MEMBERS ONLY

Top Techniques for Finding Strength in Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius gives a quick update on sector rotation, then examines the strength uncovered in Consumer Discretionary. He analyzes names like TSLA, AMZN, and LULU; some are in full swing uptrends, but there are also a few names that are on the verge of turning around...

READ MORE

MEMBERS ONLY

Unlock Options Trading Opportunities with StockCharts & OptionsPlay

by Tony Zhang,

Chief Strategist, OptionsPlay

by Grayson Roze,

Chief Strategist, StockCharts.com

Tony and Grayson are back with another informative video highlighting the opportunities the OptionsPlay add-on brings to the StockCharts platform. Tony highlights income generation ideas you can find with the add on. Together, the duo also cover the strategy center, and the SharpCharts and ACP widgets.

This video premiered on...

READ MORE

MEMBERS ONLY

Stock Market Sells Off Ahead of CPI: Charts You Should Be Watching

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 and Nasdaq Composite are inching toward key support levels.

* Gold prices have risen on news of China's central bank's decision to buy gold.

* NVDA is under investigation for antitrust activities, and its stock price is declining.

The Tuesday afternoon...

READ MORE

MEMBERS ONLY

Several Intermarket Relationships Precariously Positioned for Stocks

by Martin Pring,

President, Pring Research

Chart 1 compares the S&P Composite with the NYSE A/D Line and its Common Stock counterpart. These, of course, are not intermarket relationships, but the chart does show that some near-term weakness would violate their bull market trendlines. Violating a trendline is not necessarily the end of...

READ MORE

MEMBERS ONLY

How to Spot Low-Volatility Stocks That are Ready to Explode

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* If you want to reposition your portfolio for 2025, consider the potential policy changes that can significantly affect the market.

* Focusing on financials and using MarketCarpets Bollinger BandWidth setting identifies stocks with low volatility setups, among other qualities.

* Identify stocks that meet your investing criteria and add them...

READ MORE

MEMBERS ONLY

3 WAYS to Pinpoint When a Stocks Uptrend is Ending

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave unveils his "line in the sand" technique to help determine when stocks in established uptrends may be near the end of the bullish phase. He'll share specific levels he's watching for the S&P 500, AMZN, TMUS, and KR,...

READ MORE

MEMBERS ONLY

Options Trade Ideas YOU NEED to SEE!

by Tony Zhang,

Chief Strategist, OptionsPlay

Looking for options trade ideas? In this video, Tony presents some of the best options trading strategies! After discussing special 0DTE strategies, the big picture, and individual sectors and industries, Tony covers bullish and bearish ideas for stocks including NVDA, SHOP, GOOGL, META, CAT and many more.

This video premiered...

READ MORE

MEMBERS ONLY

Bearish Opportunity in Tractor Supply Co (TSCO) with OptionsPlay Strategy Center

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Tractor Supply Co. may be setting up for a declining move in its stock price.

* Take advantage of the downside move in Tractor Supply using a call vertical spread.

* Monitor the OptionsPlay scans to identify options strategies to apply to stocks like Tractor Supply Co.

Despite attempts to...

READ MORE

MEMBERS ONLY

Market As Good As It Gets

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the 26 indexes, sectors and groups in a CandleGlance to see how the indexes stack up. It is clear that all of the indexes are as good as they can get. Carl warns that when things are as good as they can get, the only place...

READ MORE

MEMBERS ONLY

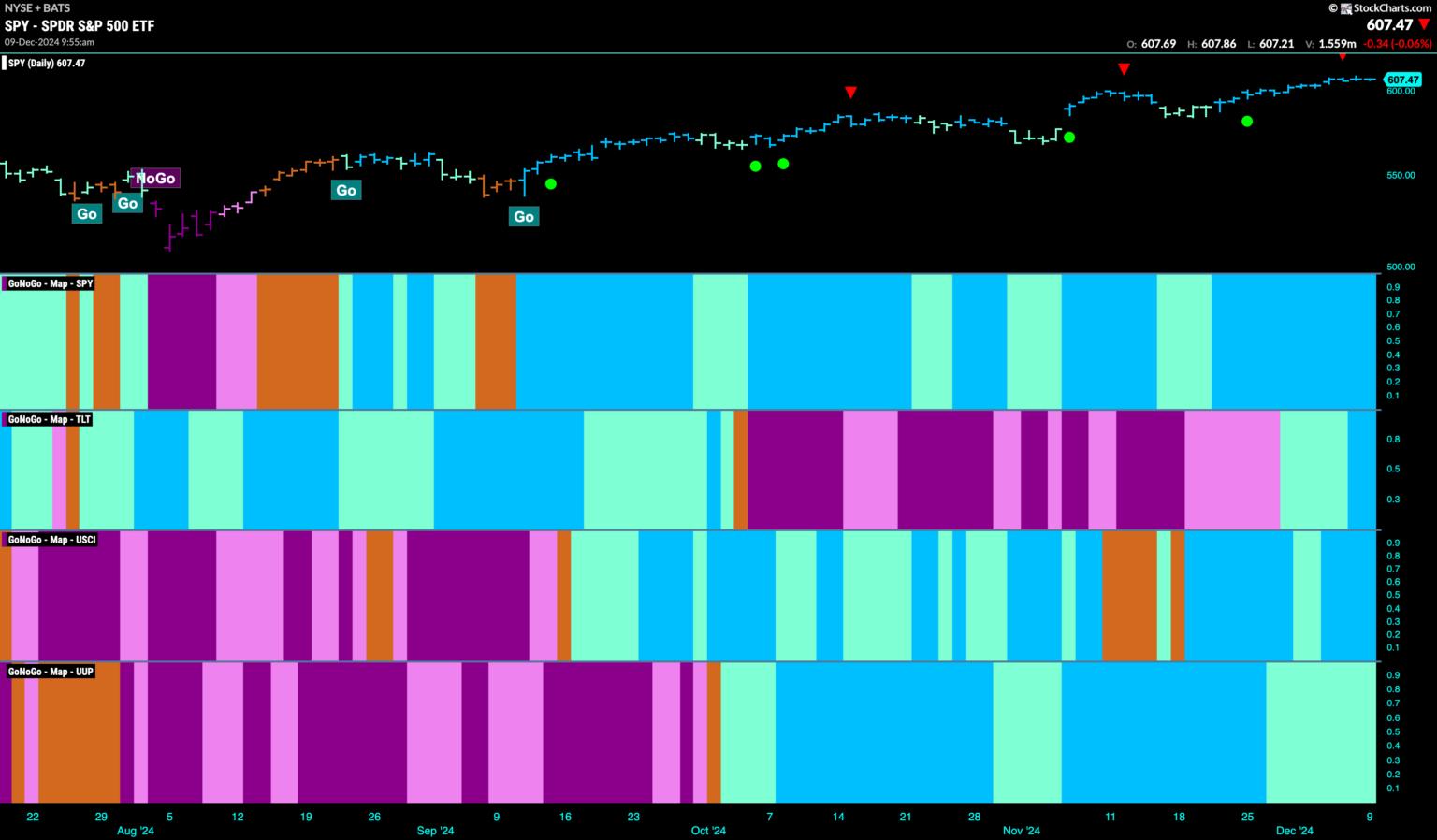

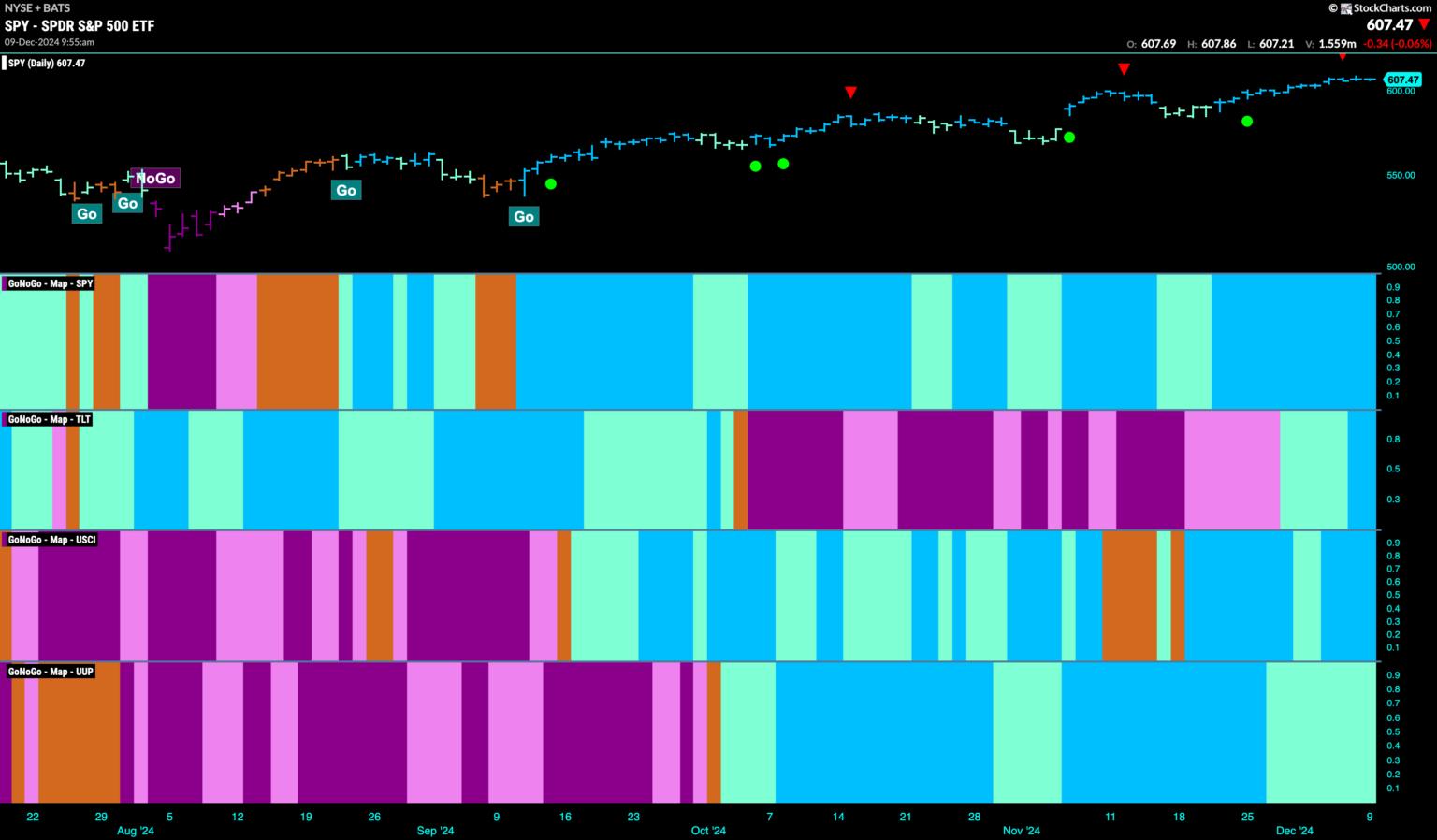

Equities Remain in Strong "Go" Trend as Tech Returns to Leadership

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. The "Go" trend in equities continued again this past week and we saw a full week of uninterrupted bright blue bars. Treasury bond prices painted "Go" bars and the week ended with strong blue bars....

READ MORE

MEMBERS ONLY

Week Ahead: Consolidation Likely as NIFTY Tests Crucial Levels; Guard Profits Mindfully

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets closed with gains for the third week in a row, as key indices posting gains while extending their technical rebound. The Nifty trended higher most of the week. The volatility was largely absent, but the Indices stayed quite choppy on most days except the last, where it remained...

READ MORE

MEMBERS ONLY

Fintech Leadership Provides Good Hunting Ground for Bullish Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* The FinTech ETF (FINX) is leading the market since September.

* FINX is both strong and extended as the PPO exceeded 20%.

* It is time to wait for the next setup or look within the group for setups.

Chartists looking for stock setups can start with strong industry groups....

READ MORE

MEMBERS ONLY

The Stock Market's Simmering Rally: Indexes Keep Setting New Highs

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes continue to notch new record highs.

* Risk appetite is strong as Bitcoin rises while Treasury yields and volatility retreat.

* Earnings from Oracle, Adobe, Broadcom, and Costco may move the stock market next week.

The first trading week in December started on a positive...

READ MORE

MEMBERS ONLY

Are ARK's Innovation ETFs on to Something BIG?

by Mary Ellen McGonagle,

President, MEM Investment Research

After a broad market review, Mary Ellen shares strategies for trading pull backs and breakouts in stocks. Highlights include a deep dive into ARK's Innovation ETFs and their holdings, locating market strength in the process. Tune in for valuable insights and tips to help you make informed investment...

READ MORE

MEMBERS ONLY

The Most Important Chart to Watch Into Year-End 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Low VIX reading implies that conditions are favorable for stocks.

* The MOVE index is basically a VIX for bonds, and can help to corroborate volatility readings across asset classes.

* High yield spreads remain quite narrow, implying bond investors perceive a low risk environment.

"The market goes up...

READ MORE

MEMBERS ONLY

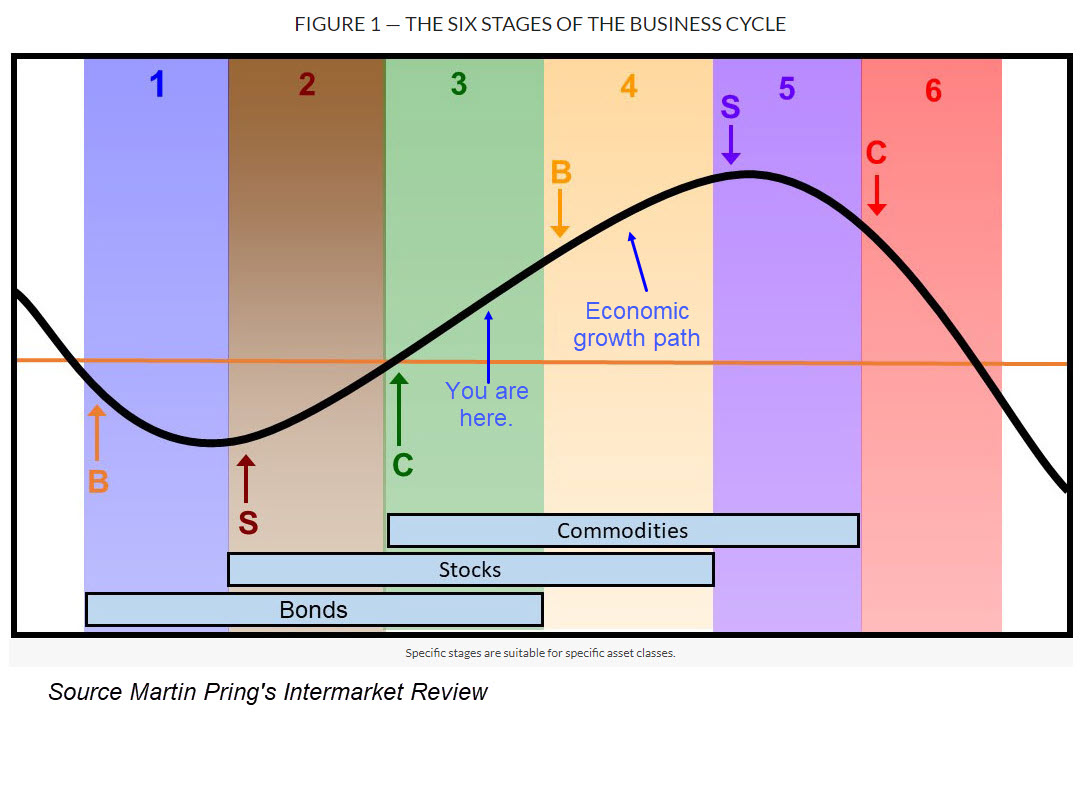

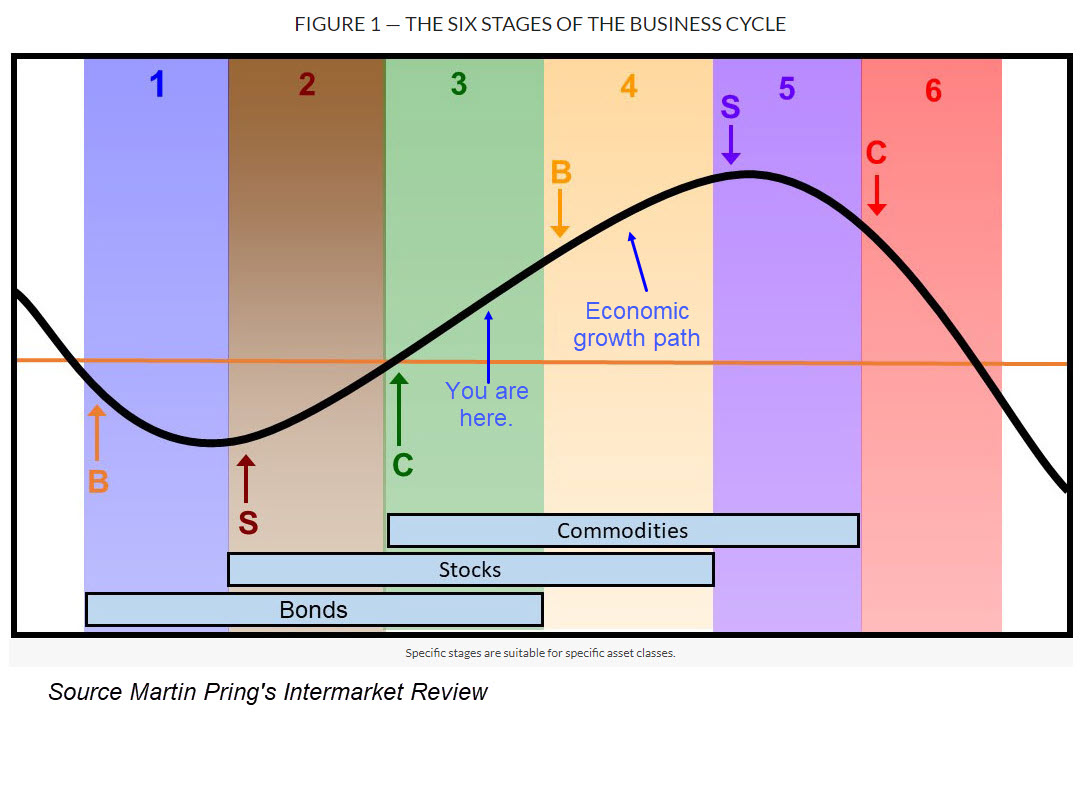

What the Economic Indicators are Saying About Stocks and Commodities

by Martin Pring,

President, Pring Research

You may not know it, but StockCharts' library of economic indicators has recently been enlarged. It's not as extensive as, say, the stock coverage, but it does include a lot of indicators that actually work, in the sense of helping identify major reversals in stock, bond, and...

READ MORE

MEMBERS ONLY

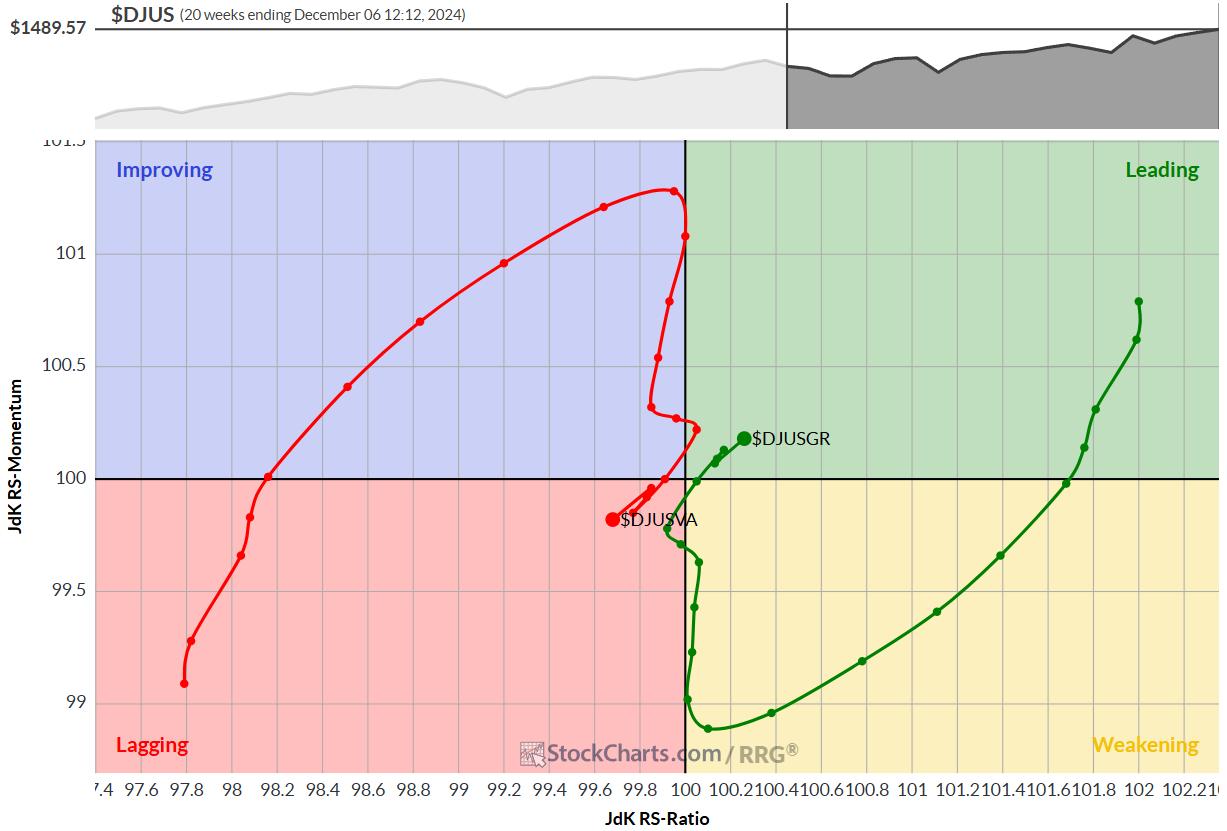

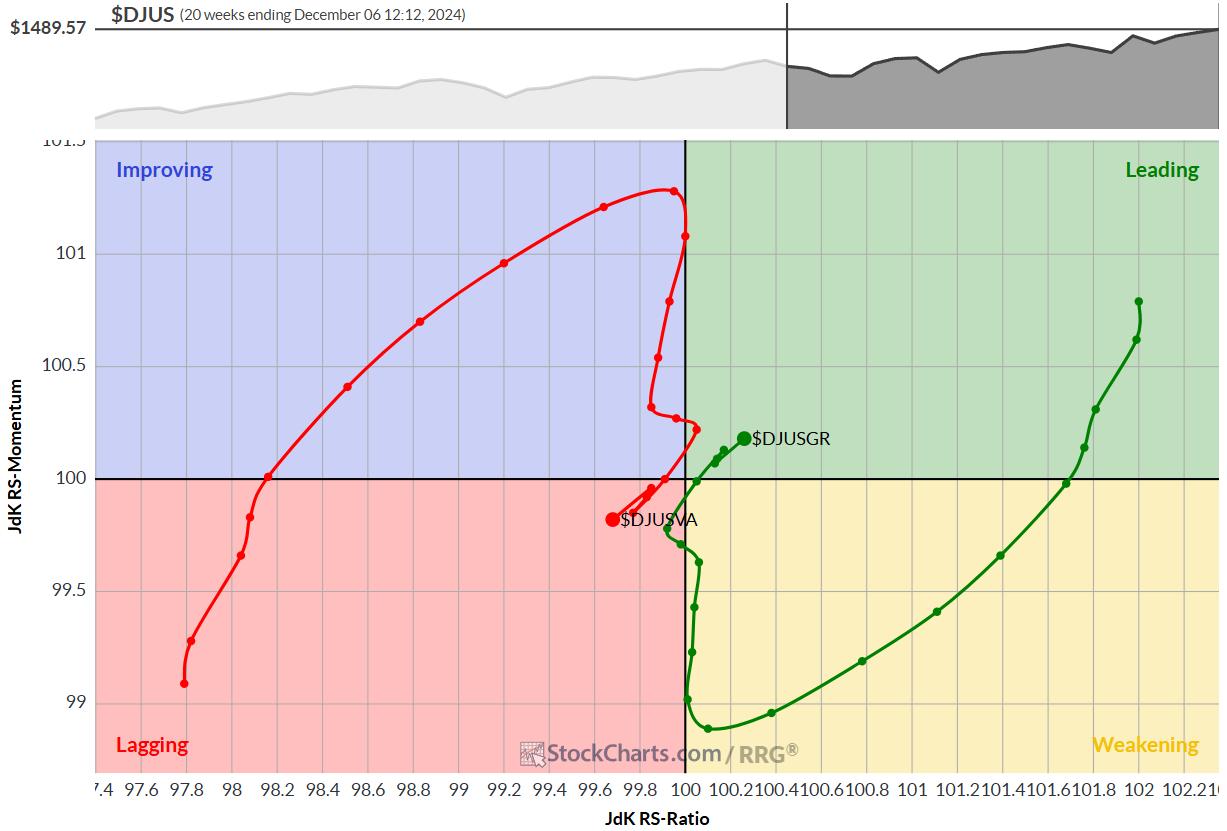

Stay Away from Large-Cap Value Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Growth stocks are regaining leadership over value.

* Small and mid-cap growth sectors are leading the charge.

* Large-cap value is currently the weakest market segment.

Growth vs. Value Rotation: The Pendulum Swings Again

Relative Rotation Graphs (RRG) are not just good tools to use in analyzing sector rotation; they&...

READ MORE

MEMBERS ONLY

Double Top on Industrials (XLI)

by Erin Swenlin,

Vice President, DecisionPoint.com

Industrials (XLI) benefited greatly from the "Trump Trade", but fell back to digest the gap up rally. It rallied again, but failed after overcoming overhead resistance at the prior November top. Now it is pulling back once again, which that has formed a bearish double top formation. The...

READ MORE

MEMBERS ONLY

What's The Outlook For December AND For 2025?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Could we see a short-term shift towards defensive sectors? Real estate? Utilities? I haven't uttered these words in awhile. And why should I as our major indices have forged into new all-time record high territory? Well, I'm only talking about very near-term, maybe the next 1-3...

READ MORE

MEMBERS ONLY

Step 1: Asset Creation, Step 2: —————?, Step 3: Asset Growth

by Gatis Roze,

Author, "Tensile Trading"

The secret sauce of 1-2-3 investing is quite simple: don't skip Step 2. Far too many investors who've succeeded in creating wealth are anxious to rush forward with "all gas, no brakes" to embrace the excitement of Step 3 - Asset Growth. Only in...

READ MORE

MEMBERS ONLY

Two ETFs That Could Thrive Based on a Normal Yield Curve

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My recent discussions on the Market Misbehavior podcasthave often included some comments on the interest rate environment, particularly the shape of the yield curve. We've had an inverted yield curve since late 2022, and so the yield curve taking on a more normal shape could mean a huge...

READ MORE

MEMBERS ONLY

CSCO Stock: A Hidden Gem With Upside Potential

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* CSCO stock has been in a slow uptrend since August and is outperforming the Nasdaq Composite.

* CSCO's stock price is at an all-time high and indicators suggest the stock can continue trending higher.

* Look for a pullback and a bounce off its 21-day exponential moving average....

READ MORE

MEMBERS ONLY

Master the Market: Navigating Up Days and Down Days

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Assess the cumulative strength or weakness of a stock's up and down days to help decide on a prospective trade or investment.

* MarketCarpets can comprehensively display the cumulative strength or weakness of stocks in a specific group, such as the S&P 500.

* Discover how...

READ MORE

MEMBERS ONLY

Leverage Salesforce.com's Growth: A Guide to Smart Options Trading

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The technology sector got a boost from Salesforce's stellar rise in stock price.

* In lieu of purchasing shares of Salesforce stock, you could try trading options on the stock.

* The call vertical spread is an optimal strategy to take advantage of Salesforce's growth.

When...

READ MORE

MEMBERS ONLY

Get Ahead of 2025 Stock Trends!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe uses long-term views of the S&P 500 to explain how the market is positioned as we move into 2025. He uses Yearly and Quarterly Candles and describes why there is a risk of a pullback next year, and he also covers the...

READ MORE

MEMBERS ONLY

After a 29% Bounce, Can SMCI Reclaim Its Former Glory?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* On Monday, Super Micro Computer Inc. (SMCI) jumped 29%.

* Bullish investors began buying SMCI on news of the company's financial stability after its 85% plunge in November.

* Watch the $50 resistance level in SMCI's stock price, in addition to other key levels, as a...

READ MORE

MEMBERS ONLY

Financials Primed to Beat Tech in December!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive video,Julius analyzes the completed monthly charts for November and assesses the long-term trends for all sectors. What we can expect for the coming month of December based on seasonality? With the technology sector under pressure, an interesting opportunity appears to be arising in Financials.

This video...

READ MORE

MEMBERS ONLY

Can You Really Predict Stock Market Success Using the Yield Curve?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reflects on the shape of the yield curve during previous bull and bear cycles with the help of StockCharts' Dynamic Yield Curve tool. He shares insights on interest rates as investors prepare for the final Fed meeting of 2024, and shares two additional charts he&...

READ MORE

MEMBERS ONLY

Best Bullish and Bearish OptionsPlay Ideas for the Week!

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony shows how he starts his week with a clear technical and fundamental perspective of the stocks he's likely going to enter, and of options positions throughout the week, and how you can apply that yourself. Tony shares bullish (NVDA, DIS, SHOP) and bearish (AAPL,...

READ MORE

MEMBERS ONLY

NVDA Stock Price Gives Bullish Signal: An Ultimate Options Strategy to Maximize Gains

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* NVDA's stock price has retested its $130 support level and bounced higher, which could provide a bullish trading opportunity using options.

* NVIDIA's fundamentals are compelling and support a rise in its stock price.

* Selling a put vertical spread provides a limited-risk scenario with a...

READ MORE

MEMBERS ONLY

DP Trading Room: Swenlin Trading Oscillators Top!

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday our short-term Swenlin Trading Oscillators (STOs) turned down even after a rally. This is an attention flag that we shouldn't ignore, but what do the intermediate-term indicators tell us? Are they confirming these short-term tops?

Carl goes through the DP Signal tables to start the program...

READ MORE

MEMBERS ONLY

Equities Remain in Strong "Go" Trend, Edging Ever Higher

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. The "Go" trend in equities continues this week and we saw an uninterrupted week of strong blue bars. Treasury bond prices have seen a return to a "Go" trend with a pale aqua bar at...

READ MORE

MEMBERS ONLY

Five Ways You Should Use ChartLists Starting Today!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Having used many technical analysis platforms over my career as a technical analyst, I can tell you with a clear conscience that the ChartList feature on StockCharts provides exceptional capabilities to help you identify investment opportunities and manage risk in your portfolio. Once you get your portfolio or watch list...

READ MORE

MEMBERS ONLY

Navigating Holiday Stock Market Changes: Turn Sentiment Shifts into Successes

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes take a breather.

The day before Thanksgiving, the stock market took a little breather. But the weekly performance was still impressive.

The Dow Jones Industrial Average ($INDU) remains the broader index leader, rising 0.96% for the week. The S&P 500...

READ MORE

MEMBERS ONLY

Can the S&P 500 Rally Without Tech?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a deep dive into US sector rotation, breaking it down into offensive, defensive and cyclical sectors. He first looks at the relative rotations that are shaping up inside the group, assessing each sector's price chart in combination with the rotation...

READ MORE

MEMBERS ONLY

Here's Why the Small Cap IWM Will Soar Nearly 70% by the End of 2025

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you want big returns, I'm convinced you'll find them in small caps. When I make bold predictions, and many of you know that I do fairly often, it's usually supported by long-term perspective. Most everyone has a negative bias towards small caps right...

READ MORE

MEMBERS ONLY

Plunge in Treasury Yields Triggers Gap-Surge in Home Builders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* The 10-yr Treasury Yield reversed its upswing with a sharp decline.

* The 7-10 Yr Treasury Bond ETF surged and reversed its downswing.

* Lower yields provided a big boost to the Home Construction ETF.

The 10-yr Treasury Yield reversed its upswing with a sharp decline and the Home Construction...

READ MORE

MEMBERS ONLY

How to Trade MicroStrategy's Painful Plunge: The Levels Every Investor Must Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* MicroStrategy's price is correlated with Bitcoin's.

* In 2024, Microstrategy's stock price surged from a low of $43 to a high of $543.

* Look for MicroStrategy's stock price to fall between $318 and $320, its next support level.

On November 21,...

READ MORE

MEMBERS ONLY

Three Charts That Could Be About to Break in a Big Way

by Martin Pring,

President, Pring Research

This article is not centered around a specific theme; rather, it focuses on some charts which look as if they are about to signal an important change in trend. In this case, "important" is defined as a forthcoming move lasting at least 3-months.

My indicator of choice for...

READ MORE

MEMBERS ONLY

OptionsPlay: Macro Market Outlook and Options Strategies

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, and shares his top bearish and bullish options trading ideas. He talks growth vs. value, commodities, bonds, the Dollar Index, sectors like homebuilders and semiconductors, and stocks like NVDA, DIS, INTC, and more.

This video premiered on November 26,...

READ MORE