MEMBERS ONLY

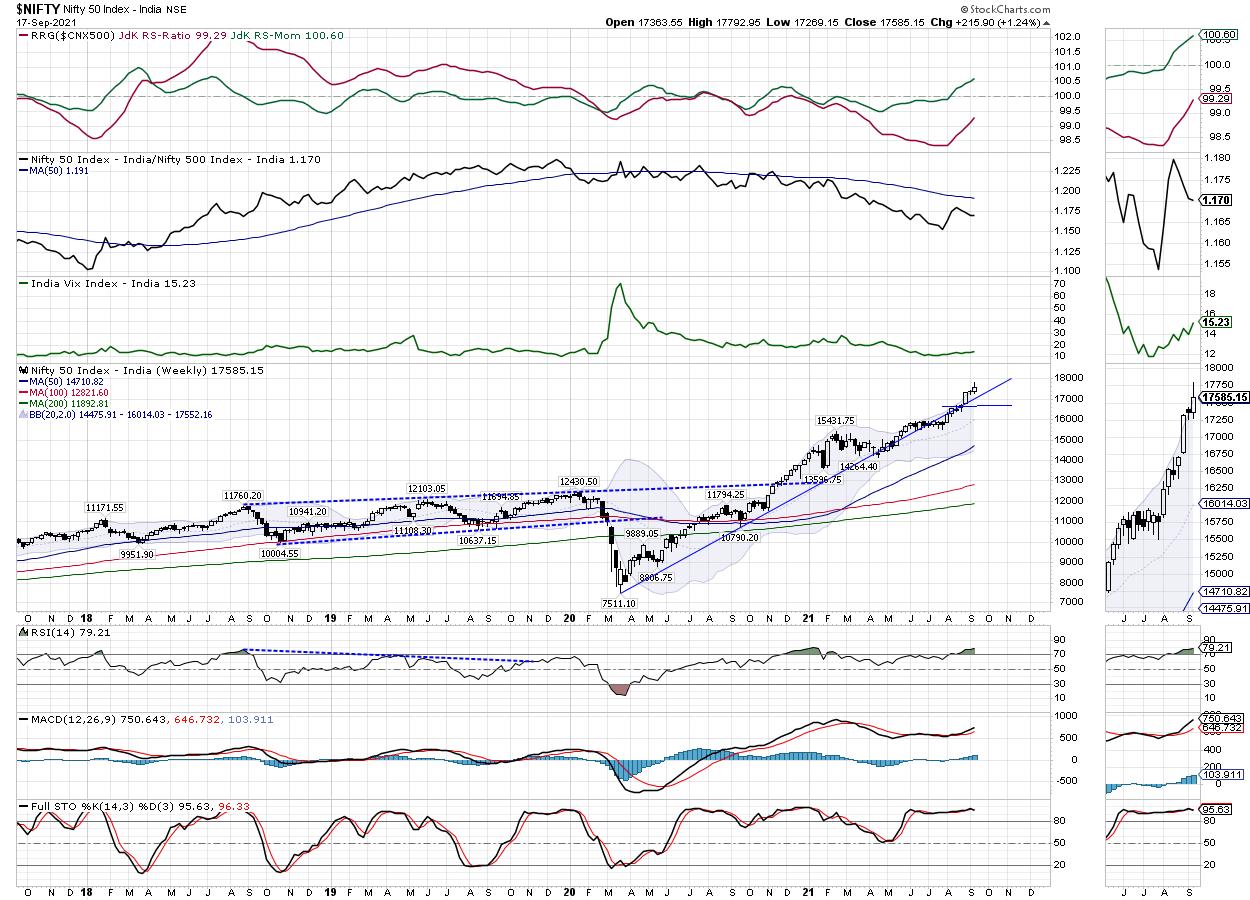

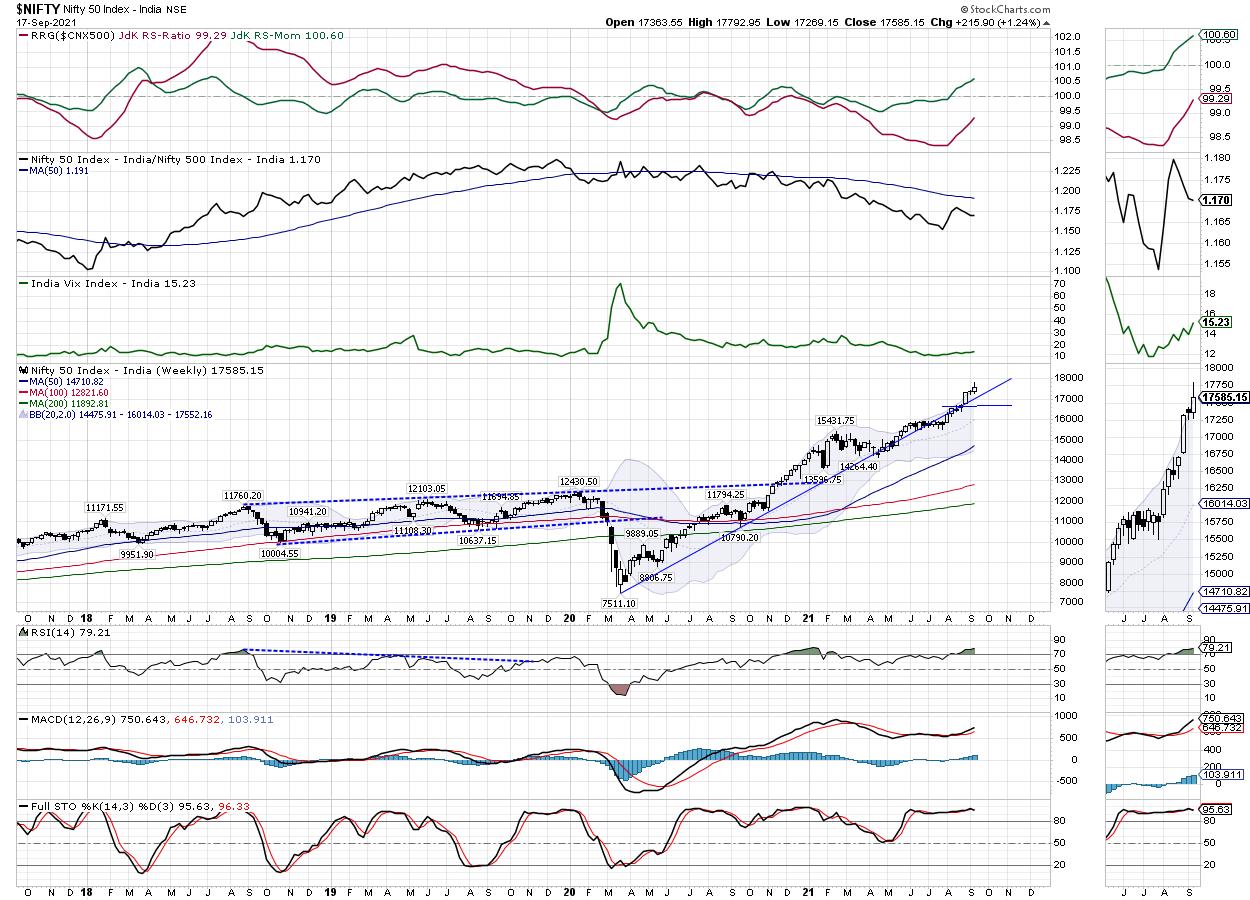

Week Ahead: NIFTY Stares at Important Support Levels; RRG Charts Show These Sectors Lending Inherent Strength to the Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by remained on much of the analyzed lines. In the previous weekly note, it was mentioned that the NIFTY is unlikely to see any runaway rise as per the technical setup, as well as the Options data that point in time. It was also mentioned that...

READ MORE

MEMBERS ONLY

Step Aside Chairman Powell, Mr. Market is Tightening for You

by Martin Pring,

President, Pring Research

Last week, the Fed announced that tapering is likely to begin later in the year, to be later followed by a leisurely hike in rates. As usual, those pesky impatient markets have decided to raise rates now rather than wait for the clobbering they know they will get later. It...

READ MORE

MEMBERS ONLY

Two More Climax Days Last Week That Were on the Mark

by Erin Swenlin,

Vice President, DecisionPoint.com

In last week's ChartWatchers newsletter, I wrote about the climax days that occurred the previous week. We saw two more last week and I'll give you the heads up that today we saw an upside initiation climax.

Here's a refresher on what a "...

READ MORE

MEMBERS ONLY

Let Charts Help You Identify Possible Winners - And Losers

by John Hopkins,

President and Co-founder, EarningsBeats.com

With Q3 earnings season kicking off over the next few weeks, it's important to try to identify those companies that might shine and those that might suffer once they release their earnings. It's true that you cannot rely solely on one company's chart to...

READ MORE

MEMBERS ONLY

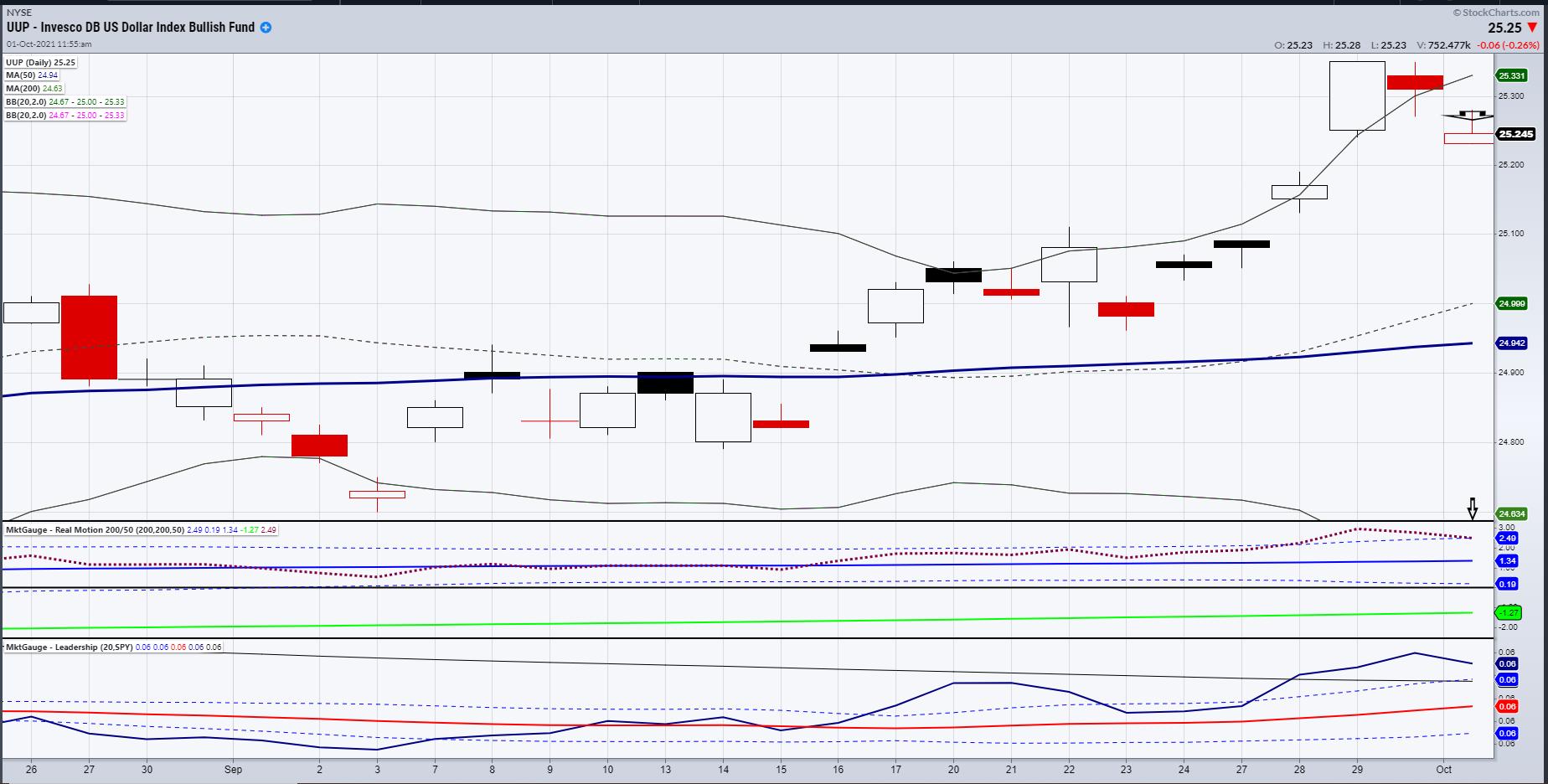

Mish: The U.S. Dollar Has Had Its Day

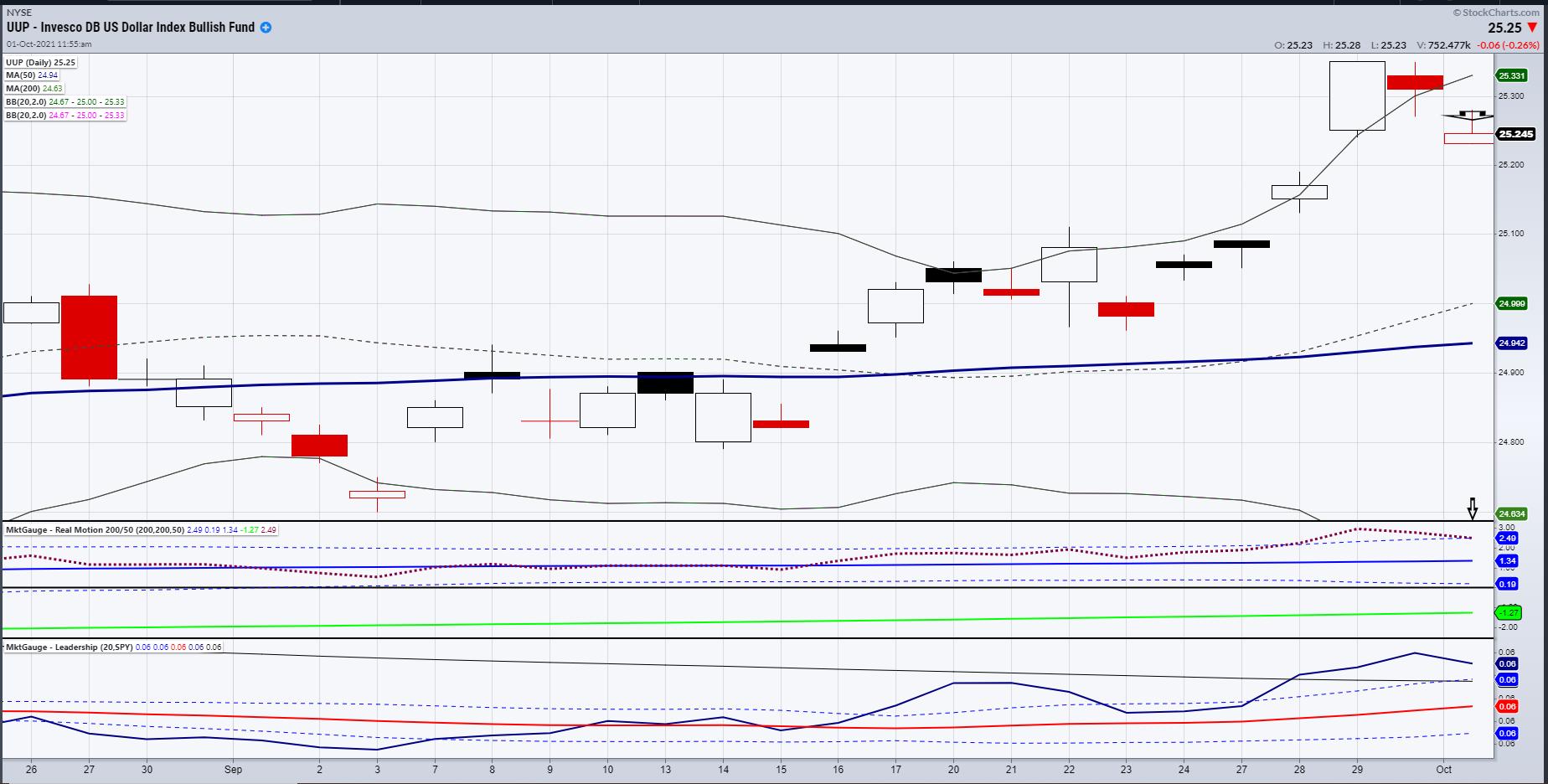

The U.S. Dollar chart, as represented by the Invesco DB US Dollar ETF (UUP), shows some classic signs of a top.

Before I delve deeper into the technicals though, let's look at the fundamental reasons for the dollar rally last week. For starters, China's slowing...

READ MORE

MEMBERS ONLY

Reviewing the "Weight of the Evidence"

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe spends a few minutes reviewing his "weight of the evidence" by briefly going through all the indicators in his arsenal. He then spends the bulk of the show going through the stock requests that came...

READ MORE

MEMBERS ONLY

A Strong Uptrend and Bullish Continuation Pattern for this Agriculture ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking to trade in the direction of the bigger trend have two options. First, take trend signals and act when the trend turns up. Once an uptrend is underway, chartists must then rely on pullbacks, short-term oversold conditions and bullish continuation patterns to hitch a ride. Today's...

READ MORE

MEMBERS ONLY

Chartwise Women: Power Up Your Investments by Using Momentum

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

The premiere of an all-new, all-different Chartwise Women is here! Mary Ellen and Erin kick things off by talking about momentum investing, their experience with it and show you some charts demonstrating how powerful momentum can be in your investing. They also share their own "runway stories" that...

READ MORE

MEMBERS ONLY

Double Tops Could Become "A Thing" in the Bond Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Bond Market Holds all the keys. And one of the key charts here is TLT.

After setting a big double top in 2020 and completing it at the end of the year, the start of 2021 was characterized by an acceleration lower, pushing yields higher. Support was found around...

READ MORE

MEMBERS ONLY

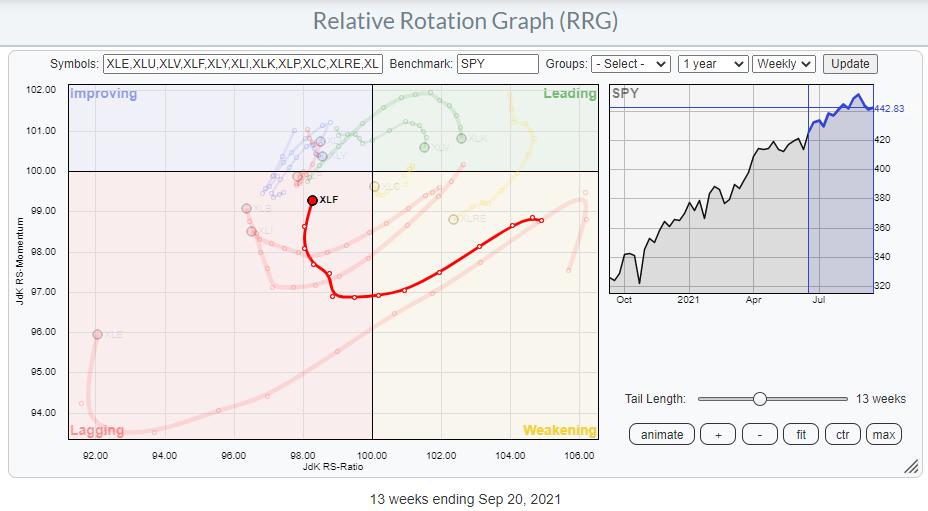

Strength Rotates Into the Financial Sector

Wednesday showed weakness in key sectors, including biotech (IBB), semiconductor (SMH) and transportation (IYT). We have closely been watching the transportation sector for improving strength as it has attempted to clear its 50-day moving average (DMA). However, IYT has instead broken underneath the 200-DMA and, though it sits in a...

READ MORE

MEMBERS ONLY

Hybrid Money Management and Strategies for Finding Hot IPOs

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave starts out with Mystery Charts and Mystery Chart reveals while covering methodology in Action. Next, he discusses "Hybrid Money Management" and whether or not it is psychological or statistical. Finally, he shares his strategies for finding hot IPOs.

This video was...

READ MORE

MEMBERS ONLY

Mish - Stock Traders: Buy the Dip or Buy Some Dip?

As many of you know, I am on many media outlets talking about the market, commodities, the state of the economy, and - yes - I was one of the first to talk about stagflation.

Oftentimes, I am joined by other investors, traders, analysts and financial consultants. What I and...

READ MORE

MEMBERS ONLY

RISE IN 10-YEAR TREASURY YIELD HURTS STOCKS -- TECH IS TAKING THE BIGGEST HIT -- ENERGY IS TOP SECTOR -- BANKS SHOULD BENEFIT FROM HIGHER YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD HITS 3-MONTH HIGH...The steep rise in Treasury yields that started last week continued again today. Chart 1 shows the 10-Year Treasury yield climbing 5 basis points today to 1.53%. That puts the TNX at the highest level in three months. Yields are being pushed higher...

READ MORE

MEMBERS ONLY

Sector Spotlight: Does The Bond Market Hold All the Keys?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I review the current rotations for Asset Classes and Sectors. As it is the last Tuesday of the month, I bring in the seasonality segment to find out if there are any meaningful seasonal patterns coinciding with current rotations on...

READ MORE

MEMBERS ONLY

This Tech Stock Breaks Out And Is Added To The RRG Long Basket

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After the last update of the RRG Baskets we were left with 3 shorts and 3 longs:

LONG : EXR, WM, CRM

SHORT: XLY, SWKS, PSX

LONG

Looking at the recent performance for the members of the long basket we see CRM and WM holding up well vs the S&...

READ MORE

MEMBERS ONLY

Rising Yields Have A History Of Favoring These Stocks; One Such Stock Is Being Heavily Accumulated

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Rising treasury yields can have a tremendous impact on which groups outperform and underperform. Many of us here at StockCharts.com write about the positive impact that rising yields can have on financials (XLF), especially banks ($DJUSBK) and life insurance companies ($DJUSIL). Because rising yields normally reflect Wall Street'...

READ MORE

MEMBERS ONLY

DP TV: Sky's the Limit on Energy and Oil ETFs

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl covers the major markets with a peek at mid- and small-cap ETFs. Indicators are positive, so certainly a bullish bias. There were two new IT Trend Model signal changes on XLE and XLU. Additionally, Carl and Erin review the Financial sector "under the...

READ MORE

MEMBERS ONLY

Step Aside Chairman Powell, Mr. Market is Tightening for You

by Martin Pring,

President, Pring Research

Last week, the Fed announced that tapering is likely to begin later in the year, to be later followed by a leisurely hike in rates. As usual, those pesky impatient markets have decided to raise rates now rather than wait for the clobbering they know they will get later. It...

READ MORE

MEMBERS ONLY

Mish - Transportation Sector, Budgets, Debts and Stocks

The key sector to reflect optimism/pessimism about consumers, industrial demand, supply chain issues and the upcoming budget proposals is Transportation (IYT).

The Retail sector improved to start the week. As measured by XRT, we see an improved phase back to bullish, but still a very much rangebound sector. We...

READ MORE

MEMBERS ONLY

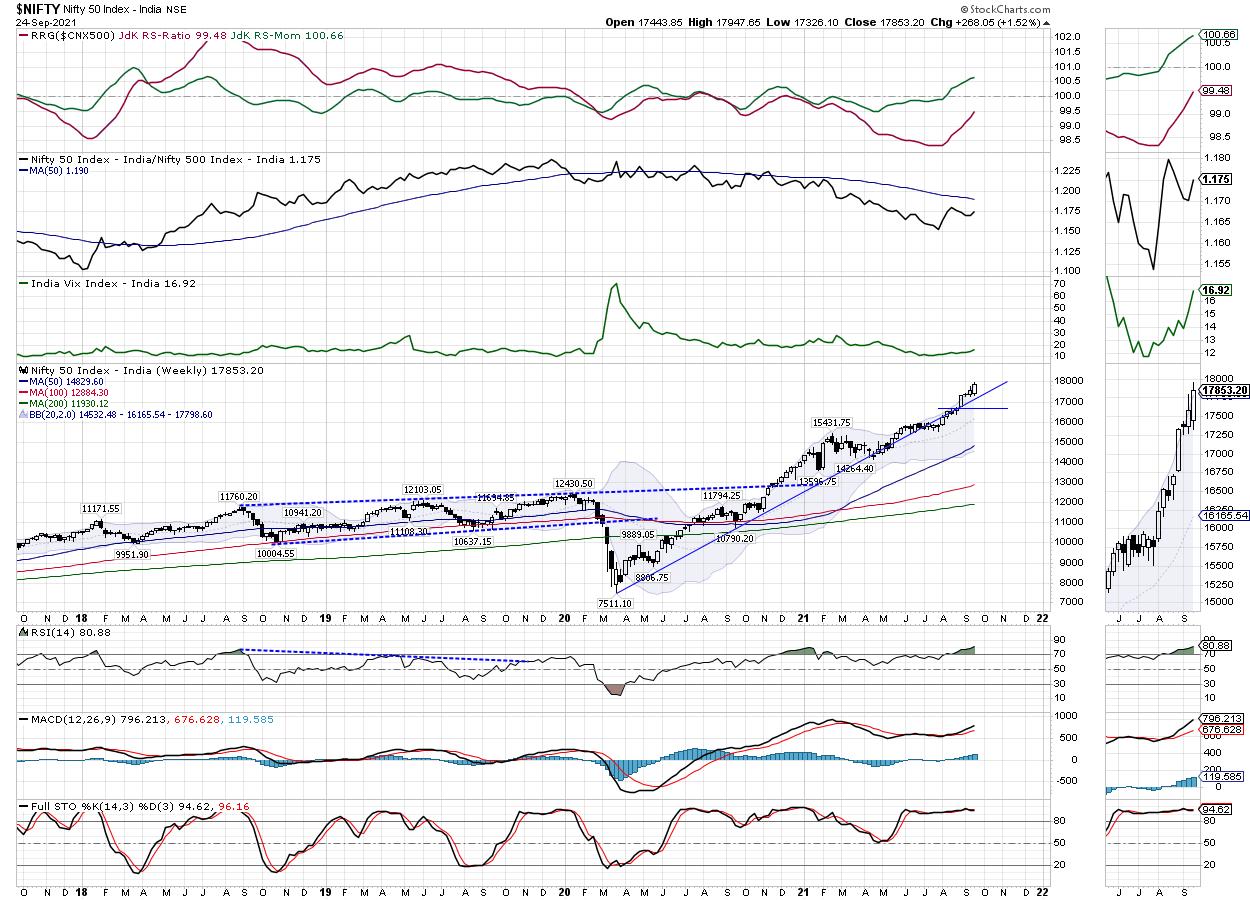

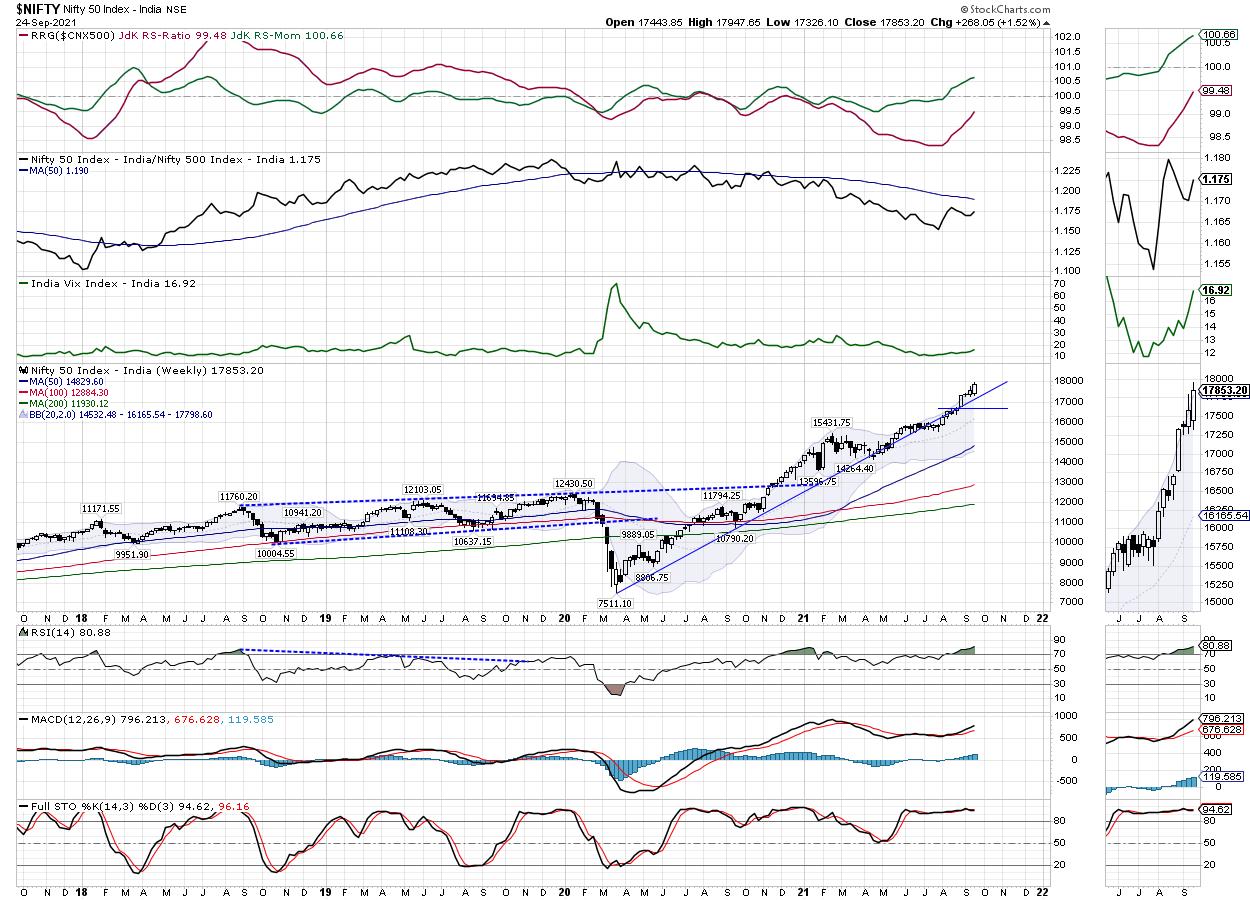

Week Ahead: Buoyant NIFTY May Face Consolidation at Higher Levels; Expect Outperformance from These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Much on the expected lines, the Indian equity markets had a strong week. Despite being overbought and a bit overextended on the charts, the stocks put up a resilient show while the NIFTY tested and closed at a fresh lifetime high point. The Indian market was one of the most...

READ MORE

MEMBERS ONLY

Bonds Throw a Tantrum and Banks Cheer

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 20+ Yr Treasury Bond ETF (TLT) threw a tantrum this week with the biggest two day decline since March 2020, which was a very chaotic month. With a sharp decline in bonds, the 10-yr Treasury Yield broke above its summer highs and the bulls stampeded into the Regional Bank...

READ MORE

MEMBERS ONLY

A Hundred Large Cap Stocks are in a Bear Market - And Wall Street is Looking for 35 of Them to Soar

by Mary Ellen McGonagle,

President, MEM Investment Research

While the S&P 500 and the Nasdaq 100 (QQQ) are in striking distance of their early September highs in price, over 20% of the Large Cap stocks within these Indices are in a bear market.* That is to say, they're down at least 20% from their...

READ MORE

MEMBERS ONLY

Why Gold Remains Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Gold has captivated human beings for millennia, infatuated with its appearance and it scarcity. Gold has also attracted investors for its value in hedging inflation and providing a stable store of wealth during periods of uncertainty.

While there are many narratives for gold related to transitory inflation, the Fed'...

READ MORE

MEMBERS ONLY

Three Climax Days This Week That Were Right On

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

Climax analysis is something unique to DecisionPoint and we've found that "climax days" are highly accurate in determining market bottoms and tops in the very short term.

A climax is a one-day event when market action generates very high readings in (primarily) breadth and volume indicators....

READ MORE

MEMBERS ONLY

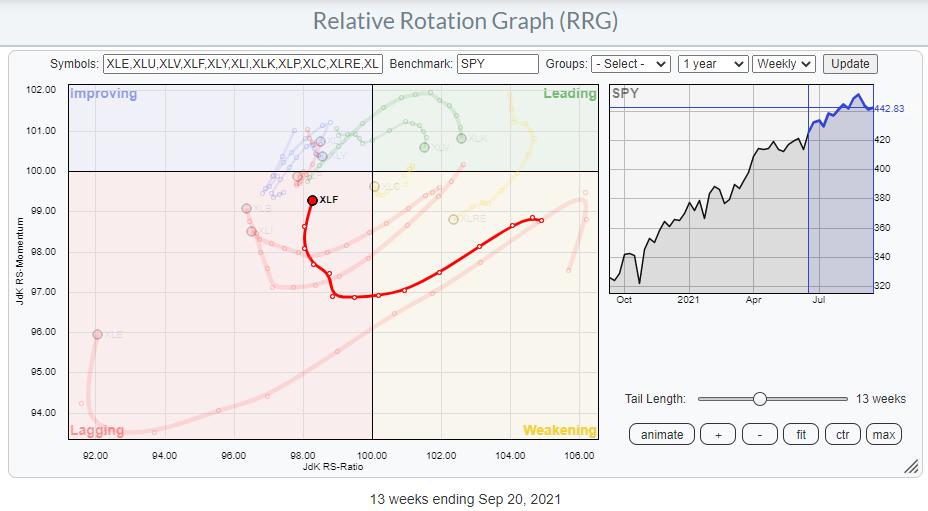

Breaking Down the Financials Sector on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for sectors, the Financials sector, XLF, is positioned inside the lagging quadrant and heading upwards to the improving quadrant. The sector is gaining on the vertical JdK RS-Momentum axis, but not so much (yet) on the horizontal Jdk RS-Ratio axis.

On the price chart, XLF...

READ MORE

MEMBERS ONLY

Markets Regain Upside Momentum

by Mary Ellen McGonagle,

President, MEM Investment Research

This week on StockCharts TV'sThe MEM Edge, Mary Ellen reviews the broader markets and highlights a shift into newer sectors. She also reviews stocks that had major moves last week which, in turn, impacted other stocks in their group.

This video was originally recorded on September 24, 2021....

READ MORE

MEMBERS ONLY

Are Transportation Stocks Setting up for Monday?

On Friday, the transportation (IYT) sector made a comeback from this week's lows, along with clearing resistance from its 200-day moving average (DMA) at $249.46. Next, it will need to clear its 50-DMA at $252.16.

A strong transportation sector is important because this sector helps show...

READ MORE

MEMBERS ONLY

This Sector Is Turning The Bullish Corner; Higher Prices Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As you probably know, my background is in public accounting. I practiced as a CPA for two decades prior to turning my full attention to technical analysis. My analysis of the stock market always includes both fundamental and technical analysis, with a historical component sprinkled in. (I never met a...

READ MORE

MEMBERS ONLY

STOCK INDEXES REGAIN 50-DAY LINES -- ENERGY AND FINANCIALS ARE STRONGEST SECTORS -- INDUSTRIALS AND MATERIALS BOUNCE OFF 200-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS MAKE UP LOST GROUND...Two strong days in a row have more than made back losses suffered on Monday. In addition, some of the short-term technical damage has been repaired. More specifically, 50-day moving averages that were broken on Monday have been regained on the S&P 500...

READ MORE

MEMBERS ONLY

The Market Fails to Clear Key Price Levels

On Wednesday, the Fed announcement continued past promises of reducing their bond-buying program and keeping interest rates low. The 120-billion-dollar bond-buying program will first look to reduce $15 billion per month beginning near the end of the year before it moves towards raising interest rates.

Looking through the eyes of...

READ MORE

MEMBERS ONLY

What You Need to Know to Trade Cryptos

by Larry Williams,

Veteran Investor and Author

Larry is back again! The topic du jour is "Trading Bitcoins & Cryptocurrencies." They have become really big markets with a huge following. Larry will share his insights on how to trade them, the problems with them and the opportunities. If you're a Bitcoin trader, you&...

READ MORE

MEMBERS ONLY

When the Market Takes a Tumble and How to Handle It

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave discusses the elephant in the room and he has a lot of thoughts about it. He talks about methodology in action and market timing - "Where are we now?" The charts will change over time, but the concepts are still there....

READ MORE

MEMBERS ONLY

Is the Market Sending Mixed Signals to Dip Buyers?

On Tuesday, the Market attempted a recovery, with an initial gap higher followed by choppy price action throughout the day. Because the market is not selling off like it did early Monday, this is showing that the market is having trouble bouncing back quickly.

For the past week, the media...

READ MORE

MEMBERS ONLY

Commodities Experience a False Upside Breakout -- Or Did They?

by Martin Pring,

President, Pring Research

Earlier in the month, I pointed out that the long-term indicators for commodities were still bullish, but getting overbought. At the same time, several intermarket relationships were signaling danger, which suggested some degree of vulnerability. Prices have not moved very much since then, but, bearing in mind that overstretched technical...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Markets Take a Nose Dive -- What's Next?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Be Careful what you wish for.... the market finally seems to be starting to give in. As Europe opens the week lower and the US follows, I assess the rotations at asset class and sector level on this edition of StockCharts TV's Sector Spotlight. With the market now...

READ MORE

MEMBERS ONLY

STOCKS SUFFER BIGGEST DROP SINCE THE SPRING -- 50-DAY MOVING AVERAGES HAVE BEEN BROKEN -- BREADTH MEASURE WEAKEN FURTHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEPTEMBER SELLING DEEPENS ON CHINA CONCERNS... Monday's heavy selling of stocks was the biggest drop since the spring. The selling started in China on concerns over its property market and spread to Europe and the U.S. Going into Monday, stocks were already pulling back on fears that...

READ MORE

MEMBERS ONLY

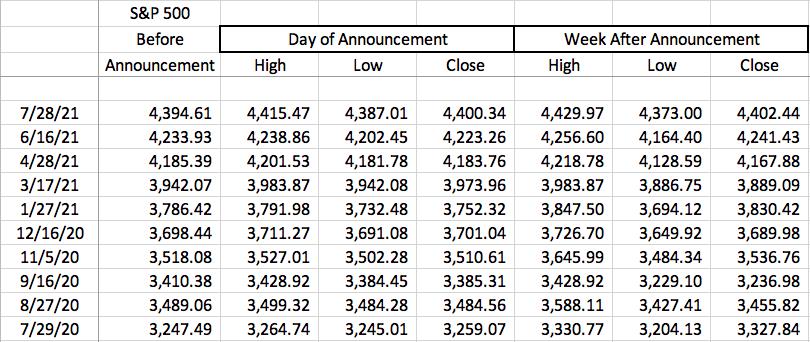

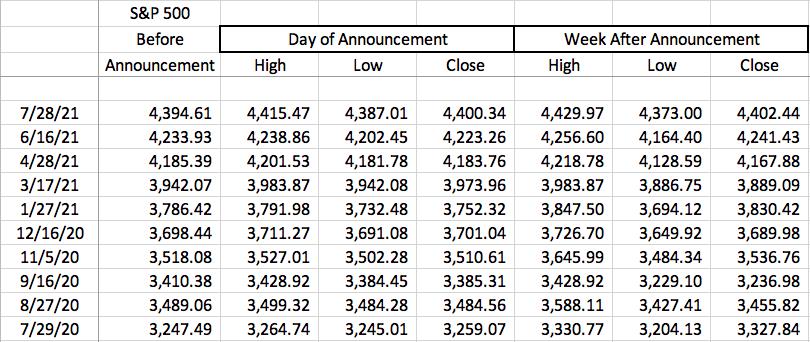

Here's How Wall Street Has Reacted To The Fed The Last 10 Meetings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Fed began its latest 2-day meeting this morning and it'll release its latest FOMC policy decision on Wednesday at 2pm ET. From past experience, I know there's been significant volatility after Fed announcements, so I thought I'd summarize the S&P 500...

READ MORE

MEMBERS ONLY

DP TV: FAANG+ Safety Net Gone!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin and Carl concentrate on what could be a Downside Exhaustion Climax. Carl covers off the broad markets and indicators with special attention to a possible exhaustion. Will it form a solid market bottom? The FAANG+ stocks (top 10 cap-weighted SPX stocks) were already showing...

READ MORE

MEMBERS ONLY

How to Create a Successful Trading Plan

Some people say that trading takes nerves of steel and insane willpower. Maybe people with these skills exist, but to become successful at trading you don't need to have such rare superpowers. What a successful trader needs, and what many traders fail to create, is a solid plan....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Broadly Consolidate; RRG Chart Shows This Sector Ending Its Relative Underperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As discussed in an earlier technical note, the Indian equity markets were grossly overbought; as a result, they were largely expected to consolidate. However, in the first four days of the week, the NIFTY put up a very strong show as it kept marking incremental lifetime highs on a closing...

READ MORE