MEMBERS ONLY

3 Types of Breakouts To Upgrade Your Portfolio

Use this StockCharts scan to identify three categories of stocks and ETFs that are making new three-month highs.... READ MORE

Use this StockCharts scan to identify three categories of stocks and ETFs that are making new three-month highs.... READ MORE

Here's an analysis of the recent bullish developments in the Shanghai Stock Exchange Composite Index and liquid Chinese ETFs. ... READ MORE

Markets hit another all-time high as rotation accelerates into biotech, software, and alt-energy names. Follow along as Mary Ellen breaks down the top-performing sectors and ETFs, including key breakouts in Bloom Energy, DoorDash, and Deckers. She also highlights meme stocks' action, examines what international leadership in countries like Spain... READ MORE

Optimism surrounds the stock market indexes with lofty price targets. Could the fulfillment of Point & Figure targets mean the end of a bull market? Find out here. ... READ MORE

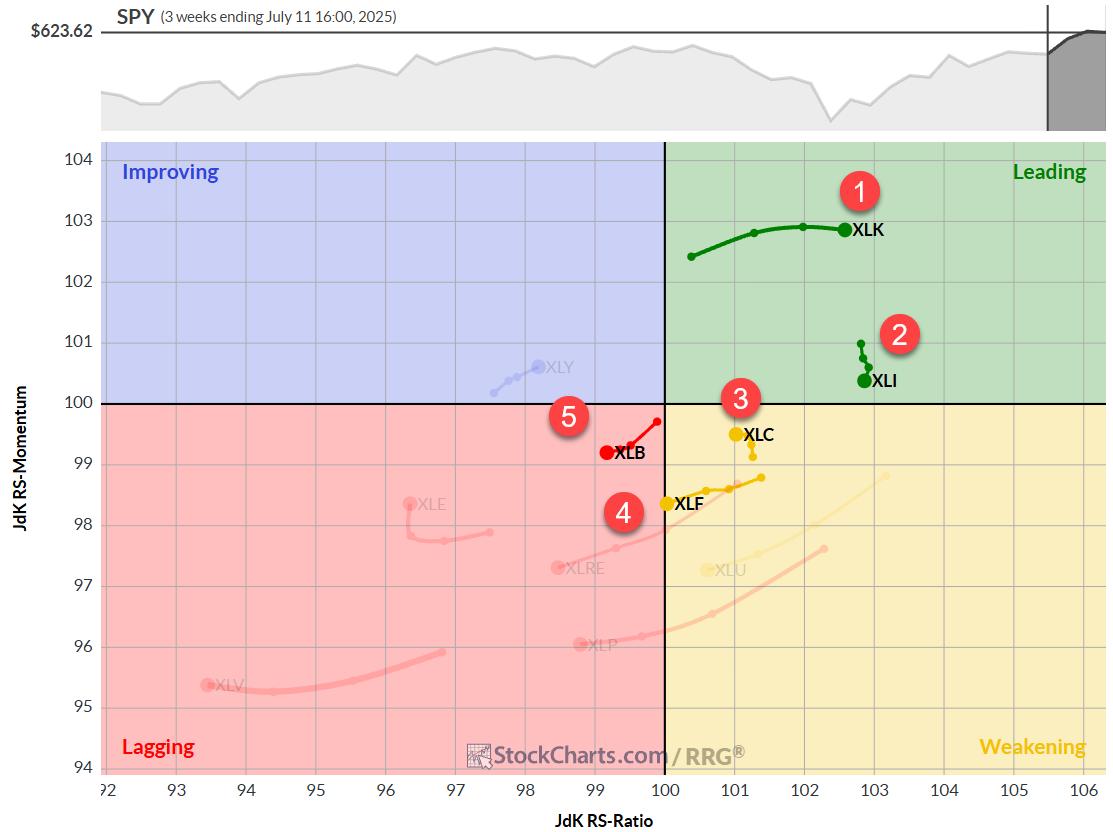

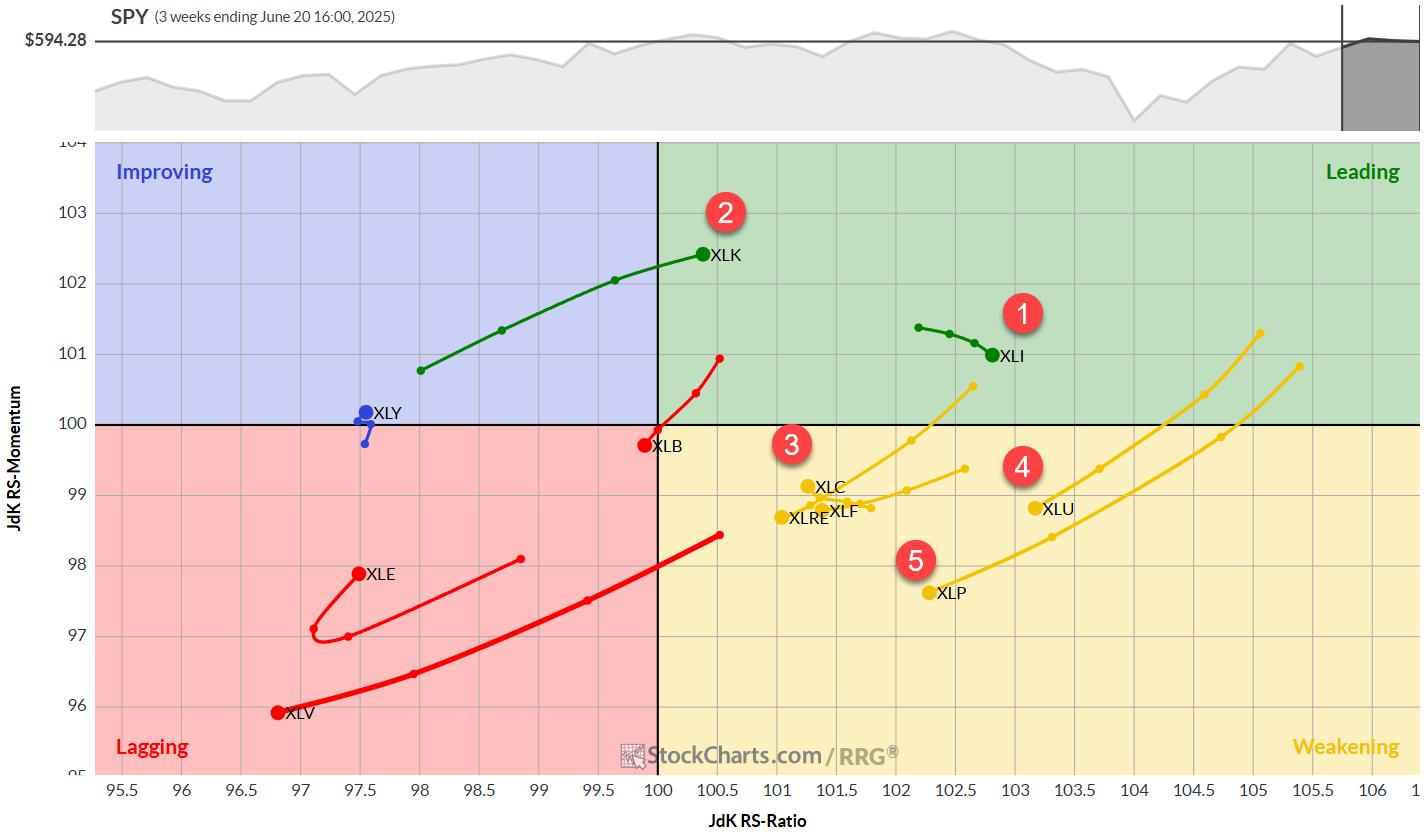

Relative Rotation Graphs or RRGs will help investors to keep an eye on relative trends that unfold within a universe. Among other things this will help to visualize sector rotation... READ MORE

Tech stocks are heating up, utilities break out, metals lead, and homebuilders hit a moment of truth.... READ MORE

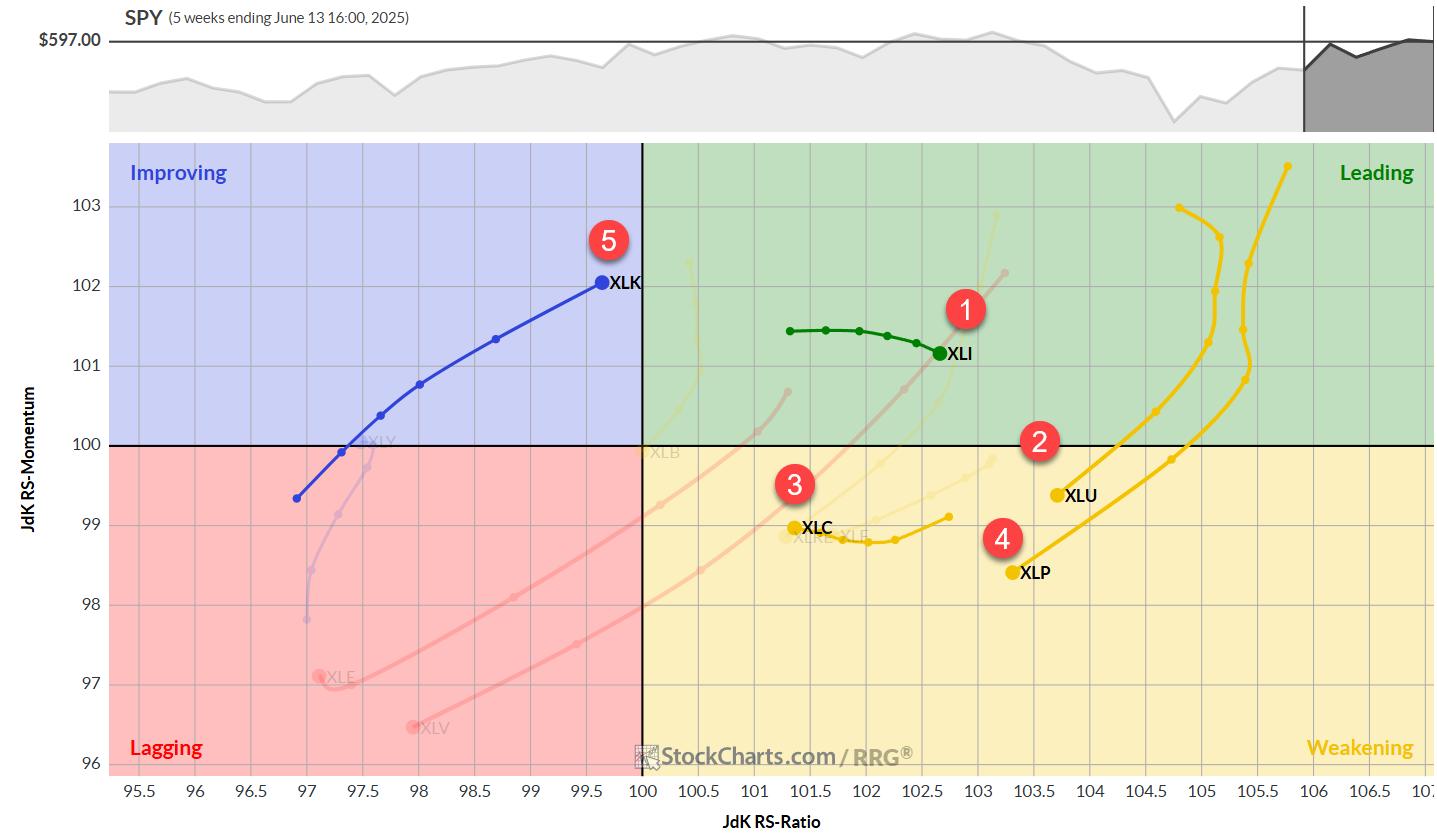

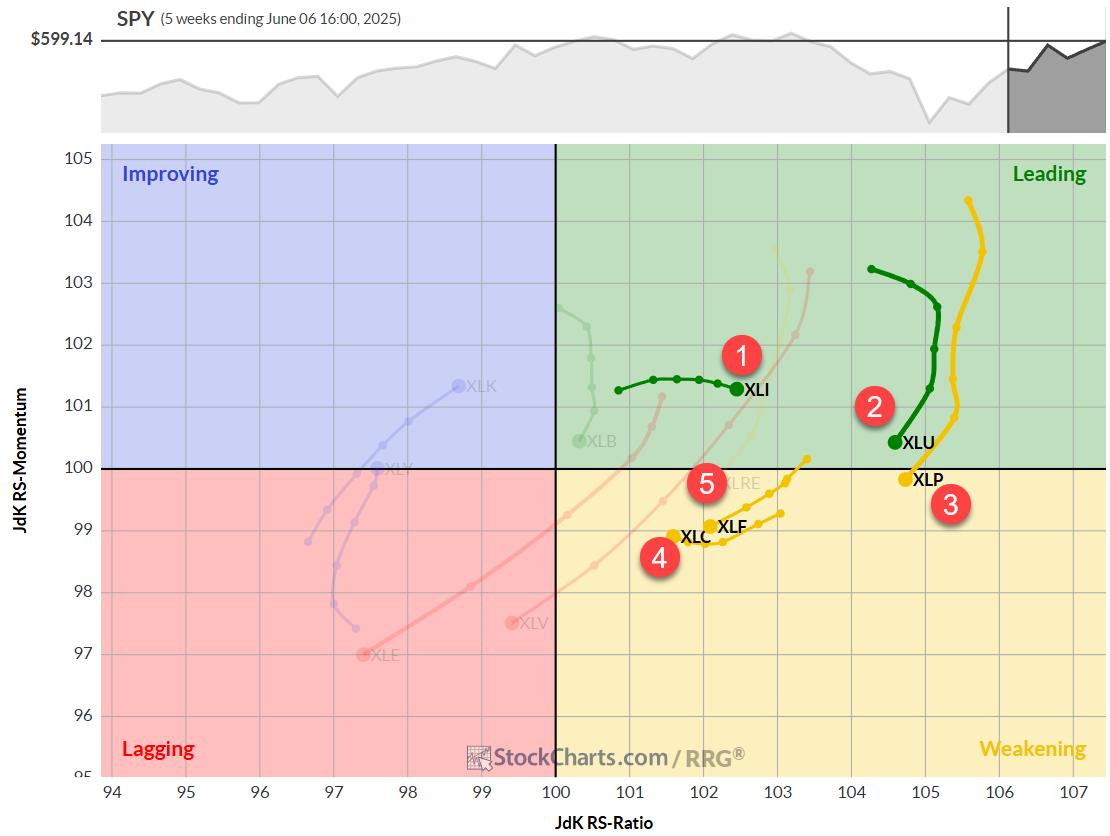

The Technology sector continues to dominate, while Industrials are rotating out of the leading quadrant.... READ MORE

In this video, Mary Ellen spotlights the areas driving market momentum following Taiwan Semiconductor's record-breaking earnings report. She analyzes continued strength in semiconductors, utilities, industrials, and AI-driven sectors, plus highlights new leadership in robotics and innovation-focused ETFs like ARK. From there, Mary Ellen breaks down weakness in health... READ MORE

Tech stocks led by semiconductors pushed the Nasdaq to a record high. Learn why this sector is gaining momentum and how to track top stocks.... READ MORE

KEY TAKEAWAYS * Materials sector climbs to #5 in rankings, displacing Utilities * Technology maintains leadership, but Communication Services and Financials show weakness * Daily RRG reveals potential for Materials, caution needed for Comm Services and Financials * Portfolio drawdown continues, currently 8% behind S&P 500 YTD After a relatively quiet week... READ MORE

The stock market continued to push higher with the S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) closing at record highs on Thursday. The Dow Jones Industrial Average ($INDU) tacked on a solid 192 points (+0.43%). There was a pullback on Friday, but July is a seasonally strong... READ MORE

Investing in triple-leveraged ETFs may not be on your radar. But that may change after you watch this video. Tom Bowley of EarningsBeats shares how he uses the 3x leveraged ETFs to take advantage of high probability upside moves. Tom shows charts of 3x leveraged ETFs that mirror their benchmark... READ MORE

A good trade starts with a well-timed entry and a confident exit. But that's easier said than done. In this video, Joe Rabil of Rabil Stock Research reveals his go-to two-timeframe setup he uses to gain an edge in his entry and exit timings and reduce his investment... READ MORE

For those who focus on sector rotation, whether to adjust portfolio weightings or invest directly in sector indexes, you're probably wondering: Amid the current "risk-on" sentiment, even with ongoing economic and geopolitical uncertainties, can seasonality help you better anticipate shifts in sector performance? Current Sector Performance... READ MORE

After months of whiplash sector swings, the market may finally be showing signs of settling down. In this video, Julius de Kempenaer uses Relative Rotation Graphs (RRG) to analyze asset class rotation at a high level and then dives into sectors and factors. Julius highlights the rotation into cryptocurrencies and... READ MORE

The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we're seeing some interesting shifts within the rankings that warrant closer examination. Let's dive into the details and see what the Relative Rotation... READ MORE

Joe presents a deep dive into MACD crossovers, demonstrating how to use them effectively across multiple timeframes, establish directional bias, and improve trade timing. He explains why price action should confirm indicator signals, sharing how to identify "pinch plays" and zero-line reversals for higher-quality setups. Joe then analyzes... READ MORE

Last month, the Dollar Index triggered a number of sell signals confirming that it is in a bear market. Chart 1, for instance, shows that the red up trendline emanating in 2011 has been decisively ruptured, thereby pushing the Index further below its moving average. The Coppock Curve, seen in... READ MORE

In this video, Mary Ellen spotlights key pullback opportunities and reversal setups in the wake of a strong market week, one which saw all-time highs in the S&P 500 and Nasdaq. She breaks down the semiconductor surge and explores the bullish momentum in economically-sensitive sectors, including software, regional... READ MORE

A Greek Odyssey First of all, I apologize for any potential delays or inconsistencies this week. I'm currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight back home was first delayed, then canceled, then... READ MORE

Chartists can improve their odds and increase the number of opportunities by trading short-term bullish setups within bigger uptrends. The first order of business is to identify the long-term trend using a trend-following indicator. Second, chartist can turn to more granular analysis to find short-term bullish setups. Today's... READ MORE

MACD, ADX and S&P 500 action frame Joe Rabil's latest show, where a drifting index push him toward single-stock breakouts. Joe spotlights the daily and weekly charts of American Express, Fortinet, Parker-Hannifin, Pentair, and ServiceNow as showing strong ADX/MACD characteristics. He outlines how the patterns... READ MORE

Think trading against the trend is risky? You may want to reconsider. When a stock or ETF is trending lower, the smart money watches for signs of a reversal; those early signals can get you into a trend before everyone else and lead to favorable risk-to-reward ratios. In this video,... READ MORE

The stock market has been on quite the rollercoaster of late, thanks to news headlines. But investors seem to have shrugged off the past weekend's geopolitical tensions, at least for now. On Tuesday, we saw a surge of enthusiasm. Investors were diving back into stocks and selling off... READ MORE

In this video, Mary Ellen opens with a look at the S&P 500, noting that the index remains above its 10-day average despite a brief pullback—a sign of healthy market breadth. She points to ongoing sector leadership in technology, while observing that energy and defense stocks are... READ MORE

Some Sector Reshuffling, But No New Entries/Exits Despite a backdrop of significant geopolitical events over the weekend, the market's reaction appears muted -- at least, in European trading. As we assess the RRG best five sectors model based on last Friday's close, we're... READ MORE

The S&P MidCap 400 SPDR (MDY) is trading at a moment of truth as its 5-day SMA returns to the 200-day SMA. A bearish trend signal triggered in early March. Despite a strong bounce from early April to mid May, this signal remains in force because it has... READ MORE

Joe presents his game-changing "undercut and rally" trading pattern, which can be found in high volatility conditions and observed via RSI, MACD and ADX signals. Joe uses the S&P 500 ETF as a live case study, with its fast shake-out below support followed by an equally... READ MORE

Follow along with Frank as he presents the outlook for the S&P 500, using three key charts to spot bullish breakouts, pullback zones, and MACD signals. Frank compares bearish and bullish setups using his pattern grid, analyzing which of the two is on top, and explains why he&... READ MORE

The Canadian dollar peaked in 2007 and 2011 at around $1.05, and it has been zig-zagging downwards ever since. Now at a lowly 73 cents USD, the currency looks as if it may be in the process of bottoming, or at the very least entering a multi-year trading range.... READ MORE

With oil prices surging and geopolitical unrest stirring in the Middle East, it's no surprise that energy stocks are drawing renewed attention. And, quite frankly, this week didn't have many market-moving earnings. So this week, we skate to where the puck is, or, in this case,... READ MORE

In this video, Mary Ellen spotlights breakouts in Energy and Defense, Technology sector leadership, S&P 500 resilience, and more. She then unpacks the stablecoin fallout hitting Visa and Mastercard, highlights Oracle's earnings breakout, and shares some pullback opportunities. This video originally premiered June 13, 2025. You... READ MORE

This Time Technology Beats Financials After a week of no changes, we're back with renewed sector movements, and it's another round of leapfrogging. This week, technology has muscled its way back into the top five sectors at the expense of financials, highlighting the ongoing volatility in... READ MORE

Catching a sector early as it rotates out of a slump is one of the more reliable ways to get ahead of an emerging trend. You just have to make sure the rotation has enough strength to follow through. On Thursday morning, as the markets maintained a cautiously bullish tone,... READ MORE

Three sectors stand out, with one sporting a recent breakout that argues for higher prices. Today's report will highlight three criteria to define a leading uptrend. First, price should be above the rising 200-day SMA. Second, the price-relative should be above its rising 200-day SMA. And finally, leaders... READ MORE

While the S&P 500 ($SPX) logged a negative reversal on Wednesday, the Cboe Volatility Index ($VIX), Wall Street's fear gauge, logged a positive reversal. This is pretty typical: when the S&P 500 falls, the VIX rises. Here's what makes it interesting: the... READ MORE

The U.S. stock market has been painting a subtle picture recently. While the broader indexes, such as the S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Average ($INDU), are indeed grinding higher, the daily movements have been relatively subdued. This is a noticeable shift from... READ MORE

Unlock the power of divergence analysis! Join Dave as he breaks down what a bearish momentum divergence is and why it matters. Throughout this video, Dave illustrates how to confirm (or invalidate) the signal on the S&P500, Nasdaq100, equal‑weighted indexes, semiconductors, and even defensive names like AT&... READ MORE

Sector Rotation: A Week of Stability Amidst Market Dynamics Last week presented an intriguing scenario in our sector rotation portfolio. For the first time in recent memory, we witnessed complete stability across all sector positions -- no changes whatsoever in the rankings. 1. (1) Industrials - (XLI) 2. (2) Utilities... READ MORE

QQQ and tech ETFs are leading the surge off the April low, but there is another group leading year-to-date. Year-to-date performance is important because it includes two big events: the stock market decline from mid February to early April and the steep surge into early June. We need to combine... READ MORE