MEMBERS ONLY

Not All Trades Are Created Equal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

10 years ago, I traded the stock market much differently. I didn't maintain a "Strong Earnings ChartList" to trade exclusively from like I do now. I considered relative strength, but it wasn't a primary focus. But I look at the overall stock market and...

READ MORE

MEMBERS ONLY

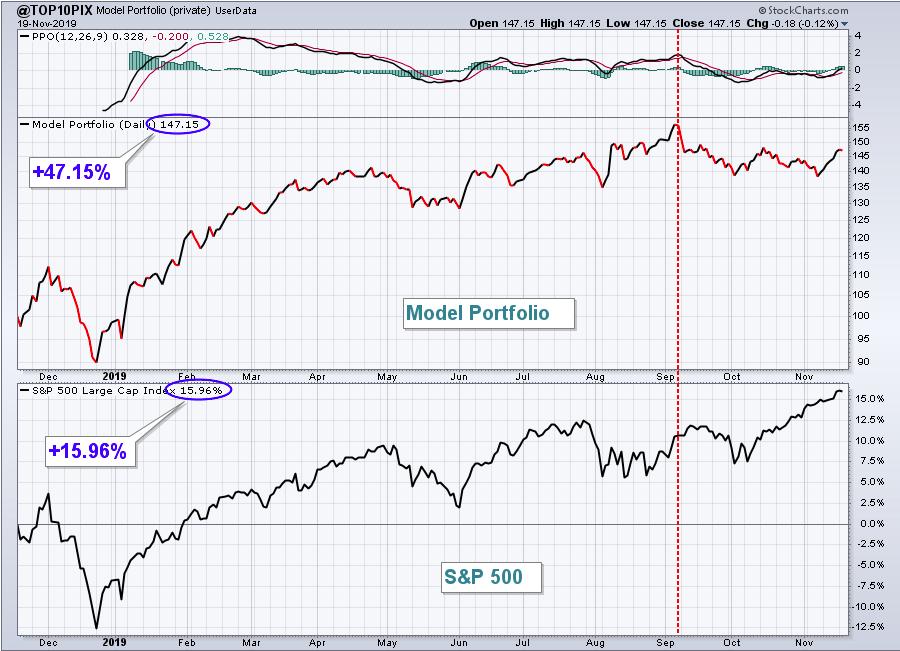

Creating A Portfolio To Trounce The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While there's no sugar coating that the market's sudden shift in August from growth stocks to value stocks cut into my returns, I'm still quite proud of my Model portfolio's performance after its one year anniversary yesterday. On November 19, 2018, I...

READ MORE

MEMBERS ONLY

Another Industry Breakout And A Stock That's Leading The Charge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The good news is that this breakout in the S&P 500 is littered with mini-breakouts in various sectors and industry groups. One of the latest industry groups to join the party is diversified industrials ($DJUSID), home of General Electric (GE). The former closed at a 52 week high...

READ MORE

MEMBERS ONLY

2020 Market Outlook And A Turnaround Candidate To Consider In An Unlikely Area

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you've followed my blogging and shows, then you know how bullish I've been and still am. During all the trade war, Fed, recession, and political worries, I've called for new all-time highs. I'm not stopping there. Don't be shocked...

READ MORE

MEMBERS ONLY

Looking Ahead To 2020 For Sector Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain quite bullish about 2020 prospects and one reason is the relative strength of our 5 aggressive sectors - technology (XLK), consumer discretionary (XLY), communication services (XLC), financials (XLF), and industrials (XLI). Wall Street has not positioned itself for anything other than a market advance ahead, so you should...

READ MORE

MEMBERS ONLY

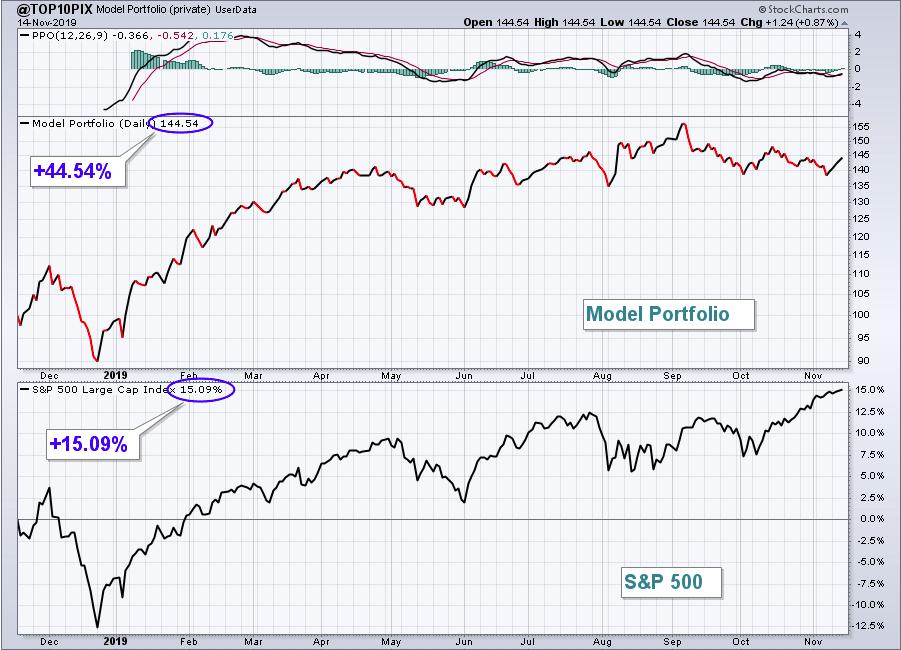

What A First Year It's Been For My Model Portfolio! +44.54% With 3 Days Left

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Any time you can beat the benchmark S&P 500, it's saying something. Many professionals managing money set the S&P 500 as the standard and try to beat it....and most fail. It's not an easy thing to do. But I do believe...

READ MORE

MEMBERS ONLY

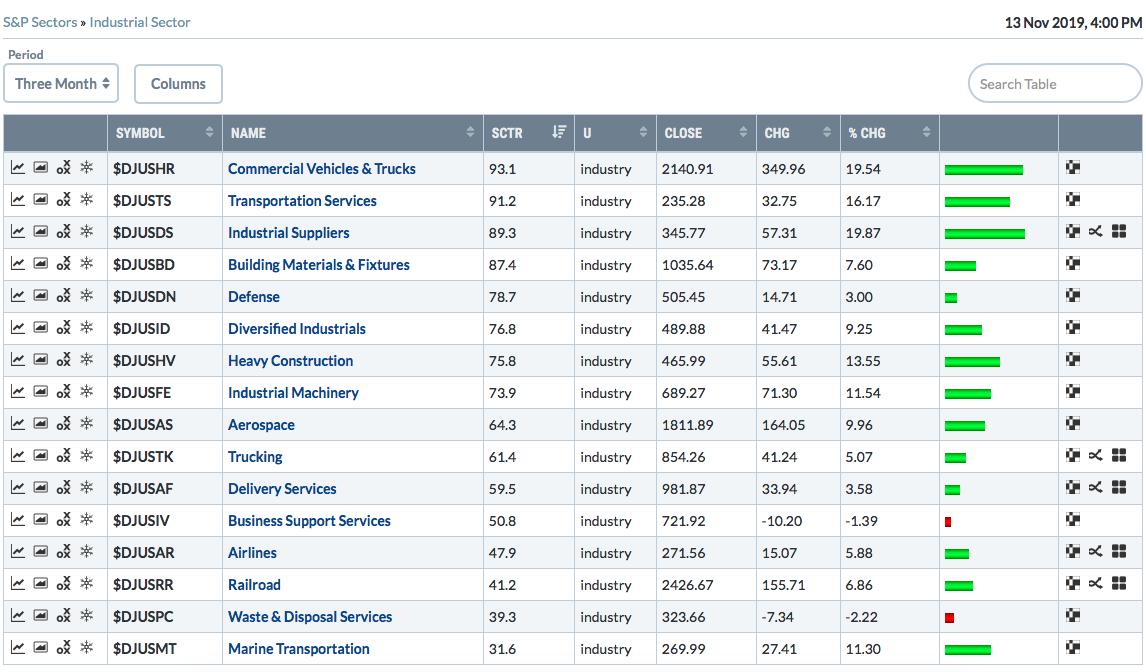

New Leadership In The Industrials, But How Do We Break Down The Group For Winners?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my last article, I illustrated the relative breakout in industrials vs. the benchmark S&P 500. The market goes through cycles and leadership rotates - even during the same bull market. StockCharts.com recently added SCTR scores for industry groups, so if you're unsure as to...

READ MORE

MEMBERS ONLY

A Key New Theme Has Emerged

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've witnessed a major shift in relative strength among sectors and industry groups and in order to prepare for the overall market strength in late-2019 and into 2020, we need to recognize this fundamental shift. Below I've identified a major thematic change in the U.S....

READ MORE

MEMBERS ONLY

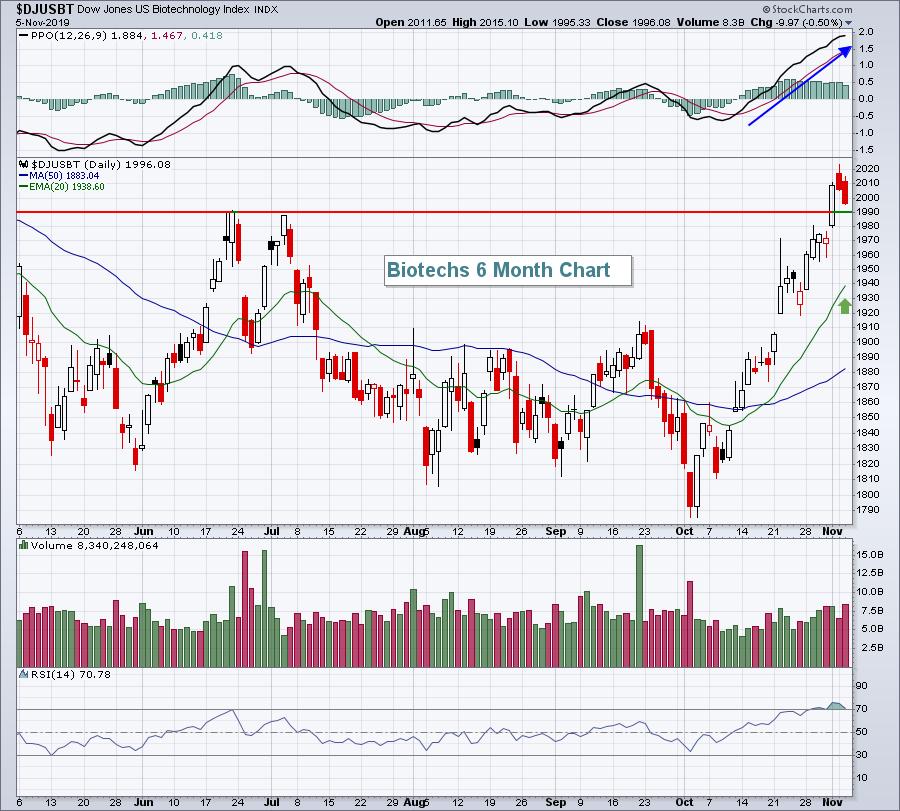

Biotechs Have Finally Caught Fire; Trading Candidates To Consider

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When the biotechs ($DJUSBT) get rolling, make sure to jump on board for the ride! The DJUSBT broke out above 600 at the beginning of 2012; by the time the run was over 3 1/2 years later, it had gained 167%! Since the middle of 2015, this same group...

READ MORE

MEMBERS ONLY

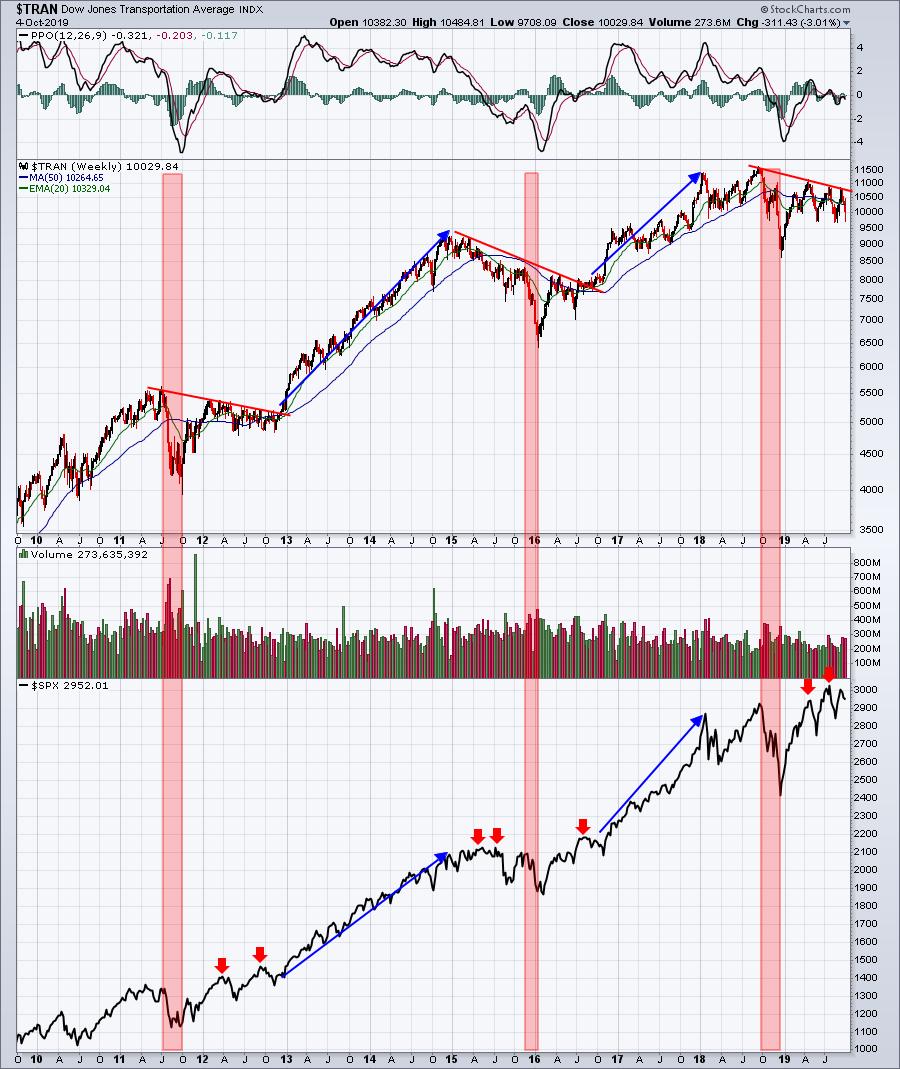

Transports Will Lead A Major Bull Market Rally During Q4 And Throughout 2020

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've maintained a bullish stance throughout the past 21 months of stock market turbulence. My signals simply reminded me to ignore the negative media and all the attempts to take the stock market lower. Don't follow CNBC's rhetoric. If they were right, we'...

READ MORE

MEMBERS ONLY

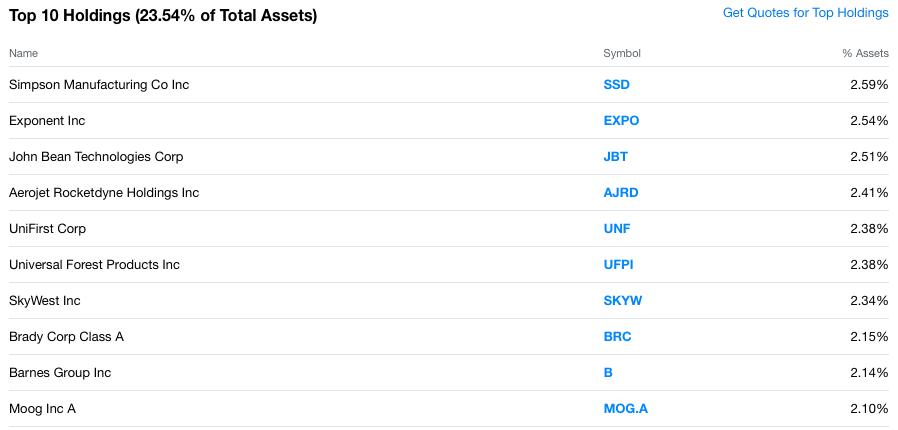

Breaking Down Small Cap Industrials - What To Buy?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I wrote an article earlier this morning in the free EarningsBeats Digest newsletter that showed the Invesco S&P SmallCap Industrials ETF (PSCI) outperforming its larger cap counterpart industrials sector ETF (XLI) over the past few months, a change from what we'd grown accustomed to since August...

READ MORE

MEMBERS ONLY

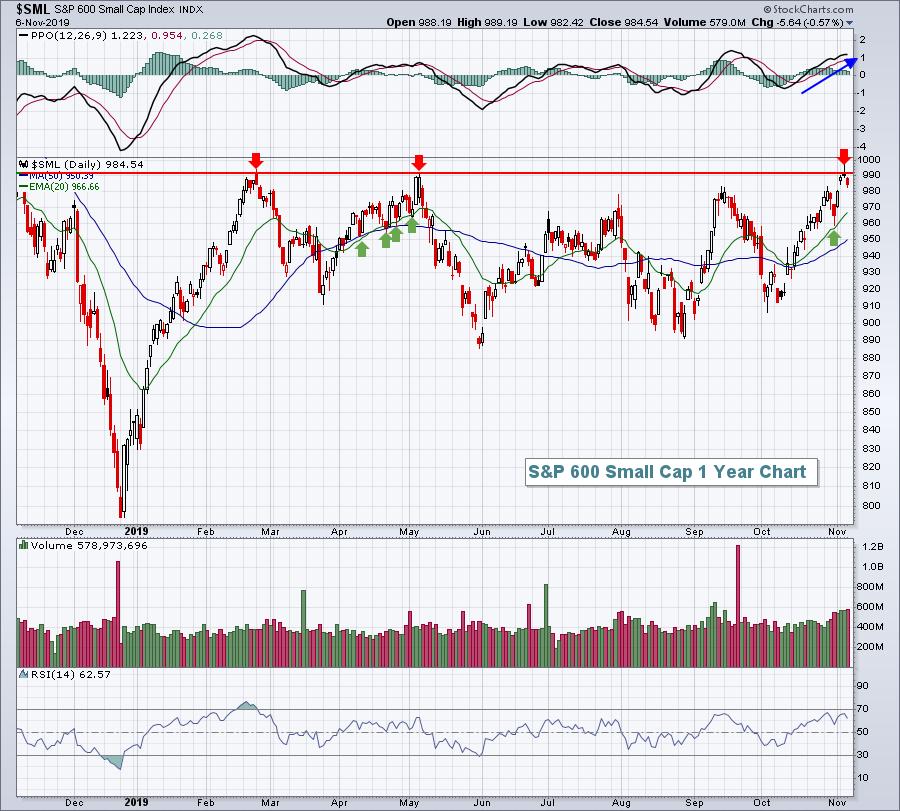

S&P 600 Small Cap Index Fails At Resistance - What Does It Mean?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Well, at first it simply means that there were enough sellers to hold off the bulls on their initial attempt to join the Dow Jones, S&P 500 and NASDAQ in breakout territory. I wouldn't worry a whole lot, however, as I believe it's just...

READ MORE

MEMBERS ONLY

This Group Could Be Poised For A 50% Rise Over The Next 1-2 Years

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are two groups, when they get rolling, that you do not want to miss. The first is semiconductors ($DJUSSC), which have exploded through resistance over the past two weeks and are higher by roughly 30% since June. KLA Corp (KLAC), Teradyne (TER), Advanced Micro Devices (AMD), Lam Research (LRCX)...

READ MORE

MEMBERS ONLY

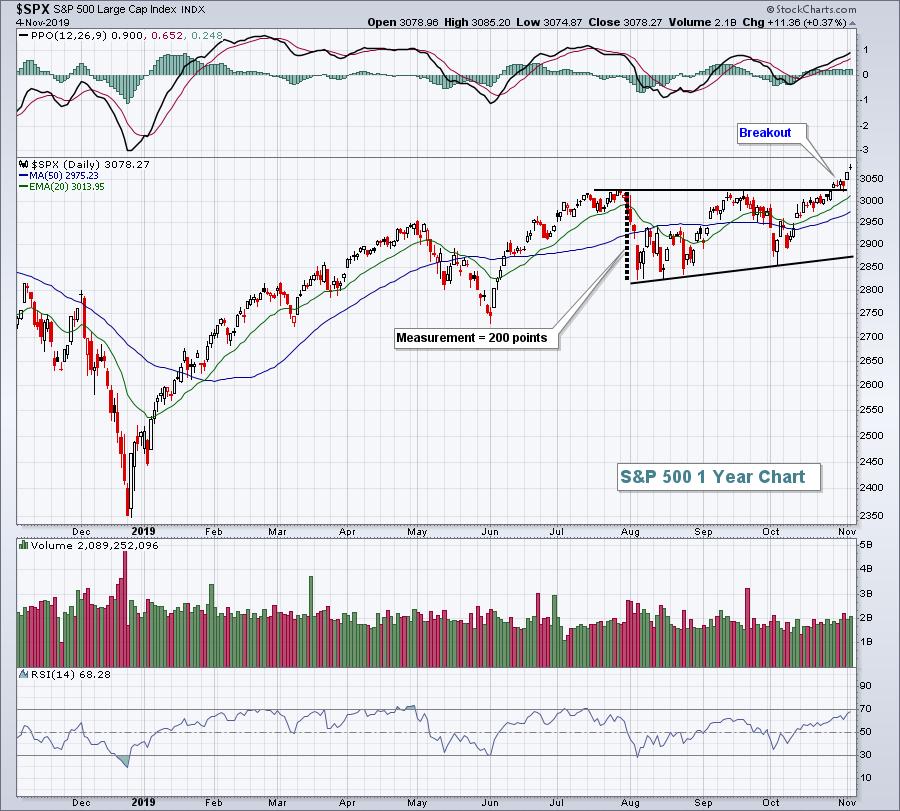

How Can You Spot A Top In All-Time High Territory?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

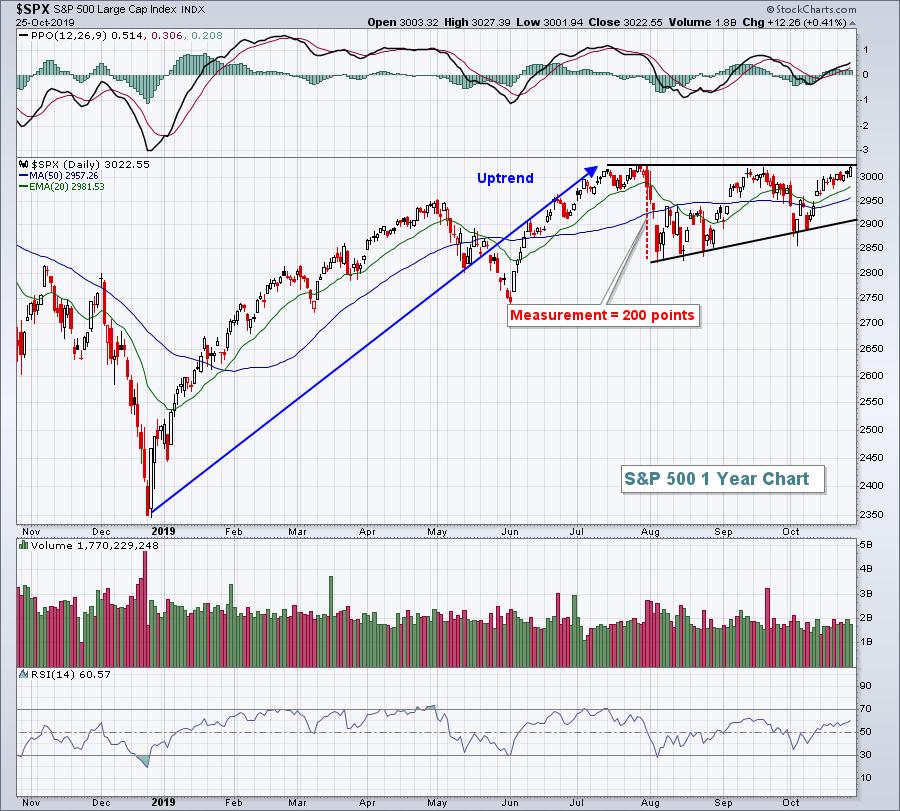

I generally look to prior price highs in determining overhead resistance, but in the case of all-time highs, there are none. So where do we go next? From a bigger picture outlook, we can use pattern measurements. Based on the recent ascending triangle breakout, I'd look to 3225...

READ MORE

MEMBERS ONLY

Understanding The Hints That Relative Strength Or Weakness Provides

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Here's today's EB Digest article that I sent to free subscribers close to 8am EST this morning. I just wanted to provide a sample of what you'll get if you SIGN UP.

Looking for a Negative Earnings Surprise

I've been providing a...

READ MORE

MEMBERS ONLY

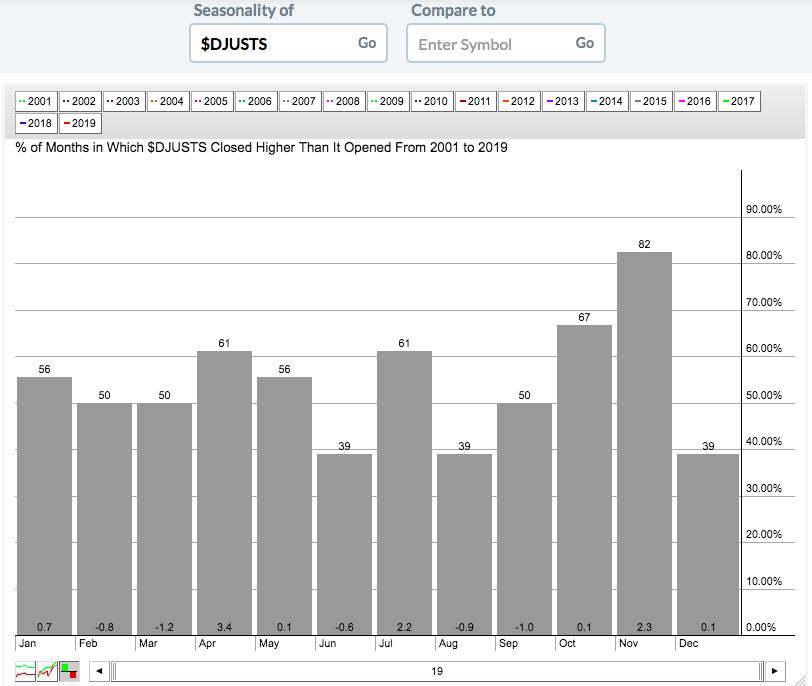

Take Your Relative Strength Analysis To The Next Level And Predict Earnings Reports

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ok, it might be a tad early to call it a leader, but transportation services ($DJUSTS) recently broke out to an 8 month relative high to the benchmark S&P 500. Money has been rotating there and we need to be aware of this relative strength. Before we look...

READ MORE

MEMBERS ONLY

Don't Overlook These Two Boring Areas If Breakouts Occur

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Stock market rotation occurs on a small level each and every day, but longer-term "big picture" themes emerge and it's critical for us to spot them early in their development in order to take advantage and ensure a much better chance of outperforming the major indices....

READ MORE

MEMBERS ONLY

It's Happening! The Puzzle Pieces Are Coming Together, Get Ready Bulls!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Anyone who has followed my work for the past decade knows that I've remained steadfastly bullish despite all the negative media rants. Follow the charts. There is no recession. The economy will strengthen. We'll get a trade deal. Heck, even the Fed is finally on board...

READ MORE

MEMBERS ONLY

Separating Winners From Wannabes After Two Weeks Of Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On each of the past two Mondays, I've hosted webinars that have highlighted stocks poised to trend higher with earnings results. It's a concept I discuss frequently and most of it has to do with relative strength. If Wall Street is accumulating, we need to take...

READ MORE

MEMBERS ONLY

Can You See An Earnings Report Before It's Announced?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I completely understand that it's really not possible, but Wall Street does provide us a number of clues. When a company is being accumulated and is outperforming its industry group peers plus the benchmark S&P 500, there's typically a reason for it. As I&...

READ MORE

MEMBERS ONLY

Check Out The New Leadership Over The Past Month

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As a trader, I'm constantly watching my industry group relative strength charts. There are 104 of them, so I could look at each one individually....or I could use the cool StockCharts tools to do all the work for me. Once I am in the ChartList that I&...

READ MORE

MEMBERS ONLY

Lock Into A Strengthening Industry For Great Earnings Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It works like a charm. Wall Street places their bets ahead of earnings season, then the solid results pour in. Shocking? Not really. That's a big advantage to have - to be able to meet with management teams ahead of earnings reports (before the "quiet period"...

READ MORE

MEMBERS ONLY

NFLX Dropped A Bomb, How Will The Other FAANG Stocks React To Earnings?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's been a lot said and written about the struggles of the FAANG stocks. Don't let any of it fool you. The only FAANG stock reeling in my view is Netflix (NFLX). In last week's "Q3 Earnings Sneak Preview", I said I...

READ MORE

MEMBERS ONLY

Earnings-Related Gaps - How To Profit From Them

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season is, by far, my favorite time of the year. It occurs four times a year and provides a significant number of trading opportunities if you know what you're looking for. My first piece of advice is this: Not all gaps are created equal. Many traders consider...

READ MORE

MEMBERS ONLY

What A Month For The Banks So Far!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

October volatility in the banking industry ($DJUSBK) has been nothing short of crazy! On September 30th, the DJUSBK stood at 457.39. A little more than two weeks later, we show an index value of 460.82. No big deal, right? Well, October began with that infamous ISM manufacturing number...

READ MORE

MEMBERS ONLY

JP Morgan Chase (JPM) Banks A Huge Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

JPM did not disappoint Wall Street. The Street had been "banking" on a solid report, as evidenced by its solid relative performance to its banking peers and to the benchmark S&P 500. And wow did they get it! JPM reported revenues of $30.06 billion and...

READ MORE

MEMBERS ONLY

Consumer Discretionary Poised To Lead Market Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

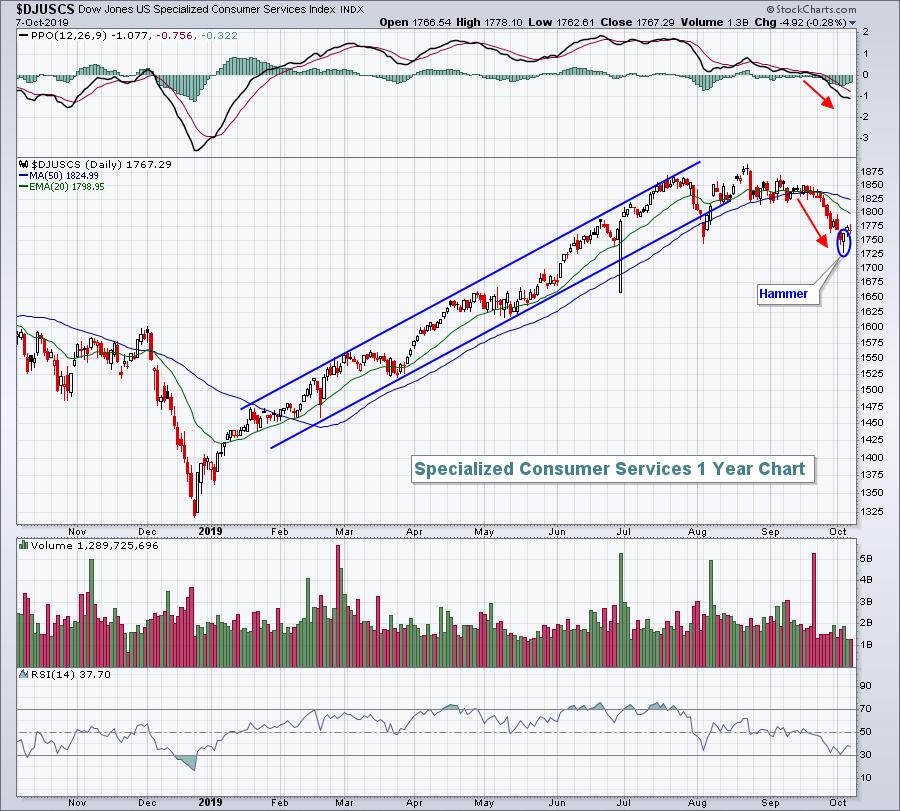

Last week, there were eight industry groups within consumer discretionary (XLY) that gained 2% or more, lead by the rapidly-improving apparel retailers ($DJUSRA), which gained 4.57% and broke out to 5 month absolute and relative highs:

The strength in the DJUSRA helped the XLY bounce off trendline support this...

READ MORE

MEMBERS ONLY

You Should Be Watching This Earnings Report On Tuesday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every earnings season, there are a few key reports that I focus on. It could be that an industry group is beginning to show strength and a key component is reporting that could influence the direction of the group for the entire upcoming quarter. Or it could be that a...

READ MORE

MEMBERS ONLY

Industries Most Likely To Produce Blow Out Earnings Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wall Street has placed its bets as we work our way into earnings season. It's very easy to see which groups are favored by big money - just look where that money has been going. Today, I'll give you my top 2 industry groups at the...

READ MORE

MEMBERS ONLY

Banks Likely To Be Big Part Of Q4 Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season officially starts this morning, in my opinion, with quarterly results coming in from Citigroup (C). While C may provide the banking group a lift today, the bigger report comes on Tuesday when JP Morgan Chase (JPM) reports its numbers. Why is JPM more important? Because Wall Street has...

READ MORE

MEMBERS ONLY

Daily Market Report - Wednesday, October 9, 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

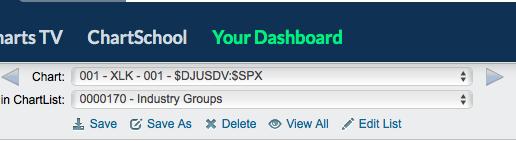

Note

The following is the EB Daily Market Report for yesterday. It is sent out each day (usually between 11am and noon EST) to our members at EarningsBeats.com. It's one of several new products and services that we've unveiled over the past month. If you&...

READ MORE

MEMBERS ONLY

Can Banks Be The Catalyst For A Strong Quarter?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technically-speaking, things are about to get very interesting for U.S. stocks. We've seen two economic reports out in the past two weeks that beg for at least a 25 basis point Fed rate cut. There was the weak ISM manufacturing data out last week and then yesterday...

READ MORE

MEMBERS ONLY

Daily Charts vs. Weekly Charts: Which Are Better?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That answer depends on your trading strategy quite honestly. Day traders likely don't care too much about technical indications on weekly charts whereas longer-term investors probably aren't going to grow too concerned by looking at charts day-to-day. Having said that, I put a lot more weight...

READ MORE

MEMBERS ONLY

A Breakout Won't Be Sustainable Without This

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've discussed this on many occasions, but bull market advances requires the rotation of dollars from the bond market. We can have money going into both stocks and bonds for a short period of time, but that generally won't work over a longer period of time....

READ MORE

MEMBERS ONLY

Here's ONE Thing I'm Looking For In Q4

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ok, I'm being somewhat dramatic. I'm looking for several things. First of all, I'm quite bullish. It's hard to tell exactly how long this consolidation lasts, but I'm definitely nowhere near the camp that believes we're heading for...

READ MORE

MEMBERS ONLY

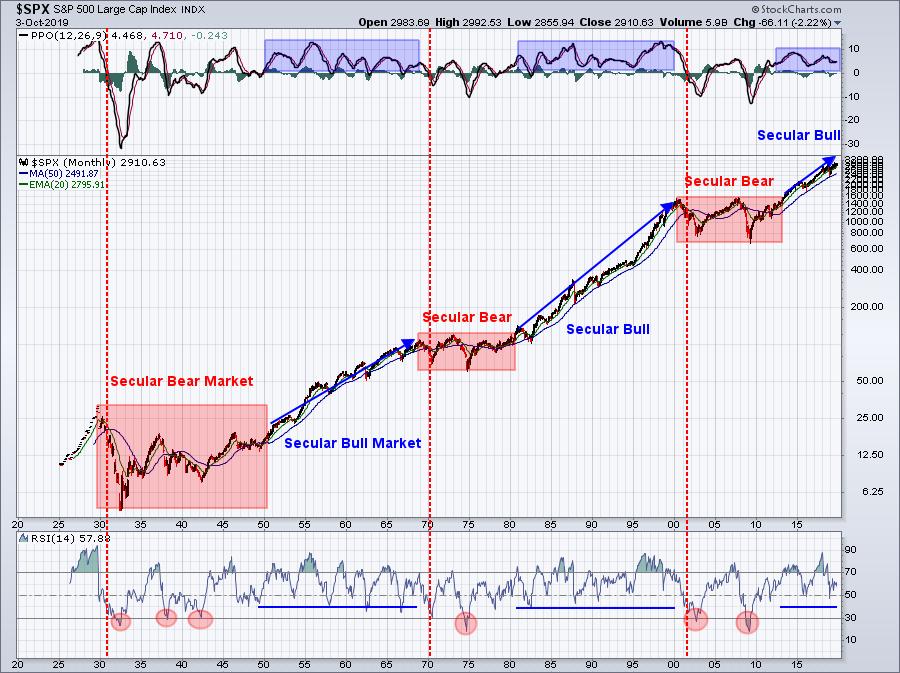

Q4: What's In Store For U.S. Equities?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's a great question and one that will be much easier to answer in 3 months. :-)

U.S. stocks have been through a lot over the past 21 months. Since topping in 2018, we've seen tremendous volatility, but there have been a few constants. For...

READ MORE

MEMBERS ONLY

Stop The Insanity! We're Going Higher And Here's Why

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Before I talk about jobs, let's discuss the S&P 500. We're consolidating. In a secular bull market, that's fashionable. We went through this from 2014 through early 2016. This is simply the 2018/2019 version. Every downturn and we hear from the...

READ MORE

MEMBERS ONLY

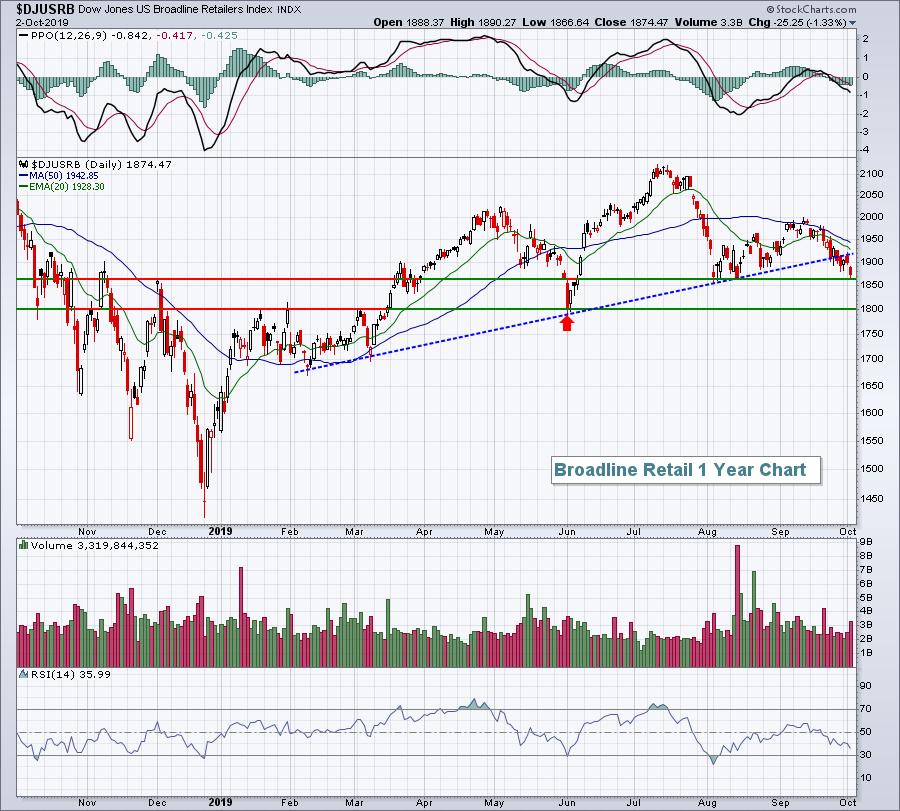

There Seems To Be No Bottom For This Broadline Retailer

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Broadline retail ($DJUSRB), once a Wall Street darling and bull market leader, has fallen upon hard times the past three months. While the S&P 500 recently moved up to challenge its all-time record high, the DJUSRB never came close. Its recent downtrend is now approaching key price support...

READ MORE

MEMBERS ONLY

Weak Manufacturing Spooks Wall Street, Sparking Selloff

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The September ISM manufacturing index fell from 49.1 in August to 47.8 this month, signaling a rather significant contraction. Export orders were much worse, posting 41.0, which was their third consecutive month of contraction. The report was released at 10am and, following a move lower heading into...

READ MORE

MEMBERS ONLY

Medical Equipment Remains A Leader; 2 Stocks To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Medical equipment stocks ($DJUSAM) have been solid absolute and relative performers for the past 7 years with few exceptions, so it certainly seems worthwhile to stay on top of its relative strength leaders. One such leader in 2019 has been Avedro, Inc. (AVDR). After a wicked week last week, AVDR...

READ MORE