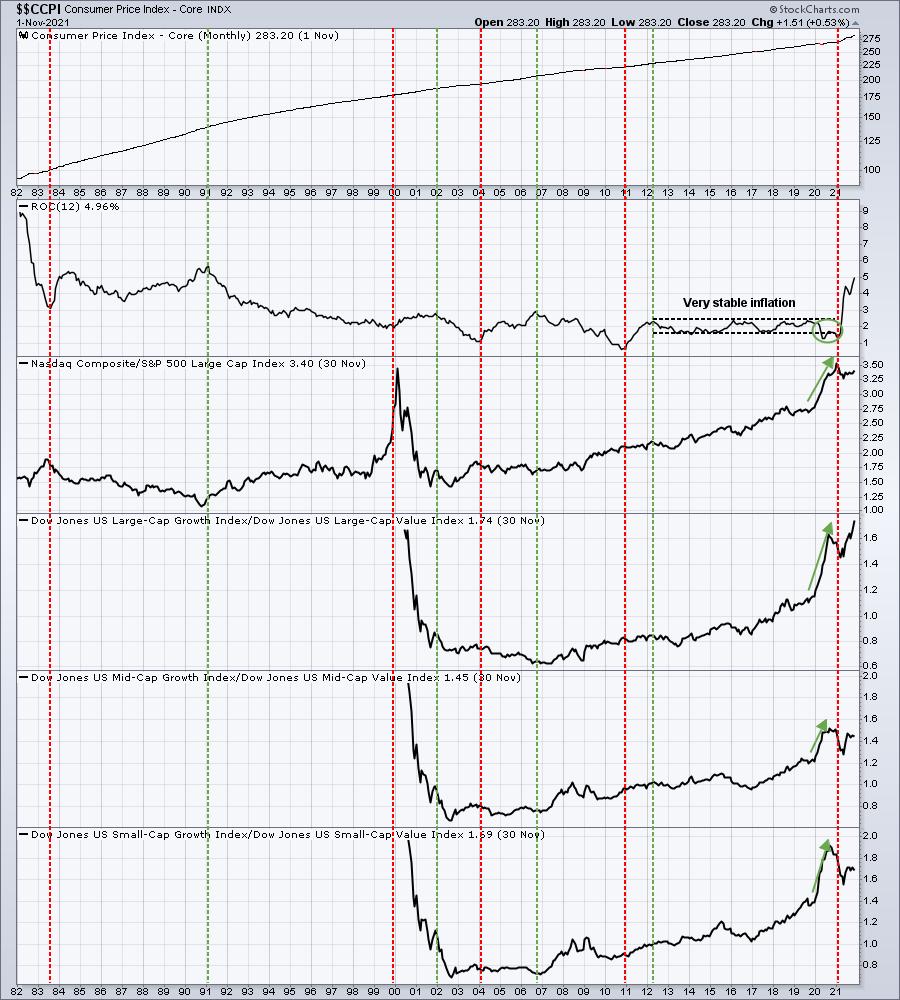

When it comes to stock market performance, it's not always about reality. Many times, perceived problems can be a bigger problem than actual problems. As we wrap up 2021 and head into 2022, there's really no denying that inflation is a problem at both the consumer...

READ MORE

MEMBERS ONLY

Sorry, But I Don't Believe in This Santa Claus Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It might take more than Old Saint Nick to sustain this current stock market rally. I'm not a believer this year. It reminds me of that catchy holiday tune:

"StockCharts is making a chart and I've checked it twice, gonna find out that Wall Street&...

READ MORE

MEMBERS ONLY

Is This Pharma The Next GameStop (GME) Short Squeeze?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been quite a volatile ride today, but one pharmaceutical stock has made 5 years' worth of returns in a couple hours. It's what happens when there's a huge imbalance in demand vs. supply on a stock and it breaks out to new...

READ MORE

MEMBERS ONLY

Fireworks in December? Monthly Options Expire Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Tuesday before the third Friday of each month gets the blood pumping at EarningsBeats.com. As momentum traders, it's EXTREMELY important to be aware as monthly options expiration approaches. We have seen time and time again how crazy the short-term market action can be when market makers...

READ MORE

MEMBERS ONLY

Is Inflation Truly A Problem? Here Are 3 Charts To Follow

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Most of you know I'm not a fan of the media. It has zero to do with who they are as people and everything to do with how they make their money. They need visitors at their websites in order to sell ads. The best way to attract...

READ MORE

MEMBERS ONLY

Bitcoin vs. Ethereum: It's An Easy Choice

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As technicians, what do we care about? The charts, right? Well, when I look at the charts of Bitcoin ($BTCUSD) and Ethereum ($ETHUSD), the choice between the two is relatively simple. The charts tells us everything, and this one simple price-relative chart says to go with Ethereum until further notice:...

READ MORE

MEMBERS ONLY

Panic Selling Accelerating; Watch These Sentiment Indicators For A Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As the Volatility Index ($VIX) rises, it becomes fairly obvious that market makers are "on vacation." The primary role of the market maker is to provide liquidity when there's an imbalance between buyers and sellers. Rarely do we see panicked buying when buyers completely swamp sellers....

READ MORE

MEMBERS ONLY

Are Valuations Too High? Here are the Three Primary Ingredients to Tell

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I practiced in public accounting for 20 years and was involved in a number of company valuations. I worked very little with public companies, but did have to value private companies on occasion. Most of the valuation metrics that I used in the 1980s and 1990s remain absolutely the same...

READ MORE

MEMBERS ONLY

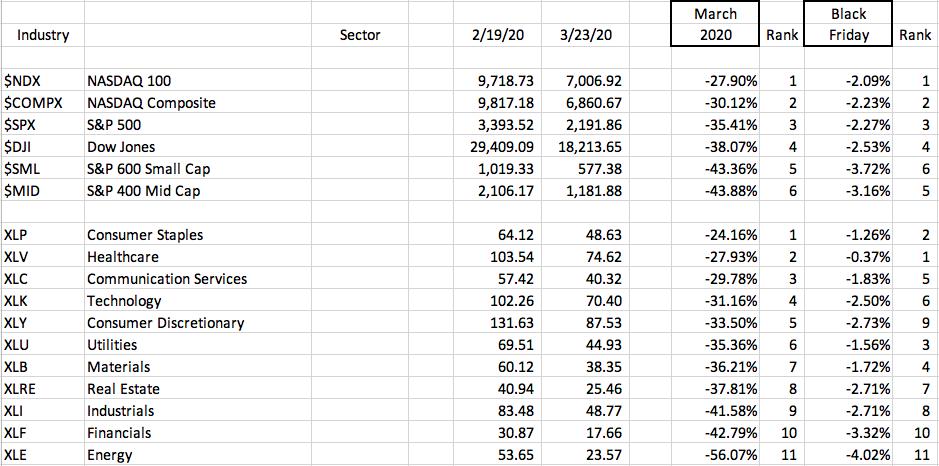

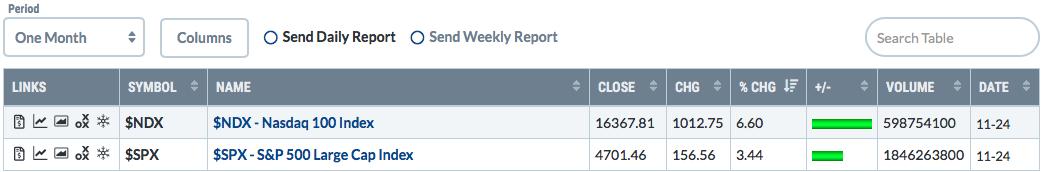

How Did Friday's Selling Compare To March 2020 Selling? My Takeaways

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

News that a new COVID-19 variant has surfaced in South Africa spooked global equity markets on Friday. Was it an overreaction and an opportunity to buy some of your favorite stocks cheaper? Or is the start of a much deeper, panic-driven selloff. Unless you're a scientist with inside...

READ MORE

MEMBERS ONLY

Giving Thanks!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Thanksgiving is celebrated here in the US on the 4th Thursday of November and is a day to give thanks. Let me say that I'm very thankful for God and family. I was blessed with my first grandchild a little over a year ago and she's...

READ MORE

MEMBERS ONLY

It's Draft Day for EarningsBeats.com; Will This HUGE Winner Remain in Our Portfolio?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have a favorite day each quarter. It's the day that I set aside hours to reassess the overall market to determine what I believe will take place over the next three months, focus on the best areas of the market, and ultimately select 10 equal-weighted stocks to...

READ MORE

MEMBERS ONLY

Dark Clouds Are Engulfing Wall Street; Bulls, Strike Three You're Out!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Before I begin this article, let me be clear that I remain extremely bullish for the long-term. We're nowhere close to where we're going, which is much, much higher. But in the very near-term, I'm growing increasingly bearish. There are a few reasons, which...

READ MORE

MEMBERS ONLY

Is This Stock Being Accumulated or Distributed?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sometimes, when I look at a chart, I see conflicting signals. That is definitely the case for 10x Genomics Inc. (TXG), an $18.1 billion medical equipment company. Medical equipment stocks ($DJUSAM) have been consolidating for the past 2-3 months, which has led to relative underperformance by the group as...

READ MORE

MEMBERS ONLY

These 2 Breakouts Should Lead To A Strong 2021 Finish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm partial to the formation of long bases, followed by breakouts, and breakouts of bullish continuation patterns. Well, I have two of these to share with you. Let me first start with CNH Industrial (CNHI), a $25.3 billion commercial vehicles & trucks company ($DJUSHR). They absolutely crushed...

READ MORE

MEMBERS ONLY

4 of My Favorite Earnings Reports This Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I spend hundreds of hours during each quarterly earnings season researching earnings reports, deciphering which beat revenue and EPS estimates and then annotating every one of those charts. It's what makes up our Strong Earnings ChartList (SECL), a ChartList that we update every 1-2 weeks for our EarningsBeats....

READ MORE

MEMBERS ONLY

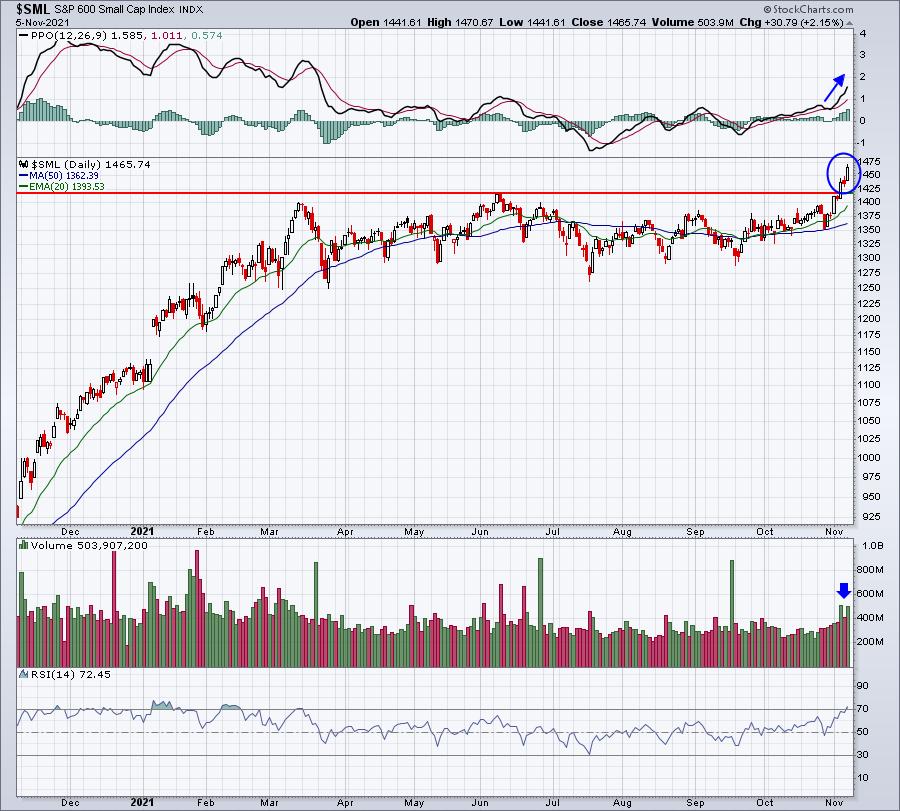

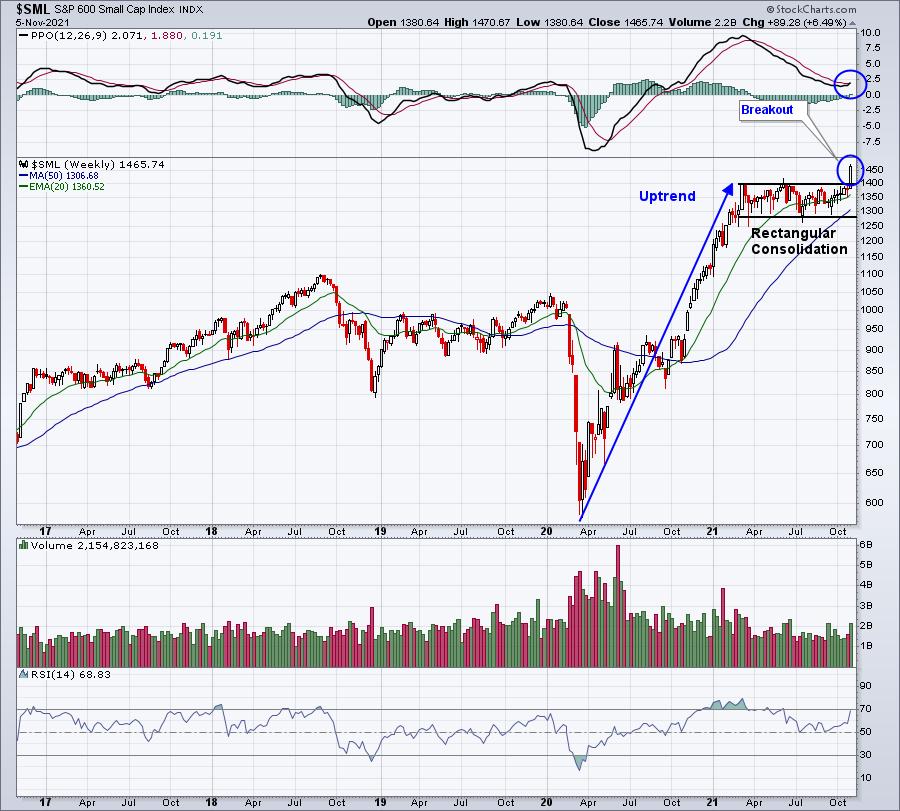

Small Caps Broke Out, But Which Small Caps Should We Consider?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For me, the breakout in a particular area triggers a series of questions in order to find the best trading opportunities. Last week, small caps finally joined the U.S. equities party in all-time high territory. The chart breakout is simply the first step in my research:

This provides us...

READ MORE

MEMBERS ONLY

3 Major Leadership Changes in November

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Like most technicians, I take a "top down" approach when it comes to my trading strategy. I start with the overall market, which, I believe, continues to be insanely bullish. My two biggest worries in the market have been alleviated as both small-cap stocks ($SML) and transportation stocks...

READ MORE

MEMBERS ONLY

Let Me Show You Why Relative Strength Is So Important

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you're not already familiar with relative strength, then I have to ask why not? Yes, absolute price action is extremely important, but so is relative strength. I'm going to give you a perfect example of why you need to be aware of relative strength. Texas...

READ MORE

MEMBERS ONLY

Semiconductors are Flying - Here's a Major Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My favorite breakout is one that occurs after a lengthy basing period. Stocks that go through these frustrating periods can be quite rewarding when they finally make the breakout. And when those breakouts occur in an industry group that Wall Street loves, well, even better!

Currently, there aren't...

READ MORE

MEMBERS ONLY

The Key Ingredient In Short Squeezes Is Triggering Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Have you ever heard a meteorologist describe the odds of a tornado touching down? They usually start by outlining the "conditions necessary" for a tornado. Early in the day, or possibly even the prior day, the meteorologist will say something like "this area has a 30% chance...

READ MORE

MEMBERS ONLY

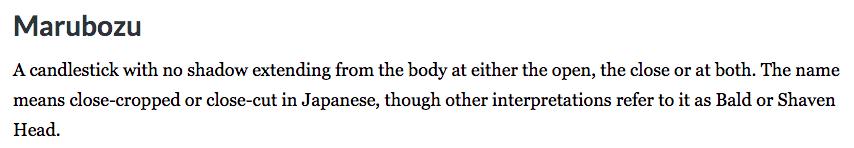

One Candle Can Light Up A Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I occasionally refer to myself as a Technifundahistorian, because I believe in technicals, fundamentals, and history. I practiced in public accounting in 20 years, so I cannot ignore those basics. Earnings matter. And beating earnings estimates and raising future guidance REALLY matters. That's why we regularly update our...

READ MORE

MEMBERS ONLY

Which Stocks Are Under Heavy Accumulation? Here Are Two To Consider

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Where should you invest your hard-earned money? That's a question that we ask ourselves quite frequently. And I don't know that there's an easy answer to this question. I like to see where Wall Street is investing its money and then make a decision...

READ MORE

MEMBERS ONLY

This Company is About to Start a Monster Seasonal Period

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As we wrap up another October, it's time to start looking ahead at the seasonally bullish November period. U.S. equities have LOVED November for many years, as the S&P 500 has risen during November in each of the last 10 years. But which stocks ride...

READ MORE

MEMBERS ONLY

Catching Breakouts One at a Time - Here's Another

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season presents so many opportunities, especially during a secular bull market advance. We appear to have another one of those advances underway and the daily opportunities are increasing. The difference between a breakout and a failed breakout, however, many times comes down to one simple number - the closing...

READ MORE

MEMBERS ONLY

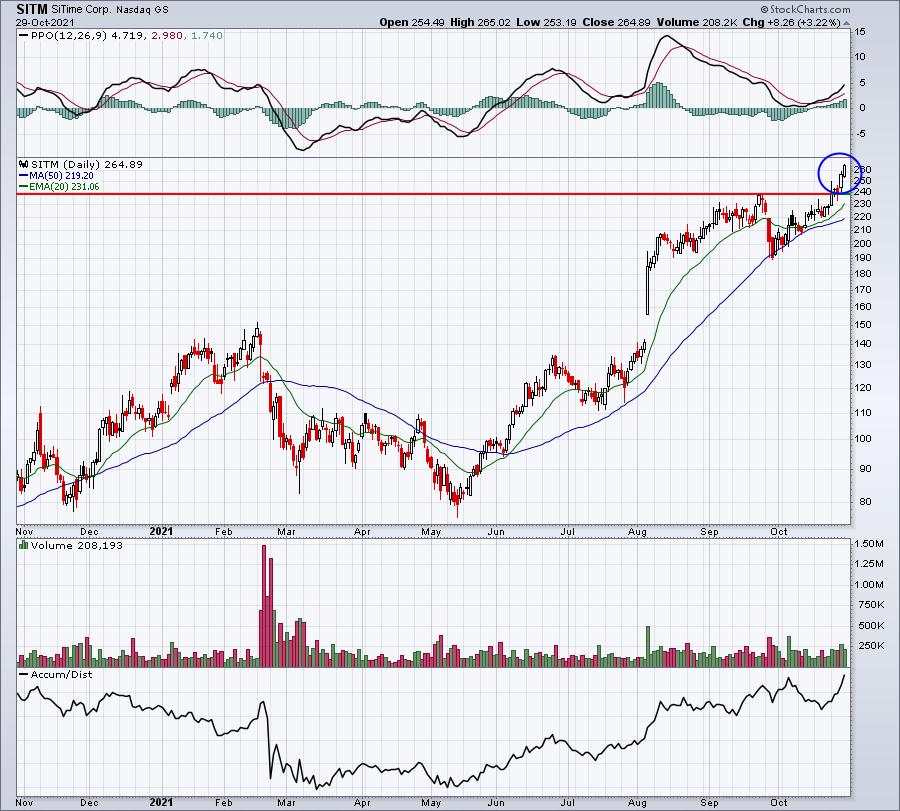

U.S. Equities Have One VERY Serious Short-Term Problem

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I began looking at my key index charts this morning, along with sector and industry charts, one thing became apparent very, very quickly. In the near-term, we appear to be running out of bullish momentum. 60-minute divergences are negative across many key indices, sectors, and industries, not to mention...

READ MORE

MEMBERS ONLY

Could We Have Just Topped?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

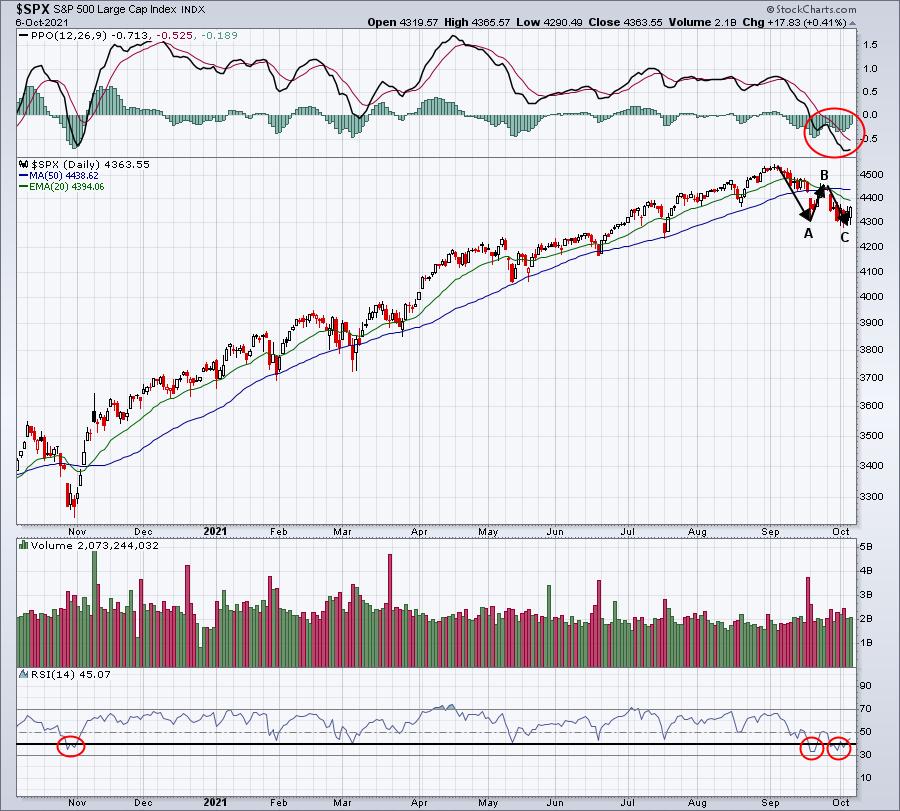

I guess the first question I'd ask is, "Are we talking about the short-term or the long-term?" Because I'd say there's very little chance that we've just reached a long-term top. But could this be a short-term top? Absolutely. Let...

READ MORE

MEMBERS ONLY

Finding Stocks Under Heavy Accumulation - Three Examples of What I Look For

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On September 28th, I wrote a "Trading Places" blog article titled "Rising Yields Have A History of Favoring These Stocks; One Such Stock is Being Heavily Accumulated". The stock I wrote about was Opendoor Technologies (OPEN), which, after pulling back temporarily, has exploded higher recently. A...

READ MORE

MEMBERS ONLY

PayPal Holdings (PYPL) Looks Like A Solid Long-Term Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I look at longer-term trading opportunities, I typically step back and view the weekly charts, which differs from my typical review of daily charts. There are times, however, that the bigger picture shows opportunities that you cannot see on the daily chart. Let me show you two charts of...

READ MORE

MEMBERS ONLY

Hips Don't Lie, But Lips Do

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I follow the money. Not the hype. Not the talk. Just show me the money! I remember growing up and learning to play basketball. Defensively, my first coach told me to "follow their hips". They can fake you with their eyes, they can fake you with their legs,...

READ MORE

MEMBERS ONLY

Max Pain: Market Makers' Monthly Miracle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've seen it over and over and over again. Very short-term, almost inexplicable moves, seem to occur around the 3rd Friday of each month, which just so happens to represent monthly options expiration. When stock market traders, particularly options traders, all line up on one side of the...

READ MORE

MEMBERS ONLY

Know What You Own - It Sounds Much Simpler Than It Is

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

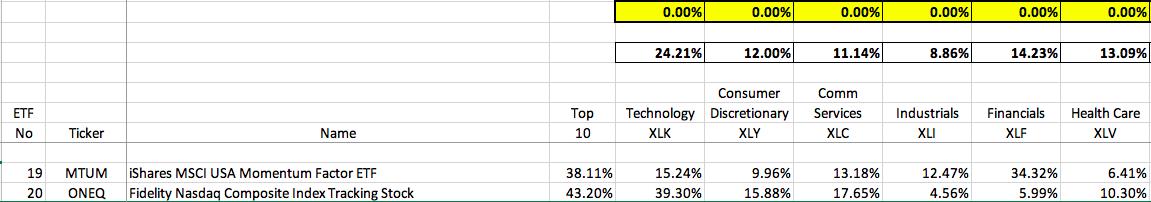

There's an assumption that ETFs are well-diversified and that buying leading ETFs will be profitable. That may turn out to be true, but it may not. ETFs are no better than the stocks they own and they could be extremely risky depending on the weighting of their top...

READ MORE

MEMBERS ONLY

The Secret to Selecting the ETFs that are Right For You

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have two reasons for writing this article. First, I'm hosting a FREE webinar relating to ETF selection on Saturday morning that I'll discuss later. Second, I was having a market-related discussion with a good friend a few nights ago and he was explaining his investment...

READ MORE

MEMBERS ONLY

Has The September Swoon Ended? Well....

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's never an easy question to answer while you're in the midst of a downtrend. It's a whole lot easier to be a Monday Morning Quarterback and say it's over when you've returned to a new all-time high. That'...

READ MORE

MEMBERS ONLY

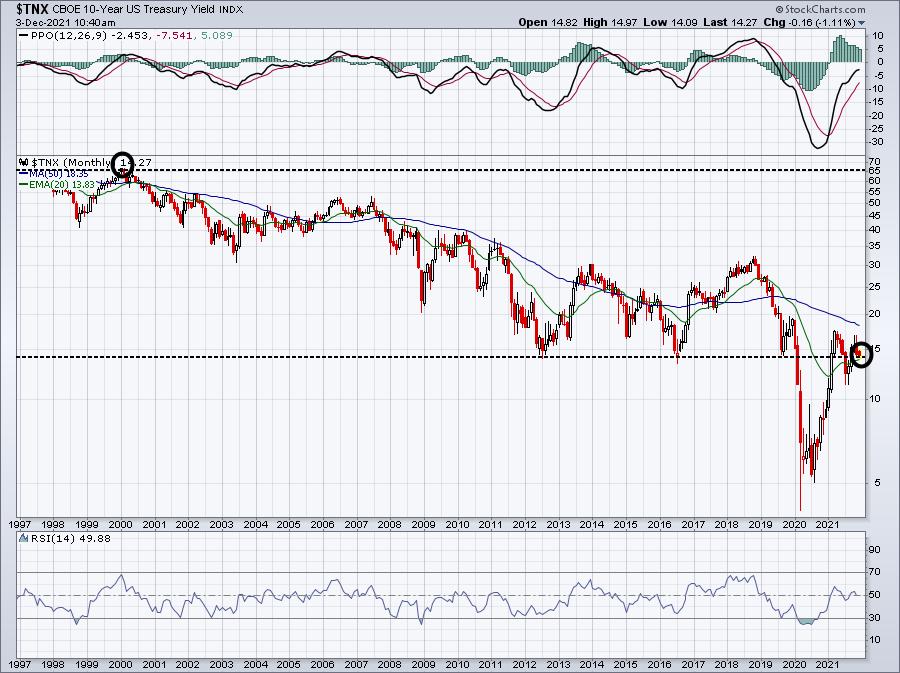

Rising Yields Have A History Of Favoring These Stocks; One Such Stock Is Being Heavily Accumulated

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Rising treasury yields can have a tremendous impact on which groups outperform and underperform. Many of us here at StockCharts.com write about the positive impact that rising yields can have on financials (XLF), especially banks ($DJUSBK) and life insurance companies ($DJUSIL). Because rising yields normally reflect Wall Street'...

READ MORE