MEMBERS ONLY

DP Trading Room: This Powerful Scan Finds Stocks Showing NEW Momentum

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl covers the major markets as well as the Dollar, Gold, yields, and Bitcoin. Erin runs her "Momentum Sleepers Scan" to find stocks that are showing new momentum under the surface. She uncovers a few stocks for...

READ MORE

MEMBERS ONLY

DP Trading Room: Bad News for Buyers Weighing Hefty Mortgage Rates

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a look at a very bearish market BIAS Table. He examines how the latest mortgage rates are squeezing buyers and sellers alike by comparing today's mortgage payments versus payments at the lows;...

READ MORE

MEMBERS ONLY

Is the Bear Back?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 (SPY) has fallen about 10 percent from the July top, and the last two weeks has been pretty rough, so should we be looking for the Bear to take charge again?

First, looking at a weekly chart, it is not clear that the Bear actually...

READ MORE

MEMBERS ONLY

Complimentary Edition of the DecisionPoint "Weekly Wrap"

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* Golden Cross BUY Signal for Gold

* Death Cross SELL Signal for NYSE Composite

* Death Cross SELL Signal for Materials (XLB)

Gold (GLD) has been strong this month and today its 50-day EMA crossed up through its 200-day EMA (Golden Cross), generating an LT Trend Model BUY Signal. You...

READ MORE

MEMBERS ONLY

DP Trading Room: Mortgage Rates Hit Multiyear High -- Who Goes Bankrupt First?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl discusses the war's effect on the market and looks closer at the effects of high mortgage rates, which have hit multiyear highs. These are pinching not only buyers, but sellers and homebuilders. Afterwards, he goes deeper...

READ MORE

MEMBERS ONLY

DP Trading Room: Exponential vs. Simple -- This is the Moving Average We Use

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a discussion of the yield curve, followed by his coverage of the Magnificent 7+ and the market in general. Erin looks at the effect of war on the Energy sector, as well as a...

READ MORE

MEMBERS ONLY

Earnings for 2023 Q2 Still Trending Up

by Carl Swenlin,

President and Founder, DecisionPoint.com

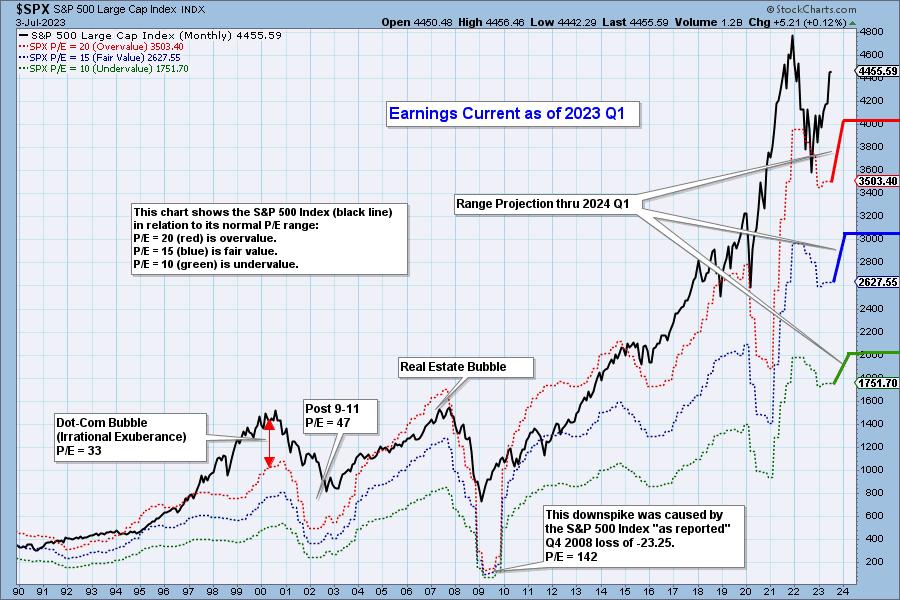

S&P 500 earnings are in for 2023 Q2, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

DP Trading Room: This is the ONLY Sector Showing STRENGTH Right Now

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl, after a walkthrough of the Magnificent 7+ stocks, examines how, while it was clear that there's some strength to be had in the Nasdaq, one look at the Ultrashort for Dow 30 (SDOW) and an internal...

READ MORE

MEMBERS ONLY

New Tables Show Intermediate-Term Overview is Negative

by Carl Swenlin,

President and Founder, DecisionPoint.com

We have introduced two new tables in the DecisionPoint ALERT to give an overview of trend and BIAS for the major market indexes, sectors, and industry groups that we track. The first is our Market Scoreboard, which shows the current Intermediate-Term and Long-Term Trend Model (ITTM and LTTM) signal status....

READ MORE

MEMBERS ONLY

DP Trading Room: Don't Forget The MONTHLY CHARTS! Earnings Spotlight

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens with a discussion on why you should use monthly charts even if you are investing in the shorter term. He gives us insight into the market as a whole and reviews the Magnificent 7 stocks and Tesla...

READ MORE

MEMBERS ONLY

DP Trading Room: Mega-Caps Looking Bearish

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl notes that the "Magnificent 7" stocks are looking "toppy", with only a few exceptions. These leadership stocks could put downside pressure on an already weak market. Erin picks out the strongest of the sectors...

READ MORE

MEMBERS ONLY

Bonds: Don't Forget the Long-Term Trend

by Carl Swenlin,

President and Founder, DecisionPoint.com

Many of the forecasts I hear regarding bonds seem to be based upon what bonds have done for most of the last 40 years, without acknowledging what has happened more recently. The chart below shows that 30-Year T-Bonds were in a rising trend from the 1982 low, but, in early...

READ MORE

MEMBERS ONLY

DP Trading Room: Can Tech's Bullish Bias Hold?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl reviews the markets and shares the new DecisionPoint BIAS assessment list. Erin concentrates on Technology (XLK) and Utilities (XLU). Technology is only sector holding a bullish bias in the intermediate and long terms, will that hold up? Utilities...

READ MORE

MEMBERS ONLY

Gold Buyers Should Remember FDR

by Carl Swenlin,

President and Founder, DecisionPoint.com

With the Federal Government piling on debt at a record rate, many investors are looking to gold as a way to protect against all the bad things that could happen as a result of the reckless spending. Part of the process would be deciding how much of a portfolio should...

READ MORE

MEMBERS ONLY

DP Trading Room: New Market Bias Assessment Table

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl introduces viewers to the new Market Bias table now included in the DecisionPoint Alert. This table covers all the major indexes, sectors, and select industry groups. He goes over how we determine the bias in the intermediate and...

READ MORE

MEMBERS ONLY

DP Trading Room: Two Bullish Industry Groups

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl presents a thorough review of the markets, including Gold and Crude Oil. He also comments on the possibility that the housing market has hit rock bottom... though that's not likely. Erin digs out two industry groups...

READ MORE

MEMBERS ONLY

DP Trading Room: Mega-caps are Showing Bearish Bias

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a review of a very high-yielding ETF he recently became aware of. The "Magnificent 7" stocks all show bearish biases; SPY is holding support, but indicators are still quite weak. Erin Swenlin...

READ MORE

MEMBERS ONLY

Big Tech, Big Troubles

by Carl Swenlin,

President and Founder, DecisionPoint.com

The seven mega-tech stocks, known to some as the Magnificent Seven, have had a magnificent advance since late last year, but now we're seeing some weakness, and it is likely that they will be under-performing for a while. Many have been affected by an emerging expectation of miracles...

READ MORE

MEMBERS ONLY

DP Trading Room: Finding Pockets of Strength in Financials

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens by reviewing the "Magnificent 7+", a.k.a. the mega-cap darlings plus Tesla (TSLA). He discusses Apple (AAPL)'s demise and later discusses possible support levels. The bias is bearish in all three timeframes,...

READ MORE

MEMBERS ONLY

DP Trading Room: The "Magnificent 7" Mega-Caps

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl starts the program with an in-depth review of the "Magnificent 7" + Tesla (TSLA). These mega-cap stocks help us determine the temperature of the major indexes, and bias assessment suggests weakness under the surface in the short...

READ MORE

MEMBERS ONLY

Is Gold Headed for New All-Time Highs?

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Wednesday, the SPDR Gold Shares ETF (GLD) 20-day EMA crossed up through the 50-day EMA, generating an IT Trend Model BUY Signal. This means that GLD is bullish in the intermediate-term. GLD was already in a long-term bull market when, in January, the 50-day EMA crossed up through the...

READ MORE

MEMBERS ONLY

DP Trading Room: Technology On Its Way Down?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

Technology has shown leadership on the way up, but will it show it on the way down? In this week's edition of The DecisionPoint Trading Room, Carl looks at the internals and a large double-top that is forming, while Erin covers the sectors in depth. They finish by...

READ MORE

MEMBERS ONLY

S&P 500 2023 Q1 Earnings Show Improvement

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an undervalued...

READ MORE

MEMBERS ONLY

DP Trading Room: Downside Exhaustion Climax

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl begins by discussing the downside exhaustion climax that occurred on Friday. He goes through DecisionPoint indicators and covers the major markets, as well as Crude Oil, Bitcoin and a discussion on the Dollar and Gold. Erin finds new...

READ MORE

MEMBERS ONLY

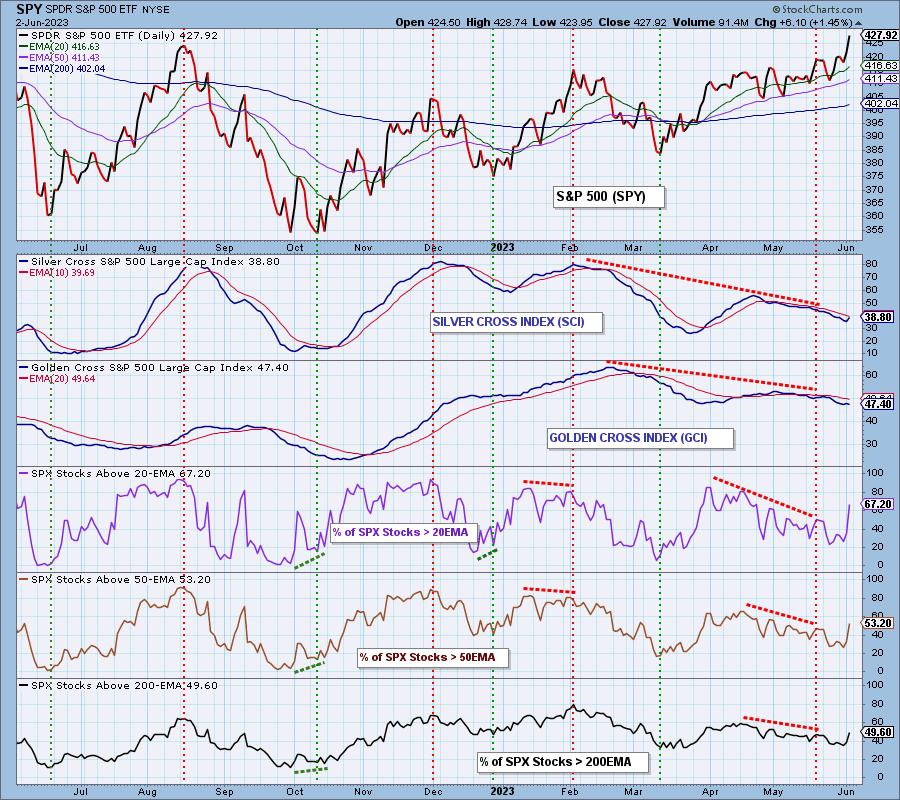

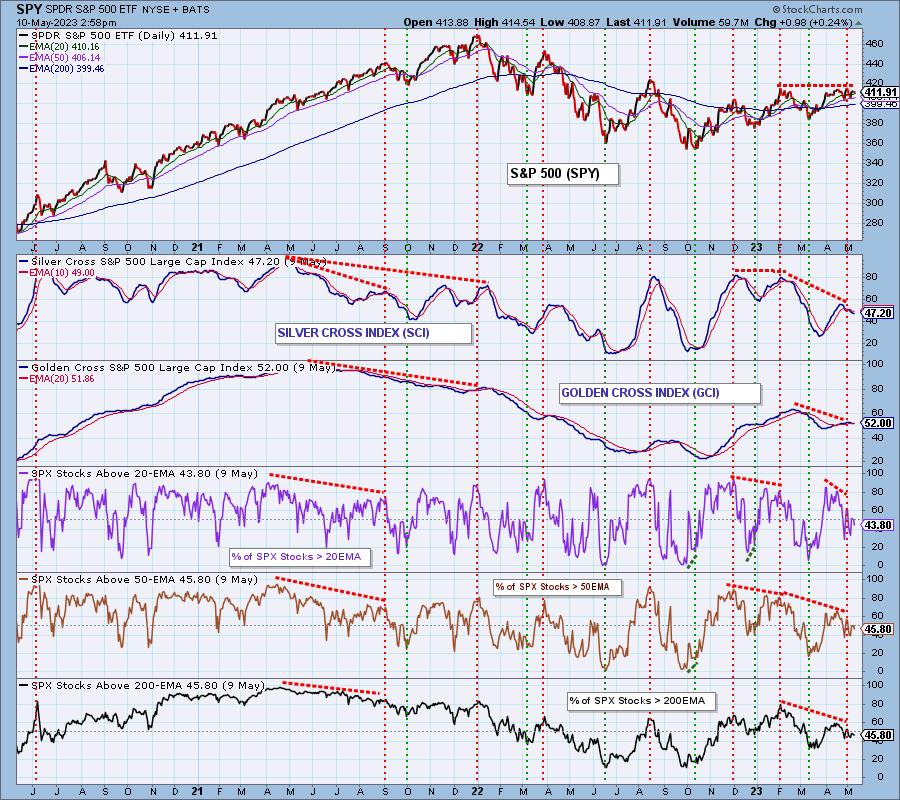

Major Indexes Have Reached Bull Market Participation Levels

by Carl Swenlin,

President and Founder, DecisionPoint.com

A Silver Cross is when a stock's 20-day EMA crosses above the 50-day EMA, and that event rates the stock to be bullish in the intermediate term. DecisionPoint's Silver Cross Index (SCI) expresses the percentage of stocks in the index that have a Silver Cross. We...

READ MORE

MEMBERS ONLY

DP Trading Room: Shareholders Should Come First

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the trading room with a discussion of Target (TGT) and Anheuser-Busch (BUD) technicals and compares them to their industry groups. Shareholders can't be pleased. After an overview of the market as a whole, Erin follows...

READ MORE

MEMBERS ONLY

Broad Market Rally a Turning Point

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, we saw broadening of participation by comparing the percentage change of the cap-weighted version of the S&P 500, SPY (+1.50%), versus the equal-weighted, RSP (+2.25%), which shows that today's RSP advanced 52% more than SPY.

Our biggest beef with the SPY rally was...

READ MORE

MEMBERS ONLY

DP Trading Room: Advance-Decline Lines Explained

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the Trading Room with a discussion on what the Advance-Decline Line is and how it is calculated. Importantly, he shows us how best to use it. Erin dives into the Energy Sector (XLE) and covers the industry...

READ MORE

MEMBERS ONLY

Sucker Rally?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Considering our bearish outlook, this week's rally has been hard to watch; however, the configuration of the Silver Cross Index* (SCI) continues to show how this rally may ultimately fail. On the chart below, we can see in 2022 the market fell off the all-time price high, initiating...

READ MORE

MEMBERS ONLY

DP Trading Room: Why SPY, Not SPX? Dividends!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl begins the trading room by explaining negative divergences between the SPY and equal-weight RSP. He also covers why DecisionPoint uses the SPY and not the SPX; the reason is dividends, which he explains in detail later in the...

READ MORE

MEMBERS ONLY

Market Participation Is Dismal

by Carl Swenlin,

President and Founder, DecisionPoint.com

When we talk about "participation," we are referring to the number of stocks actually taking part in a given market move. Presently, we are looking at the rally from the October lows and the indicators we use to assess it. First, we have our Silver Cross Index (SCI)...

READ MORE

MEMBERS ONLY

DP Trading Room: Beware These Groups of Stocks

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens by discussing two groups of stocks that you should avoid in the near future. He gives his take on the overall market, Gold, Bonds and more. Erin takes a look "under the hood" of the...

READ MORE

MEMBERS ONLY

DP Trading Room: Market Holds Its Breath

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

As the upcoming Fed rate announcement nears, investors are holding their breath; on this week's edition of The DecisionPoint Trading Room, Carl talks about what that likely means for the market short-term. He covers the top ten mega-cap stocks, and both he and Erin discuss Banks and the...

READ MORE

MEMBERS ONLY

Six-Month Period of UNfavorable Seasonality Begins Next Week

by Carl Swenlin,

President and Founder, DecisionPoint.com

An interesting Seasonality Timing System was developed by Yale Hirsh of the Stock Trader's Almanac. It was based upon the observation that stock market seasonality is broken into two six-month periods. The favorable period begins on November 1 and ends on April 30. The unfavorable period begins on...

READ MORE

MEMBERS ONLY

DP Trading Room: Long-Term View of the Dollar

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl, as always, opens the show with a market overview, but, in this episode, spends extra time looking at the Dollar in all three timeframes. He also reviews key indicator charts which favor a intermediate-term market top on the...

READ MORE

MEMBERS ONLY

DP Trading Room: Equal-Weight RSP vs. SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens with a discussion of Regional Banks and gives us a link to a video that explains the safety of brokerage versus savings account insurance. He also covers why we use relative strength of the SPY v. the...

READ MORE

MEMBERS ONLY

DP Trading Room: Sector Deep Dive

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Erin presents a review of all of the sectors to find out where new momentum lies and where relative strength is -- you might be surprised. Carl gives us his take on the market, as well as the Dollar,...

READ MORE

MEMBERS ONLY

2022 Q4 Earnings Results: Market Becomes More Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an undervalued...

READ MORE

MEMBERS ONLY

Are Semiconductors Ready for a Pullback?

by Carl Swenlin,

President and Founder, DecisionPoint.com

After a bear market decline of nearly -50%, the Semiconductor ETF (SMH) has rallied over +60% out of the October low. The long-term picture still looks promising, with the weekly PMO rising steeply above the zero line. But let's look in a shorter-term timeframe to see if there...

READ MORE

MEMBERS ONLY

DP Trading Room: Negative Divergences Explained

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl starts off the trading room with a closer look at Regional Banks (KRE) and gives his opinion of not only the market, but the top ten capitalized stocks. Erin picks up with a discussion on how to find...

READ MORE