MEMBERS ONLY

The Seasonality Trend Driving XLK and XLI to New Highs

by Karl Montevirgen,

The StockCharts Insider

For those who focus on sector rotation, whether to adjust portfolio weightings or invest directly in sector indexes, you're probably wondering: Amid the current "risk-on" sentiment, even with ongoing economic and geopolitical uncertainties, can seasonality help you better anticipate shifts in sector performance?

Current Sector Performance...

READ MORE

MEMBERS ONLY

Small Caps Are Rotating In — Here's Why It Matters

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After months of whiplash sector swings, the market may finally be showing signs of settling down.

In this video, Julius de Kempenaer uses Relative Rotation Graphs (RRG) to analyze asset class rotation at a high level and then dives into sectors and factors. Julius highlights the rotation into cryptocurrencies and...

READ MORE

MEMBERS ONLY

Breakout Watch: One Stock in Each Sector to Watch Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When sector performance shifts gears from one day to the next, it's best to be prepared with a handful of stocks from the each of the sectors.

In this hands-on video, David Keller, CMT, highlights his criteria for picking the top stocks in 10 of the 11 S&...

READ MORE

MEMBERS ONLY

The Battle Between Fed Chairman and the President Will Ultimately Be Won by the Market!

by Martin Pring,

President, Pring Research

The President and the Fed Chair have been in a battle over lower rates for some time. One has been pressuring for easy money to boost the economy, the other prefers to hold off for a while to see what effects the tariffs and other factors might have on inflation....

READ MORE

MEMBERS ONLY

Tariff Shock Spurs "Buy-the-Dip" Setups in Tesla and ON Semiconductor

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Just when we thought tariff talk had gone quiet, it's back on center stage. With the reciprocal tariff deadline landing this Wednesday, President Trump has mailed out notices that new duties will kick in on August 1. Countries such as Japan, South Korea, Malaysia, and Kazakhstan face a...

READ MORE

MEMBERS ONLY

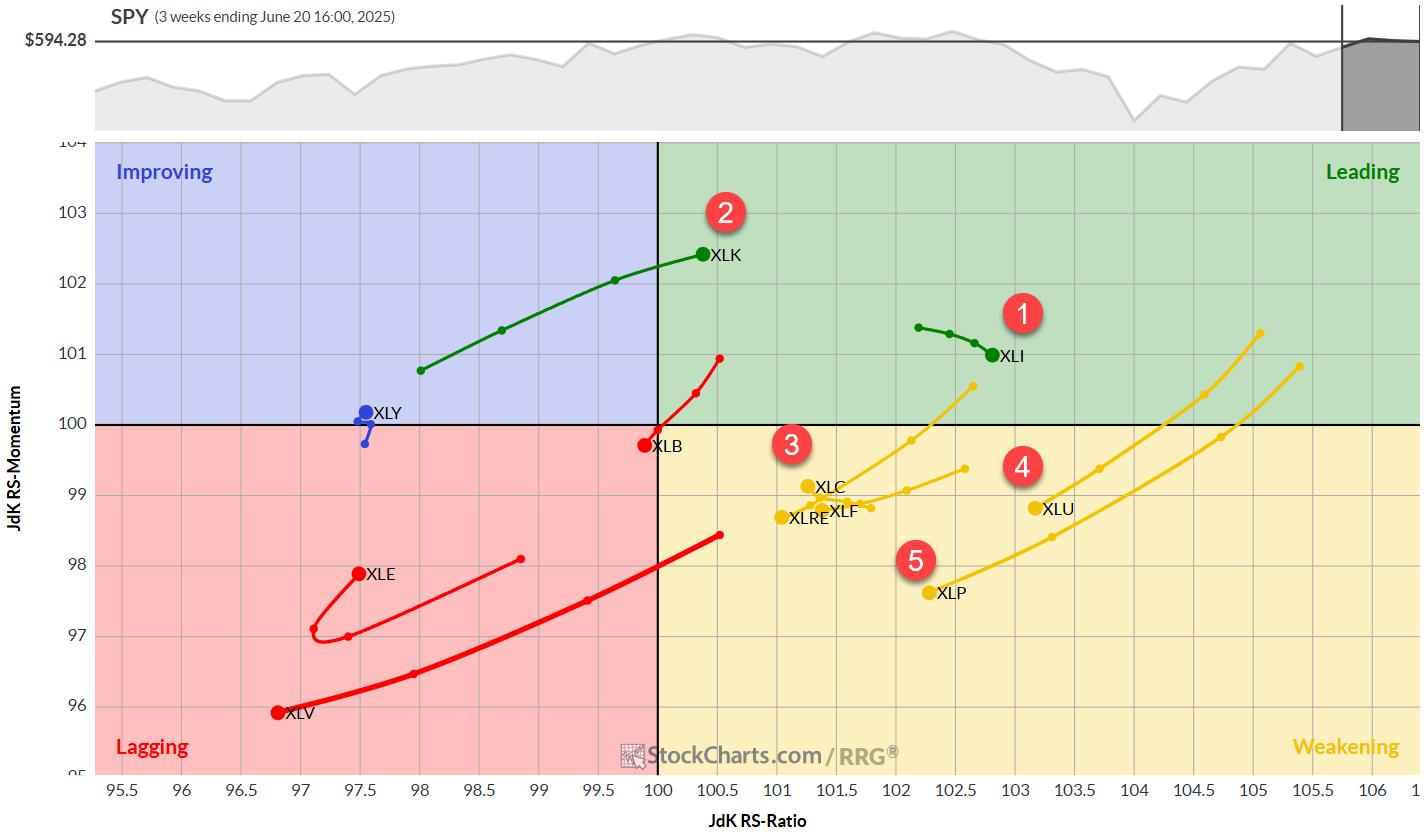

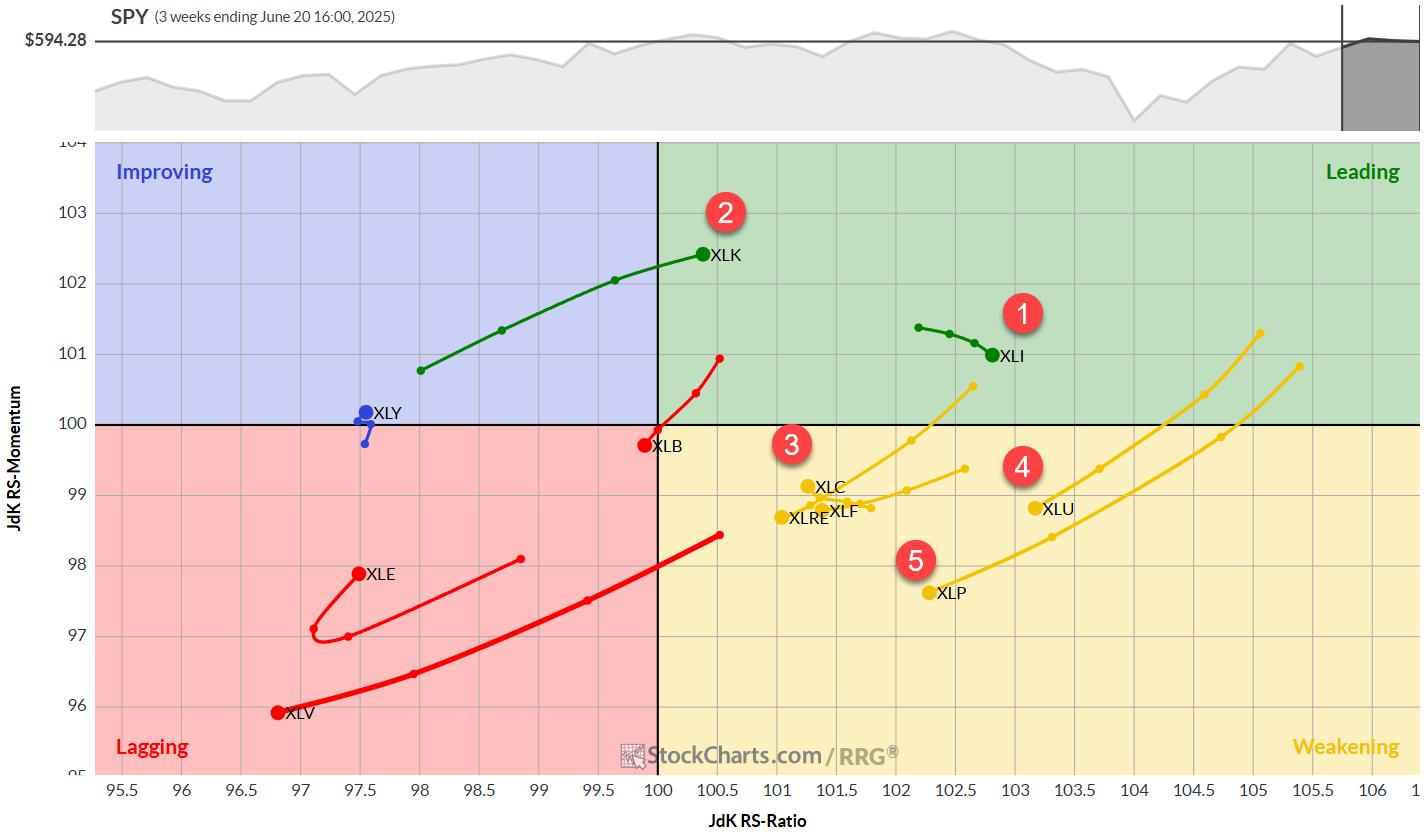

The Best Five Sectors, #26

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we're seeing some interesting shifts within the rankings that warrant closer examination. Let's dive into the details and see what the Relative Rotation...

READ MORE

MEMBERS ONLY

Don't Overlook This Lagging Industry; I Believe It's Set To Explode!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I like to trade stocks that are relative leaders and belong to industry groups that are leaders as well. For the past 2-3 months, much has been written about and discussed with respect to semiconductors ($DJUSSC), software ($DJUSSW), electrical components & equipment ($DJUSEC), electronic equipment ($DJUSAI), recreational services ($DJUSRQ), travel...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set To Stay In A Defined Range Unless These Levels Are Taken Out; Drags Support Higher

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a strong move in the week before this one, the Nifty spent the last five sessions largely consolidating in a very defined range. The markets traded with a weak underlying bias and lost ground gradually over the past few days; however, the drawdown remained quite measured and within the...

READ MORE

MEMBERS ONLY

From Oversold to Opportunity: Small Caps on the Move

by Mary Ellen McGonagle,

President, MEM Investment Research

This holiday-shortened week was anything but short on action! The S&P 500 and Nasdaq Composite closed at record highs, but what is really driving the market?

In this essential recap, expert Mary Ellen McGonagle dives into the sectors and stocks making big moves. She'll reveal why...

READ MORE

MEMBERS ONLY

Money's Not Leaving the Market - It's Rotating!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Feeling a little anxious about the market, even with a strong economy? The truth is, money isn't fleeing the market; it's simply moving around, creating fresh opportunities.

In this must-watch video, Tom Bowley of EarningsBeats eases those anxieties by providing charts that show this rotation. Tom...

READ MORE

MEMBERS ONLY

Missed Disney's Rally? Grab This Defined-Risk Put Spread for a Second Chance

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Stocks keep notching record highs. If you're like most investors, you're probably wondering, "Should I really chase these prices or sit tight and wait for a pullback?"

Instead of overthinking and ending up in Analysis-Paralysis land, however, it may be worth exploring other avenues...

READ MORE

MEMBERS ONLY

Should You Buy Roblox Stock Now? Key Levels to Watch

by Karl Montevirgen,

The StockCharts Insider

Roblox Corporation (RBLX), the company behind the immersive online gaming universe, has been on a strong run since April. This isn't the first time the stock demonstrated sustained technical strength: RBLX has maintained a StockCharts Technical Rank(SCTR) above 90, aside from a few dips, since last November....

READ MORE

MEMBERS ONLY

MACD Crossovers: Why Most Traders Get It Wrong

by Joe Rabil,

President, Rabil Stock Research

Joe presents a deep dive into MACD crossovers, demonstrating how to use them effectively across multiple timeframes, establish directional bias, and improve trade timing. He explains why price action should confirm indicator signals, sharing how to identify "pinch plays" and zero-line reversals for higher-quality setups. Joe then analyzes...

READ MORE

MEMBERS ONLY

Market Signals Align - Is a Bigger Move Ahead?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

This week, Frank analyzes recent technical signals from the S&P 500, including overbought RSI levels, key price target completions, and the breakout potential of long-term bullish patterns. He examines past market breakouts and trend shifts, showing how overbought conditions historically play out. Frank also walks through a compelling...

READ MORE

MEMBERS ONLY

The Dollar Index Just Gave a Major Sell Signal - Does That Mean It's About to Implode?

by Martin Pring,

President, Pring Research

Last month, the Dollar Index triggered a number of sell signals confirming that it is in a bear market. Chart 1, for instance, shows that the red up trendline emanating in 2011 has been decisively ruptured, thereby pushing the Index further below its moving average. The Coppock Curve, seen in...

READ MORE

MEMBERS ONLY

Top 10 July 2025 Stock Picks You Shouldn't Miss

by Grayson Roze,

Chief Strategist, StockCharts.com

Join Grayson for a solo show as he reveals his top 10 stock charts to watch this month. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. As a viewer, you'll also gain insight into key market...

READ MORE

MEMBERS ONLY

S&P 500 Earnings for 2025 Q1 — Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2025 Q1, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

Tech Stocks Lead the Charge: What's Driving the Momentum?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The last day of trading for the first half of 2025 ended with a bang. The S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) closed at record highs - an impressive finish, given the year has seen significant swings.

We saw signs of investors rotating into technology stocks last...

READ MORE

MEMBERS ONLY

Is This Rally Sustainable? You Better Bet Your Bullish Sweet Dollar It Is!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Below is the EB Weekly Market Report that I sent out earlier to our EarningsBeats.com members. This will give you an idea of the depth of our weekly report, which is a very small piece of our regular service offerings. We called both the stock market top in February...

READ MORE

MEMBERS ONLY

Pullbacks & Reversals: Stocks Setting Up for Big Moves!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen spotlights key pullback opportunities and reversal setups in the wake of a strong market week, one which saw all-time highs in the S&P 500 and Nasdaq. She breaks down the semiconductor surge and explores the bullish momentum in economically-sensitive sectors, including software, regional...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #25

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A Greek Odyssey

First of all, I apologize for any potential delays or inconsistencies this week. I'm currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight back home was first delayed, then canceled, then...

READ MORE

MEMBERS ONLY

Week Ahead: As NIFTY Breaks Out, Change of Leadership Likely to Keep the Index Moving

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After six weeks of consolidation and trading in a defined range, the markets finally broke out from this formation and ended the week with gains. Over the past five sessions, the markets have largely traded with a positive undercurrent, continuing to edge higher. The trading range was wider than anticipated;...

READ MORE

MEMBERS ONLY

3 Stock Setups for the Second Half of 2025

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

As we head into the second half of 2025, here are three stocks that present strong technical setups with favorable risk/reward profiles. One is the largest market cap stock we're familiar with, which bodes well for the market in general. The second is an old tech giant...

READ MORE

MEMBERS ONLY

Fibonacci Retracements: The Key to Identifying True Breakouts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

If you've looked at enough charts over time, you start to recognize classic patterns that often appear. From head-and-shoulders tops to cup-and-handle patterns, they almost jump off the page when you bring up the chart. I would definitely include Fibonacci Retracements on that list, because before I ever...

READ MORE

MEMBERS ONLY

All-Time Highs and An Upcoming Rate Cut: We're Just Getting Started on This Move Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The bears are now left grasping at straws. What about tariffs? What about inflation? What about recession? What about the Fed? What about interest rates? What about the Middle East? What about the deficits? Blah, blah, blah.

When it comes to the media, you need to bury your head in...

READ MORE

MEMBERS ONLY

How to Improve your Trading Odds and Increase Opportunities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can improve their odds and increase the number of opportunities by trading short-term bullish setups within bigger uptrends. The first order of business is to identify the long-term trend using a trend-following indicator. Second, chartist can turn to more granular analysis to find short-term bullish setups. Today's...

READ MORE

MEMBERS ONLY

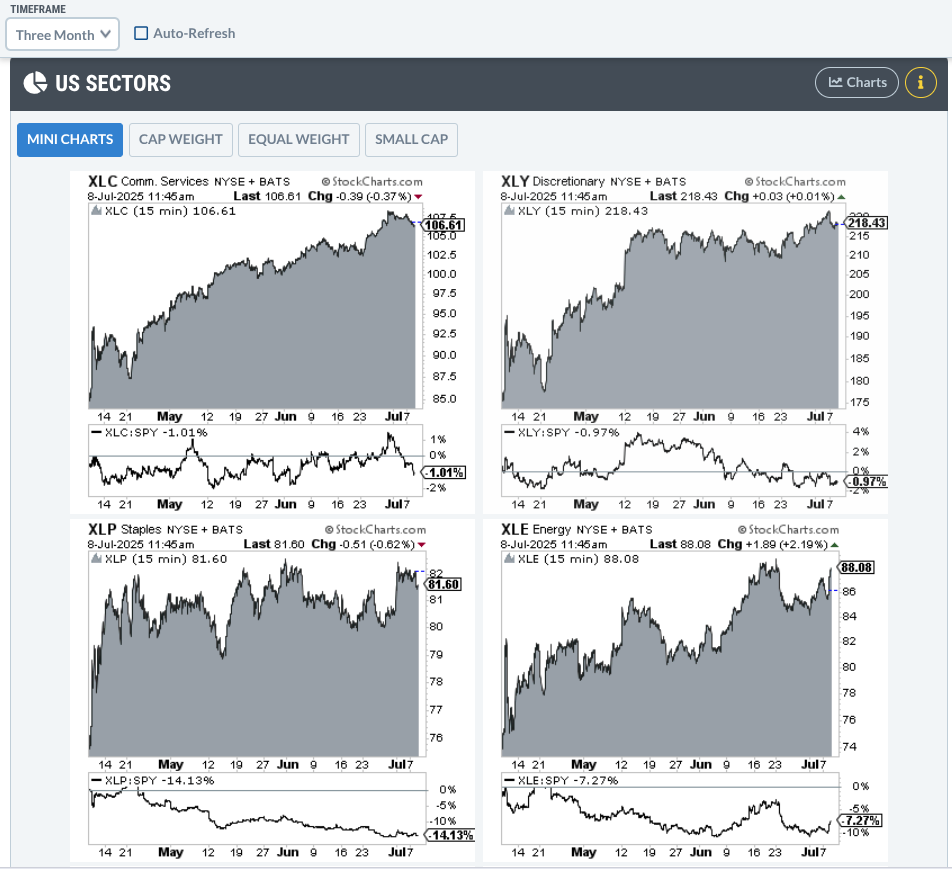

NEW! 5 Significant Additions to Our Professionally-Curated Market Summary Dashboard

by Grayson Roze,

Chief Strategist, StockCharts.com

Take a tour of the FIVE latest updates and additions to our fan-favorite, professionally-curated Market Summary dashboard with Grayson!

In this video, Grayson walks viewers through the new charts and indexes that have been added to multiple panels on the page. These include mini-charts for the S&P sectors,...

READ MORE

MEMBERS ONLY

SMCI Stock Surges: How to Invest Wisely Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Over a month ago, Super Micro Computer, Inc. (SMCI) appeared on our StockCharts Technical Rank(SCTR) Top 10 list. SCTRs are an exclusive StockCharts tool that can help you quickly find stocks showing strong technical strength relative to other stocks in a similar category.

Now, the stock market is dynamic,...

READ MORE

MEMBERS ONLY

From Drift to Lift: Spotting Breakouts Before Momentum Hits

by Joe Rabil,

President, Rabil Stock Research

MACD, ADX and S&P 500 action frame Joe Rabil's latest show, where a drifting index push him toward single-stock breakouts. Joe spotlights the daily and weekly charts of American Express, Fortinet, Parker-Hannifin, Pentair, and ServiceNow as showing strong ADX/MACD characteristics. He outlines how the patterns...

READ MORE

MEMBERS ONLY

Breakdown of NVDA's Stock Price and S&P 500: Actionable Technical Insights

by Frank Cappelleri,

Founder & President, CappThesis, LLC

The S&P 500 ($SPX) just logged its second consecutive 1% gain on Tuesday. That's three solid 1% advances so far in June. And with a few trading days remaining in the month, the index has recorded only one 1% decline so far.

A lot can still...

READ MORE

MEMBERS ONLY

Find Highest Probability Counter-Trend Setups

by Tony Zhang,

Chief Strategist, OptionsPlay

Think trading against the trend is risky? You may want to reconsider. When a stock or ETF is trending lower, the smart money watches for signs of a reversal; those early signals can get you into a trend before everyone else and lead to favorable risk-to-reward ratios.

In this video,...

READ MORE

MEMBERS ONLY

Shifting Tides in the Stock Market: A New Era for Bulls?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market has been on quite the rollercoaster of late, thanks to news headlines. But investors seem to have shrugged off the past weekend's geopolitical tensions, at least for now.

On Tuesday, we saw a surge of enthusiasm. Investors were diving back into stocks and selling off...

READ MORE

MEMBERS ONLY

How to Use Fibonacci Retracements to Spot Key Levels

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he shares how he uses the power of Fibonacci retracements to anticipate potential turning points. He takes viewers through the process of determining what price levels to use to set up a Fibonacci framework, and, from there, explains what Fibonacci retracements are telling him about the charts...

READ MORE

MEMBERS ONLY

Never Easy to Predict, the Price of Crude Just Got Harder

by Martin Pring,

President, Pring Research

Earlier in the month, I wrote an article pointing out that gold and copper typically move ahead of oil. It's true, the leads and lags between these three entities differ from cycle to cycle. However, since gold momentum turned up in early 2023 and copper in early 2022,...

READ MORE

MEMBERS ONLY

Offense vs. Defense: How Geopolitical Tensions Shape Market Trends

by Karl Montevirgen,

The StockCharts Insider

As the cycle of uncertainty continues to yield confusion than clarity, investors are again caught having to decide between taking an offensive and defensive posture in the market. The tough part in today's market environment is how fast situations can shift. With headlines driving the action, sentiment can...

READ MORE

MEMBERS ONLY

AI Stocks Ignite Again—Where Smart Money is Heading Next

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen opens with a look at the S&P 500, noting that the index remains above its 10-day average despite a brief pullback—a sign of healthy market breadth. She points to ongoing sector leadership in technology, while observing that energy and defense stocks are...

READ MORE

MEMBERS ONLY

This Week's Earnings Watch: Turnarounds and Momentum Plays

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

This week, we're keeping an eye on three major stocks that are reporting earnings. Two of them have been beaten down and are looking to turn things around, while the third has had a tremendous run and is looking to keep its extraordinary momentum going. Let's...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #24

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Some Sector Reshuffling, But No New Entries/Exits

Despite a backdrop of significant geopolitical events over the weekend, the market's reaction appears muted -- at least, in European trading. As we assess the RRG best five sectors model based on last Friday's close, we're...

READ MORE

MEMBERS ONLY

Lagging Mid-cap ETF Hits Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P MidCap 400 SPDR (MDY) is trading at a moment of truth as its 5-day SMA returns to the 200-day SMA. A bearish trend signal triggered in early March. Despite a strong bounce from early April to mid May, this signal remains in force because it has...

READ MORE

MEMBERS ONLY

US Strikes Iran: What Comes Next For Stocks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In today's "Weekly Market Recap", EarningsBeats.com's Chief Market Strategist Tom Bowley looks ahead to determine the likely path for U.S. equities after the weekend bombing of Iran nuclear sites. Are crude prices heading higher? Will energy stocks outperform? What additional roadblocks might...

READ MORE