MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

A Grand Slam: Broader Stock Market Indexes Soar to New Highs

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500, Dow Jones Industrial Average, and the Nasdaq Composite close at all-time highs

* Bond prices also moved higher, as did gold and silver

* The VIX remains low, indicating investors are complacent

The bull market hasn't gone anywhere. Despite of worrying about the...

READ MORE

MEMBERS ONLY

Powerful Entry Strategy Using One Moving Average

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use one SMA to pinpoint great entries in pullback plays, demonstrating how it can develop in slightly different ways. He shows 3 different types of setups in the price action and its relationship to...

READ MORE

MEMBERS ONLY

China Tariffs Drive Upside for Rare Earth Minerals

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Mish Schneider of MarketGauge. Mish breaks down one materials name that could benefit from recently announced China tariffs, and describes how regional banks could benefit from Fed actions in 2024. David charts the S&P 500'...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, May 16 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, May 16 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

Meme Stock Frenzy Back In the Spotlight: Are Traders Losing Patience?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investors look like they're keeping their powder dry until key economic data is released this week

* The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite are trading close to their highs, but are hesitant to reach it

* Meme stocks showed their might today,...

READ MORE

MEMBERS ONLY

Four Reasons Why Emerging Markets are Headed Higher

by Martin Pring,

President, Pring Research

Last February, I wrote an article on emerging markets, using the iShares MSCI Emerging Markets ETF (EEM) as my benchmark. I pointed out that this sector was close, but had not quite broken out to the upside. Now it has, and the outlook is favorable for at least a 4-6-month...

READ MORE

MEMBERS ONLY

Watch for Higher Lows in These Three Tech Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator. He shares his favorite chart for analyzing relative strength ratios for leading stocks, and also answers viewer questions on price patterns for XLB and PYPL, plus best...

READ MORE

MEMBERS ONLY

This is the #1 Options Income Strategy You Should Master

by Tony Zhang,

Chief Strategist, OptionsPlay

In this exclusive interview, StockCharts' Grayson Roze sits down with Tony Zhang, Chief Strategist at OptionsPlay. Tony shares an informative overview of the Covered Call Strategy, explains how it can be used to generate reliable income for your portfolio, and explores best practices for the strategy including expiration and...

READ MORE

MEMBERS ONLY

DP Trading Room: Bonds & Yields At An Inflection Point

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's focus was on the current and long-term conditions of Bonds and Yields which are at an inflection point. Yields are attempting to hold onto a rising trend and Bonds are plodding along to the upside for now. One reader asked if it is time to start dollar...

READ MORE

MEMBERS ONLY

Week Ahead: Markets to Stay Tentative; This Defensive Sector May Start Showing Relative Outperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, we had expressed concerns over the Nifty and VIX rising in the same direction simultaneously. As mentioned earlier, in such circumstances, the VIX often ends up acting as a leading indicator and a precursor to an impending corrective move. The previous week had seen VIX...

READ MORE

MEMBERS ONLY

Top 5 Stocks in "Go" Trends

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Trend Continuation

* Breakouts

* Bullish Flags

* Momentum Confirmation

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE

MEMBERS ONLY

MEM TV: This Stealth AI Stock is Ready to EXPLODE Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish bias in the broader markets, along with the sector rotation into cyclical areas as growth areas languish. She then highlights the perils of buying, or holding, stocks around earnings releases, and shares a high-yielding stock...

READ MORE

MEMBERS ONLY

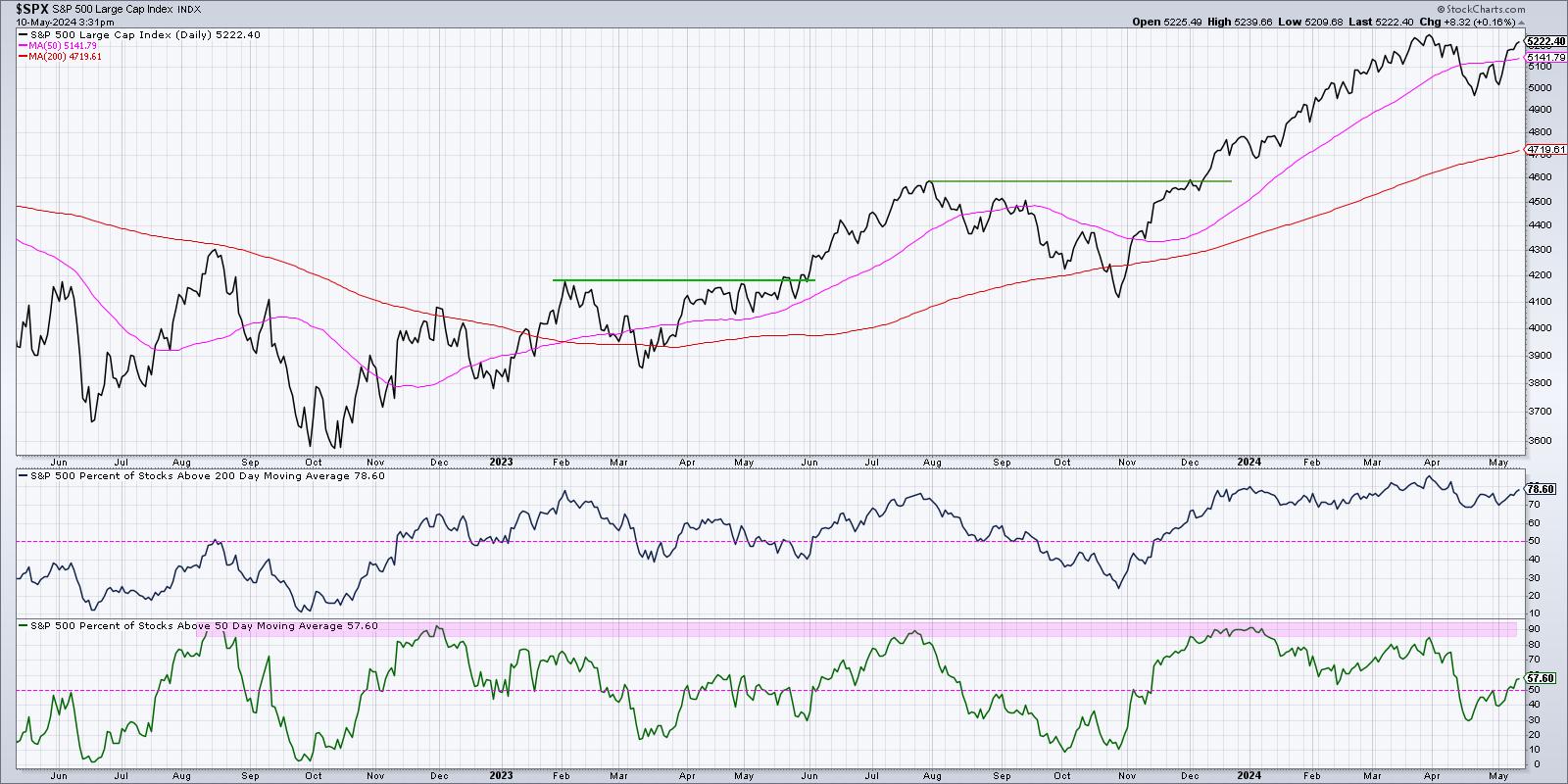

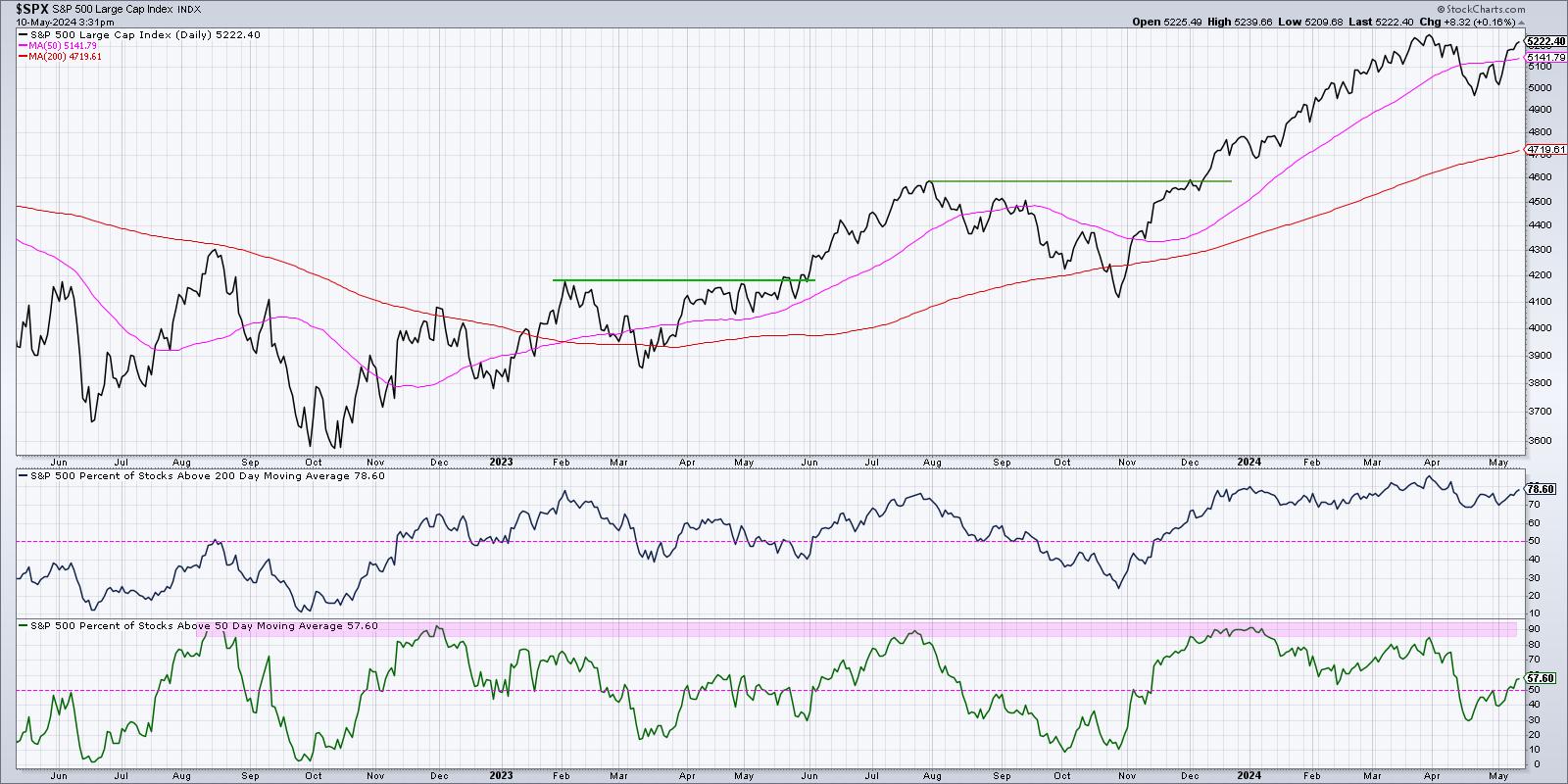

Three Breadth Indicators to Confirm a Bullish Market Trend

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There's no denying the strength the major averages have displayed off their April lows. The S&P 500 finished the week within a rounding error of the previous all-time high around 5250. What would it take for the SPX and NDX to power to new all-time highs...

READ MORE

MEMBERS ONLY

Relative Strength Screams Bullish for This Tech Stock

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator. He shares his favorite chart for analyzing relative strength ratios for leading stocks, and also answers viewer questions on price patterns for XLB and PYPL, plus best...

READ MORE

MEMBERS ONLY

Stocks Pop Higher as Defensive Sectors Thrive

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down an unusual day for stocks. The S&P 500 and Nasdaq closed higher, but the top sectors were defensive - real estate and utilities! He shares key levels to watch for NVDA, AAPL, TSLA, and more,...

READ MORE

MEMBERS ONLY

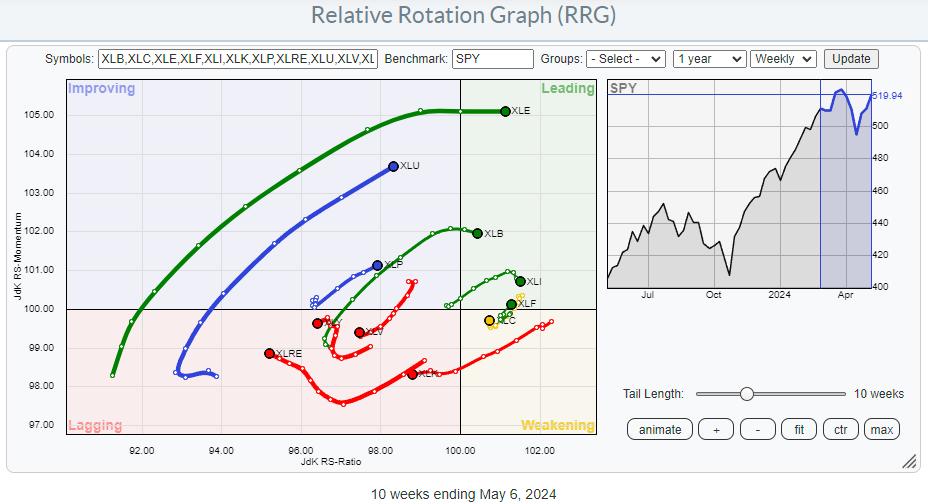

These Three Strong Financial Stocks Look Ready To Surge Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* XLF on strong RRG-Heading, rotating back into leading quadrant

* XLF price approaching overhead resistance after short setback

* Three major financial stocks ready for upward breaks to lead the sector higher

The Relative Rotation Graph for US sectors shows long tails for XLE and XLU. Both are on a...

READ MORE

MEMBERS ONLY

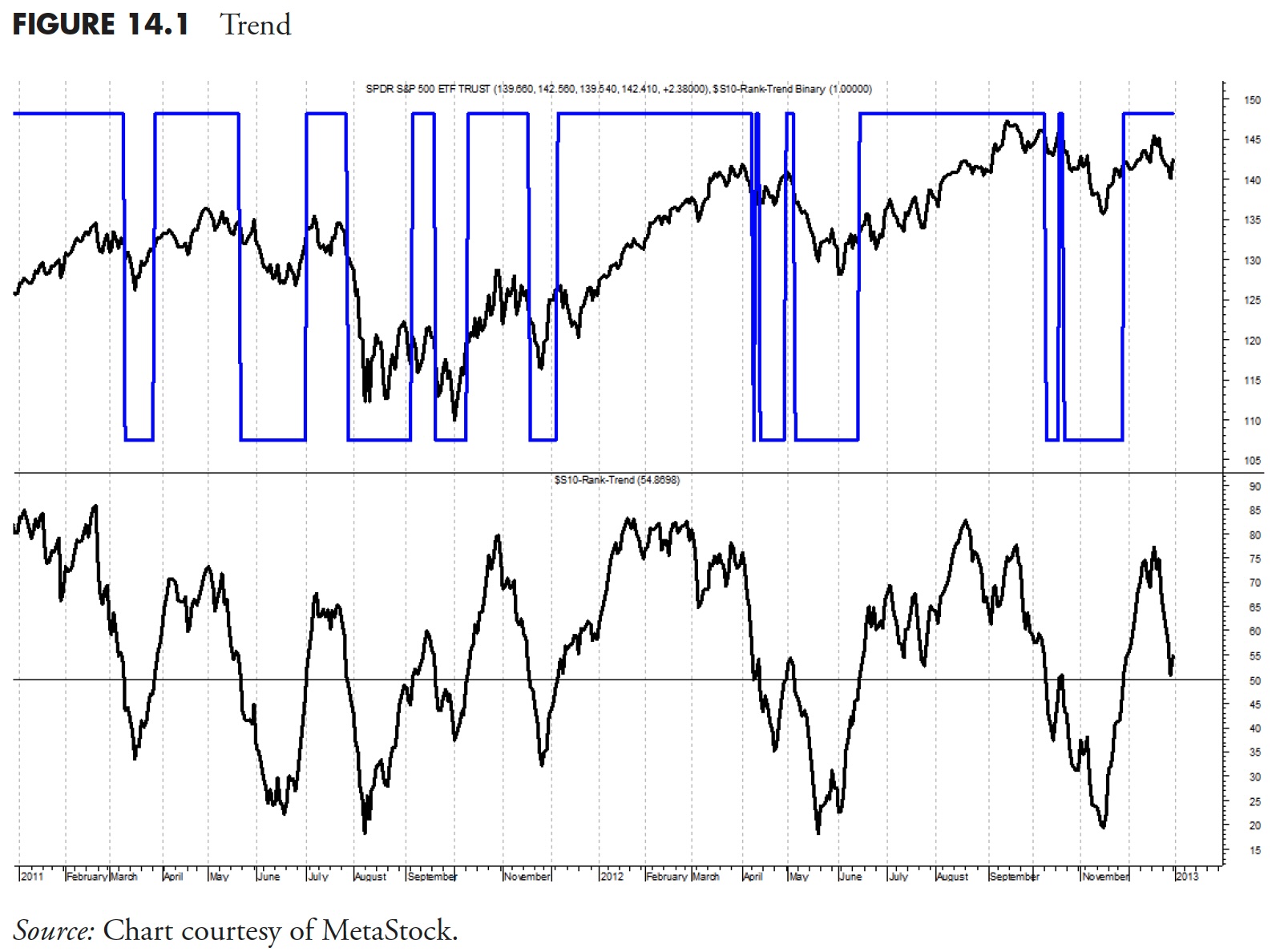

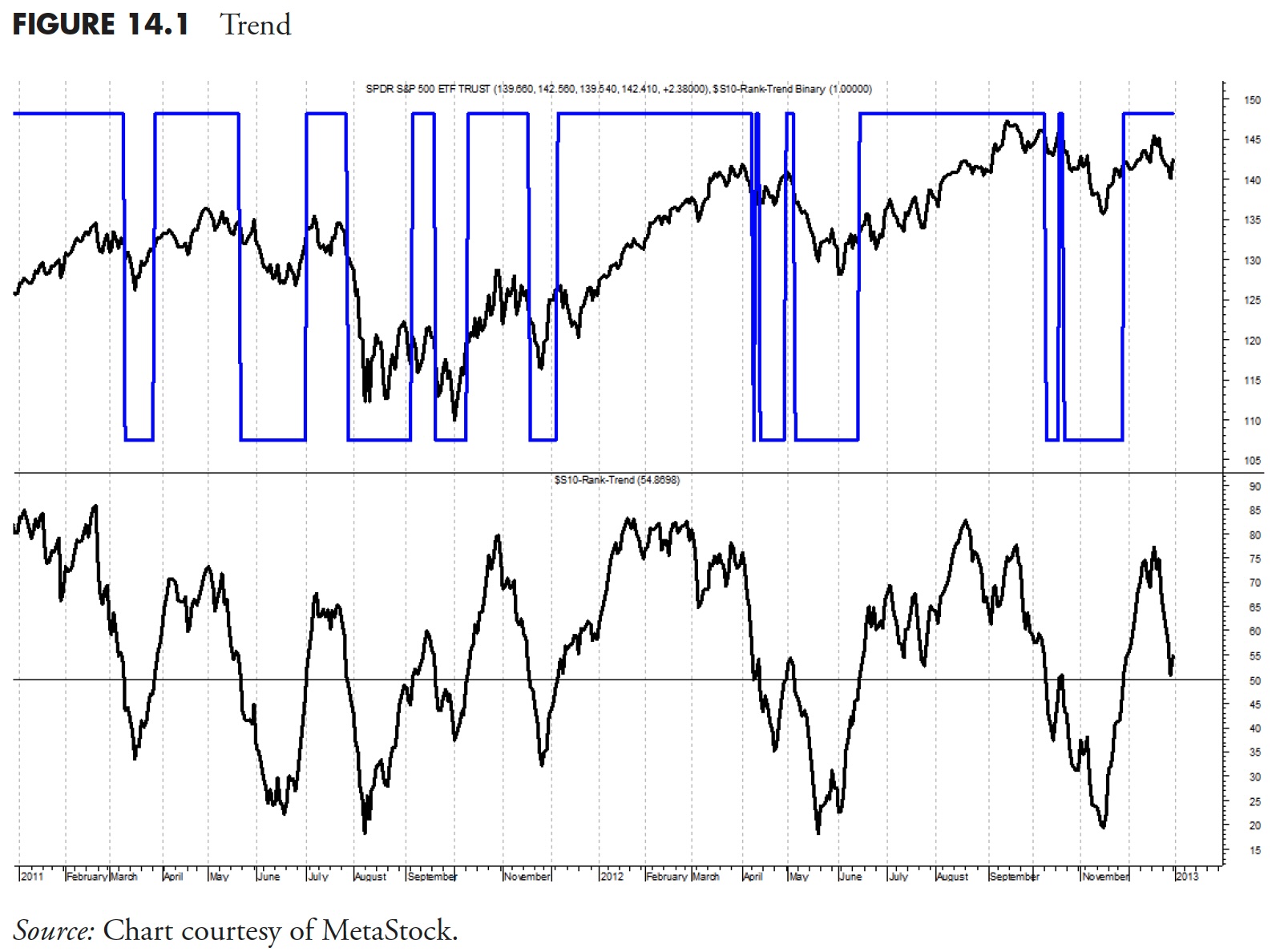

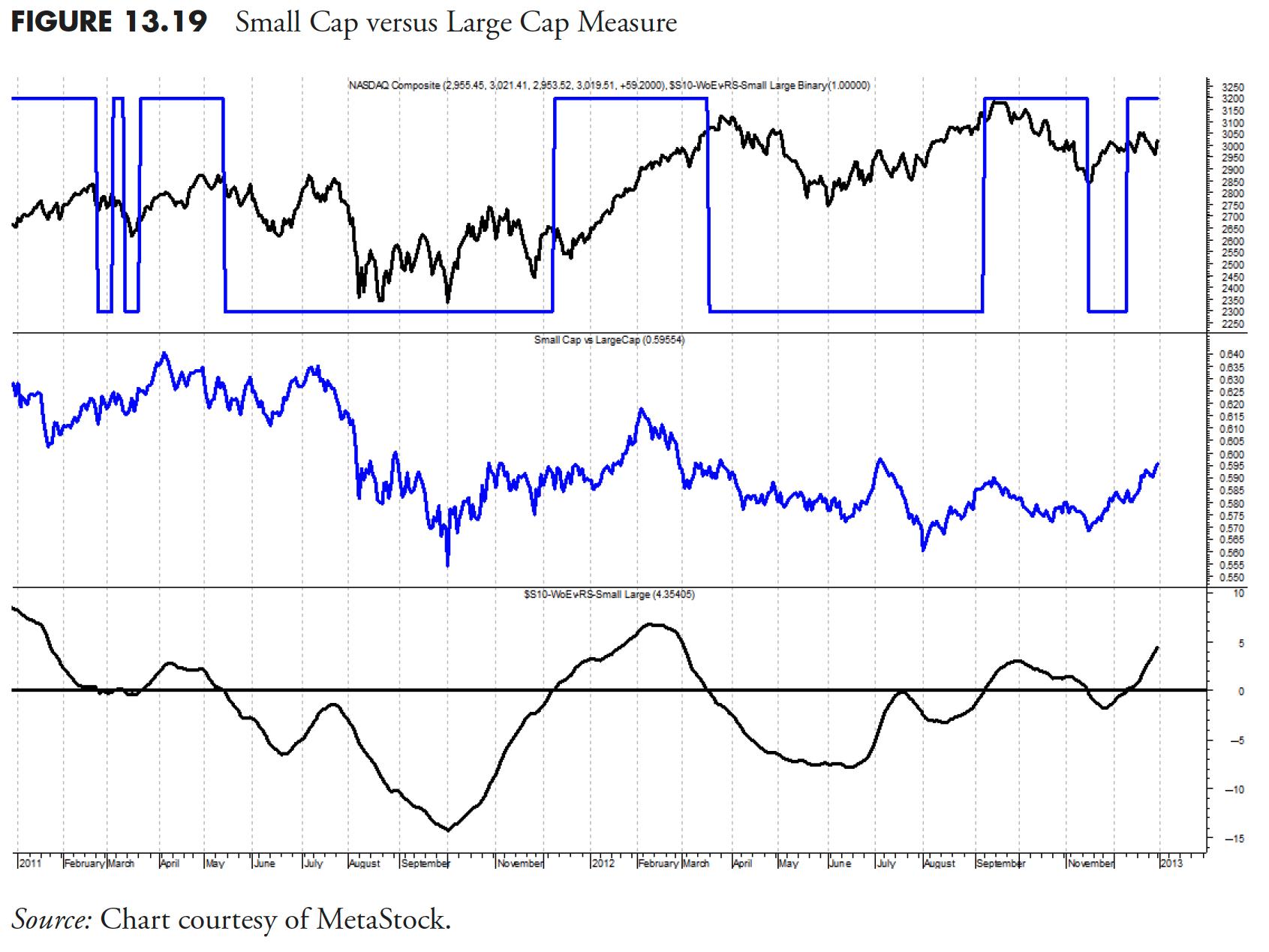

Rules-Based Money Management - Part 4: Security Ranking Measures

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twentieth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Top Performing Sector is Utilities?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a choppy day for equities, with utilities remaining atop the leaderboard for a second straight session. He lays out a potential reversal in interest rates, what that could mean for growth stocks, and recaps earnings plays including WYNN,...

READ MORE

MEMBERS ONLY

Silver Cross BUY Signals on the Dow (DIA) and Russell 2000 (IWM)

by Erin Swenlin,

Vice President, DecisionPoint.com

The Dow Jones Industrial Average ETF (DIA) 20-day EMA crossed up through the 50-day EMA (a Silver Cross), generating an IT Trend Model BUY Signal. The Dow saw a better rally today than the SPY, but, under the hood, it isn't quite as strong as the SPY. We...

READ MORE

MEMBERS ONLY

What Rising Volatility Means to the Current Market

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how he uses a rising volatility condition to signal increased risk. He then discusses what needs to take place to offer a nice trading opportunity, and shows how to adjust your approach when volatility is increasing....

READ MORE

MEMBERS ONLY

Is the S&P 500 Forming a Bear Flag Pattern?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave focuses in on price pattern analysis for the S&P 500, then reflects on the emergence of defensive sectors like consumer staples. He also recaps earnings movers, including DIS, SHOP, and more.

This video originally premiered on May...

READ MORE

MEMBERS ONLY

NYSE and Global A/D Lines Trade at New All-Time Highs

by Martin Pring,

President, Pring Research

The magnitude and duration of corrections are largely determined by the direction of the prevailing primary trend. If it's bearish, they tend to be more severe and last longer. In a bull market, it's just the opposite, as they are generally short and sweet, if you...

READ MORE

MEMBERS ONLY

The Market Breadth Indicator You Should Be Following

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps another strong day for stocks as the S&P 500 regains its 50-day moving average. He then identifies key levels to watch for PLTR, LCID, NFLX, NVDA, and AAPL, and breaks down the latest market breadth indicator...

READ MORE

MEMBERS ONLY

DP Trading Room: Two Industry Groups To Watch!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin uncovers two industry groups that are showing strength and potential in the short term. She takes a look "Under the Hood" to reveal participation and trends that are quite bullish.

Carl walks us through the market overall, covering not only the SPY, but also interest rates,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Vulnerable to Disruption of Primary Trend; Volatility Likely to Stay

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets traded in a much wider range in the past trading week. Over the past few days, we had seen the markets and the VIX inching higher, i.e. moving in the same direction. In the previous technical note, we had expressly mentioned this concern, as instances of VIX...

READ MORE

MEMBERS ONLY

MEM TV: NVIDA is Setting Up To SURGE

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it'...

READ MORE

MEMBERS ONLY

Is this a Dead-Cat Bounce or a Bounce with Legs?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* A key short-term breadth indicator became oversold in mid April.

* Stocks are bouncing after this oversold reading.

* Breadth, however, has yet to show a serious expansion in participation.

Stocks fell sharply into late April and then rebounded over the last two weeks. SPY fell 5.34% from March...

READ MORE

MEMBERS ONLY

Technology Stocks Back In the Lead: Are Inflation Fears Behind Us?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes closed higher, but failed to show enough follow through to the upside

* Technology stocks were in the lead today and led the stock market higher

* The CBOE Volatility Index is back below 15, indicating lack of fear among investors

The weaker-than-expected jobs report...

READ MORE

MEMBERS ONLY

Key Breadth Indicator Flashes Buy Signal for Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave opens The Final Bar mailbag to answer viewer questions on the Nasdaq Bullish Percent Index, the value of long-term technical analysis techniques, how sentiment indicators relate to the market trend, and how the CMT program helped him improve his...

READ MORE

MEMBERS ONLY

The Bull Case for Buffett's Biggest Holding

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As investors flock to Omaha, Nebraska in their annual pilgrimage to learn from the great Warren Buffett, it seems an opportune time to reflect on the technical evidence for Berkshire's biggest holding, Apple (AAPL).

Today, we'll consider AAPL using "multiple time frame analysis", in...

READ MORE

MEMBERS ONLY

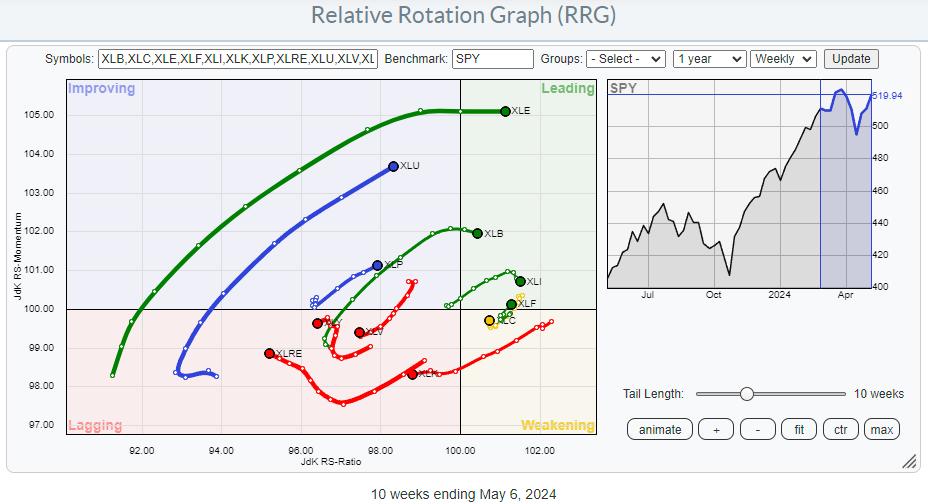

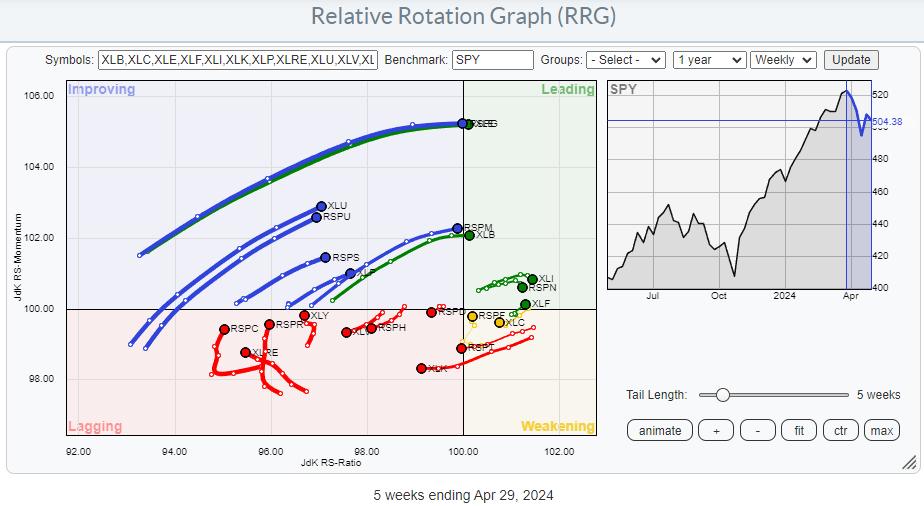

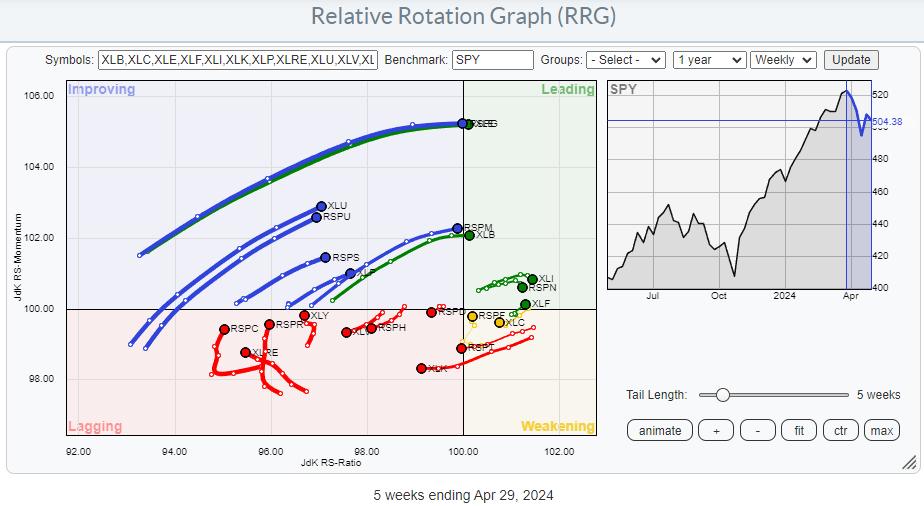

Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Comparing equal-weighted and cap-weighted sectors on a Relative Rotation Graph can offer interesting insights

* When the trajectory of the tails and their position on the chart differ significantly, further investigation is warranted

* At the moment, two sectors are showing such divergences

All on the Same Track... or?

The...

READ MORE

MEMBERS ONLY

The BULL Case for BITCOIN

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Adrian Zduńczyk, CMT of The ₿irb Nest. David recaps a busy earnings week, breaking down the charts of PTON, AAPL, and more. Adrian tracks the recent pullback for Bitcoin and why the long-term uptrend still remains the prevailing...

READ MORE

MEMBERS ONLY

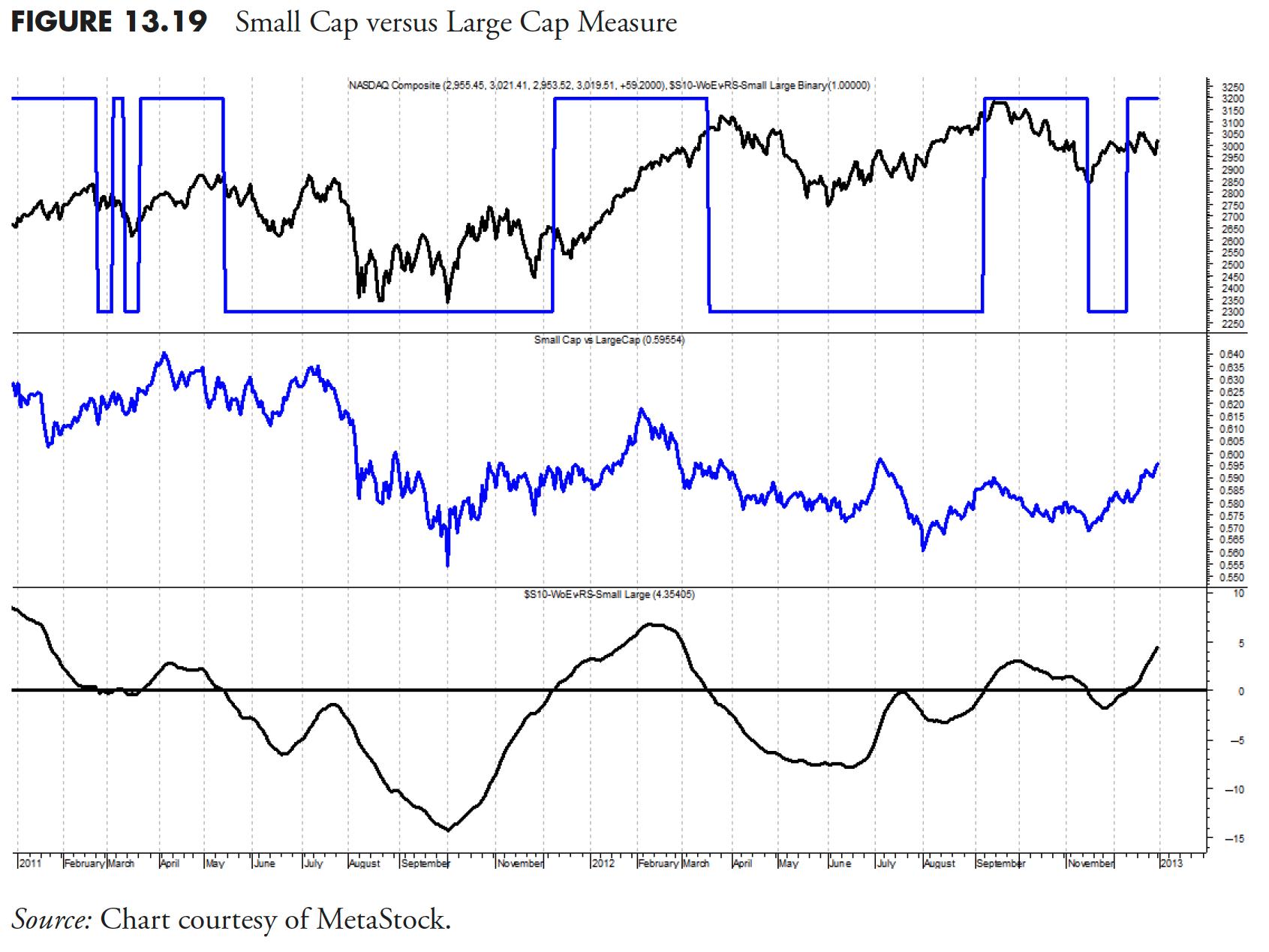

Rules-Based Money Management - Part 3: Relative Strength and Other Measures

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the nineteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Market Pops, Then Drops on Fed Day

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Adam Turnquist, CMT of LPL Financial. Dave debriefs on today's Fed meeting market reaction, reviewing concerning technical developments for NVDA, AMD, SMCI, NCLH, and MAR. Adam relates short-term weakness in growth stocks to long-term strength...

READ MORE

MEMBERS ONLY

Time for a Pause in the Ongoing Dollar Bull Market? Or Full Steam Ahead?

by Martin Pring,

President, Pring Research

I last wrote about the dollar in December, where I came to the conclusion that a limited rally was a likely possibility in what was assumed to be a primary bull market. I am still of the view that the bull market is alive and well, but it's...

READ MORE

MEMBERS ONLY

Gain AN EDGE Over Other Traders with ADX/DI

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe breaks down the differences between buyers and sellers, and shows how the ADX/DI can be used in three different ways: The action phase, low ADX period and an expansion phase. Understanding this indicator will give you...

READ MORE

MEMBERS ONLY

Stocks Plunge with Key Earnings on Tap

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Gina Martin Adams, CMT CFA of Bloomberg Intelligence. David highlights a spike higher in the VIX, and charts names for earnings including AMZN, AMD, SMCI, SBUX, MCD, PYPL, and ETN. Gina shows how rising interest rates continue to...

READ MORE

MEMBERS ONLY

Key Levels for AMZN, AMD, & AAPL Earnings!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the S&P 500's late inning rally to test the 50-day moving average from below. What levels could come into play with this week's Fed meeting on Wednesday? He also focuses on key...

READ MORE

MEMBERS ONLY

DP Trading Room: Intermediate-Term View of the Magnificent 7

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl puts the spotlight on the Magnificent 7 with a look at not only the daily charts, but also a review of the intermediate term using weekly charts. See where they are headed short-term and what are our expectations are in the intermediate term.

Carl also gave us his...

READ MORE