MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2020-01-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup videofor January is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Escalating International Tensions Could Lead To Channel Support Test

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

U.S. indices have gone nearly straight up since early October, are extremely overbought near-term, and have needed reason for a pause. They may have received their reason overnight with U.S. airstrikes in Iraq. I refrain from political discussions because it honestly is not necessary nor productive. As technicians,...

READ MORE

MEMBERS ONLY

Bull in a China Shop

by Martin Pring,

President, Pring Research

* Major Breakouts Coming Out of China

* Four Chinese ETFs

Major Breakouts Coming Out of China

Thursday's price action in China resulted in a powerful signal that Chinese equities are headed significantly higher. That should be bullish not only for China but for the world as a whole. In...

READ MORE

MEMBERS ONLY

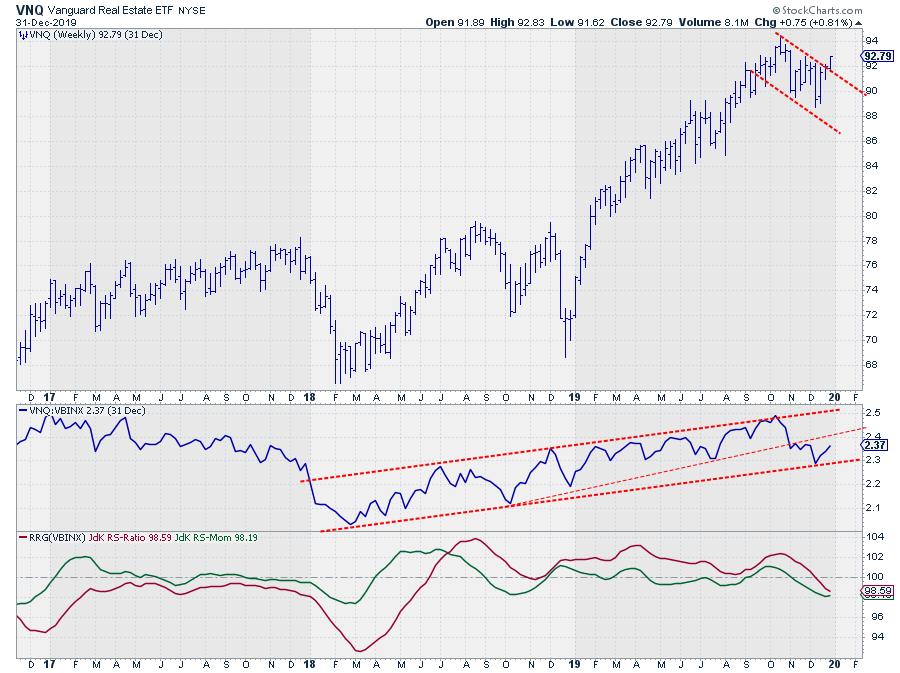

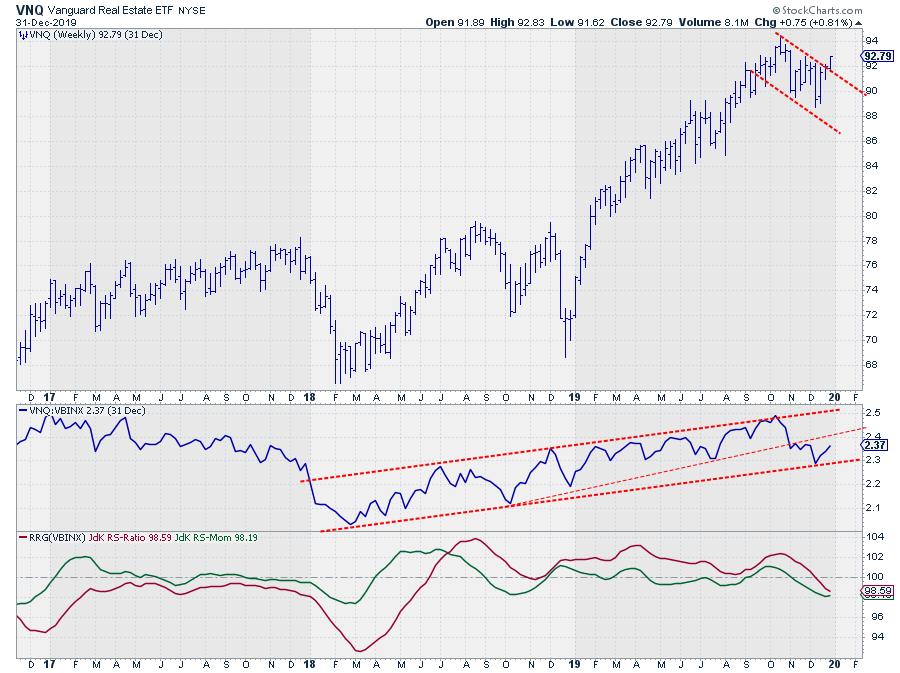

Is Real Estate Coming to Life Again?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Real Estate started to lose relative strength vs. VBINX in November, then crossed over into the lagging quadrant on the weekly Relative Rotation Graph in December. On the weekly RRG for asset classes, VNQ is still well inside the lagging quadrant and considered one of the weak(er) asset classes....

READ MORE

MEMBERS ONLY

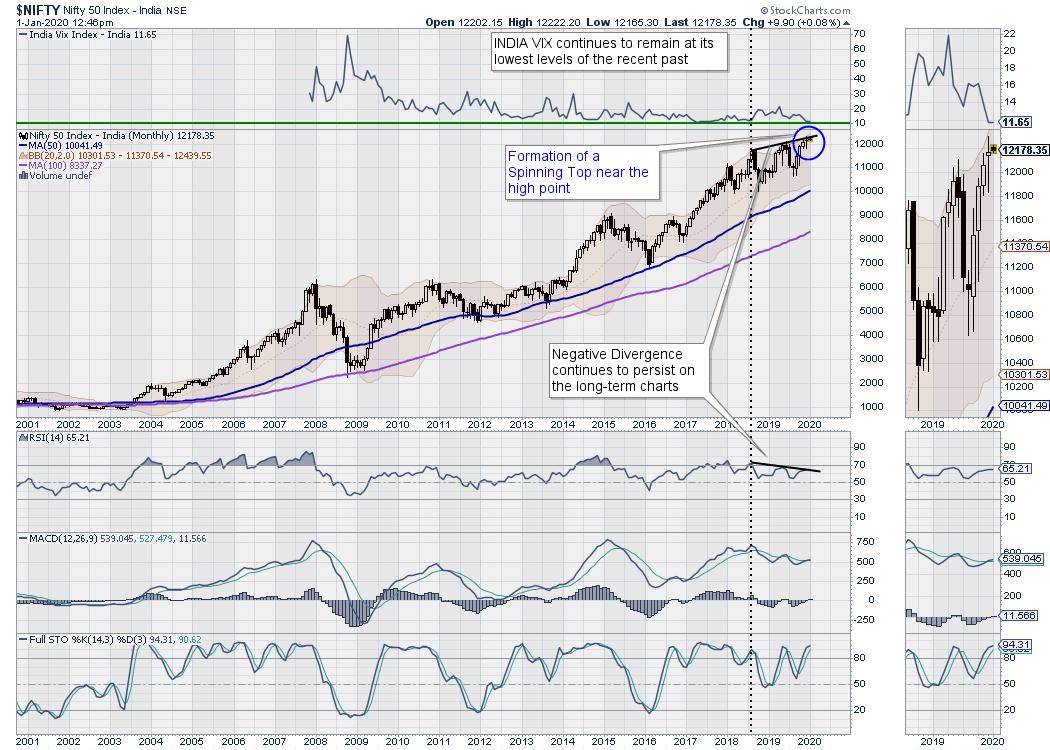

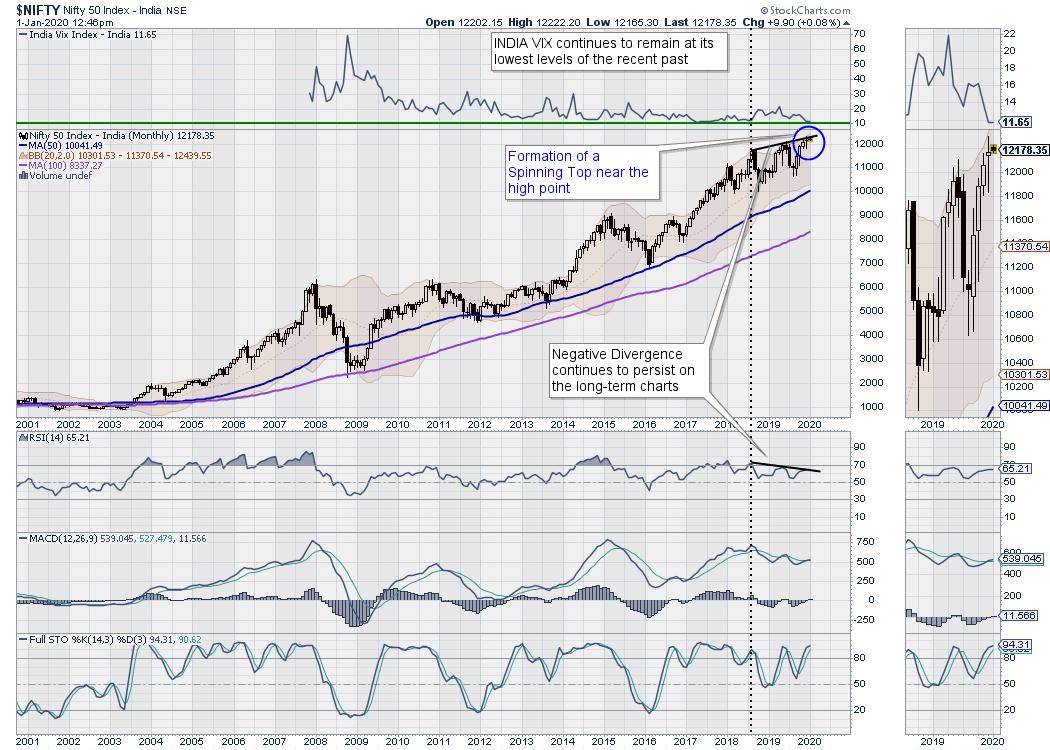

Special Note: Are We Looking At 2020 As A Year Of Capped Gains? These Charts Have A Story To Tell

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As 2019 ended, we saw the markets ending near the high point of the year. Despite the negative ending on the last trading day of the year, the front-line NIFTY50 has ended the year with strong gains of 11.53% on an annual note. However, that being said, the year...

READ MORE

MEMBERS ONLY

Sector Spotlight: Plotting Seasonality for All Sectors in One Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I discuss a way to plot multiple seasonality patterns on one graph and combine them with the tails on a Relative Rotation Graph. This video originally aired on December 31st, 2019.

Sector Spotlight airs weekly on Tuesdays 10:30-11:00am ET....

READ MORE

MEMBERS ONLY

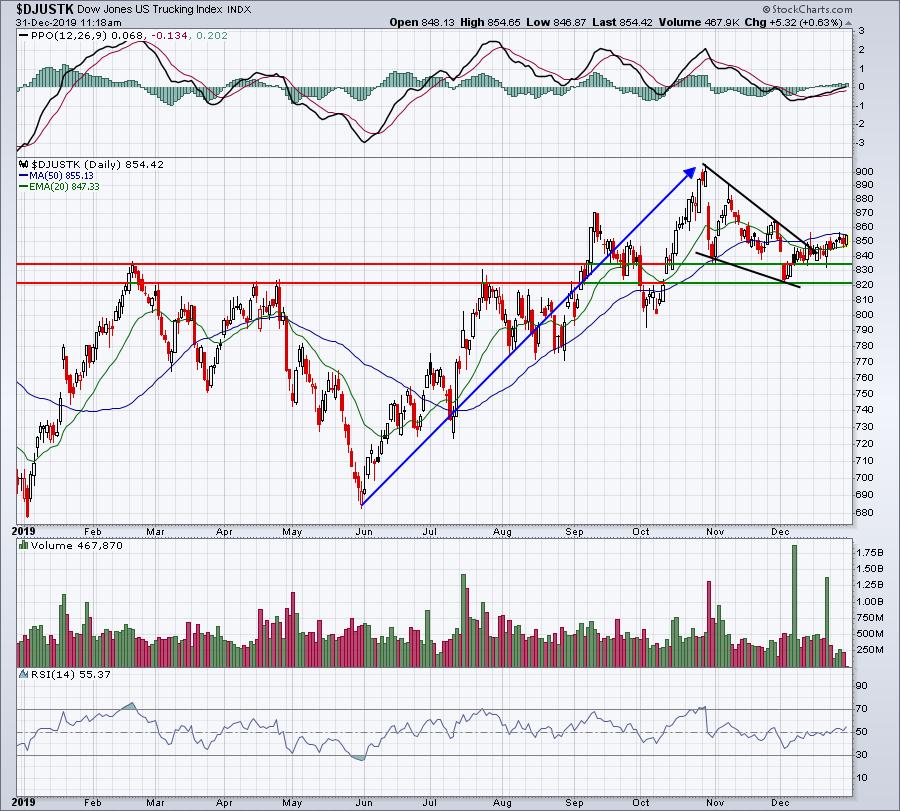

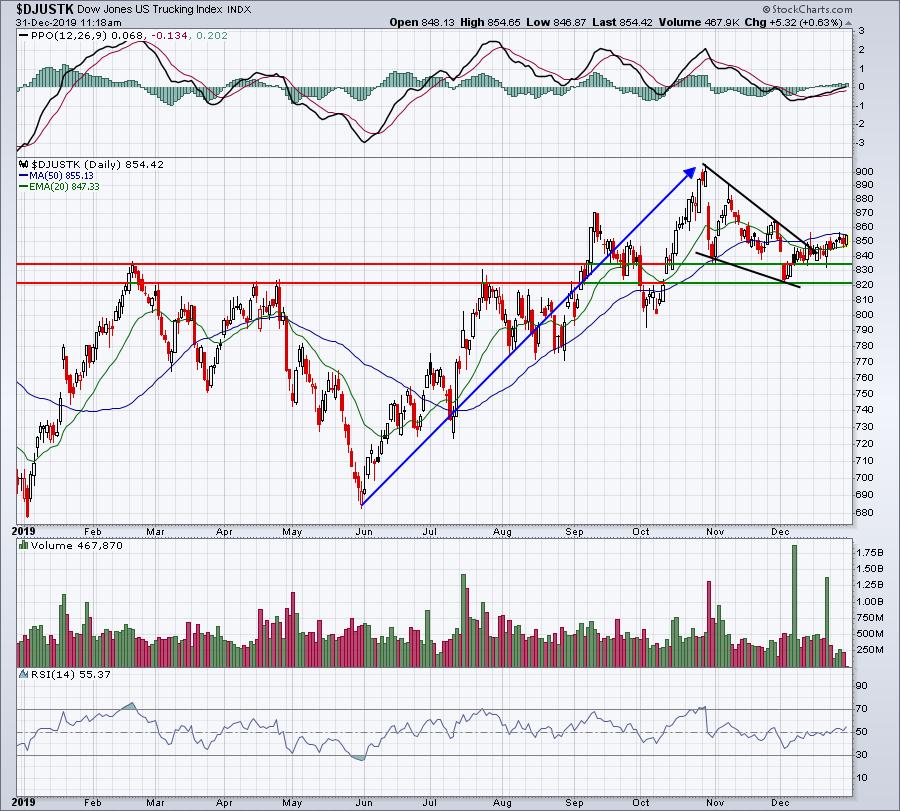

Truckers Appear Poised To Drive Us Into 2020

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* Futures were relatively flat today, but we have seen some slight selling to close out a very solid 2019

* Small and mid caps are leading on a relative basis and clinging to fractional gains

* All sectors are fairly flat to close out the year

* Gold ($GOLD) and...

READ MORE

MEMBERS ONLY

Are We Looking At Some Moves Here?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

JUBLFOOD.IN

This stock has seen 2 months of sideways moves and, during this time of consolidation, the RS line, which compares the stock against the broader NIFTY 500 Index, is strongly moving higher.

The Bollinger Bands have grown over 60% narrower than usual, which reflects a period of low...

READ MORE

MEMBERS ONLY

Here's A Solid Support Level To Watch On The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* Futures were slightly higher this morning

* Sellers have dominated the action since the opening bell, although small caps are bucking the trend and slightly higher

* Financials (XLF) are unchanged and the relative leader today

* Energy (XLE) and healthcare (XLV) are the hardest hit sectors

* Semiconductors ($DJUSSC) and...

READ MORE

MEMBERS ONLY

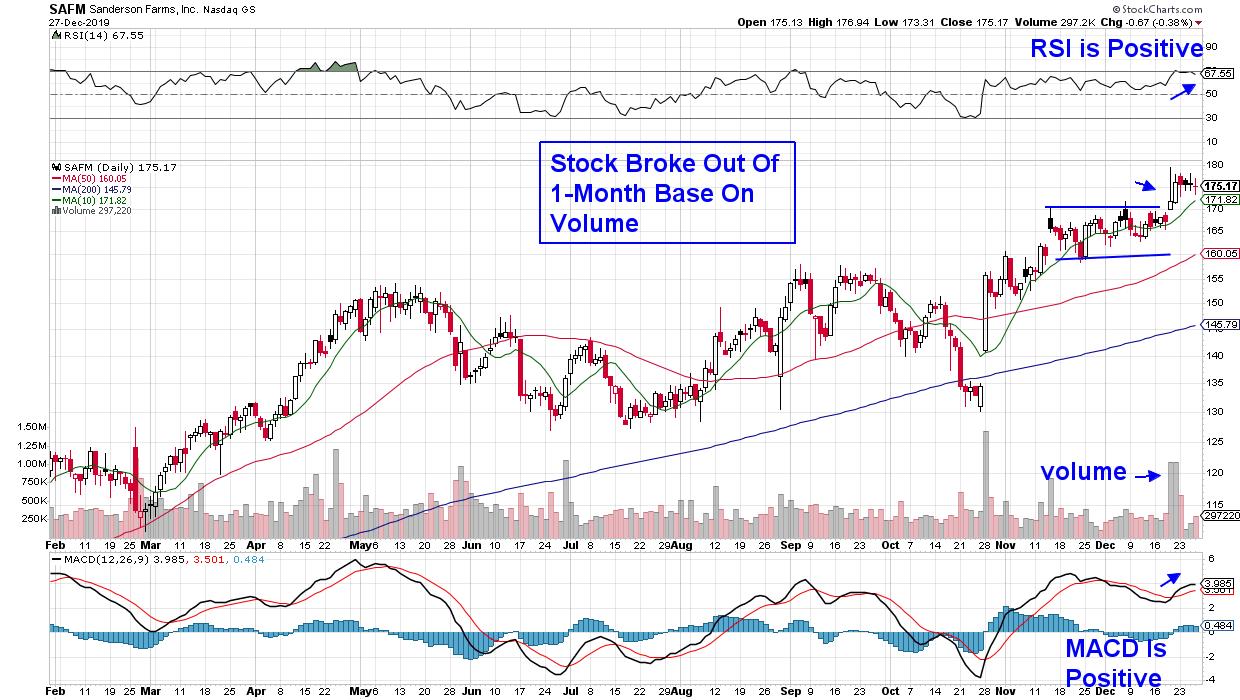

Four Breakthrough Stocks For 2020 That'll Benefit Most From The Phase 1 Trade Deal

by Mary Ellen McGonagle,

President, MEM Investment Research

News of next month's signing ceremony for Phase 1 of the U.S.–China trade pact is moving things closer to finalization. As experts sort through the 86-page trade document, clear-cut winners and losers are emerging as we move into 2020.

Among some of the biggest winners are...

READ MORE

MEMBERS ONLY

Determining If A Group Could Be A 2020 Market Leader; 2020 Market Vision Is Just One Week Away!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Whether a group looks strong or weak can easily be debated and it's what makes the stock market go round and round. Nondurable household products is one example. Is it breaking out or breaking down? This could be an interesting debate and it really gets to the heart...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY at a Crucial Juncture Again; RRG Chart shows Steady Rotation of These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With just two trading days left in the year, this week will usher us into 2020. The markets are set to end near their highs this year, but they are also leaving us at a critical juncture if we look at the market technical from the long-term point of view....

READ MORE

MEMBERS ONLY

Two Expectations For The New Year

by Gatis Roze,

Author, "Tensile Trading"

Happy New Year! In my world, this means looking backwards over the year just past and looking forwards to set goals for the year to come. A recent article in the Wall Street Journal about GRACE provided the catalyst for my thinking herein about my own expectations in the coming...

READ MORE

MEMBERS ONLY

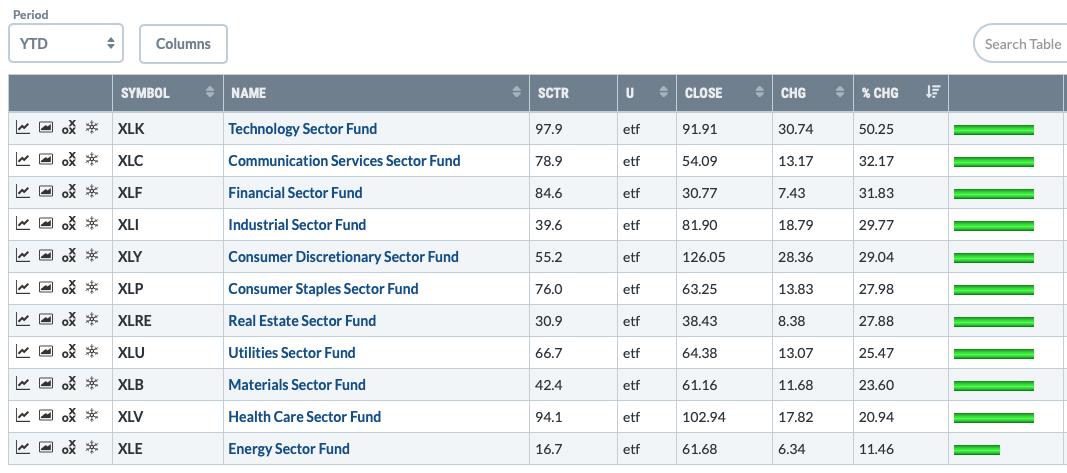

This Sector is Poised to Outperform According to DecisionPoint Indicators

by Erin Swenlin,

Vice President, DecisionPoint.com

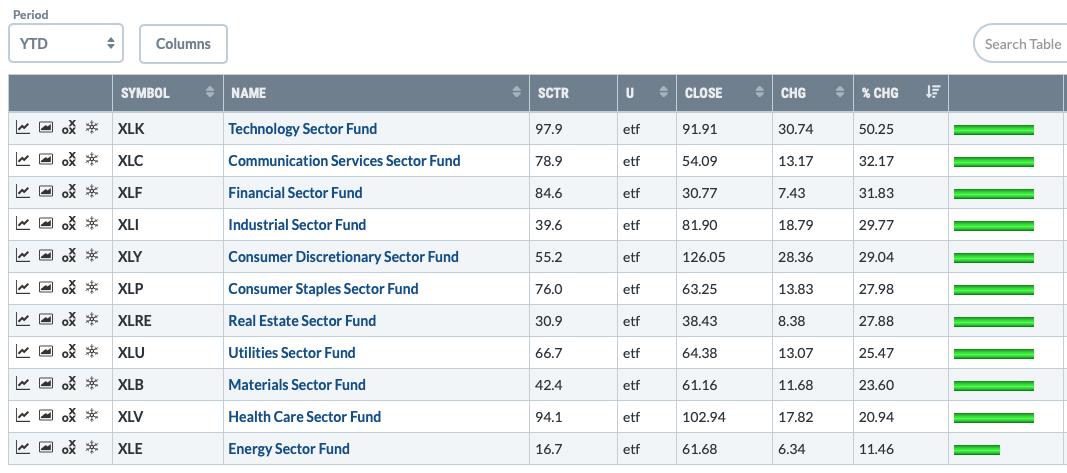

Carl and I have put together our Sector SPDR ChartList that includes all of our major indicators on each chart. I've been watching the sectors closely; most of the sectors Year-To-Date have been performing well, although none have really outpaced Technology when you look at the Sector Summary:...

READ MORE

MEMBERS ONLY

DP ALERT WEEKLY WRAP: Monthly Chart Review; New Gold BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Thursday the gold 20EMA crossed up through the 50EMA, generating an IT Trend Model BUY signal. Notice also, that we had other indications alerting us that gold's price action was about to turn positive. There was a double bottom, followed immediately by the PMO crossing up through...

READ MORE

MEMBERS ONLY

Why the Dollar Could Weaken in 2020

by John Murphy,

Chief Technical Analyst, StockCharts.com

Yesterday's message suggested that commodity prices may be bottoming; which could lead to a better 2020 for the first time in years. Part of that analysis, however, was based on expectations for a lower dollar. That's because a falling dollar is usually necessary for commodity markets...

READ MORE

MEMBERS ONLY

What's in a Forecast? See for Yourself and Be Amazed!

by John Hopkins,

President and Co-founder, EarningsBeats.com

On September 23, our Chief Market Strategist Tom Bowley, who had just returned to EarningsBeats.comafter 4.5 years as Senior Technical Analyst at StockCharts, made a bold call. Right as the market was in danger of rolling over, Tom saw something that caught his attention, which he shared with...

READ MORE

MEMBERS ONLY

WHY THE DOLLAR COULD WEAKEN IN 2020 -- SPREAD OVER FOREIGN YIELDS HAS NARROWED -- STRONGER FOREIGN STOCKS BOOST LOCAL CURRENCIES -- CANADIAN DOLLAR RISES WITH COMMODITIES -- EM CURRENCIES ARE TURNING UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHY A LOWER DOLLAR...Yesterday's message suggested that commodity prices may be bottoming; which could lead to a better 2020 for the first time in years. Part of that analysis, however, was based on expectations for a lower dollar. That's because a falling dollar is usually...

READ MORE

MEMBERS ONLY

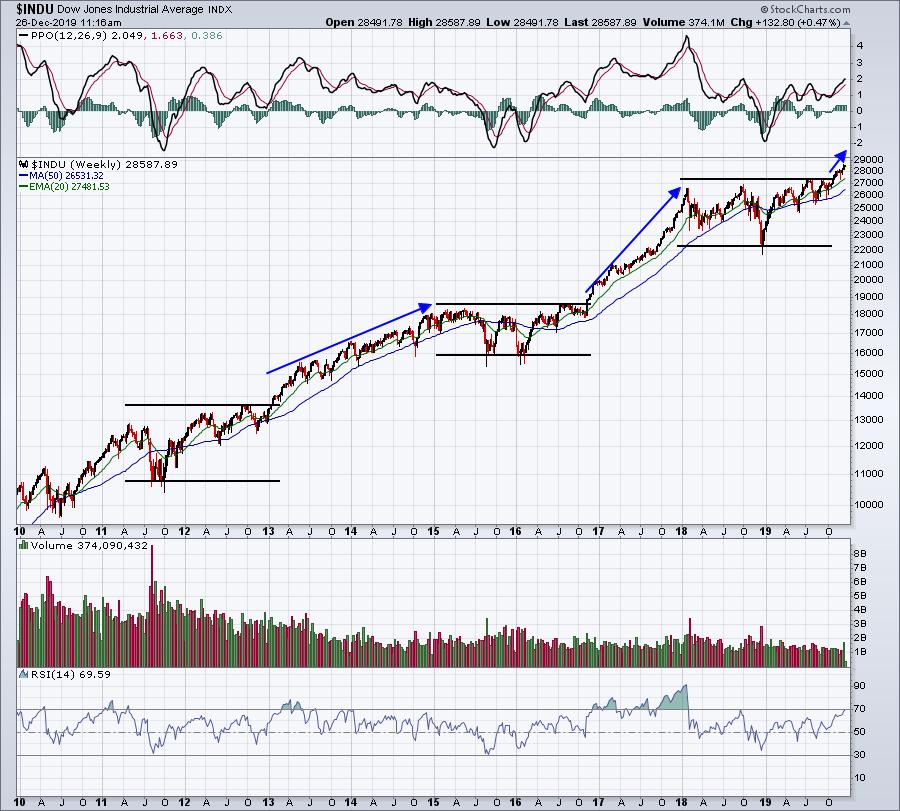

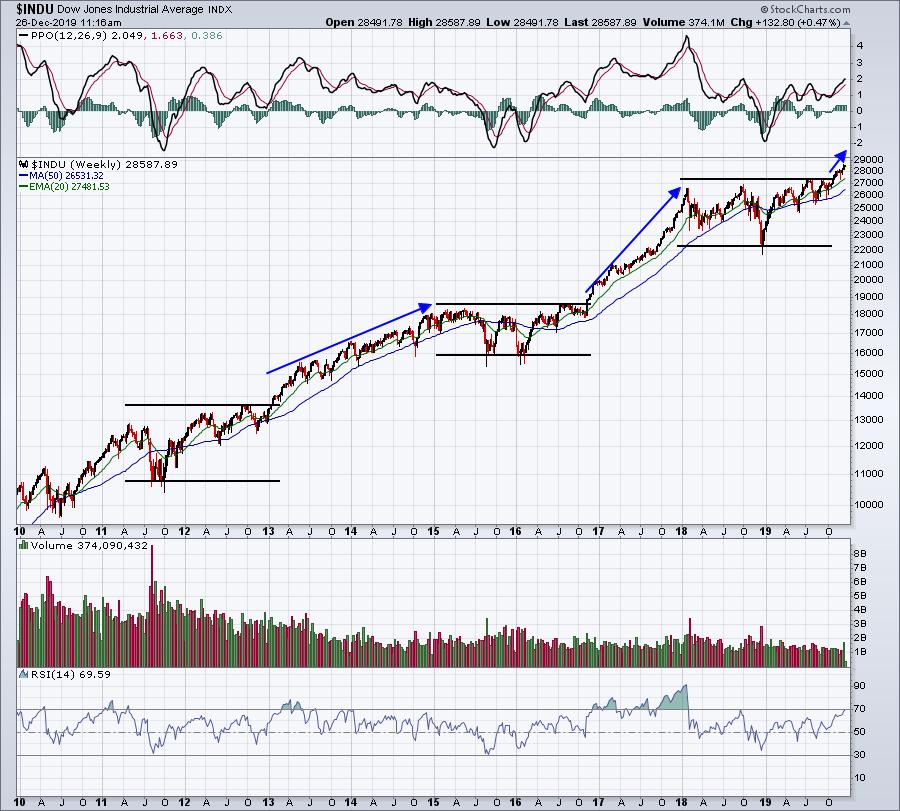

2019: A Year Filled with Distractions

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2019 was a year with lots of distractions, and yet the S&P 500 recorded 52-week highs in six of the last nine months. The index surged 17.7% the first four months and recorded its first 52-week high in late April. It then finished strong with a new...

READ MORE

MEMBERS ONLY

Will This Rally Continue In January? Use This Chart As A Guide

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* Pre-market action is pointing to another strong open as the year end rally continues

* Dow Jones futures are pointing an 80 point gain at the open and NASDAQ futures are showing relative strength once again

* A couple smaller biotechs - Flexion Therapeutics (FLXN) and Immunomedics, Inc. (IMMU)...

READ MORE

MEMBERS ONLY

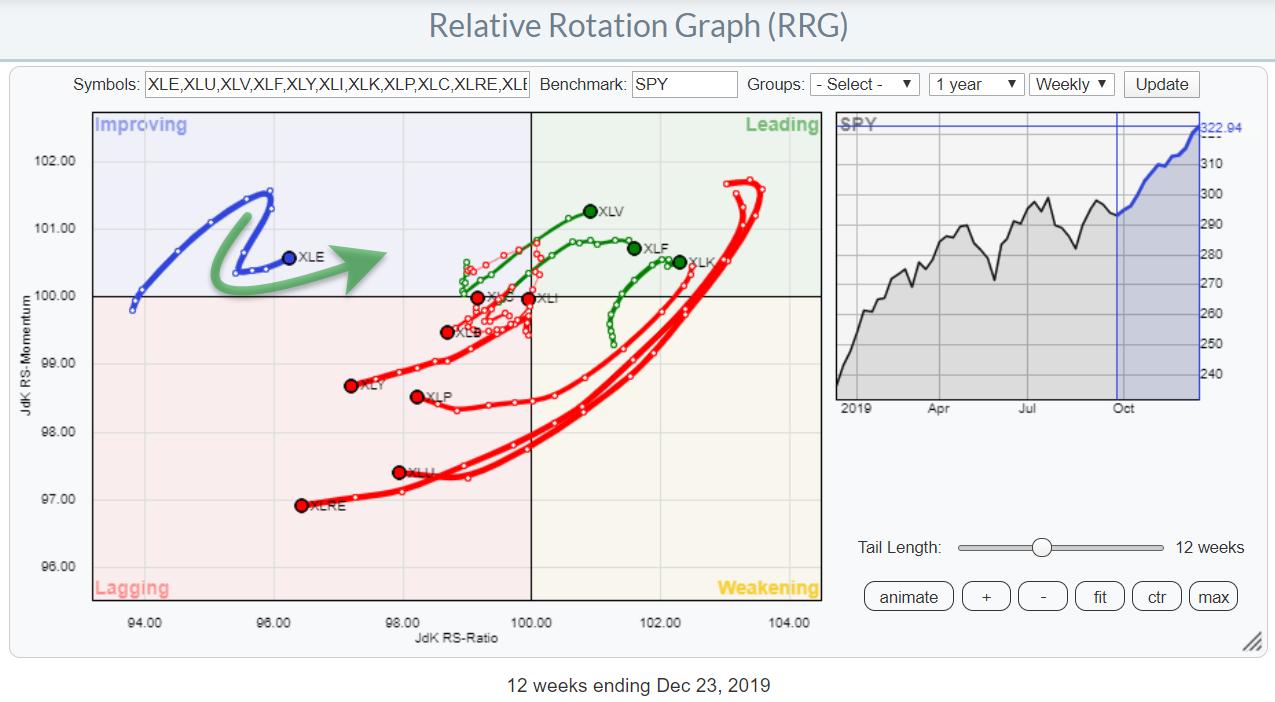

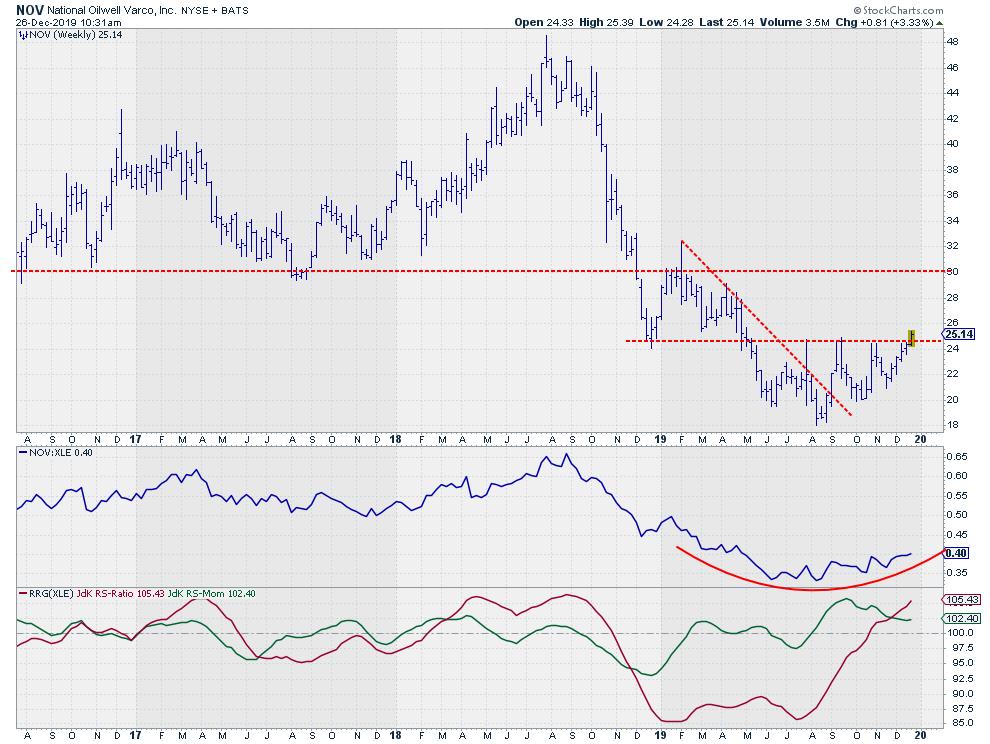

Is The Energy Sector Preparing For a Turnaround?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

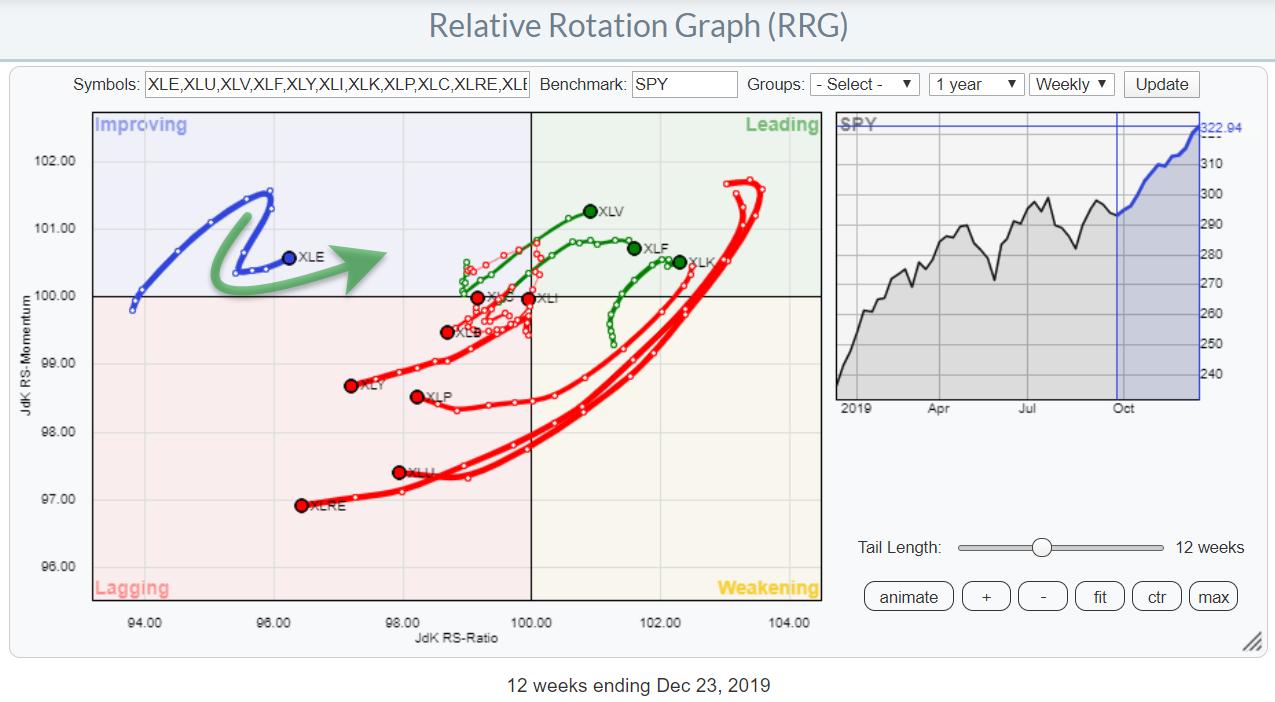

The RRG showing the Relative Rotation for US sectors has the energy sector inside the improving quadrant. Make no mistake, based on the JdK RS-Ratio reading, this is still the weakest sector in the S&P 500 - but things seem to be changing.

XLE crossed from weakening into...

READ MORE

MEMBERS ONLY

WEAKER DOLLAR COULD MAKE 2020 A BETTER YEAR FOR COMMODITIES AND STOCKS TIED TO THEM -- MOST COMMODITY GROUPS ARE STRENGTHENING -- THAT INCLUDES ENERGY WHICH MAY BE BOTTOMING

by John Murphy,

Chief Technical Analyst, StockCharts.com

A WEAKER DOLLAR COULD GIVE COMMODITIES A BETTER 2020... Commodities have become the forgotten asset class over the past several years. And for good reason. They've been the weakest part of the financial universe for nearly a decade. But that doesn't mean that they should continue...

READ MORE

MEMBERS ONLY

OLED, SNAP, AMZN; They're Moving Today, But Are They Worthy?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* We're up again today with leadership from the NASDAQ; small caps lag

* Most sectors are higher with technology (XLK) showing a slight lead

* Apple's (AAPL) leadership is helping the NASDAQ and computer hardware ($DJUSCR)

* Banks ($DJUSBK) are strong with the 10 year treasury...

READ MORE

MEMBERS ONLY

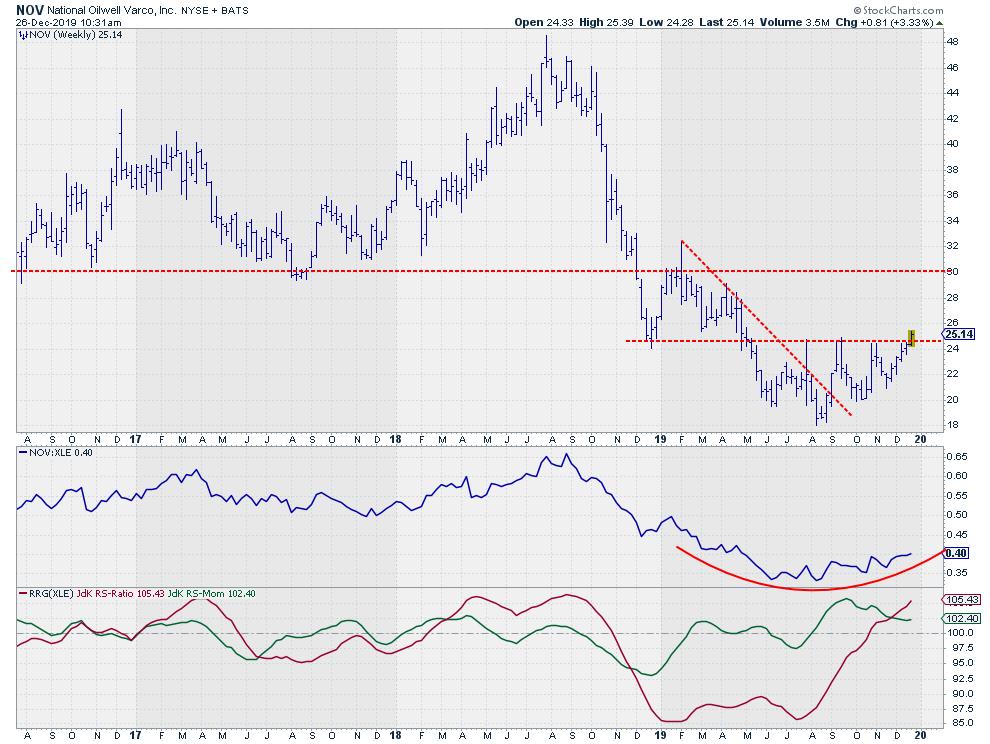

This Energy Stock is Turning Around

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the above Relative Rotation Graph, the Energy sector (XLE) hooked back towards a positive RRG-Heading while inside the improving quadrant. In terms of the JdK RS-Ratio, it is still the weakest sector, but things seem to be starting to improve.

Although the sector as a whole may not be...

READ MORE

MEMBERS ONLY

Random Thoughts: 20 Trading Resolutions for 2020 and Beyond, Part 1

by Dave Landry,

Founder, Sentive Trading, LLC

Well, it's that time of year. A time to look back at last year and, more importantly, to look ahead to a new year. Are you going to be the great trader in 2020 that you are meant to be? Or are you going to fall into your...

READ MORE

MEMBERS ONLY

Look For Wall Street Records To Keep Falling Throughout The Holidays

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Executive Market Summary

* Today is an abbreviated session with the equity market closing at 1pm EST; many global equity markets are closed today

* Wall Street opened slightly higher, but has been trading near the flat line

* There are no economic reports of significance due out today as the 10 year...

READ MORE

MEMBERS ONLY

Power Charting TV: Wyckoff Workshop

by Bruce Fraser,

Industry-leading "Wyckoffian"

Good friend Tom Bowley invited me to conduct a Wyckoff Accumulation Workshop this past Friday. On January 4th Tom, with John Hopkins of earningsbeats.com, will be hosting the epic event Market Vision 2020. This day long event will include nine top market strategists. Each will summon their immense analytical...

READ MORE

MEMBERS ONLY

PRECIOUS METALS APPEAR TO BE TURNING UP -- BUT SILVER IS IN THE LEAD -- SO ARE ITS MINERS -- SINCE SILVER IS PART INDUSTRIAL METAL, IT SHOULD DO BETTER THAN GOLD IN A STRONGER ECONOMY

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD IS TURNING HIGHER... Money appears to be flowing back into precious metals. Chart 1 shows the GOLD SPDR (GLD) rising above a falling trendline extending back to early September which suggests that the four-month downside correction may have run its course. It's also trading at the highest...

READ MORE

MEMBERS ONLY

Market Report for Monday, December 23, 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

During the holidays, I'll be publishing my EarningsBeats.com Daily Market Report here in my Trading Places blog. I hope you enjoy it.

Happy holidays!

Executive Market Summary

* We're seeing another solid day as seasonal strength really begins to kick in

* The Dow Jones is...

READ MORE

MEMBERS ONLY

Aggressive Small And Mid Cap Stocks Could Be Poised To Soar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I established an Aggressive portfolio of 10 equal-weighted stocks in 10 different industry groups on May 19th. Every 3 months thereafter, on August 19th and then again on November 19th, I repositioned the portfolio with new relative leaders. That's the concept behind the portfolio. Stick with leaders in...

READ MORE

MEMBERS ONLY

A Boring Stock with a Bullish Theme for 2020

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A theme is a fundamental trend that could influence a stock's price in the coming months, or even years. As powerful as themes seem, they are still secondary to price action. There are many forces driving price movements and we cannot be expected to know them all. In...

READ MORE

MEMBERS ONLY

Week Ahead: Follow Trend Cautiously as Loss Of Momentum Seen; RRG Tells Us to Focus on These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The risk-on global setup, which had begun a week before, continued throughout the past week as well. The resultant buoyant setup fueled the Indian markets higher as well, which ended at their high lifetime levels. Though the momentum continued to falter, the markets did not show any sign of retracement...

READ MORE

MEMBERS ONLY

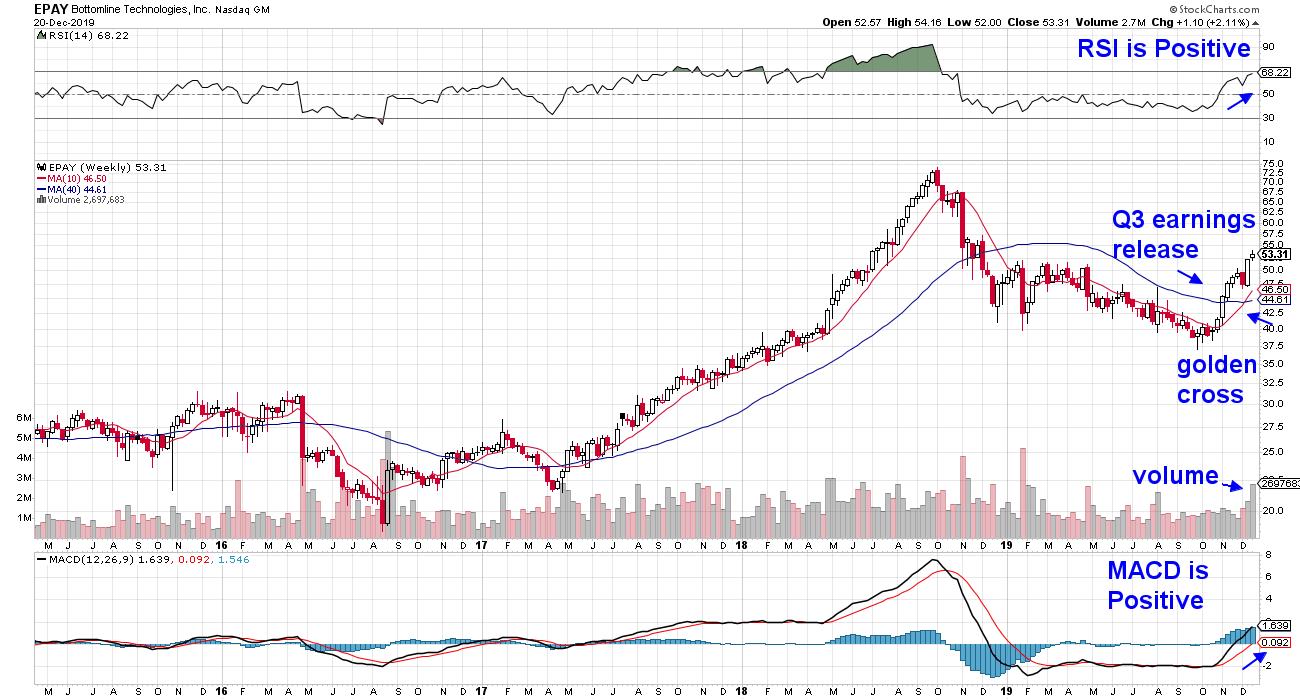

This IPO Shifted The Dynamics For An Entire Group and Here Are 3 Stocks Poised To Benefit

by Mary Ellen McGonagle,

President, MEM Investment Research

It's been a tough year for many new IPO's as most of the 170 companies that came public this year are now trading below their initial price offerings. That said, there have been a couple of high-flying new offerings that have spurred moves in their peers....

READ MORE

MEMBERS ONLY

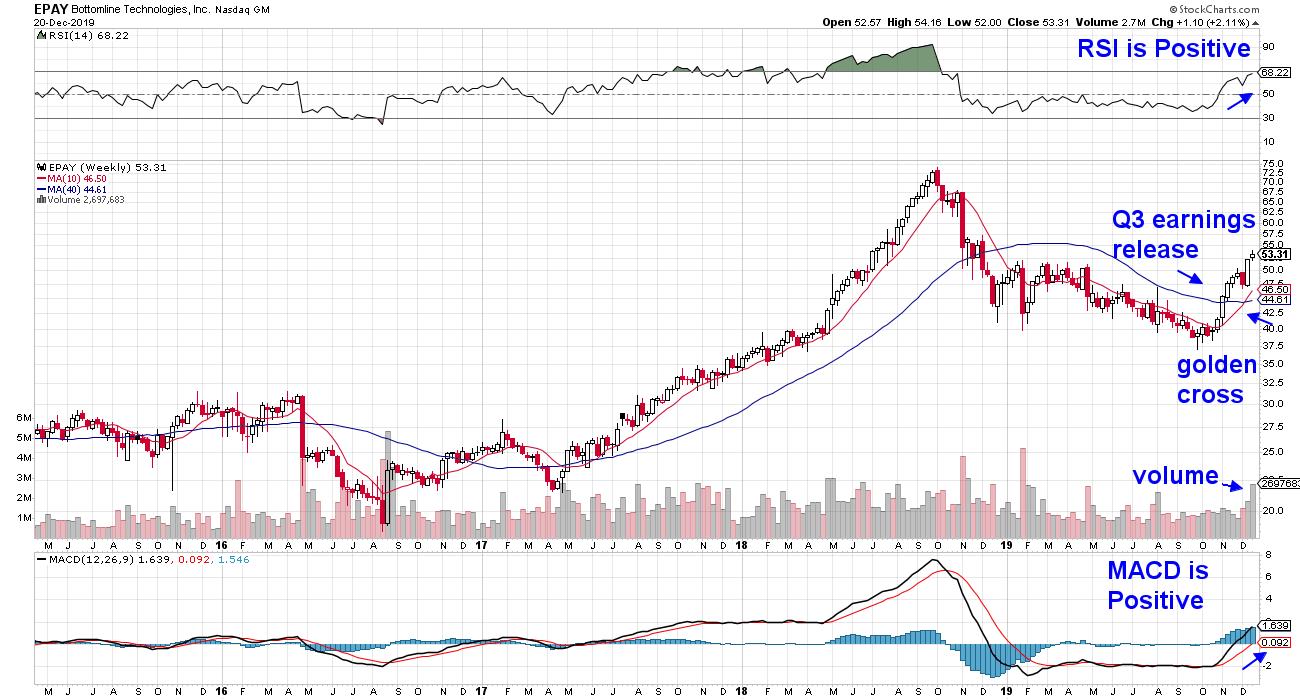

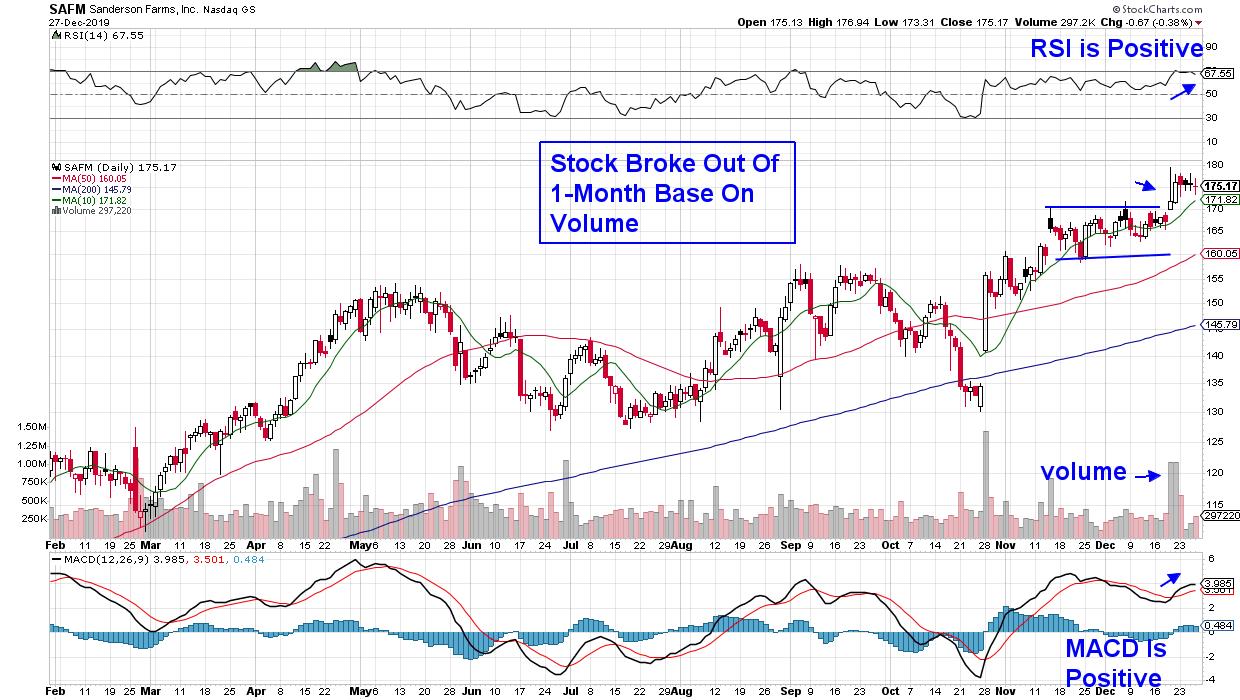

Here's a Stock Breaking Out With 21% of its Float Short!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I was looking at the performance of NASDAQ 100 stocks after the close on Friday and realized that Tesla (TSLA) closed above 400 for the first time in its history. Volume was unusually high all week long as TSLA gained 13% to clear resistance in the upper 300s. TSLA had...

READ MORE

MEMBERS ONLY

Coffee, Charts and a Proper Perspective

by David Keller,

President and Chief Strategist, Sierra Alpha Research

You pour yourself a cup and coffee, fire up the computer and begin your daily investment process. What do you look at first? What's the last thing you review before moving on to other things? Most importantly, is your daily process consistent from one day to the next?...

READ MORE

MEMBERS ONLY

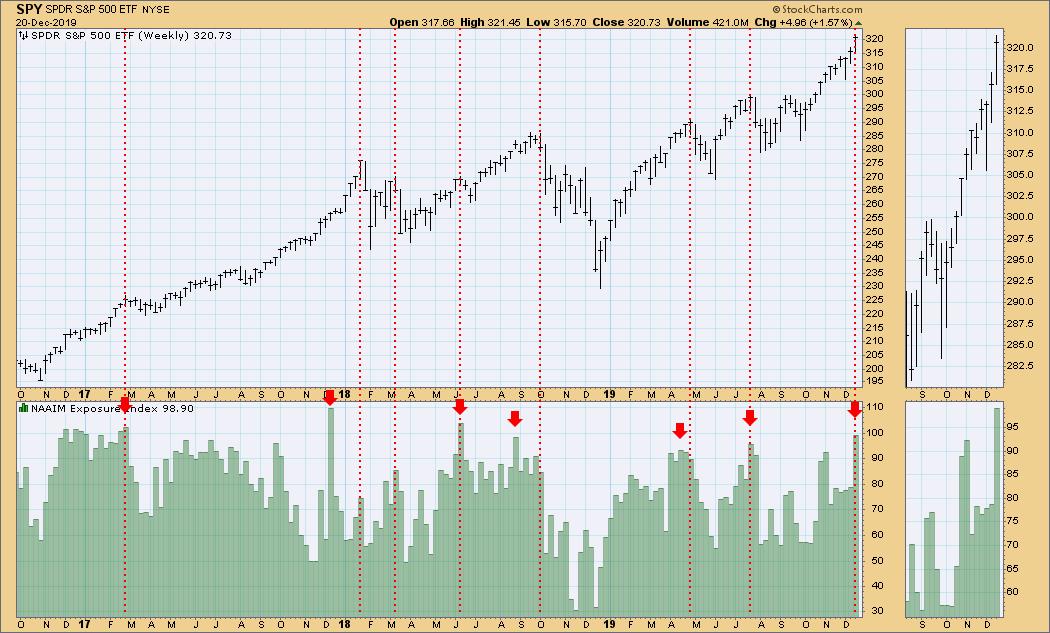

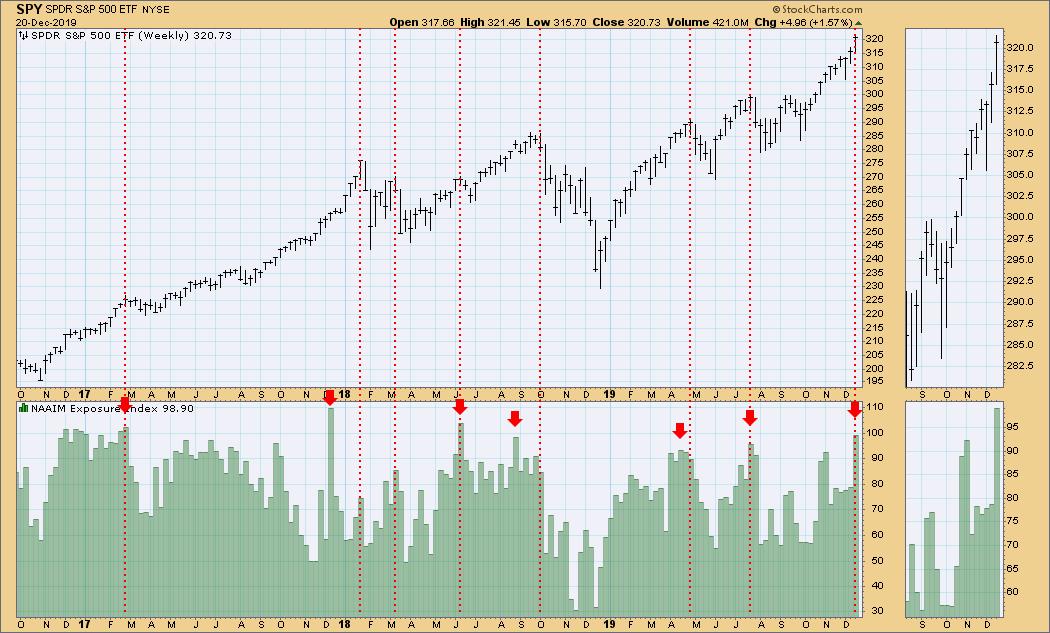

DP ALERT WEEKLY WRAP: Sentiment Getting Wildly Bullish

by Carl Swenlin,

President and Founder, DecisionPoint.com

I have been noticing on the business channels that analysts have become quite complacent regarding their market outlook. They remind me of the line from an old favorite song, "Nothing but blue skies do I see." Yesterday I posted the latest *NAAIM Exposure Index number and snapped to...

READ MORE

MEMBERS ONLY

MEM Edge TV: How to Tell When the Near-Term Uptrend Has Ended

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares how you can tell when upward momentum in your stock has shifted. She also discusses trading on news versus trading on a rumor, before presenting detailed insights into where the strength in the markets is now. This...

READ MORE

MEMBERS ONLY

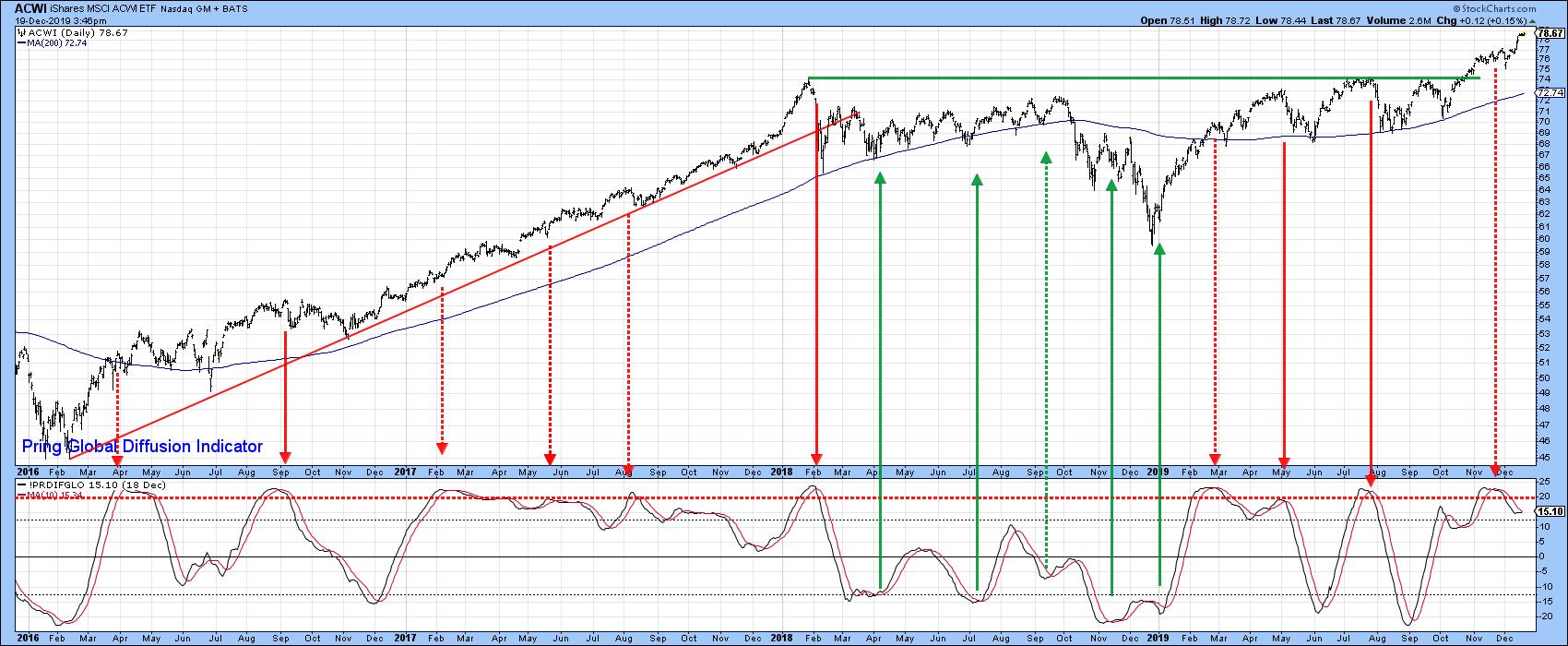

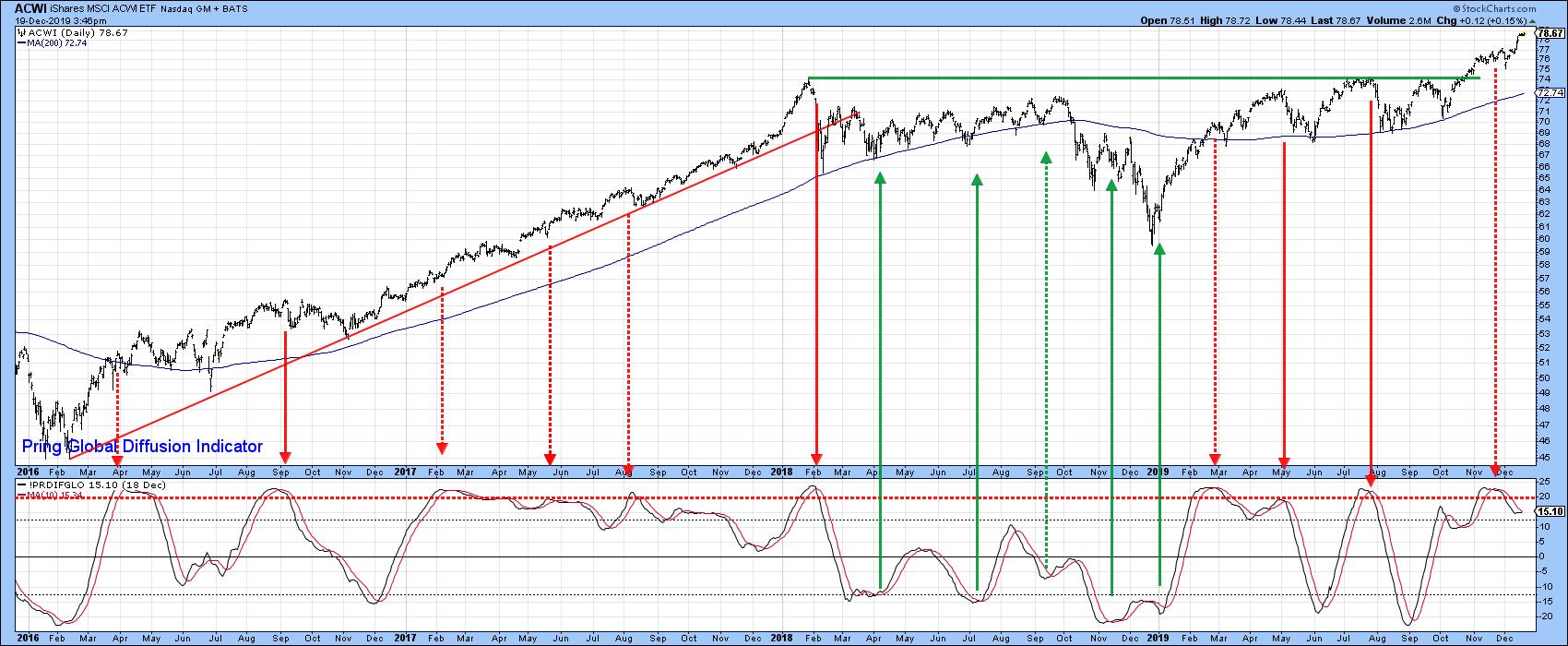

Stocks are Overdue for a Correction, But These Charts Say it Doesn't Matter

by Martin Pring,

President, Pring Research

Right now, stocks are very overextended and likely due for a correction. In Chart 1, for instance, you can see that my Global Diffusion indicator has just triggered a sell signal from an extreme level. The solid red arrows show that the MSCI World Stock ETF (ACWI) has usually responded...

READ MORE

MEMBERS ONLY

Risk-adjusted Returns

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This article will wrap up the presentation of various performance metrics for two of our trend following strategies.

The last few charts will focus on risk-adjusted returns, which attempt to measure how much risk a strategy takes in order to generate the returns. Looking at risk-adjusted returns is a very...

READ MORE

MEMBERS ONLY

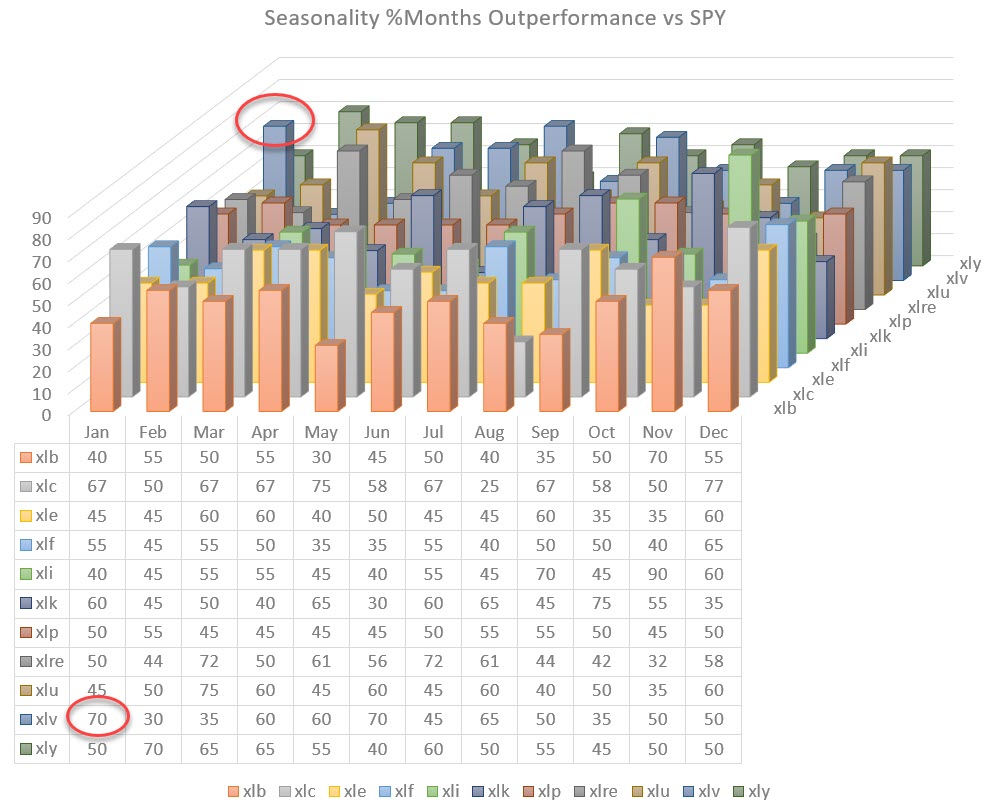

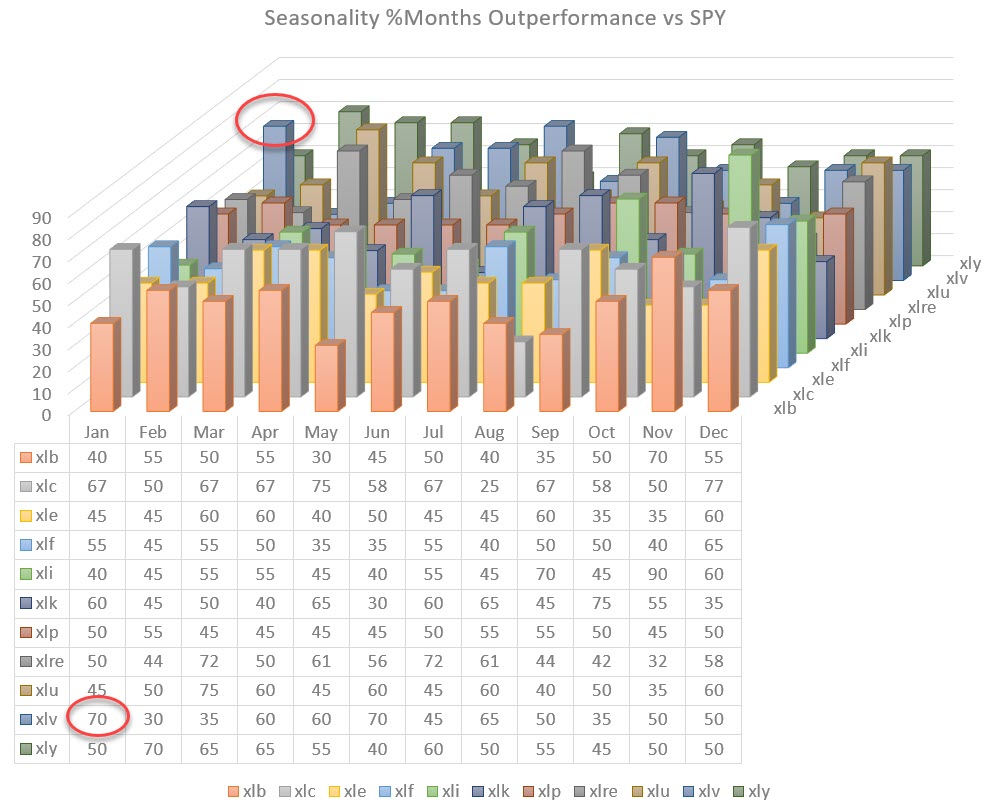

Slicing and Dicing Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I previously highlighted the chart below in this past Thursday's DITC article (12/19). But what does it mean?

What is it Showing?

This chart visualizes the collective seasonality of all 11 sectors in the S&P 500.

To get there, I collected the numbers from the...

READ MORE