MEMBERS ONLY

Week Ahead: NIFTY May Stay Vulnerable At Higher Levels; This Sectors Rolls Inside The Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Despite the volatile moves during the four sessions of this week's shortened frame, we ended on a very flat note for the second time in a row. The trading range remained slightly wider compared to the previous week. Compared to the 274.55-point range in the week before,...

READ MORE

MEMBERS ONLY

Stock Market Ends Week on Positive Note; Market Internals May Be Turning Bullish

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Strong September jobs report caused an initial shock but investors overcame it and the broader stock market indexes all closed higher

* Volatility remained below 20 during the trading day

* In addition to Technology and Communication Services, Financials may be showing bullish strength

September's strong labor market—...

READ MORE

MEMBERS ONLY

The Most Important Moving Average to Boost Your Investing Success

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses the importance of the 18-month MA line for investing. He shows how it can provide a bias for a stock or market for years, and how it reveals when to play counter to the trend. Joe...

READ MORE

MEMBERS ONLY

How Market Breadth Indicators Can Lead You Out of Market Bottoms

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave digs out his market correction playbook and shares what market breadth indicators tend to do leading into and out of market bottoms. He also reveals the charts that can serve investors well in corrective phases, using relative strength as...

READ MORE

MEMBERS ONLY

How to Not Just Survive But PROSPER During Market Downturns

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action by discussing his current portfolio and how he is seeing each position to its fruition. He then resumes his series on Jesse Livermore. This week, he explains how years of experience can give you intuition,...

READ MORE

MEMBERS ONLY

Here's a Scary Scenario for You: S&P 500 Downside to 2200?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investment Partners updates his Elliott Wave count for the S&P 500 and shares what the MOVE index can tell us about further upside potential for interest rates. Dave recaps the continued deterioration...

READ MORE

MEMBERS ONLY

Watch for These Signs of a Bottom As Market Breadth Conditions Crumble

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how market breadth conditions have continued to deteriorate to the point where signs of a bottom may emerge. He answers viewer questions on historical Fed cycles, under-performance of defensive sectors like utilities, and how to use technical analysis...

READ MORE

MEMBERS ONLY

Focus on Stocks: October 2023

by Larry Williams,

Veteran Investor and Author

First & Foremost

I want to personally thank you for subscribing to "Focus on Stocks". I will do all I can to earn the confidence you have placed in me. -- Larry Williams

Is it a Different World?

"I have to pay attention to the implications of...

READ MORE

MEMBERS ONLY

Your Burning Questions, Answered: FATE of TESLA & Bullish Bias Solutions!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions about Tesla's potential trajectory towards the 200-day moving average and ways to normalize relative strength graphs using volatility measures. He also dives into his past trades' technical setup, shares tips for setting up...

READ MORE

MEMBERS ONLY

ChartPacks: The Quick and Easy Way to UNLEASH THE POWER of Your StockCharts Account

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson talks all about ChartPacks -- the QUICKEST and EASIEST way to enhance your StockCharts account (old or new) in just one click! ChartPacks are pre-created collections of ChartLists that you can install right into your account;...

READ MORE

MEMBERS ONLY

Beware of Shorts in EXTREME Cycle Lows For The Market

by TG Watkins,

Director of Stocks, Simpler Trading

The internals have all cycled to extreme low areas, which tells TG that being short would be risky -- just like being super long at the end of July was also risky. The pendulum has swung to the lows, and now, in this week's edition of Moxie Indicator...

READ MORE

MEMBERS ONLY

Is it Possible for the S&P 500 to Hold the 4300 Level?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Samantha LaDuc of LaDuc Capital breaks down the implications of higher interest rates and why semiconductors remain a crucial space to watch. Host David Keller, CMT tracks the recent rally in Bitcoin and identifies two key names testing moving average...

READ MORE

MEMBERS ONLY

What to Do When The MACD Is Broken

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how the creator of the MACD, Gerald Appel, used this indicator as an overbought/oversold oscillator. He shows how using the SPY on the daily chart as an example. He then explains what to do when...

READ MORE

MEMBERS ONLY

Looking at Recent Market PULLBACK in a Long-Term Context & More!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Joe Rabil of Rabil Stock Research walks through his monthly, weekly, and daily S&P 500 charts to put the recent market pullback into proper long-term context. Host David Keller, CMT digs into breadth indicators that have turned quite...

READ MORE

MEMBERS ONLY

Riding Out the Storm in Less-Than-Ideal Conditions

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action by sticking with the original plan with his portfolio vs. giving up due to less-than-ideal conditions. He then resumes his series on the wisdom of Jesse Livermore.

This week, Dave discusses that there is a...

READ MORE

MEMBERS ONLY

SharpCharts vs. ACP - Comparing & Contrasting Your Charting Platform Choices

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson explores the two primary charting platforms on StockCharts - SharpCharts and ACP - to highlight the strengths of each, compare and contrast the two and share his thoughts on when and why you may want to...

READ MORE

MEMBERS ONLY

Nvidia Stock: Why It's Screaming a Spectacular Buy Signal

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* NVDA stock is holding on to the support of its 100-day moving average

* NVDA has maintained a high StockCharts Technical Rank (SCTR) since early 2023

* NVDA's relative strength with respect to the S&P 500 is approaching 200%

Nvidia's stock has maintained a...

READ MORE

MEMBERS ONLY

Market Begs: Tell Us Something Good!

We compiled a list of the 10 biggest uncertainties in the stock market right now.

In no particular order:

1. China-trade wars and chip wars

2. Oil and food inflation

3. Strikes

4. Government shutdown

5. Corporate and individual bankruptcies on the rise

6. Commercial real estate and banking

7....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Forms A Potential Top; Low VIX Continues To Stay A Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was mentioned that the markets are prone to some consolidation and corrective retracements due to the technical setup on the charts. It was also mentioned that the precariously low levels of volatility need to be watched, and this also can keep the markets vulnerable...

READ MORE

MEMBERS ONLY

GNG TV: "Go" Trends in Rates & Dollar Causing Problems for Equity

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, with rates gapping higher and breaking above resistance, Alex and Tyler walk through the macro charts that can have an impact on markets. After discussing rates, they look at the dollar, which also is in a strong "Go" trend.

This...

READ MORE

MEMBERS ONLY

It's Time to Get Long

by Larry Williams,

Veteran Investor and Author

As a follower of my "Focus on Stocks" blog, you know we had a signal to sell on the opening Sunday night (10th day left).

That was forecast last month... now I think it's time to start to get long.

Where? At the August lows.

When?...

READ MORE

MEMBERS ONLY

Fed Keeps Hands Off Rates, Leaves DOOR OPEN for More Hikes!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Danielle Shay of Simpler Trading joins Dave to discuss what's the technical take on the FAANG stocks after today's Fed announcement going into earnings season? Powell and Co. leave rates unchanged, leave the door open for...

READ MORE

MEMBERS ONLY

Jesse Livermore on Mistakes & Rising From the Ashes

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave continues his series on Jesse Livermore. In spite of Livermore's greatness, he made a lot of mistakes, and these mistakes often resulted in him blowing up. In this episode, Dave discusses how Livermore let extraneous influences force him...

READ MORE

MEMBERS ONLY

Timing the Market With the WillTrend Indicator

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The WillTrend indicator helps identify stock trends and optimal entry and exit points

* The WillTrend indicator provides clear signals in weekly and daily charts that help determine actionable trading scenarios

* It's important to take each signal within the context of the stock's current technical...

READ MORE

MEMBERS ONLY

When to BUY, When to SELL, and When to SIT On Your Hands

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Dave Landry of DaveLandry.com shares his own approach to what he calls the "Three Whens"- when to buy, when to sell, and when to sit on your hands! Meanwhile, host Dave Keller reviews charts of...

READ MORE

MEMBERS ONLY

Analyzing Risks for Mega-Cap Growth Stocks Before Key FED Meeting

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave conducts a deep dive into current market breadth indicators, including advance-decline data, the McClellan Oscillator, and the Bullish Percent Index. He reviews key support and resistance levels for AAPL, TSLA, NVDA, and other growth stocks as the market waits...

READ MORE

MEMBERS ONLY

Quick Access to Your Chart Templates, The Secret Sauce That Makes ACP Fly

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson demonstrates the importance of Chart Templates in StockCharts' ACP platform, then pulls back the covers on a new "quick access" feature that just launched in the platform.

StockCharts users can now access any...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Current State of ARGoN -- Applying the Concept to 30 DOW Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I continue my chat with Ralph Acampora in the StockCharts.com studio.

After recording our previous video (see here!), I put Ralph on the spot, and together we flip through the 30 Dow stocks, calling the current price and relative...

READ MORE

MEMBERS ONLY

MEM TV: Best Ways for You to Hedge Tech Weakness

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen McGonagle shares her outlook for the markets heading into next week's interest rate decision by the Federal Reserve. She also reviews why Technology was the weakest sector and what it means for the group. She then...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Story of ARGoN (Acampora's Relative Grid of Nine)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I chat with guest Ralph Acampora in the StockCharts.com studio in Redmond, WA. We discuss the birth of ARGoN, a special way of looking at markets from both a price and a relative perspective.

Once upon a time, Ralph...

READ MORE

MEMBERS ONLY

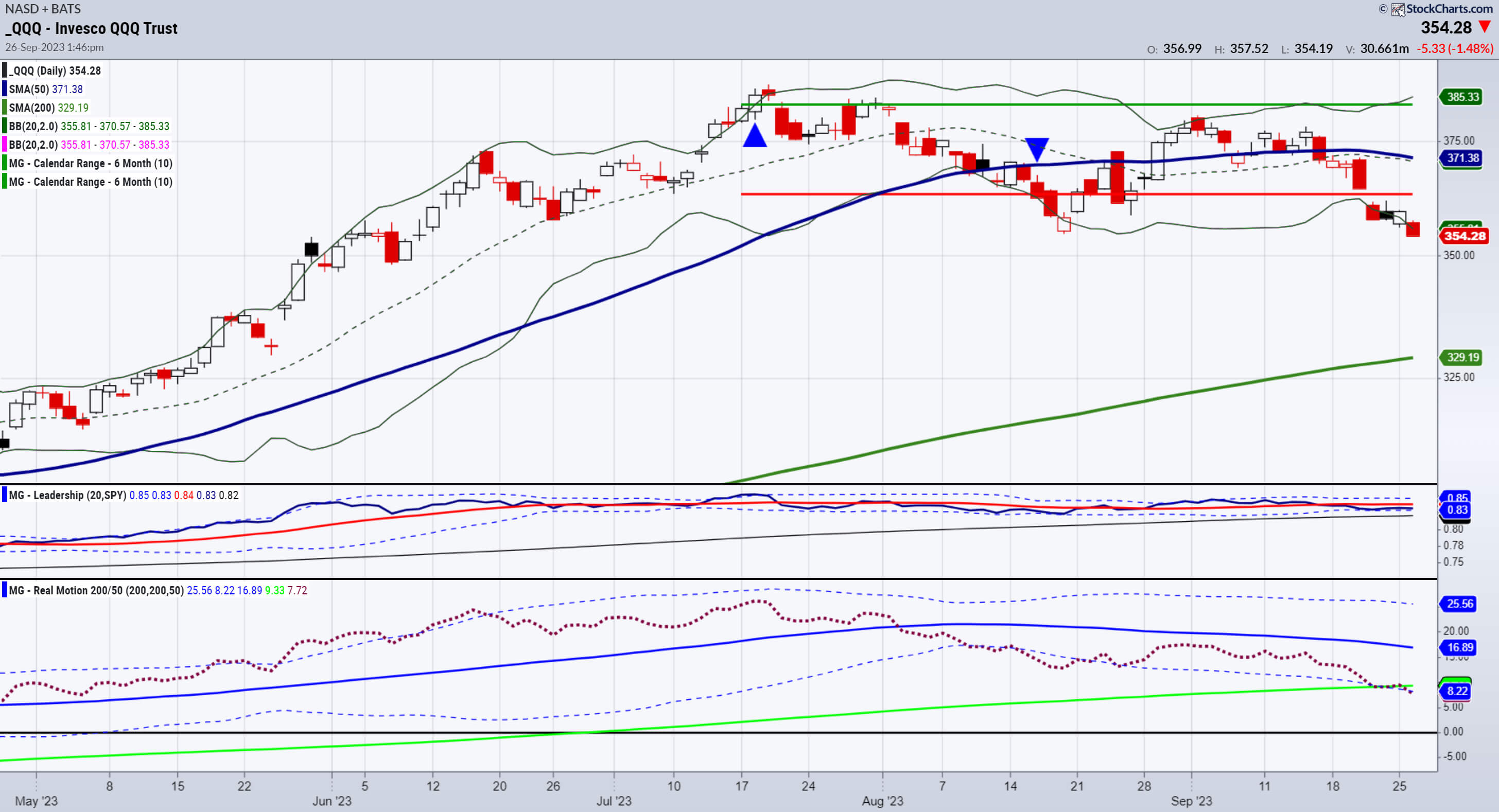

Three ETFs Suggest Further Downside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This past week had all the potential to see a revival of the great bull market of 2023. The September inflation data, Apple's latest product announcements, and Arm's IPO all seemed had the possibility to reignite the fire of bullishness for investors.

By Friday's...

READ MORE

MEMBERS ONLY

Deep Dive Into Stop Losses, Volatility Hacks, and Bullish Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave drops a special all-mailbag episode, including viewer questions on using Average True Range for stop losses, stocks vs. bonds, India's test of all-time highs, and best practices for price volatility.

This video originally premiered on September 15,...

READ MORE

MEMBERS ONLY

Using the Chikou Span to Identify Early Trading Signals

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Like a swiss army knife, the Ichimoku Kinko Hyo is a multi-purpose indicator that can be used to shape your trading setups and decisions

* The Chikou Span, with its 26-day look-back, can be used to confirm market sentiment and identify potential trend reversals

* Even as a retroactive feature,...

READ MORE

MEMBERS ONLY

Timeless Lessons from the Godfather of Technical Analysis

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave sits down with Ralph Acampora, CMT, co-founder of the CMT Association, for a memorable conversation on all things technical analysis. They review lessons learned from the October 2022 market low, words of wisdom for traders new to technical analysis,...

READ MORE

MEMBERS ONLY

Bonds: Don't Forget the Long-Term Trend

by Carl Swenlin,

President and Founder, DecisionPoint.com

Many of the forecasts I hear regarding bonds seem to be based upon what bonds have done for most of the last 40 years, without acknowledging what has happened more recently. The chart below shows that 30-Year T-Bonds were in a rising trend from the 1982 low, but, in early...

READ MORE

MEMBERS ONLY

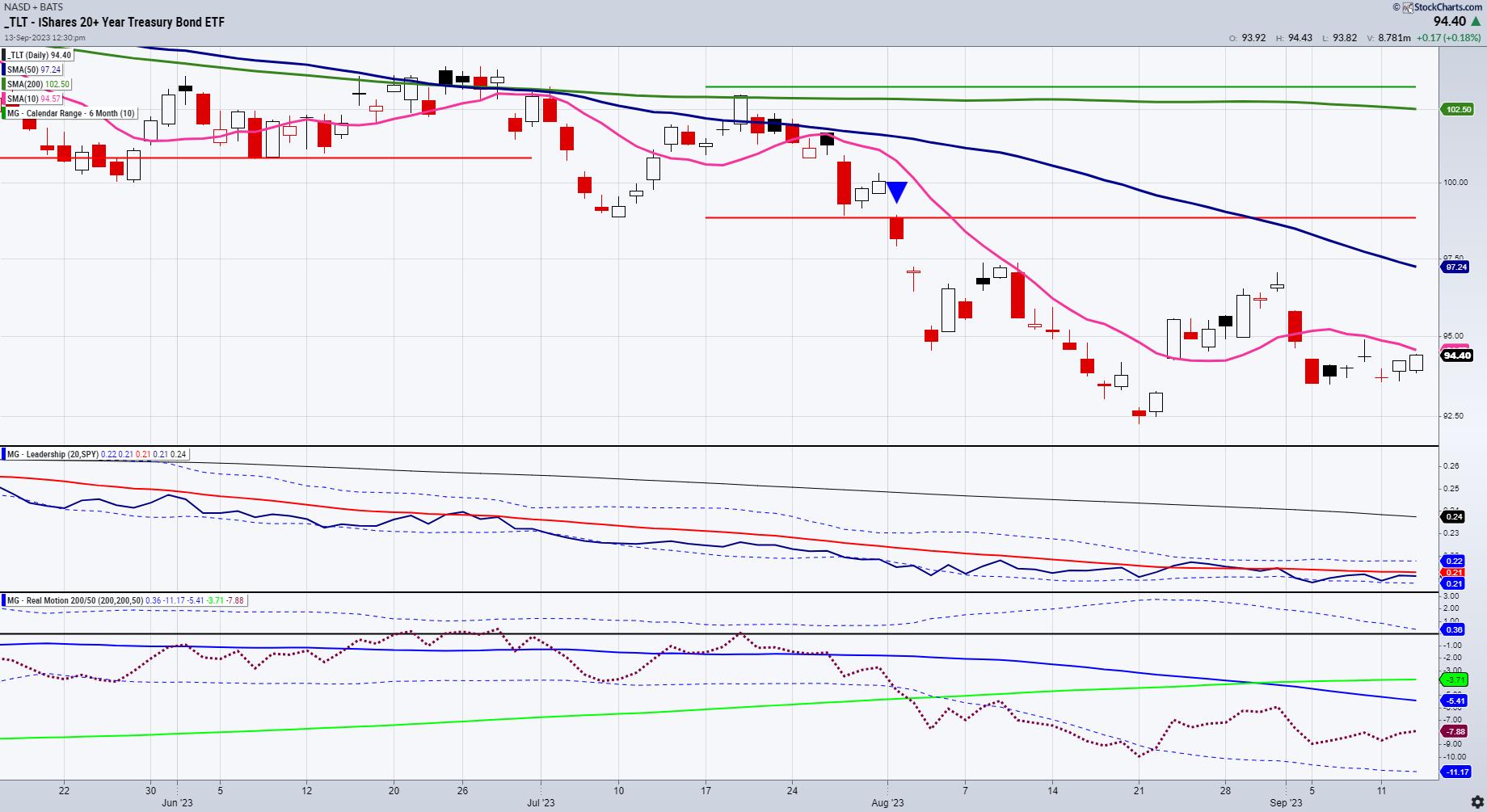

Fresh Look at Long Bonds

I doubt any of our readers are too surprised by the CPI reading coming in a bit hotter than expected.

The bulk of it was in energy costs. Food costs were, mixed with bread and meat, up, while eggs and milk were down. Services inflation was up slightly, while shelter...

READ MORE

MEMBERS ONLY

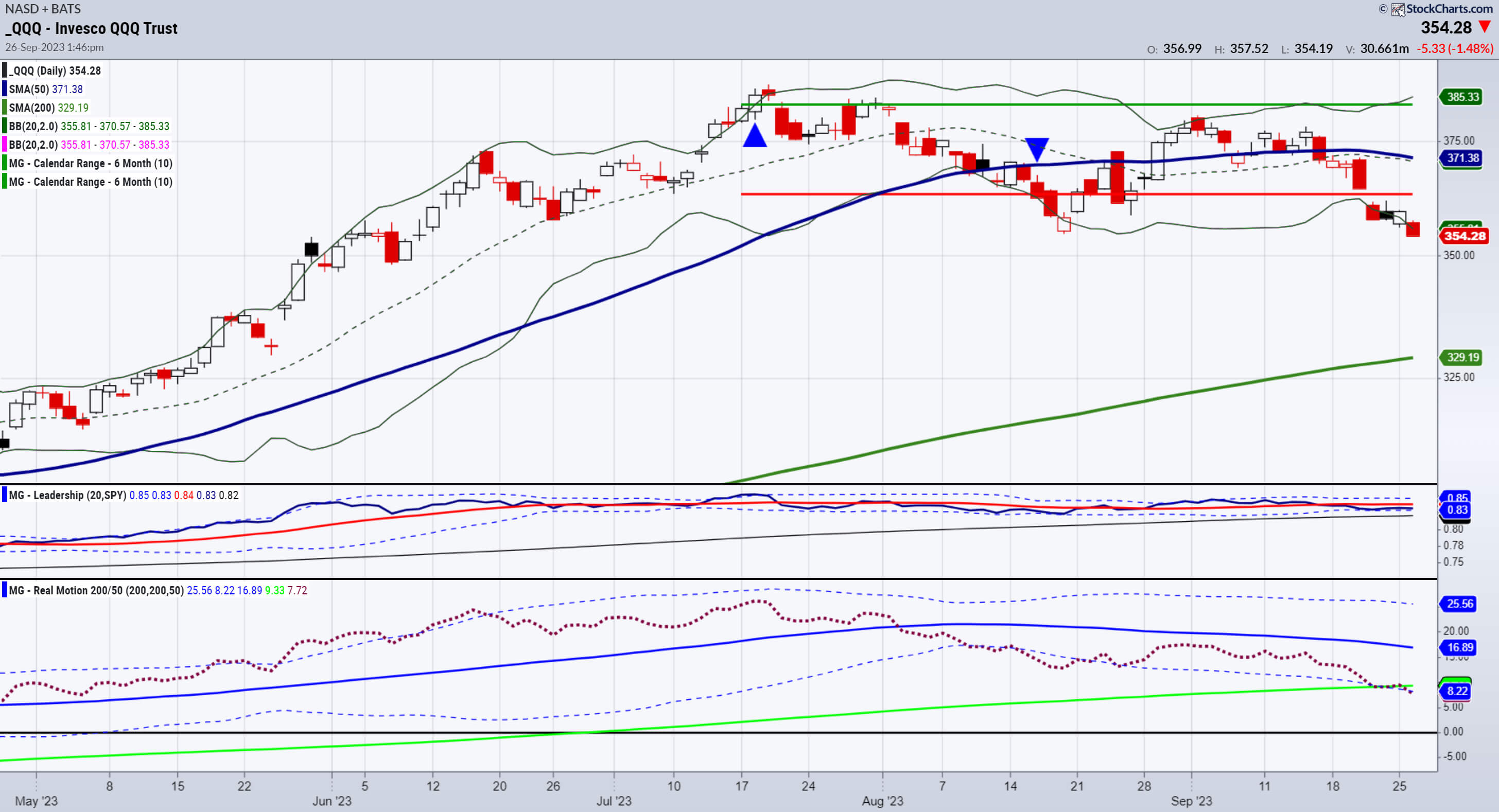

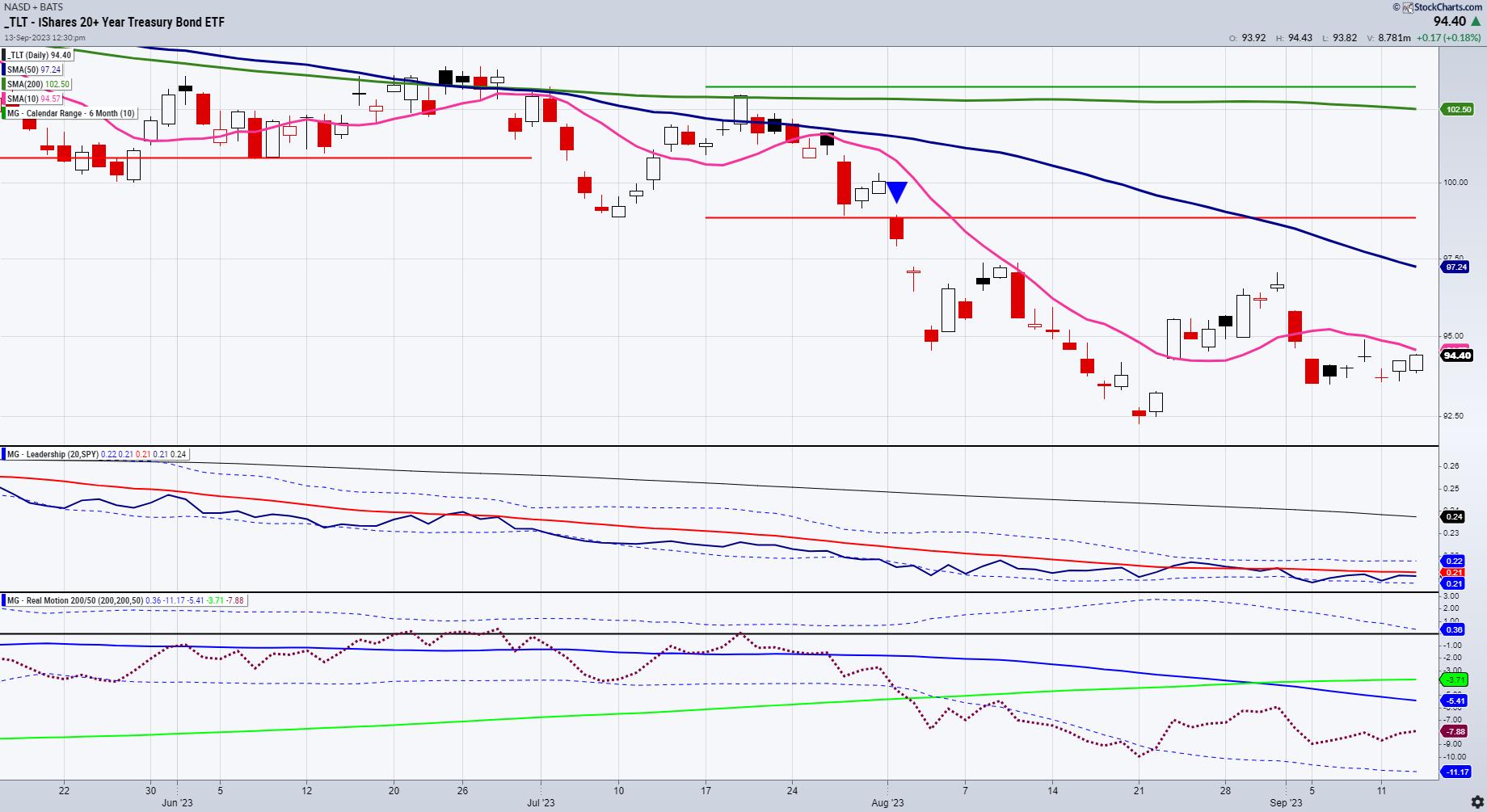

Finding and Trading Instrument Bottoms

In June, we wrote about the bottom in oil and cannabis through USO and MSOS (ETFs) respectively. In July, we wrote about the potential top in NASDAQ and SPY. In August, we wrote about the importance of the retail sector; XRT is below the July calendar range and a major...

READ MORE

MEMBERS ONLY

The Bull Case for Commodities

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, David Cox, CFA CMT of Raymond James reviews underperformance for defensive sectors like Utilities and describes why commodities should be an area of focus for investors. Host David Keller, CMT reviews today's drop in ORCL and AAPL as...

READ MORE

MEMBERS ONLY

Don't Even Think About Investing Without Addressing These 10 Essentials (Part 1: Essentials #1 - #5)

by Gatis Roze,

Author, "Tensile Trading"

We investors are frequently guilty of hearing only what we want to hear. The justification often being "that doesn't apply to me." Or my other favorite line, "Oh, I don't do that." In my previous blog — a tribute to William J. O&...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, September 14th at 3:00pm EDT!

by Larry Williams,

Veteran Investor and Author

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, September 14th at 3:00pm EDT.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE