MEMBERS ONLY

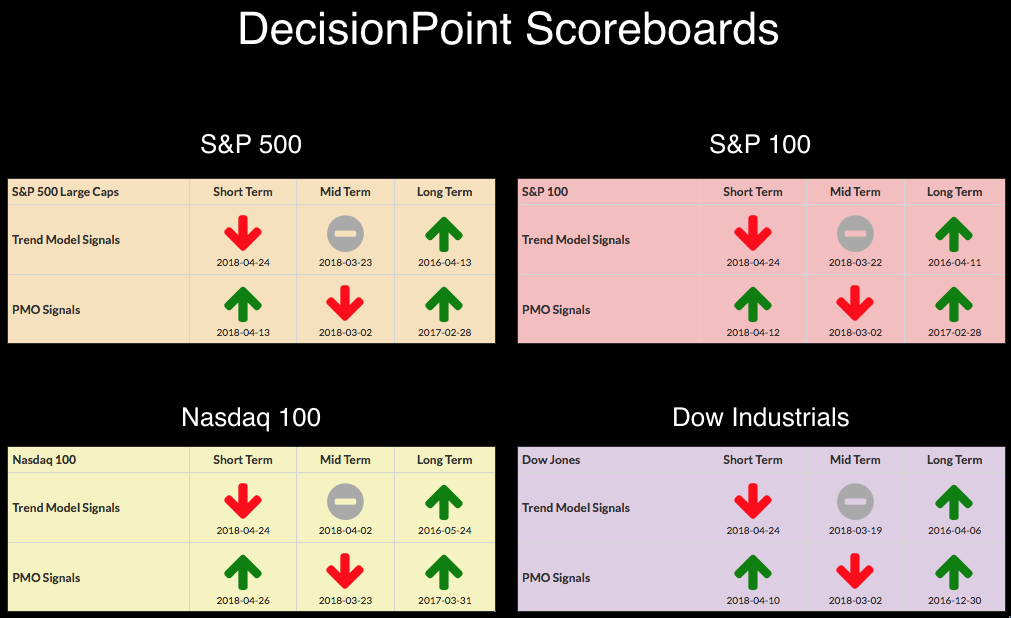

DP Bulletin #2: SPX and OEX Garner New Short-Term Trend Model BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

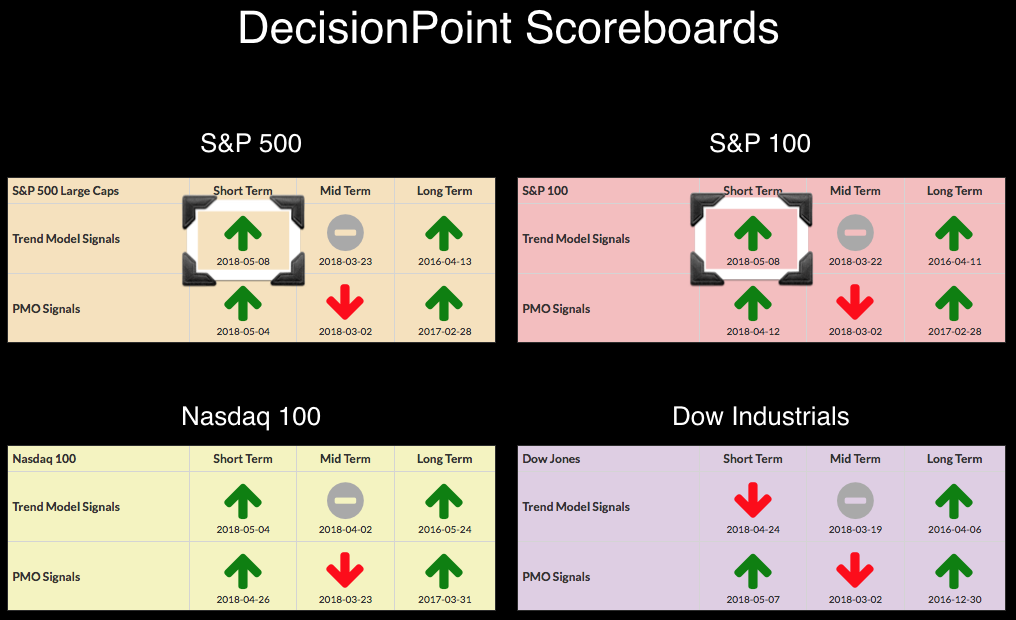

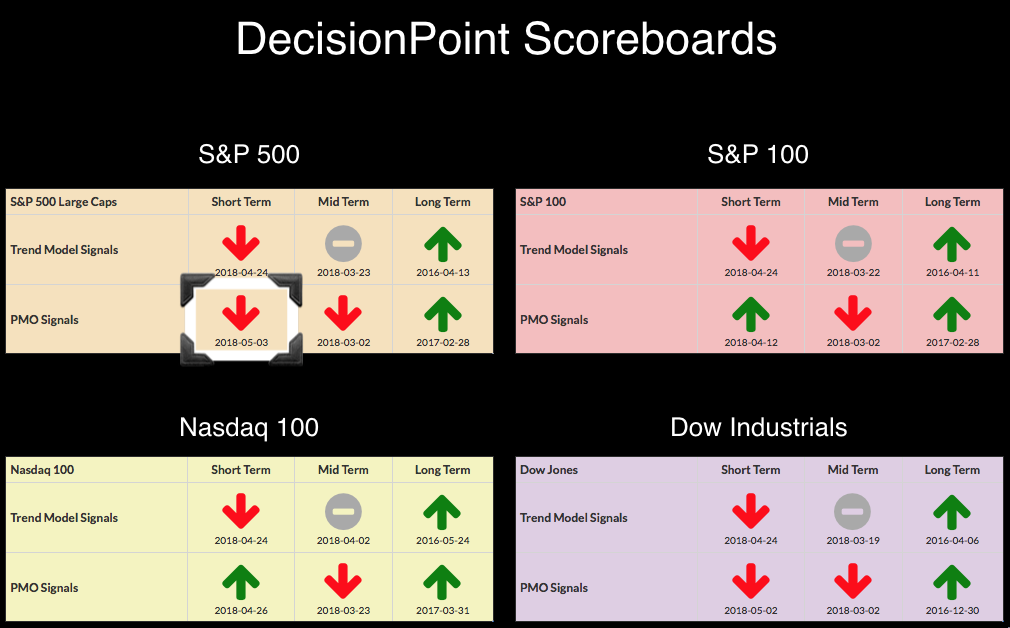

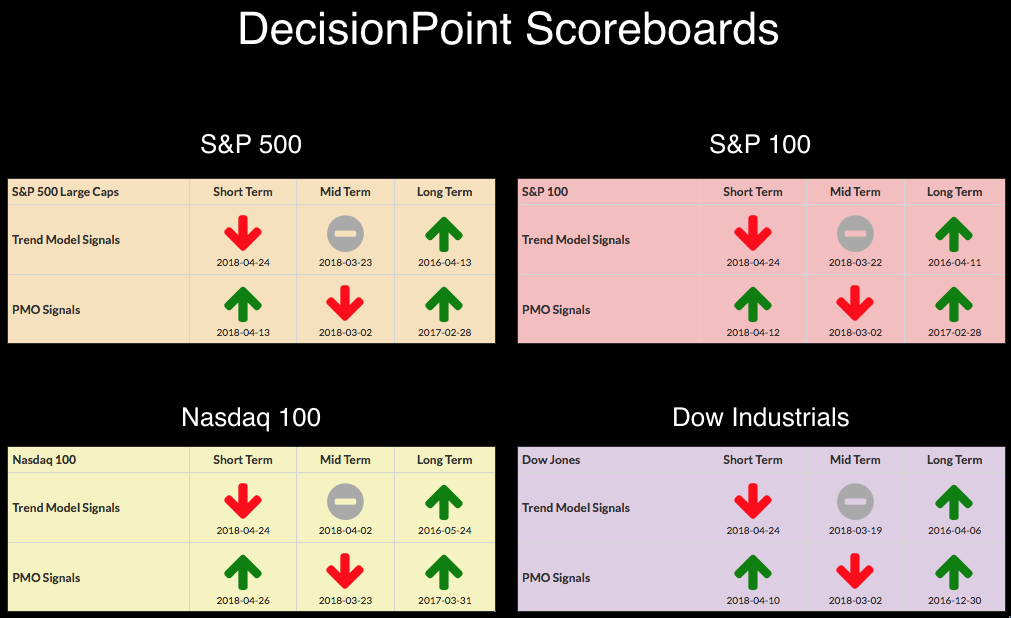

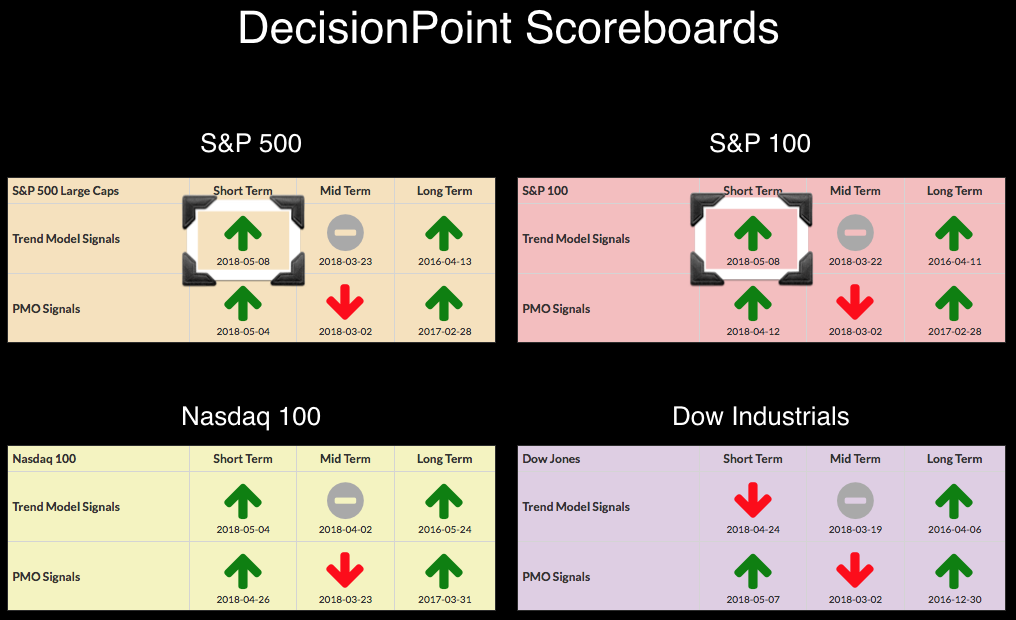

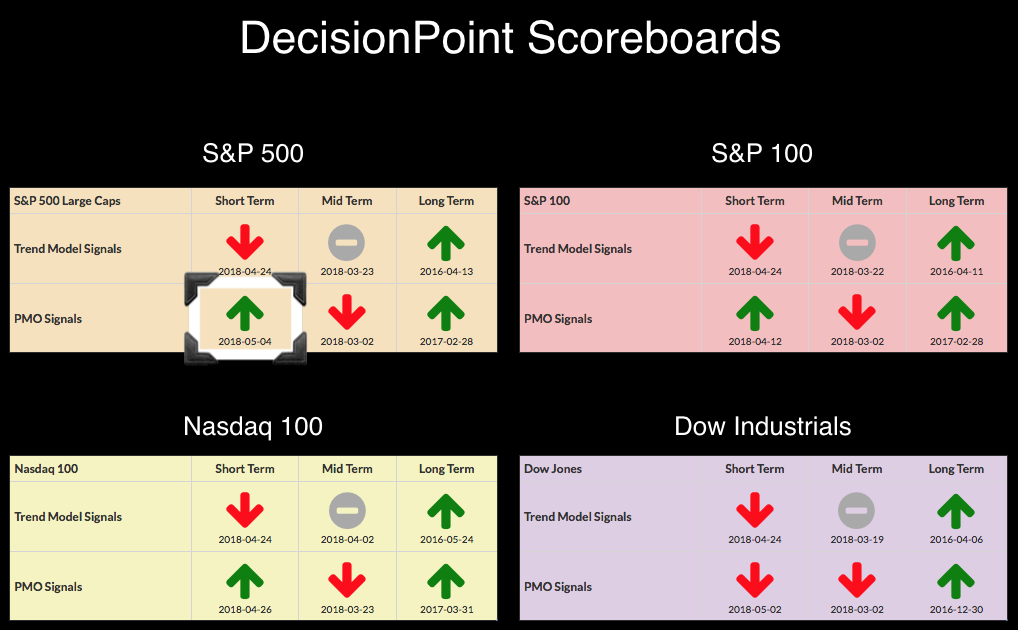

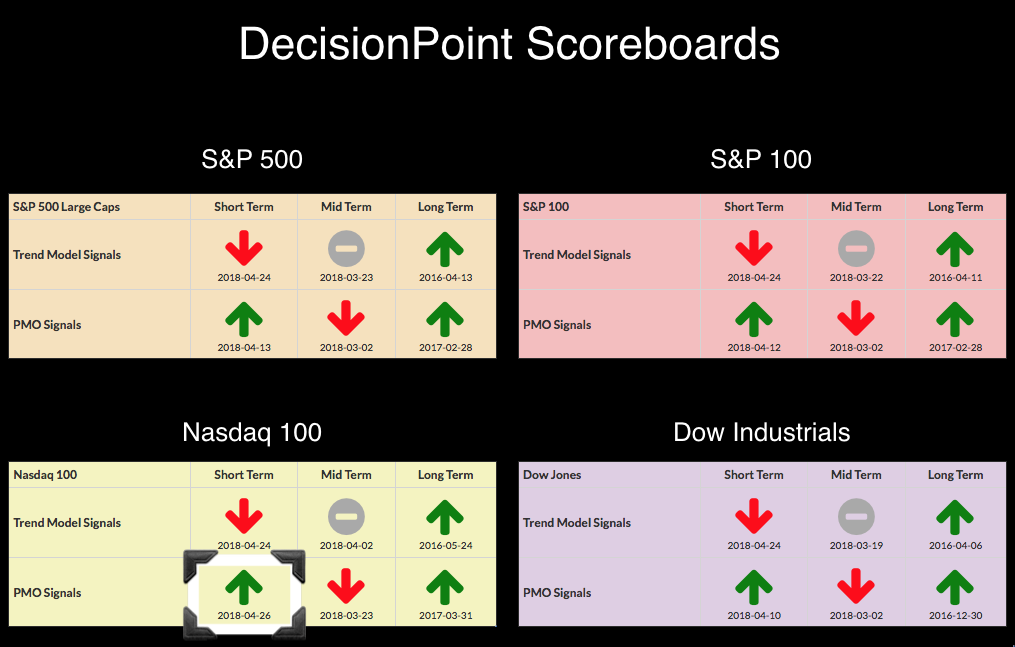

The SPX and OEX both triggered new ST Trend Model BUY signals as the 5-EMAs crossed above the 20-EMAs. However, the charts are less than impressive.

We are seeing new strength on the DecisionPoint Scoreboards with four new PMO BUY signals and now 3 out of 4 indexes carrying ST...

READ MORE

MEMBERS ONLY

Gains Moderate, But Relative Strength Felt In Key Areas

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 7, 2018

There was plenty of green on Monday, adding to the gains we saw late last week. The only areas of the market that struggled were the defensive consumer staples (XLP, -0.62%) and utilities (XLU, -0.52%). On the flip side, money rotated...

READ MORE

MEMBERS ONLY

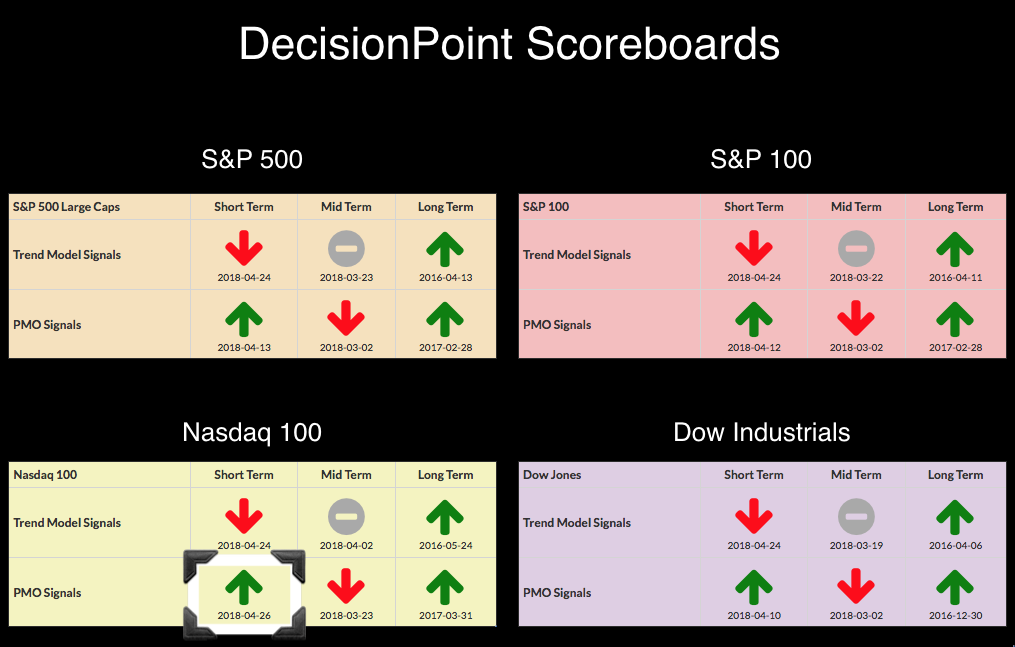

DP Bulletin #1: Short-Term PMO BUY Signal Logged on Dow Industrials

by Erin Swenlin,

Vice President, DecisionPoint.com

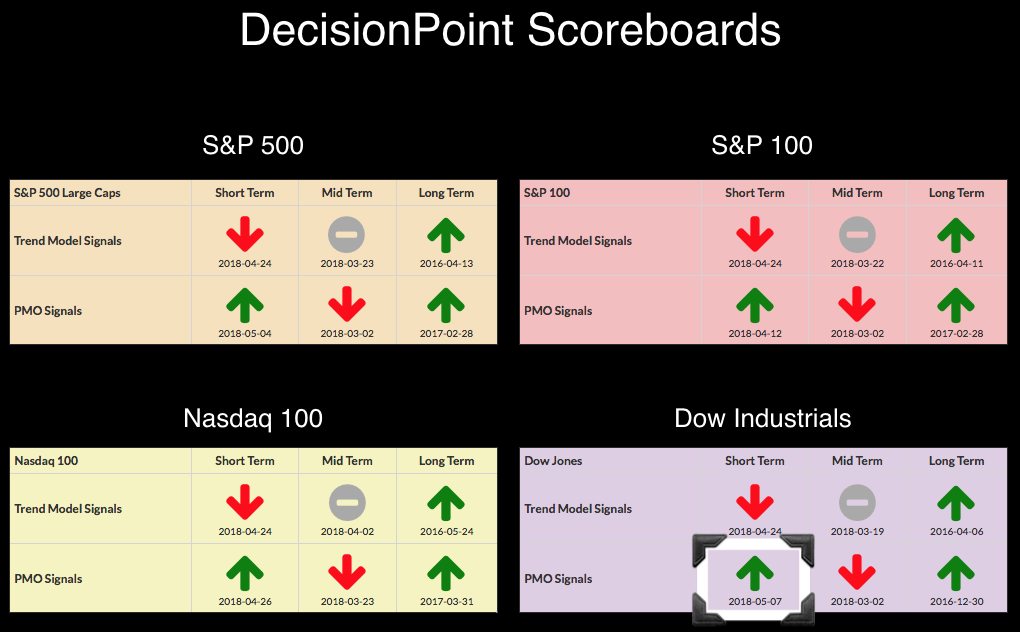

All four Scoreboard indexes have PMO BUY signals as of today. The Dow was the laggard, but between Friday's and today's rallies, momentum has shifted enough to push the PMO over its signal line.

While we do have a PMO BUY signal, I'm not...

READ MORE

MEMBERS ONLY

Buy In May And Say Hooray?

by Martin Pring,

President, Pring Research

* Sell in May does not have a great track record

* Technology continues to outpace staples, and that’s bullish

* Technology, consumer cyclicals and REITS are well positioned for a rally

Sell in May does not have a great track record

If there is a seasonal saying that seems ubiquitous at...

READ MORE

MEMBERS ONLY

Discount Brokers Lead the Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The discount brokers are showing strength in the broader market with E-Trade Financial (ETFC) and Interactive Brokers (IBKR) hitting new highs in May. Schwab (SCHW) is breaking out of a small triangle, while TD Ameritrade is bouncing within a bigger triangle. A picture is worth a thousand words and the...

READ MORE

MEMBERS ONLY

Breadth Thrust Shows Expanding Participation - SOXX Surges off Support - A Bunch of Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* One-Day Breadth Thrust.

* SOXX Surges off Support.

* Four Semiconductor Stocks to Watch.

* A Bollinger Band Squeeze for Akamai.

* Five Stocks to Watch: ABT, ACN, ANTM, HCA, SLB.

One-Day Breadth Thrust...

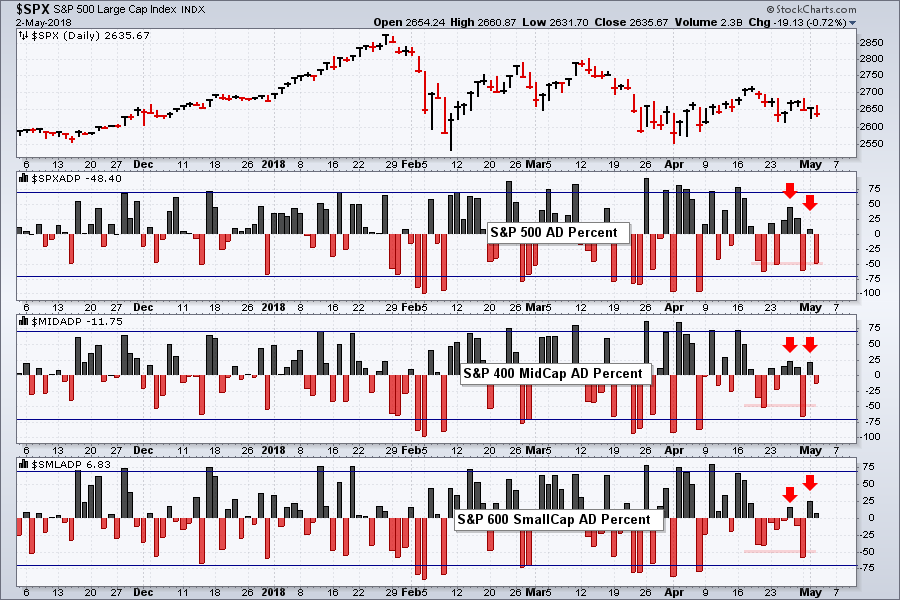

As noted last Thursday, I was not impressed with the breadth indicators because they showed narrow upside participation. This changed...

READ MORE

MEMBERS ONLY

Jobs Come Up Short, But Technology And Consumer Stocks Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 4, 2018

For many weeks, we've seen the stock market seemingly ignore great earnings news and retreat. Highly visible companies like Boeing (BA), Caterpillar (CAT), Intel (INTC) and Microsoft (MSFT) gained initially after blowout earnings, then stumbled after traders attempted to figure out...

READ MORE

MEMBERS ONLY

MESSAGE FROM FEBRUARY PUT CURRENT TRIANGULAR FORMATION IN ELLIOTT WAVE CONTEXT -- TRIANGLES NORMALLY HAVE FIVE WAVES WITH THREE PULLBACKS -- THIS PAST WEEK'S PULLBACK WAS THE THIRD ONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

FEBRUARY MESSAGE SUGGESTED THAT TRIANGULAR FORMATION WAS LIKELY... Everyone is talking about the triangular formation that the stock market has been forming over the last three months. It's important that the situation leading up to that formation be understood, as well as its meaning. My February 21 Market...

READ MORE

MEMBERS ONLY

Rising Dollar Should Change Your Investment Strategy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Throughout 2017 the U.S. Dollar Index ($USD) was falling and aiding profits on multinational companies found on the S&P 500. But it was time for the dollar to rise, as evidenced by a surging U.S. 10 year treasury yield ($UST10Y) vs. Germany's 10 year...

READ MORE

MEMBERS ONLY

Climactic Breadth Readings: Buying Exhaustion or Initiation? - Whipsaw BUY Signal for SPX

by Erin Swenlin,

Vice President, DecisionPoint.com

The SPX whipsawed into a Price Momentum Oscillator (PMO) BUY signal, suggesting a short-term rally is up next. Climactic breadth indicators popped on Friday and the VIX penetrated the upper Bollinger Band. When I see these types of readings, I classify them as a buying exhaustion or buying initiation.

Below...

READ MORE

MEMBERS ONLY

The Bird's Eye View: Big Advances Deserve Big Corrections

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2018 has been a tough year for stocks with the S&P 500 SPDR (SPY) basically unchanged (+.08%) for the year. During this journey to unchanged, SPY was up around 7% at its late January high and down around 5% at its February low. The index has since gyrated...

READ MORE

MEMBERS ONLY

Stocks Are Ending The Week On a Strong Note

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, May 4th at 3:50pm EST

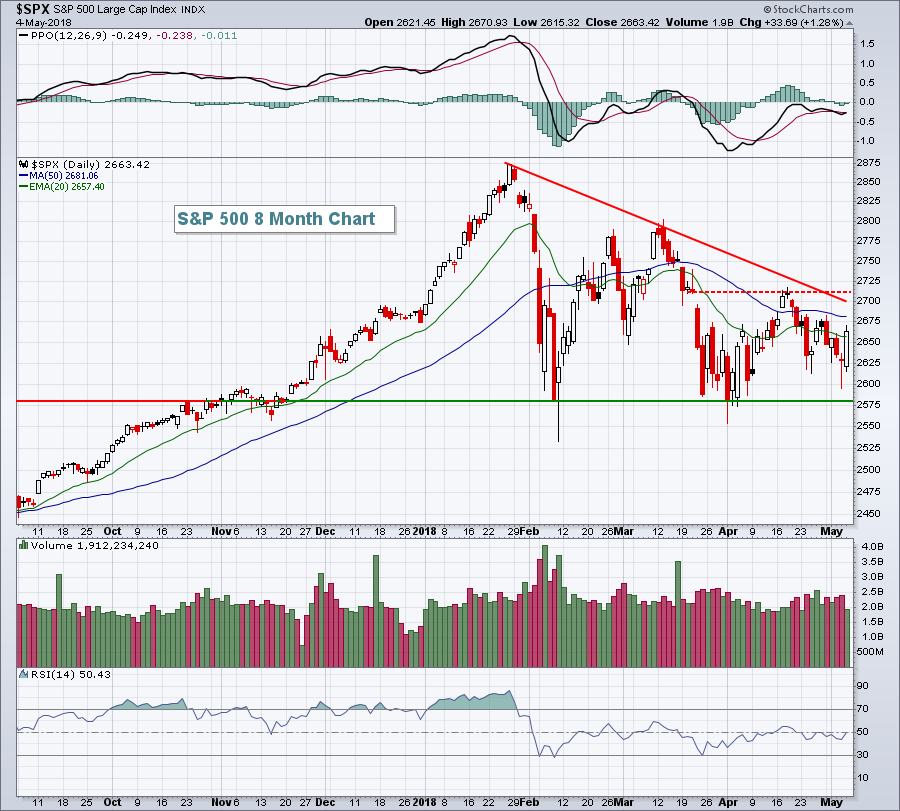

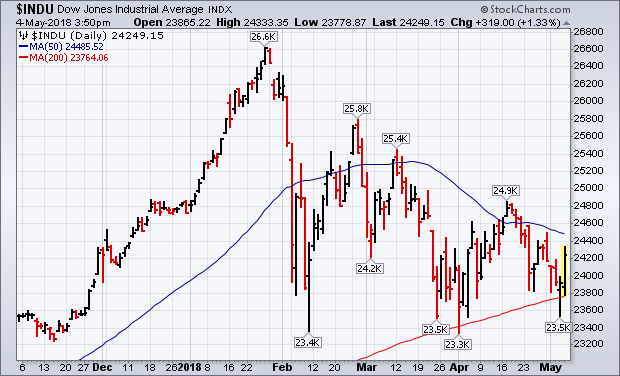

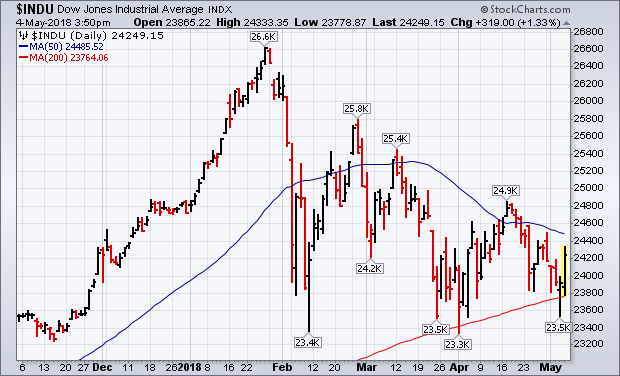

STOCKS REBOUND OFF 200-DAY LINES... Chart 1 shows the Dow surging more than 300 points after surviving another test of its 200-day average yesterday. Chart 2...

READ MORE

MEMBERS ONLY

Profiting from Weak Earnings

by John Hopkins,

President and Co-founder, EarningsBeats.com

Analysts will tell you that this earnings season has been a great success. In fact, many companies exceeded earnings expectations and were handsomely rewarded by the market. However, there were also plenty of companies that missed earnings expectations and/or provided worse than expected guidance, taking those stocks lower, and...

READ MORE

MEMBERS ONLY

Does This Market Have Bad Breadth?

by Bruce Fraser,

Industry-leading "Wyckoffian"

The percentage of stocks above their 200 day moving average (200dma) is a breadth indicator that I have depended on for many years. It theoretically oscillates from zero to 100 percent. During bull markets this oscillator spends most of its time between 40% and 85%. During bear markets between 60%...

READ MORE

MEMBERS ONLY

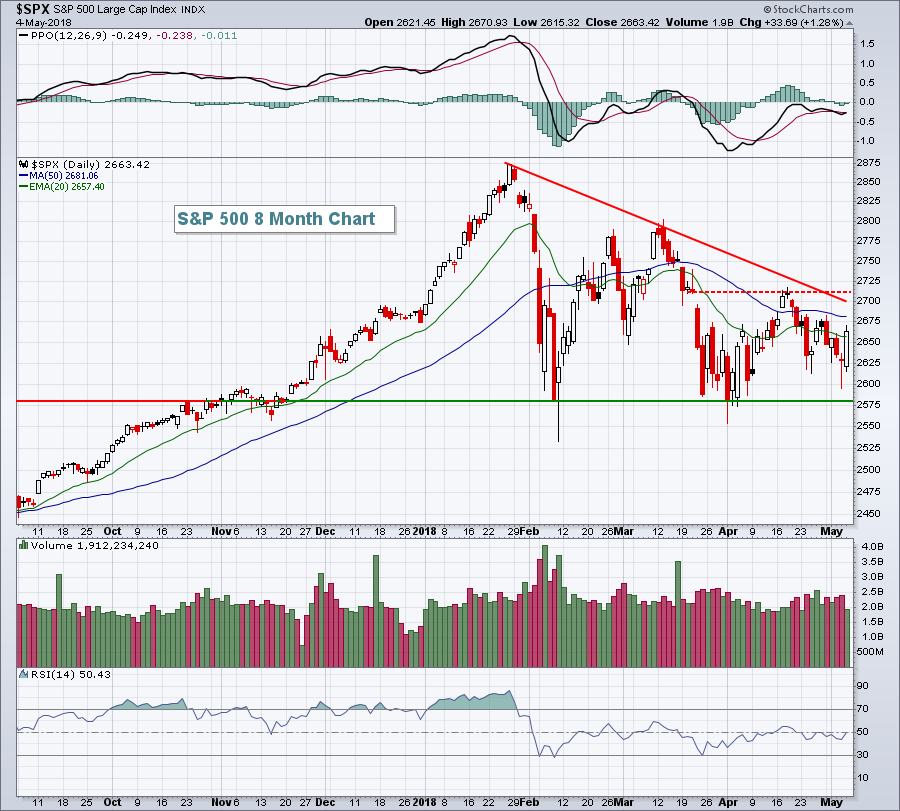

DP Weekly Wrap: Strong Finish, but Where's the Love?

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Thursday the market recovered nicely from an early selloff, and today it had a strong finish. But in the market, volume equals love, and the short volume on Friday was barely a peck on the cheek. On my SPY chart I like to show, in addition to SPY volume,...

READ MORE

MEMBERS ONLY

STOCKS ARE ENDING THE WEEK ON A STRONG NOTE -- NASDAQ 100 CLEARS 50-DAY AVERAGE -- SO DOES THE RUSSELL 2000 -- THE THIRD SUCCESSFUL TEST OF 200-DAY MOVING AVERAGES IS A GOOD SIGN

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS REBOUND OFF 200-DAY LINES... Stocks are ending the week on a strong note. Chart 1 shows the Dow surging more than 300 points after surviving another test of its 200-day average yesterday. Chart 2 shows the S&P 500 doing just as well. Both indexes still need to...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Slugging without Conviction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* S&P 500 Caught in the Crossfire.

* SPY Reverses Upswing.

* Large-cap Tech Holds up Well.

* A Bull Flag in the S&P SmallCap iShares.

* Finance and Industrials Weigh.

* Healthcare Breakdown Tilts the Balance.

* Mind the Gap in Tech-Related ETFs.

* Oil Forms Bull Flag.

* Gold Forges Lower Low and...

READ MORE

MEMBERS ONLY

Banks Lead Reversal Off Major Support And UNH Could Be Ripe For A Strong May

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 3, 2018

The Dow Jones was the only major index to finish in positive territory on Thursday, but it could have been so much worse. In the first 90 minutes of trading, the S&P 500 found itself back below 2600 and within just...

READ MORE

MEMBERS ONLY

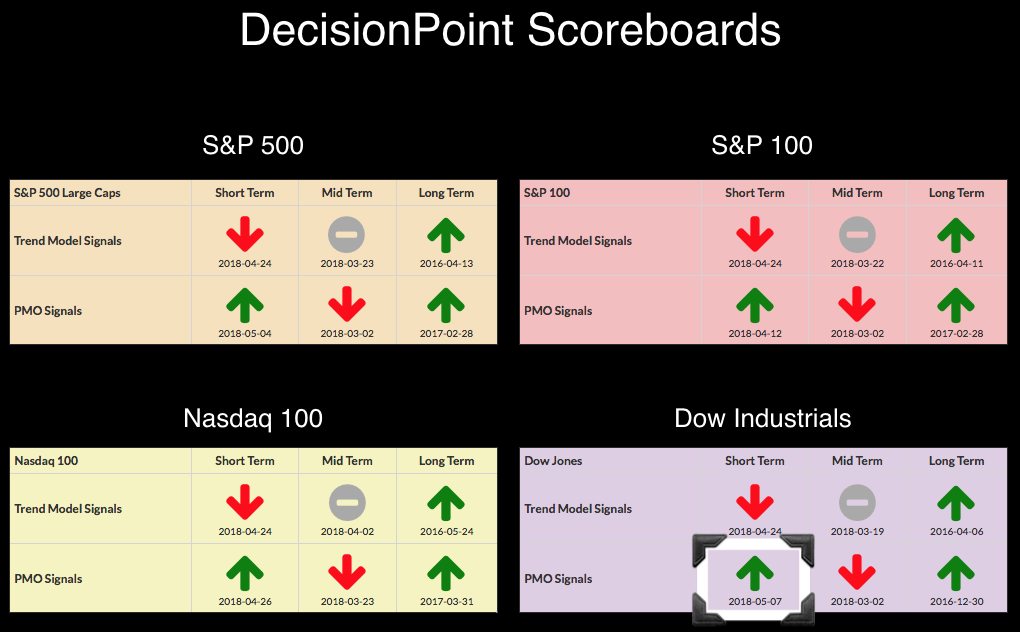

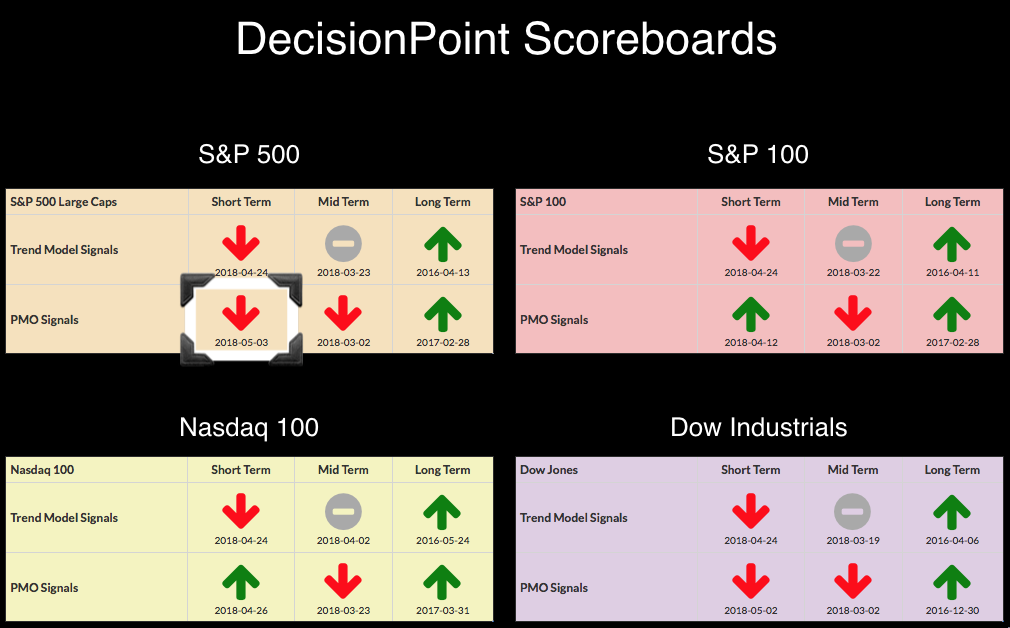

DP Bulletin: SPX Joins Dow with a New ST PMO SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Today the SPX joined the Dow with a new PMO SELL signal. If the correction continues much longer, the OEX and NDX will follow suit.

Today's action left the SPX with a long tail that tested the purple rising bottoms trendline. This test was successful, but the breakdown...

READ MORE

MEMBERS ONLY

Commodities taking over from equities?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

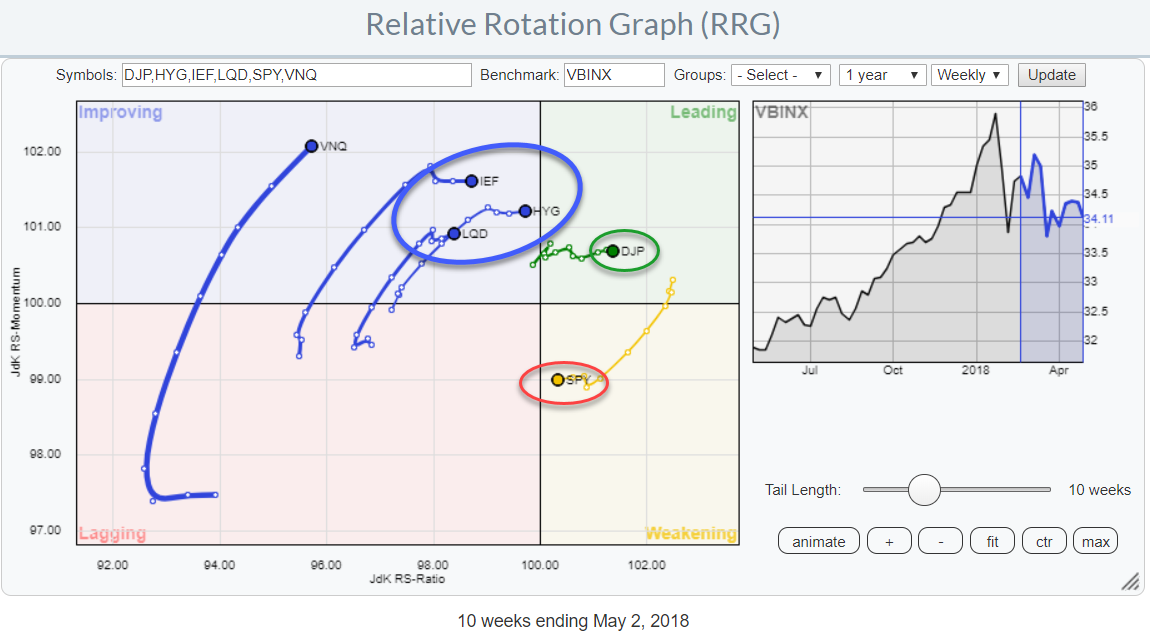

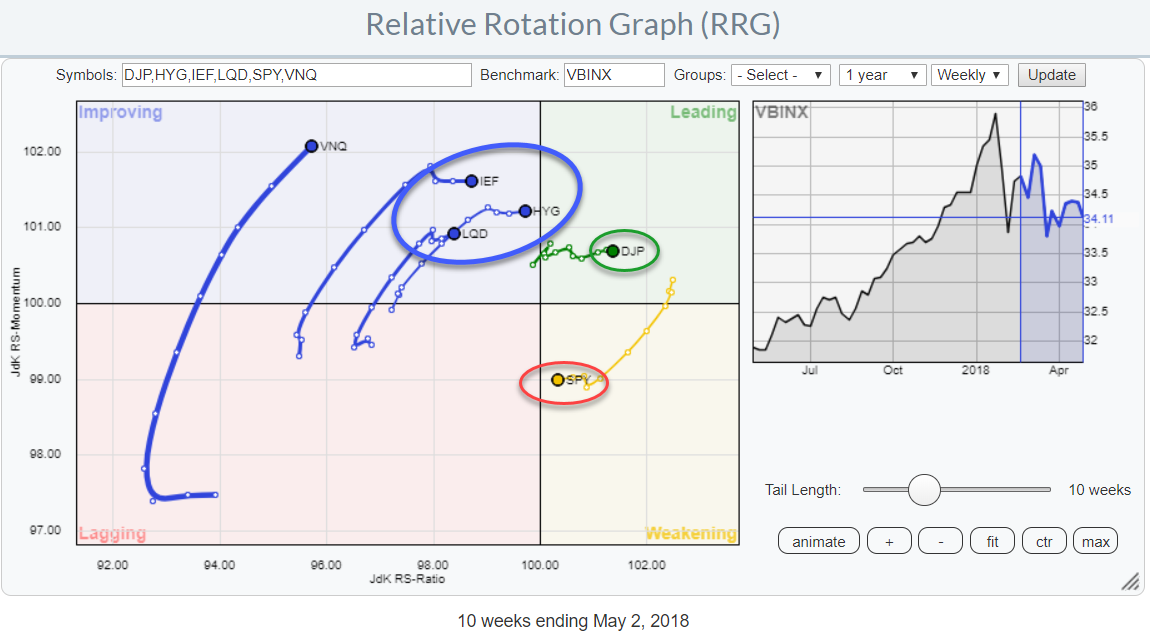

For a very long time equities have been the dominating asset class, stuck at the right-hand side of the Relative Rotation Graph showing six different asset classes.

That situation is now changing. Equities (SPY) is still at the right hand (positive) side of the RRG but inside the weakening quadrant,...

READ MORE

MEMBERS ONLY

MARKET TEST CONTINUES -- THE DOW AND S&P 500 DIPPED BELOW THEIR 200-DAY AVERAGES -- THAT PUTS THE MARKET IN DANGER OF RESTESTING ITS 2018 LOWS -- INDUSTRIAL AND FINANCIAL SPDRS LED MARKET LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 DIP BELOW 200-DAY LINES... Stocks started the day under pressure. Chart 1 shows the Dow Jones Industrial Average trading below its 200-day moving average this morning (before recovering later in the day). A close below the red line would signal that a test of...

READ MORE

MEMBERS ONLY

Fed Talks Inflation, Traders Head For The Hills

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for May 2, 2018

Well, the Fed spoke and Wall Street listened. While there weren't any dire warnings from the Fed about inflation, simply acknowledging that inflation could be returning to its target 2% rate spooked traders for an afternoon. If you were wondering if the...

READ MORE

MEMBERS ONLY

Breadth Indicators Fail to Inspire (with Video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

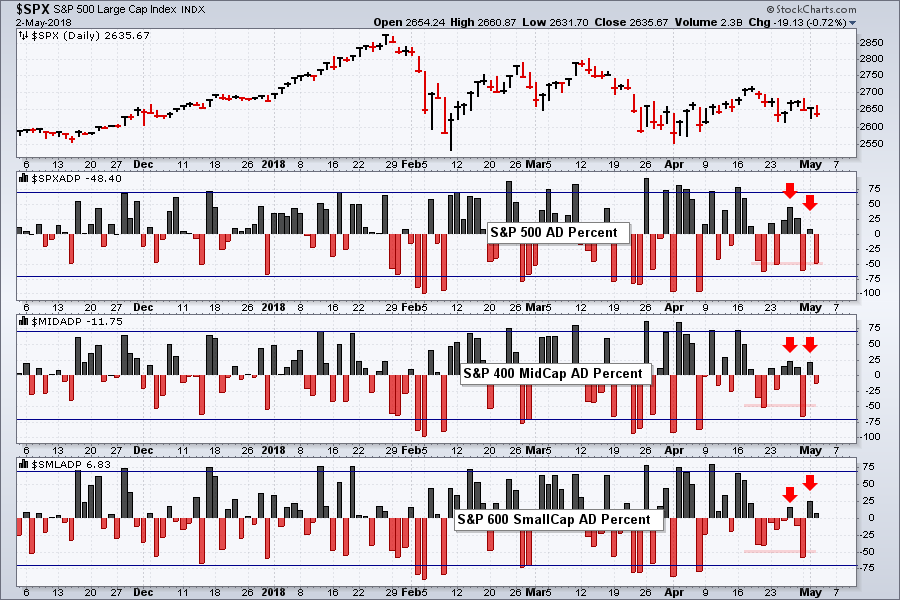

* Breadth Falls Short.

* Chart Links and Video.

* Looking for a Breadth Thrust.

* Still a Correction?

* %Above 200-day Indicator Waffles.

* The Weight of the Evidence.

* Where to Find the Symbols.

Breadth Falls Short

Enthusiasm among the bulls is waning and this is reflected in the breadth stats over the last two...

READ MORE

MEMBERS ONLY

DP Alert: Dow Logs PMO SELL Signal - ST and IT Negative Divergences! - ITTM Neutral for Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

As noted in the signal table below, the Dow logged a new Price Momentum Oscillator (PMO) SELL signal. I've included the chart below with commentary. The other important news is two new negative divergences showing on the DP indicator charts for the short term and intermediate term! And,...

READ MORE

MEMBERS ONLY

Dollar Breakout Starts To Infect Other Markets

by Martin Pring,

President, Pring Research

* Dollar Index breaks to the upside

* Dollar sympathy relationships

* The Aussie Dollar close to a mega signal for itself and commodities

Dollar Index breaks to the upside

Chart 1 shows that the Dollar Index falsely broke to the downside at the very beginning of the year. In the last couple...

READ MORE

MEMBERS ONLY

Technology Leads Tuesday Turnaround

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for May 1, 2018

The Dow Jones led the early selling on Tuesday as traders were not impressed with quarterly earnings results from two pharma giants, Pfizer (PFE, -3.31%) and Merck (MRK, -1.51%). Both were down considerably more in the morning session, but rebounded to make...

READ MORE

MEMBERS ONLY

Alphabet: Is it time to Bounce?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It has been a rough year for Alphabet, also known as Google, but the stock is still in a long-term uptrend and firming near a solid support zone. This could give way to a bounce.

First, the stock advanced some 30% and hit a 52-week high in January. Second, the...

READ MORE

MEMBERS ONLY

DOLLAR INDEX RISES TO NEW HIGH FOR THE YEAR -- THAT'S HURTING U.S. LARGE CAP PERFORMANCE -- THE DOLLAR IS GETTING A BOOST FROM RISING SPREAD BETWEEN US AND GERMAN YIELDS -- THE S&P 500 IS HEADED FOR ANOTHER TEST OF ITS 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX HITS NEW 2018 HIGH... Chart 1 shows the PowerShares Dollar Index (UUP) rising today to the highest level since last December. It's also climbed back above its 200-day moving average and a falling trendline extending back to the start of 2017. The UUP may now be...

READ MORE

MEMBERS ONLY

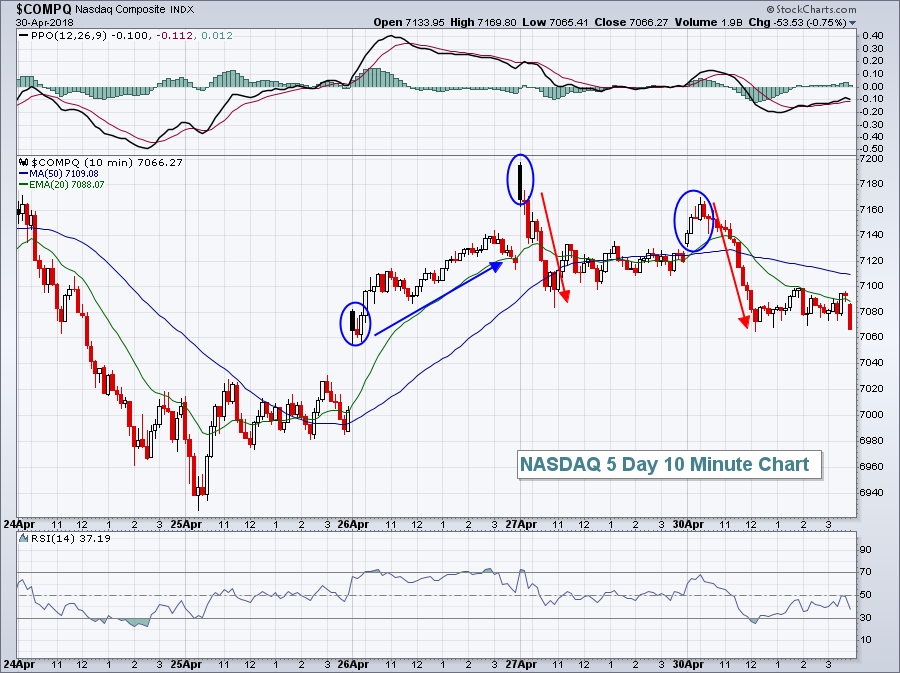

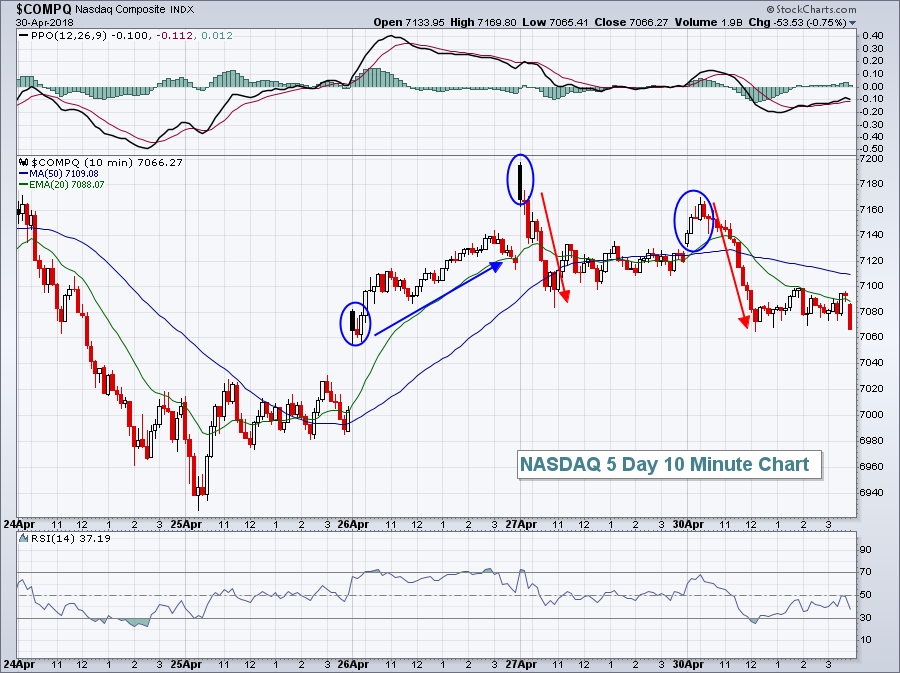

S&P 500 Stuck In Trading Range; AAPL, Then Fed, On Deck

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 30, 2018

Monday was a "rinse and repeat" session from Friday. We opened higher, sold off for 90 minutes, then consolidated the balance of the day. Since Thursday's close, the NASDAQ has fallen 0.75%, but it seems like much more...

READ MORE

MEMBERS ONLY

Monthly Charts Reveal Bearish Bias - Review of Major Indexes, Dollar, Gold, Oil & Bonds

by Erin Swenlin,

Vice President, DecisionPoint.com

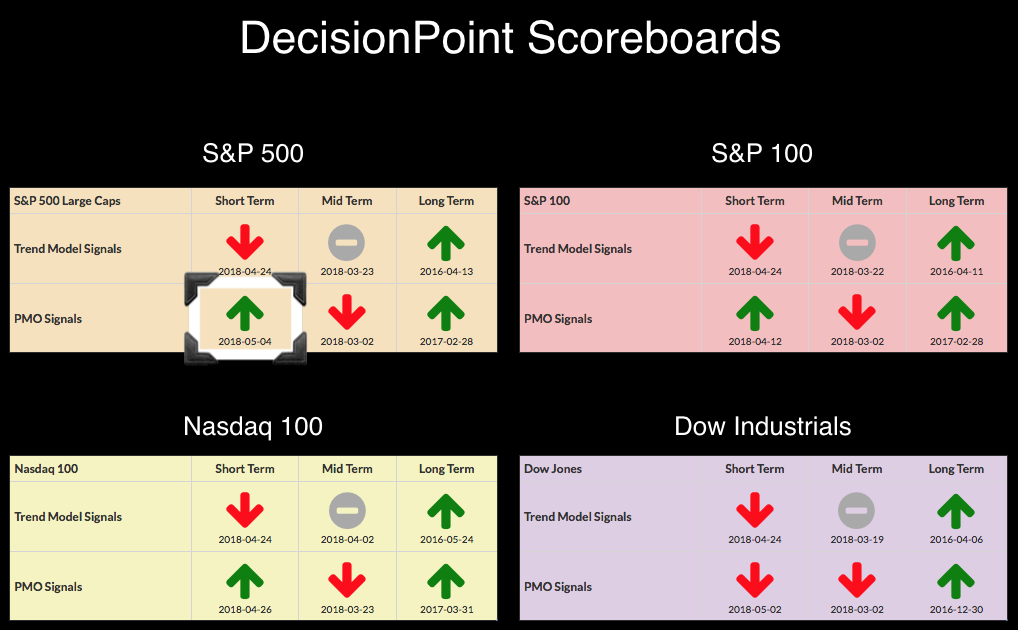

All of our monthly charts went "final" today so it is time for a review of the current signals and their implications. The DecisionPoint Scoreboards show BUY signals on all of the four major indexes and that is not changing today. However the DP Scoreboards don't...

READ MORE

MEMBERS ONLY

Visa Hits New High and Chases Mastercard

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Visa (V) is leading the stock market as it breaks out of a triangle and records a fresh new high. The stock is now setting its sights on its big rival, Mastercard.

The chart below shows Visa in the top window with a steady advance from May to January and...

READ MORE

MEMBERS ONLY

A Baker's Dozen - Stocks to Watch for this Stock Picker's Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Throwbacks after Breakouts.

* Triangles within Bigger Uptrends.

* Stock with Fresh Breakouts.

* Corrections within Uptrends.

* Two Dozen Strong Uptrends.

As noted in Friday's commentary, the performance of stocks in the S&P 500 is split and it a stock picker's market. I am even seeing divisions...

READ MORE

MEMBERS ONLY

Strong GDP And Blowout Earnings Fail To Inspire Bulls

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

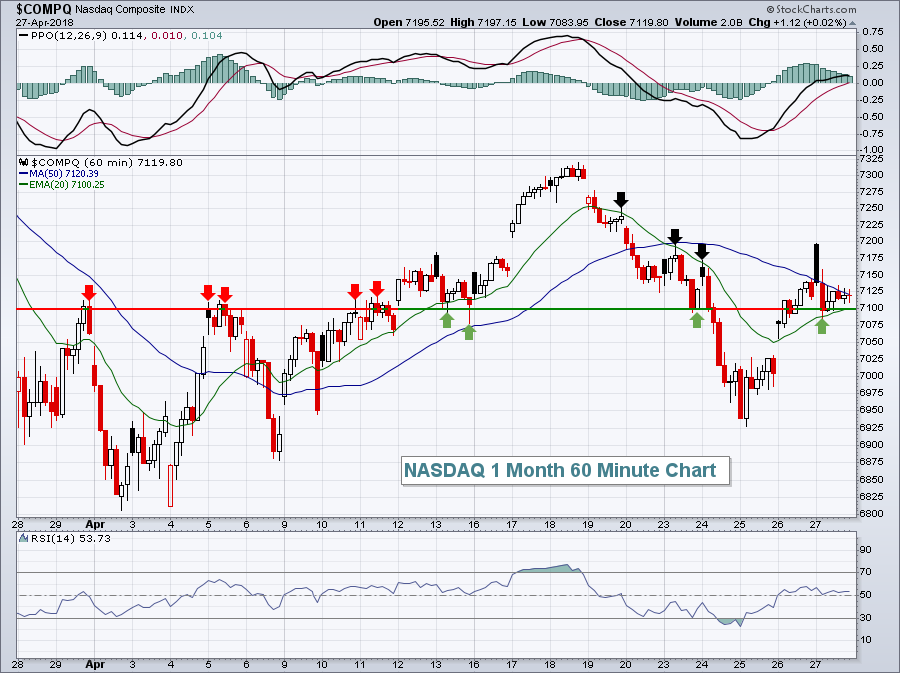

Market Recap for Friday, April 27, 2018

The news heading into Friday couldn't have been much better. The initial reading of Q1 GDP came in stronger than expected at 2.3% vs. 2.0%. We had blowout earnings from key leaders including Amazon.com (AMZN), Microsoft (MSFT) and...

READ MORE

MEMBERS ONLY

A Wyckoff Week

by Bruce Fraser,

Industry-leading "Wyckoffian"

Two events happened this week that captured the attention of Wall Street. There was much buzz about both and they seem to be related. On Tuesday the stock market took a big tumble, with the Dow Jones Industrials falling 424 points. The next day the Ten-Year US Treasury Yield ($TNX)...

READ MORE

MEMBERS ONLY

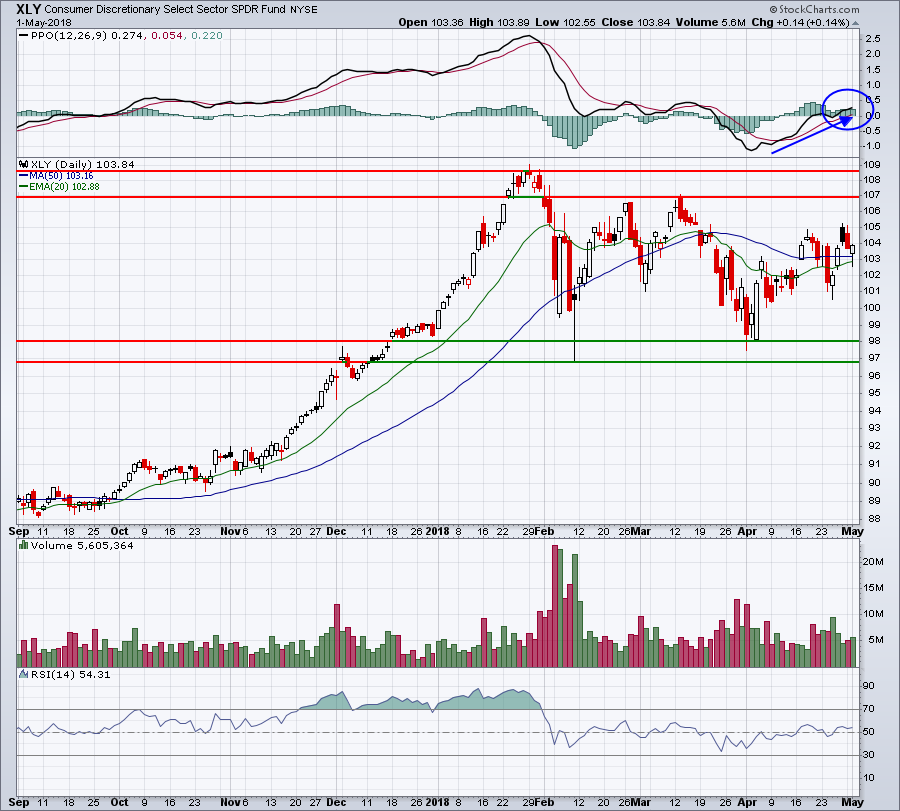

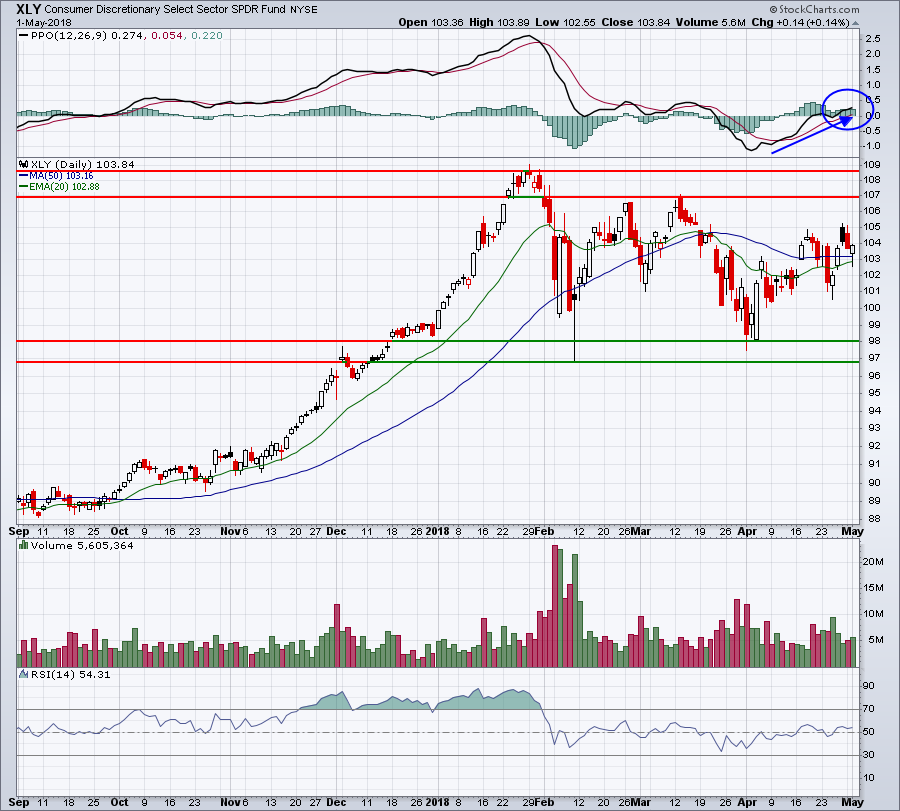

DP Weekly Wrap: Consumer Discretionary (XLY) Back on BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Consumer Discretionary sector (XLY) switched from NEUTRAL to BUY when the 20EMA crossed up through the 50EMA. For me this is a low-confidence signal because XLY has been moving sideways, with price chopping above and below those EMAs with enough range to cause the dreaded whipsaw. Also undermining my...

READ MORE

MEMBERS ONLY

The Two Pillars of Probability Enhancement: How To Systematically Reduce Risk and Increase Rewards

by Gatis Roze,

Author, "Tensile Trading"

If you didn't catch my interview on Wednesday morning, I joined Tom Bowley and Erin Swenlin on their StockCharts TV show, MarketWatchers LIVE, for a special presentation: "The Two Pillars of Probability Enhancement". I demonstrated the asset allocation strategies and routines I use to reduce risk...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Divided and Range Bound

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps Continue to Lead.

* IJR Remains with Bullish Continuation Pattern.

* Large-cap Techs are Lagging, but Trending Up.

* A Divided Market.

* The S&P 500 is Stuck in the Middle.

* %Above 50-day EMA Struggling.

* Countering the Downward Breadth Thrusts.

* Healthcare Perks Up.

* Biotech ETFs Get Oversold Bounces.

* Notes from the...

READ MORE

MEMBERS ONLY

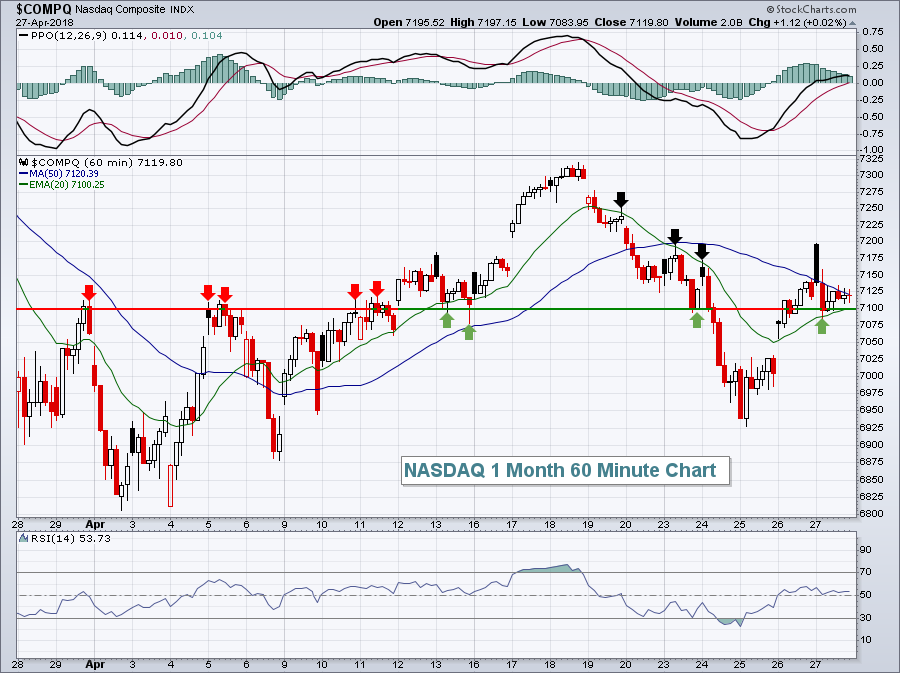

NASDAQ 100 Trio Report Blowout Results, Technology Looking To Extend Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 26, 2018

Two familiar areas - technology (XLK, +1.82%) and consumer discretionary (XLY, +1.62%) - saw money rotate their way on Thursday, with especially strong action in both internets ($DJUSNS, +4.11%) and semiconductors ($DJUSSC, +2.35%) leading the technology space. Discretionary stocks...

READ MORE

MEMBERS ONLY

DP Bulletin #3: NDX PMO Whipsaws Back to a BUY

by Erin Swenlin,

Vice President, DecisionPoint.com

Not surprisingly, the NDX which had triggered a Price Momentum Oscillator (PMO) SELL yesterday, whipsawed into a new PMO BUY Signal. With a rally that moved price higher by 2.08%, the PMO was jerked back up.

Unfortunately, the margin remains thin between the PMO and its signal line so...

READ MORE

MEMBERS ONLY

NASDAQ 100 LEADS MARKET REBOUND -- FACEBOOK LEADS TECH SECTOR HIGHER -- VISA, HOME DEPOT, AND MICROSOFT ARE DOW LEADERS -- S&P 500 SURVIVES ANOTHER TEST OF ITS 200-DAY AVERAGE -- RISING DOLLAR CAUSES PULLBACK IN GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 LEADS MARKET REBOUND... Stocks are enjoying a rebound today off chart support near 200-day moving average lines. And the Nasdaq is leading it higher. Chart 1 shows the PowerShares Nasdaq 100 (QQQ) rising 2% today to outpace other stock indexes. After finding support from just above its 200-day...

READ MORE