MEMBERS ONLY

DP WEEKLY WRAP: Gray Swan? - Black Friday/Cyber Monday Sale is ON!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

(Our holiday gift to you... today's ChartWatchers article is a reprint of today's subscriber-only DP Weekly Wrap.)

Today, it was announced that we are faced with another COVID variant. This was not exactly a "black swan" event, something no one imagined, but maybe we...

READ MORE

MEMBERS ONLY

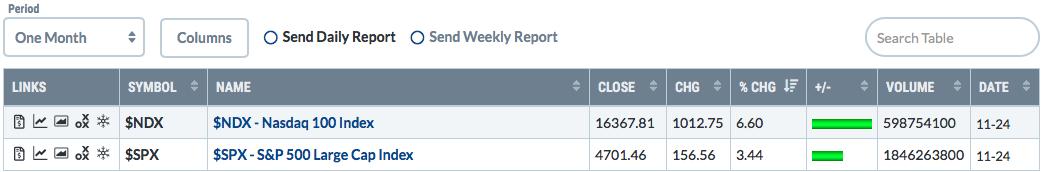

STOCKS PLUNGE ON NEW COVID VARIANT -- ALL ELEVEN SECTORS LOSE GROUND -- TREASURY YIELDS ALSO PLUNGE IN FLIGHT TO SAFETY

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES PLUNGE... Reports of a new covid variant in South Africa pushed stocks sharply lower the day after Thanksgiving. As a result, all three major U.S. stock indexes suffered short-term technical damage. Chart 1 shows the Dow Industrials falling -904 points (-2.5%) and ending the day well...

READ MORE

MEMBERS ONLY

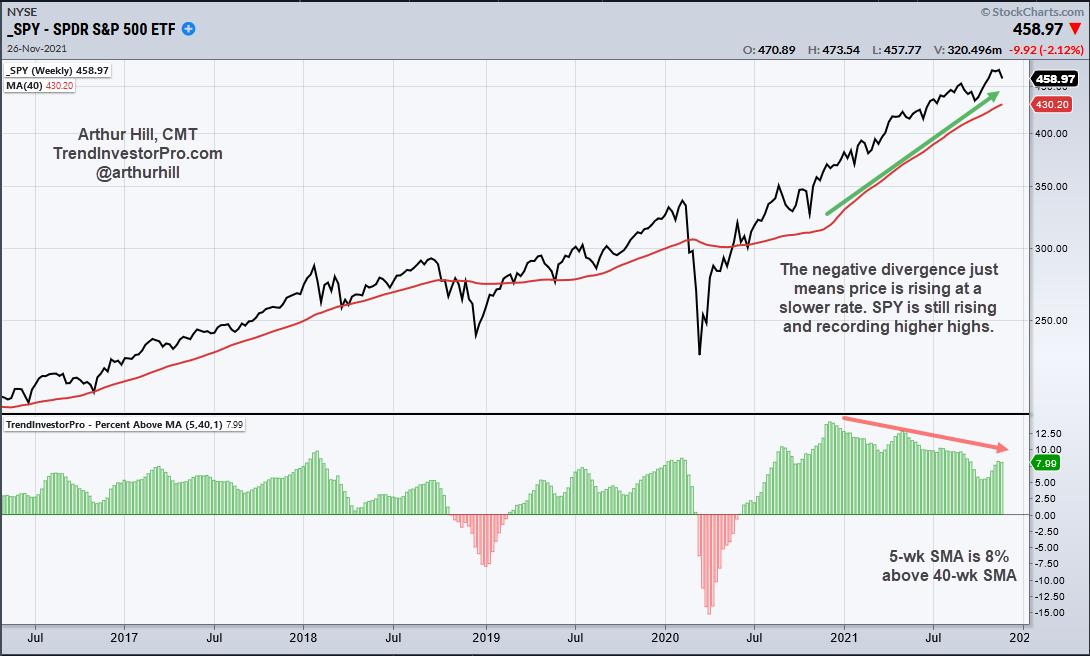

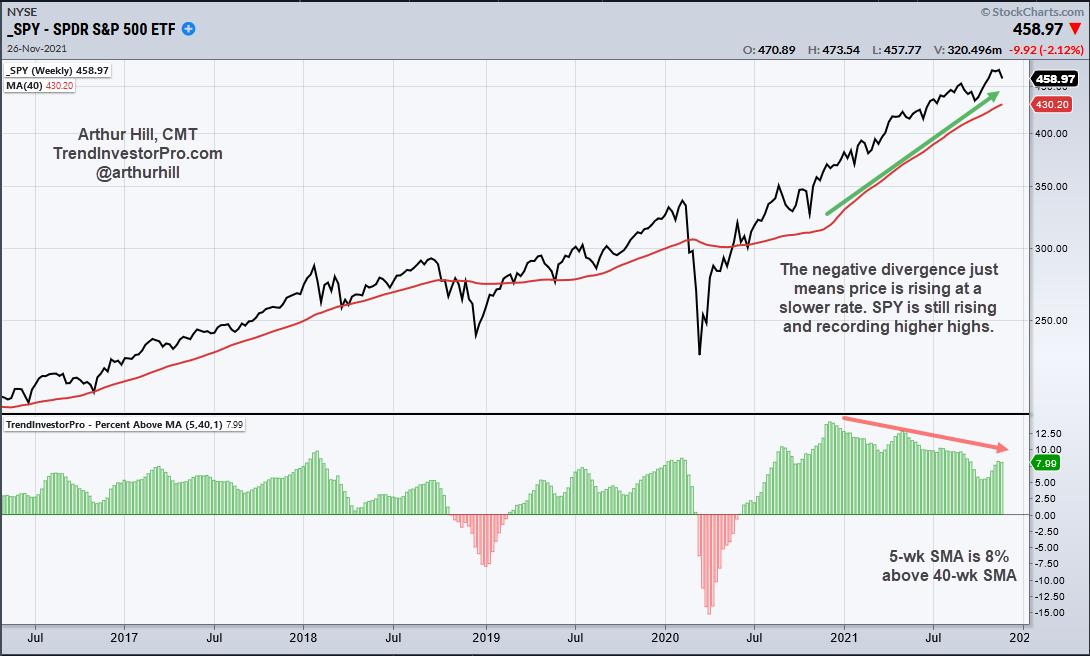

Trend Monitoring and Setup Phases for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Note that this article has been revised to account for Friday's price action. Stocks were slammed on Black Friday with small-caps leading the way lower and stay-at-home stocks bouncing. The declines were big, but they should be put into perspective. First, Black Friday is pretty much a holiday...

READ MORE

MEMBERS ONLY

Giving Thanks!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Thanksgiving is celebrated here in the US on the 4th Thursday of November and is a day to give thanks. Let me say that I'm very thankful for God and family. I was blessed with my first grandchild a little over a year ago and she's...

READ MORE

MEMBERS ONLY

What Is Going On With the Oil Market?

The oil market has the media spotlight, with projected prices continuing to rise. Shortages, inflation and economic growth have all been major factors in oil trending higher throughout this year. With gas at a 7-year high, pressure has been mounting on the Biden administration to ease the consistent price climb....

READ MORE

MEMBERS ONLY

Can the Market Bounce if Junk Bonds Sell Off?

The small-cap index Russell 2000 (IWM) looks hopeful for a Wednesday bounce, while the High-Yield Corporate Debt ETF (JNK) sends another warning sign. Though we are watching all major indices, IWM is the most interesting since it found intraday support near its 50-day moving average at $228.06. It should...

READ MORE

MEMBERS ONLY

Key Index Experiences a Bearish Outside Day: Could There Be More Downside to Come?

by Martin Pring,

President, Pring Research

One piece of Monday's market action that really stood out to me was a bearish outside day in the NASDAQ, as shown in Chart 1. A classic outside day develops after a persistent short-term rally and signals a short-term reversal in sentiment. The outside part refers to the...

READ MORE

MEMBERS ONLY

DP TV: Focus on Defensive Utilities

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl walks viewers through the market and the DecisionPoint indicators on the broad markets, as well as the S&P 400/600. Get his thoughts on shrinking participation! He covers 10-year yield and long Bonds (TLT), along with Bitcoin, Crude Oil, the Dollar and...

READ MORE

MEMBERS ONLY

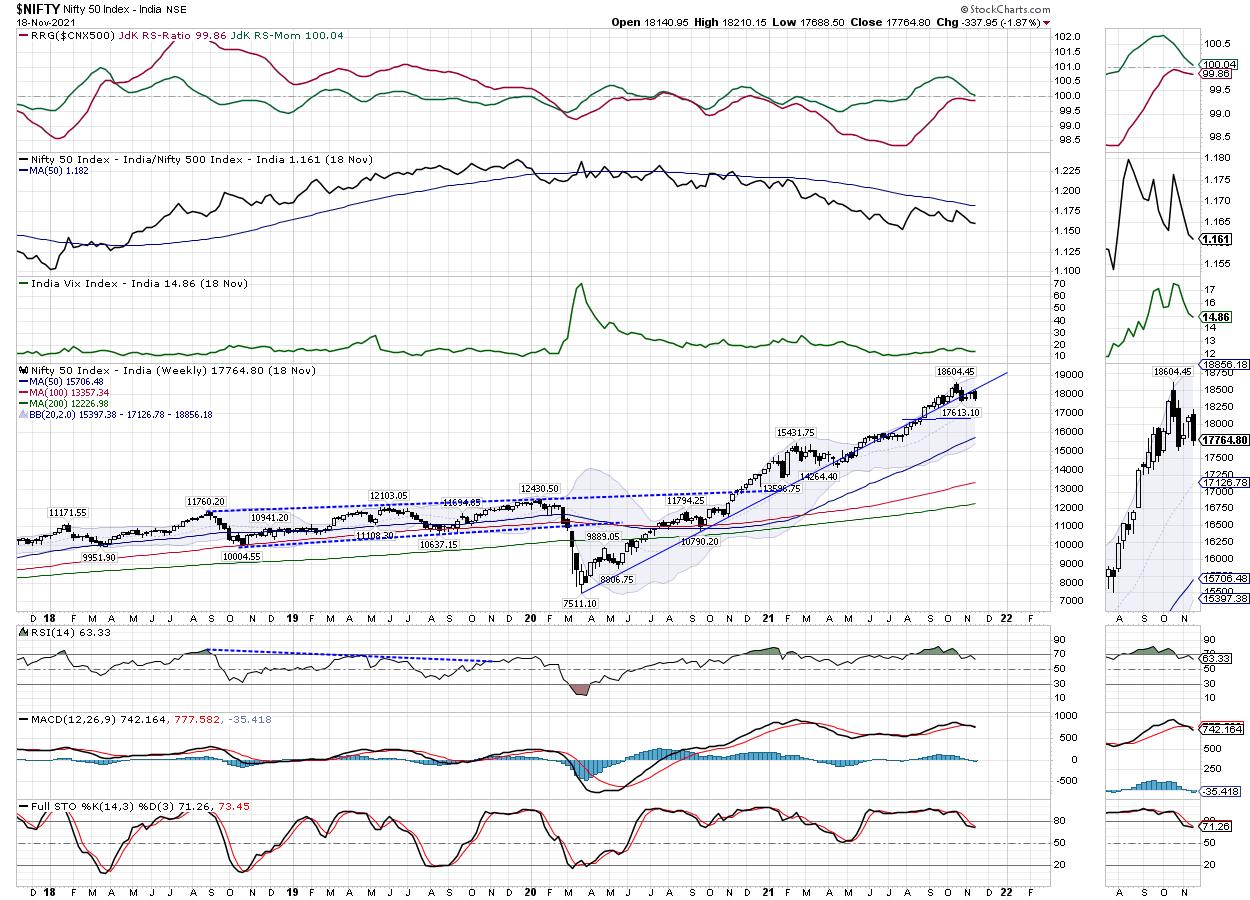

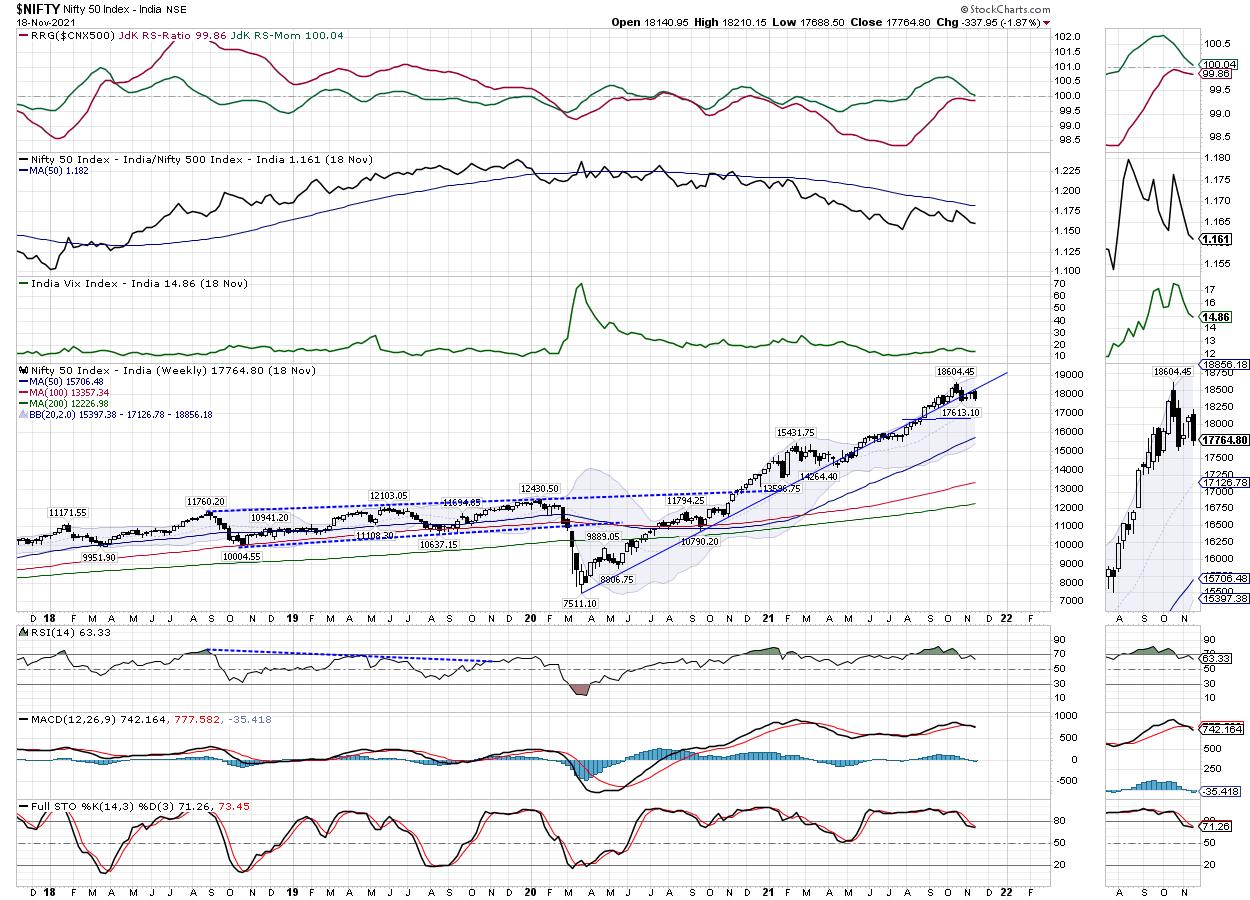

Week Ahead: NIFTY's Price Behavior Against This Zone Crucial; RRG Chart Shows This Sector Rolling Inside Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had a truncated week, with Friday being a trading holiday on account of Gurunanak Jayanti. In the four-day trading week, the NIFTY remained in corrective mode and ended on a negative note all four trading days of the week. In the process, the Index has violated important supports...

READ MORE

MEMBERS ONLY

2 Wall Street Upgrades and 1 Activist-Led Shakeup - These 3 Stocks are on the Move!

by Mary Ellen McGonagle,

President, MEM Investment Research

Last week, the S&P 500 traded mostly sideways despite outsized gains in several heavyweight FAANMG stocks. In fact, most of the underlying sectors in this Index were down over 1% for the week while investors sorted through news, such as a potential shift in the Federal Reserve'...

READ MORE

MEMBERS ONLY

Five Stocks I'm Watching Next Week

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My Market Trend Modelremains positive on all three time frames, which means I focus on three main goals: identify breakout opportunities with upside potential, lean into positive trends that continue to work and, lastly, look for signs of weakness that may indicate thebull market phase is exhausted.

On Friday'...

READ MORE

MEMBERS ONLY

The Biggest Update In A Decade - Introducing The Totally New, Totally Revamped "Stock Market Mastery" ChartPack!

by Grayson Roze,

Chief Strategist, StockCharts.com

It's not often you get to say something is the biggest moment in a decade – the biggest change, the biggest update, the biggest overhaul. But here we are, introducing the most monumental evolution of our "Tensile Trading" ChartPack since the launch of the original version. In...

READ MORE

MEMBERS ONLY

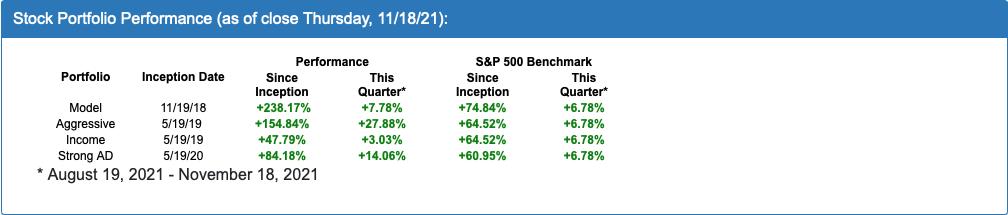

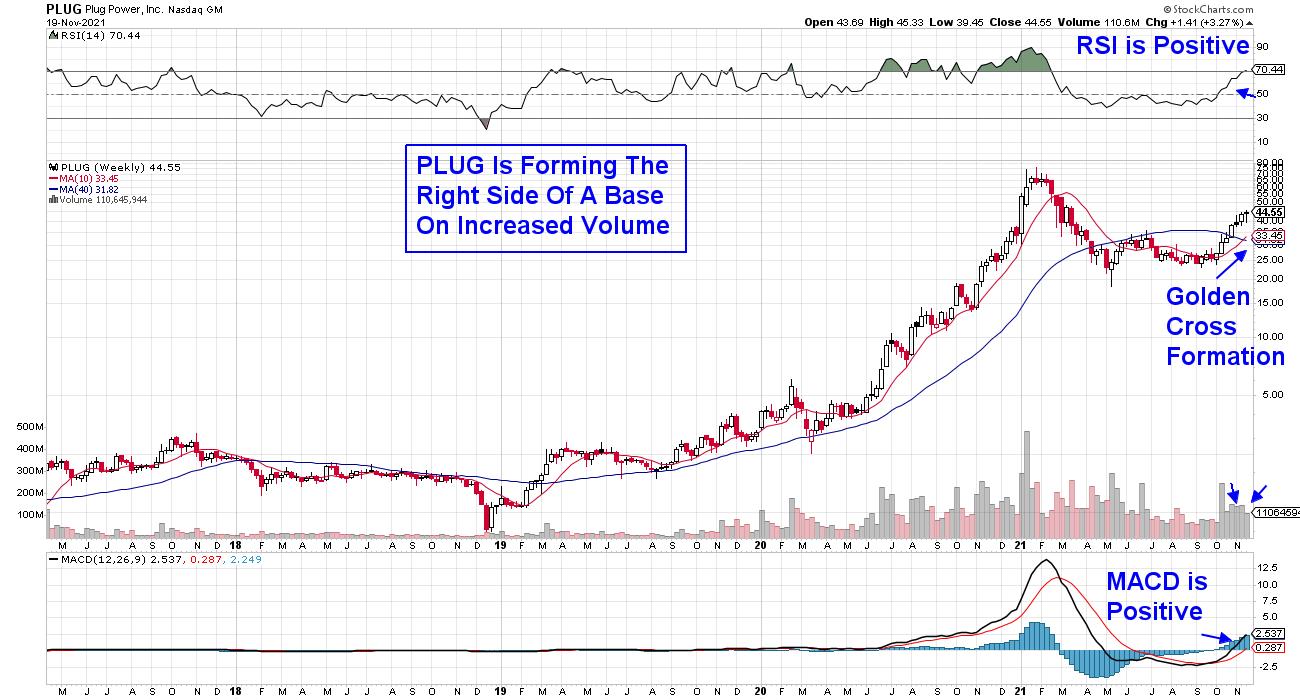

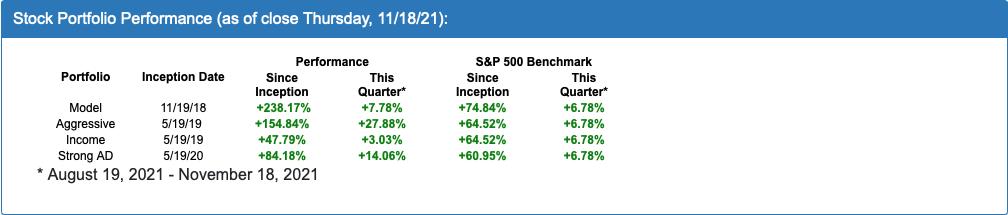

Top Stock Picks Revealed

by John Hopkins,

President and Co-founder, EarningsBeats.com

This past Thursday evening, our Chief Market Strategist Tom Bowley unveiled his "Top 10 Stock Picks" for our 4 portfolios, 40 stocks in all. These stocks are meant to be held for the subsequent 90 days, when a new batch of stocks will be unveiled and the process...

READ MORE

MEMBERS ONLY

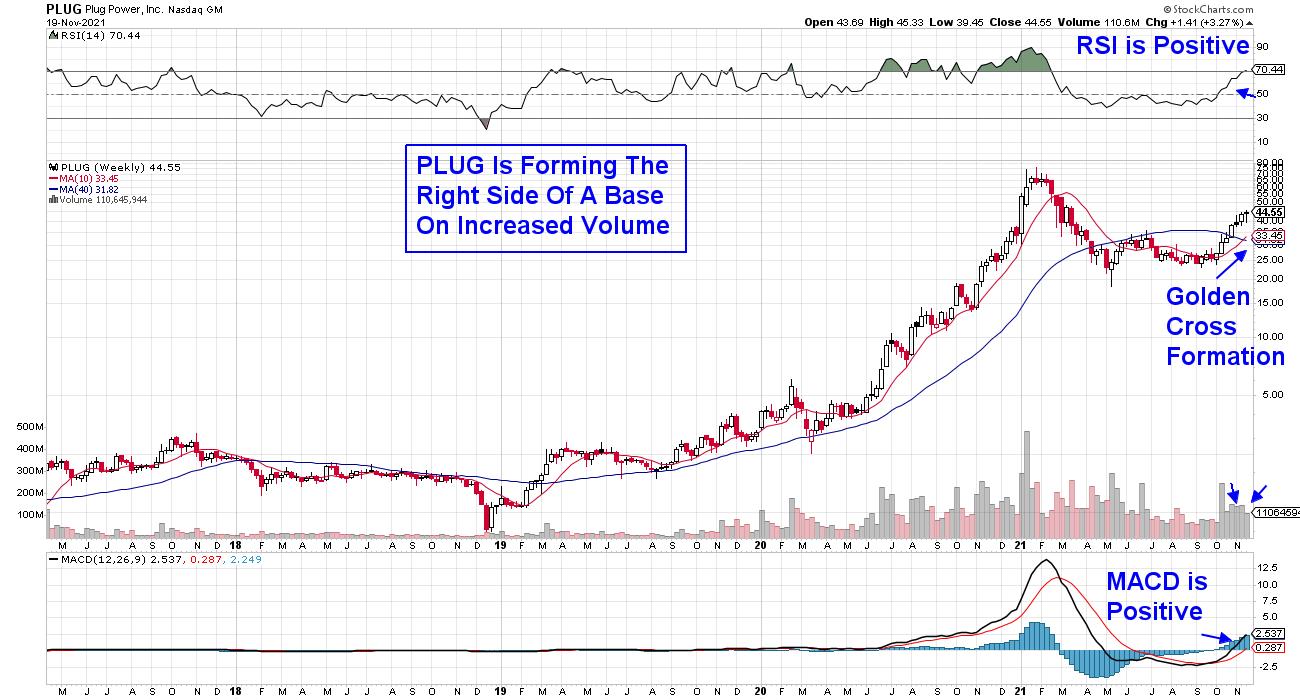

Playing the Pullback in Big Movers

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode StockCharts TV'sThe MEM Edge, Mary Ellen shares how to trade stocks after they have big gaps up. She also reviews signals that a downtrend reversal has further upside potential, as well as SmallCap stocks in bullish positions.

This video was originally recorded on November 19,...

READ MORE

MEMBERS ONLY

Mish: The Key Market Relationships -- Love or Rancor?

This past week, the market found both love and irreconcilable differences.

The love came from the big cap tech stocks. Nvidia, Apple, Google, Microsoft all gave investors hearts and flowers. On the flip side, small caps, energy, industrial metals, and transportation stocks gave investors indigestion, inconveniently ahead of Thanksgiving.

It&...

READ MORE

MEMBERS ONLY

Broad Market Participation is Drying Up

by Erin Swenlin,

Vice President, DecisionPoint.com

Here is part of the opening paragraph from yesterday's subscriber-only DP Diamonds Report:

"I am still not in favor of expanding exposure. Big reason would be the diminishing participation within the major indexes. It's going to get harder and harder to find solid winners as...

READ MORE

MEMBERS ONLY

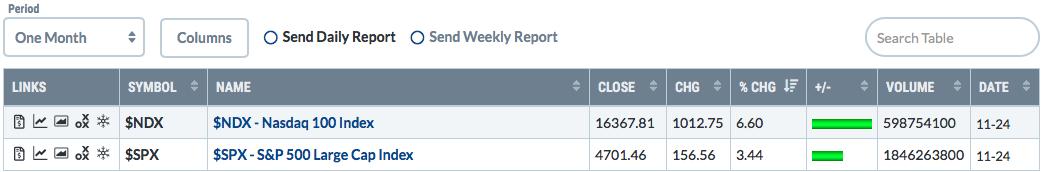

BREADTH FIGURES WEAKEN -- MARKET MAY BE DUE FOR A PULLBACK

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 SHOWS SOME NEGATIVE DIVERGENCE... Stocks are ending the week in a mixed fashion. The Dow Jones Industrials are weakening, while the Nasdaq 100 is hitting a new record. That being the case, this message will focus on the S&P 500 which is in the...

READ MORE

MEMBERS ONLY

Chartwise Women: Muted Black Friday & Cyber Monday + Retail Stock Talk

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of Chartwise Women, Mary Ellen and Erin talk about the new dynamics taking place among the retail group. As consumers are starting their shopping early, "Black Friday" and "Cyber Monday" are expected to be rather muted due to supply chain...

READ MORE

MEMBERS ONLY

Key Candlestick and Moving Average Setups

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe discusses key candlestick patterns that he uses in his analysis. He then takes these individual bars and explains their importance based on the relationship to the moving average lines. Joe also analyzes the stock requests from viewers...

READ MORE

MEMBERS ONLY

Understanding Irrational Market Behavior Through Your Own Behavior

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave explains how markets are irrational and emotional - just like you. Many times traders make trades that have nothing to do with the underlying security. Wrapping your head around this through the lens of your own personal behavior will help you understand and...

READ MORE

MEMBERS ONLY

It's Draft Day for EarningsBeats.com; Will This HUGE Winner Remain in Our Portfolio?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have a favorite day each quarter. It's the day that I set aside hours to reassess the overall market to determine what I believe will take place over the next three months, focus on the best areas of the market, and ultimately select 10 equal-weighted stocks to...

READ MORE

MEMBERS ONLY

CryptoPulse Daily Report: Cryptocurrencies Get a Healthy Reset

Pretty much everyone in crypto is hurting this week, with the overall Cryptocurrency market cap decreasing by over $300 billion since Sunday 11/14. The first domino to fall was Bitcoin (BTC), as the coin sold off 3% on Monday and then another 8% Tuesday, finally finding support at its...

READ MORE

MEMBERS ONLY

Sector Spotlight: Railroad Group Pops on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I take my usual look at last week's rotation in Asset Classes and put that into longer-term perspective. From this universe, I highlight the strength of the US dollar and take a closer look at the relationship between...

READ MORE

MEMBERS ONLY

Did the Long-Term Treasury Bonds (TLT) Turn Risk On?

On Tuesday, the Long-Term Treasury Bond ETF (TLT) closed underneath its 50-day moving average for two consecutive days confirming a cautionary phase. TLT's trend has been relatively dormant for the past four months with multiple failed attempts to clear the $151.80 price area. However, this recent breakdown...

READ MORE

MEMBERS ONLY

After Seven Months of Consolidation Food Prices are Starting to Resume their Advance

by Martin Pring,

President, Pring Research

The Invesco DB Agricultural Fund (DBA) consists of grains (37%), softs (sugar, coffee and cocoa; 35%) and livestock (24%). A small allocation is also given to cotton. Chart 1 shows that this ETF began a bull market back in the spring of last year. Late 2020 also saw it break...

READ MORE

MEMBERS ONLY

Railroads are On Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Two sectors that have my attention at the moment are Industrials (XLI) and Materials (XLB).

Looking at the Relative Rotation Graph above, we can see how similar the rotation for both sectors has been over the last 23 weeks, and still is. A few weeks ago, both tails rotated back...

READ MORE

MEMBERS ONLY

Dark Clouds Are Engulfing Wall Street; Bulls, Strike Three You're Out!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Before I begin this article, let me be clear that I remain extremely bullish for the long-term. We're nowhere close to where we're going, which is much, much higher. But in the very near-term, I'm growing increasingly bearish. There are a few reasons, which...

READ MORE

MEMBERS ONLY

Is The Retail Sector (XRT) Stronger Than Investors Expect?

As of Monday, the strongest sector within Mish's Economic Modern Family is the Retail space (XRT). Though we will look at other key sectors in the Family, XRT is of special interest with the upcoming holiday season.

Struggling from limited employees, companies are feverishly attempting to keep an...

READ MORE

MEMBERS ONLY

Is This Stock Being Accumulated or Distributed?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sometimes, when I look at a chart, I see conflicting signals. That is definitely the case for 10x Genomics Inc. (TXG), an $18.1 billion medical equipment company. Medical equipment stocks ($DJUSAM) have been consolidating for the past 2-3 months, which has led to relative underperformance by the group as...

READ MORE

MEMBERS ONLY

These 2 Breakouts Should Lead To A Strong 2021 Finish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm partial to the formation of long bases, followed by breakouts, and breakouts of bullish continuation patterns. Well, I have two of these to share with you. Let me first start with CNH Industrial (CNHI), a $25.3 billion commercial vehicles & trucks company ($DJUSHR). They absolutely crushed...

READ MORE

MEMBERS ONLY

Week Ahead: Truncated Week to See NIFTY Defending Crucial Levels; RRG Chart Show These Sectors Continuing to Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past five days, the somewhat volatile NIFTY oscillated in a defined range before ending the week with modest gains. Throughout the week, the majority of the time was spent on a corrective note. It was only the last day of the trading week that saw massive short-covering and...

READ MORE

MEMBERS ONLY

Watch the Metal; It May Soon Be Time to Pedal

by Martin Pring,

President, Pring Research

The gold price zig-zagged its way down between August of last year and April of this one. Since then, it's really been in a trading range and now looks as if it is breaking out.

I'll start off by taking a look at the longer-term picture....

READ MORE

MEMBERS ONLY

The Metaverse and The Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode StockCharts TV'sThe MEM Edge, Mary Ellen shares 2 areas of the market that sprung to life last week amid corporate announcements of growth. She also reviews where the current strength is and how you can capitalize.

This video was originally recorded on November 12, 2021....

READ MORE

MEMBERS ONLY

Stocks to Watch in the Top 3 Performing Sectors

Last week the market faced a pullback. However, the four major indices closed above Thursday's high on Friday, ending the week on a positive note. With each index potentially poised to run towards highs, we should prepare our watchlist with picks from the top-performing sectors.

Looking at the...

READ MORE

MEMBERS ONLY

Supercharge Your Routines With This Simple Yet Powerful Organizational Trick

by Gatis Roze,

Author, "Tensile Trading"

Academic research has proven that the profitability of investors and traders is directly linked to the quality of their organizational routines and their discipline to follow those routines.

One of the most delicious tools we have in our organizational arsenal is using different symbols as prefixes for equities in our...

READ MORE

MEMBERS ONLY

4 of My Favorite Earnings Reports This Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I spend hundreds of hours during each quarterly earnings season researching earnings reports, deciphering which beat revenue and EPS estimates and then annotating every one of those charts. It's what makes up our Strong Earnings ChartList (SECL), a ChartList that we update every 1-2 weeks for our EarningsBeats....

READ MORE

MEMBERS ONLY

STOCK INDEXES MAINTAIN UPTRENDS -- MATERIALS ARE WEEK'S STRONGEST SECTOR -- BOND YIELDS RISE ON INFLATION REPORT -- SO DOES GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES MAINTAIN UPTRENDS... Stocks are ending the week trying to make up some losses from Wednesday's sharp selloff after the CPI annual inflation report of 6.2% was the highest level in thirty years. Chart 1 shows the Dow Industrial staying above its 20-day moving average. Charts...

READ MORE

MEMBERS ONLY

The 10-yr Treasury Yield and Relative Performance for Small-caps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The surge in the 10-yr Treasury Yield is the talk of the town this week, and last week it was the breakout in the Russell 2000 ETF and relative strength in small-caps. Is there a correlation between small-cap relative performance and Treasury yields? Today's commentary will look at...

READ MORE

MEMBERS ONLY

Chartwise Women: Practice Gratitude to Ease the Anxieties of Investing

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of Chartwise Women, it's all about abundance and gratitude! Erin and Mary Ellen share the indicators they are thankful for and how you can use them to help with your investing. During the "Wisdom of the Week" segment, they share...

READ MORE

MEMBERS ONLY

You Want to Get Better at Trading?

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe discusses his background in more detail and talks about the significant amount of intraday trading he has done over the years. He explains the reasons for that and the fractal nature of the markets. Then Joe analyzes...

READ MORE