MEMBERS ONLY

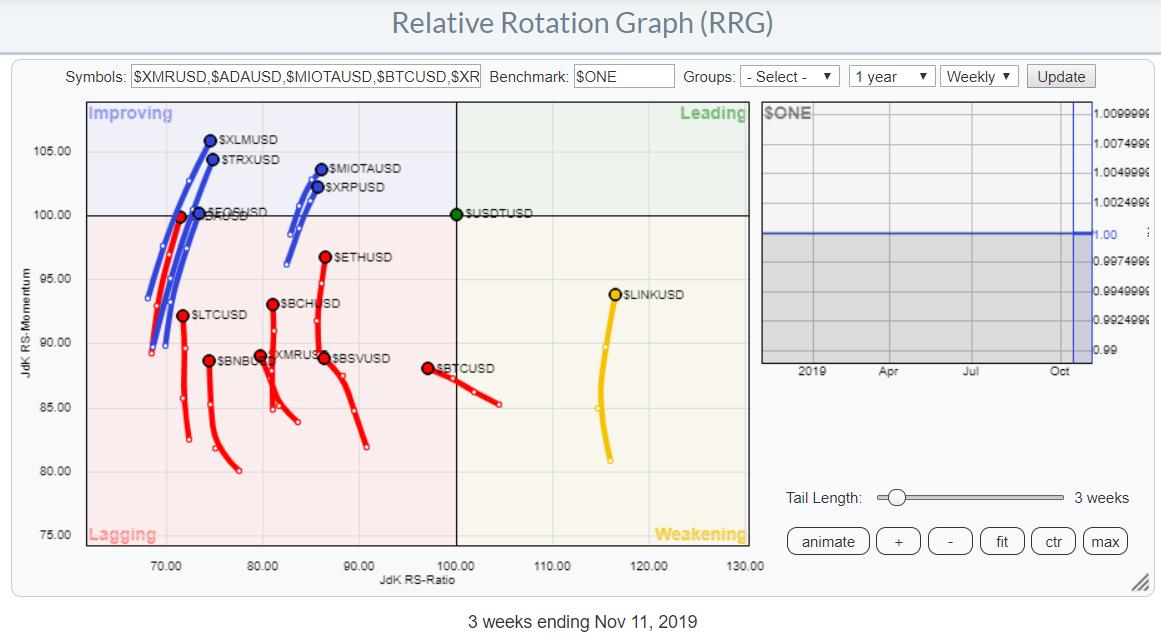

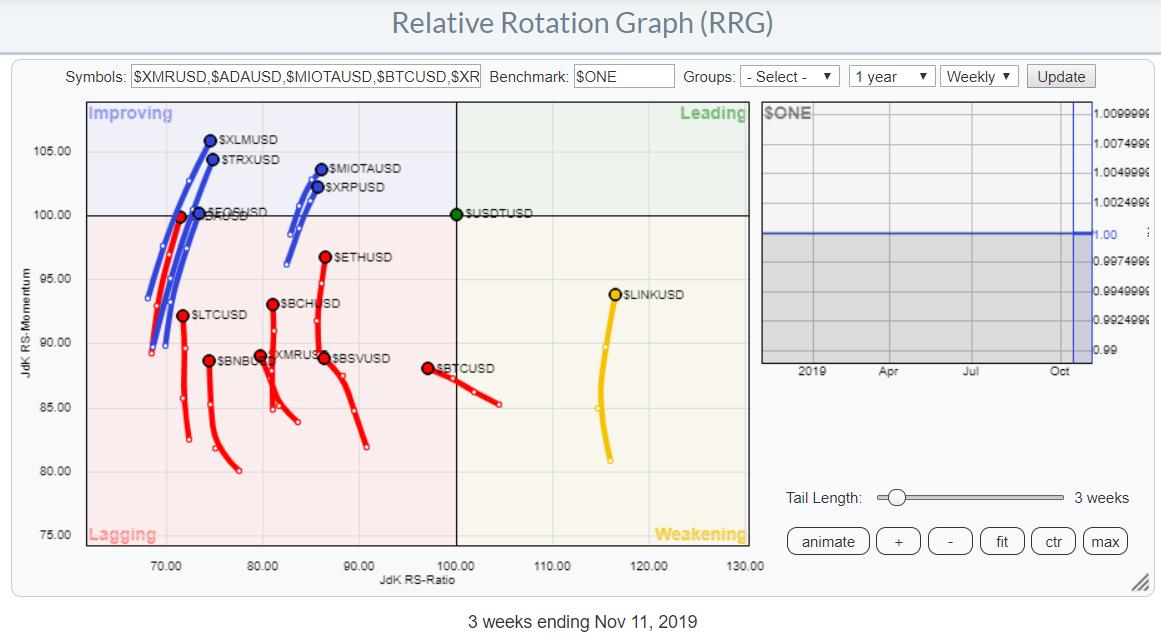

Always Wanted to See Cryptocurrencies on RRG? Now You Can.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On 8 November, StockCharts.com announced the arrival of cryptocurrency data in this ChartWatchers article. Regardless of what you think of cryptocurrencies, it's becoming increasingly hard to ignore them as the group of people that engage in trading them continues to grow.

Personally, I have no super-strong belief...

READ MORE

MEMBERS ONLY

HEALTHCARE IS WEEK'S STRONGEST SECTOR -- PHARMA HAS BEEN A SECTOR LAGGARD -- BUT IS STARTING TO MOVE UP IN THE RANKINGS -- DOW JONES PHARMACEUTICALS INDEX IS RISING TO FIVE-MONTH HIGH -- PHARMA ISHARES ARE DOING THE SAME -- JNJ AND LLY MAY BE BREAKING OUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE CONTINUES TO GET STRONGER... Last Friday's message wrote about healthcare stocks going from one of the market's weakest sectors to one of the strongest. During the first eleven months of the year, healthcare was the market's second weakest sector (with only energy doing...

READ MORE

MEMBERS ONLY

Emerging Leadership: When Should We Trust An Emerging Group For Trading?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This is a very interesting question. Many lagging groups will outperform for a day, week, or even a month, but then they fall right back into their relative downtrends. If you're trading stocks within sectors and industry groups showing poor relative strength, you're fighting an uphill...

READ MORE

MEMBERS ONLY

Not All Trades Are Created Equal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

10 years ago, I traded the stock market much differently. I didn't maintain a "Strong Earnings ChartList" to trade exclusively from like I do now. I considered relative strength, but it wasn't a primary focus. But I look at the overall stock market and...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - I'm Going to Disneyland

by Erin Swenlin,

Vice President, DecisionPoint.com

Scan results are beginning to wane on the majority of my bullish scans. If this continues, I will likely unveil some shorting opportunities next week. Today's results include Disney (DIS), which I've been watching since the release of Disney+. I like that chart. I've...

READ MORE

MEMBERS ONLY

MEM Edge TV: Playing to Strength in a Bullish Market

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV's The MEM Edge, Mary Ellen reviews the one screen to watch for short-term trades and shares how to uncover bullish stocks in the hot healthcare sector. In addition, she also covers Chinese ADRs benefitting from trade relief. This video originally aired on...

READ MORE

MEMBERS ONLY

How to Trade News

by Larry Williams,

Veteran Investor and Author

On this episode of Real Trading with Larry Williams, Larry presents an update on his stock market forecast and talks about how to account for the news when making trading decisions. In addition, this video includes an analysis of coffee and coffee stocks and a discussion of developments on Wall...

READ MORE

MEMBERS ONLY

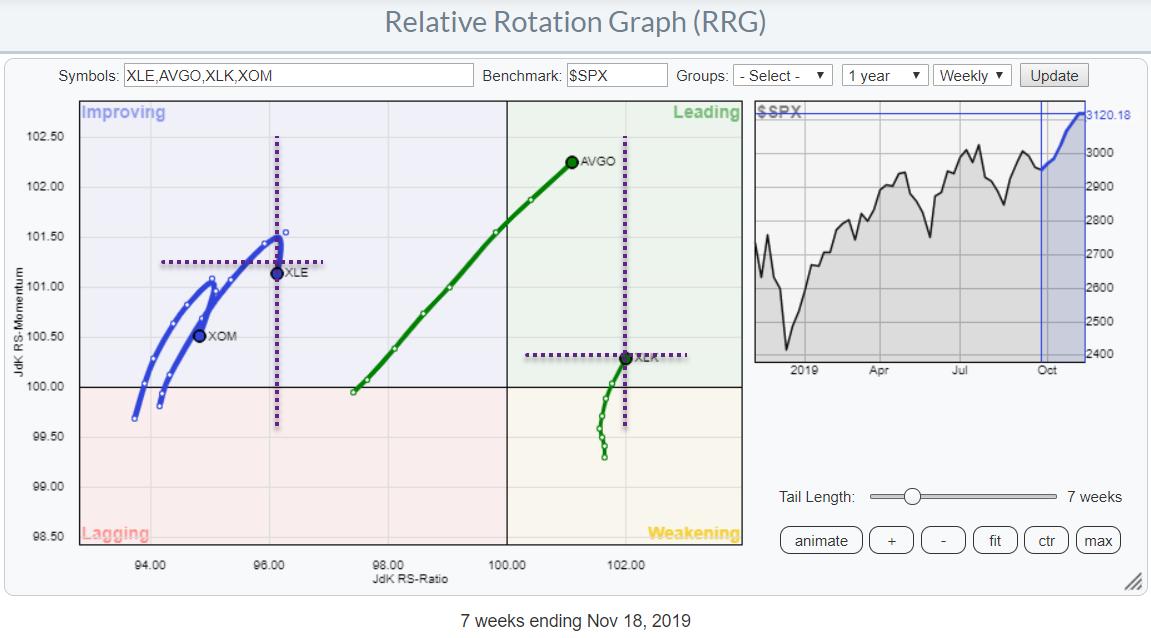

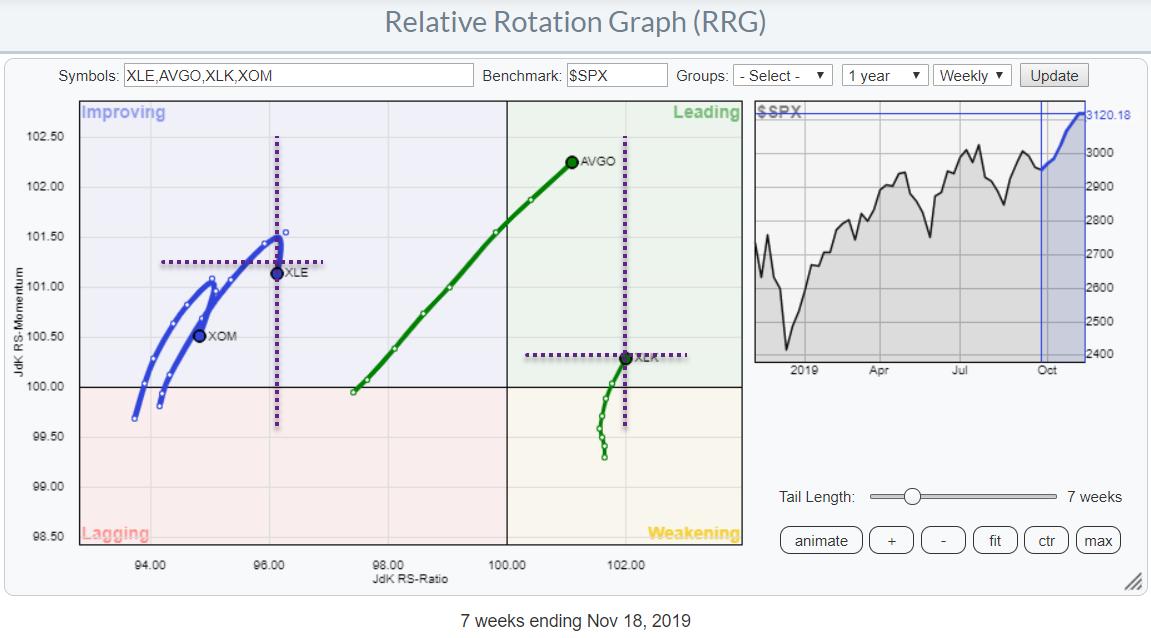

AVGO vs. XOM - Pair Trade Idea

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are perfectly suited for finding pair trade opportunities. In this week's episode of Sector Spotlight (November 19th), I showed one way to find a possible pair-trading opportunity.

Wanting to find a sector with high (or the highest) upward potential and the sector with high (or...

READ MORE

MEMBERS ONLY

Is It A Pullback Or Something More? Today's Market Selloff Reminds Us To Stay Sharp

by Mary Ellen McGonagle,

President, MEM Investment Research

Today's sharp midday selloff on negative trade news was a stark reminder that market conditions can change on a dime. It's also a reminder that you need to have an exit strategy in place should a pullback turn into a correction or worse.

Below is a...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: Possible Selling Initiation? - Bonds Breakout and Nullify Bearish Pattern

by Erin Swenlin,

Vice President, DecisionPoint.com

Last Monday (11/18/19) on the DecisionPoint show, Carl and I introduced the Golden Cross and Silver Cross Indexes ChartList! You can get it too by downloading the free "DP Market Indicators" ChartPack. If you have previously downloaded the ChartPack, just re-install it; the new Golden Cross...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Five Different Sectors

by Erin Swenlin,

Vice President, DecisionPoint.com

I ran quite a few scans today, ultimately selecting four from my "Diamond Scan" and one from "Carl's Scan". The Diamond Scan picks stocks that are enjoying an uptrend already, while Carl's Scan finds bottom fishing opportunities. I'll discuss this...

READ MORE

MEMBERS ONLY

Introduction To Market Timing

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave discusses the significance of market timing, which is less about beating the market and more about not letting the market beat you. Dave explores how to put his methodology into action, focusing on Landry Light, 10% TFM and more. Finally, Dave presents the...

READ MORE

MEMBERS ONLY

DP Show: Introducing the Golden Cross and Silver Cross Indexes

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin introduce the new Golden Cross and Silver Cross Indexes. The new ChartList in the DecisionPoint Market Indicators ChartPack includes the indexes for not only the major markets, but ask those of the S&P sectors, along with a special "Gold...

READ MORE

MEMBERS ONLY

STOCKS PULL BACK ON TRADE NEWS -- STOCK INDEXES REMAIN OVERBOUGHT BUT STILL IN UPTRENDS -- RETAILERS WEIGH ON CONSUMER DISCRETIONARY SECTOR -- ENERGY STOCKS REBOUND WITH CRUDE OIL -- DROP IN BOND YIELDS BOOST DEFENSIVE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES PULL BACK FROM OVERBOUGHT TERRITORY... News that a "phase one" trade deal may not be reached this year is contributing to selling in stocks today. That and the fact that stocks have reached overbought territory and are probably due for some profit-taking anyway. In fact, several...

READ MORE

MEMBERS ONLY

Sector Spotlight: How to Spot a Pair Trade on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

How can you use RRGs (Relative Rotation Graphs) to spot potential pair trades?

In this episode of Sector Spotlight, I explain one way to find a potential pair trading opportunity, searching for a stock with high(est) potential in a sector with high(est) potential and off-setting that position with...

READ MORE

MEMBERS ONLY

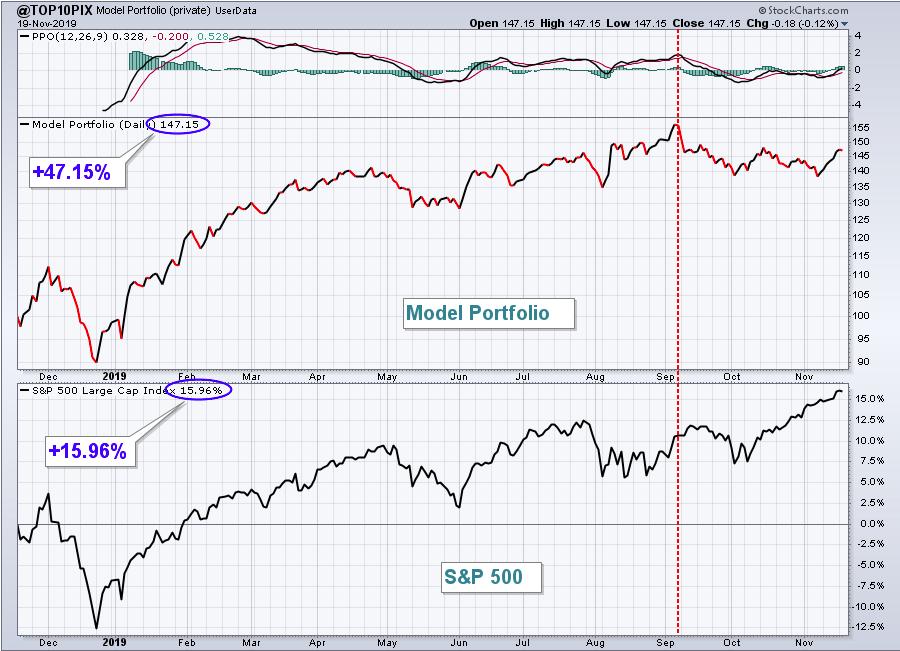

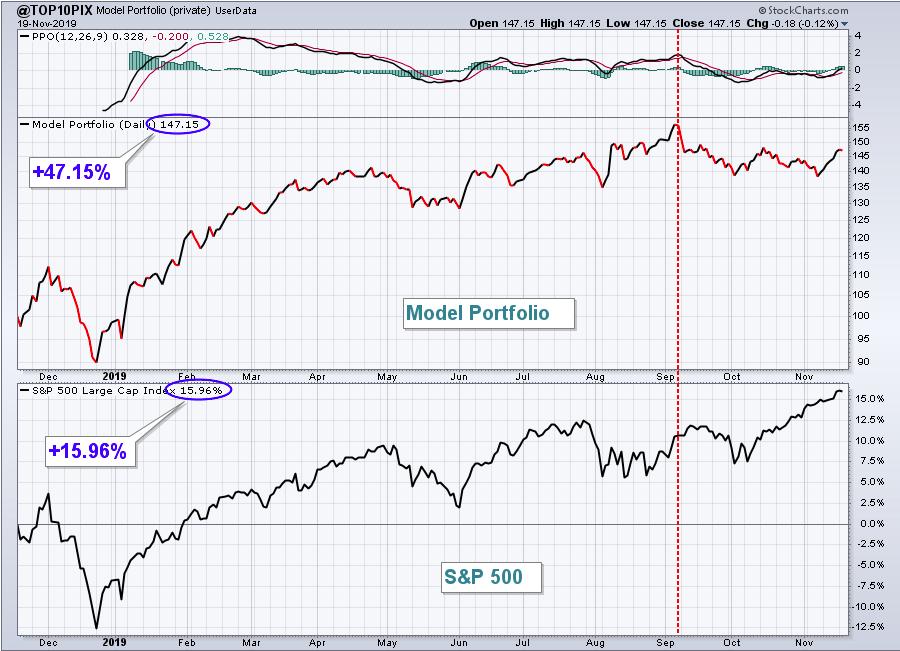

Creating A Portfolio To Trounce The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

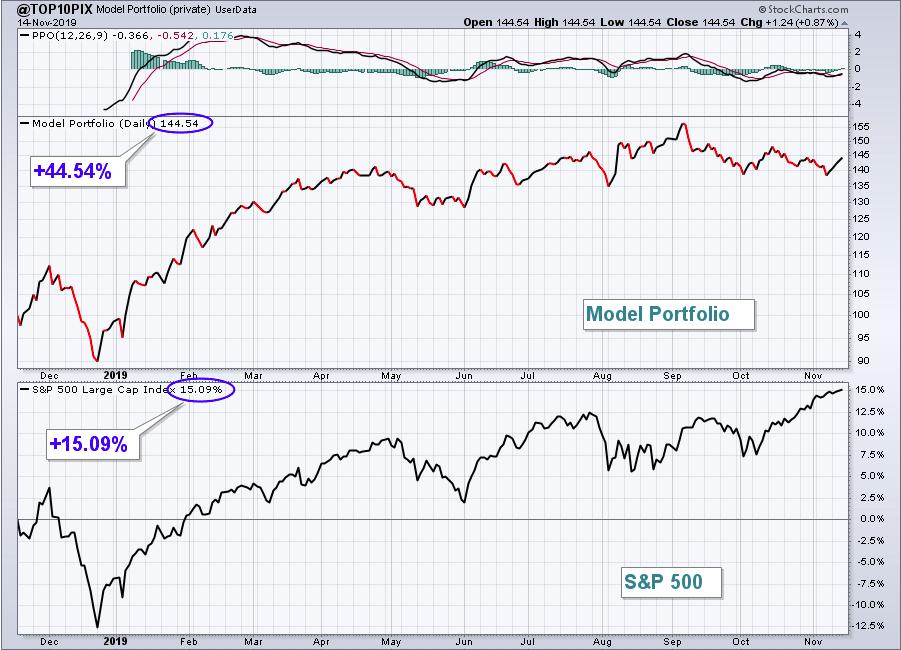

While there's no sugar coating that the market's sudden shift in August from growth stocks to value stocks cut into my returns, I'm still quite proud of my Model portfolio's performance after its one year anniversary yesterday. On November 19, 2018, I...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Building Materials May Be Benefiting from Bullish Home Builders

by Erin Swenlin,

Vice President, DecisionPoint.com

Many of my colleagues have been noting the hot Home Builders industry group. I found a Building Materials stock that could be benefiting from this and have also included a Home Builder stock as well. I wrote about the Home Builders group last week in this article, where I spotlighted...

READ MORE

MEMBERS ONLY

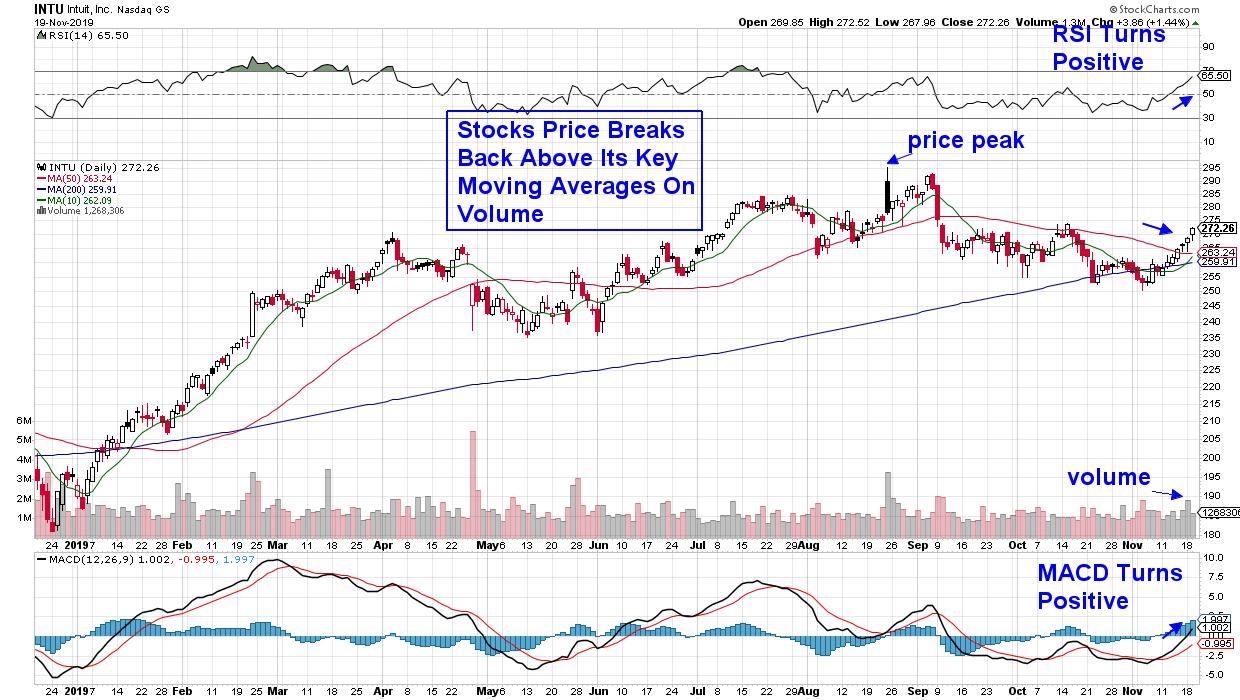

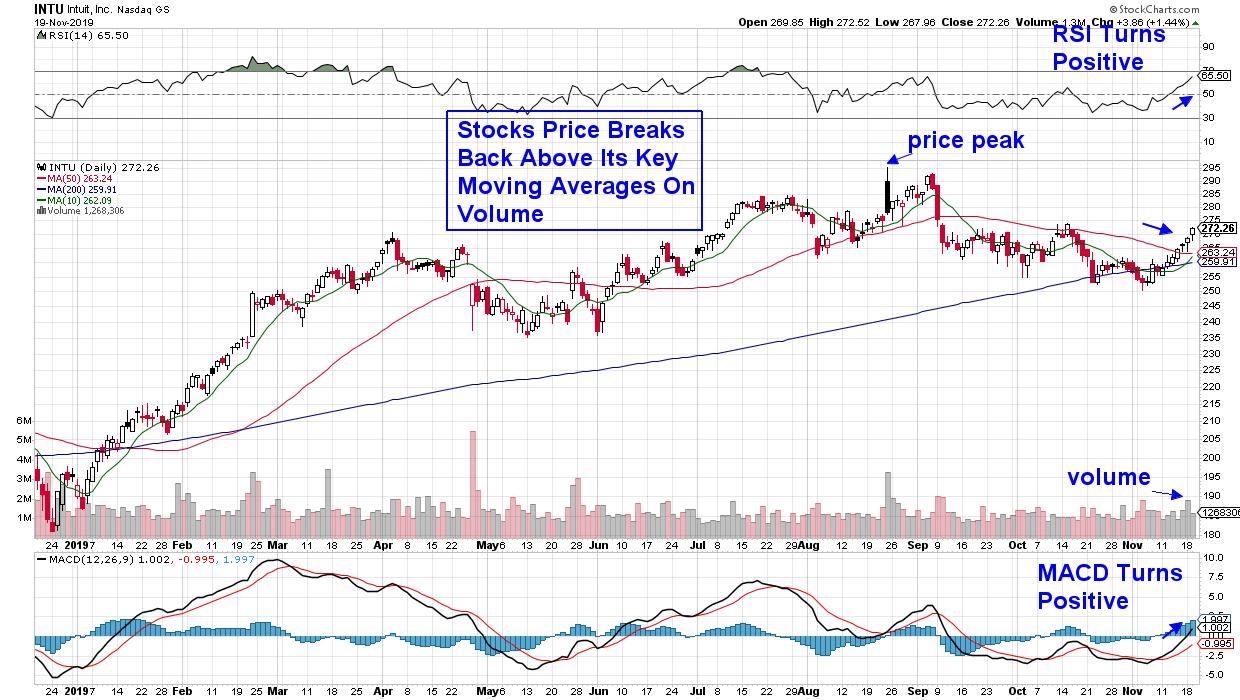

They're Baaaacck......! Midyear Leaders Are Beginning To Reverse Their Downtrends.

by Mary Ellen McGonagle,

President, MEM Investment Research

The ebb and flow of the markets always keeps things interesting, but when fast-moving, high growth stocks were stopped in their track's midyear, it was quite perplexing. Many of these stocks still had strong growth prospects that would normally continue to propel them higher. Instead, investors' interest...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Watch Your Weight and Eat Soup at Home Depot

by Erin Swenlin,

Vice President, DecisionPoint.com

We've got an interesting mix of "diamonds" today. I'm not particularly clever with my titles, but today's does give away that Weight Watchers (WW), Campbell's (CPB) and Home Depot (HD) are on today's list. I also have Dominion...

READ MORE

MEMBERS ONLY

Another Industry Breakout And A Stock That's Leading The Charge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The good news is that this breakout in the S&P 500 is littered with mini-breakouts in various sectors and industry groups. One of the latest industry groups to join the party is diversified industrials ($DJUSID), home of General Electric (GE). The former closed at a 52 week high...

READ MORE

MEMBERS ONLY

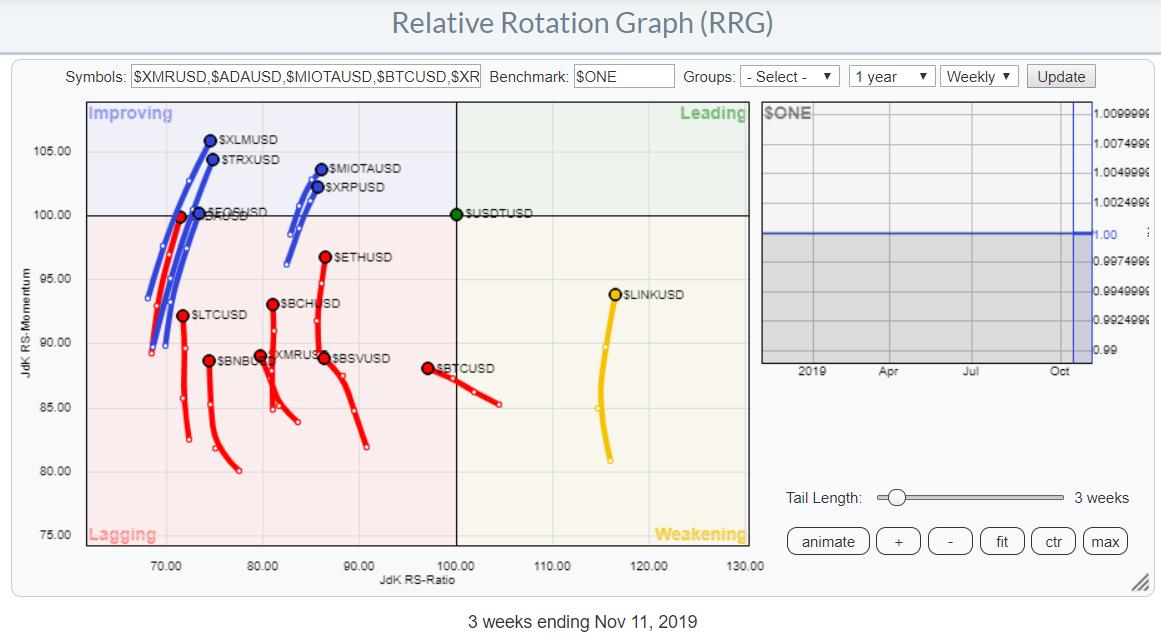

How to Plot Cryptocurrencies on Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On 8 November, StockCharts.com announced the arrival of cryptocurrency data in this ChartWatchers article.Regardless of what you think of cryptocurrencies, it's becoming hard to ignore them as the group of people that engage in trading them continues to grow.

Personally, I have no super-strong belief (yet)...

READ MORE

MEMBERS ONLY

Don't Look Now, but New Highs are Expanding within the Small-cap Universe

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The number of stocks making new highs has been a lagging link in the breadth indicators this year. While the S&P 500 trades at a new high, the number of new highs within the index has yet to exceed 100 and get back to the levels seen in...

READ MORE

MEMBERS ONLY

2020 Market Outlook And A Turnaround Candidate To Consider In An Unlikely Area

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you've followed my blogging and shows, then you know how bullish I've been and still am. During all the trade war, Fed, recession, and political worries, I've called for new all-time highs. I'm not stopping there. Don't be shocked...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Healthy But Exhausted At Higher Levels; RRG Shows These Sectors To Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by continued to trade on the expected lines, while the 12000-12050 zone continued to pose resistance to the markets on the upside. The week was spent with the markets consolidating at higher levels while demonstrating weakness near the critical resistance zone. The NIFTY headed nowhere over...

READ MORE

MEMBERS ONLY

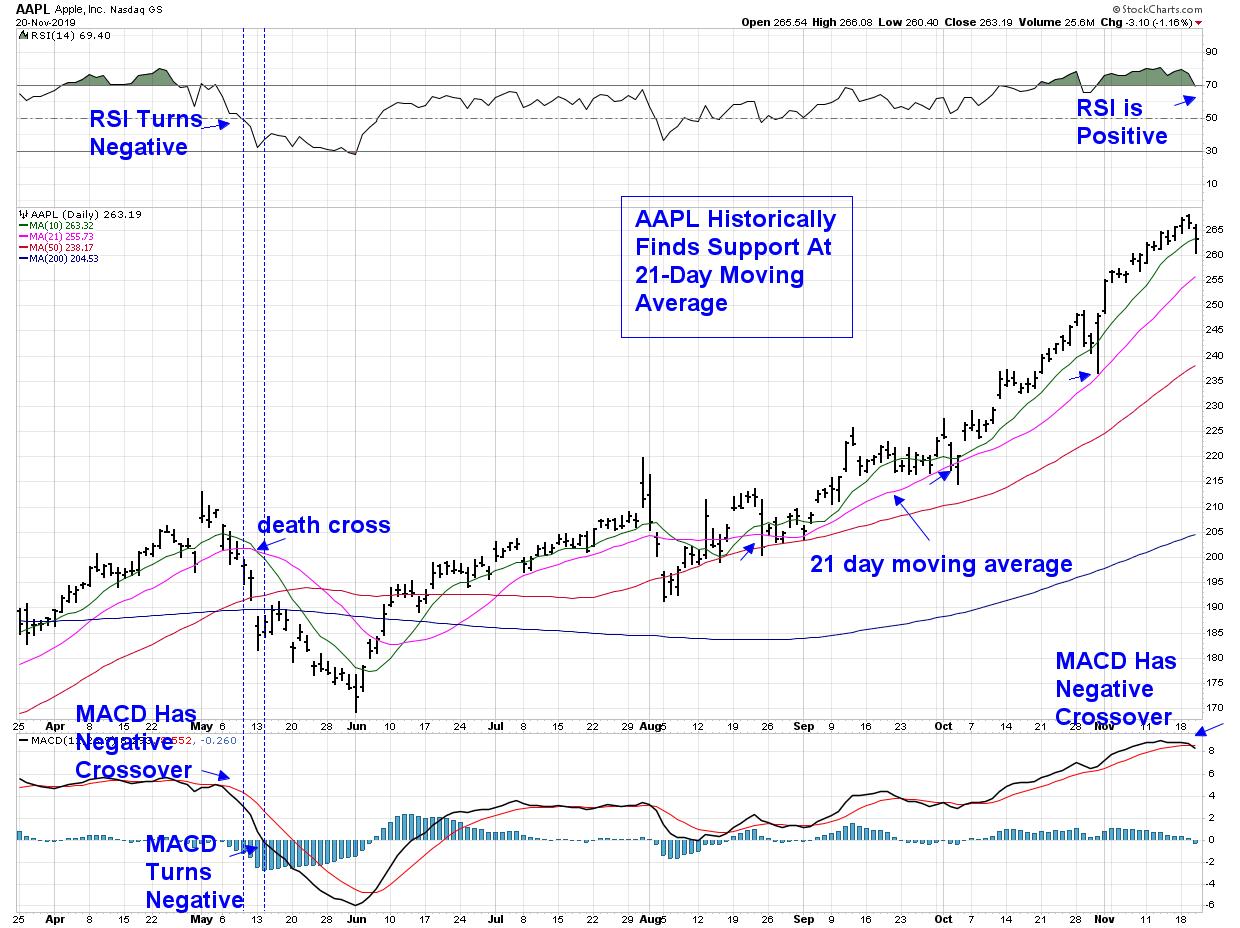

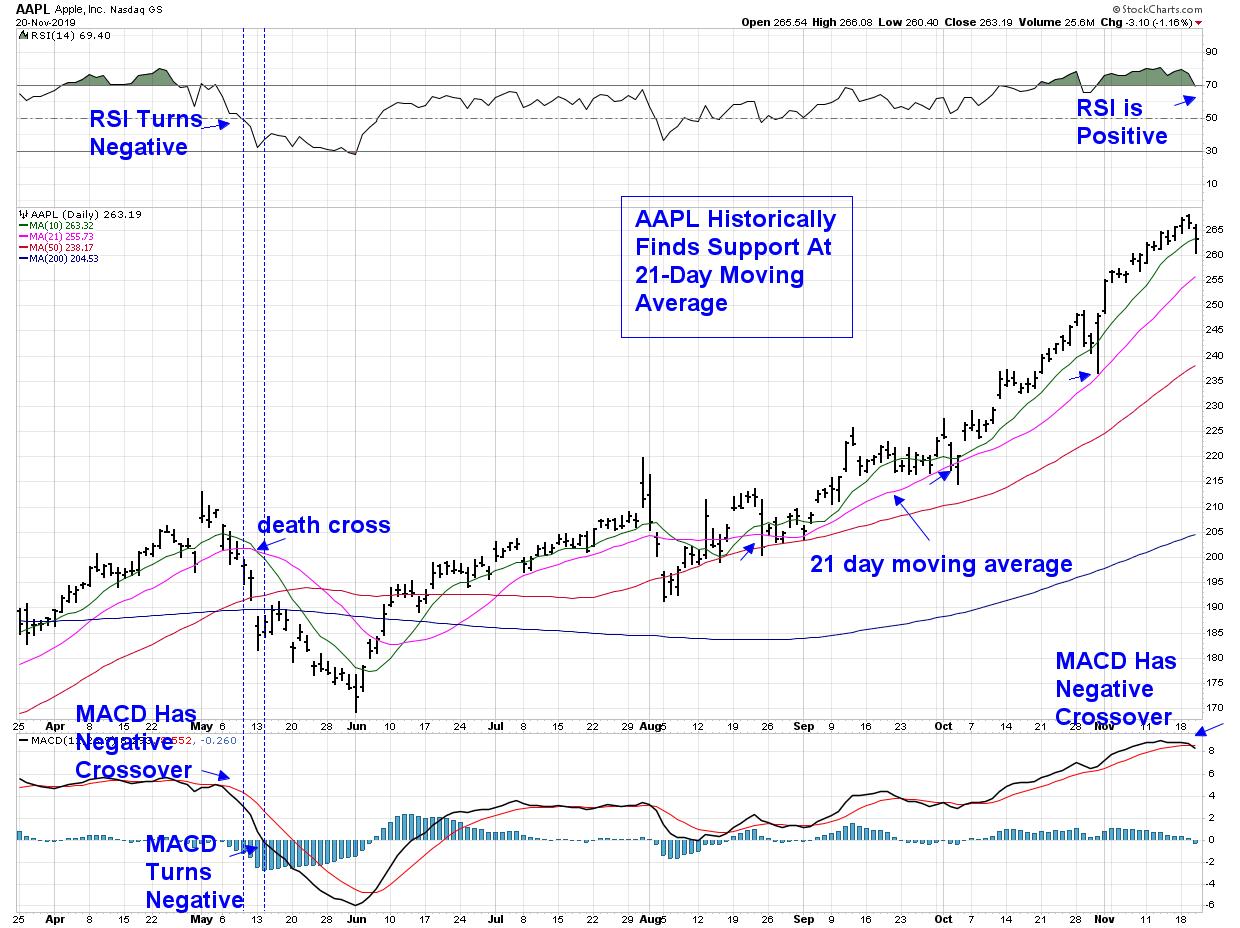

DP WEEKLY WRAP: Apple Going Vertical Again

by Carl Swenlin,

President and Founder, DecisionPoint.com

Late last year I wrote about Apple (AAPL) when it had broken down from a parabolic advance, a break which ultimately resulted in a total decline of about -40%. To see it on a chart just boggles my mind. I mean, here is a company with over $200 billion in...

READ MORE

MEMBERS ONLY

DP Diamonds: Darlings & Duds from 9/27/2019

by Erin Swenlin,

Vice President, DecisionPoint.com

For those of you not yet familiar, I have started a new report in our blog called "DecisionPoint Daily Diamonds", in which I select five stocks or "diamonds in the rough" from the results of one of my many DecisionPoint scans. Basically, I do the work...

READ MORE

MEMBERS ONLY

Three Major Stock Indexes Hit New Records

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, November 15th at 4:14pm ET.

Stocks are ending the week in record territory. The three charts below show the three major U.S. stock indexes closing at record highs on Friday....

READ MORE

MEMBERS ONLY

How is YOUR Market Vision?

by John Hopkins,

President and Co-founder, EarningsBeats.com

First off, it gives me GREAT pleasure to announce our first ever online Financial Conference, Market Vision 2020,which will take place just as the new year begins. EarningsBeats.comChief Market Strategist Tom Bowley and I will be joined by some of the biggest names in the industry (we'...

READ MORE

MEMBERS ONLY

Three Signs Showing that the Offense has Taken the Field

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The character of the stock market changed over the last six to seven weeks as the market took on a more offensive tone. Don't get me wrong. The stock market was already in bull mode and the S&P 500 has been above its 200-day SMA since...

READ MORE

MEMBERS ONLY

STOCK INDEXES HIT NEW RECORDS -- HEALTHCARE, COMMUNICATION, INDUSTRIALS, AND TECHNOLOGY ALSO HIT RECORDS -- INTERNET STOCKS LEAD XLC HIGHER -- SURGE IN HEALTH INSURERS LEADS HEALTHCARE SPDR TO NEW RECORD -- UNITEDHEALTH IS ONE OF DAY'S LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THREE MAJOR STOCK INDEXES HIT NEW RECORDS...Stocks are ending the week in record territory. The three charts below show the three major U.S. stock indexes closing at record highs on Friday. And the rally is pretty broad-based. Ten of the eleven market sectors gained on the day. Healthcare...

READ MORE

MEMBERS ONLY

Don't Be A Mystery Box Investor: Blending Technicals, Fundamentals and Observationals For A More Stable Approach

by Grayson Roze,

Chief Strategist, StockCharts.com

Quick, don't think, just answer – what's your favorite thing about investing? I can't answer for you, but I can tell you mine.

I admit it, I have a problem. I'm a true stock junkie through 'n through. I love the markets....

READ MORE

MEMBERS ONLY

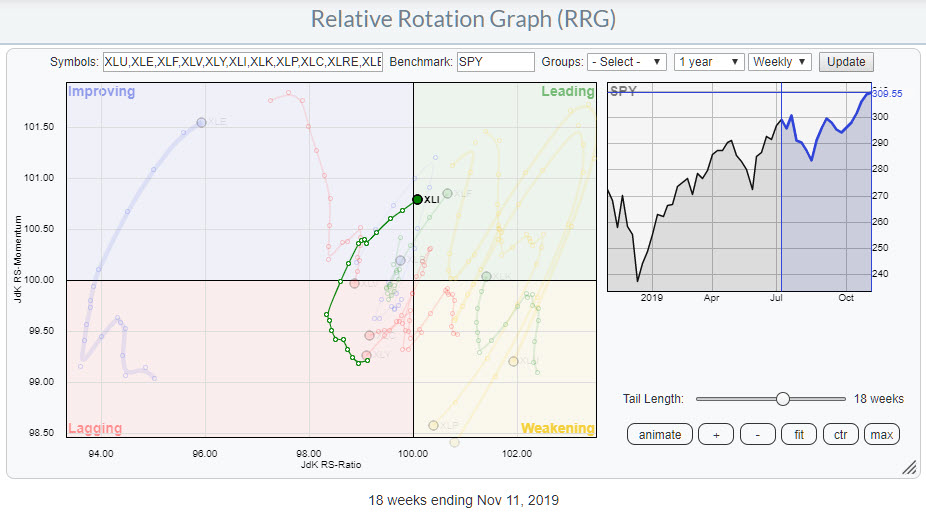

Looking Ahead To 2020 For Sector Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain quite bullish about 2020 prospects and one reason is the relative strength of our 5 aggressive sectors - technology (XLK), consumer discretionary (XLY), communication services (XLC), financials (XLF), and industrials (XLI). Wall Street has not positioned itself for anything other than a market advance ahead, so you should...

READ MORE

MEMBERS ONLY

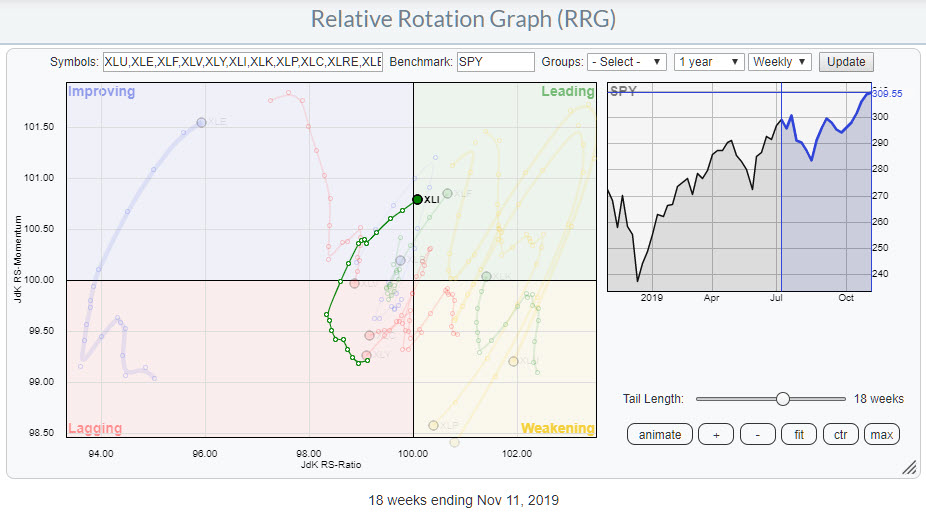

Industrials is a Sector to Watch - Here are Two Stocks that May Stand Out

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, Industrials continue to show a strong rotation. They are now just about to cross over into the lagging quadrant on the weekly timeframe.

I spoke about this strong rotation more in depth in last week's Sector Spotlight show on StockCharts...

READ MORE

MEMBERS ONLY

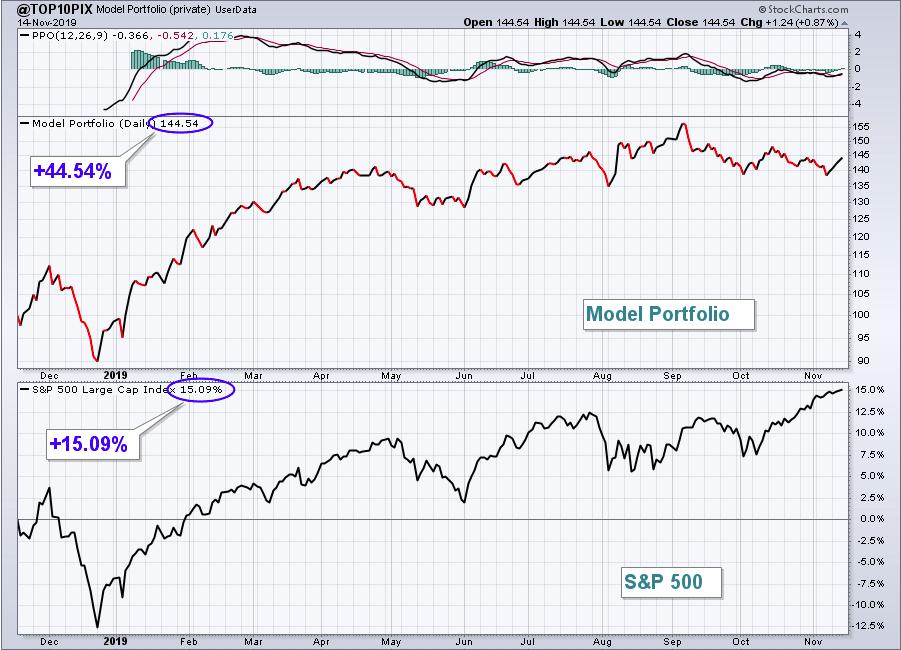

What A First Year It's Been For My Model Portfolio! +44.54% With 3 Days Left

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Any time you can beat the benchmark S&P 500, it's saying something. Many professionals managing money set the S&P 500 as the standard and try to beat it....and most fail. It's not an easy thing to do. But I do believe...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Is Your "Cash Safe" in Home Builders?

by Erin Swenlin,

Vice President, DecisionPoint.com

Forgive the pun today, but I found it quite funny when the only two results on my Diamond PMO Scan were "CASH" and "SAFE"! I have included both today as I did find them very interesting. From there, I ran a different scan and a number...

READ MORE

MEMBERS ONLY

US Stocks, Gold and Open Mic!

by Larry Williams,

Veteran Investor and Author

On this episode of Real Trading with Larry Williams, Larry presents his new Great Growth Stock, "Brad's Drink". He also gives his take on Disney (DIS), Copper (CPER), Lending Club (LC) and Bitcoin ($BTCUSD). This episode originally aired on November 14th, 2019.

New episodes of Real...

READ MORE

MEMBERS ONLY

STOCK INDEXES HOLD THEIR GAINS -- COMMUNICATION SERVICES SPDR NEARS RECORD HIGH -- GOOGLE, DISNEY, AND CHARTER COMMUNICATIONS HIT NEW RECORDS -- ENERGY SPDR MEETS SELLING AT 200-DAY LINE -- SO DOES CRUDE OIL AND DB COMMODITY INDEX

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES HOLD THEIR GAINS... The first three charts below show the major stock indexes holding onto their November gains. All three remain above their July highs which should now provide support on any pullbacks. [Broken overhead resistance becomes new support. That's why the red horizontal trendlines...

READ MORE

MEMBERS ONLY

Friends with Diversification Benefits

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Last time we showed you charts of many different market indices along with two of our strategies. We started with drawdown (our preferred measure of risk), instead of starting with returns, as we believe that managing risk is the more important aspect of developing strategies. Risk management is paramount to...

READ MORE

MEMBERS ONLY

Rotating Back Into the Leading Quadrant While Breaking Above Resistance in Price and Relative Strength... What More Do You Want?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When I ran the RRG for the most active movers in the S&P 500 (at yesterday's close), I noted a strong rotation for AMD.

This stock entered the leading quadrant in the week of 18 March and moved inside that quadrant until the week of June...

READ MORE

MEMBERS ONLY

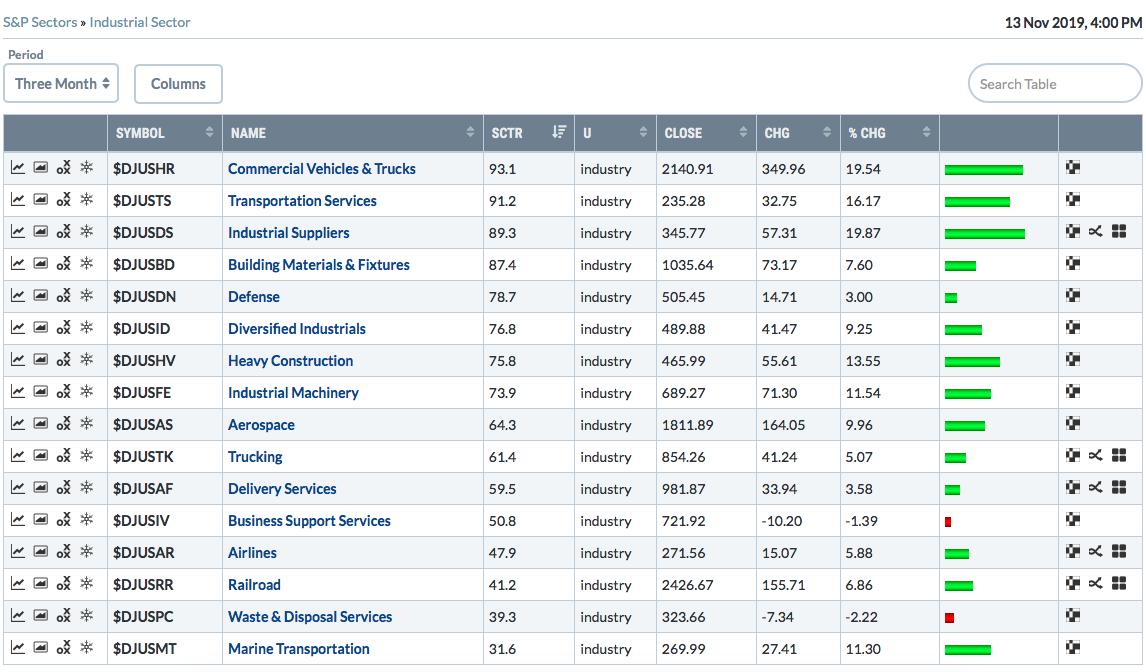

New Leadership In The Industrials, But How Do We Break Down The Group For Winners?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

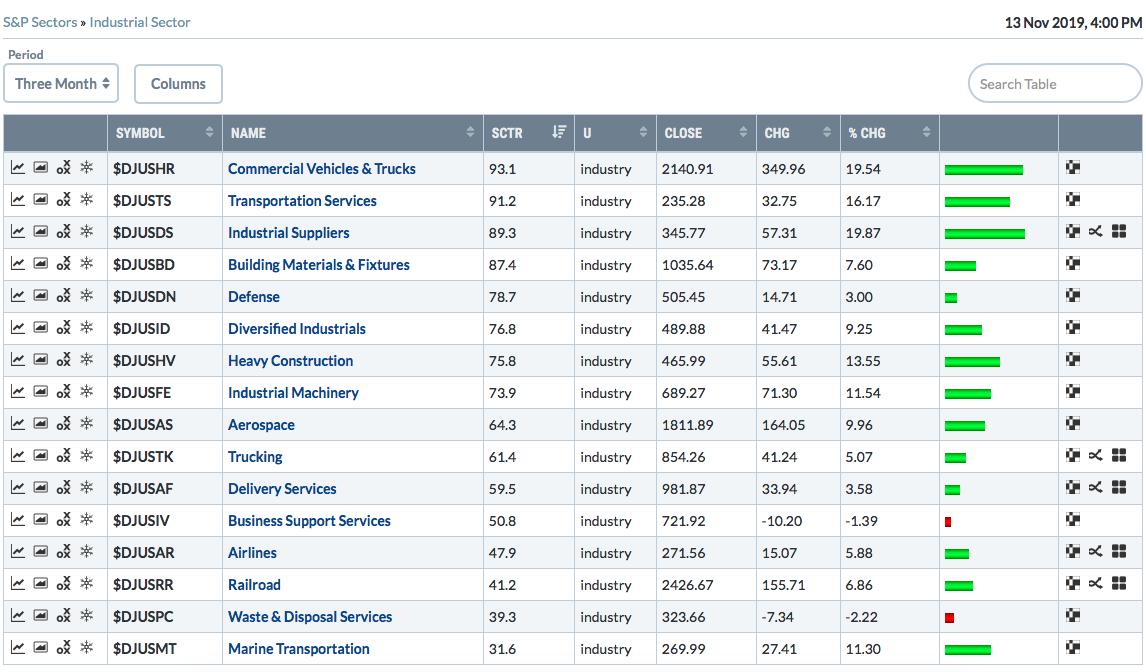

In my last article, I illustrated the relative breakout in industrials vs. the benchmark S&P 500. The market goes through cycles and leadership rotates - even during the same bull market. StockCharts.com recently added SCTR scores for industry groups, so if you're unsure as to...

READ MORE