MEMBERS ONLY

Bearish Reversal for QQEW, New Highs Surge as Low Vol Leads, Strength in EW Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Money is moving into stocks with relatively low volatility, most equal-weight sectors are up, and QQEW reversed its long-term uptrend. What does Arthur Hill make of this? Find out here....

READ MORE

MEMBERS ONLY

Finance SPDR Takes a Hit, but Maintains Uptrend as Trading Setup Emerges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

In the last few weeks, the Financials sector took a hit. However, it's oversold within a long-term uptrend. Find out what indicators Arthur Hill uses to identify an ideal long setup....

READ MORE

MEMBERS ONLY

A Four Point Plan Using Market Analysis, PPO, and CCI to Find Robust Entry Points

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

If you're looking to build a position in a specific industry group ETF, here's a four-point plan to follow....

READ MORE

MEMBERS ONLY

Broadening Trade Benefits Small-Caps and Non-Tech, But Don't Count XLK Out Just Yet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bull market is seeing broader participation with industry groups such as Home Construction, Retail, and Regional Bank stocks breaking out. Here's an analysis of the various sectors and industry groups that are showing strength, plus a stock you may want to consider....

READ MORE

MEMBERS ONLY

The State of the Market: Trend, Breadth & Leadership, Plus a Trend-Momentum Strategy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is in a clear uptrend with strong breadth, and three sectors leading the trend are Finance, Health Care, and Industrials. Arthur Hills shows you how to use a top-down approach to identify oversold stocks within uptrends....

READ MORE

MEMBERS ONLY

To Be Invested or Not to be Invested? That is the Question

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

These three indicators will filter out the noise and identify whether the stock market is bullish or bearish. This, in turn, will help you determine whether you should remain invested or not. Explore these indicators and find out which key levels to watch....

READ MORE

MEMBERS ONLY

Using Trend Signals and Oversold Conditions to Get a Jump on the Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

If you're looking to get in early on a breakout, first identify the uptrend and then find oversold setups. Arthur Hill walks you through how to look for the ideal setups....

READ MORE

MEMBERS ONLY

Breadth Not Ideal, but Still Net Bullish; Homebuilders Breakout Could Bode Well for 2026

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Learn how to quantify signals using new highs, new lows, and the percentage of stocks with golden crosses. Another area that could hold the key to broadening leadership in 2026 is homebuilder stocks. ...

READ MORE

MEMBERS ONLY

Discretionary Lags; Speculative Names Thrown Out; Trend Signals within MAG7 & Utilities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Healthcare, consumer staples, and gold stocks continue to hold steady while speculative tech names are flashing bearish signals. Get a closer look at the different sectors and one stock that looks like it's ready to trend higher....

READ MORE

MEMBERS ONLY

Cracks within Tech; Bonds Outperform, Bitcoin; Insurance Names Catch a Strong Bid

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When technology ETFs are breaking down, insurance stocks and bonds are showing strength, and Bitcoin is triggering a downtrend, it means the stock market is showing signs of risk aversion. Arthur Hill analyzes charts of these asset groups and identifies the signals they are sending....

READ MORE

MEMBERS ONLY

One Sector Stands Strong as the Most Economically Sensitive Sector Breaks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Arthur Hill analyzes the performance of the Health Care sector relative to other S&P 500 sectors. Find out why Health Care shows promise as we head into the end of the year. ...

READ MORE

MEMBERS ONLY

MAG7 Powers Market; Breadth Wanes, But Still Bullish; QQQ Two Standard Deviation Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The primary driving forces in the stock market are the QQQ and key mega-cap companies. In this article, Arthur Hill shares his insights and observations on the technical price action in the Mag7 ETF and QQQ. ...

READ MORE

MEMBERS ONLY

3 Key Influences on Stock Performance; Bullish Continuation Patterns for Two Cybersecurity Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

In a bullish market environment, with the technology sector leading the way and cybersecurity stocks in an uptrend, Arthur presents a couple of stocks that may be poised to break out....

READ MORE

MEMBERS ONLY

Ranking Long-Term Breadth; Healthcare Improves; Finance Breaks Down; Technology Holds Up; MAG7 Sets Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Arthur Hill analyzes breadth in the Health Care, Financials, and Technology sectors. Which sectors are still in a long-term trend, and which are ready to break down? Find out here....

READ MORE

MEMBERS ONLY

QQQ Channels Higher, 5 Healthcare Leaders, How to Trade Pullbacks: Case Study and Current Signal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Arthur Hill takes a deep dive into charts of QQQ, healthcare stocks, and tech stocks. ...

READ MORE

MEMBERS ONLY

Trend Signals in Healthcare and Healthcare Stocks, 5 New Signals, 12 Leading Uptrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Health Care sector is making a comeback, with stocks within the sector generating new bullish signals. Here's a deep dive into the sector....

READ MORE

MEMBERS ONLY

102 Days Above 50-Day; New Lows Expand; Tech Power; Commodity Bull Market; Oil Gets Interesting

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The SPY has traded above its 50-day simple moving average for 102 days, commodities are in a bull market, and crude oil is starting to turn up. Explore what Arthur Hill's analysis uncovers some of the activity taking place below the surface....

READ MORE

MEMBERS ONLY

Bonds Still Underperforming, Best Sectors for Hunting, IWM Starts to Leads SPY, Healthcare and Biogen Perk Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

TLT broke out, but is still underperforming SPY; meanwhile, IWM has begun outperforming SPY. Arthur explains how to find the ideal "hunting grounds" for sectors....

READ MORE

MEMBERS ONLY

New Highs vs New Lows; XLC Goes Beast Mode; Risk is On; Dissecting Gold; A Cyber Setup

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This week, new highs are consistently outpacing new lows. The Communication Services sector is leading the pack, gold is surging, and there's a cybersecurity stock setting up for a big move. Read all about the stock market's price action here....

READ MORE

MEMBERS ONLY

Uptrends Expand; Tech Consolidates, Cybersecurity Breaks Out; A Classic Trading Setup; Big Banks Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Market breadth is strengthening as more stocks move into long-term uptrends. The percentage of S&P 500 stocks above their 200-day moving average hit 70%. small and mid-caps are driving this expansion, signaling broad market strength....

READ MORE

MEMBERS ONLY

QQQ/SPY Targets, IWM Best Hold, NDX Dominance Quantified, Bitcoin/QQQ Relationship, Costco Holds Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Signs of correction and rotation emerged this week as money moved out of tech-related groups and into defensive groups. Here's a perspective on this week's rotation with some year-to-date performance metrics....

READ MORE

MEMBERS ONLY

Friday Chart Fix: QQQ Overtakes QQEW, GOOGL Near New High, Groups with Most Highs, Verizon Gaps Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Which charts stand out this week? Arthur Hill analyzes the market and does a deep dive into the charts with price action that's not to be ignored....

READ MORE

MEMBERS ONLY

Friday Chart Fix: 2024 vs. 2025, Commodities with a Dash of Crypto, Moment of Truth for IWM, The Tesla Squeeze

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Here's a deep dive into the differences between the 2024 bull market and 2025 bull run, small-cap performance, the price action in Bitcoin and gold, and the Bollinger Band squeeze in Tesla's stock price....

READ MORE

MEMBERS ONLY

Narrow Leadership Is a Concern, but the Bear Signal Has Yet To Trigger: Here's What To Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

New highs show narrow leadership in the S&P 500, yet new highs are outpacing new lows. Will the leadership broaden? Watch these indicators....

READ MORE

MEMBERS ONLY

What Happens to Bitcoin Should QQQ Correct?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stock market correction risks are rising as key indicators flash warnings. Discover sector correlations with SPY, potential safe havens, and how Bitcoin's surge aligns with QQQ in this data-driven analysis....

READ MORE

MEMBERS ONLY

Chart Mania - 23 ATR Move in QQQ - Metals Lead 2025 - XLV Oversold - XLU Breakout - ITB Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tech stocks are heating up, utilities break out, metals lead, and homebuilders hit a moment of truth....

READ MORE

MEMBERS ONLY

How to Improve your Trading Odds and Increase Opportunities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can improve their odds and increase the number of opportunities by trading short-term bullish setups within bigger uptrends. The first order of business is to identify the long-term trend using a trend-following indicator. Second, chartist can turn to more granular analysis to find short-term bullish setups. Today's...

READ MORE

MEMBERS ONLY

Lagging Mid-cap ETF Hits Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P MidCap 400 SPDR (MDY) is trading at a moment of truth as its 5-day SMA returns to the 200-day SMA. A bearish trend signal triggered in early March. Despite a strong bounce from early April to mid May, this signal remains in force because it has...

READ MORE

MEMBERS ONLY

Three Sectors Stand Out and One Sports a Bullish Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Three sectors stand out, with one sporting a recent breakout that argues for higher prices. Today's report will highlight three criteria to define a leading uptrend. First, price should be above the rising 200-day SMA. Second, the price-relative should be above its rising 200-day SMA. And finally, leaders...

READ MORE

MEMBERS ONLY

Tech ETFs are Leading Since April, but Another Group is Leading YTD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

QQQ and tech ETFs are leading the surge off the April low, but there is another group leading year-to-date. Year-to-date performance is important because it includes two big events: the stock market decline from mid February to early April and the steep surge into early June. We need to combine...

READ MORE

MEMBERS ONLY

Moving from Thrust Signals to a Bull Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bullish signals stacked up in April and May, but most long-term breadth indicators are still bearish. SPY and QQQ showed signs of capitulation in early April and rebounded into mid April. A Zweig Breadth Thrust triggered on April 24th and several other thrust indicators turned bullish in May. We...

READ MORE

MEMBERS ONLY

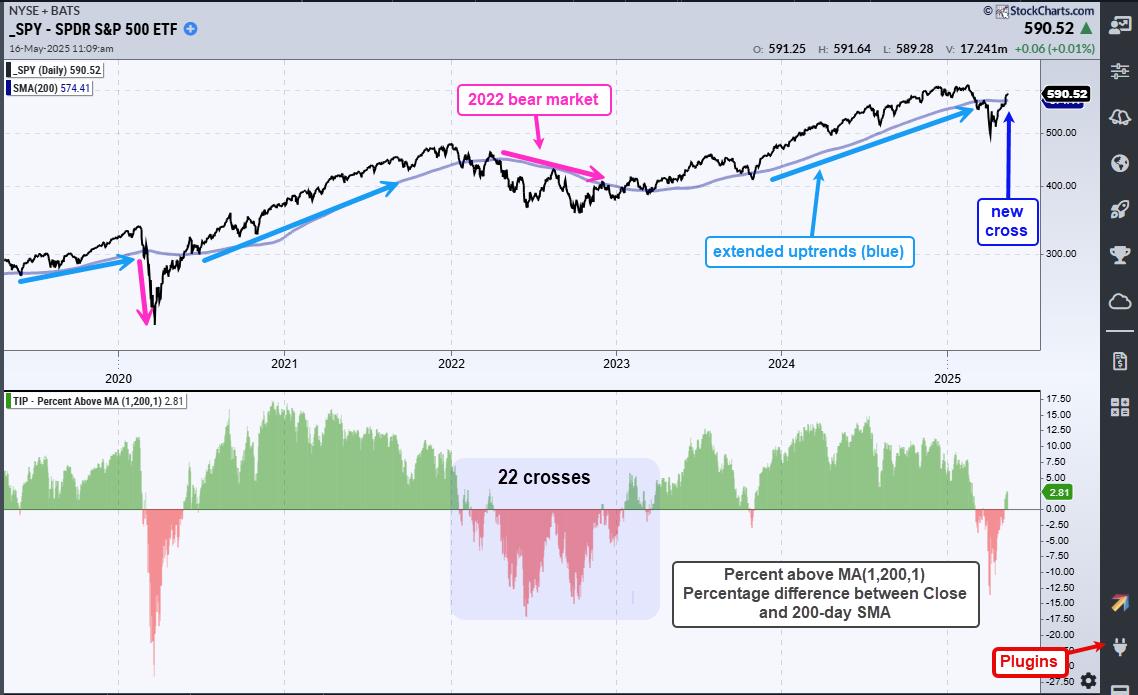

SPY and QQQ Recapture their 200-day SMAs - Tips for Reducing Whipsaws and Improving Performance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* SPY and QQQ surged above their 200-day SMAs this week.

* The signal is bullish, but prone to whipsaws.

* Chartists can reduce whipsaws with smoothing and signal filters.

SPY and QQQ crossed above their 200-day SMAs with big moves on Monday, and held above these long-term moving averages the...

READ MORE

MEMBERS ONLY

The V Reversal is Impressive, but is it Enough?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* SPY broke down in March, plunged into early April and surged into early May.

* This V bounce is impressive, but it is not enough to reverse the March breakdown.

* A significant increase in upside participation is needed to move from bear market to bull market.

Stocks plunged into...

READ MORE

MEMBERS ONLY

Two Down and Two to Go - Capitulation and Thrust are just a Start

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Stocks are halfway after capitulation in early April and a Zweig Breadth Thrust.

* SPY is still below its 200-day SMA and late March high.

* Follow through is needed to trigger the medium and long term signals.

The market does not always follow the same script or sequence, but...

READ MORE

MEMBERS ONLY

Zweig Breadth Thrust Dominates the Headlines - But What about an Exit Strategy?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* S&P 1500 Advance-Decline Percent triggered a Zweig Breadth Thrust this week.

* These signals reflect a sudden and sharp shift in participation (net advancing percent).

* ZBT signals only cover the entry, which means chartists need to consider an exit strategy should it fail.

The Zweig Breadth Thrust...

READ MORE

MEMBERS ONLY

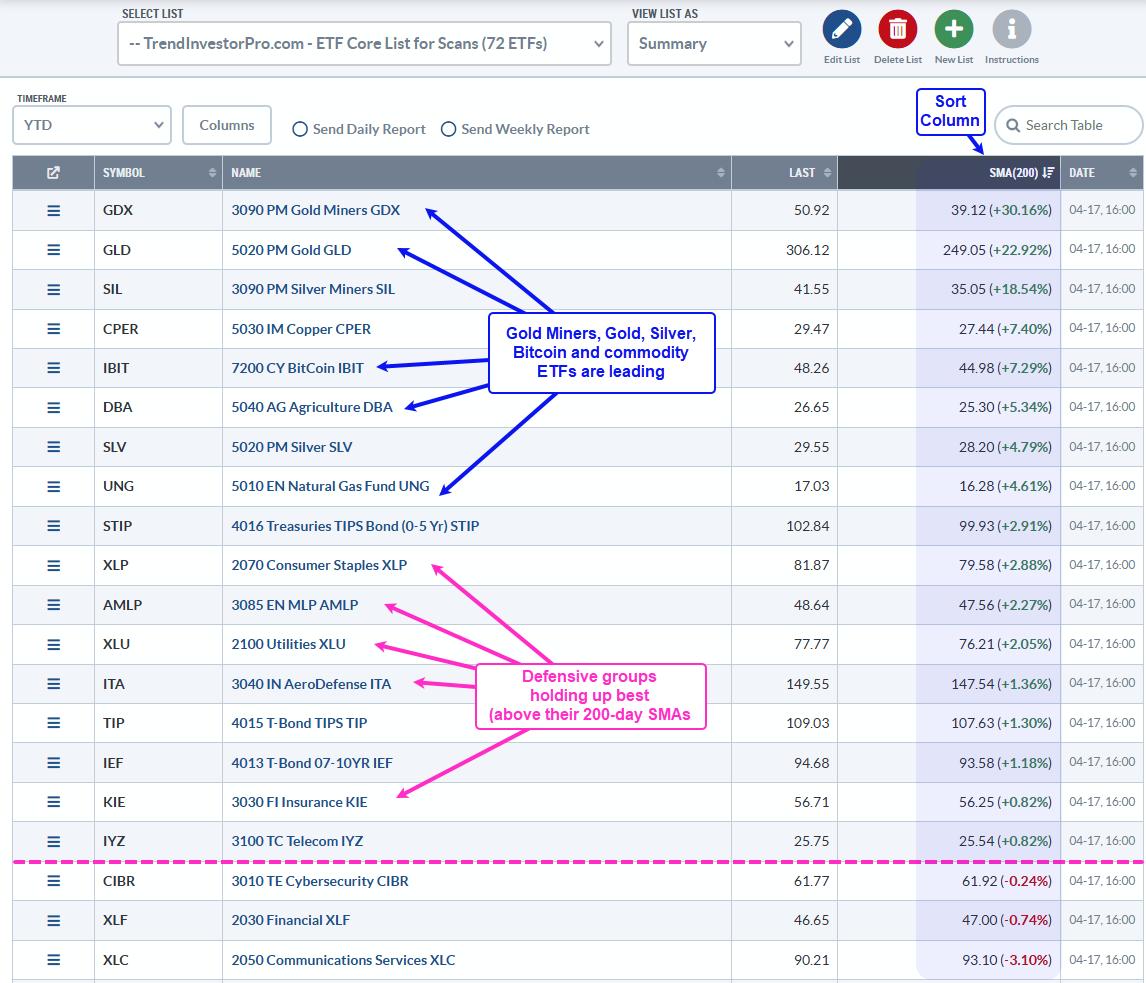

Equities? Fuhgeddaboudit! Alternative Assets are Leading

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* A simple ranking shows leadership in alterative assets and commodities.

* Stocks are not the place to be because the vast majority are below their 200-day SMAs.

* Bitcoin is holding up relatively well as it sets up with a classic corrective pattern.

Trading is all about the odds. Trade...

READ MORE

MEMBERS ONLY

An Oversold Bounce is One Thing - A Bullish Breadth Thrust is Another

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Price and breadth fell to extremes in early April as the market panicked.

* These extremes produced an oversold bounce, but this is still within a bear market.

* Follow through is what separates bear market bounces from bullish breadth thrusts.

Panic selling and oversold extremes gave way to a...

READ MORE

MEMBERS ONLY

This Report Might Self Destruct in 5 Days

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* With fast-moving markets, this report is vulnerable to self-destruction within 5 days.

* The bond vigilantes sent a message as long-term yields surged and bonds plunged.

* Unless reversed, these developments are negative for stocks, especially rate sensitive stocks.

In the opening scene of Mission Impossible 2, Ethan Hunt receives...

READ MORE

MEMBERS ONLY

Bitcoin Holds Up, but Remains Short of Relative Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Traders may consider alternatives, such as Bitcoin, in bear markets.

* Bitcoin and SPY are positively correlated long-term, but one period stands out.

* Even though Bitcoin shows short-term relative strength, it is short of a relative breakout.

Stocks are in a freefall with selling pressure spreading into industrial metals...

READ MORE