MEMBERS ONLY

Our Very Last Trading Room

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, Carl and Erin made a big announcement! They are retiring at the end of June so today was the last free DecisionPoint Trading Room. It has been our pleasure educating you over the years and your participation in the trading room has been fantastic! Be sure and sign up...

READ MORE

MEMBERS ONLY

DP Trading Room: Long-Term Outlook for Bonds

by Erin Swenlin,

Vice President, DecisionPoint.com

The market continued to slide lower today as the bear market continues to put downside pressure on stocks in general. Bonds and Yields are at an inflection point as more buyers enter the Bond market which is driving treasury yields higher. What is the long-term outlook for Bonds? Carl gives...

READ MORE

MEMBERS ONLY

DP Trading Room: SPX Earnings Update

by Erin Swenlin,

Vice President, DecisionPoint.com

The market has been overvalued for some time but how overvalued is it? Today Carl brings his earnings chart to demonstrate how overvalued the market is right now. We have the final data for Q4 2024.

The market continues to show high volatility but it did calm down somewhat Monday....

READ MORE

MEMBERS ONLY

DP Trading Room: Key Support Levels for the SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

The market is in a tailspin as tariffs add volatility to the market. Carl and Erin believe the SPY is in a bear market given key indexes like the Nasdaq are already in bear markets. It's time to consider where the key support levels are.

Carl addressed his...

READ MORE

MEMBERS ONLY

DP Trading Room: Magnificent Seven Stocks in Bear Markets

by Erin Swenlin,

Vice President, DecisionPoint.com

You may not know it, but all of the Magnificent Seven stocks are in bear markets. Given they are such an integral part of the major indexes, we have to believe that the market will follow suit and continue lower in its own bear market. The SP500 is in correction...

READ MORE

MEMBERS ONLY

Silver Cross Index Tops Beneath Signal Line on SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

One of the indicators that Carl Swenlin developed is the Silver Cross Index. It is one of the best participation indicators out there! Here's how it works:

We consider a positive 20/50-day EMA crossover a "Silver Cross". If a stock has a Silver Cross it...

READ MORE

MEMBERS ONLY

DP Trading Room: Tariffs Narrowing, Sparks Market Rally

by Erin Swenlin,

Vice President, DecisionPoint.com

Over the weekend it was announced that tariffs will be narrowing and possibly not as widespread as initially thought. Negotiations are continuing in the background and this seems to be allaying market participants' fears. The market rallied strongly on the news.

Carl and Erin gave you their opinions of...

READ MORE

MEMBERS ONLY

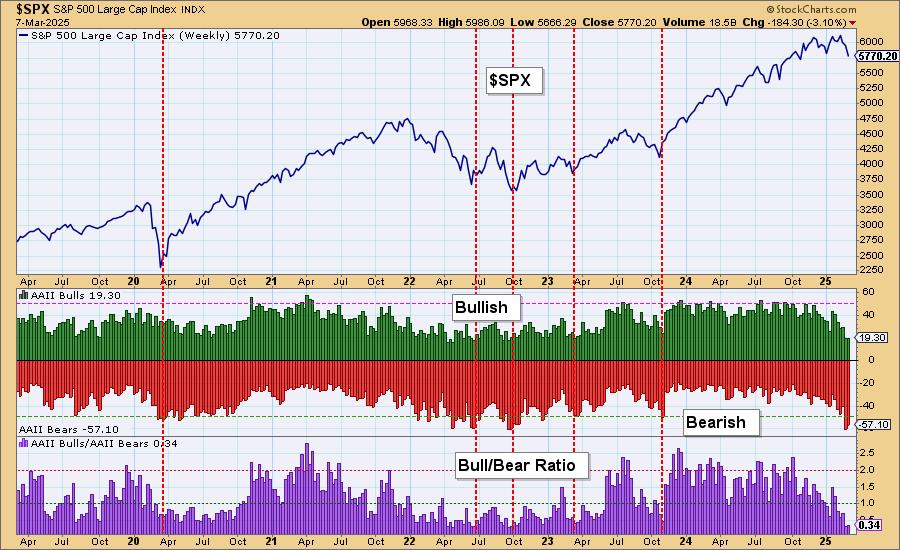

American Association of Individual Investors (AAII) Breaks Record

by Erin Swenlin,

Vice President, DecisionPoint.com

We wrote about the American Association of Individual Investors (AAII) poll results a few weeks ago. Since then, the bearish activity on the chart has broken a record for the poll. Going back to the poll's inception in 1987, we have never seen four weeks in a row...

READ MORE

MEMBERS ONLY

DP Trading Room: Upside Initiation Climax?

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday DP indicators logged an Upside Initiation Climax. This exhaustion events often mark the beginning of new rallies and could indicate that the market is indeed ready to rebound. However, we do question its veracity given lukewarm trading to begin Monday's trading.

Carl started us off by...

READ MORE

MEMBERS ONLY

Retail (XRT) Dropping Quickly

by Erin Swenlin,

Vice President, DecisionPoint.com

It's been rocky for the S&P 500 and particularly rocky for some industry groups and sectors. The market does appear ready to give us a good bounce, but past that we aren't overly bullish.

Tariff talk has really pummeled the Retail (XRT) industry group...

READ MORE

MEMBERS ONLY

DP Trading Room: Market Sell-Off

by Erin Swenlin,

Vice President, DecisionPoint.com

The market sell-off continued in earnest after a brief respite on Friday. Uncertainty of geopolitical tensions and tariff talk has spooked the market and given the weakness of mega-cap stocks, we are likely to see more downside before a snapback rally.

Carl was off today so Erin had the controls!...

READ MORE

MEMBERS ONLY

American Association of Individual Investors (AAII) Hitting Bearish Extremes

by Erin Swenlin,

Vice President, DecisionPoint.com

One thing to understand about sentiment measures is that they are contrarian. If investors are too bullish or too bearish, everyone has jumped on the bandwagon, and now it is time for the wheels to fall off.

Right now, we are seeing extraordinarily bearish sentiment coming out of the American...

READ MORE

MEMBERS ONLY

DP Trading Room: Bitcoin Surges!

by Erin Swenlin,

Vice President, DecisionPoint.com

The news is that the United States will have a Cryptocurrency reserve. How this will occur is still murky, but Bitcoin surged on the news. Carl and Erin give you their opinion on Bitcoin's chart setup and possible future movement.

Carl opens the trading room with a review...

READ MORE

MEMBERS ONLY

New Indicator for Your Toolbox

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of our regular market review in the DP Alert, we have begun to notice a very good indicator to determine market weakness and strength. It may not be new to all of you, but we've found as of late that this indicator tells a story.

We...

READ MORE

MEMBERS ONLY

DP Trading Room: Defensive Sectors Lead the Pack

by Erin Swenlin,

Vice President, DecisionPoint.com

The complexion of the market is changing. Aggressive sectors which have led the market higher are now beginning to show signs of strain as momentum slowly dissipates and prices turn lower. However, defensive sectors (XLP, XLRE, XLV and XLU) are now leading the market. Typically when this occurs the market...

READ MORE

MEMBERS ONLY

Mega-Caps Weakening, More Trouble Ahead

by Erin Swenlin,

Vice President, DecisionPoint.com

The market declined heavily on Friday likely setting up for more downside ahead. We had already begun to notice that mega-cap stocks were beginning to weaken. You can see this on the relative strength line of the SPY versus equal-weight RSP. The relative strength line has been in decline. You&...

READ MORE

MEMBERS ONLY

Double Tops In Bitcoin and the Dollar

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of the DP Alert, we cover Bitcoin and the Dollar every market day. We have been watching some bearish indications on both Bitcoin and the Dollar with the double top chart patterns.

On Bitcoin, price has been moving mostly sideways above support at 90,000. This happens to...

READ MORE

MEMBERS ONLY

DP Trading Room: Gold Hits Another All-Time High

by Erin Swenlin,

Vice President, DecisionPoint.com

The market rebounded to start trading on Monday, but indicators on Friday suggest internal weakness. Carl gives us his latest analysis on the market as well as taking a look at Gold which is making more all-time highs. Get Carl's perspective on the Gold rally.

Besides looking at...

READ MORE

MEMBERS ONLY

IT Breadth Momentum (ITBM) and IT Volume Momentum (ITVM) Top - Participation Draining

by Erin Swenlin,

Vice President, DecisionPoint.com

We are currently in a declining trend in the market and internals are telling us that this weakness will continue to be a problem. Our primary indicators in the short- and intermediate-term have topped with one exception. The Swenlin Trading Oscillators (STOs) started down on Thursday and the STO-B continued...

READ MORE

MEMBERS ONLY

DP Trading Room: Tariff Trepidation

by Erin Swenlin,

Vice President, DecisionPoint.com

Trading is being affected by the scare of a trade war. With new tariffs being placed on Mexico, Canada and China, the market fell heavily on Friday. The same was occurring this morning, but then the tariff on Mexico was delayed by one month which helped the market breathe a...

READ MORE

MEMBERS ONLY

S&P 600 (IJR) Silver Cross BUY Signal May Arrive Too Late

by Erin Swenlin,

Vice President, DecisionPoint.com

Today on the S&P 600 (IJR), the 20-day EMA nearly crossed above the 50-day EMA for a "Silver Cross" IT Trend Model BUY Signal. Price is really going nowhere. Bulls might look at it as a bull flag, but the 'flag' is horizontal, not...

READ MORE

MEMBERS ONLY

DP Trading Room: Black Swan Monday

by Erin Swenlin,

Vice President, DecisionPoint.com

The market opened with a bang as news of a cheaper Artificial Intelligence program, DeepSeek out of China. It has spurred investors to rethink the overbought Technology space, AI in particular. NVDA was down over 17% and other high profile AI companies also suffered.

Carl reviewed the DP Signal Tables...

READ MORE

MEMBERS ONLY

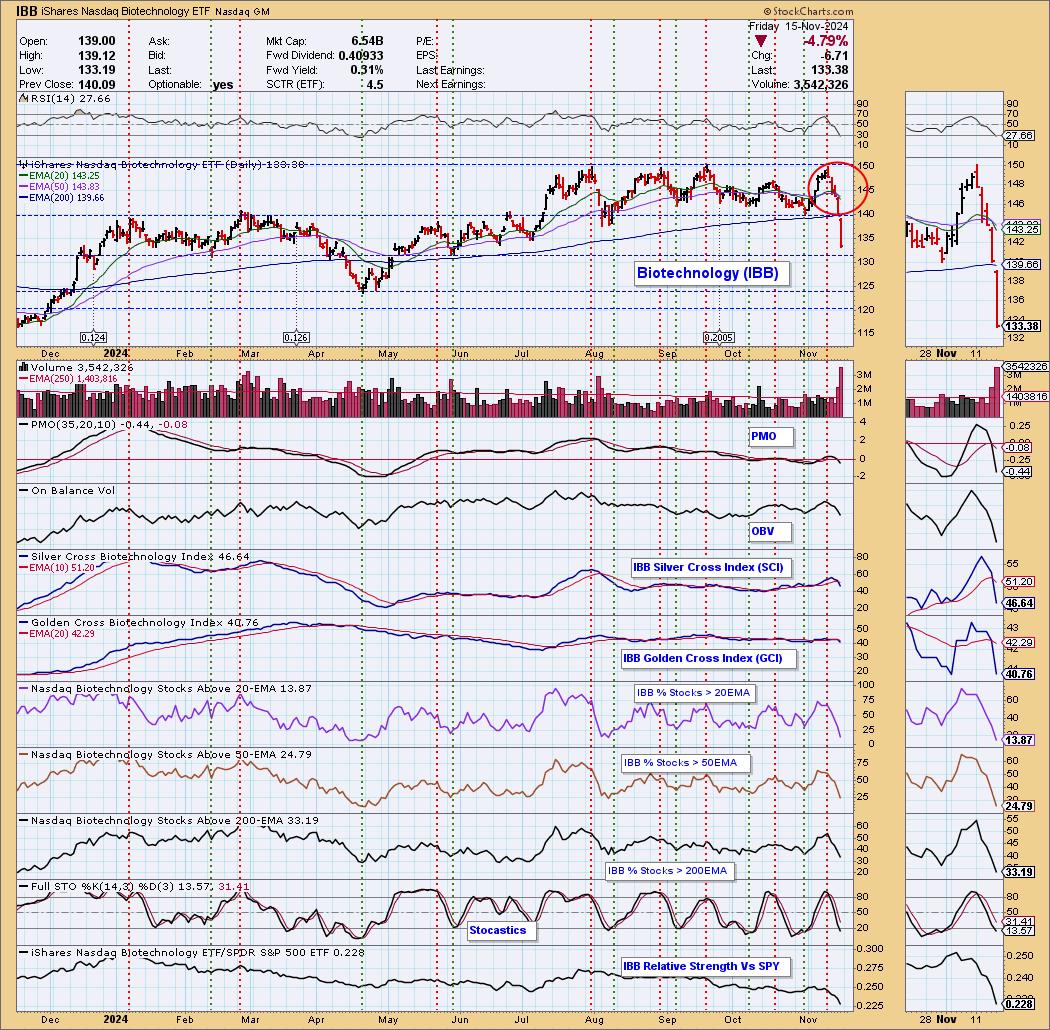

Biotechs Looking Up - Two Stocks To Take Advantage

by Erin Swenlin,

Vice President, DecisionPoint.com

The Biotech industry group is making a comeback, with the 'under the hood' chart displaying new strength coming into the group. We have a constructive bottom that price is breaking from and, while it does need to overcome resistance at the 200-day EMA, it looks encouraging. What was...

READ MORE

MEMBERS ONLY

DP Trading Room: Does This Rally Have Legs?

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DP Trading Room Carl and Erin discuss whether this market rally can get legs and push the market even higher? Mega-caps are looking very positive with the Magnificent Seven leading the charge. Technology is showing new strength along with Communication Services.

Carl starts the trading...

READ MORE

MEMBERS ONLY

SPY Weekly Chart Breaking Down

by Erin Swenlin,

Vice President, DecisionPoint.com

We monitor the weekly SPY chart and present it to our subscribers every Friday in our DP Weekly Wrap. We have been watching a bearish rising wedge on the weekly chart. The rising wedge pattern implies that you will get a breakdown from the rising bottoms trendline. That is exactly...

READ MORE

MEMBERS ONLY

DP Trading Room: Natural Gas (UNG) Breaks Out!

by Erin Swenlin,

Vice President, DecisionPoint.com

It's an interesting market day with the market moving lower despite positive seasonality. Natural Gas (UNG) broke out in a big way up over 15% at the time of writing. Is it ready to continue its big run higher?

Carl took the day off so Erin gave us...

READ MORE

MEMBERS ONLY

DP Trading Room: Deceptive Volume Spikes

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DecisionPoint Trading Room Carl discusses volume spikes and how we have to analyze big volume spikes carefully to determine whether they express a confirmation of a move or whether they are a special case and do not really provide insight.

Carl goes over the signal...

READ MORE

MEMBERS ONLY

Oversold Conditions Not Always a Friend

by Erin Swenlin,

Vice President, DecisionPoint.com

Nearly all of our charts currently show deeply oversold conditions. While this is usually a good thing, in a market downturn, it isn't necessarily your friend. As you can guess, we believe that Wednesday's big decline was the beginning of something more serious. But the question...

READ MORE

MEMBERS ONLY

DP Trading Room: Is Broadcom (AVGO) the New NVIDA (NVDA)?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin looks at the Broadcom (AVGO) chart and compares it to the NVIDIA (NVDA) chart. She shows us the differences between the two and tells you whether she believes AVGO will be the new NVDA, meaning it will perform as NVDA used to perform with a concerted move up...

READ MORE

MEMBERS ONLY

Market As Good As It Gets

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the 26 indexes, sectors and groups in a CandleGlance to see how the indexes stack up. It is clear that all of the indexes are as good as they can get. Carl warns that when things are as good as they can get, the only place...

READ MORE

MEMBERS ONLY

Double Top on Industrials (XLI)

by Erin Swenlin,

Vice President, DecisionPoint.com

Industrials (XLI) benefited greatly from the "Trump Trade", but fell back to digest the gap up rally. It rallied again, but failed after overcoming overhead resistance at the prior November top. Now it is pulling back once again, which that has formed a bearish double top formation. The...

READ MORE

MEMBERS ONLY

DP Trading Room: Swenlin Trading Oscillators Top!

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday our short-term Swenlin Trading Oscillators (STOs) turned down even after a rally. This is an attention flag that we shouldn't ignore, but what do the intermediate-term indicators tell us? Are they confirming these short-term tops?

Carl goes through the DP Signal tables to start the program...

READ MORE

MEMBERS ONLY

Market Rally Broadens - New All-Time Highs?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the small-caps and mid-caps that have now begun to outperform the market. Clearly the rally is broadening, the question now is can we continue to make new all-time highs. It does seem very likely especially given the positive outlook on the Secretary of Treasury nomination.

Carl...

READ MORE

MEMBERS ONLY

Stocks: "...a PERMANENTLY high plateau"?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today we explore the bullish sentiment that has taken SPX valuations to the moon. There are many out there that believe we have hit a plateau on prices that will continue permanently. We talk about the quote: "Stock prices have reached 'what looks like a permanently high plateau,...

READ MORE

MEMBERS ONLY

Biotechs Fall Apart with Dark Cross Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from the subscriber-only DP Weekly Wrap for Friday)

On Friday, the Biotechnology ETF (IBB) 20-day EMA crossed down through the 50-day EMA (Dark Cross) and above the 200-day EMA, generating an IT Trend Model NEUTRAL Signal. IBB recently switched to a BUY Signal on Friday November...

READ MORE

MEMBERS ONLY

Key Support Levels for Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's DP Alert short video we discuss the key support levels for Gold as it has likely begun a longer-term correction. We also take a look at Gold Miners under the hood! Charts and commentary are taken from our subscriber-only DP Alert publication. Subscribe now and try...

READ MORE

MEMBERS ONLY

Is the Trump Rally Like the Reagan Rally?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl compares this week's Trump Rally with the rally we saw after Reagan was elected in 1980. There are similarities and differences. The Trump rally has lifted certain sectors of the market as well as Cryptocurrencies. While the Reagan rally had different catalysts.

The market continues to...

READ MORE

MEMBERS ONLY

DP Trading Room: Six-Month Period of Favorable Seasonality Begins Now!

by Erin Swenlin,

Vice President, DecisionPoint.com

It's here! The SPY starts a period of favorable seasonality for the next six months. Carl takes us through his charts and explains favorable versus unfavorable periods of seasonality.

Carl covers our signal tables showing new weakness seeping in despite this period of favorable seasonality. The market looks...

READ MORE

MEMBERS ONLY

Price Momentum Oscillator (PMO) Internals Still a Problem

by Erin Swenlin,

Vice President, DecisionPoint.com

We noticed on Thursday evening how poor the internals were for the SPY, based on Price Momentum Oscillator (PMO) internals. These internals are the percent of stocks with rising PMOs and the percent of stocks with PMO Crossover BUY Signals. The accompanying short-term Swenlin Trading Oscillators (STOs), along with IT...

READ MORE

MEMBERS ONLY

DP Trading Room: Magnificent Seven Earnings Preview

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of today's coverage of the Magnificent Seven we remind you when the big mega-caps are reporting and give you are current perspective of each. We also cover all of the Magnificent Seven in the short and intermediate terms with daily and weekly charts.

Carl gives us...

READ MORE