MEMBERS ONLY

Sucker Rally?

by Carl Swenlin,

President and Founder, DecisionPoint.com

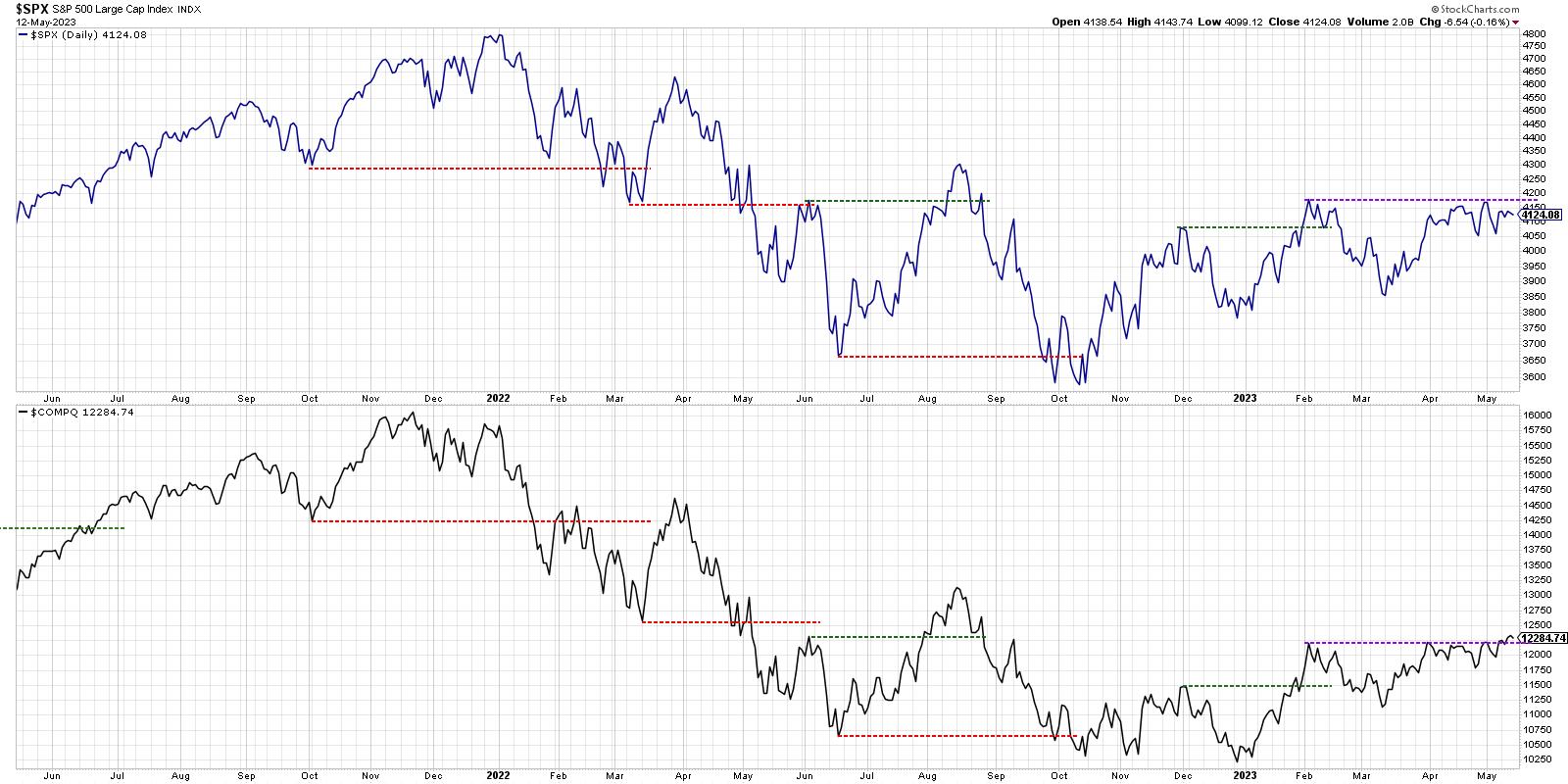

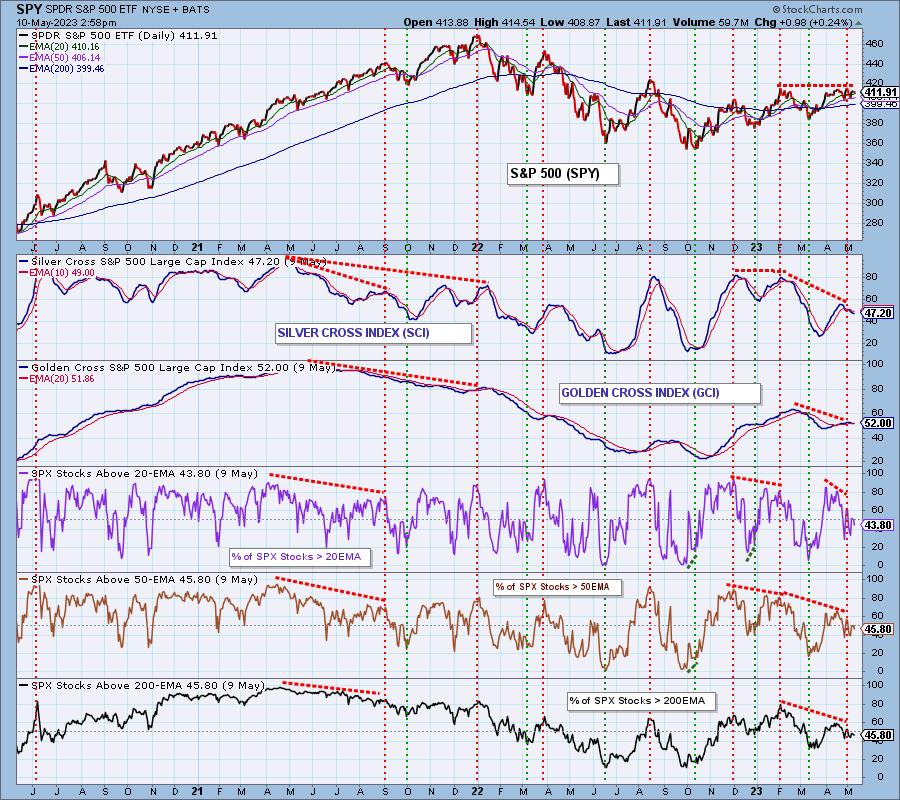

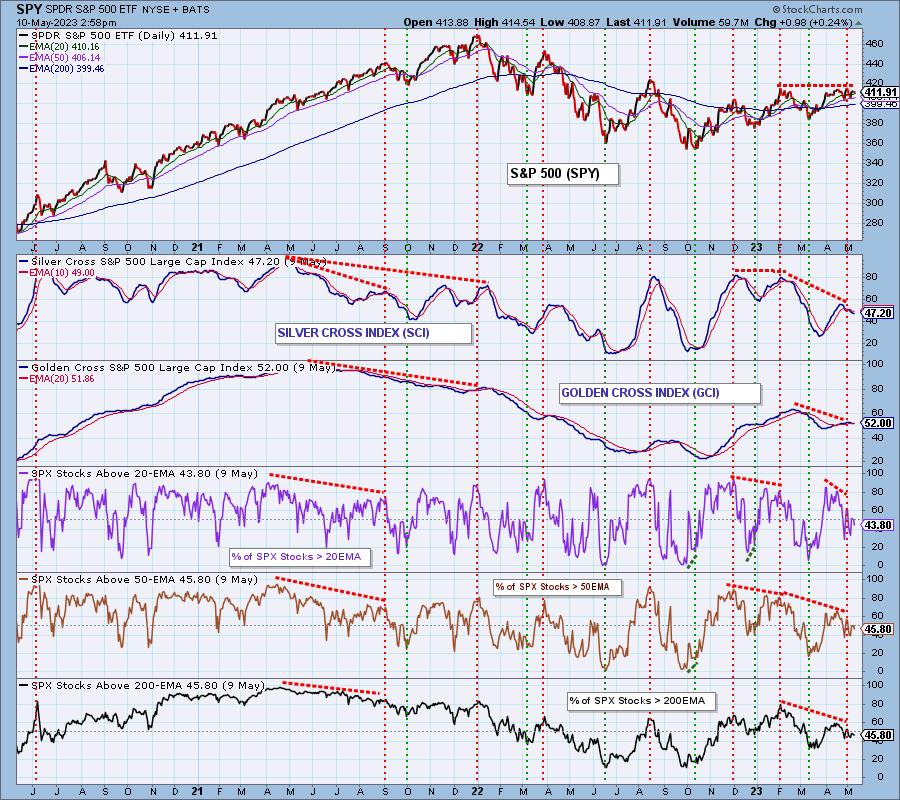

Considering our bearish outlook, this week's rally has been hard to watch; however, the configuration of the Silver Cross Index* (SCI) continues to show how this rally may ultimately fail. On the chart below, we can see in 2022 the market fell off the all-time price high, initiating...

READ MORE

MEMBERS ONLY

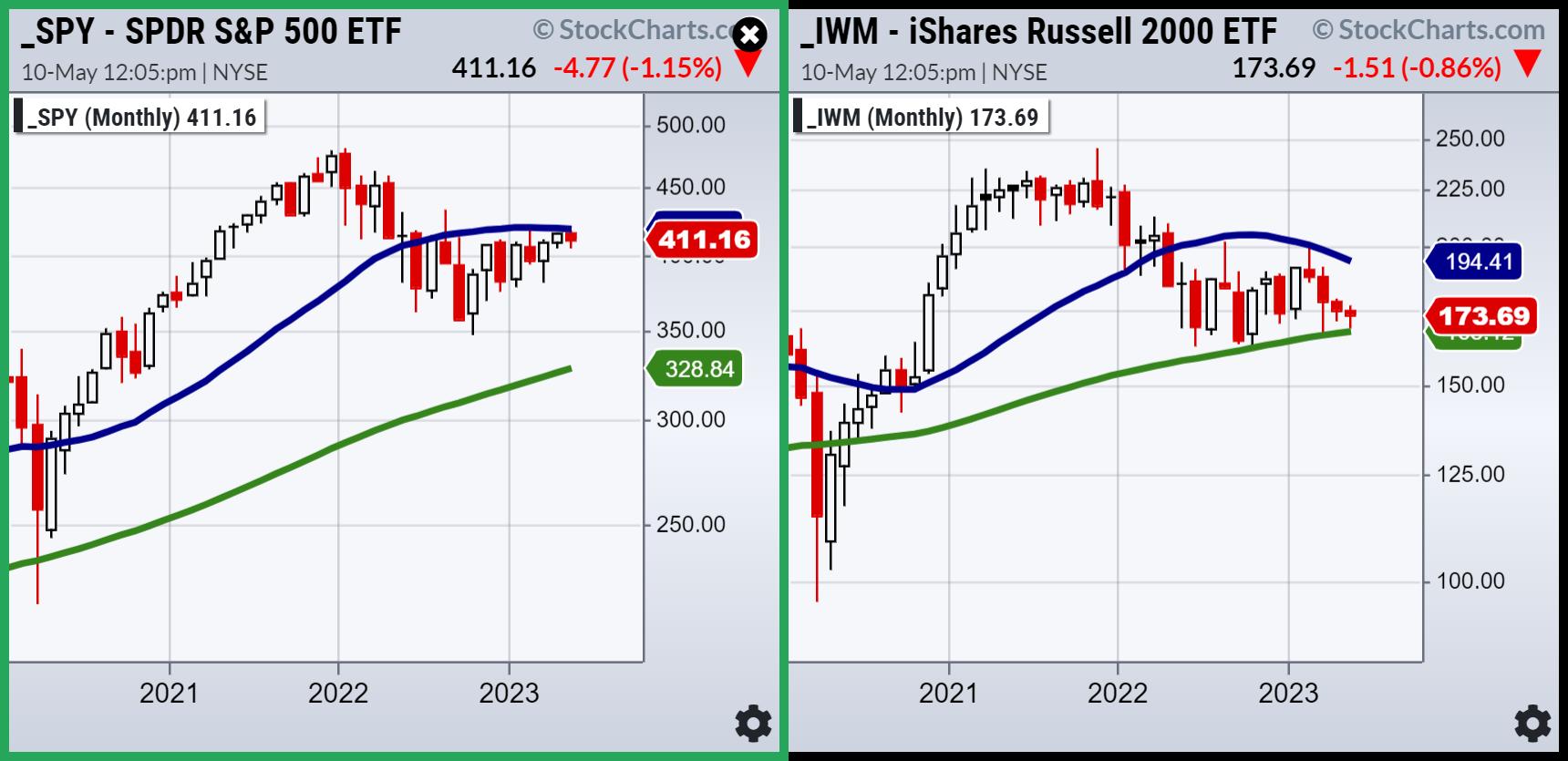

The Yin and the Yang of the Stock Market

We started out this year thinking that the economy stagnates, and inflation has a second wave or a super-cycle.

At this point, with 5 months into the year, the recent economic stats still support that our economy is contracting.

But those numbers are looking back not forward.

Risk factors which...

READ MORE

MEMBERS ONLY

Celebrating AAPI Heritage Month: Tony Zhang's Options Trading Journey

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

In honor of Asian American and Pacific Islander Heritage month, StockCharts spoke with a few individuals in the financial industry to hear about their challenges and experiences that have helped shape their careers in finance.

Tony Zhang, Chief Strategist at OptionsPlay, started in the financial industry at a very young...

READ MORE

MEMBERS ONLY

TECH STOCKS CONTINUE TO LEAD MARKET HIGHER -- MOST OTHER SECTORS, HOWEVER, CONTINUE TO LAG BEHIND THE S&P 500 FOR THE YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIG TECH STOCKS LEAD MARKET HIGHER... The largest stocks in the technology sector saw big gains during the week. That pushed the Invesco QQQ Trust to the highest level in more than a year as shown by the weekly bars in Chart 1. Technology and Communication Services SPDRS were the...

READ MORE

MEMBERS ONLY

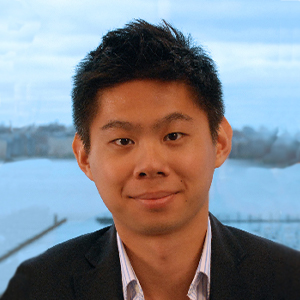

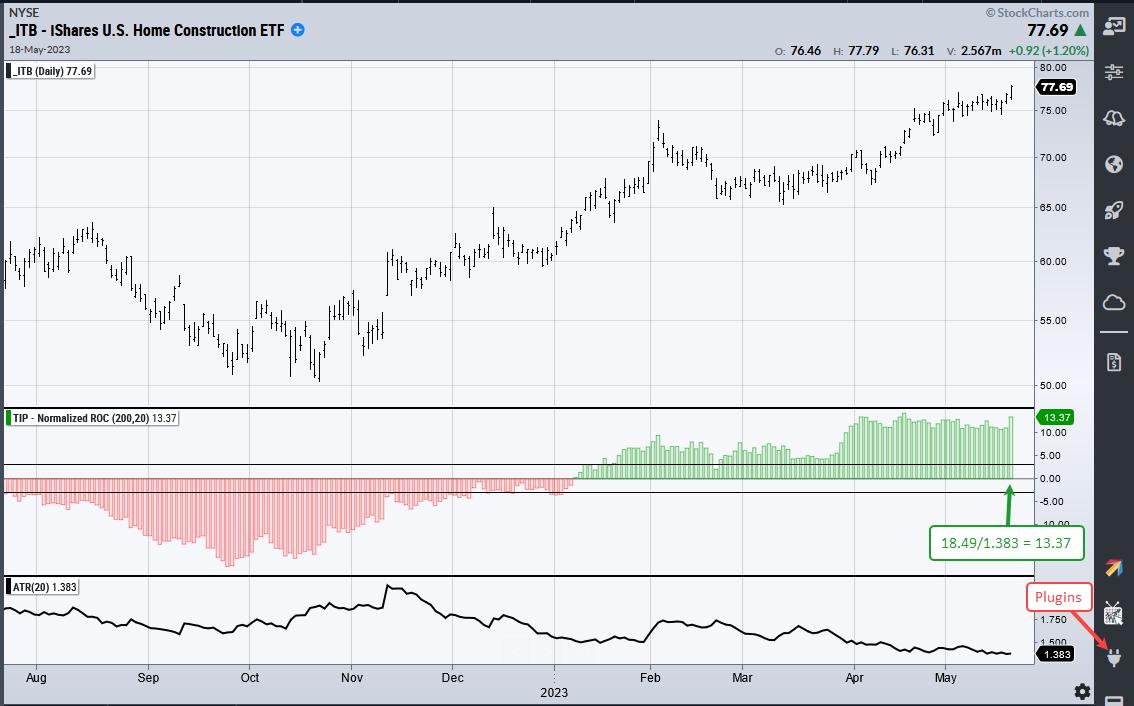

Finding the Leaders with ATR Momentum

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can find leaders by ranking ETF performance in ATR multiples, and there is even an indicator for that. Normalized-ROC puts point performance in ATR multiples and we can compare these values against others. Current Normalized-ROC leaders include the Home Construction ETF (13.37), the Technology SPDR (6.40) and...

READ MORE

MEMBERS ONLY

Natural Gas and Oil -- Always on the Radar

This week I wrote a Daily on USO, the US Oil Fund.

Plus, I did a video for CMC Markets on those 2 commodities plus on Dollar pairs with Yen, Euro, British Pound.

I wrapped things up with a look at Lithium (another Daily this week) plus a look at...

READ MORE

MEMBERS ONLY

Contrarian Trading Strategy: Scanning For Stocks to Fade

by Karl Montevirgen,

The StockCharts Insider

Fading an overextended market move is always tricky. Risky too. To go long on something you estimate is oversold, or to go short on an asset you think might be overbought, means capitalizing on a market sentiment misstep. And it takes guts to make a contrarian trade—you're...

READ MORE

MEMBERS ONLY

Does this Technology Rally Have Legs?

by Martin Pring,

President, Pring Research

In the last couple of months, we have seen a number of analysts and commentators point out that the current rally has been led by a handful of large-cap tech stocks and is therefore suspect. That observation suggests this week's extension to the advance is doomed. It'...

READ MORE

MEMBERS ONLY

GNG TV: "Building" Go Trends in US Equities

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, drilling into the equity landscape, Alex & Tyler share a GoNoGo Sector Relmap to find the sectors outperforming the rising S&P500. Leadership is now squarely focused on growth equity sectors – XLK, XLY, XLC – information technology, consumer discretionary, and communications are...

READ MORE

MEMBERS ONLY

Simplify Your Analysis By Using Moving Average Lines

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how to use the 18- and 40-SMA lines to define the trend in multiple timeframes. He explains what defines a trend, no trend as well as a transitional phase. He uses MSFT and TSLA for his...

READ MORE

MEMBERS ONLY

Bitcoin's Tug-of-War: Navigating the Bearish Trend Amid Potential Bullish Outlook

by Karl Montevirgen,

The StockCharts Insider

Bitcoin bears currently hold a slight edge in the ongoing technical tug-of-war for prices. The 'OG' crypto is about to break below a two-month support level, leaving BTC bulls scouring the next series of local lows either to scoop up more of the crypto or to exit an...

READ MORE

MEMBERS ONLY

The Long-term Trend of the US Dollar May Not Be as Bearish as You Think

by Martin Pring,

President, Pring Research

There has been a lot of talk recently about diversifying away from the dollar and it potentially losing its reserve status. The primary trend of the Dollar Index may be bearish, but the longer-term charts do not agree; they suggest that the dollar's death is greatly exaggerated. Let&...

READ MORE

MEMBERS ONLY

Analysts are Bearish While Risk-On Explodes!

The four ratio indicators track key intermarket relationships which identify risk on/off market conditions. These indicators can be used together to confirm or identify the strength of the core risk on/off indicator, which is the S&P 500 v. Utilities.

These charts come from our Big View...

READ MORE

MEMBERS ONLY

The Wisdom of Jesse Livermore, Part 5

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action with a recent Crypto trade where he's "free rolling." He also discusses how that's the secret to longer-term trading success. He then resumes his series on the wisdom of...

READ MORE

MEMBERS ONLY

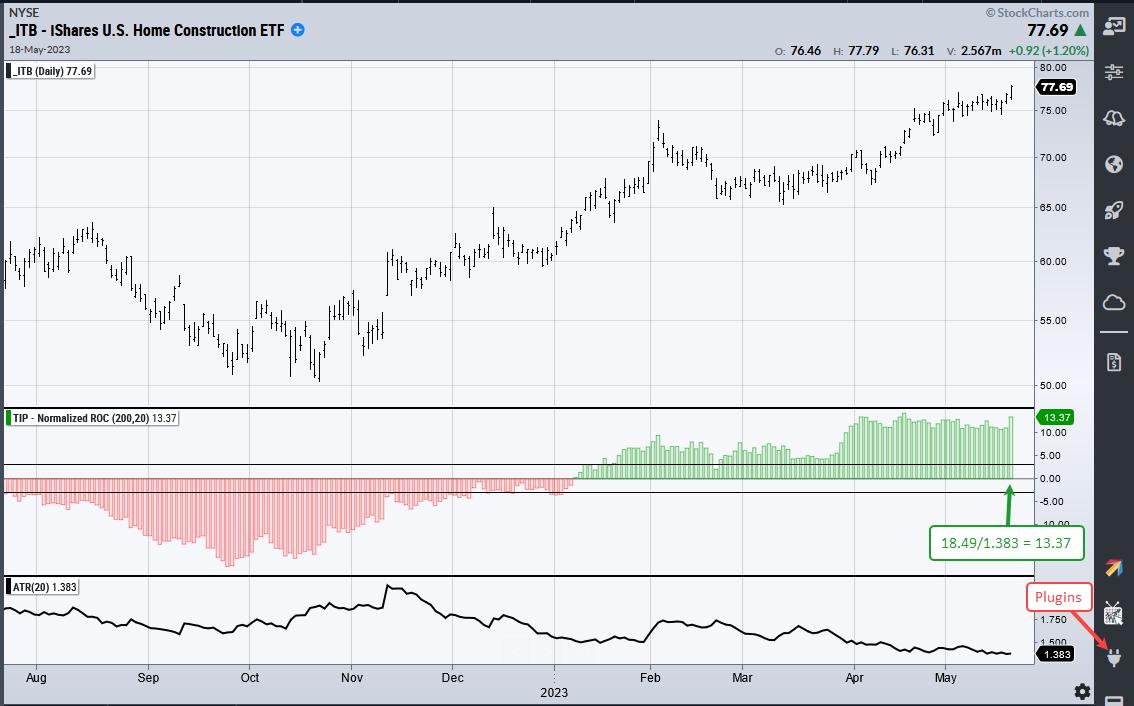

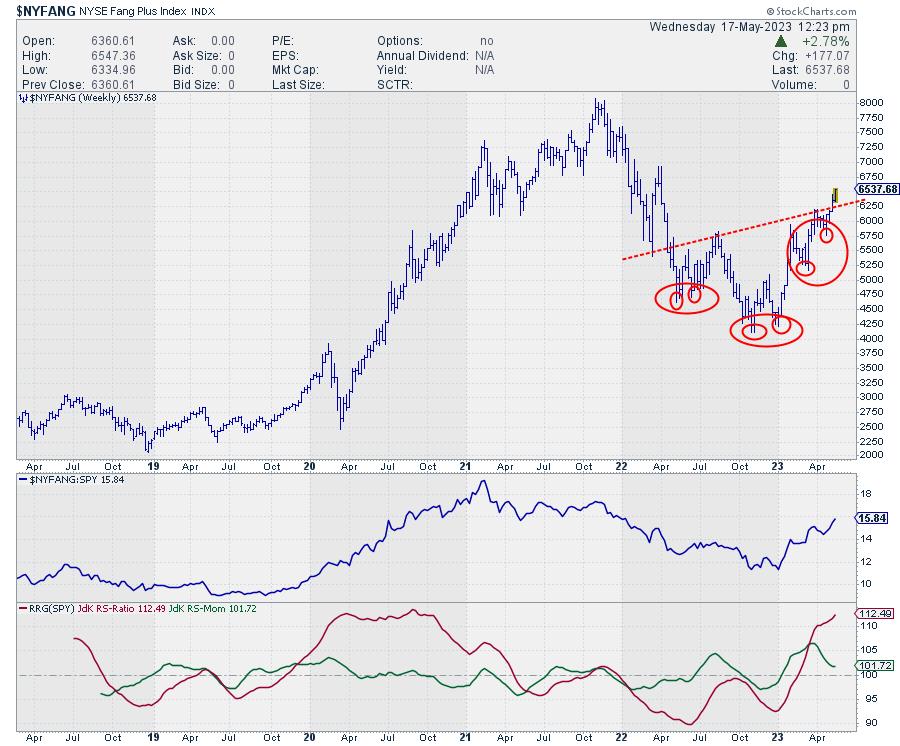

Superior NYFANG+ Performance Leaves S&P 500 in the dust

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The NYSE FANG+ index $NYFANG holds ten of the largest stocks in the US.

1. Alphabet - GOOGL

2. Snowflake - SNOW

3. META Platforms - META

4. NVIDIA Corp - NVDA

5. Amazon - AMZN

6. Microsoft - MSFT

7. Advanced Micro Devices - AMD

8. Apple - AAPL...

READ MORE

MEMBERS ONLY

Technical and Fundamental Analysis on Lithium

Most associate lithium with EV usage.

The largest holding in the Global X Lithium ETF (LIT) basket is Albemarle Corp. (ALB). The US-based company isn't purely a lithium business. It also produces chemicals related to petroleum refining and consumer electronics. Interestingly, Tesla (TSLA) is a holding in LIT...

READ MORE

MEMBERS ONLY

Trading Opportunities: Is Amazon Stock a Buy?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Amazon's stock price is starting to show some momentum. Will the stock break above its February high and ride to its next resistance level? Keep an eye on its SCTR score. If it stays above 70, this could be a nice ride.

The StockCharts Technical Ranking (SCTR) scan...

READ MORE

MEMBERS ONLY

Sector Spotlight: GOOGL and Double Benchmark RRGs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I take a look at developments on asset class level and more specifically, the USD and BTC. I then compare current cap-weighted sector rotation with its equal-weight equivalent to find some interesting differences. Finally, I re-introduce the...

READ MORE

MEMBERS ONLY

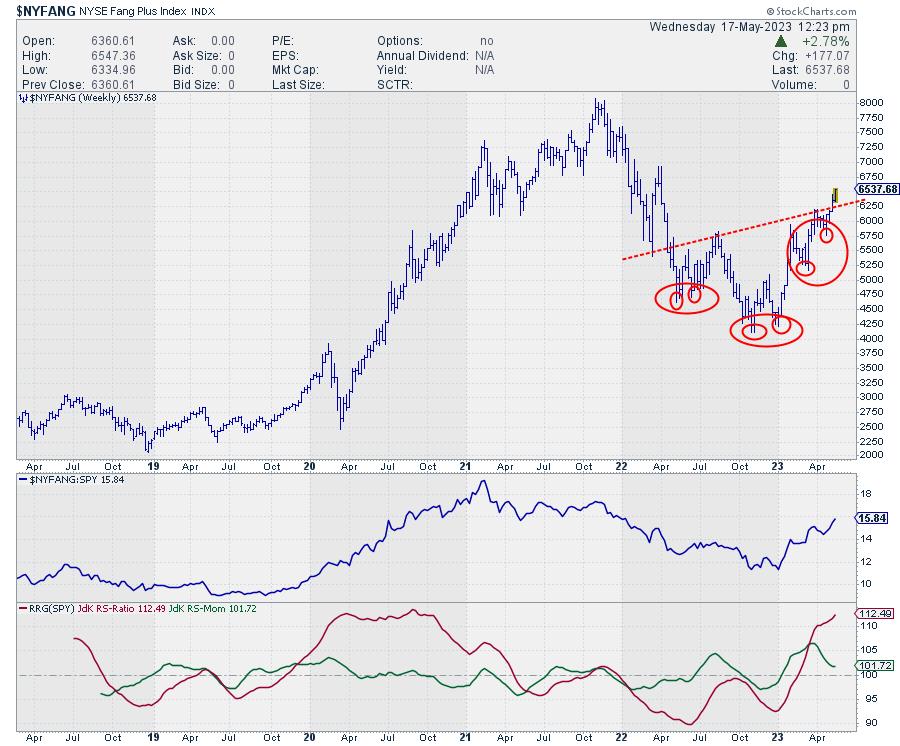

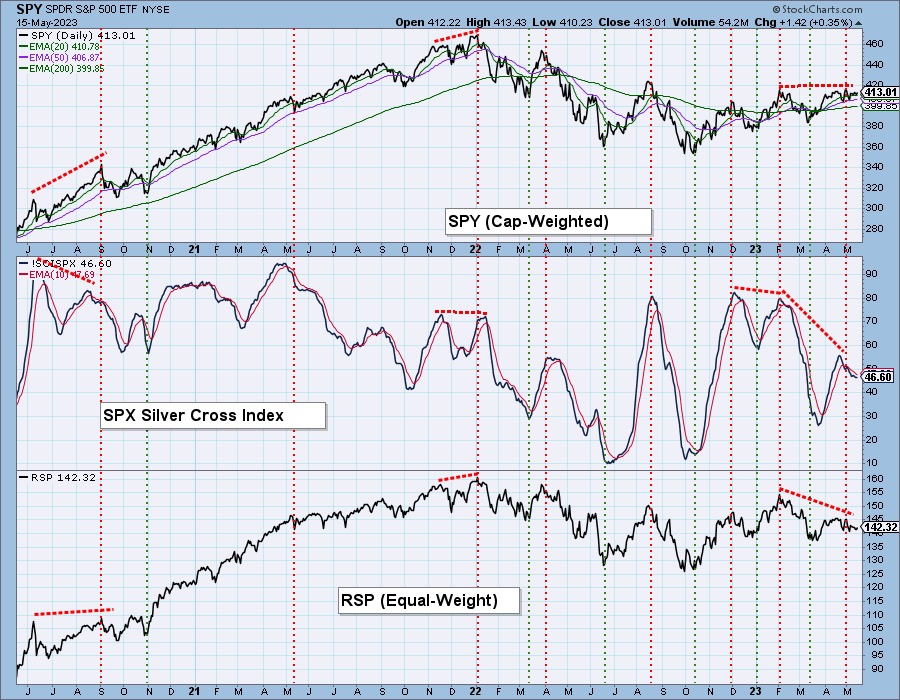

Severe Silver Cross Index Negative Divergence a Tip Off to Severe Decline?

by Erin Swenlin,

Vice President, DecisionPoint.com

Over the weekend, Carl decided to put together the chart below. We often make comparisons between the SPY and its equal-weight sibling, RSP. By determining divergences between the two ETFs, we can see whether the mega-cap stocks are leading the charge or whether a rally is supported by the rest...

READ MORE

MEMBERS ONLY

Harnessing Momentum: Jumping On the 52-Week Breakout (Before It Happens)

by Karl Montevirgen,

The StockCharts Insider

In the dynamic world of market prices, timing is often everything.

Knowing when to buy or sell is key to a successful trade. But how can you identify the opportune moment to make a move? One strategy many traders embrace involves focusing on stocks breaking their 52-week highs. This is...

READ MORE

MEMBERS ONLY

Technical and Fundamental Analysis on US Oil Fund

USO, the US Oil Fund ETF, invests primarily in futures contracts for light, sweet crude oil, other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels. Essentially, the top 6 holdings are crude oil futures from May to August--which, like futures, will continue to roll out...

READ MORE

MEMBERS ONLY

DP Trading Room: Why SPY, Not SPX? Dividends!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl begins the trading room by explaining negative divergences between the SPY and equal-weight RSP. He also covers why DecisionPoint uses the SPY and not the SPX; the reason is dividends, which he explains in detail later in the...

READ MORE

MEMBERS ONLY

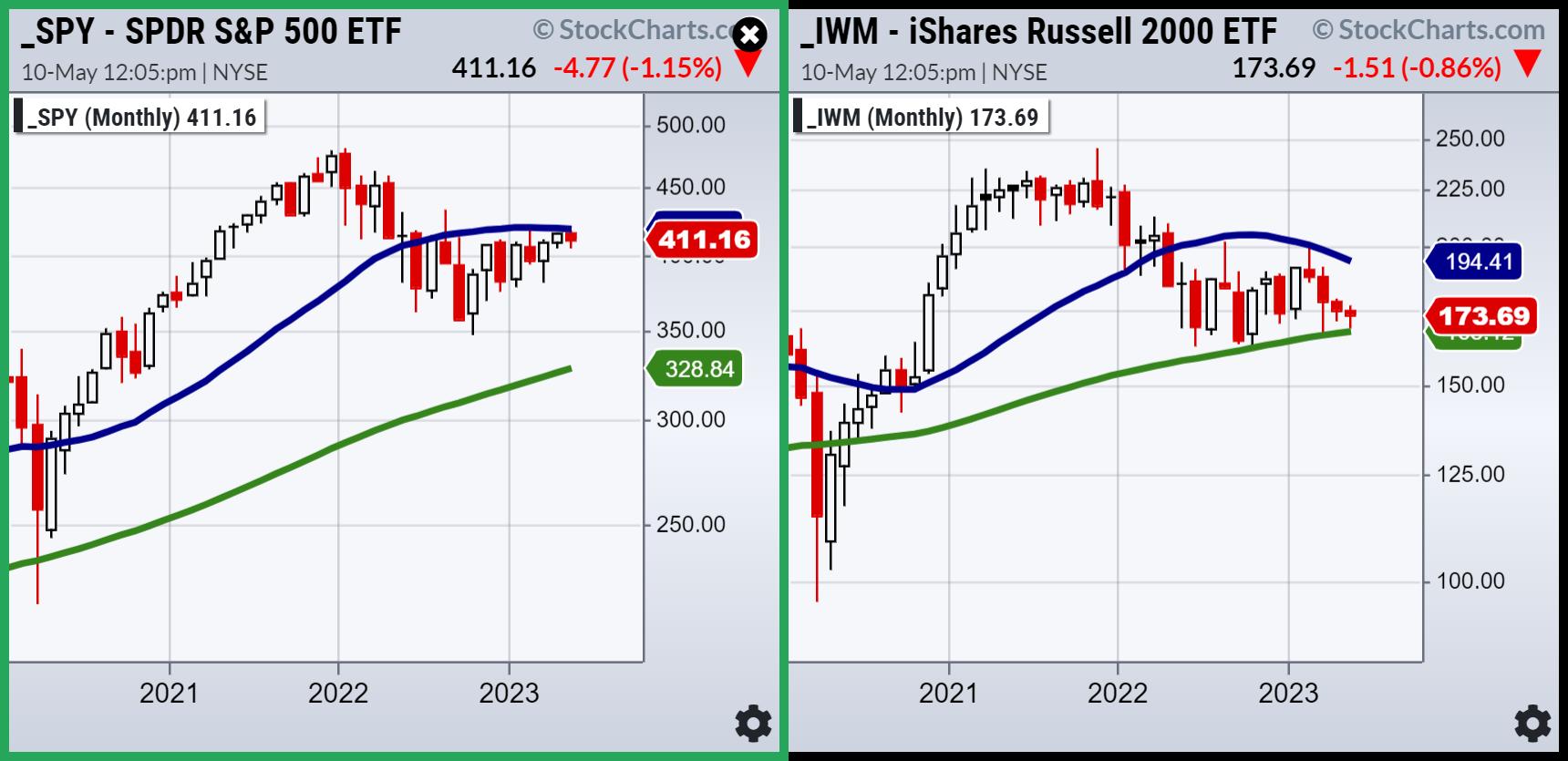

Where Are We? Can We Say This Is A Bull Market?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Price Action

Clearly, the most important aspect of the stock market is price action. That's where it all begins. Currently, I like the daily and weekly charts, but we do still have one very important price resistance level to clear:

S&P 500 - Weekly:

There are...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See A Quiet Start; Only a Few Sectors Show Strength on RRG

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

VIX rose through the week, and so did the NIFTY. Over the past five sessions, the Indian equity markets continued to inch higher, showing a lot of resilience, and ended with a modest gain over the week. Over the past several weeks, the persistently low levels of VIX have remained...

READ MORE

MEMBERS ONLY

High-Yield Opportunities for an Uncertain Market

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets remain in a tight trading range amid mixed inflation data and a slowdown in the number of earnings being reported last week. With the bulls looking for a soft landing as the Fed pauses their rate hike campaign, the bears are fearing a more harsh recession due to...

READ MORE

MEMBERS ONLY

Ending the Sloppy Choppy Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the last two weeks, I've heard this market described as "frustratingly neutral", "decidedly sideways", "stuck", and my personal favorite, the "sloppy choppy" phase. So how does the market breakout of this sideways period and move into a new bullish...

READ MORE

MEMBERS ONLY

Is "Wonder Woman" Semiconductors Immortal?

Sister Semiconductors is a character and leading sector in the Economic Modern Family.We use the ETF SMH to represent her contribution to the market, family, and economy.

The cartoon you see reflects some of her Wonder Woman-like superpowers as I created the image from AI. Yes, AI. Cool, huh?...

READ MORE

MEMBERS ONLY

MEM TV: Top Strategies to Outperform This Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews ways to outperform during this tough market. In addition to sharing pockets of strength, she also highlights stocks in a position to trade higher after reporting strong earnings. Most importantly, she shares key resistance and support for...

READ MORE

MEMBERS ONLY

Looking for Strong Stocks to Buy? Start with These Three Tools

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you three of the quickest, easiest, most effective ways to find strong stocks – and funds – in just a few simple clicks. Armed with the power of SCTRs – the StockCharts Technical Ranking system – you'll...

READ MORE

MEMBERS ONLY

Indexes Masked by Mega Tech

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, I spoke about a turning point in the market. This week, not much has changed for the major indexes, but underneath the surface strength is not easily found. Money is hiding out in a handful of the biggest names, and...

READ MORE

MEMBERS ONLY

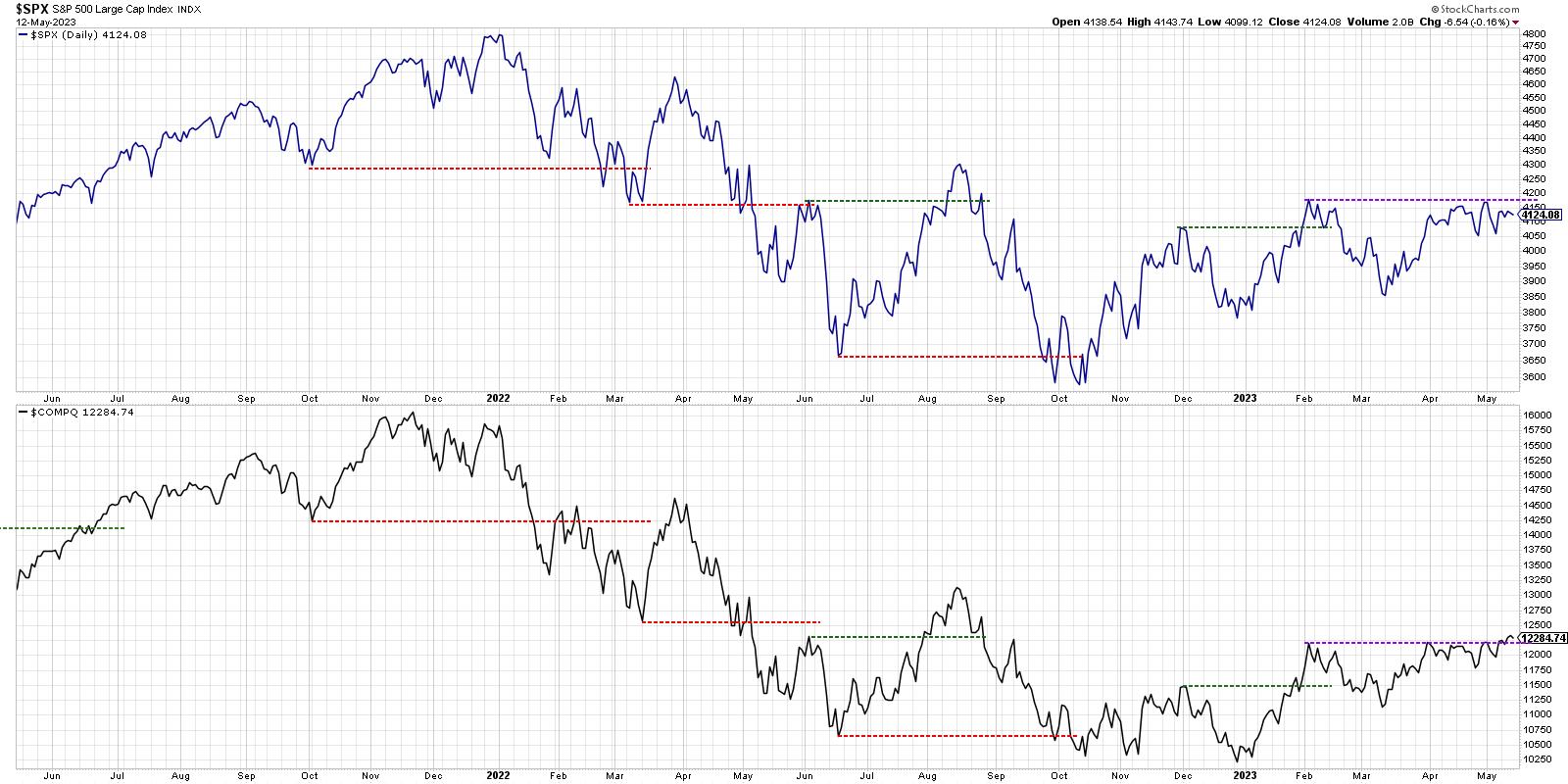

MARKET BREADTH REMAINS WEAK -- FINANCIALS AND MATERIALS LEAD DECLINE -- WEAK COPPER AND REGIONAL BANKS WEIGH ON MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

BAD BREADTH CONTINUES... Several recent messages have demonstrated poor stock market breadth. Unfortunately, that negative situation hasn't shown any improvement. One of the charts used to demonstrate that negative situation is repeated below. Chart 1 compares the S&P 500 Large Cap Index (black bars) to the...

READ MORE

MEMBERS ONLY

Three ROCs can be Better than One

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking for momentum leaders should consider more than one timeframe. A stock may be leading over the last 200 days, but lagging over the last 100 days. Similarly, a stock could show big gains the last 100 days, but still be down over the last 200 days. Measuring performance...

READ MORE

MEMBERS ONLY

Inflation's Cooling, But Stock Market Isn't Celebrating: What Gives?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When inflation is a huge concern, you'd think the stock market would celebrate in a big way when inflation shows signs of cooling. Not so much.

April consumer price index (CPI) and producer price index (PPI) data came close to estimates. Headline CPI rose 0.4% in April...

READ MORE

MEMBERS ONLY

Currencies, Metals and Soft Commodities

Today, I am including a clip that covers currency pairs and several commodities.

The four-chart screen is a daily screenshot of gold (GLD), sugar (continuous contract), the US dollar to the Euro (USDEUR) and platinum continuous contract (PLAT). Gold is falling from its recent highs. Sugar has run into some...

READ MORE

MEMBERS ONLY

GNG TV: BEER Stocks -- Own What You Know

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Legendary investor Peter Lynch told the world to "own what you know" – meaning use the products and services of companies in the equity market. The Top-Down approach to market analysis yielded some interesting idea generation today. In this edition of the GoNoGo Charts show, using GoNoGo Charts on...

READ MORE

MEMBERS ONLY

Trade Pullbacks -- 3 Things to Know

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses the 3 criteria he uses when evaluating a pullback trade to determine whether to buy. He shows how to evaluate the higher timeframe, then the lower timeframe for key criteria. If both are met, Joe explains...

READ MORE

MEMBERS ONLY

Fresh Macroeconomic Look after CPI

I was honored to spend time on Making Money with Charles Payne, which airs on Fox Business, and give a brief glimpse into why I'm not as bearish right now based on the macro. (link below)

My macro take based on business cycles and zooming out on the...

READ MORE

MEMBERS ONLY

Market Participation Is Dismal

by Carl Swenlin,

President and Founder, DecisionPoint.com

When we talk about "participation," we are referring to the number of stocks actually taking part in a given market move. Presently, we are looking at the rally from the October lows and the indicators we use to assess it. First, we have our Silver Cross Index (SCI)...

READ MORE

MEMBERS ONLY

The Wisdom of Jesse Livermore, Part 4

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action by showing a recent stock pick that he believes has tremendous potential. He then continues his series on the wisdom of Jesse Livermore. This week, he focuses on the fact that you must be patient...

READ MORE

MEMBERS ONLY

Stock Picks from the 2023 Market Outlook

The Market Outlook for 2023was written in December 2022.

I have a designated radar screen for all the predictions and stock picks. The picks especially remain a focus for short-term and longer-term trades, depending on market conditions. In December, I wrote, "This stock, Tetra Tech (TTEK) made our radar...

READ MORE