MEMBERS ONLY

Recent Selling In Technology Improving Trading Opportunities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 6, 2017

It was a bifurcated day on Wall Street with the NASDAQ being lifted by an improving technology sector (XLK, +0.64), while a very weak energy group (XLE, -1.30%) put the brakes on both the Dow Jones and S&P 500....

READ MORE

MEMBERS ONLY

Did Uptrends Reverse for Semiconductor ETFs? - Five Semiconductors to Watch - Biotech ETFs and Five Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Did the Uptrends Reverse for Semiconductors?

.... Intel and Four Semiconductor Equipment Stocks

.... Biotech ETF Test November Lows

.... BIIB Shows Relative Chart Strength

.... Bearish Wedges for Two Energy-related ETFs

.... Junk Bonds Continue to Struggle ....

Did the Long-term Uptrends Reverse for Semiconductors?

The Semiconductor SPDR (XSD) and Semiconductor iShares (SOXX) were hit...

READ MORE

MEMBERS ONLY

Bull/Bear Market Rules and Head & Shoulders Patterns (UUP and TLT)

by Erin Swenlin,

Vice President, DecisionPoint.com

I'm sure many have heard the phrases, "Bull Market Rules Apply" or "Bear Market Rules Apply". I thought today I'd give you two examples of how these "rules" interact with chart patterns. In particular, a previous reverse head and shoulders...

READ MORE

MEMBERS ONLY

December 2017 Market Roundup With Martin Pring 2017-12-06

by Martin Pring,

President, Pring Research

This months Market Roundup highlights the three main assets of bonds, commodities and stocks. Rotations between these asset classes can help find major secular moves. This month shows multiple trends changing.

Market Roundup With Martin Pring 2017-12-06 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring...

READ MORE

MEMBERS ONLY

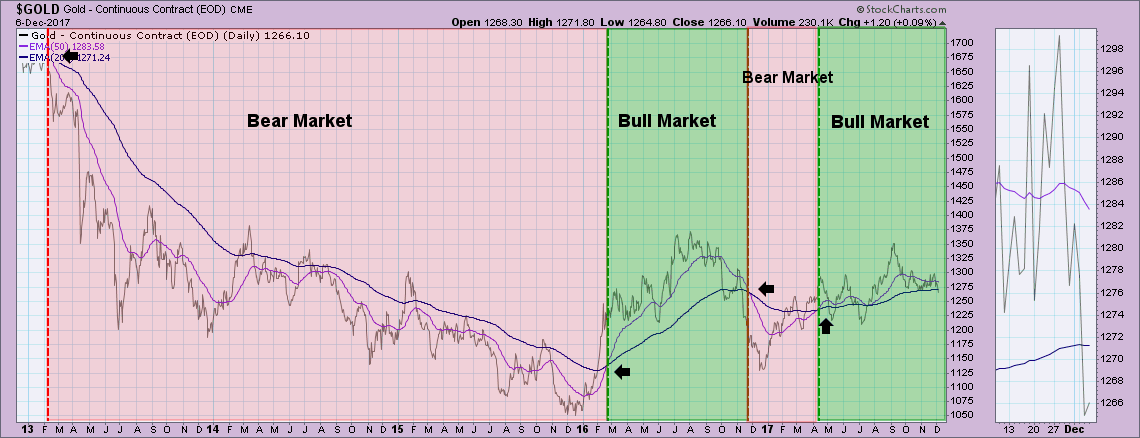

Precious Metals And Commodities Starting To Break Down

by Martin Pring,

President, Pring Research

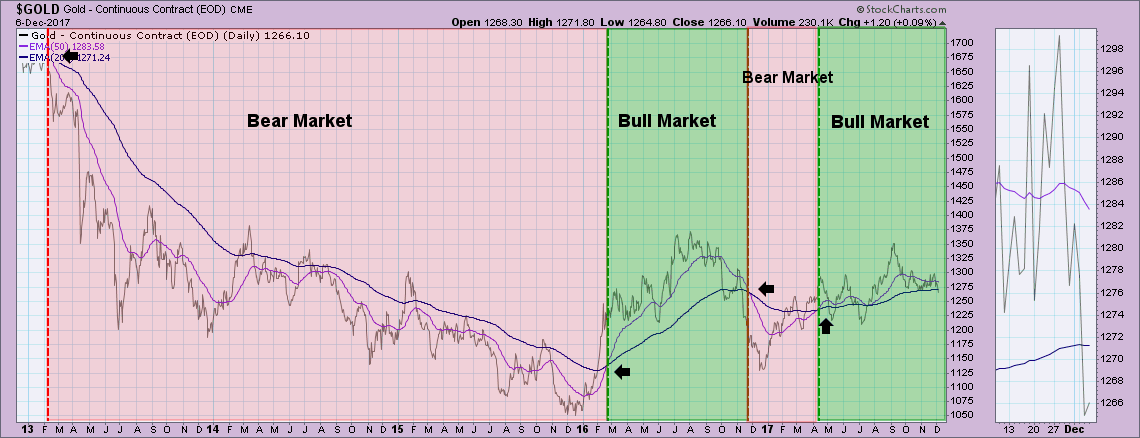

* Gold leads commodities

* Gold, gold shares and silver complete head and shoulder patterns

* Two confidence ratios are forecasting lower gold prices

* Commodities headed lower

Gold leads commodities

Chart 1 compares the price of gold to commodities in the form of the CRB Composite. The green shaded areas represent rally periods...

READ MORE

MEMBERS ONLY

EMERGING MARKETS ISHARES FALL TO TWO-MONTH LOW -- MOST OF THE SELLING IS COMING FROM ASIA, AND TAIWAN IN PARTICULAR -- SELLING IN TAIWAN SEMICONDUCTOR IS THE MAIN REASON WHY -- SEMICONDUCTOR ETFS HAVE SLIPPED BELOW THEIR 50-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING MARKETS ISHARES FALL TO TWO-MONTH LOW... The recent rotation out of technology stocks may be taking a toll on emerging markets which are heavily exposed to that sector. Chart 1 shows Emerging Markets iShares (EEM) falling below its 50-day average to the lowest level in two months. And it&...

READ MORE

MEMBERS ONLY

United Technologies Forms Classic Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

United Technologies (UTX) looks ripe for a breakout to new highs as a bullish cup-with-handle pattern takes shape. Note that UTX is in the industrials sector and the defense-aerospace industry group. The Industrials SPDR (XLI) and the iShares Aerospace & Defense ETF (ITA) both hit new highs on December 1st....

READ MORE

MEMBERS ONLY

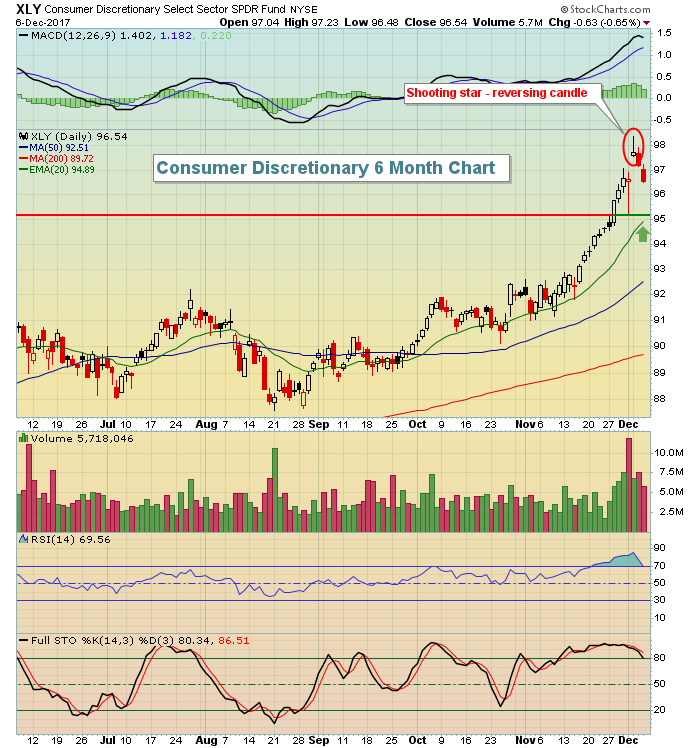

Here's One Case For A Near-Term Top

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

If you enjoy my blog articles, I'd love for you to subscribe. It's the only way I know that I'm providing you with useful and thought-provoking information. There is no charge for subscription, it's completely FREE! Simply scroll down to the...

READ MORE

MEMBERS ONLY

DP Alert: Indicators Topping - Gold Triggers PMO SELL and STTM SELL Signals - NDX STTM Neutral

by Erin Swenlin,

Vice President, DecisionPoint.com

First and foremost I am pointing out the new ST Trend Model Neutral signal that arrived today on the NDX. Despite attempting to rally from the recent decline, price was unable to move high enough to prevent this Neutral signal from appearing. Today I discussed with Tom thoughts on whether...

READ MORE

MEMBERS ONLY

Dow Transports Gain 1000 Points During Last 8 Days' Melt Up

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 4, 2017

Recent bullish themes continued on Monday. Outperformance by the Dow Jones (+0.24%) and S&P 500 (-0.11%) overshadowed ugly relative performance from technology (XLK, -1.61%) and the NASDAQ (-1.05%). Even the riskier Russell 2000 index ($RUT, -0.30%...

READ MORE

MEMBERS ONLY

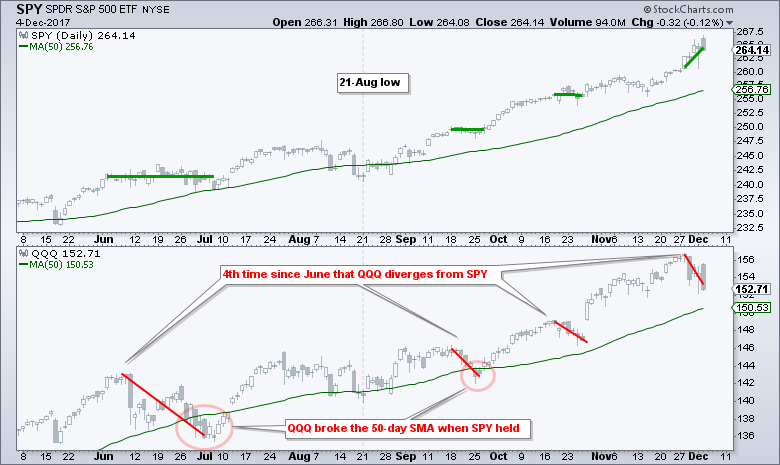

QQQ Diverges from SPY Again - Candles versus Closing Prices - Gold, Bonds and Dollar - Three Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

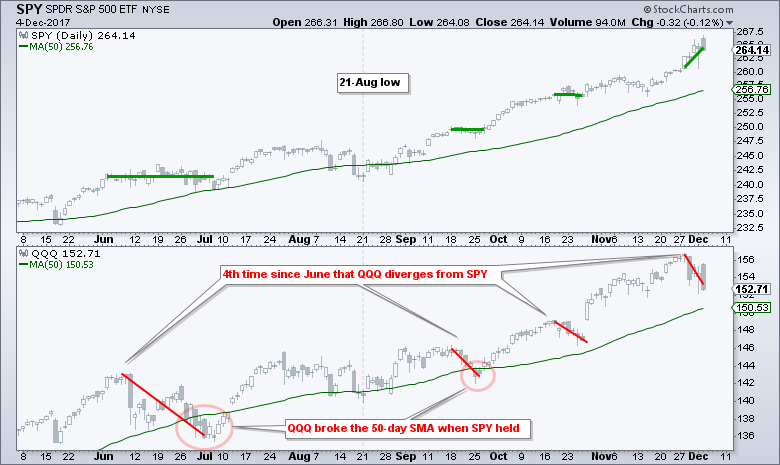

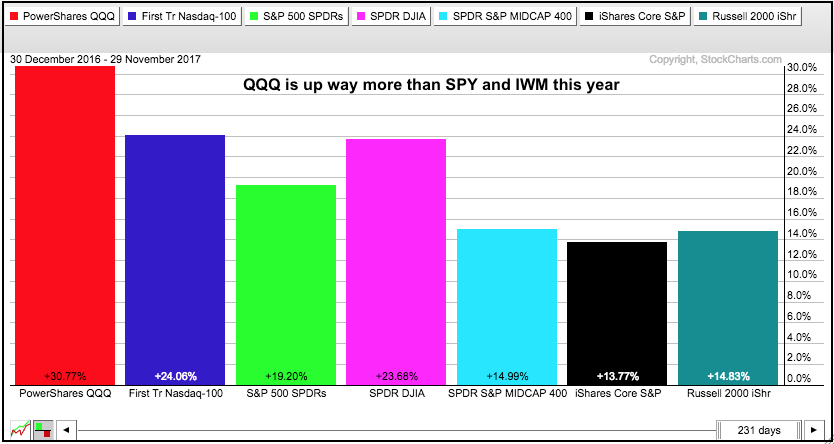

.... QQQ Diverges from SPY Again

.... Mid-caps Shine on PerfChart

.... Candlesticks versus Closing Prices

.... Bonds and Dollar Push-Pull Gold

.... IDXX Breaks Flag Resistance

.... EBAY Bids to End Correction

.... Ball Corp Surges off Support Zone ....

QQQ Diverges from SPY Again

QQQ diverged from SPY over the last few days and this marks...

READ MORE

MEMBERS ONLY

MONEY CONTINUES TO ROTATE OUT OF TECHNOLOGY AND INTO BANKS, RETAILERS, ENERGY AND TRANSPORTS -- FAANG STOCKS AND SEMICONDUCTORS WEIGH ON TECHNOLOGY SECTOR -- S&P 500 VALUE ISHARES ARE OUTPERFORMING GROWTH ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHEAPER STOCKS ARE GAINING ... The rotation into cheaper undervalued stocks that started last week is continuing today on the back of the weekend passage of the tax reform package. The relative strength lines in Chart 1 show the past week's leaders to be banks (blue line), retailers (red...

READ MORE

MEMBERS ONLY

We're Quickly Approaching A Seasonal Bearish Period; Consider Taking Some Profits

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 1, 2017

An early selloff on Friday quickly became a buying opportunity as the bulls jumped back on board for what they hope will be another big upturn. All of our major indices ended the Friday session in negative territory, but the losses early in...

READ MORE

MEMBERS ONLY

Mylan Continues its Move with Expanding Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Mylan (MYL) was hit hard in early August with a plunge to 30, but firmed and recovered with a gap and surge to the upper 30s. The stock consolidated after this gap-surge and recently broke out with above average volume. Notice that the gap-zone held in the mid 30s as...

READ MORE

MEMBERS ONLY

Here's The Only ChartList You'll Ever Need And The Five Keys To Trading Success

by John Hopkins,

President and Co-founder, EarningsBeats.com

'Tis the season and I'd first like to wish everyone a happy holiday season. To health, happiness and prosperity!

Feel free to sing along....

"We've made our (Chart)List

we've checked it twice

but we won't buy stocks

at any...

READ MORE

MEMBERS ONLY

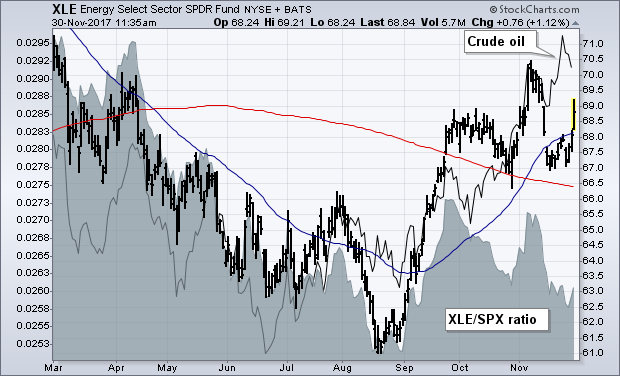

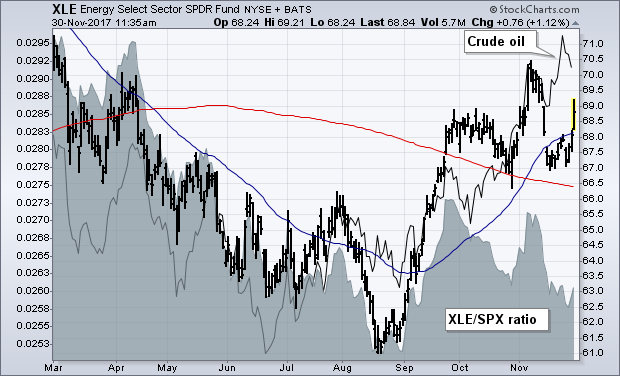

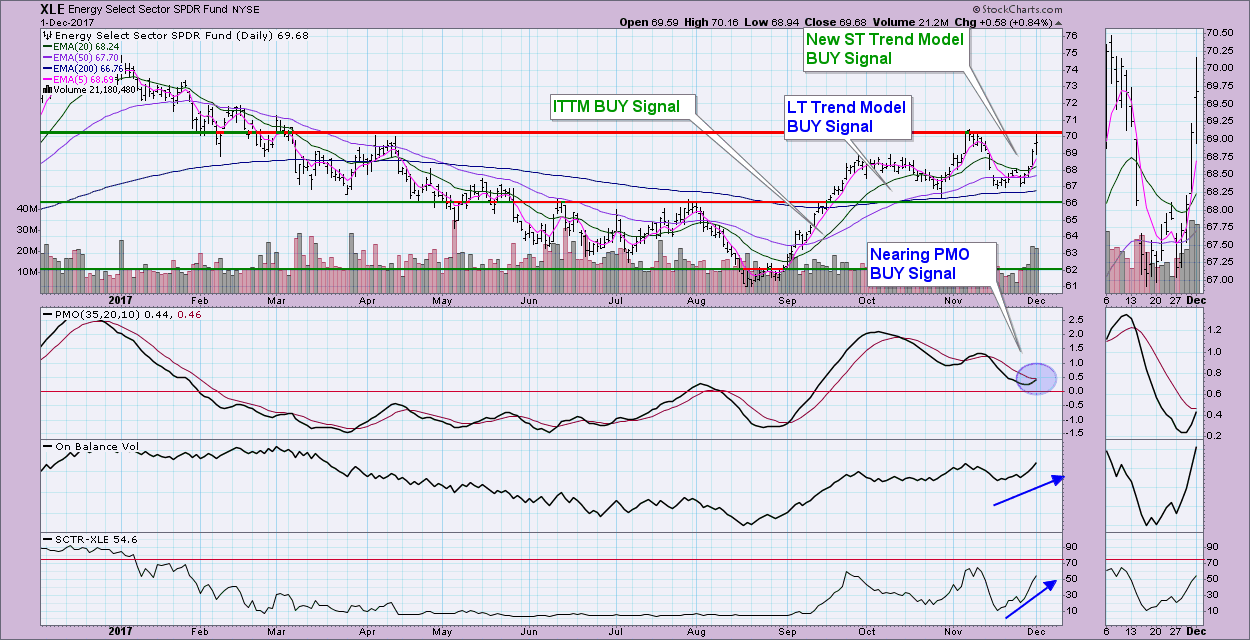

Energy Shares Are Bouncing on Optimism Over OPEC Agreement

by John Murphy,

Chief Technical Analyst, StockCharts.com

Energy shares are finally showing some bounce. The daily bars in the chart below shows the Energy Sector SPDR (XLE) climbing above its 50-day average today. The XLE is bouncing off chart support along its late October low and its 200-day moving average. Those are logical chart points for the...

READ MORE

MEMBERS ONLY

Here Are Two Stocks To Consider In December...And One To Avoid

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love to combine bullish seasonality with strong or strengthening technical conditions. As we move into December, it's important to realize that there has been no better month for the S&P 500 since 1950 than December, which has produced annualized returns of +19.51%. Also, December...

READ MORE

MEMBERS ONLY

Do Semiconductors Still Compute?

by Bruce Fraser,

Industry-leading "Wyckoffian"

Semiconductor stocks have been top performers throughout most of 2016 and 2017. Often a strong Semiconductor group performance encourages speculation across the entire stock market and that has certainly been the case in 2017. Preceding the current 21-month uptrend in the Semiconductor ETF (SMH), a Reaccumulation formed and built a...

READ MORE

MEMBERS ONLY

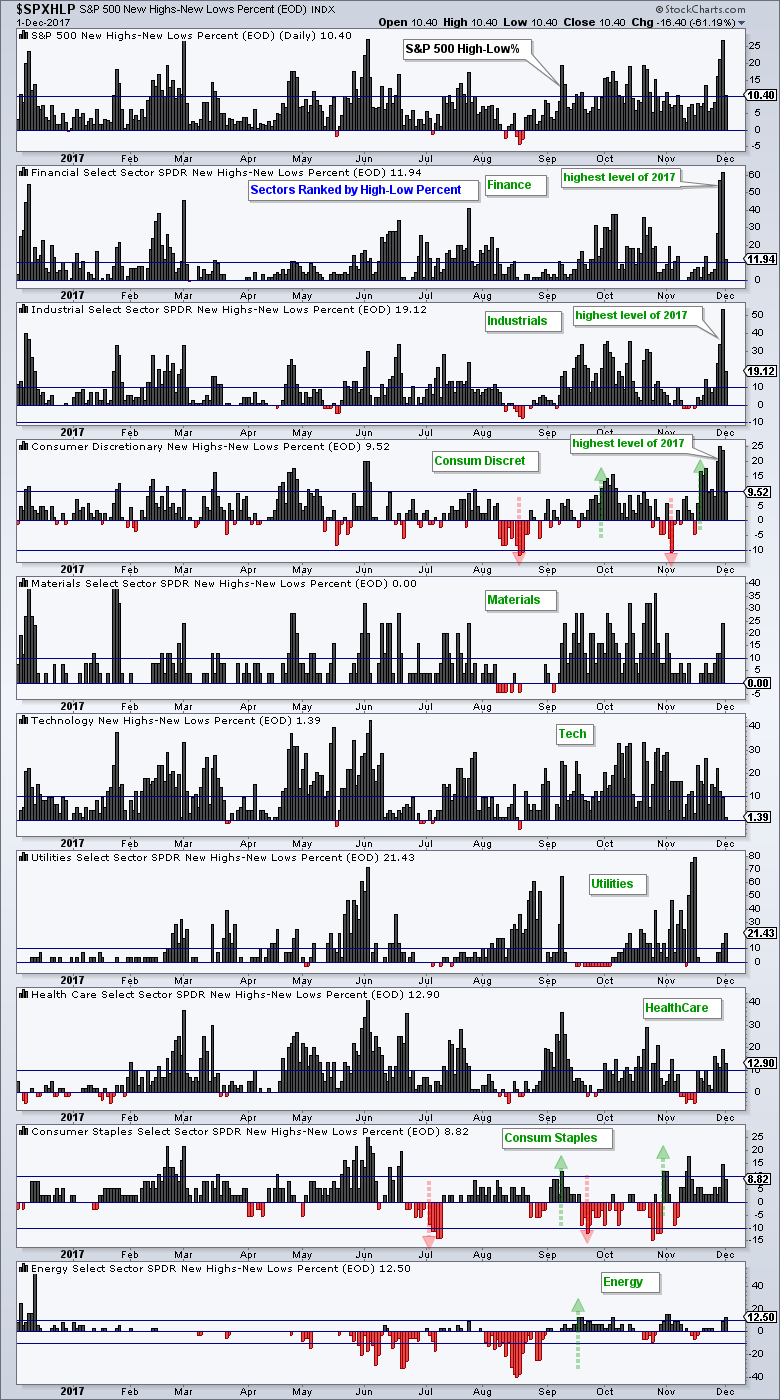

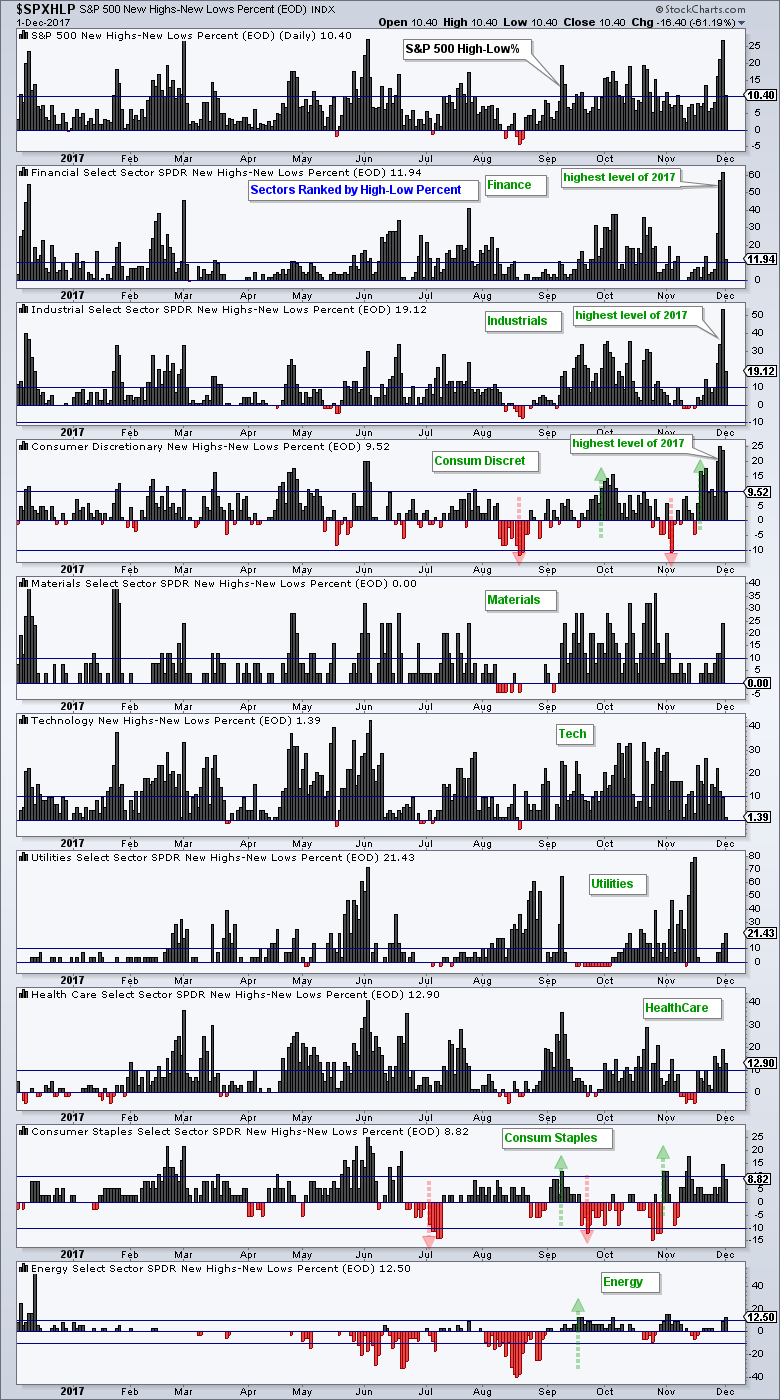

Financials and Industrials Lead New High Expansion

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can plot High-Low Percent for the nine sectors to identify areas of strength within the stock market. The chart below shows the High-Low Percent ranked by this week's highest value. The finance, industrials and consumer discretionary sectors stand out this week because their High-Low Percent indicators hit...

READ MORE

MEMBERS ONLY

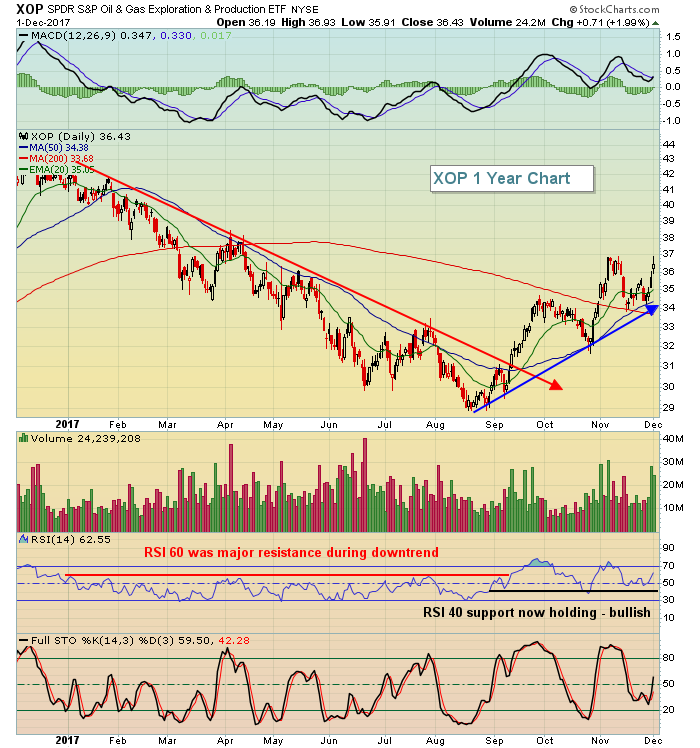

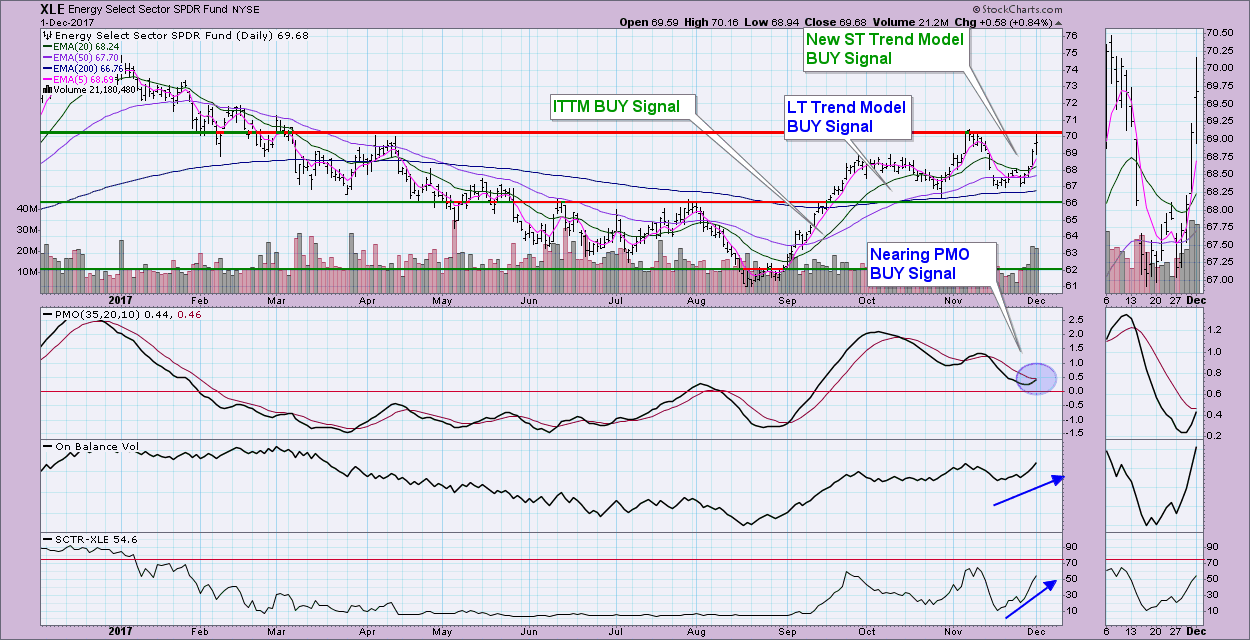

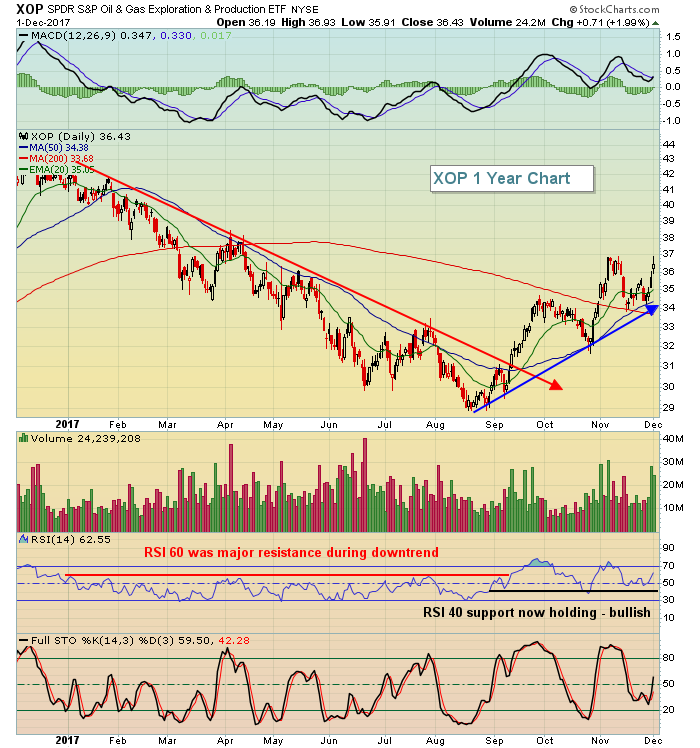

Energy ETFs Triggering Bullish Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

The energy sector has been on a bit of a rollercoaster the three months, moving from deep lows in August to a new trading range of large percentage highs and lows. I'm starting to see signs that the trading range is going to be history as price now...

READ MORE

MEMBERS ONLY

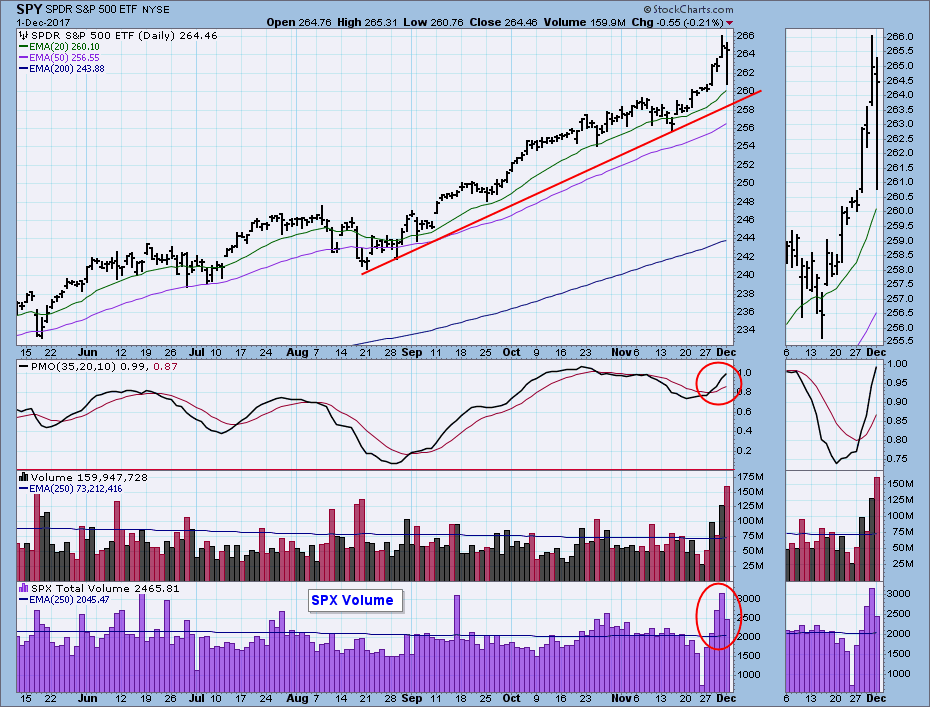

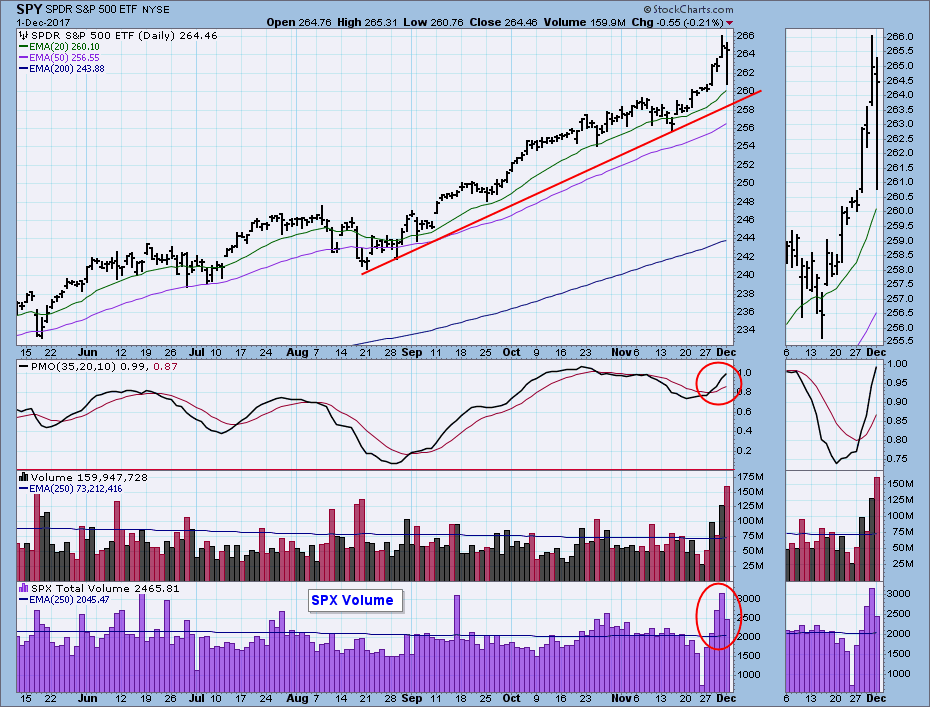

DP Weekly Wrap: Blowoff

by Carl Swenlin,

President and Founder, DecisionPoint.com

There were a couple of news stories on which to blame Friday's pullback, but my opinion is that the vertical up move of the prior three days was a short-term blowoff that needed to be corrected. The blowoff is most readily identified by the rapidly expanding volume midweek,...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #23

by Gatis Roze,

Author, "Tensile Trading"

With 25 years under his belt at Morningstar, Russel Kinnel, Director of Manager Research, has certainly earned my respect. So my radar went up when he wrote a column entitled “Lessons Learned.” Considering that Kinnel has been a keen observer of individual investor behavior for a generation, I believe all...

READ MORE

MEMBERS ONLY

The Dow Jones Has Its Biggest Gain of 2017, Closes Above 24000

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 30, 2017

It was another broad-based rally on Wall Street with traders ditching bonds and rushing into equities. The Dow Jones rallied 331.67 points to easily close above 24,000 for the first time in its history. The records just keep piling up. It...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Long-term Bullish and Short-term Frothy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Bullish But Getting Frothy

.... Bull Market Broadens with Surge in New Highs

.... Finance, Industrials and Consumer Discretionary Lead

.... Consumer Staples and Discretionary Lead November

.... SPY and QQQ Hit New Highs

.... Small-caps Extend Recent Leadership Run

.... New High Hat-Tricks for Four Sectors

.... XLI, XLF, XLB and XLV Resume Uptrends

.... Oil Pulls...

READ MORE

MEMBERS ONLY

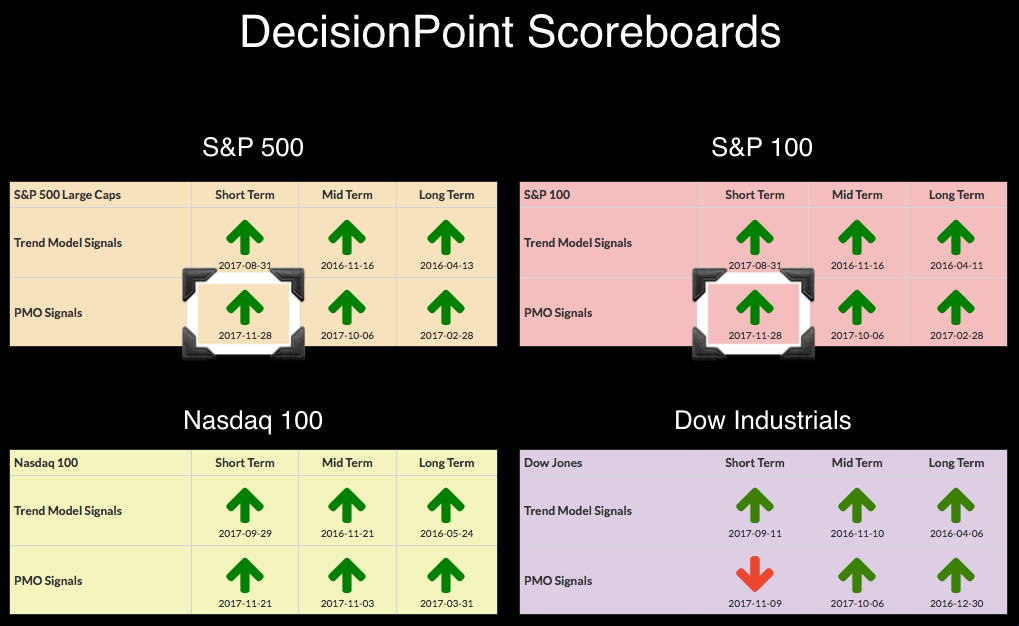

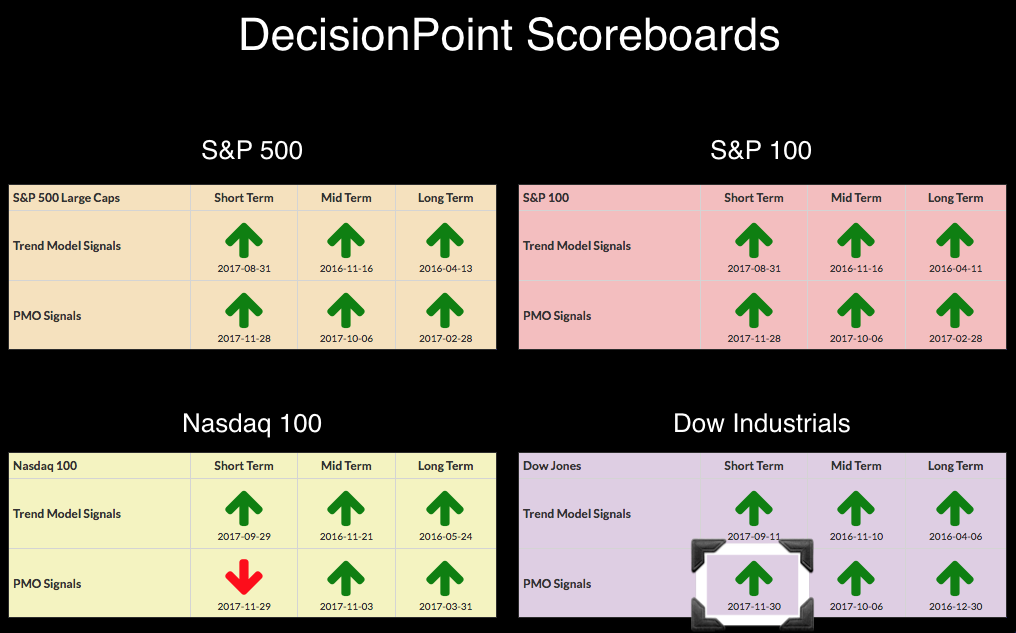

Dow Logs New PMO BUY Signal - UUP Triggers an IT Trend Model SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Two important signal changes arrived today that you need to know about. First, the Dow Industrials triggered a new ST PMO BUY signal. Talk about a bifurcated market, the NDX gets a PMO SELL signal yesterday and today the Dow continues its parabolic rise and logs a BUY signal. The...

READ MORE

MEMBERS ONLY

Rising Treasury Yields Signal Two Things

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's a renewed selling effort in U.S. treasuries and that's sending yields soaring. Bullish performance in small caps, transportation stocks (especially railroads), financials, industrials and consumer discretionary are painting a picture of a strengthening economy ahead and the selling of treasuries would certainly support that...

READ MORE

MEMBERS ONLY

ENERGY SHARES ARE BOUNCING ON OPTIMISM OVER OPEC AGREEMENT -- EXXON MOBIL MAY BE ON THE VERGE OF A BULLISH BREAKOUT -- CHEVRON IS NEARING A NEW RECORD HIGH -- ENERGY SHARES MAY START TO BENEFIT FROM RECENT BUYING OF CHEAP STOCK GROUPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY SHARES REBOUND ... Energy shares are finally showing some bounce. The daily bars in Chart 1 shows the Energy Sector SPDR (XLE) climbing above its 50-day average today. The XLE is bouncing off chart support along its late October low and its 200-day moving average. Those are logical chart points...

READ MORE

MEMBERS ONLY

Three Things To Take Away From Wednesday's Bizarre Market Action

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 29, 2017

One quick glance at the S&P 500's meager 1 point loss on Wednesday and you might assume that Wall Street meandered through another one of its boring days. But a deeper look will tell you that yesterday was anything...

READ MORE

MEMBERS ONLY

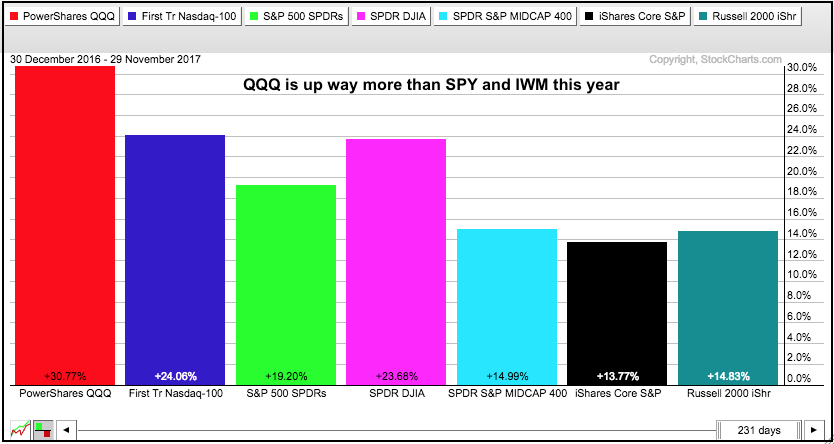

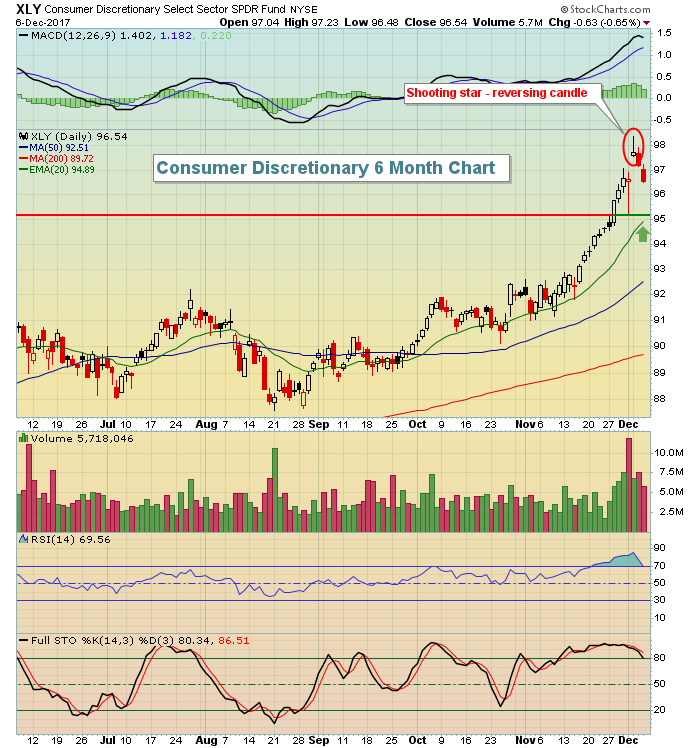

QQQ Still Leads Year-to-Date - Playing the Pullback in Healthcare - Consumer Discretionary Stocks Come Alive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... One Day does not Ruin the Year

.... Drastic Declines are Part of the Uptrend

.... Stock Picking Goes in Waves

.... Stocks to Watch: ADP, ARRS, FISV, LH

.... Playing the Pullback in Healthcare (BIIB, BMY)

.... Auto and Restaurant Stocks Join the Upturn ....

One Day does not Ruin the Year

Tech stocks were...

READ MORE

MEMBERS ONLY

DP Alert: PMO SELL Signal on NDX - SPX Indicators Very Bullish

by Erin Swenlin,

Vice President, DecisionPoint.com

Technology fell apart today as money appeared to be rotating out of technology and into financials which had a brilliant day. The PMO was yanked down below its signal line on the NDX. Yesterday, the PMO was rising and price looked strong. What a difference a day can make. Meanwhile,...

READ MORE

MEMBERS ONLY

RETAIL SPDR ACHIEVES BULLISH BREAKOUT -- TODAY'S RETAIL LEADERS INCLUDE NORDSTROM, KOHLS, AND TJX -- TRANSPORTATION AVERAGE RISES SHARPLY -- AIRLINES AND DELIVERY SERVICE STOCKS ARE HAVING A STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P RETAIL SPDR BREAKS OUT TO THE UPSIDE... My Monday message showed the S&P Retail SPDR (XRT) attempting an upside breakout above its October high. Chart 1 shows the XRT accomplishing that in pretty decisive fashion over the last two days. In fact, retailers have been...

READ MORE

MEMBERS ONLY

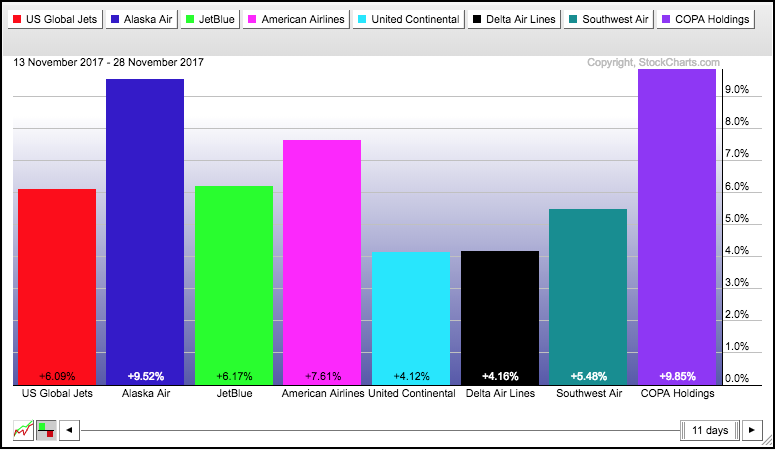

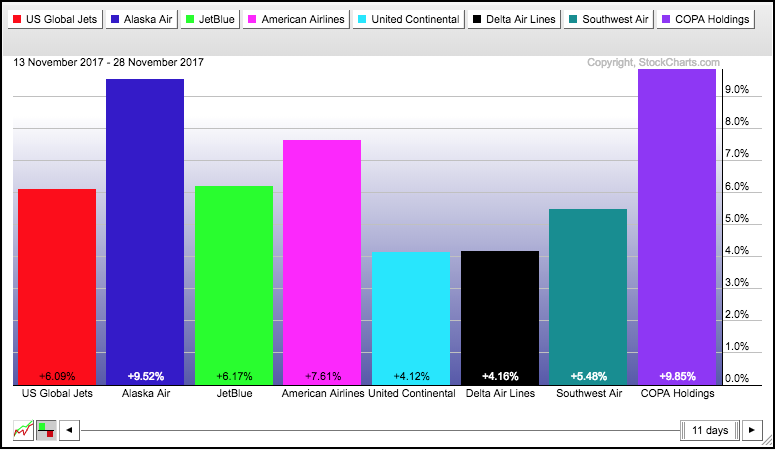

Delta Air Lines Reverses with Outside Reversal Day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Airline stocks are moving higher again with solid gains across the board over the last two weeks. The PerfChart below shows the performance for the Airline ETF (JETS) and seven other airline stocks since mid November. All are up with Alaska Air (ALK), Southwest (LUV) and COPA Airlines (COPA) sporting...

READ MORE

MEMBERS ONLY

Equities Explode Higher, Led By Financials, Industrials And Small Caps

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 28, 2017

It was party day on Wall Street. The bullish environment accelerated into a much faster gear as all nine sectors advanced and the small cap Russell 2000 soared 23 points, or 1.53%, to a fresh new record with its most bullish historical...

READ MORE

MEMBERS ONLY

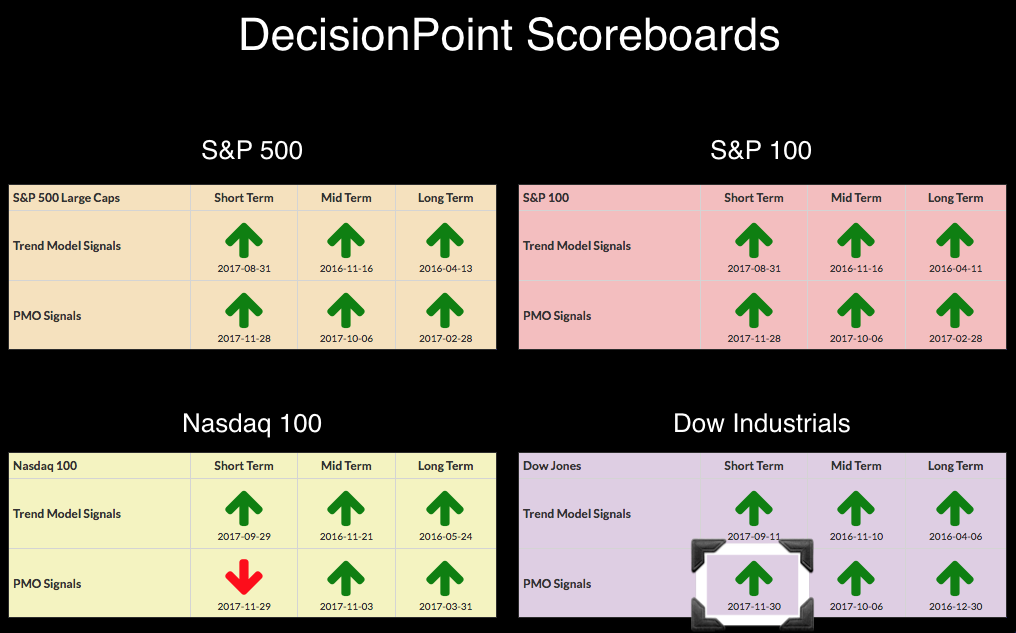

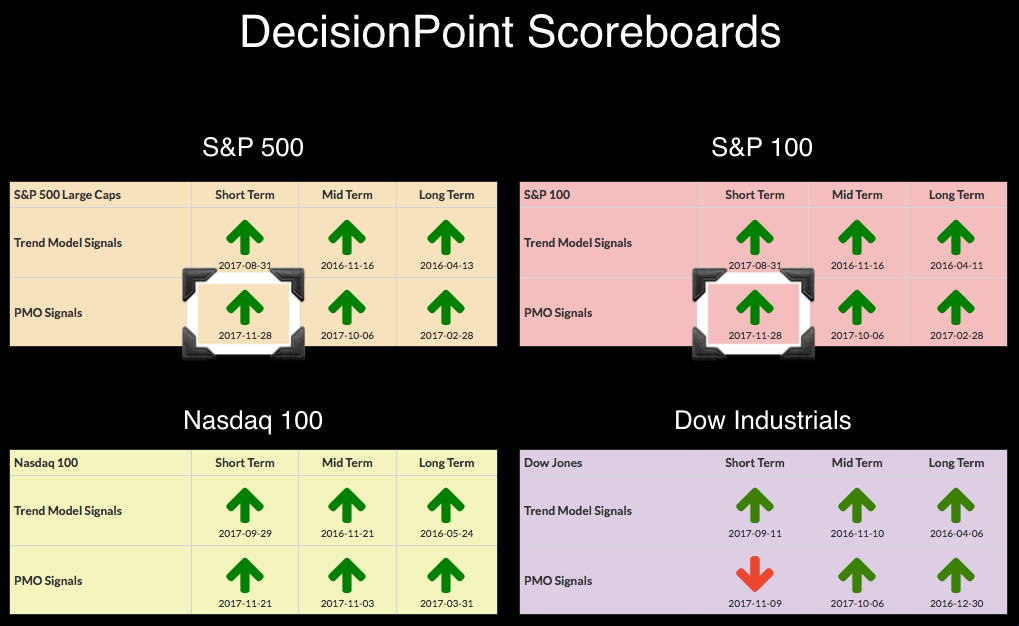

DP Scoreboard Shake Up

by Erin Swenlin,

Vice President, DecisionPoint.com

After today's rallies and big breakouts, it shouldn't surprise anyone that the OEX and SPX finally shed their PMO SELL signals. What is interesting is the Dow's 'laggard' status on triggering a PMO BUY signal. It is the last SELL signal standing....

READ MORE

MEMBERS ONLY

FINANCIAL SPDR IS FINDING SUPPORT AT 50-DAY AVERAGE -- S&P BANK SPDR IS ALSO TRADING ABOVE ITS 50-DAY LINE -- BANK LEADERS INCLUDE J.P. MORGAN CHASE, REGIONS FINANCIAL, AND ZIONS BANCORP -- INSURERS ARE ALSO HAVING A STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIAL SPDR CONTINUES TO BOUNCE OFF 50-DAY AVERAGE... My message from last Wednesday showed the Financial Sector SPDR (XLF) starting to bounce off its 50-day moving average. Chart 1 shows that the XLF continues to find support at its 50-day line. That's an encouraging sign. The gray area...

READ MORE

MEMBERS ONLY

Is The Oil Price Topping?

by Martin Pring,

President, Pring Research

* Oil experiences a major upside breakout

* Overstretched energy markets on a short-term basis

* Where oil goes commodities in general often follow

I recently came across a commitment of traders hedgers chart that shows a record low short position. Now it’s true that since the 1990’s there has been...

READ MORE

MEMBERS ONLY

Defense Industry Stocks Look Poised To Benefit From Market Rotation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 27, 2017

We saw bifurcated action in the major indices on Monday as the Dow Jones tacked on another 23 points after nearly closing above 23600 for the first time ever. Instead, the bulls had to settle for an all-time intraday high of 23638.92....

READ MORE

MEMBERS ONLY

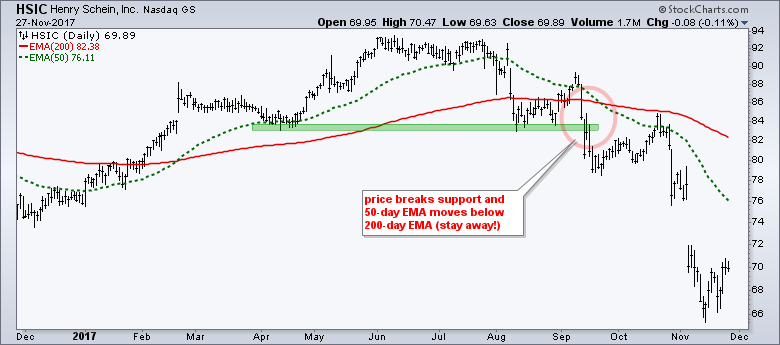

Ugly Charts versus Strong Charts - Broad Market Leadership - Charts for Cintas, Netflix, Eli Lilly and Tesla

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Lots of Ugly Charts can be Found

.... There are also Plenty of Strong Uptrends

.... New Highs in the Nasdaq 100

.... Netflix and Cintas Consolidate within Uptrends

.... Lilly Turns Up at Key Retracement Zone

.... Billy and Bobby Debate Tesla ....

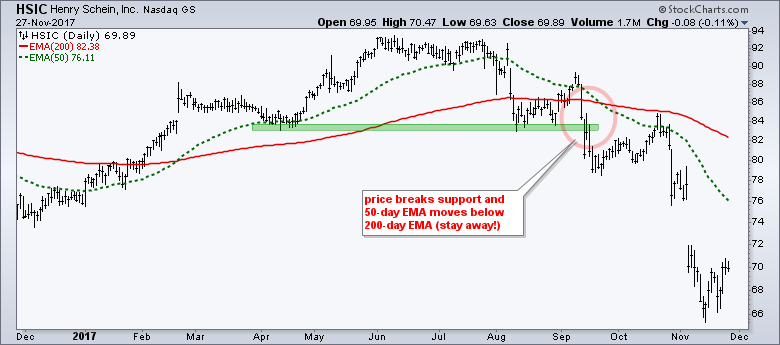

Lots of Ugly Charts can be Found

Chartists looking for weakness in...

READ MORE

MEMBERS ONLY

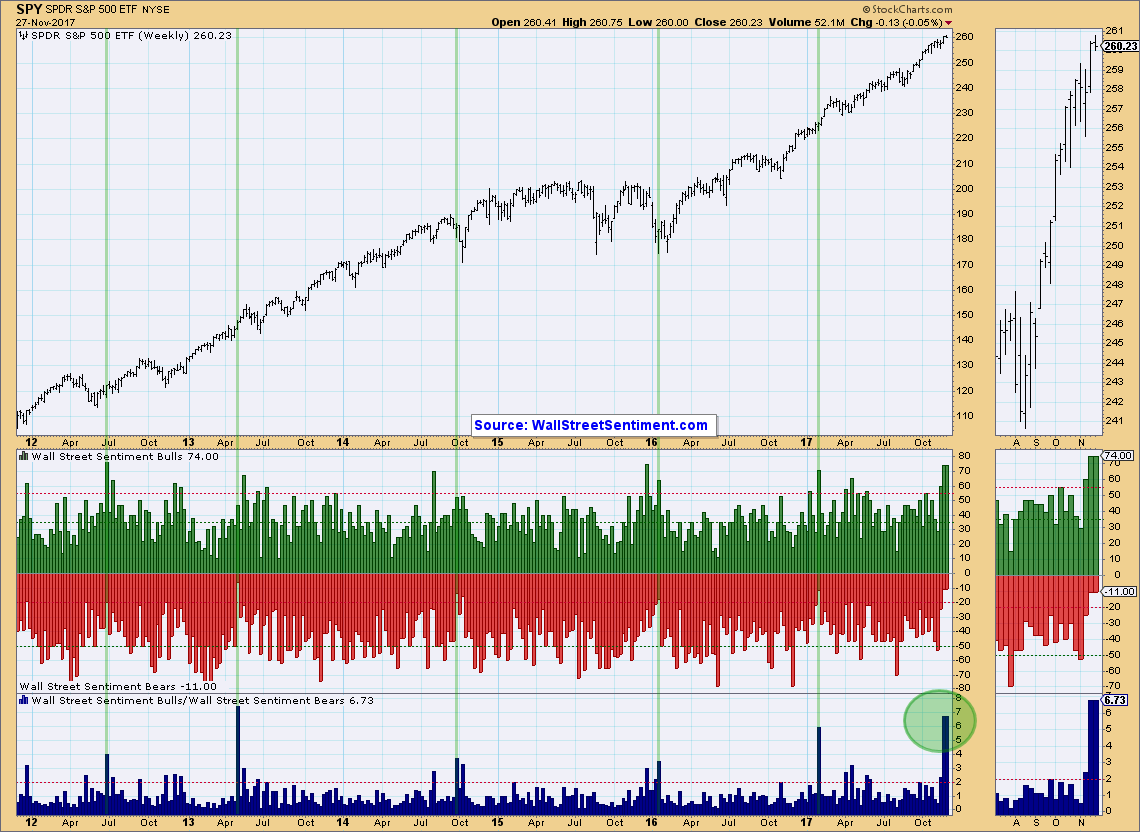

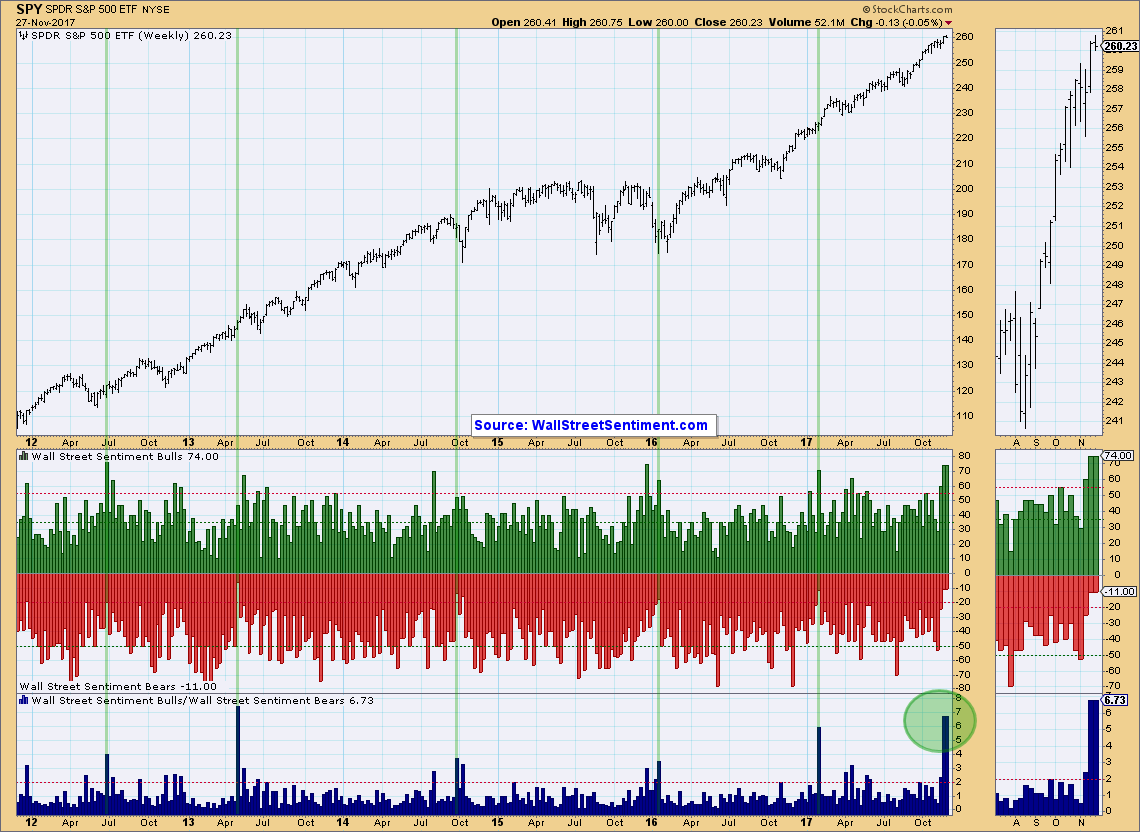

Wall Street Sentiment Soars Bullish - IT Indicators Bottom - TLT at a Decision Point

by Erin Swenlin,

Vice President, DecisionPoint.com

I have a few DecisionPoint charts that are "must-see" right now. Anytime I look at my ChartLists and a chart smacks me in the face, I always try to share it. Today during the MarketWatchers LIVE show, two of those charts got me and the third, Carl slid...

READ MORE

MEMBERS ONLY

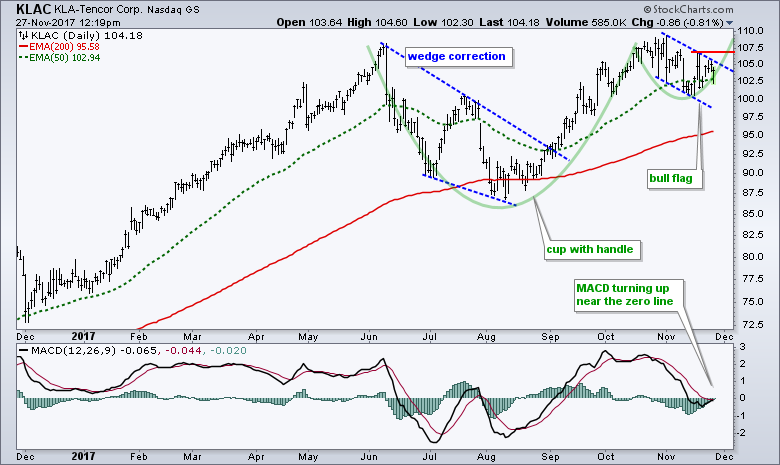

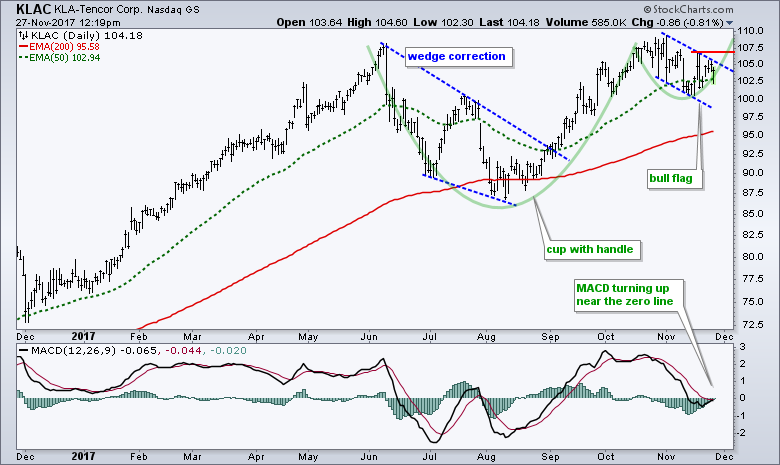

KLA-Tencor Traces out Two Continuation Patterns

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KLA-Tencor (KLAC), a semiconductor equipment and materials designer and manufacturer, is in a long-term uptrend with large and small bullish continuation patterns working. The chart shows 52-week highs in May and October so the long-term trend is clearly up. The green outline highlights a cup-with-handle forming from June to November....

READ MORE