MEMBERS ONLY

MEM TV: Here's Why the Nasdaq OUTPERFORMED Last Week

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews areas of the market that are bucking the downtrend pressure elsewhere, as those often go on to provide leadership once the markets turn. She also shares how to use ETFs to uncover rotation taking place beneath the...

READ MORE

MEMBERS ONLY

Your Burning Questions, Answered: FATE of TESLA & Bullish Bias Solutions!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions about Tesla's potential trajectory towards the 200-day moving average and ways to normalize relative strength graphs using volatility measures. He also dives into his past trades' technical setup, shares tips for setting up...

READ MORE

MEMBERS ONLY

ChartPacks: The Quick and Easy Way to UNLEASH THE POWER of Your StockCharts Account

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson talks all about ChartPacks -- the QUICKEST and EASIEST way to enhance your StockCharts account (old or new) in just one click! ChartPacks are pre-created collections of ChartLists that you can install right into your account;...

READ MORE

MEMBERS ONLY

GNG TV: We're in BIG TROUBLE If Large Tech Stocks Rollover

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Tyler and Alex walk through a top-down approach to the markets and see that there are plenty of reasons why equities are struggling. Treasury rates and the Dollar are in strong "Go" moves and breaking out. The trend was strong...

READ MORE

MEMBERS ONLY

Beware of Shorts in EXTREME Cycle Lows For The Market

by TG Watkins,

Director of Stocks, Simpler Trading

The internals have all cycled to extreme low areas, which tells TG that being short would be risky -- just like being super long at the end of July was also risky. The pendulum has swung to the lows, and now, in this week's edition of Moxie Indicator...

READ MORE

MEMBERS ONLY

Stock Market Weekly Wrap-Up: The Charts You Need to Have on Your Radar Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Market volatility is low yet few stocks are trading above their 50-, 100-, and 200-day moving averages

* Market indicators are showing lack of momentum in the stock market

* Q4 earnings could be the catalyst that moves the market

As Q3 and a dismal September end, some interesting dynamics...

READ MORE

MEMBERS ONLY

Risk-Neutral Market Gauges Ahead of Sunday Deadline

We do not want to walk down the political aisle. Nonetheless, what person can turn their heads away from the Sunday deadline on funding the government?

The aftermath of a shutdown will most likely include a credit downgrade for the US. Do Americans need another reason to distrust the politicos?...

READ MORE

MEMBERS ONLY

FALLING BOND PRICES ARE HURTING BOND PROXIES LIKE UTILITIES, REITS, AND CONSUMER STAPLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEPTEMBER SECTOR RANKING... September has lived up to its reputation of being the year's weakest month. All major stock indexes have fallen during the month. And so have most S&P sectors -- except for one. Chart 1 shows energy being the only sector to end the...

READ MORE

MEMBERS ONLY

Is it Possible for the S&P 500 to Hold the 4300 Level?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Samantha LaDuc of LaDuc Capital breaks down the implications of higher interest rates and why semiconductors remain a crucial space to watch. Host David Keller, CMT tracks the recent rally in Bitcoin and identifies two key names testing moving average...

READ MORE

MEMBERS ONLY

New Tables Show Intermediate-Term Overview is Negative

by Carl Swenlin,

President and Founder, DecisionPoint.com

We have introduced two new tables in the DecisionPoint ALERT to give an overview of trend and BIAS for the major market indexes, sectors, and industry groups that we track. The first is our Market Scoreboard, which shows the current Intermediate-Term and Long-Term Trend Model (ITTM and LTTM) signal status....

READ MORE

MEMBERS ONLY

What to Do When The MACD Is Broken

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how the creator of the MACD, Gerald Appel, used this indicator as an overbought/oversold oscillator. He shows how using the SPY on the daily chart as an example. He then explains what to do when...

READ MORE

MEMBERS ONLY

Which Cyber Security ETF is the Strongest?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit hard the last two weeks with the S&P 500 SPDR (SPY) breaking below its August low. SPY also forged a lower high from July to August. Stocks and ETFs that held above their August lows are showing relative strength. With that in mind, the three...

READ MORE

MEMBERS ONLY

Looking at Recent Market PULLBACK in a Long-Term Context & More!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Joe Rabil of Rabil Stock Research walks through his monthly, weekly, and daily S&P 500 charts to put the recent market pullback into proper long-term context. Host David Keller, CMT digs into breadth indicators that have turned quite...

READ MORE

MEMBERS ONLY

Riding Out the Storm in Less-Than-Ideal Conditions

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action by sticking with the original plan with his portfolio vs. giving up due to less-than-ideal conditions. He then resumes his series on the wisdom of Jesse Livermore.

This week, Dave discusses that there is a...

READ MORE

MEMBERS ONLY

Boyz to Men -- Step Back to Small Caps & Growth Stocks

We started this year looking at the monthly charts and the 2 moving averages that depict business cycles.

Back in February, we wrote:

All in all, the key sectors (retail, transportation) have more to prove, especially by clearing the 23-month moving average or 2-year business cycle. This is a significant...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Sends Mixed Signals

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, after two weeks of non-regular market updates, I'm back with a regular episode. Here, I dive deep into the current state of rotation in asset classes, highlighting the strength of commodities and the opposing rotations for stocks and...

READ MORE

MEMBERS ONLY

DP Trading Room: Don't Forget The MONTHLY CHARTS! Earnings Spotlight

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens with a discussion on why you should use monthly charts even if you are investing in the shorter term. He gives us insight into the market as a whole and reviews the Magnificent 7 stocks and Tesla...

READ MORE

MEMBERS ONLY

The Halftime Show: Fixed Income Continues To Fall, Can't Say I Didn't WARN You!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Pete has been monitoring and calling out the downfall of TLT for nearly 20 months. In this week's edition of StockCharts TV'sHalftime, Pete explains why the ETF broke below $90 and how the US 10-year is over 4.5% on the same day. He dives into...

READ MORE

MEMBERS ONLY

MEM TV: How to Tell When It's Safe to Get Back Into the Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the previous week's sharp pullback and what we'll need to see before the markets can turn positive again. She also highlights recession-proof stocks that are currently attractive as well as high...

READ MORE

MEMBERS ONLY

SharpCharts vs. ACP - Comparing & Contrasting Your Charting Platform Choices

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson explores the two primary charting platforms on StockCharts - SharpCharts and ACP - to highlight the strengths of each, compare and contrast the two and share his thoughts on when and why you may want to...

READ MORE

MEMBERS ONLY

Nvidia Stock: Why It's Screaming a Spectacular Buy Signal

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* NVDA stock is holding on to the support of its 100-day moving average

* NVDA has maintained a high StockCharts Technical Rank (SCTR) since early 2023

* NVDA's relative strength with respect to the S&P 500 is approaching 200%

Nvidia's stock has maintained a...

READ MORE

MEMBERS ONLY

Market Begs: Tell Us Something Good!

We compiled a list of the 10 biggest uncertainties in the stock market right now.

In no particular order:

1. China-trade wars and chip wars

2. Oil and food inflation

3. Strikes

4. Government shutdown

5. Corporate and individual bankruptcies on the rise

6. Commercial real estate and banking

7....

READ MORE

MEMBERS ONLY

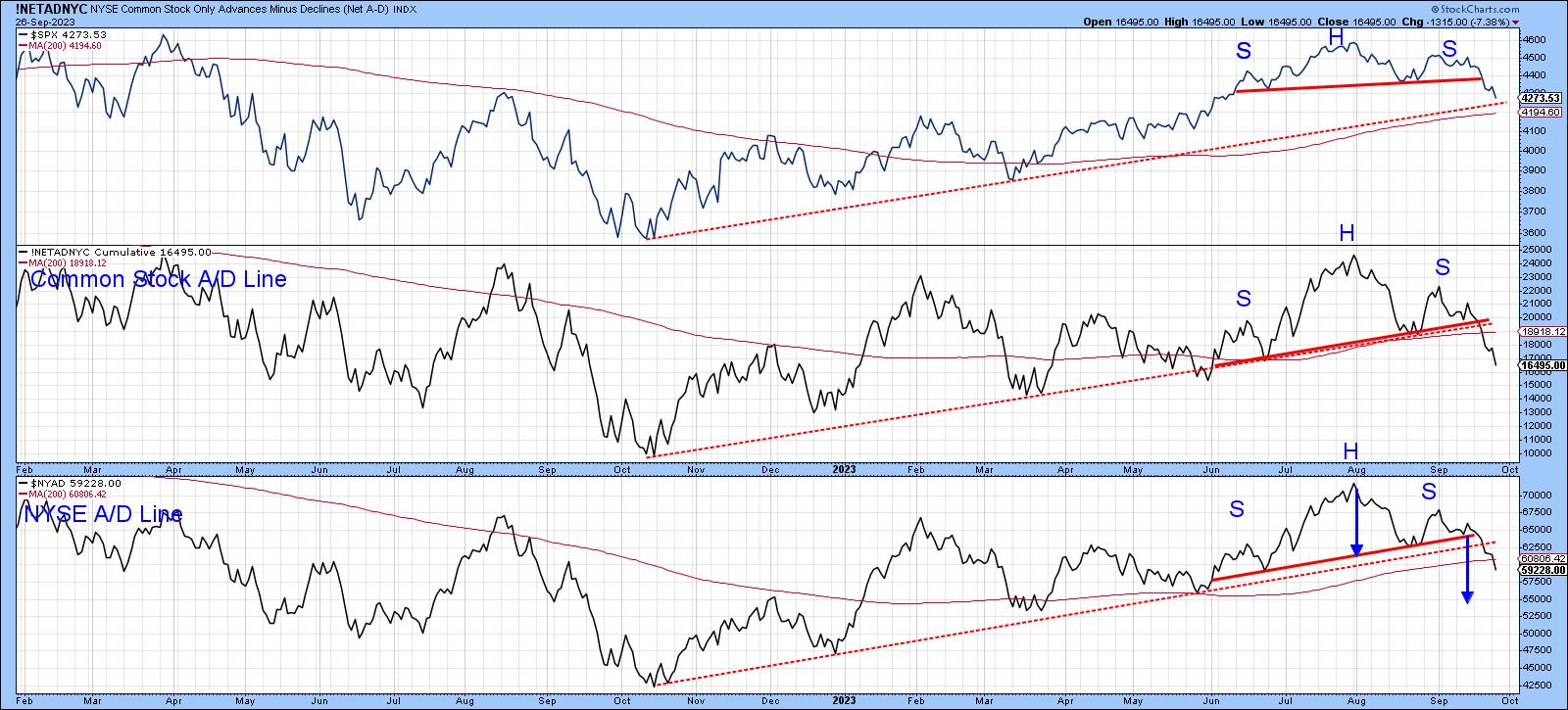

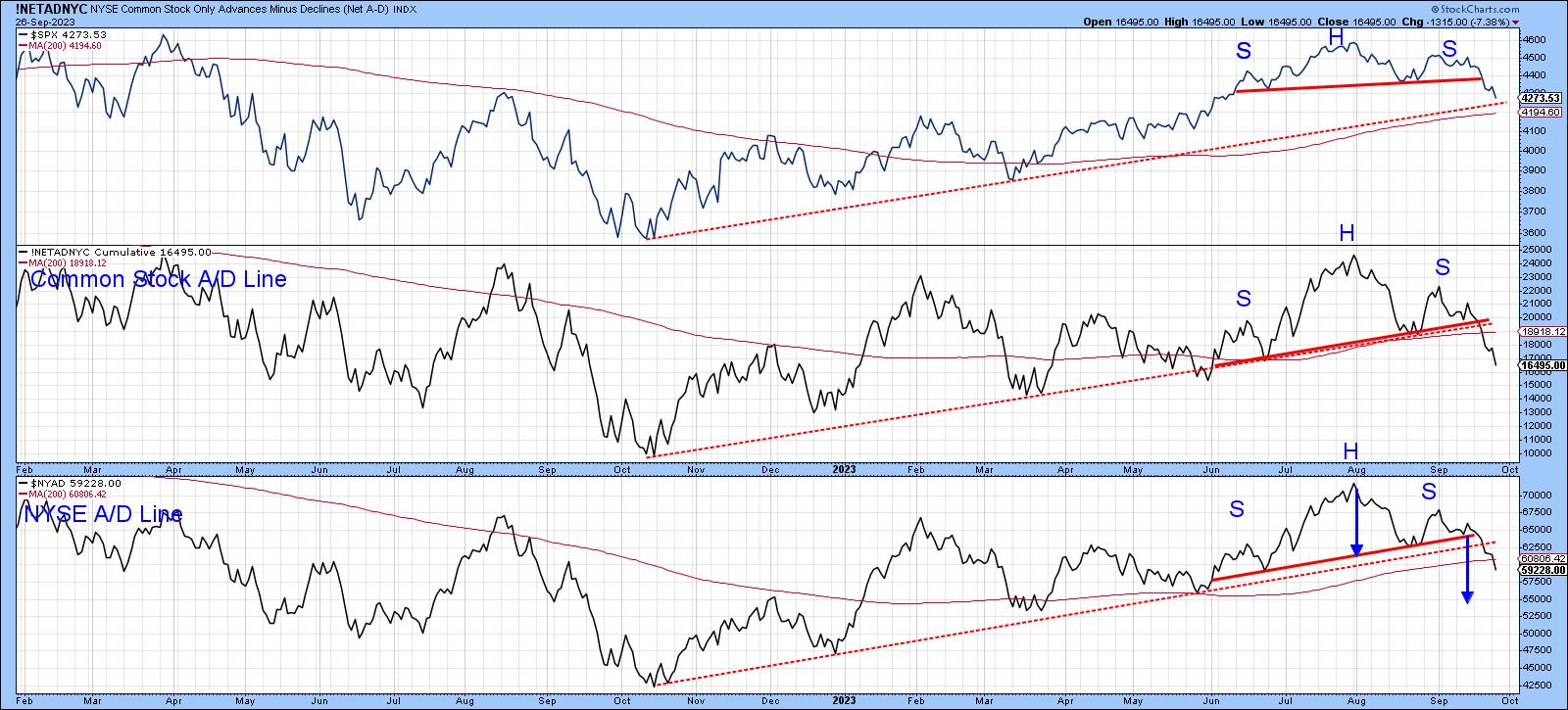

This Stock Market Looks Horrible... But...

by Martin Pring,

President, Pring Research

Chart 1 shows that the S&P Composite, like both A/D Lines, has completed and decisively broken down from a head-and-shoulders top. The two breadth indicators have also violated their bull market up trendlines. On the surface, things look pretty grim, with three seasonally weak September days left...

READ MORE

MEMBERS ONLY

Energy Sector Roulette: Bullish Signals, Sluggish Projections

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Energy Select Sector SPDR Fund (XLE) shows some promising technicals, signaling room for a potential climb and a strong chance for a breakout to the upside

* Technical indicators suggest that the Energy sector has a high probability of breaking out to the upside

* A breakout above its all-time...

READ MORE

MEMBERS ONLY

Finding the Leaders after a Sharp Decline - with Video

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks fell sharply in September with the S&P 500 SPDR (SPY) breaking below its August low. Chartists can now use this low as a benchmark low to gauge relative performance. Stocks that held above the August low are showing relative strength. This is valuable information because stocks that...

READ MORE

MEMBERS ONLY

S&P 500 Turnaround: 3 Charts You Need To Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Rising Treasury yields have hurt growth stocks but buying opportunities could lie ahead

* The stock market could bottom at the end of September and present buying opportunities

* Watch Fibonacci levels, Equal Weighted S&P 500 Index, and market breadth for a reversal

Last week wasn't...

READ MORE

MEMBERS ONLY

I Say We're Setting Up For A Major Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's almost impossible to call market tops and market bottoms using basic technical analysis tools like price and volume. Don't get me wrong, that combination is my favorite during trend-following periods. But trying to spot bearish reversals is difficult when price action keeps riding higher and...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Forms A Potential Top; Low VIX Continues To Stay A Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was mentioned that the markets are prone to some consolidation and corrective retracements due to the technical setup on the charts. It was also mentioned that the precariously low levels of volatility need to be watched, and this also can keep the markets vulnerable...

READ MORE

MEMBERS ONLY

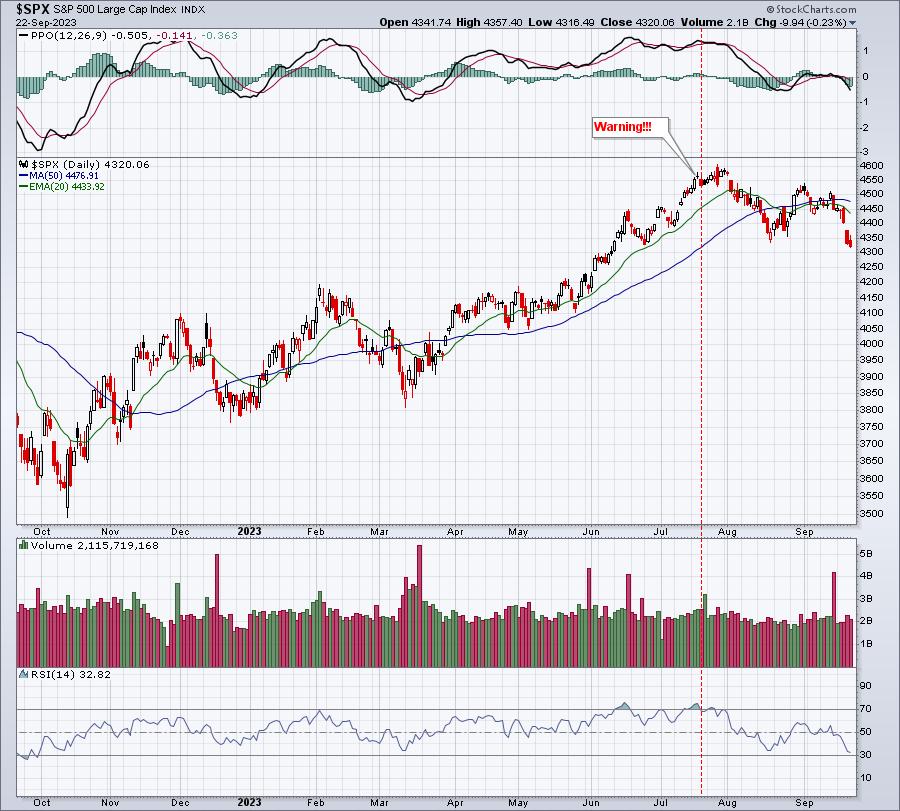

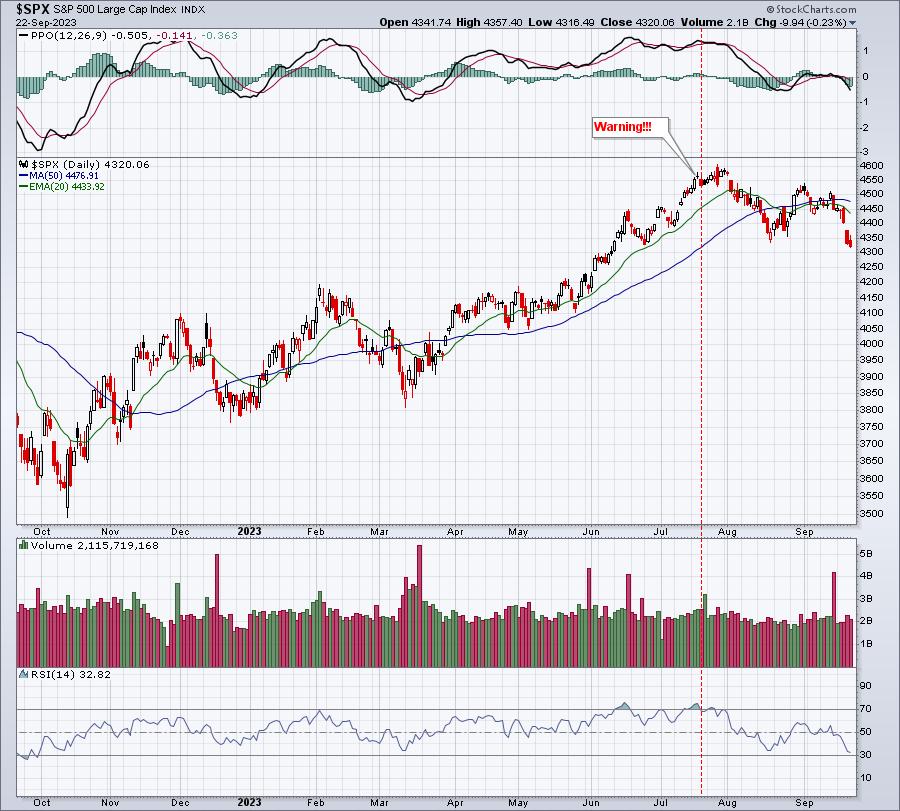

S&P 500 Head and Shoulders Top Confirmed

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The head and shoulders pattern is a classic price pattern that confirms an exhaustion of buyers.

* Investors should consider the three phases of price patterns, and make sure to confirm all three phases before taking action.

* This pattern yields a minimum downside objective of around 4080-4100 for the...

READ MORE

MEMBERS ONLY

Volatility Taunting Fresh Equity Buyers

This week I appeared with David Keller on Stockcharts Final Bar. We discussed how the market is at a precipice. And no doubt, the words I wrote on April 20th Daily "Now That "Stagflation" Has Gone Mainstream"some five months later are buzzing in my head:...

READ MORE

MEMBERS ONLY

Sector Rotation Signals an Important Week Ahead for Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Short Term, Risk-Off Sector Rotation While Heading into new week

* Did The Market Complete a H&S Top, or Is SPY Looking For Support?

* 430 Is The Crucial Level To Watch in SPY

First of all, my apologies for everybody who has been waiting for a Sector...

READ MORE

MEMBERS ONLY

SPIKE IN TEN-YEAR YIELD PUSHES STOCKS LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR BOND YIELD HITS 16-YEAR HIGH...Recent market messages have been focusing on the upturn in energy prices which threatened to boost inflation pressures and put upward pressure on bond yields. Those same messages have shown the 10-year Treasury yield nearing an upside breakout. That breakout took place this week...

READ MORE

MEMBERS ONLY

GNG TV: "Go" Trends in Rates & Dollar Causing Problems for Equity

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, with rates gapping higher and breaking above resistance, Alex and Tyler walk through the macro charts that can have an impact on markets. After discussing rates, they look at the dollar, which also is in a strong "Go" trend.

This...

READ MORE

MEMBERS ONLY

Confirmed! Head-and-Shoulders Top Pattern for the S&P 500!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Mish Schneider of MarketGauge shares why the most important ETFs to watch are Retailers (XRT) and Small Caps (IWM) and also shares their latest plugin on the StockCharts ACP platform. Host David Keller, CMT tracks today's risk-off move...

READ MORE

MEMBERS ONLY

Seasonality and Fundamentals Converging on GLD

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A convergence of fundamental and seasonality data predicts a potential decline in gold prices by the end of the year

* Demand for gold has decreased by about 5% year-over-year in the first half of 2023, with central banks being the primary buyers

* The Williams True Seasonal indicator aligns...

READ MORE

MEMBERS ONLY

1-2-3 Change in Trend Setup

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the 1-2-3 change in trend sequence in multiple timeframes. First, he discusses focuses on the higher timeframe and how to identify a zone or a pool of support. Then, he shows how to take advantage of...

READ MORE

MEMBERS ONLY

It's Time to Get Long

by Larry Williams,

Veteran Investor and Author

As a follower of my "Focus on Stocks" blog, you know we had a signal to sell on the opening Sunday night (10th day left).

That was forecast last month... now I think it's time to start to get long.

Where? At the August lows.

When?...

READ MORE

MEMBERS ONLY

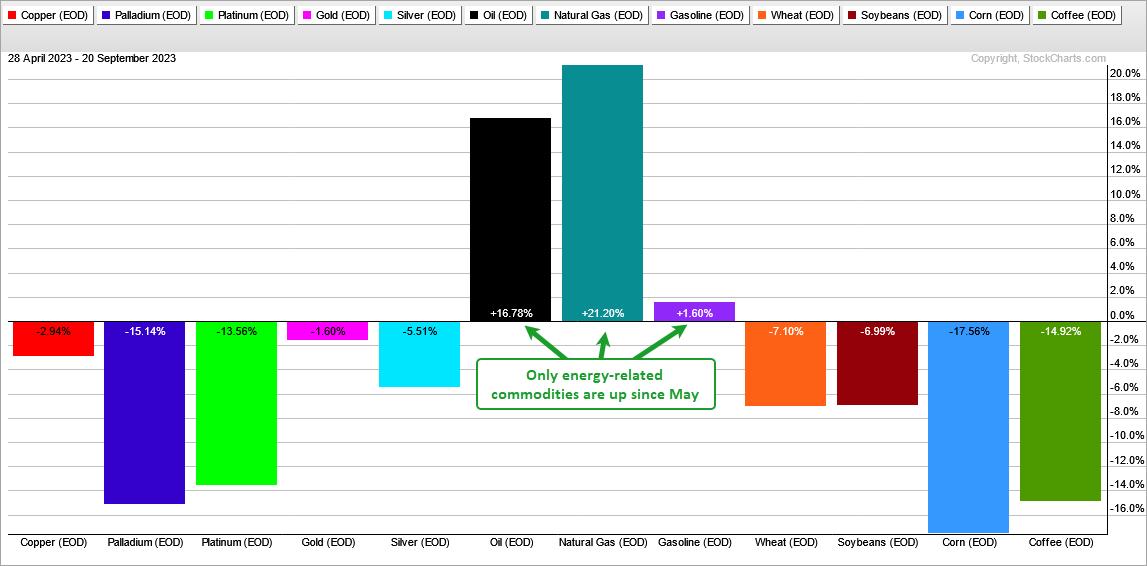

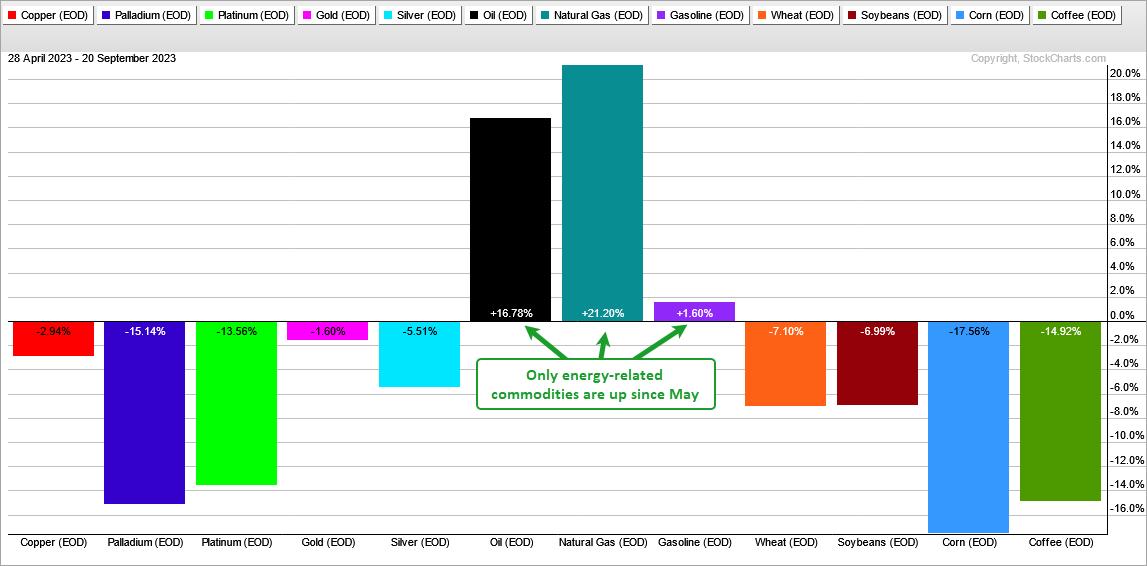

Energy-related Commodities Lead, but Oil Looks Vulnerable

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It has been a rough ride for most commodities this year and especially over the last 100 trading days (since May). Of the twelve spot prices I track, nine are up and three are down. Precious metals, base metals, lumber and grains are all down. The energy complex is the...

READ MORE

MEMBERS ONLY

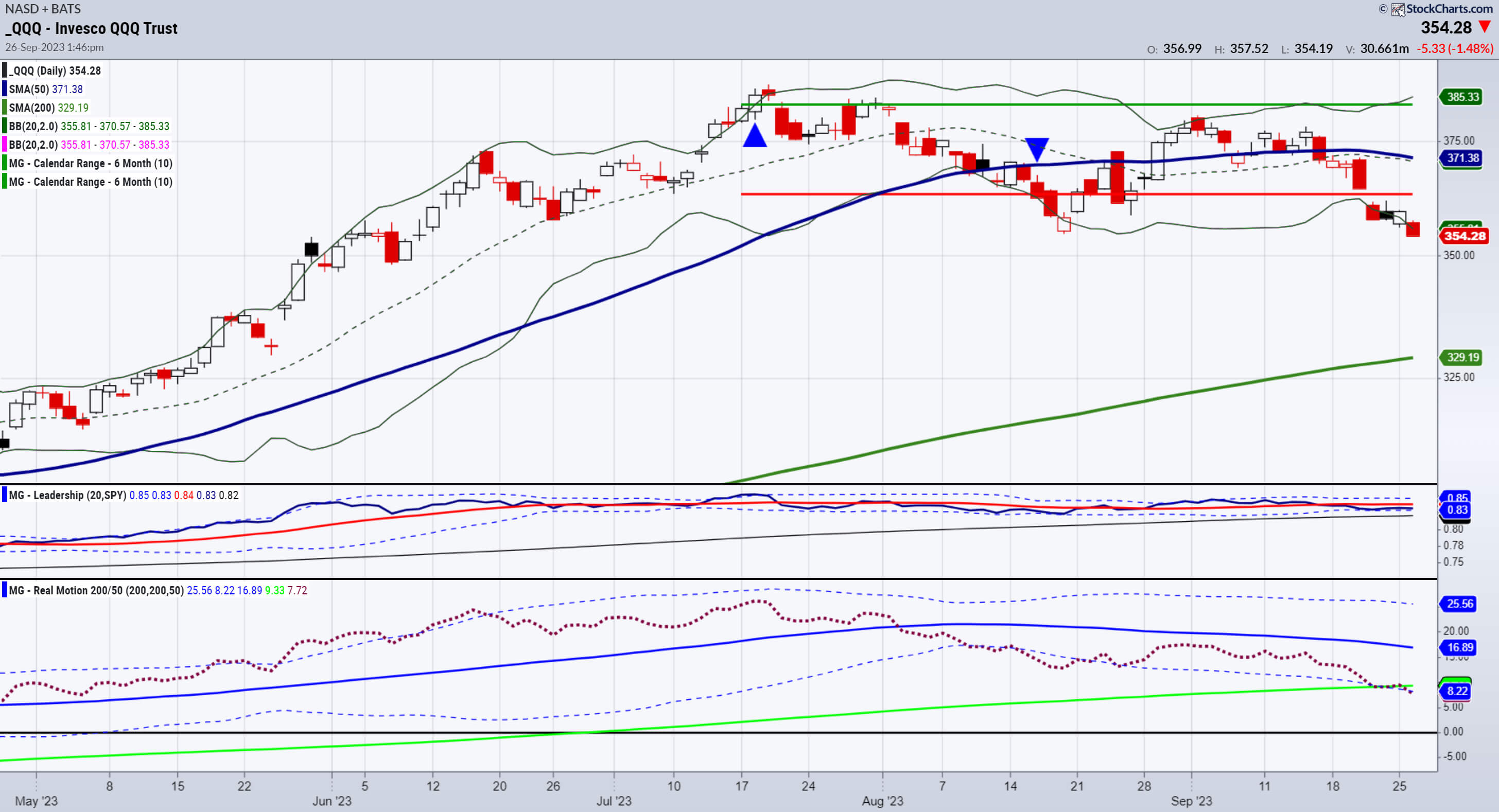

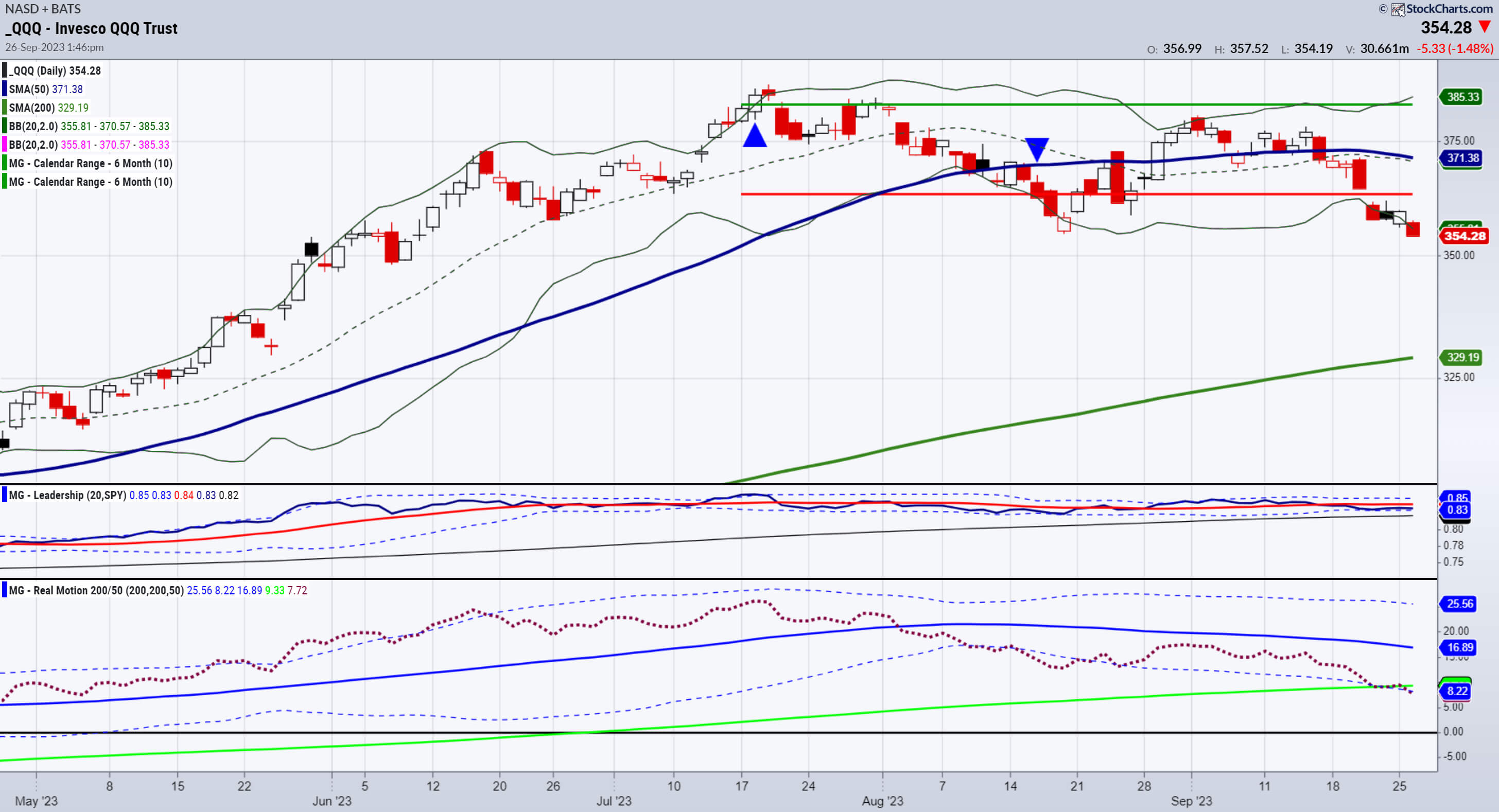

When Calendar Ranges, Leadership, Momentum and Price Align

We are so excited that StockCharts.com is now offering you our ACP plugins, we had to write about it for today's Daily, especially since you can read anywhere the thousands of differing opinions on what Powell said today and the implications for the market. Simply put, these...

READ MORE

MEMBERS ONLY

Fed Keeps Hands Off Rates, Leaves DOOR OPEN for More Hikes!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Danielle Shay of Simpler Trading joins Dave to discuss what's the technical take on the FAANG stocks after today's Fed announcement going into earnings season? Powell and Co. leave rates unchanged, leave the door open for...

READ MORE