MEMBERS ONLY

You Just Need To Beware One Week In July

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 25, 2019

Sellers returned to the stock market yesterday as the NASDAQ posted a 1.51% drop, its largest decline since June 3rd. Volatility ($VIX, +6.68%) has been on the move higher as the market grows more nervous with the G-20 summit beginning later...

READ MORE

MEMBERS ONLY

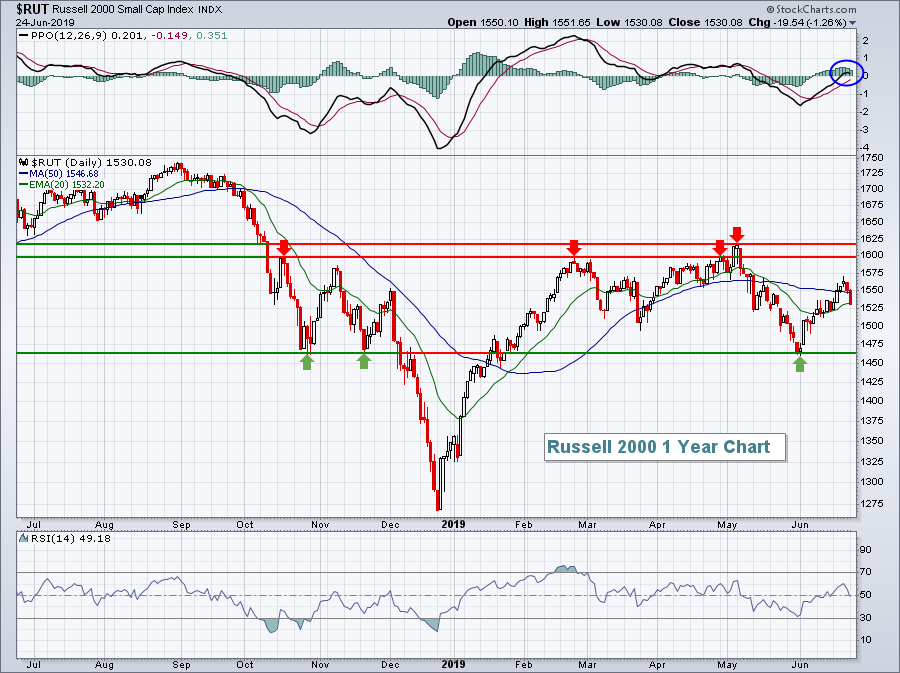

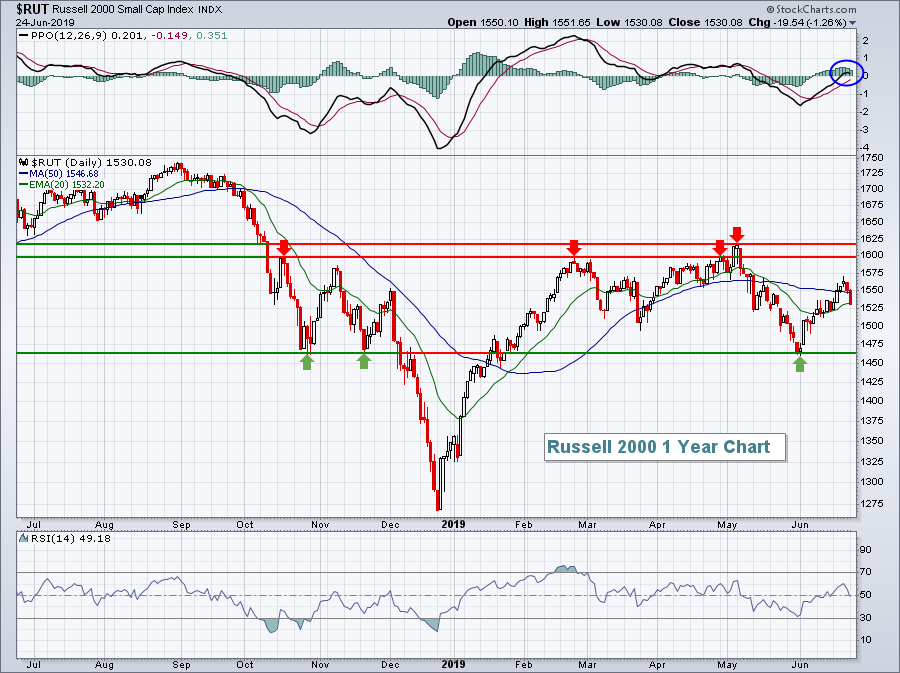

SMALL CAPS HAVE BEEN WEAKER THAN LARGE CAPS THIS YEAR -- A WEAKER DOLLAR MAY BE A REASON -- FALLING RATES ARE MORE LIKELY -- FINANCIALS ARE BIGGEST SMALL CAP SECTOR -- PREFERENCE FOR LARGE DIVIDEND-PAYING STOCKS MAY ALSO BE HURTING SMALL CAPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS CONTINUE TO UNDERPERFORM...Small cap stocks have been lagging behind larger stocks for most of this year. And in a big way. The black bars in Chart 1 show the Russell 2000 Small Cap Index (RUT) lagging behind the S&P 500 Large Cap Index (gray area)...

READ MORE

MEMBERS ONLY

Seasonality Suggests BIDU Could Be Ready To Launch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 24, 2019

The U.S. stock market waffled yesterday as the G-20 summit set to begin later this week. We know from history that any time the headlines are littered with US-China trade, we need to be vigilant. While there wasn't widespread selling...

READ MORE

MEMBERS ONLY

Four Reasons Why The Gold Breakout Is Likely To Be Valid

by Martin Pring,

President, Pring Research

* A Weaker Dollar is Bullish for Gold

* The Gold 6/15 PPO Model for Gold is Bullish

* Global Gold is Breaking Out

* Gold Shares Showing Signs of Strength

* Gold Special K Crossed its Bear Market Trend Line

Last week, Gold experienced an upside breakout from a multi-year base. I always...

READ MORE

MEMBERS ONLY

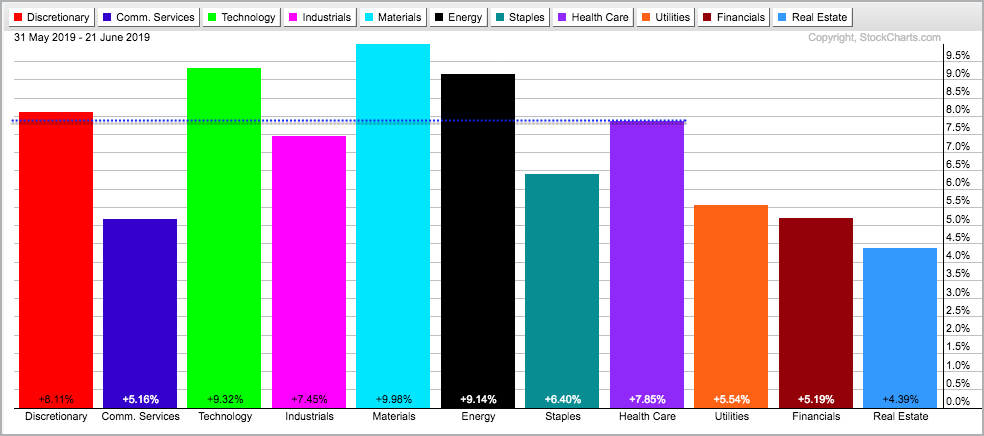

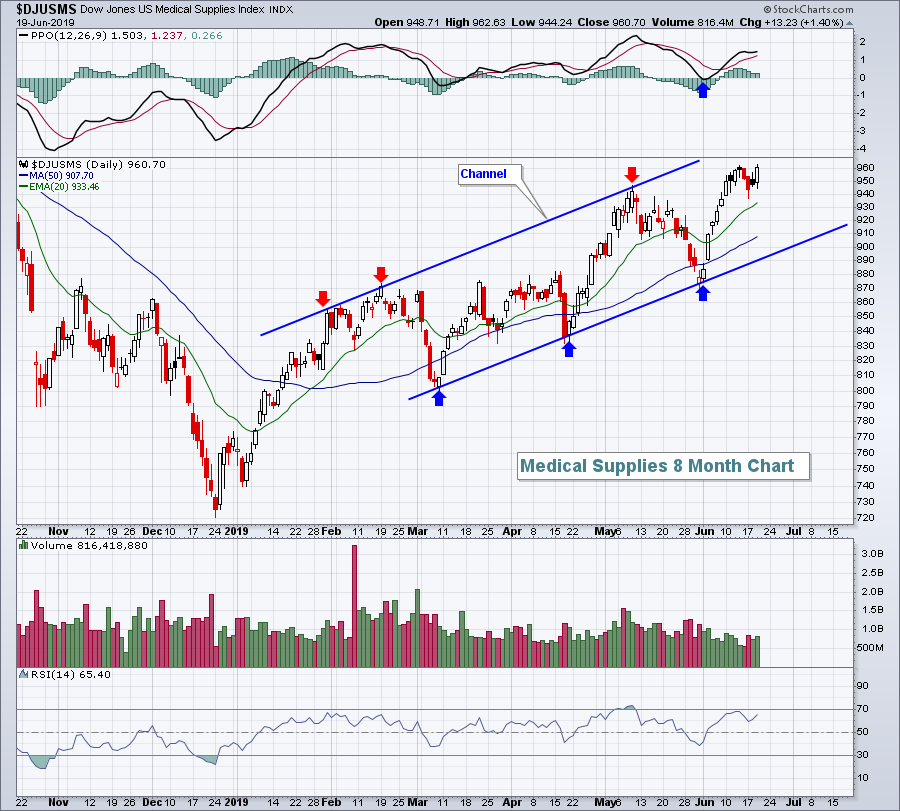

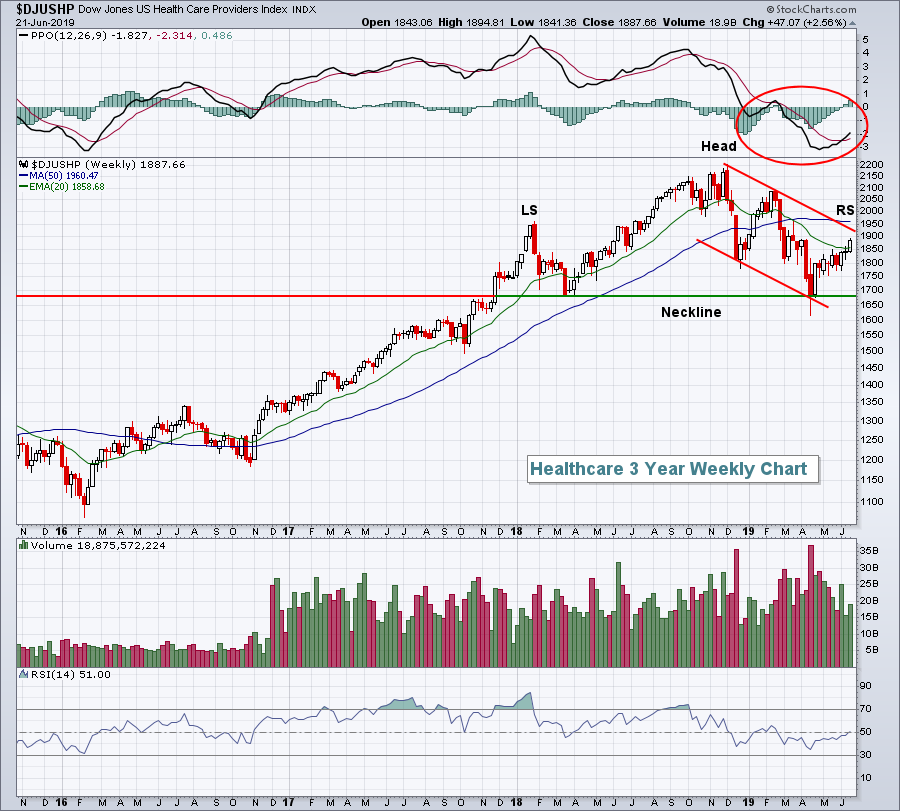

S&P 500 Flat But Healthcare Showing Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 21, 2019

The S&P 500 ended Friday's session relatively flat, but had a very solid week as it raced to an all-time high before sellers hit on quad-witching day. As usual, quad-witching day volume was extremely heavy. I wouldn't...

READ MORE

MEMBERS ONLY

Pfizer Hits a Milestone for 2019

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 hit a new high last week and the Health Care SPDR (XLV) broke out of a large symmetrical triangle with a big surge in June. The stock market is in bull mode and healthcare is coming alive. XLV was the worst performing sector from January...

READ MORE

MEMBERS ONLY

Week Ahead: Mild Pullbacks Likely But Broader Technical Setup Remains Weak; Volatility May Increase

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In our previous weekly note, we had mentioned the possibility of the markets not giving any runaway moves on the higher side. The week that went by remained on expected lines as the headline index resisted to one of its significant double top resistance areas, which lies in the 11840-11880...

READ MORE

MEMBERS ONLY

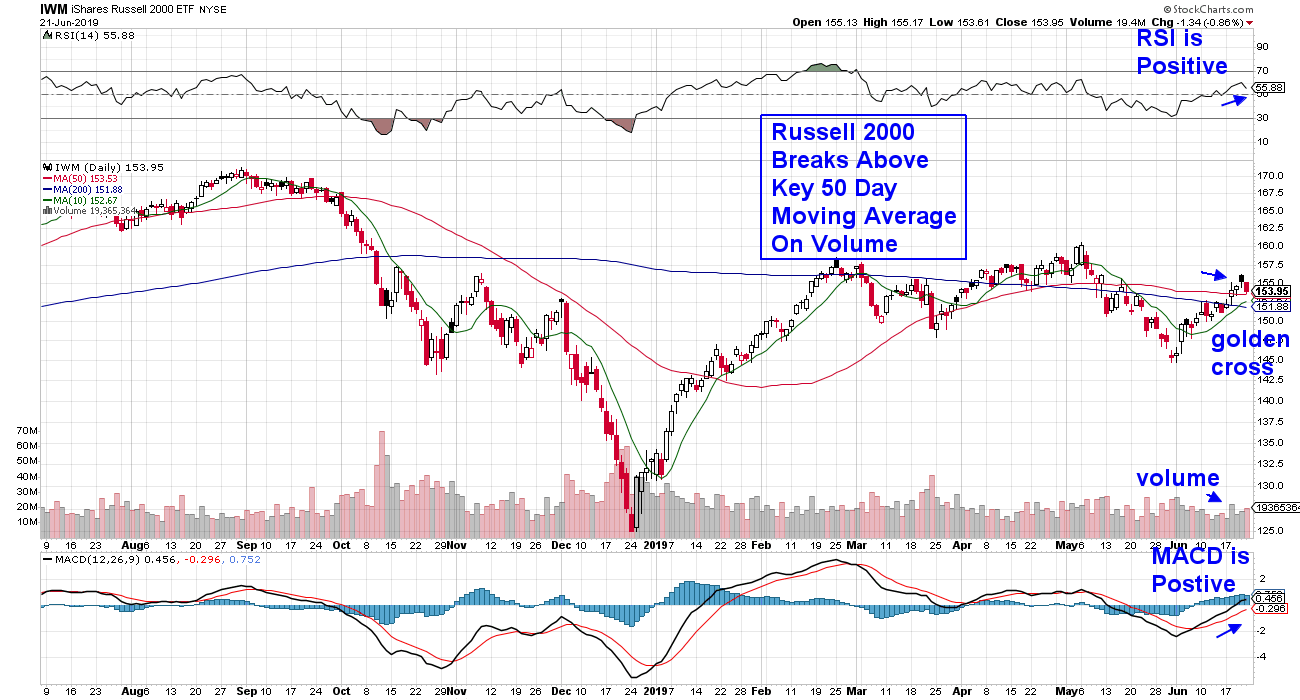

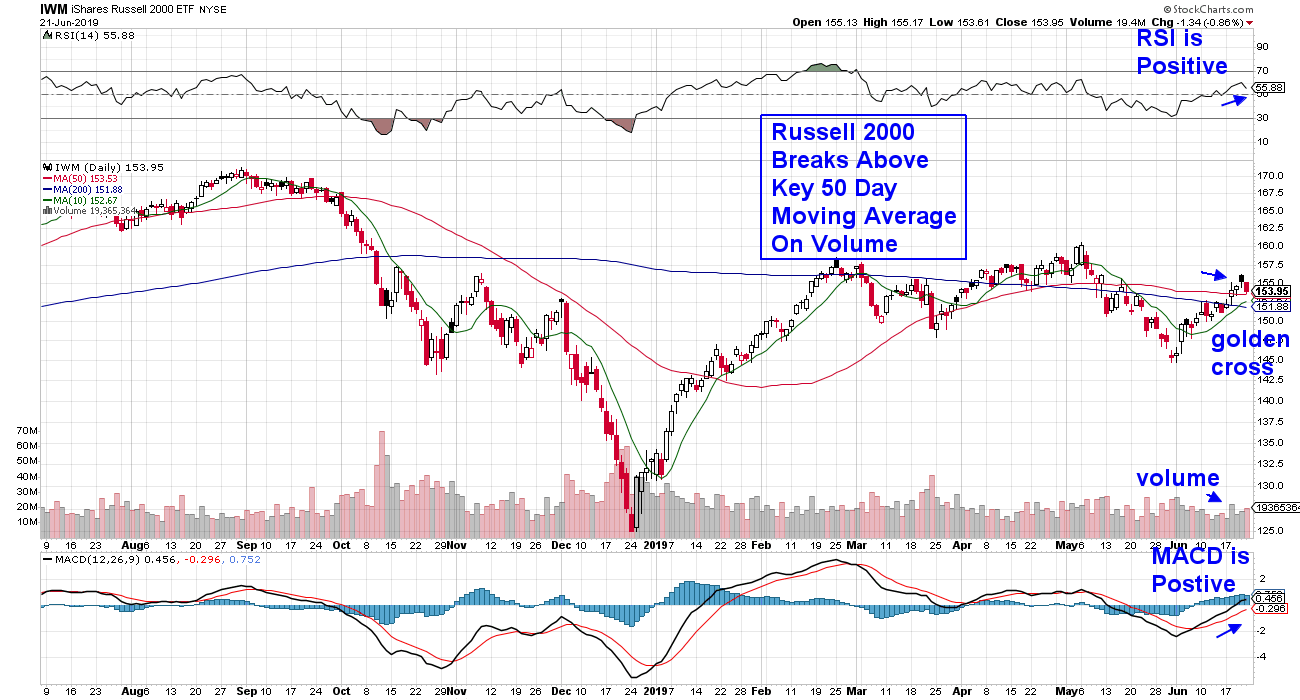

Small Caps and Biotechs Have Both Turned Positive - Here Are 3 Candidates for Your Consideration

by Mary Ellen McGonagle,

President, MEM Investment Research

June is shaping up to be quite a month, with the S&P 500 on track to outpace January as the best-performing period. Of special note is this week’s move into Biotechnology and Small Cap stocks, which both have struggled since stalling out in February. With money flows...

READ MORE

MEMBERS ONLY

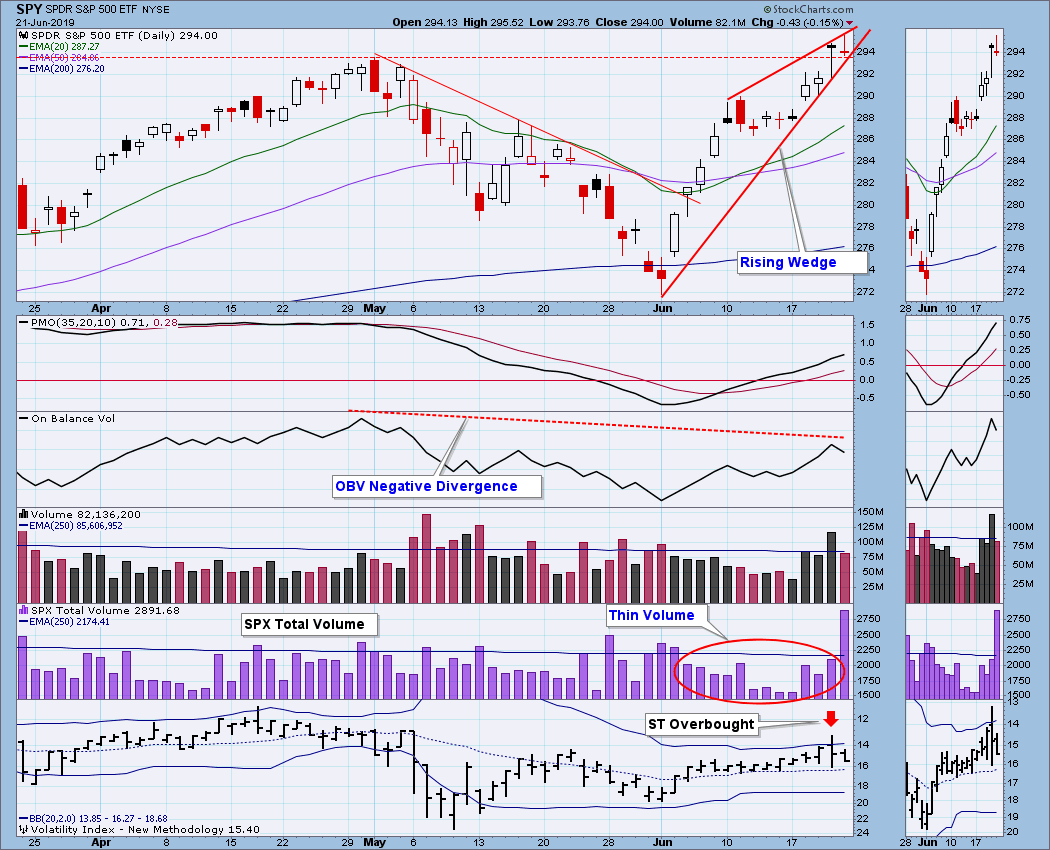

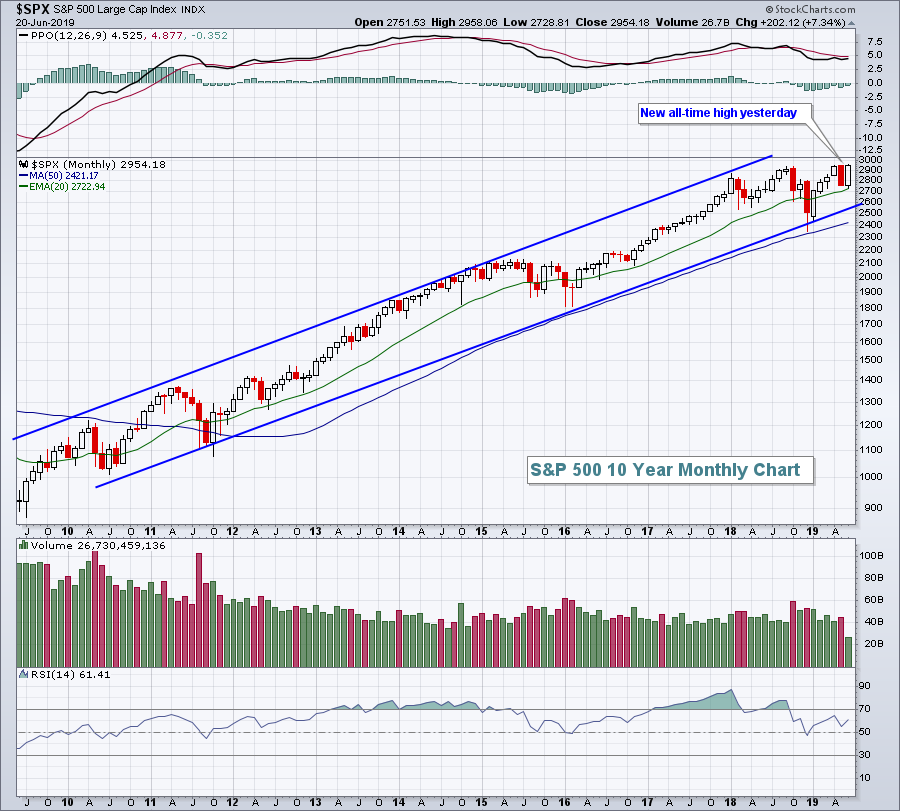

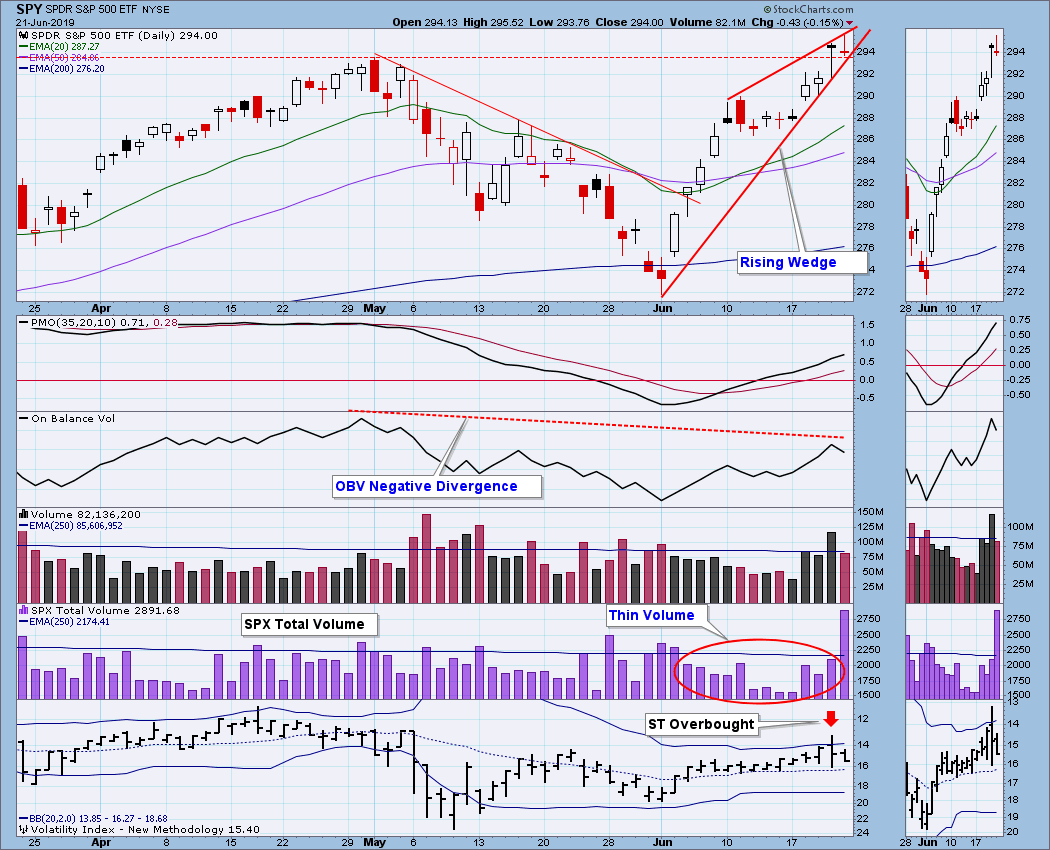

DP WEEKLY WRAP: Short-Term Bearish Indications

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market closed at an all-time high on Thursday, then on Friday it hit an all-time intraday high; however, there are some technical problems: (1) a bearish rising wedge pattern has formed; (2) there is an OBV negative divergence; (3) volume has been thin since the June low; and (4)...

READ MORE

MEMBERS ONLY

The Bullish Case For Gold Isn't All That Strong

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The price of gold ($GOLD) closed on Friday at $1400.10 per ounce. The weekly gain of 4.14% was the best such weekly advance since April 2016 and the close above $1400 was the first such close since September 3, 2013. Since testing 2019 lows on May 21st, GOLD...

READ MORE

MEMBERS ONLY

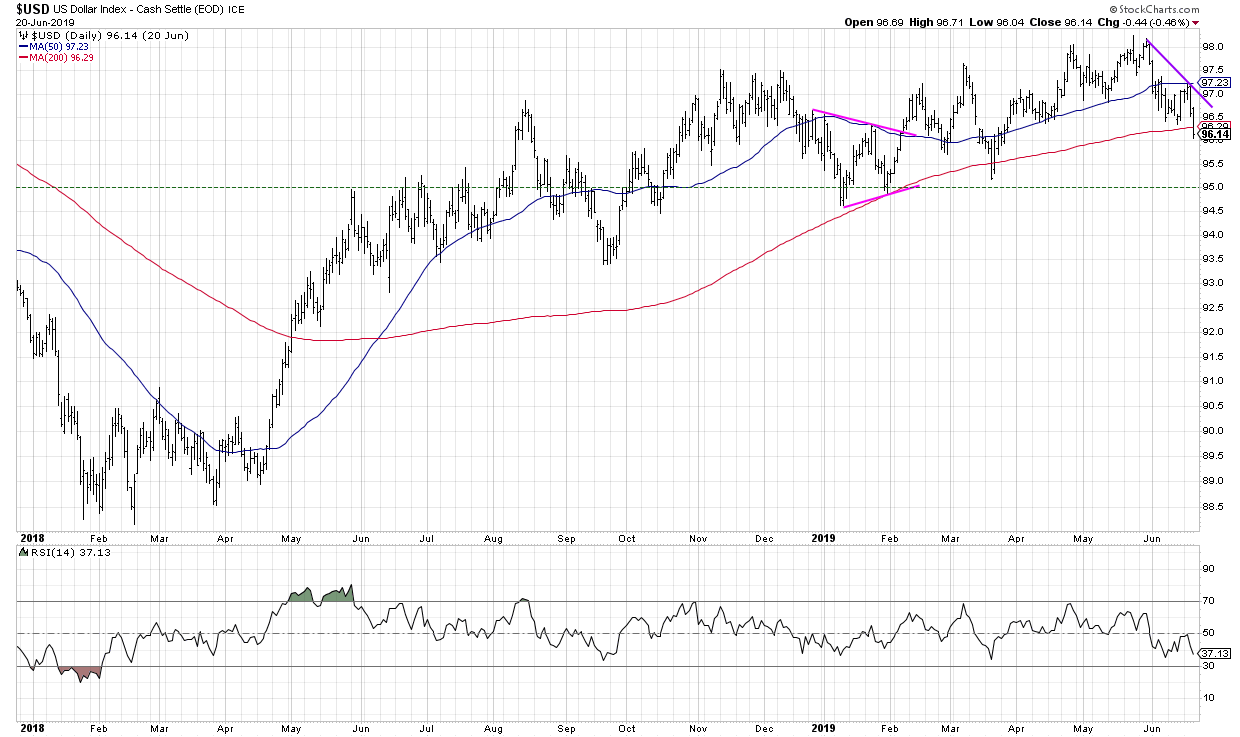

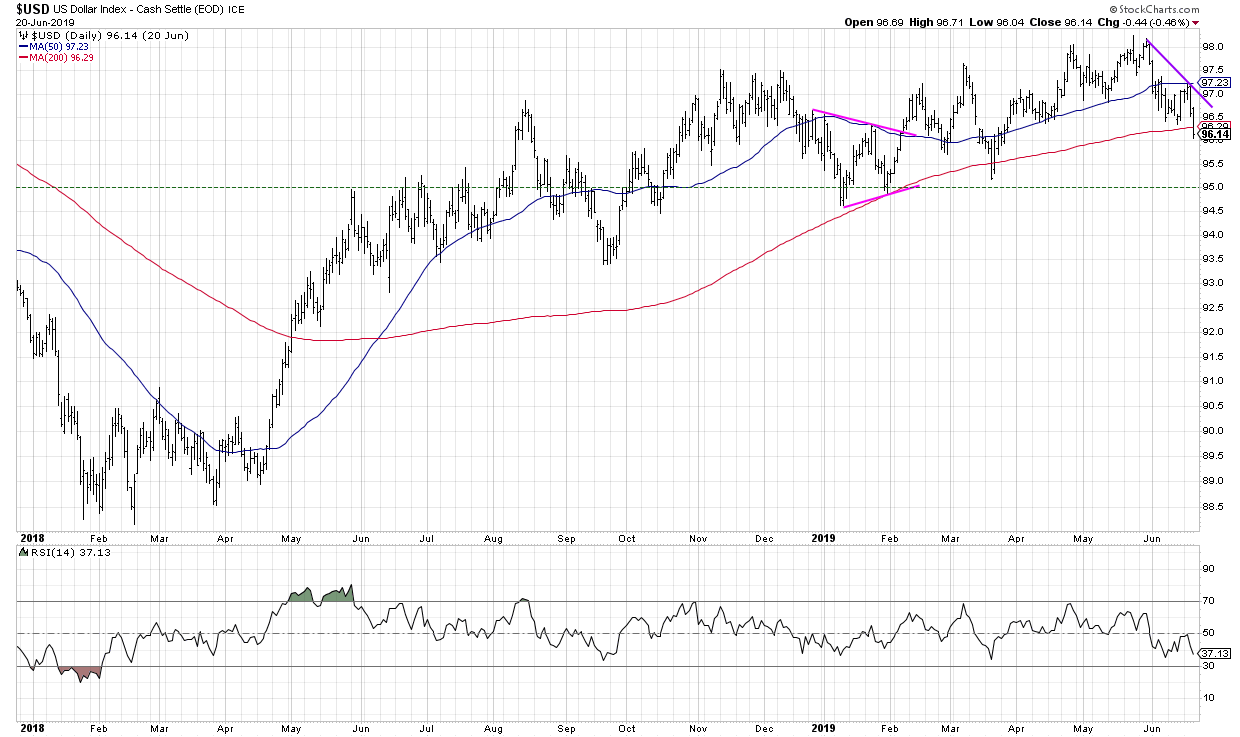

Dialing Down the Dollar

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Has the slow and grinding uptrend in the US Dollar finally reached its exhaustion point? A quick review of the charts suggests this may be the case.

The $USD chart has certainly been a frustrating one for Dollar bulls, as the trend, while steadily positive, has not provided the upside...

READ MORE

MEMBERS ONLY

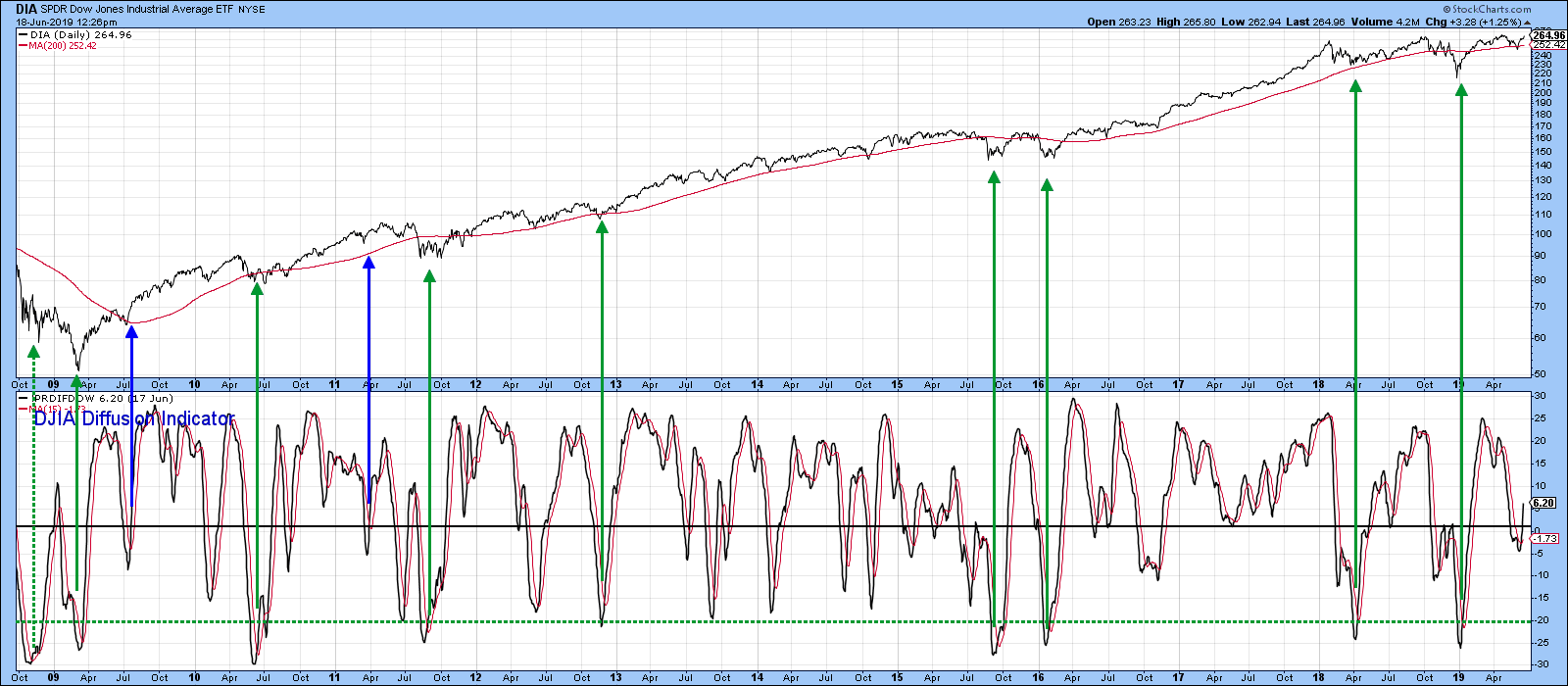

More Short-Term US Market Indicators Turn Bullish

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, June 18th at 2:30pm ET.

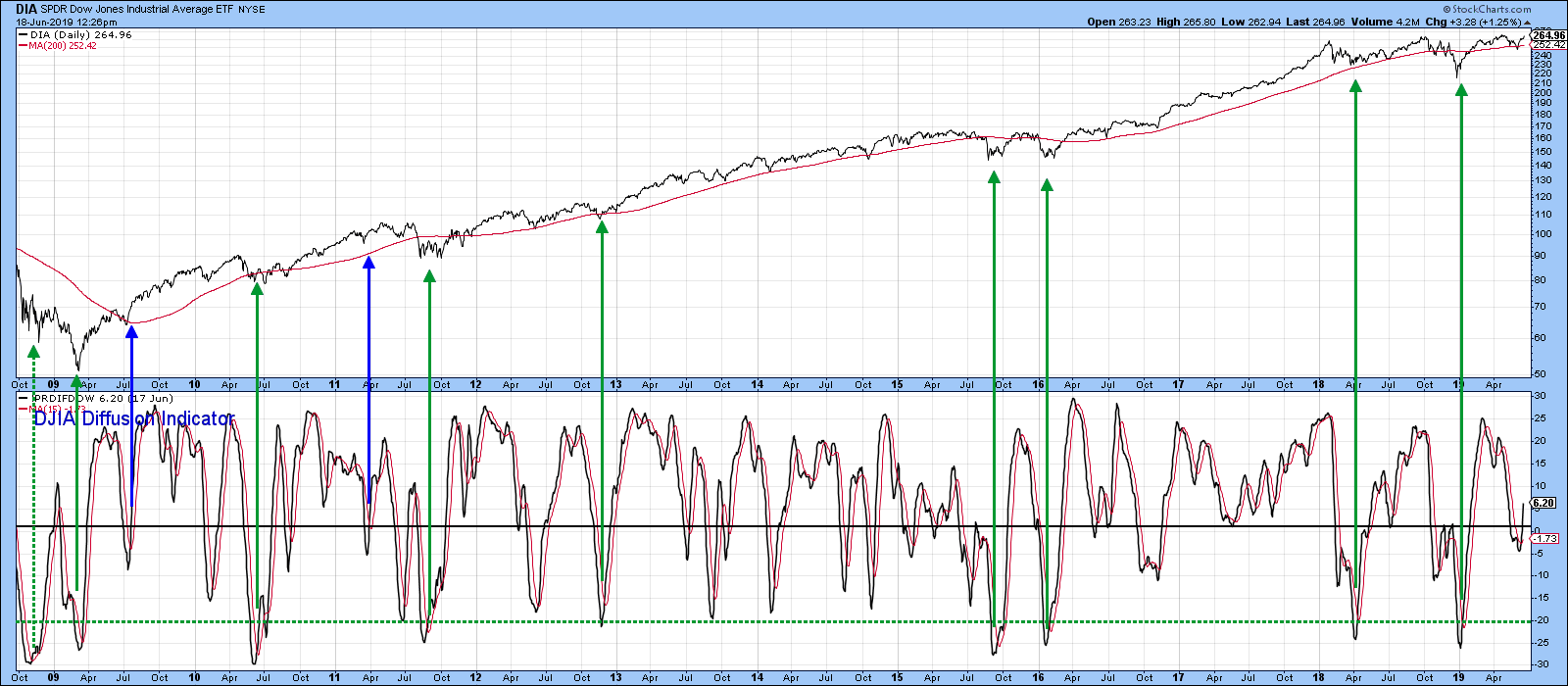

Several reliable short-term oscillators have just turned bullish. Chart 5, for instance, features my Dow Diffusion Indicator. This one is similar to the Global Oscillator, but...

READ MORE

MEMBERS ONLY

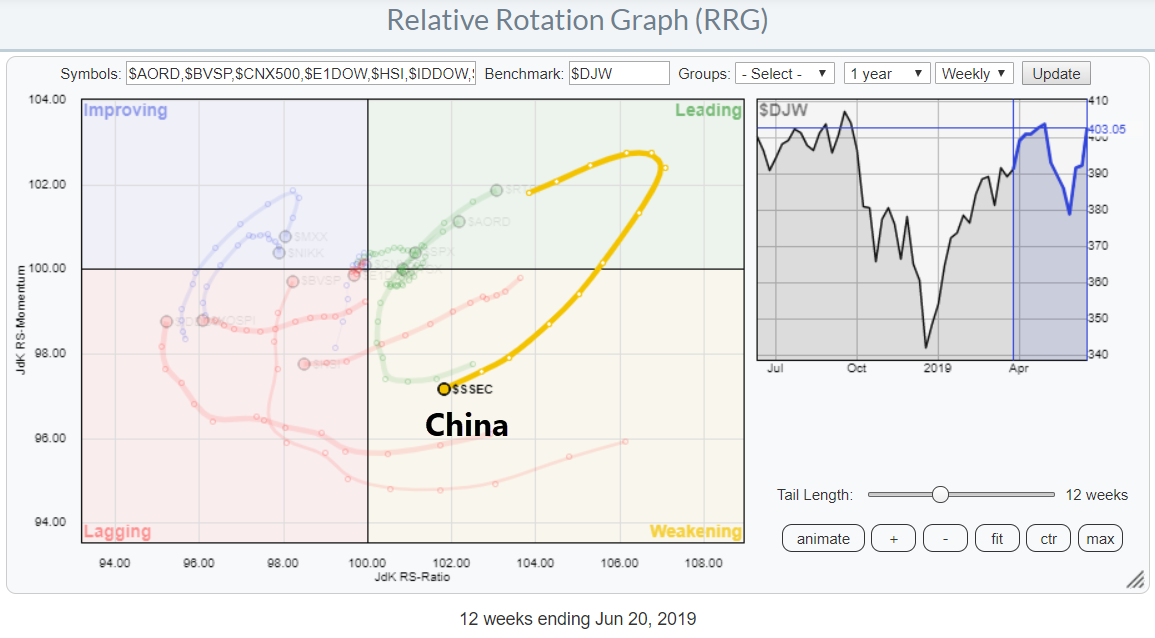

Will China Be Able To Complete Its Current Rotation Inside Positive Territory And Start A New Period Of Outperformance??

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

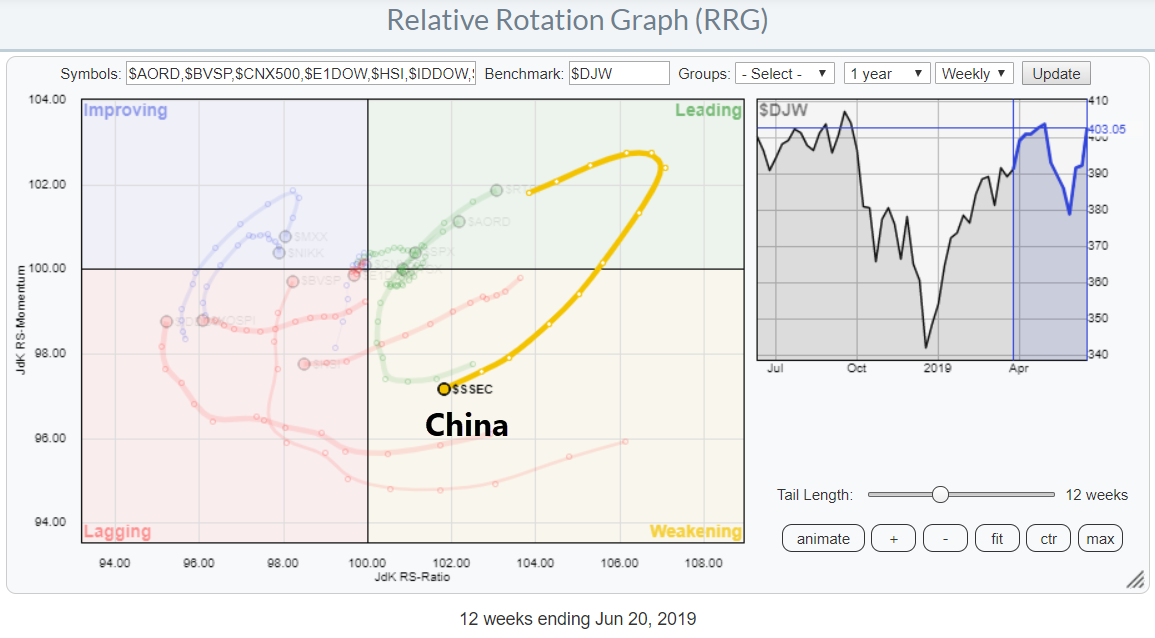

On the above Relative Rotation Graph, which shows the rotation for international stock indexes against the Dow Jones World index, we really ought to pay attention to the long tail inside the weakening quadrant for the Chinese market.

This rotation follows a strong performance of the Chinese market during the...

READ MORE

MEMBERS ONLY

Market Highs and Mental Hurdles

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Years ago, I was looking to hire a junior analyst to focus on database management and creating new data visualizations. We received quite a large pile of resumes; I'll never forget spending an afternoon flipping through papers until one of the them jumped out at me.

What stood...

READ MORE

MEMBERS ONLY

FALLING FOREIGN BOND YIELDS ARE PULLING TREASURY YIELDS LOWER -- GLOBAL STOCK INDEXES HAVE A STRONG WEEK AND NEAR UPSIDE BREAKOUTS -- FALLING YIELDS AND A WEAKER DOLLAR PUSH GOLD TO SIX-YEAR HIGH -- GOLD MINERS ALSO HAD A BREAKOUT WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

NEGATIVE FOREIGN YIELDS LEAD TREASURY YIELDS LOWER...Bond yields are dropping all over the world. The British 10-Year yield fell this week to the lowest level since 2016 (0.80%). The Japanese yield remains in negative territory. Nearly a quarter of bond yields in global developed markets are already negative...

READ MORE

MEMBERS ONLY

The State of the Stock Market - Healthcare and Tech Lead New High List

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* S&P 500 Affirms Weight of the Evidence.

* New Highs Expand Yet Again.

* Sector Table Improves with Two Bullish Signals.

* Healthcare and Technology Lead New High List.

* What if you already Knew....?

* Art's Charts ChartList Update.

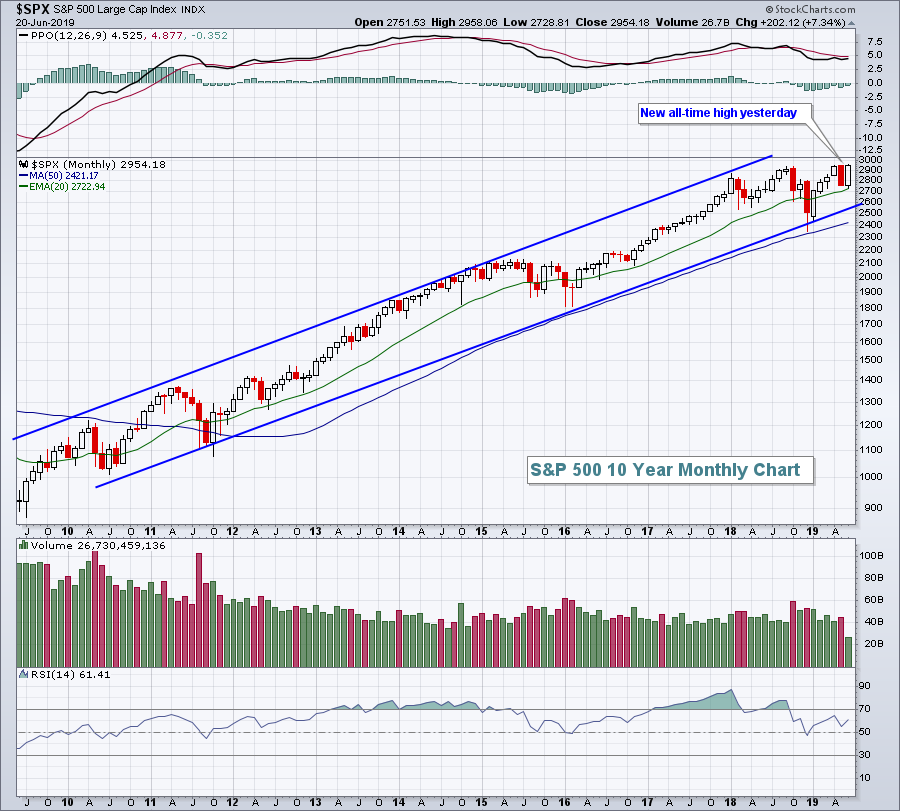

... All Time High Means only One Thing

... The S&P...

READ MORE

MEMBERS ONLY

S&P 500 Breaks Record, Crude Oil Surges

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 20, 2019

More dovish Fed policy is already having its effects. The anticipation of those changed policies has sent investors around the globe into U.S. treasuries, as yields have dropped precipitously since Q4 2018. But yesterday, U.S. equities climbed aboard as the S&...

READ MORE

MEMBERS ONLY

Fed Offers Traders Hope, Travel & Tourism Has Big Challenge Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 19, 2019

Yesterday was Fed day, or Fednesday as one MarketWatchers LIVE viewer said, and U.S. equities liked what the Fed had to say. What it had to say was essentially what most market pundits were expecting - that the word "patient"...

READ MORE

MEMBERS ONLY

The Dollar Beats All Currencies In The G10 Except For The Japanese Yen

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can be used to visualize the relative movement of much more than just stocks and sectors.

In the example below, the RRGshows the relative rotation for the G10 currency universe usingUSD as the base currency.In this case, you will see nine currencies, all expressed in USD...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: VIX Nears Bollinger Band Break, But Short-Term Indicators are Bullish

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday, in a DP Bulletin, I covered the new IT BUY signals on the NDX and Dow. We should soon see the Dow's weekly PMO click a new IT BUY signal. That would only leave the Long-Term PMO SELL signals that still linger on the monthly charts. Indicators,...

READ MORE

MEMBERS ONLY

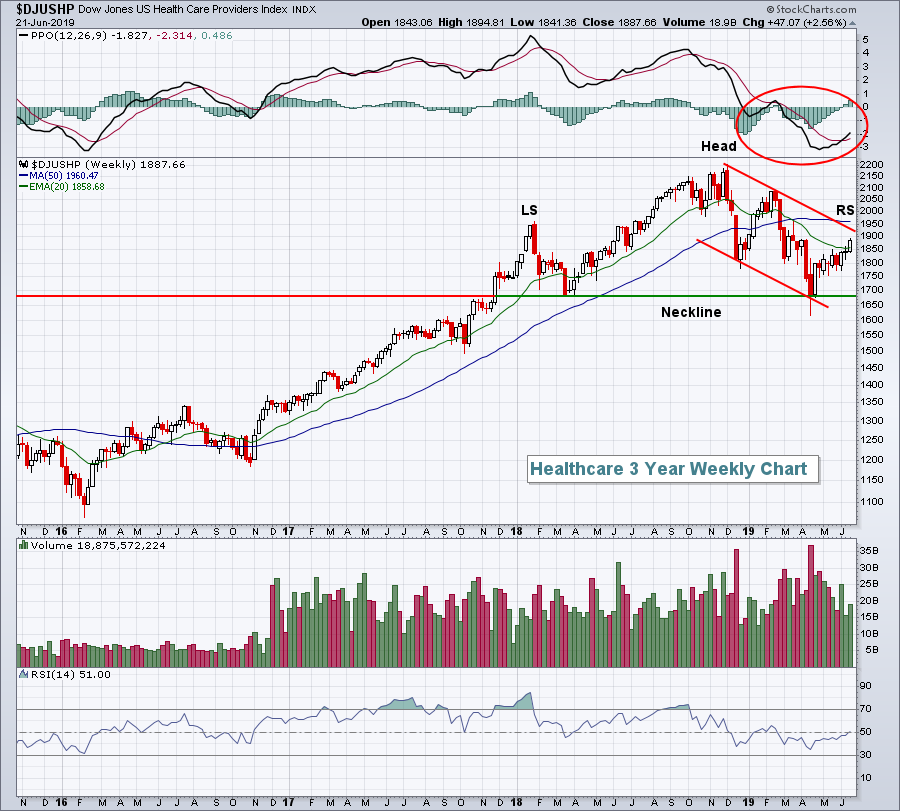

FED LEAVES RATES UNCHANGED BUT SETS STAGE FOR JULY RATE CUT -- BOND AND STOCK PRICES GAIN -- BIG DROP IN BOND YIELDS WEAKENS BANK STOCKS -- WEAK DOLLAR PUSHES GOLD TO NEW HIGH FOR THE YEAR -- HEALTHCARE SPDR ACHIEVES BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS GAIN ON EXPECTED RATE CUT... The Fed left rates unchanged today, but dropped the word "patient" from its statement, and gave the strong impression that a rate cut is likely. Fed fund futures are betting on a rate cut in July. That sent bond and stock prices...

READ MORE

MEMBERS ONLY

REGIONAL BANK LEADERS INCLUDE SUNTRUST, CITIZENS FINANCIAL, AND BB&T -- ALL THREE APPEAR TO BE FORMING SYMMETRICAL TRIANGLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRIANGLES ON DISPLAY...Today's earlier message showed the S&P Bank SPDR (KBE) trying to rise above its 200-day moving average. It also mentioned that regional banks were leading today's bank rebound. While drilling down through some regional bank charts, I noticed that many of...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR NEARS UPSIDE BREAKOUT -- DRUG STOCKS ARE ALSO BREAKING OUT -- BANKS RALLY ON FED DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

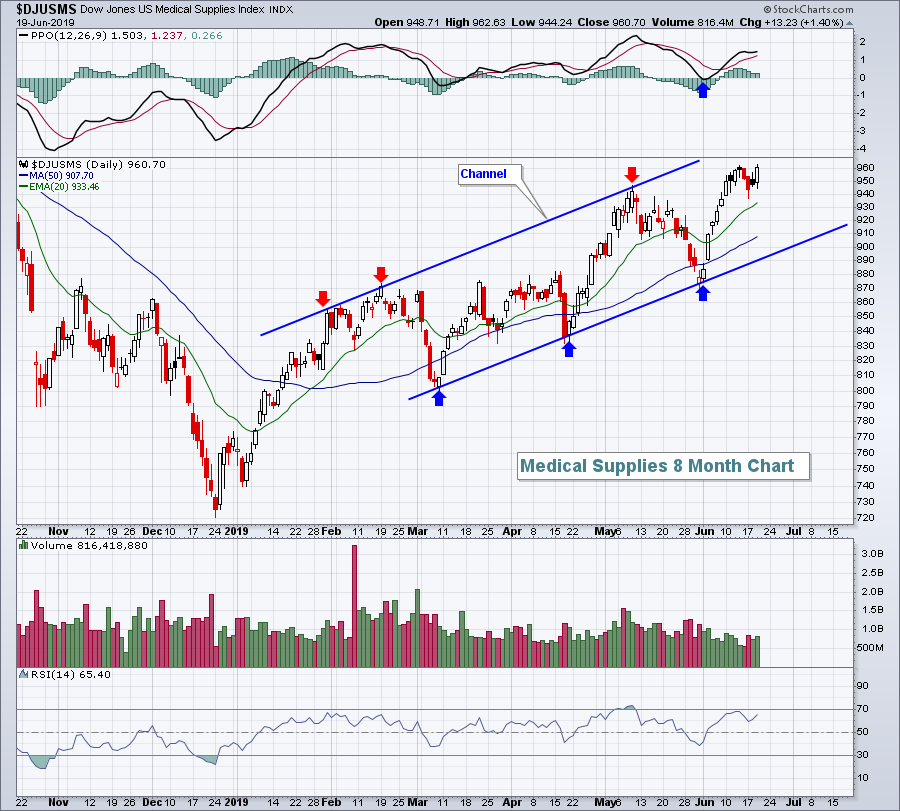

HEALTHCARE SPDR NEARS UPSIDE BREAKOUT...Money has been flowing into healthcare stocks since the end of April. And the sector may be on the verge of a bullish breakout. The daily bars in Chart 1 show the Health Care SPDR (XLV) testing its early March intra-day peak at 93.10....

READ MORE

MEMBERS ONLY

GE Takes the Lead with a 3-month High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I featured GE in mid-May as it attempted to break out of a falling wedge (DITC on May 15th). The breakout failed as the stock fell back in May, but a higher low formed and a triangle evolved. Overall, some sort of bullish consolidation formed from February to June and...

READ MORE

MEMBERS ONLY

SystemTrader - Scanning for Consistent Uptrends with Limited Pullbacks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

... As a trend-momentum kind of guy, my first task is to find stocks with strong uptrends and this starts with a scan. Chartists looking for scan ideas should first find several visually appealing price charts and then study these charts carefully. Stocks like Autozone (AZO), Gallagher (AJG), Abbot Labs (ABT)...

READ MORE

MEMBERS ONLY

Relative Strength In Two Key Sectors Says All We Need To Know

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 18, 2019

It was a day of rallying global equities, especially in the German DAX ($DAX, +2.03%). The DAX ($DAX) moves more in sync with U.S. equities than any other foreign equity market - in my opinion. The long-term positive correlation between the...

READ MORE

MEMBERS ONLY

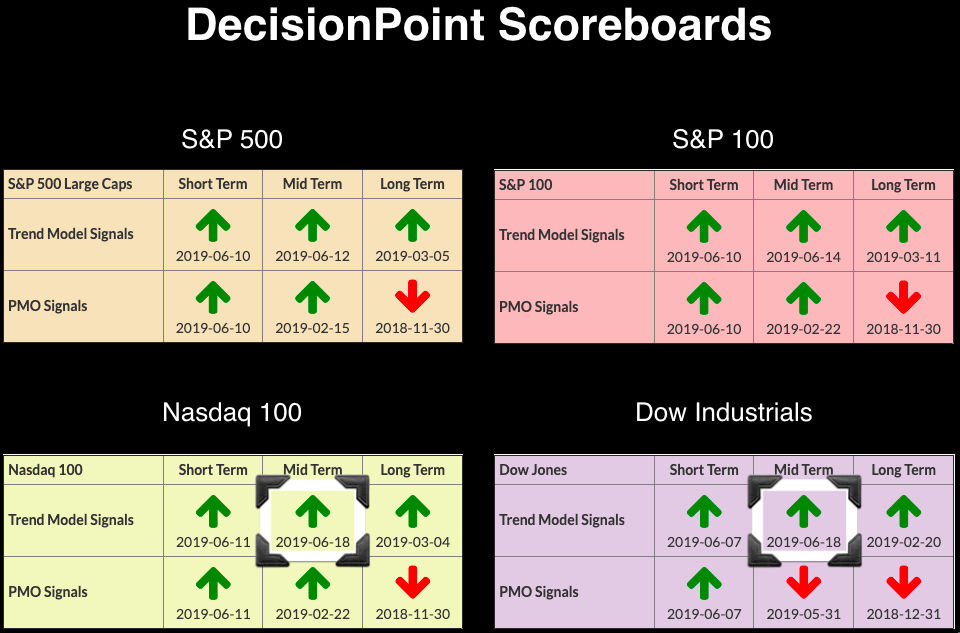

DP Bulletin: IT Trend Model BUY Signals for NDX and Dow - Bull Flags Execute

by Erin Swenlin,

Vice President, DecisionPoint.com

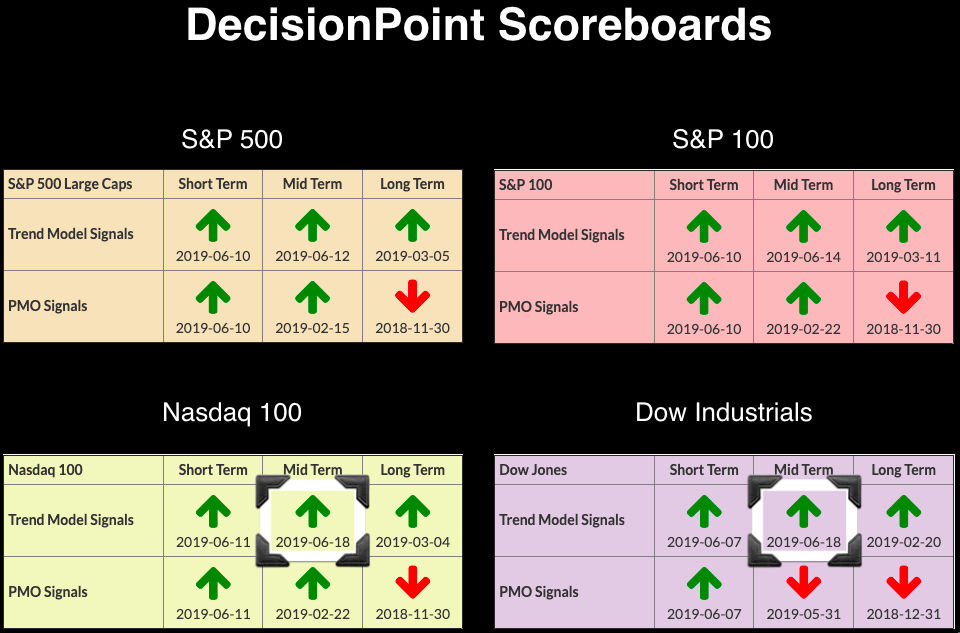

More changes to report on the DP Scoreboards, as well as a pending signal. Both the NDX and Dow Industrials garnered IT Trend Model BUY signals when the 20-EMA crossed above the 50-EMA for both. You'll note that the Dow is the only one left out on the...

READ MORE

MEMBERS ONLY

S&P Composite Continues To Lead The World Higher As More Short-Term Indicators Go Bullish

by Martin Pring,

President, Pring Research

* US Breaking Out Against the World

* The World Itself Looks to be in Pretty Good Technical Shape

* NYSE A/D and Upside/Downside Lines at Record Levels

* More Short-Term US Market Indicators Turn Bullish

* Multiple Momentum Trend Line Breaks is Very Positive

* There Is Always Something to Worry About

US...

READ MORE

MEMBERS ONLY

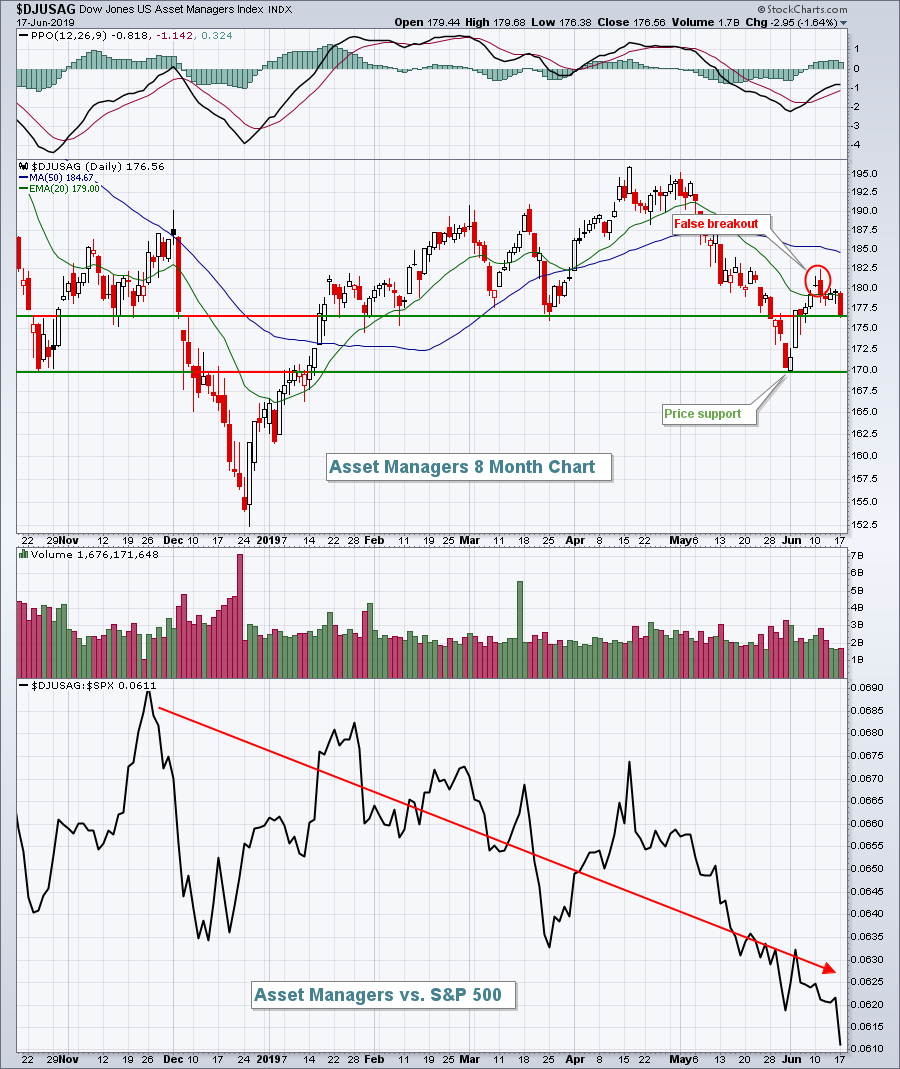

Autos Back On The Road To Nowhere; Tesla Loves June

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 17, 2019

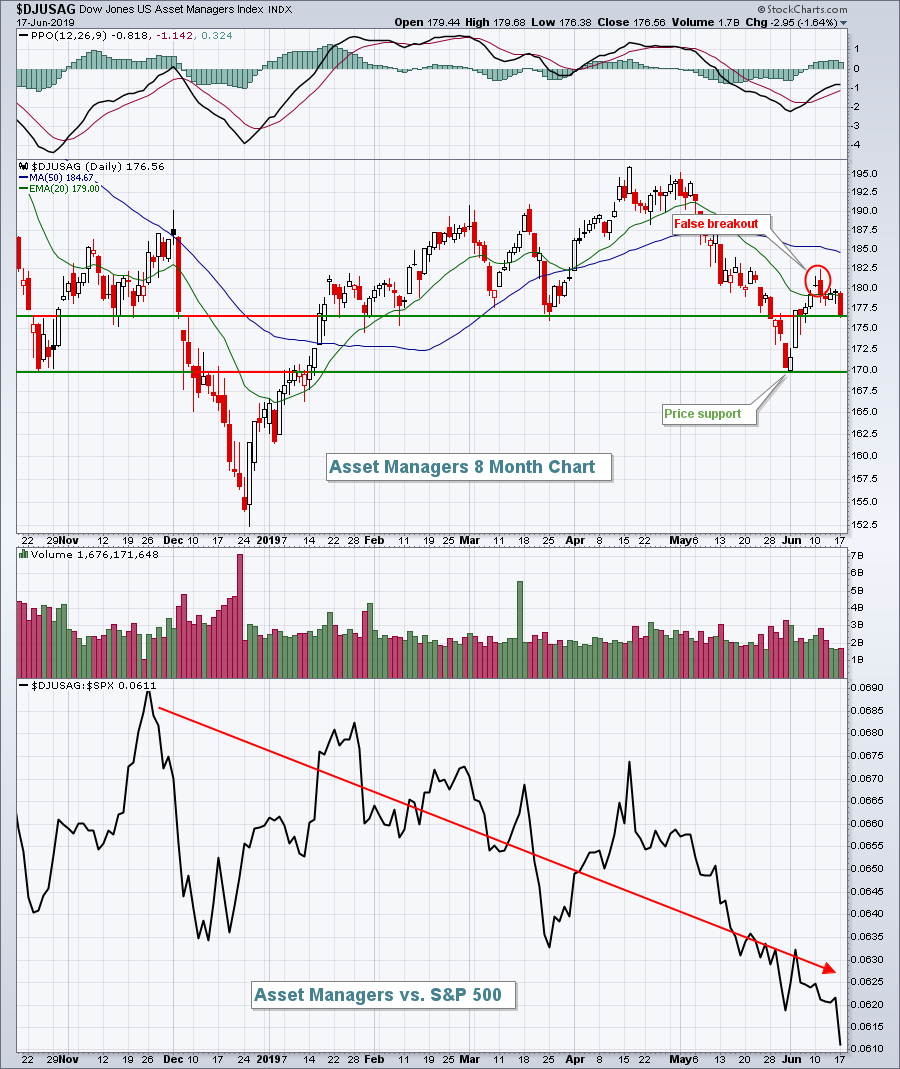

Facebook (FB, +4.24%) announced a platform cryptocurrency with a white paper due out today, while Netflix (NFLX, +3.21%) received positive comments from a Piper Jaffray analyst looking for solid results out next month. That combination lifted communications services (XLC, +1.14%...

READ MORE

MEMBERS ONLY

Why Technical Analysis?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Technical analysis offers an unbiased truth about the markets. I am writing this article because I have a large number of new readers. I addressed this subject a few years ago.

If one is going to follow and utilize a particular discipline, hopefully they have done a thorough investigation as...

READ MORE

MEMBERS ONLY

Illumina Rises above the Biotech Crowd

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It has been a rough three months for many biotechs and the Biotech iShares (IBB), but Illumina (ILMN) rose above the crowd with a big gain and three month high. The long-term chart also looks bullish.

The table below shows the Biotech iShares and the top ten stocks (sans Celgene)...

READ MORE

MEMBERS ONLY

Home Construction Breaks Out As S&P 500 Consolidates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

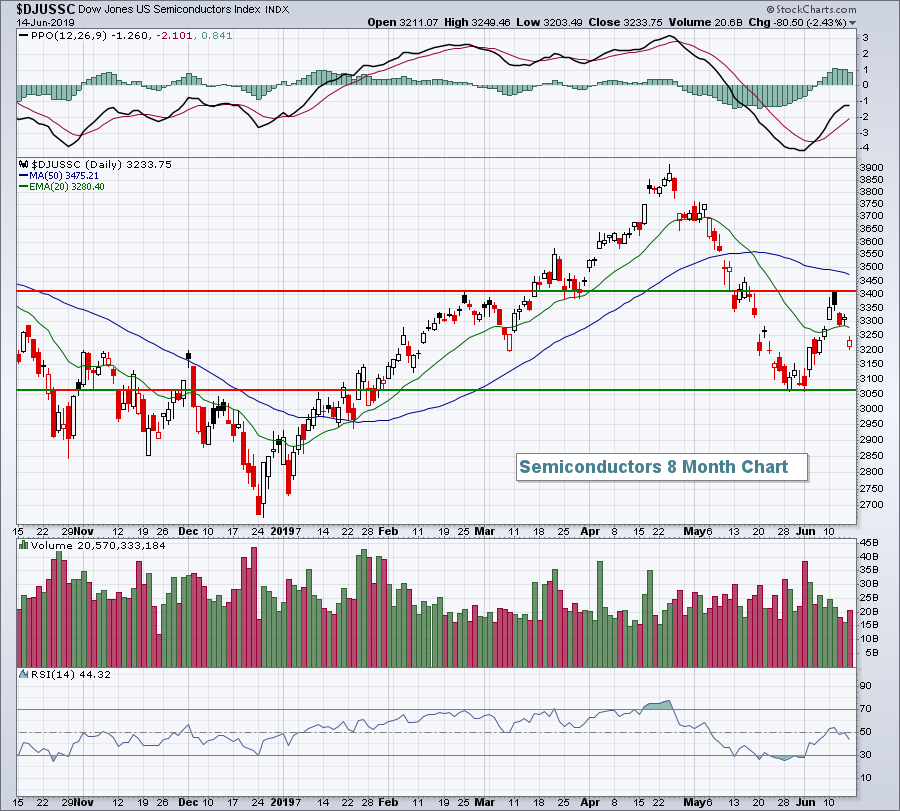

Market Recap for Friday, June 14, 2019

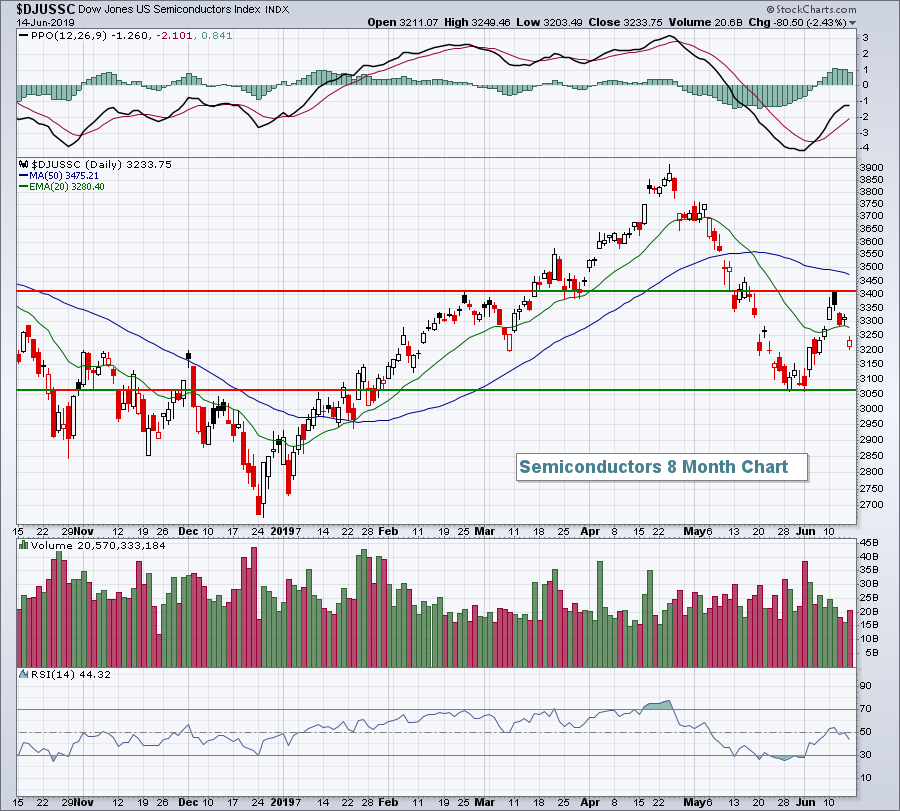

The big news on Friday was Broadcom's (AVGO, -5.57%) quarterly results and outlook, neither of which were particularly good. AVGO fell short of its revenue estimate and offered a very broad warning regarding upcoming revenues in the semiconductor industry ($DJUSSC,...

READ MORE

MEMBERS ONLY

(Technical) Market Analysis And Portfolio Construction Are Two Completely Different Animals In The Same Zoo.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

First of all, let me say that I really appreciate any feedback and comments I get on any of my articles, either via DISQUS below each blog post, via email or in SCAN. I do read all of them and I try to answer most of them, I think my...

READ MORE

MEMBERS ONLY

Week Ahead: No Runaway Surge Expected; Markets May Continue Exhibiting Negative Bias

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In yet another wide-ranging week, the NIFTY oscillated in a 400-point range, ending the week with a modest cut. In our previous weekly note, we had raised concerns about the NIFTY failing to confirm the attempted breakout. In line with the our analysis, the index did not show any intention...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Market Quiet Ahead of Fed; Gold Has Long-Term "Smile"

by Carl Swenlin,

President and Founder, DecisionPoint.com

Sometimes I can be a little slow on the uptake, and the monthly gold chart is the latest example. This week it dawned on me that gold is in its seventh year of forming a bullish saucer, which would be the reverse equivalent of a bearish rounded top. After activating...

READ MORE

MEMBERS ONLY

Speeding Up the Price Momentum Oscillator (PMO)

by Erin Swenlin,

Vice President, DecisionPoint.com

Viewers of MarketWatchers LIVE know how much I rely on my scans to find all those interesting symbols I review. In a ChartWatchers article last month, I shared my new favorite scan (Bullish EMA | Midrange SCTR), where I adjusted my time-tested "scan to rule them all" and found...

READ MORE

MEMBERS ONLY

I've Never Seen An Earnings Signal This Bullish

by John Hopkins,

President and Co-founder, EarningsBeats.com

At EarningsBeats.com, we track the best U.S. companies in a "Strong Earnings ChartList." In order for a company to be included in our ChartList, they must do 3 things:

(1) Beat quarterly revenue estimates

(2) Beat quarterly EPS estimates

(3) Look solid technically

If a company...

READ MORE

MEMBERS ONLY

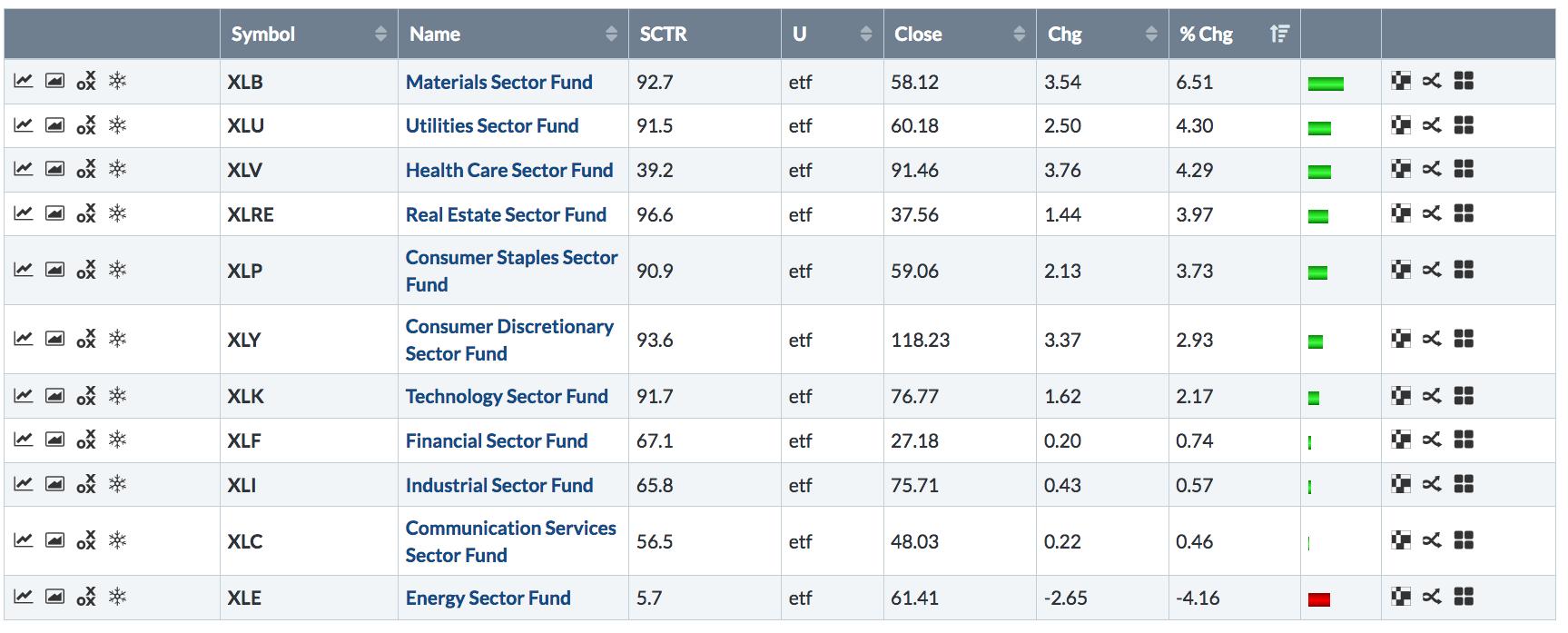

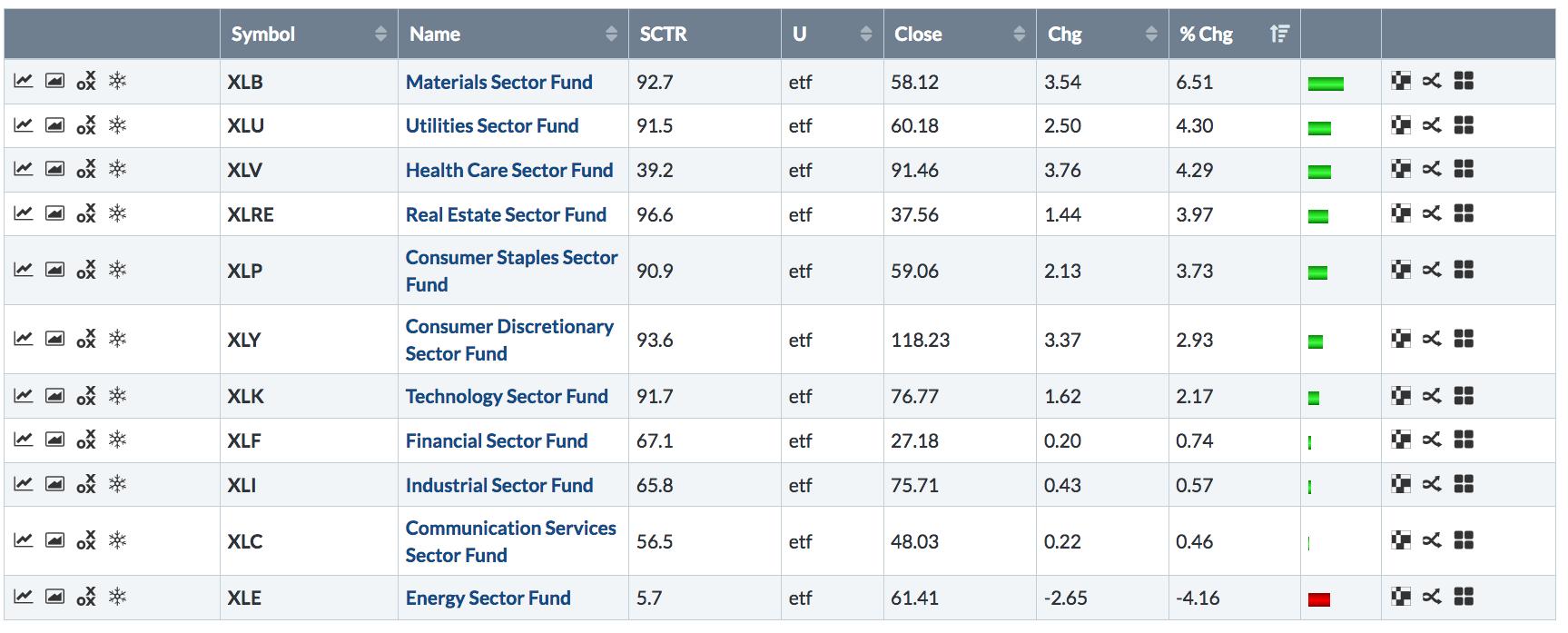

Monthly Sector Rankings Show Defensive Leadership

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, June 14th at 1:20pm ET.

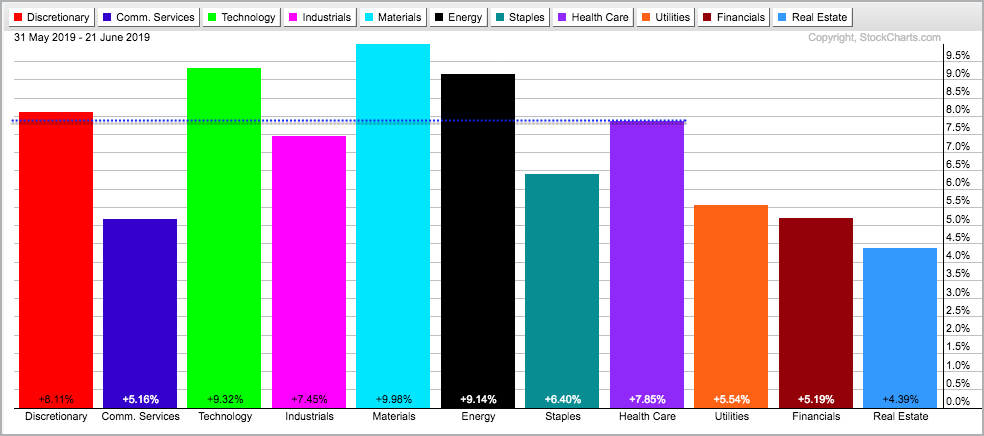

Chart 1 is taken from the Sector Summary page for the past month. And it shows that investors are still gravitating toward defensive issues. Four of...

READ MORE

MEMBERS ONLY

Are Small-caps Really the Canaries in the Coal Mine?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Many a pundit considers small-caps as the canaries in the coal mine and this implies that relative weakness in small-caps is negative for the broader market. As Missanei of Game of Thrones might say: It is known. Known, yes, but is it actually true?

In the interest of full disclosure,...

READ MORE

MEMBERS ONLY

Climb a Mountain, Beat The Market: What The Mountaineers "Essential 10 Checklist" Can Teach You About Investing

by Gatis Roze,

Author, "Tensile Trading"

The mountaineers “Essential 10 Checklist” is seared into the memory of every serious hiker and climber. Why? Because it may literally determine life or death. Similarly, every investor's financial life or death is determined by what I am calling the “Investors Essential 10 Checklist”.

Both checklists are comprehensive....

READ MORE