MEMBERS ONLY

Where the Market Goes Next: Key Resistance Levels + Top Bullish Stocks to Watch Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Want to know where the stock market is headed next? In this week's market update, Mary Ellen McGonagle analyzes key resistance levels and reveals what's fueling the current uptrend. She highlights top bullish setups among U.S. leadership stocks, plus global names showing strength.

This video...

READ MORE

MEMBERS ONLY

Investment Portfolio Feeling Stagnant? Transform Your Path Today

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tariffs and trade talks add to investor uncertainty with short-lived rallies.

* Frequent shifts between offensive and defensive sectors indicate ongoing stock market volatility.

* Mid-cap and small-cap stocks are gaining momentum and worth monitoring.

When your investment portfolio isn't gaining ground, it's natural to feel...

READ MORE

MEMBERS ONLY

Which Will Hit First: SPX 6100 or SPX 5100?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Last Friday, the S&P 500 finished the week just below 5700. The question going into this week was, "Will the S&P 500 get propelled above the 200-day?" And as I review the evidence after Friday's close, I'm noting that the...

READ MORE

MEMBERS ONLY

Confused by the Market? Let the Traffic Light Indicator Guide You

by Grayson Roze,

Chief Strategist, StockCharts.com

In this insightful session, Grayson introduces the Traffic Light indicator, a unique tool available exclusively on the Advanced Charting Platform (ACP). Amidst the current volatility of the S&P 500, Grayson demonstrates how this indicator can help investors clarify trend directions and make more confident decisions.

This video originally...

READ MORE

MEMBERS ONLY

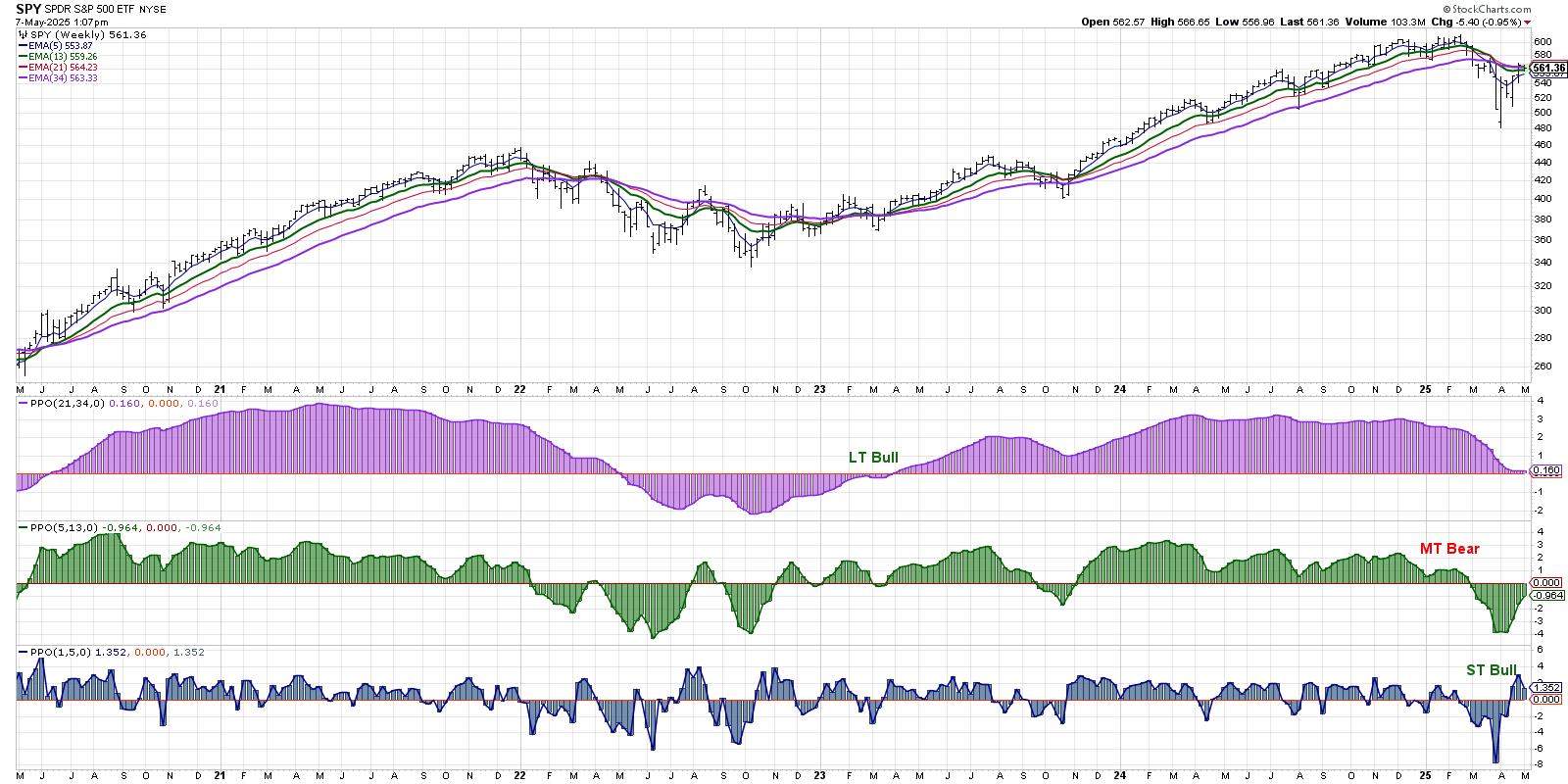

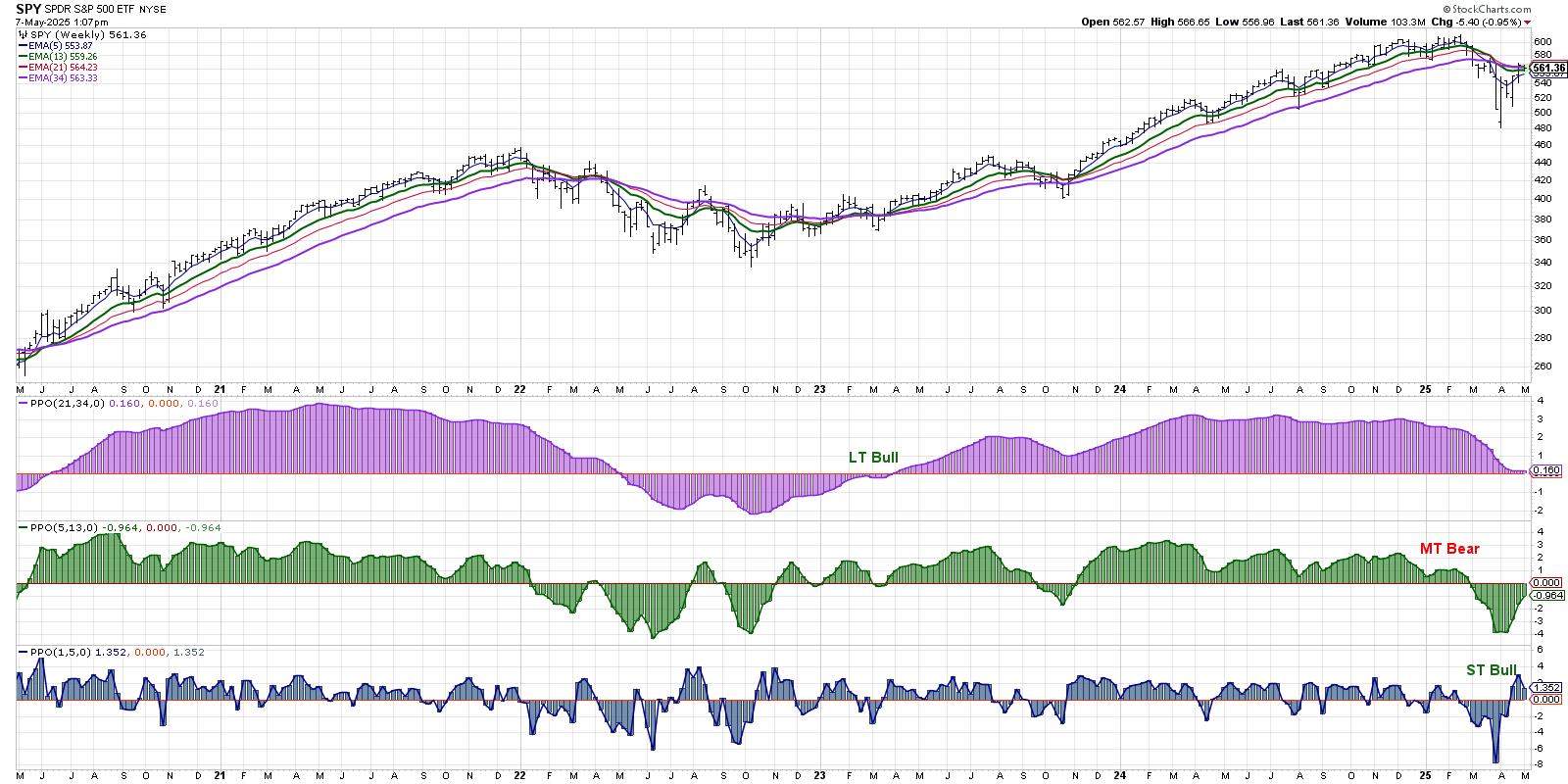

The V Reversal is Impressive, but is it Enough?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* SPY broke down in March, plunged into early April and surged into early May.

* This V bounce is impressive, but it is not enough to reverse the March breakdown.

* A significant increase in upside participation is needed to move from bear market to bull market.

Stocks plunged into...

READ MORE

MEMBERS ONLY

The Unpredictable Stock Market: How to Make Sense of It

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 is struggling to break above key resistance levels.

* It's a headline-driven market out there, with stocks reacting quickly to geopolitical and policy changes.

* The Cboe Volatility Index (VIX) indicates investors are still uncertain.

The stock market's action on Wednesday...

READ MORE

MEMBERS ONLY

Use This Multi-Timeframe MACD Signal for Precision Trades

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe shares how to trade MACD signals using multiple timeframes, and how to spot stock market pullback setups that can help to pinpoint a great entry off a low. He then reviews sector performance to identify market leadership, covers key chart patterns, and discusses a looming bearish...

READ MORE

MEMBERS ONLY

Three Charts to Watch for an "All Clear" Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* If our medium-term Market Trend Model turns bullish this Friday, that would mean the first bullish reversal since October 2023.

* Less than 50% of S&P 500 members are above their 200-day moving average, and any reading above 50% could confirm bullish conditions.

* Offensive sectors like Consumer...

READ MORE

MEMBERS ONLY

Fed Watch: Key Bullish Patterns in the S&P 500, Utilities, and Crypto

by Frank Cappelleri,

Founder & President, CappThesis, LLC

KEY TAKEAWAYS

* Bullish chart patterns, such as the inverse head-and-shoulders and cup with handle, are in play in the S&P 500.

* Utilities are breaking to new 50-day highs.

* Bitcoin and Ethereum continue to signal rising risk appetite.

The S&P 500 ($SPX) wrapped up Tuesday just below...

READ MORE

MEMBERS ONLY

Four Charts to Track a Potential Market Top

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reveals four key charts he's watching to determine whether the S&P 500 and Nasdaq 100 will be able to power through their 200-day moving averages en route to higher highs. Using the recently updated StockCharts Market Summary page, he covers moving average...

READ MORE

MEMBERS ONLY

Gold Is Showing Signs of Exhaustion, But Is It Enough to Call a Top?

by Martin Pring,

President, Pring Research

Chart 1 shows that inflation-adjusted gold recently broke above a 45-year line of resistance. Since the third leg of the secular bull market began in 2023, the price of the yellow metal has been moving up sharply, thereby propelling the long-term KST to the edge of its overbought zone. It...

READ MORE

MEMBERS ONLY

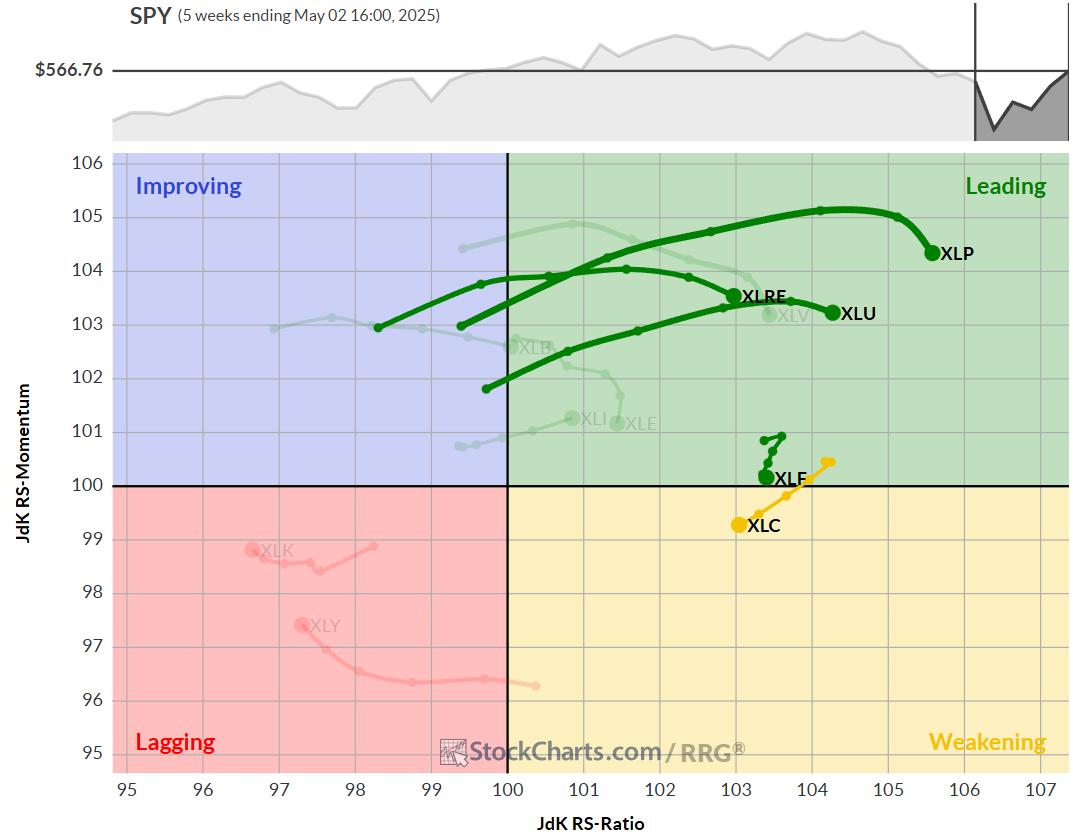

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

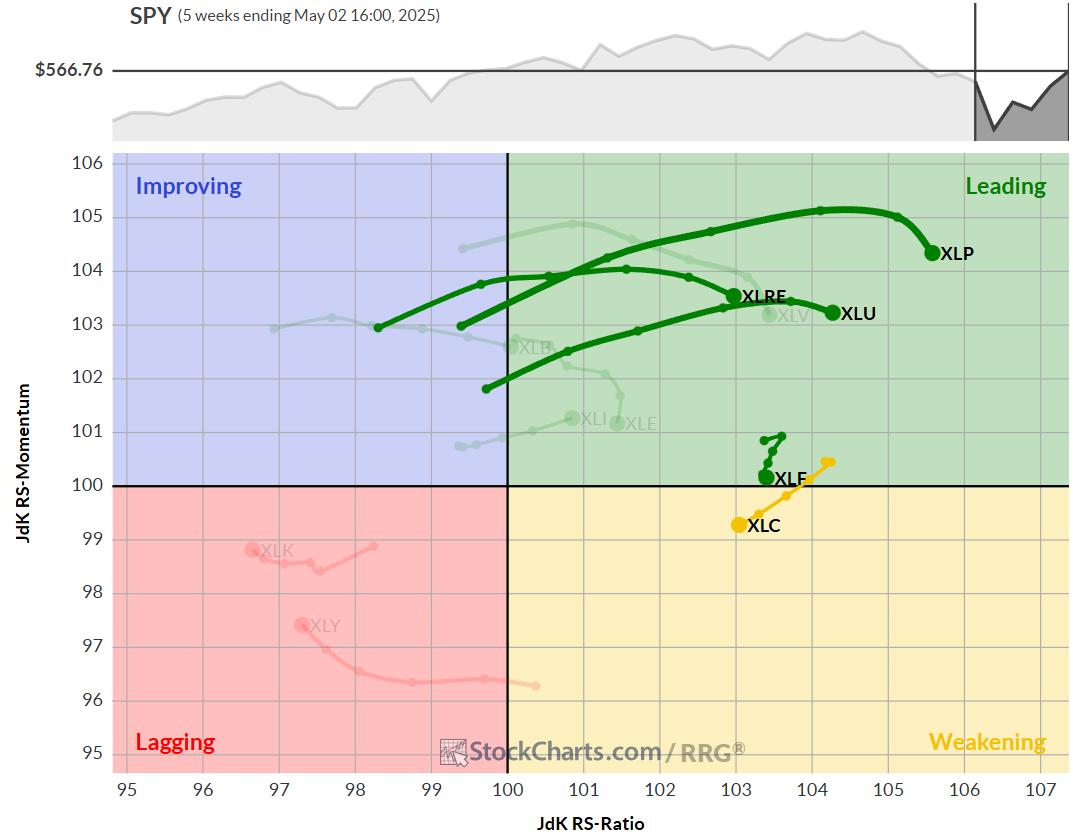

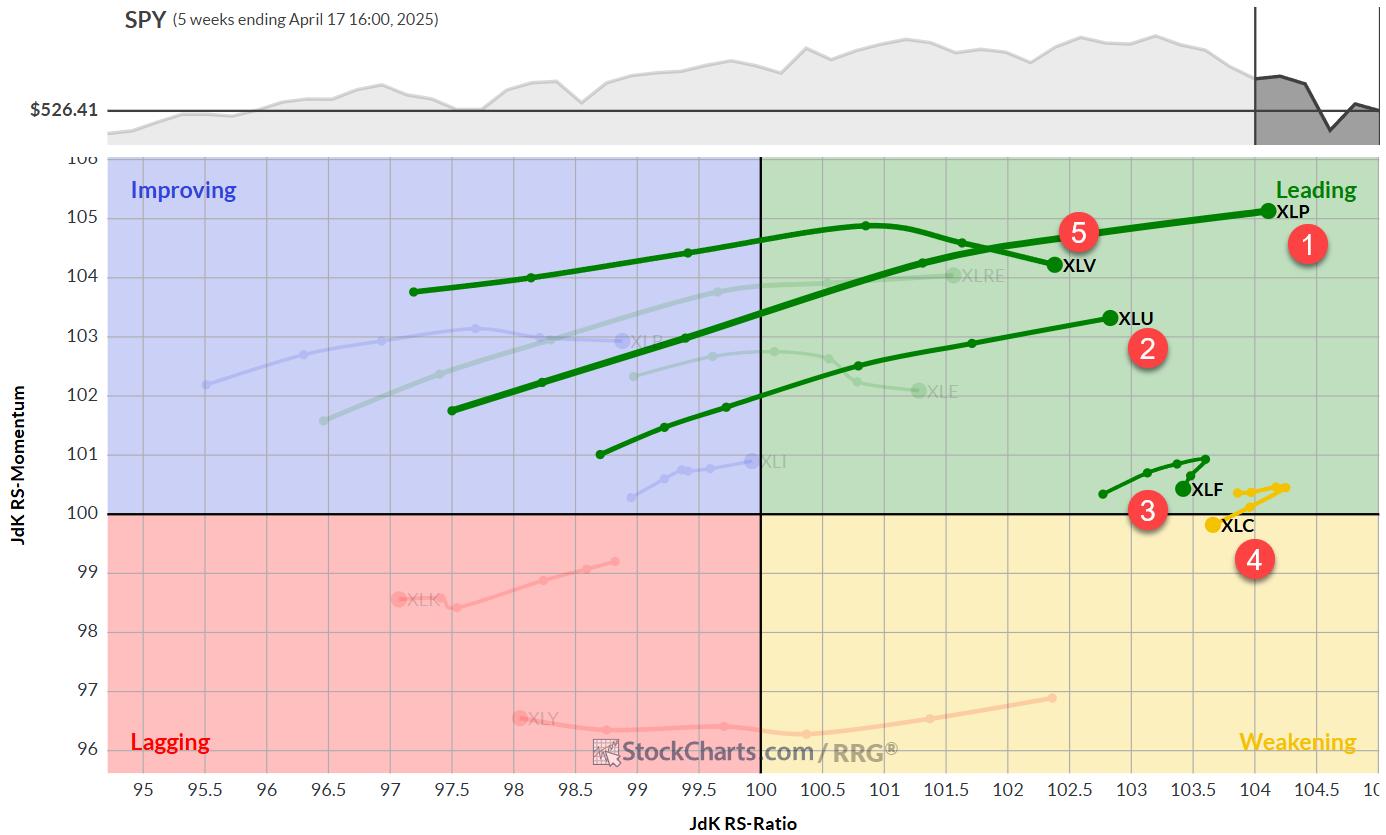

KEY TAKEAWAYS

* Top 5 sectors remain unchanged, with minor position shifts

* Leading sectors showing signs of losing momentum

* Daily RRG reveals top sectors in weakening quadrant

* Communication services at risk of dropping out of top 5

Communication Services Drops to #5

The composition of the top five sectors remains largely...

READ MORE

MEMBERS ONLY

Two Down and Two to Go - Capitulation and Thrust are just a Start

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Stocks are halfway after capitulation in early April and a Zweig Breadth Thrust.

* SPY is still below its 200-day SMA and late March high.

* Follow through is needed to trigger the medium and long term signals.

The market does not always follow the same script or sequence, but...

READ MORE

MEMBERS ONLY

Week Ahead: While NIFTY Continues To Consolidate, Watching These Levels Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the truncated week due to one trading holiday, the markets extended their gains and closed the week on a positive note. While remaining largely within a defined range, the Nifty continued consolidating above its 200-DMA while not adopting any sustainable directional bias. Though the Index continued defending its key...

READ MORE

MEMBERS ONLY

The Easiest Road to Supercharge Your Investing Reflexes and Reactions!

by Gatis Roze,

Author, "Tensile Trading"

Riches are found in reactions—your reactions to changes in the markets. By this, I mean that if you spot a change in money flowing from one asset class to another, one sector to another, one industry to another, before the masses notice, you will be rewarded handsomely. My experience...

READ MORE

MEMBERS ONLY

Stock Market Wrap: Stocks Rebound as May Kicks Off with a Bang—What Investors Should Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* A strong jobs report sparked a stock market rally, with major indexes closing the week higher.

* Positive earnings from Microsoft and Meta Platforms took the Nasdaq Composite above its 50-day moving average.

* Financials, Industrials, and Technology were the leading sectors this week, with Financials showing technical strength.

We...

READ MORE

MEMBERS ONLY

Top 10 Stock Charts For May 2025: Breakouts, Trends & Big Moves!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

Discover the top 10 stock charts to watch this month with Grayson Roze and David Keller, CMT. They break down breakout strategies, moving average setups, and technical analysis strategies using relative strength, momentum, and trend-following indicators. This analysis covers key market trends that could impact your trading decisions. You don&...

READ MORE

MEMBERS ONLY

Master the 18/40 MA Strategy: Spot Trend, Momentum & Entry

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe demonstrates how to use the 18-day and 40-day moving averages to identify trade entry points, assess trend direction, and measure momentum. He breaks down four key ways these MAs can guide your trading decisions—especially knowing when to be a buyer. Joe also analyzes commodities, noting...

READ MORE

MEMBERS ONLY

If Non-US Equities Continue to Outperform the S&P, Will Europe or Asia Benefit Most?

by Martin Pring,

President, Pring Research

Since the tariff war first broke out, there have been widespread reports in the financial press telling us that investors have decided to cash in on their U.S. profits and move their capital abroad. The U.S., they tell us, is no longer regarded as a safe haven. Indeed,...

READ MORE

MEMBERS ONLY

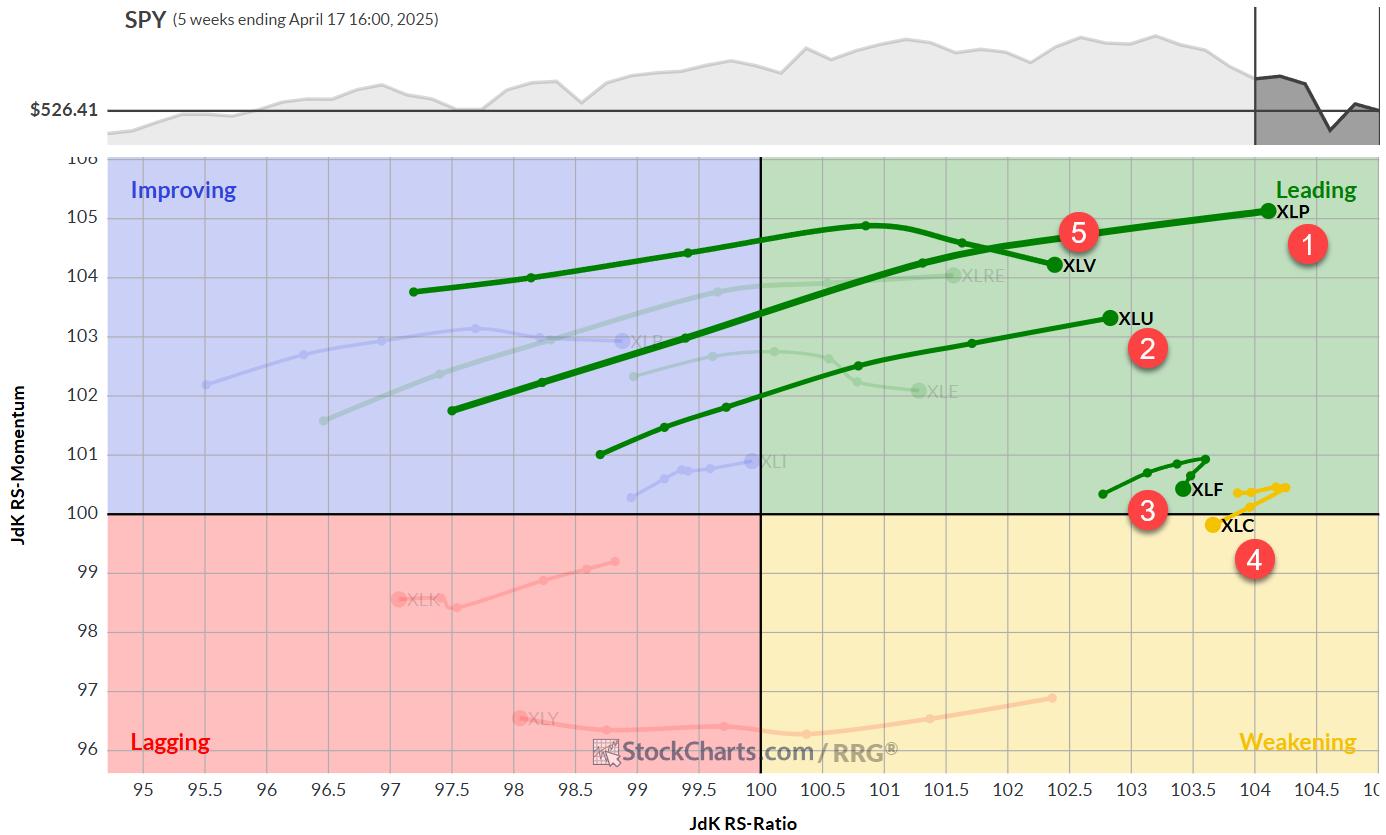

Sector Rotation + SPY Seasonality = Trouble for Bulls?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video, Julius analyzes current asset class rotation, revealing why stocks in the lagging quadrant may signal continued market weakness. By combining sector rotation trends—particularly strength in defensive sectors—with SPY seasonality, Julius builds a compelling case that downside risk in the S&P 500 may outweigh...

READ MORE

MEMBERS ONLY

Big Tech, Big Data, Big Moves: Why This Week Could Be a Market Game-Changer

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market is holding steady after last week's bounce, but remains hesitant.

* Big tech earnings and economic data are the focus this week.

* Sector rotation indicates that investors are shifting to defensive mode.

Speaking overall, the stock market hasn't changed course after last...

READ MORE

MEMBERS ONLY

Our Very Last Trading Room

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, Carl and Erin made a big announcement! They are retiring at the end of June so today was the last free DecisionPoint Trading Room. It has been our pleasure educating you over the years and your participation in the trading room has been fantastic! Be sure and sign up...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #17

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Defensive sectors maintain dominance in top 5, despite strong market performance.

* Real Estate enters top 5, replacing Health Care; Consumer Staples, Utilities, and Financials remain stable in top 3 positions.

* Defensive positioning has put a dent in portfolio performance after strong week.

Real Estate and Healthcare Swapping Positions...

READ MORE

MEMBERS ONLY

Zweig Breadth Thrust Dominates the Headlines - But What about an Exit Strategy?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* S&P 1500 Advance-Decline Percent triggered a Zweig Breadth Thrust this week.

* These signals reflect a sudden and sharp shift in participation (net advancing percent).

* ZBT signals only cover the entry, which means chartists need to consider an exit strategy should it fail.

The Zweig Breadth Thrust...

READ MORE

MEMBERS ONLY

Week Ahead: RRG Indicates Sector Shifts; NIFTY Deals With These Crucial Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a strong move the week before, the markets took on a more consolidatory look over the past five sessions. Following ranged moves, the Nifty closed the week on just a modestly positive note. From a technical standpoint, the Nifty tested a few important levels on both daily and weekly...

READ MORE

MEMBERS ONLY

Navigate Market Shifts Like a Pro: Utilize This Key Indicator Effectively

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Market breadth indicators are flashing a bullish signal.

* Sector rotation is favoring risk-on investing.

* The Zweig Breadth Thrust triggered a signal, indicating a reversal from bearish to bullish conditions.

After weeks of uncertainty, the stock market finally gave us something to smile about. The major indexes just wrapped...

READ MORE

MEMBERS ONLY

S&P 500 Rises from Bearish to Neutral, But Will It Last?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* This week's rally pushed the S&P 500 above an important trendline formed by the major highs in 2025.

* Improving market breadth indicators confirm a broad advance off the early April market low.

* Using a "stoplight" technique, we can better assess risk and...

READ MORE

MEMBERS ONLY

Two EASY Ways to Find the Strongest Stocks in Seconds

by Grayson Roze,

Chief Strategist, StockCharts.com

In this video, Grayson highlights the crucial 5,500 level on the S&P 500 using our "Tactical Timing" chart. He then demonstrates two of the easiest methods for identifying the strongest stocks within key indexes like the S&P 500, NASDAQ 100 and Dow Industrials....

READ MORE

MEMBERS ONLY

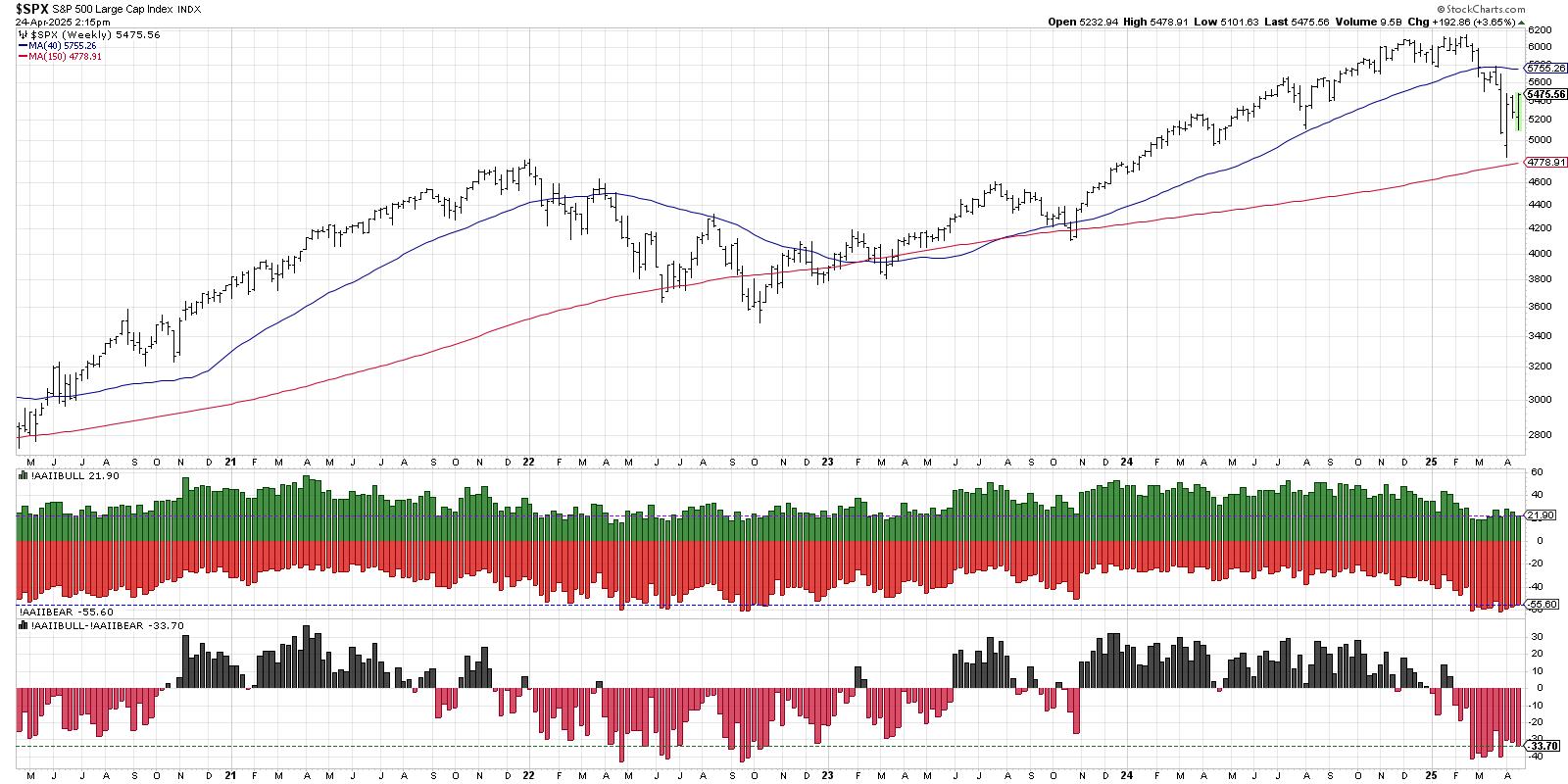

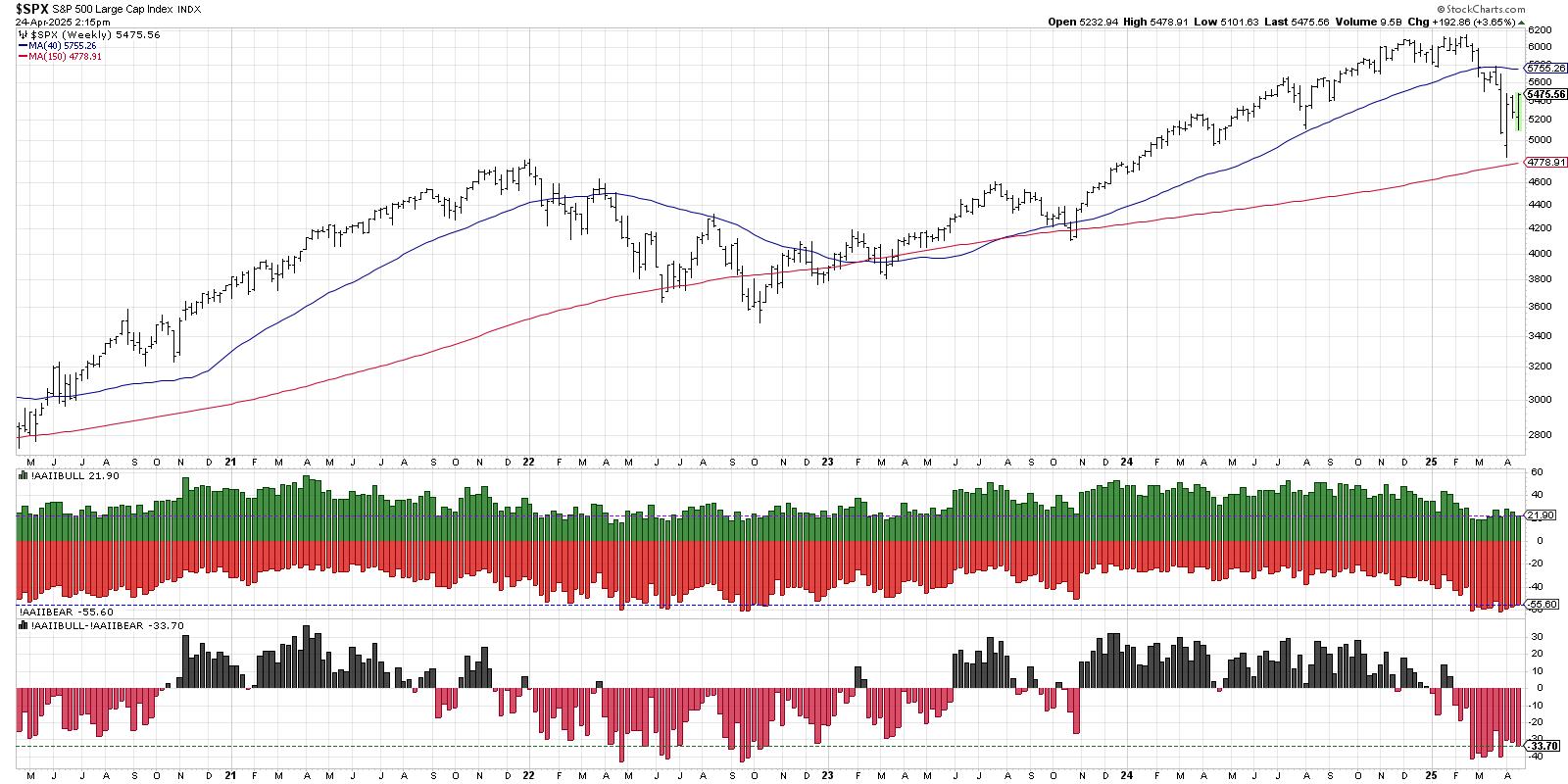

Sentiment Signals Suggest Skepticism

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The AAII survey demonstrates a lack of bullish optimism after the recent bounce higher.

* The NAAIM Exposure Index suggests that money managers remain skeptical of the recent advance.

* While Rydex fund flows show a rotation to defensive positions, previous bearish cycles have seen much larger rotations.

When I...

READ MORE

MEMBERS ONLY

Everything Looks Fine... Until You See This Chart

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Even though the stock market outlook may appear cautiously optimistic, it helps to monitor sentiment and money flow indicators.

* The S&P 500 is below its 40-week moving average and sentiment reads bearish.

* In a headline-driven market, any signs of optimism may reflect a pause, which means...

READ MORE

MEMBERS ONLY

Bonds Down, But Are They Out?

by Martin Pring,

President, Pring Research

Something didn't seem to ring true a couple of weeks ago when the whole world, by which I mean from the Treasury Secretary to your favorite cable news host, seized on the recent sell-off in bonds and why they would no longer be a safe haven and therefore...

READ MORE

MEMBERS ONLY

Hidden Gems: Bullish Patterns Emerging in These Country ETFs

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe highlights key technical setups in select country ETFs that are showing strength right now. He analyzes monthly and weekly MACD, ADX, and RSI trends that are signaling momentum shifts. Joe also reviews the critical level to watch on the S&P 500 (SPX), while breaking...

READ MORE

MEMBERS ONLY

$4,000 Gold? Analysts Eye New Highs on Inflation and Geopolitical Risk

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The price of gold is climbing on safe-haven demand, with key support levels mapped for potential entry.

* The U.S. dollar is sliding as speculation grows over whether its weakness is part of a larger strategy.

* Bitcoin is testing resistance and could rally further if safe-haven flows accelerate....

READ MORE

MEMBERS ONLY

Bearish Warning: 3 Market Sentiment Indicators You Can't Ignore

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, market sentiment, investor psychology, and stock market trends take center stage as David Keller, CMT, shares three powerful sentiment indicators that he tracks every week. He explains how the values are derived, what the current readings say about the market environment in April 2025, and how these...

READ MORE

MEMBERS ONLY

DP Trading Room: Long-Term Outlook for Bonds

by Erin Swenlin,

Vice President, DecisionPoint.com

The market continued to slide lower today as the bear market continues to put downside pressure on stocks in general. Bonds and Yields are at an inflection point as more buyers enter the Bond market which is driving treasury yields higher. What is the long-term outlook for Bonds? Carl gives...

READ MORE

MEMBERS ONLY

Safer Stock Picks for an Uncertain Market (High Yield + Growth)

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, as earnings season heats up, Mary Ellen reviews current stock market trends, highlighting top-performing stocks during past bear markets that are showing strength again today. She also shares a proven market timing system that's signaled every stock market bottom, helping investors stay ahead of major...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #16

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer staples and utilities continue to lead sector rankings.

* Defensive sectors are showing strength in both weekly and daily RRGs.

* Health care struggling, but maintains position in top 5

* RRG portfolio slightly underperforming S&P 500 YTD, but gap narrowing.

Top 5 Remains Unchanged

The latest sector...

READ MORE

MEMBERS ONLY

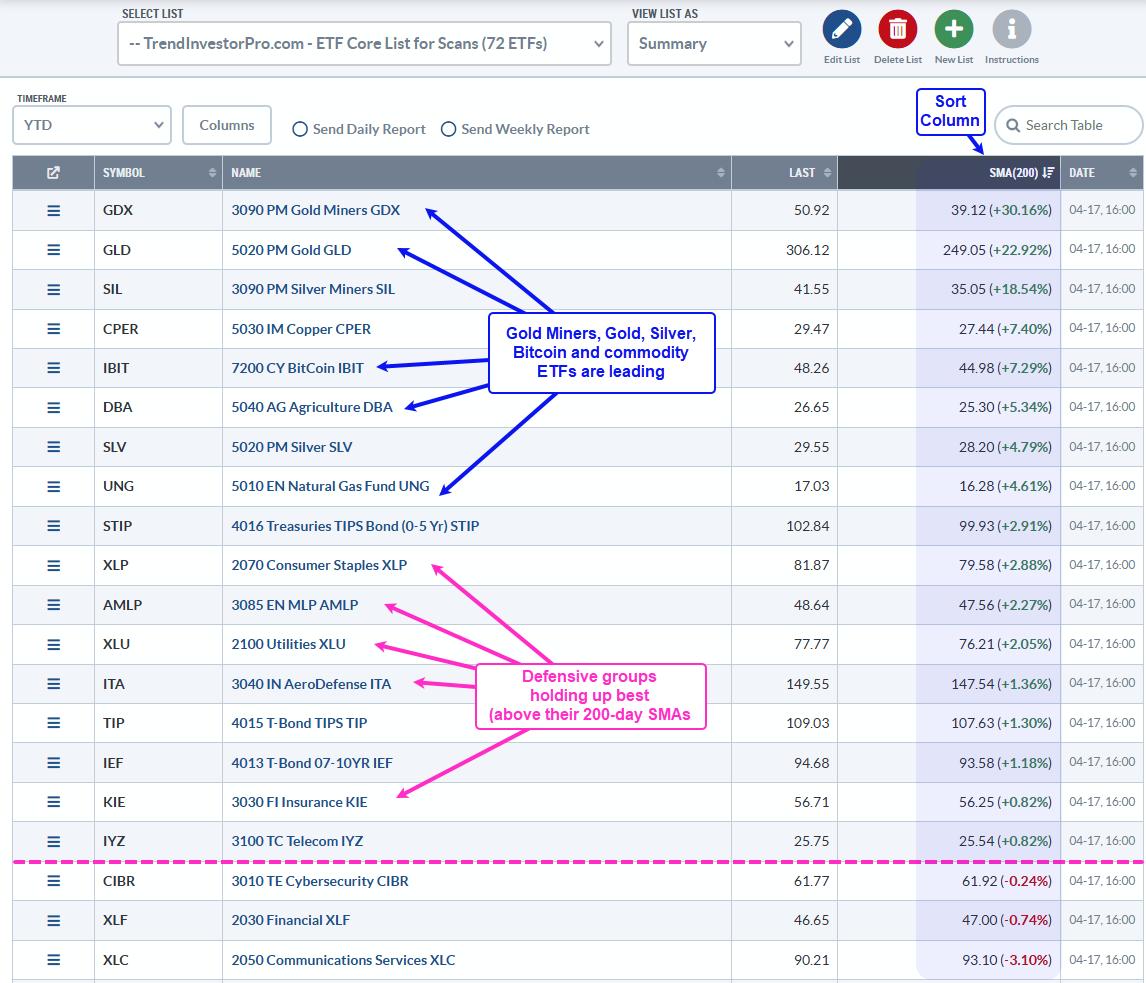

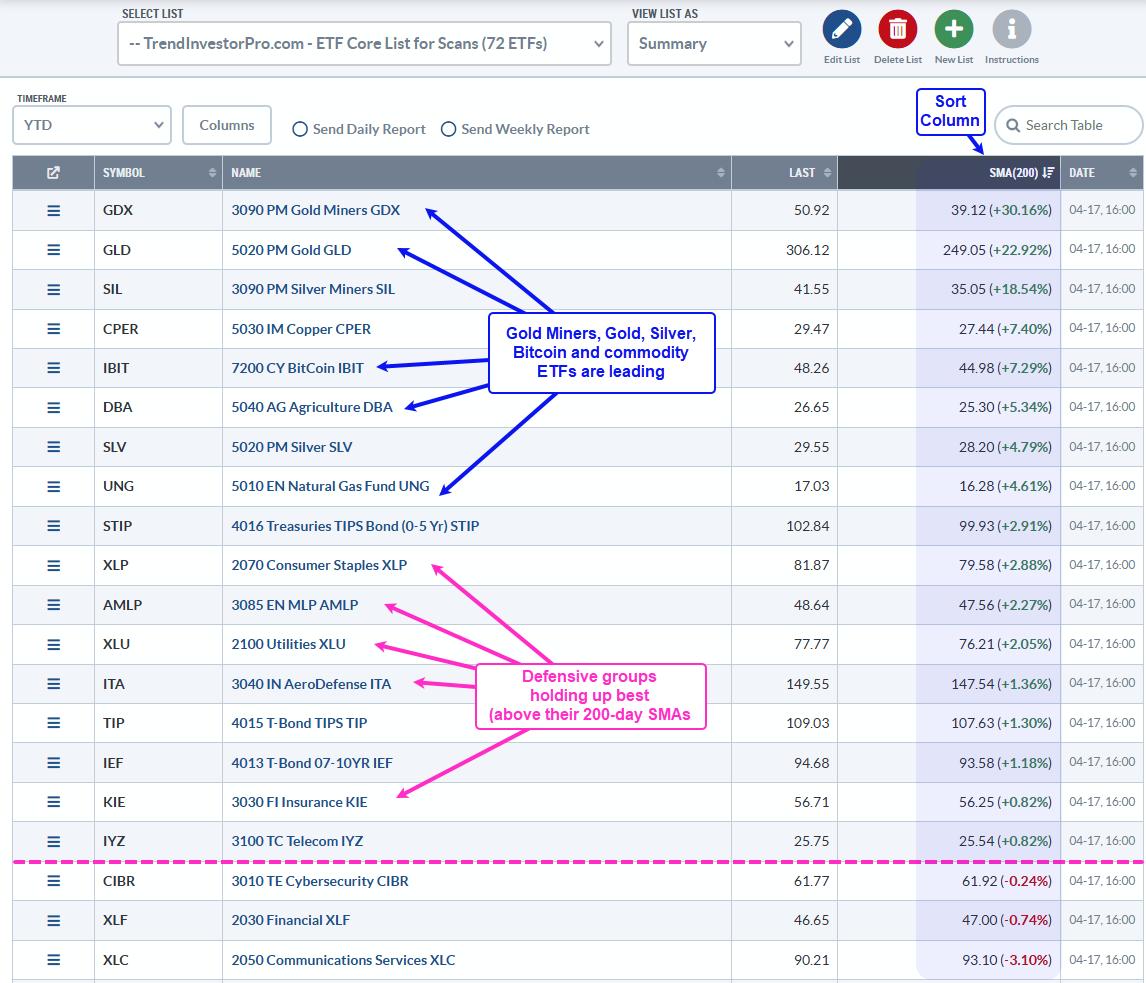

Equities? Fuhgeddaboudit! Alternative Assets are Leading

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* A simple ranking shows leadership in alterative assets and commodities.

* Stocks are not the place to be because the vast majority are below their 200-day SMAs.

* Bitcoin is holding up relatively well as it sets up with a classic corrective pattern.

Trading is all about the odds. Trade...

READ MORE

MEMBERS ONLY

Week Ahead: What Should You Do as Nifty Marches Higher Towards the Resistance Zone?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by was a short trading week with just three trading days. However, the Indian equities continued to surge higher, demonstrating resilience, and the week ended on a positive note.

During the week before last, the Nifty was able to defend the 100-week MA; last week, it...

READ MORE

MEMBERS ONLY

When in Doubt, Follow the Leadership

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Consumer Discretionary sector has underperformed the Consumer Staples sector since February, indicating defensive positioning for investors.

* The Relative Rotation Graphs (RRG) show a clear rotation from "things you want" to "things you need" as investors fear weakening economic conditions.

* We remain focused on...

READ MORE