MEMBERS ONLY

New Highs In The Market ... But Fewer Stocks Are Participating

by Martin Pring,

President, Pring Research

* Market still overstretched

* Greater selectivity as the market moves higher

* Whatever happened to China?

Last week, I pointed out that several indicators were pointing to a short-term correction. I also said that counter-cyclical corrections are difficult to play, essentially because they are usually over before you realize it. To quote...

READ MORE

MEMBERS ONLY

SystemTrader .... Building a Momentum Trading System for Stocks .... Backtest Results .... Scan Code

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- Introduction

---- Trading Universe and Timeframe

---- Culling the Herd

---- Volatility Filter

---- Minimum Liquidity Filter

---- Minimum Price Filter

---- Maximum Rate-of-Change Filter

---- Setting the Trading Rules

---- Backtest Results

---- Conclusions, Scan Code and FAQ ----

Introduction

This System Trader article will introduce and update...

READ MORE

MEMBERS ONLY

Utilities Break To Four Month High; Consumer Stocks Strong

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 8, 2017

The 10 year treasury yield ($TNX) has dropped back toward the lower end of its 2-3 month trading range from 2.30% to 2.60%, closing on Wednesday at 2.35%. That apparently has been enough to spark utilities (XLU, +0.98%) as...

READ MORE

MEMBERS ONLY

GOLD CONTINUES RALLY BUT NEARS RESISTANCE -- SO DO GOLD MINERS -- EURO STAYS FLAT -- PULLBACK IN BOND YIELDS ARE HELPING GOLD BUT MAYBE NOT FOR LONG -- REBOUND IN SAFE HAVEN BONDS AND THE YEN NOT THAT IMPRESSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD REACHES THREE-MONTH HIGH... The price of gold continues to rise. Chart 1 shows the Gold Shares SPDR (GLD) trading at the highest level in three months. It has reached a point, however, where some overhead resistance may appear. For one thing, it has retraced 62% of its November/December...

READ MORE

MEMBERS ONLY

Expeditors Hits Reversal Zone and Turns

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Expeditors International of Washington (EXPD), a logistics services provider, is part of the Dow Transports and the Industrials SPDR. The stock caught my eye because it is in a long-term uptrend and recently pulled back to a potential reversal zone. First, the long-term trend is clearly up because the stock...

READ MORE

MEMBERS ONLY

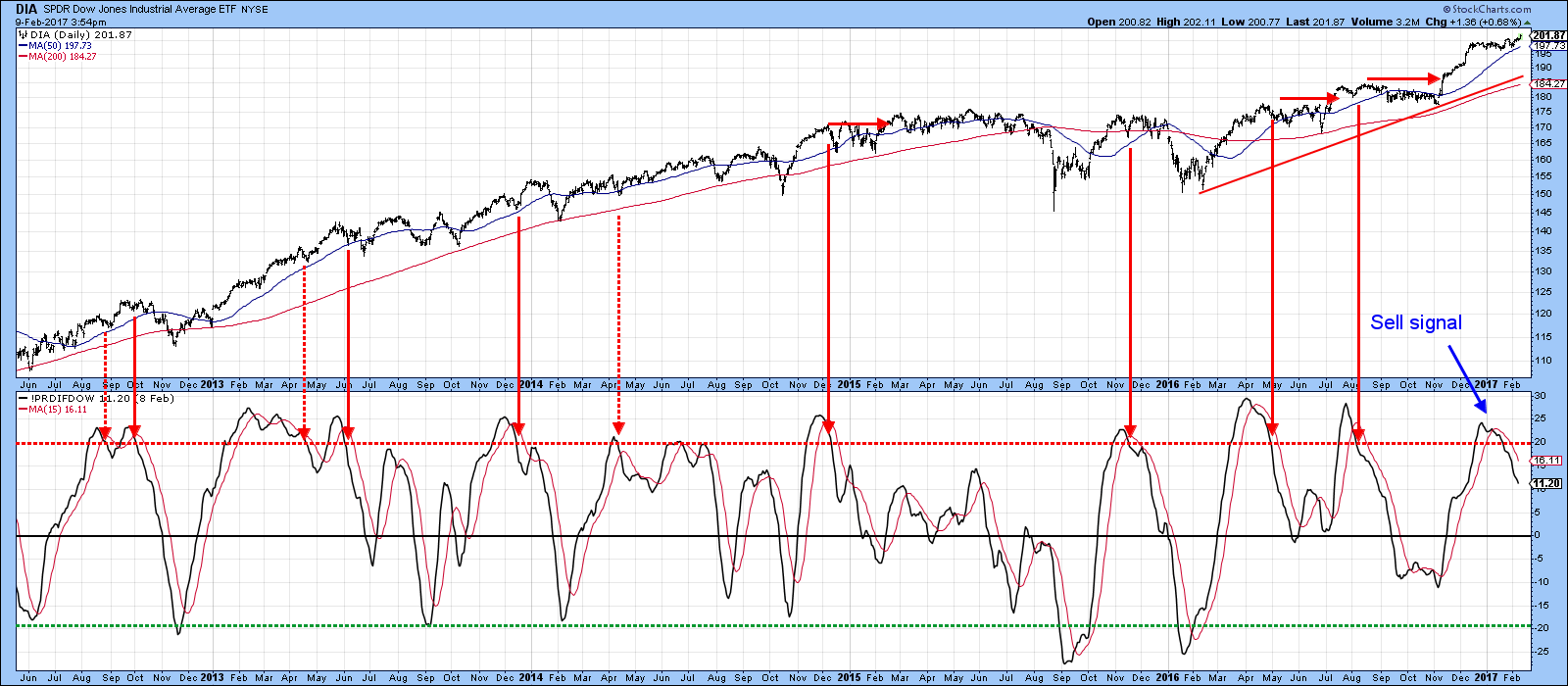

Dow Jones Sets New All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 7, 2017

The Dow Jones moved into blue sky, all-time high territory intraday on Tuesday as it touched 20155. If there was any bad news, it's that the move didn't hold into the close as the Dow came up 10 points...

READ MORE

MEMBERS ONLY

Cooling Energy ETFs - New Intermediate-Term Trend Model Neutral Signals on XLE and RYE

by Erin Swenlin,

Vice President, DecisionPoint.com

Both the Energy SPDR (XLE) and its counterpart, the equally-weighted Energy ETF (RYE) triggered new Intermediate-Term Trend Model Neutral signals when the 20-EMAs crossed below the 50-EMAs while the 50-EMA was below the 200-EMA. We consider a stock, index, ETF, etc. to be in a "bull market" as...

READ MORE

MEMBERS ONLY

Key Relative Ratios Argue For Continuing Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, February 6, 2017

Please be sure to subscribe to my blog at the bottom of this article and all of my articles will be sent to your e-mail address as soon as they're published. Thanks! :-)

It's noteworthy to point out that...

READ MORE

MEMBERS ONLY

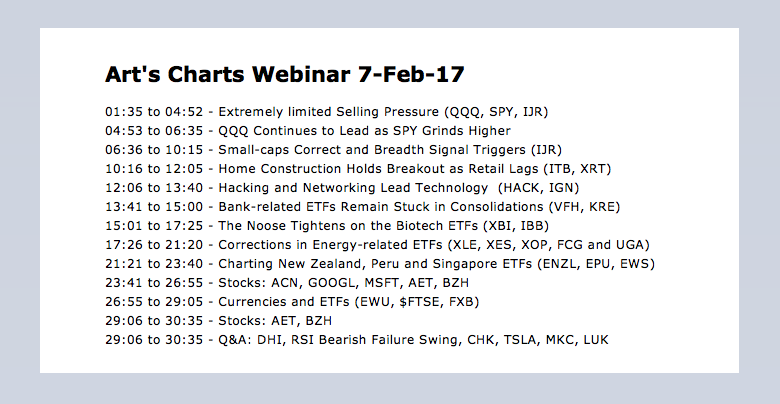

Webinar Recording - Minimal Selling Pressure - Are Small-Caps Ending their Correction? - HACK and IGN Lead Techs - Defense Breaks Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

----- Webinar Video ----- Art's Charts ChartList -----

Today I will start out with simple close-only charts for SPY, QQQ and IJR. Close-only charts filter out the intraday noise and gaps that may occur between sessions. These charts show us just how dull the market has been since...

READ MORE

MEMBERS ONLY

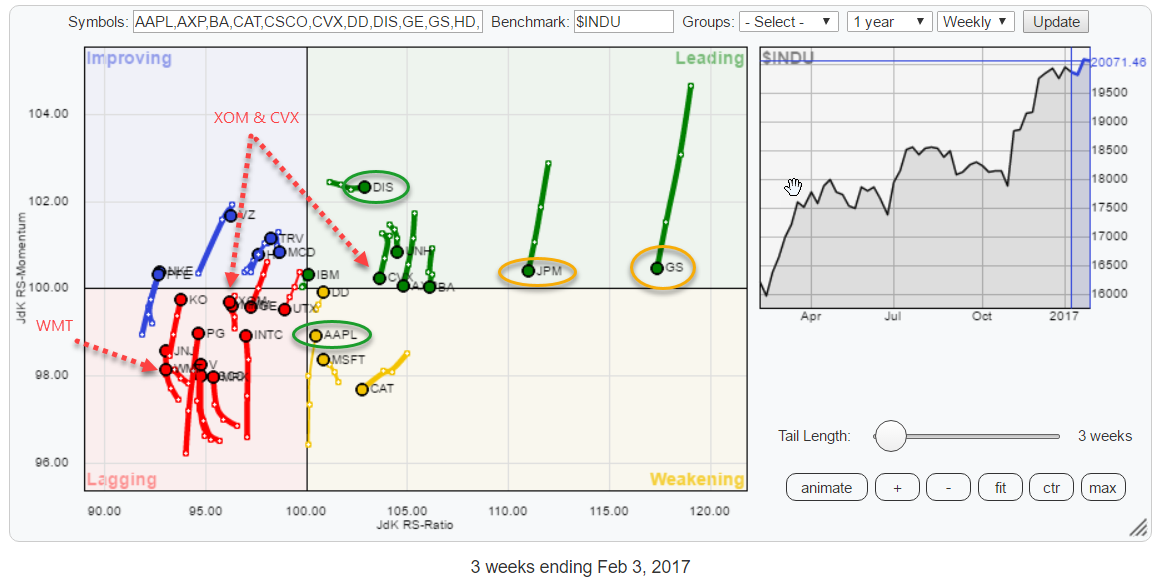

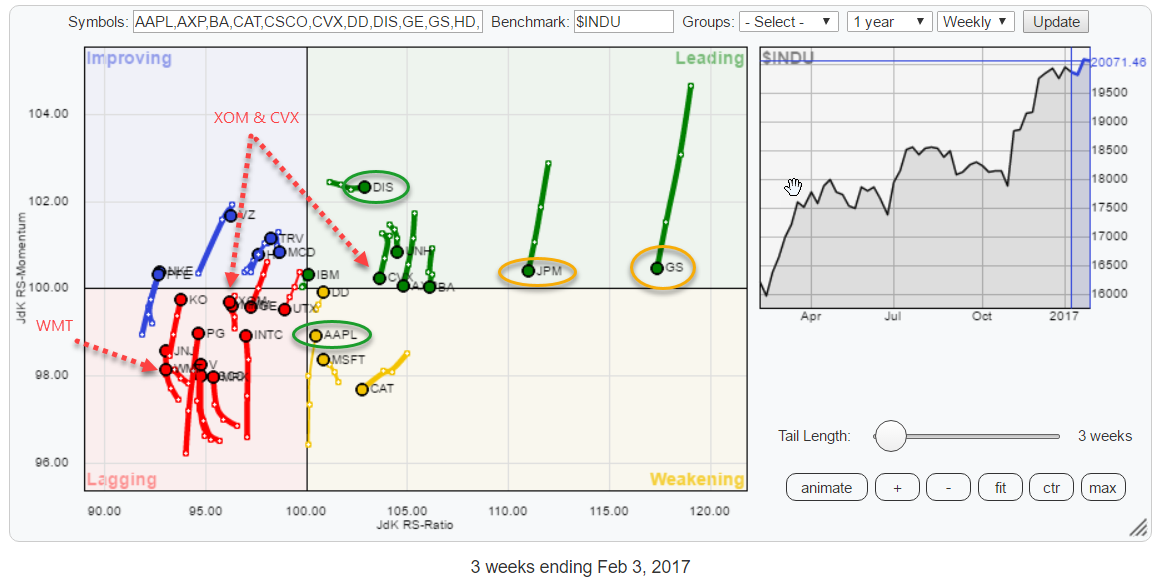

AAPL starting to lead technology sector rotation again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

* Inside Financials, money is shifting from GS & JPM to V

* AAPL turning back up towards leading quadrant, makes it leading stock in technology

* XOM and CVX confirm weak rotation for Energy sector

* Opposite rotations for DIS and WMT inside Staples sector

Quick scan

The Relative Rotation Graph above...

READ MORE

MEMBERS ONLY

Oil & Gas Equipment & Services SPDR Stalls after Big Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Oil & Gas Equipment & Services SPDR (XES) surged to 52-week highs in November and early December. It is clear after this surge that the bigger trend is up. First, the 40-week Slope turned positive in late July and remains positive. Second, the ETF broke out of a large...

READ MORE

MEMBERS ONLY

Financials Lead Dow Jones Back Above 20,000

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 3, 2017

Financials (XLF, +2.02%) had another huge day with consumer finance, investment services and banks leading the charge. The former had been struggling with a negative divergence over the past couple months while remaining in an uptrend. But just after testing its 50...

READ MORE

MEMBERS ONLY

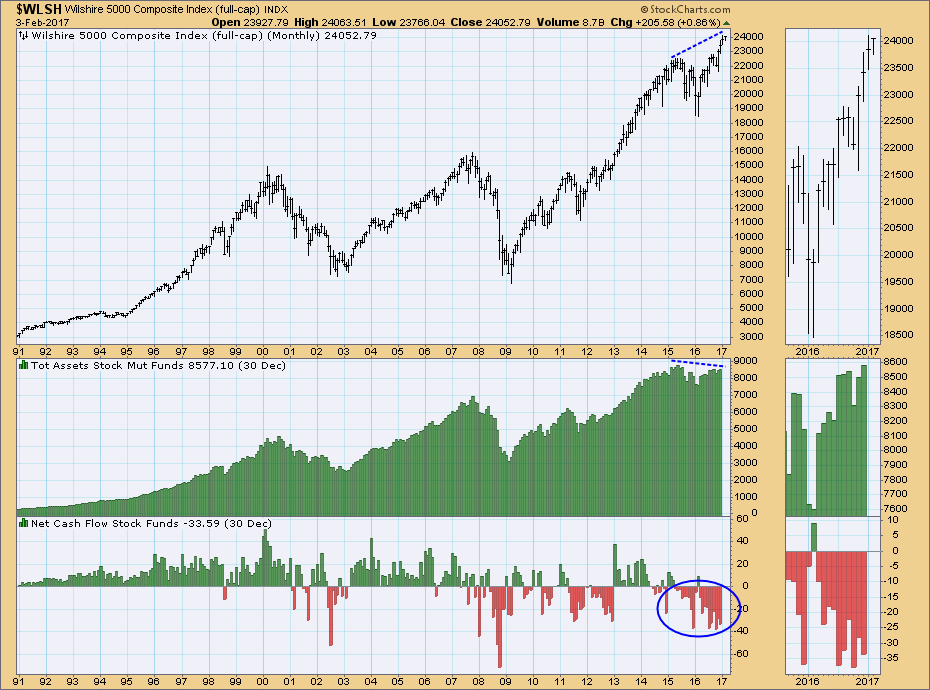

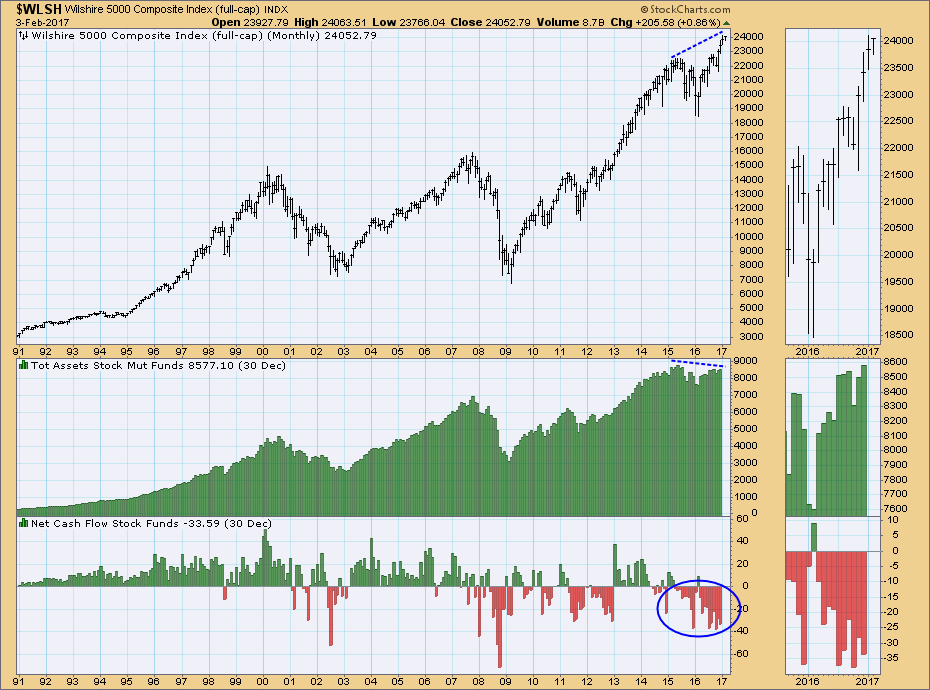

Net Cash Flow Going In Wrong Direction

by Carl Swenlin,

President and Founder, DecisionPoint.com

With some broad market indexes making record highs, one would think that total mutual fund assets would be following suit. But no. As of the end of December Total Stock Mutual Fund Assets were still below the record highs set in 2015, and are failing to confirm record price highs....

READ MORE

MEMBERS ONLY

Using Support, Resistance And Trendlines To Better Your Trading

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Exercising patience and discipline to enter trades at appropriate reward vs. risk levels is obviously very important to any trader's success, but planning trades before they set up is just as important. Let me give you a few examples. First, let's take a look at Cullen...

READ MORE

MEMBERS ONLY

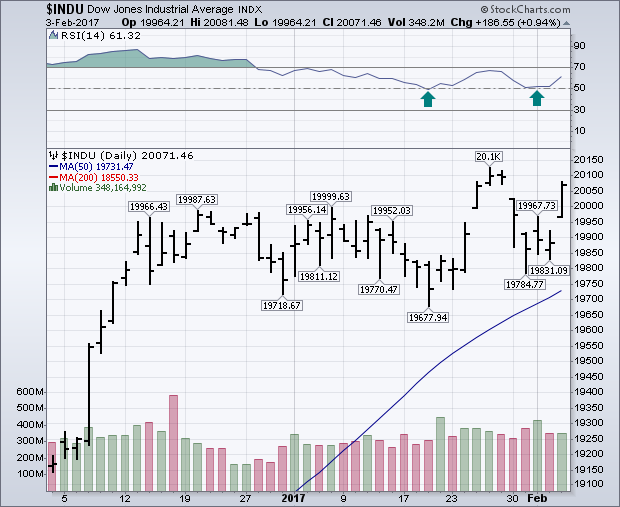

Dow and S&P 500 End Week On a Strong Note

by John Murphy,

Chief Technical Analyst, StockCharts.com

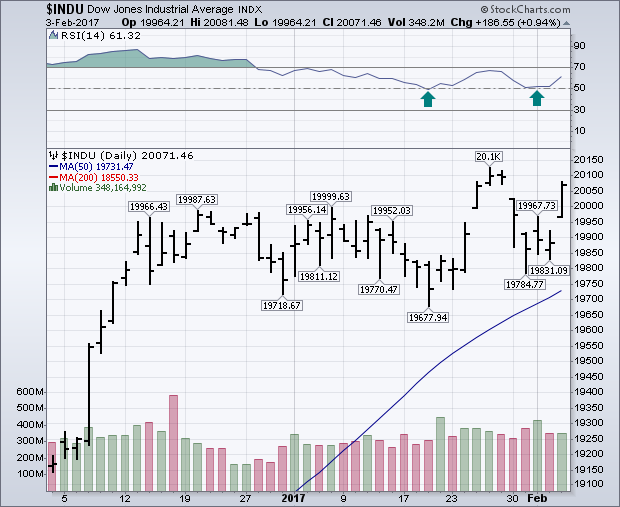

What started off as a soft week for stocks ended on a strong note. Friday's gain was enough to keep stock indexes basically flat for the entire week. But there was some improvement on the charts. The daily bars in Chart 1 show the Dow Industrials jumping 186...

READ MORE

MEMBERS ONLY

FINANCIALS LEAD FRIDAY'S STOCK BOUNCE -- SO DO SMALL CAPS AND TRANSPORTS -- HEALTCHARE IS WEEK'S STRONGEST SECTOR -- HCA HOLDINGS ACHIEVES BULLISH BREAKOUT -- AMGEN SURGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 END WEEK ON A STRONG NOTE ... What started off as a soft week for stocks ended on a strong note. Friday's gain was enough to keep stock indexes basically flat for the entire week. But there was some improvement on the charts....

READ MORE

MEMBERS ONLY

Sectors. Groups. Stocks.

by Bruce Fraser,

Industry-leading "Wyckoffian"

Let’s continue our discussion about using Relative Strength Analysis to find leading stocks. A blend of Wyckoff analysis and Relative Strength analysis offers an efficient method for zoning in on the best leading stock candidates. In the prior post, Industry Group analysis was explored. Here we will jump into...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Healthcare Heats Up - Energy Extends Correction - Bonds Remain Weak - Gold and Dollar Hit Reversal Zones

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Weekly Performance Review

There was a lot of pushing and shoving in the markets this week. Stocks started the week with a modest move lower and finished the week with a modest move higher. The end result was a .16% gain for the S&P 500 SPDR. The 20+...

READ MORE

MEMBERS ONLY

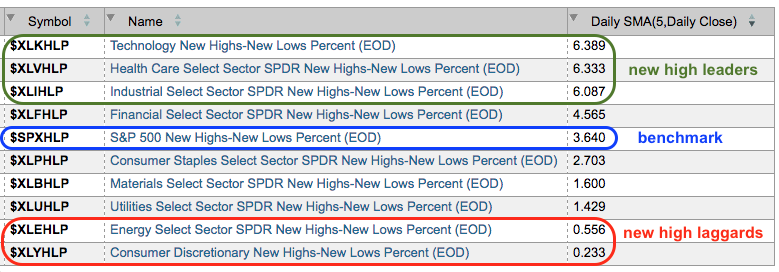

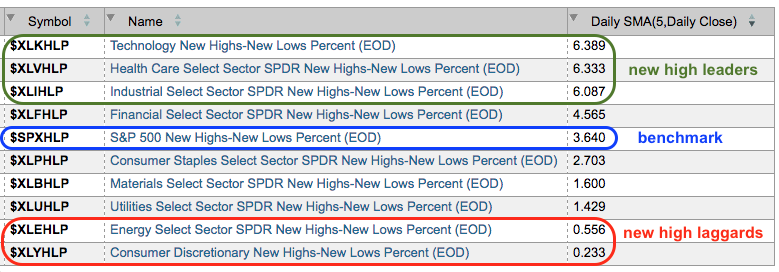

New Highs Expand in the Healthcare Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

New highs are a sign of underlying strength and chartists can measure this indicator using High-Low Percent. In particular, I like to rank the nine sectors by High-Low Percent or a moving average of High-Low Percent. Note that High-Low Percent equals new highs less new lows divided by total issues....

READ MORE

MEMBERS ONLY

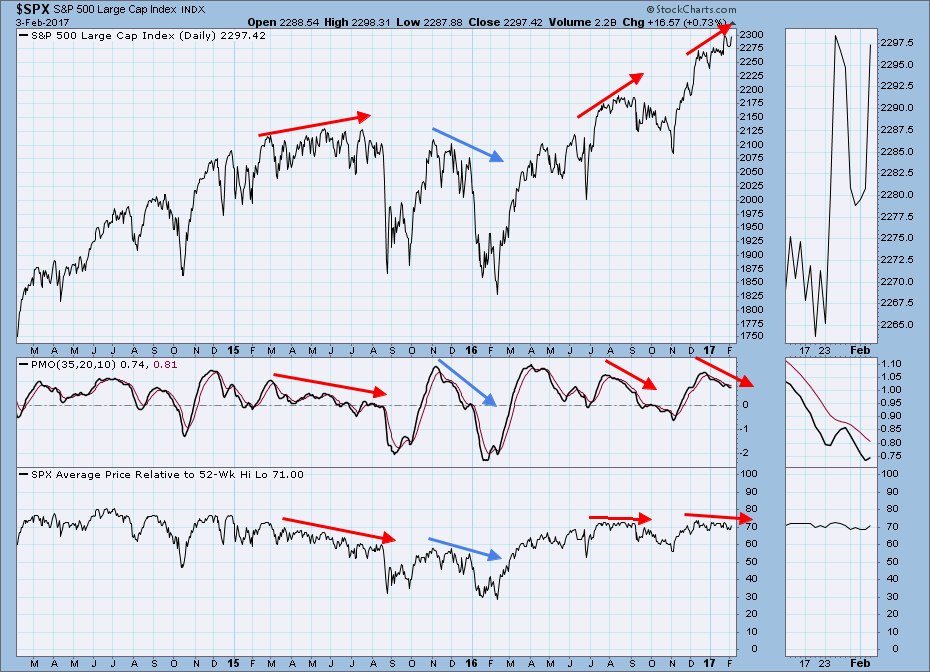

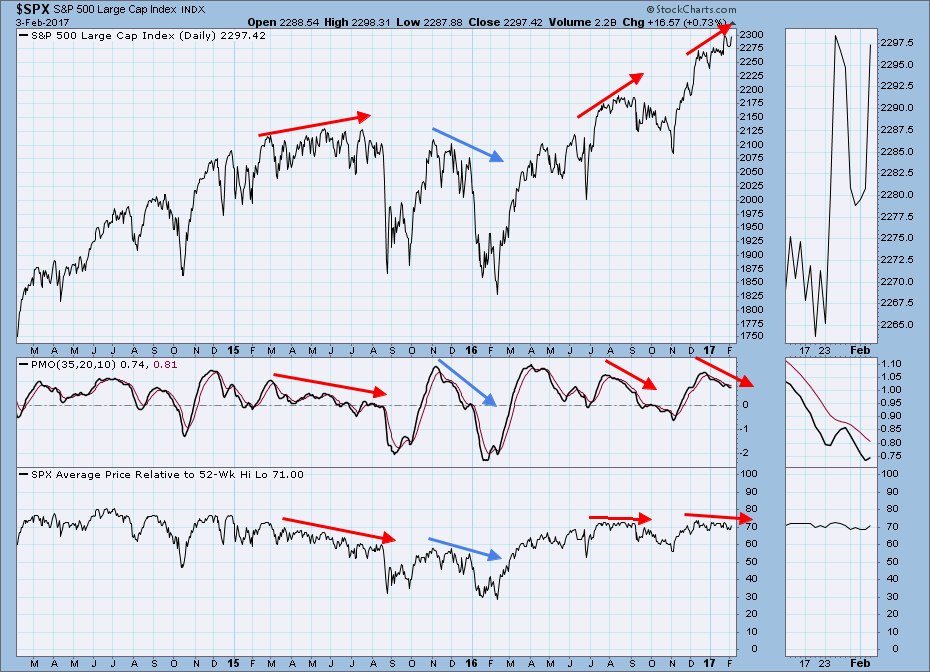

Stocks Relative to Their 52-Week High-Low - SPX v. NDX

by Erin Swenlin,

Vice President, DecisionPoint.com

Today during my DecisionPoint Report webinar, I pulled the intermediate-term indicator chart of SPX Stocks Relative to Their 52-Week Hi-Lo to show my viewers the divergences that are all over this chart. After I finished the webinar and reviewed the chart again, I decided it would be great to see...

READ MORE

MEMBERS ONLY

No Chasing Allowed

by John Hopkins,

President and Co-founder, EarningsBeats.com

At EarningsBeats we are steadfast in avoiding being involved in stocks into a company's earning's report because one can never tell how the market will respond to a company's numbers. Case in point is Amazon who reported their numbers last week.

Just look at...

READ MORE

MEMBERS ONLY

How Investing, Brain Training and Longevity Fit Together

by Gatis Roze,

Author, "Tensile Trading"

Yes, the fountain of youth really does exist, and academic research is increasingly proving it to be found amidst your investment portfolio. A growing body of scholarly research shows that, in many ways, life can get better as we get older, and being an active investor can contribute in significant...

READ MORE

MEMBERS ONLY

February Is A Time For Toys And The Chart Agrees

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 2, 2017

Defensive stocks were once again at the forefront of U.S. stock market action on Thursday with utilities (XLU, +1.06%) and consumer staples (XLP, +0.92%) easily the best two sectors on the session. Over the past week, healthcare (XLV, +2.79%...

READ MORE

MEMBERS ONLY

The January Barometer - Myth or Statistically Relevant?

by Erin Swenlin,

Vice President, DecisionPoint.com

Yale Hirsch was the first to propose, "As the Standard & Poor's goes in January, so goes the year". Simply meaning, if the S&P 500 closes higher in January, the end of the year should finish higher OR if it closes lower, it will...

READ MORE

MEMBERS ONLY

Are Housing Stocks Topping Out?

by Martin Pring,

President, Pring Research

* Housing economic data is finely balanced

* The long-term technicals for housing equities are also evenly matched

* The bearish short-term picture could be the domino that tips everything

Housing economic data is finely balanced

The housing industry has not exactly been on a roll since the last recession, but it has...

READ MORE

MEMBERS ONLY

AMD Completes Right Side Of Cup

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Advanced Micro Devices (AMD) was one of the best performing stocks in 2016 and the bullish pattern that's printed in the first five weeks of 2017 suggests the rally hasn't ended just yet. One bearish development today was that AMD broke out above its late December...

READ MORE

MEMBERS ONLY

TECHNOLOGY SECTOR REACHES OVERBOUGHT TERRITORY -- BIG TECH STOCKS ARE UP AGAINST RESISTANCE OR PULLING BACK -- HEALTHCARE WINNERS INCUDE IDEXX LABS, BOSTON SCIENTIFIC, AND MERCK -- HCA HOLDINGS MAY BE NEAR BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SPDR FINALLY REACHES OVERBOUGHT TERRITORY ... One of the trends supporting the stock market rally has been a strong technology sector. That group, however, has reached overbought territory for the first time in six months and is starting to weaken. Chart 1 shows the 14-day RSI for the Technology SPDR...

READ MORE

MEMBERS ONLY

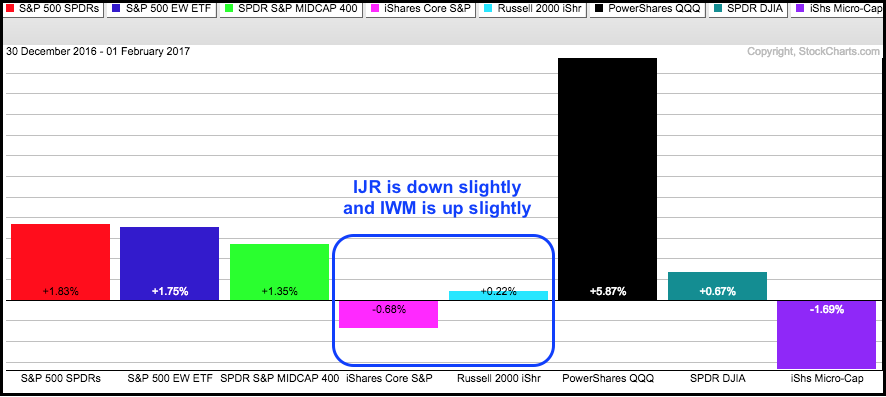

Blame Small-Caps - A Surprising Sector Shows Leadership in 2017 - EEM Nears 52-week High - ChartList Update

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

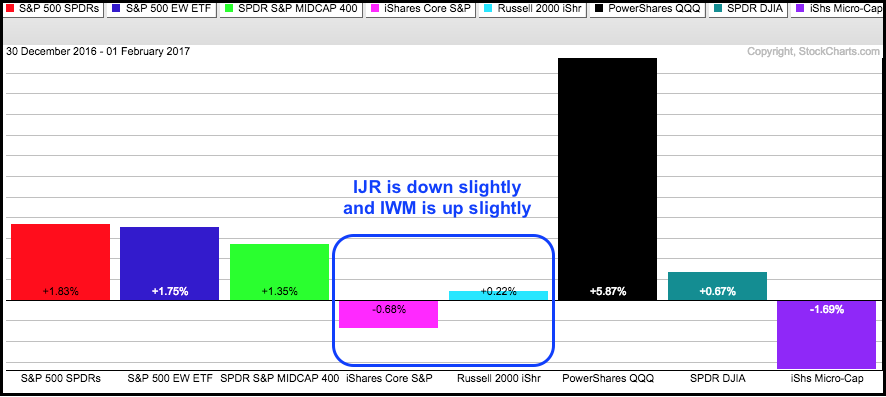

Blame Small-Caps for Mixed Up Market .... A Big Surprise for the 3rd Leading Sector .... Breadth Indicators Trigger for Healthcare Sector .... XLV Moves back above Long-term Moving Averages .... Biotech ETFs Spring Back to Life .... Emerging Markets ETF Nears 52-week High .... ChartList Update (16 stocks) .... Food for Thought .... //// ....

Blame Small-Caps for Mixed...

READ MORE

MEMBERS ONLY

Healthcare Leads Wednesday Rally But Still Suffers From Relative Weakness

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 1, 2017

U.S. equities staged a recovery on Wednesday after a recent bout of profit taking, but the recovery could've been much stronger after a very solid open. The NASDAQ jumped 40 points at the open after Apple (AAPL) posted results well...

READ MORE

MEMBERS ONLY

Capitalization

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This will not be about punctuation. Have you ever wondered why most of the media focuses on the Dow Jones Industrial Index? Some would say it isn’t a good measure of the overall market, including me? Yet, it does a reasonable job of representing the overall market. Same goes...

READ MORE

MEMBERS ONLY

DOLLAR STILL UNDER PRESSURE -- BUT EURO AND YEN ARE STILL IN DOWNTRENDS -- GOLD'S TREND MAY DEPEND ON THE EURO -- DOW MAY RETEST 50-DAY LINE -- TRANSPORTS FAIL TO REACH NEW HIGHS -- UTILITIES WEAKEN AT 200-DAY LINE -- APPLE NEARS RECORD HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR BREAKS SHORT-TERM SUPPORT... I keep writing about prospects for a bounce in the U.S. Dollar, and it keeps dropping. My last message showed the PowerShares Dollar Index Fund (UUP) testing chart support at its early December low. The red circle in Chart 1 shows the UUP slipping below...

READ MORE

MEMBERS ONLY

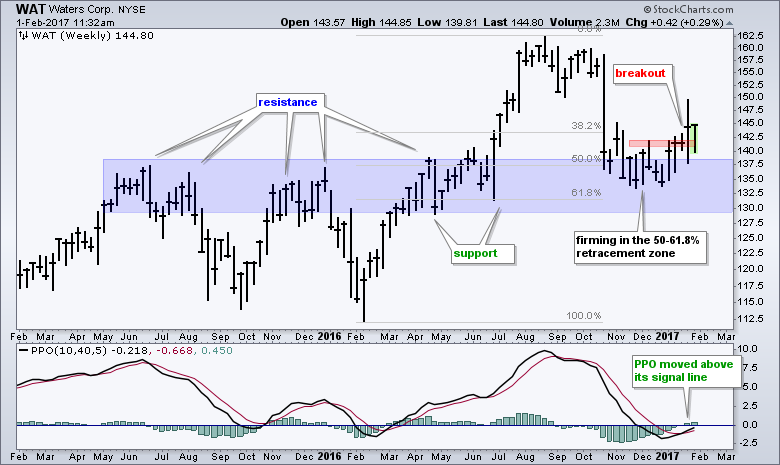

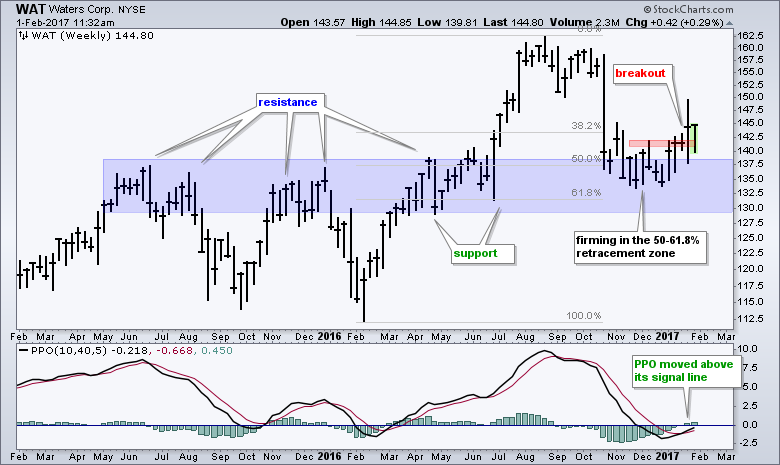

Waters Corp Turns Up and Leads in 2017

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Waters Corp (WAT) was hit hard with a double-digit decline in October, but the stock ultimately firmed in November-December and turned up in 2017. Waters Corp is in the top 20% of S&P 500 stocks for year-to-date gain. The chart also looks rather promising. Even though the October...

READ MORE

MEMBERS ONLY

Apple Beats Earnings Estimate; Tech Poised To Jump

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 31, 2017

It was a second day of rotation into defensive stocks as leadership came from healthcare (XLV, +1.60%), utilities (XLU, +1.55%) and consumer staples (XLP, +0.48%). Unfortunately, all of the aggressive sectors were lower and that kept a lid on overall...

READ MORE

MEMBERS ONLY

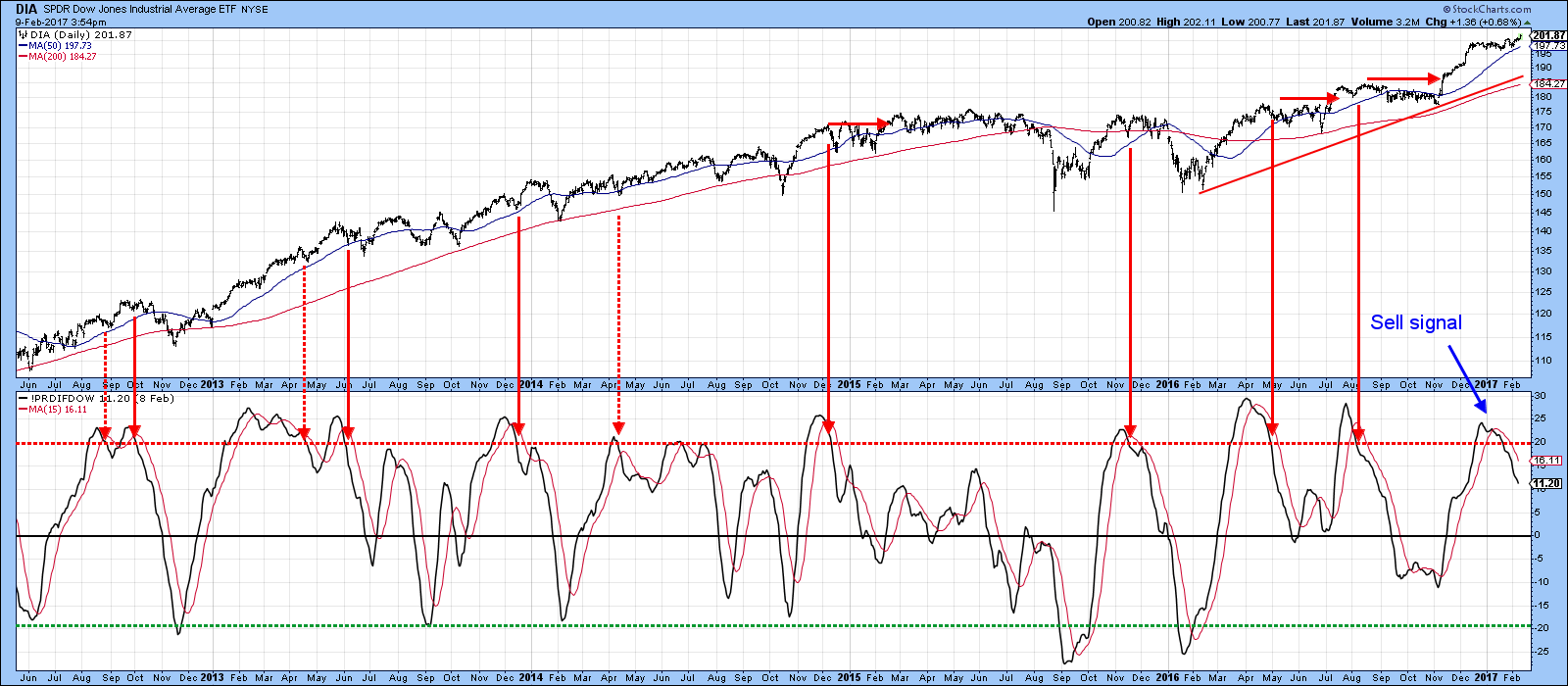

The Main Trend Is Still Positive But The Consensus Says?

by Martin Pring,

President, Pring Research

* One reliable long-term indicator is bullish

* What are the short-term indicators saying?

* Bottom fisher to the rescue?

The long-term indicators for equities have been pointing north for quite a while. Quite often I’ll include one of those indicators in my articles as testimony to the bull, but hedge my...

READ MORE

MEMBERS ONLY

Here Are The Key Support Levels To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 30, 2017

It was most definitely a day of profit taking across U.S. equities on Monday. All of our major indices finished lower, although an afternoon rally did cut into some of the earlier losses. Still, the Russell 2000 was hit hardest and finished...

READ MORE

MEMBERS ONLY

Webinar Video - Volatility Contraction Extends - Next Bullish Setup for SPY - Retail SPDR Bucks the Selling

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

----- Webinar Video ----- Art's Charts ChartList -----

S&P 500 Extends Volatility Contraction .... The Next Bullish Setup for SPY .... IJR Fails to Hold Flag Break .... Housing ETFs Take a Hit, but Breakouts Remain .... Retail ETF Bucks the Selling Pressure .... Airline ETF Fails to Hold Breakout .... iShares...

READ MORE

MEMBERS ONLY

Hang Seng Reverses after a Normal Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Hang Seng Composite ($HSI) is having a good year with a 6% gain year-to-date. The weekly chart also looks bullish because the big trend is up and a correction just ended. First, the index broke resistance with a sharp advance from late June to early September. Second, the index...

READ MORE

MEMBERS ONLY

February Typically Sees This Sector Shine

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 27, 2017

Last week was a milestone week for U.S. equities as the Dow Jones closed above 20000 for the first time in its history and the S&P 500 tagged 2300 for the first time as well. But that doesn't...

READ MORE

MEMBERS ONLY

Gold Rally Stumbles

by Carl Swenlin,

President and Founder, DecisionPoint.com

After correcting nearly -20% from the July 2016 top, gold rallied off the December low, hitting a rally high on Monday. Then it spent the rest of the week correcting, dropping below horizontal support set last year. It also dropped below the 20EMA and 50EMA, which action turned those EMAs...

READ MORE

MEMBERS ONLY

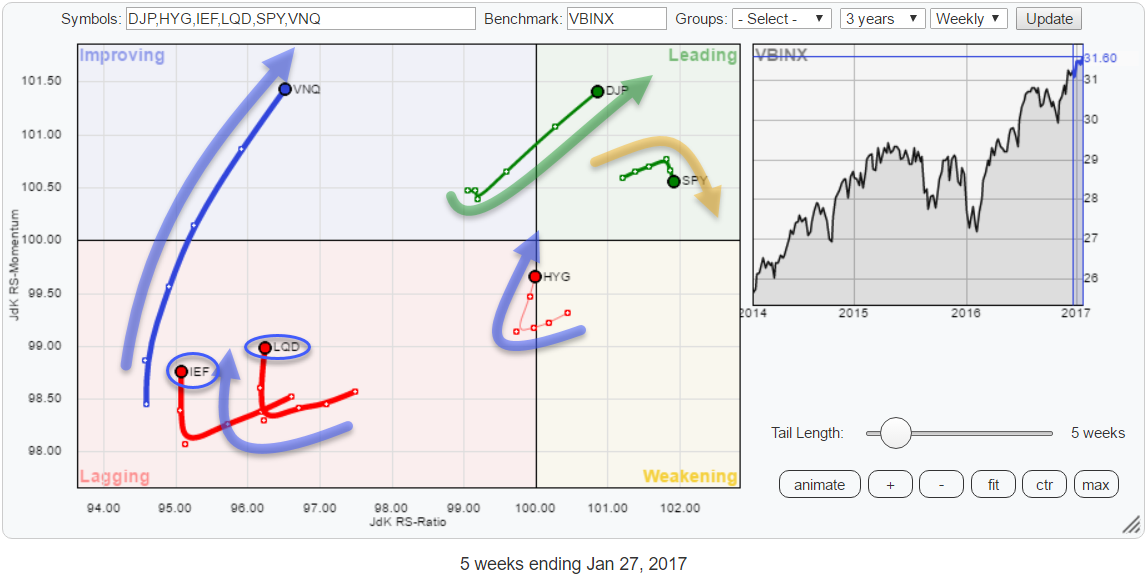

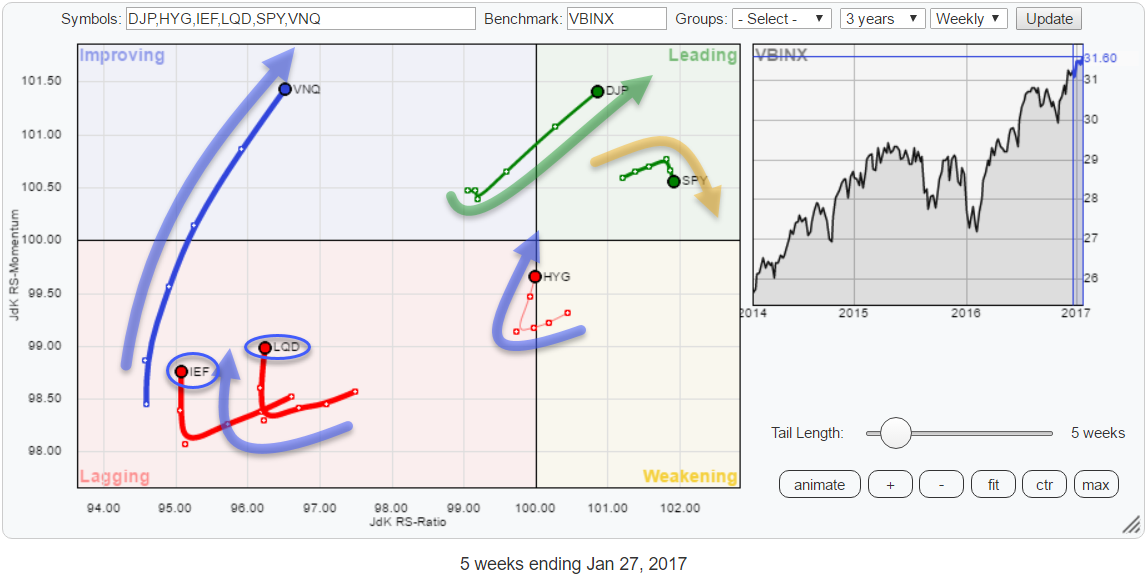

RRG shows money flowing into commodities!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph holding a number of asset class ETFs is showing a strong push of commodities (DJP) into the leading quadrant. Together with Real Estate (VNQ), these two asset classes are showing the most powerful headings in combination with the longest tails.

They deserve a further investigation.

Summary...

READ MORE