MEMBERS ONLY

This Sector Is Turning The Bullish Corner; Higher Prices Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As you probably know, my background is in public accounting. I practiced as a CPA for two decades prior to turning my full attention to technical analysis. My analysis of the stock market always includes both fundamental and technical analysis, with a historical component sprinkled in. (I never met a...

READ MORE

MEMBERS ONLY

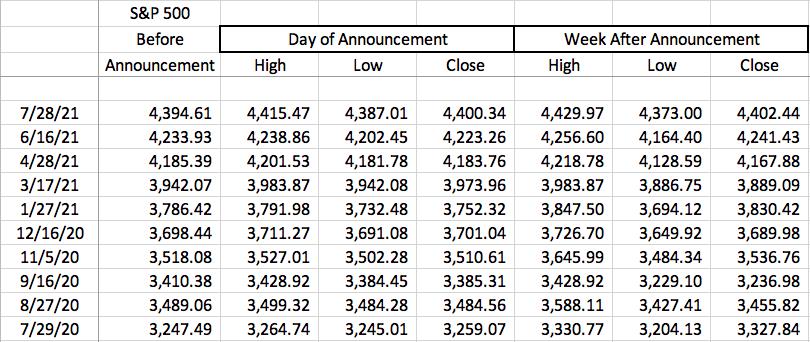

Here's How Wall Street Has Reacted To The Fed The Last 10 Meetings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Fed began its latest 2-day meeting this morning and it'll release its latest FOMC policy decision on Wednesday at 2pm ET. From past experience, I know there's been significant volatility after Fed announcements, so I thought I'd summarize the S&P 500...

READ MORE

MEMBERS ONLY

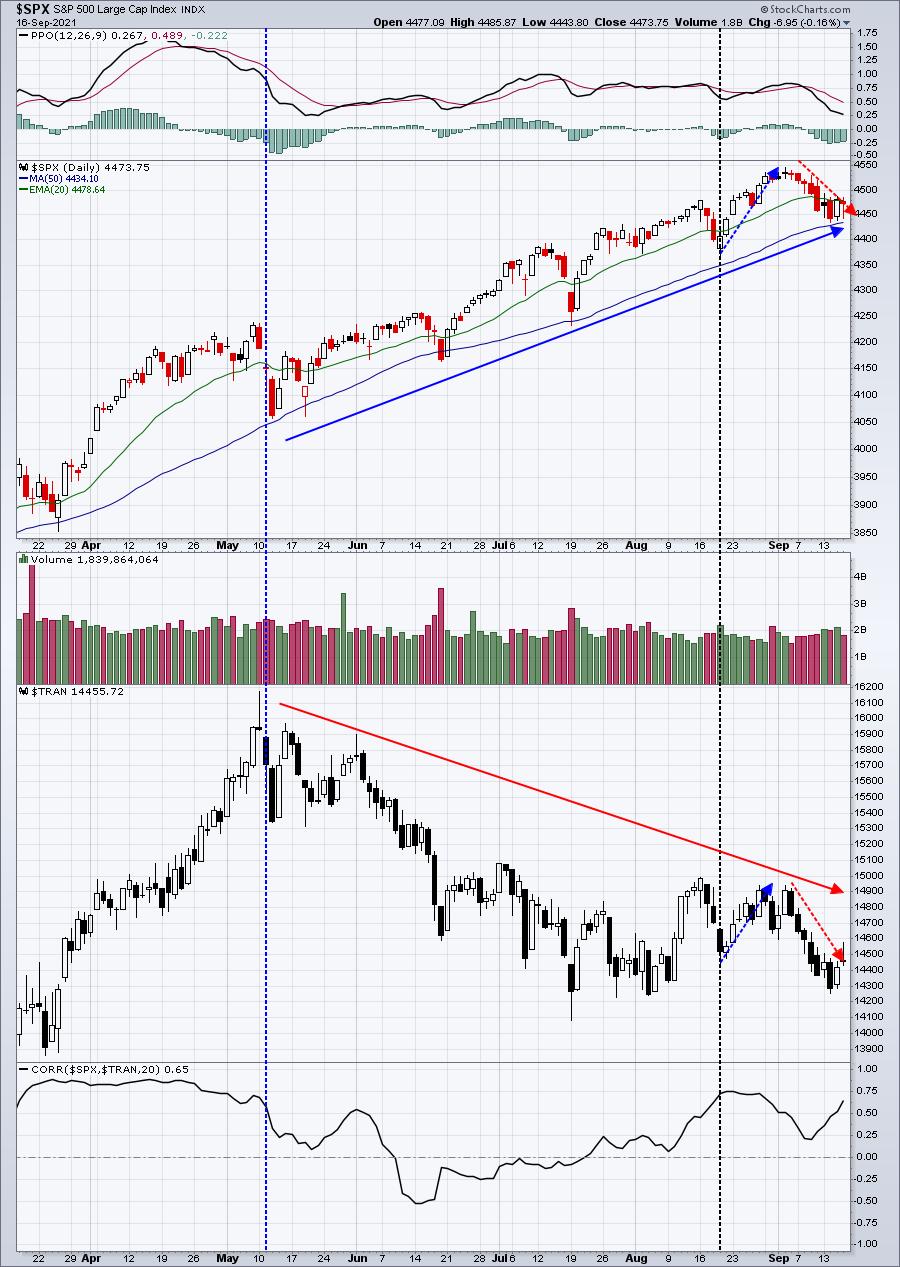

Does Poor Transportation Performance Signal A Bear Market Ahead?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's an interesting question. After all, during periods of economic expansion, transportation stocks ($TRAN) should ship more goods, report higher profits, and be rewarded with higher stock prices. If you're not already aware, the TRAN and the S&P 500 have a very tight long-term...

READ MORE

MEMBERS ONLY

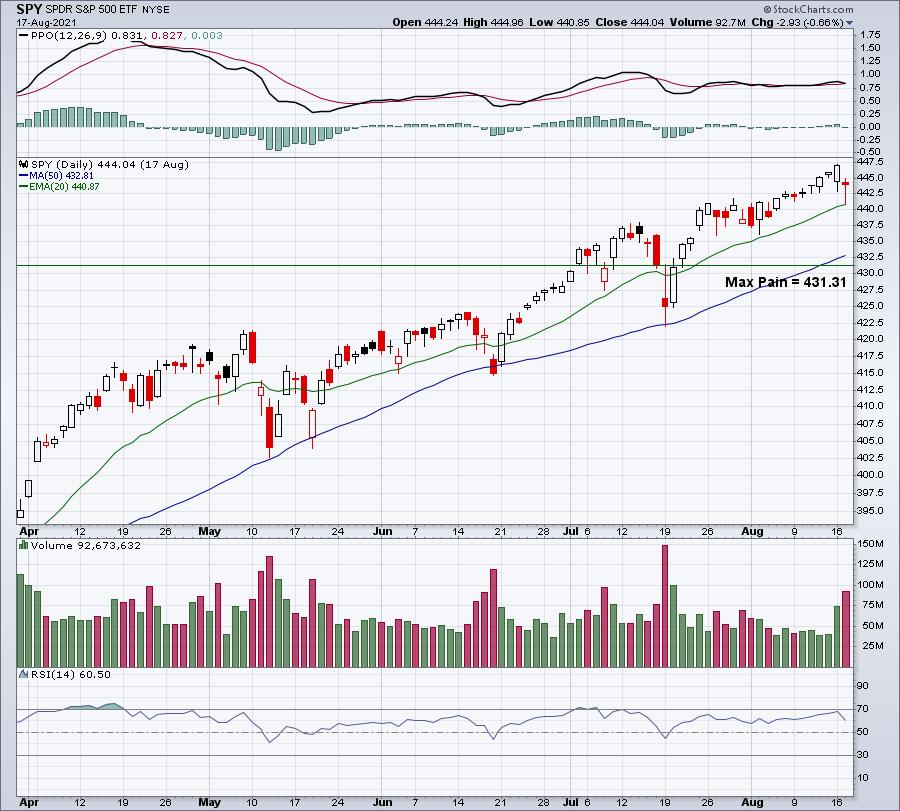

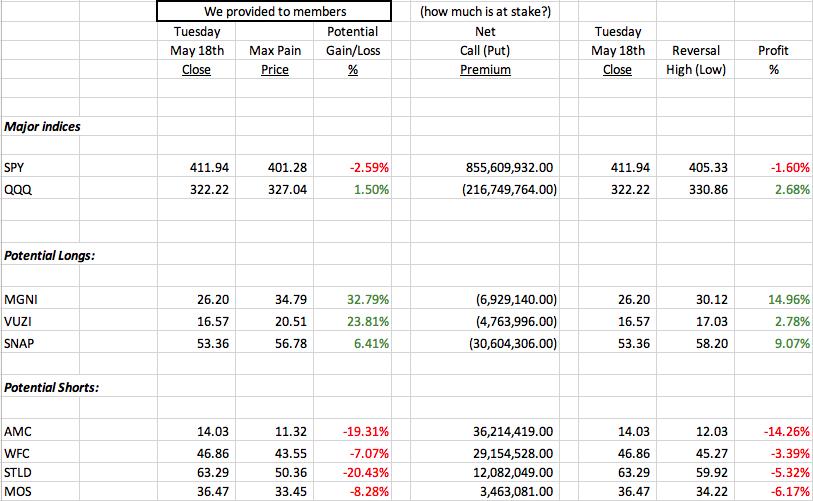

Will The Market Maker Manipulation Kick In Again This Month?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of my favorite times to trade is leading up to options expiration, because it's one time where I feel fairly comfortable which side of the trade that market makers are on. It's options expiration week and a time where we do a lot of research...

READ MORE

MEMBERS ONLY

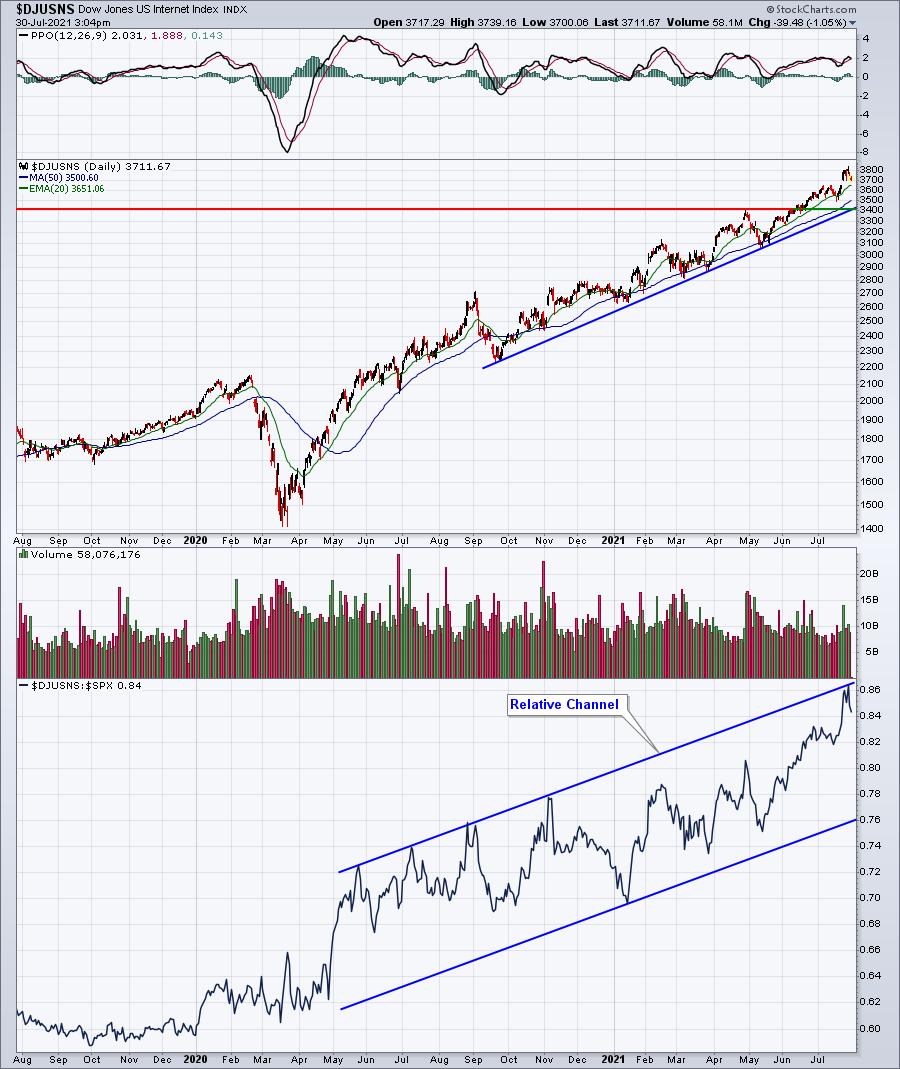

My PRIMARY Technical Indicator And One Industry Group Likely Under Your Radar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Following rotation in 2021 has been difficult because few industry groups have maintained leadership roles for any length of time. There have been a few. Specialty finance ($DJUSSP), internet ($DJUSNS), and software ($DJUSSW) come quickly to mind among our 5 aggressive sectors. Outside of the aggressive sectors, I could certainly...

READ MORE

MEMBERS ONLY

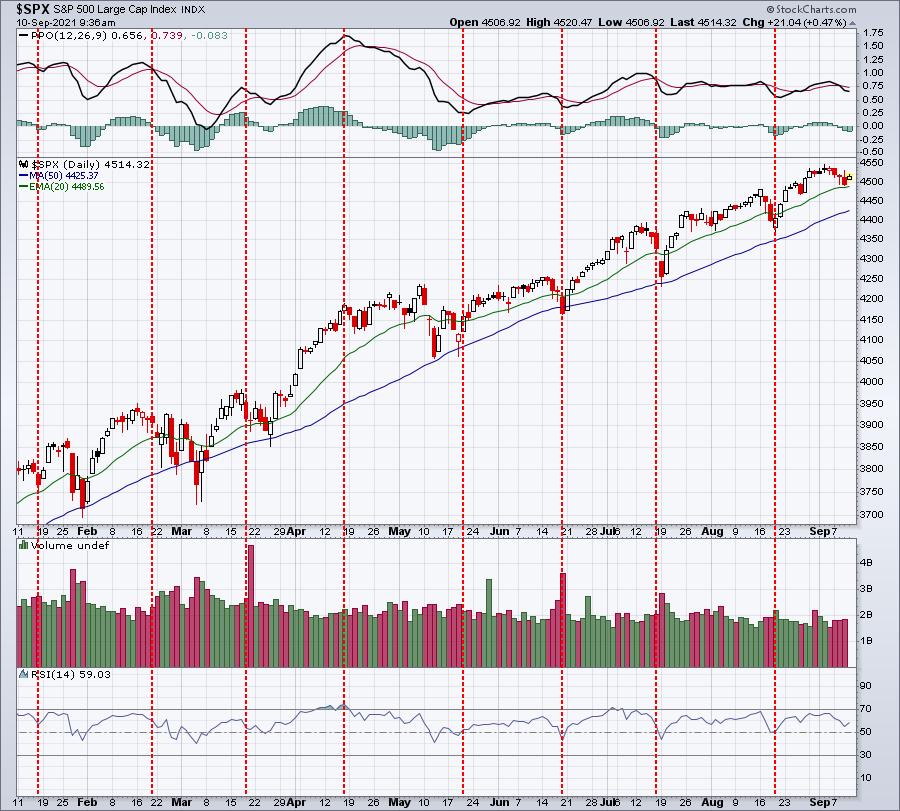

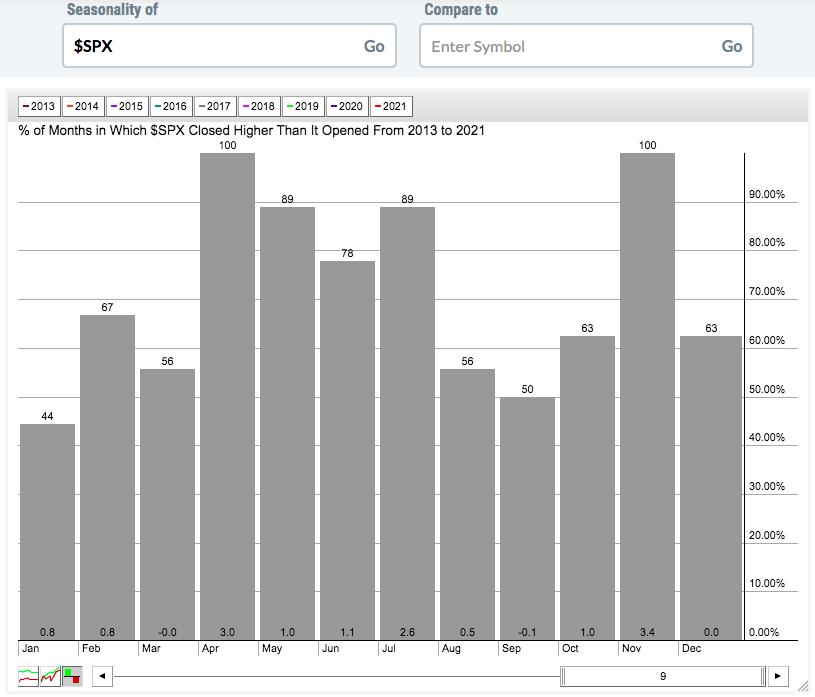

What You Need to Know About September Weakness

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Congratulations! We've made it through the first 10 days of September mostly unscathed. At the time of this writing, the S&P 500 is down slightly more than 0.50% month-to-date. Momentum remains fairly strong and the trend is up, so why should we worry? Well, let&...

READ MORE

MEMBERS ONLY

Strong Stocks Hitting Key Support Levels; S&P 500 Performance Could Be Impacted

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's no doubt that U.S. equities have been carried higher by a handful of mega-cap superstars. The S&P 500 is a market cap weighted index and its top holdings include:

* Apple (AAPL): 5.90%

* Microsoft (MSFT): 5.60%

* Amazon.com (AMZN): 4.05%

* Alphabet (GOOGL)...

READ MORE

MEMBERS ONLY

Making the Case for This Small Cap Software Stock to Explode

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It wasn't too long ago that a $5 billion market cap company was considered a "mid-cap". But in today's mega-cap world of Apple (AAPL) and Microsoft (MSFT) sporting $2.46 trillion and $2.25 trillion market caps, respectively, $5 billion to them is spare...

READ MORE

MEMBERS ONLY

Sample: EB Monthly Short Report - August 2021

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading stocks with a lot of short interest is a risky proposition. Many are being shorted for a reason and they drift lower and lower over time. However, not all short sellers are correct, and when a stock begins to break out and forces short sellers to cover (buy), that&...

READ MORE

MEMBERS ONLY

Two Scorching-Hot Groups Are Set Up For A Significant Decline - SELL NOW

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of the biggest developments in recent weeks has been the breakout in the U.S. Dollar Index ($USD). I've been expecting it and it happened last week:

The black arrows are marking all of the RSI tops at 65 and above and all the bottoms at 35...

READ MORE

MEMBERS ONLY

Taper Talk: Smoke and Mirrors to Drive Prices Lower

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One key element of our service at EarningsBeats.com is to address monthly max pain, which I define as the point at which in-the-money call premium completely offsets in-the-money put premium. As of Tuesday's close, there was a TON of net in-the-money call premium. On the SPY alone,...

READ MORE

MEMBERS ONLY

Should We Pay Attention To Bearish Seasonal Tendencies?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've studied the major indices from a historical perspective for decades. I believe there are reasons why bullish and bearish tendencies develop over time and why such seasonality repeats itself. For instance, I've published articles here in this blog and in ChartWatchers discussing significant tendencies before,...

READ MORE

MEMBERS ONLY

What Will Strong Results and an Ascending Triangle Get You?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's not at all unusual for a company to see a huge uptrend followed by a lengthy consolidation period. Many traders with short-term time frames will grow increasingly impatient and sell long before they should. But properly-employed capital is vital to a trader, so it makes sense to...

READ MORE

MEMBERS ONLY

Rotation and Seasonality Point To This Sector As Our Next Leader

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Rotation is nothing new during secular bull markets; it's actually what drives bull markets. Rather than money leaving the stock market for another asset class when leading sectors sell off, it simply moves from one sector to another sector. Financials (XLF) recently caught fire as treasury yields rebounded....

READ MORE

MEMBERS ONLY

Deciphering This Earnings Season - Winners and Losers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I can't help it. I love analyzing quarterly earnings reactions and how the entire stock market is being impacted. So, as of Friday, August 6th, we have an Excel spreadsheet at EarningsBeats.com that incorporates nearly 1700 lines of earnings data that includes:

* Quarterly earnings, both actual and...

READ MORE

MEMBERS ONLY

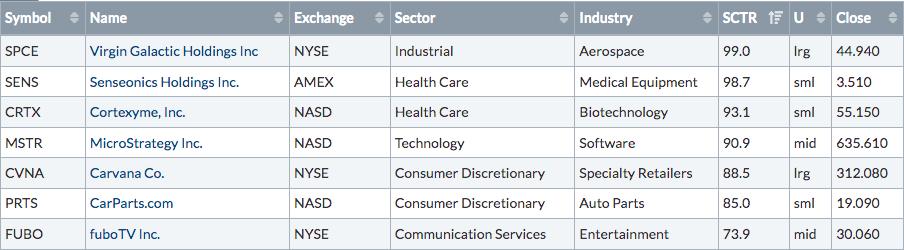

Hottest Stocks in The Hottest Industries

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's no secret that I'm a fan of leading stocks in leading industries. So, as we move through yet another earnings season -- and there's still plenty left in it -- I thought I'd review what I consider to be the best...

READ MORE

MEMBERS ONLY

Major Breakouts Are Continuing In A Big Way

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Months of consolidation is now resulting in key breakouts for a number of growth stocks. Amazon.com (AMZN), which will report quarterly results later today, was a high-profile breakout after nearly a year of consolidation. But that's simply set the beginning of a trend. Here are two more...

READ MORE

MEMBERS ONLY

It May Be The Boring Summertime, But Don't Tell These Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's 2021, but it's beginning to feel like it's 2020 again. I know, I know. Who wants to relive 2020 all over again, right? Well, thankfully, I'm just referring to the stock market. Many of the stocks that soared during 2020, and...

READ MORE

MEMBERS ONLY

Evaluating Early Earnings Results: 3 Big Winners Thus Far

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A great post-earnings set up needs to check several boxes. The first box I need to check is the "beat revenue and earnings estimates" box, followed closely by the "raised guidance" box. When a company beats top and bottom line estimates and raises guidance, it results...

READ MORE

MEMBERS ONLY

Will Earnings Be The Catalyst To Drive Breakouts In These 3 Dow Jones Stocks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As the stock market pushes further and further into record high territory, many companies have been slower to participate. For instance, the Dow Jones keeps trying to close above 35000 for the first time in history, yet many of its component stocks are still on the verge of breaking out....

READ MORE

MEMBERS ONLY

Don't Blindly Buy ETFs, Use This Strategy Instead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's great to hear about an awesome stock over the water cooler, but you should definitely do your own due diligence before committing capital. Exchange-traded funds, or ETFs, are a different animal altogether. ETFs are nothing more than a basket of stocks. They provide much more diversification, in...

READ MORE

MEMBERS ONLY

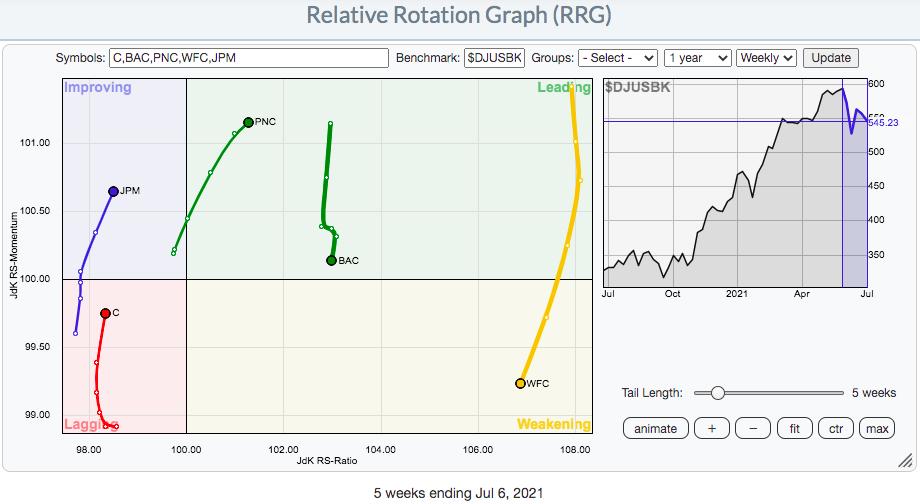

Are Strong AD Lines Suggesting Big Earnings Ahead for These 3 Companies?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season kicks off next week, with the big banks getting things started. After a rough stretch with falling treasury yields, the banks index ($DJUSBK) rallied on Friday as yields rebounded. Recently, I provided a relative strength look at key banks reporting next week. Here's a quick recap...

READ MORE

MEMBERS ONLY

Amazon (AMZN) "Prime" for a Breakout?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've been waiting a LONG time for Amazon (AMZN) to "deliver" a breakout. Well, our package may be arriving today. After setting an all-time high close in early September and testing that level in April, AMZN is soaring today to print an all-time intraday high in...

READ MORE

MEMBERS ONLY

Using RRG To Zero In On Opportunities Quickly

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

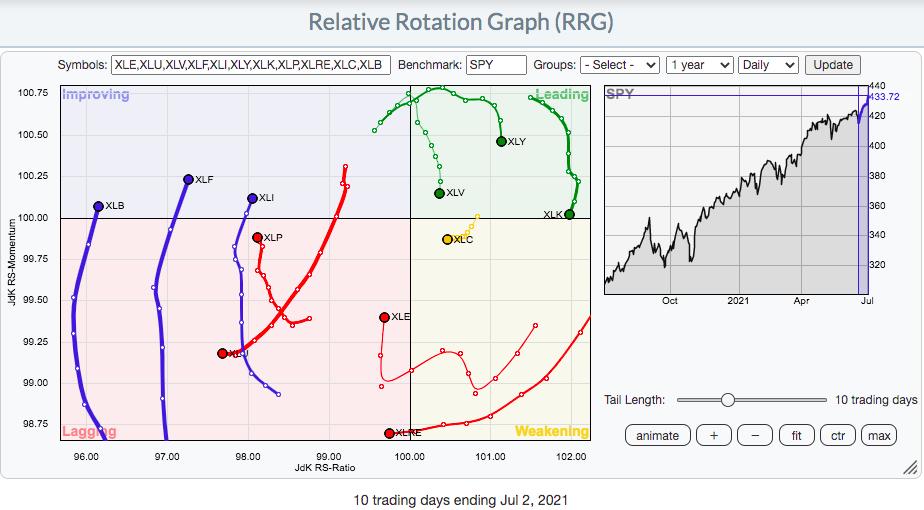

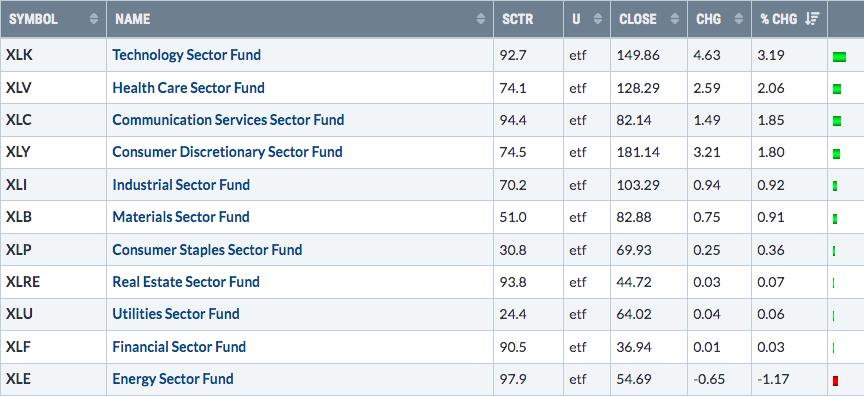

RRG (Relative Rotation Graphs) can quickly point us in the direction of leadership. Let me show you how. First, let's look at a daily RRG to see which sectors are strengthening and which are weakening:

I used a "tail length" of 10 days so we can...

READ MORE

MEMBERS ONLY

Is This Pre-Earnings Advance Sustainable?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

U.S. equities are doing what U.S equities normally do. They're rising as we approach earnings season. I wrote a ChartWatchers article recently, "Wall Street Doesn't Want You To See These S&P 500 Performance Numbers", summarizing the typical pre-earnings outperformance. Be...

READ MORE

MEMBERS ONLY

How to Determine Which Companies Will Report Blowout Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I view relative strength as one of the most important aspects of technical analysis. It helps me visualize where the money is going. When you review a price chart, it's very easy to see if a stock is going up or going down. As an example, let'...

READ MORE

MEMBERS ONLY

This Bottoming Head & Shoulders Pattern Is Set To Explode!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a big believer in patterns. I follow continuation patterns primarily, because I'm a momentum trader. So as stocks consolidate, I try to identify the pattern that shapes in order to gain insight into a possible measurement. That's what technical patterns offer - measurements/...

READ MORE

MEMBERS ONLY

Jinko Solar (JKS) Soars After Beating Estimates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Non-StockCharts.com Members

EarningsBeats.com members that DO NOT also have a StockCharts.com membership have asked for Excel downloads for use on platforms other than StockCharts.com. Within 24 hours, we will have all of our ChartLists available for Excel download.

Executive Market Summary

* Futures were bifurcated overnight and...

READ MORE

MEMBERS ONLY

These Two Growth Stocks are Likely Pausing Before a Big Run Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of our key ChartLists at EarningsBeats.com is our Raised Guidance ChartList. As the name implies, it tracks companies that raised their revenue and/or EPS expectations at some point over the last 90 days. Many times, once a stock raises guidance, profit-taking kicks in, traders grow impatient and...

READ MORE

MEMBERS ONLY

The Fed Has Spoken; What Did Wall Street Hear?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The latest FOMC meeting has come and gone. Fed Chair Jay Powell capped it off by recognizing that inflation was hotter than expected and even signaling that the Fed is ready to hike rates by the end of 2023, stepping up its earlier April guidance of "no rates hikes...

READ MORE

MEMBERS ONLY

It's Options Expiration Week, Be Careful With This Semiconductor

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Listen, NVDA has been one of the strongest market performers in 2021 and I believe there's a very good chance it goes much higher. But if I wanted to buy it, I'd likely wait a week or so. There are never any guarantees, but the number...

READ MORE

MEMBERS ONLY

Weekend Recap: Inflation Soars But Who Cares?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In The News

It was a light week for headlines as there wasn't much in the way of either economic or earnings news. Thursday did provide us our next glimpse into the inflation story as May CPI jumped 0.6%, ahead of the 0.4% expectation. That left...

READ MORE

MEMBERS ONLY

How To Avoid Option-Related Manipulation This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Friday, June 18th is the next monthly options expiration day and, if it's like recent option-expiration Fridays, then get ready for crazy reversals. To best illustrate how the madness around options expiration works, we'll review past results.

Before I do that, let me explain that I...

READ MORE

MEMBERS ONLY

Very Bullish Pattern Setting Up for This Leading Semiconductor Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Leading stocks go through consolidation periods where weak hands forego their shares as impatience takes over. It's never fun to watch the stock market break to new highs while your stock(s) consolidate and fail to gain ground. A trained technical eye, however, needs to recognize continuation patterns...

READ MORE

MEMBERS ONLY

Anticipating Where Money May Rotate Next and a Strong Trading Candidate

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Catching an industry group as it bottoms and begins to lead the market can be very profitable. We're seeing tons of rotation in the stock market, which is the biggest reason why selling doesn't last long. Money comes out of one group and then rotates into...

READ MORE

MEMBERS ONLY

Looking Ahead: Expect Selling Next Week For One Primary Reason

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

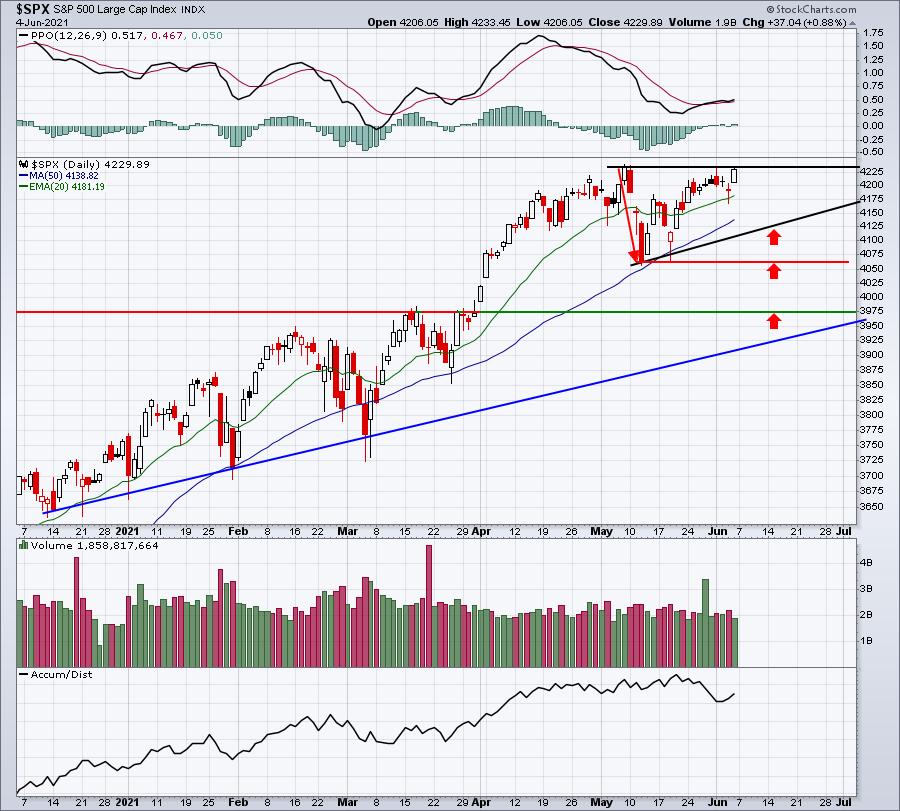

The S&P 500 reached a high on Friday of 4233.45, narrowly eclipsing the all-time high close of 4232.60 from May 7th. Unfortunately for the bulls, selling in the final few minutes ruined the breakout attempt. This false breakout, ever so slight, could be quite ominous for...

READ MORE

MEMBERS ONLY

Looking Ahead: What Might June Have in Store?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are two sides to every coin. Similarly, I can look at the market from an optimistic or pessimistic perspective. Each provides different answers as we look into June 2021.

The Bullish View

The first reason to be bullish is as simple as it gets. We're in a...

READ MORE

MEMBERS ONLY

Change the Range When the Trend Ends

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a momentum trader, so I look for consistent uptrending patterns before I commit capital. As I've said many times before, I'm most comfortable trading leading stocks in leading industry groups. These are the stocks that Wall Street favors and, in my opinion, offer...

READ MORE

MEMBERS ONLY

Has The Technology Run Ended?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I suppose the answer really depends on your level of expectation and your time frame. If you're looking for technology to outperform the benchmark S&P 500 over the next few months the way it did throughout much of 2020, then you'll likely be quite...

READ MORE

MEMBERS ONLY

Breakouts: Deciphering the Good from the Bad

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

From a long-term perspective, it's hard to imagine that it's a bad thing for your stock to be setting a fresh 52-week or all-time high. But from a short-term trader's perspective, there could be a world of difference. Two keys are the candlestick and...

READ MORE