MEMBERS ONLY

Quantum Computing Stocks: Why You Should Invest in Them Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

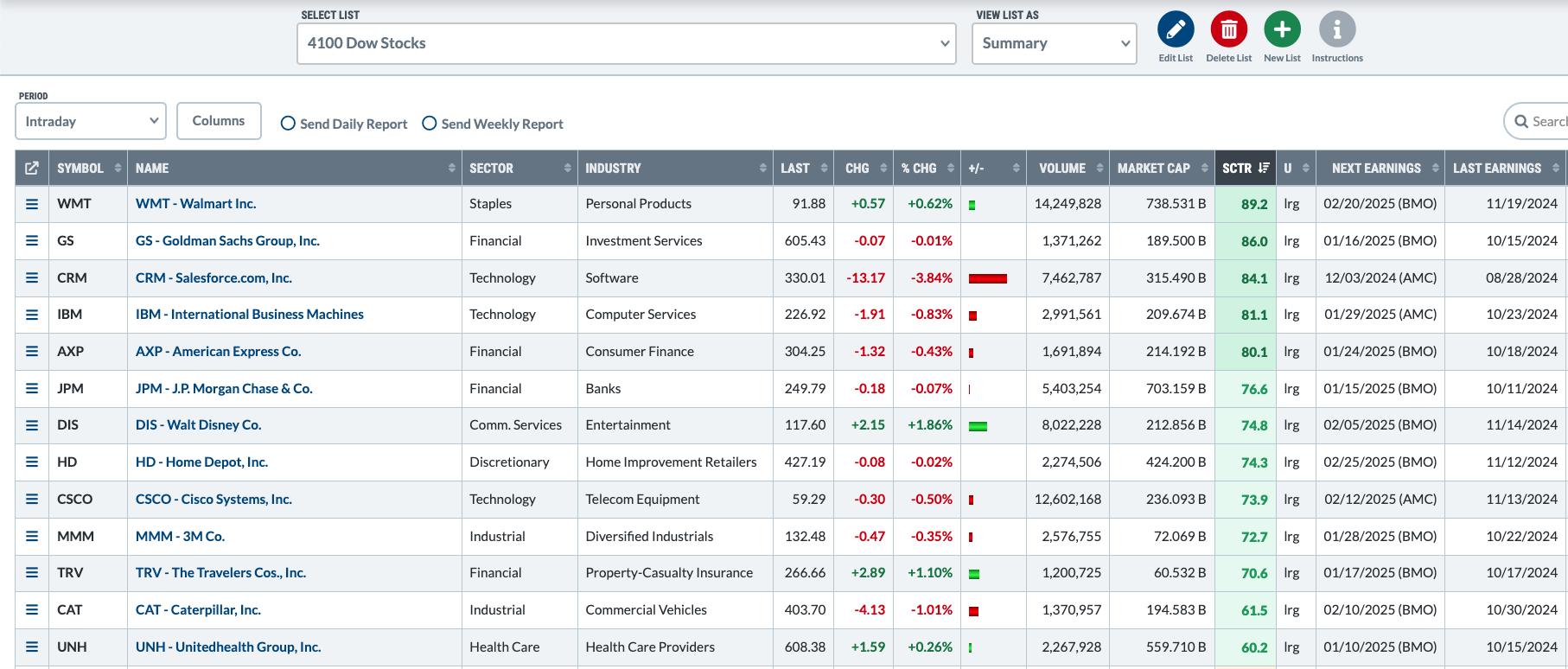

* Quantum computing stocks have been rising since November.

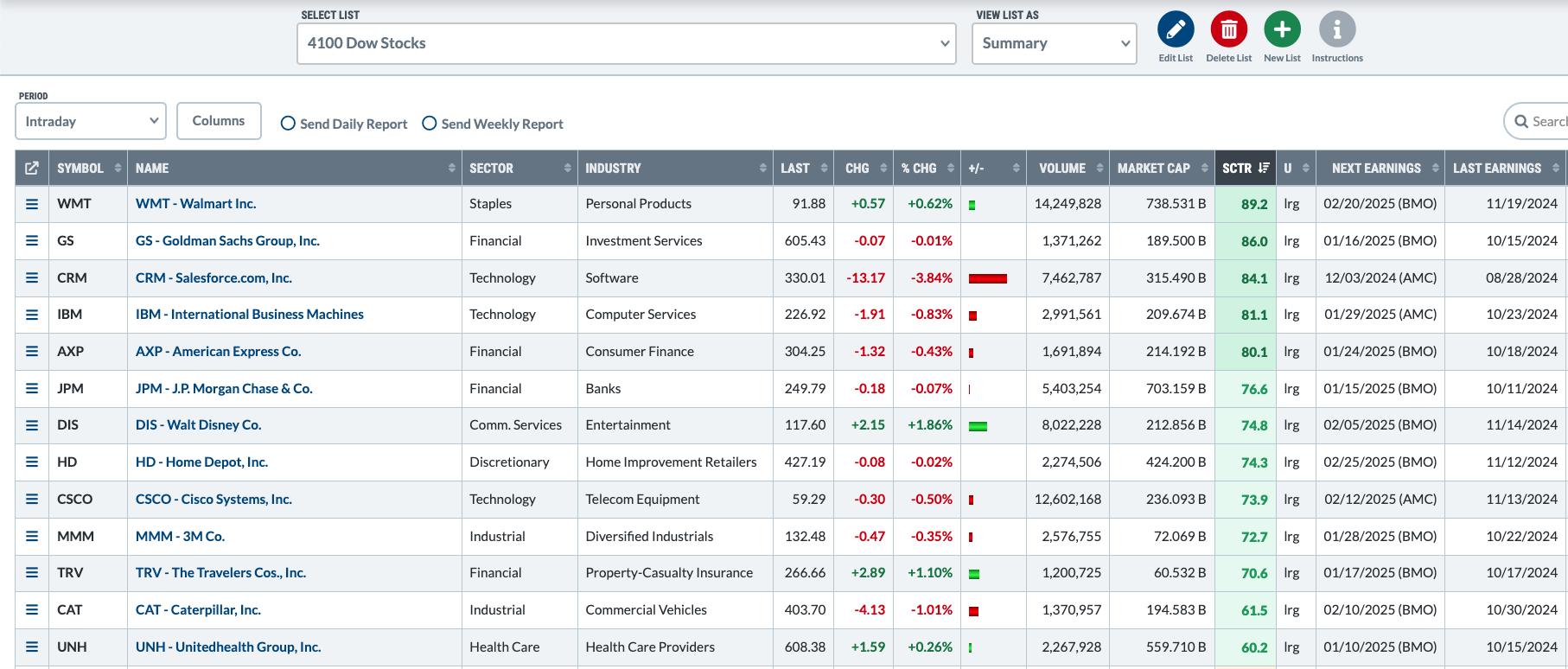

* Four quantum computing stocks were in the "Small-Cap, Top 10" category in the StockCharts Technical Rank (SCTR) report.

* You can also gain exposure to quantum computing stocks by investing in the Defiance Quantum ETF.

Qubits, quantum advantage, gate...

READ MORE

MEMBERS ONLY

MUST SEE Options Trade Ideas! DIS, AAPL, META, BA, LULU

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, after a rundown of the general markets and sectors, Tony brings you the latest options trade ideas. These include a number of bullish and bearish ideas, including DIS, AAPL, META, BA, LULU, and many more.

This video premiered on December 23, 2024....

READ MORE

MEMBERS ONLY

Why Now Might Be the Best Time to Invest in META Stock

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* After a pullback, META's stock price could be ready for a reversal.

* The uptrend is still on from a weekly perspective, but the daily chart shows the price is at a crossroads and could move in either direction.

* If META's stock price is too...

READ MORE

MEMBERS ONLY

DP Trading Room: Deceptive Volume Spikes

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DecisionPoint Trading Room Carl discusses volume spikes and how we have to analyze big volume spikes carefully to determine whether they express a confirmation of a move or whether they are a special case and do not really provide insight.

Carl goes over the signal...

READ MORE

MEMBERS ONLY

Will the Stock Market's Santa Rally Bring Holiday Cheer to Investors?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes closed higher on Friday but lower for the week.

* Market breadth continues to be weak despite Friday's rally.

* More follow-through next week is required to confirm a reversal and the hope for a Santa Claus rally.

A smart investor listens to...

READ MORE

MEMBERS ONLY

AI Boom Meets Tariff Doom: How to Time Semiconductor Stocks

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Semiconductors are caught in a tug-of-war with AI demand on one side and tariff fears on the other.

* The industry's technical performance shows a narrow standstill that can break either way.

* Watch SMH and its top three holdings—NVDA, TSM, and AVGO—for insights into timing...

READ MORE

MEMBERS ONLY

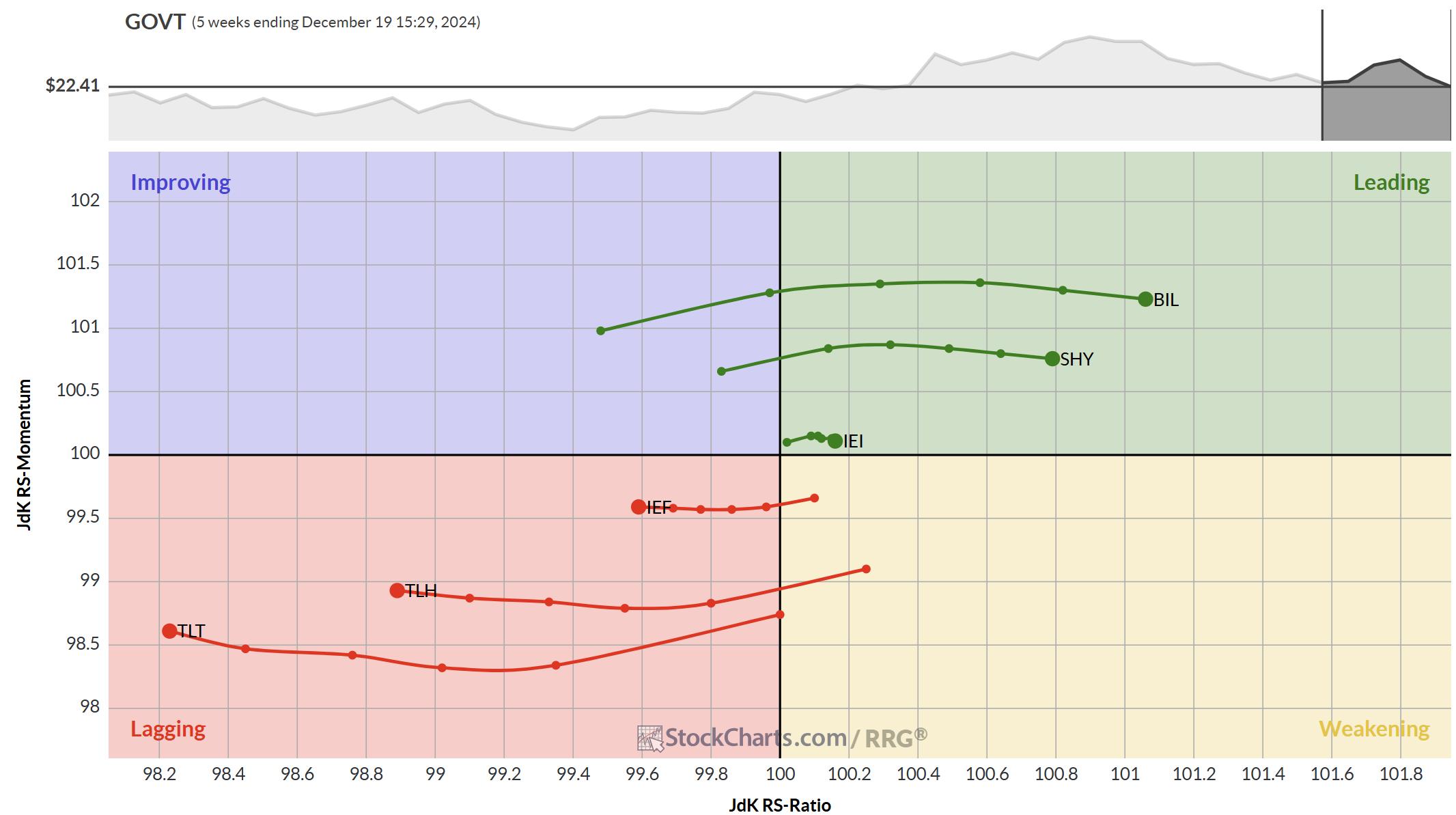

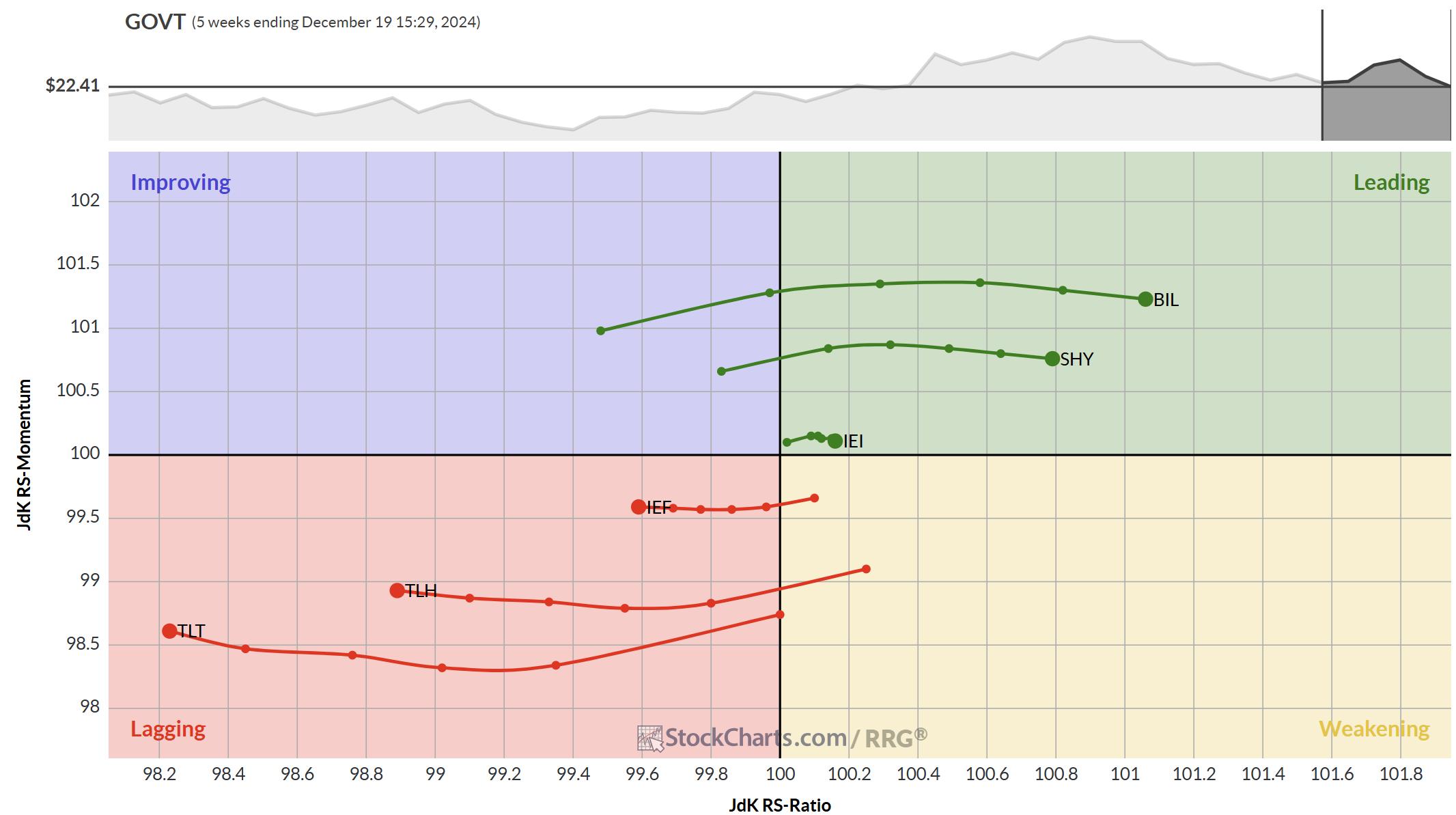

Three RRGs to Keep You on Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Track the Yield curve moving back to normal on RRG

* USD showing massive strength against all currencies

* Stock market drop not affecting sector rotation (yet)

The Yield Curve

The RRG above shows the rotations of the various maturities on the US-Yield Curve.

What we see at the moment...

READ MORE

MEMBERS ONLY

Stock Market Sell-Off: Is the Bull Market Over?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes got a bearish jolt on Wednesday.

* Gold, silver, and cryptocurrencies joined the equity selloff.

* Treasury yields and the US dollar jump higher.

Uncertainty in the stock market makes it difficult to make investment decisions. When investors sell off stocks, everyone follows without giving it...

READ MORE

MEMBERS ONLY

DP Trading Room: Is Broadcom (AVGO) the New NVIDA (NVDA)?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin looks at the Broadcom (AVGO) chart and compares it to the NVIDIA (NVDA) chart. She shows us the differences between the two and tells you whether she believes AVGO will be the new NVDA, meaning it will perform as NVDA used to perform with a concerted move up...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Halts at Crucial Levels; Staying Above This Point Necessary to Extend The Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had a wide-ranging week once again; however, they ended near its high point this time. The Nifty had ranged sessions for four out of five days; the last trading day of the week saw the Nifty swinging wildly before closing near its high point. The trading range also...

READ MORE

MEMBERS ONLY

How to Buy WINNERS When They Pull Back!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights how select M7 stocks, mostly TSLA, propped the markets up while some sectors continued to trend lower. She reviews how to find entry points in winning stocks, and also discusses why Small Caps are falling.

This video originally premiered December 13, 2024. You can...

READ MORE

MEMBERS ONLY

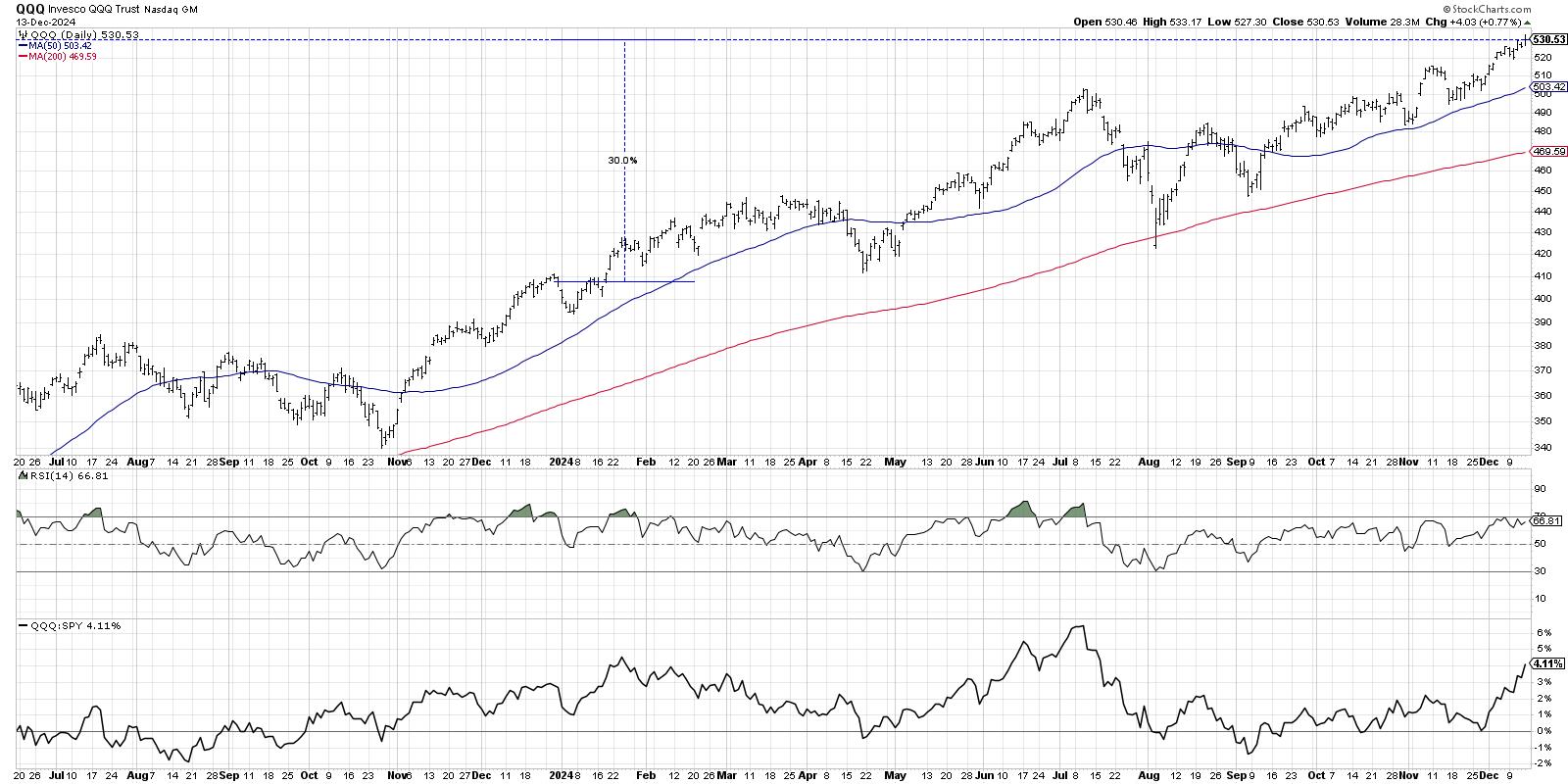

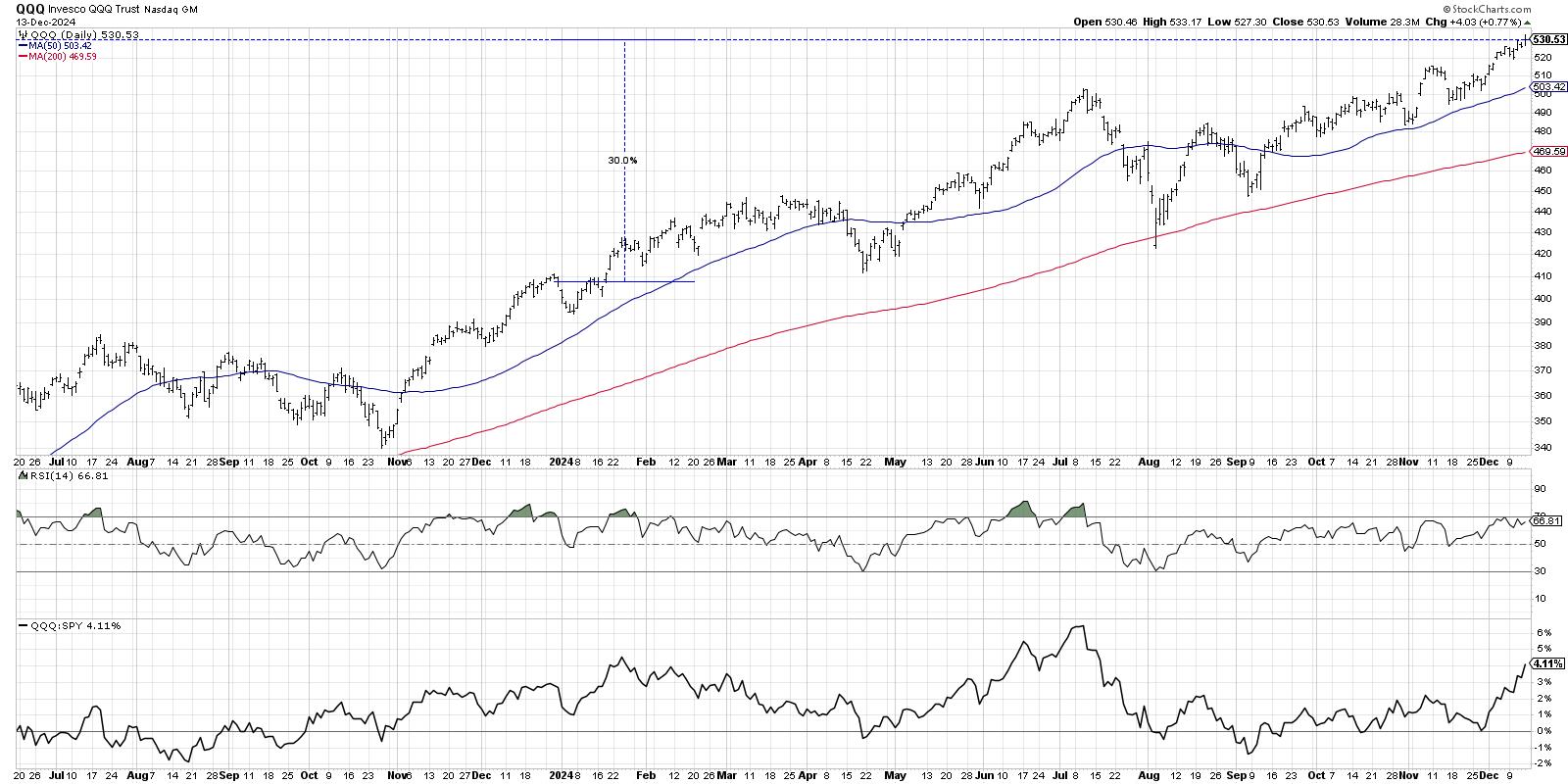

Will the QQQ Sell Off in January? Here's How It Could Happen

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In recent interviews for my Market Misbehavior podcast, I've asked technical analysts including Frank Cappelleri, TG Watkins, and Tom Bowley what they see happening as we wrap a very successful 2024. With the Nasdaq 100 logging about a 30% gain for 2024, it's hard to imagine...

READ MORE

MEMBERS ONLY

Pumping the Brakes on Ferrari (RACE)

by Tony Zhang,

Chief Strategist, OptionsPlay

Despite its position as a luxury automaker synonymous with prestige and performance, Ferrari N.V. (RACE) may be showing signs of a near-term downturn. Recent price action, coupled with stretched valuations and slowing shipment trends, suggests that RACE may face potential downside.

By incorporating both technical and fundamental analysis, we...

READ MORE

MEMBERS ONLY

Why Cisco's Stock Reversal Could Be a Game-Changer

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* CSCO stock has pulled back to its 21-day exponential moving average and is poised for a reversal.

* Monitor the stochastic indicator to confirm a reversal in CSCO's stock price.

* If you enter a long position in CSCO, establish your stop loss and have the discipline to...

READ MORE

MEMBERS ONLY

SOFI Advances to SCTR's Top 10: Is Now the Time to Buy?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SOFI's stock price recently appeared in the SCTR Report's top 10 list in the large-cap category.

* After a strong two-month rally, the fintech stock is now pulling back.

* Monitor SOFI's chart and watch key levels closely as the stock approaches a potential...

READ MORE

MEMBERS ONLY

Master the MACD Zero Line for a Trading Edge!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows how to use the MACD zero line as a bias for a stock. As opposed to offering a buy signal, this Zero line level can provide insight into a market or stock's underlying condition; Joe shows how to refine that information...

READ MORE

MEMBERS ONLY

Top Techniques for Finding Strength in Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius gives a quick update on sector rotation, then examines the strength uncovered in Consumer Discretionary. He analyzes names like TSLA, AMZN, and LULU; some are in full swing uptrends, but there are also a few names that are on the verge of turning around...

READ MORE

MEMBERS ONLY

Stock Market Sells Off Ahead of CPI: Charts You Should Be Watching

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 and Nasdaq Composite are inching toward key support levels.

* Gold prices have risen on news of China's central bank's decision to buy gold.

* NVDA is under investigation for antitrust activities, and its stock price is declining.

The Tuesday afternoon...

READ MORE

MEMBERS ONLY

3 WAYS to Pinpoint When a Stocks Uptrend is Ending

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave unveils his "line in the sand" technique to help determine when stocks in established uptrends may be near the end of the bullish phase. He'll share specific levels he's watching for the S&P 500, AMZN, TMUS, and KR,...

READ MORE

MEMBERS ONLY

Options Trade Ideas YOU NEED to SEE!

by Tony Zhang,

Chief Strategist, OptionsPlay

Looking for options trade ideas? In this video, Tony presents some of the best options trading strategies! After discussing special 0DTE strategies, the big picture, and individual sectors and industries, Tony covers bullish and bearish ideas for stocks including NVDA, SHOP, GOOGL, META, CAT and many more.

This video premiered...

READ MORE

MEMBERS ONLY

Bearish Opportunity in Tractor Supply Co (TSCO) with OptionsPlay Strategy Center

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Tractor Supply Co. may be setting up for a declining move in its stock price.

* Take advantage of the downside move in Tractor Supply using a call vertical spread.

* Monitor the OptionsPlay scans to identify options strategies to apply to stocks like Tractor Supply Co.

Despite attempts to...

READ MORE

MEMBERS ONLY

Market As Good As It Gets

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the 26 indexes, sectors and groups in a CandleGlance to see how the indexes stack up. It is clear that all of the indexes are as good as they can get. Carl warns that when things are as good as they can get, the only place...

READ MORE

MEMBERS ONLY

Week Ahead: Consolidation Likely as NIFTY Tests Crucial Levels; Guard Profits Mindfully

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets closed with gains for the third week in a row, as key indices posting gains while extending their technical rebound. The Nifty trended higher most of the week. The volatility was largely absent, but the Indices stayed quite choppy on most days except the last, where it remained...

READ MORE

MEMBERS ONLY

The Stock Market's Simmering Rally: Indexes Keep Setting New Highs

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes continue to notch new record highs.

* Risk appetite is strong as Bitcoin rises while Treasury yields and volatility retreat.

* Earnings from Oracle, Adobe, Broadcom, and Costco may move the stock market next week.

The first trading week in December started on a positive...

READ MORE

MEMBERS ONLY

Are ARK's Innovation ETFs on to Something BIG?

by Mary Ellen McGonagle,

President, MEM Investment Research

After a broad market review, Mary Ellen shares strategies for trading pull backs and breakouts in stocks. Highlights include a deep dive into ARK's Innovation ETFs and their holdings, locating market strength in the process. Tune in for valuable insights and tips to help you make informed investment...

READ MORE

MEMBERS ONLY

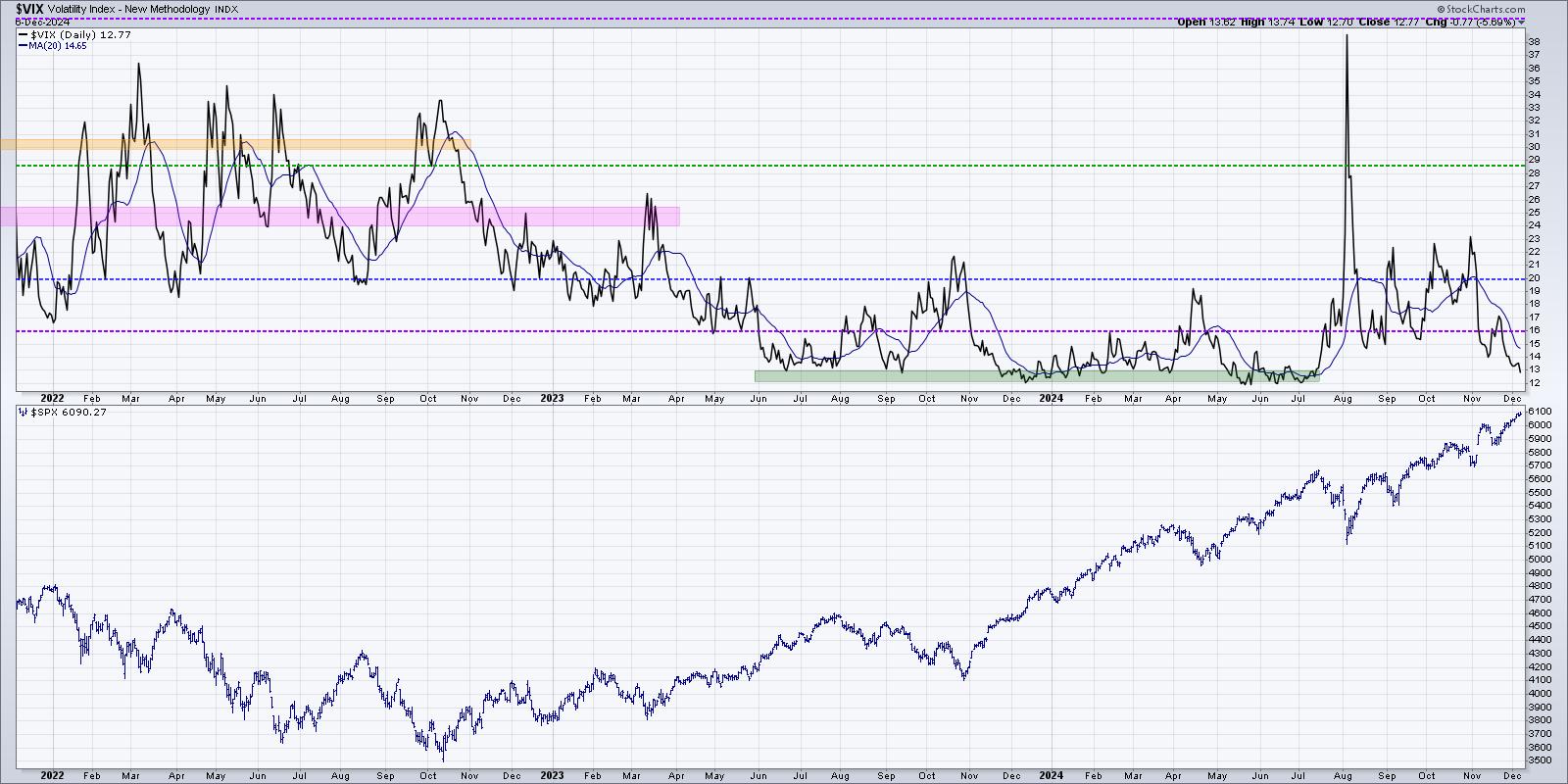

The Most Important Chart to Watch Into Year-End 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

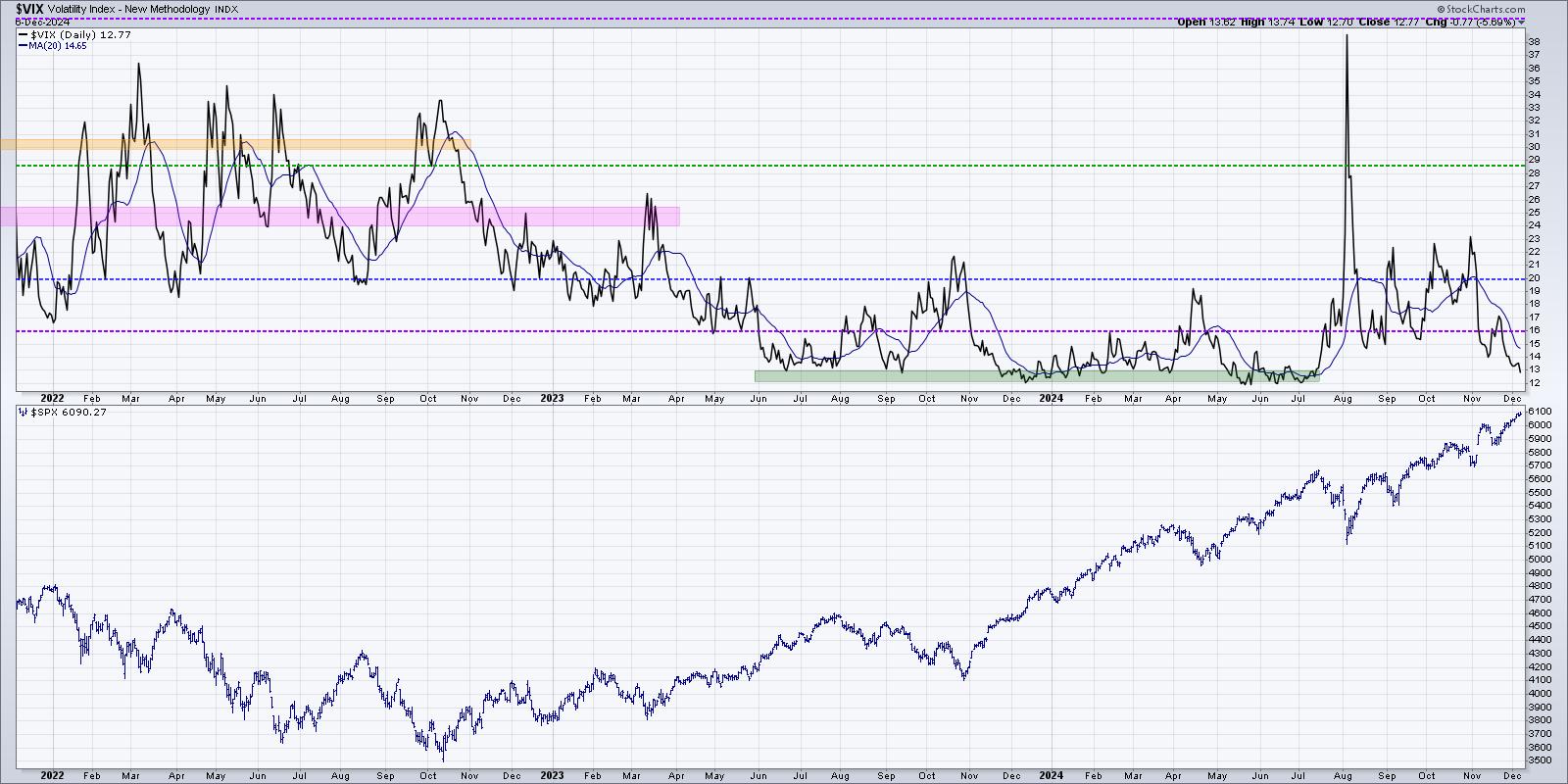

KEY TAKEAWAYS

* Low VIX reading implies that conditions are favorable for stocks.

* The MOVE index is basically a VIX for bonds, and can help to corroborate volatility readings across asset classes.

* High yield spreads remain quite narrow, implying bond investors perceive a low risk environment.

"The market goes up...

READ MORE

MEMBERS ONLY

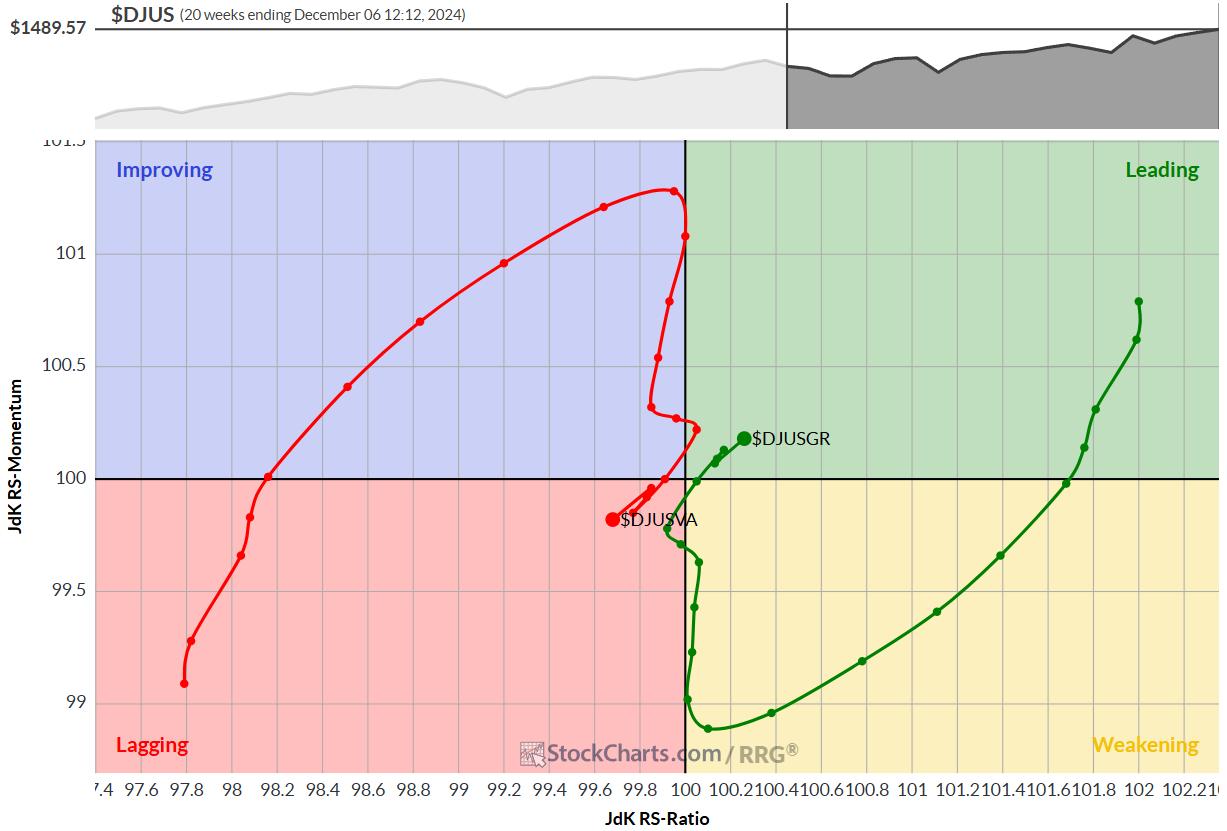

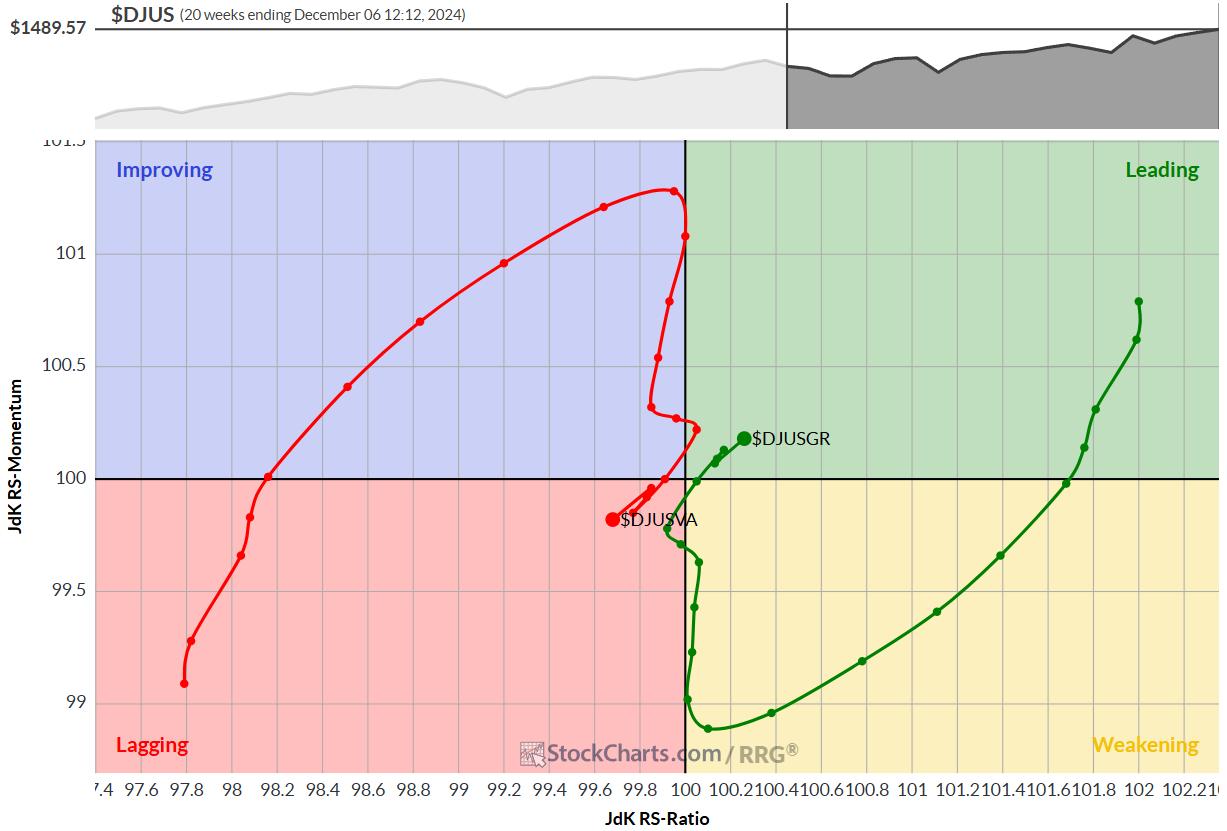

Stay Away from Large-Cap Value Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Growth stocks are regaining leadership over value.

* Small and mid-cap growth sectors are leading the charge.

* Large-cap value is currently the weakest market segment.

Growth vs. Value Rotation: The Pendulum Swings Again

Relative Rotation Graphs (RRG) are not just good tools to use in analyzing sector rotation; they&...

READ MORE

MEMBERS ONLY

CSCO Stock: A Hidden Gem With Upside Potential

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* CSCO stock has been in a slow uptrend since August and is outperforming the Nasdaq Composite.

* CSCO's stock price is at an all-time high and indicators suggest the stock can continue trending higher.

* Look for a pullback and a bounce off its 21-day exponential moving average....

READ MORE

MEMBERS ONLY

Master the Market: Navigating Up Days and Down Days

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Assess the cumulative strength or weakness of a stock's up and down days to help decide on a prospective trade or investment.

* MarketCarpets can comprehensively display the cumulative strength or weakness of stocks in a specific group, such as the S&P 500.

* Discover how...

READ MORE

MEMBERS ONLY

Leverage Salesforce.com's Growth: A Guide to Smart Options Trading

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The technology sector got a boost from Salesforce's stellar rise in stock price.

* In lieu of purchasing shares of Salesforce stock, you could try trading options on the stock.

* The call vertical spread is an optimal strategy to take advantage of Salesforce's growth.

When...

READ MORE

MEMBERS ONLY

After a 29% Bounce, Can SMCI Reclaim Its Former Glory?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* On Monday, Super Micro Computer Inc. (SMCI) jumped 29%.

* Bullish investors began buying SMCI on news of the company's financial stability after its 85% plunge in November.

* Watch the $50 resistance level in SMCI's stock price, in addition to other key levels, as a...

READ MORE

MEMBERS ONLY

Best Bullish and Bearish OptionsPlay Ideas for the Week!

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony shows how he starts his week with a clear technical and fundamental perspective of the stocks he's likely going to enter, and of options positions throughout the week, and how you can apply that yourself. Tony shares bullish (NVDA, DIS, SHOP) and bearish (AAPL,...

READ MORE

MEMBERS ONLY

NVDA Stock Price Gives Bullish Signal: An Ultimate Options Strategy to Maximize Gains

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* NVDA's stock price has retested its $130 support level and bounced higher, which could provide a bullish trading opportunity using options.

* NVIDIA's fundamentals are compelling and support a rise in its stock price.

* Selling a put vertical spread provides a limited-risk scenario with a...

READ MORE

MEMBERS ONLY

DP Trading Room: Swenlin Trading Oscillators Top!

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday our short-term Swenlin Trading Oscillators (STOs) turned down even after a rally. This is an attention flag that we shouldn't ignore, but what do the intermediate-term indicators tell us? Are they confirming these short-term tops?

Carl goes through the DP Signal tables to start the program...

READ MORE

MEMBERS ONLY

Five Ways You Should Use ChartLists Starting Today!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Having used many technical analysis platforms over my career as a technical analyst, I can tell you with a clear conscience that the ChartList feature on StockCharts provides exceptional capabilities to help you identify investment opportunities and manage risk in your portfolio. Once you get your portfolio or watch list...

READ MORE

MEMBERS ONLY

Navigating Holiday Stock Market Changes: Turn Sentiment Shifts into Successes

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes take a breather.

The day before Thanksgiving, the stock market took a little breather. But the weekly performance was still impressive.

The Dow Jones Industrial Average ($INDU) remains the broader index leader, rising 0.96% for the week. The S&P 500...

READ MORE

MEMBERS ONLY

How to Trade MicroStrategy's Painful Plunge: The Levels Every Investor Must Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* MicroStrategy's price is correlated with Bitcoin's.

* In 2024, Microstrategy's stock price surged from a low of $43 to a high of $543.

* Look for MicroStrategy's stock price to fall between $318 and $320, its next support level.

On November 21,...

READ MORE

MEMBERS ONLY

OptionsPlay: Macro Market Outlook and Options Strategies

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, and shares his top bearish and bullish options trading ideas. He talks growth vs. value, commodities, bonds, the Dollar Index, sectors like homebuilders and semiconductors, and stocks like NVDA, DIS, INTC, and more.

This video premiered on November 26,...

READ MORE

MEMBERS ONLY

A Bullish Opportunity in CrowdStrike (CRWD) with OptionsPlay Strategy Center

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* CrowdStrike's stock price is showing signs of reaching its 52-week highs and breaking above it.

* The bull put spread is an options strategy you can implement to take advantage of CrowdStrike stock's bullish move.

* A bull put spread will benefit even if CrowdStrike'...

READ MORE

MEMBERS ONLY

Market Rally Broadens - New All-Time Highs?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the small-caps and mid-caps that have now begun to outperform the market. Clearly the rally is broadening, the question now is can we continue to make new all-time highs. It does seem very likely especially given the positive outlook on the Secretary of Treasury nomination.

Carl...

READ MORE