MEMBERS ONLY

Silver May Be Close to a Major Breakout

by Martin Pring,

President, Pring Research

* Silver has been Range-Bound - But is That About to End?

* Silver Shares Starting to Perk Up

* Silver Bottoming Against Gold?

Silver has been Range-Bound - But is That About to End?

Gold has been in a strong bull market recently, which has eclipsed the performance of the gray metal....

READ MORE

MEMBERS ONLY

Random Thoughts on the New Bullish Market Calls

While there was a big boost from NASDAQ on Monday, the "inside" sectors are not yet believing that the tech sector tells the whole story.

For example, the financial sector continues to underperform SPY and tech - partly because of the lower dividends, inability to buy back their...

READ MORE

MEMBERS ONLY

RISING CHINESE STOCKS PULL COPPER HIGHER -- ALONG WITH COPPER PRODUCERS -- FREEPORT MCMORAN IS DAY'S SPX LEADER

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE STOCKS AND COPPER HAVE BEEN RISING TOGETHER...This morning's message showed the Shanghai Stock Index surging to the highest level in two years; and mentioned that was also good for copper prices. This message elaborates a bit more on the relationship between the two. The red bars...

READ MORE

MEMBERS ONLY

CHINESE STOCKS LEAD GLOBAL STOCKS HIGHER -- CHINESE ETFS NEAR MAJOR UPSIDE BREAKOUTS -- ASIA LEADS EMERGING MARKETS HIGHER -- STRONGER CHINA BOOSTS COPPER PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE STOCK SOAR... A huge rally in China is leading a rally in stock markets around the world. The red arrow in Chart 1 shows the Shanghai Composite Index surging 5.7% to close at the highest level in more than two years. The SSEC close at 3332 also puts...

READ MORE

MEMBERS ONLY

This Relative Strength Configuration In An Industry Group Tells Us Everything We Need To Know

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm constantly discussing relative strength, and I don't just discuss it with respect to individual stocks. I want to know where money is rotating to among industry groups. It's why I keep an industry group relative strength ChartList at EarningsBeats.com. I view every...

READ MORE

MEMBERS ONLY

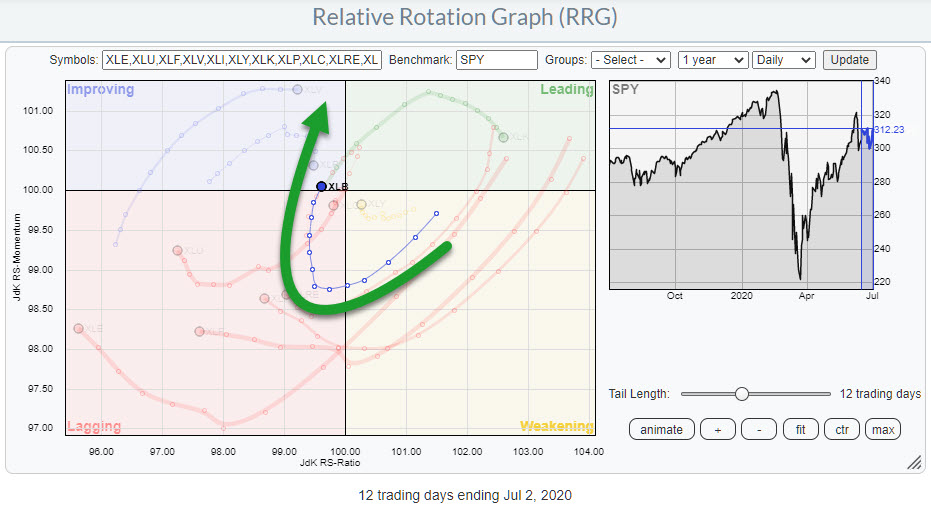

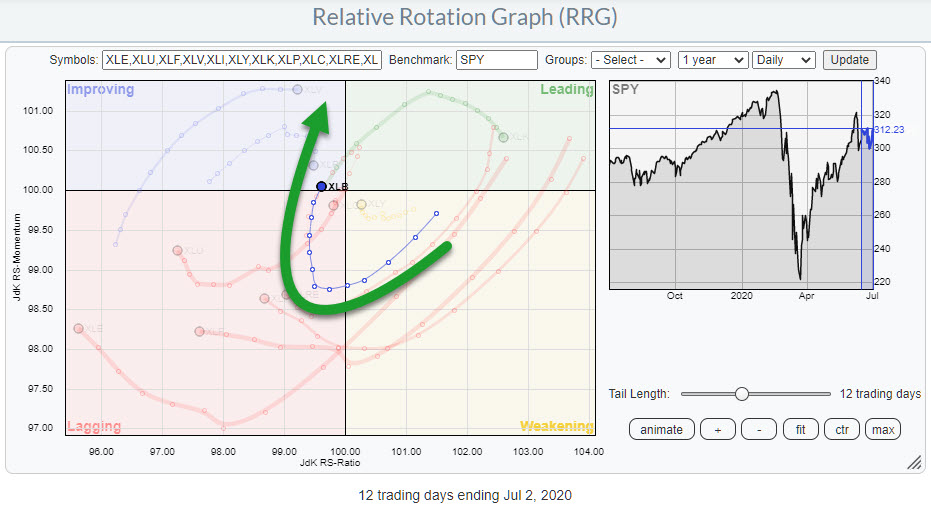

The Materials Sector (XLB) is Lining Up For a Good Week!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

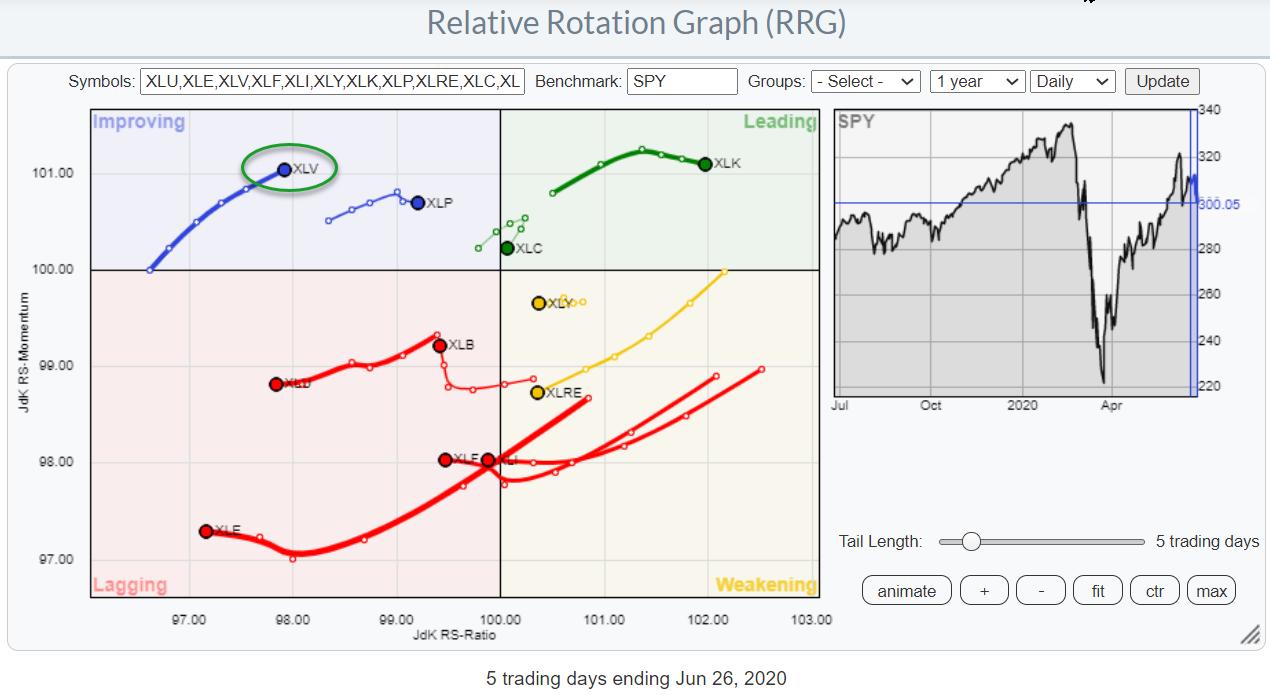

I hope all of you had a great (long) 4th of July weekend. At the end of the short trading week, the Materials sector turned into a 0-90 degree heading on the Relative Rotation Graph as it crossed over into the improving quadrant from lagging at the same time.

This...

READ MORE

MEMBERS ONLY

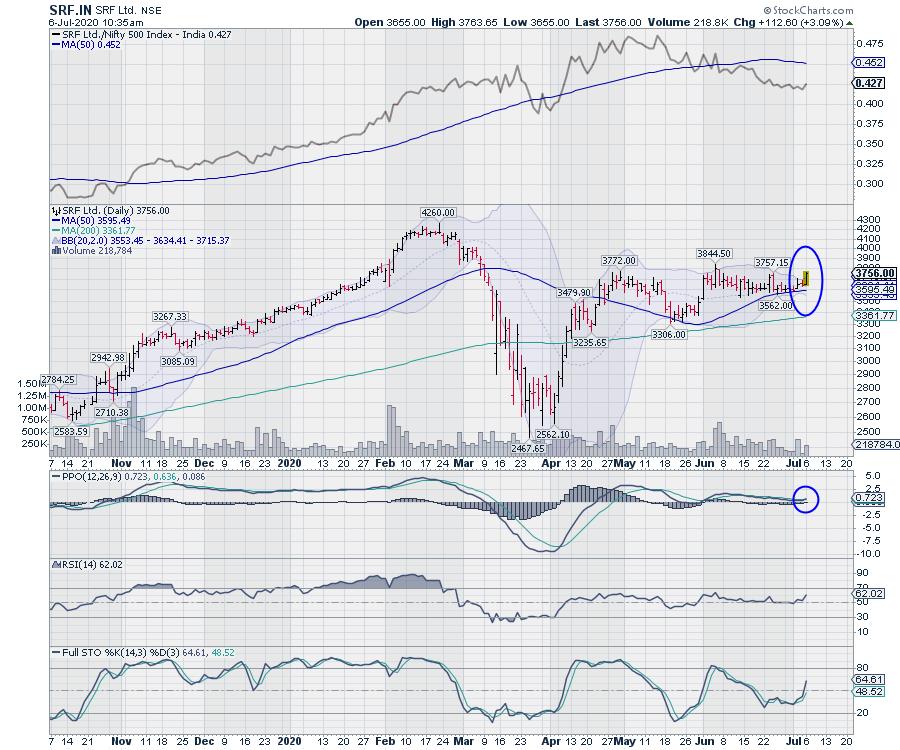

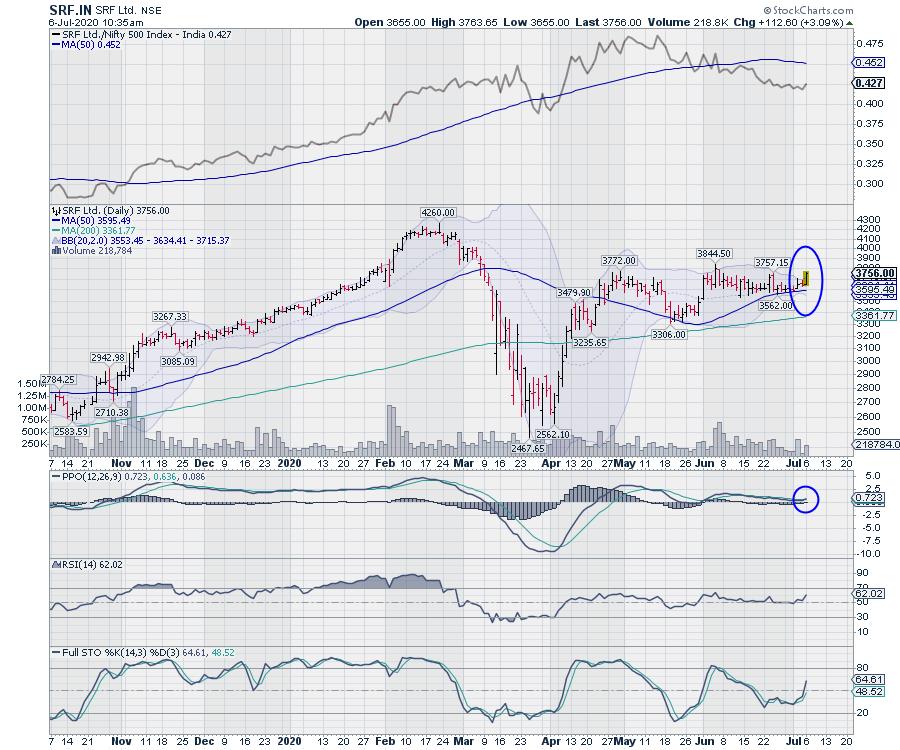

Probable Breakout From A Bollinger Band Squeeze

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

SRF Ltd - SRF.IN

Over the past several weeks, this stock moved in a capped range which has been getting narrower. The price action has formed a bullish ascending triangle and has also resulted in a classic Bollinger Band Squeeze.

Bollinger bands are over 60% narrower than normal. This...

READ MORE

MEMBERS ONLY

Will 2020's 2nd Half Be Strong? Watch This Chart for a Clue

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Transportation stocks ($TRAN) are important because they tend to go higher and drive the S&P 500 higher when the economy is strong, expected to strengthen, or both. Off of the 2009 market bottom, the best advances on the S&P 500 during this secular bull market have...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY To Make Measured Moves; RRG Chart Show Sector Rotation on Expected Lines

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The NIFTY continued its surge for the third week in a row as it extended its gains. In the previous weekly note, we had mentioned the possibilities of the mild extension of the up move. In the week that went by, the NIFTY saw itself oscillating in a slightly expanded...

READ MORE

MEMBERS ONLY

Are You An Aggressive Trader? If So, You Might Like These 2 Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I try to minimize risks as best I can. That means generally trading only companies that are in Wall Street's good graces. In order to get there, I believe it's really important for companies to deliver on their promises. It's called "under promise...

READ MORE

MEMBERS ONLY

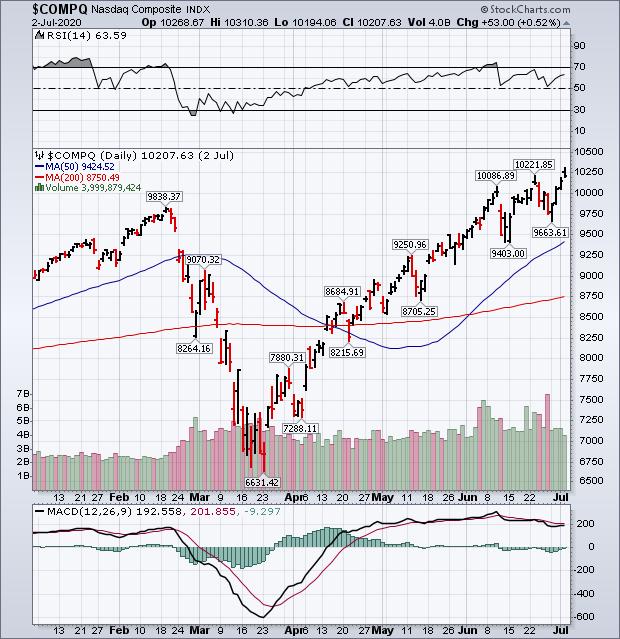

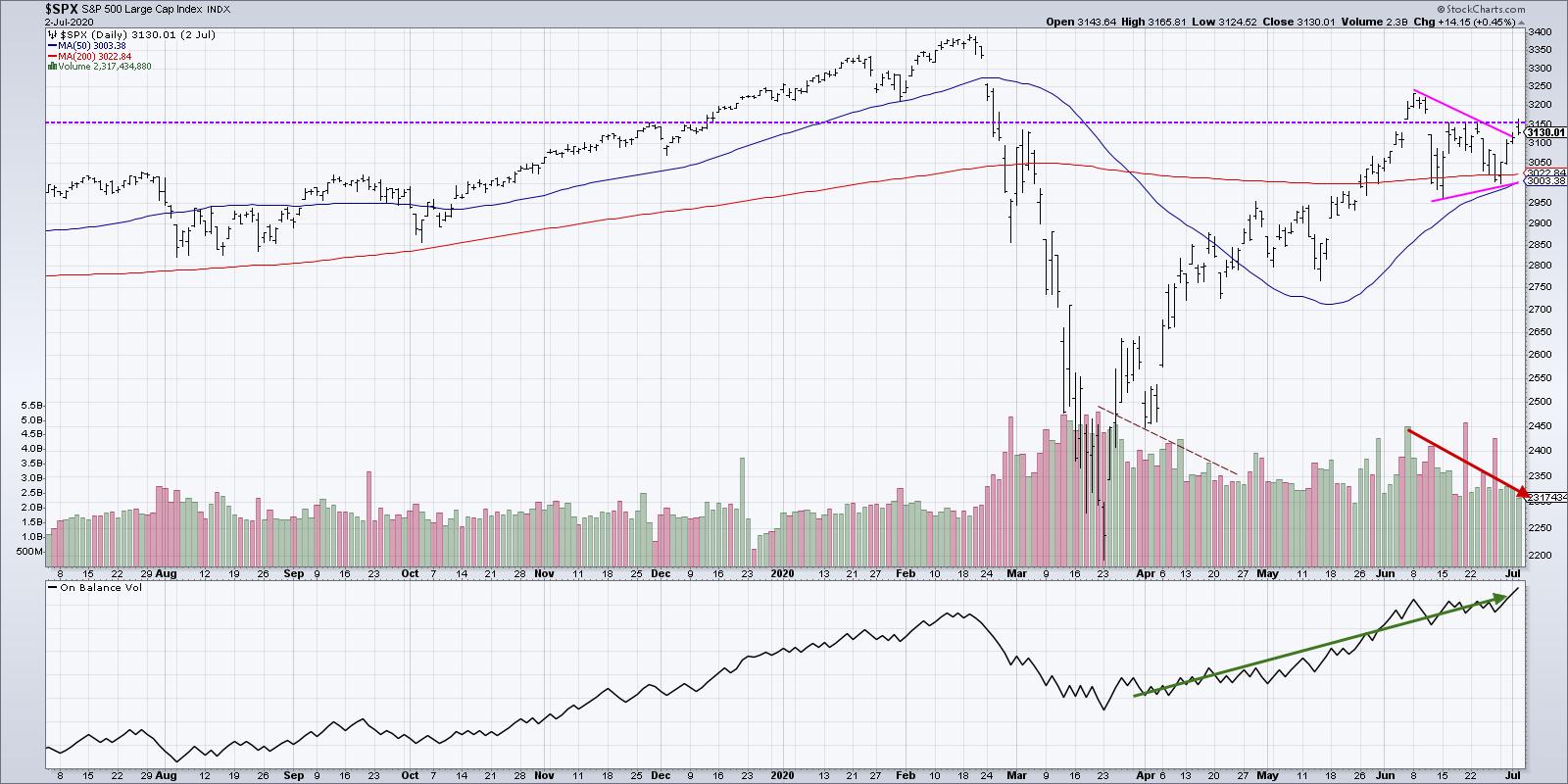

A Tale of Two Markets

by John Murphy,

Chief Technical Analyst, StockCharts.com

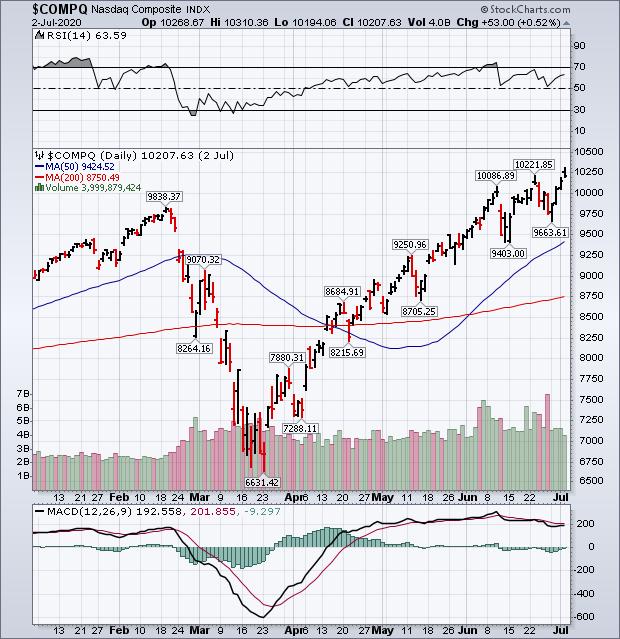

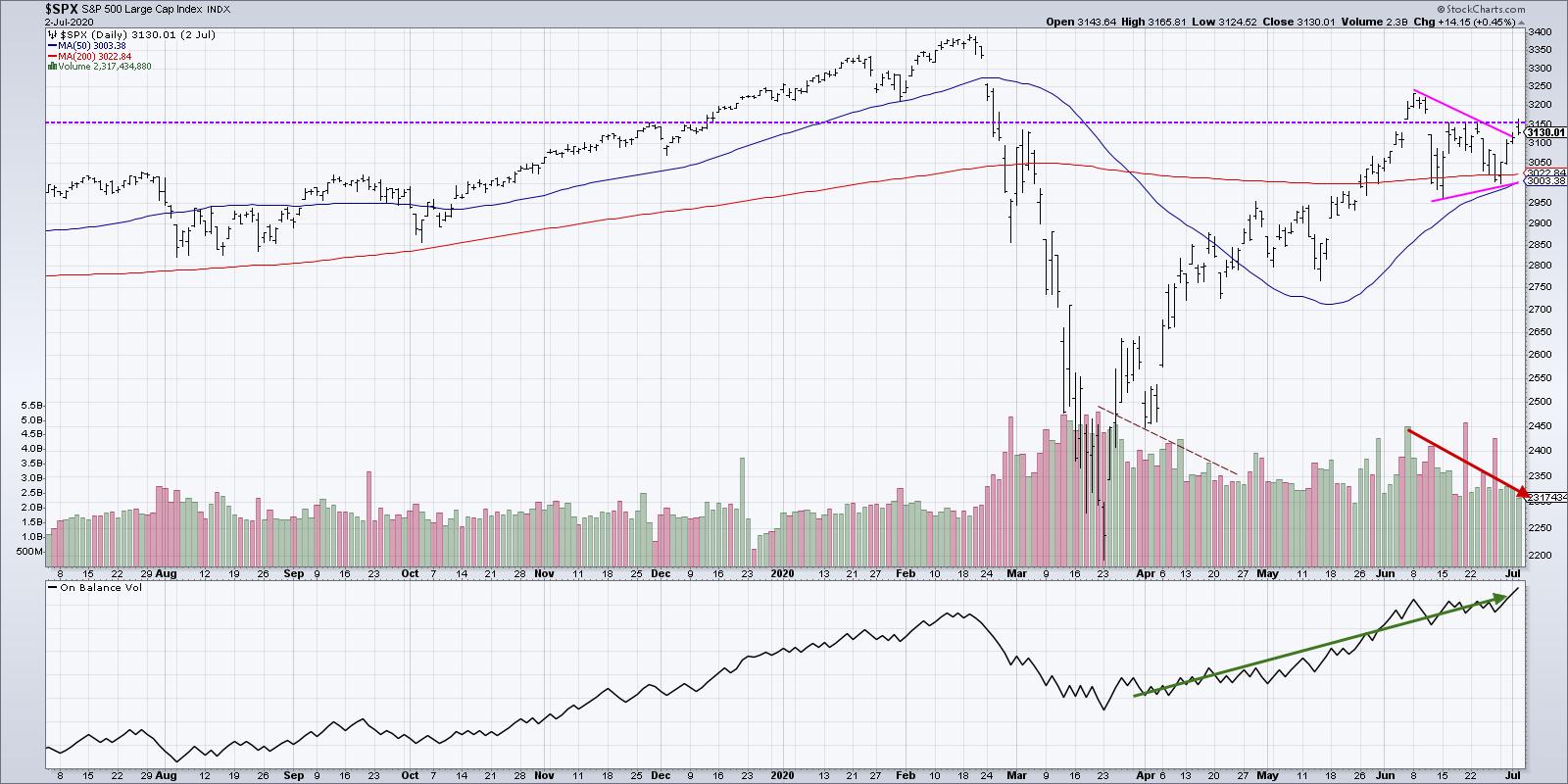

Despite gaining ground this past week, little has changed for the market's major stock indexes. Continued buying of technology growth stocks pushed the Nasdaq Composite to a new record (Chart 1). The rest of the market, however, continued to lag behind. Chart 2 shows the S&P...

READ MORE

MEMBERS ONLY

Market Breakout! Can We Go Higher?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the market's dynamics and shares how you can uncover areas that are poised to benefit from the recent breakout. She also highlights defensive groups with high growth prospects.

This video was originally broadcast on July...

READ MORE

MEMBERS ONLY

The Mindful Six Stocks to Follow Here

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 index has remained in consolidation mode, spending the shortened holiday week in a rally back to the upper end of the recent trading range. Last week on The Final Bar,I announced "The Mindful Six", a group of six stocks that I feel...

READ MORE

MEMBERS ONLY

AMZN Move Over Please... Coming Through

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the ratios that a lot of market watchers and commentators look at is the relationship between Consumer Staples and Consumer Discretionary stocks. The assumption or rationale behind watching this pair is that Consumer Discretionary stocks usually do well in a rising market (SPY), while Consumer Staples stocks tend...

READ MORE

MEMBERS ONLY

Economic Modern Family and the Recycled Gold Capsule

What an incredible - and shorter - week in the world of high finance.

Doomsday news appeared EVERYWHERE, yet did not impact the market per se. Gold however, like our recycled, solid gold art installation, held its ground. Only the metal looks like it is about to go into orbit....

READ MORE

MEMBERS ONLY

Could We Be In For A Bullish Earnings Season? This Mega Stock's Numbers Say Yes!

by Mary Ellen McGonagle,

President, MEM Investment Research

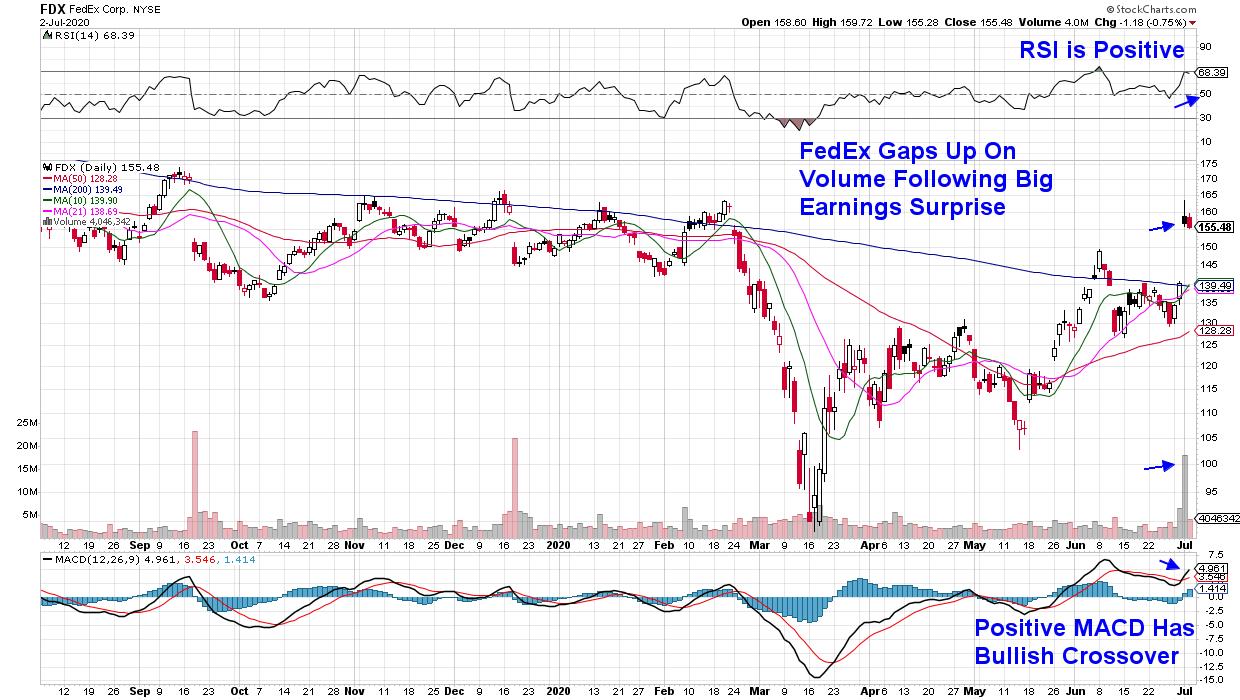

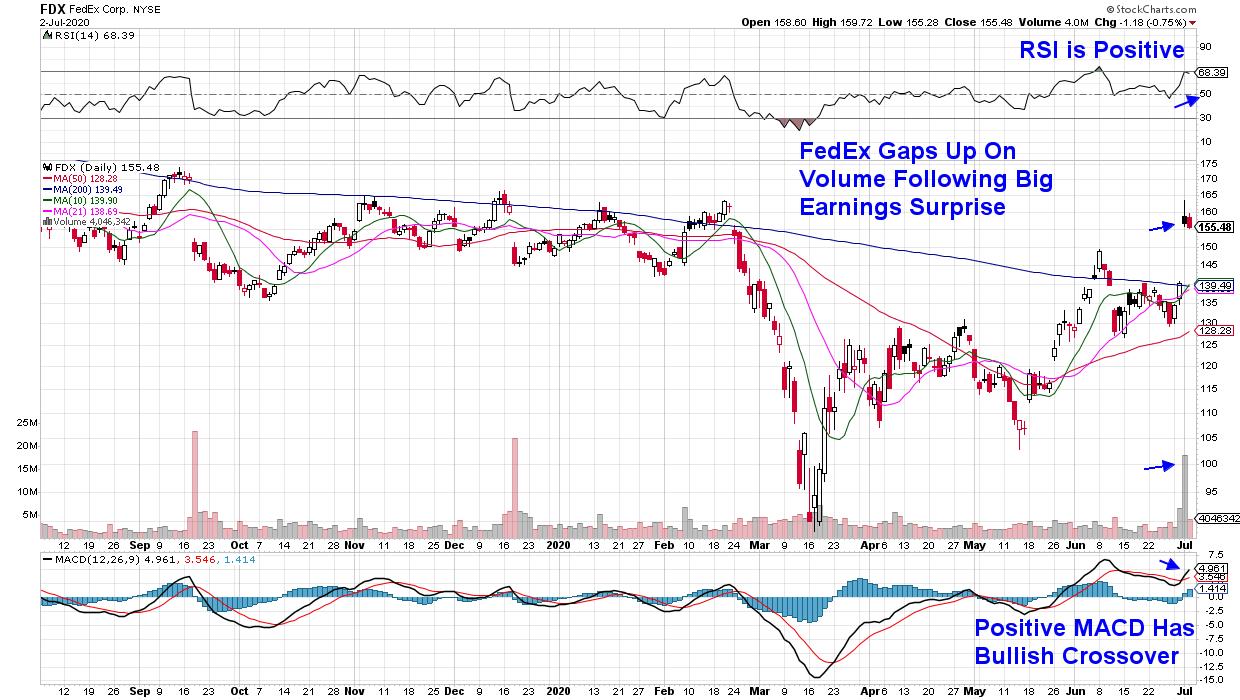

We may have gotten an encouraging preview to earnings season for select areas of the economy this week after global air-freight carrier FedEx Corp. (FDX) posted earnings that were well ahead of analyst's estimates.

The positive earnings surprise not only helped the stock gap up to its biggest...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT BOOSTS STOCKS -- NASDAQ HITS NEW HIGH -- WHILE DOW AND S&P 500 REMAIN IN TRADING RANGES -- AIRLINES AND FINANCIALS REMAIN WEAK -- SMALL CAPS LAG BEHIND -- A TALE OF TWO MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND SPX REMAIN IN TRADING RANGES...Despite gaining ground this past week, little has changed for the market's major stock indexes. Continued buying of technology growth stocks pushed the Nasdaq Composite to a new record (Chart 1). The rest of the market, however, continued to lag behind....

READ MORE

MEMBERS ONLY

One Thing Always Drives Stocks Higher..... And It'll Happen Again During 2020's Second Half

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Fear is an almost uncontrollable emotion. And when you combine that with financial anxiety, it typically results in predictable fashion - a "throw the baby out with the bath water" selling event. But the good news is that, once the masses grow fearful enough, stock markets rally. After...

READ MORE

MEMBERS ONLY

The Shanghai Composite Experiences A Historic Breakout

by Martin Pring,

President, Pring Research

* Shanghai Composite Ruptures Mega Trendline

* Chinese ETFs Breaking as Well

* Interesting Chinese Sector ETFs

Back in March, I wrote about the Chinese stock market, as it had started to improve in terms of relative action against the S&P. Since then, Chinese equities have moved higher with no net...

READ MORE

MEMBERS ONLY

As July 4th Approaches, Watch the PEs Explode

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats, we've been trying to tell anyone willing to listen why the stock market is going higher. I was definitely among the tiny minority back in March and April when I suggested that this downturn was a cyclical bear market within a secular bull market. I think...

READ MORE

MEMBERS ONLY

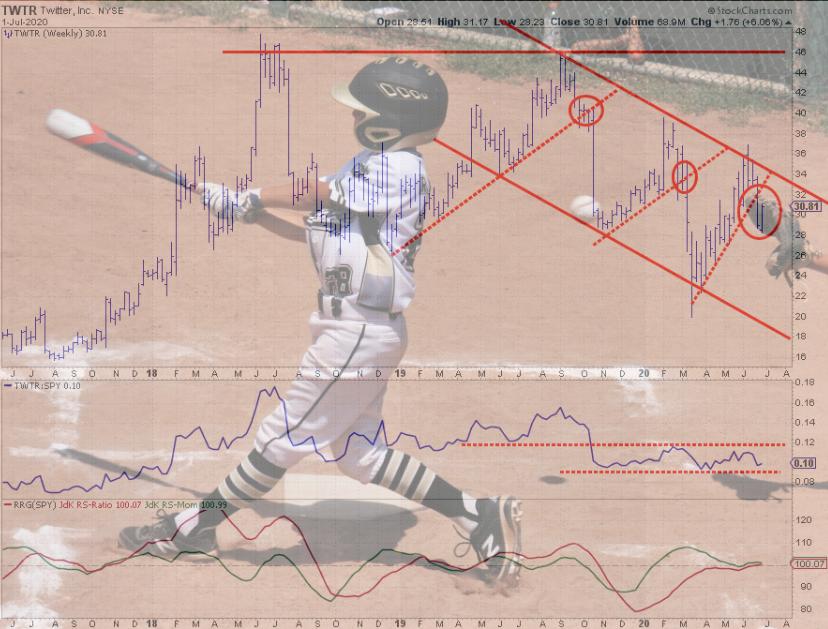

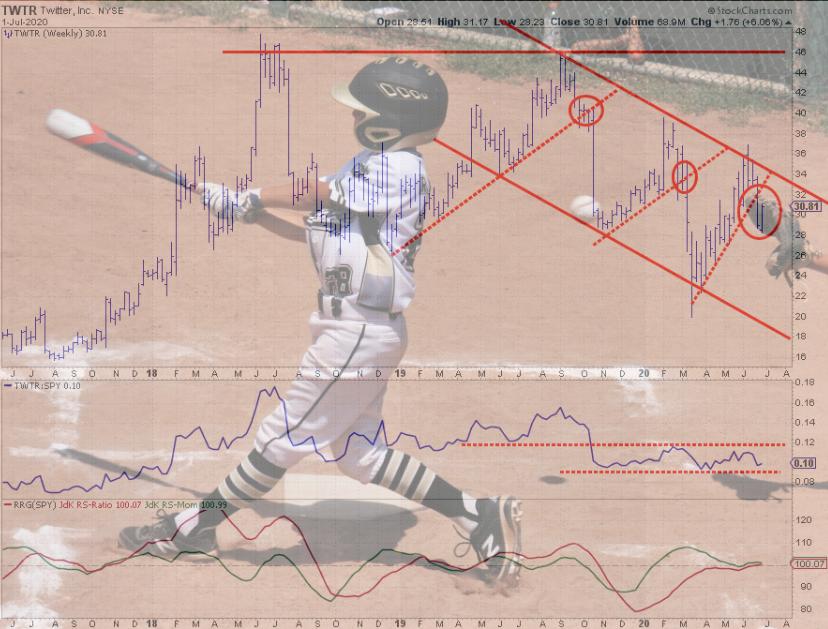

Three Tweets and you're......

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly chart of Twitter (TWTR), a clear downward trend is visible. The last three peaks are lining up nicely and connecting a downward-sloping resistance line. Parallel to that downward sloping resistance line, there is an also downward-sloping support line that connects the last three lower lows.

This channel...

READ MORE

MEMBERS ONLY

DP Show: First Quarter Earnings Are In!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl reviews the DecisionPoint charts that track "fair value" based on earnings and earnings estimates. We now have actual 1st quarter earnings added to the charts! It's already eye-opening, but what to expect for the 2nd quarter? Erin focuses in on...

READ MORE

MEMBERS ONLY

WEAK DOLLAR BOOSTS COMMODITY PRICES -- CRUDE OIL, COPPER, GOLD HAVE STRONG QUARTER -- SO DO STOCKS TIED TO THEM -- GOLD TOUCHES 11-YEAR HIGH -- WITH A LOT OF HELP FROM LOW INTEREST RATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

US DOLLAR HAD WEAK SECOND QUARTER... After surging during March (as stock prices plunged), the U.S. Dollar peaked in late March and moved lower during the second quarter. Rising stock prices during that quarter reduced the appeal of the dollar as a haven currency. Rising foreign currencies also reflected...

READ MORE

MEMBERS ONLY

Here Comes The Sun

by Gatis Roze,

Author, "Tensile Trading"

I'm in the midst of a major life change. After 25 years in downtown Seattle, I've decided to move my office. Doing this during the fog of a pandemic seemed irrational at first blush. In truth, recalibrating the space in my brain at the same time...

READ MORE

MEMBERS ONLY

UPSIDE GAPS IN FEDEX AND UPS BOOST TRANSPORTS -- A REBOUND IN AIRLINE STOCKS IS ALSO HELPING -- BOTH GROUPS ARE ALSO CONTRIBUTING TO THE XLI

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS NEAR TEST OF 200-DAY AVERAGE...Transportation stocks are off to a strong start this morning. Chart 1 shows the Dow Transports rising to a two-week high after bouncing off their 50-day moving average last week. They may be headed for a test of their 200-day moving average. Tranportation...

READ MORE

MEMBERS ONLY

Sector Spotlight: S&P Losing Momentum

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I check the seasonality for the month of July, but no clear over- or underperforming sectors are visible. The rotation of international stock markets is sending a clearer message; the US is losing momentum vs the rest of the world, especially Japan. Following some...

READ MORE

MEMBERS ONLY

Tesla (TSLA) Is Driving Through Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tesla has been a leading auto stock ($DJUSAU) since it bottomed at 176.99 on June 3, 2019, but few traders expected the stock to clear the $1,000 barrier in just over a year. It's been a crazy run, but Wall Street continues to support the stock...

READ MORE

MEMBERS ONLY

The Financial ETF - Dissecting the Chart

Over the weekend, I covered the financial sector in depth.

Last week, the Volcker rule was rolled back, while the Federal Reserve decreased dividends paid to shareholders and ruled against corporate buybacks. One would guess that the rollback of the Volcker Rule should have more impact, as this could be...

READ MORE

MEMBERS ONLY

STOCKS OFF TO A STRONG START -- DOW AND S&P 500 HOLD CHART SUPPORT -- SMALL CAPS ARE HAVING A STRONG DAY -- BOEING AND SOUTHWEST AIR LEAD INDUSTRIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND SPX HOLD CHART SUPPORT... Stocks are off to a strong start for the week. And are holding some important support levels. Chart 1 shows the Dow Industrials bouncing off potential chart support at its 50-day average (blue line) and its early June intra-day low at 24,800. It&...

READ MORE

MEMBERS ONLY

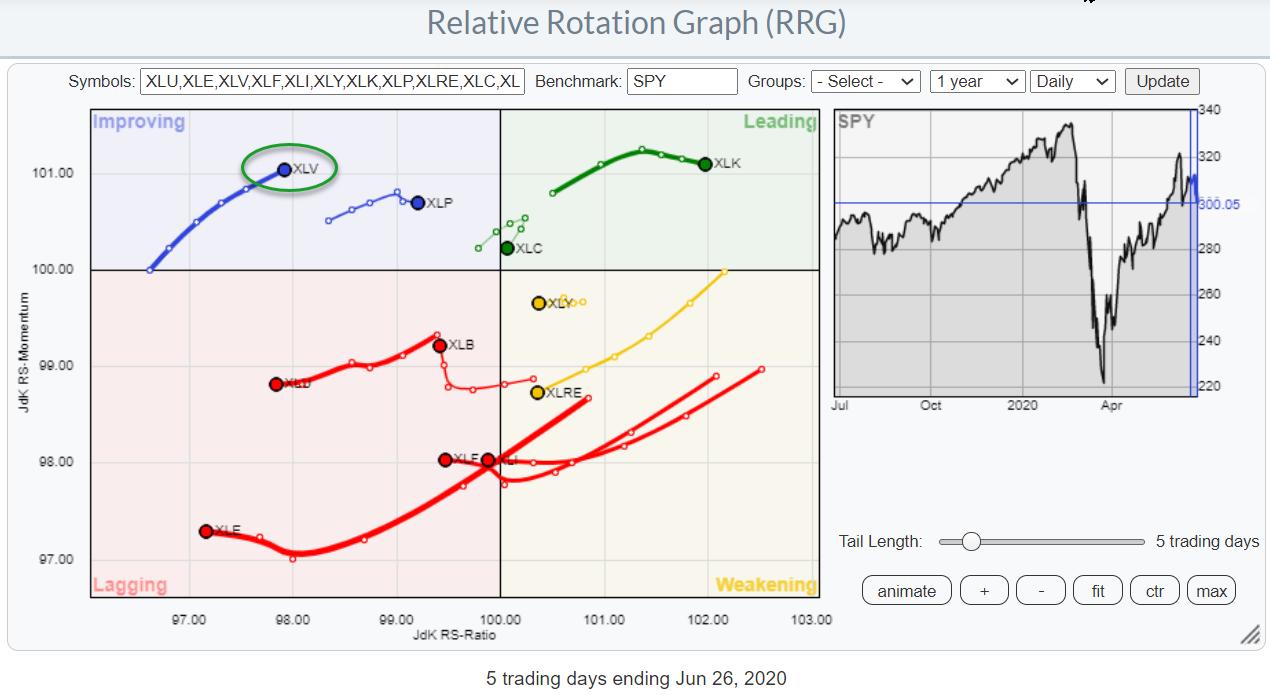

Watching the Health Care Sector This Week As It Started Rotating at a Strong RRG-Heading

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week's sector rotation has pushed the Health Care sector into the improving quadrant at a positive RRG-Heading. This makes the sector stand out in a positive way on the DAILY Relative Rotation Graph for US sectors.

The only two other sectors that are rotating from left to...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Crucially Poised Amid Mixed Signals; RRG Chart Shows This Sector Topping Out

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a relatively less volatile week, the Indian equities continued to surge higher amid liquidity-driven rally. After gaining 2.72% in the week before this one, the NIFTY extended its up move this week as well. The index saw range-bound movement of just 359 points over the past five session,...

READ MORE

MEMBERS ONLY

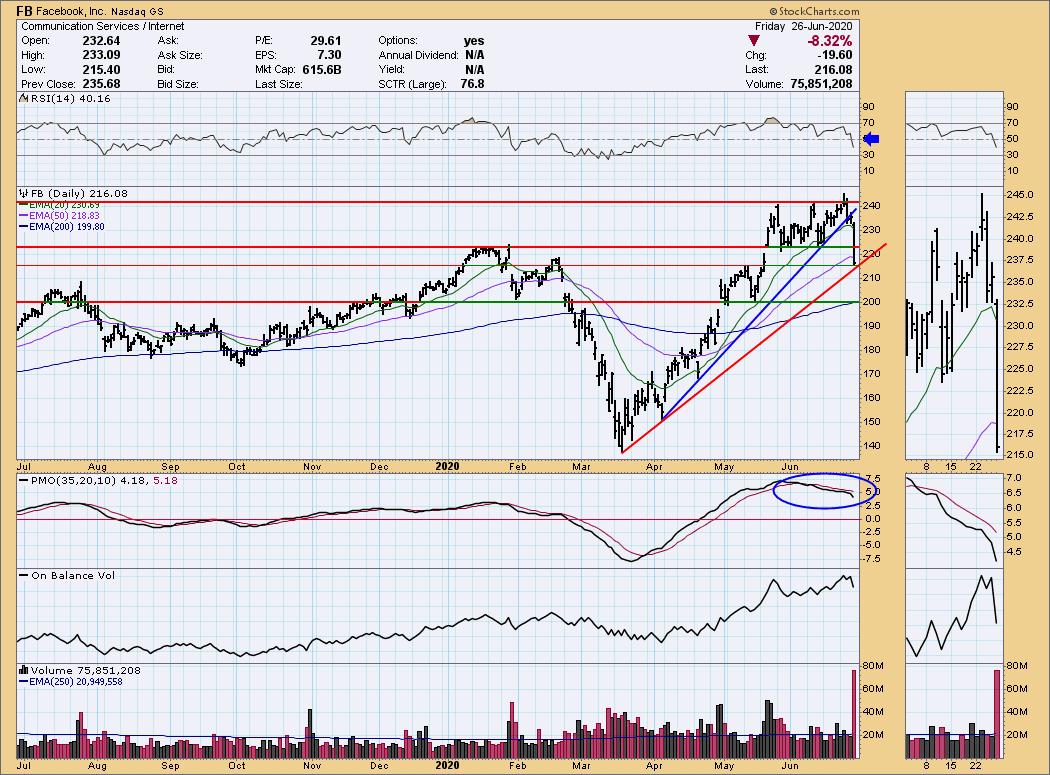

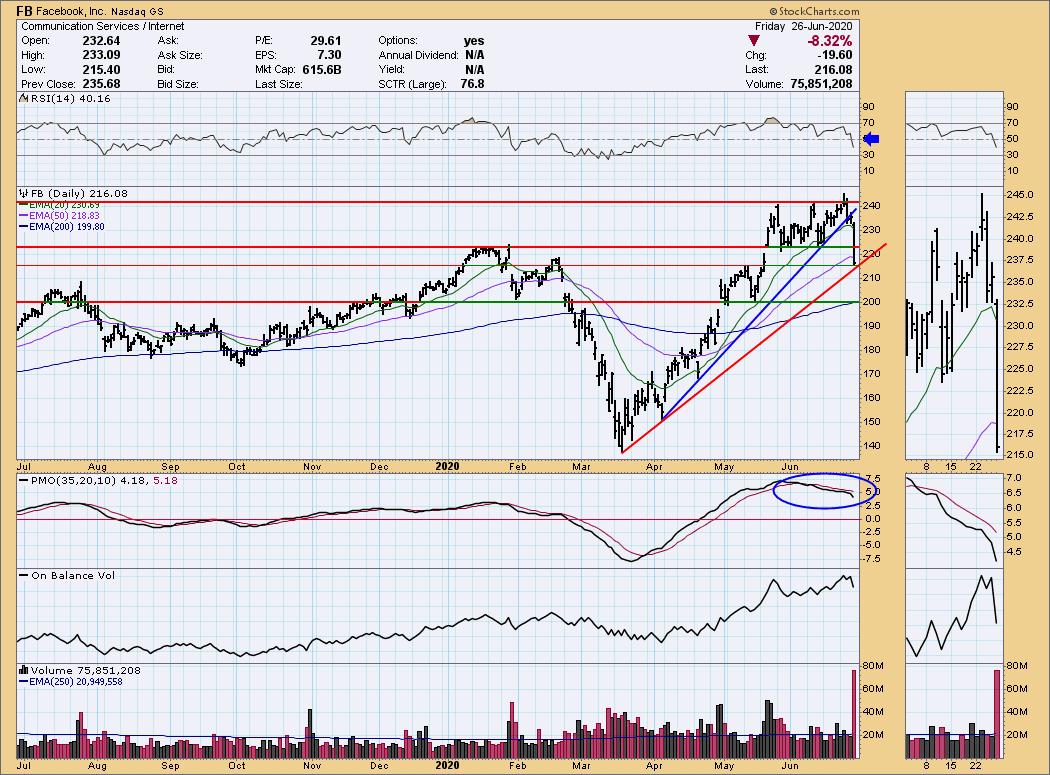

STOCKS WEAKEN AS CORONAVIRUS CASES RISE -- NASDAQ PULLS BACK FROM OVERBOUGHT CONDITION -- WHILE S&P 500 ENDS BELOW ITS 200-DAY LINE -- SECTOR LEADERSHIP REMAINS THIN -- FINANCIALS HAVE A BAD WEEK -- FACEBOOK LEADS INTERNET STOCKS LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES WEAKEN... Major stock indexes lost ground this week on a disturbing rise in coronavirus cases which could undermine the U.S. economy. Chart 1 shows the Nasdaq Composite pulling back from a record high set on Tuesday. Its 14-day RSI line in the upper box shows a...

READ MORE

MEMBERS ONLY

Would You Be Happy to Beat the S&P by a Mile?

by John Hopkins,

President and Co-founder, EarningsBeats.com

On Friday, April 3, I submitted my article for the ChartWatchers newsletter with the following headline: "Get Ready to be Shocked - To the Upside". As someone who has been involved in the market for many years and who has made his fair share of bad calls, this...

READ MORE

MEMBERS ONLY

The Financial Sector Takes Center Stage

This past week, the financial sector saw some fireworks. The Volcker rule was rolled back, while the Federal Reserve decreased dividends and ruled against corporate buybacks.

Where does the name Volcker Rule come from? Volcker was the Fed Chairman in the 1970s-1980s. When inflation began to go out of control...

READ MORE

MEMBERS ONLY

Is the Stock Market Going to Crash Again?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV's The MEM Edge, Mary Ellen takes a close look at the current status of the broader markets after this week's selloff. She also shares lockdown stocks that are poised for more upside, as well as breakout stocks with increased Wall...

READ MORE

MEMBERS ONLY

FAANG Stocks: Darlings and Duds

by Erin Swenlin,

Vice President, DecisionPoint.com

I decided to take a look at the FAANG stocks to see which ones are experiencing damage (duds) and which ones are continuing to show internal strength despite the S&P 500 stalling before reaching all-time highs. There are definitely some winners and losers. I must say that, overall,...

READ MORE

MEMBERS ONLY

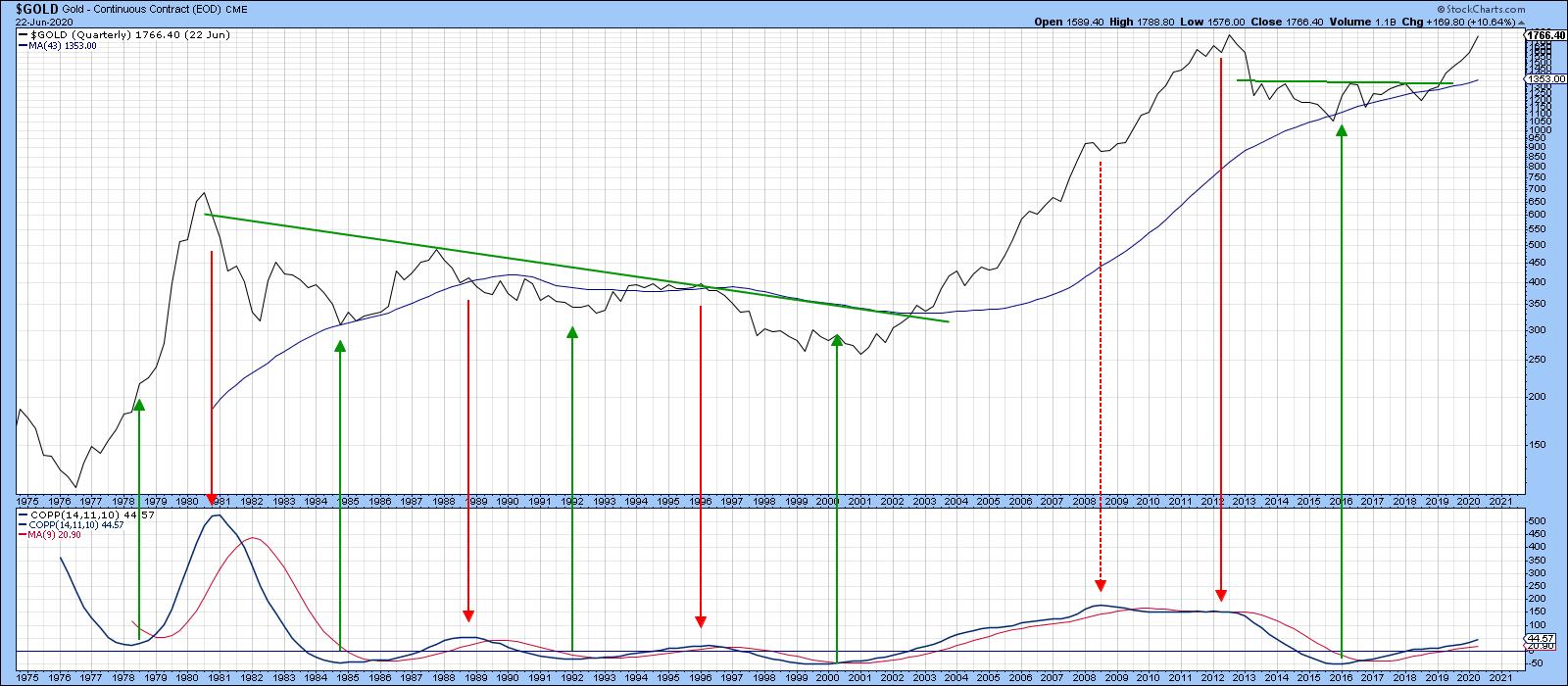

Gold Moves to a New High; Will the Breakout Hold?

by Martin Pring,

President, Pring Research

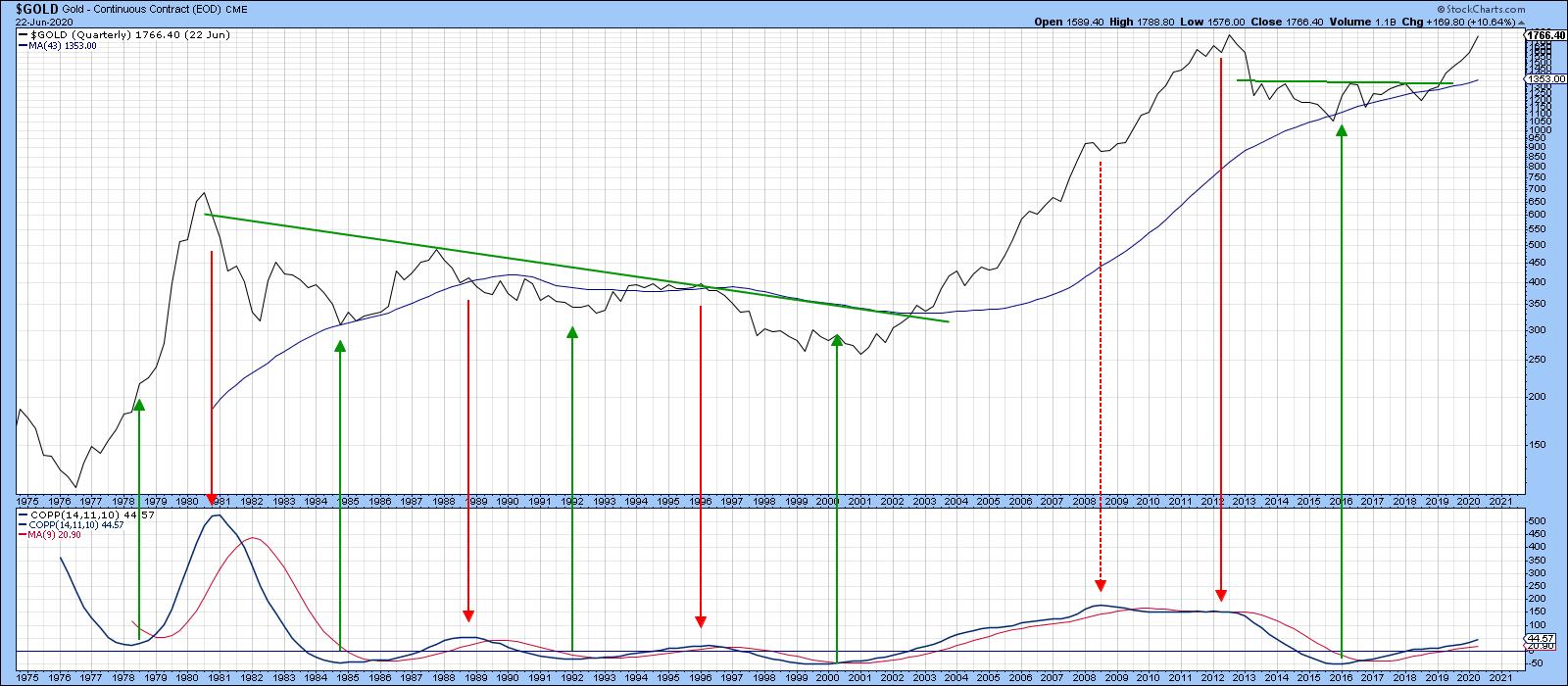

Long-Term Gold Charts Give Perspective

Gold broke out to a new recovery high on Tuesday and looks set to gain more ground, all with a favorable background from the long-term trend.

Chart 1 compares the quarterly gold price to a Coppock indicator and its 9-quarter moving average. This is not...

READ MORE

MEMBERS ONLY

Measuring the Balance of Power in the Equal-weight Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 200-day SMA is a long-term trend indicator that chartists can use across the equal-weight sectors to measure the balance of power in the broader market. The more sectors trading above their 200-day SMAs, the more bullish the market. The more sectors trading below their 200-day SMAs, the more bearish...

READ MORE

MEMBERS ONLY

NASDAQ, Internet, Software All Facing Critical Tests

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

June has been fairly kind to the NASDAQ 100 index ($NDX), technology (XLK), software ($DJUSSW), and internet ($DJUSNS) and these have all been leaders, but the combination of overbought, negative divergences and a weak seasonal period has sent all four down to areas not seen recently. Let's start...

READ MORE

MEMBERS ONLY

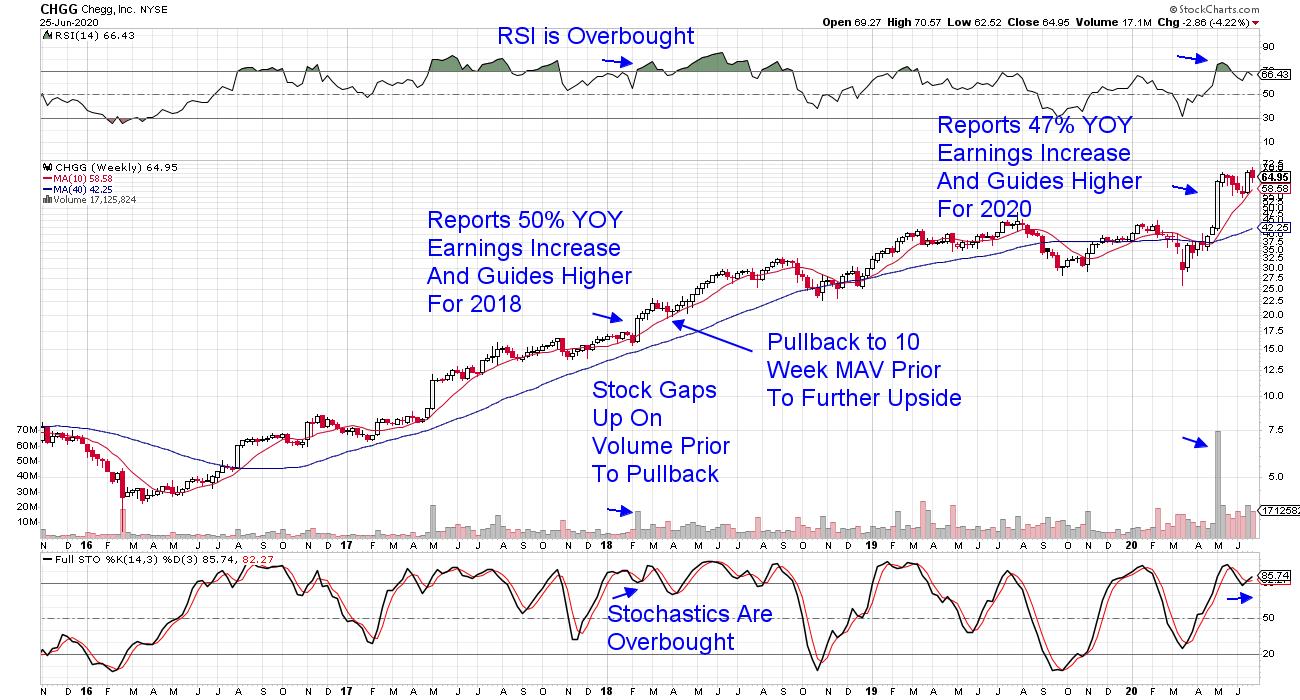

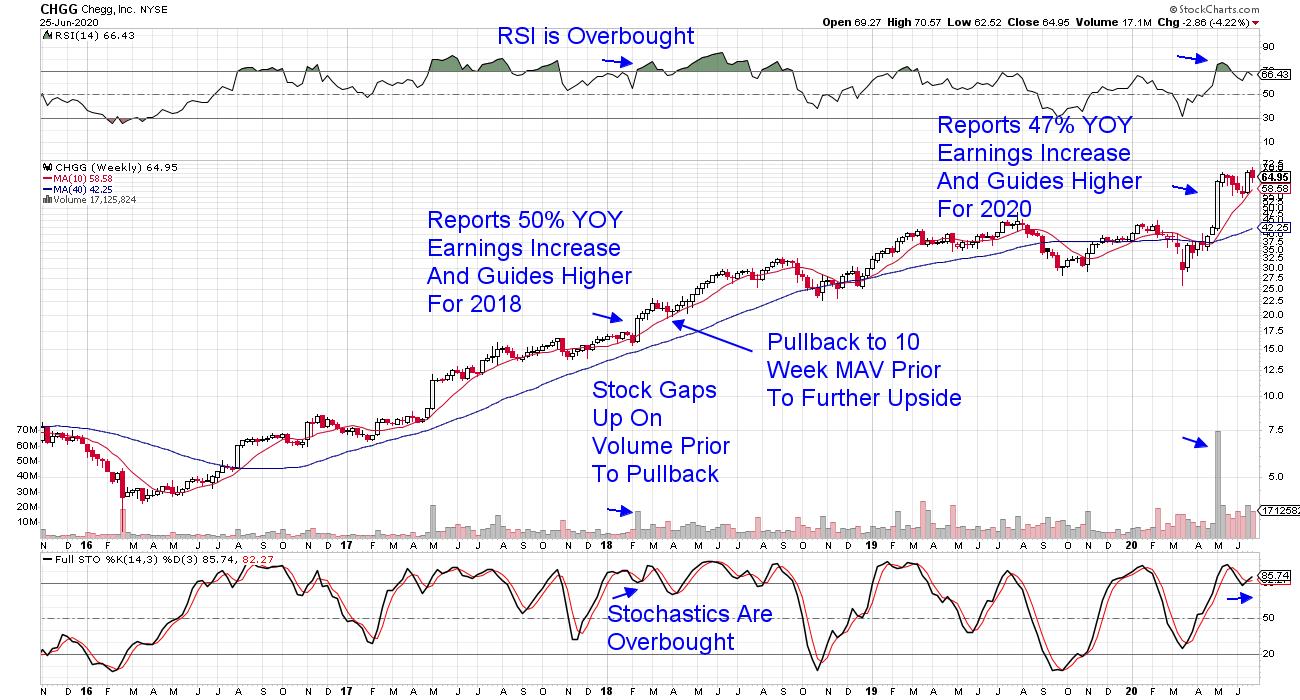

Historical Precedence Suggests This Stock Has a Lot More Upside

by Mary Ellen McGonagle,

President, MEM Investment Research

Looking at historical precedence with stocks is the best way to create a foundation from which to build your trading plan going forward. My 15 years working with IBD founder Bill O'Neil solidified this fact for me, as his proven strategy to uncover big, winning stocks was centered...

READ MORE