MEMBERS ONLY

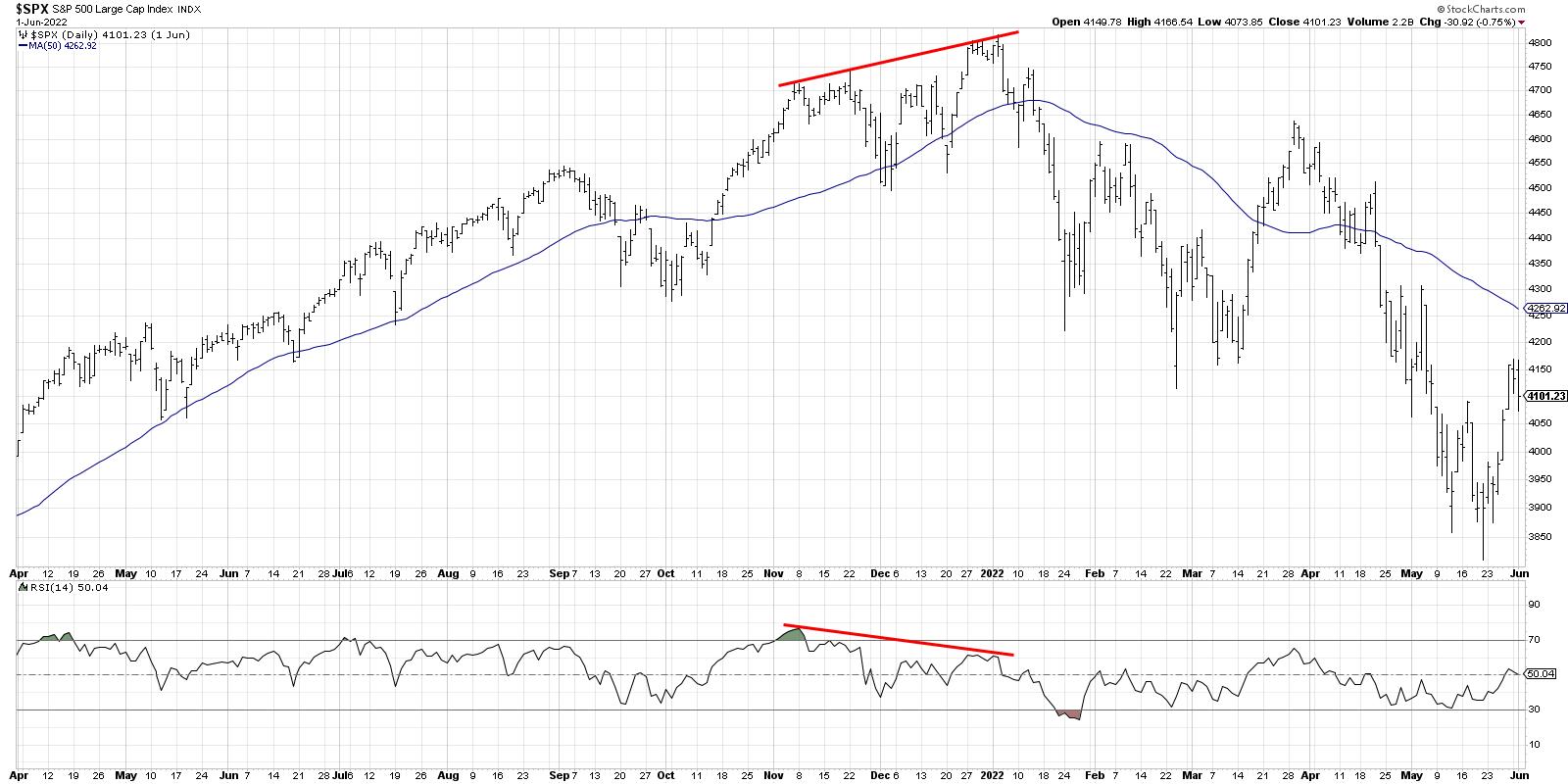

Three Key Charts Showing Bearish Divergences

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Bearish momentum divergences suggest exhaustion for buyers after a long bullish phase.

* The 2021 market top was marked by a bearish momentum divergence for the S&P 500.

* Bearish divergences between price and RSI indicate potential downside for leading growth stocks, including AMZN and LRCX.

* The S&...

READ MORE

MEMBERS ONLY

Bearish Divergences Cause Market to Drop

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Dave wraps the week with a focus on a growing number of bearish momentum divergences, including on the S&P 500 index itself! He answers viewer questions on trailing stops, taking profits on strong performers, and running technical indicators...

READ MORE

MEMBERS ONLY

Secular Trends Contrasted with Deterioration

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, guest Mary Ann Bartels of Sanctuary Wealth reinforces the strength of long-term secular trends contrasted with short-term deterioration for growth stocks. Meanwhile, Dave highlights one of the FAANG stocks prominently displaying the dreaded bearish momentum divergence!

This video was originally...

READ MORE

MEMBERS ONLY

Red Flags Raised by Bearish Engulfing Patterns

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Dave talks through potential red flags on two key growth stocks as the market uptrend pushes into the second half of the year. He answers viewer questions on tracking "smart money" behavior, navigating double top patterns and scanning...

READ MORE

MEMBERS ONLY

Top 10 Stocks to Watch in July 2023, Part 1

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Part 1 of a two-part special examining the Top Ten Stocks to Watch in July 2023, Dave covers #10-#6, including AAPL, FDX, and more. Stay tuned for Part 2 tomorrow, in which Grayson will follow up with #5-#1....

READ MORE

MEMBERS ONLY

What's Next for QQQ: Super Bullish to Super Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Exactly how long is this raging bull market driven by mega-cap growth stocks supposed to last? I was taught that, when price trends higher over time, there would often be brief countertrend pullbacks along the way. Apple (AAPL) has completely ignored that market truismand managed to ride this unrelenting ascent...

READ MORE

MEMBERS ONLY

Downside Targets For S&P 500 Pullback

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Recently, we've focused on the overextended nature of the small group of mega-cap leadership names in 2023, and even identified threekey charts to watch for a pullback in the technology sector.This week, we observed further deterioration in breadth indicators, with the cumulative advance-decline lines for all cap...

READ MORE

MEMBERS ONLY

Three Charts Show Bear Case for Technology

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As a trend follower, I'm bullish. I can't deny that the trend is positive on all three time frames using my Market Trend Model. So any bear case at this point has to be based on a market being so overextended that it is ripe for...

READ MORE

MEMBERS ONLY

The Super Bullish to the Super Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of my favorite parts of hosting a show on StockCharts TVis being able to interview analysts, traders, and money managers with all sorts of different backgrounds.

Recently, I was asked in our mailbag segment about why and how my guests can have very different takes on the markets at...

READ MORE

MEMBERS ONLY

The Bull Case for Energy is Clear

by David Keller,

President and Chief Strategist, Sierra Alpha Research

What compels me to write a bold headline claiming one sector is obviously poised to break out to the upside?

As a trend follower, I have three goals every day: identify trends, follow those trends, and anticipate when those trends may reverse. Simple, right?

Energy has been the worst-performing sector...

READ MORE

MEMBERS ONLY

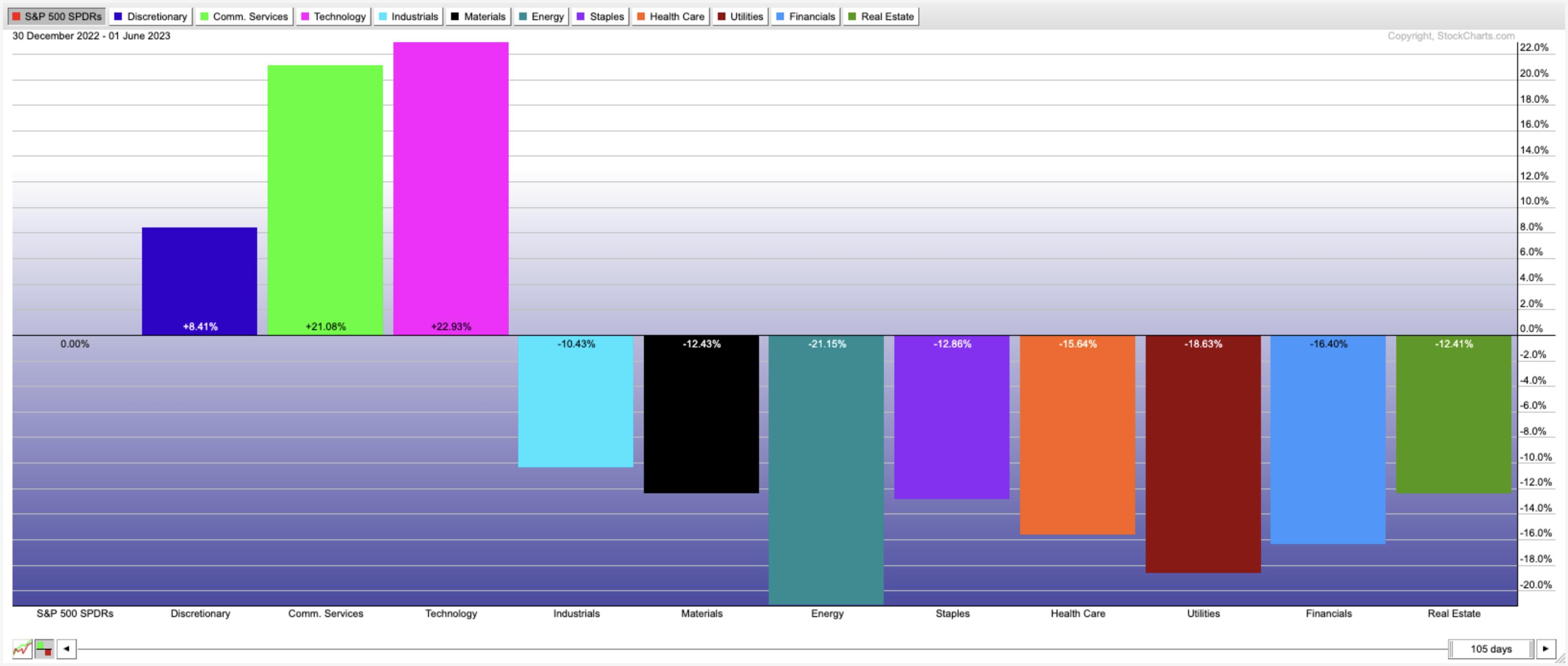

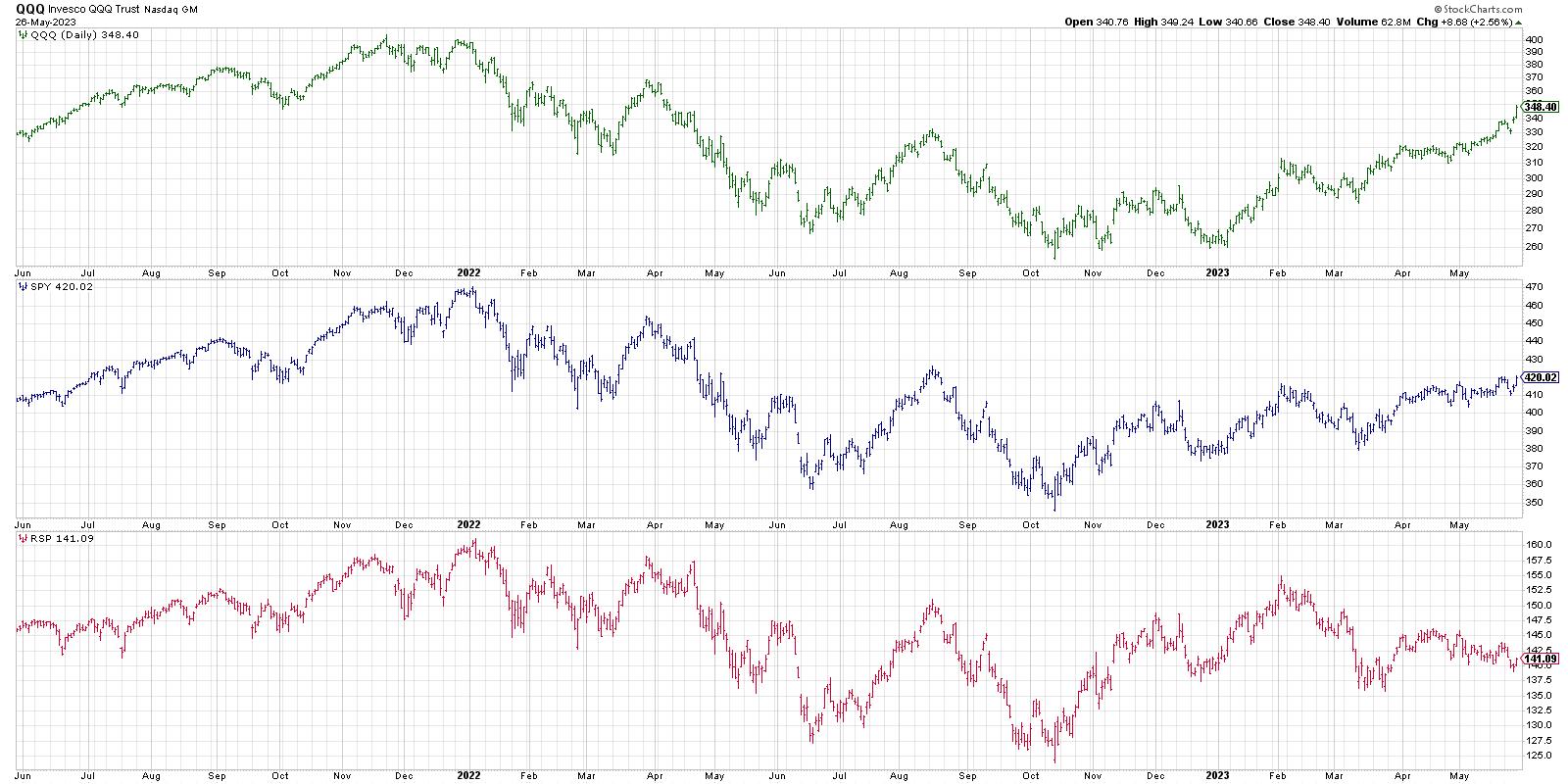

The Downside to This Up Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

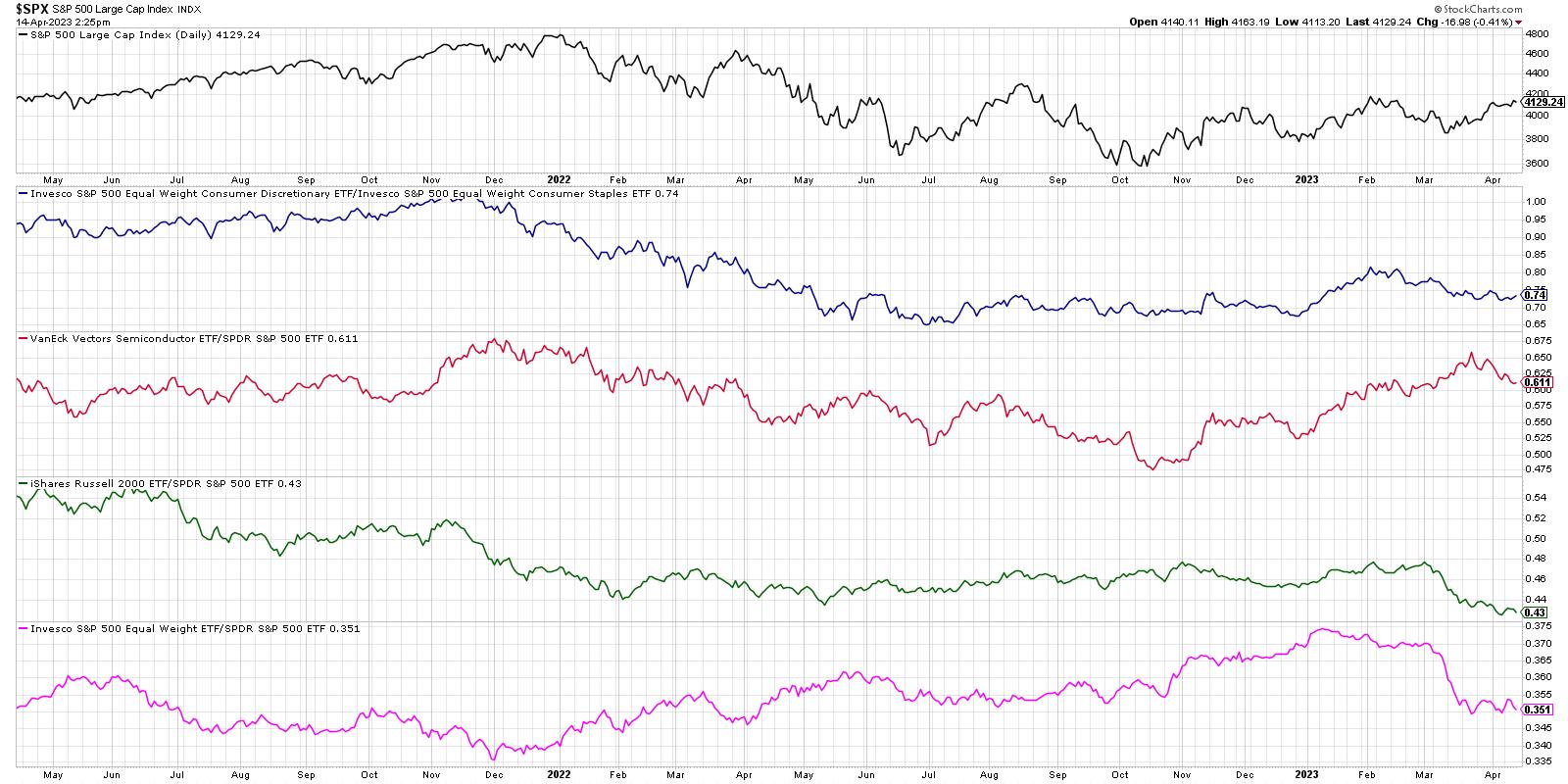

Are stocks in a bull market phase at the moment?

Well, that certainly depends on where you're looking. If you're analyzing the Nasdaq 100 index, or semiconductors, or AAPL, or NFLX, or a handful of other mega-cap growth names, then that is basically an undeniable truth...

READ MORE

MEMBERS ONLY

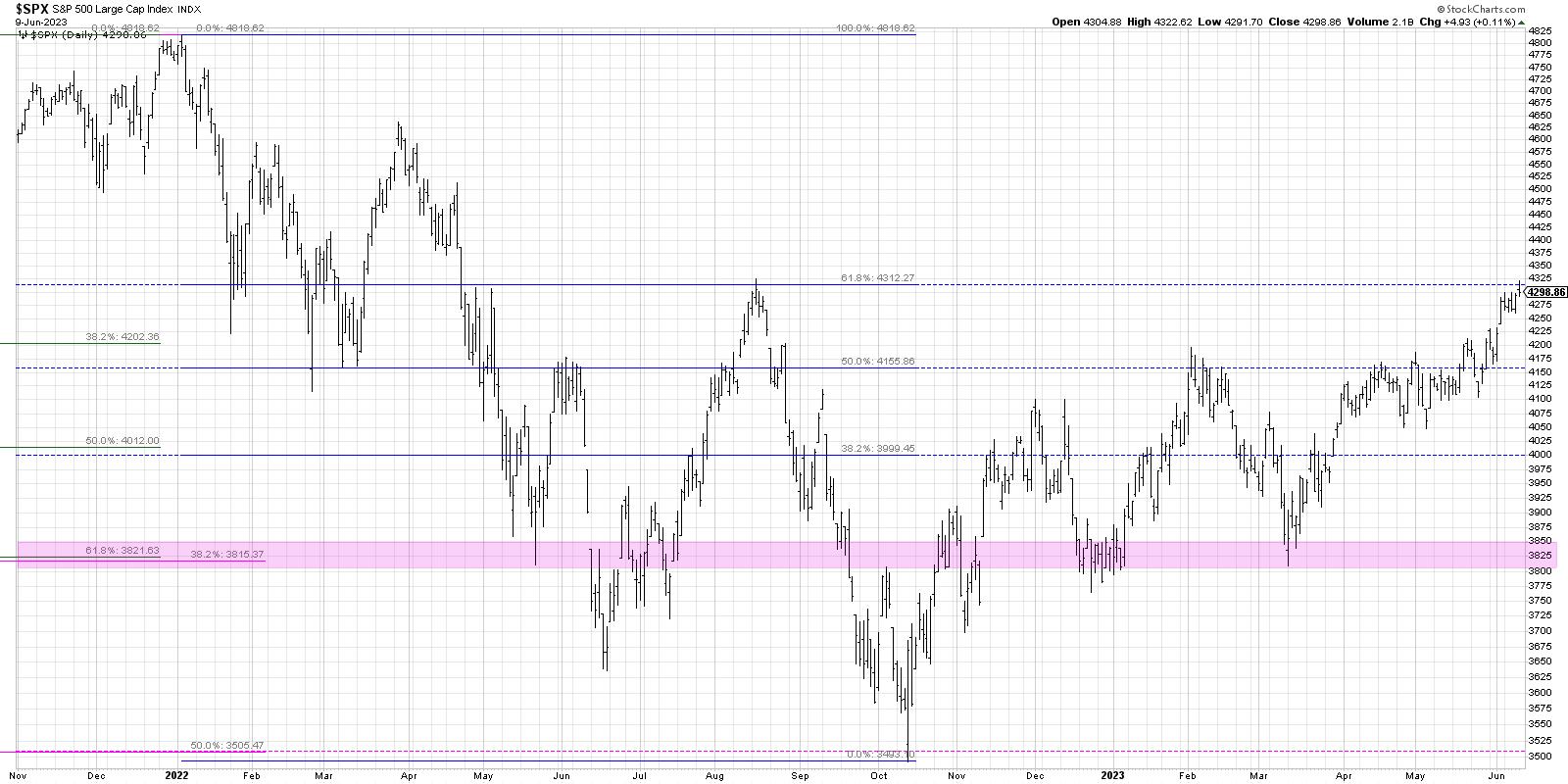

Fibonacci Says Upside to SPX 4300

by David Keller,

President and Chief Strategist, Sierra Alpha Research

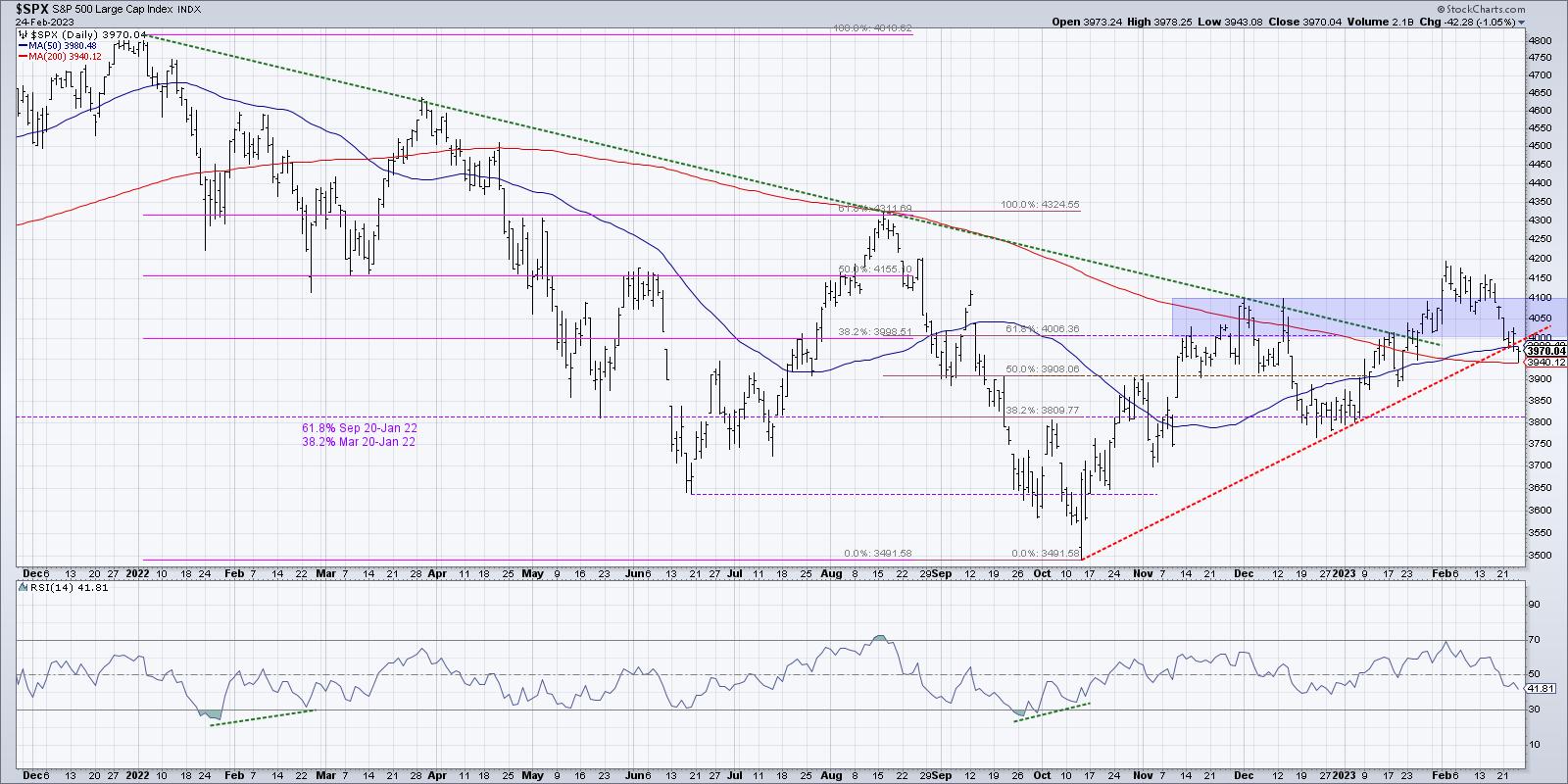

Earlier this week, I completed a "clean slate" exercise on the S&P 500 chart.

You see, my charts become pretty busy over time, because I draw lots of trend lines and put notes on the charts as well. Basically, I consider charts to be the way...

READ MORE

MEMBERS ONLY

Ending the Sloppy Choppy Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the last two weeks, I've heard this market described as "frustratingly neutral", "decidedly sideways", "stuck", and my personal favorite, the "sloppy choppy" phase. So how does the market breakout of this sideways period and move into a new bullish...

READ MORE

MEMBERS ONLY

Three Charts Suggest Pullback Imminent

by David Keller,

President and Chief Strategist, Sierra Alpha Research

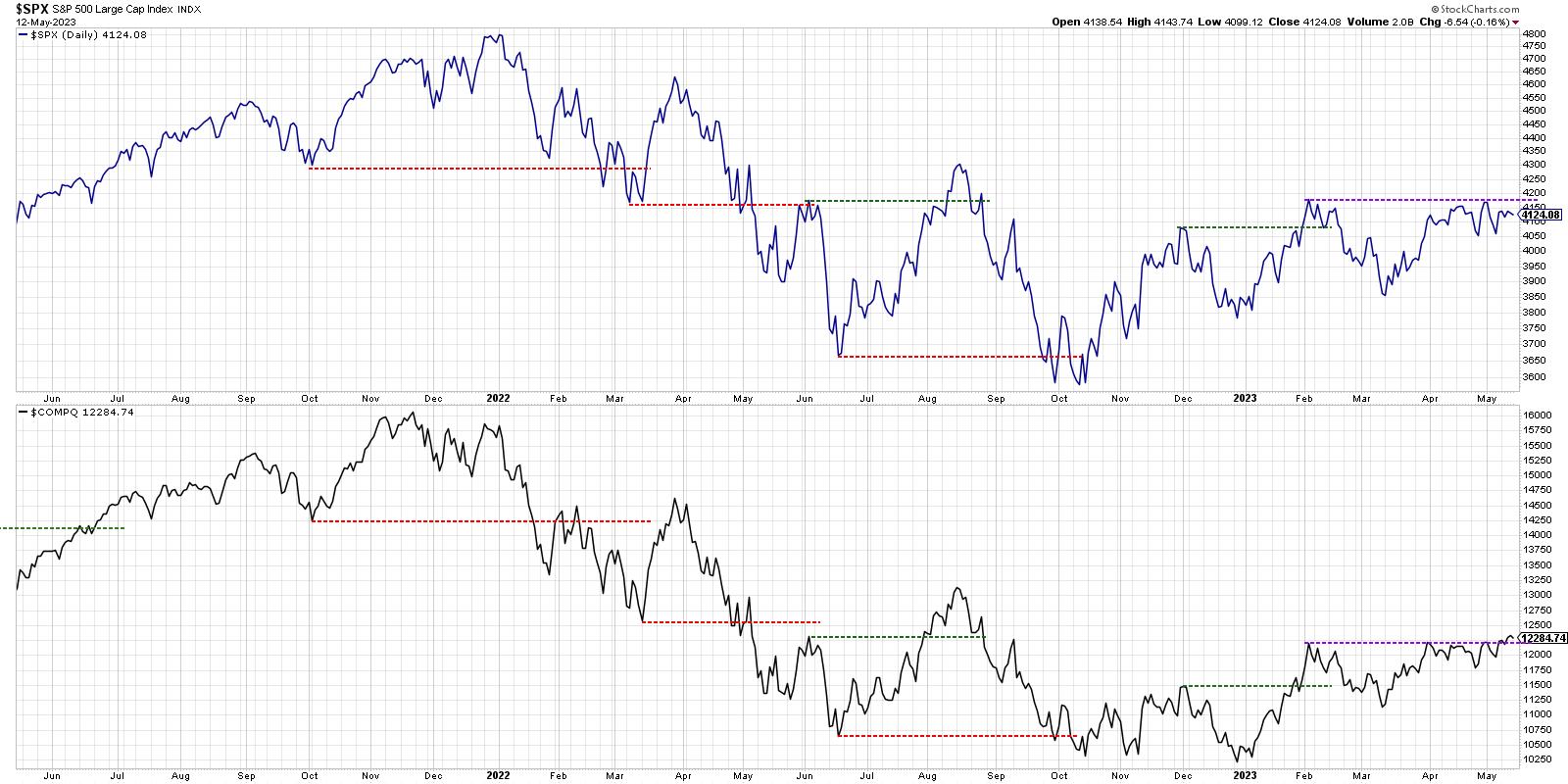

The major equity averages have stalled out in recent weeks, trading up to their February highs but unable to muster enough positive momentum to push to new swing highs.

The key question as we continue through earnings season is whether there will arise a catalyst to propel the S&...

READ MORE

MEMBERS ONLY

Why Market Conditions Are Not Yet Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

A number of my recent conversations on The Final Barhave related to the conflict presented in the markets in April 2023.Classic measures of market trend, from the Coppock Curve to the Zweig Breadth Thrust to my own Market Trend Model, are all giving a strong positive signal on trend...

READ MORE

MEMBERS ONLY

Key Levels for the FAANG Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

A number of my conversations this week on The Final Bardealt with the challenges presented by narrow leadership. Joe Rabil pointed out theweakness in small caps,and Jeff Huge focused on the difference between theYTD returns of FAANG stocksversus pretty much everything else.

Why is narrow leadership such a problem?...

READ MORE

MEMBERS ONLY

Three ETFs Showing Renewed Strength

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With the first quarter of 2023 drawing to a close, what impresses me most about the equity markets are the improving breadth conditions. While the markets can move higher on strength from the MANAMANA stocks, sustained bull market phases usually need additional support from other stocks.

One could argue that...

READ MORE

MEMBERS ONLY

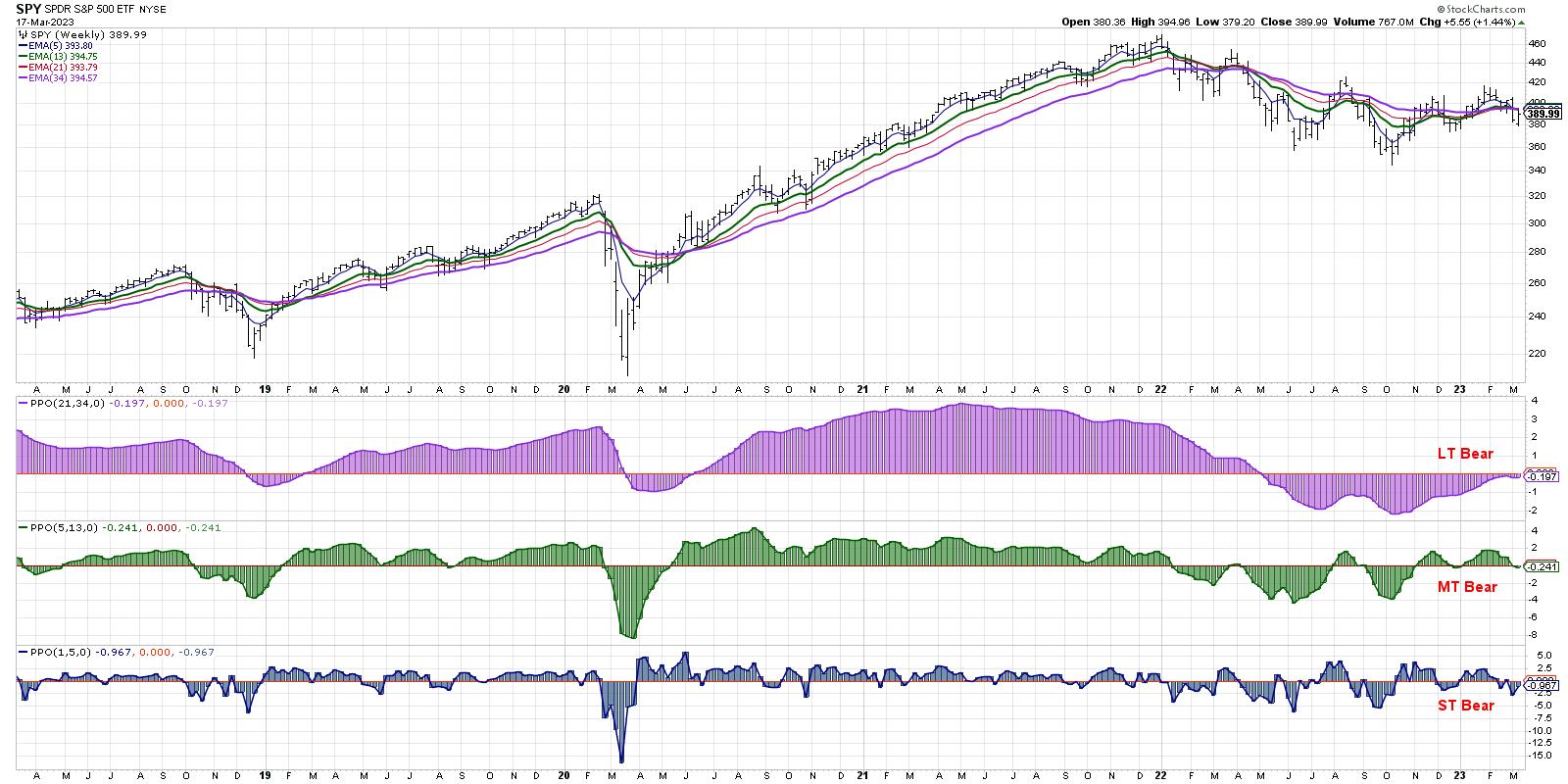

Market Trend Model Turns Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This week, stocks started in a position of strength and ended in a position of weakness. While some groups, like semiconductors, have managed to remain strong, the major benchmarks managing to pound out a positive return for the week, the broad market message appears cautious-at-best by my read.

My main...

READ MORE

MEMBERS ONLY

Downside for Bitcoin as Cryptos Crumble

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I'm a big fan of playing the long game as an investor, particularly for long-term accounts that should arguably not be affected by short-term market fluctuations. Talking with experts like Jon Markman, author of Fast Forward Investing, has reminded me that overarching themes like artificial intelligence, electric vehicles,...

READ MORE

MEMBERS ONLY

The Road to SPX 5000

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My conversations with Chris Verrone, Adrian Zduńczyk, and Mary Ellen McGonagle this week on The Final Barleft me striving to simplify my analysis of the S&P 500.

It's been a confusing time for stocks and as a result, my main daily chart of the S&...

READ MORE

MEMBERS ONLY

Nothing Good Happens Below the 200-Day

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of my early mentors often remarked, "Nothing good happens below the 200-day."This was his way of recognizing that, while stocks can certainly pop higher from beaten down levels, you're more likely to experience sustained advances once the price is above the 200-day moving average....

READ MORE

MEMBERS ONLY

The Bullish Case for Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

People absolutely love to not love gold. When I post bullish gold comments on social media, I am guaranteed to get some not-so-constructive pushback on an optimistic thesis.

Why do people love to hate the gold trade? Well, for starters, it hasn't worked in a long time. But...

READ MORE

MEMBERS ONLY

Three Concerning Signs for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

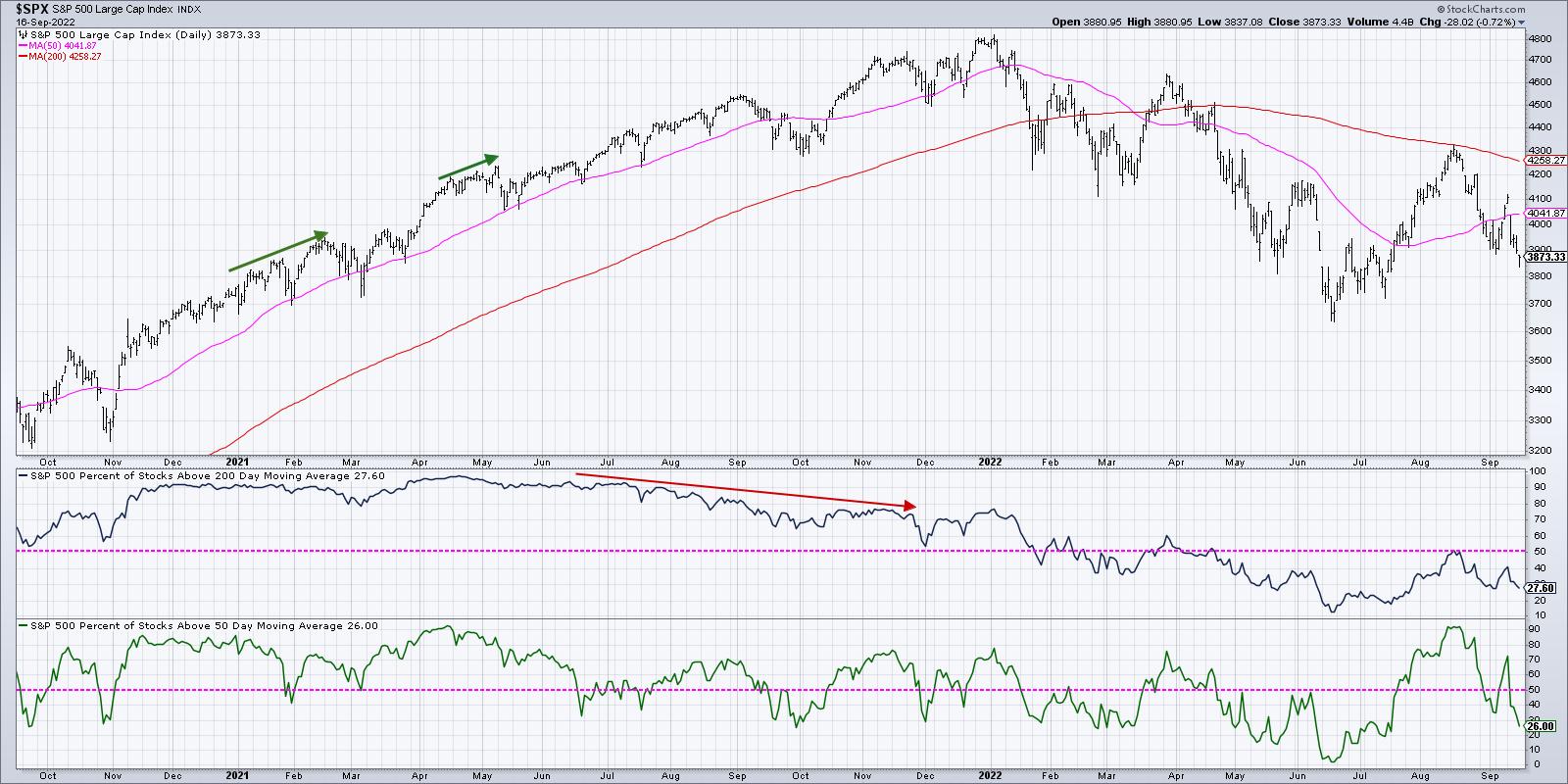

I've recognized the strength displayed by the S&P 500 and Nasdaq Composite off the October lows. I've written about the New Dow Theory buy signaland the improvement in breadth indicators like thepercent of stocks above moving averages.So, while I am not as all-in...

READ MORE

MEMBERS ONLY

New Dow Theory Declares Bullish Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the technical analysis toolkit has certainly evolved over time, having benefitted from advances in computing and data analysis, in many ways, the tools of the modern technical analyst are not far from the original work of Charles Dow in the early 20th century. But an updated version of his...

READ MORE

MEMBERS ONLY

The S&P 500 Leaves the 200-Day Behind

by David Keller,

President and Chief Strategist, Sierra Alpha Research

How much weight should we put on the fact that the S&P 500 index powered above its 200-day moving average (MA) this week? If history is any indication, then this is actually a fairly momentous occasion. Unless it's a repeat of March 2022, in which case...

READ MORE

MEMBERS ONLY

The Most Important Breadth Indicator to Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I like to keep my process simple. That means I define the market trend using a simple combination of exponential moving averages. That also means that my charts are relatively straightforward, avoiding too many indicators and sticking to what I consider simple measures of trend and momentum.

So when I...

READ MORE

MEMBERS ONLY

The Four Scenarios for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Position for the most probable scenario, but plan for alternative scenarios.

Why is this a sentence that should be printed out and taped to your monitor, now if not sooner? Because, as investors we often become very tied to a particular narrative.

The Fed is wrapping up its tightening cycle...

READ MORE

MEMBERS ONLY

Respecting the Rangebound S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As the great bear market of 2022 was really hitting its stride, the 3800 level came into view as a likely support level for stocks. We keyed in on that level based on Fibonacci Retracements using the March 2020 low and the January 2022 high. At the time, that seemed...

READ MORE

MEMBERS ONLY

My Worst Call of the Year

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When I worked on the institutional buyside, we had the opportunity to hear from lots of brokers, strategists, and analysts in the industry. And I was thrilled to have some of the top technical analysts around coming through to talk charts with us. One of my favorite questions to ask...

READ MORE

MEMBERS ONLY

The End of Another Bear Market Rally?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Charts give you a window into the collective psychological state of investors. Are people excited or panicky? Euphoric or despondent? Optimistic or pessimistic? All of that is embedded in price action if you know how to analyze the trends.

As the market rallied strongly off the October lows, fueled by...

READ MORE

MEMBERS ONLY

And That's Why We Wait for the Close

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've now been hosting our closing bell show, The Final Bar, for over three years. It's been such a fascinating experience to use my daily show as a way to focus my own analytical process, and I truly believe that hosting a show like this has...

READ MORE

MEMBERS ONLY

Three Trendlines I'm Watching Next Week

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In early October, market trends appeared to make sense—at least, as much as could be expected in 2022. The S&P 500 Index ($SPX) had just made a new 52-week low, the U.S. dollar had just achieved a new 52-week high, and the 10-Year Treasury yield had...

READ MORE

MEMBERS ONLY

Limited Upside Until This Chart Changes

by David Keller,

President and Chief Strategist, Sierra Alpha Research

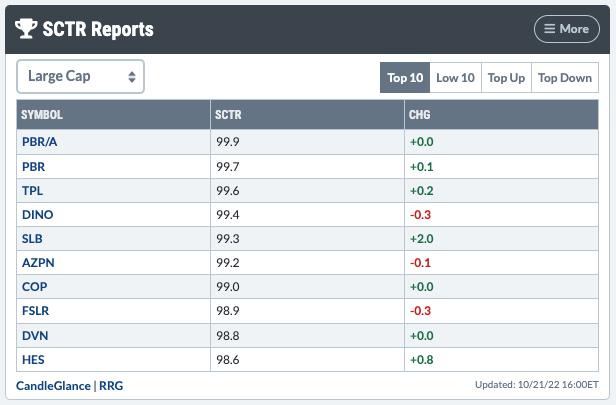

I was reviewing my weekly ChartList reports this afternoon and noticed this one, showing the top performing sectors for the week.

Only three of the 11 S&P 500 sectors were up on the week: Consumer Staples, Utilities and Health Care. Not exactly an offensive powerhouse on the top...

READ MORE

MEMBERS ONLY

The Bullish Case for Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While gold has not done much in 2022 in terms of absolute returns, the SPDR Gold Shares (GLD) has indeed outperformed the SPDR S&P 500 (SPY) by about 11% year-to-date. Why has gold not done better as a safe haven? It's all about the U.S....

READ MORE

MEMBERS ONLY

The Perfect Chart for Navigating 2022

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Bruce Fraser joined me on The Final Bar this week and shared a thought-provoking point & figure chart of the S&P 500 index. With the recent upswing, you can use a horizontal count to identify potential upside targets for the bear market rally. (Yes, I am still labeling...

READ MORE

MEMBERS ONLY

Top Ten Stocks in Accumulation Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When someone sends me a ticker to review, the first thing I do is bring up my standard two-year daily chart on StockCharts. And the very first question I ask myself is always the same: is this chart in an accumulation phase or a distribution phase?

Now that is a...

READ MORE

MEMBERS ONLY

What a Difference a Day Makes

by David Keller,

President and Chief Strategist, Sierra Alpha Research

On Thursday, the S&P 500 index opened around 3500, which is a fairly significant level. That price point represents a 50% retracement of the 2020-2022 bull market phase.

Was I surprised to see a bounce off the 50% retracement level? Absolutely not. As Katie Stockton shared on The...

READ MORE

MEMBERS ONLY

New Dow Theory Confirmed Sell Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

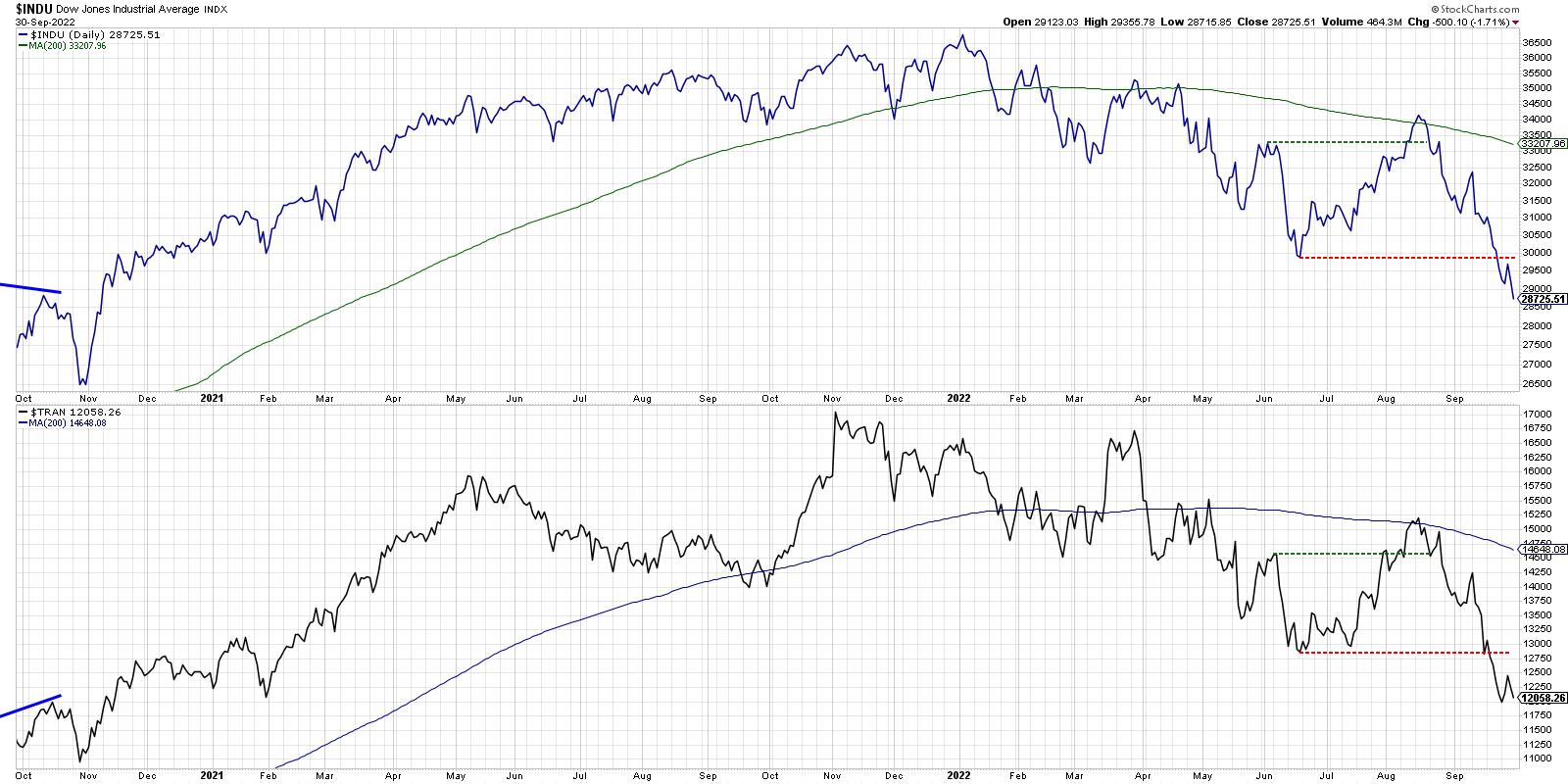

OK, so we know the market is going down. And, save for a mid-summer bear market rally, the S&P 500 and Nasdaq have been in fairly consistent downtrends.

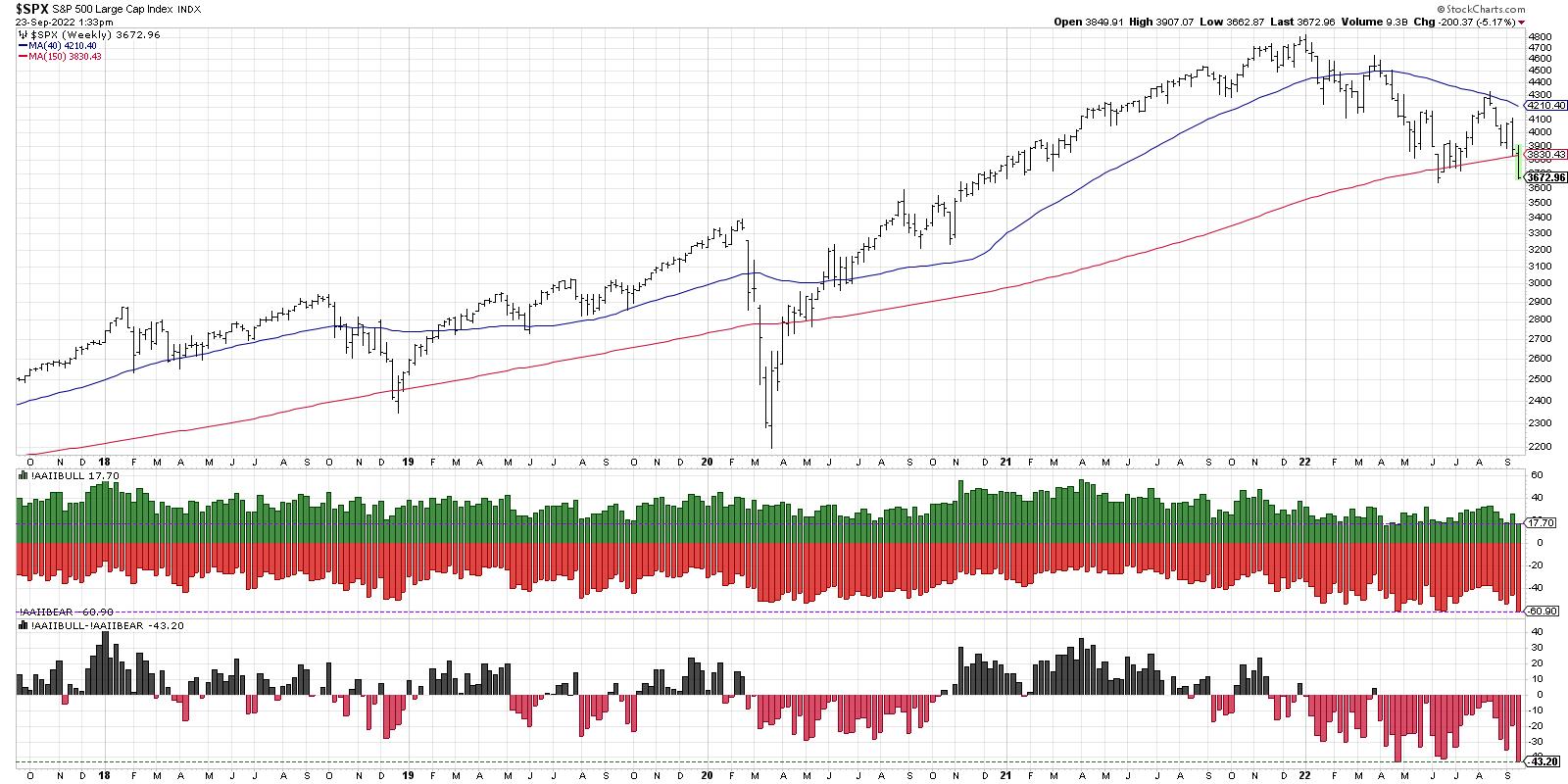

Last week, I highlighted the extreme bearish readings in the AAII Survey(it's worth noting that this weekNAAIM...

READ MORE

MEMBERS ONLY

Exceptionally Bearish Breadth

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I have very fond memories of time spent in the Fidelity Chart Room, from discussing the merits of contrary opinion with teams of financial advisors to teaching student investment clubs about the value of technical analysis. But one of my favorite "behind the scenes" moments came in 2009....

READ MORE

MEMBERS ONLY

It's Not a Stock Market, It's a Market of Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I was taught early on that "a rising tide lifts all boats" and that the real game as an equity investor was to get the market call right. Forget about the individual stocks and instead focus your attention on the macro call.

Because most stocks just follow the...

READ MORE