MEMBERS ONLY

Money's Not Leaving the Market - It's Rotating!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Feeling a little anxious about the market, even with a strong economy? The truth is, money isn't fleeing the market; it's simply moving around, creating fresh opportunities.

In this must-watch video, Tom Bowley of EarningsBeats eases those anxieties by providing charts that show this rotation. Tom...

READ MORE

MEMBERS ONLY

MACD Crossovers: Why Most Traders Get It Wrong

by Joe Rabil,

President, Rabil Stock Research

Joe presents a deep dive into MACD crossovers, demonstrating how to use them effectively across multiple timeframes, establish directional bias, and improve trade timing. He explains why price action should confirm indicator signals, sharing how to identify "pinch plays" and zero-line reversals for higher-quality setups. Joe then analyzes...

READ MORE

MEMBERS ONLY

Market Signals Align - Is a Bigger Move Ahead?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

This week, Frank analyzes recent technical signals from the S&P 500, including overbought RSI levels, key price target completions, and the breakout potential of long-term bullish patterns. He examines past market breakouts and trend shifts, showing how overbought conditions historically play out. Frank also walks through a compelling...

READ MORE

MEMBERS ONLY

The Dollar Index Just Gave a Major Sell Signal - Does That Mean It's About to Implode?

by Martin Pring,

President, Pring Research

Last month, the Dollar Index triggered a number of sell signals confirming that it is in a bear market. Chart 1, for instance, shows that the red up trendline emanating in 2011 has been decisively ruptured, thereby pushing the Index further below its moving average. The Coppock Curve, seen in...

READ MORE

MEMBERS ONLY

Top 10 July 2025 Stock Picks You Shouldn't Miss

by Grayson Roze,

Chief Strategist, StockCharts.com

Join Grayson for a solo show as he reveals his top 10 stock charts to watch this month. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. As a viewer, you'll also gain insight into key market...

READ MORE

MEMBERS ONLY

Tech Stocks Lead the Charge: What's Driving the Momentum?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The last day of trading for the first half of 2025 ended with a bang. The S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) closed at record highs - an impressive finish, given the year has seen significant swings.

We saw signs of investors rotating into technology stocks last...

READ MORE

MEMBERS ONLY

Pullbacks & Reversals: Stocks Setting Up for Big Moves!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen spotlights key pullback opportunities and reversal setups in the wake of a strong market week, one which saw all-time highs in the S&P 500 and Nasdaq. She breaks down the semiconductor surge and explores the bullish momentum in economically-sensitive sectors, including software, regional...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #25

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A Greek Odyssey

First of all, I apologize for any potential delays or inconsistencies this week. I'm currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight back home was first delayed, then canceled, then...

READ MORE

MEMBERS ONLY

Week Ahead: As NIFTY Breaks Out, Change of Leadership Likely to Keep the Index Moving

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After six weeks of consolidation and trading in a defined range, the markets finally broke out from this formation and ended the week with gains. Over the past five sessions, the markets have largely traded with a positive undercurrent, continuing to edge higher. The trading range was wider than anticipated;...

READ MORE

MEMBERS ONLY

Fibonacci Retracements: The Key to Identifying True Breakouts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

If you've looked at enough charts over time, you start to recognize classic patterns that often appear. From head-and-shoulders tops to cup-and-handle patterns, they almost jump off the page when you bring up the chart. I would definitely include Fibonacci Retracements on that list, because before I ever...

READ MORE

MEMBERS ONLY

NEW! 5 Significant Additions to Our Professionally-Curated Market Summary Dashboard

by Grayson Roze,

Chief Strategist, StockCharts.com

Take a tour of the FIVE latest updates and additions to our fan-favorite, professionally-curated Market Summary dashboard with Grayson!

In this video, Grayson walks viewers through the new charts and indexes that have been added to multiple panels on the page. These include mini-charts for the S&P sectors,...

READ MORE

MEMBERS ONLY

Breakdown of NVDA's Stock Price and S&P 500: Actionable Technical Insights

by Frank Cappelleri,

Founder & President, CappThesis, LLC

The S&P 500 ($SPX) just logged its second consecutive 1% gain on Tuesday. That's three solid 1% advances so far in June. And with a few trading days remaining in the month, the index has recorded only one 1% decline so far.

A lot can still...

READ MORE

MEMBERS ONLY

Shifting Tides in the Stock Market: A New Era for Bulls?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market has been on quite the rollercoaster of late, thanks to news headlines. But investors seem to have shrugged off the past weekend's geopolitical tensions, at least for now.

On Tuesday, we saw a surge of enthusiasm. Investors were diving back into stocks and selling off...

READ MORE

MEMBERS ONLY

How to Use Fibonacci Retracements to Spot Key Levels

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he shares how he uses the power of Fibonacci retracements to anticipate potential turning points. He takes viewers through the process of determining what price levels to use to set up a Fibonacci framework, and, from there, explains what Fibonacci retracements are telling him about the charts...

READ MORE

MEMBERS ONLY

Never Easy to Predict, the Price of Crude Just Got Harder

by Martin Pring,

President, Pring Research

Earlier in the month, I wrote an article pointing out that gold and copper typically move ahead of oil. It's true, the leads and lags between these three entities differ from cycle to cycle. However, since gold momentum turned up in early 2023 and copper in early 2022,...

READ MORE

MEMBERS ONLY

Offense vs. Defense: How Geopolitical Tensions Shape Market Trends

by Karl Montevirgen,

The StockCharts Insider

As the cycle of uncertainty continues to yield confusion than clarity, investors are again caught having to decide between taking an offensive and defensive posture in the market. The tough part in today's market environment is how fast situations can shift. With headlines driving the action, sentiment can...

READ MORE

MEMBERS ONLY

AI Stocks Ignite Again—Where Smart Money is Heading Next

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen opens with a look at the S&P 500, noting that the index remains above its 10-day average despite a brief pullback—a sign of healthy market breadth. She points to ongoing sector leadership in technology, while observing that energy and defense stocks are...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #24

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

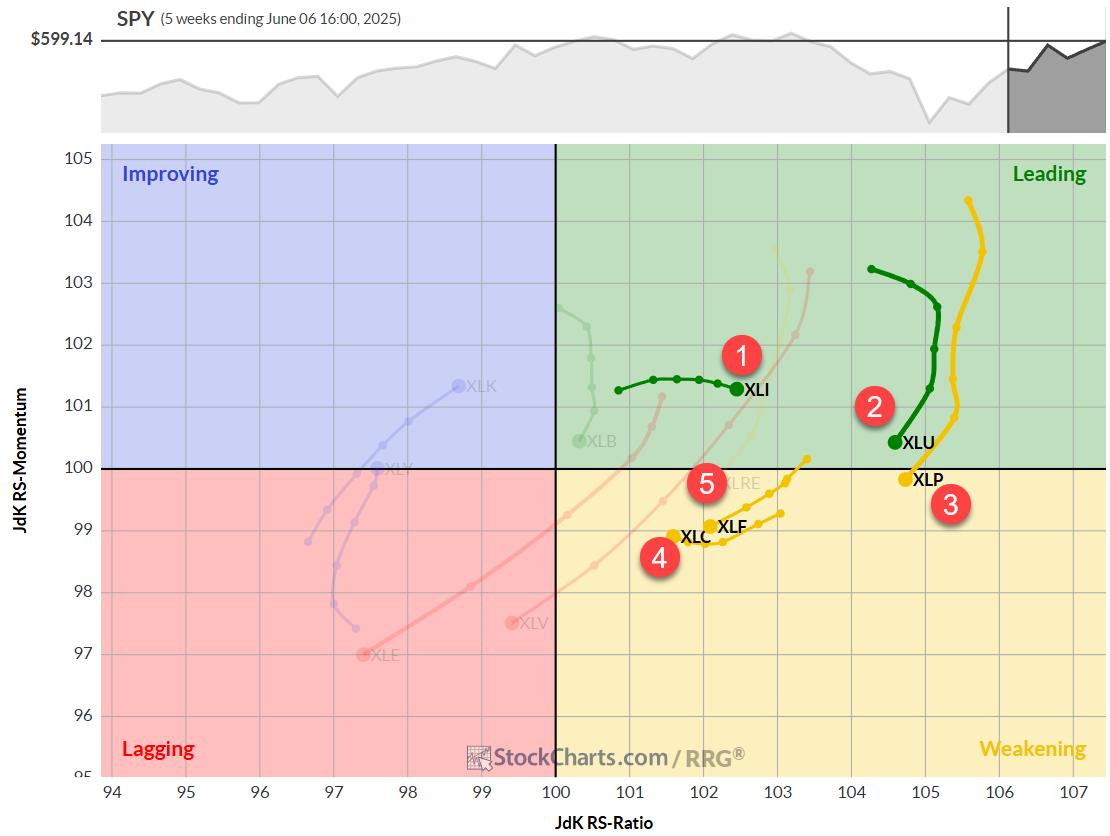

Some Sector Reshuffling, But No New Entries/Exits

Despite a backdrop of significant geopolitical events over the weekend, the market's reaction appears muted -- at least, in European trading. As we assess the RRG best five sectors model based on last Friday's close, we're...

READ MORE

MEMBERS ONLY

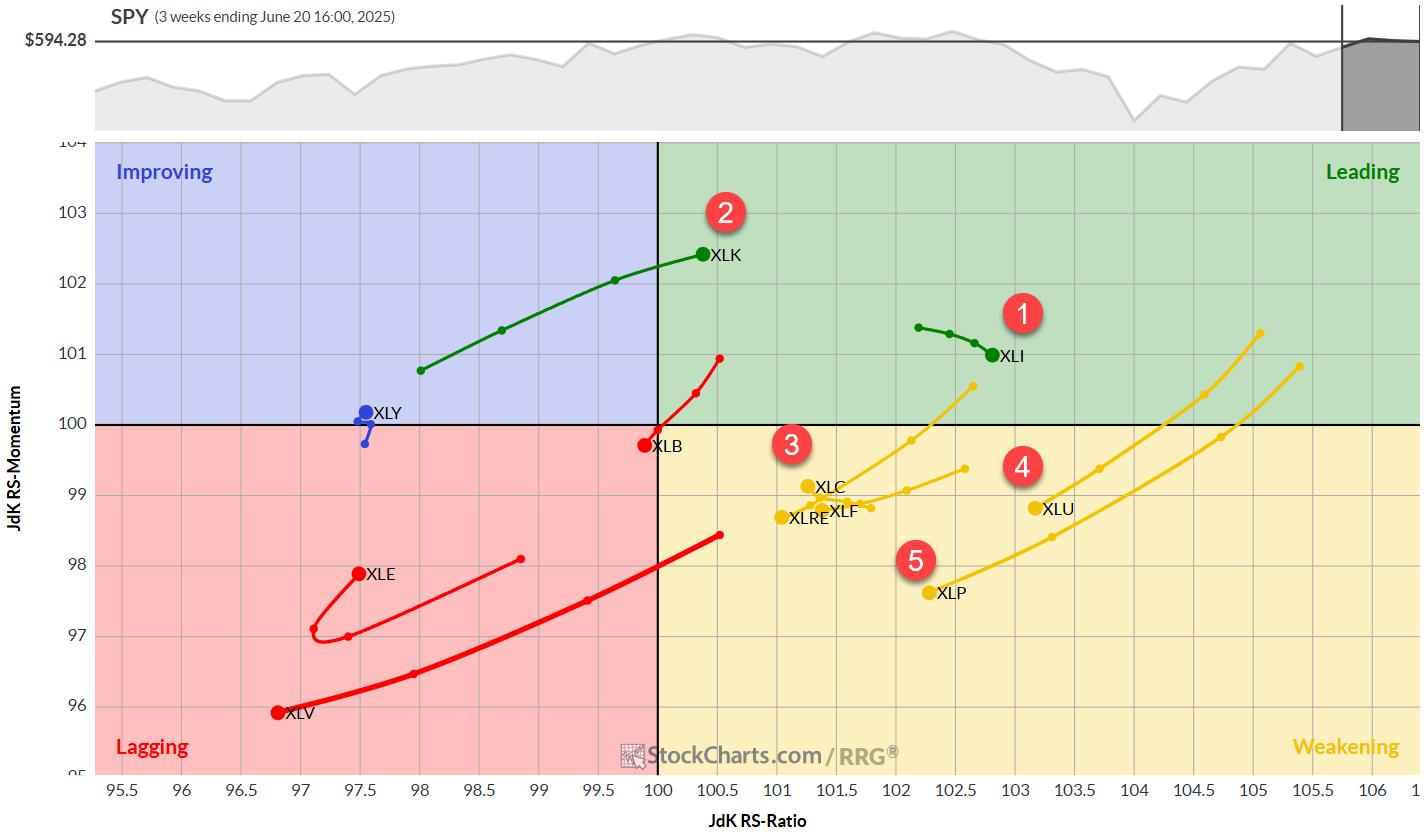

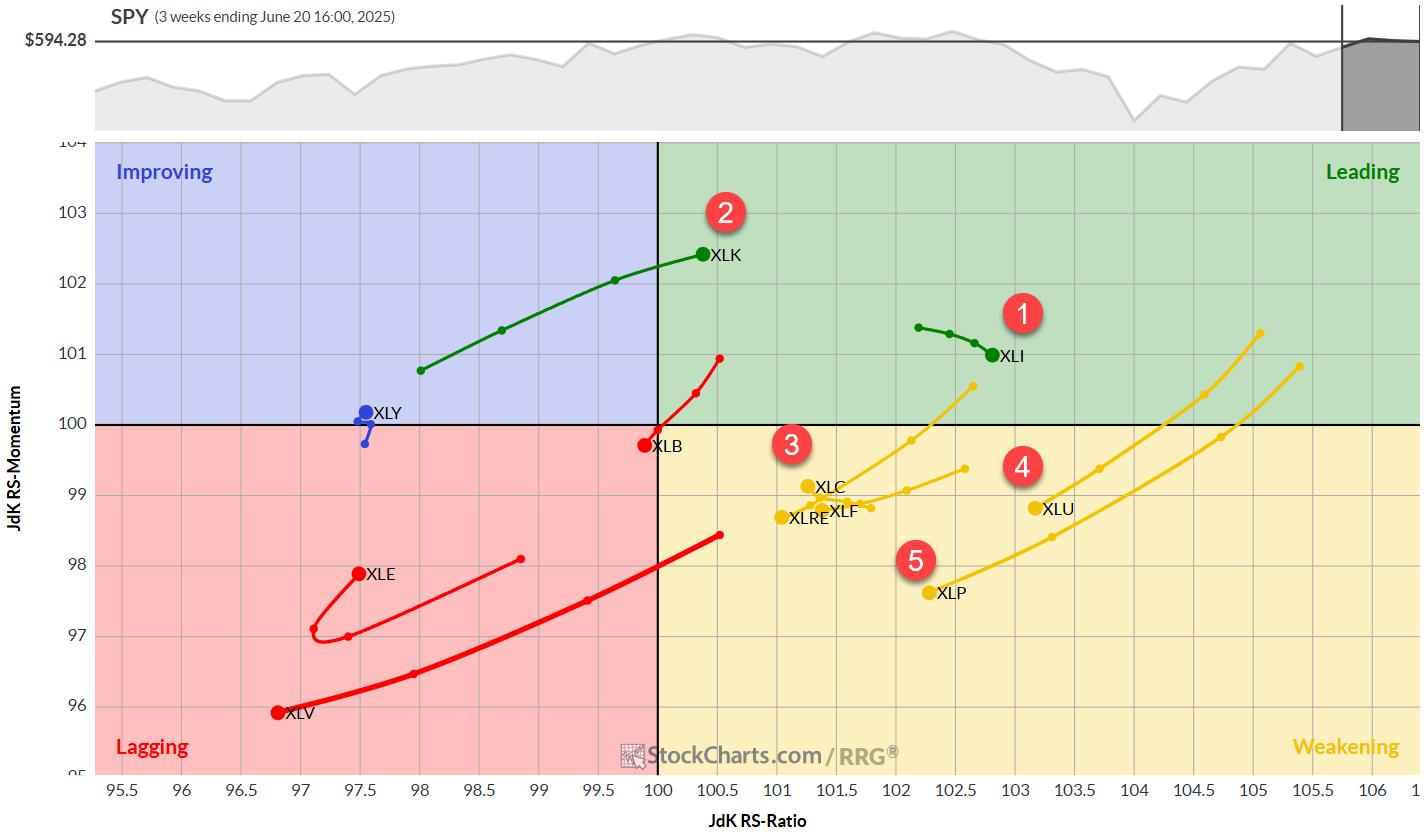

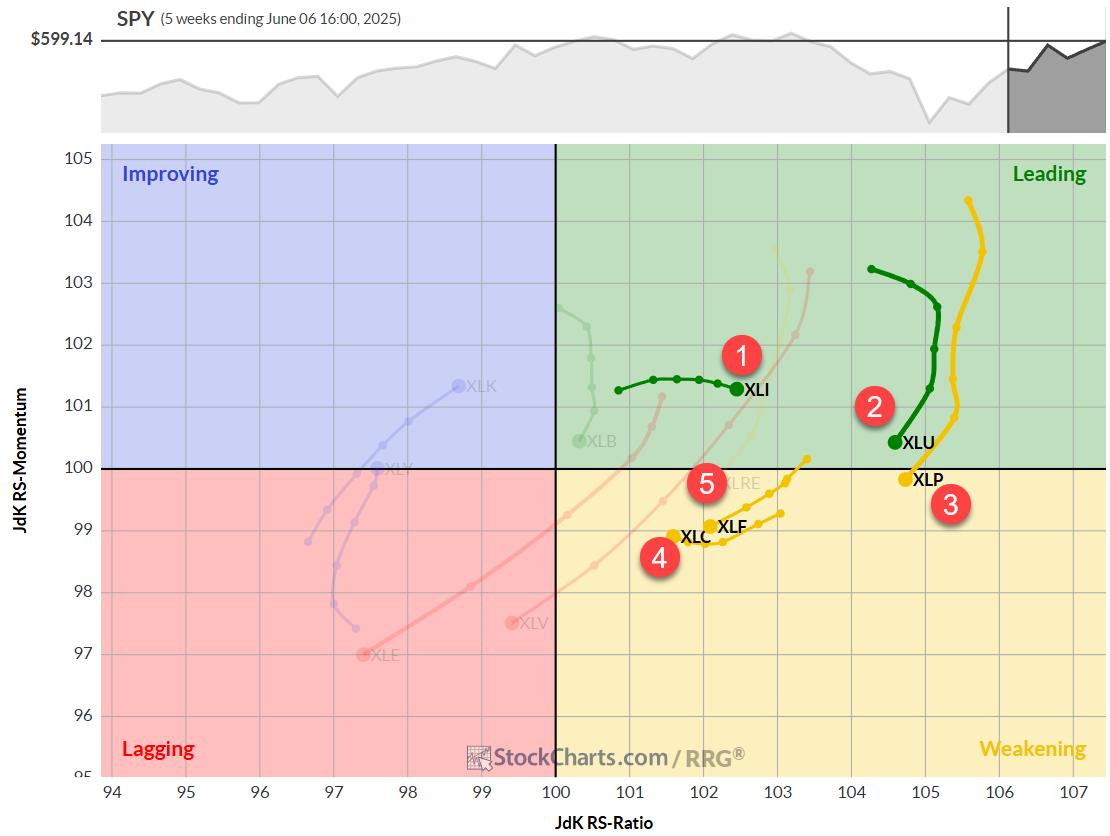

RRG Alert Tech Vaults to ‘Leading'—Is XLK Signaling a New Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, Julius breaks down the current sector rotation using his signature Relative Rotation Graphs, with XLK vaulting into the leading quadrant while utilities and staples fade. He spotlights strength in the technology sector, led by semiconductors and electronic groups that are outpacing the S&P 500. Microchip heavyweights...

READ MORE

MEMBERS ONLY

Feeling Unsure About the Stock Market's Next Move? These Charts Can Help

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When the stock market seems to be drifting sideways without displaying a clear bullish or bearish bias, it's normal for investors to get anxious. It's like being at a crossroads, wondering whether to go left, right, or stay put.

The truth is nobody has a crystal...

READ MORE

MEMBERS ONLY

Joe Rabil's Undercut & Rally Pattern: From DROP to POP

by Joe Rabil,

President, Rabil Stock Research

Joe presents his game-changing "undercut and rally" trading pattern, which can be found in high volatility conditions and observed via RSI, MACD and ADX signals. Joe uses the S&P 500 ETF as a live case study, with its fast shake-out below support followed by an equally...

READ MORE

MEMBERS ONLY

3 S&P 500 Charts That Point to the Next Big Move

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Follow along with Frank as he presents the outlook for the S&P 500, using three key charts to spot bullish breakouts, pullback zones, and MACD signals. Frank compares bearish and bullish setups using his pattern grid, analyzing which of the two is on top, and explains why he&...

READ MORE

MEMBERS ONLY

G7 Meeting in Canada Could Be Opportune Time for Accumulating Canadian Dollar and Canadian Equities

by Martin Pring,

President, Pring Research

The Canadian dollar peaked in 2007 and 2011 at around $1.05, and it has been zig-zagging downwards ever since. Now at a lowly 73 cents USD, the currency looks as if it may be in the process of bottoming, or at the very least entering a multi-year trading range....

READ MORE

MEMBERS ONLY

Navigate the Stock Market with Confidence

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When you see headlines about geopolitical tensions and how the stock market sold off on the news, it can feel unsettling, especially when it comes to your hard-earned savings. But what you might not hear about in the news is what the charts are indicating.

Look at what happened in...

READ MORE

MEMBERS ONLY

Major Shift in the Markets! Here's Where the New Strength Is

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen spotlights breakouts in Energy and Defense, Technology sector leadership, S&P 500 resilience, and more. She then unpacks the stablecoin fallout hitting Visa and Mastercard, highlights Oracle's earnings breakout, and shares some pullback opportunities.

This video originally premiered June 13, 2025. You...

READ MORE

MEMBERS ONLY

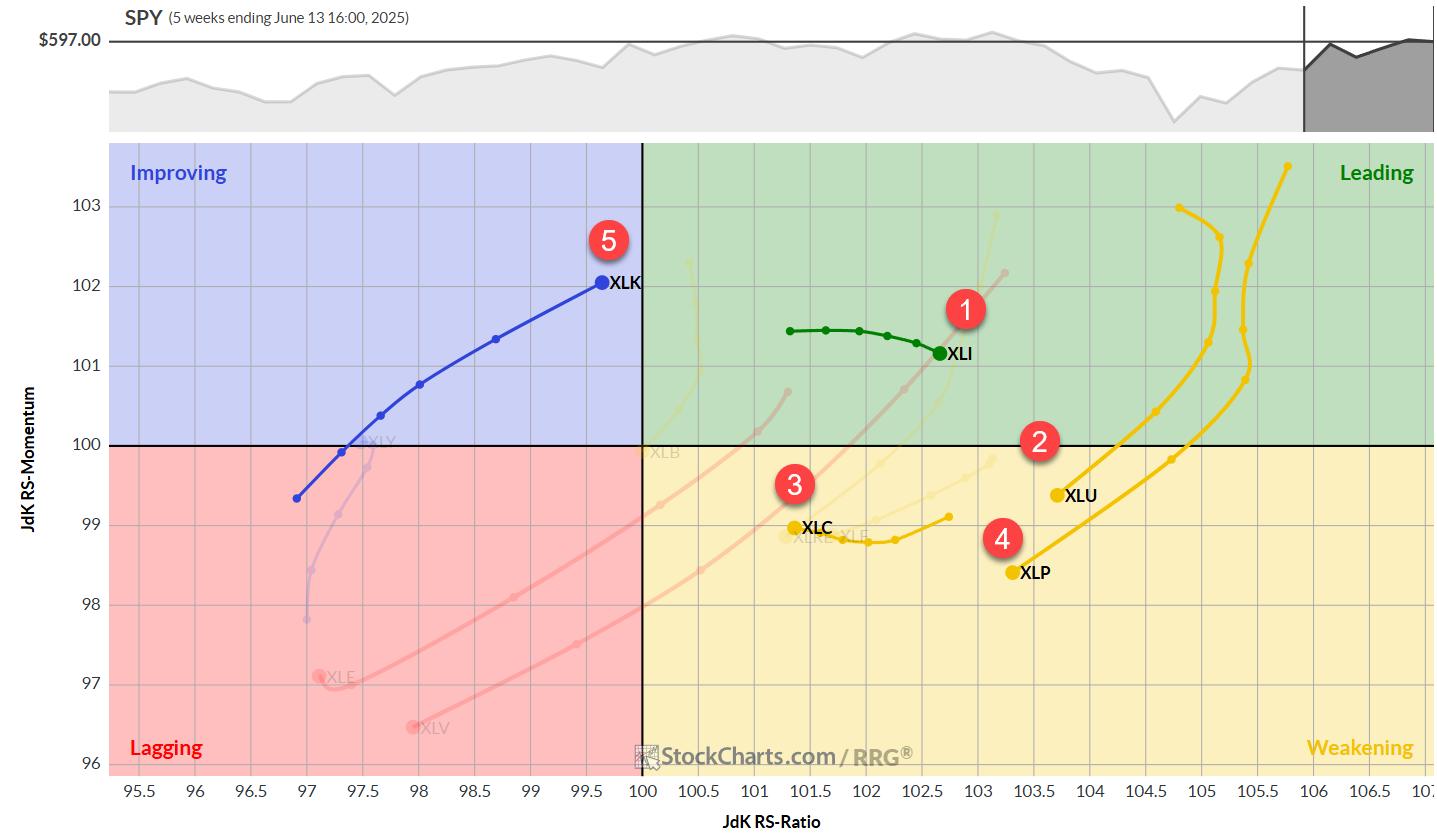

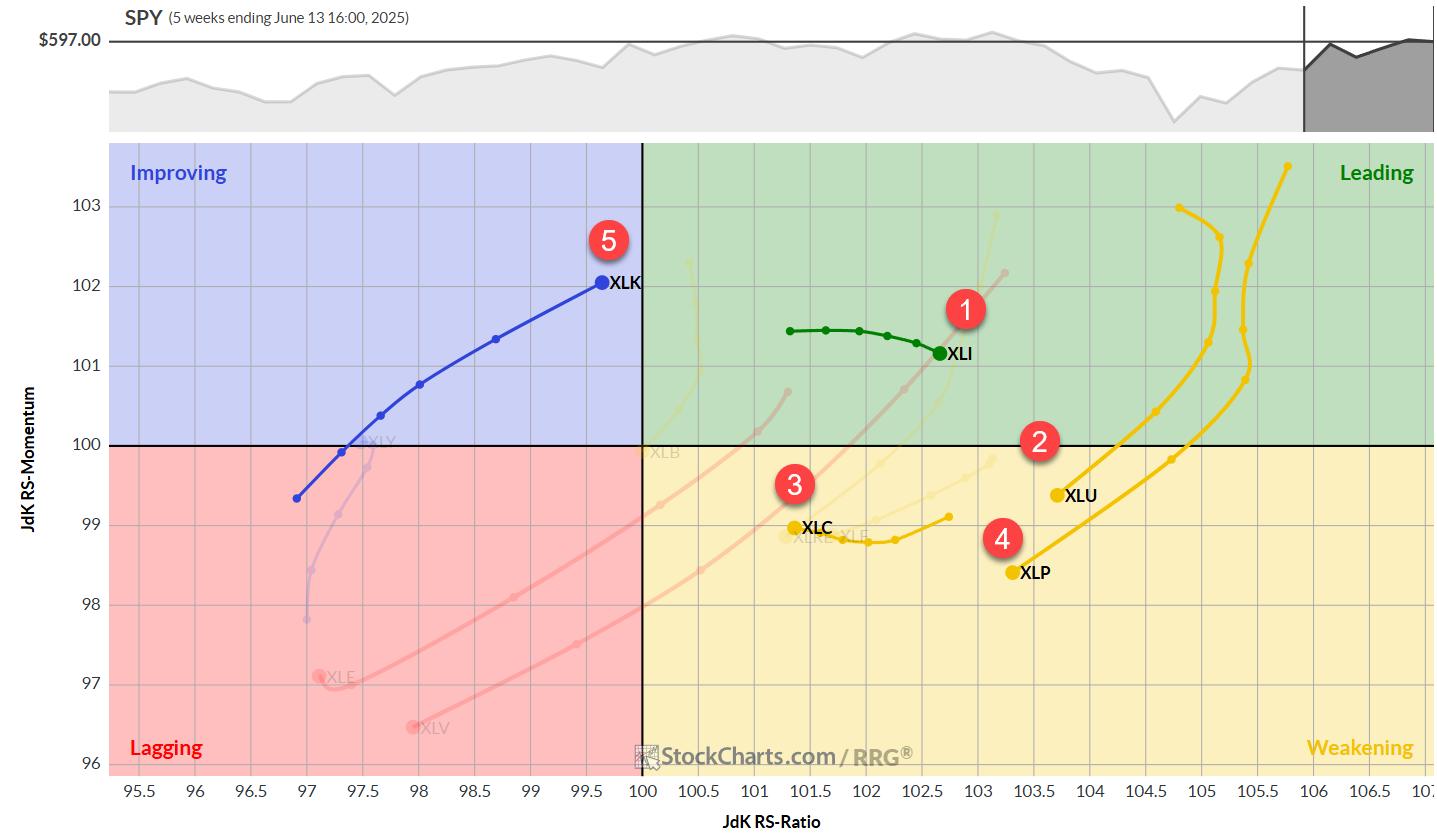

The Best Five Sectors, #23

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Time Technology Beats Financials

After a week of no changes, we're back with renewed sector movements, and it's another round of leapfrogging.

This week, technology has muscled its way back into the top five sectors at the expense of financials, highlighting the ongoing volatility in...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Continue Showing Resilience; Broader Markets May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

An attempt to break out of a month-long consolidation fizzled out as the Nifty declined and returned inside the trading zone it had created for itself. Over the past five sessions, the markets consolidated just above the upper edge of the trading zone; however, this failed to result in a...

READ MORE

MEMBERS ONLY

Bearish Divergence Suggests Caution For S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With Friday's pullback after a relatively strong week, the S&P 500 chart appears to be flashing a rare but powerful signal that is quite common at major market tops. The signal in question is a bearish momentum divergence, formed by a pattern of higher highs in...

READ MORE

MEMBERS ONLY

What the S&P 500, VIX, and ARKK are Telling Us Now

by Frank Cappelleri,

Founder & President, CappThesis, LLC

While the S&P 500 ($SPX) logged a negative reversal on Wednesday, the Cboe Volatility Index ($VIX), Wall Street's fear gauge, logged a positive reversal. This is pretty typical: when the S&P 500 falls, the VIX rises.

Here's what makes it interesting: the...

READ MORE

MEMBERS ONLY

10‑Year Yield Warning! ADX + RSI Point to a Major Shift

by Joe Rabil,

President, Rabil Stock Research

Joe kicks off this week's video with a multi‑timeframe deep dive into the 10‑year U.S. Treasury yield (TNX), explaining why a sideways coil just below the 5% level could be "downright scary" for equities. From there, he demonstrates precise entry/exit timingwith a...

READ MORE

MEMBERS ONLY

Unlocking Stock Market Insights: Identify Global Opportunities with StockCharts' Market Summary

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The U.S. stock market has been painting a subtle picture recently. While the broader indexes, such as the S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Average ($INDU), are indeed grinding higher, the daily movements have been relatively subdued. This is a noticeable shift from...

READ MORE

MEMBERS ONLY

This Widely Used Commodity Could Be About to Surprise Us on the Upside

by Martin Pring,

President, Pring Research

Chart 1 lays out the long-term momentum (KST) relationship between gold, copper, and crude oil for the last 30 years. The arrows slant towards the right, indicating that gold leads copper, which subsequently turns up ahead of oil. Gold reversed to the upside in early 2023 and copper at the...

READ MORE

MEMBERS ONLY

Is the S&P 500 Flashing a Bearish Divergence?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Unlock the power of divergence analysis! Join Dave as he breaks down what a bearish momentum divergence is and why it matters. Throughout this video, Dave illustrates how to confirm (or invalidate) the signal on the S&P500, Nasdaq100, equal‑weighted indexes, semiconductors, and even defensive names like AT&...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #22

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sector Rotation: A Week of Stability Amidst Market Dynamics

Last week presented an intriguing scenario in our sector rotation portfolio.

For the first time in recent memory, we witnessed complete stability across all sector positions -- no changes whatsoever in the rankings.

1. (1) Industrials - (XLI)

2. (2) Utilities...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY's Behavior Against This Level Crucial as Index Looks at Potential Resumption of Up Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After consolidating for two weeks, the Nifty finally appeared to be flexing its muscles for a potential move higher. Over the past five sessions, the Nifty traded with an underlying positive bias and ended near the week's high point while also attempting to move past a crucial pattern...

READ MORE

MEMBERS ONLY

From Tariffs to Tech: Where Smart Money's Moving Right Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Stay ahead of the market in under 30 minutes! In this video, Mary Ellen breaks down why the S&P 500 just broke out, which sectors are truly leading (industrials, technology & materials), and what next week's inflation data could mean for your portfolio.

This video originally...

READ MORE

MEMBERS ONLY

Your Weekly Stock Market Snapshot: What It Means for Your Investments

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

This week, we got a smorgasbord of jobs data — JOLTS, ADP, weekly jobless claims, and the nonfarm payrolls (NFP). Friday's NFP, the big one the market was waiting for, showed that 139,000 jobs were added in May, which was better than the expected 130,000. Unemployment rate...

READ MORE

MEMBERS ONLY

S&P 500 on the Verge of 6,000: What's at Stake?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

A lot has happened in the stock market since Liberation Day, keeping us on our toes. Volatility has declined significantly, stocks have bounced back from their April 7 low, and the economy has remained resilient.

If you're still feeling uncertain, though, you're not alone. The stock...

READ MORE

MEMBERS ONLY

Why ADX Can Mislead You — And How to Avoid It

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe walks through a comprehensive lesson on using the ADX (Average Directional Index) as part of a technical analysis strategy. Joe explains the key components of the ADX indicator, how to interpret DI+ and DI- lines, and how to identify strong or weak trends in the market....

READ MORE

MEMBERS ONLY

S&P 500 Bullish Patterns: Are Higher Highs Ahead?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

In this market update, Frank breaks down recent developments across the S&P 500, crypto markets, commodities, and international ETFs. He analyzes bullish and bearish chart patterns, identifies key RSI signals, and demonstrates how "Go No Go Charts" can support your technical analysis. You'll also...

READ MORE