MEMBERS ONLY

Week Ahead: Markets Have A Difficult Terrain To Negotiate; Will Continue To Resist At Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets were range-bound over the course of the week, but remained volatile on anticipated lines while digesting the Union Budget on Friday. As expected, the event failed to infuse any cheer in the markets, with the NIFTY remaining within a defined range and oscillating in a limited band. The...

READ MORE

MEMBERS ONLY

Mindful Investors Minimize Distractions

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When you're a student pilot, your first couple of solo flights remain very close to your home airport. Basically, you get up in the air and do a couple laps around the landing pattern. This is meant to get you comfortable being in the plane by yourself, as...

READ MORE

MEMBERS ONLY

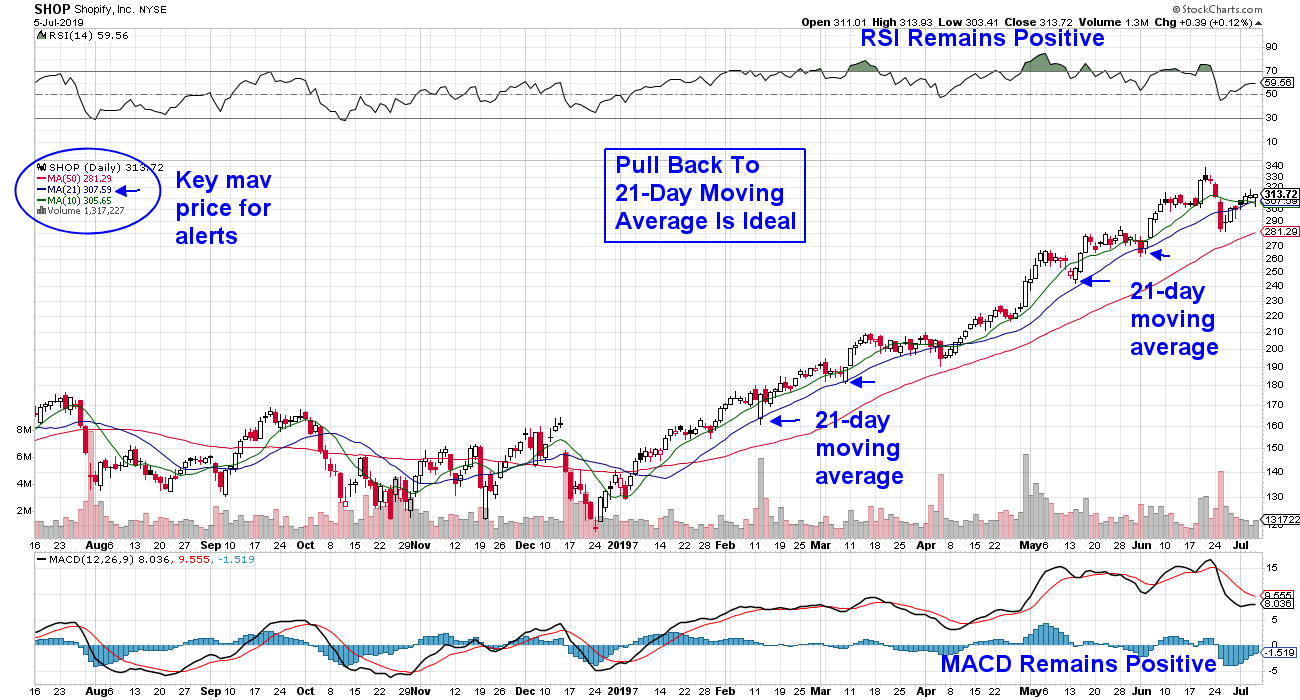

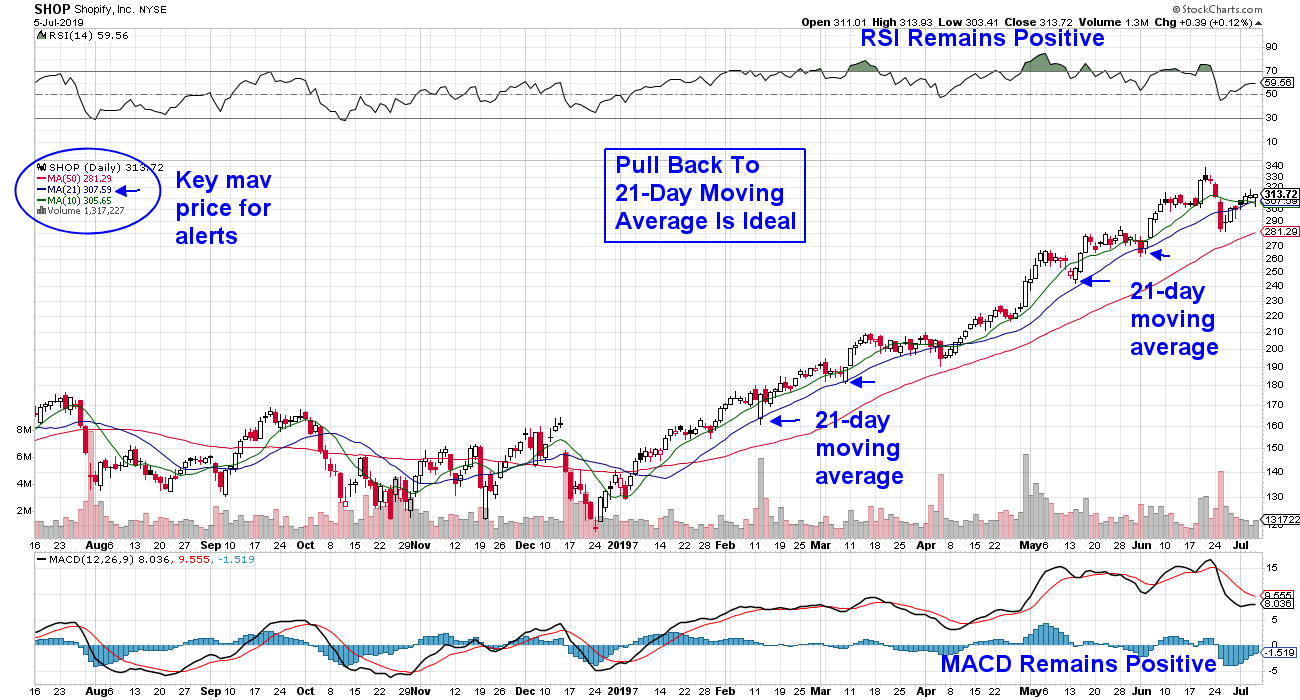

Alert Yourself To Pullback Opportunities In Fast-Moving Stocks

by Mary Ellen McGonagle,

President, MEM Investment Research

It’s been quite a star-spangled week for the markets, with the S&P 500 and Nasdaq hitting a new high 3 out of their 4 sessions. One sector showing particular strength has been Technology, which also reached a new high as many underlying stocks are posting significant returns....

READ MORE

MEMBERS ONLY

Why U.S. Equities Are Poised For Another 40-50% Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I want to discuss two charts that really need to be monitored closely as we enter the second half of 2019. A rise in these charts is synonymous with massive bull market rallies. They both make great common sense, so let's discuss them before visualizing the charts.

1....

READ MORE

MEMBERS ONLY

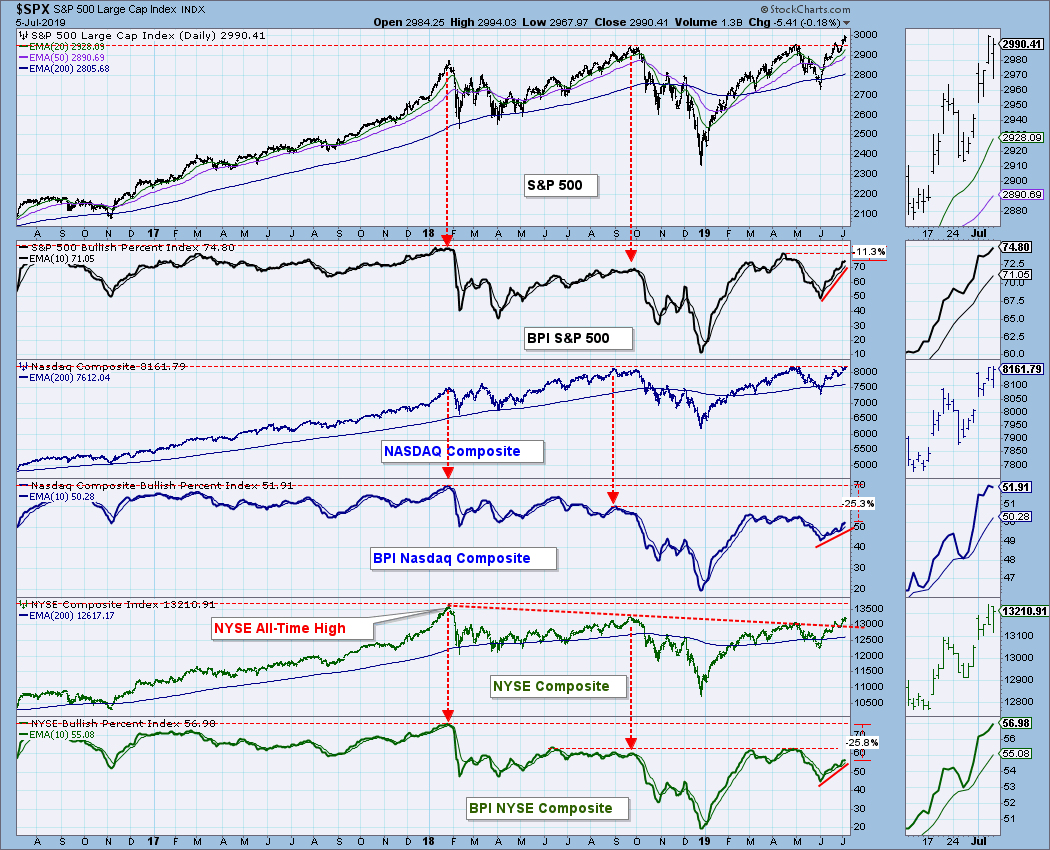

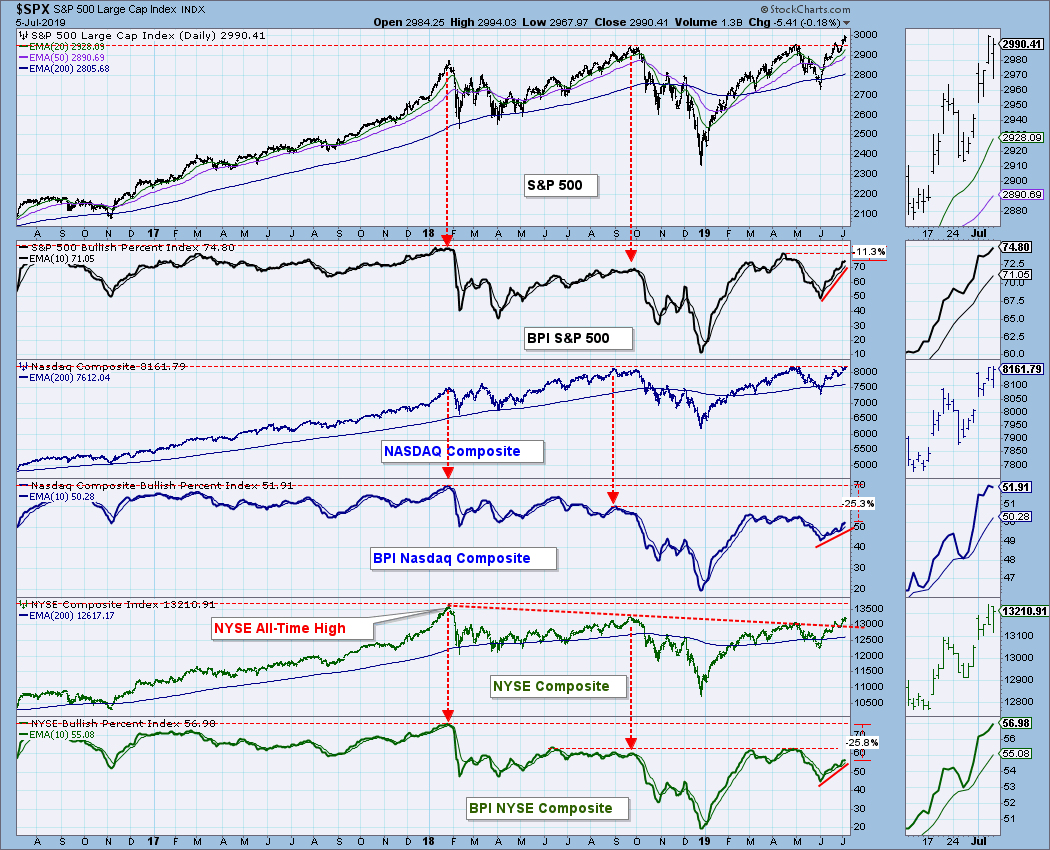

DP WEEKLY WRAP: Watch Out For BPI Trend Breaks

by Carl Swenlin,

President and Founder, DecisionPoint.com

With the S&P 500 and NASDAQ Composite making or equaling all-time highs, it would be appropriate to check the participation behind this up surge. The Bullish Percent Index (BPI) measures the percentage of stocks in a given index that have point & figure BUY signals. In January of...

READ MORE

MEMBERS ONLY

CRB Still Caught in a Trading Range

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, July 2nd at 12:36pm ET.

Back in May, I wrote an article entitled “Commodities: Down Now, Up Later?" in which I pointed out some of the long-term technical bullish potential...

READ MORE

MEMBERS ONLY

EARNINGS: 2019 Q1 Finalized; S&P 500 Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 earnings for 2019 Q1 have been finalized. The following chart shows us the normal value range of the S&P 500 Index, as well as where the S&P 500 would have to be in order to have an overvalued P/E of...

READ MORE

MEMBERS ONLY

The S&P Just Broke Out of a Two-Year Consolidation, But There are Still Some Pockets of Concern

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A short, but strong, trading session just before the Fourth of July holiday pushed the S&P, along with the Nasdaq 100 and the DJ Industrials indexes, to new highs.

Breaks to new highs are pretty strong signs and should not be ignored. At the end of the day,...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT SENDS BOND YIELDS HIGHER ON DIMINISHED HOPE FOR JULY RATE CUT -- DIVIDEND-PAYING STOCKS ARE LEADING TODAY'S MARKET RETREAT -- RISING YIELDS ARE BOOSTING BANKS AND FINANCIALS -- A STRONGER DOLLAR IS CAUSING PROFIT-TAKING IN GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STRONGER THAN EXPECTED JOBS REPORT BOOSTS YIELDS...A increase of 224,000 jobs in June was much higher than expected, and may have diminished hopes for a July rate cut. That can be seen by rising bond yields today. The 10-Year Treasury yield is rising 11 basis points to 2....

READ MORE

MEMBERS ONLY

Dow Jones Sets New Record To Join S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 3, 2019

26 of 30 Dow Jones component stocks advanced as the most widely known stock index set all-time intraday and closing highs one day before Independence Day and during an abbreviated session. It gives traders an extra day to relax and reflect on the...

READ MORE

MEMBERS ONLY

Investors' Expectations: Knee-Jerk Reactions And Volatile Oscillations Aside, Budget May Remain A Non-Event

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After claiming an absolute majority again in the 2019 General Election, the Narendra Modi Government is slated to come up with their first budget of the second term on Friday, the 4th of July, 2019. Many expectations have been building up around this event, which has always been one of...

READ MORE

MEMBERS ONLY

Brexit is SOOO 1776!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Happy Fourth of July!

On this public holiday - for the US, anyway; not so much for me ;) - I looked up a bit more about the history of Independence Day and, while doing so, it occurred to me that even back then, the British were involved in a separation....

READ MORE

MEMBERS ONLY

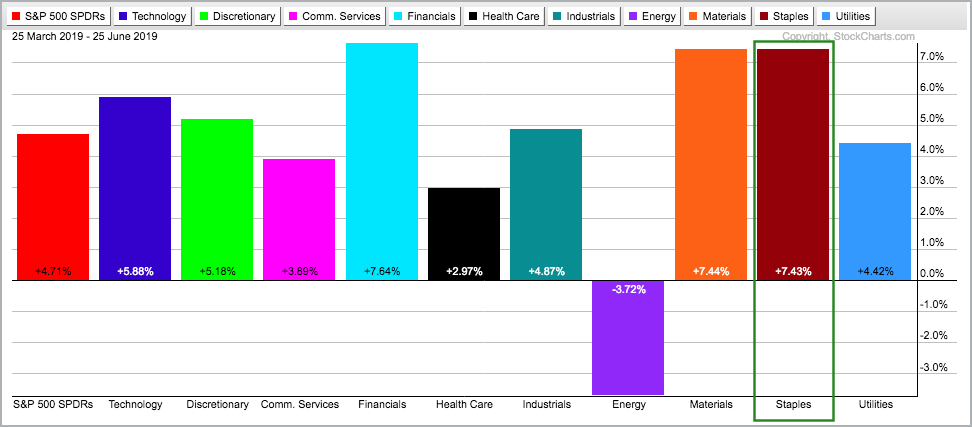

DOW AND S&P 500 ARE POISED TO CLOSE AT RECORD HIGHS -- DROP IN BOND YIELDS CONTINUES TO SUPPORT DIVIDEND-PAYING STOCKS -- CONSUMER CYCLICALS ARE TRADING AT RECORD HIGHS TODAY -- BUT STAPLES HAVE DONE BETTER THAN CYCLICALS SINCE LATE APRIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 SETS NEW RECORD... DOW IS GETTING CLOSE...Stocks are trading higher again today in a shortened pre-holiday trading session. Chart 1 shows the S&P 500 trading well above its late-April high and trading in new record territory again today. The SPX is trading well...

READ MORE

MEMBERS ONLY

S&P 500 Sets A New All-Time High; Get Used To It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 2, 2019

I saw a headline Tuesday morning when all of our major indices were lower that suggested "renewed trade fears" were impacting the stock market in negative fashion. When will the insanity stop? So Monday the market moved higher on trade relief...

READ MORE

MEMBERS ONLY

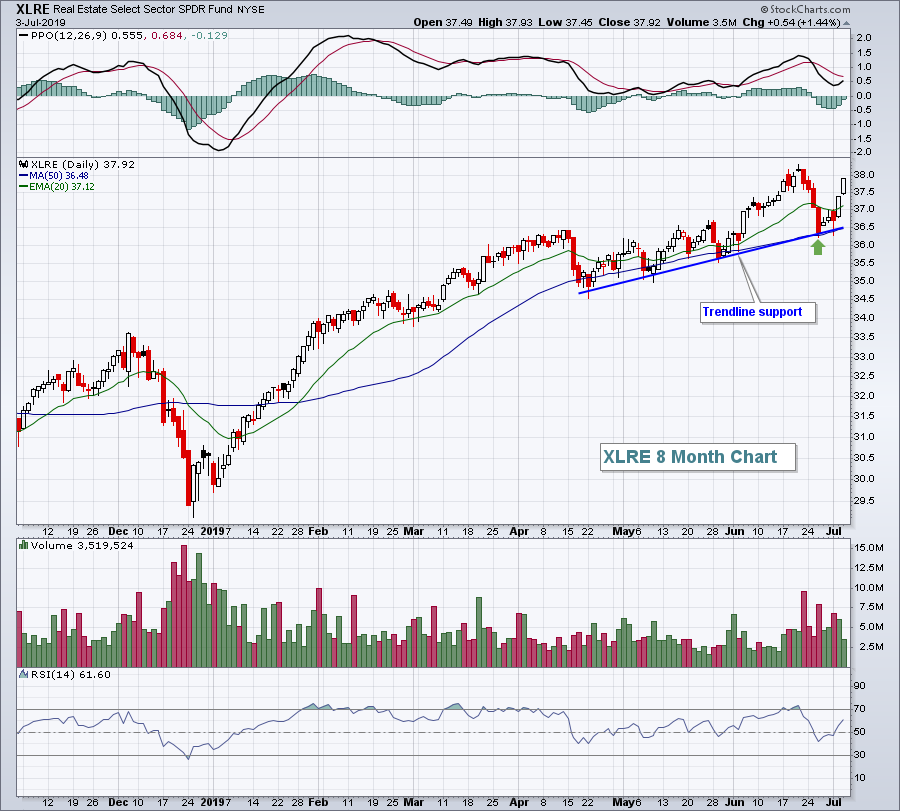

This is the Strongest Industry Group ETF within the Strongest Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On a closing basis, only one sector hit a new high on Tuesday and that sector just happens to be the biggest sector in the S&P 500. According to SPDRs.com, the Technology SPDR (XLK) accounts for 21.63% of the S&P 500 and is by...

READ MORE

MEMBERS ONLY

Are Commodities About To Turn Up?

by Martin Pring,

President, Pring Research

* CRB Still Caught in a Trading Range

* Commodity/Bond Ratio Holding On By its Teeth

* Watch the Canadian Dollar for Clues

CRB Still Caught in a Trading Range

Back in May, I wrote an article entitled “Commodities: Down Now, Up Later?" in which I pointed out some of the...

READ MORE

MEMBERS ONLY

XLE and Oil Hit Reversal Alert Zones - On Trend Video

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is much more to a sector than its price chart and StockCharts has the data to take your sector analysis to the next level. Yes, I am talking about the unique breadth indicators that our crack data team calculates and publishes every day. These indicators include AD Percent, High-Low...

READ MORE

MEMBERS ONLY

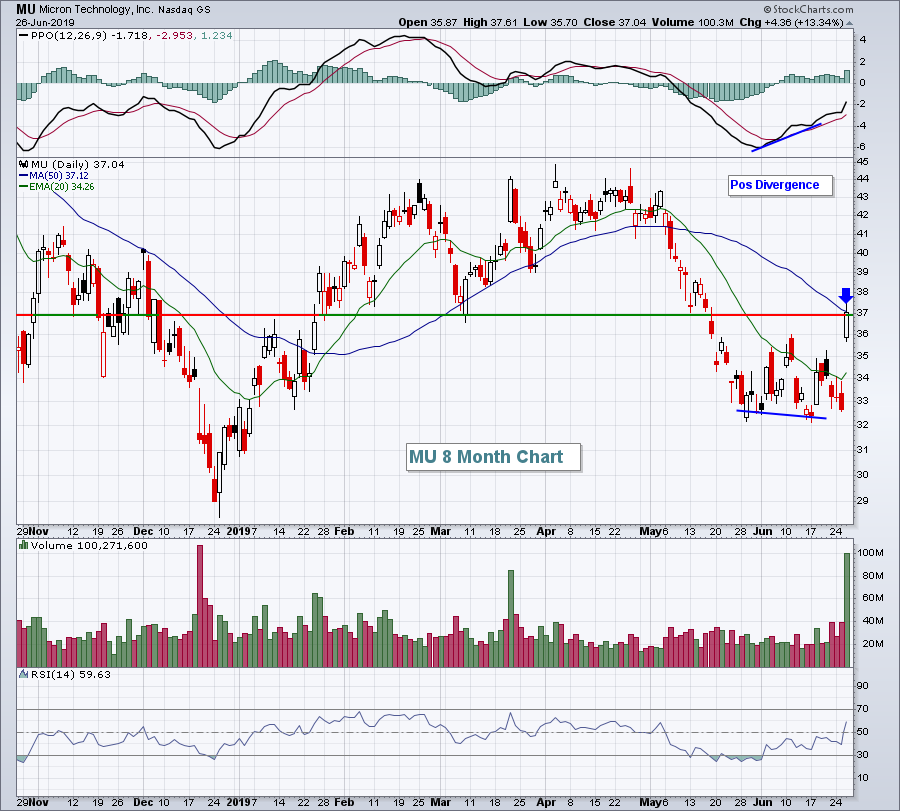

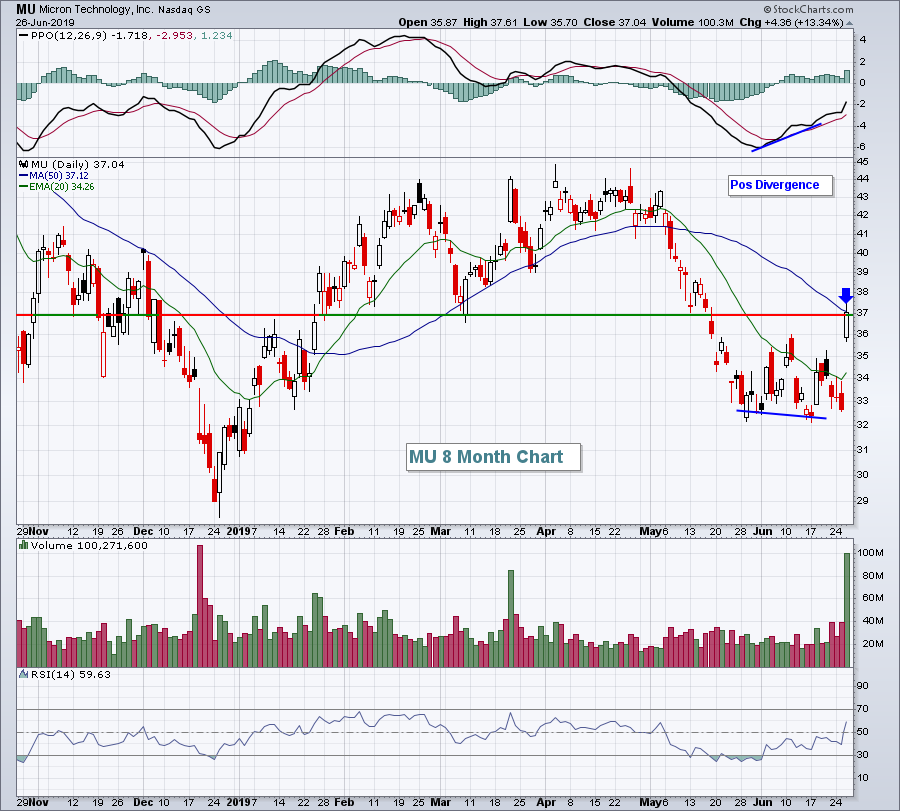

Semiconductor Stocks Open Door To Further Gains

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 1, 2019

The S&P 500 ($SPX, +0.77%) closed once again at an all-time high and all of our major indices ended Monday's session with gains. Leadership came in the form of the NASDAQ, which rang up a 1.06% gain....

READ MORE

MEMBERS ONLY

Passive versus Active Management

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I spent a lot of time discussing technical analysis and want to help readers try to understand its value by discussing passive versus active management.

Passive means that the investor or manager does not change the portfolio components except for occasional, usually based upon the calendar, rebalancing to some preconceived...

READ MORE

MEMBERS ONLY

Dine Brands Serves up Some Tasty Technicals

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Dine Brands (DIN) is the parent company for the Applebees and iHop restaurant chains. Regardless of what you think of the restaurants or food, business must be good because DIN is one of the best performing restaurant stocks this year (+44%). It is clearly leading on the price charts and...

READ MORE

MEMBERS ONLY

2019 Second Half Outlook Plus 8 Monday Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 28, 2019

I'm posting this early (and on Sunday) this week because I did a lot of chart-reviewing this weekend and there's a lot to digest here. Before I get into my Market Outlook for the second half of the year,...

READ MORE

MEMBERS ONLY

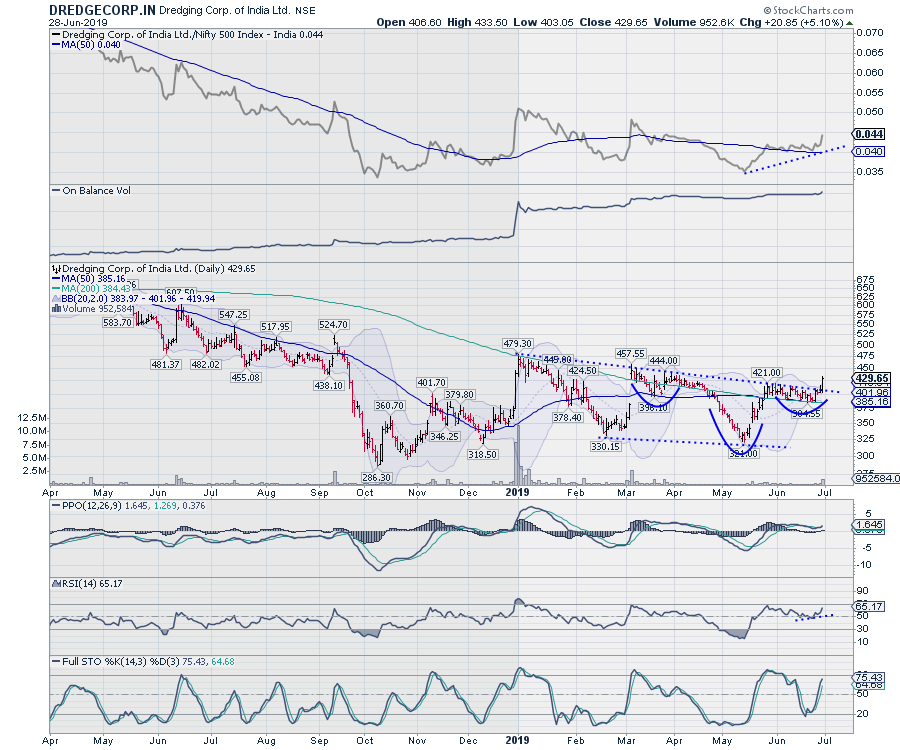

Bullish Setup On This Stock

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

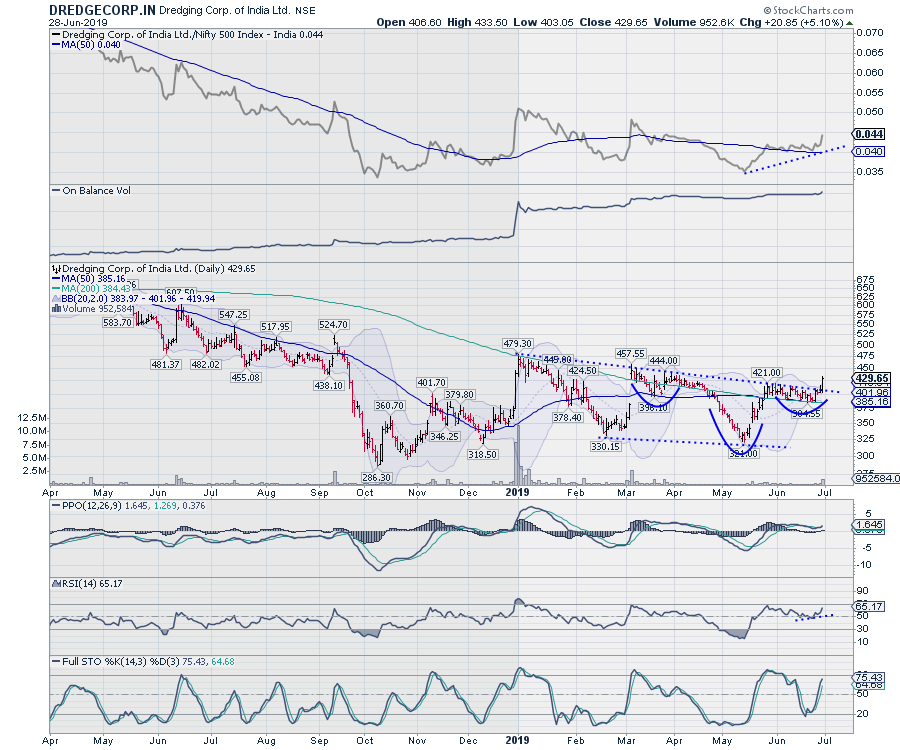

DREDGING CORP. OF INDIA LTD -- DREDGECORP.IN

Following a prolonged down move and some subsequent bottom-finding, DREDGECORP is set to confirm its reversal. The stock is currently breaking out of a falling trend line resistance, which begins from 479 and joins the subsequent lower tops. In the process, the...

READ MORE

MEMBERS ONLY

An Investment Process Is All About Piecing Things Together To Get Other Or Better Insights.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

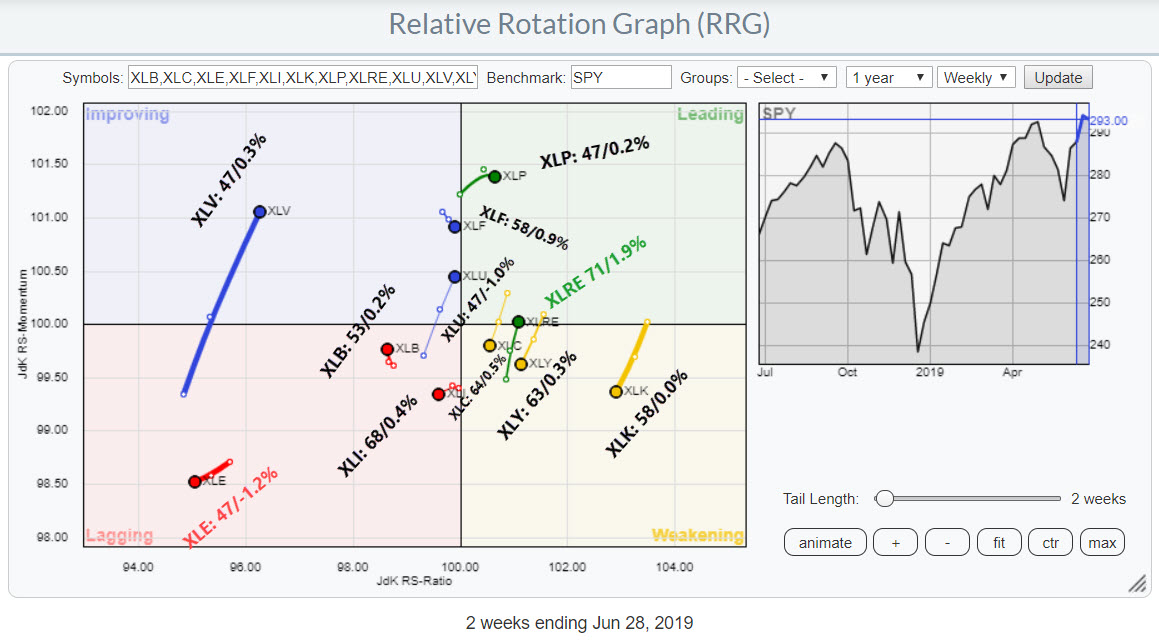

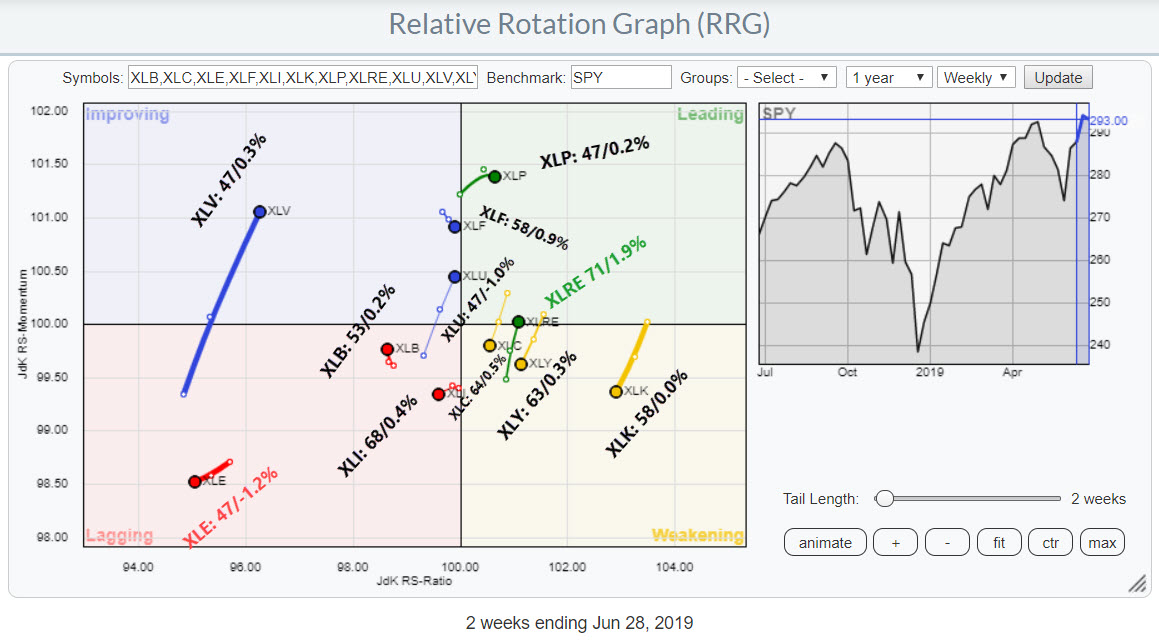

In my last DITC contribution, I wrote about the Real Estate sector, which is crossing over into the leading quadrant at the same time as the seasonality chart for that sector indicates that, over the last 20 years, XLRE closed the month of July higher 71% of the time, with...

READ MORE

MEMBERS ONLY

Week Ahead: Larger Technical Setup Remains Challenging; Reaction To Budget May Increase Volatility

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous week, the markets were expected to remain mostly volatile and to remain under range-bound oscillation without making any significant headway. In line with this analysis, the NIFTY headed nowhere, had a lackluster week and ended with mild gains on a weekly note. While the NIFTY continued to...

READ MORE

MEMBERS ONLY

Here, Try On These Investor Goggles, They'll Help You See A Path To Profits

by Grayson Roze,

Chief Strategist, StockCharts.com

In a recent moment of self-reflection, I was forced to arrive at the conclusion that I do not view the world the same way that many others do. In fact, more specifically I was forced to arrive at the conclusion that I do not view the world the same way...

READ MORE

MEMBERS ONLY

Building Portfolio Power: Start With Stocks Like These!

by John Hopkins,

President and Co-founder, EarningsBeats.com

Let me start by saying that we track a "Best of the Best" list at EarningsBeats.com. Technically, it's actually 3 "Best of the Best" lists - a Model Portfolio, an Aggressive Portfolio and an Income Portfolio. They each include 10 stocks that are...

READ MORE

MEMBERS ONLY

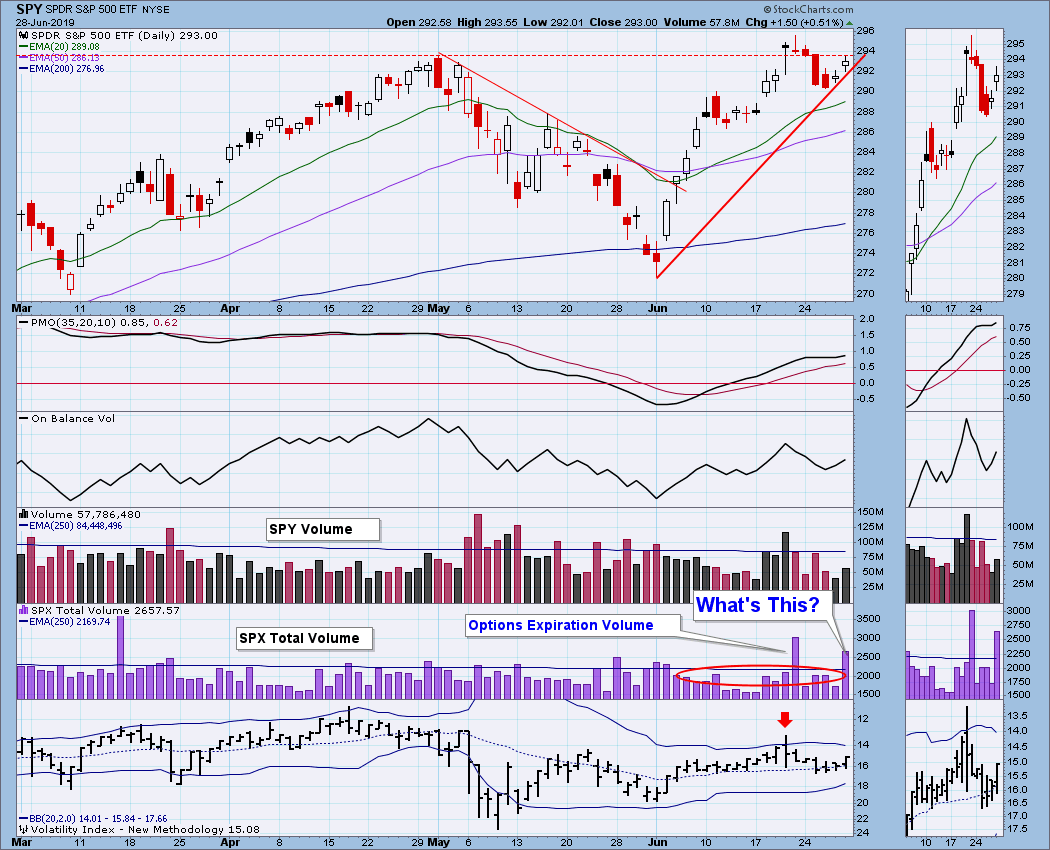

DP WEEKLY WRAP: Waiting for an Excuse to Do Something

by Carl Swenlin,

President and Founder, DecisionPoint.com

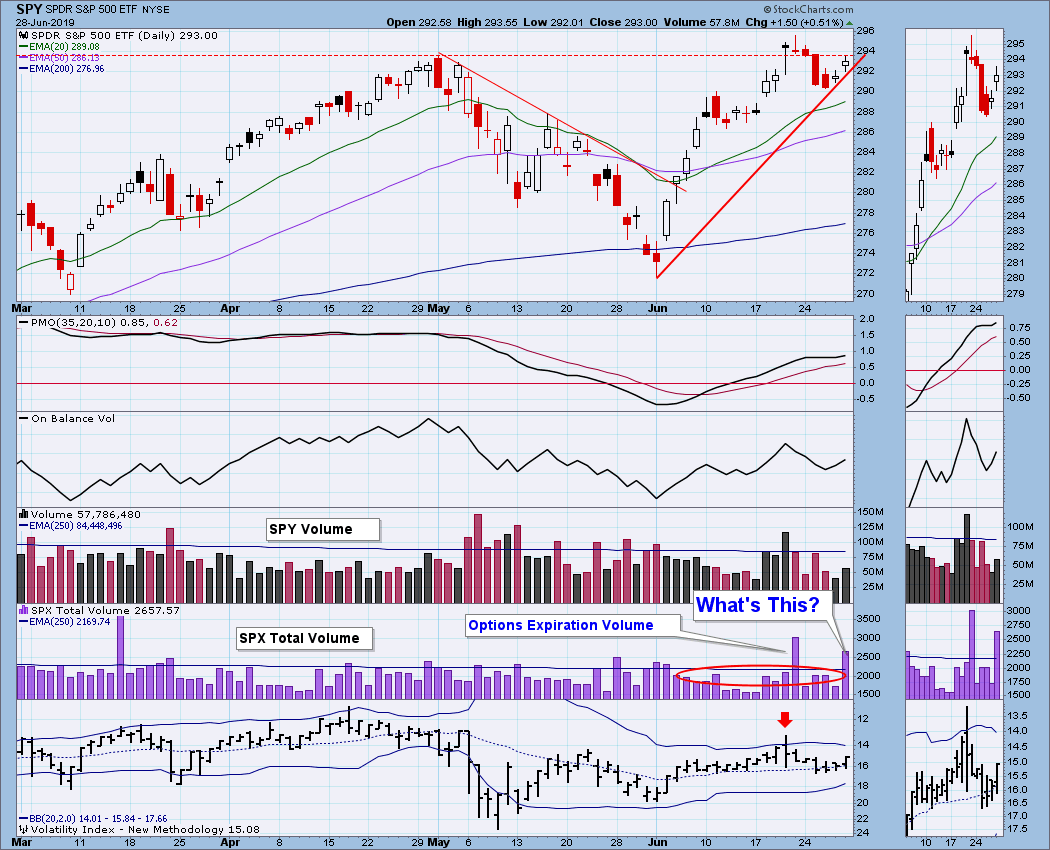

So much of the time it seems we are waiting for some event that will determine what the market is going to do next. Last week it was waiting for the Fed. This week it was waiting for the meeting between President Trump and President Xi tomorrow. What the market...

READ MORE

MEMBERS ONLY

S&P 600 Under the Indicator Microscope - Bouncing Off Relative Lows

by Erin Swenlin,

Vice President, DecisionPoint.com

Be prepared! I have a plethora of charts this week to share that focus only on the S&P 600. If you look closely, you can see that, even before the last two days of an impressive rally, the indicators were already suggesting a renewed interest in small-cap stocks....

READ MORE

MEMBERS ONLY

How to Spot Reversal Alert Zones and Get the Jump on Breakouts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Breakouts are bullish and often look great, but they do not always offer the best reward-to-risk ratio when taking a trade. As with so many aspects of technical analysis and trading, we must often walk the fine line between anticipation and confirmation. The first step to anticipating a breakout is...

READ MORE

MEMBERS ONLY

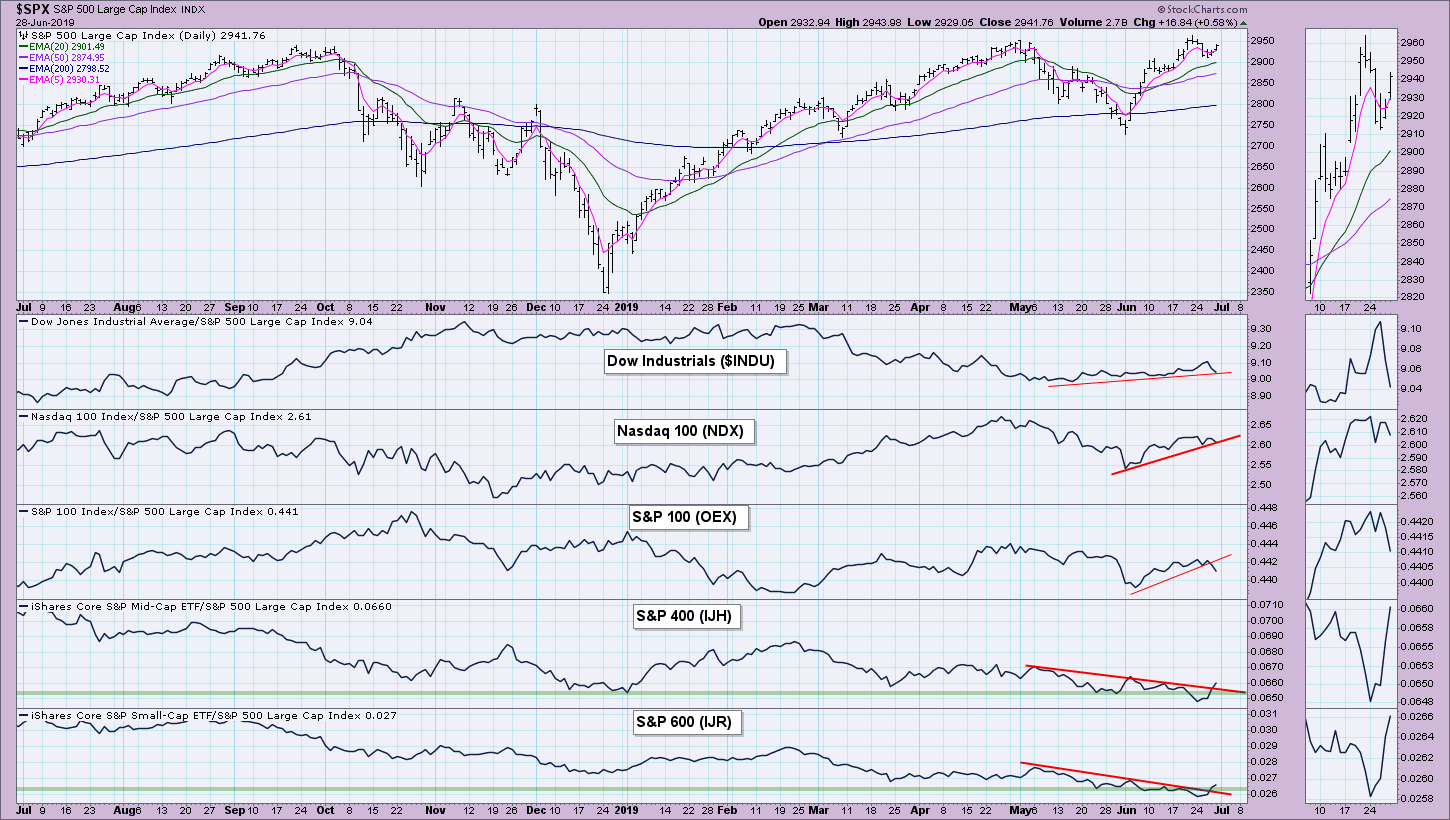

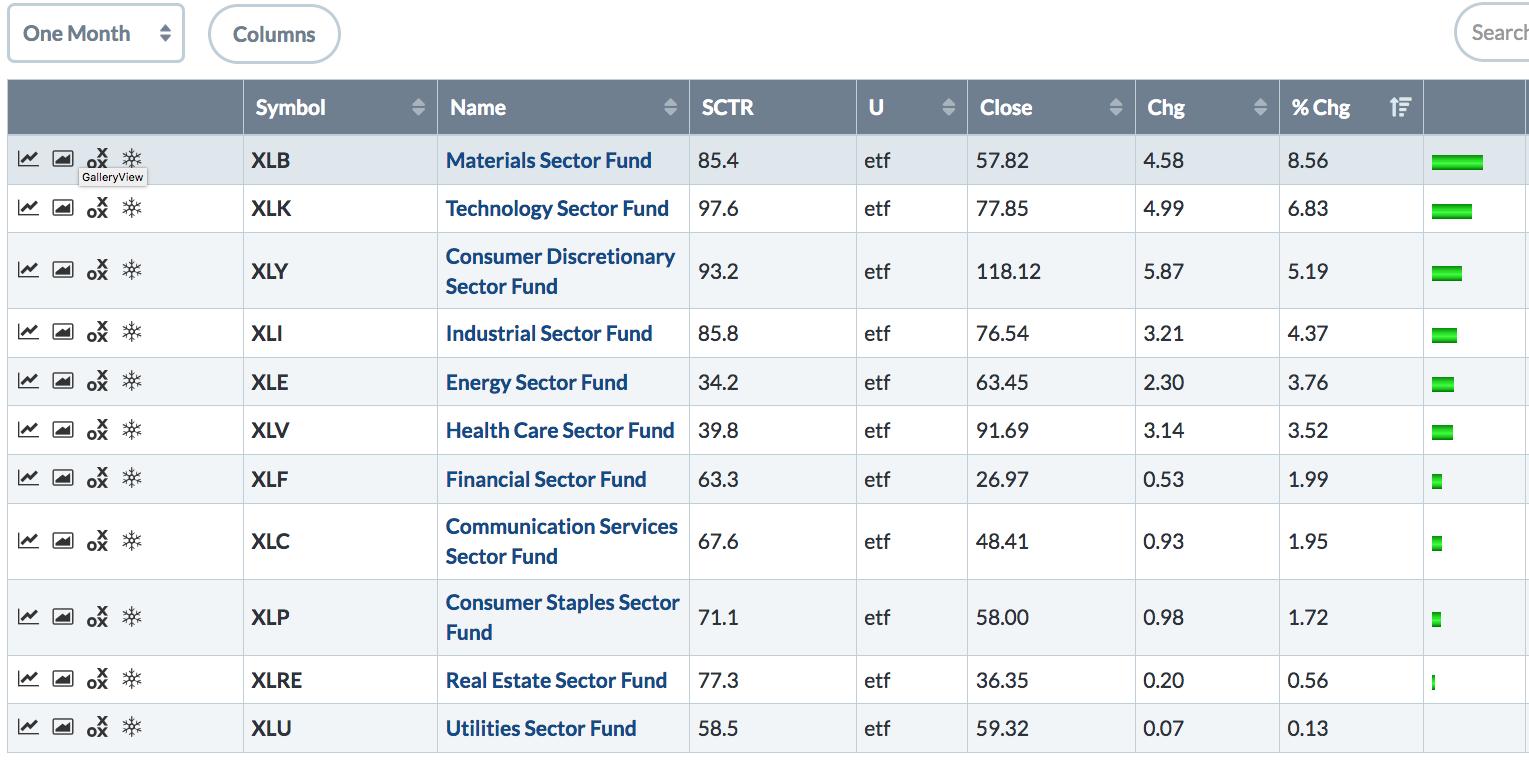

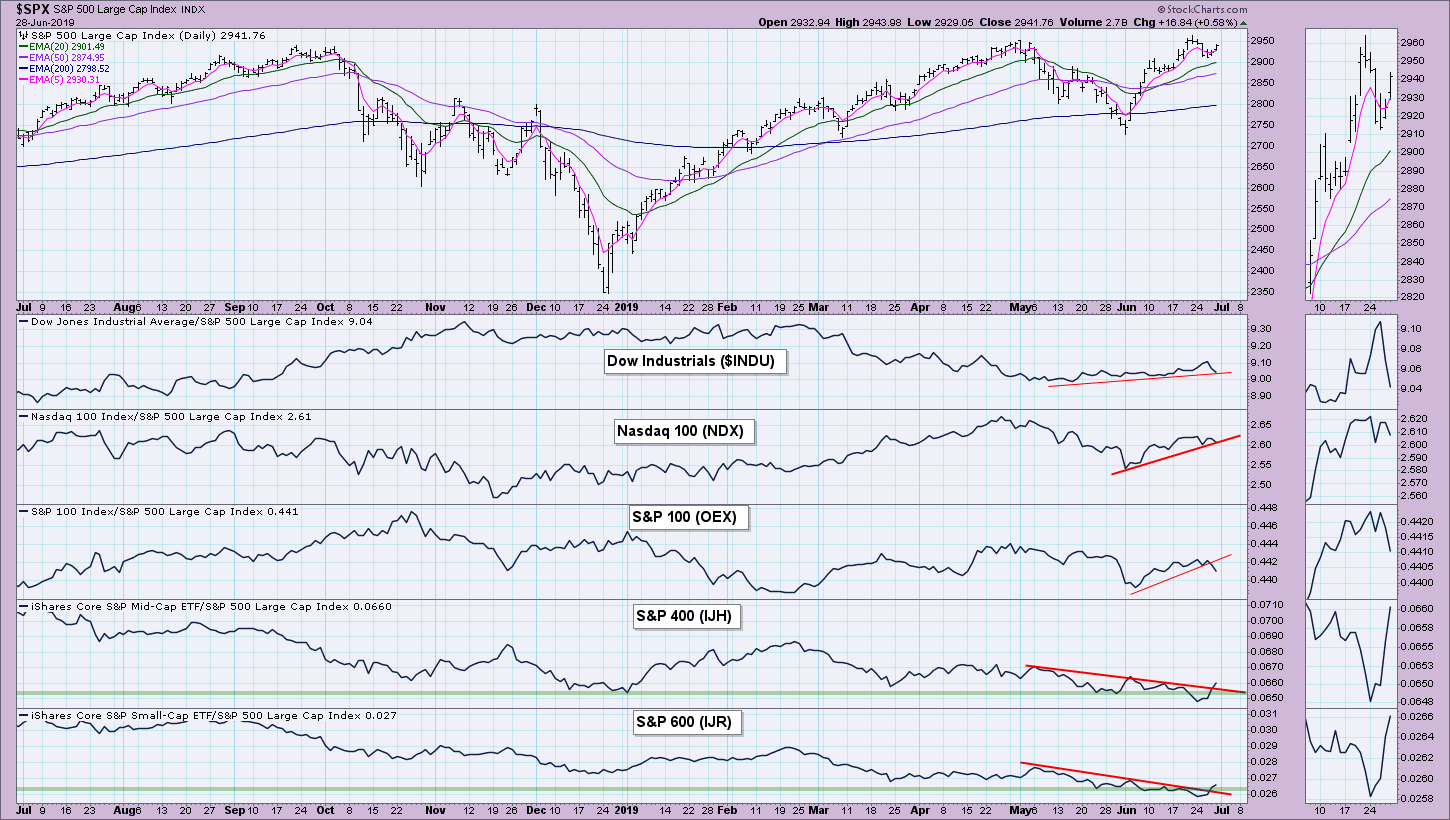

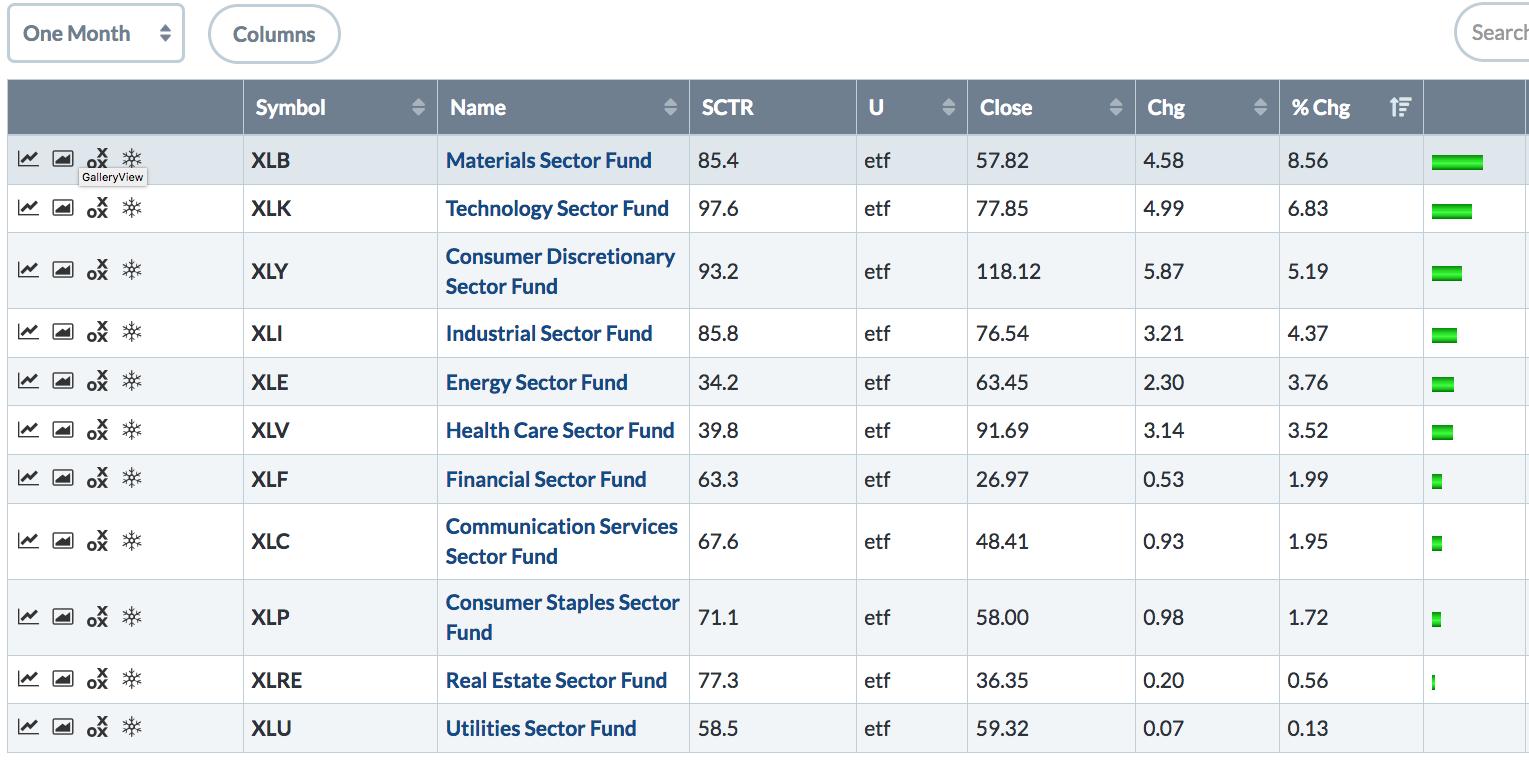

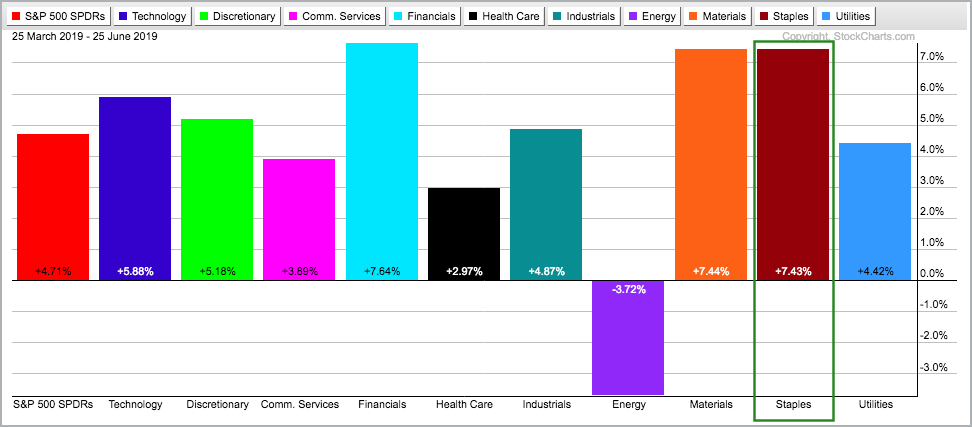

Defensive Sectors Fall Behind While Technology, Cyclicals, and Industrials Take the Lead

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, June 27th at 3:49pm ET.

Previous messages have pointed out that defensive stock sectors were top performers since the market hit a peak at the end of April when trade tensions...

READ MORE

MEMBERS ONLY

TRANSPORTS AND SMALL CAP INDEXES CLEAR 200-DAY AVERAGES -- TODAY IS REBALANCING DAY FOR RUSSELL INDEXES -- FINANCIALS ARE THE DAY'S STRONGEST SECTOR AND MAY BE BOOSTING SMALL CAPS -- BIG BANKS PASS ANNUAL STRESS TEST AND ARE LEADING XLF HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS CLEAR 200-DAY AVERAGE...Two market groups that have been market laggards all year are suddenly attracting new buying. I'm referring to small cap stocks and transports. Chart 1 shows the Dow Jones Transportation Average ending the week above its 200-day moving average. It's also one...

READ MORE

MEMBERS ONLY

The State of the Stock Market - Bullish Until You Know What

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* When Higher Highs are Expected.

* Small-cap Breadth Comes Alive.

* Sector Table Remains Firmly Bullish.

* ETF Leaders and Setups.

* Art's Charts ChartList Update.

... When Higher Highs are Expected

... Let's review the weekly chart for the S&P 500 first. The index surged some 26% from late...

READ MORE

MEMBERS ONLY

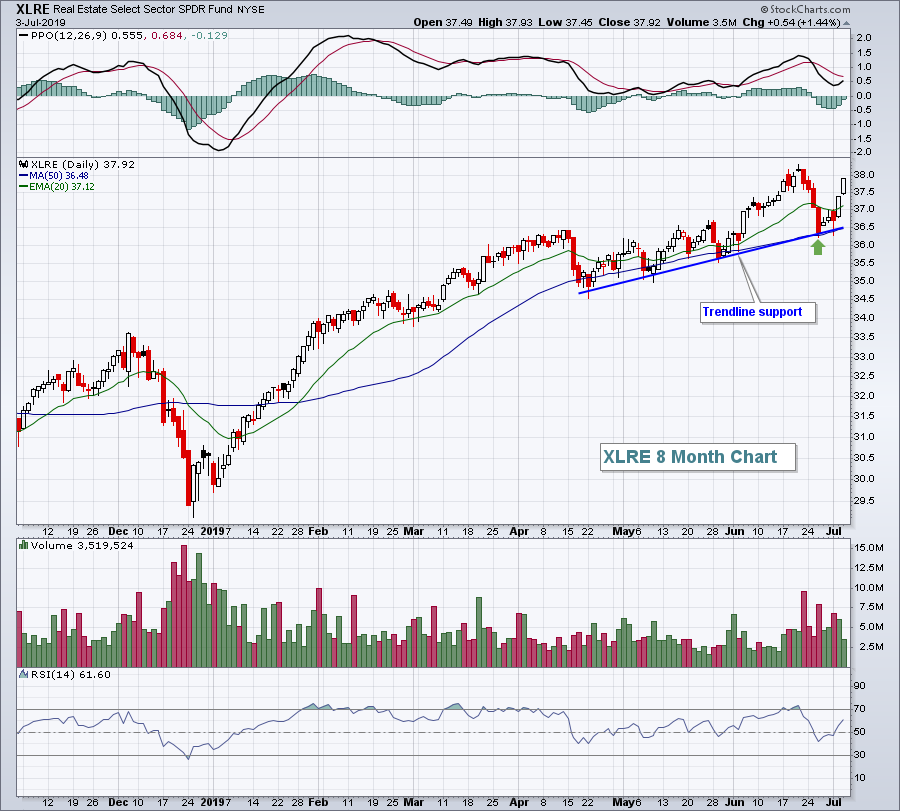

Real Estate Poised To Bounce After Rough Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 27, 2019

It was mostly a solid day on Wall Street, except for the late selling that carried the Dow Jones to a slight 10 point loss. The problem child for the Dow Jones was Boeing (BA, -2.91%), which fell after providing an update...

READ MORE

MEMBERS ONLY

JUNE SECTOR ROTATIONS SHOW MORE CONFIDENCE -- DEFENSIVE SECTORS FALL BEHIND -- WHILE TECHNOLOGY, CYCLICALS, AND INDUSTRIALS TAKE THE LEAD -- SEMICONDUCTORS LEAD TECH HIGHER -- CHIP STOCKS ARE TRACKING THE CHINESE STOCK MARKET VERY CLOSELY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DEFENSIVE SECTORS FALL BEHIND... Previous messages have pointed out that defensive stock sectors were top performers since the market hit a peak at the end of April when trade tensions started to resurface. Stocks, however, have recovered most of their May losses during the month of June. And sector leadership...

READ MORE

MEMBERS ONLY

This Industry Group Is Printing A Handle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 26, 2019

It was a day of bifurcated action as the NASDAQ was able to cling to a 0.32% gain, but the other major indices fell. Honestly, it felt like a down day on the NASDAQ as well. This tech-laden index surged to a...

READ MORE

MEMBERS ONLY

This Sector Just Returned to the Leading RRG-Quadrant AND Shows an Outperformance 71% of the Time in July

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I do not believe that there is just one single tool, strategy, method, etc. that fits all our needs as investors or traders. For me, the power of research and analysis lies in combining information from various sources and subsequently putting all that together into a market-view, strategy, system, etc....

READ MORE

MEMBERS ONLY

DP Alert Mid-Week Review: Is it Time to Get Bearish on Gold?

by Erin Swenlin,

Vice President, DecisionPoint.com

The market has cooled this week. There are no changes on the DP Scoreboard indexes, nor on the Sector Scoreboard. Indicators are starting to look worrisome, but we do need to see some digestion of last week's rally. Gold has been on fire! I'm starting to...

READ MORE

MEMBERS ONLY

SystemTrader - Setting Expectations and Finding Setups within the Aroon/RSI Strategy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Strategy Recap.

* RSI Signal Examples.

* Aroon Signal Examples.

* Testing the Individual Signals.

* Selecting from Scan Results.

... Last week I showed a scan using RSI(65) and Aroon(65) to find stocks showing steady and consistent uptrends. Today I will backtest this scan on stocks in the S&P 500...

READ MORE

MEMBERS ONLY

Here's a Food Stock with Performance Written All Over It

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Staples SPDR (XLP) is the third best performing sector over the last three months and one of only three sector SPDRs to record a new high here in June (along with XLU and XLRE). In addition, the S&P 500 is trading comfortably above its 200-day SMA....

READ MORE

MEMBERS ONLY

You Just Need To Beware One Week In July

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 25, 2019

Sellers returned to the stock market yesterday as the NASDAQ posted a 1.51% drop, its largest decline since June 3rd. Volatility ($VIX, +6.68%) has been on the move higher as the market grows more nervous with the G-20 summit beginning later...

READ MORE