MEMBERS ONLY

BANK WEAKNESS WEIGHS ON MARKET -- PLUNGE IN BOND YIELDS SHOWS FLIGHT TO SAFETY -- THAT'S HELPING GOLD AND TECH STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANK INDEX WEIGHS ON STOCKS...Despite day to day volatility, major stock indexes are trying to hold onto small gains for the week and are trying to hold underlying support levels. The black bars in Chart 1 show the S&P 500 bouncing last week off potential support at...

READ MORE

MEMBERS ONLY

Tickers Still Bullish

by TG Watkins,

Director of Stocks, Simpler Trading

The SPY is down twice now after the FOMC, where Powell continued to hike rates with another 25BPS. Despite that, there are still many sectors and tickers that are bullish. Of course this can change and we need to always be on guard for that, but, on this week'...

READ MORE

MEMBERS ONLY

NVDA Stock: Waiting For a Big Plunge?

by Karl Montevirgen,

The StockCharts Insider

Racing ahead of the semiconductor pack, Nvidia (NVDA) appears to be edging toward the upper regions of a parabolic curve.

What Does This Mean for NVDA Stock Price?

It's a sign of confidence coming off a strong Q4 2022 earnings performance on top and bottom lines. NVDA surprised...

READ MORE

MEMBERS ONLY

Will the Generals follow the Troops?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Small-caps are leading the way lower and breadth indicators are showing some serious deterioration under the surface. Large-caps are holding up for now, but keep in mind that weakness in small-caps foreshadowed the January 2022 peak in SPY. Today's article will compare price charts for SPY and IWM,...

READ MORE

MEMBERS ONLY

Confirming the 1-2-3 Reversal

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the higher timeframe to help confirm a 1-2-3 change in trend on the lower timeframe. In many cases, the cross of key MA lines will coincide with this potential reversal signal. Joe then...

READ MORE

MEMBERS ONLY

Were There Technical Warnings Ahead of the Regional Banking Crash? Oh, Yeah!

by Carl Swenlin,

President and Founder, DecisionPoint.com

With the recent crash of the SPDR S&P Regional Banking ETF (KRE), you may wonder if there were adequate technical warnings ahead of the crash. Yes, there were. (To clarify, we're looking for reasons not to be long KRE.)

1. To begin, last April, the KRE...

READ MORE

MEMBERS ONLY

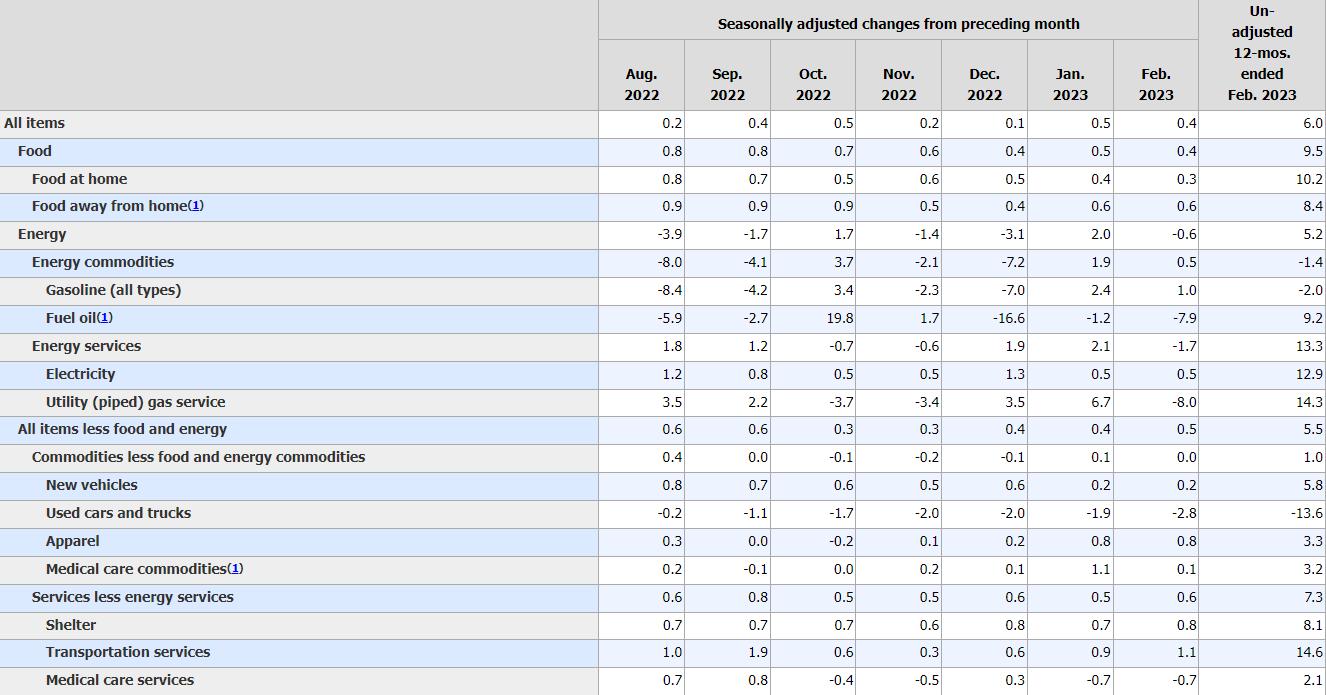

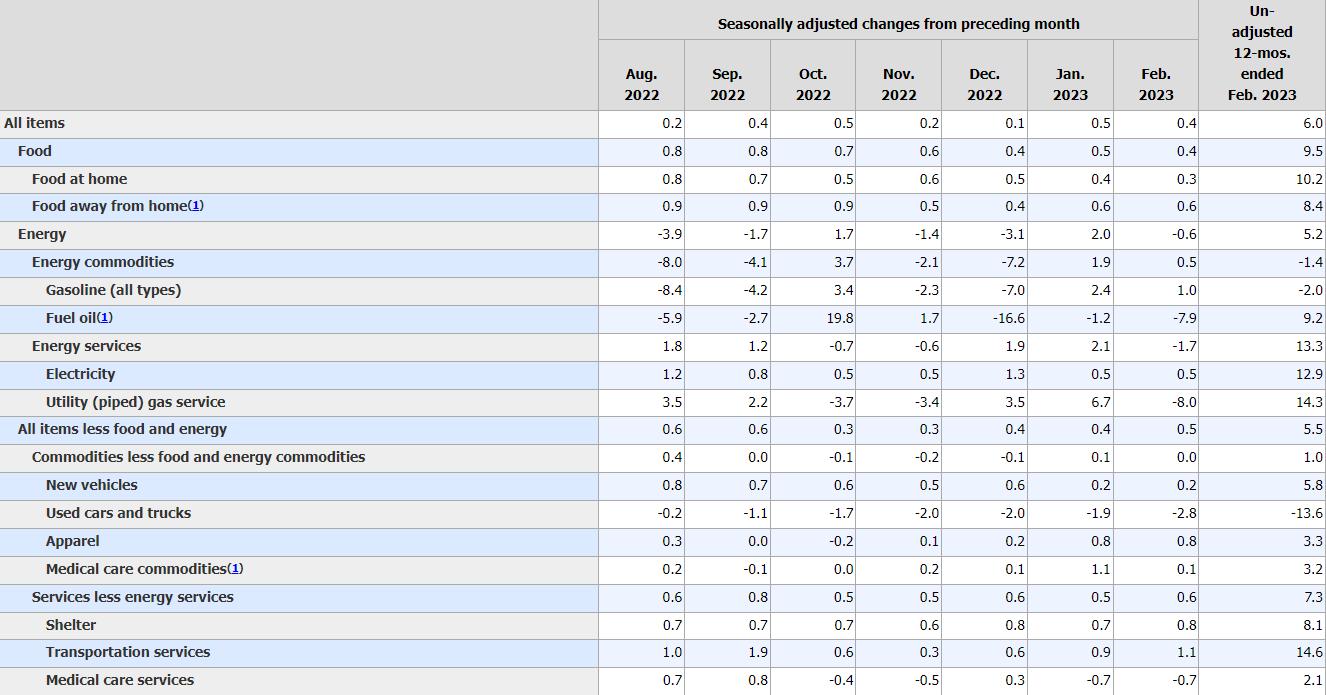

Two Big Signs of Stagflation

The Federal Reserve raised rates by 25 basis points. The decision was unanimous. The terminal rate projection is unchanged at 5.1%.

The FOMC statement modifies guidance: "The committee anticipates that some additional policy firming may be appropriate."

My first tweet @marketminute this morning before the market opened:...

READ MORE

MEMBERS ONLY

Managing Fear and Expectations

by Dave Landry,

Founder, Sentive Trading, LLC

All trades, no matter how well thought out, have the potential to end in a loss. Therefore, we must manage our expectations and be willing to accept risk and fear as part of the trading process. In this week's edition of Trading Simplified, Dave discusses ways to deal...

READ MORE

MEMBERS ONLY

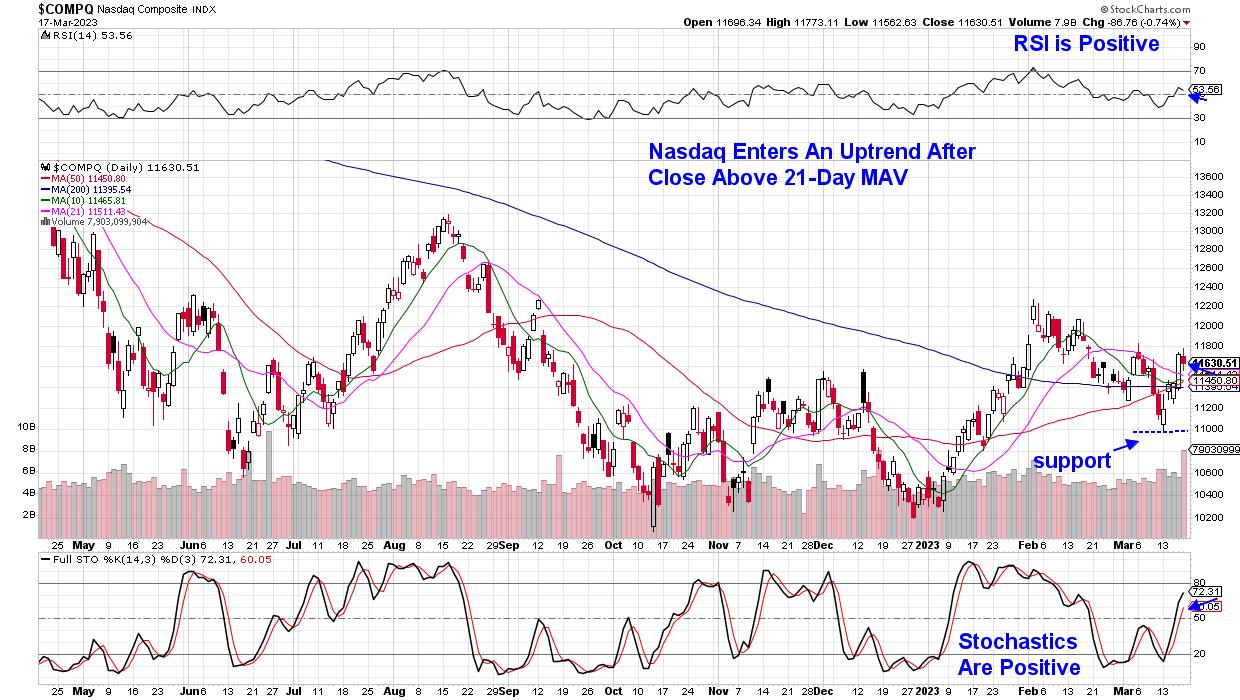

The Bears Are On Life Support And Hoping For A Fed Miracle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The end is at hand. Bears, just surrender now. Since the mid-June low (where I called the S&P 500 bottom), we've seen the fed funds rate jump from 1.00% to 4.75%. Of course, all we've heard since then is what?

Don'...

READ MORE

MEMBERS ONLY

The Market's Contagious Buzz: What About the China/Russian Brah-Fest?

The market buzz can be quite contagious.

* "Market didn't collapse on the bank news-must be bullish."

* "Yellen will save the day buy making sure depositors are safe."

* Yellen herself: "We have an economy that is performing very well."

And, of course, we...

READ MORE

MEMBERS ONLY

Sector Spotlight: When Stocks are Not Marked Down on Bad News

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I talk you through my assessment of what's going on in terms of sector rotation and how that connects with my observations of the S&P 500 chart. Following that assessment of current market behavior, I then...

READ MORE

MEMBERS ONLY

The Halftime Show: Is Tech Becoming a Safe Haven?

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete discusses the noise that's been driving the markets, starting with Silver Gate and moving in to speculation on Silicon Valley and Signature banks. Although he can't believe it, he talks about the idea of...

READ MORE

MEMBERS ONLY

DP Trading Room: ETFs vs. Indexes

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens the trading room discussing why DecisionPoint.com uses ETFs for signal changes versus actual Index readings. He also explains how the Price Momentum Oscillator (PMO) has different meanings when it is above or below the zero line....

READ MORE

MEMBERS ONLY

Where is the Market Finding Joy?

Where is the market finding joy? Is it here, in the Russell 2000 (IWM)? Let's check out the weekly chart.

The 50-week moving average just crossed below the 200-week moving average. That is bearish. The Leadership Indicators shows IWM well underperforming the SPY; also bearish. The Real Motion...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Hangs in Balance Near Crucial Supports; Important to Defend These Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week remained a technically damaging one, as the NIFTY violated a few important supports while closing on a negative note. The volatility, too, increased; however, this was on the expected lines. The past five days also saw the global markets dealing with the collapse of SVB (SVIB); the...

READ MORE

MEMBERS ONLY

Here's What the Markets are Telling Us - And It's Not All Bad

by Mary Ellen McGonagle,

President, MEM Investment Research

It was another wild week for the markets, as turmoil amid the Banking industry spread to other areas. Oil prices slid to 1-year lows and Treasury yields skidded lower. Other commodities also fell, while global-facing Industrial companies took it on the chin. Overall, the price action highlighted investors' shift...

READ MORE

MEMBERS ONLY

Market Trend Model Turns Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This week, stocks started in a position of strength and ended in a position of weakness. While some groups, like semiconductors, have managed to remain strong, the major benchmarks managing to pound out a positive return for the week, the broad market message appears cautious-at-best by my read.

My main...

READ MORE

MEMBERS ONLY

CHAOS-Insert Any Headline Here-BUY #GOLD

When we wrote How to Grow Your Wealth in 2023,we began with

* Chaos

* Trying to Fit a Square Peg into a Round Hole

* Looking for Inflation in All the Wrong Places

Could we have known at the time what headlines would emerge? No. Yet what was obvious is that...

READ MORE

MEMBERS ONLY

MEM TV: Cross Currents Driving Market Action

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen walks through the broader markets and sector rotation, before drilling down into the market dynamics that are driving earnings and analysts upgrades. She finishes out the show by highlighting some defensive names, gold stocks, and software companies to...

READ MORE

MEMBERS ONLY

Four Ways to See the World's Second-Most Important Indicator

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson explores four unique ways to chart, and analyzes what many would argue is the 2nd most important technical indicator of them all: Relative Strength! Using some creative chart setup tricks in both SharpCharts and ACP, Grayson...

READ MORE

MEMBERS ONLY

Trading Legend Larry Williams' 2023 Market Forecast and Trading Setups

by Karl Montevirgen,

The StockCharts Insider

In a recent StockCharts special presentation, Larry Williams revealed his detailed forecast of the broader US market, gold, and stocks Apple (AAPL), AMD (AMD), and Amazon (AMZN).

A Quick Preface to Larry Williams' Presentation

In the early 2000s, at the start of my finance-related career, I came across two...

READ MORE

MEMBERS ONLY

Tug of War

by TG Watkins,

Director of Stocks, Simpler Trading

The financial crisis helped to bring interest rates back down, which is benefiting tech and the growth sector. But the Energy sector is starting to decline which implies a weakening economy. And interest rates going down could be for the bad reason, not the good reason. In this week'...

READ MORE

MEMBERS ONLY

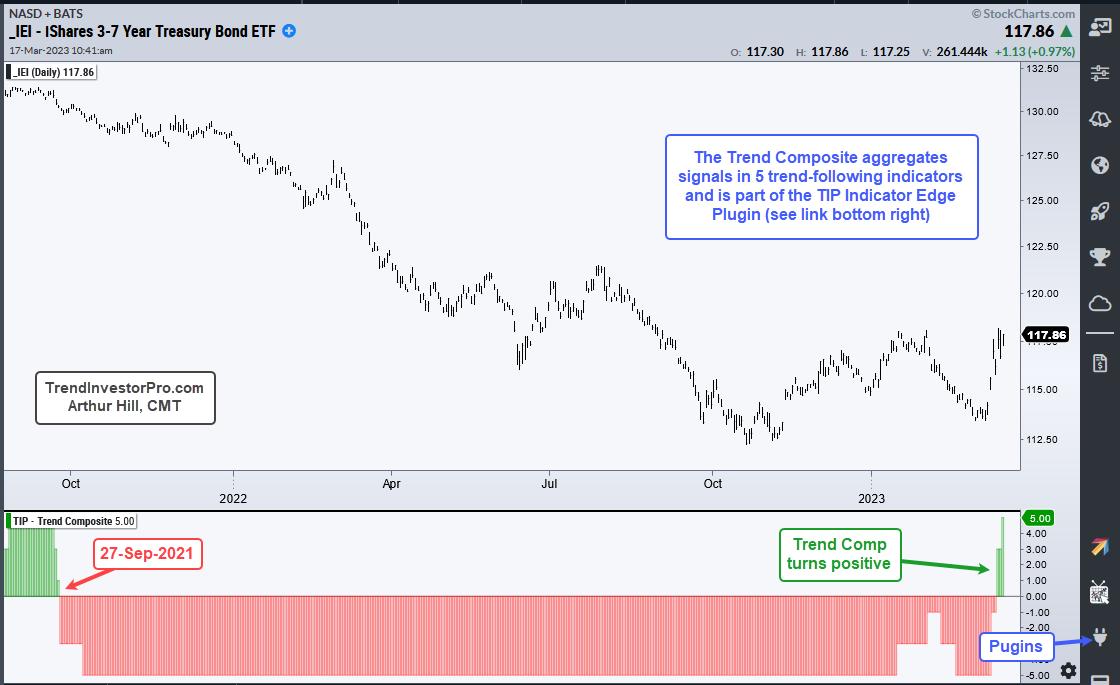

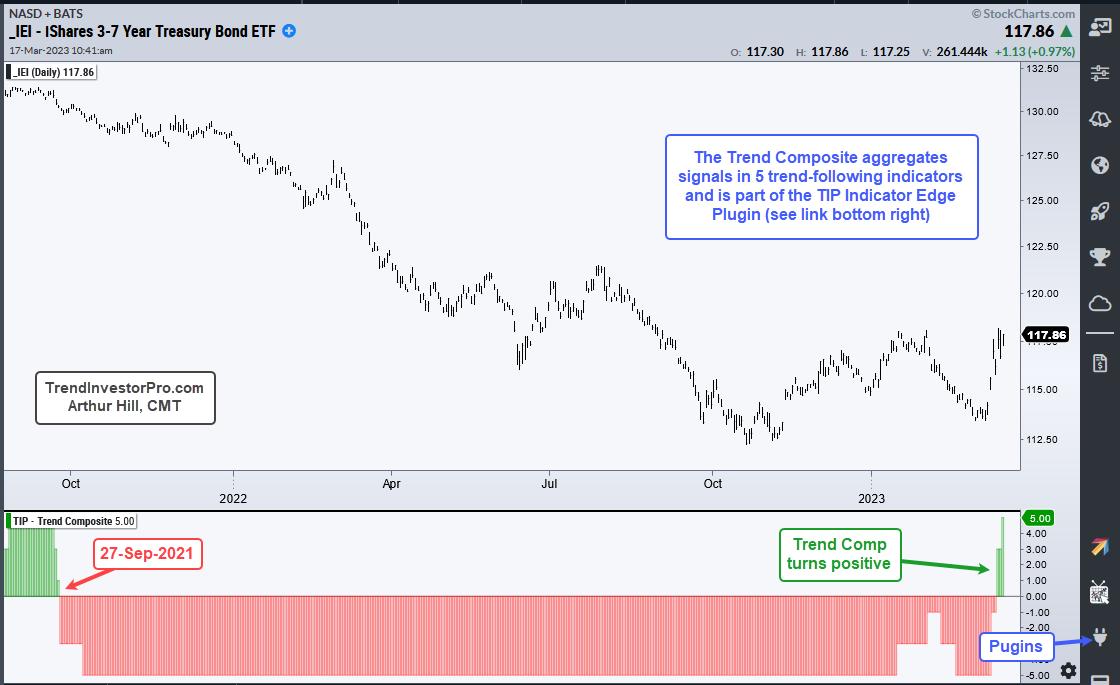

A Risk-off Alternative Turns Up as Stocks Falter

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Sometimes markets trend, sometimes they oscillate and sometimes they simply frustrate. I would venture to guess that trading since 2022 falls into the frustration basket. Trend following and momentum strategies are suffering because big moves are failing to extend and develop into trends. Mean-reversion strategies were doing well, but got...

READ MORE

MEMBERS ONLY

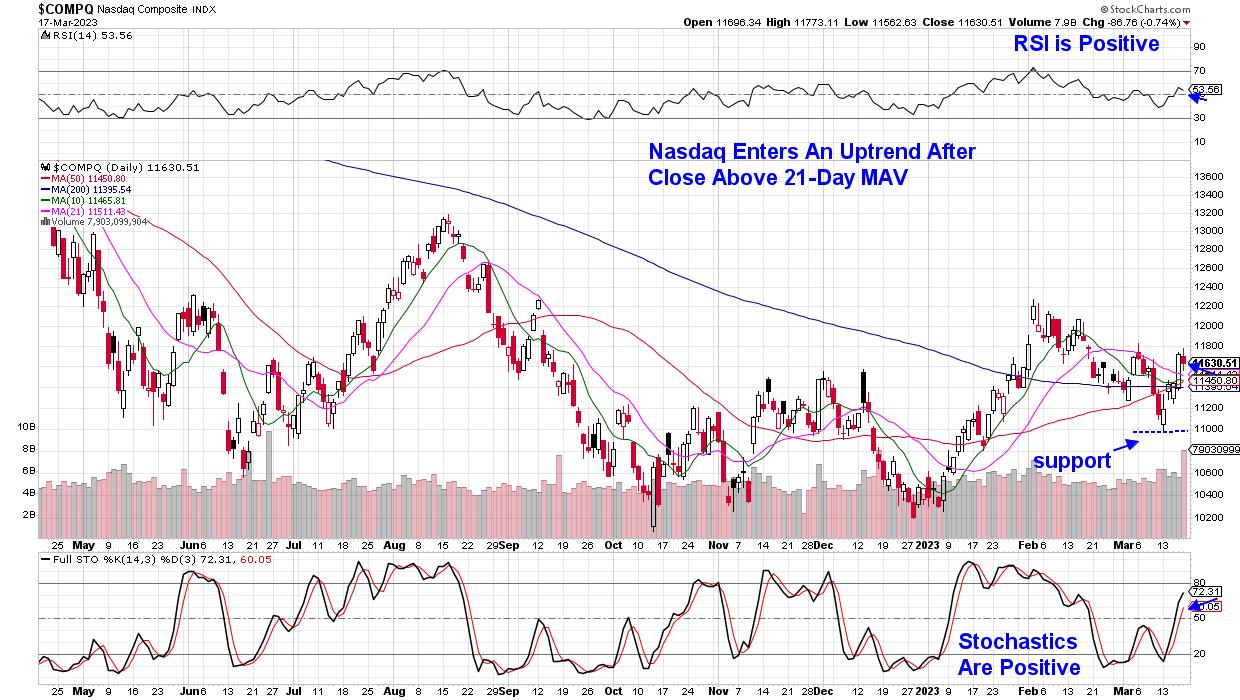

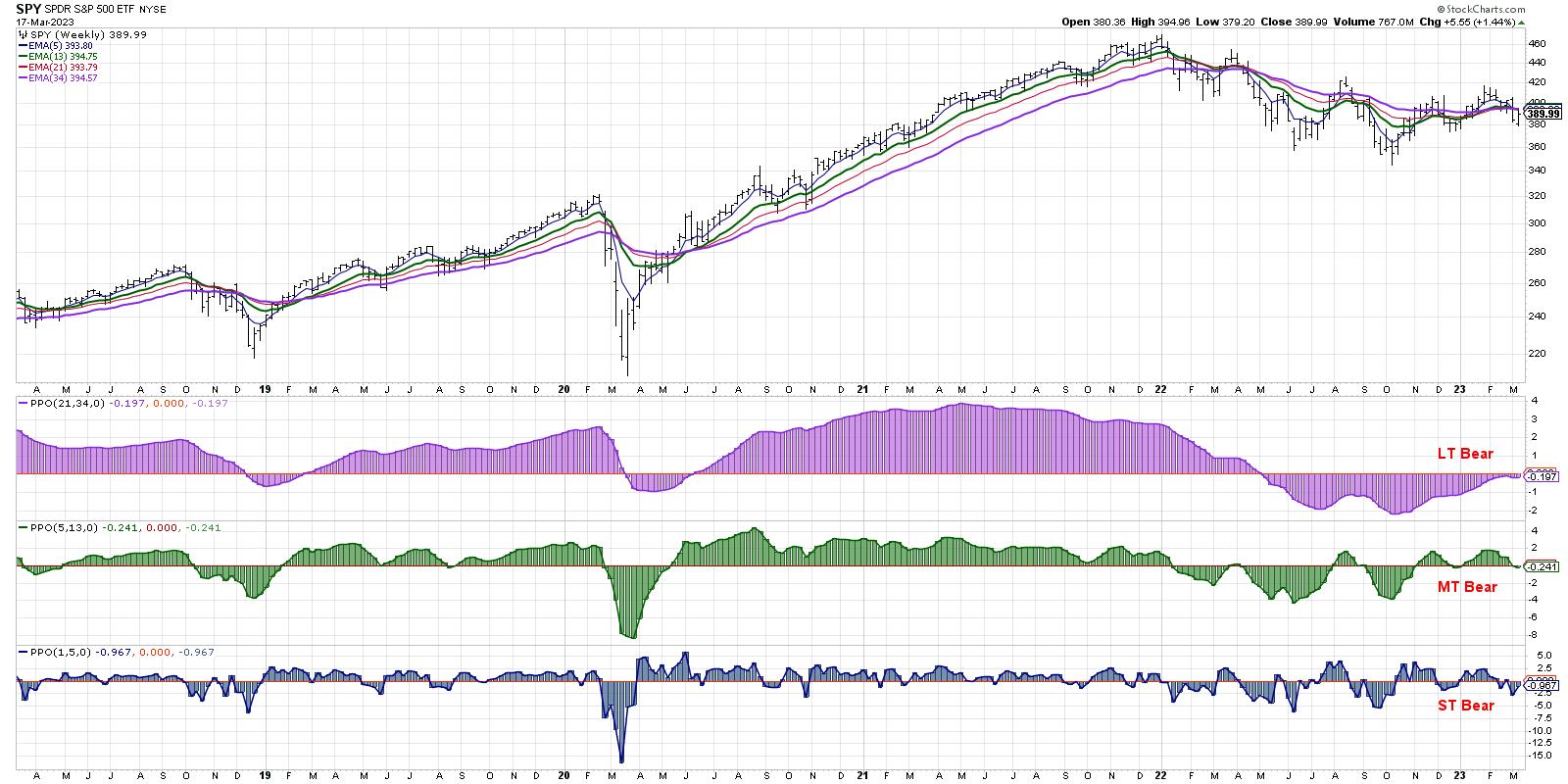

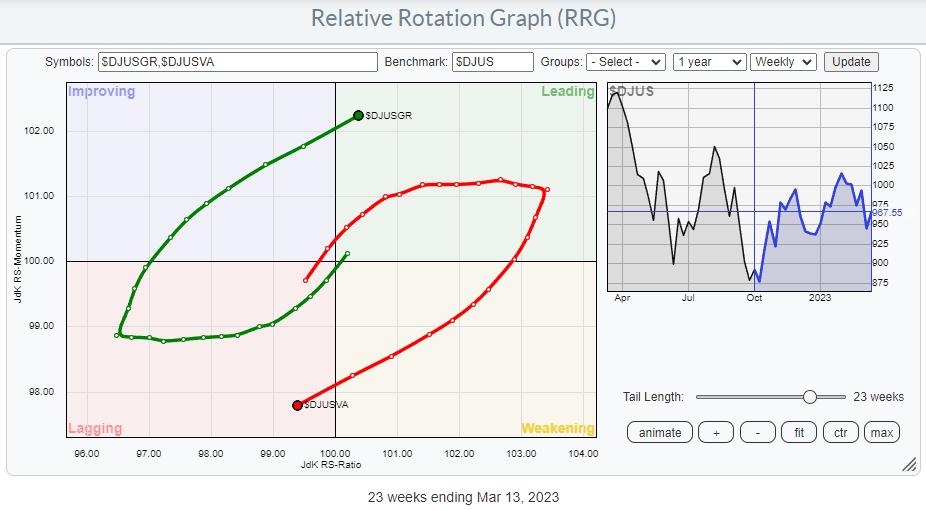

Fearless Rotation Back to Growth Stocks Unfolding Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

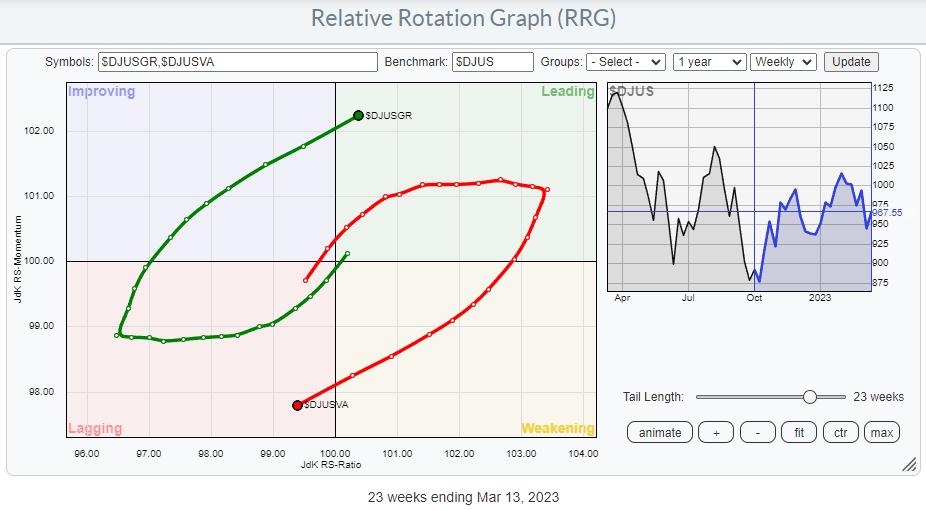

Since late 2021, value stocks have been dominating Growth. The $DJUSGR:$SJUSVA ratio rode the way down together with $SPX. I highlighted this development in a few articles back in 2022.

At the moment, that situation seems to be reversing. The Relative Rotation Graph above shows the Growth Value rotation...

READ MORE

MEMBERS ONLY

Don't Be Surprised by a Pleasant Surprise

by Martin Pring,

President, Pring Research

In early February, I pointed out that five consistently correct long-term indicators had triggered primary bull trend buy signals. The article certainly did not represent good timing from a short-term point of view, as the market has been selling off ever since. Nevertheless, these indicators remain in the bullish camp....

READ MORE

MEMBERS ONLY

GNG TV: Volatility Abounds as Banks Weight Heavy on Equities

by Alex Cole,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex takes the GoNoGo approach to the markets this week as he looks at the GoNoGo Asset map, noting the NoGo Trends in equities and commodities, while the dollar holds on to its "Go" trend. After running...

READ MORE

MEMBERS ONLY

Using the 4MA to Improve Timing

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how the the 4MA can be used to provide insight into short-term countertrend opportunities. He then explains how these opportunities can be used as a part of a bigger play. He then covers the stock symbol...

READ MORE

MEMBERS ONLY

The Banking Crisis: How To Make Your Portfolio Stable

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

What a difference a day makes. So much for Tuesday's relief rally in banks. The banking contagion continued with Credit Suisse's fallout, which brought the banking fiasco to a global level. The domino effect was felt in the banking sector once again and continued into Thursday,...

READ MORE

MEMBERS ONLY

STOCKS ATTEMPT TO STABILIZE NEAR SUPPORT -- BOND PRICES TEST RESISTANCE -- COMMODITY DROP CARRIES MIXED MESSAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 STABILIZES NEAR DECEMBER LOW...A short-term oversold condition helps support stocks. The daily bars in Chart 1 show the S&P 500 bouncing off potential chart support at its December low. In addition, its 9-day RSI line in the upper box is bouncing off its...

READ MORE

MEMBERS ONLY

Semiconductors Making Big Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Semiconductors ($DJUSSC) opened 2023 with a BANG! They spent the entire month of February and the first two weeks of March consolidating in a bullish ascending triangle pattern, but today we're either going to get a confirmed breakout or a false breakout. It simply depends on where we...

READ MORE

MEMBERS ONLY

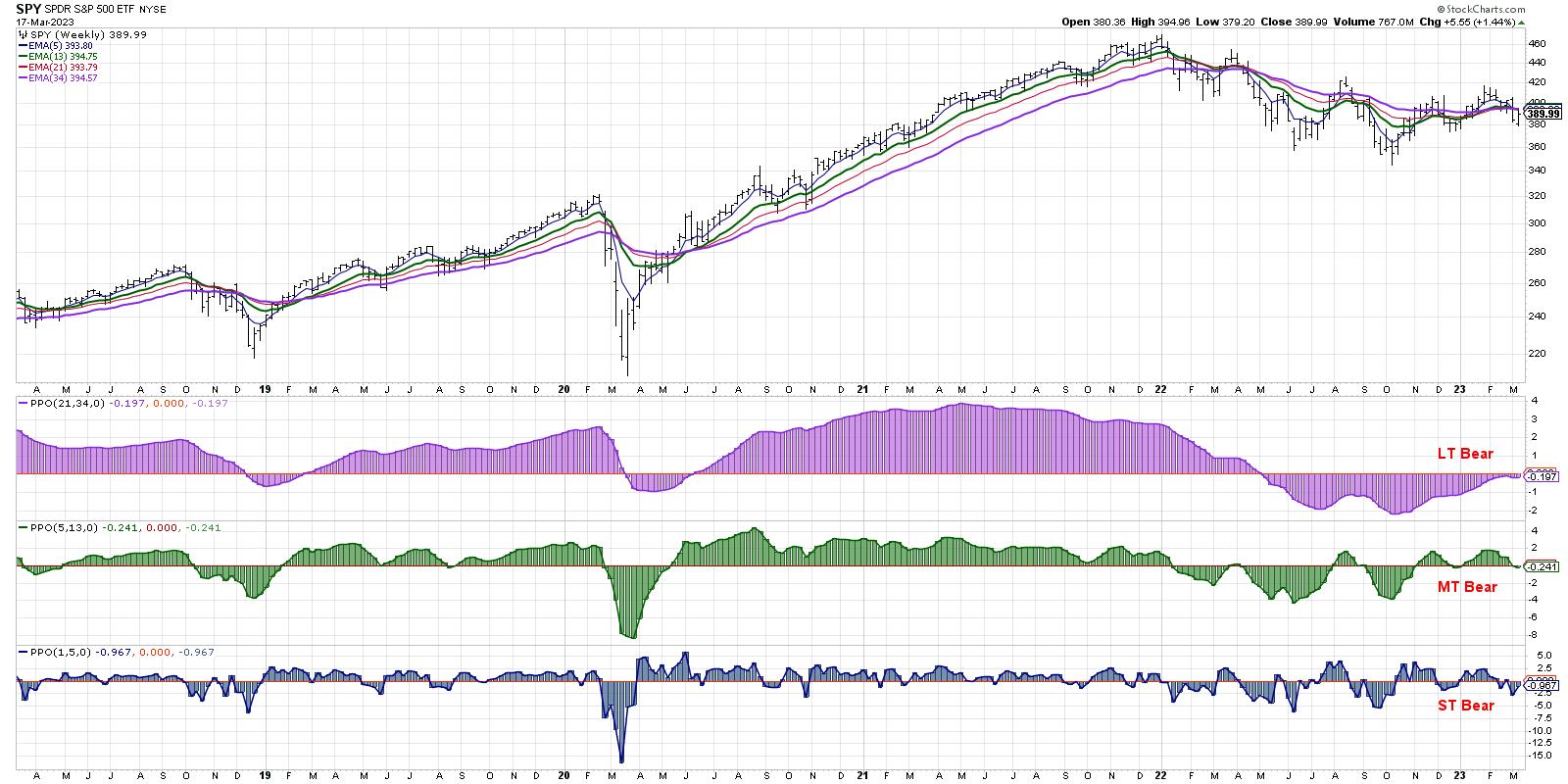

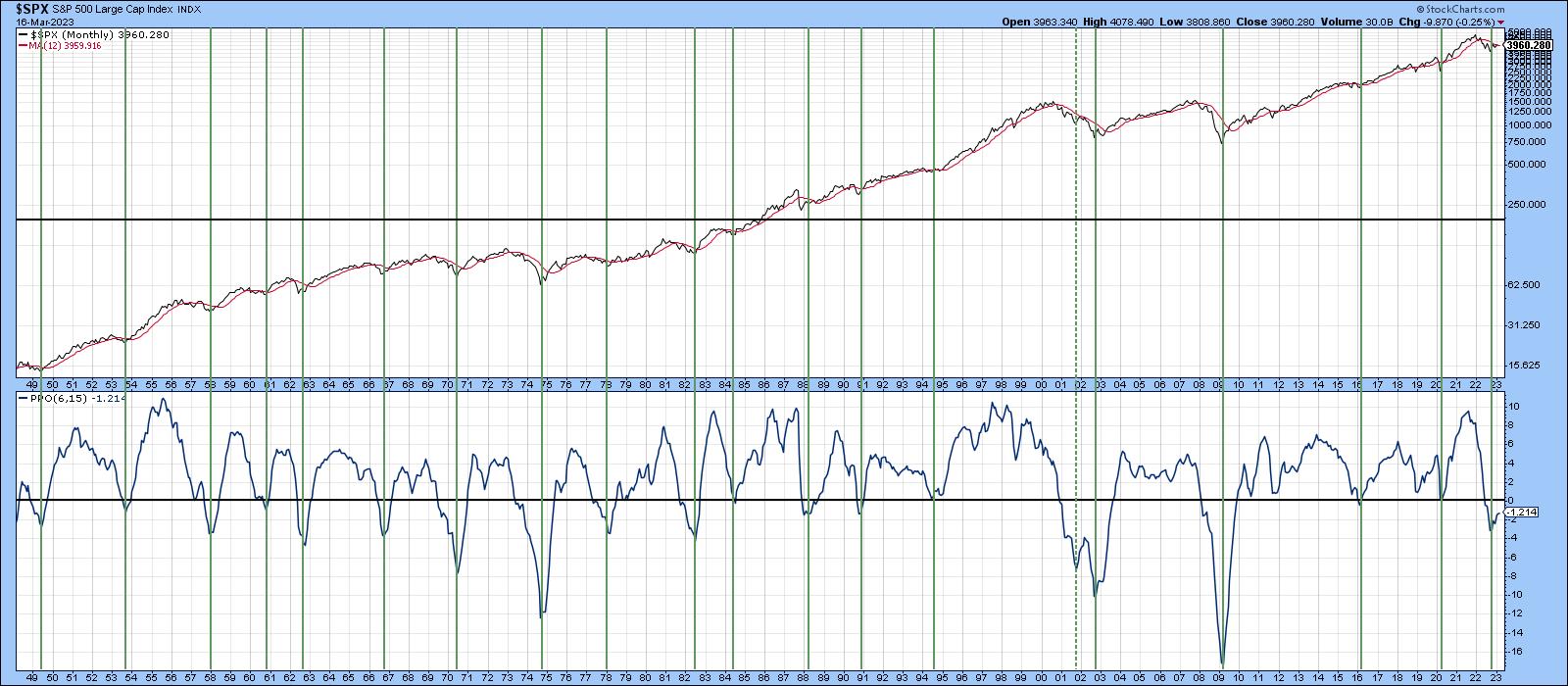

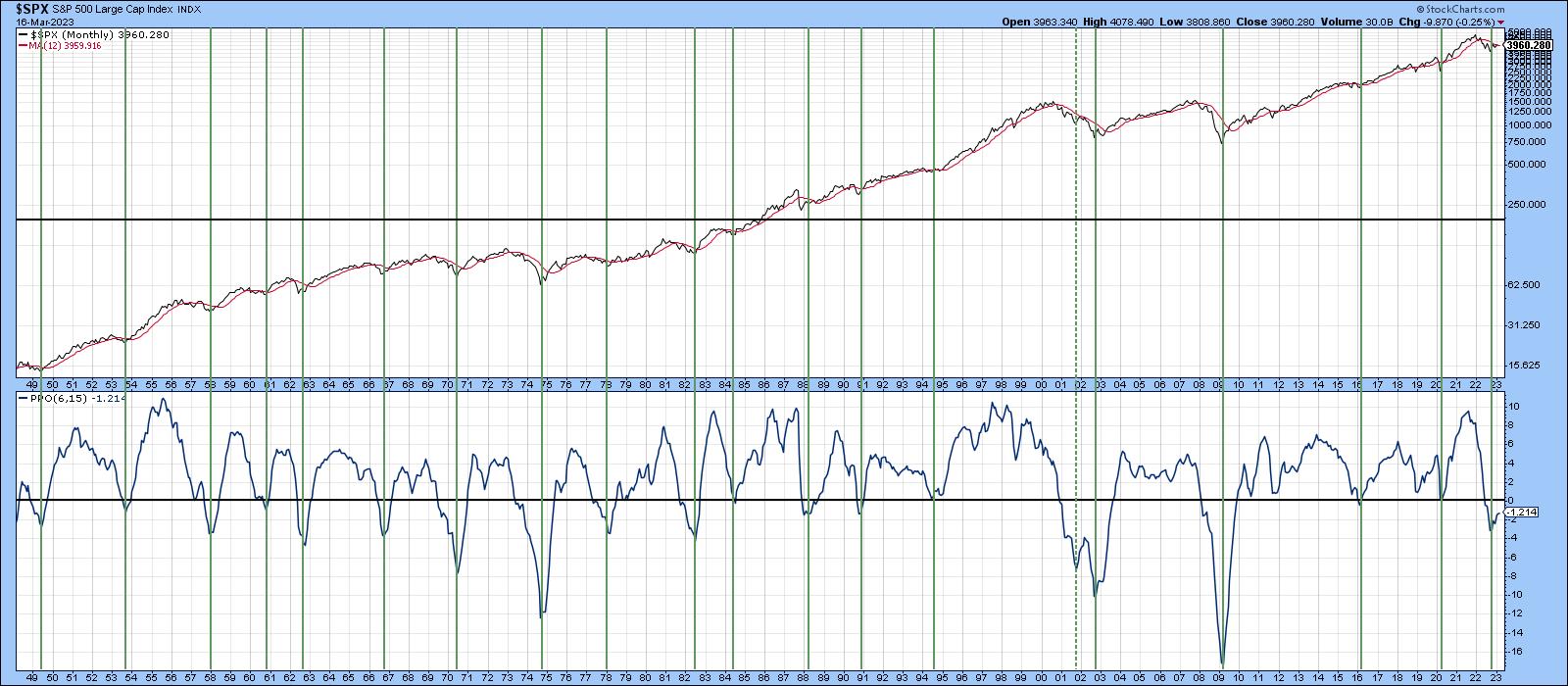

Technology Resets PPO, Now Rolling; Fed Should Pause

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain extremely bullish stocks the balance of 2023 and into 204, but I've been a little short-term cautious the overall market since mid-February, but bullish signals are beginning to emerge once again. The most important sector, in my opinion, is technology (XLK). This sector reeks of aggressiveness...

READ MORE

MEMBERS ONLY

Crude Oil Collapses - Will It Move Even Lower?

by Erin Swenlin,

Vice President, DecisionPoint.com

Below is an excerpt from today's subscriber-only DecisionPoint Alert (Subscribers, forgive the repeat performance):

CRUDE OIL (USO)

IT Trend Model: SELL as of 2/2/2023

LT Trend Model: SELL as of 12/6/2022

USO Daily Chart: USO obliterated support today and closed at New 52-Week Lows....

READ MORE

MEMBERS ONLY

Silver: An Undervalued Monetary-Industrial Hybrid

by Karl Montevirgen,

The StockCharts Insider

Silver is like that drab and boring coworker who you say "hi" to, but never really care to engage.

It may not possess gold's glitz but... it's the only metal that has can boast both monetary and industrial-tech use cases. Its history as money...

READ MORE

MEMBERS ONLY

Small Caps and Semis -- Their 2- and 7-Year Business Cycles

In our book How to Grow Your Wealth in 2023,we featured our projections for the Economic Modern Family.

To begin with the Granddad of the Family -- Russell 2000 (IWM) -- in December 2022, we wrote this:

"The Russell 2000 IWM is the granddad of the Family. Hence,...

READ MORE

MEMBERS ONLY

Closing the Potential Gap

by Dave Landry,

Founder, Sentive Trading, LLC

There's a big gap between your performance with your methodology and your methodology's potential. In this week's edition of Trading Simplified, Dave introduces you to what might be keeping you from reaching your full potential. Spoiler alert: It's you! Dave then gets...

READ MORE

MEMBERS ONLY

Bull or Bear Market? A StockCharts Member Special

by Larry Williams,

Veteran Investor and Author

When Larry talks, you listen.

It's a great rule to live by. Anyone who has followed Larry Williams' legendary work in the markets knows the expertise he brings and the value of his analysis. So, when Larry called and said "I've got thoughts to...

READ MORE

MEMBERS ONLY

Silver, Gold, and Miners

Folks are calling the FED opening swap lines on the entire US Banking deposit base to the tune of $17.6 trillion as QE infinity. Moody's cut its outlook on the banking system to negative, saying that it is a rapidly deteriorating operating environment. The market though, generally...

READ MORE

MEMBERS ONLY

Sector Spotlight: Watch How Technology Sector Leads on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, after two episodes looking at longer term trends, first in seasonality and then in price trends on the monthly charts, I talk you through what's happening in current rotations for asset classes and sectors. We look at the...

READ MORE

MEMBERS ONLY

The Good News About SVB Bank They Are Not Telling You

by Martin Pring,

President, Pring Research

There is a well-known saying going around Wall Street that, when the Fed hits the brakes, someone inevitably crashes through the windscreen. That obviously applies to shareholders and directors of Silicon Valley Bank (SIVB), though depositors, following a nail-biting weekend, are apparently off the hook. It also warns the central...

READ MORE

MEMBERS ONLY

Avoid Analysis Paralysis: Focus on the Important Trading Tools

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Technical analysis provides a broad toolkit of indicators, and if you use too many indicators on your chart, it can get complex and lead to "analysis paralysis." But when you put some thought into selecting a combination of indicators, it can give you a weight of the evidence...

READ MORE